1

12

Renminbi Derivatives: Recent Development and Issues

Wensheng Peng, Chang Shu and Raymond Yip

The market infrastructure and price discovery mechanism for the onshore renminbi derivatives market have built up rapidly in 2006, with empirical evidence suggesting that pricing is increasingly determined by financial fundamentals such as the covered interest rate parity. However, the growth of the market has been restrained by restrictions on participants, limited variations in the RMB/USD exchange rate, market participants’ lack of technical capacity and experience, and inadequate supporting financial market infrastructure. The non-deliverable forward (NDF) market is more developed, but has the drawback that its pricing is not tied to financial fundamentals.

Two issues are of particular importance for market development on the Mainland: the balance between regulation and development, and the relationship between onshore and offshore markets. There are merits in pursuing a proactive policy in broadening the participant base, introducing new products, and allowing some form of linkage between the onshore and offshore markets. The systemic risk arising from derivatives trading should be limited, particularly at the early stage of market development. On the contrary, reducing hedging cost and promoting substitutability between domestic and foreign assets would induce capital outflows, and help address the acute external imbalance in the economy.

Number 5/06, November 2006

China Economic Issues

2

China Economic Issues - Number 5/06, November 2006

I. Introduction

The new renminbi exchange rate regime established in July 2005 has provided impetus for developing foreign exchange derivatives. The increased variation in the RMB/USD exchange rate has raised demand for hedging instruments. At the same time, the People’s Bank of China (PBoC) has also unleashed a series of measures to build up the infrastructure of the foreign exchange market. As a result, the domestic renminbi derivatives market has grown significantly in 2006.

There are also offshore renminbi derivatives markets. Renminbi non-deliverable forward (NDF) contracts have been traded (mostly in Hong Kong and Singapore) since the mid- 1990s, and their trading volume has increased rapidly in recent years. The NDF market, with deep liquidity and technical expertise, has helped to provide hedging service to Mainland entities and their business partners. However, its activity has dropped following a recent guideline by the State Administration of Foreign Exchange (SAFE) which formalised a long-standing unwritten restriction on Mainland entities’

participation in the NDF market. Separately, the Chicago Mercantile Exchange (CME) launched renminbi futures and options in August 2006.

The demand for renminbi derivatives will rise along with increasing flexibility in the renminbi exchange rate and relaxation of the restrictions on currency convertibility for capital account transactions. A liquid renminbi derivatives market is a key component of the financial market on the Mainland, and is important for efficient financial intermediation. The regulatory authorities’ policies play a significant role in the development of the market, particularly in relation to the balance between development and regulation, and interactions between onshore and offshore markets.

This paper reviews the recent development in renminbi derivatives markets, and discusses key market development issues.

Section II of the paper provides an overview of developments in the main renminbi derivatives markets, covering the aspects of supply and demand, price discovery mechanism and market infrastructure.

Section III considers the linkages between the onshore and offshore markets, and analyses empirically the pricing of the onshore forward and NDF rates. Section IV discusses onshore market development issues from a policy perspective.

II. Developments in the major renminbi derivatives markets

This section reviews the key features of the individual renminbi derivatives market – the onshore market and two offshore markets (NDF and the Chicago Mercantile Exchange (CME)), and evaluates their strengths and weaknesses.

2.1 Onshore market

Some form of renminbi derivatives were traded on the Mainland before the exchange rate reform in July 2005 as four state banks and three joint-stock banks carried out forward purchase and sale of foreign currencies with corporates. The development of onshore renminbi derivatives was boosted by the shift to the new exchange rate regime and a series of policy initiatives by the authorities. The PBoC issued in August 2005 two closely related regulations which allow more banks to engage in renminbi forward business, and introduce renminbi swaps to the foreign exchange market.1 The participation of the

1 The forward contract is what is known as an outright forward contract, under which two currencies – one being the renminbi – are exchanged at an agreed forward exchange rate for settlement at a future date. A foreign exchange swap product can be decomposed into a spot transaction and a forward

3 China Foreign Exchange Trade System (CFETS) was broadened substantially, as non-bank financial institutions and non- financial enterprises could also become members and eligible for trading derivatives.

Soon after the issuance of these regulations, inter-bank forward trading started on 15 August 2005. The first foreign exchange swap trades took place in November when the PBoC selected 10 banks to conduct one- year RMB/USD swaps worth USD 6 billion.

Swap trading was later launched in the interbank market in April 2006 when eligible banks started to trade swaps through the CFETS.

It is useful to review major developments from the dimensions of demand and supply, price discovery mechanism and market infrastructure.

Demand side

The fundamental demand for onshore renminbi derivatives largely comes from corporates whose business involves conversion of trade and financial flows between the renminbi and foreign currencies.

The recent regulation introduced by the State Administration of Foreign Exchange (SAFE) also allows individuals to conduct some forward and swap transactions for approved overseas investments or portfolio management.

A number of factors have limited the demand in the onshore market. First, under what is known as the ‘real demand principle’, companies need to demonstrate that the derivative transaction is for hedging against future flows in the current account or financial flows in the permitted categories (including transactions for direct investment overseas, capital income of

transaction, i.e. two parties exchange a given amount of two currencies at the spot rate in the first leg, and then exchange them back in the second leg at the pre- specified exchange rate after a specified period of time.

foreign investment, funds raised in overseas listing by domestic companies, repayment of foreign currency loans and repayment for overseas borrowing).

Second, limited variations in the RMB/USD exchange rate have affected firms’

incentives to hedge against exchange rate risks. There are reported cases where companies sold the US dollar forward, but the actual renminbi appreciation turned out to be milder than anticipated. The foreign exchange gains foregone by locking in the exchange rate in advance can be seen as an opportunity cost for hedging, which had been persistently positive until June 2006 (Chart 1).

Third, many companies lack knowledge and expertise in hedging techniques. They often opt for alternative means to deal with exchange rate risks, e.g. hold more renminbi and less foreign currencies under the general expectations of currency appreciation, or match the timing for receiving and paying foreign exchange.

-1.2 -0.8 -0.4 0.0 0.4 0.8 1.2 1.6

%

-1.2 -0.8 -0.4 0.0 0.4 0.8 1.2 1.6

%

2005 2006

Jun Mar

Nov Dec Jan Feb Apr May

(Actual appreciation) - (Expected appreciation from 3-m NDF rate) (Actual appreciation) - (Expected appreciation from 3-m onshore rate)

Greater actual appreciation Greater expected appreciation

Jul Aug Sources: Bloomberg, staff estimates.

Chart 1. Expected vs actual appreciation

4

China Economic Issues - Number 5/06, November 2006

Supply side

Eligible banks supply derivative trading service to their corporate clients in the retail segment of the market, and trade among themselves and with non-bank financial institutions in the interbank market for portfolio and net position management.

Licences need to be obtained for operations in both the retail and interbank derivatives markets. According to the latest information from CFETS, 75 banks and non-bank financial institutions have obtained the forwards licence in the interbank market, 20 of which are domestic entities and 55 foreign, and 61 are eligible to trade swaps (CFETS, 2006).

Currently derivatives contracts of renminbi vis-à-vis five currencies are offered: the US dollar, euro, Japanese yen, Hong Kong dollar and British pound. Among the five, trading between the renminbi and the US dollar dominates, estimated to account for around 95% of the total. The tenors of contracts available are 1-week, 1-month, 2- month, 3-month, 6-month, 9-month, 1-year and 3 years, but the most liquid tenors are up to one year.

Financial institutions operating in the foreign exchange market are required to maintain a US dollar position between zero and a ceiling on a daily basis, covering both customer and proprietary trading accounts.2 That is, banks are not allowed to short the US dollar, nor can they hold a large position.

Flexibility in position management improved when the accounting practice regarding the net position was changed from cash basis to accrual basis for market makers in January 2006 and for other financial institutions in July. Accrual accounting allows the net open position to be taken on each day as the aggregate over the spot and the forward positions, and

2 The ceiling of the net open position for each bank is approved individually by SAFE.

banks can conduct either spot or forward transactions to meet the required net position.

There is a disparity in developments between foreign and domestic banks.

Foreign banks, having operated in currency markets in other parts of the world, tend to be experienced in dealing with derivatives products, while domestic banks, with the exception of some major ones, notably the Bank of China, generally lack understanding of derivatives products and pricing capacity.

Many of the domestic banks buy foreign pricing systems in which prices are obtained by inputting some key parameters, but find it difficult to price if there are modifications from the standard model.

Price discovery and market infrastructure Price discovery for forwards and swaps is through the request-for-quotes (RFQ) mechanism. Trading is arranged in what is known as the over-the-counter (OTC) form for which licenced banks and non-bank financial institutions interact among themselves and with their customers in a decentralised fashion to make arrangements on trading currencies, contract amount, tenor, exchange rates and delivery.

In the early period, pricing in the onshore market often follows that of the NDF market. It is reported that banks increasingly price forwards and swaps based on interest rate parity in recent periods.

That is, the forward discount or premium reflects the interest rate differential between renminbi and the other contracting currency.

While this is a positive development in that the derivatives market is increasingly driven by financial fundamentals, pricing efficiency is hampered by the absence of a well-established benchmark yield curve.

Interbank interest rates and central bank bill rates are often used as reference rates.

However, interbank borrowing is active mostly for overnight and one-week

5 arrangements, and not all maturities of central bank bills are actively traded. As a result, banks, while making reference to some market rates, often adjust prices based on their own liquidity and open positions, leading to a wide range of quotes on forward and swap rates.

2.2 Offshore markets

The offshore renminbi derivatives markets include mainly the NDF market centred in Hong Kong and Singapore, and the renminbi futures and options recently launched at the CME.

NDF market

According to information from some major banks participating in the NDF market, demand of NDF come from hedgers and speculators. 3 Corporates – mostly multinational companies – are in the market mainly for hedging purposes. Apart from corporates, there is a significant presence of hedge funds, which take positions to profit from renminbi exchange rate movements.

Prior to the introduction of the recent guideline by SAFE, some Mainland banks and entities were known to be active in the NDF market.

Tenors of NDFs offered run up to three years, although those under one year are more liquid. Corporate participants typically concentrate on the three-month tenor, while hedge funds trade NDFs with maturities up to a year.

Banks operate in the NDF market to meet demand from corporates and hedge funds.

3 A non-deliverable forward contract is an arrangement in which forward transactions are settled by making a net payment in a convertible currency (typically the US dollar) proportional to the difference between the agreed forward exchange rate and the actual spot rate on the transaction date, without involving a delivery of the pair of underlying currencies.

They also trade among themselves to achieve their desired investment position.

Earlier surveys by the Hong Kong Monetary Authority (HKMA) suggest that there are seven market makers in the NDF market – the HSBC, Standard Chartered Bank, and DBS in Hong Kong, JP Morgan, Citibank, Deutsch Bank and Bank of America in Singapore.

It is difficult to assess the scale of the NDF market, as its trading is through the OTC method arranged on individual brokers’

systems or the Reuters’ trading platform.

One survey undertaken by the Trade Association for the Emerging Markets in 2004 suggests that the total trading volume of renminbi NDFs in 2003 was around USD 67.9 billion, accounting for about 7% of the global NDF market (EMTA, 2004). The market grew substantially in the last couple of years, with the trading volume rising to around USD 800 million per day in the months leading up to the exchange rate regime reform in July 2005. The market went quieter during the period immediately following the reform as participants generally did not expect another revaluation in the near future. Since volatility in the onshore spot market started to rise in February 2006, the NDF market resumed its growth, with the average daily trading volume reaching around USD 1 billion between February and early October.

However, since the SAFE guideline on restricting Mainland entities’ participation was issued, trading activity in the NDF market has reportedly declined noticeably.

In the early days of the NDF market, around 70% of the trading took place in Singapore.

But Hong Kong has grown to rival Singapore, taking about half of the market share in the past two years. Many major international banks moved their NDF business to Hong Kong, attracted by its geographic proximity and contacts with the Mainland, and the resultant more efficient information flows.

6

China Economic Issues - Number 5/06, November 2006 Renminbi derivatives at the CME

The CME, which is the world’s largest exchange for financial derivatives, launched in August 2006 renminbi futures and options vis-a-vis three currencies – the US dollar, euro and yen. The HSBC and Standard Chartered Bank were selected as the market makers to make two-ways quotes for futures contracts of the renminbi against the US dollar during trading hours of Hong Kong.

The CME renminbi futures can be considered standardised, exchange-based NDFs. Each CME futures contract is RMB 1 million, and there are fixed dates for settlement. The trading arrangements are made through the CME’s electronic platform, which can be accessed around the globe almost around the clock. Apart from easy access and long trading hours, the CME products have a number of other strengths. Trading on the CME platform is anonymous, and carried out in an open and fair environment. Its central clearing system provides guaranteed settlement, thus virtually eliminates counterparty risk.

Despite their attractiveness, the CME renminbi derivatives had a slow start.

According to an internal report of the HKMA based on interviews with major market players, the average daily turnover in the first few trading weeks was 70 contracts worth a total of RMB 70 million or USD 8.8 million – considerably smaller than that of around USD 1 billion in the NDF market. There were days when there was little or no trading at all. As a result, the average bid-ask spread was higher than that of renminbi NDFs, even though pricing

of the CME renminbi futures is based on that of renminbi NDFs. All the transactions were futures contracts of the renminbi against the US dollar, with no trading recorded for contracts of the renminbi against other currencies, or renminbi options.

The slow start of CME renminbi futures probably reflects the restrictive nature of the products. Owing to restrictions in deal sizes and settlement dates, hedgers and speculators may prefer forward contracts arranged over-the-counter for more flexible arrangements.

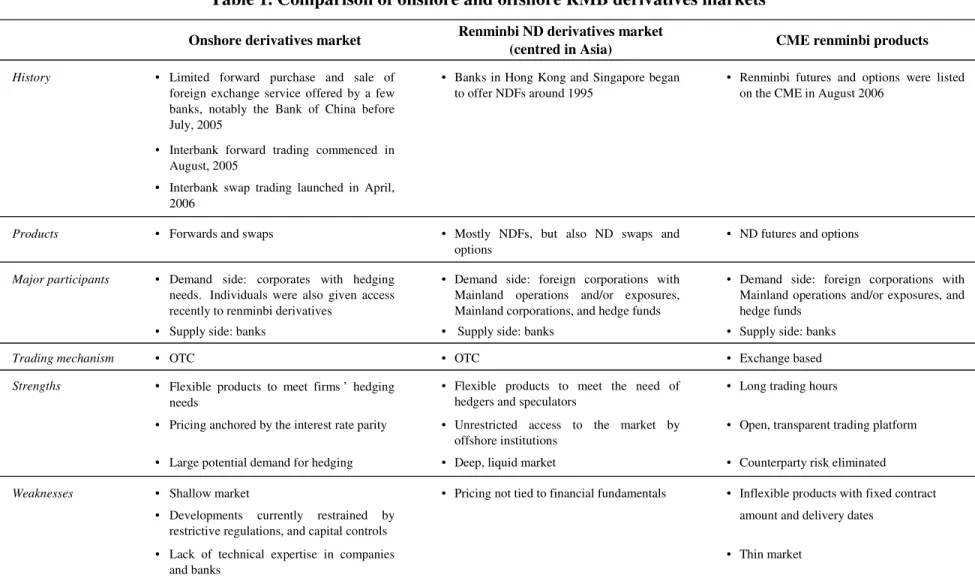

2.3 Summary of comparison of the markets A comparison of the main features of the three markets is provided in Table 1. The onshore derivatives market has seen a rapid build-up in terms of regulations, price discovery and trading mechanisms since the exchange rate regime reform in July 2005.

However, the growth of the market has been restrained by a number of factors including the restrictive regulations on the participant base, lack of technical capacity on the part of the corporate sector and banks, and inadequate supporting financial market infrastructure for pricing.

The NDF market is deep and liquid with unrestricted access and flexible products to meet the demand of hedgers and speculators, but has the drawback that its pricing is not tied to financial fundamentals. Separately, renminbi derivatives at the CME, which have had a slow start, have advantages of using an open, transparent trading platform and little counterparty risk, but suffer from lack of flexibility in the deal amount and settlement time.

• Limited forward purchase and sale of foreign exchange service offered by a few banks, notably the Bank of China before July, 2005

• •

• Interbank forward trading commenced in August, 2005

• Interbank swap trading launched in April, 2006

Products • Forwards and swaps • Mostly NDFs, but also ND swaps and

options

• ND futures and options

• Demand side: corporates with hedging needs. Individuals were also given access recently to renminbi derivatives

• Demand side: foreign corporations with Mainland operations and/or exposures, Mainland corporations, and hedge funds

• Demand side: foreign corporations with Mainland operations and/or exposures, and hedge funds

• Supply side: banks • Supply side: banks • Supply side: banks

Trading mechanism • OTC • OTC • Exchange based

• Flexible products to meet firms ’ hedging needs

• Flexible products to meet the need of hedgers and speculators

• Long trading hours

• Pricing anchored by the interest rate parity • Unrestricted access to the market by offshore institutions

• Open, transparent trading platform

• Large potential demand for hedging • Deep, liquid market • Counterparty risk eliminated

• Shallow market • • Inflexible products with fixed contract

• Developments currently restrained by restrictive regulations, and capital controls

amount and delivery dates

• Lack of technical expertise in companies and banks

• Thin market

CME renminbi products Onshore derivatives market Renminbi ND derivatives market

(centred in Asia)

Table 1. Comparison of onshore and offshore RMB derivatives markets

History Banks in Hong Kong and Singapore began

to offer NDFs around 1995

Renminbi futures and options were listed on the CME in August 2006

Weaknesses Major participants

Pricing not tied to financial fundamentals Strengths

III. Relationship between onshore and offshore markets

From a policy perspective, it is important to monitor and analyse the interactions between onshore and offshore forward markets, and those between the forward and spot markets.

This section discusses the links

between the markets, and presents an empirical analysis.

3.1 Channels of influence between the onshore and offshore markets

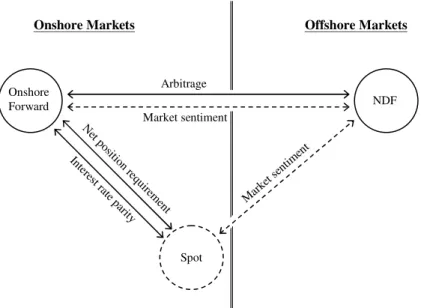

Figure 1 provides a bird’s eye view on the potential links between the NDF, onshore forward and spot markets.4

4 As noted earlier, trading of the CME renminbi non-deliverable futures has yet to take off, and develop its own pricing capacity. Thus, it has not become a significant and independent source of influence in the onshore market.

Figure 1. Links between different renminbi derivatives markets

Market sentiment Market sentiment

Onshore

Forward NDF

Net pos

ition req uirem

ent Inter

est ra te parity

Arbitrage

Spot

Onshore Markets Offshore Markets

There are two channels through which developments in the NDF and onshore forward markets may affect each other.

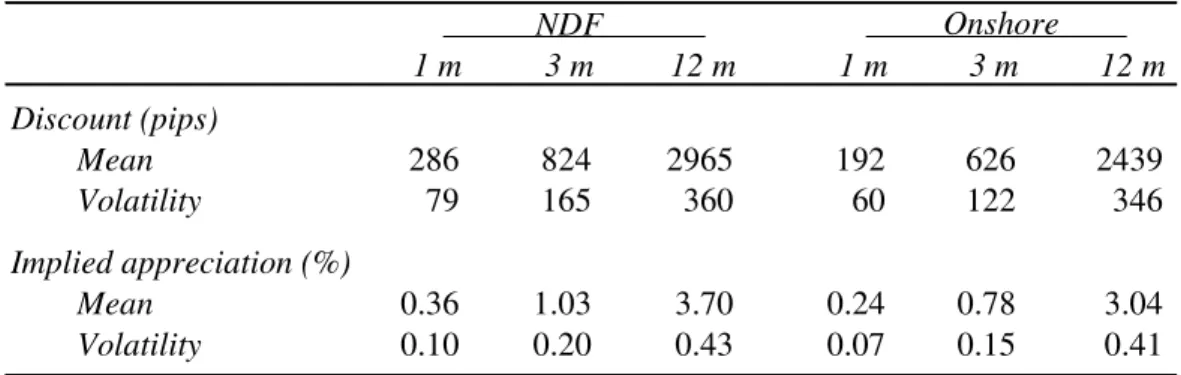

First, until recently, the participation of some Mainland entities in both markets enabled them to arbitrage between the two to exploit price differences. Indeed, the forward rates in the NDF market have persistently implied greater renminbi appreciation, i.e. a cheaper US dollar than in the

onshore market, and profits could be made by buying the US dollar/selling the renminbi in the NDF market, and selling the US dollar/buying the renminbi on the onshore market (Table 2). This trade would raise the price of the US dollar in the NDF market, but add to onshore forward appreciation pressure on the renminbi.

9

Table 2. Discounts and implied appreciation in

onshore forward and NDF rates (October 2005 – November 2006) NDF

1 m 3 m 12 m 1 m 3 m 12 m

Discount (pips)

Mean 286 824 2965 192 626 2439

Volatility 79 165 360 60 122 346

Implied appreciation (%)

Mean 0.36 1.03 3.70 0.24 0.78 3.04

Volatility 0.10 0.20 0.43 0.07 0.15 0.41

Onshore

Sources: Bloomberg and staff estimates.

Apart from arbitrage, market sentiment may spill over, and the two markets may make reference to each other in pricing their own products. In the early days, onshore forward rates often followed NDF rates which were more established. However, it is suggested by some that influence may have started to run from the onshore to offshore market. NDF rates are not tied down by financial fundamentals, as the settlement of NDF contracts is made to reflect the differential between the agreed forward rate and actual spot exchange rate on the settlement date, and does not require holding the renminbi. For these reasons, NDF rates do not necessarily need to reflect financial fundamentals such as the interest rate differential between the renminbi and the US dollar. In contrast, onshore forwards are deliverable, involving settlement in the agreed currencies in the full principal amount. Therefore, forward discounts/premiums should be determined, to a large extent, according to the differential in returns of domestic and foreign assets, although the efficiency of arbitrage that ensures the covered interest parity is likely to be constrained by the prevailing capital controls and the absence of a well-established interest rate structure. The NDF market has become more stable since the

exchange rate regime reform, as reflected by a decline in the implied volatilities of the NDF rates (Chart 2).

This may partly reflect the influence of pricing in the onshore market which is tied down by financial fundamentals.

0.0 2.5 5.0 7.5 10.0 12.5

0.0 2.5 5.0 7.5 10.0 12.5

2002 2003 2004 2005 2006

% %

Source: Bloomberg.

Forward markets can influence the spot exchange rate, through sentiment spillovers, the interest parity condition and net open position requirement. In particular, as the spot and forward rates are linked by the covered interest parity, changes in forward rates would affect the spot exchange rate for given interest rate differentials. The net open position requirement would compel banks to sell the US dollar in the spot market if their holding of the US dollar in the forward market exceeds the approved ceiling as a result of buying the dollar from their corporate clients.

Chart 2. Implied volatility of NDF rates

10

China Economic Issues - Number 5/06, November 2006

3.2 Empirical evidence

An empirical analysis is conducted to assess the correlation between onshore forward and NDF rates, and the importance of financial fundamentals in the pricing of forward rates. It is based on a sample period from October 2005 when data for the onshore forward rates became available.

Correlation between NDF and onshore forward rates

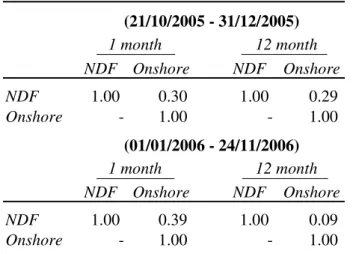

The estimated correlation between the NDF and onshore forward rates is presented in Table 3, and that between the changes of these rates in Table 4.

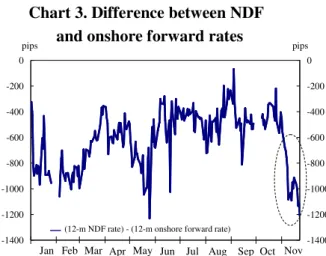

These two tables show that NDF and onshore forward rates were highly correlated, and their correlation increased in 2006 in the case of the one-month tenor (Table 3). There was also some correlation between changes

in onshore and offshore forward rates of shorter tenors (Table 4). However, movements of onshore and offshore rates diverged since the SAFE guideline was issued, with the NDF rates pricing in much greater appreciation (Chart 3). This suggests that the linkage between the two markets possibly through arbitrage by Mainland entities has been reduced.

-1400 -1200 -1000 -800 -600 -400 -200 0

-1400 -1200 -1000 -800 -600 -400 -200 0

(12-m NDF rate) - (12-m onshore forward rate)

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov pips pips

Sources: Bloomberg, staff estimates.

Table 3. Correlation between onshore forward and NDF rates

NDF Onshore NDF Onshore

NDF 1.00 0.80 1.00 0.87

Onshore - 1.00 - 1.00

NDF Onshore NDF Onshore

NDF 1.00 0.99 1.00 0.84

Onshore - 1.00 - 1.00

(21/10/2005 - 31/12/2005)

(01/01/2006 - 24/11/2006) 1 month 12 month 1 month 12 month

Sources: Bloomberg, staff estimates.

Chart 3. Difference between NDF and onshore forward rates

11

Table 4. Correlation between changes in onshore forward and NDF rates

NDF Onshore NDF Onshore

NDF 1.00 0.30 1.00 0.29

Onshore - 1.00 - 1.00

NDF Onshore NDF Onshore

NDF 1.00 0.39 1.00 0.09

Onshore - 1.00 - 1.00

(21/10/2005 - 31/12/2005)

(01/01/2006 - 24/11/2006) 1 month 12 month 1 month 12 month

Sources: Bloomberg, staff estimates.

Price determination

The evidence that the forward rates are closely correlated does not say anything about which one is the dominant force in price formation. To address this issue, an empirical analysis is conducted to examine the importance of the interest parity condition in determining the forward rates. Specifically, the covered

interest parity (CIP) states that under the assumption of an efficient market, the forward premium or discount should be equal to the interest rate differential between domestic and foreign assets. To test the condition for the renminbi vis-à-vis the US dollar, we estimate an equation of the following form:

(1) ft.k − st = α +β (it,k − i*t,k ) + ut,

where:

k

ft.

: logarithm of the forward RMB/USD exchange rate for a contract expiring in k periods

st: logarithm of the spot RMB/USD exchange rate

k

it,

: domestic interest rate

* ,k

it : US dollar interest rate.

The RMB/USD exchange rate is measured as the price of the US dollar in units of renminbi. The forward contract tenor used in the benchmark estimation is twelve months.

Accordingly, the domestic interest rate

is taken as the 12-month central bank bill rate, and the US dollar interest rate is the 12-month London Inter-bank Offered Rate. In Equation (1), if α = 0 and β =1, the CIP holds, pointing to an efficient market.

12

China Economic Issues - Number 5/06, November 2006

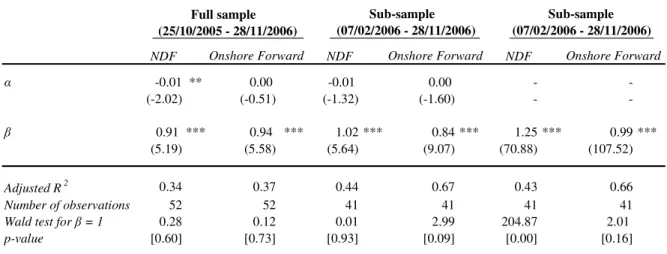

Equation (1) is estimated for both the NDF and onshore forward rates first using weekly data from October 2005 to November 2006. The estimation shows that α is statistically different from zero in the NDF equation (inconsistent with the CIP relationship), but not significant in the equation for the onshore market.

More importantly, β carries the expected sign, and is significantly different from zero in both the NDF and onshore equations. Furthermore, the Wald test shows that β equals to 1 in a statistical sense (Columns 1-2 of Table 5).

We further estimated the equation over a sub-sample starting from February 2006 in order to test whether the interest differential has become more important in recent periods in affecting forward rates. From January 2006, market makers in the Mainland’s foreign exchange market can use either the spot or forward market for managing their net open position.

This effectively links up the spot, forward and money markets, fulfilling an essential condition for the CIP to work. The estimated equations over

this sub-sample show that while α becomes statistically insignificant in both equations, the estimates for β remain robust, with the expected sign and being significantly different from zero (Columns 3-4 of Table 5). The R2 has risen in the sub-sample estimation, particularly for the onshore rate equation. Furthermore, recursive estimation suggests that the estimate of the coefficient on the interest rate differential (β) is quite stable for both equations (Chart 4). 5

These results suggest that the interest rate differential between the renminbi and US dollar assets has played a role in both the NDF and onshore forward markets in determining forward rates between the two currencies. However, there is evidence that the interest rate differential explains a much higher proportion of variations in the onshore forward rate than in the NDF rate. The adjusted R2 of the equation for the onshore forward rate is 0.67 for the onshore foreward rate equation, compared with that of 0.44 for the NDF rate.

5 The recursive estimates are based on the equations without the constant (columns 5-6 of Table 5).

Table 5. Determination of onshore and offshore forward rates

Full sample (25/10/2005 - 28/11/2006)

NDF NDF NDF

α -0.01 ** 0.00 -0.01 0.00 - -

(-2.02) (-0.51) (-1.32) (-1.60) - -

β 0.91 *** 0.94 *** 1.02 *** 0.84 *** 1.25 *** 0.99 ***

(5.19) (5.58) (5.64) (9.07) (70.88) (107.52)

Adjusted R2 0.34 0.37 0.44 0.67 0.43 0.66

Number of observations 52 52 41 41 41 41

Wald test for β = 1 0.28 0.12 0.01 2.99 204.87 2.01

p-value [0.60] [0.73] [0.93] [0.09] [0.00] [0.16]

Sub-sample (07/02/2006 - 28/11/2006)

Onshore Forward Onshore Forward Onshore Forward

Sub-sample (07/02/2006 - 28/11/2006)

Note: t-values are in ( ), p-values in [ ]. ** and *** indicate that coefficients are significant at the 5% and 1%

levels respectively.

Sources: Bloomberg, CEIC, and staff estimates.

Chart 4. Recursive estimates of β

a. NDF market b. Onshore market

1.16 1.20 1.24 1.28 1.32 1.36 1.40

1.16 1.20 1.24 1.28 1.32 1.36 1.40

Jul Apr

Mar May Jun Aug Sep Oct Nov

0.93 0.94 0.95 0.96 0.97 0.98 0.99 1.00 1.01 1.02

0.93 0.94 0.95 0.96 0.97 0.98 0.99 1.00 1.01 1.02

Apr Jul

Mar May Jun Aug Sep Oct Nov

To summarise, the empirical evidence seems to confirm that the CIP has played a role in determining onshore forward rates. The evidence that NDF rates are also affected by the interest rate differential suggests that onshore rates, driven by financial fundamentals, may have started to gain pricing power, and impact on prices in offshore markets. This is a positive development from the perspective of managing risks arising from

derivatives trading in onshore and offshore markets. Of course, in times of market volatility, NDF rates may deviate from onshore rates significantly. In this case, a link between the two markets allowing arbitrage activity would help to stabilise offshore market conditions.

This in turn would reduce sentiment spill-over that otherwise would affect the onshore market.

14

China Economic Issues - Number 5/06, November 2006

IV. Market development issues: a policy perspective

The development of the renminbi derivatives market depends upon a wide range of factors related to overall financial market development on the Mainland and government policies.

The demand for hedging against exchange rate risks is related to the flexibility of the renminbi exchange rate and convertibility of the currency for capital account transactions, two important macroeconomic policy issues facing the Mainland authorities.

A well-established benchmark term structure of interest rates is important for pricing of derivatives. There is also a prudential perspective, as sound market infrastructure and regulation are important for managing risks associated with leveraged trading, potential concentration of exposure and cross-border and cross-market spillover effects. From the policy point of view, two issues are particularly important at this stage, namely the balance between regulation and development, and the relationship between onshore and offshore markets.

4.1 Balance between development and regulation

At a macro level, exchange rate flexibility and currency convertibility and the development of the renminbi derivatives market are mutually reinforcing. Considering the challenge to macroeconomic policy management posed by the rising balance of payment surpluses, there are merits in considering a proactive policy to develop the renminbi derivatives market. A liquid derivatives market will facilitate greater flexibility of the exchange rate by reducing costs for individuals and corporates to manage exchange rate risks. It also increases

the substitutability between domestic and foreign assets, and thus helps to induce capital outflows.

To build up the market, two measures can be considered. First is to broaden the participant base, which is currently limited to those with hedging needs associated with current account and permitted capital account transactions.

While the participant base will expand along with the relaxation of capital controls over time, this ‘real demand’

principle is probably too restrictive for the growth of market liquidity. It would be helpful to allow, in some form, the participation of entities without permitted underlying transactions (speculators). Some element of speculation, coupled with an increase in flexibility of the spot exchange rate, would help to reduce one-sided positions and increase market liquidity, as speculators are prepared to take different positions from hedgers.

Second is to introduce new products such as exchange-traded renminbi futures contracts and options. This will offer hedgers and investors alternative instruments which are standardised and relatively easily accessible. As the central clearing system would virtually eliminate counterpart risk, it helps those entities such as small-sized enterprises which otherwise may have difficulties in obtaining forward contracts from banks. The open and fair environment in which transactions are conducted also helps pricing efficiency. The introduction of exchange-traded products would require a relaxation of the “real demand” principle, as it is difficult to ascertain the nature of transactions and enforce the restriction.

In considering market development initiatives, an important concern for the authorities is risk management. At

15 this early stage of development, the risk for large shocks that may threaten financial system stability should be limited, given the small scale of derivatives trading. However, regulation and supervision are important to ensure that risks taken by financial institutions are properly identified and managed to avoid a situation where adverse developments of individual institutions may lead to major policy reversals and setbacks in development efforts. It is important for the management of financial institutions to possess sufficient understanding of the derivatives business and the associated risks, and have the appropriate internal mechanisms in place for monitoring and control. The regulators should promote market transparency and high reporting standards, and put in place a robust infrastructure for clearing and settling exchange-traded transactions.

There is also a concern on whether currency derivatives trading may intensify the appreciation pressure on the renminbi. Derivatives could reduce the cost of speculative capital flows by expanding leverage, and market makers may add to pressures on the currency when they cover their corresponding counterpart short positions through purchase of domestic currency assets in the spot market. However, experience elsewhere suggests that the two-way connection between derivatives and spot markets is unlikely to be a significant concern except under the circumstances of severe market volatility, particularly when the currency is under downward pressures (Eichengreen and Mathieson, 1998).

Some increased volatility at the early stage of exchange-traded instruments may spill over to the spot market, as a result of uninformed traders migrating to derivatives markets and increased

leveraging in trade. But this initial stage of market development is inevitable, and is unlikely to pose systemic risks.

More importantly, fostering the development of the derivatives market at present can help to reduce one-sided positions on the renminbi by promoting asset substitutability. The Qualified Domestic Investor Scheme (QDII) and banks’ offshore wealth management business have not had a strong start in inducing outflows by the private sector. This reflects general expectations of reminbi appreciation by investors, which reduce the ex ante risk-adjusted return on external investment. While a widening of the scope of permissible investment products will help, it is probably equally important to reduce the cost of hedging against exchange rate risks by increasing the types of instruments available and their liquidity.

4.2 Relationship between onshore and offshore markets

Another important issue is the relationship between onshore and offshore renminbi derivatives markets.

Unlike domestic currency denominated financial assets, exchange rate derivatives inevitably involve foreign participants, who have a need to hedge against their Mainland-related activities and exposures. If these participants do not have access to the onshore market, an offshore market would develop. It is difficult to separate the onshore and offshore markets, as sentiments in the two markets may affect each other even if direct arbitrage in the forward market is restricted. An important policy issue is whether some form of a direct link between the two markets should be allowed, enabling arbitrage

16

China Economic Issues - Number 5/06, November 2006

by the participants having access to both markets. There are both benefits and risks associated with such a direct link. The interaction between the two markets would help the development of the onshore market, with domestic market participants benefiting particularly from the transferable skills and experience of international market players. One potential concern is that pressures in the NDF market may transmit to the onshore market.

The link can take two forms:

international institutions participating in the onshore market (coming in) and domestic entities trading in the offshore market (going out). The opening up of the domestic market to international players can help expand trading activity, increase liquidity as well as promote a more competitive environment which improves market efficiency. Interaction with international banks also enables transfer of technical know-how to domestic banks.

From the risk management perspective, the ‘going out’ option may be advantageous compared with the

‘coming in’ option at the early stage of market development. First, the opening of the domestic derivatives market to foreign participation has significant implications for relaxing controls on renminbi convertibility for capital account transactions.

Moreover, large transactions undertaken by international players

could lead to excessive volatility in a shallow domestic market. This would make it difficult for relatively inexperienced domestic banks to deal with risk management. Thus, domestic market developments may be better served if the onshore market remains closed to international players while domestic entities are allowed to participate in the international market in some form.

One possibility is to allow Mainland- based banks to trade in the NDF market. This would keep hedging transactions of non-bank entities in the onshore market while allowing banks to learn and gain experience from trading with international market players. In normal times, NDF rates are likely priced against onshore forward rates, and the anchoring role of the onshore market will only increase over time as the financial market on the Mainland deepens and the renminbi becomes increasingly convertible for capital account transactions. In times of market volatility when NDF rates may deviate from onshore rates significantly, arbitrage by Mainland banks between the two markets would help to stabilise NDF rates. This would in turn stabilise the onshore market through the sentiment spillover channel, and reduce pressure on the renminbi exchange rate.

17 References

China Foreign Exchange Trade System, 2006,

http://www.chinamoney.com.cn/column/waihui/hyxx/hyhzssmd/index.html.

Eichengreen, Barry and Donald Mathieson, 1998, Hedge Funds and Financial Dynamics, IMF Operational Paper 166, (Washington; International Monetary Fund).

Trade Association for the Emerging Markets, (2004), ‘2003 Annual emerging markets NDF volume survey’.

中國人民銀行, (2006), 《企業規避匯率風險情況調查》.

About the Author

Wensheng Peng is a Division Head, Chang Shu a Senior Manager and Raymond Yip a Manager in the External Department. The authors would like to thank Nathan Chow and Jun-yu Chanfor research assistance. The authors are responsible for the views expressed in this article and any errors.

About the Series

China Economic Issues provide a concise analysis of current economic and financial issues in China. The series is edited by the External Department.