中國人壽保險市場研究 - 政大學術集成

全文

(2) A Study of Life Insurance Market in China. Student: Wang, Chien-Wen Advisor: Hwang, Jen-Te. A Thesis Submitted to International Master’s Program in China Studies National Chengchi University In partial fulfillment of the Requirement For the degree of Master in China Studies. 98 July 2009. 7.

(3) Acknowledgement I am deeply grateful to my supervisor, Dr. Hwang, Jen-Te (. ), whose. patience, advice and guidance from the initial to the final stage enabled me to complete the thesis. Dr. Hwang is a self-driven and devoted professor. I learned a lot from him not only his lectures but also his spirit of prudential attitude for academic research. I would also like to express my sincere respect to the final defense committee, professor Yen, Chung-Ta (. ) and professor Wang, Yao-Shing (. ). They provide many concrete and constructive suggestions. It is really very hard to manage working, studying and family. My parents, husband, and my little boy are my spirit pillar during this period of time. Without their support, I can not complete my thesis. Therefore, this thesis is dedicated to my beloved family. How lucky I am in pursuit of knowledge in National Chengchi University. There are so many kind, professional, and devoted professors here. They open my eyes and increase my knowledge in the field of China Studies. I will not forget this hard and happy period in my life.. I.

(4) Abstract Started in 1978, but after Deng’s Southern Speech in 1992, Mainland China officially entered an evolution and opening year, which last 20 years till now. Nowadays China is a moderately prosperous society. The change of the concept “private” replaces “state-owned” is a huge driven power for the society. Following the market economy step, insurance industry joins and become a stable power to the society. In the two decades, life insurance industry is one of the fastest developing industries in China. Understanding how important the stable power for the society, the Chinese government enacts many regulations and pushes insurance industry to actively join the whole financial system. Under globalization environment and WTO structure, Chinese government accelerates the open steps by perfect legal system and attracts foreign investment. Nowadays China’s insurance market reaches a certain scale. Bancassurance brings continuous growth of China’s life insurance market and keep playing important role for insurer’s premium income. This study suggests that the Chinese government should pay more attention on monopoly situation, risk management, and the changes of interest rate to avoid negative spread problem in the future. Foreign insurers nowadays only accounted for minor market share which is not good for the development for the financial system if the situation exists continuously. The probabilities of risk transmission across industries will increase day by day; therefore, the government should create a sound financial environment and also keep their eyes on risk control.. II.

(5) Contents Chapter 1. Introduction ...........................................................................................1. 1.1. Research Background ...................................................................................1. 1.2. Methodology and Research Proposition .......................................................5. Chapter 2. The Retrospect of China’s Life Insurance Development ..................7. 2.1. The Transition of China’s Insurance System ................................................8. 2.2. Starting Period: Pre-1949 ..............................................................................9. 2.3. The Insurance Market of Socialist Period –––– 1949. 2.4. The Insurance Market after Reform –––– 1979. 2.5. All-Round Development of China’s Life Insurance –––– 1992. 2.6. The Arrangement of Property Right .............................................................23. 2.7. Summary .......................................................................................................31. Chapter 3. 1978.......................10. 1991................................12 2008 .......14. The Market Environment and Status of China’s Life Insurance Industry ...................................................................................................33. 3.1. The Function of China’s Life Insurance Market ...........................................33. 3.2. Customers and Their Life Insurance Demand ..............................................37. 3.3. Globalization and the Development of Life Insurance Industry...................39. 3.4. China’s Economic Growth and the Development of Life Insurance Industry ..........................................................................................................42. 3.5. The Regional Differences of China’s Life Insurance Market .......................45. 3.6. The Status of China’s Life Insurance Market ...............................................48. 3.7. Summary .......................................................................................................51. Chapter 4 4.1. The Distribution Channels in China’s Life Insurance Market ........53. The Development History of Bancassurance Channel .................................53 4.1.1. The Origin of Bancassurance ...............................................................54. 4.1.2. Product Types in Bancassurance Channel ...........................................54. III.

(6) 4.2. The Historic Development of Taiwan’s Bancassurance Channel and the Implication to China ......................................................................................56. 4.3. 4.4. 4.5. 4.6. 4.2.1. Sales Results of Taiwan Bancassurance Channel ................................58. 4.2.2. Life Insurance Products of Taiwan Bancassurance Channel ...............59. 4.2.3. Taiwan’s Bancassurance Business in China ........................................60. The Development History of China’s Bancassurance Channel ....................63 4.3.1. Initial stage –––– 1981. 1992 .............................................................63. 4.3.2. Exploring period –––– 1993. 4.3.3. Development period –––– 2000. 4.3.4. Transformation period –––– 2004. 1999 ....................................................64 2003...............................................65 the present ..................................66. The Operation Model of China’s Bancassurance Channel ...........................70 4.4.1. Sales Channel on Bancassurance .........................................................72. 4.4.2. Win-Win Strategy for Banks and Insurers ...........................................73. The Issues and Prospect of China’s Bancassurance Channel .......................76 4.5.1. Issues of China’s Bancassurance Development ...................................76. 4.5.2. Prospect of China’s Bancassurance Development ...............................78. Summary .......................................................................................................79. Chapter 5. Conclusion .............................................................................................81. 5.1. Issues of life insurance development in China .............................................81. 5.2. Prospect of China’s Life Insurance Market ..................................................85. Reference ....................................................................................................................89. IV.

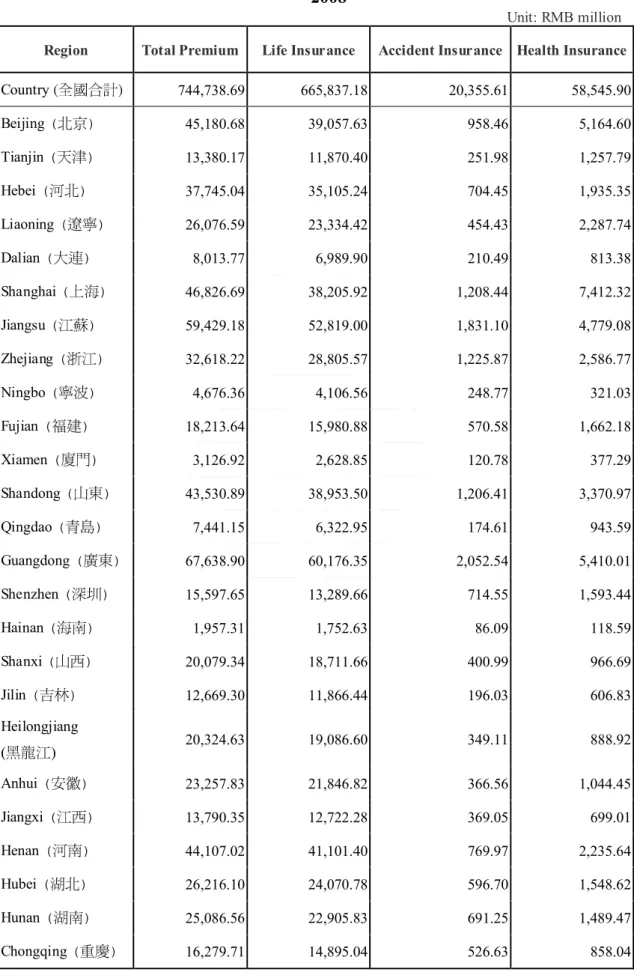

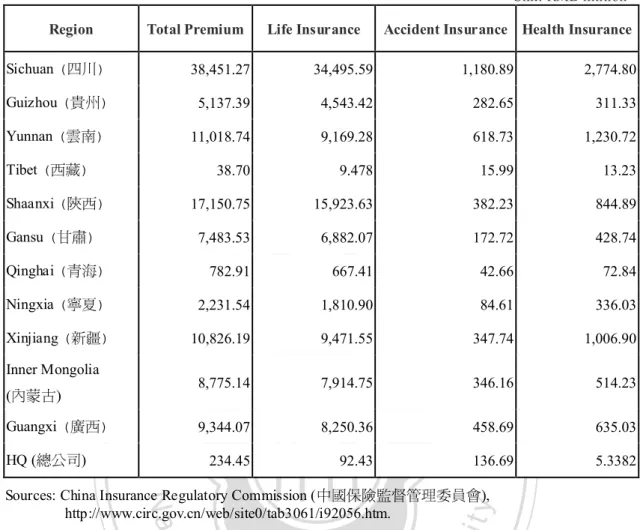

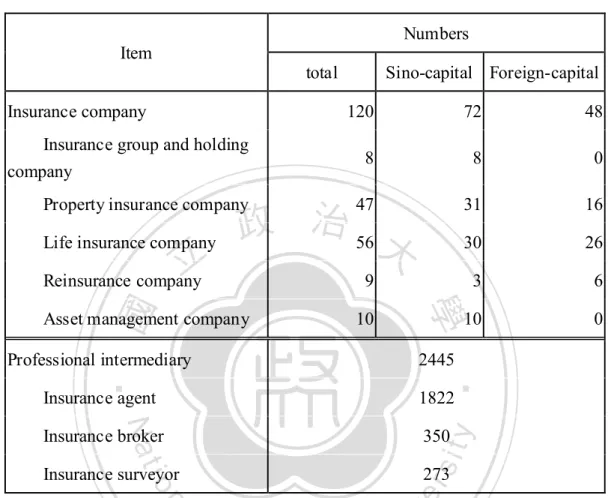

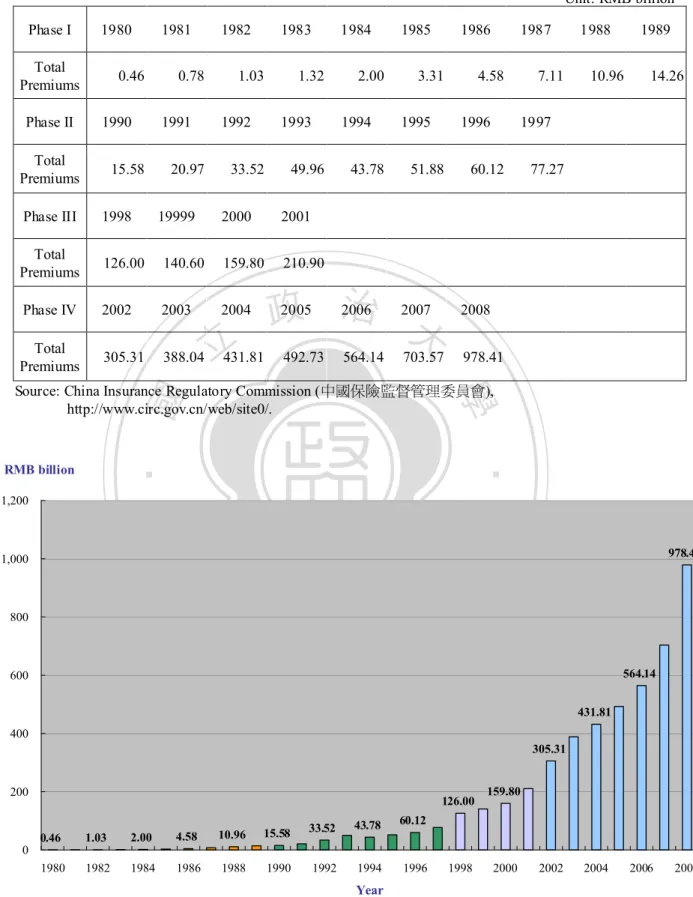

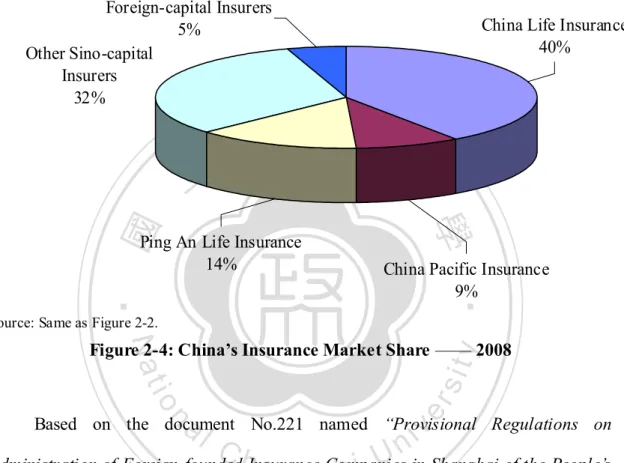

(7) Table List Table 2-1: China’s Total Premiums in Four Phases .....................................................28 Table 3-1: Total Premium of China –––– 1992. 2008................................................34. Table 3-2: Premium Income of Each Product Type in China –––– 2001 Table 3-3: China’s Residents Income –––– 1998. 2008 ........36. 2008 ............................................44. Table 3-4: China’s Regional Premium Income of Life Insurance Industry –––– 2008...................................................................................................46 Table 3-5: Numbers of Insurance Institutes –––– 2008 ...............................................50 Table 4-1: Taiwan’s Insurance Density, Insurance Penetration, and Ratio of Life Insurance and Annuity ...............................................................................57 Table 4-2: Taiwan’s First Year Premium Income by Distribution Channels ...............59 Table 4-3: Taiwan’s First Year Premium Income by Products –––– 2008...................59 Table 4-4: Number of Insurance Companies and Branches in Taiwan ........................61 Table 4-5: Three Giant Insurers’ Distribution Arrangements in China ........................62 Table 4-6: The Products Overview in Bancassurance Market of the Largest Six Life Insurers ...............................................................................................69. V.

(8) Figure List Figure 2-1: Premium Histogram of China’s Insurance Market –––– 1992. 2008 .....15. Figure 2-2: China’s Total Premiums in Four Phases....................................................28 Figure 2-3: China’s Insurance Market Share –––– 2004 .............................................29 Figure 2-4: China’s Insurance Market Share –––– 2008 .............................................30 Figure 4-1: Three Phases of Product Types in Bancassurance Channel of France ......55 Figure 4-2: Premium Income of Life Insurance and Bancassurance in China –––– 2001. 2005.....................................................................................67. Figure 4-3: Proportion of Total Premiums of Distribution Channels in China ––– 2008...................................................................................................68 Figure 4-4: Model of Distribution Agreement .............................................................70 Figure 4-5: Model of Strategic Alliance ......................................................................71. VI.

(9) HAPTER 1 Introduction. 1.1. Research Background Started in 1978, the beginning of reform, China’s insurance businesses have. increased quickly, service field has been expanded, market system has been perfected day by day, laws and regulations have been completed step by step, supervision level has been improved constantly, risks have been prevented efficiently and the whole strength has been reinforced obviously, each aspect played an active role because of confirming open policy. Life insurance industry is one of the fastest developing industries in China. In 2008, there were 56 life insurance companies including 26 foreign companies. Since 2002, the average annual growth rate of China’s life premium revenues was 27.91%, and reached 744.74 billion RMB in 2008, and which was 3.2 times of that in 2002. 1 At the same time, premium income of foreign insurance companies was 36.10 billion RMB; foreign insurance held 4.92% of market shares. In 2008 China’s premium income ranked the 6 th of the world and occupied 3.85% of global total premium income, increased by 1.45% than that in 2007 (Swiss Re, 2009). Over the past two decades, following more and more strengthened internationalized situation, the intense competition of insurance industry was much stronger than before. Mainland China, as one of a greatest potential markets, has attracted amazing huge foreign capital and giant companies to set up branches. And in the predicable future, we believe that there will be more and more companies’ most 1. See China Insurance Regulatory Commission, Statistics of China’s insurance industry, http://www.circ.gov.cn/web/site0/tab61/. 1.

(10) important strategy is to start a business in China. Just like many foreign enterprises, they have to conquer acclimatization problem, especially when they face a totally different culture. Foreign companies have to adjust to China’s local society and respect different thinking if they want to survive and develop. Insurance industry is highly supervised by government, if a company can not adjust to the local culture and follow local laws, not only the proportion of market share will decrease, but also withdraw from a market at last. There are too many examples in Taiwan such as ING Life ( PCA Life (. ), AVIVA Life (. ), and. ). For the other side, follow the opening footstep, it means that. China insurance companies have to adjust to international regulation and implement international operation skills to connect the world. Nowadays China’s insurance industry has entered a high intense competition period, they need to make the whole financial system sound in a sudden. The potential of the Chinese insurance market is enormous because its current per capita insurance spending is only a fraction of that in other developed economies. The Chinese authorities are aware that the development of insurance capability is one of essentials to China's economic restructure, and these foreign insurers will play very import role in this transforming process. Because the Chinese government knew that the process is very difficult and complicated, they progressed cautiously. They started to improve related laws, functions of official supervisor, and to liberalize the policy environment for foreign insurers. China’s economic open policy started in 1978, and began to undergo great changes in 1992 after President Deng Shao-ping delivered a speech to confirm and encourage economic development. The Chinese insurance market has been developing rapidly since 1993, and has continued this trend to present day (Neftci and Yuan, 2007). From the beginning of the open policy confirmed, China’s insurance 2.

(11) market was under a long-term oligopoly; price, products, business scope, and entry restrictions were under strict supervision. Following the reform footsteps, China entered the WTO in 2001. More and more Sino-foreign joint ventures and foreign insurance companies entered the market. As of April 30th, 2009, there are 29 Chinese insurance companies and 27 foreign insurance companies in the market. 2 Competition among insurers has reached new levels. Although there are more and more distribution channels appeared, just like the more and more important role in Taiwan, I believe Bancassurance will also play much more important role than the present for the continuous development of China’s life insurance market and occupy an even higher proportion of the total premiums in the future. Moreover, the continuous development of Bancassurance channel will be the key driver for the growth of China’s life insurance market. The insurance density of China in 2007 was USD 105.4, life insurance density was USD 71.7, and the insurance penetration was 3.3%, life insurance penetration was 202%, accounting for around half of the average value in Asia. From the experiences of America, when the GDP per capita reaches USD 2,000, the growth rate of life insurance consumption will enter into a significant increasing trend. Profound economic reform in China has been moving the country toward a market-oriented economy from planned economy. Key features of this economic transition include the arrangement of property right: a reduction in the share of state-owned industry, and the establishment of a market system. A good social insurance system is necessary to facilitate the economic transition toward a market system. At the end of 2004, following the complete open policy of the China’s 2. See China Insurance Regulatory Commission ( Income of Life Insurance Companies from January to April 2009, ttp://www.circ.gov.cn/web/site0/tab61/i101803.htm. 3. ), Statistics of Premium.

(12) government to the foreign life insurance companies, which accelerated their overall logistic arrangements in advanced cities and extend to inland cities (second-tier cities). Because of the development strategy, foreign life insurance companies’ market share increased at 4.92 in 2008. In many coastal cities such as Shanghai and Shenzhen, the market share even achieved 20% and 14% respectively. The foreign insurers have abundant product development experiences and advanced management capabilities, so they would rather sell indemnificatory policies to those top clients. And furthermore, some important insurance indexes such as surrender rate and premium conversion rate keep a good level. But due to the large administration expenses, for example, the ratio of management expenditure of China’s life insurance industry is only 14%, which is 10% lower than foreign insurance companies. Therefore, the late comers’ management achievements are not easy to surpass the pioneers in the short run. Moreover, the assumed interest rate is restricted to less than 2.5%, the inherent disadvantages of small insurance enterprises on expense rate and the lacking of investment tools make it difficult for small size insurance enterprises (including foreign funded life insurance enterprises) to shake the dominant position of the leading Sino-funded insurance companies. Longevity is an ordeal to every advanced country, which is also a significant issue for Chinese government. How to face the situation of aging population and raise good policy will be front burner. Insurance can be a very stable power to the society which can give an overall support for that government does not have enough resources to do. Aging population nowadays is a global phenomenon. Reviewing the development of the western countries, it shows that when GDP per capital surpass USD10,000, a country may enter an aging society. Comparing with China’s development, China did not complete a wealth accumulation process yet, but begin to 4.

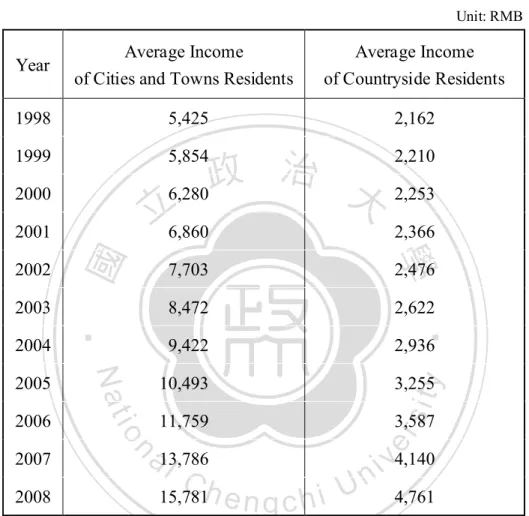

(13) face aging problem. “Getting old before getting rich” is a famous description to China’s society. Therefore, no matter Sino-capital or foreign-capital insurers, they have to work out sufficient and appropriate insurance policies to fit for the society’s need. Now is a turning point and no doubt also a great opportunity for insurers too.. 1.2. Methodology and Research Purposes This study adopt mainly following methods: historical document analysis and. content analysis. Historical documents about life insurance in China were collected in order to find the relative factors of China’s life insurance development. From the whole history, we can have a complete understanding with China’s development of financial system and provide appropriate suggestions. Content analysis is a kind of social science research methods. Earl Babbie (1975) defines it as “the study of recorded human communications, such as books, websites, paintings and laws.” In the thesis, a lot of information from those recorded human communications such as books and websites will be quoted. In the past 20 years, life insurance industry developed speedily, especially in emerging economies. Although there are many studies about life insurance, most of the studies focused on those well-developed markets in advanced countries, but we can not find too much data of life insurance about developing countries. Therefore, one of the purposes of this thesis is to collect data and make the data in order for China herself. As one of the most powerful arising economy, we believe that the word is important. Life insurance gradually becomes an important part of the financial system, no matter in emerging economies or advanced countries. Insurance offers a lot of financial services for consumers, become the main source of investments in the capital market. What makes the different consumption of insurance are still not that 5.

(14) unclear. According to the research before, we can generalize which factors are significant and which are not. Income and life insurance consumption are found to be strongly correlated. Education is also a significant factor, but price is found to be insignificant, which largely overthrows our primary judgment. Levels of social security are not that significantly related. Different level of economic development cause different consideration for life insurance consumption. This study is to examine and find out answers of the following questions: 1.. What are key factors affecting life insurance consumption in mainland. China? 2. We also attempt to gain an understanding of the different characteristics of the life insurance market in each territory of China. 3. What the role Bancassurance play? How fast will it develop, and will it be the most important distribution channel in China? 4. What kinds of insurance products are popular in each phase of China’s development? 5. How Taiwan experiences of insurance industry affect China? 6. What does the Chinese government should pay attention to on risk management? Generally, compare with developing countries, advance countries will arrange more consumption on insurance. As one of the greatest developing counties, we can expect China’s enormous potential of insurance market.. 6.

(15) HAPTER 2 The Retrospect of China’s Life Insurance Development China’s insurance market began in 1805, enjoyed tremendous development in 1993, and has continued its upward trend to present day. Within this 200-year history, China experienced significant and unstable social transformation. From the Qing Dynasty to the China’s acceptance to the WTO, every step forward has been amazing. When the socialist regime was founded in 1949, the Chinese government reorganized the market and cut foreign insurers’ business, so foreign insurers generally withdrew from China after 1952. In the socialist era, numerous political manipulations caused an unstable society, and the insurance industry was at a standstill. The chaos continued until the government’s direction changed to economic development. To help stimulate the recovery of the insurance market from the Cultural Revolution, the Chinese Government adjusted, or legislated many new laws. The insurance business recommenced around 1980 and has continued its developing trend present times. This chapter is organized by time, historic trends, future prospects, and to find insufficient or deficient parts (i.e. regulations, investment tools, talent, etc.) for the development of the life insurance market. In addition to the vertical organization, horizontal analysis is also an important part of this chapter; therefore, the transition of government policies, the change of market scale, the development of insurance products are also to be discussed. In this chapter, we will detail the developing trends and the potential of China’s life insurance market.. 7.

(16) 2.1. The Transition of China’s Insurance System China’s economic open policy started in 1978, and began to undergo great. changes in 1992 after President Deng Shao-ping delivered a speech to confirm and encourage economic development. The Chinese insurance market has been developing rapidly since 1993, and has continued this trend to present day (Neftci, and Yuan, 2007). China’s insurance market was under a long-term oligopoly; price, products, business scope, and entry restrictions were under strict supervision. Following the reforms footsteps, China entered the WTO in 2001. More and more Sino-foreign joint ventures and foreign insurance companies entered the market. As of April 30 th, 2009, there are 29 Chinese insurance companies and 27 foreign insurance companies in the market;1 this is a reduction of 27 companies since 2005’s year end (47 Chinese insurance companies and 46 fo eign insurance companies). The Chinese government restricted foreign insurance companies and began to merge Chinese private insurance companies from 1949 to 1970; therefore, the insurance market was forced to stop its business development. Furthermore, there was only one national insurance company in the market, the People’s Insurance Company of China (PICC). Starting in 1978, the Chinese government began its reform and began to carry out an open policy. This was the beginning for the insurance industries recovery. Following the enactment and issue of the Insurance Law in 1995, 2 the Chinese government issued step by step structured related regulations (Qiou, 2005) such as 2005 Regulations on Administration of Foreign-founded Insurance Companies of the People’s Republic of China , Regulations on Administration of Foreign-founded Insurance Representative 1. See China Insurance Regulatory Commission ( ), http://www.circ.gov.cn/web/site0/tab61/i101803.htm. 2 See China Insurance Regulatory Commission ( ), http://www.circ.gov.cn/web/site0/tab68/i94860.htm. China’s Insurance Law was enacted on 30 June 1995, and the latest revise was on 28 February 2009. 8.

(17) Organizations. , Regulations on. Administration of Insurance Companies. , Provisional. Management Measures for Information Disclosure of the New-Type Products , Regulations on Administration of Insurance Companies’ Solvency Margin and Supervision Index . The prospe ous business activity, property insurance and later life insurance has been developing at high speed. The four developing periods will be described below.. 2.2. Pre-1949 Similar to world insurance development, marine insurance appeared earlier than. other types of insurance because of prosperous shipping businesses. The first two companies to introduce insurance concepts to Chinese people were British companies. Canton Insurance Society, which was the first meaningful insurance company, was founded by British businessmen at Guangzhou port in 1805. By the end of 1838, there were 15 foreign companies operating in Guangzhou, the original insurance hub because it was the only port for trading before the Opium War (Liou, 2008). After the Opium War (1840-1842), the foreign merchandisers swarmed China to set up insurance companies; nevertheless, life insurance still did not appear until 30 to 40 years later than marine insurance. 3 Yong Fu (. ) and Da Dong Fang (. ) assurance companies were set up in Shanghai in 1846 to offer life insurance business in Southern cities. Following the demand for shipping and marine insurance, a domestic insurance company named Ren Ji He was formed in 1887. In 1991 a second domestic insurance company named Hua An He Quan began operations, which was the irst domestic Chinese life insurance company. All the 3. See Insurance Institute of China (2005), 200 Years of China’s Insurance Industry. 9.

(18) pioneer nsurance companies choose Shanghai as a base of operation because of economic, historic, and geographic reasons. Shanghai was the insurance center at that time. The first insurance association called Shanghai Insurance Association, and the first academic organization, China Insurance Society, were founded in Shanghai in 1928 and in 1935. From 1846 to 1949, domestic insurance companies did not play an important role because the market had been divvied around by 60 foreign insurance companies 75% market share (Neftci and Yuan, 2007). The first Chinese insurer under Sino-capital ownership was a property insurer, founded in Shanghai, named De-Sheng ). Before the middle period of the 20th century, foreign insurers. Co. (. monopolized China’s insurance market. From 1865 to 1911 before the forming of Republic of China, the number of insurance companies increased to 45 in China, 37 in Shanghai, 8 in Guangzhou and Tianjin. According to the statistics of China Insurance Yearbook 1937, there were 40 insurance companies in China, in which 37 were private and 3 were national. During the War of Resistance against Japan (1937-1945), China’s insurance market swelled in Shanghai and Chongqing. At the end of 1945, there were 59 insurance companies. Some important accomplishments in this period were: the first China Insurance Yearbook. was issued, the first insurance research. institute -China’s Insurance Association- was established, moreover, the government enacted Postal Life Insurance Law Articles. 2.3. , Postal Life Insurance. , and Insurance Industry Law. The Insurance Market of Socialist Period –––– 1949. .. 1978. The People’s Republic of China was founded in 1949, in the meanwhile on October 20 th, the State Council approved a suggestion from People’s Bank of China to 10.

(19) set up a national insurance company named People’s Insurance Company of China (. , PICC), the first state-owned insurance company (Xu, 2005). Because of the exceptional historic atmosphere, the principle market was. narrow and depressed. The People’s Insurance Company of China, that is to say, monopolized the insurance market and there was only one sales mode, direct marketing by staff. In this period, due to restricted market development, there were less product types and simple policy designs. Initially, there was travel accident and injury compulsory insurance, group insurance, life insurance, occupational group life insurance (. ), and accident insurance in the market. These were. later followed by comprehensive welfare insurance (. ) and the. development of health insurance (Wu, 1997). The Chinese government started to trim and organize the insurance market after the foundation of the People’s Republic of China. Three years later (1952) all the foreign insurance companies gave up on the Chinese insurance market and left China. Even the domestic private insurance companies were forced to close their doors. This left PICC, as a monopoly, to run all kinds of insurance business including property insurance and life insurance. With local insurance business wiped out in 1959, PICC’s accumulated reserve was RMB 0.4 billion, but only left RMB 50 million for dealing with foreign insurance businesses, and the remaining 350 million was handed over to the Treasury. The PICC maintained its title for overseas, nevertheless, it had become an insurance division under the foreign business administration bureau of the People’s Bank of China (Zhu, 2005). The Chinese government dominated all the business activities, local insurance companies were completely nationalized. In this period of time, some important events happened: 1. The first insurance institute named Xin-Hua Insurance Company conducted by the Communist Party and the government was founded in Harbin in 1949. 11.

(20) 2. In Shanghai, 15 private insurance companies merged and the national insurance company participated in setting up a joint venture named Tai Ping Insurance Company (. ) in 1951.. 3. Agricultural insurance was halted in 1953. 4. Local insurance business ceased in 1958 but resumed in Guangzhou ( Tianjin (. 2.4. ),. ) in 1963.. The Insurance Market after Reform –––– 1979. 1991. The economic reform started late 1970, so did the relevant business activities. In April 1979, The State Council made a significant decision, which was to approve to re-establish insurance institutions and meanwhile generally resume local insurance business (He, 2008). At the beginning of this revival, enterprises’ property insurance, cargo insurance, and family property insurance were first to reappear in the market, but until 1982 did life insurance resume. 4 In this revival period, People’s Insurance Company of China (PICC) was still the giant insurance company taking almost all the insurance business including agricultural insurance, marine insurance, export credit insurance, and reinsurance. PICC also re-established itself in the life insurance field in 1982. In addition to the PICC resuming its life insurance business; the Chinese government permitted new players to enter the insurance market but the places they chose were not only Shanghai. She Kou Industrial Zone of the Shenzhen Special Economic Zone (. ) was also included. In 1987, the. People’s Bank of China approved that the Bank of Communications and its branches would set up an Insurance Department, furthermore, agreeing to form China Pacific. 4. Life insurance resumed in 1982 includes simple life insurance, group accident insurance, and annuity. 12.

(21) Insurance Company. Ping An Insurance Company was approved in May 1988, and later renamed as China Ping An Insurance Company in 1992 (Neftci and Yuan, 2007). In 1991, People’s Bank of China set up many local insurance companies in Guangzhou ( Nanjing (. ), Taiyuan ( ), and Kunming (. ), Tianjing (. ), Fuzhou (. ), Harbin (. ),. ). But until 1982, only one insurance company set. up in Xingjian, the monopolistic position of PICC had been smashed. There was a breakthrough in March 1988, Ping-An insurance company set up in Shenzhen Special Economic Zone (. ), which was the first stocked-limited (. ). insurance company in Chinese history (He, 2008). Along with the step of open policy, foreign insurance companies returned to the market,5 but the three pillars in the insurance market were still domestic insurance companies: PICC, China Pacific, and China Ping An. During this period, the Chinese government completed and enacted “The Insurance Law of the People’s Republic of China” in 1995, and the content included basic requirements to the insurance industry; insurance regulation, and government policies were also elaborated in this basic law. China Insurance Regulatory Commission (CIRC) was set up in 1998 to supervise the insurance industry, which was an announcement that the insurance industry would be an independent sector and would play a more and more important role in the financial system. Some other significant events occurred during this period. In 1979, the State Council decided and approved the recovery of domestic insurance business. The People’s Insurance Company of China ( insurance businesses. In 1985, Nankai University ( ), Liaoning University (. ) began to run local ), Wuhan University (. ), Southwestern University of Finance and. 5. The Chinese government issued the first life insurance license to AIA, one life insurance company of AIG. 13.

(22) Economics (. ) were approved by Ministry of Education of PRC to set. up insurance courses.6. 2.5. All-Round Development of China’s Life Insurance –––– 1992. 2008. During this period, life insurance experienced a great leap regardless of premium increase, products multiplicity, business operation, investment strategies, and numbers of insurance companies. Many important achievements happened during this period such as the development of diversified products and distribution channels, implementation of insurance law, a worked out Chinese first experience life table, the set up of China Insurance Regulatory Commission (CIRC), and the WTO acceptance. China’s successful accession to the WTO paved the way for further connections to the world operating system. According to Fugure 2-1, the opening of China’s insurance market can be traced back to 1992. Starting in 1992, agency channels appeared, in 1999 new product types were introduced, and in 2001 Bancassurance developed. Before 1992 property insurance was the main business in China’s insurance market. Group direct sales and part-time agents were the only two sales channels. Agency channel became the main sales channel for the development of life insurance market after 1996, and the total premium of life insurance exceeded property insurance in 1997 (Wu, 1997). In 2008 the total premium of life insurance came to RMB 744.74 billion, which accounted for 76.12% of the insurance market. The total premium came to RMB 978.41 billion in 2008, a year-by-year increase of 39.06%, of which, RMB 744.74 billion from life insurance, a growth of 47.82%, RMB 233.67 billion from property insurance, an increase of 16.97%. As of late 2008, the total assets of insurance companies were RMB 33418.44 billion, an increase of RMB 29,003.92 billion from 2007. 6. See The Insurance Institute of China (2005), 200 Years of China’s Insurance Industry. 14.

(23) Total Premium Life Insurance. RMB billion. Property Insurance. 1200. 978.41. 1000. 800 703.57 564.14. 600 492.73 431.81 388.04. 400 305.31 210.94. 200 36.79 49.96. 60. 68.3. 80.07 108.74. 124.73 139.32 159.59. 0 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 Year Source: China Insurance Regulatory Commission, http://www.circ.gov.cn/web/site0/tab454/.. Figure 2-1: Premium Histogram of China’ Insurance Market –––– 1992. 2008. Through agent’s introduction and promotion of insurance concepts to people of cities and villages, the whole society’s insurance-awareness was rapidly enhanced. 1. Products in the market Before 1999, insurance companies’ main products were traditional-style products, so the mortality, expense rate, and interest risk were undertaken by insurance companies, meanwhile the value of the insurance policy was guaranteed by insurers. The interest risk is significant inasmuch as interest assumption follows Central Bank’s basic interest, which was over 9% before 1997, but the one-year term rate decreased 7 consecutive times starting from 10.98% in May 1996 to 2.25% June 1999, meanwhile five-year term rates took a nosedive from 13.68%to 2.88% (Neftci,. 15.

(24) and Yuan, 2007). Due to the assumed interest rate of traditional products also fixed at a high level, and the assets of the insurance industry was basically invested in government bonds or deposited in banks, which eventually brought a huge negative spread (. ). To prevent new negative spread from happening, in June 1999 the. China Insurance Regulatory Commission asked that the assumed interest rate not rise over 2.5% which effectively decreased the negative spread. Thus the implicit risk of traditional products was exposed: firstly, the negative spread was significant to those original policies with high assumed interest rate. Secondly, it is hard to develop business once the assumed interest rate decreased because premiums will be increasing. High lapse rate is another issue for the traditional policies with low assumed interest rates. Thus, traditional products did not easily survive in the market and risk management became quite an urgent and significant issue for insurers. Under the market pressure, insurance companies developed a series of new-type insurance policies which are participating policy ( policy (. ), 8 and universal life insurance (. ), 7 investment-linked ). 9 A lot of new. policies showed up in the market during this period as a result of the Chinese government’s positive support. China Ping An Insurance Company launched an investment-linked product on 25 October 1999 in Shanghai which marked the beginning of these new-type products. Thus other insurance companies enhanced their research for new products and launched them to match market need and competition.. 7. Participating policy was launched by AIA Shanghai, China Life Insurance, and Zhong Hong Life Insurance companies in March 2000. Policy value will be including non-guaranteed dividend from insurers’ investment performance, which was the feature of this product.. 8. Investment-linked product was launched by Ping An Insurance Company in October 1999. Policyholder’s premium will be saved in separate account after deducting required fee. All the investment profits the assets of separate account belong to policyholders but meanwhile investment risks were also taken by policyholders.. 9. Universal life insurance policy, also called unbundled life insurance policy, was launched by Pacific Insurance Company in August 2000. The features of this kind of product are: (1) premium is flexible; (2) amount of insurance can be changed; and (3) insurer discloses cost and fee to policyholders. 16.

(25) Until 2004, almost all types of insurance products existed in the market because of two main factors. The economy developed rapidly which increased people’s demand for different types of insurance products and product innovation was stimulated due to open policy and day by day competitions. 2. Distribution channels Not only products developed, but sales channels diversified. Before 1999, the scale of Bancassurance was very small and the insurance companies did not develop specific products for banks either. Not until China Ping An launched a product named Qian Xi Hong (. ) in 2000 (Chen et al., 2007), did Bancassurance begin to. develop, and subsequently expand in 2001. The premium of Bancassurance exceeded group insurance in the third quarter of 2002, and the proportion of revenue from Bancassurance increased yearly. After 10-years of being open, starting from 1992, there were 29 foreign insurance companies, including 16 Sino-foreign joint venture and 13 foreign insurance companies from 12 countries and areas in China as of the end of 2001. The speed of premium increase was amazing. RMB 295K in 1992 skyrocketed to RMB 3.28 billion in 2001. A stable global economic environment in 2001 provided an open atmosphere to the development of the insurance market. China’s GDP increase also speed up its domestic insurance market. 3. Insurance Law of PRC On 19 October 1991, the People’s Bank of China founded a group that was responsible for drafting law insurance. This new group included 10 members (the members for drafting the Insurance Law of PRC are Qin, Dao-Fu ( Li-Ping (. ), Wang, En-Shao (. ), Fu, An-Ping ( ), and Luo Peng (. ), Li, Jia-Hua (. ), Xing Wei (. ), Wang Jian (. ), Xia,. ), Liou, Fu-Shou ( ), Feng Zhi-Jun (. )). On 30 June 1995, Insurance Law of PRC was approved 17.

(26) in the 14th Session of the Standing Committee of the 8 th National People’s Congress of China (. ) and was promulgated on 1 October 1995. Because of the. implementation of the Insurance Law of PRC, People’s Bank of China enacted a series of regulations, especially after the China Insurance Regulatory Commission (CIRC) was founded in November 1998. 4. Chinese First Experience Life Table In 1992, People’s Insurance Company of China (PICC) was entrusted by the Insurance Division of the People’s Bank of China to work out Chinese first experience life table. The Actuarial Division of PICC took the responsibility and set up a specialized group. In July 1995, Chinese first experience life table was presented to the public and then all the calculations of premiums and reserves would follow the table from 1 April 1997. Henceforth it became the basis of actuarial development. Further, there was a scientific basis for rate-making and reserve estimation. 5. China Insurance Regulatory Commission The China Insurance Regulatory Commission was established in 1998, a proclamation that insurance would not be a tiny part of China’s financial system but a significant role and stable power for the market. There are 15 departments of the ), Accounting Department (. CIRC which are Administrative Office ( ), Life Insurance Supervisory Department ( Department (. ), Broker Supervisory. ), Property Insurance Supervisory Department (. ), International Department (. ), Education Department (. Supervisory Bureau (. ), Development Reform Department (. Statistics Department (. ), Regulation Department (. Capital Management Department ( ), Audit Bureau (. ), ), ), Insurance. , Policy Research Office (. ), and Party Committee Propaganda Department (. 18.

(27) ).10 The progress of insurance supervision can be divided into four phases as follows. The first phase was from 1979 to 1985, the recovery, insurance supervision and insurance operation had no clarified separation. Phase II, the implementation of Provisional Management Acts of the Insurance Industry was started in March 1985. This clarified the responsibility of People’s Bank of PRC and meanwhile separated insurance supervision and insurance operation. June 1995, the beginning of phase III, was an important breakthrough inasmuch as Insurance Law of PRC was enacted, insurance enterprises were now supervised in accordance with law. November 1999 China Insurance Regulatory Commission was founded, which inaugurated a new phase for insurance supervision. Nowadays supervision of solvency became the core issue for insurance supervision. 6. Domestic and foreign insurers From 1980 to 1992 was the preparatory time frame for opening the insurance market. Some foreign insurers set up representative offices in advance expecting the market to open. AIA was the first foreign insurer established in October 1992 in Shanghai after the opening. Successfully entering into the WTO was another breakthrough for the development of China’s insurance market. Foreign capital was continually being invested in China’s insurance companies. Manulife-Sinoche Insurance Company was the first Sino-Foreign life insurer founded on 26 November 1996 in Shanghai. Many foreign insurers use different strategies to enter the market. One such strategy is cooperating with non-insurance enterprises to set up an insurance company with access to the Chinese insurance market. 11 In 2005, foreign insurance 10. See China Insurance Regulatory Commission ( ), http://www.circ.gov.cn/web/site0/tab59/. 11 See CNA, “Taiwan Insurers Want In On China Market,” China Post, 18 February 2008, http://www.chinapost.com.tw/print/143345.htm. Cathay Life partnered with China Eastern Airlines to establish a life insurance company in Shanghai. Shin Kong Life Insurance joined with Hainan 19.

(28) enterprises generally expanded their businesses to interior China. Total premium in the end of 2001 was only RMB 3.33 billion, but rapidly increased to RMB 36.1 billion in 2008. The market share went from 1.44% of 2002 to 4.56% of Q1 2009. 12 Entering the WTO opened a door to access China’s insurance market for foreign insurance companies meanwhile domestic insurers are also able to connect with the international insurance market. China Insurance Regulatory Commission promulgated Management Regulations for Insurers to Establish Offshore Insurers , Management Regulations for Non-Insurers to Investment Offshore Insurers. in. March 2006 to encourage domestic insurers to expand their business overseas; Therefore, domestic insurance companies began to seek overseas development. As of the end of 2006, domestic insurance and non-insurance enterprises had set up 41 insurance operating institutes and 9 agencies, which are mainly distributed over Hong Kong (25 operating institutes), Britain (9 institutes), and the USA (6 institutes). The People’s Property Insurance Company was successfully listed in Hong Kong Exchanges & Clearing Limited and was making OTC trading on 6 November 2003. It became the first national finance institute which completed transformation to stock-limited. In the same year on December 17 th and 18 th, China Life Insurance Company was listed in New York Stock Exchange and Hong Kong Exchanges & Clearing Limited. Ping An Life Insurance Company was listed in Hong Kong Exchanges & Clearing Limited on 24 June 2004. Thus China’s domestic insurance companies were formally connecting with the international market (Liou, 2008). 7. The commitments for WTO accession Airlines to set up a life insurance company in Beijing. Taiwan Life Insurance joined with Xiamen D&D Inc. to set up a life insurance venture. These big local insurers all choose different industry to cooperate with. 12. See China Insurance Regulatory Commission ( http://www.circ.gov.cn/web/site0/tab3060/.. ),. 20.

(29) Experiencing back and forth negotiation, China finally became one of the formal members of WTO on 11 December 2001. Along with entering in the WTO, the Chinese government promised to abandon limitations on the admittance and business scope within 5 years, which prompted the Chinese government’s acceleration to enact and issue many insurance regulations 13 in order to catch up the requirements of the WTO. According to the commitment to the WTO, Chinese government not only enacted Regulations on Administration of Foreign-funded Insurance Companies of the People’s Republic of China. and. implemented it on Feb 1st, 2002, but also revised Insurers Management Regulations to delete those articles not conforming with the WTO regulations. The terms for entering the WTO were listed as follows: (1) Regions for running insurance business: Open Shanghai (. ), Dalian (. ), Shenzhen (. ),. Foshan (. ) right after entering; Open Beijing (. ), Shenyang (. ),. Tianjin (. ), Wuhan (. (. ), Suzhou (. ), Guangzhou (. ), Chongqing ( ), Xiamen (. ), Chengdu (. ), Fuzhou (. ), Ningbo ) for running. insurance business 2 years after entering the WTO; Cancel regional restriction within 3 years after entering the WTO. (2) Business scope: When entering the WTO, joint venture was allowed to provide personal life insurance to Chinese or foreign citizens; foreign insurance companies’ 13. In 2001, China’s State Council issued “Regulations on Administration of Foreign-Funded Insurance Companies of the People’s Republic of China” , “Foreign Insurers Branch Management Regulations” , , “Information Disclosure Provisional “Insurers Management Regulations” Management Measures for New-Type products of Life Insurance” . In 2003, China Insurance Regulatory Commission issued Regulations on Administration of Insurance Companies’ Solvency Margin and Supervision Index . 21.

(30) branches, joint ventures, or subsidiaries were allowed to provide reinsurance business of life insurance and non-life insurance. Within two years after entering the WTO, foreign non-life insurance companies’ branches, joint ventures, and subsidiaries were allowed to provide non-life insurance service to foreign and Chinese customers. Within three years after entering the WTO, joint venture was allowed to provide health insurance, group insurance, pensions, and endowment/annuity to Chinese and foreign citizens. (3) Company structure: Foreign life insurance companies were allowed to set up joint venture which the proportion of foreign capital could not exceed 50% but could choose partners without restriction when entering the WTO. Foreign non-life insurance companies were allowed to set up branches or joint ventures which the proportion could be up to 51%. Foreign insurance companies’ branches or subsidiaries were allowed to provide reinsurance service of life and non-life insurance. Foreign brokers were allowed to set up joint ventures which the proportion of foreign capital can be up to 50%. Within two years after entering the WTO, foreign non-life insurance companies were allowed to set up subsidiaries. Within three years of entering the WTO, brokers under the joint venture model could be up to 51% foreign capital. Within five years after entering the WTO, foreign brokers were allowed to set up a foreign subsidiary. From the date of entering the WTO, foreign life insurance companies were approved to provide health, group, endowment, and annuity insurance to Chinese citizens; regional restrictions were cancelled; the proportion of foreign share in joint venture of broker could be up to 51% (Sun and Yu, 2007). 22.

(31) In June 2006, the State Council announced “State Council’s Opinions to Reform and Development of Insurance Industry” , thus China’s insurance market inaugurated a long opening period. The numbers say it all. There were only 8 Sino-foreign insurance companies in 2001, but this increased to 134 operating institutes of foreign insurers from 15 countries and regions by the end of 2007 (He, 2008).. 2.6. The Arrangement of Property Right In October 2003, the 3rd Plenary Session of the 16 th CPC Central Committee ( ) approved a guideline name “The. Decisions for Perfect Planned Economy under Socialism from the Central Government”. for. state-owned enterprises it was a revolutionary breakthrough that the central government recognized as the basis on which structure modern enterprise system. The guideline showed the central government’s determination to set up a system for modern property rights, and perfect corporate management structure. If the government did not advance regulations of property rights, the long standing problems that follow would continue to exist (Peng, 2006). (1) No one can really care about business operation because the last ownership is not a concrete person or a crowd. (2) Internal control, which means the leadership to the control of operation management. (3) Unreasonable distribution measures and leadership expenses. (4) Management structure problems, which mean everything would be politicized such as resources distribution, operating goals, and leadership nomination. 23.

(32) (5) Unreasonable operating behaviors and low efficiency. 14 Starting from the 3rd Plenary Session of the 11 th CPC Central Committee ( ), the reform of state-owned enterprises was the focal problem, and the key point was property rights system. The Chinese government quickly worked to reform the property rights system, especially for the access to the WTO. This would ensure state-owned enterprises and the foreign insurers competed under fair situation, if the state-owned insurers could not have ultimate reform of property right, it would be hard to survive from the severe market. The property right of insurance industry experienced a three-stage change in detail: 1. Before 1979, monopolistic nationalized property right Nationalized insurers had been set up main to protect national property and retrench national expenditure. A report from the Finance and Economic Committee of the Government Administration Council conveyed to the Central Government a clear reason as to why China should have a nationwide insurer on 21 September 1949: “We think that insurance industry can be significant help to protect national property, to protect industrial safety, to improve commodities interflow, to stabilize people’s livelihood, to arrange a society’s capital.… In consideration of the above situation Financial Team of Shanghai Finance and Economics Meeting agrees that centralize management of insurance industry is important…to set up a nationwide insurance company to take the responsibilities, named People’s Insurance Company of China.” 15 Thus under the planned economy, reimburse country finance the loss due to. 14. The representation of unreasonable operating behavior is price competition. For perusing market share or operating scale, the state-owned enterprises can take vicious competition.. 15. See The Insurance Institute of China (1998), History of China Insurance. Beijing: China Financial Publishing House. 24.

(33) accident risk through insurance to maintain budgeted revenue and expenditure in balance. As a result, the assignments to People’s Insurance Company were “protect state-owned property, ensure industrial safety, improve commodities interflow, and increase people’s benefits” (Liou, 2008). The People’s Insurance Company of China provided insurance for state-owned enterprises, cooperatives which the level were above counties, and compulsory insurance for property of national apparatuses, and also for passengers who traveled by ship, railroad, and flight. In cities, the company provided fire insurance, transportation insurance, group insurance, personal insurance, car insurance, travel accident insurance, air transportation insurance, and ship insurance. In villages, the company provided agricultural insurance, which was mainly live animal insurance, cotton insurance, and fishery insurance, but agricultural insurance had been terminated by the end of 1953 (Xu, 2005). Private insurance companies mainly provided insurance to cities’ non-national enterprises. Following the integration of properties of domestic industries, the ratio of national enterprises was quickly rising. Private insurers had lost the basis of existence, while national property expanded further, and the insurance industry became state monopoly property. The disorder from 1966 to 1976, China’s domestic insurance, was totally terminated. 2. After 1979, public-ownership property right It was the period that transformed from planned economy to market economy. From 1979 to 1990, it was still a monopolistic phase due to People’s Insurance Company of China (PICC,. ) was chartered by government policy. to operate insurance business without competition. 16 PICC as a monopolist. 16. In PICC’s constitution, it regulated PICC as a state-owned enterprise. 25.

(34) represented in three aspects: (1) PICC was the only provider for insurance products; (2) There were no substitutes of insurance products in the market; and (3) A huge access barrier to the insurance market because of government’s policy.. During the recovery of the domestic insurance industry, the. Chinese government still adopted a monopolistic state-owned property right in regards to insurers’ property rights (Zhu, 2005), but according to the open policy, state-owned property rights generally became public property rights.17 Even if the Chinese government had strict control of the insurance industry, some departments or local governments still set up insurance companies or insurance sectors without People’s Bank of China’s permission, which directly reduced People’s Bank of China’s premium income and also effected development of insurance business.18 Until the State Council published “A Notice to Enhance the Management of Insurance Industry”. , People’s Bank of China. based on the notice put a stop some departments’ insurance business and also rectified their illegal operations. Due to the State Council incorporated operating tax income in local finance increased local governments’ earnings from the insurance industry, a lot of local finance departments’ insurance apparatus were terminated. Before 1992, a stock-limited economy was not accepted by the public; state-owned enterprises still walked on the path of planned economy. But after 1992, 17. State-owned assets were in fact controlled by local governments and central departments, not by National Peoples’ Congress and its Standing Committee. Local and central departments set up insurance companies which not only brought tax revenue, but also earn capital gains. It was the important factor that the monopoly of property right transformed to public property right, and which also brought competitiveness.. 18. Set up insurance companies or insurance sectors were a tactic for some departments or local governments. The aim is to increase income. They did not have enough experiences and skills to run the business which blocked the development of insurance industry because they revised insurance clauses and rates randomly, or did not prepare reserve, etc. 26.

(35) the concept of stock-limited and non-single-state capital was born. Compared to the 100% state-capital insurance company, stock-limited insurance companies represented higher efficiency though the ultimate property right of stock-limited insurance companies was possessed by the government. The reasons are (1) determined the property right ownership; (2) initially established company management structure; and (3) personal income linked with operating achievements. Therefore, the reform of the system proved North and Thomas’ theory that “an efficient economic organization is the key factor to economic growth” (North and Thomas, 1973). Table 2-1 shows the changes of total premiums in four phases in China. Phase I was from 1980 to 1989, which known as monopolistic phase. Phase II was from 1990 to 1997. After 1997, an oligopoly phase. Life insurance premium was over property insurance premium starting from 1997. Phase III was from 1998 to 2001, which is still an oligopoly phase. CIRC was founded in 1998. Phase IV was from 2002 after entering in the WTO on 11 December 2001. After the direction of open policy was confirmed, the Chinese government had recognized the significance of life insurance, and took many measures to improve the development of the insurance industry. In this period, a lot of laws and economic measures had kept pace with the government’s open policy to support the stable development of life insurance industry. Guaranteeing the implementation of a property rights system and to clarify legal rights and obligations were necessary for the life insurance industry inasmuch as customers should be confident to insure enterprises’ long-term solvency (Walker, 2006). That is why the revolution for property right is significant for industry development. The above figure shows the trend from the change of property right. In the oligopoly phase during 1990 to 2000, the premium has no obvious increase (Figure 2-2).. 27.

(36) Table 2-1: China’s Total Premiums in Four Phases Unit: RMB billion Phase I. 1980. Total Premiums Phase II. 1981. 0.46. 0.78. 1990. Total Premiums. 1991. 15.58. Phase III. 1998. Total Premiums. 126.00. Phase IV Total Premiums. 20.97 19999. 1982. 1983. 1.03. 1984. 1.32. 1992. 1993. 33.52. 2.00 1994. 49.96. 43.78. 1985. 1986. 3.31 1995. 1987. 4.58 1996. 51.88. 7.11. 1989. 10.96. 14.26. 1997. 60.12. 2000. 2001. 140.60. 159.80. 210.90. 2002. 2003. 2004. 2005. 2006. 2007. 2008. 305.31. 388.04. 431.81. 492.73. 564.14. 703.57. 978.41. Source: China Insurance Regulatory Commission ( http://www.circ.gov.cn/web/site0/.. 1988. 77.27. ),. RMB billion 1,200. 978.41. 1,000. 800. 564.14. 600 431.81 400 305.31. 200. 126.00 2.00. 4.58. 15.58. 33.52. 60.12. 1.03. 10.96. 43.78. 0.46 1980. 1982. 1984. 1986. 1988. 1990. 1992. 1994. 1996. 159.80. 0 1998. 2000. 2002. Year. Source: China Insurance Regulatory Commission (. ),. http://www.circ.gov.cn/web/site0/.. Figure 2-2: China’s Total Premiums in Four Phases 28. 2004. 2006. 2008.

(37) The total premium of 2008 grew 4.6 times that of 2001. Starting from 2001, the premium increased remarkably when the Chinese government successfully accessed the WTO, meanwhile the monopolistic property rights of the insurance industry no longer existed. Below were the figures that show the change of the market share. It is easy to see that the foreign insurers’ market share had an obvious increase. According to Figure 2-3 and Figure 2-4, in the four years, the foreign insurers’ market share increased from 3% to 5%, meanwhile China Life Insurance Company’s market share decreased from 55% to 40%, China Pacific Insurance Company decreased from 11% to 9%, and Ping An Life Insurance Company decreased from 17% to 14%. China Life Insurance Company’s market share dove significantly.. Other Sino-capital Insurers 14%. Foreign-capital Insurers 3%. Ping An Life Insurance 17%. China Life Insurance 55% China Pacific Insurance 11% Source: Same as Figure 2-2.. Figure 2-3: China’s Insurance Market Share –––– 2004. 3. Private-ownership property right China implemented its open policy starting in 1978; a lot of large-scale insurance companies set up more than 10 representative organizations, but could not operate insurance business. After Deng Shao-Ping famous speech in 1992, steps accelerated noticeable, and it was the first time that the foreign capital was allowed to 29.

(38) invest in the insurance market, henceforth, this type of private property right began to exist in China’s insurance industry. Shanghai was the first experimental city in the beginning. The Chinese government implemented strict region-restraint policy for foreign insurers’ access.. Foreign-capital Insurers 5% Other Sino-capital Insurers 32%. China Life Insurance 40%. Ping An Life Insurance 14%. China Pacific Insurance 9%. Source: Same as Figure 2-2.. Figure 2-4: China’s Insurance Market Share –––– 2008. Based on the document No.221 named “Provisional Regulations on Administration of Foreign-founded Insurance Companies in Shanghai of the People’s Republic of China”. , People’s Bank of China was. the authority to foreign insurers. In October 1992, PBC approved American International Assurance to set up a branch in Shanghai, which became the first foreign insurer entering into China’s insurance market (Wang, 2006), and thus the private property rights appeared. Instead of the impact of sales income for the domestic insurers, operating principles, products, and skills that foreign insurers introduced to the market were no doubt to bring deeper effect. The impact represented on these advanced skills such as actuary, risk management, claim and underwriting,. 30.

(39) reinsurance, etc. would no doubt be long lasting and immeasurable. Under the pressure of competition, in 1999, the State Council approved People’s Insurance Company of China (PICC) to divided into four independent companies which were People’s Insurance Company of China to run property insurance business, People’s Life Insurance Company of China to run life insurance business, China Reinsurance Company to run reinsurance business, and China Insurance Company Limited to run overseas business. These state-owned independent insurance companies then implemented a series of reform on business process, personnel arrangement, and distribution regulations, but did not reach expected results because the core problem had not been touched, which was the 100% state-owned insurance company only changed management measures but not reformed property rights arrangement. Taiwan Life Insurance Company’s President Zhu, Bing-Yu is very positive about China’s insurance market. He estimates that China’s penetration rate will reach 4% in 2010,. 2.7. 19. but it is still a long way to catch up with Taiwan’s.. Summary After the open policy confirmed by Deng Shao-Ping in 1992, China has taken. some impressive strides to completely overhaul their insurance market industy. Before 2001 China forced herself to accelerate reform speed in order to enter the WTO and thus China’s local insurance industry competes against foreign insurance industry on the same scales. Foreign insurers will keep seeking inroads into China, and push all their resources such as skills, capital, sales channels, talent, and service to earn their share of the Chinese market. 19. See , United Evening News, 17 December 2008, http://udn.com/NEWS/STOCK/STO1/4647992.shtml. 31.

(40) During the past nearing three decades, 1980 to 2008, China’s total premiums grew 2,127 times. The Insurance market began its limited competition starting from Ping-An Insurance Company and Pacific Insurance Company of China established in 1988 and 1991. The State Council published “Provisional Management Acts of Insurance Industry” in 1985, and followed it with “Insurance Law of the People’s Republic of China” implemented in 1995. Soon after the China Insurance Regulatory Commission was set up in 1998, which proclaimed that supervision of China’s insurance market had entered into a professional period. Starting September 1992, after American International Assurance became the first foreign insurance enterprise established in Shanghai, foreign insurers surged into the market. Access into the WTO is no doubt a force to drive China’s insurance market to move forward; the Chinese government started a series of system reforms, in which the factor that made the reform successful was property rights arrangement. North found that an efficient organization came from adaptable arrangements of systems and property right establishment to bring about a kind of motivation for people’s economic activities. The best arrangement for property right is to enhance one’s personal income as far as possible to make the amount close to social income, thus, economy has sufficient incentive to keep growing. In contrast, if property right arrangement can not make personal income close to social income, one will lose his motivation of skill reform, capital accumulation, and innovation, and those are important and advantageous for economic growth. North’s theory did not just explain the western world rise, but also interpreted China’s high-speed development. Nowadays China’s insurance market reaches a certain scale: insurance business types tend to be diversified; the number of insurers is increasing; broker and reinsurance market are beginning to form. We can expect that the high growth rate will continue, and the potential of China’s insurance market is indeed promising. 32.

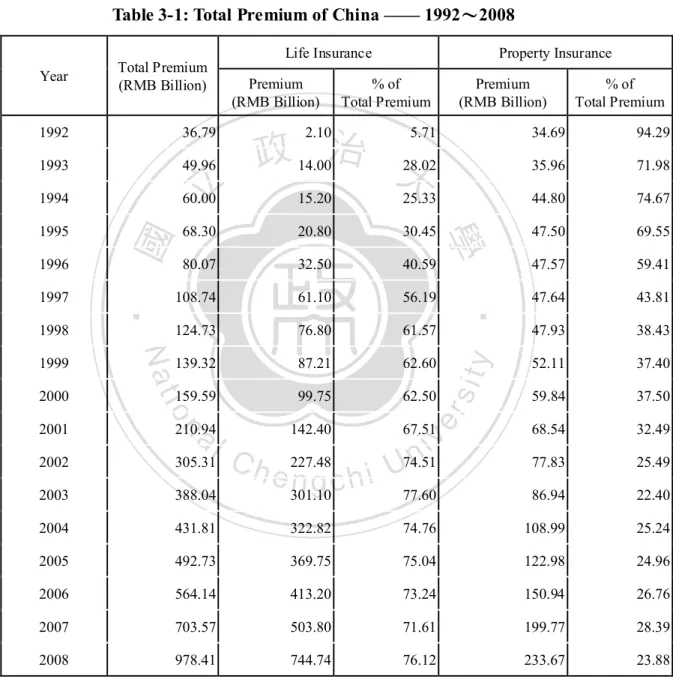

(41) HAPTER 3 The Market Environment and Status of China’s Life Insurance Industry In the western countries, the insurance market is part of the financial market. No matter its total assets or economical importance, the function of the insurance industry is always only just a part of the banking industry. If the Chinese government plans to have an international financial market, the insurance market would be directly affected and show positive steps forward as well (Wei et al., 1999). Opening the insurance market has improved the development of financial market. Statistics indicated that in 1993 the United States’ money market was USD 780.5 billion, in which the life insurance industry was USD 143.7 billion, equaling 18.4% of the total money market supply; which proves how important insurance industry is in the financial system. This chapter not only demonstrates the current situation of China’s insurance market, but also explores the motivation of life insurance product needs, and the factors that affect life insurance needs.. 3.1. The Function of China’s Insurance Market After 1982, the resurrection of the in urance industry, China’s life insurance. industry experienced amazing development. According to statistics, in the ten years from 1990 to 2000, the premium of the life insuranc industry grew at an average of 31.15% each year. The market still maintained a steady and rapid growth in 2008. According to the table below, the total premium reached RMB 978.41 billion, in which life insurance premium was RMB 744.74 billion, 76.12% of total premiums, up 33.

(42) 47.82% from the same period of the last year. Since the life insurance premium exceeded the property insurance premium in 1997, the life insurance industry has dominated more than half of market shares. From Table 3-1, we can easily see the trend of People’s need and also the market change in China.. Table 3-1: Total Premium of China –––– 1992 Life Insurance Year. Total Premium (RMB Billion). Premium (RMB Billion). 2008 Property Insurance. % of Total Premium. Premium (RMB Billion). % of Total Premium. 1992. 36.79. 2.10. 5.71. 34.69. 94.29. 1993. 49.96. 14.00. 28.02. 35.96. 71.98. 1994. 60.00. 15.20. 25.33. 44.80. 74.67. 1995. 68.30. 20.80. 30.45. 47.50. 69.55. 1996. 80.07. 32.50. 40.59. 47.57. 59.41. 1997. 108.74. 61.10. 56.19. 47.64. 43.81. 1998. 124.73. 76.80. 61.57. 47.93. 38.43. 1999. 139.32. 87.21. 62.60. 52.11. 37.40. 2000. 159.59. 99.75. 62.50. 59.84. 37.50. 2001. 210.94. 142.40. 67.51. 68.54. 32.49. 2002. 305.31. 227.48. 74.51. 77.83. 25.49. 2003. 388.04. 301.10. 77.60. 86.94. 22.40. 2004. 431.81. 322.82. 74.76. 108.99. 25.24. 2005. 492.73. 369.75. 75.04. 122.98. 24.96. 2006. 564.14. 413.20. 73.24. 150.94. 26.76. 2007. 703.57. 503.80. 71.61. 199.77. 28.39. 2008. 978.41. 744.74. 76.12. 233.67. 23.88. Source: China Insurance Regulatory Commission, http://www.circ.gov.cn/web/site0/.. The earliest concepts of insurance were to share risks and compensate losses; therefore, insurance has these two original and basic functions, but following social improvement and enhancement of products, there are increasingly more and more 34.

(43) functions of insurance. Nowadays insurance does not just mean products and services, but a kind of system arrangement which is advantageous to economic development and social stability. It participates in many aspects of social life: reducing economic disputes among social members, participating in social risk management, perfecting social protection system, and maintaining social stability. Modern insurance has at least. three functions in finance, risk management, and social governance (Liou,. 2008). Firstly, the original function of insurance was risk management, which is a concept of diversification. People face a lot of unavoidable risks, and no one knows when and where; therefore insurance is an effective mechanism for risk shift. Insurers collect premiums to build an insurance fund. When policy holders suffer from loss no matter property or life, the insurance fund can be used to compensate the individual. This form of compensation stabilizes societies, improves economic development, and protects people’s lives. Secondly, insurance has financial attributions. The Financial function means accumulation, circulation and the allocation process of bankrolls. These attributes are all functions of insurance. The insurers attract, collect, and accumulate society’s idle money to mobilize social capital from savings to investments. This is done through the sale of product. It becomes a channel to diversify centralized bank savings and minimize financial risks. For long-term operation, insurers have to enhance investment return from insurance capital, for the reason, insurers become key investors of capital market. Thirdly, insurance has another derivative function, social governance. Insurance realized social reallocation through economic compensation to provide strong economic protection for people’s daily lives. It can decrease unstable factors of social development. Not only does it passively support the protection system, but insurance 35.

(44) also participates in risk governance in a positive manner. For example, some insurers provide a basic physical examination every two years if customers buy cancer products ). 1 That is a positive action for risk management. From the table below we can. (. find that the premium of pension, accident, and health insurance increase generally and make steady progress.. Table 3-2: Premium Income of Each Product Type in China –––– 2001. 2008. Unit: RMB million Life Insurance Year. Total Premium. Premium. Accident Insurance. % of Total Premium. Premium. % of Total Premium. Health Insurance Premium. % of Total Premium. Endowment Enterprises Pension). 2001. 142,396.31 128,757.62. 90.42. 7,483.58. 5.26. 6,155.12. 4.32. -. 2002. 227,484.77 207,368.47. 91.16. 7,871.38. 3.46 12,244.91. 5.38. -. 2003. 301,099.12 266,948.54. 88.66. 9,958.17. 3.31 24,192.41. 8.03. -. 2004. 322,824.91 285,130.23. 88.32 11,706.97. 3.63 25,987.71. 8.05. -. 2005. 369,747.51 324,427.93. 87.74 14,089.38. 3.81 31,230.19. 8.45. -. 2006. 413,201.08 359,263.76. 86.95 16,247.05. 3.93 37,690.27. 9.12. -. 2007. 503,802.35 446,375.21. 88.6 19,010.53. 3.77 38,416.61. 7.63. 8,554.61. 2008. 744,738.69 665,837.18. 89.41 20,355.61. 2.73 58,545.90. 7.86. 20,548.23. Source: China Insurance Regulatory Commission, http://www.circ.gov.cn/web/site0/tab454/ module443/page3.htm.. Insurance can strengthen or aid the government in areas of social concern when there are not enough resources all ready allocated to do so. Understanding the social function of insurance, the Chinese government formulated and implemented Methods on Endowment Insurance Business Management for Insurance Companies. This involved strengthening cooperation among relevant ministries to research pension insurance tax preferential policy. Then choose a method to promote personal. 1. See Shin-Kong Life Insurance Company, http://www.skl.com.tw/general/product_com_DV.asp. 36.

數據

Outline

相關文件

Mie–Gr¨uneisen equa- tion of state (1), we want to use an Eulerian formulation of the equations as in the form described in (2), and to employ a state-of-the-art shock capturing

Attitude determines state, the state decided to state of mind.. John:I’m planning to go camping next weekend with my

GCG method is developed to minimize the residual of the linear equation under some special functional.. Therefore, the minimality property does not hold... , k) in order to construct

You are a property agent working for the Quality Property Company. A potential client has contacted you from Australia because he will soon be moving to Hong Kong with

背景 SISTIC 壟斷「門票銷售」服務,其市場占有率達 85%至 95%。SISTIC 基本上是一家 新加坡政府企業(65% owned by Singapore Sports Council, a government body, and 35%. owned

Unless prior permission in writing is given by the Commissioner of Police, you may not use the materials other than for your personal learning and in the course of your official

• Hong Kong Education City originated from a Quality Education Fund project in 2000 and developed into wholly-owned limited incorporated company of the Government of the HKSAR

● the F&B department will inform the security in advance if large-scaled conferences or banqueting events are to be held in the property.. Relationship Between Food and