Chapter 5 Analyses

This chapter aims to provide an analysis of the results obtained. All the results were examined based on the determinant factors of powerful buyer group and

powerful supplier group proposed in literature review. The determinant factors include the concentration of the players in the industry, competition from any substitute product, transaction volume, differentiation of products/services, importance of the products/services as a business input, switching costs, threat of vertical integration, industry profit, perceived amount of payment, dependence on the other party, total cost of products/services, urgency of delivery, and full information of the market. The perceptions of the software localization vendors and freelance TRADOS translators are to be presented.

5.1 The power of the software localization vendors and freelance TRADOS translators

5.1.1 Concentration of the software localization vendors and freelance TRADOS translators

The Survey of the Translation and Interpretation Industry in Taiwan

(Government Information Office, 2004) shows that Taiwan's software localization vendors are concentrated on seven major localization companies and some software localization business is undertaken by translation agencies. It is also indicated that 90% of the translation in the software localization companies are outsourced to freelance translators. As freelance translators are not the regular employees of the company, they may work with several vendors at the same time. This makes it

difficult to compile statistics of the total number of freelance translators in Taiwan's software localization industry although it is reported in the Survey (2004) that the job opportunities for freelance translators offered by the software localization companies in 2003 were 2,670 jobs. As a result, the information of exact market shares of the freelance TRADOS translators is not available. It is then difficult to measure the concentration of the software localization vendors relative to that of the freelance TRADOS translators.

5.1.2 Purchase volume of the software localization vendors

In terms of the purchase volume of the software localization vendors relative to the translation outputs of the freelance TRADOS translators, research findings show that four of seven freelance TRADOS translators use TRADOS for cases other than software localization. This means that the software localization vendors are not the only group that can purchase the translation done with TRADOS from the freelance TRADOS translators. However, only one translator reports that 50% of all cases she does by using TRADOS are for software localization. The remaining seven translators still sell over 90% of their TRADOS translation outputs to the software localization vendors. This indicates that the software localization vendors are buying large volume of translation outputs that freelance TRADOS translators do by using TRADOS.

While software localization vendors purchase large volume of TRADOS translation, only four freelance TRADOS translators think the software localization vendors are an important customer. These four translators have relatively longer experience of using TRADOS, which ranges between 2.5 years to 4 years. These

translators use TRADOS for over half of their software localization cases, with reported percentages at 50% (Respondent A), 60% (Respondent B), 95% (Respondent G) and higher than 95% (Respondent E). However, only two out of these four

freelance TRADOS translators rely on the software localization vendors as a major source of income. These two translators report respectively that 60% (Respondent B) and 80% (Respondent G) of their cases come from software localization industry and represent the same portion in their income. Another translator reports that 95% of her cases are from software localization vendors but those cases only represent 10% of her income. However, further details of this translator is not available. This may indicate that the more software localization cases the freelance TRADOS translators do, the more likely they rely on the software localization vendors as a major source of income, provided they do not have other jobs.

According to Porter (1980), when the buyer group is concentrated and purchases large volumes relative to the sales of sellers, it enjoys relative bargaining power. Large purchase volume gives buyers strong power in particular. The relative high

concentration and large purchase volume allows the software localization vendors to enjoy strong bargaining power. The only respondent, who reported 50% of her TRADOS cases are for software localization, points out that large-volume projects which require cross-referencing are the ideal application field of TRADOS. This indicates that TRADOS, which is to facilitate the translation of large-volume documents with a high percentage of repetitive content, may be used by freelance TRADOS translators to extend the application field of TRADOS beyond software localization to other types of projects. When freelance TRADOS translators use TRADOS for cases other than software localization, they are likely to counterbalance

the bargaining power of the software localization vendors which derives from the large purchase volume. As a result, while the software localization vendors enjoy a high bargaining power, their bargaining power may be offset if freelance TRADOS translators reduce the amount of TRADOS translation sold to the software localization industry. Currently, the software localization vendors still enjoy relatively high bargaining power as they purchase large volume of translation from freelance TRADOS translators.

5.1.3 Total cost of the software localization vendors

Porter (1980) states that when the purchases account for a large percentage of the buyer's costs, the buyer tends to be price-sensitive in purchasing and has strong bargaining power. Research findings show that 30% to 40%, or lower, of the software localization vendors' total cost is spent on outsourcing translation to freelance

TRADOS translators. The figure may change due to the nature of the project and the payment scales for freelance TRADOS translators whose translation qualities vary.

Six out of seven vendors interviewed say that they categorize freelance TRADOS translators into a few levels according to their translation quality and provide different rates. Currently, no other benchmark figure is available as software localization vendors do not make their detailed breakdown of costs publicly available. Although it can not be proved that the translation outsourcing expenses account for a large percentage of the software localization vendor's costs, the software localization vendors are found to be price-sensitive as the industry competition is severe and the profit level is not high, according to the responses of the vendors. The industry players are then likely to cut down purchasing costs and can not offer attractive

translation rates to the freelance TRADOS translators, according to Porter (1980) who expresses that low industry profit makes the industry purchase selectively. The

research findings show that both software localization vendors and freelance TRADOS translators tend to consider the translation rates offered by the software localization vendors are average in general.

5.1.4 Switching costs for the software localization vendors

Another cost-related issue is the switching costs of the software localization vendors, which may vary in different situations. Porter (1980) points out that switching costs lock buyers to particular suppliers, and vice versa. In general, the switching costs could be high if the software localization vendors have to switching to new translators and start the training of translation and TRADOS from the beginning.

Two vendors said they usually call upon the next person in line with similar capability in translation and TRADOS so the switching costs may not be very high. Another two vendors said the cost may be high if translators of no TRADOS using experience have to be used. The remaining two specifically pointed out their concerns with the

possible deterioration of translation quality. It can be seen that translation quality is the first concern of six vendors out of seven. Therefore, freelance TRADOS

translators' availability, translation proficiency, and TRADOS capability are likely to lock the software localization vendors to freelance TRADOS translators who offer quality translation. In this situation, the bargaining power of the software localization vendors is likely to decrease against the superior freelance TRADOS translators.

5.1.5 Product differentiation

Porter's (1980) theory suggests that when the product a buyer group purchases is standard or undifferentiated, the buyer group enjoys higher bargaining power. This is because the buyer group may go to another buyer for the same type of product.

However, this is not the case in the software localization industry. The research findings show that the translation outputs of freelance TRADOS translators tend to come up with differentiated translation for new content, according to six vendors interviewed. Only two vendors indicated that translations among experienced translators may seem to show smaller differences. The level of differentiation is determined by individual differences, experience in translation and TRADOS, as well as the quality of translation memory. The vendors interviewed stated that when the different styles of translation conform to the project requirements, the styles are acceptable to the vendors.

5.1.6 Substitute product

According to Porter (1980), when the substitute product and competition from the substitute product exist, the buyer group enjoys more power. When the vendors were asked whether the output machine translation is qualified as a substitute product for the translation output of freelance TRADOS translators, all of them do not regard machine translation as a substitute product. They believe that there is no substitute products for human translators and no competition from the substitute product for the translation outputs of freelance TRADOS translators. Thus, the software localization vendors do not enjoy high bargaining power in purchasing by this criterion.

5.1.7 Important business input to the software localization vendors

In addition, if the product purchased by the buyer is an important business input for his or her business and can affect the quality of his or her business, the buyer does not enjoy bargaining power (Porter, 1980). Software localization vendors indicated that freelance TRADOS translators' outputs are an important input and affect the quality of their products or services. All of the vendors rated the importance as high or very high. As indicated by one vendor that translators are like the raw materials of the business, freelance TRADOS translators' outputs are vital. Three vendors especially pointed out that the quality of translators' outputs is most likely to affect the quality of their products and services during peak seasons when labor shortage may lead to quality deterioration. Therefore, software localization vendors tend to have low bargaining power in this regard because they rely on the freelance TRADOS translators for business input which is also likely to influence their service quality, especially during peak seasons.

5.1.8 Information possessed by the software localization vendors

The resource exchange theory (Ramsay, 1995) and Porter's (1980) theory both propose that when buyers have full information of the market and are equipped with proper system to evaluate the performance of the suppliers, they are likely to be in an advantageous position for bargaining. In the software localization industry, it is found that all the vendors think they are clear about the market situation to some extent.

Over half of the software localization vendors either keep an eye on the market

demand or believe they possessed enough information of the market. Almost all the vendors interviewed conduct quality assurance procedure based on their own policy or the requirements from the clients. With evaluation results quantified and retrieved from the databases, five vendors are able to evaluate the performance of freelance TRADOS translators correctly without misjudging the translation performance and its attractiveness. These vendors either use their own quality assurance procedure or comply with the criteria requested by clients to verify the translation quality of freelance TRADOS translators. The quality assurance procedure may come up with qualitative or quantitative results. In addition, a variety of answers were given by the software localization vendors in terms of the attractive features of a translation output.

While accuracy, fluency, mistakes, style, format, terminology, readability, prompt delivery, punctuation, omission, typo, and consistency were proposed, accuracy is the most important criterion, followed by readability. It can then be concluded that buyers enjoy certain bargaining power which derives from the information they possess.

5.1.9 Threat of backward integration posed by the software localization vendors

Porter (1980) believes that when buyers are able to conduct backward integration by producing some products or services on their own instead of buying from the suppliers, they are likely to enjoy an advantage in negotiation. The threat posed by the software localization vendors was considered to be average, to low, even zero. All software localization vendors considered that it is not possible for them to offer translation services on their own. Cost is the major concern, according to four vendors.

The reasons provided include the high costs involved, the limited capacity of a vendor, and the huge demand from clients. All of the respondents think the current

collaboration approach suits the current situation. As a result, the software localization vendors do not enjoy the power of bargaining in this aspect as they do not pose a threat of backward integration.

5.1.10 Total cost of product provided by the freelance TRADOS translators

The resource exchange theory states that low total cost of the supplier's product makes the product more attractive (Ramsay, 1995). Freelance TRADOS translators indicated that computer, TRADOS software, Internet connection and time are the costs that arise when TRADOS is used for translation. In general, when a copy of TRADOS is available from the vendor, the total cost of a freelance TRADOS translator is not high and seems to be attractive to the software localization vendors.

As no one mentioned that another new computer should be bought for using

TRADOS, the hardware cost is low. In terms of obtaining a copy of TRADOS, three respondents indicated that the purchase of TRADOS could be considered as an investment. However, the other three did not consider it a cost at all because it was offered by the vendor. While the total cost of producing translation via TRADOS remains average to low as indicated by most of the freelance TRADOS translators, the translation output of the freelance TRADOS translators is appealing to the software localization vendors.

5.1.11 Fast delivery of product provided by the freelance TRADOS translators

Ramsay (1995) also states that fast delivery of product makes the product more attractive to the buyers when time is a concern. As software localization vendors

answered, the freelance TRADOS translators are no doubt favoured as long as the quality meets a certain standard. One respondent said that the tight schedule within the industry usually pushes for fast turnaround. To ensure quality, the vendors like to work with translators with faster turnaround so the follow-up procedure of review can be conducted properly. While the total cost of freelance TRADOS translators is not high for producing translation with TRADOS, their translation outputs has certain appeal to the software localization vendors to cut down the purchase costs. When the fast turnaround of the translation is available, the output of the freelance TRADOS translators appear to be even more appealing.

5.1.12 Switching costs for the freelance TRADOS translators

The concept of switching cost (Porter, 1980) can also be applied to the freelance TRADOS translators. Freelance TRADOS translators can increase the switching costs of the software localization vendors. The software localization vendors are likely to face high switching costs because the TRADOS training may have to be provided sometimes. In addition, translation quality of new freelance TRADOS translators remain a concern for the software localization vendors. However, almost all the freelance TRADOS translators consider the switching cost of working with new software localization vendors as low. The possible reason is that freelance TRAODS translators with TRADOS capability and translation proficiency are likely to take on new cases as there is a great demand for freelance TRADOS translators, according to some respondents.

5.1.13 Attractiveness of price offered by the software localization vendors

Although the product of freelance TRADOS translators is appealing to the software localization vendors in terms of low total cost, the translation rates offered by the vendors are not very attractive to the translators. The research findings show that four out of seven translators consider that the translation rates are of average attractiveness while the remaining three gave low or very low as an answer. As Porter (1980) points out, when the industry does not make high profit, the purchasing price of the buyers tends to be lower. This corresponds to the research findings.

5.1.14 Threat of forward integration posed by the freelance TRADOS translators

Six out of seven translators gave a negative answer for posing a threat to the software localization vendors by offering other products and services of the vendors.

In general, six translators gave the answers of a bit low, or low. Only one translator said the threat level is very high. It was mentioned by three translators that the business of software localization vendors involves more than the translation of the software. It is not likely for individual translators to take on the work of a software localization vendor.

5.2 General examination of the buyer group and supplier group

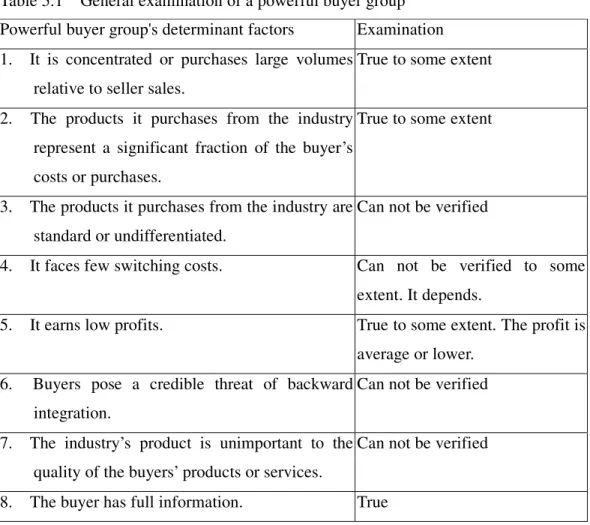

The examinations of the criteria of a powerful buyer group and a powerful supplier group are presented in the following two tables (Table 5.1 and Table 5.2). In terms of the powerful buyer group determinant factors, three determinant conditions

can be verified and present and another three can not be verified for the software localization vendors. It can be assumed that the software localization vendors pose certain power against their suppliers, the freelance TRADOS translators, but the software localization group is not in an absolute advantageous position. In addition, the amount of money offered by the software localization vendors do not have high attractiveness as freelance TRADOS translators do not necessarily rely on the

software localization vendors for income. Therefore, the overall money attractiveness to the freelance TRADOS translators is not high.

Table 5.1 General examination of a powerful buyer group Powerful buyer group's determinant factors Examination 1. It is concentrated or purchases large volumes

relative to seller sales.

True to some extent

2. The products it purchases from the industry represent a significant fraction of the buyer’s costs or purchases.

True to some extent

3. The products it purchases from the industry are standard or undifferentiated.

Can not be verified

4. It faces few switching costs. Can not be verified to some extent. It depends.

5. It earns low profits. True to some extent. The profit is average or lower.

6. Buyers pose a credible threat of backward integration.

Can not be verified

7. The industry’s product is unimportant to the quality of the buyers’ products or services.

Can not be verified

8. The buyer has full information. True

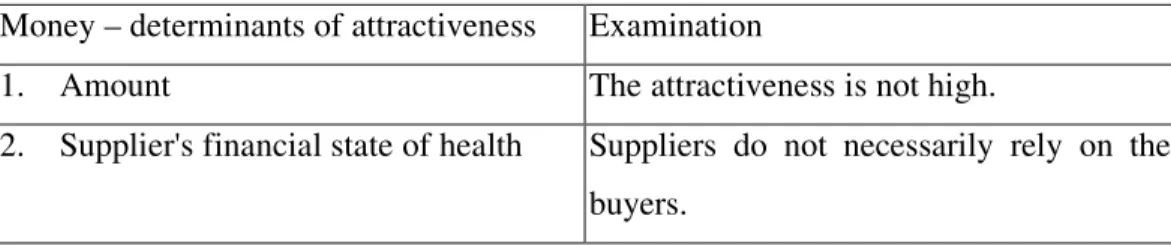

Table 5.2 Attractiveness of money to suppliers

Money – determinants of attractiveness Examination

1. Amount The attractiveness is not high.

2. Supplier's financial state of health Suppliers do not necessarily rely on the buyers.

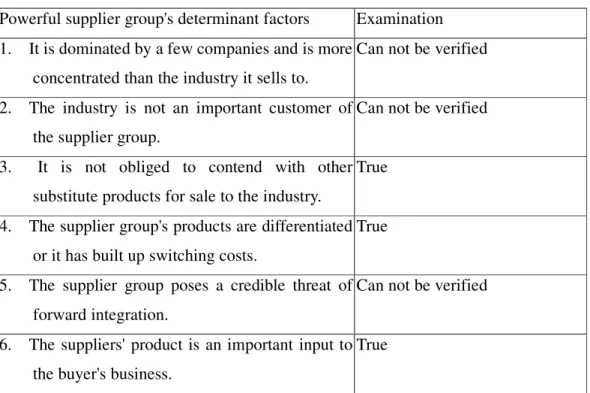

Table 5.3 and Table 5.4 present the examinations of the conditions for a powerful supplier group, which refers to the freelance TRADOS translators. It can be seen that three out of the six determinant factors of a powerful supplier group can not be verified. Three conditions of a powerful supplier group are confirmed to be true to some extent and only two conditions can not be verified. It appears that the freelance TRADOS translators have certain bargaining power. If the software localization vendors are not an important customer of the freelance TRADOS translators, the freelance TRADOS translators enjoy even more power. In terms of the attractiveness of the translation output offered by freelance TRADOS translators, the output should enjoy some degree of attractiveness. Three possible explanations can be identified from the following perspectives – cost, speed, and quality. The total cost of translating with TRADOS is not necessarily high if translators do not have to spend their own money to buy TRADOS. Secondly, when the software localization vendors require faster turnaround, the vendors are definitely attracted to translators with fast turnaround. The last reason is that software localization vendors posses enough information of the market and suppliers so that they will not misjudge the market demand and the performance of the translators.

Table 5.3 General examination of a powerful supplier group Powerful supplier group's determinant factors Examination 1. It is dominated by a few companies and is more

concentrated than the industry it sells to.

Can not be verified

2. The industry is not an important customer of the supplier group.

Can not be verified

3. It is not obliged to contend with other substitute products for sale to the industry.

True

4. The supplier group's products are differentiated or it has built up switching costs.

True

5. The supplier group poses a credible threat of forward integration.

Can not be verified

6. The suppliers' product is an important input to the buyer's business.

True

Table 5.4 Attractiveness of products to buyers

Products – determinants of attractiveness Examination

1. Total cost The total cost is not necessarily high.

2. Urgency Fast delivery of translation output is in great demand.

3. Information Buyers possess full information.

5.3 Summary

The software localization vendors are concentrated and purchase large amounts of products relative to the translation outputs of freelance TRADOS translators.

However, not all freelance TRADOS translators use TRADOS only for the translation of the software localization industry. The translation outputs that the software

differentiated and important to the quality of the products/services of the software localization vendors. Even when the translation outputs of the freelance TRADOS are differentiated, the software localization vendors have full information of the market and suppliers. The software localization industry faces average profit or lower and is likely to face high switching costs. Thus the industry can not afford to pay premium rates to all freelance TRADOS translators. Only the freelance TRADOS translators offering stable quality translation are paid premium rates, according to the vendors.

The attractiveness of the payment offered by the software localization vendors is low as most of the freelance TRADOS translators do not necessarily rely on the software localization vendors for major income source. In addition, it is not likely for the software localization vendors to employ in-house TRADOS translators for translation demands, which is also known as backward integration, due to the high costs

involved.

The freelance TRADOS translators are probably relatively less concentrated than the software localization vendors. It is interesting to note that over 90% of the cases done by using TRADOS are dedicated to the software localization industry. However, the software localization vendors are not always the important customer for the freelance TRADOS translators as the freelance TRADOS translators do not rely on the software localization vendors as a major source of income. While freelance TRADOS translators do not rely on the software localization vendors, the vendors depend on the translation outputs of the freelance TRADOS translators as an important business output. As the products of the freelance TRADOS translators are mainly differentiated due to personal background, knowledge domain, translation proficiency and TRADOS capability, translators do not have to compete with other

substitute products for sale to the software localization industry. The TRADOS capability of freelance TRADOS translators also increases the switching costs for the software localization vendors. However, it is almost impossible for the freelance TRADOS translators to pose a threat of forward integration to threaten the presence of the software localization vendors. The total cost of the freelance TRADOS translators is not necessarily high and fast turnaround requests of the software localization vendors can be satisfied sometimes. While the software localization vendors have full information of the market and suppliers, the performance of the freelance TRADOS translators is correctly evaluated and rewarded.