October 2000 pp. 15-36

CPA Attested Tax Returns and Tax

Evasion

*

Suming Lin

ABSTRACT: For a considerable number of years, business income tax returns attested by a certified public accountant (CPA) have enjoyed special tax incentives. There has, however, been no documentary evidence to justify the existing tax incentive policy. This study, which uses a Tobit model to undertake an analysis of business income tax return data, empirically demonstrates that CPA attested tax returns are more compliant with the tax law than non-attested tax returns. This finding suggests that tax authorities should continue to promote the use of CPA attested tax returns. As well, this finding recommends the auditing of a greater proportion of non-attested returns in order to reduce the incidence of tax evasion.

Key Words: Attested tax returns, Tax evasion, CPA, Tobit model, Tax

policy.

Data Availability: from the Data Processing Center, Ministry of Finance;

data available for academic research with permission.

I.

INTRODUCTION

I

n an effort to reduce the workload of the tax authorities in Taiwan, and to assist firms in meeting their tax obligations, Article 102 of the Income Tax Law prescribes that a firm may entrust a certified public accountant (CPA) to prepare, attest and file its business income tax returns. In preparing an attested tax return, the entrusted CPA is responsibleforchecking thefirm’saccounting recordsand related documentary evidence, adjusting the accounting income to taxable income based on the tax law, and attaching a signed ‘tax return attestation report’to thetax return.In caseswherean attested return is selected as part of an auditing sample, tax officials generally conduct the audit based on the tax return attestation report. Only when certain abnormalities are found will the tax*

This paper has benefited from the comments of two anonymous reviewers, as well as Chih-Chung Yeh, Tsing-Zai Wu, William W. Sheng, Chung-Yuan Hsi, Po-Kuei Chen and participants in workshops at National Cheng Kung University, and the Fourth Taiwan Conference on Accounting Research, cosponsored by the Taiwan Accounting Association and Tunghai University, which awarded the Best Empirical Paper prize to an earlier version of this paper (in Chinese). The author is grateful to Yu-Ming Yang, Director General of the Data Processing Center, Ministry of Finance, for data used in this study. This research was funded by the National Science Council.

officialsnormally demand to examinetheCPA’sattestation worksheetand thefirm’s accounting records.

For those firms whose tax returns are attested by a CPA, the Income Tax Law provides various tax incentives, including additional deductibility of entertainment expenses, the carry forward of net losses, and an extension of filing deadline. Thus far, however, no evidence has been documented to justify the policy of offering such tax benefits to those firms opting for CPA attested tax returns. The purpose of this study, therefore, is to empirically examine incidences of tax evasion among CPA attested business income tax returns versus ordinary (non-attested) returns, as a means of investigating the effectiveness of the tax return attestation system. In other words, if empirical results indicate a wider prevalence of tax evasion among CPA attested tax returns than among ordinary tax returns, then the aim of the attestation system - i.e., to reduce the workload of tax authorities and assist firms in meeting their tax obligations – will not have been effectively met. The findings of this study will, therefore, provide certain policy implications as to whether the government should curtail, or indeed extend, the scope of the tax return attestation system. As well, they will give guidance as to whether there should be any expansion or reduction in the auditing budget of tax authorities with respect to CPA attested tax returns.

While there are certain specific firms that are required by the tax law to use CPA attested tax returns, other firms can also elect to use CPA attested returns and thus enjoy those tax advantages made available as a means of encouraging tax attestation. Nevertheless, even with these incentives, the attestation system is still not widely employed by firms. For instance, CPA attested returns accounted for just 8.2% of all tax returns reported for 1994, a ratio of approximately 12:1 in favor of non-attested returns (see Table 1). In accordance with the administrative regulations prescribed by the Ministry of Finance, all listed companies, financial and insurance institutions and firms with annual net sales of NT$100 million or more must entrust their tax returns to CPAs for attestation. However, ironically, no penalties exist for those who ignore this requirementsinceno authorization hasbeen provided by theLegislativeYuan (Taiwan’s congress) to the Ministry of Finance to stipulate such penalties. As a result, some firms may well be encouraged to evade their tax liability by disregarding the attestation requirement.1

Another important reason for the current limited use of attested tax returns is the Expanded Paper Review (EPR) system. The EPR system can be used by firms whose total amount (total receipts) of net operating revenue and gross non-operating revenue (excluding transaction gains from lands, adhered properties of lands and tax exempt income) is NT$30 million or less. Irrespective of the gains or losses that a firm has actually made,oncethefirm’sreported netprofitratio reaches the prescribed industry profitstandard,and fulltax paymentismade,theEPR system will assessthefirm’s incometax in lightoftheinformation available on the ‘papers’presented with thetax returns.2 On the one hand, a firm with net losses may willingly pay tax under the EPR

1

As Table 2 indicates, about 4,380 firms with net sales over NT$100 million did not use a CPA to attest their 1994 tax returns.

2

Under the EPR system, a firm’staxableincomeisgenerally calculated by multiplying itssalesrevenueby the prescribed industry profit standard (generally around 6%), regardless of the gain or loss that the firm

system in order to dispose of the time-consuming process, and perhaps even psychological anxiety, caused by dealing with tax officials; on the other hand, however, a firm which conceals a proportion of its sales receipts through its intentional failure to issue uniform invoices, can take advantage of the EPR system to pay a much lower level of tax than the amount which would be assessed through auditing its accounting records and related documents.

If the evidence suggests a greater level of compliance with the tax law among CPA attested tax returns than ordinary tax returns, then tax return attestation clearly does achieve the goal of reducing the workload of tax authorities. Accordingly, it would then be advisable for the Ministry of Finance to expand the tax return attestation system, for example, to firms with net sales over NT$80 million, as opposed to the current standard of NT$100 million. It would also seem sensible for the Ministry of Finance to narrow the scope of the EPR system, for example, to firms with total receipts of less than NT$20 million, from the current NT$30 million.3 It also seems reasonable for the Legislative Yuan to propose an early amendment to the Income Tax Law to allow for the imposition of penalties against those firms whose tax returns are not attested by a CPA in disregard of the tax regulations. The empirical results of this paper may, therefore, offer some relevant evidence and guidance in the formulation of tax policy in the Ministry of Finance and the Legislative Yuan.

The remainder of this paper proceeds as follows. Section 2 briefly reviews the existing work on tax evasion and theattestation ofTaiwanesecompanies’tax returns.The methodology adopted for this study is introduced in Section 3, along with the data source of the study. The empirical results are presented in detail in Section 4, with Section 5 offering concluding remarks.

II. LITERATURE REVIEW

Ever since the 1970s, tax evasion has attracted considerable attention on a worldwide scale among academic researchers and tax policy makers. More recently, some of this attention has begun to focus upon the effect on tax evasion behavior of the tax services provided by CPAs. This section briefly reviews the previous work on tax evasion related topics.

Allingham and Sandmo (1972) presented one of the earliest and most famous theoretical studies on tax evasion. Their model, a straightforward application of individual choice under expected utility theory, aimed to determine the effect on tax evasion of government instruments, such as changes in the penalty for evasion, audit probability and tax rates. Among the main findings, it was noted that under-reported income drops as the government increases the penalty rate or the probability of audit. However, their theoretical analysis failed to determine the emergence of any clear-cut relationship between tax rate and reported income.

As a pioneering example of the empirical study of tax evasion, the work of

actually has. The sales revenue is decided according to the total amount shown on the uniform invoices issued by the firm. All of the uniform invoices throughout Taiwan must be pre-numbered and consequently controlled by the Ministry of Finance.

3

A firm whose total receipts exceed NT$20 million is then deprived of using the EPR system, and it may decide to opt for tax return attestation.

Clotfelter (1983) used 1969 data from the US Internal Revenue Service’s Taxpayer Compliance Measurement Program (TCMP) to investigate the relationship between marginal tax rate and individual income tax evasion, with the difference between assessed and reported income being used as a proxy for evasion. One of the most important empirical findings was that marginal tax rate had a significantly positive association with tax evasion. Since there was no evidence of evasion in a sizable proportion of the observations, the dependent variable was censored at zero, and Clotfelter, therefore, adopted Tobitregression analysis.Thispaper,likeClotfelter’s,willemploy theTobit model for statistical analysis.

Based on the prospect theory of Kahneman and Tversky (1979), Chang and Schultz (1990) proposed that differential tax compliance exists between taxpayers with additional tax due (under-withheld) at filing time, and taxpayers who are due to receive tax refunds (over-withheld). Using the 1982 TCMP data, they provided evidence consistent with their proposition. More recently, Yaniv (1999) also applied the prospect theory to a theoretical model to mathematically demonstrate that advance tax payments will affect the decision to evade tax. Following on from Chang and Schultz (1990), the present study will examinewhetherafirm’srefund-due or balance-due position at filing time has an impact on business income tax evasion.

Beck et al. (1991) utilized an experimental design to explore the under-reported income of taxpayers under different tax rates, penalty rates, and audit probabilities, and under different levels of income uncertainty. Among their findings, they reported that tax compliance rises with penalty rate and audit probability, but that there is no identifiable relationship with thetaxpayer’stax rate. Risk averse taxpayers will be more compliant when the uncertainty of income is increased (i.e., when the tax law becomes more ambiguous).

Turning to the studies on the impact of the role of CPAs on tax evasion, Klepper et

al. (1991) argued that since tax professionals (e.g., CPAs and lawyers in the US) are

subject to disciplinary sanctions for willful or negligent breach of tax rules, they will undoubtedly help to enforce the clear requirements of the tax law. However, since tax professionals are also more astute and knowledgeable than the general public in terms of finding ways to exploit the tax law, they will also help taxpayers take advantage of any ambiguous provisions of the law. Klepper et al. (1991), therefore, present a theoretical model, which jointly addresses the decision to engage a tax professional and the tax evasion outcomes conditional on whether a professional is engaged. However, only the latter is empirically tested. The 1982 TCMP data is used in the test, and ambiguity is measured using the number of revenue rulings pertaining to the line item, divided by the true amount of that line item. The test results were basically as they had predicted; that is, where ambiguous line items are involved, tax professionals will play an advocacy role, thus contributing to greater evasion, whereas, in the case of unambiguous line items, such professionals will play an enforcement role, contributing to greater compliance. Survey studies also present similar results. In an experiment using the partners and managers of the (then) Big 6 CPA firms as subjects, Spilker et al. (1999) provided evidence to show that tax professionals will interpret ambiguity to the benefit of their clients in a compliance decision context. Based on the 1982 TCMP data, Erard (1993) also found that returns prepared by tax professionals were more aggressive in tax evasion than returns

prepared by taxpayers themselves. However, in contrast to Klepper et al. (1991) and Erard (1993), who examined personal income tax evasion, this paper concentrates on business income tax.

Therehavealso been somestudiesinvestigating tax evasion,oraCPA’stax services, in Taiwan. Huang (1982) compared personal income in the national income accounts, and the income reported in all of the individual income tax returns, concluding that around 71% of income was unreported by taxpayers in the 1979 tax year. Again based on national income accounts, Chen (1987) found that around 53% of business income was unreported in 1983 business income tax returns. The proportion of under-reported income was also found to vary among different industries in Taiwan.

Chu (1988)interviewed 54 ofTaiwan’sCPAsin an attemptto establish thepossible factors that cause businesses to evade tax. According to his MIMIC (multiple-indicator-multiple-cause) analysis, significant indicators of business income tax evasion include the quality and integrity of tax officials, the tax rate structure, and the flexible interpretation of the tax law. However, the role played by a CPA in tax evasion was beyond the scope of his research.

Wang et al. (1993) conducted a questionnaire survey and held panel discussions to examine the benefits of using CPA attested tax returns. Their main findings, as they relate to this paper were: (i) the reasons forusing CPA tax attestation included ‘agood bargain to entrusttax attestation along with financialattestation’,‘can enjoy tax preferences’, ‘required by tax regulations’,etc.;(ii)approximately 66% ofCPA attested tax returns were selected for subsequent tax audit, while 57% of ordinary returns were selected; and (iii) in the opinion of tax officials and businesses, CPA tax attestation has played a positive role - CPAs can assist firms to fulfill their tax obligations and simultaneously safeguard thefirms’interests.In addition,tax attestation reducestax authorities’audit workload and costs.

While the Wang et al. (1993) study utilized a survey approach; the present study will employ micro-unit data from real tax returns to investigate any specific association between CPA tax attestation and business income tax evasion.

III. METHODOLOGY

Data and Sample

Business income tax returns filed for the tax year 1994 are used as the data for this study. The Data Processing Center of the Ministry of Finance maintains an annual record, on computer disks, of reported amounts of all items on original tax returns, and the amountsdeemed ‘correct’following auditby tax authorities.4

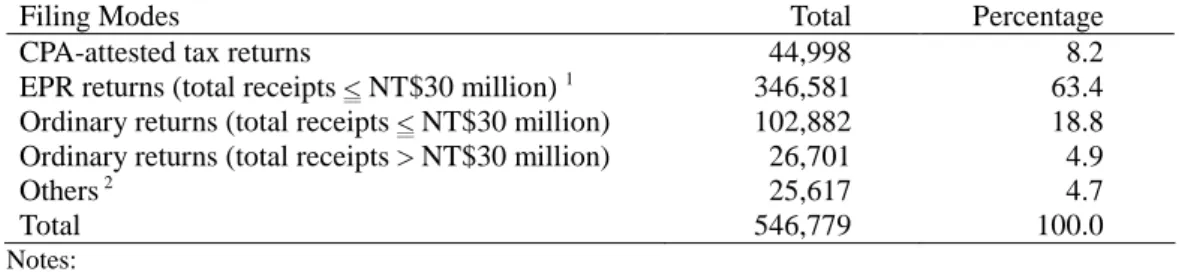

The filing modes of all business income tax returns reported for the 1994 tax year are shown in Table 1, revealing that around half a million returns were filed in Taiwan during that year, and that most returns, around 63.4%, used the Expanded Paper Review (EPR) system. Those firms with total operating and non-operating receipts not exceeding NT$30 million, which could opt to use the EPR system, but chose not to, accounted for

4

1994 tax year returns were filed in 1995. It takes around two years to audit these returns and to store the data on computer disks. Therefore, by using the 1994 tax year data, this study obtained the latest available data, to February 1998, when the study commenced.

18.8% of the total returns. The combination of these two groups indicates that more than 80% of all returns came from businesses with total receipts not exceeding NT$30 million. Only around 45,000 firms, less than 10% of the total, entrusted their tax returns to CPA attestation.

The sample for statistical analysis excludes firms with total receipts not exceeding NT$30 million, since they have the option of applying the EPR system and records in the EPR returns are often incomplete. Firms whose net sales were equal to, or greater than, NT$100 million are also eliminated from the sample because they are compelled to use CPA attested tax returns under current tax regulations.

Table 2 demonstrates the sample selection procedure. The numbers displayed in the second row are taken from Table 1, and after eliminating the firms with total receipts not exceeding NT$30 million and those firms with net sales of NT$100 million and above, we are left with 14,998 CPA attested tax returns, and 22,321 ordinary returns.

Table 1 Filing modes for business income tax returns reported for the 1994 tax year

Filing Modes Total Percentage

CPA-attested tax returns 44,998 8.2

EPR returns (total receipts < NT$30 million)1 346,581 63.4

Ordinary returns (total receipts < NT$30 million) 102,882 18.8

Ordinary returns (total receipts > NT$30 million) 26,701 4.9

Others2 25,617 4.7

Total 546,779 100.0

Notes:

1. For an explanation of EPR (Expanded Paper Review) returns, please see the Introduction section.

2. Including returns of educational, cultural, public welfare, or charitable organizations, returns of foreign corporation branches in Taiwan, returns of government-controlled firms, returns of firms changing their fiscal year, returns of liquidating firms, etc.

Firms that did not report balance sheet data, those for which tax assessed data after official audits were unavailable, or those that included missing or illogical values are further deleted from the sample.5 In the final stage, the sample consists of 34,356 observations, including 14,082 CPA attested tax returns (41%) and 20,274 ordinary returns (59%).6

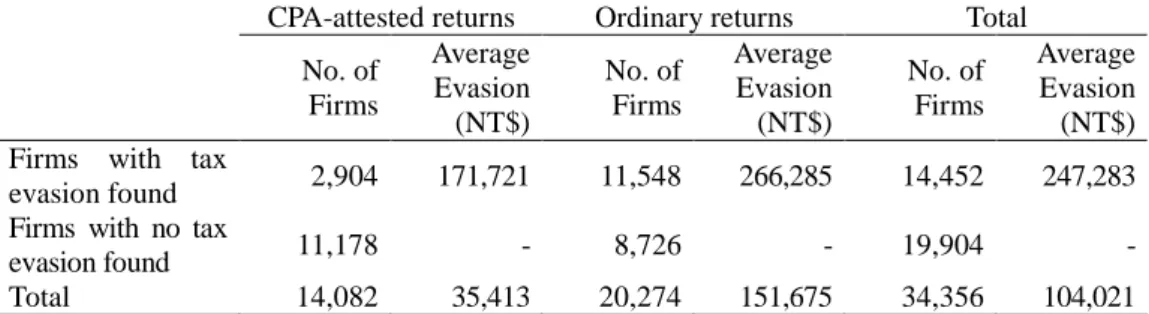

Table 3 divides the CPA attested returns and ordinary returns selected in the sample into two groups, respectively; those firms within which tax evasion was subsequently found in an official audit (defined below), and those firms not found to have been involved in any tax evasion. Of those firms using ordinary returns, there were 11,548 that were found to have evaded taxes, far more than the 2,904 firms that had used CPA attested returns that were found to be evading taxes.

5

The Data Processing Center retains business income returns data in three files: Income Statements, Balance Sheets and Tax Assessed after Audits. These files can be merged according to each firm’s8-digit business identification number assigned by the government. Before the Data Processing Center releases the data for academic research, the identification number is transformed by a certain formula unknown to the public.

6

There are 163 firms with reported tax liability greater than the assessed tax liability after audit. They are deemed as erroneous observations and deleted from the sample.

Table 2 Sample selection procedure and number of sample observations

Selection Procedure CPA-attested

Tax Returns

Ordinary Returns with Receipts > NT$30 million

Total

Firms reporting income statement in tax return 44,998 26,701 71,699

Less: receipts < NT$ 30 million

or net sales > NT$100 million - 30,000 - 4,380 - 34,380

Firms with receipts > NT$ 30 million

andnet sales < NT$100 million 14,998 22,321 37,319

Less: firms without balance sheet or tax

assessed data after audit - 724 - 1,666 - 2,390

Subtotal 14,274 20,655 34,929

Less: firms with missing or illogical values - 192 - 381 - 573

Total No. of observations used in the sample 14,082 20,274 34,356

Note: In this table, receipts means total receipts, and stands for the total amount of net operating revenue (net

sales) and gross non-operating revenue (excluding transaction gains from land and adhered properties of land, and tax-exempt income).

Table 3 Occurrences of tax evasion in CPA attested and ordinary tax returns

CPA-attested returns Ordinary returns Total

No. of Firms Average Evasion (NT$) No. of Firms Average Evasion (NT$) No. of Firms Average Evasion (NT$)

Firms with tax

evasion found 2,904 171,721 11,548 266,285 14,452 247,283

Firms with no tax

evasion found 11,178 - 8,726 - 19,904

-Total 14,082 35,413 20,274 151,675 34,356 104,021

In those firms within which tax evasion had been assessed, the average tax evasion from ordinary returns was NT$266,285, far in excess of the average NT$171,721 of the CPA attested returns, by around NT$95,000 (the average reported tax liability was NT$189,000 for ordinary returns, and NT$195,000 for CPA attested returns).

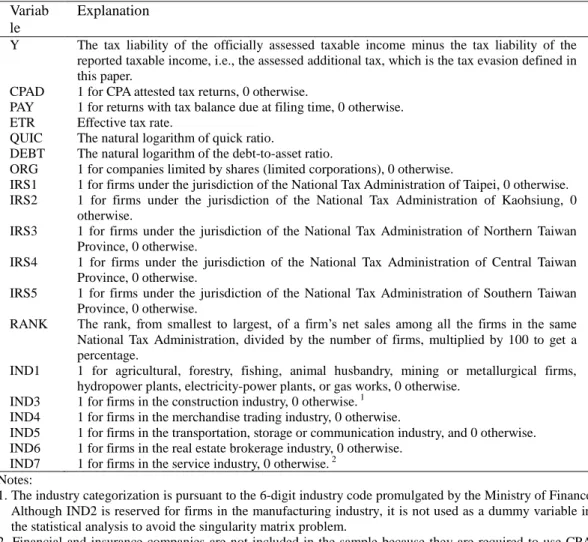

Variables

Since all firms in the sample were restricted to total receipts in excess of NT$30 million, and net sales of less than NT$100 million, the amount of tax evasion is necessarily limited within a certain range. Therefore, the amount of tax evasion, as the dependent variable, will not be taken logarithmically or transformed into any other value. This will also ensure a much easier explanation of the statistical results. All the variables used in this study are listed in Table 4 below, followed by complementary explanations where necessary.

While under-reported income was used as the proxy of tax evasion by both Allingham and Sandmo (1972) and Clotfelter (1983), this study defines tax evasion as the amount of assessed additional tax, i.e., the tax liability that tax officials determined to be

due, less the tax liability of the reported taxable income. Using assessed additional tax as the dependent variable, it is considered that this paper can more clearly demonstrate the association between the independent variables and the magnitude of the tax evaded. Tax evasion includesnotonly ‘intentional’tax evasion subsequently detected,butalso the additional tax due as a result of the rejection of expenses claimed, or the upward adjustmentofreceiptsarising from tax officials’opposition to taxpayers’advantageous interpretations of the tax law. In other words, in this study, tax evasion includes both intentional and unintentional non-payment of taxes. However, over-reported expenses and under-reported receipts that the tax officials failed to discover in their subsequent audits are not included in the definition of tax evasion.

Table 4 Variables and their explanations

Variab le

Explanation

Y The tax liability of the officially assessed taxable income minus the tax liability of the reported taxable income, i.e., the assessed additional tax, which is the tax evasion defined in this paper.

CPAD 1 for CPA attested tax returns, 0 otherwise.

PAY 1 for returns with tax balance due at filing time, 0 otherwise.

ETR Effective tax rate.

QUIC The natural logarithm of quick ratio.

DEBT The natural logarithm of the debt-to-asset ratio.

ORG 1 for companies limited by shares (limited corporations), 0 otherwise.

IRS1 1 for firms under the jurisdiction of the National Tax Administration of Taipei, 0 otherwise. IRS2 1 for firms under the jurisdiction of the National Tax Administration of Kaohsiung, 0

otherwise.

IRS3 1 for firms under the jurisdiction of the National Tax Administration of Northern Taiwan Province, 0 otherwise.

IRS4 1 for firms under the jurisdiction of the National Tax Administration of Central Taiwan Province, 0 otherwise.

IRS5 1 for firms under the jurisdiction of the National Tax Administration of Southern Taiwan Province, 0 otherwise.

RANK Therank,from smallestto largest,ofafirm’snetsalesamong allthefirmsin thesame National Tax Administration, divided by the number of firms, multiplied by 100 to get a percentage.

IND1 1 for agricultural, forestry, fishing, animal husbandry, mining or metallurgical firms, hydropower plants, electricity-power plants, or gas works, 0 otherwise.

IND3 1 for firms in the construction industry, 0 otherwise.1 IND4 1 for firms in the merchandise trading industry, 0 otherwise.

IND5 1 for firms in the transportation, storage or communication industry, and 0 otherwise. IND6 1 for firms in the real estate brokerage industry, 0 otherwise.

IND7 1 for firms in the service industry, 0 otherwise.2 Notes:

1. The industry categorization is pursuant to the 6-digit industry code promulgated by the Ministry of Finance. Although IND2 is reserved for firms in the manufacturing industry, it is not used as a dummy variable in the statistical analysis to avoid the singularity matrix problem.

2. Financial and insurance companies are not included in the sample because they are required to use CPA attested tax returns.

evasion of CPA attested returns differs from that of ordinary returns. As the extant literature has failed to provide a clear-cut theory capable of predicting the impact of CPA tax services on tax compliance, this study will try to investigate the association, rather than the causality, between the usage of CPA attested returns and tax evasion.

Based on Kahneman and Tversky’s (1979) prospect theory, Chang and Schultz (1990) hypothesize that at filing time, individual taxpayers will assume their withholding position, i.e., whether under-withheld or over-withheld, as their reference point. Therefore, taxpayers with an under-withheld (tax balance due) position have a higher rate of tax evasion than taxpayers with an over-withheld (tax refund due) position. Simply because Chang and Schultz (1990) were able to present supporting evidence from US individual income tax data, the withholding position (the dummy variable PAY) will be used as an independent variable in this study.

A further independent variable, ETR (effective tax rate), is obtained by subtracting the applicable tax credits from the tax liability of the assessed taxable income, and then dividing this by the total assessed taxable and exempt income. When the denominator is less than or equal to zero, or when it is positive but the numerator is negative, the ETR is set at zero. Clotfelter (1983) found that US taxpayers with a higher marginal tax rate (MTR, rather than ETR), tended to have more income under-reported. Theoretically, MTR is more suitable than ETR as the explanatory variable of tax evasion; this is because, for a taxpayer to increase his under-reported income by $1, his tax saving, if not detected by tax officials,willbetheequivalentofMTR ($MTR).However,whereafirm’sannual taxable income is over NT$100,000, the applicable tax rate will be 25% (the highest in Taiwan).Sinceitisclearthatthevariation offirms’MTR willbequitesmall,thisstudy uses ETR rather than MTR as an explanatory variable. Firms with more tax exempt income or more tax credits have a lower ETR, and these firms may well prove to be more compliant to the tax law because their tax burden is already low. Therefore, the conjecture is that ETR and tax evasion are positively related.

The more widespread the ownership, then the less the possibility that the benefits of business income tax evasion can be shared among a small number of people (for example, the management team). Tax return data maintained by the Data Processing Center, however, lacks information on the number of shareholders, or the proportion of shares held by the board of directors. Therefore, this study can only consider whether a firm is a limited corporation (limited by shares) as the proxy for the dispersion of ownership. If a firm is limited by shares then ORG=1, otherwise ORG=0 (e.g., for a partnership, a sole proprietorship, or a corporation in any other form).

A firm’sfinancialposition may impactupon itstax compliancebehavior.A firm with a higher quick ratio (QUIC) has more funds available in the short term, therefore, it has less cash outflow pressure impacting upon income tax payment, and may, therefore, have alowerpropensity to play thetax evasion game.Conversely,thehigherafirm’sdebt ratio, the greater its interest expenses and bankruptcy risk and the lower its tax paying ability, thus, the higher will be its propensity to evade tax. In order to avoid any zeros arising in the denominator of the QUIC calculation, both the numerator and the denominator are increased by NT$10,000, similar to the manipulation carried out in Broman (1989), and to avoid the extreme impact of the outliers, QUIC takes the quick ratio in natural logarithmic form. The debt ratio denoted by DEBT is total liability (plus

NT$10,000) divided by total assets (plus NT$10,000), which then takes natural logarithm.

IRS1,…,IRS5 are thedummy variablesforthetax office-in-charge. The Tobit model in the study has no constant term, so five dummies are taken to represent all five national tax administrations. In addition, all firms are classified into seven industry categories, according to the 6-digit industry code. (Refer to the notes in Table 4 for more information on industry codes).

A unique variable used in this study is RANK. Assume, for example, that a firm is under the jurisdiction of the National Tax Administration of the Southern Taiwan Province. This study ranks its net sales with every other firm in the same jurisdiction. If the firm ranks Rthlargest among the whole S firms in that tax jurisdiction, then its RANK = (1-R/S) ×100. It is speculated that a firm with larger RANK has a higher probability of selection for audit by the tax office-in-charge, and that the tax office will scrutinize its tax return more closely. Therefore, it is predicted that RANK will be positively associated with the amount of tax evasion detected by the tax office. The last column in Table 5 demonstrates the sample mean of each independent variable; this information is indispensable in the explanation of the results of Tobit analysis.

Statistical Model

As Table 3 indicated, there were 19,904 firms (about 58% of the sample), which were not found to have evaded tax. Therefore, the dependent variable, i.e., the amount of tax evasion, was observed to be zero in a sizable proportion of the sample. Economists referto this kind of dataas ‘censored data’ (further clarification will follow). In his research on the household demand for durable goods, Tobin (1958) proposed a new statistical model to analyze his censored data. The model, designated as the Tobit model by Goldberger (1964), has been widely employed in social science research (Amemiya 1984), such as the Greene and Quester (1982) study of the working hours of female laborers, the Clotfelter (1983) examination of US tax evasion in individual income tax, and the Lin (1997) study of R&D expenditure by Taiwanese manufacturers.

Similar to the argument in Tobin (1958), different firms may have different propensities towards tax evasion, even though they are not found to have evaded tax. Therefore, what we observe for the dependent variable yi(the evaded tax) is:

0 ' i i i x y wherey*

(the propensity to evade tax) is the latent variable, and: i i i x y * ' , i = 1,…,n, i

~N(0,σ2 ) (2) If yi*>0, the observed tax evasion is y i=yi

* . If yi

*≦0, only y

i=0 is observed, and the exact value of yi

*

is not observed. For example, even if firms A and B are both observed to have no tax evasion (yA=yB=0), firm A may have a greater propensity towards evading tax (yA

*>y B

*

). Once business conditions are changed, yA *

may exceed zero at greater speed than yB*so that yA>0 will be observed while yBis still equal to zero.

Based on the explanations of the Tobit model in Greene (2000: Ch.20), Maddala (1983: Ch.6) and Judge et al. (1985: Ch.18), the following four equations derived from

otherwise, (1)

if yi *>0,

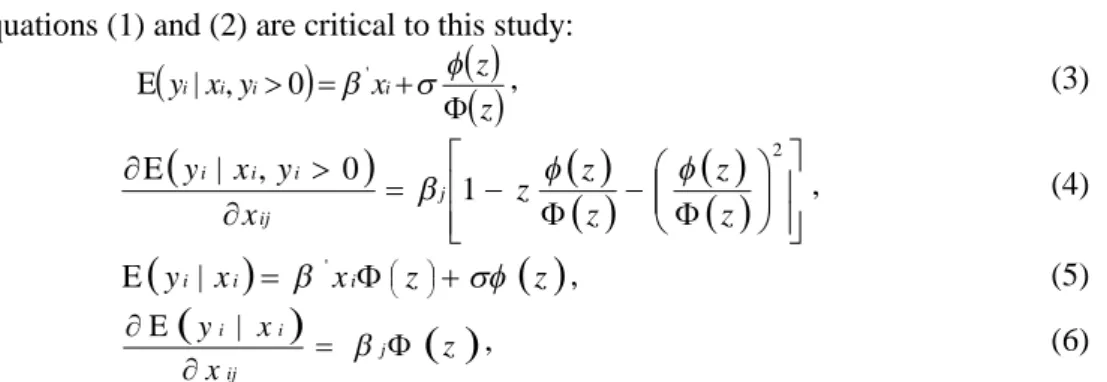

equations (1) and (2) are critical to this study:

z z x y x yi i i i ' 0 , | E , (3)

2 1 0 , | E z z z z z x y x y j ij i i i , (4)

yi|xi

'xiz

z E , (5)

z x x y j ij i i E | , (6)where (.) andΦ(.) are notations for the standard normal density function and

cumulative normal distribution function, respectively; xijis the value of the j

th

variable in the ithobservation vector (the ithfirm); and z = βxi/σ, the standard normal deviate.

Equation (3) is related to y>0 only. Given x=xi, it is the expected value of tax evasion for those noncompliant firms (y>0), while those firms with y=0 are excluded. As indicated in Judge et al. (1985:780), the traditional least squares regression will result in biased and inconsistent (the estimator of β). This is because the second term in equation (3) is ignored. Given x=xi, equation (4) represents the marginal effect of a unit increase in the jthvariable of xijvector on the expected value of yifor those tax evading firms only. Because this takes into account only the firms with y>0, it ignores the fact that the xijchangemay causesomefirms’propensity forevasion to increasefrom yi

*≦0 to

yi *

>0, i.e., to become tax evaders from non-evaders.

On the other hand, equation (5) represents the overall expected value of tax evasion not only for the y>0 firms, but also for the y=0 firms. Equation (6) is the partial derivative function of equation (5), and this study will use equation (6) to predict the effect of a unit increase in the independent variable on the marginal increase in the tax evasion from both firms that already evaded tax, and those firms that had not been tax evaders but that would subsequently become evaders. Thus, Equation (6), rather than equation (4), plays the main role in this study because it carries more relevant tax implications.

The LIMDEP 7.0 software (Greene, 1995) is used for the maximum likelihood estimation of the Tobit model. As stated above, the partial derivative in equation (6) will be used to predict the marginal effect of independent variables. Although the marginal effects can be calculated for any pertinent values of the regressors, this study primarily calculates this at the means of the regressors (

x

). However, for dummy variables (e.g., CPAD, PAY, and ORG) the partial derivative is not meaningful. Instead, taking CPAD as an example, we apply equation (5) to compute the marginal effect as follows, as was suggested in Greene (2000:817).

| except 1

E | except 0

E yi xxi CPAD yi xxi CPAD (7)

IV.

EMPIRICAL RESULTS

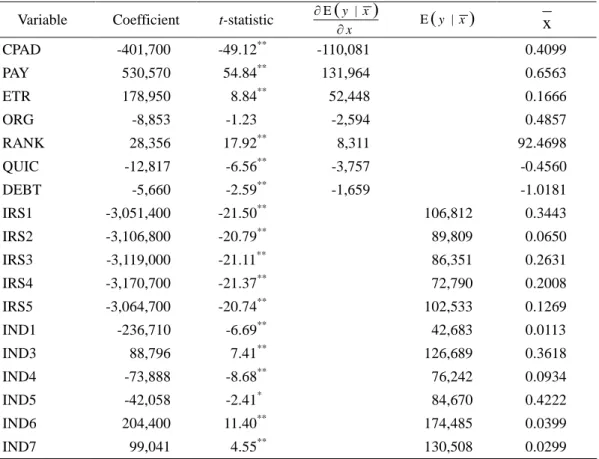

Table 5 summarizes the Tobit regression results, with the second column presenting the estimated β coefficients, and the third column offering the t-statistics. Unlike cases in the linear model, theβcoefficients of the Tobit model, which is nonlinear, are not the

marginal effects of independent variables on the dependent variable. According to equation (6), the marginal effects for continuous regressors are the β coefficients multiplied by Φ(βx /σ), and these are shown in the fourth column of Table 5. However, the marginal effects of the dummy variables (CPAD, PAY, and ORG) are computed by equation (7). The last column provides the sample means of the independent variables. The means and the σvalue of equation (2) shown in Note 2 of Table 5 are indispensable to the computation of values in columns four and five. Taking IRS1 as an example, the

y |xE =106,812 in the second last column represents that for all sampled firms under the jurisdiction of the National Tax Administration of Taipei (IRS=1,IRS2=…=IRS5=0), the average amount of tax evasion estimated at the means of all regressors, with the exception of tax jurisdiction dummies, is NT$106,812.

The most important objective of this study was to undertake a comparison of business income tax evasion between CPA attested tax returns and ordinary returns. The Tobit analysis shows that the β coefficient of CPAD is negative and statistically significant at the 0.01 level. The fourth column of Table 5, also demonstrates that the marginal effect of CPAD is –NT$110,081; that is, setting all the independent variables except CPAD at their mean values, using these conditions as the base point for comparison, then on average, CPA attested tax returns under these conditions evaded less tax by about NT$110,000 than ordinary tax returns under the same conditions. Therefore, the empirical results provide supporting evidence for tax incentive policies, such as allowing extra deductible entertainment expenses, in order to promote the use of CPA tax return attestation. On the other hand, Wang et al. (1993), and several tax officials in various national tax administration offices, indicated that the audit probabilities were the same for CPA attested returns and ordinary returns. Therefore, the empirical results also indicate that reinforcing the tax audit of ordinary returns may uncover more tax evasion, and enhance tax equity.

The coefficient of PAY is significantly greater than zero, and the marginal effect is NT$131,964, implying that firms with tax balances due at filing time evaded more tax than those firms with tax refunds due. This finding demonstrates that, similar to the evidence documented by Chang and Schultz (1990) in the case of US individual income taxes, the prospect theory (Kahneman and Tversky, 1979) is applicable to the reporting of Taiwan’sbusinessincometax.

The coefficient ofETR isalso significantly greaterthan zero.Ifafirm’seffective tax rate increases by 1%, its tax evasion increases by about NT$524, as suggested by the fourth column of Table 5. This finding runs parallel to the Clotfelter (1983) study in which the individual income tax rate was found to be positively associated with under-reported income in the US. The CPAs interviewed in Chu (1988) also claimed, similarly, that a high rate of income tax was one of the main causes of tax evasion in Taiwan.

As the proxy of the dispersion of ownership, ORG is the only variable whose coefficient is not statistically significant. Although this result does not support the hypothesis that firms with dispersed ownership have less motivation to evade tax, it is

worth reiterating that ORG may be an imperfect proxy of the dispersion of ownership, as stated earlier.

The coefficient of RANK is significantly positive, with the marginal effect being NT$8,311.Thisimpliesthatiftherank ofonefirm’snetsalesisonepercentagepoint higher than another, then its tax evasion will be about NT$8,300 higher. This finding supports the earlier proposition that a firm with a larger RANK has a higher probability of selection for audit by the tax office-in-charge, and that the tax office will scrutinize its tax returns more closely. The finding is also consistent with the argument of the political cost hypothesis in Zimmerman (1983).

Table 5 Tobit analysis of business income tax evasion

Variable Coefficient t-statistic

x x y E | x y | E x CPAD -401,700 -49.12** -110,081 0.4099 PAY 530,570 54.84** 131,964 0.6563 ETR 178,950 8.84** 52,448 0.1666 ORG -8,853 -1.23 -2,594 0.4857 RANK 28,356 17.92** 8,311 92.4698 QUIC -12,817 -6.56** -3,757 -0.4560 DEBT -5,660 -2.59** -1,659 -1.0181 IRS1 -3,051,400 -21.50** 106,812 0.3443 IRS2 -3,106,800 -20.79** 89,809 0.0650 IRS3 -3,119,000 -21.11** 86,351 0.2631 IRS4 -3,170,700 -21.37** 72,790 0.2008 IRS5 -3,064,700 -20.74** 102,533 0.1269 IND1 -236,710 -6.69** 42,683 0.0113 IND3 88,796 7.41** 126,689 0.3618 IND4 -73,888 -8.68** 76,242 0.0934 IND5 -42,058 -2.41* 84,670 0.4222 IND6 204,400 11.40** 174,485 0.0399 IND7 99,041 4.55** 130,508 0.0299 Notes: 1. *:P<0.05, **:P<0.01 (one-tailed test).

2. log-likelihood = -217,751, n=34,356, σ=499,460 (see Greene, (1995), at p.587).

Standing forafirm’sfinancialstrength,asexpected,QUIC (quick ratio)isfound to be negatively associated with tax evasion. However, DEBT (debt ratio) is somewhat unexpectedly, also negatively associated with tax evasion. This contradicts the prediction that a firm with high debt ratio has a lower tax paying ability, and thus a higher propensity towards tax evasion. This study made an effort to delete the outliers, i.e.,

observations with DEBT less than ln (1/1000), but the regression results are still similar to those in Table 5. A possible explanation for the negative relationship between DEBT and tax evasion is as follows; other things being equal, a high leveraged firm has a higher interest expense, thus lowering its taxable income and tax liability. Since its tax liability is already low (or is zero due to interest expense exceeding operation income), there is less motivation to evade tax.

Likelihood ratio tests have been employed in this study to investigate whether the jurisdiction dummies,IRS1,IRS2,…,IRS5,orthe industry dummies,IND1,IND3,…, IND7, or indeed both, can be discarded from the model specification. However, the test results all suggest that both jurisdiction and industry dummies have to be specified in the Tobit model. Furthermore, since the coefficients of all the jurisdiction dummies are quite close to one another, this study has attempted to impose the equality restriction on the coefficients (Greene 1995:134-136). The likelihood ratio test also rejects the equality constraint.

Although the coefficients of the jurisdiction dummies are all negative, the expected tax evasion E(y︱x) within each jurisdiction is consistently positive. This is because E(y︱x) has two components in equation (5); its first termβxΦ(z), which may be negative due to negative coefficients, is less than the second termσ(z), which is positive, in magnitude. Among the five tax jurisdictions, firms under the National Tax Administration of Taipei have the largest average tax evasion, followed by firms under the National Tax Administration of Southern Taiwan Province. A possible explanation to this finding is that firms in these two areas are more inclined to evade tax, but an alternative is that these two tax offices have better trained tax officials and thus have better audit performance. It would be a worthwhile study for tax analysts and policy-makers to further explore the relationship between the training of tax officials and the performance of tax offices. As indicated in Chen (1987), under-reported income varies significantly among different industries; column five of Table 5 also demonstrates that tax evasion varies with different industries.

V. CONCLUSIONS

The basic contribution of this paper is to provide empirical evidence supporting the proposition that CPA attested business income tax returns evade less tax than ordinary returns. This finding indicatesthataCPA’stax attestation servicescan help firmsto fulfill their tax obligations, and that this supports the use of tax policies offering incentives. On the other hand, the empirical results of this study also imply that a transfer of some of the effort from the auditing of CPA attested returns, towards the scrutiny of ordinary returns, may uncover more tax evasion, and thus enhance overall tax equity.

Turning to the administrative policy on tax return filing, this study suggests that the scope of CPA attested tax returns should be extended to include more firms. According to the‘MeasuresGoverning theCPA Tax ReturnsAttestation Entrusted by Profit-seeking Enterprises’ prescribed by the Ministry of Finance in 1982, a firm with net sales of NT$100 million or more, should entrust a CPA to attest its tax return. Since the mid-1980s, the pass rates of CPA examinations have been significantly higher than in the preceding period, indicating therefore, that there are currently sufficient CPAs to match

any demand growth. Thus, it seems that an extension of the scope of tax attestation, for example, a lowering of the standard from NT$100 million to NT$80 million, would be feasible. In order to punish those firms who willfully disregard the attestation requirement, the Legislative Yuan should add a specific article to the Income Tax Law delegating to the Ministry of Finance the power to penalize these firms.

In 1991, the Taiwanese government narrowed the scope of the Expanded Paper Review (EPR) system from firms with total receipts not exceeding NT$40 million to the current standard of NT$30 million. As described in the Introduction to this study, the EPR system helps to reduce the cost to the government of auditing small and medium enterprises (SMEs), and these SMEs can avoid tax audits on detailed accounting records and documentary evidence. However, the EPR system conflicts with the policy of fostering the SMEs’ establishment of sound accounting systems and of maintaining honest accounting records. This study also recommends, therefore, that tax policy-makers should narrow the scope of the EPR system further by lowering the upper limit, for example, from NT$30 million to NT$25 million or even NT$20 million. This may also have a knock-on effect of increasing the use of CPA tax attestation.

For firms using CPA attested tax returns, their CPA can represent them in dealings with tax authorities, thus saving their time and avoiding any psychological anxiety caused by dealing with tax officials. On top of this, the empirical results of this paper indicate that‘theassessed additionaltax afteraudit’(thetax evasion defined in thispaper)islower for CPA attested returns than for ordinary returns, by an average of NT$110,000, suggesting that those firms not currently engaging a CPA to attest their tax returns should re-evaluate their filing strategy. However, in addition to these benefits, consideration should also be given to issues such as CPA fees, as well as the cost and benefits coming from aCPA’sreconstruction ofaclientfirm’saccounting system.Theseissuesshould be taken into consideration as a whole by firms reviewing the alternative of using CPA tax attestation.

Some research limitations should be noted. As this paper aims to contrast the tax evasion of CPA attested returns with that of ordinary returns, the costs of CPA fees, which mustbesetagainstthesavingsofafirm’slaborand timefortax return filing,areissues that are not investigated in this paper. Due to the lack of relevant data in the tax returns, it seems that an exploration of this aspect of tax filing can only be accomplished by a survey study. Furthermore, the details contained in the tax return data file compiled by the Data Processing Center represent the numbers adjusted to meet the tax law provisions by the firm, or by its CPA, not the original numbers recorded for the firm’s financial accounting purposes. Therefore, this paper cannot effectively investigate how firms manipulate their income, through the selection of appropriate accounting principles, in order to pay less tax.

In 1998, Taiwan adopted an imputation credit system, the ‘two taxes into one’ system, in order to integrate business and individual income taxes. In accordance with the current Article 66-9, which took effectin 1998,afirm’spost-tax earnings incur 10% surtax if not distributed. However, if a CPA attested tax return was assessed to have under-reported taxable income, the same Article also prescribes that the 10% surtax which should have been levied on the additional undistributed earnings will be exempted. Although this is a new tax incentive aimed at encouraging the use of CPA attested tax

returns, it appears that more research is needed to explore whether this provision is reasonable, particularly with regard to the issue of whether this provision will encourage unscrupulous CPAs to help their clients to evade the surtax.

(Submitted July 1998; accepted March 1999.)

REFERENCES

Allingham, M.G. and A. Sandmo. 1972. Income tax evasion: A theoretical analysis.

Journal of Public Economics 1 (November): 323-338.

Amemiya, T. 1984. Tobit models: A survey. Journal of Econometrics 24 (January/February): 3-63.

Beck, P.J., J.S. Davis and W. Jung. 1991. Experimental evidence on taxpayer reporting under uncertainty. The Accounting Review 66 (July): 535-558.

Broman, A.J. 1989. Statutory tax rate reform and charitable contributions: Evidence from a recent period of reform. The Journal of the American Taxation Association 11 (Fall): 7-21.

Chang, O.H. and J.J. Schultz Jr. 1990. The income tax withholding phenomenon: Evidence from TCMP data. The Journal of the American Taxation Association12 (Fall): 88-93.

Chen, Li-wen.1987.Imputation ofthetax evasion ofbusinessincometax from Taiwan’s underground economic activities. Masters thesis, Graduate Institute of Public Finance, National Chengchi University, (in Chinese).

Chu, C.Y. Cyrus. 1988. Causes and indicators of business income tax evasion in Taiwan-An application of the MIMIC model. Taiwan Economic Review 16 (December) (in Chinese): 481-489.

Clotfelter, C.T. 1983. Tax evasion and tax rates: An analysis of individual returns. The

Review of Economics and Statistics 65 (August): 363-373.

Erard, B. 1993. Taxation with representation: An analysis of the role of tax practitioners in tax compliance. Journal of Public Economics 52 (September): 163-197.

Goldberger, A.S. 1964. Econometric Theory. New York: Wiley.

Greene, W.H. 1995. Limdep Version 7.0 User’s Manual.New York: Econometric Software, Inc.

________. 2000. Econometric Analysis. 4th ed. New York: Macmillan.

________,and A.O.Quester.1982.Divorcerisk and wives’laborsupply behavior.Social Science Quarterly 63 (March): 16-27.

Huang, Yophy. 1982. An empirical study on the tax evasion of Taiwan’s individual income tax. Masters thesis, Graduate Institute of Public Finance, National Chengchi University, (in Chinese).

Judge, G.G., W.E. Griffiths, R.C. Hill, H. Lütkepohl, and T. Lee. 1985. The Theory and

Practice of Econometrics. New York: Wiley.

Kahneman, D. and A. Tversky. 1979. Prospect theory: An analysis of decision under risk.

Econometrica 47 (March): 263-291.

Klepper, S., M. Mazur, and D. Nagin. 1991. Expert intermediaries and legal compliance: The case of tax preparers. Journal of Law and Economics 34 (April): 205-299. Lin, Hui-lin. 1997. Specification and selection of econometric models for censored

(March), (in Chinese): 73-94.

Maddala, G.S. 1983. Limit-Dependent and Qualitative Variables in Econometrics. New York: Cambridge University Press.

Spilker,B.C.,R.G.Worsham Jr.,and D.F.Prawitt.1999.Tax professionals’interpretations of ambiguity in compliance and planning decision contexts. The Journal of

American Taxation Association 21 (Fall): 75-89.

Tobin, J. 1958. Estimation of relationships for limited dependent variables. Econometrica 26 (January): 24-36.

Wang, Yi-hsin., Chu-pei Lee, Hrong-tai Fai, Shiou-chih Wang and Guey-song Hwang. 1993. The benefit of using CPA attested tax return research. Report of the Department of Accounting, National Chung Hsing University (National Taipei University), (in Chinese).

Yaniv, G., 1999. Tax compliance and advance tax payments: A prospect theory analysis.

National Tax Journal 52 (December): 753-766.

Zimmerman, J.L. 1983. Taxes and firm size. Journal of Accounting and Economics 5 (August): 119-149.