93

Controlling Shareholders and Earnings Informativeness: Evidence from

Taiwan

Jei-FangLewa,*, Shing-Jen Wub a

Department of Accounting, National Kaohsiung University of Applied Sciences, Taiwan

b

Department of Accounting, Soochow University, Taiwan

Received 10 December 2010; Received in revised form 5 October 2011; Accepted 30 March 2012

Abstract

Taiwanese listed corporations, characterized by a high degree of separation between control rights and cash flow rights, are empirically studied in this research. This study investigates how the separation of cash flow rights from board seat control rights, as distinct from voting rights, affects the informativeness of earnings, as measured by the relationship between returns and earnings. This study extends the extant research by investigating the extent to which the level of disparity between these two rights affects the magnitude of earnings informativeness. Based on an empirical sample of Taiwanese listed corporations, the results indicate that earnings are generally less informative when there is a divergence between board seat control rights and cash flow rights.

Keywords: Earnings informativeness, ownership structure, board seat control rights

1. Introduction*

Ownership concentration and ineffective corporate governance were two factors that contributed to the Asian financial crisis in 1997 (hereafter referred to as the Crisis) (Prowse, 1998). In particular, areas of concern included concentrated ownership, the dominance of controlling shareholders, separation of control rights and cash flow rights, and the limited protection of minority rights. These problems were particularly acute in countries negatively affected by the Crisis (Claessens et al., 2000). Since the Crisis, there has been increasing investor demand requesting corporate governance reforms in emerging markets (Johnson et al., 2000; Gibson, 2003). Taiwan provides an ideal setting for examining the effectiveness of corporate governance due to the high ownership concentration, weak legal protection for shareholders, deficient law enforcement, and the abundance of family controlled firms (La Porta et al., 1999; Lemmon and Lins, 2003).

However, according to Claessens et al. (2002), regarding their opinion in the Journal of Finance, 2002, the empirical data for Asian countries including Hong Kong, Indonesia, and South Korea all suggested that the divergence of ownership and control rights had a negative correlation with firm value, but this trend was not as evident in the empirical results on Taiwan. Moreover, the level of divergence demonstrated by Taiwanese corporations was generally lower than that shown by corporations in Singapore, Japan, and Indonesia.

*Corresponding author. Email: jeifang_lew@hotmail.com **DOI: 10.6126/APMR.2013.18.1.06

94 They stated:

Results by Economy

We also study the relationship between firm valuation and ownership and control in the hands of the largest shareholder at the economy level, … Singapore and Taiwan show a negative relationship between rights and firm valuation, but the relationship is statistically

significant only in Singapore. (p.2761)

~ Claessens, Djankov, Fan, and Lang ~ Journal of Finance, 2002

We believe that by adopting voting control rights, Claessens et al. (2002) underestimated the divergence of ownership and control rights in Taiwanese corporations, which in Taiwan may lead to the underestimation of agency problems ultimately caused by the controlling shareholders’ control rights.

The existence of differing ownership structures results in different types of agency problems. Given the different ownership context when analyzing East Asian corporations in general, the results of prior researches may not be directly applicable to Taiwanese corporations. Due to the complicated pyramidal and cross-holding ownership structures typically evident in many Taiwanese listed corporations, a significant number of controlling shareholders in Taiwan possess greater control than their equity ownership indicates, thus worsening the entrenchment effect. We included an example of the computation of board seat control rights as opposed to voting control rights (refer to the Supplementary Figure) using the Koo family’s holding to demonstrate how an analysis of traditional voting control rights will underestimate the deviation in control rights of Taiwanese concentrated ownership structures. It is important for policy makers and regulators to understand the connection between the concentrated ownership structure in Taiwan and the incentives for firms to reduce the quality of accounting information.

Therefore, in contrast to the previous literature, which used the voting rights of controlling shareholders to define control, this research introduces board seat control rights, which are more appropriate, as a new measure of control. Specifically, this research examines how the divergence of control rights and cash flow rights affects the informativeness of accounting earnings, as measured by the return-earnings relationship. We define informativeness to mean the slope coefficient between returns to earnings, as obtained from regressions of returns on earnings, measured annually. The differences in the slope coefficients are interpreted as evidence of differences in the credibility or quality of accounting information associated with the level of divergence.

In this research, the analyses develop upon the prior research which has examined factors affecting the credibility of earnings as captured by the coefficient relating to earnings (Teoh and Wong, 1993; Imhoff and Lobo, 1992; Warfield et al., 1995; Subramanyam and Wild, 1996; Fan and Wong, 2002; Yeo et.al., 2002). Teoh and Wong (1993) found a positive relationship between the credibility of accounting information and informativeness, measured as the coefficient relating return to earnings. Furthermore, Fan and Wong (2002) predicted that the credibility-reducing effects of entrenchment are increasing, corresponding to the degree of divergence between voting rights and cash flow rights.

As the separation of control and ownership (cash flow rights) becomes gradually entrenched in Taiwanese corporations, the ownership structure’s entrenchment effect may potentially affect a firm’s financial reporting. Furthermore, when control rights and cash flow rights diverge, the agency problem between controlling shareholders and minority shareholders becomes more severe.

This paper focuses on the relationship between ownership structure and the quality of accounting information in Taiwan. Using 4,594 firm-year observations of Taiwanese listed corporations over the period 2000 to 2009 as the basis for empirical sampling, it is expected

95

that the empirical findings generated extend the extant research. The empirical results indicate that earnings informativeness is significantly negatively related to the degree of divergence between the ultimate owner’s seats control and the equity ownership level. In addition, we also investigated whether a certain type of owner – i.e. family-owned or controlled, mutual management, professional manager, and government – were able to influence the results. We found that the earnings coefficient from a regression of return on earnings is negatively related to the two sub-samples of family-owned and manager groups.

The primary contribution of this paper is the empirical testing of the new measure of board seat control rights, from which we are able to draw strong evidence as follows. On the magnitude of the effects, it is demonstrated that the earnings of the firms are about 20.18% to 29.57% less informative based on annual regressions and about 10.17% to 31.06% less informative based on pooled regressions than studies which have only considered traditional voting rights, comparing our results with those obtained in Claessens et al. (2002). This demonstrates that there is effectively an underestimation in the deviation of control rights and cash flow rights in Taiwanese listed corporations, thus contributing to the agency problem in the ownership structure of Taiwanese corporations. Therefore, whilst our findings concurred with the previous research by Fan and Wong (2002), which suggested the deviation of control rights and cash flow rights will result in an decrease in earnings informativeness, the emphasis of this research is on the finding that an underestimation of control rights will subsequently result in an underestimation of its tangible economic effect, and thus indirectly influences investors’ assessment on the magnitude of the controlling shareholder’s agency problem. Regulator can also consider the findings from this empirical research, which suggests that in order to improve the corporate governance mechanisms to protect investors and minority shareholders, regulator should monitor and control the excess board seat control rights that controlling shareholders exercise, rather than merely assessing the impact of their actual voting rights. When conducting an audit, an auditor must heed particular attention to identify whether a firm with serious controlling shareholder agency problem has infringed on the rights of its minority shareholders through the manipulation of its financial data.

The remaining sections of this paper are organized as follows. Section 2 provides a detailed description of the motivation and provides a review of the related literature behind the development of the hypotheses. Section 3 discusses sample selection and develops the empirical models, while section 4 presents the empirical results. Robustness checks are demonstrated in section 5. Finally, section 6 concludes the paper.

2. Literature review and hypothesis development

2.1 Ownership structures in Taiwan

Developments in the methodology of the ultimate owner’s identification through the tracing of control chains (La Porta et al., 1999) have resulting in new research opportunities for examining the differences in ownership structures in different global markets, as well as the mechanisms employed by majority shareholders in enhancing their control rights over ownership rights. This approach defines an ultimate owner as the largest controlling shareholder that has both capital and voting rights in a corporation through any combination of direct and indirect holdings (Claessens et al., 2000; Faccio and Lang, 2002). The concentrated level of control is achieved through complicated ownership arrangements, i.e., stock pyramids, cross-holdings and board seat control rights. The ultimate owner can effectively control a company with a relatively small share of invested capital, creating a separation in control and ownership.

Claessens et al. (2000) reported the average cash flow rights owned by the ultimate owner in Taiwanese listed companies as approximately 16% and the average cash flow rights over

96

voting rights to be 83.2%. However, Yeh et al. (2003) argued that Claessens et al. (2000) underestimated the control rights and cash flow rights of controlling shareholders and the proportion of family-controlled companies in Taiwan due to inadequate disclosure of the ultimate ownership structure of companies (see Supplementary Table). In Taiwan, it is common practice for controlling shareholders to enhance their control through external means by board representation (e.g. public solicitation of proxies or by holding shares on behalf of friends and family members), and to have actual seat control rights. This is also why traditional voting rights are unable to correctly measure the degree of controlling shareholder’s controlling rights.

We use the Koo family’s control rights and cash flow rights on the China Development Financial Corp. (hereafter, CDFH) as an example (refer to the Supplementary Figure). The well-known Koo family’s Chinatrust Group is an integrated financial group in the financial services industry, and is also involved in petrochemical, construction, and security investment industries. In 2006, the Koo family enterprise included the China Development Financial Holding Corp, KGI Securities Corp, China Life Securities, China Development Industry Bank, Grand Pacific Petrochemical Corp (hereafter, GPPC) and many other unlisted enterprises.

In 2006, from the structure chart, we can see that the Koo family did not hold any shares of CDFH in the name of individuals, rather, holding CDFH’s 2.85%, 2.93% and 0.01% through KGI Securities, China Life and GPPC respectively. They also held 7.7% of CDFH through other organizations and investment firms which it held or controlled. According to La Porta et al.’s (1999) approach, through tracing the combination of direct and indirect holdings, the Koo family’s voting control rights on CDFH is 13.49%. However, the Koo family has greater actual board seat control rights on CDFH, which is 29.16%, when they enhance their control by holding shares on behalf of friends and family members or through public solicitation of proxies, without including seats held by government-owned shares. The 15.67% increase to actual seat control for the Koo family on the board, when compared to traditional control rights, is enhanced via proxy contests or by holding shares on behalf of friends and family members. As such, this research introduces board seat control rights as a new measure of control instead of voting rights, as used by the previous literature.

2.2 Ownership structure and earnings informativeness

Public corporations in East Asia typically have low levels of transparency and disclosure quality. The prevalence of concentrated ownership in East Asian companies has led to the belief that controlling shareholders have opportunistic incentives to take advantage of weak domestic legal systems and ineffective corporate governance mechanisms to increase their own wealth at the expense of minority shareholders (Shleifer and Vishny, 1997; La Porta et al., 1999; Johnson et al., 2000; Claessens et al., 2000). The strategic use of pyramidal, cross-holding ownership structures and board seat control rights exacerbates the problem as it results in a divergence between control rights and cash flow rights, which are most pronounced in family-owned or controlled firms. Additionally, the managers of East Asian corporations are usually related to the family of the controlling shareholder. Thus, it is possible to analyze the relative importance of the incentive alignment and entrenchment effects in East Asian corporations as their ownership is highly concentrated and the divergence between cash-flow rights and control rights is large, while manager-owner conflicts are generally limited. In short, when the controlling owner is entrenched by their voting power, the negative entrenchment effect therefore leads to greater opportunistic incentives to expropriate property from minority shareholders and thus, the credibility of the accounting information is subsequently reduced.

The effects of ownership structure on earnings informativeness: the incentive alignment effect versus entrenchment effect.

97

The complexity of the corporate relationship leads to information asymmetry, making it difficult for dispersed stockholder groups to monitor a manager’s performance where control is separated from ownership (Jensen and Meckling, 1976). The reduced credibility of earnings reports lowers stock price informativeness. Prior studies have noted the importance of credibility in affecting earnings.

From an incentive alignment perspective, large shareholders have strong incentives to maximize their firm’s value and are able to collect information and oversee managers or even to oust them through a proxy fight or a takeover, and so can help overcome one of the principal-agent problems in the modern corporation that of conflicts of interest between shareholders and managers (Jensen and Meckling, 1976; Shleifer and Vishny, 1997).

However, earnings credibility is weakened as minority shareholders anticipate that the ownership structure provides the controlling owners with both the ability and incentive to manipulate earnings for outright expropriation, or to report uninformative earnings to avoid detection of their expropriation activities.

On the other hand, from an entrenchment effect perspective, Morck et al. (1988) found an inverse U-shaped relationship between managerial equity ownership and firm valuation for a sample of U.S. firms. In the research, it was found that after a certain point, the manager would become entrenched and would pursue private benefits at the expense of outside investors (Jensen and Ruback, 1983). In addition, the majority of large shareholders (controlling shareholders) tend to increase their influence and controlling power over the company decisions by active participation in management, such as by appointing their family members as the manager, or by controlling board seats (Yeh, 2005). In Taiwan, supervisors are also deemed as an organization equal power to the board of directors. Therefore, the supervisors have no actual rights to inspect or question the decisions of the directors. Even if they can request for managers or directors to deal with any issues or queries they have, the managers or directors will still have overriding influence as compared with the supervisors. Yeh and Woidtke (2005) pointed out that controlling shareholders in Taiwanese organizations are able to appoint family members to monitor both the board of directors and the supervisors, such that they have greater controlling power. In this way, they have the opportunity to influence management decisions through utilizing the power and rights that the directors have, while at the same time rationalizing the decisions they make through the role of the supervisors, thereby concealing their potential opportunistic behaviors. Thus, they have the incentive to increase the opacity of financial information.

This paper focuses on the relationship between the core agency problems arising from controlling shareholders and the quality of accounting information in Taiwan. In this research, the informativeness of accounting earnings to investors is used as a measure of the quality of accounting information. The ownership structure shapes the firm’s core agency problems through the entrenchment effect of controlling owners, which leads to our hypothesis pertaining to the relationship between ownership structure and earnings informativeness.

In summary, by concentrating their ownership, firms are given the opportunity to limit their information disclosure to the public, which in turn reduces corporate transparency. The entrenchment effect suggests that high ownership concentration is associated with lower earnings informativeness. Therefore, in a business environment where concentrated ownership exists, it is in the controlling owner’s interests to minimize the disclosure of accounting information to the public, which suggests that a large divergence between control rights and cash flow rights is associated with low earnings informativeness. In order to measure the corporate governance mechanism, this paper predicts that the higher the ratio of board seat control rights to cash flow rights, the higher the tendency for the controlling shareholder to reduce the credibility of accounting information.

98

H: Earnings informativeness decreases with the increasing deviation of controlling shareholder’s control rights from their cash-flow rights.

3. Research design

3.1 Sample and data

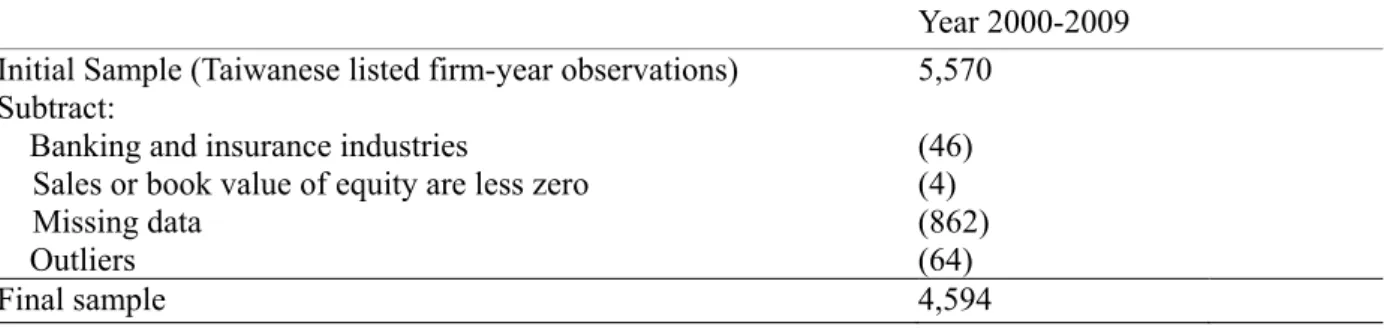

The financial market returns and corporate governance data (including board seat control rights and cash flow rights) used in this paper are retrieved from the Taiwan Economic Journal (TEJ) Database. Panel A of Table 1 describes the details of the sample selection process. First, we gathered 5,570 listed firm-year observations from 2000 to 2009 available in the TEJ Database. We then removed 46 observations of firms from financial and insurance industries for their unique industry characteristics. We also excluded 4 observations with negative sales or book values of equity since they were likely to be in financial distress, and eliminated 862 observations with missing values in either financial or governance variables. Finally, we deleted 64 observations which are regarded as outliers with R-student statistic are larger than three in the regression analysis. Panel B of Table 1 summarizes the final sample’s industry composition. The sample consists of 640 publicly listed Taiwan corporations and 4,594 firm-year observations over the time spanning 2000-2009 and includes firms that have sufficient data on ownership, stock returns, EPS, common stock dividends, and other financial data for empirical analysis.

99

Table 1. Sample selection and distribution Panel A: Sample selection procedure

Year 2000-2009 Initial Sample (Taiwanese listed firm-year observations) 5,570

(46) (4) (862) (64) Subtract:

Banking and insurance industries

Sales or book value of equity are less zero Missing data

Outliers

Final sample 4,594

Panel B: Sample distribution by year and industry

Industry 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Number PercentTotal 11 Cement 6 6 6 6 6 7 7 7 7 7 65 1.41 12 Food 9 9 11 14 14 15 20 20 20 19 151 3.29 13 Plastics 14 16 15 16 16 19 20 21 21 21 179 3.90 14 Textiles 18 20 24 25 26 27 39 41 38 36 294 6.40 15 Electric and machinery 11 10 16 17 23 24 32 32 33 31 229 4.98 16 Electrical appliance and cable 7 7 7 7 7 8 12 12 12 12 91 1.98 17 Chemical 12 13 14 19 21 23 27 29 30 33 221 4.81

18 Glass and ceramics 3 3 3 3 4 4 4 4 4 3 35 0.76

19 Paper and pulp 5 5 4 4 5 6 7 7 7 7 57 1.24

20 Steel and iron 10 8 9 11 12 15 22 22 21 20 150 3.27

21 Rubber 6 7 7 8 8 8 9 10 9 10 82 1.78 22 Automobile 2 4 4 4 4 5 5 5 5 4 42 0.91 23 Electronics 98 133 167 192 219 236 285 301 313 304 2248 48.93 25 Construction 12 12 18 11 19 22 30 31 30 30 215 4.68 26 Transportation 10 11 11 12 14 14 16 17 17 17 139 3.03 27 Tourism 2 2 2 2 2 2 3 4 4 4 27 0.59 29 Department stores 6 7 8 9 9 9 9 8 9 9 83 1.81 99 Other 21 24 26 27 27 31 32 32 33 33 286 6.23 Total 252 297 352 387 436 475 579 603 613 600 4594 100% 3.2 Variables definition

3.2.1 Definition of the critical deviation variable and control variables Board seats control rights

This research identifies the critical issues regarding the measurement of control which are specific to the corporate governance of Taiwanese companies, being board seat control rights, the ratio of board members controlled by the ultimate owners to board size, as distinct from voting rights. This contrasts with the previous literature, which uses the voting rights of controlling shareholders to define control rights.

Voting rights measure the control right on firm’s decisions. As referred to by La Porta et al. (1999), the voting right computes the minimum in each “control chain” of the ownership structure, and the voting right is the sum of the minimum ownership. The reason for tracing

100

the minimum ownership for each “control chain” is to determine the lowest voting right that the controlling shareholder possesses.

Due to the controlling shareholder’s control of the company through their seats on the board, there are three methods for exerting control: (1) Controlling shareholders and their family members undertake to be board members on their own behalf; (2) Invest as publicly listed or non-listed companies or investment companies, and undertake board activities through corporate identities; (3) Managers of related enterprises undertake to be board members as the legal person of associated enterprises. The ratio of controlling shareholder seats and total board seats can be calculated below:

Seats Board Total Seats Board Manager Companies Associated Seats Board Total Seats Board al Insitution Seats Board Total Seats Board Individual Right Control Seat '

Cash flow rights

The cash flow right is the right of the shareholder to receive distributed earnings of the firm. This study follows Claessens et al. (2000) research in determining the cash flow right of the controlling shareholder and uses cross-ownership to determine the cash flow right in the family group. This paper references the method of Claessens et al.’s (2000) cash flow right to summarize the multiplication of ownership on each control chain.

Cash Flow RightDirect Ownership of Ultimate Controller Multiplication of ownerships on each control chain

3.2.2 Control variables

In investigating the relationship between informativeness and ownership, we include four factors that may potentially influence informativeness in the empirical models as control variables to enhance the reliability of inferences from the empirical analyses of ownership structures, i.e., firm size, growth opportunities, incidence of loss, and leverage.

Firm size

The securities price may differ systematically between large and small firms due to differential incentives for information search. If search activities are concentrated on large firms and are successful, security prices reflect more precise estimates of large firm’s earnings than small firm’s earnings. Chaney and Jeter (1992) found that the coefficient increases with firm size.

However, the differential information hypothesis also implies that the magnitude of the abnormal returns related to the current year’s earnings is a decreasing function of firm size. This is because larger companies typically release more private development of non-earnings information than small companies, making the earnings announcements relatively more informative for small companies (Atiase, 1985). However, Freeman (1987) found the coefficient to be negatively related to firm size. Therefore, the inclusion of firm size is motivated by its implications for the determination of accounting information.

Growth opportunities

Growth firms have more intangible assets, and their valuation depends heavily on future profitability. Growth opportunities are likely to be positively associated with future earnings levels and/or earnings persistence (Collins and Kothari, 1989). A firm’s growth and/or investment opportunities are reflected in the book-to-market ratio, based on Collins and Kothari’s (1989) finding that the market-to-book ratio is positively associated with earnings informativeness. On the other hand, Claessens et al. (2002) suggested that the book-to-market

101

ratio is negatively related to the separation between cash flow rights and voting rights; that is, the greater the separation between cash flow rights and voting rights, the greater the market value discount. Thus, the fact that high growth firms are potentially more risky weakens the relationship between return and earnings.

Loss incidence

We include the variable of loss incidence as this is associated with the magnitude of the coefficient relating returns to earnings. Specifically, Hayn (1995) found that the coefficient is smaller for loss observations than for profit observations.

Leverage

Fan and Wong (2002)’s argument is that, from the risk perspective, highly leveraged firms are associated with high risk and hence their earnings-return relationship is weakened. Dhaliwal et al. (1991) also documented that the coefficient relating earnings to returns is decreasing in situations of financial leverage. On the other hand, with respect to growth opportunities, highly leveraged firms with low growth opportunities are likely to have informative earnings. We also incorporate leverage in the regression to empirically examine the net effect.

3.3 Empirical models

Outside investors give less attention to the reported accounting figures as they expect the controlling shareholder to report accounting information out of self-interest, rather than as a reflection of the firm’s true underlying economic transactions. In particular, outside investors may place little trust on the firm’s reported earnings as the controlling owner may manipulate earnings for the outright expropriation of the property of minority shareholders. The loss of credibility in earnings reports lowers the stock price informativeness of earnings.

The first test we conducted tests whether the informativeness of earnings is conditional on the divergence of board seat control rights from cash flow rights. This test examines whether the cross-sectional variation in the earnings coefficient (the slope coefficient from a regression of returns on earnings) is conditional on the divergence between these two rights. To test for differential informativeness of earnings (as reflected in the earnings coefficient) conditional on ownership structure, the following pooled regressions are formulated, with a divergence of board seat control rights from cash flow rights interaction term:

4 , 0 1 , 2 , , , , , 1 ( ) k i t i t i t i t k i t i t i t k

R Earn Earn DEV Earn X Year and industry indicators

(1)

where,

Ri,t = firm i’s cumulative 12-month raw stock return until four months after the end of fiscal year t

Earni,t = firm i’s earnings per share (excluding extraordinary items) for fiscal year t

DEVi,t = the ratio of board seat control rights over cash flow rights of the largest ultimate owner of firm i for fiscal year t

, k i t

X = vector of control variables, k=1-4

k=1 (Sizei,t) = size of the firm, natural logarithm of firm i’s net worth at the end of fiscal

year t-1

k=2 (Growthi,t) = M/B ratio computed as the market value of equity/book value of equity

k=3 (Lossi,t) = 1 if Earni,tless than zero, and 0 otherwise

102

Following Easton and Harris (1991), this research investigates the tests for both the level of and change in earnings. In order to enhance the reliability of inferences from the empirical analyses of ownership structure, four additional factors, firm size (Size), growth opportunities (Growth), loss incidence (Loss), and leverage (Lev), are included as control variables in the pooled regressions. , 0 1 , 2 , , 3 , 4 , , 4 4 , , , , , 1 1 ( ) i t i t i t i t i t i t i t k k k i t i t k i t i t i t k k

R Earn Earn DEV Earn Earn DEV

Earn X Earn X Year and industry indicators

(2) where, t i Earn, = the change in Earni,t between year t-1 and t

* Definitions of the remaining variables in Model (2) are the same as in Model (1).

There is an expectation that the credibility of a firm’s accounting information and consequently its informativeness to outside investors decreases with a increase in the degree to which the level of board seat control rights exceeds the associated level of cash flow rights. Therefore, this research assumes that an increase in the degree of divergence between the controlling owner’s board seat control rights and cash flow rights decreases the informativeness of firm earnings. For Model (2), if 24 <0, this implies that there exists less earnings informativeness.

4. Empirical results

4.1 Descriptive statistics

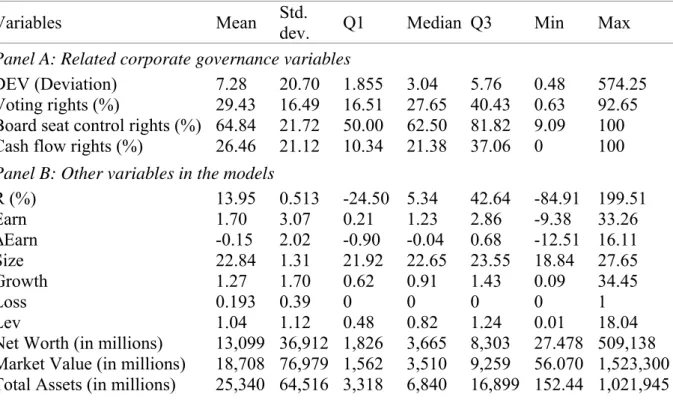

Table 2, Panel A, presents the descriptive statistics of voting rights, board seat control rights, and cash flow rights of the largest ultimate owners of the final sample of corporations. The calculated multiple of board seat control rights over cash flow rights is the main measure of the degree of divergence between the two rights, of which the deviation has a mean (median) of 7.28 (3.04). The average deviation in degrees between board seat control rights and cash flow rights is 7.28, which suggests that the ultimate owners receives approximately 7.28 units of controlling power for every one unit of capital input.

Panel A shows that firms have a mean (median) of 64.84% (62.50%) for board seat control rights, compared to a mean (median) of 29.43% (27.65%) for voting rights. Notably, the number of board seat control rights is 2.14 (64.84/29.43) times the number of voting rights in Taiwanese companies. This provides evidence of the underestimation of voting rights used. Panel B shows the mean (median) value of selected financial variables. The mean (median) annual stock return is 13.95% (5.34%), while the mean (median) of Earn is $1.70 ($1.23). The firms in the sample have a mean (median) of $25,340 ($6,840) million, and $13,099 ($3,665) million in total assets, and net worth, respective.

103

Table 2. Descriptive statistics (640 firms, 4594 firm-year observations)

Variables Mean Std.

dev. Q1 Median Q3 Min Max

Panel A: Related corporate governance variables

DEV (Deviation) 7.28 20.70 1.855 3.04 5.76 0.48 574.25

Voting rights (%) 29.43 16.49 16.51 27.65 40.43 0.63 92.65

Board seat control rights (%) 64.84 21.72 50.00 62.50 81.82 9.09 100

Cash flow rights (%) 26.46 21.12 10.34 21.38 37.06 0 100

Panel B: Other variables in the models

R (%) 13.95 0.513 -24.50 5.34 42.64 -84.91 199.51 Earn 1.70 3.07 0.21 1.23 2.86 -9.38 33.26 ∆Earn -0.15 2.02 -0.90 -0.04 0.68 -12.51 16.11 Size 22.84 1.31 21.92 22.65 23.55 18.84 27.65 Growth 1.27 1.70 0.62 0.91 1.43 0.09 34.45 Loss 0.193 0.39 0 0 0 0 1 Lev 1.04 1.12 0.48 0.82 1.24 0.01 18.04

Net Worth (in millions) 13,099 36,912 1,826 3,665 8,303 27.478 509,138 Market Value (in millions) 18,708 76,979 1,562 3,510 9,259 56.070 1,523,300 Total Assets (in millions) 25,340 64,516 3,318 6,840 16,899 152.44 1,021,945 Notes: Variable definitions: DEV is the calculated multiple of board seat control rights over cash flow rights.

Voting rights is the procedure of identifying ultimate owners used in La Porta et al. (1999). Board seat control rights are the ratio of board members controlled by the ultimate owners to board size. Cash flow rights are the cash flow right held by the controlling shareholder. R is measured by the cumulative 12-month raw stock return until four 12-months after the end of fiscal year t. Earn is earning per share (before extraordinary items) for fiscal year t. ∆Earn is the change in Earn. Size is the size of firm which is measured as natural log of total assets at the end of year t-1. Growth is M/B ratio computed as the market value of equity/book value of equity. Loss is loss incidence which equals 1 if firm’s earnings before extraordinary items are less than 0, and 0 otherwise. Lev is measured as total liability divided by total equity at the end of year t.

4.2 Explanatory power of earnings conditional on divergence of board seat control rights and cash flow rights

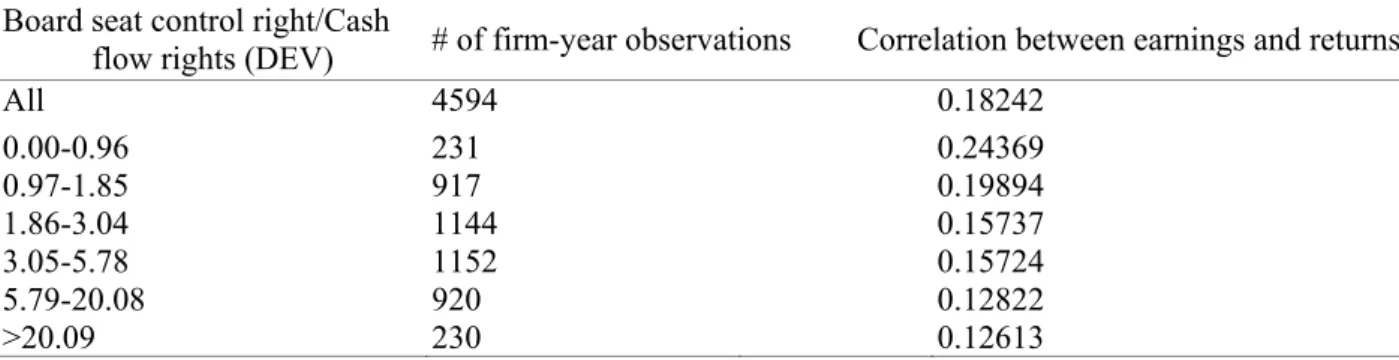

Our hypothesis predicts that the informativeness of earnings is negatively related to the divergence of board seat control rights from cash flow rights. One measure of the informativeness of earnings is the explanatory power of returns. Table 3 presents the evidence from our investigation. The regression is performed range by range over 4,594 firm-year observations and the estimated coefficient of earnings (Earn) is both positive and statistically significant at the 1% statistical level across all the observations, suggesting that earnings have an informative role in the sample used in this study.

104

Table 3. Relationship between earnings and returns dependent on the level of divergence between board seat control rights and cash flow rights

Board seat control right/Cash

flow rights (DEV) # of firm-year observations Correlation between earnings and returns

All 4594 0.18242 0.00-0.96 231 0.24369 0.97-1.85 917 0.19894 1.86-3.04 1144 0.15737 3.05-5.78 1152 0.15724 5.79-20.08 920 0.12822 >20.09 230 0.12613

Notes: 1. All correlations (Pearson) between annual accounting earnings per share (Earn) and stock returns (R), and the earnings coefficients from the regression of stock returns on accounting earnings per share, are significant at the 0.001 level or better.

2. The six divergence groups are categorized according to the percentile of 5%, 25%, 50%, 75% and 95% of DEV distribution.

The correlation between earnings and return is positive (0.18242) and significantly greater than zero at the 1% level or better. Specifically, the correlations range from a low 0.12613 for the ratio above 20.09 for divergence between board seat control rights and cash flow rights, to a high 0.24369 for the ratio 0-0.96 for the separation between these two rights. The more serious the divergence is, the smaller the correlation coefficient of earnings and share price. This finding suggests the divergence between board seat control rights and cash flow rights as one of the determinants of earnings informativeness. However, the divergence between control rights and cash flow rights has a negative impact on the informativeness of earnings. This research will examine whether the control of other variables will affect earnings informativeness by using a regression model, which will be used as the inference for the final empirical results.

Table 4 provides the Pearson correlation matrix for the dependent variable and explanatory variables. From Table 4, based on the univariate analysis, we find that both Earn and ∆Earn have positive correlations with cumulative raw returns (R), and when the divergence between control rights and cash flow rights (DEV) increases, the cumulative raw return (R) decreases. In addition, we found that the correlation coefficient between each explanatory variable is smaller than 0.6, and VIFs are all less than 10 (refer to Table 5 and Table 6). This indicates that the multicollinearity between variables is not significant, and consequently the following regression analysis will not cause incorrect coefficient estimation and affect the assumption of empirical results due to the serious multicollinearity between explanatory variables.

Table 4. Pearson correlation analysis

Variables 1 2 3 4 5 6 7 8 1. R 2. Earn 0.173*** 3. ∆Earn 0.345*** 0.273*** 4. DEV -0.046*** -0.010 -0.010 5. Size 0.018 0.149*** -0.009 0.200*** 6. Growth 0.053*** 0.079*** 0.016 0.057*** -0.045*** 7. Loss -0.178*** -0.530*** -0.241*** 0.033** -0.062*** 0.093*** 8. Lev -0.025* -0.205*** -0.002 -0.003 0.182*** 0.209*** 0.220***

Notes: 1. Variables are defined as in Table 2 (footnotes).

105

4.3 Explanatory power of earnings conditional on ownership structure

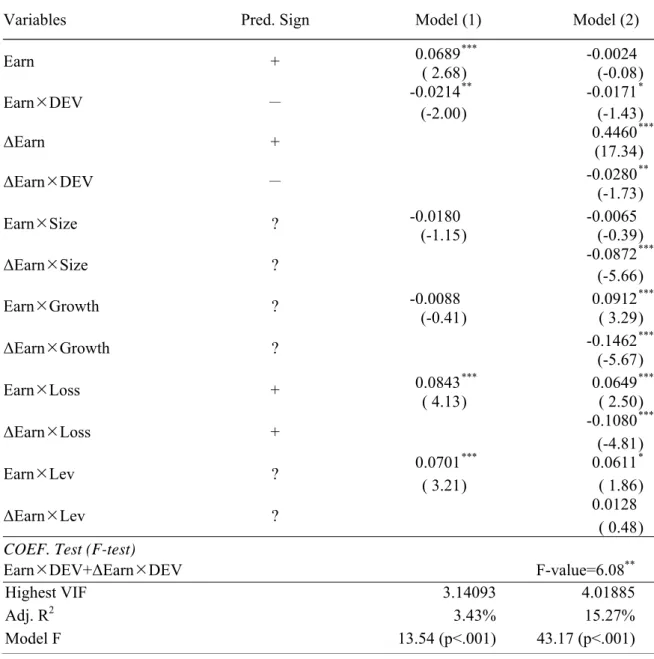

The empirical results of Model (1) and Model (2) are presented on Table 5. The pooled regressions demonstrate positive coefficients and a significant relationship between stock returns to the earnings level ˆ1 (Earn) and change in earnings ˆ3(ΔEarn). However, the earnings levelˆ1 (Earn) in Model (2) appears as a negative coefficient but loses its significance.

The test of relative earnings informativeness for firms with an ownership structure where the level of board seat control rights deviates from the level of cash flow rights depends on the sign for 2 and 4. For Model (1), under H, less earnings informativeness implies 2<0, while greater earnings informativeness implies 2 >0. For Model (2), less earnings informativeness implies 2 4<0, while greater earnings informativeness implies 24 >0.

For Model (1), the variable we are concerned with is EarnDEV. From Table 5, we can find that the coefficient is -0.0214, at the 5% significance level, and hypothesis (H) can be proved initially. As a result, the empirical result proved by Model (2) is -0.0171 as the coefficient of EarnDEV, at the 10% significance level. Meanwhile, the coefficient of Δ

EarnDEV is significantly negative (the coefficient is -0.0280, at the 5% significance level).

According to the results of the F-test, the sum of these two coefficients is -0.0451 (-0.0171-0.0280 = -0.0451), at the 5% significance level (F-value=6.08).

In terms of the magnitude of the effects, the ratio of ˆ2 to ˆ1 in Model (1) or the ratio of

2

ˆ

+ˆ4 to ˆ1+ˆ3 in Model (2) suggests that the earnings of firms with a larger divergence in the degree between board seat control rights and cash flow rights (DEV) is approximately 10.17%−31.06% less informative based on pooled regression [-0.0214/0.0689 =-31.06% for Model (1), and (-0.0171-0.0280)/(-0.0024+0.4460)=-10.17% for Model (2)].

As for the control variables, the inclusion of firm size, growth opportunities, and loss incidents are motivated by its implications for the determination of accounting information. Consistent with Freeman (1987), it has been assumed that a larger firm’s earnings are less informative, as indicated by the significantly negative estimated coefficient of EarnSize and Δ EarnSize (at the 1% significance level). Given these control variables, firm size is important in explaining the coefficient relating returns to earnings informativeness, as evidenced by a significantly negative coefficient on firm size correlated with the change in earnings (p<0.01).

The results of the estimated coefficient of EarnGrowth presents mixed and weak evidence that the interaction between Earn and Growth are insignificantly different from zero in some cases. This research deduces that the impact of company growth on earnings informativeness can been explained in large part by Earn, and therefore its positive impact on Δ Earn has been weakened. The results of the estimated coefficient of EarnLev are significantly positive in most cases, consistent with Fan and Wong (2002).

In terms of the control variable loss incidence (EarnLoss), it corresponds to the positive forecast in Model (1), which is that companies with loss have lower earnings informativeness. This variable leads to similar findings in Model (2), both at the 1% significance level. However, the coefficient of ΔEarnLoss remains significantly negative in Model (2). As such, it is believed that, similarly in effect to Growth, the impact of loss on the increment of earnings informativeness is the key reason for the change in symbol.

106

Table 5. The effect of divergence between board seat control rights and cash flows right on the earnings informativeness (n=4594)

Variables Pred. Sign Model (1) Model (2)

Earn + 0.0689*** -0.0024 ( 2.68) (-0.08) EarnDEV - -0.0214** -0.0171* (-2.00) (-1.43) ΔEarn + 0.4460*** (17.34) ΔEarnDEV - -0.0280** (-1.73) EarnSize ? -0.0180 -0.0065 (-1.15) (-0.39) ΔEarnSize ? -0.0872 *** (-5.66) EarnGrowth ? -0.0088 0.0912*** (-0.41) ( 3.29) ΔEarnGrowth ? -0.1462*** (-5.67) EarnLoss + 0.0843*** 0.0649*** ( 4.13) ( 2.50) ΔEarnLoss + -0.1080 *** (-4.81) EarnLev ? 0.0701 *** 0.0611* ( 3.21) ( 1.86) ΔEarnLev ? 0.0128 ( 0.48)

COEF. Test (F-test)

EarnDEV+ΔEarnDEV F-value=6.08**

Highest VIF 3.14093 4.01885

Adj. R2 3.43% 15.27%

Model F 13.54 (p<.001) 43.17 (p<.001)

Notes: 1. The Huber-White heteroscedasticity-consistent robust standard errors (Rogers, 1993, generalizing White 1980) adjustment procedure is used to estimate the reported t-statistics (in parentheses).

2. Model specification: 4 , 0 1 , 2 , , 1 , , , k i t i t i t i t k i t i t i t k

R Earn Earn DEV Earn X

(1) 4 4 , 0 1 , 2 , , 3 , 4 , , , , , , , 1 1 k k i t i t i t i t i t i t i t k i t i t k i t i t i t k k

R Earn Earn DEV Earn Earn DEV Earn X Earn X

(2)

3. Variables are defined as in Table 2 (footnotes).

4. ***, **, and * respectively indicate significance levels at the 1%, 5%, and 10% (one-tailed for the coefficients with predicted sign, and two-tailed otherwise).

123

Panel (5). The analysis for deviation of Koo family’s control rights from cash flow rights on CDFH

Deviation of Controlling Shareholders’ Control Rights from their Cash Flow Rights

Reasons for Deviation

(A) – (C) 13.49% - 0.45% = 13.04% Deviation between control holdings and actual investment

(B) – (C) 29.16% - 0.45% = 28.71% Deviation between control seats and actual investment

(A) / (C) 13.49% ÷ 0.45% = 29.98% Deviation between control holdings and actual investment

(B) / (C) 29.16% ÷ 0.45% = 64.80% Deviation between control seats and actual investment

(B) – (A) 29.16% - 13.49% = 15.67% Deviation between control seats and control holdings (via proxy contests)

References

Asian Wall Street Journal. (1999) Business transparency in region has worsened. Survey shows, November 24, 5.

Atiase, R.K. (1985) Predisclosure information, firm capitalization, and security price behavior around earnings announcement. Journal of Accounting Research, 23, 21-36.

Chaney, P., Jeter, D. (1992) The effect of size on the magnitude of long-window earnings response coefficients. Contemporary Accounting Research, 8, 540-560.

Claessens, S., Djankov, S., Lang, H.P. (2000) The separation of ownership and control in East Asian corporations. Journal of Financial Economics, 58, 81-112.

Claessens, S., Djankov, S., Fan, J., Lang, H.P. (2002) Disentangling the incentive and entrenchment effects of large shareholders. Journal of Finance, 57(6), 2741-2771.

Collins, D.W., Kothari, S.P. (1989) An analysis of intertemporal and cross-sectional determinants of earnings response coefficient. Journal of Accounting and Economics, 11, 143-181.

Core, J., Guay, W. (1999) The use of equity grants to manage optimal equity incentive levels. Journal of Accounting and Economics, 28, 151-184.

DeAngelo H., DeAngelo, L., Skinner, D. (1992) Dividends and losses. Journal of Finance, 47, 1837-1863.

Demsetz, H., Lehn, K. (1985) The structure of ownership: causes and consequences. Journal of Political Economy, 93, 1155-1177.

Dhaliwal, D., Lee, K., Fargher, N. (1991) The association between unexpected earnings and abnormal security returns in the presence of financial leverage. Contemporary Accounting Research, 8, 20-41.

Easton, P., Harris, T. (1991) Earnings as an explanatory variable for returns. Journal of Accounting Research, 29(1), 19-36.

Faccio, M., Lang, L., Young, L. (2001) Dividends and expropriation. American Economic Review, 91(1), 54-78.

Faccio, M., Lang, L. (2002) The ultimate ownership in Western European corporations. Journal of Financial Economics, 65, 365-395.

Fama, E., MacBeth, J. (1973) Risk, return and equilibrium: Empirical tests. Journal of Political Economy, 81, 607-636.

Fan, P.H., Wong, T.J. (2002) Corporate ownership structure and the informativenss of accounting earnings. Journal of Accounting and Economics, 33, 401-425.

124

Francis, J., Smith, A. (1995) Agency costs and innovation: Some empirical evidence. Journal of Accounting and Economics, 19, 383-409.

Francis J., Schipper, K., Vincent, L. (2005) Earnings and dividend informativeness when cash flow rights are separated from voting rights. Journal of Accounting and Economics, 39, 329-360.

Freeman, R. (1987) The association between accounting earnings and security returns for large and small firms. Journal of Accounting and Economics, 55, 615-646.

Gibson, M.S. (2003) Is corporate governance ineffective in emerging markets? Journal of Financial and Quantitative Analysis, 38, 231-250.

Hartzell, J., Starks, L. (2003) Institutional investors and executive compensation. Journal of Finance, 58, 2351-2374.

Haw, I.M., Hu, B., Hwang, L.S., Wu, W. (2004) Ultimate ownership, income management, and legal and extra-legal institutions. Journal of Accounting Research, 42, 423-462. Hayn, C. (1995) The information content of losses. Journal of Accounting and Economics, 20,

125-153.

Imhoff, E., Lobo, G. (1992) The effect of ex ante earnings uncertainty on earnings response coefficients. The Accounting Review, 67, 427-439.

Jensen, M.C., Meckling, W.H. (1976) Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3, 305-360.

Jensen, M.C. and Ruback, R.S. (1983) The market for corporate control: Empirical evidence. Journal of Financial Economics, 11(1-4), 5-50.

Johnson, S., Boone, P., Breach, A., Friedman, E. (2000) Corporate governance in the Asian financial crisis. Journal of Financial Economics, 58, 141-186.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A. (1999) Corporate ownership around the world. Journal of Finance, 54, 471-517.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., Vishny, R. (2000) Agency problems and dividend policies around the world. Journal of Finance, 55, 1-33.

Lemmon, M.L., Lins, K.V. (2003) Ownership structure, corporate governance, and firm value: Evidence from the East Asian financial crisis. Journal of Finance, 58, 1445-1468.

Morck, R., Shleifer, A, Vishny W. (1988) Management ownership and market valuation: An empirical analysis. Journal of Financial Economics, 20(1-2), 293-315.

Prowse, S. (1998) Corporate governance: Emerging issues and lessens from East Asia. Responding to the global financial crisis. World Bank memo.

Shleifer, A., Vishny, R. (1997) A survey of corporate governance. Journal of Finance, 52, 737-783.

Subramanyam, K.R., Wild, J. (1996) Going-concern status, earnings persistence, and informativeness of earnings. Contemporary Accounting Research, 13, 251-273.

Teoh, S., Wong, T.J. (1993) Perceived auditor quality and the earnings response coefficient. The Accounting Review, 68, 346-366.

Warfield, T., Wild, J., Wild, K. (1995) Managerial ownership, accounting choices and informativeness of earnings. Journal of Accounting and Economics, 20, 61-91.

Yeh, Y.H. (2005) Do controlling shareholders enhance corporate value? Corporate Governance: An International Review, 13, 313-325.

Yeh, Y.H., Ko, C.E., Su, Y.H. (2003) Ultimate control and expropriation of minority shareholders: New evidence from Taiwan. Academic Economic Papers, 31(3), 263-299. Yeh, Y.H., Woidtke, T. (2005) Commitment or entrenchment? Controlling shareholders and

board composition. Journal of Banking and Finance, 29(7), 1857-1885.

Yeo, G.., Tan, P., Ho, K., Chen, S. (2002) Corporate ownership structure and the informativeness of earnings. Journal of Business, Finance and Accounting, 29, 1023-1046.