Why A-share market volatility is high?

Hui Miao and Wensheng Peng

Developments in the A-share market are notable not only for the strong rally in the past year, but also for sharp fluctuations in prices. Historical numbers show that volatility in A-share prices is much higher than that in share prices in the US and Hong Kong, including prices of Hong-Kong-listed Mainland companies. Our analysis suggests that macroeconomic and monetary conditions are unlikely to be a significant factor in explaining the relatively high volatility of the Mainland stock markets.

Of more importance are structural and institutional factors that reflect the developing stage of the Mainland market. The large presence of individual investors, high concentration in cyclical sectors, and inadequate sophistication of the trading mechanism including the lack of derivatives for risk management all play a role.

Continued efforts are required to develop institutional investors, increase sectoral diversification of listed companies, and improve the trading mechanism including the launch of derivative products such as index futures trading. It is also important to strengthen the links between the Hong Kong and Mainland markets, which would help to improve investor base, product breadth and market depth and foster the development of a combined world class stock market over time.

Number 4/07, June 2007

China Economic Issues

I. Introduction

The Mainland stock market has made significant progress in the past few years.

The A-share market witnessed phenomenal growth with the market capitalisation rising from 17% of GDP in January 2005 to 76% in May 2007.

Investor confidence recovered after a five-year bear market as the share re-designation reform resolves the problem of non-tradable shares and reduces concerns about corporate governance of listed companies.

Institutional investors have emerged as an important market force. Regulation and supervision have also improved.

Recent development in the A-share market is notable not only for the strong rally in the past year, but also for sharp swings in stock prices. On 27 February 2007, the A-share market experienced its biggest one-day decline in 10 years (down 8.8% for the Shanghai Composite Index with 840 companies or 58% of total listed A shares hitting the 10% daily trading downside limit). The sell-off was followed by a sharp rebound, and the Shanghai Composite Index recorded a 55% gain from March to May 2007. The index dropped by 6.5% on 30 May following the increase of the stamp duty for stock transaction from 0.1% to 0.3%, and fell by 8.3% on 4 June.

Historical numbers show that A Share prices were much more volatile than stock prices in Hong Kong including H-share prices and other more developed markets. Volatility is a natural part of financial markets and provides useful signal of changing value of investment opportunities. However, large volatility

unrelated to market fundamentals may indicate structural deficiencies in the market and will impede its role of price discovery and resource allocation.

This paper provides a review of structural factors that may help explain relatively large volatility in the A-share market. The rest of the paper is organised as follows. Section 2 presents the stylised facts about stock price volatility in Mainland China, Hong Kong and the US. It is shown that volatility in macroeconomic and monetary conditions, which are often considered to be factors contributing to volatility in emerging market economies, are unlikely to be a significant factor explaining the relatively high volatility in A-share prices. Section 3 presents some of the plausible structural explanations for the difference in volatility with a focus on three issues:

the investor structure, index composition and trading mechanism. Section 4 concludes with remarks on policy implications.

II. Stock market volatility and possible contributing factors

A-share prices have shown striking variations of volatility. Chart 1 shows the rolling 10-day historical volatility (standard deviation) of the Shanghai Composite A-share Index (SHCOMP), Hang Seng Index (HSI) and S&P500 (SPI), all adjusted to the annual rate by multiplying the square root of the number of trading days in the year. A-share index has recorded the largest volatility among the three indices and the difference has increased in the last few years.

Chart 1 Comparison of Historical 10-day Volatility

Shanghai Composite Index

0 10 20 30 40 50 60 70

Jan-00 Oct-00 Aug-01 Jun-02 Apr-03 Feb-04 Dec-04 Oct-05 Jul-06 May-07

U.S. S&P 500 Index

0 10 20 30 40 50 60 70

Jan-00 Oct-00 Aug-01 Jun-02 Apr-03 Feb-04 Dec-04 Oct-05 Jul-06 May-07

Hong Kong Hang Seng Index

0 10 20 30 40 50 60 70

Jan-00 Oct-00 Aug-01 Jun-02 Apr-03 Feb-04 Dec-04 Oct-05 Jul-06 May-07

Source: Bloomberg

Note: The 10-day historical volatility is calculated as ten day standard deviation of daily percentage change times annual factor (16).

In particular, for the period January 2000 to April 2007, SHCOMP experienced both higher average volatility and more frequent occurrence of extreme high-volatility episodes than the other two indices. The average annualised monthly volatility of

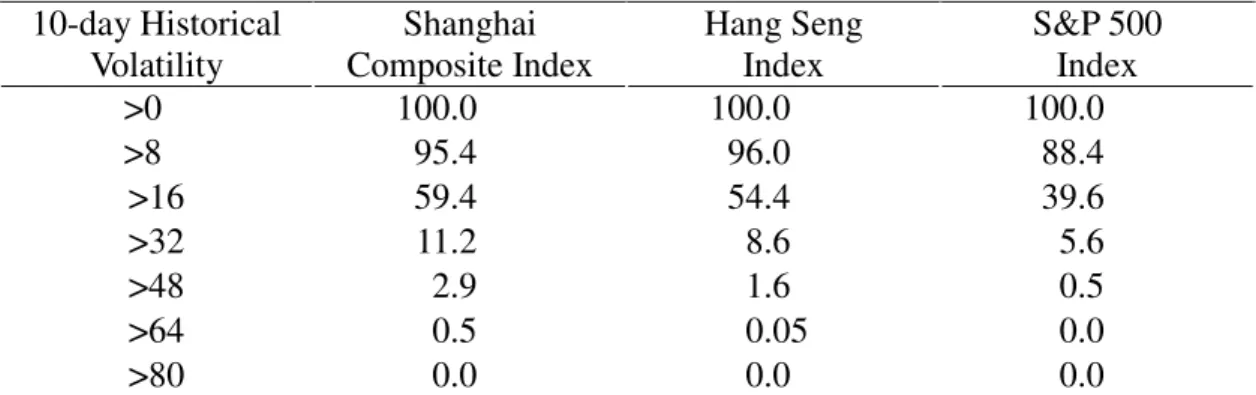

SHCOMP is 21% compared to 15% for HSI and 13% for SPI. Table 1 shows that SHCOMP is six times more likely than SPI to see 10-day annualised volatility exceeding 48%.

Table 1 Percentile Distribution of 10-day Historical Return Volatility (Sample: January 2000 to April 2007 daily data, in percent)

Source: Bloomberg and staff estimate

Macroeconomic conditions and structural and institutional factors contribute to the difference in volatility across markets and over time. Schwert (1989) studied the relationship between stock price volatility and real and nominal macroeconomic volatility using U.S. monthly data from 1857 to 1987. He found that macroeconomic volatility such as inflation, money and industrial production growth are significant explanatory factors though they account for less than half of stock price volatility. Relatively high volatility in macroeconomic conditions and policy uncertainties are often cited to be a factor explaining high financial market volatility in emerging markets (Wei, 2004).

The maturity of the asset market also matters. The emerging markets in general tend to be more volatile than the highly-liquid developed markets. This might be related to structural and institutional factors such as speculative investors (“noisy

traders”), inexperienced regulators, inside trading and manipulation, limited investment products and instruments for risk management. Ng and Wu (2005) investigated the impact of trading behaviour on stock market volatility based on the trading records of 7 million investor accounts on the Shanghai Stock Exchange from 2001 to 2002, and found that rising stock volatility was associated with positive-feedback behaviour or herding by individual investors. Wei (2004) found that inside trading is positively related to the stock market volatility based on a cross-country sample of 55 markets. Skinner (1989) shows that volatility of the underlying security typically declines after the introduction of derivative trading. The availability of derivative securities such as options and futures helps risk management and usually reduces market volatility.

Table 2 compares Mainland China, Hong Kong and US markets in terms of volatility 10-day Historical

Volatility Shanghai Composite Index

Hang Seng Index

S&P 500 Index

>0 100.0 100.0 100.0

>8 95.4 96.0 88.4

>16 59.4 54.4 39.6

>32 11.2 8.6 5.6

>48 2.9 1.6 0.5

>64 0.5 0.05 0.0

>80 0.0 0.0 0.0

in stock price index, macroeconomic and monetary policy indicators and market maturity indicators. It shows that the higher A-share market volatility cannot be explained by difference in volatility in macroeconomic and monetary conditions in the sample period. In fact, there is no marked difference between Mainland China and the US in terms of volatility in real GDP growth, inflation and broad money growth.

But the Mainland market is at an early stage of development as reflected in the low market size relative to GDP and the high turnover ratio. The difference in volatility of the stock price index seems to be attributable more to the stage of market development and associated structural and institutional factors than to macroeconomic and monetary conditions.

Table 2 Stock Price Volatility and Economic Fundamentals (Sample period: January 2000 to April 2007)

Mainland China U.S. Hong Kong SAR

Stock Price Index

(Standard Deviation) 21.1 15.3 13.4

Macroeconomic Indicators (Standard Deviation)

Real GDP Growth 1.0 1.2 3.8

Inflation 1.6 0.8 2.7

Broad Money Growth 2.5 1.9 5.8

Market Maturity Indicators (%)

Tradable Market-Cap /GDP 20 143 913

Turnover/Market Capitalisation 645 148 134

Source: CEIC and staff estimate

Note: Stock price volatility refers to average historical monthly volatility (annualised)

III. Structural and institutional factors There are three structural factors, that in our view are likely to have contributed to the observed high volatility in the A-share market; these are investor structure, market composition and trading mechanism.

Investor base

The ownership structure of stock market has important implications for market volatility.

Professional investors tend to focus on the

long-term investment potential of a company and follow more rigorous analytical approach in their stock selection process, while individual investors tend to follow the herd and concentrate on short term performance. The presence of institutional investors thus helps reduce irrational market movements.

On the Mainland retail investors are dominant market players. Institutional investors, mainly mutual funds, are growing rapidly but from a low base. As shown in

Table 3, individual investors account for 69% of tradable investment holdings in the A-share market compared with 37% in the US. Mainland mutual fund companies (57 in total) hold about 25% of the total tradable A-share market capitalisation by the end of

1Q 2007. The National Pension Fund and insurance companies hold about 4% of the tradable market capitalisation, while Qualified Foreign Institutional Investors (QFII) holding is less than 3%.

Table 3 Comparison of Investor Structure

Mainland China U.S. Hong Kong SAR (in percent)

Individual investors 69 37 30

Institutional investors 31 63 70

Mutual funds 27 25 --

Contracted savings 4 38 --

Source: Shenzhen Stock Exchange, Hong Kong Exchange, Blume (2002), and staff estimate

Note: Mainland China and U.S.A. investor structure is breakdown by tradable investment holding, while Hong Kong investor structure is breakdown by trading volume. Contracted saving includes investment by insurance companies and pension funds.

In contrast, the US market is dominated by professional investors. Institutional investors like mutual funds, pension funds and insurance companies hold 63% of the US stock market by value, with individual investors holding the remaining 37%

(Blume 2002). These individual direct holdings are highly concentrated as well, with millionaires 1 holding 52% of all individual-held stocks. Since millionaires are usually classified as professional investors, the total shares of stocks controlled by professional investors would be as high as 81%.

In Hong Kong, local and overseas institutional investors account for 70% of the trading volume with international investors making up 47% of the total stock turnover. Global institutional investors like European pension funds are active investors

1 Investor with financial assets over 1 million US dollars (Blume 2002)

in Hong Kong.

The quality of institutional investors also matters. On the Mainland, the fund industry is at an early stage of development and is not sophisticated as indicated by the high turnover ratio of some mutual funds (see below). Furthermore, contracted long-term investors such as pension funds and insurance companies are only recently allowed to invest in the stock market, and their significance is yet to grow. In the US, contracted savings such as pension and insurance funds hold about 38% of the market capitalisation.

Two recent developments on the Mainland are noteworthy. First, new individual investors are increasing and have become an important group of players in the A-share market. By the end of 1Q 2007, the total number of individual accounts reached 84 million with 10.9 million accounts

opened during the past year; therefore at least 13% of investors are first time investors during the last 12 month. Since some old accounts are dormant accounts with zero balance (estimated at around 35 million), newcomer accounts could make up more than a quarter of the total active retail investor accounts. New market players are particularly susceptible to euphoria and panic and likely to increase market volatility.

Second, the herding behaviour tends to put pressure on institutional investors, particularly mutual funds, which are subject to ranking and redemption pressure. It is reported that in 2006 the annual turnover ratio of most mutual fund companies was 219%, that is, a typical mutual fund usually holds a stock for 6 months. In the meantime individual investors normally hold a stock for only 3 month (with an annual turnover ratio of 376%). In the US, the majority of the mutual funds have a turnover ratio of less than 50%, that is, the average holding period of a stock is about 2 years for U.S.

intuitional investors.

Market Concentration

The concentration of listed companies by sector and size will also affect stock market volatility. Concentration of stock listings from cyclical sectors would increase the overall market volatility. Conversely, if there is a balanced mix of industry sector representation in the stock market, the volatility will be reduced.

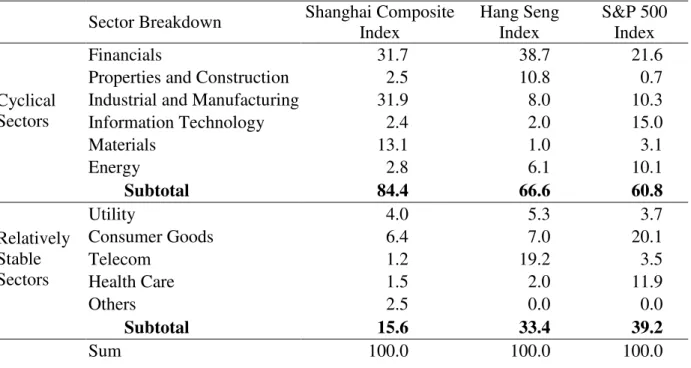

The weight of cyclical sectors is estimated to be about 84% for SHCOMP compared to only 61% for SPI and 67% for HSI. While defensive sectors like consumer staples and health care have a weight of 32% in SPI, they have minimal weighting in SHCOMP.

The SHCOMP components have changed somewhat with the new listing of big banks and insurance companies since 2006. The financial stocks now account for 32% of the total SHCOMP weight. Overall the listing of large financial firms has improved the market structure in terms of quality of listed firms, but it does not reduce the skewed distribution of cyclical and non-cyclical sectors.

Table 4 Sectoral Distribution of the Stock Market Index (in percent)

Sector Breakdown Shanghai Composite Index

Hang Seng Index

S&P 500 Index

Financials 31.7 38.7 21.6

Properties and Construction 2.5 10.8 0.7

Industrial and Manufacturing 31.9 8.0 10.3

Information Technology 2.4 2.0 15.0

Materials 13.1 1.0 3.1

Cyclical Sectors

Energy 2.8 6.1 10.1

Subtotal 84.4 66.6 60.8

Utility 4.0 5.3 3.7

Consumer Goods 6.4 7.0 20.1

Telecom 1.2 19.2 3.5

Health Care 1.5 2.0 11.9

Relatively Stable Sectors

Others 2.5 0.0 0.0

Subtotal 15.6 33.4 39.2

Sum 100.0 100.0 100.0

Source: Bloomberg and Internet and staff estimate

It is noted that HSI is skewed towards the finance and property sectors (with a weight of about 49). This reflects the unique structure of the Hong Kong economy and its role as an international financial centre.

Even though HSBC accounts for 20% of the index weight, HSBC as a global bank has geographically diversified business lines, which helps to limit its vulnerability to cyclical movements of any particular economy.

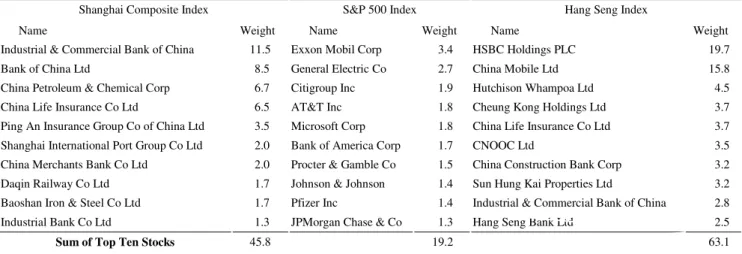

The concentration of individual stocks also has implications for market volatility. The presence of a large number of diverse companies helps to smooth out the idiosyncratic firm-specific earning surprises and thus reduce volatility. In this respect, the Mainland market also seems to be dominated by a few large firms. The top ten stocks account for 46% of the SHCOMP weighting compared to only 19.2% for the S

& P 500 Index.

Table 5 Stock Concentration in Market Indexes

Shanghai Composite Index S&P 500 Index Hang Seng Index

Name Weight Name Weight Name Weight

Industrial & Commercial Bank of China 11.5 Exxon Mobil Corp 3.4 HSBC Holdings PLC 19.7

Bank of China Ltd 8.5 General Electric Co 2.7 China Mobile Ltd 15.8

China Petroleum & Chemical Corp 6.7 Citigroup Inc 1.9 Hutchison Whampoa Ltd 4.5

China Life Insurance Co Ltd 6.5 AT&T Inc 1.8 Cheung Kong Holdings Ltd 3.7

Ping An Insurance Group Co of China Ltd 3.5 Microsoft Corp 1.8 China Life Insurance Co Ltd 3.7

Shanghai International Port Group Co Ltd 2.0 Bank of America Corp 1.7 CNOOC Ltd 3.5

China Merchants Bank Co Ltd 2.0 Procter & Gamble Co 1.5 China Construction Bank Corp 3.2

Daqin Railway Co Ltd 1.7 Johnson & Johnson 1.4 Sun Hung Kai Properties Ltd 3.2

Baoshan Iron & Steel Co Ltd 1.7 Pfizer Inc 1.4 Industrial & Commercial Bank of China 2.8

Industrial Bank Co Ltd 1.3 JPMorgan Chase & Co 1.3 Hang Seng Bank Ltd 2.5

Sum of Top Ten Stocks 45.8 19.2 63.1

Source: Bloomberg

Trading Mechanism

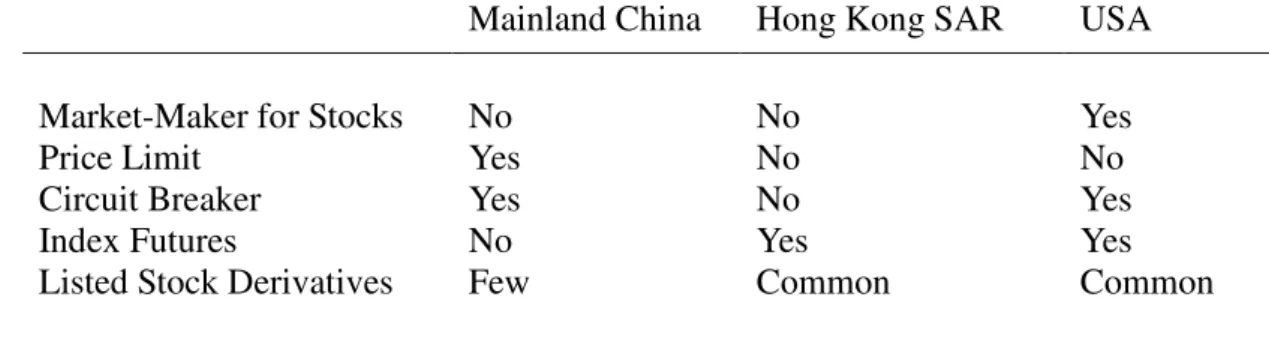

Trading mechanism could be a key factor in explaining the difference in market volatility.

Due to the variation in regulatory constraints, investor sophistication and market tradition, exchange features such as microstructure for price formation, trading halts and shorting mechanism might be designed with different focus. The existing market instruments and trading mechanism in the Mainland stock market are not sophisticated enough to limit market volatility.

First, the Mainland stock market is an order-driven market that employs an automated electronic trading system without market-makers. All liquidity is provided by

limit orders submitted from buyers and sellers. In contrast, in more developed markets such as the US and London, a substantial amount of liquidity is supplied by market-makers in addition to public limit orders. For example, only 54% of the orders in the New York Stock Exchanges are limit orders in 1996 (Ahn 2001). The market-makers are obliged to quote two-way prices within a narrow bid-ask spread and thus contribute to market stability.

Under the current system, the Mainland market is relatively shallow. At the end of 2006, the market depth for a typical SSE180 index component stock, measured as the sum of the highest five and ten limit orders, is only RMB2.87 million and RMB5.66

million respectively, which are considered small (Shanghai Stock Exchange, 2007). As a result, a small order could have a significant impact on price movements and the market is prone to volatility and manipulation. According to the same research by Shanghai Stock Exchange (2007), a transaction of RMB100,000 yuan can have a price impact (liquidity cost) of 0.32, which is about 10 times higher than mature markets like the Hong Kong Stock Exchange and the New York Stock Exchange.

Second, the Mainland exchanges impose a 10% movement limit for the price of ordinary stocks in any trading day. Trading for a stock is set to shut down for the day if that particular stock moves more than 10%

up or down from the previous day’s closing price. The 10% price limit was imposed after a market crash in 1996 and has remained in place ever since. The goal was to avoid sharp price movements caused by buying manias and panic selling. Stopping trading would allow information to be better disseminated and processed by market participants, thus helping to reduce volatility.

However, there could be an adverse effect.

If investors value the ability to transact quickly, the trading halt will reduce liquidity and thus increase volatility (Schwert, 1998).

The reduced liquidity makes it easier to manipulate stock prices. As a comparison, the Hong Kong Stock Exchange does not

impose any price limit or circuit breaker.

The New York Stock Exchange has circuit breakers, but they are rarely triggered.

Unlike price limits, circuit breakers are temporary trading halts when price changes exceed certain pre-set daily limits. Trading will resume after the short break.

Finally, the Mainland exchanges are long-only markets with almost no derivative trading; investors can only make money by taking long positions. There is no short selling mechanism through either index futures trading or stock lending, which is vital for market discipline. Short selling increases the tools available to execute diverse investment strategies. It also paves the way for derivative product development.

Stock lending also artificially increases the supply of stocks for current sale, leading to more price-sensitive trading and increasing the depth of the market. Both Hong Kong and the US have sophisticated derivative products, including futures contracts, which attract investors with different level of risk appetite and thus increase market liquidity.

A summary of Exchange features discussed above is provided in Table 6. It should be noted that the development of derivatives market including index futures trading is constrained by the shallow cash market, narrow investor base and lack of technical expertise on pricing complex instruments. If the cash stock market is not liquid and deep, index futures could be easily manipulated.

Table 6 Summary of Exchange Features

Mainland China Hong Kong SAR USA

Market-Maker for Stocks No No Yes

Price Limit Yes No No

Circuit Breaker Yes No Yes

Index Futures No Yes Yes

Listed Stock Derivatives Few Common Common

IV. Policy Implications

In order to prevent excess volatility, further reform and development are required to widen the investor base and reduce market concentration. This would facilitate the development of derivative products and improvement of the trading mechanism. The authorities including the China Security Regulatory Commission (CSRC) have implemented several measures in recent years such as boosting the supply of large-cap stocks, improving the standard of information disclosure and supervision of irregular stock trading, raising risk awareness of investors. Some other measures are also being explored.

A number of policy initiatives are particularly worth noting. First, as pointed out in Shenzhen Stock Exchange (2006), both the size and the quality of the fund industry can be improved. It is encouraging that mutual funds have started to gain popularity among individual investors recently. Instead of buying stocks on their own, an increasing number of retail investors are investing in mutual funds.

In this respect, it is important to expand the investor base to include more long-term investors such as regional pension funds and insurance companies. As assets of regional pension funds are growing rapidly, regulatory restrictions on their investment in Mainland equity markets can be gradually relaxed. Apart from supervision and regulation of the fund industry by the regulators, market based discipline such as rating on mutual funds and fund managers can also help improve the quality of professional investors.

Second, the increase of supply of stocks through public offerings has been remarkable in the past year, helping to mitigate stock and industry concentration.

The reduction of government holdings of shares may also be considered. On a broader scope, supply of alternative investment

products like corporate bonds, real estate investment trust, asset-backed securities and exchange-traded funds (ETFs) would help address the shortage and imbalanced supply of financial assets.

Third, it is important to improve the trading mechanism. Measures should be explored to improve the price discovery process including whether the 10% price limit should be removed or widened and whether market-makers should be introduced. More investment products like derivatives, ETFs and index futures will bring in a diverse set of investment styles and trading demand and thus improve the depth of the market.

Last but not least, Hong Kong can and should play a helpful role in the development of the Mainland market given its position as an international finance centre.

It should also play a significant role in providing financial intermediation for the Mainland. A gradual integration between the Mainland and Hong Kong markets would help improve the investor base, product breadth and market depth of the A-share market, thereby improving the efficiency of price discovery. The pooled liquidity and investor base would create a world class stock market by market capitalisation, trading volume and liquidity (Yam, 2007a,b).

The two markets are currently segmented in many ways as evidenced by the large price gaps between A and H shares of dual-listed companies. This is largely due to the restrictions on renminbi convertibility for capital account transactions. The links between the two markets could be strengthened gradually through various channels. First, the scope of the Qualified Domestic Institutional Investors (QDII) and QFII schemes can be increased. The recent announcement of expanding QFII quota to USD30 billion (equivalent to about 5% of the A-share tradable market capitalisation) will increase the participation of international investors. Considering the

overheating concerns in the A-share market and renminbi appreciation pressure, of more importance at this stage is to expand the QDII scheme to induce more outflows of funds in an orderly manner. The recent expansion of the scope of bank QDIIs by the China Bank Regulatory Commission is an important step, and there are reported similar efforts by other regulators. Second,

financial instruments in the two markets can be cross-listed to allow better investor access. For example, to increase the supply of financial assets on the Mainland market, products such as ETF and China Depository Receipts (CDR) can be introduced to allow Hong-Kong-listed shares of Mainland companies to be traded on the Mainland.

Reference:

何基报,王霞, “机构投资者发展战略研究”, Shenzhen Stock Exchange Research Centre, August 2006

刘逖,叶武,“对我国股市流动性不足及其危害的几点思考”, Shanghai Stock Exchange Research Centre, August 2006

杨海成, 陈工孟, 芮萌, “投资者行为及政策含义——交易制度和产品创新的微观基础”,

Shenzhen Stock Exchange Research Centre, July 2006

Ahn, H.J., Bae, K.H. and Chan, K., “ Limit Orders, Depth and Volatility: Evidence from the Stock Exchange of Hong Kong”, The Journal of Finance, 2001

Hong Kong Stock Exchange, “The HKEx Cash Market Transaction Survey 2004/05”, May 2006

Hong Kong SFC, “Circuit Breakers: International Practices and effectiveness” Quarterly Bulletin, Autumn 2001

Marshall E. Blume, “The Structure of U.S. Equity Markets”, University of Pennsylvania, March 2002

Ng, Lilian and Wu Fei, “The Trading Behaviour of Institutions and Individuals in Chinese Equity Markets”, University of Wisconsin, January 2005

Shanghai Stock Exchange, “Market Performance Report”, April 2007

Skinner, D., “Option Markets and Stock Return Volatility”, Journal of Financial Economics, 1989

Schwert, G.W., “Why Does Stock Market Volatility Changes Over Time? ”, The Journal of Finance, 1989

Schwert, G. W., “Stock Volatility in the New Millennium: How Wacky is Nasdaq? ”, NBER Working Paper No. 8436, August 2001

Schwert, G. W., “Stock Volatility: Ten Years After the Crash”, NBER Working Paper No.

6381, January 1998

Wei, Shangjin, “Does Insider Trading Raise Stock Market Volatility? ”, Economic Journal, 2004

Yam, Joseph, “linking the Mainland's and Hong Kong's financial markets (II)”, View Point, Feb 2007

Yam, Joseph, “Linking the Mainland's and Hong Kong's financial markets”, View Point, Jan 2007

About the Author

Wensheng Peng is Division Head and Hui Miao Manager in the External Department. The authors are responsible for the views expressed in this article and any errors.

About the Series

China Economic Issues provides concise analysis of current economic and financial issues in China.