Development of contactless mobile payment services

Taking the advantage of the latest Near Field Communication (NFC) technology development, a number of economies have recently launched or plan to launch

NFC-related mobile services in their market. However, some economies are still facing challenges to achieve mass-market deployment and adoption. Major challenges include possible complex business and operating models; and, if a poorly designed and

fragmented model is adopted, the interoperability problems that could result. It was against this background that the Hong Kong Monetary Authority (HKMA) has

commissioned a consultancy firm to undertake a study with the express aim of ensuring the implementation in Hong Kong of a cost-effective and interoperable NFC mobile payment infrastructure. This article discusses the possible NFC mobile services and infrastructure, the related benefits, a case study in France and explains the objectives and scope of the study and the way ahead.

by the Financial Infrastructure Department

Introduction

Hong Kong people are familiar with contactless payments due to the high acceptance of Octopus cards. Over 23 million of these cards have been issued in Hong Kong and around 12 million payment transactions, totalling up to HK$130 million, are made each day. There is also growing acceptance of other contactless payment cards, such as Visa payWave. In June 2012, the number of mobile phone service subscribers was 15.79 million, representing a penetration rate of about 221%.1 And, it appears smartphones have become the obvious choice of consumers in Hong Kong as 35% of all mobile phone users have smartphones and, of these, 63% are first-time smartphone owners.2 The facts, therefore, indicate that the Hong Kong market is ready to embrace the new NFC mobile payment services when they are available to users.

NFC mobile payment infrastructure

What is NFC?

NFC is a short-range wireless connectivity technology that provides intuitive, simple and safe communication between electronic devices. The communication occurs when two NFC-compatible devices are brought within a short distance, usually less than four centimeters of one another. Due to the short transmission range and the application of authentication technology, NFC-enabled transactions are inherently secure. As mobile phones have

become a pervasive commodity today, consumers clearly benefit from the ease and convenience of paying for goods and services using this innovative payment channel (see Box 1 on benefits of NFC service to the general public). The arrival of

contactless NFC technology on mobile phones has opened even more possibilities, where consumers can communicate, shop and pay in a way that best fits their needs and lifestyles with a simple tap, click or touch in-store. The possible uses of NFC are numerous, and many exciting ideas are now in development around the world.

1 Source: Office of the Communications Authority. 2 Google Survey on Mobile Behaviour of Hong Kong, 2011.

The key stakeholders

The key stakeholders in NFC mobile payment infrastructure include payment service providers (covering both banks and non-banks), mobile network operators, handset manufacturers and trusted service managers.3 A typical processing flow of installing a payment application on a mobile phone is depicted in Diagram 1.

The importance of an interoperable NFC mobile payment infrastructure

To fully realise the potential of NFC mobile payments and ensure its success in Hong Kong, it is essential to put in place an interoperable NFC mobile payment

Payment service providers

Trusted service managers

Mobile network operators

Merchants

1 Request for payment application 2 Request for

payment application

4 Load payment application to the mobile phone

Make mobile payment 6

3 Grant authorization

Customers

Load payment application 5

NFC mobile phone

Secure element

Secure element issuers Diagram 1

Major components of NFC mobile payment infrastructure

Payment application activation flow Payment transaction flow

infrastructure and operating environment that is capable of supporting multi-payment service providers and multi-mobile network operators. This will in turn serve as a platform to enable the proliferation of more innovative mass-market applications and services, as well as the further development of m-commerce in Hong Kong.

We understand, in general, there are three

approaches adopted overseas to drive development of interoperable NFC mobile payment infrastructure.

The table below summarises the approaches adopted by Singapore, the United Kingdom, the United States and France. It is worth-noting that each market has its own characteristics and may require a different approach to ensure successful implementation of the infrastructure.

Table

Example

Info-communications Development Authority of Singapore’s NFC Payment and Mobile Services Initiative (a)

Project Oscar (b) in the UK and ISIS (c) in the US

Association Française du Sans Contact Mobile in France (see Box 2 on a case study on the NFC project in France)

Approach

Government-driven: both government and industry consortium sponsor the development of an

interoperable NFC mobile payment infrastructure A mobile network operator-driven approach: joint venture set up by mobile network operators, with minimal or no government authorities’ involvement A cross-industry consortium approach: joint industry consortium formed by both mobile network operators and payment service providers, with minimal or no government authorities’ involvement

Notes:

(a) See Info-communications Development Authority of Singapore website (www.ida.gov.sg).

(b) See the Guardian’s article “Project Oscar hopes to bring mobile wallets to Europe” issued on 7 March 2012.

(c) See ISIS website (www.paywithisis.com).

Consultancy study

Although development of NFC mobile payment services is still in the early stages globally, given the limited availability of NFC-enabled phones in the market, we understand certain payment service providers are currently exploring the opportunity of delivering NFC mobile payment services in Hong Kong. There is a market expectation of close collaboration among payment service providers, mobile network operators, handset manufacturers and trusted service managers to make such services available to the market in the next 12 - 18 months.

With this in mind, the HKMA engaged a consultancy firm with the relevant expertise to conduct a study on the latest developments in NFC mobile payment services and to recommend the most appropriate business and operating model that best suits Hong Kong’s needs. The study also aims to identify and establish an interoperable NFC mobile payment infrastructure that allows a level-playing field for all possible stakeholders.

Objective and scope

The review’s objective is to identify the most effective and practical solution to achieve the following goals:

• Customers to be able to install different payment applications on a single NFC storage device in a mobile phone to transact with other

NFC-supported contactless readers in the market

• Payment service providers to have a uniform way of provisioning the NFC mobile payment

applications to their consumers, regardless of the mobile network operators their consumers use

• Mobile network operators to provide a common interface for different payment service providers and other applications providers to provision new applications and services to their consumers.

In addition, the HKMA believes that the design of an interoperable NFC mobile payment infrastructure needs to adhere to the following broad principles to allow the above mentioned benefits to be achieved:

• Portability – the model shall allow consumers to switch from one mobile network operator to another without any impact on the types and numbers of NFC mobile payment applications that can be carried on their mobile phones

• Open standard and open platform – the NFC mobile payment infrastructure shall be accessible by all payment service providers and mobile network operators, and shall not preclude any parties from joining it. The platform shall be developed and operated in open standards for participants to find it convenient to use

• Interoperability – over-the-air provisioning of NFC mobile payment infrastructure potentially deployed by different mobile network operators shall be interoperable with each other, whether it is achieved by having a common interface between the infrastructure operated by different parties or developing a common platform to connect each of them

• Flexibility and scalability – the NFC mobile payment infrastructure shall accommodate evolving technological, industry and consumer requirements. It shall be easily scaled and upgraded to support additional players, new form factors and new requirements

• Security and reliability – adequate controls shall be put in place to prevent malicious attacks and unauthorised access to the NFC mobile payment infrastructure and any relevant system components that are interfaced with the infrastructure.

Possible NFC mobile payment infrastructure

The study will recommend the preferable design of the NFC mobile payment infrastructure in Hong Kong taking into consideration the technical feasibility and business viability. The recommendations will include, among other things, the optimal number of the NFC mobile payment infrastructure in Hong Kong:

• if a single NFC mobile payment infrastructure is recommended, how to ensure that it provides a level-playing field for all relevant stakeholders

• if more than one NFC mobile payment

infrastructure is recommended or if more than one will exist in the market, how to ensure that they are interoperable with each other, and the feasibility to develop a common platform or interface for connection with multiple NFC mobile payment infrastructures that are operated by different parties.

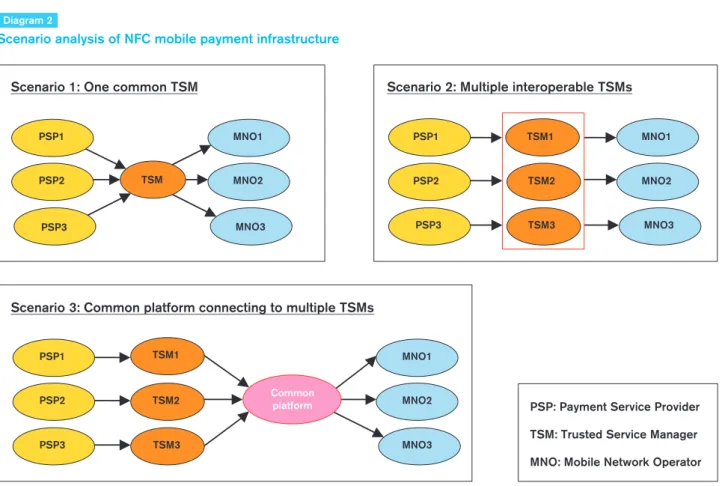

Diagram 2 elaborates on different scenarios.

Current progress

The consultancy firm appointed by the HKMA in July 2012 is tasked to complete the study and make a recommendation at the end of this year or early in 2013. It will interview stakeholders, including banks, card scheme operators, non-bank payment service providers, mobile network operators and handset manufacturers. The HKMA will consult the banking industry and relevant stakeholders on the next steps taking into account the recommendation of the final consultancy report.

Looking ahead

NFC technology facilitates mobile payment services, as well as non-payment services. While the study focuses primarily on the mobile payment functionality, it will also take into account the need to

accommodate non-payment services within the same infrastructure. Our strategy is to launch the mobile payment services first while non-payment services will be considered at the next stage.

Diagram 2

Scenario analysis of NFC mobile payment infrastructure

PSP2

MNO1

MNO2

MNO3

Scenario 1: One common TSM

TSM1 PSP1

PSP2

PSP3

MNO1

MNO2

MNO3

Scenario 2: Multiple interoperable TSMs

TSM2

TSM3

MNO1

MNO2

Scenario 3: Common platform connecting to multiple TSMs

PSP3 PSP1

TSM

PSP1

PSP2

TSM1

TSM2 Common

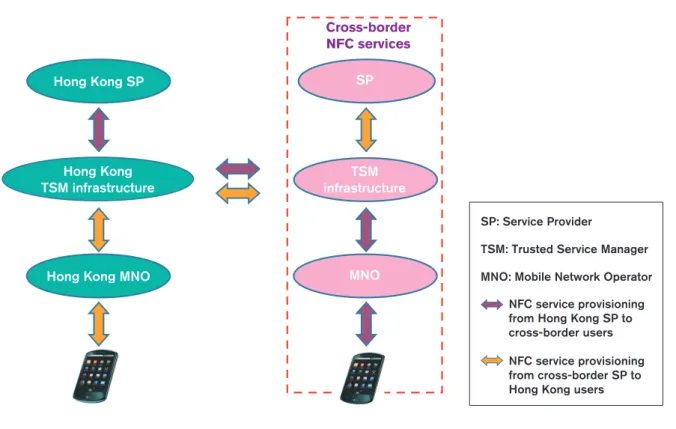

Cross-border NFC Infrastructure

Given the growing cross-border economic activities taking place daily in Hong Kong, it is anticipated the demand for cross-border NFC mobile services will increase, such as cross-border retail payments. It will be essential for Hong Kong’s NFC mobile

infrastructure to be interoperable with other

economies’ NFC infrastructures, particularly Mainland China, to enable users in Hong Kong to access other economies’ NFC services and vice versa.

Diagram 3 illustrates the concept of a cross-border NFC infrastructure that will enable Hong Kong service providers provisioning NFC services to cross-border customers, while non-local service providers can provide NFC services to Hong Kong users. Our study will ensure that the recommended

infrastructure complies with the international

standards and is able to interface with other markets’

NFC mobile infrastructures adopting the same standards.

Hong Kong is renowned for its widespread use of electronic payment systems and services in everyday life, and we must grasp the next wave of

opportunities offered by NFC technology. As part of the HKMA’s mission to maintain Hong Kong as an efficient and convenient digital city, we aim to facilitate the early development of NFC mobile payment services in Hong Kong for the convenience of all. The ease and efficiency of making payments, especially cross-border payments, are also

conducive to reinforcing Hong Kong’s position as an international financial centre and payment hub.

Diagram 3

Cross-border NFC infrastructure

Hong Kong TSM infrastructure

SP

Hong Kong MNO MNO

TSM infrastructure

Cross-border NFC services Hong Kong SP

NFC service provisioning from Hong Kong SP to cross-border users NFC service provisioning from cross-border SP to Hong Kong users SP: Service Provider

TSM: Trusted Service Manager MNO: Mobile Network Operator

With the help of an NFC-enabled mobile phone, your daily life can be so easy in future without the need to bother about your wallet, coins and notes, debit and credit cards, keys, business cards, boarding passes, theatre tickets and transit tickets. Also, imagine what it would be like if you could establish connections with a simple touch or transfer information from one device to another, just by holding the devices close to one another.

All these ideas can become reality under NFC technology.

The concept of using mobile phones to make payments in a secure and convenient manner is emerging around the world and considered to be the next logical step in the development of mobile applications and payment services. Given the extensive use of mobile phones nowadays, consumers can easily benefit from the ease and convenience of this innovative “tap-and-go”

payment channel.

For instance, if you want a “hassle-free” business or leisure trip, say to Shanghai and Beijing, the first thing you need to do before leaving home is to check your NFC-enabled mobile phone to make sure that:

• e-payment instruments are sufficiently topped up or available, including e-purses for both the renminbi and Hong Kong dollar, e-credit cards and/or e-debit cards

• required e-documents and e-tickets have been properly provisioned over-the-air to your mobile phone such as e-boarding passes, e-tickets of high speed train, e-theatre tickets and

electronic hotel key in order to save check-in and queuing time

• e-business cards are stored in your phone

• e-coupons are downloaded or provisioned to your phone for shopping.

You basically can leave your wallet, coins and notes home when setting off to the airport.

BOX 1

Benefits of NFC service to the general public

This project is a good example to demonstrate the value of NFC technology to the general public in France and was launched in Nice at the beginning of 2010. The NFC mobile services are jointly provided by four mobile network operators, three banks and one transport operator.4 The project offers multiple services including:

• Payments – consumers who purchase an NFC-enabled phone will be able to make payments at any merchants equipped to handle contactless payments

• Transport – purchase of transport tickets and access to real-time travel information for all services at each bus and tram departure point in the Nice region through 1,500 NFC and 2D barcode-enabled information points being installed across the local transport network.

These information points will also allow access to certain services provided by the City Council, events listings and the latest news articles from Nice Matin, the region’s daily newspaper

• Information services – apart from travel services, additional information services will be available, including an NFC tag-based tour of the old city of Nice

• Loyalty points – consumers will be able to collect loyalty points automatically when they use their NFC-enabled phone to make a purchase.

The project is named “Cityzi” by the Association Française du Sans Contact Mobile (AFSCM) and promoted in various cities in France. Different Cityzi logos have been defined to identify the devices, the environment and the tags that support the NFC services. By the first half of 2012, more than one million Cityzi mobile phones had been sold in France.5

BOX 2

A case study on the NFC project in France

4 Source: Gemalto. 5 See AFSCM press release “NFC mobile phones: More than

a million people in France have Cityzi mobile phones!”

issued on 21 June 2012.