National Chiao Tung University

Institute of Management of Technology

Thesis

Strategy of Emerging Clusters Development

Student: Boev Igor

Advisor: Prof. Benjamin Yuan

Strategy of Emerging Clusters Development

新興族群發展策略

研 究 生:柏宜格 Student: Boev Igor

指導教授:袁建中 Advisor: Prof. Benjamin Yuan

國 立 交 通 大 學

科技管理研究所

碩 士 論 文

A Thesis

Submitted to Institute of Management of Technology College of Management

National Chiao Tung University in Partial Fulfillment of the Requirements

for the Degree of Master

in

Institute of Management of Technology Oct 2011

Hsinchu, Taiwan, Republic of China

新興族群發展策略

學生:柏宜格 指導教授:袁建中

國 立 交 通 大 學

科技管理研究所

摘要

本研究旨在發展評估科技群集在資源、經營範疇以及發展方向模式。

在群集裡為了營運以及得到所需資源,會擁有屬於自己企業內、外群集間

的連結。而本研究提出方法去操作在群集裡必要元素的現狀,其必要元素

包含人力資源、供應鏈、社會網絡、財務資源以及創業活動等。而本研究

進一步延伸去規劃群集的理想狀態模式,並分析在群集現況以及一個所需

建構群集發展策略方案可能性的兩者間差異。群集評估的最終目標是增加

在創業活動指標內群集的內力優於外力或者換句話說為群集管理的活動。

而上面所述的增加,是需要透過模式的發展,當中使用群集管理或是政府

機構針對增進模型中的弱點為目的,所提供的輔助而達成。.

關鍵詞:技術群集、創業、群集策略、內力、外力、

Porter’s DiamondStrategy of Emerging Clusters Development

Student: Igor Boev Advisor:Dr. Benjamin Yuan

Institute of Management of Technology

National Chiao Tung University

ABSTRACT

This study seeks to develop a model to evaluate a Technology Cluster in terms of its resources, fields of business, and direction of its development. The Cluster has its own linkages between firms in-and-outside of the Cluster for making business as well as all

obtaining the resources required. Then, the author proposes the methodology to operationalize current state of necessary elements of the Cluster including human resources, supply chains, social networks, financial resources, and entrepreneurship activity. The study further extends to propose the model to plan desirable state of the Cluster. Analysis of differences between current state of the Cluster with desired one gives the possibility to construct Strategic Program of Cluster Development. The ultimate goal of this assessment of the Cluster is to increase index of entrepreneurship activity to the point where the Internal Forces of Cluster are prevailing on External Forces or, in other words, activities of Cluster Management. The increase should be achieved by developing model which uses Complement Forces provided by Cluster Management or Government Institutes as purpose to improve all needed weak nodes of the Model.

Keywords: Technology Cluster, Entrepreneurship, Cluster Initiative, Internal Forces, External Forces, Porter’s Diamond

Acknowledgement

In memory of my wife Lydia and daughter Lital.

We went to Taiwan in 2005 for relocation. From the beginning it was planned to be one year only. However plans were changed and we stayed almost 5 years. Taiwan became our second home. We realized how warm and full of hospitality are people here and how beautiful is this country. First courses from NCTU have been chosen occasionally. The course,

“Start-Ups and VC” given by Prof. Hsiao-Cheng Yu, became my favorite topic for many years. I continued my study by taking 2-3 courses every semester. Finally NCTU accepted me as partial time student. I really appreciate help given me by my advisor Prof. Benjamin Yuan and Prof. Hsiao-Cheng Yu . I met great teachers here who gave me a lot of knowledge and new skills. Prof. Yuan gave me a lot of practical advises that helped me in writing this work. Especially I’d like to give great thanks Dr. Jinsu Kang. Her courses were so hard and

requested most of my weekend’s time. But, without this knowledge my MBA would be incomplete. And finally Jinsu and her great family became our best friends in Taiwan. They gave us so much help during hardest time in our life, mine and my daughter Liel. Now her family and many others , collegues from Nuvoton Technology Company and NCTU students became our family.

I greatly appreciate MOT decision to allow me to have defense remotely. I hope this research will be continued with MOT and GMBA departments.

Table of Contents

摘要 ... III ABSTRACT ... IV ACKNOWLEDGEMENT ... V TABLE OF CONTENTS ... VI FIGURES ... IX I. INTRODUCTION ... 1 1.1. RESEARCH BACKGROUND ... 1 1.2. RESEARCH PURPOSE ... 1

1.3. EXPECTED OUTCOME & LIMITATIONS ... 1

II. THEORIES RELATED TO THE DEVELOPMENT OF TECHNOLOGY CLUSTERS ... 2

2.1. CIRCLE OF ECSTASY ... 2

2.2. PORTER’S DIAMOND MODEL ... 3

III. METHODOLOGY ... 4

3.1. MODEL ASSUMPTIONS ... 4

3.2. MODEL OBJECTIVES ... 5

3.3. PROPOSED MODEL: THE LIFE SPHERE OF CLUSTER ... 5

3.3.1. Common assumptions ... 6

3.3.2. Hypotheses ... 6

3.3.3. Model Description ... 7

3.3.4. Methodology : The hypothesis of Self-Sufficiency ... 8

3.3.5. Methodology: The hypothesis of Building one Cluster based on another one. 9 3.3.6. Methodology: The hypothesis of strengthening one Cluster by link to neighboring one ... 9

3.3.7. Methodology: The hypothesis of Declining Cluster ... 10

3.3.8. Methodology: The Strategic Plan of Cluster Initiative Management ... 10

IV. ANALYSIS ... 11

4.1. ISRAEL WADI SILICON ... 11

4.1.1. Unique Advantage, Technology and Market Space ... 11

4.1.2. Market Capitalization ... 12

4.1.3. Management Teams & Skilled Personnel ... 12

4.1.4. Supply and Value Chains, Infrastructure ... 12

4.1.5. Social Networks ... 12

4.2. TAIWAN SBIP HSINCHU ... 13

4.2.1. Technology and Market Space, Social Networks ... 13

4.2.2. Market Capitalization ... 14

4.2.3. Management Teams & Speed of Attack ... 14

4.2.4. Underwriters & VC companies, Board and Advisors ... 14

4.2.5. Supply and Value Chains ... 14

4.3. RUSSIA “SKOLKOVO” PROJECT. ... 16

4.3.1. Technology and Market Space, Social Networks ... 16

4.3.2. Market Capitalization ... 17

4.3.3. Management Teams & Speed of Attack ... 17

4.3.4. Underwriters & VC companies, Board and Advisors ... 18

4.3.5. Supply and Value Chains ... 18

V. CONCLUSION ... 19

5.1. RESEARCH SUMMARY ... 19

5.2. LIMITATIONS IN THIS RESEARCH & EXTENSIONS OF FURTHER STUDY ... 20

VI. REFERENCES ... 21

7.1. UNIQUE ADVANTAGE ... 21

7.2. BUSINESS FIELDS ANALYSIS ... 22

7.3. SUPPLY AND VALUE CHAINS ANALYSIS ... 22

7.4. PHYSICAL ASSETS AND INFRASTRUCTURE ANALYSIS ... 22

7.5. VC FUNDS , FINANCIAL AND INVESTMENT ANALYSIS ... 22

7.6. HUMAN RESOURCES ANALYSIS ... 23

Figures

Figure 1: Circle of Ecstasy ... 2

Figure 2: Porter’s Diamond ... 3

Figure 3: The Life Sphere of Cluster ... 5

Figure 4: Model Numeric Presentation ... 7

Figure 5: The hypothesis of Self-Sufficiency ... 8

Figure 6: The hypothesis of Building one Cluster based on another one ... 9

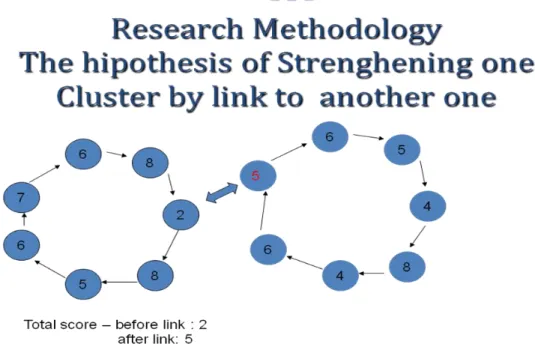

Figure 7: The hypothesis of strengthening one Cluster by link to neighboring one ... 9

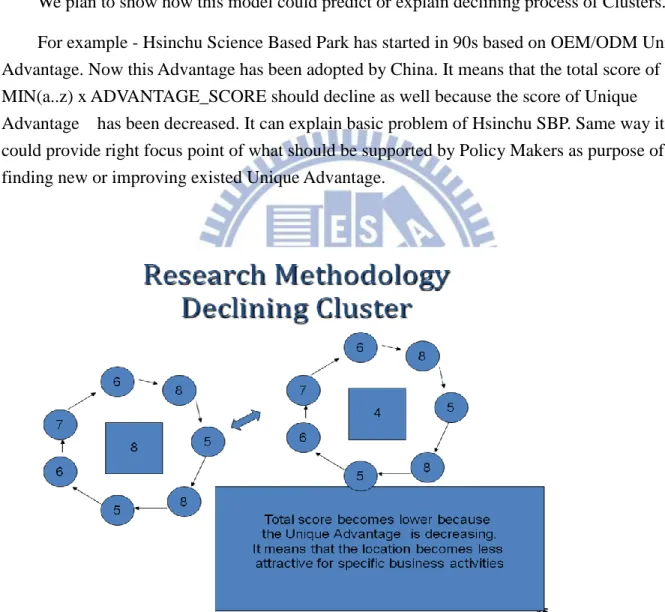

Figure 8: The hypothesis of Declining Cluster ... 10

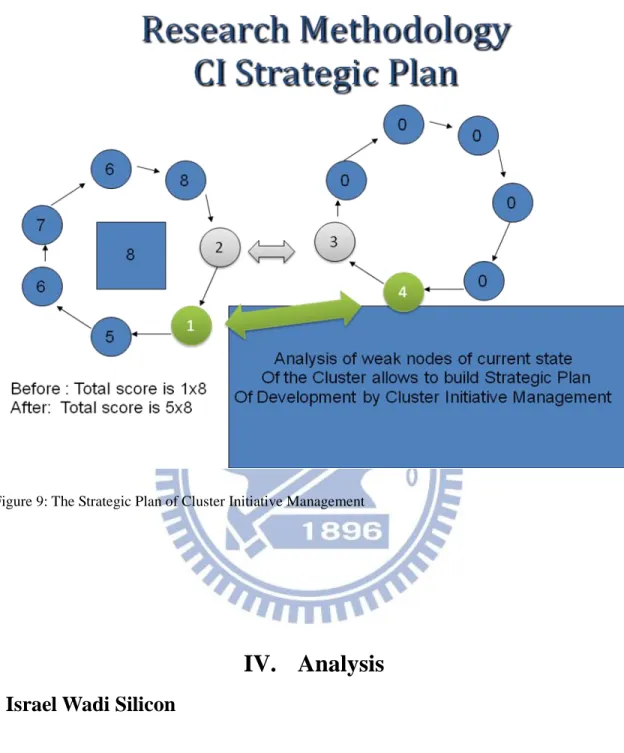

Figure 9: The Strategic Plan of Cluster Initiative Management ... 11

Figure 10: Israel Wadi Silicon model ... 13

Figure 11: Hsinchu SBIP Model (90s) ... 15

Figure 12: Hsinchu SBIP Model (2010s) ... 16

I.

Introduction

1.1. Research Background

Cluster development has since become a focus for many government programs since Porter (1990) introduced the term business cluster, also known as an industry cluster, competitive cluster, or Porterian cluster. He claims that clusters have the potential to affect competition in three ways: by increasing the productivity of the companies in the cluster, by driving innovation in the field, and by stimulating new businesses in the field. In addition, he states that in the modern global economy, comparative advantage of regions could not be achieved just by only existence of physical assets such as cheap labor, harbor, etc.

A business cluster is a geographical location where enough resources and competences amass and reach a critical threshold, giving it a key position in a given economic branch of activity, and with a decisive sustainable competitive advantage over other places, or even a world supremacy in that field (i.e. Silicon Valley and Hollywood).

Especially after the success of several business clusters such as Silicon Valley, it became of critical importance to government to understand factors clearly to define why some places around the world benefit from environment of innovation and other do not. Therefore, this study intends to investigate historical trends of creating technological clusters in US, Europe, Israel, Taiwan, China and Russia to form and define common and different factors that explain overall positioning, strength and weakness of each one. This will give us the answer why most of “top- down“ Cluster Initiatives are not successful by identifying conditions that create “invisible hand” of evolutionary forces that are working behind of successful Technology Clusters. Lastly, this study will develop “the recipe” for creating such forces in mixed top-down and bottom-up approach for building successful Cluster Initiative.

1.2. Research Purpose

This study aims to provide a quantitative assessment method of Technological Clusters. Numeric and Graphical model will represent the state of the cluster to date. The model will show how this Cluster is attractive in terms of development of businesses as well as entrepreneurship activities in total. The model can be used to develop a Strategy of Development of this Cluster in the future. Also will be discussed linkages with neighboring clusters. The empirically build model will be able to give numeric measures to support Strategic Policy of particular Cluster development.

1.3. Expected outcome & Limitations

The model proposed in this study enables to provide for any given country measures of qualitative and quantitative model and practical recommendations for building Innovative High Technology cluster. We verify the scores in the model given by common intuition, which is main limitation of the current study. In future research we plan to provide basic methodology of giving

scores based on statistical analysis. For this project we plan to use statistical data from Cluster Project (“Green Book”, 2003), Cluster Initiatives in Transition and Developing Countries,

Clusters – Balancing Evolutionary and constructive Forces (Orjan Solvell, 2006). In addition, the further analysis will focus on finding “neighborhood” cluster that can work with given one in cooperation according to qualitative and quantitative characteristics such way that combination of two or more models could update overall total score of the model.

II.

Theories related to the Development of Technology Clusters

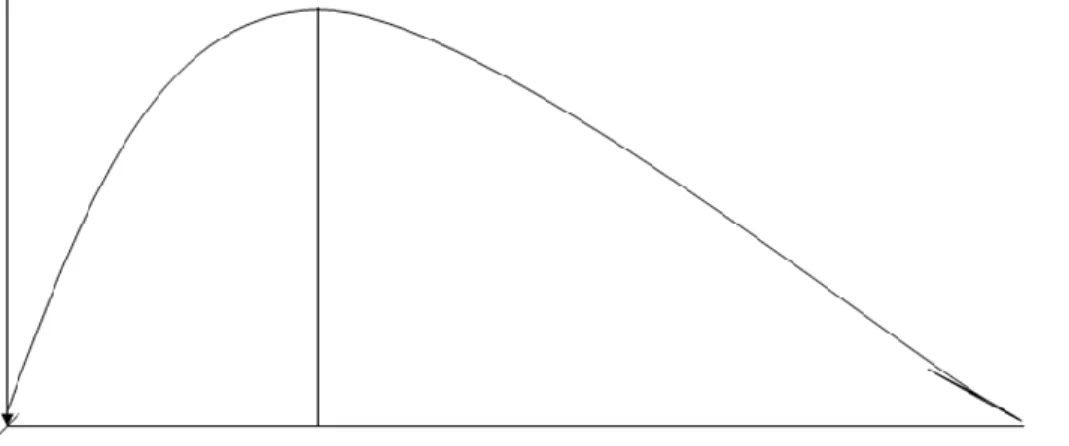

This study utilizes “Circle of Ecstasy” Model (Timmons and Spinelli, 2007) together with Porter’s diamond (Porter, 2003), a model that most cluster practitioners adopt to describe factors of development of technology cluster.2.1. Circle of Ecstasy

The highly organic and situational character of the entrepreneurial process underscores the criticality of determining fit and balancing risk and reward (Timmons, 2007)

Figure 1: Circle of Ecstasy

2.2. Porter’s Diamond Model

Michael Porter's National Diamond framework resulted from a study of patterns of

comparative advantage among industrialized nations. It works to integrate much of Porter's previous work in his competitive five forces theory, his value chain framework as well as his theory of competitive advantage into a consolidated framework that looks at the sources of competitive advantage sourced from the national context. It can be used both to analyze a firm's ability to function in a national market, as well as analyse a national markets ability to compete in an international market.

It recognizes four pillars of research (factor conditions, demand conditions, related and supporting industries, firm structure, strategy and rivalry) that one must undertake in analysing the viability of a nation competing in a particular international market, but it also can be used as a comparative analysis tool in recognising which country a particular firm is suited to expanding into.

Two of the aforementioned pillars focus on the (national) macroeconomics environment to determine if the demand is present along with the factors needed for production (i.e. both extreme ends of the value chain). Another pillar focuses on the specific relationships supporting industries have with the particular firm/nation/industry being studied. The last pillar it looks at the firm's strategic response (microeconomics) i.e. its strategy, taking into account the industry structure and rivalry. In this way it tries to highlight areas of competitive advantage as well as competitive weakness, by looking at companies or nations suitability to the particular conditions of a particular market. (Wikipedia)

Figure 2: Porter’s Diamond

Our research suggests that both Models describe “Bottom-Up” approaches . In case of the Porter’s model it gives implicit way to build Company Strategic policy based on 4 important forces: Competition, Substitution, Demand, and Supply. In case of Timmons’s Model we can see how “hidden” forces of “Circle of Ecstasy” improve total environment for entrepreneurship activities. Same time new Ventures improve the environment and increase its strength.

As the “Bottom-Up” approach, both models give answer for as following as questions: What winning Strategy should my company choose based on current market situation (Competitors, Substitution, Demand, and Supply)?

“I have the IDEA”. Do I have any chance to succeed in case I open Start-Up in specific location? (Timmon’s model)

Both models use current situation as is and suggest way to build either Strategic Strategy of already established company or Strategy of building New Venture by evaluation all needed resources of specific location : VC money, Human Resources, etc.

Our methodology proposes way for Clusterpreneur or Cluster Initiator as prime model to choose right way, right location and Strategy to build new Cluster, or in other words – New Environment that both above mention Models should use in future. The Model of “Life Sphere Circle” is “Top-Down” approach. It gives numeric scores and the methodology how to use these measures. This methodology differs from Porter’s Diamond or Timmon’s “Ecstasy Circle”.

III. Methodology

3.1. Model Assumptions

All known successful technology clusters have following characteristics:

They are “unique” and based on some “unique advantage” as the core. This core could be based on: scarce resources, unique accumulated knowledge, unique human resources or some combination of above characteristics, etc.

They grow as result of “invisible hand” of evolutionary forces that work in unique environment of supporting conditions, resources, entrepreneurial activities, etc.

They have continual connection, either inside or outside of the Cluster, of all needed “value chains” – from the idea creation to final product and customer.

The major purpose of these Clusters is to be effective “life sphere” for established and emerging enterprises.

Our additional assumption is that the way of evaluation of the Cluster Initiative during all stages of its life cycle should be based on Start-Up evaluation process by Venture Capital firm.

This means that as the Clusterpreneur or Cluster Initiator we should evaluate “life sphere” of already established or proposed Cluster in terms of:

How good enough this location for entrepreneurial activity? What activity or business fields fit better for this Cluster?

What should be done to create real opportunities for Entrepreneur?

What measures should be done to evaluate such Cluster in terms of “life sphere” for New Ventures?

What conditions should be created to ensure that internal forces of such Cluster are working as “magnet” for New Ventures establishment.

3.2. Model Objectives

There are several objectives that this proposed model aims at.

First, this model helps develop a reliable mathematical model to provide recommendations for each Cluster given. Second, the model helps understand how the Cluster could be updated in terms of new demands from emerging markets. Thirds, we propose optimal Cluster Initiative Strategy based on analysis mentioned above for developing new or supporting current

technological cluster. Lastly, we target to develop detailed methodology, that is, “Cookbook for Clusterpreneur” that should specify each step of the methodology to build successful technology cluster from the entry to the “break-even” point where internal forces of established Cluster start to prevail external forces of Cluster Initiative.

3.3. Proposed Model: The Life Sphere of Cluster

The Figure shows the proposed model in this study, called the Life Sphere of cluster.

Figure 3: The Life Sphere of Cluster

technology companies is not possible. All selected elements have been chosen according to practice and research in field of Entrepreneurship and Venture Capital.

3.3.1. Common assumptions

The model will be presented as numeric graph

The total graph score is assigned according to the node with minimal score. Maximum available score is 10.

The score is given as relative to the size of local economic and not absolute. The max score means that current location is providing best support in this field. External conditions will be analyzed and assigned as additional score for each factor. It

should be allowed to update total score for each node. It means that some resources are not necessarily located locally but could be used easily for Ventures located in this Cluster. The “invisible hand” of evolutionary forces start to work when total score of the graph is

bigger than 5. This “5” is different measure for different Cluster. It just means about “break-even” point of prevailing of Internal Forces on External Forces. From this point, according to our assumption, the Cluster starts to work as the “magnet” for New Venture establishment. Also from this point total score is growing without real involvement of External Forces of the Cluster Initiative management.

Future research will deal with developing exact metrics for evaluation the score for every given factor in the Model.

3.3.2. Hypotheses

Based on the Model we will check 3 basic hypotheses:

- The Life Sphere is becoming self-sufficient when total score of the graph is bigger than 5.

- The Emerging Cluster could be built on the base of another Cluster.

- The Emerging Cluster could be strengthened by link to another Cluster. The

methodology will propose to strength the weakest chain by connection to similar chain in another Cluster

3.3.3. Model Description

Figure 4: Model Numeric Presentation

Every node receives evaluated number. Every specific measure is not absolute. Maximal score will be given to specific node if the resource is widely available and effective. Major assumption is that the total score of the “Life Sphere Circle” is equal to the weakest node measure. (“bottle neck”)

The total score of the Model is: S = MIN(a..b) x A Where

MIN(a..b) is the minimal measure between nodes ( “bottle-neck”); A is the score of the “Unique Advantage” characteristic of the Cluster; S is the score of Index of Entrepreneurship Activity in the Cluster

3.3.4. Methodology : The hypothesis of Self-Sufficiency

Figure 5: The hypothesis of Self-Sufficiency

The "break point" point in this case means that Life Sphere should start to work and

resources of "top-down" activities achieve its MAX point. From this point Cluster will need less and less investments from outside - "hidden forces" are starting to prevail on Internal Forces managed by Cluster Initiative Management. By “hidden forces” we mean uncontrolled business linkages between companies,VC firms, suppliers, providers ,etc. - local companies in Cluster and outside

of it while Internal Forces mean all activities of CI Management or Government to

encourage firms in Cluster or new Entrepreneurs to start new business there . The assumption is that maximal score have been given for independent developed Cluster such as Silicon Valley, Israel Wadi Silicon or Hsinchu SBIP. These clusters don’t need or need just minimal additional CI involvement for creating new ventures.

3.3.5. Methodology: The hypothesis of Building one Cluster based on another one.

Figure 6: The hypothesis of Building one Cluster based on another one

The proposed model suggests the emergence of new clusters based on the old ones. For example, Optical-Electronics Cluster could be based on the electronic one. The Cluster

Management can identify a new opportunity. The Cluster Management will build new model of cluster based on found new Unique Advantage. New model will show weakest nodes. The next step will be creating new Strategic Policy of the Cluster as purpose of increasing total score of the cluster or in other words, increasing the Index of Entrepreneurship Activity of the Cluster.

3.3.6. Methodology: The hypothesis of strengthening one Cluster by link to neighboring one

This hypothesis means that specific Cluster doesn’t necessarily include all needed nodes. For example, most Israeli Start Up companies have R&D while Marketing, Production, Sales and VC investment are outside. All mention above resources are taken from another Clusters – VC Money from Silicon Valley, Production from Taiwan (OEM/ODM) , etc. The fact that these resources are scarce or not developed in Israel is not a problem because of existing links to other Clusters. However, links itself are very strong and developed.

3.3.7. Methodology: The hypothesis of Declining Cluster

We plan to show how this model could predict or explain declining process of Clusters. For example - Hsinchu Science Based Park has started in 90s based on OEM/ODM Unique Advantage. Now this Advantage has been adopted by China. It means that the total score of MIN(a..z) x ADVANTAGE_SCORE should decline as well because the score of Unique Advantage has been decreased. It can explain basic problem of Hsinchu SBP. Same way it could provide right focus point of what should be supported by Policy Makers as purpose of finding new or improving existed Unique Advantage.

Figure 8: The hypothesis of Declining Cluster

3.3.8. Methodology: The Strategic Plan of Cluster Initiative Management

The ultimate goal of this assessment of the Cluster is to increase index of entrepreneurship activity to the point where the Internal Forces of Cluster are prevailing on External Forces or, in other words, activities of Cluster Management. The increase should be achieved by developing

model which uses Complement Forces provided by Cluster Management or Government Institutes as purpose to improve all needed weak nodes of the Model.

Figure 9: The Strategic Plan of Cluster Initiative Management

IV. Analysis

4.1. Israel Wadi Silicon

4.1.1. Unique Advantage, Technology and Market Space

The country has extremely strong pool of top qualified specialists in various fields of technology and science. The pool has been dramatically increased as result of immigration wave from former USSR during last 80s and 90s and previous wave of 70s. Strong connection between Universities and industry is another advantage. Besides, Israel has close connection with US industries because of high level of cooperation and openness between two countries. This connection ensures the access to best technologies. Most Israeli high-tech companies operate marketing, sales and global Management offices in US to target for foreign markets including US, West Europe and global markets as whole because of their small domestic economy.

4.1.2. Market Capitalization

The country has its own stock exchange for high-tech companies. It is one of fast growing stock market in the world, however, the growth is very volatile and investments are highly risky. Many big Israeli high-tech companies such as TEVA and Tower Semiconductors are traded outside the country including NASDAQ and NYSE. There is strong cooperation with local and external VC companies. Many pension and mutual funds play an important role in market capitalization. The government role here is not high, and mostly related to providing support to big national corporations which have financial problems. Most such companies are public and traded on local or external Stock Exchanges. The legal system provides good environment for entrepreneurship.

4.1.3. Management Teams & Skilled Personnel

Most Israeli high-tech companies keep marketing, sales and global management offices in US, R&D in Israel, and production in Asia region to allocate scare resources into the best locations. Even for start-up companies, it is a common practice that they have been planned and built as global businesses from the beginning. Most established High-Tech companies like Intel, National Semiconductors, Microsoft, Texas Instruments decide to open R&D offices in Wadi Silicon due high concentration of skilled specialists in this area. Same time this decision provide “fresh blood” to new Start-Ups. This process is well illustrated by Timmon’s model.

4.1.4. Supply and Value Chains, Infrastructure

Most Israeli high-tech companies keep production in Asia region .The infrastructure of the country doesn’t fit to mass production due high expenses and far location from major Supply Chains. However, established links to existed Supply Chains and overall nature of companies as global business make this feature as not necessary. Our Hypothesis of strengthening one Cluster by link to neighboring one describes this process well. In total most companies have whole needed Value Chains that provide full connection between Marketing, R&D, Production and Sales , even most of this chains are located around the world.

4.1.5. Social Networks

Israel has very strong diasporas around the world: US, Europe, Latin America, etc. Many specialists have previous experience working in US and Europe. Many of them became

Entrepreneurs and started their own Start Up companies in Israel and US. Israel VC companies invest money in US as well as Israel. Their pool is second in the world.

Total Score is 9 x 8 = 72

Figure 10: Israel Wadi Silicon model

4.2. Taiwan SBIP Hsinchu

4.2.1. Technology and Market Space, Social Networks

The country has strong pool of qualified specialists in various fields of technology and science. Due to the nature of preliminary base model being “followers”( OEM and ODM models were prevailing ), the technologies in most cases are not best. However, several companies started to show up as world leaders in the field during last several years such as TSMC, ACER, ASUS, etc. The overall trend for Taiwan industry is to become a “pioneer” and not a “follower”. The solutions for this challenge are not obvious yet.

There is strong connection between universities and industry, but not effective enough. The solutions for this challenge are not obvious and quite popular topic recently. As a part of

solutions, many MBA programs have been opened for recent years. Taiwan is also famous for abundant pool of skillful professionals. The pool of skilled professionals has been dramatically increasing as highly educated people from US have returned back thanks to successful policy taken by government in 80s and 90s.

They have strong connection with US industry because of high level of cooperation and openness between two countries. The access to best technologies is relatively free thanks to good cooperation with most developed countries.

Since Taiwan is a small market, the industry targets for foreign countries including US and West Europe and nowadays China. Most Taiwan High-Tech companies keep Marketing & Sales and production in China and other developing Asia countries. The economic relationship with China has strengthened dramatically recently.

4.2.2. Market Capitalization

The country has its own stock exchange for high-tech companies. Until the last decade, it has been the one of fastest growing markets in the world. The growth is very volatile and

investments are highly risky. Some high-tech companies are traded outside of the country such as NASDAQ and NYSE. However, this is only for several companies. In general, FDI inflows are much less than FDI outflows.

There is strong cooperation with local VC companies. Many pension and mutual funds play an important role in market capitalization. The government role here is not high and mostly related to providing R&D support for small businesses (e.g. ITRI). Some companies are publicly traded on local stock exchanges. Most small businesses are privately owned. The law provides flexible environment for entrepreneurship. The recent trend is high capitalization outside of Taiwan including China, Vietnam, Thailand, etc.

4.2.3. Management Teams & Speed of Attack

Most Taiwan high-tech companies keep marketing, sales and production offices locally both in Taiwan and China, R&D kept mostly in Taiwan, production in Asia region. As a common practice, Taiwan start-up companies have been planned as local businesses so that they allocate and use scarce resources locally with strong focus on external markets. However it is now under a big change because of globalization of markets and strong competition from other Asia

countries. Most companies are seeking optimal allocation of resources to be able to respond quickly to the market situation and increase operational efficiency.

4.2.4. Underwriters & VC companies, Board and Advisors

Despite its small economy Taiwanese VC companies are ranked as second/third in the world. Their structures and principles are similar to the ones of US VC companies. Their

activities are mostly focused on Taiwanese companies; however, the recent trend is to be part as global investment system.

Since Taiwanese high tech companies function as local businesses, they sometimes suffer from not being able to choose best board of directors and advisors except big companies

including TSMC, Acer, and ASUS. The same situation holds for choosing best underwriters who are in charge of proceeding initial public offering (IPO) procedures, mostly on domestic stock exchange.

4.2.5. Supply and Value Chains

We believe that this field should become new Unique Advantage for Taiwan. The country developed unique Supply Chains that include transfer of OEM and ODM to China while overall

management is located in Taiwan. Strong links between branches in Taiwan and China together with R&D and Marketing offices in US provide full Value Chains for products in different fields like consumer electronics, laptops, etc.

Figure 11: Hsinchu SBIP Model (90s)

Current Model explains how developed circle based on Unique Model of OEMs and ODMs gave great results for building High Tech Industry in Hsinchu. However, new development of China industry provides better location for OEM and ODM companies due similar culture and more cheap human resources. According to our model the total score will be decreased.

Same time overall Supply Chains and links to China has been decreased as well as overall ability of Taiwanese companies in R&D and management skills. We want to propose new Model of development of Hsunchu SBP based on new Unique Advantage: Value and Supply Chains. By replacing previous one that has been decreased it will allow to improve total score.

It means that Hsinchu Park will become attractive again. Many companies such as TSMC, ASUS, etc. are doing it well.

Figure 12: Hsinchu SBIP Model (2010s)

4.3. Russia “Skolkovo” project.

As part of the Skolkovo Innograd project a Foundation for Development of the Center of Research and Commercializing of New Technologies was officially registered in Moscow. It is a nonprofit organization purposed to provide socially useful results in the development of

innovations.

The Foundation was established by Russian Academy of Sciences, state corporation “Bank for Development and Foreign Economic Affairs” (Vneshekonombank), “Russian Corporation of Nanotechnologies” (Rusnano), Bauman Moscow State Technical University, the Russian Venture Company and a Fund for Assistance to Small Innovative Enterprises in the scientific and

technical area.

4.3.1. Technology and Market Space, Social Networks

The country has mixed range of qualified specialists in different fields of technology and science. It varies from top level scientists and specialists in different fields of technology and out-of-date skilled specialists with previous experience. However, low presence of modern technology enterprises doesn’t allow any job opportunity for most of them. The level is stayed in

high degradation from 80s. However, some exception comes from local state-owned enterprises working in military and nuclear industries. Also, the level of specialists in communication service industry and software is relatively updated.

The connection between Universities and industry is not effective. The solutions for this challenge are not obvious and highly discussed last time .The MBA programs are not developed enough to provide high top-level managers.

The connection with worldwide industry is low due poor level of cooperation .The willingness of multi-national enterprises to have presence in Russia is stopped due high entry barriers (bureaucracy, low Government support and high suspicious for FDI , language barriers , strict and ineffective laws , etc.)

As a big Economy, Russia has its own market. However mostly it is represented by Consumer Products as result of direct trade from foreign countries.

Most Russian High-Tech companies keep all operations locally and focused on own market. The presence on foreign markets is low.

4.3.2. Market Capitalization

The country has its own Stock Exchanges. These Stock Exchanges are developed relatively well according to worldwide standards. The growth is very volatile and investments have high risk level. The transparency of financial reports is low. The presence of High-Tech companies here is low. As source for additional capital and bridge to potential investors it is still not effective.

Few big companies are traded outsight: NASDAQ and NYSE. However, no real High-Tech companies are represented here. This means that outsight markets are not used as source of additional capital.

Few local VC companies are staying in seed stage. Main capital flow comes from Government funds. Last time Government is trying to find way to combine worldwide VC practice with State Control policy. It is still far from implementation. Some companies are public and traded on local Stock Exchanges – for both local and foreign investors. Mostly, these

companies act as service telecommunication enterprises. Most small businesses are privately owned and don’t have access to Capital from Stock Exchanges. The law doesn’t provide flexible environment for entrepreneurship.

The Bank system is developed. However, it doesn’t have any experience in Long-Term High Risk investment in High-Tech enterprises. As source for capital its role is low.

4.3.3. Management Teams & Speed of Attack

Most Russian High-Tech companies keep Marketing, Sales, R&D and production offices locally in Russia. The presence of foreign High-Tech enterprises is low. Some of them have only

Sales Offices in few big cities. In most cases top management of Russian companies is formed from local specialists that have no any experience working with foreign companies. Together with the fact that both production and worldwide markets are too far all these factors make presence of Russian companies that work in technology field very problematic.

As mention before, overall worldwide trend is to locate production in China. Low presence here makes position of Russian companies in big disadvantage.

4.3.4. Underwriters & VC companies, Board and Advisors

Russia can be characterizes as Big Economy according to Macro-Economy definitions. Despite of relatively high development of local Stock Exchanges, underwriters there haven’t too much experience with IPO process related to young High-Tech companies have been created from former Start-Ups. As role of underwriter in IPO process is extremely high, most High-Tech companies should have big problems in future when going to IPO.

Due to functioning as local Businesses Russian High-Tech companies should suffer from not being able to choose top Board and Advisors.

As mention before, VC companies are still staying in Seed Mode and can’t be considered as serious player in technology industry.

4.3.5. Supply and Value Chains

All connections and links to external Supply Chains are not developed. Local Supply Chains mostly work with local firms or oriented on trade. The presence of Russian technology companies in Global Market is weak. The access to Global Market is difficult because high local corruption and undeveloped business links.

Figure 13: Skolkovo Model

The Index of Entrepreneurship Activities according to the Model is very low. This

corresponds to the actual state of technology market of Russia and the almost complete absence of Entrepreneurship initiatives in field of new technologies.

V.

Conclusion

5.1. Research Summary

Technology Clusters have been a center of attention both in academia and business for a while. In Europe and the United States, several governments and NDO supported projects have been designed to gather information about the pace of development and problems faced by the emerging Technology Clusters in the world. Different groups of researchers offer a variety of models describing the processes and trends of Technological Clusters. However, none of the existing models do not offer empirical support for connected resources in the Cluster, the

direction of its development, linkage with neighboring clusters with an index of entrepreneurship activity in such clusters. It is difficult to find any empirical measures how much any specific

location is attractive for establishing new venture as well as doing any other business activity there .

This study seeks to develop a model to evaluate a Cluster in terms of its resources, fields of business and direction of its development. The aim of the research is to quantify capability of the Cluster in terms of human resources, supply chains, social networks, financial resources and entrepreneurship activity of the Cluster or region. The proposed model is applied to existing successful Cluster in the world including Israel Wadi Silicon, Taiwan Hisnchu SBIP and Russian “Skolkovo” project. All results show good correlation with statistical data of mention above Clusters.

First example : Skolkovo project received evaluation of Index of Entrepreneurship Activity - 12%. In practice , the Entrepreneurship Activity in this Cluster is practically almost doesn’t exist. If we analyse it in details we can find most “bottle-neck” problems:

Unique Advantage – is not clear at all. For meanwhile it is only private initiative of Russian Government to build similar to Silicon Valley region. No real advantage of doing business in any investigated field.

Supply Chains – don’t exist at all or no linkage to other Clusters

VC , Funds – money has been invested by Government . However, there are no real

mechanisms how to manage it. In practice, the investment activity is very low.

Second example: Israel Wadi Silicon received the evaluation of Index of Entrepreneurship Activity - 72%.This number is correlated well with Start Up activities . Today Israel is

probably number one location in terms of creating Start Up companies in the world.

However, if we conduct the Model to the situation of High-Tech Bubble in 2001 we can see that the VC activities in Silicon Valley and Israel have been decreased dramatically. In terms of our methodology it means that the node score of VC & Funds had been decreased in 5 times. This means this node became “bottle-neck” of the Circle (1.5). The total Index of

Entrepreneurship Activity will became 9 x 1.5 = 14% It is correlated well with numbers of Start Up established this time.

5.2. Limitations in this research & Extensions of further Study

While this study offers tangible way of evaluating technology clusters, they also put this claim in perspective: the evaluation process of nodes in the circle is subjective. Further research will attempt to carry out more statistical way such as expert survey. In addition, this study can be extended to propose to build strategic plan of development.

in the circle. We have to conduct survey of gathering statistical data and method of evaluating such data.Future research should define exact methodology how to build Strategic Plan of Development based on built Model. Such methodology could be similar to SWOT analysis.

VI. References

1. Porter, Michael, “Location, Competition, and Economic Development: Local Clusters in a Global Economy” , Economic Development Quarterly, 2000

2. Porter, M. E. , “Clusters and the new economics of competition”, Harvard Business Review, 1988

3. Porter, M.E. , “The Competitive Advantage of Nations”,. New York: The Free Press. 4. Krugman , P. ,” Geography and Trade”, MIT Press,1991

5. Christian Ketels, Goran Lindqvist, Orian Solvell, “Balancing Evolutionary and Constructive Forces” , Center for Strategic Competitivness” ,2009

6. Christian Ketels, Goran Lindqvist, Orian Solvell, “The Cluster Initiative Greenbook” , Center for Strategic Competitivness ,2003

7. Christian Ketels, Goran Lindqvist, Orian Solvell, “Cluster Initiatives in Developing and Transition Economies”, Center for Strategic Competitivness ,2006

8. Timmons and Spinelli ,”New Venture Creation: Entrepreneurship for the 21st Century “,McGraw-Hill ,2007

VII. Survey Basics Proposals

7.1. Unique Advantage

1. Choose location for future Cluster Initiative Project.

2. Define 3-6 fundamental characteristics for chosen location. 3. Per characteristic choose score for how unique is it.

Note: - 10 stands for characteristic about location that is completely unique , hard to be copiedor been developed in another place

-8 standsstands for characteristic that is unique but can be found in few other places. It can be developed or copied with big efforts

-5 stands for charachteristic that has strong presence in chosen location but is not unique -4 till 1 Characteristic is not enough unique and can't be considered as good enough f or analysis.

7.2. Business Fields Analysis

1. Choose 3-6 potential Business Fields considered as highly potential for Cluster Project 2. Per Businesses Field define most important characteristics for : R&D, Marketing, Production,

Sales

3. Analyze current situation of every one of chosen Business Field

Note: You have to give qualitative analysis : location , businesses conditions, specific charachteristics, etc. for all mention above parts: R&D, Marketing, Production, Sales

7.3. Supply and Value Chains Analysis

1. Analyze Value Chains for each one of chosen Business Field in Cluster. Use previous analysis for current situation. The analyzis shoud be focused in R&D and Marketing Fields.

2. Analyze Supply Chains for each one of chosen Business Field in Cluster. Use previous analysis for current situation. The analysis shoud be focused in Production and logistics fields.

Note : 10 stands for strong presence in chosen location 1 stands for very low presence

7.4. Physical Assets and Infrastructure Analysis

1. Based on Business Fields and Supply & Value chain analysis choose most important Physical Assets and Infrastructure objectives

2. Give score for chosen items

Note : 10 stands for strong presence in chosen location 1 stands for very low presence

7.5. VC Funds , Financial and Investment Analysis

2. Government financial support 3. Corporate Investment Activity

4. Banking Activity in Business investment

Note : 10 stands for strong presence in chosen location 1 stands for very low presence

7.6. Human Resources Analysis

1. Based on Business Fields and Supply & Value chain analysis choose most critical working positions

2. Per chosen position define score

Note : 10 stands for strong presence in chosen location 1 stands for very low presence

3. Educational system in total

4. Analyze level of University or private courses in critical chosen fields 5. Abilities for specialists relocation

7.7. Technology and Market space

1. Based on Business Fields and Supply & Value chain analysis choose most critical technologies 2. Per chosen position define score

Note : 10 stands for strong presence in chosen location 1 stands for very low presence