Towards a Process Model of Innovation strategies – A Case Study in Bank Industry

劉代洋 陳守維

國立台灣科技大學 北台灣科學技術學院

企業管理系 資訊管理系

教授 講師

摘要

近年來服務業對創新的需求已逐漸浮顯。其中金融業的環境在過去 數十年中,經歷了劇烈的改變已由靜態而到動態;在此產業中的專業 經理人員不止要面對殘酷激烈的競爭,而且他們也負有責任須使組織 經由創新而創造出利潤。之前有關服務業創新的文獻,大都專注於對 某單一領域的創新、成功或失敗的因素以及對其績效表現的衡量方面。

但有關於在投入與產出之間組織實際創新的過程,其如何創新及所作 創新內容的過程為何卻如同黑盒子一般少為研究者所探索。因此,本 研究根據流程理論,針對個案公司在時間歷程上發覺其創新過程的策 略及連帶所產生出的結果。根據一銀行的個案,發展出一創新策略的 流程模型並作為本研究的研究架構。本架構亦可做為未來其他服務業 公司在做創新時的依據。

關鍵字: 創新、流程理論、個案研究

Abstract

The demand for innovation in service industry has emerged recently.

The financial industry in services has sharply changed from static to dynamic environment during the past decade. Those business managers in this industry not only face fierce competition, but also are the central responsible persons to make profit to firms through innovation. Most previous research of innovation for services has focused on single field of innovation, successful or failure factors, and its performance examination.

The state of knowledge to unfold the “black box” of how and what content of innovation process between input and output are still lack of study.

Drawing on process theory, this research explores the innovation process by examine its innovation strategies and its generating outcomes in different phases over time. Based on one bank case, we also develop a process model of innovation strategies as the framework of this article.

This also could serve in guiding future innovations for service-based company.

Keyword: Innovation, Process Theory, Case Study

Introduction

In today’s high competition environment, most managers would recognize that a firm’s innovation is a key to growth. A firm’s history of innovative activity significantly affects its current financial

performance(Peter and Raphael 2003). Joe Tidd (2001) addressed that firms are innovative and achieved a combination of high differentiation and quality in their services and products can often have twice profit than those of non-differentiation products.

Today, more and more employees work in the service industries has become a worldwide tendency. Services have to be taken seriously as they now account for 60-70% of OECD economies (Dirk 2000). As a result of deregulation, increasing global competition, higher cost of developing new products, the rapid change in technology, more customize requirement and high quality demands in financial services (FS), the FS industry continues to be extremely competitive and dynamic. The future competitive

advantage in this industry lies in the ability of organizations to develop and sustain an innovation orientation. Bank industry can be a typical paragon in FS industries. Johne and Harborne (1985) have pointed to the fact that banks are traditionally characterized by tight, bureaucratic structure

involving high levels of standardization, formalization, centralization, and limited flexibility ad specialization. Therefore, there is an urgent need for banks to respond to the fast change environment (Ennew and Wright 1990).

And, the innovation studies in banks become significantly necessary to offer possible solutions to financial services’ business managers.

Many researches in innovation management have focused on the manufacturing field or examined the antecedents to or consequences of innovation. However, very little research have directly examined how and what innovation development process and its generating outcomes over time for service-based company. Since business managers are centrally responsible for directing the innovating process within the proverbial

“black box” between inputs and outcomes, a “road map” guideline is necessary for them to indicate how and what the innovating journey unfolds, and what paths are likely to lead to success or failure. From a development perspective, a process theory focuses on explaining how a

broad class of process, sequences, and performance conditions unfold along the innovation journey. In other words, business managers need a process theory that explains innovation development (van de Ven and Poole 1990).

To address the literature gap, this article draws on an in-depth case study using process theory to explore its innovation development. And, we pose two research questions, typically for service-based company:

1. Considering the contextual situation over time, what are the content and process of firms’ innovation strategies?

2. What are the generating outcomes of firms’ innovation strategies and implementation?

We select a Taiwanese bank, AJ bank, as the context for this study for two main reasons: First, the highly competition in bank industry has made developing organizational capabilities a very important issue, and

innovations are indispensable to catch the right solution. Second, the difficulties faced by managers to create different innovation strategies and implement them lasting for years in order to generate firms’ new assets and capabilities, and this development process make them an interesting

context of study. Through the case study, we create an innovation process model as our analytical framework. This could make a major contribution to improving the capabilities of managers, entrepreneurs, and policy makers to innovate. The remainder of the article is organized as follows:

We first explain the concepts of innovation, process theory, resource-base and dynamic capability theories, then describe the data collection and analysis methods. We next present a case description of AJ bank, in which we analyze its innovation strategies and the generating outcomes: new assets and capabilities. We conclude by highlighting the implication of our study for both research and practice, as well as suggestions for future research.

Theoretical Background

Innovation

Innovation can be seen as the process of discovery and development that creates new products, production processes, organizations,

technologies, institutional and systemic arrangements (van Kleef and Roome 2007). Innovation goals are often related to internal flexibility and readiness to adapt to unexpected changed in the environment (Daft 2001).

Most of studies in innovation have been focused on technology-based manufacturing approach, recently, the studies in service innovation have emerged.

However, the innovation research in financial service industry is still a relatively new area. Several researchers have devoted effort to some topics.

For example, to classify different types of innovation (Axel 1999; Axel and Robert 2000; Dave and John 2005), to examine the service innovation in new product/service development, communication flow, delivery channel, and organization structure fields (Edgett and Snow 1996; Edgett 1996;

George and Paulina 2000; Lievens and Moenaert 2001; Nancy Jo, Andy et al. 2002; Jeroen and Patrick 2003) and its performance (de Brentani 1989;

George, Paulina et al. 2001; Spiros, Paulina et al. 2003; Patrick 2004), and to find the success and failure factors in innovating financial services (Cooper and de Brentani 1991; Nicola and Russell 2000). Also, Edgett and Parkinson (1994) developed a predictive model to distinguish between successful or unsuccessful new financial service. Christopher Brooke (2006) developed another innovation model which includes three

components: context, culture and execution, and finding that both strategy and innovation are interdependent with each other, not separately.

Reviewing the historical path, a general list of the disruptive

innovations in the FS industry over time can be listed, from 1970s-Charles Schawb introduced discount brokerage, 1980s-commercial banks

introduced ATM technology, 1990s-the on line stock trading and banking to 2000s-full service operations in financial advising and wealth

management (Christopher Brooke 2006)). Although many literatures have shown the importance of innovation, it lacks a practical case to exploit the

“black box” inside the innovation process for researchers and mangers to learn.

Process Theory

Based on logical structure, theories can be divided into variance theory and process theory (Markus and Robey 1988). Variance posits an invariant relationship between antecedents and outcomes, and this may be too strain for social phenomena. In contrast to variance theory, process theory tends to explain an outcome by examining the sequence events or state that precedes it. Comparing with variance theories, there are some advantages

of process theories. First, process theories may enable researchers to find patterns in empirical data that variance theorists might miss. Second, empirical process research typically reveals that things are more complicated than variance theory represents them to be, such research should not be dismissed as isolated stories or illustrative cases only. In addition, process theories have lower aspirations about “explained

variance,” but provide richer explanations of how and why the outcomes occur when they do occur (Hee-Woong and Shan 2006).

There are three meanings of process: (i) a sequence of events that describes how things change over time; (ii) a category of concepts or variables that refer to actions of individuals or organizations; and (iii) a logic that explains a causal relationship between independent and

dependent variables(Andrew 1992). In here, events are the basic theoretical constructs of the model and are measured by observations of incidents (van de Ven and Poole 1990) According to the words meaning, a process theory consists of statements that explain how and why a process unfolds over time. Such a theory is needed not only to ground the conceptual foundation from a strategy formulation to implementation, but also to guide the design and construct for empirical research (Andrew 1992). Hence, process

models focus on sequences of events over time in order to explain how and why particular outcomes are reached (Mohr 1982) And, a good process model of innovation development does explain how and what innovations through unfold and array events over time in a particular temporal order and sequence (van de Ven and Poole 1990). And, it is also lighting the black box in process, describing a narrative about the changes which occur within a contextual situation by explaining how and what innovation

strategies and implementations, and the perceived constraints during their collective actions(Newman and Robey 1992).

Some researches have focused on analyzing and identifying process based on sequence of events (Abbott 1990; Newman and Robey 1992).

However, a single linear sequential model of development process is usually inadequately to deal with the complex environment, because

different events and multiple situations can occur simultaneously and effect each other concurrently (Andrew 1992). Thus, it is necessary to develop an adequate process model to analyze and explain multiple strategies and events simultaneously for business managers when they are facing complex

environments in the real world.

The Resource-Bases View

The resource-based view (RBV) is one of major theories in the field of strategic management that describe firms as a specific collection of

resources and capabilities that can be deployed to gain competitive advantage. Firm resources are defined as all assets (either tangible or intangible) and capabilities controlled by a firm which can be used to conceive and implement competitive strategies to improve its efficiency and effectiveness (Barney 1991). When firms are trying to search sources for sustained competitive advantage, it must focus on the resources which have heterogeneity and immobility, so barriers can be established, and these resources must also equip with four attributes: valuable, rare,

imperfect imitable and non-substitutable (Barney 1991). Hence, from the resource-based perspective, organizational effectiveness is defined as the ability of the organization to obtain scare and valued sources and

successfully integrate and manage them. Capabilities emphasize the key role of strategic management in appropriately adapting, interesting, and reconfiguring internal and external organizational skills, resources, and functional competences to match the requirements of a changing

environment (David, Gary et al. 1997).Both resources and capabilities may evolve and change over time, and the capability becomes deeply embedded inside the organizational structure after it reaches the maturity stage

(Constance and Margaret 2003). Grant (1991) addressed that it is crucial for a firm’s resources and capabilities to support its sustainable competitive advantage, and they are the primary sources of the firm’s profitability. And, a firm’s competitive advantage may be generated for a period of time only if its resources and capabilities can translate into business processes and commercialize in the market (Gautam, Jay et al. 2004).

However, RVB has been challenged that there is no clear picture to explain how a firm’s heterogeneity and immobility arise, and fail to explain how competitive advantages can be sustained in a high-velocity

environment (Constance and Margaret 2003).

Dynamic Capabilities

The dynamic capabilities approach can be seen as an extension of the RBV. It explains how firms can develop their capabilities to adapt on

rapidly changing environments. Sidney (2003) defined that the ordinary (or

‘zero-level’) capabilities can support a firm to survive in the short term, and the dynamic capabilities are the operations to extend, modify or create ordinary capabilities. David, Gary et al. (1997) and associated defined a firm’s dynamic capabilities as ‘the ability to integrate, build, and

reconfigure internal and external competences to address rapidly changing environments’. And, a firm’s dynamic capabilities depend on three factors:

first, organizational processes have three roles: coordination/integration;

learning; and reconfiguration of organizational and managerial

processes/routines; second, a firm’s position is defined by its specific and difficult–to-trade assets, which can create the sustained competitive advantage; third, a firm’s past history may create a firm’s current capabilities or as a barrier in limiting its competitive development.

Therefore, the dynamic capabilities are a firm’s competitive advantage, which is lying on its distinctive process, shaped by its specific asset positions, and the evolution paths it has adopted or inherited. From the strategy perspective, adopting different strategic approaches will significant effect a firm’s capabilities development. Also, in the knowledge intensive service industry, like the financial service industry, an organizational learning mechanism can also provide the creation and evolution of an organization’s dynamic capabilities in response to the stimuli from the external environment (Maurizio and Sidney 2002).

However, the dynamic capabilities outlined by David, Gary et al.

(1997) lack empirical evidence to help understand how these capabilities are developed. The recent years have witness increasing research interest in dynamic capabilities in the IS area (Michael and John 2004); however, considerations such as how resources and capabilities develop through innovation process over time in dynamic environments, are still

underexplored in the literature..

Research Methodology

The main research strategy adopted in this study is an interpretive in- depth case study (Heinz and Michael 1999). Our case study focus on the innovation processes in a service-based company, and its generating new resources and capabilities. These are complex processes and activities to organizations. Since the phenomenon to be studied is complex and not divided from its organizational context, we believe the cast study method

using in this research is an appropriate means.

Currently, there are more 3700 financial branches and offices all over the Taiwan island with advance ICT (information, communication and technology) support, which make the competition in Taiwan bank industry is very fierce. In this circumstance, how to make innovation in the financial scale, delivery process, organization structure, markets and products

analysis to create a firm’s capabilities and resources in order to survive within this turbulent and chaos environment is critical to all banks.

Therefore, it seems suitable to choose a Taiwanese bank to study the issue of innovation processes.

Research access was negotiated with AJ bank in August 2006; over the next four months the field research was conducted. The research is primary based on interviews in AJ bank, support by secondary information sources (investors’ reports, industry and stock exchange documents, financial magazines, newspapers, and relevant Internet publications). Interviews were arranged with AJ bank’s top manager and middle managers.

Altogether, 3 different fact-to-face interviews were conducted with an average duration of approximately 2 hours for reach interview. Besides, another six top and senior managers from other three banks were also consulted during the project implement period in order to validate and complement the AJ bank information. The collection of multiple types of data from different sources provided triangulation of evidence (Stake 1994). This also ensures that facts state by one organization could be verified by the other, and this provides multiple perspectives on issues and increases the reliability of the study. All informants were selected and scrutinize carefully to ensure the quality of the data collection. The interviews were unstructured and all interviewees were encouraged to speak freely about their innovation strategies experiences. The standard set of questions used was designed only to help initiate and guide the interview process. The study drew deeply on the perceptions of the interviewees, as revealed through their interview comments. All the interviews were tape recorded and transcribed, and notes were taken when necessary. Additional observations were noted immediately after each on-site interview was completed. These texts became the main data used for subsequent analysis.

The analysis of the data was conducted in several steps. This followed

the recommendations by Glaser (1967) to move back and forth between the empirical data and possible theoretical conceptualization. First, the field researcher used the texts (interview transcripts, documents, and noted from observations) for preparing a detailed case description (narrative as

instance) of the entire innovation process (Brian 1999). Second, a key step in the analysis was to create an event listing, which offers the insight into what, why and when those innovation strategies implement, then an incident chart with four phases delineating a two-way sequence was drew (Miles 1994). Because a phase is a period of unified and coherent activity that serves some innovation function, the phase analysis method

conceptually define discrete phases of innovation activity and analyze their sequences and properties (van de Ven and Poole 1990). Data from various sources integrate and build a narrative that explained the process outcomes (Brian 1999). The innovation processes themselves presented the

researcher’s interpretation based on evidence gathered from interviewees.

Third, the next step of the analysis was to determine the key capabilities and resource developed after the innovation strategies. Finally, these resources and capabilities were compared with the array of RBV and dynamic capabilities discussed in the literature. The entire data analysis process went through numerous iterations and involved moving back and forth among the data, the literature, and concepts to formulate a coherent and consistent overview of the case organization (Heinz and Michael 1999).

Case Description and Analysis

The Case Context

After 2000, the Taiwanese government endeavors in continue to strive to liberalize and globalize the banking system and overhaul the capital market in order to make Taiwan as an Asian financial center. Hence, the Banking Holding Company Act (BHCA) and the Enterprise Merge and Acquisition Act (EMAC) were passed on 2001. Composed of industries such as insurance, securities, banking and other diversified financial institutions, the financial holdings has become a full-functioning financial platform, which develops its cross-selling strategy and provides a one-stop shopping convenience for its customers. Hence, fourteen Taiwanese

financial holding companies (FHC) were established consequently. And, banking business is most FHC’s majority.

Traditionally, the bank business in Taiwan can be divided into three major areas: institutional financial services (ISFS), individual financial services (IDFS) and wealth management (WM). And, most ISFS business is possessed by state-owned banks. After years of de-regulation, currently, there are excess financial offices all over the island. This makes a high competition in Taiwanese financial industry. Hence, every financial organization is challenged with managing the rapid evolution of their business and external environment against the constraints of resources and time.

Established on 1992, AJ bank was one of fifteen new private banks in Taiwan after the government’s de-regulation in bank industry on late 1980s’. Without long history background like other senior banks, which were established before 1990 and most owned by the government with long history reputation, and no any enterprise support, AJ bank stood as a ”small but beauty” position. Therefore, it focused on the IDFS, like credit card and cash card business (2C card). The AJ financial holding company was

established by AJ bank and AJ securities through share exchanged on 2002.

It is one of fourteen FHCs in Taiwan with the smallest scale among them.

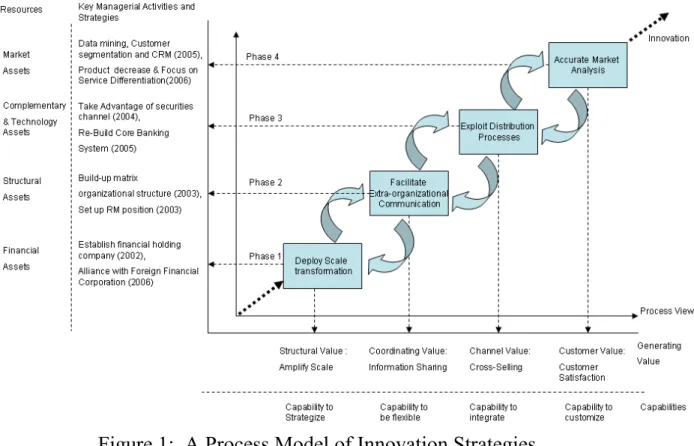

In order to survive in this turbulent environment, a series of AJ bank’s innovation strategies and activities have been created. The AJ bank’s innovations can be viewed as a four-phase process: (1) deploy scale transformation, (2) facilitate extra-organizational communication, (3) exploit distribution process, (4) accurate market analysis. And, these four processes are stacking on scale value, coordinating value, channel value, and economic value. Furthermore, five assets and four capabilities arose during AJ bank’s innovation processes.

The Case Analysis

Phase 1: Deploy Scale to Attained the Competitive Transformation

Establish AJ Financial Holding Company - After BHCA and EMAC were passed on 2001, there are more and stronger financial enterprises in Taiwan financial industry. Without any host company support, AJ bank was encompassed by strong competitors. In order to increase its scale to against other “giants”, AJ FHC was established and carried out the cross- selling strategy to enhance overall synergy.

However, during 2005 and 2006, a debt blizzard in 2C card business

occurred in Taiwan financial market which causes serious impacts to many financial companies, especial to banks. Since AJ bank’s major business focused in IDFS, it was hurt seriously. As indicated by an interviewer:

“The AJ bank capital is around NTS 10 billion, however, we had wrote-off around NT$20 billion bad debt. Actually, the financial structure is the real problem to many Taiwanese banks. In fact, there are many problems behind the glory on the surface. “

Alliance with foreign financial corporation - Under the serious and negative financial condition, AJ FHC has alliance with a foreign financial corporation on 2006 in order to get new capital to ameliorate its financial condition. And, it also hopes to learn advance corporate management concept and international experience. After this blizzard, every Taiwanese bank perceives the importance of risk control and recognizes their weak experience in this area. Why this is so important? Although one of the most successful financial companies in credit card business in Taiwan market is the Citybank Taiwan, there is almost no any hurt to it in the 2 card debt blizzard. As indicated by an interviewer:

“Those foreign banks know when should leave. However, there is no any Taiwanese bank can see and catch the critical point. It is an overall blind. …, It is already not a right timing, but we are still doing the 2C card business. ”

New Key Resources and Capabilities Creation

Financial Assets - The AJ FHC was established on 2002, and allied with a foreign financial corporation on 2006 to increase its financial condition and scale continuously. Strong financial scale is the foundation for a firm to survive in a fierce competition environment. The AJ FHC keeps this foundation determinant strong enough over time to support its long-term innovations.

Capability to Strategy – When establishing directions, a firm can develop distinct insight into the future that its competitors do not posses (Ramiro 2002). The AJ banks’ managers perceived they encompass by

“giant competitors”. At this phase, the first goal is to amplify its financial scale from a bank to a financial group over time, which makes AJ bank’s

foundation strong enough to support other innovation strategies and survive in the cut-throat competition.

At the meantime, it also shows the significant importance in

information sharing and communication within different organizations.

Phase 2: Facilitate the Operation of Extra-organizational Information Sharing and Coordinating Processes

Build-up Matrix Organizational Structure - In order to facilitate the coordination and information sharing mechanism across organizations, AJ groups adopts a new concept and divides its organizational structure into a matrix structure. This matrix structure was built according to different customers’ attributes and demands. As indicated by an interviewer:

“AJ group has divided business units by investment management. For example, no matter the investment comes from AJ bank or AJ securities, all investments is controlled under the same executive officer. … In AJ groups, it is already divided into different organizations according to different customer segmentations. Therefore, AJ group virtualized the subsidiary companies. That means the subsidiary companies in law have been

virtualized in our groups. … Four years ago, the consultant company has given us advises to adopted a function structure instead of formal system structure. And we adopt and implement it.… “

Set Up RM Position - Furthermore, a new job position, RM (Relationship Managers) was set up in order to execute the cross- organization job. As indicated by an interviewer:

“To facilitate the coordination and information sharing mechanism across organizations is important. But, how can make it work? The RM (relationship manager) plays a critical role. …. A RM can be seen as the representative of that department to ask for IT support. For example, a RM response to sales department can be seen as the IT chief in the sales

department, and he needs to complete and maximize the performance of every IT project in sales department. Also, only RM has the right to deploy IT employees. ”

Another behind reason in improving the information sharing mechanism is that both AJ bank and AJ securities has a same major

shareowner. Therefore, it also makes both companies equip with similar corporate culture. As indicated by an interviewer:

“Many FHC could not set up good mechanism for information sharing within groups because each business unit has its won boss. That’s the structure problems caused by shareholders. It doesn’t mean that every company can’t achieve the goal. The reason why that it can work in here is just because AJ bank and AJ securities has a same major shareholder.”

New Key Resources and Capabilities Creation

Structural Assets - The organizational structure (formal or informal) and its external linkage are important to a firm’s innovation directions and its competences and capabilities co-evolve (David, Gary et al. 1997).

Through matching the matrix organization structure with RM job, the cross organizations’ communication mechanism in AJ bank works well. And, this also make part of culture change in the IT department since the RM will actively catch the sales demands and he often stands as the sales representative to ask for IT support automatically. This makes a unique resource to AJ bank in facing a fierce competition.

Capability to Be Flexible - An organization structure must provide a framework of responsibilities and mechanisms for linking and coordinating organizational elements into a coherent whole that requires the use of information systems (Daft 2001). When the environment domain of the organization is both complex and uncertain, and the organization is in moderate size, the matrix structure is the correct structure (Daft 2001). The AJ group adopted the matrix structure, and it assigned new positions (RM), these can show the capability in flexibility about information flow and sharing processes through its organizational structure.

Nevertheless, after established the extra-organizational communication mechanism, AJ bank’s managers can receive more customers and markets’

information from different organizations within the AJ group. Therefore, the strategy of cross selling AJ bank’s products through AJ securities channel arises.

Phase 3: Exploit AJ Securities Distribution Value

Take Advantage of AJ securities channel - Not only both AJ bank

and AJ securities has a same major shareowner, but also AJ securities has equivalent scale as AJ bank. Furthermore, the AJ securities has stronger channel value than AJ bank since it owns a close relationship with its customers. Therefore, the AJ bank’s products can often be sold through AJ securities’ channel with tremendous performance. After this cross-selling strategy implementation, the AJ group managers perceive a new experience that is there are different selling relationships under different selling

approaches. When the products’ selling channels changes from AJ bank to AJ securities, the selling relationships also change from marketing to person-to-person. As indicated by an interviewer:

“The selling approach of traditional consuming financial products in banks, like credit cards, is a marketing model. For example, almost nobody remembers what is that sales name when he applied his credit card. … However, the securities business is focus on person-to-person relationship.

The selling model is based on a very strong relationship between sales and customers .This relationship sometimes can be very closed, even the

customers will follow the sales resign and transfer to another competitors.

… Therefore, every time when we sell financial products through securities channel, it almost reaches the ‘home run’.”

With more customers and better selling performance, the AJ bank gets more and various customers’ demands, especially from oversea. This shows the significant role of IT support to offer service to customers and to satisfy customers’ demand at any time and any place.

Re-build Core Banking System - After 1990s, many Taiwanese manufacturing firms have moved to oversea markets, especially to China.

Currently, the IT frame in AJ bank was built on the beginning of 1990s. It was preparing to serve domestic customers in Taiwan market and its function calculation is under NT$ (New Taiwanese Dollars). Definitely, it is not an appropriated system to satisfy those oversea customers’ demands any more. Therefore, the AJ group has decided to do a high priority project to change its Core Banking System (CBS). That the main purpose of this project is to support AJ bank can enter into any new oversea market successfully and satisfy their oversea customers’ demands. Hence, the AJ group strategies are outsourcing and cooperating with an international system corporation instead of a Taiwanese system company as its long-

term partner. As indicated by an interviewer:

“Because we need to face the international war, we need to change our whole IT system. We want to find an international IT partner, so it can offer us faster and more efficiency support, especially when we want to enter into a new oversea market. So, we don’t need to develop different system follow every country’s different requirements by our own. … If we want to fight an international war, the IT system should be available in advance before our office set up in the new market, then it can generate effectiveness. …. Therefore, we choose an international partner.”

New Key Resources and Capabilities Creation

Complementary Assets - New products often need related assets, like channels, to delivery them to the market. Therefore, a firm needs to build complementary assets before their products’ commercialization activities (David, Gary et al. 1997). The AJ bank uses the AJ securities channel to delivery its products to more new customers. And, the AJ group managers perceived that the person-to-person relationship is much stronger than the marketing relationship which can often cause two different selling results significantly.

Technology Assets - For service industries, a firm’s products and know-how integrates with IT functions and offers to its customers as services can be seen as an asset. The AJ FHC is building a new CBS in order to enhance its overall customer service, especially for oversea

demands. It’s planning is emphasized on advance IT support with the long- term oversea market competition.

Capability to Integrate - Through the innovation strategies, the AJ bank generates the capability to integrate different organizations to

implement cross-selling and parallel with the advance IT support to target for new international market and face the globalization competition.

With the cross-selling strategies implementation through advance IT support, it shows the multi-channel value both in traditional and technology fields. Consequently, now, the AJ bank managers can posses more its selling records from computer analysis on its customer database and find that its costs are too high for almost every its product. This shows that there

are some reasons behind the balance sheet.

Phase 4: Accurate Market Analysis through Customer Database and its Application

Establish and Apply Customer Database – The AJ banks has done several marketing projects by using data mining technology to differentiate different customers’ attributes. Therefore, they can offer appropriate

products to full fill different groups’ demands and enhance its overall customers’ satisfaction (Kotler, 2002). Through this data analysis and its results, the AJ bank’s managers find a clearer picture in market

segmentation and target customers and ‘catch the critical point’ of what are the right products to right customers at right time instead of using blind diffusion strategies to ‘hunting and hitting potential customers in dark’ as it did in the past years.

Change Product Policy – During past years, the AJ bank had adopted the imitate strategy. So, whenever there was new products offering by other competitors, AJ bank would replicate them and add into its product lines.

After years’ accumulation, its wide product lines showed that AJ bank could offer full services to customers with high flexibility and efficiency.

At the meantime, it also caused high cost to maintain each product since there was no economic scale for any product. As indicated by an

interviewer:

“We have almost every products showing in the market. However, because we imitate products from others, we don’t have the economic scale in any product. Therefore, our costs are too high. ”

Reviewing the result, AJ bank managers have changed its product policy from purely mimic others products to decrease its existing products to an applicable range.

Focus on Service Differentiation – The AJ bank’s managers found that it can integrate products with IT technology as a service and delivery them to customers. Therefore, they perceive a new concept that the critical point to light the bank business should be the service differentiation, not the product differentiation. As indicated by an interviewer:

“According to the trend, for example, you don’t need to own a

financial system, you need to own a CRM system. We can use the EC skill in products to make an integrate service offering to customers. When you sell an integrate service to customers, you can sell it as a product. … The critical point is in the service differentiation, not the product

differentiation. But, most Taiwanese banks though the product differentiation is the key point.”

New Key Resources and Capabilities Creation

Market Assets - In defining the market in which a firm competes in a way that gives economic meaning, and the market position is fragile during the rapid change environment (David, Gary et al. 1997). The AJ banks applied its customer database to analysis its selling performance and found that there was a mistake on its past product strategy. Also, it founds they should focus on the service differentiation instead of product

differentiation. The above activities show that the AJ bank can catch its own niche market and stood as an accurate but beauty position.

Capability to Customize - The customer orientation should be the main driver to service management (Fitzsimmons 2001). The AJ bank finally can ‘catch’ right customer demands and market trend, and it can offer right products to them at right time. This much enhance its customer service quality and satisfaction. This shows that the AJ bank has the capability to make customize service.

At this innovation phase, the AJ bank changed its product strategy and acquires an advance concept in its business running. That the key point to customer service in the bank industry is the service differentiation, not the product differentiation.

Conclusions

Based on the AJ bank case study and the findings that emerged, a grounded innovation process model of phenomenon over time was developed as Figure 1, which reveals it is an iterative and cumulative process. This model also shows the innovation process is not simply a black box, and it is not random. It is a lengthy, complex process influenced by multiple dimensions. Also, the findings show that this process highlights the firm’s overall innovation strategy formulation and implementation. The

inductively derived model serves as the central contribution of this research. In terms of the proposed process model and case analysis, four lessons can be learned from this case, which include: (1) deploy scale transformation (2) facilitate extra-organizational communication (3) exploit distribution processes (4) accurate market analysis.

Figure 1: A Process Model of Innovation Strategies

The first phase of the process model is to amplify its financial scale.

Therefore, it established a holding financial company first. The goals to establish AJ FHC are expecting to increase the scale from a bank to a financial group, applying the cross-selling strategy within the group and improve the overall synergy. However, there is no doubt that the 2C debt blizzard on 2005 was a deep impact to AJ bank. To solve the bad debt, AJ bank managers decided to make alliance with a foreign financial partner. It also adjusts its business operating direction from IDFS only to both ISFS and IDFS business areas. It recognizes that lots of implicit know-how and international management experience need to learn, especially in risk control management, although the learning tuition was high. The scale value is explored at this phase.

With greater scale than a single firm’s capital, it shows that sharing

information across different subsidiaries within a group is significant. This also can enhance firms’ profit and customer satisfaction. The goal is a simple and clear. Almost every FHC knows its importance and walk on the road. However, it is not easy to success. To achieve the goral of crossing extra-organizations’ communication, a matrix structure in AJ group was adopted. Hence, the formal subsidiaries in AJ group do not exist any more, except their names need to show on the group chart requiring by the law.

And, RMs are new and important persons to ‘run’ the cross communication mechanism well, who can be seen as the execution employees during the matrix structure. The coordinating value are lighting at this phase. This shows implicit innovation strategies during AJ bank’s organization development. In addition, AJ groups always reveal high efficiency in its strategy decisions and implementation because it has a same major shareowner.

In order to enhance selling performance, the products of AJ bank are sold through AJ securities channel. This explores do not only find a multi- channel capabilities in AJ group, but also perceive that the selling approach changes from marketing to person-to-person relationship. Besides, the AJ bank is getting more and more demands from oversea, especially by corporate customers. Hence, a cross-countries EC (electric commerce) platform is required. The channel value shows its significant contribution at this phase. Currently, a major project is doing to re-build its core banking system. An outsourcing strategy to find an international IT system partner has decided to increase its capabilities for future international competition.

At the fourth phase, the AJ bank’s mangers divided customer into different segmentation with distinct attributes through the computer analysis on its customer dealing records. During past years, the AJ bank imitated competitors’ products from market only. Although, it can show the efficiency and good customer services, but it also need to pay high cost to maintain. Therefore, the AJ bank’s managers have changed its product policy to customize offerings. It reveals the economic value at this phase.

They also find the critical point to differentiate with competitors should be through service differentiations instead of product differentiations. And, this new concept has not been perceived by most of Taiwanese banks’

managers.

Through a series of innovation strategies from micro to macro over time, AJ bank has successfully stands in the fierce competition of Taiwanese bank industry. Its innovation processes also carry with new resources and capabilities to support its future competitive advantage (Aaker 1989). Currently, the AJ bank is preparing to set up more oversea branches; then it will integrate them with its CBS in order to full fill its major customers’ oversea demands.

Managerial Implication and Future Research

Most process models of innovation specify a simple unitary sequence of phases of development (van de Ven and Poole 1990). However, in this article, the finding results show that the innovation strategies are not simple, linear and step by step sequences. Contrary, they are complex and multi-dimensions in the real world. Therefore, business managers need to consider various factors simultaneously when they are make decision for innovations. The study case also shows that multi-phases innovations in services are progressing simultaneously over time. The innovation processes model can be a practice framework for business managers matching with their organizations and strategies. Also, this paper explores that innovation strategies will generate firms’ new resources and

capabilities as their future sustained competitive advantage.

Since our study focus on internal process instead of output evaluation, the author recognizes that there are some limits to this article. Fist, the output and the organization’s relationship with the external environment are not evaluated. Also, evaluations of internal functioning are often subjective, because many aspects of inputs and internal processes are not quantifiable (Daft 2001). Therefore, future research can use this model in other service industry with quantitative examinations.

Acknowledgement

This study was founded by the III-ACI-IDEA-FIND, under the project number of 95-EC-17-A-34-R8-0570. The authors thank the cooperation with Institute for Information Industry during the project execution. And, this project was also under the guidance of Department of Industrial Technology of Ministry of Economic Affairs in Taiwan.

REFERENCE

1. Aaker, D. A. (1989). "Managing Assets And Skills: The Key To A Sustainable Compet." California Management Review 31(2): 91.

2. Abbott, A. (1990). "A primer on sequence methods." Organization Science 1(4): 375-392.

3. Andrew, H. V. D. V. (1992). "SUGGESTIONS FOR STUDYING STRATEGY PROCESS: A RESEARCH NOTE." Strategic

Management Journal (1986-1998) 13(SPECIAL ISSUE): 169.

4. Axel, J. (1999). "Successful market innovation." European Journal of Innovation Management 2(1): 6.

5. Axel, J. and D. Robert (2000). "Innovation in medium-sized insurance companies: how marketing adds value." The International Journal of Bank Marketing 18(1): 6.

6. Barney, J. (1991). "Firm Resources and Sustained Competitive Advantage." Journal of Management 17(1): 99.

7. Brian, T. P. (1999). "Building process theory with narrative: From description to explanation." Academy of Management. The Academy of Management Review 24(4): 711.

8. Christopher Brooke, D. (2006). "Developing an innovation orientation in financial services organisations." Journal of Financial Services Marketing 11(2): 166.

9. Constance, E. H. and A. P. Margaret (2003). "The dynamic resource- based view: Capability lifecycles." Strategic Management Journal 24(10): 997.

10.Coombs, R., Miles, I. (2000). Innovation, measurement and services:

the new problematic. Measurement and Case Study Analysis. J.

Metcafe, Miles I. Boston, Kluwer Academic Publishers: 85-103.

11.Cooper, R. G. and U. de Brentani (1991). "New Industrial Financial Services: What Distinguishes the Winners." The Journal of Product Innovation Management 8(2): 75.

12.Daft, R. L. (2001). Organization Theory and Design. Cincinnati, Ohio, South-Western College Publishing.

13.Dave, F. and B. John (2005). "Targeting innovation and implications for capability development." Technovation 25(3): 171.

14.David, J. T., P. Gary, et al. (1997). "Dynamic capabilities and strategic management." Strategic Management Journal 18(7): 509.

15.de Brentani, U. (1989). "Success and Failure in New Industrial Services." The Journal of Product Innovation Management 6(4): 239.

16.Dirk, P. (2000). "No longer services as usual." Organisation for

Economic Cooperation and Development. The OECD Observer(223):

52.

17.Edgett, S. and S. Parkinson (1994). "The development of new financial services: Identifying determinants of success and failure." International Journal of Service Industry Management 5(4): 24.

18.Edgett, S. and K. Snow (1996). "Benchmarking measures of customer satisfaction, quality and performance for new financial service

products." The Journal of Services Marketing 10(6): 6.

19.Edgett, S. J. (1996). "The new product development process for commercial financial services." Industrial Marketing Management 25(6): 507.

20.Ennew, C. T. and M. Wright (1990). "Retail banks & organizational change: evidence from the UK." The International Journal of Bank Marketing 8(1): 4.

21.Gautam, R., B. B. Jay, et al. (2004). "CAPABILITIES, BUSINESS PROCESSES, AND COMPETITIVE ADVANTAGE: CHOOSING THE DEPENDENT VARIABLE IN EMPIRICAL TESTS OF THE RESOURCE-BASED VIEW." Strategic Management Journal 25(1): 23.

22.George, J. A., G. P. Paulina, et al. (2001). "An empirically-based typology of product innovativeness for new financial services: Success and failure scenarios." The Journal of Product Innovation Management 18(5): 324.

23.George, J. A. and P. Paulina (2000). "Marketing communications and product performance: innovative vs non-innovative new retail financial products." The International Journal of Bank Marketing 18(1): 27.

24.Glaser, B. G., A. L. Strauss. (1967). The discovery of Grounded Theory:

Strategies for Qualitative Research. New York, Aldine Publishing Company.

25.Grant, R. M. (1991). "The Resource-Based Theory of Competitive Advantage: Implications for Strategy Formulation." California Management Review 33(3): 114.

26.Hee-Woong, K. and L. P. Shan (2006). "Towards a Process Model of Information Systems Implementation: The Case of Customer

Relationship Management (CRM)." Database for Advances in Information Systems 37(1): 59.

27.Heinz, K. K. and D. M. Michael (1999). "A set of principles for conducting and evaluating interpretive field studies in information systems." MIS Quarterly 23(1): 67.

28.Jeroen, P. J. d. J. and A. M. V. Patrick (2003). "Organizing successful new service development: A literature review." Management Decision 41(9): 844.

29.Joe Tidd, J. B., Keith Pavitt (2001). Managing Innovation. London, UK, John Wiley & Sons, Ltd.

30.Johne, F. A. and P. Harborne (1985). "How Large Commercial Banks Manage Product Innovation." The International Journal of Bank Marketing 3(1): 54.

31.Lievens, A. and R. K. Moenaert (2001). "Communication flows during financial service innovation." The International Journal of Bank

Marketing 19(2): 68.

32.Markus, M. L. and D. Robey (1988). "Information Technology and Organizational Change: Casual St." Management Science 34(5): 583.

33.Maurizio, Z. and G. W. Sidney (2002). "Deliberate learning and the evolution of dynamic capabilities." Organization Science 13(3): 339.

34.Michael, W. and H. John (2004). "REVIEW: THE RESOURCE- BASED VIEW AND INFORMATION SYSTEMS RESEARCH:

REVIEW, EXTENSION, AND SUGGESTIONS FOR FUTURE RESEARCH1." MIS Quarterly 28(1): 107.

35.Miles, M. B., A. M. Huberman (1994). Qualitative Data Analysis: A Sourcebook of New Methods. Beverly Hills, CA. USA., Sage.

36.Mohr, L. B. (1982). Explaining Organization Behavior. San Francisco, CA, Jossey-Bass.

37.Nancy Jo, B., L. Andy, et al. (2002). "Modelling consumer choice of distribution channels: An illustration from financial services." The International Journal of Bank Marketing 20(4/5): 161.

38.Newman, M. and D. Robey (1992). "A Social Process Model of User- Analyst Relationships." MIS Quarterly 16(2): 249.

39.Nicola, O. and A. Russell (2000). "Success and failure factors in developing new banking and insurance services in South Africa." The International Journal of Bank Marketing 18(5): 233.

40.Patrick, V. (2004). "Managing product innovation in financial services firms." European Management Journal 22(1): 43.

41.Peter, W. R. and A. Raphael (2003). "The dynamics of innovative activity and competitive advantage: The case of Australian retail banking, 1981 to 1995." Organization Science 14(2): 107.

42.Ramiro, M. (2002). "A process model of capability development:

Lessons from the electronic commerce strategy at Bolsa de Valores de

Guayaquil." Organization Science 13(5): 514.

43.Shan, P., P. Gary, et al. (2006). "A dual-level analysis of the capability development process: A case study of TT&T." Journal of the American Society for Information Science and Technology 57(13): 1814.

44.Sidney, G. W. (2003). "Understanding dynamic capabilities." Strategic Management Journal 24(10): 991.

45.Spiros, P. G., G. P. Paulina, et al. (2003). "Assessing the importance of the development activities for successful new services: Does

innovativeness matter?" The International Journal of Bank Marketing 21(4/5): 266.

46.Stake, R. E. (1994). Case Studies. Handbook of Qualitative Research.

N. K. Denzin, Lincoln Y. S., Sage Publications: 236-247.

47.van de Ven, A. H. and M. S. Poole (1990). "METHODS FOR

STUDYING INNOVATION DEVELOPMENT IN THE MINNESOTA INNOVATION RESEARCH PROGRAM." Organization Science 1(3):

313.

48.van Kleef, J. A. G. and N. J. Roome (2007). "Developing capabilities and competence for sustainable business management as innovation: a research agenda." Journal of Cleaner Production 15(1): 38-51.