R&D in China: an empirical study

of Taiwanese IT companies

Louis Y.Y. Lu

1

and John S. Liu

2

1Department of Business Administration, Yuan Ze University, 135 Yuan-Tung Road, Chung-Li,

Taoyuan, 320 Taiwan. louisyylu@yahoo.com.tw

2Institute of Business and Management, National Chiao Tung University, 4th Floor, 114, Section 1,

Chung-Hsiao West Road, Taipei, 100 Taiwan. johnliu886@yahoo.com

This study extends the research on R&D (research and development) internationalization to a new environmental context (two Asian newly-industrialized economies, mainland China and Taiwan). Based on a survey of 56 major Taiwanese information technology (IT) companies, the status of R&D internationalization with Taiwan as the home and mainland China as the host is investigated. Human-capital-augmentation is found to be the key motive for Taiwanese IT companies to extend R&D activities to the mainland. Accessing capable yet cost effective local engineers with an additional benefit of geographical and linguistic proximity is the major context of this motive. The location decision is based on three considerations – access to engineers, proximity to manufacturing site, and competition avoidance. Finally, three operational patterns of conducting the international design and development (D&D) activities are categorized, which are ‘home-base-integration’, ‘host-base-integration’, and ‘product life cycle’.

1. Introduction

T

his paper is an empirical study of R&D activities of Taiwanese IT companies in mainland China. R&D internationalization has been an extensively-addressed topic in recent literature. Existing literature covers both empiri-cal and theoretiempiri-cal studies with well-developed countries as the main investigation subjects. Is-sues discussed are widely dispersed, with most of them elaborating on the motives for extending R&D activities abroad, R&D activity classifica-tion, and national differences in R&D strategy.This study seeks to enhance the R&D inter-nationalization literature in four ways. First, it extends the research to Asian newly-industrialized economies (NIEs) – Taiwan and mainland China. The majority of prior works focused on the well-developed triad of the USA, Europe, and Japan, yet little attention has been paid to developing

countries. Mainland China has been gradually taking the role of a ‘world factory’ since the late 1990s. Considering the plentiful supply of its well-educated human capital and active participation in industrial development, it has been included in the global R&D network of MNCs (multinational corporations). Taiwanese IT companies have played an important role in mainland China’s IT industry since the early 1990s and are starting to increase their investment in recent years by setting up R&D units in mainland China. Inves-tigation of R&D activities by Taiwanese IT companies in mainland China is of particular importance in filling up a gap in the current R&D internationalization literature.

Second, human-capital-augmentation is found to be the dominant motive of Taiwanese IT companies in establishing R&D units in mainland China. Motives for extending R&D activities abroad mentioned in prior literature include

access to market (Granstrand et al., 1992; von Zedtwitz and Gassmann, 2002), access to tech-nology (Gassmann and von Zedtwitz, 1999; Kuemmerle, 1997, 1999; Patel and Vega, 1999), and access to local skilled talents (Florida, 1997). This study finds that the above motives are not the major considerations for Taiwanese IT com-panies in establishing R&D organizations in mainland China. The in-depth interviews shown herein indicate that in the Taiwan-extends-to-mainland-China R&D case, human-capital-aug-mentation plays a key role. The conclusion is consistent with the lower R&D personnel cost and insufficient home personnel motives men-tioned in Gassmann and von Zedtwitz (1998).

Third, three major location decision factors are identified. They are access to engineers, proximity to manufacturing site, and competition avoid-ance. The factor of competition avoidance may be of little importance to global conglomerates of the triad countries. However, it is a significant concern for those small and medium enterprises (SMEs).

Fourth, the R&D activities are categorized based on differences in operational patterns be-tween home and host R&D units. For all the companies surveyed and interviewed, very few Taiwanese IT companies conduct research activ-ities in mainland China. Product design and process development are the main R&D activities. Three operational patterns in this D&D setting are found to be typical to manage development activities. They are ‘home-base-integration’, ‘host-base-integration’, and ‘product life cycle’.

The research questions raised in this study include: What are the motives of Taiwanese IT companies extending their R&D activities to mainland China? What are the factors that affect the decision in selecting an R&D location in mainland China? What are the operational pat-terns between the home and host R&D units?

To address these questions, this study surveyed 56 major Taiwanese IT companies which are among the 100 largest manufacturers in Taiwan. The survey was designed to identify whether a company has R&D units in mainland China, the reasons for setting up R&D units there, the location of their host R&D units, and the opera-tional patterns between the home R&D units in Taiwan and their associated R&D units in main-land China. In-depth interviews of 12 companies were conducted afterwards to further compre-hend the motives of extending R&D to mainland China, the location decision factors, as well as the details of the operational patterns and the

challenges in managing R&D units in mainland China.

2. Literature review

2.1. Motives of extending R&D abroad

Gassmann and von Zedtwitz (1998) provide a comprehensive list of the motives in extending R&D abroad based on the classification scheme used by Beckmann and Fischer (1994). The input-oriented factor addresses those motives related to human factors and infrastructures. Insufficient home personnel and qualified personnel abroad are two significant motives. Output-oriented fac-tors address motives related to markets and customers such as market proximity and custo-mer-specific development. On the other hand, mergers and acquisitions are attributed to exter-nal factors. Efficiency-oriented factors include most elements associated with cost advantages, where lower R&D personnel cost is one such motive. Local content rules and local labour relations are categorized into political and socio-cultural factors.

In addition to this comprehensive list, one category of literature emphasizes on what-to-access. Granstrand et al. (1992) and von Zedtwitz and Gassmann (2002) discuss the motive of acces-sing to market. The motive of accesacces-sing to tech-nology is mentioned in Gassmann and von Zedtwitz (1999), Kuemmerle (1997, 1999), and Patel and Vega (1999). Florida (1997) mentions the motive of accessing to local skilled talents. To confront the question of how similar Taiwanese IT companies’ motives are to what is described in the above literature, motives mentioned in the literature are used as the basic set of questions for the questionnaire and the follow-up interviews.

Several studies in the literature explain the motives by using modelling or theoretical ap-proaches. The product life cycle model offers a general explanation on why and how MNCs establish R&D units abroad (Ronstadt, 1977, 1978; Pearce, 1989). Demand and supply consid-erations offer another dimension for analyzing the motives. The demand-side literature (Herbert, 1989; Patel and Vega, 1999) proposes market-oriented motives; while in contrast, the supply-side literature (Florida, 1997; Dalton and Serapio, 1999) proposes technology-oriented motives. The competitive advantage model is discussed in Pearson et al. (1993), which adopts Porter’s (1990) framework of the factors constituting the

competitive advantage of nations. Capabilities-oriented theories (Dunning, 1994, Dunning and Narula, 1996; Mutinelli and Piscitello, 1998) offer a similar perspective and hold that maintaining or improving an MNC’s global competitive position constitutes a strong incentive to locate R&D abroad.

Complementary-assets-seeking (Teece, 1986; Serapio and Dalton, 1999) adds another view to the motives of R&D internationalization. Serapio and Dalton (1999) argue that MNCs engage in overseas R&D so as to complement their key assets. Some companies may seek to enhance their basic R&D capabilities, some companies may aim to strengthen their development capabilities, while some companies, on the other hand, may seek process technologies to add to their product technology expertise. All are meant to meet the needs of complementing their existing key assets in order to be successful in the competitive market.

This study adopts a similar view to the compe-titive advantage and complementary-asset-seek-ing model in explaincomplementary-asset-seek-ing Taiwanese IT firms’ motives to extend R&D to mainland China. Gaining relative competitive advantages is pro-posed as the basic motive. When the host owns the complementary factors that a company needs which the home does not have, the company will establish R&D units in the host to acquire these complementary factors and to gain the relative competitive advantages. The complementary fac-tors that Taiwanese IT companies are seeking are identified through the follow-up interviews with senior R&D managers of the targeted companies.

2.2. Operational patterns

Operational patterns concern the methods and the degree of collaboration between the home and host units. Several operational patterns are dis-cussed in the R&D internationalization literature. Medcof (1997) proposes an eight-category taxon-omy based on the type of technical work (re-search, development, or support), functional areas of collaboration (marketing, manufactur-ing, marketing and manufacturmanufactur-ing, or none), and geographic area of collaboration (local and inter-national). This taxonomy is quite general and encompasses many of the other taxonomies dis-cussed in the earlier literature. For the case of Taiwanese IT companies in mainland China, ‘international development unit’ would be the

proper category. This study, however, is looking to examine the operational patterns at a more detailed level of R&D activities.

By discriminating the dispersion of R&D activ-ities and the degree of cooperation between in-dividual R&D units, Gassmann and von Zedtwitz (1999) classify R&D organizations into five types – ethnocentric centralized, geocentric centralized, polycentric decentralized, R&D hub, and inte-grated R&D network organization. Based on the prior works of Patel and Vega (1999) and Kuem-merle (1997, 1999), Le Bas and Sierra (2002) categorize four types of strategy according to the revealed technological advantages (RTA), the rela-tive technology strength between home and host countries. These are technology-seeking, market-seeking, augmenting, and home-base-exploiting FDI (foreign direct investment) in R&D. Niosi and Godin (1999) differentiate three types of expatriate R&D organization – related diversified, vertically-integrated, and truly global R&D organizations. Asakawa (2001) distin-guishes two types of organizational tension in international R&D management, where one is a headquarter-centred model and the other is a subsidiary-centred model.

Von Zedtwitz and Gassmann (2002) propose four different patterns of managing internationa-lized R&D units. The organizations are categor-ized according to the location of doing research and/or development activities. National treasure R&D represents the type of organizations that have both research and development activities conducted at home. Technology-driven R&D represents the type of organizations that have development activities conducted at home and research activities dispersed abroad. Market-dri-ven R&D represents the type of organizations that have development activities dispersed abroad while research activities conducted at home. Glo-bal R&D represents the type of organizations that have both research and development activities dispersed home and abroad.

All these above-mentioned taxonomies are mostly concluded from data of the triad countries. However, the particular environmental context in mainland China is rarely addressed. Mainland China owns plenty of engineering resources and has a huge market potential. An investigation of extending R&D activities to mainland China can enrich the R&D internationalization literature. This study focuses on the R&D activities between mainland China and Taiwan, and it extends the operational-pattern literature from the R&D set-ting to the D&D setset-ting.

3. Data sample and research methodology

The population of this study is Taiwanese IT companies. The unit of analysis is the R&D organization of each individual company. There are two reasons that the IT industry is selected in this study. First, the IT industry is the most internationalized industry in Taiwan. Second, Florida (1997) argues that different industrial sectors possess heterogeneous characteristics. Fo-cusing on a relatively homogeneous industry helps isolate the potential contamination affected by specific industry characteristics.

With a strong will to extend the small home market and with strategic support from the gov-ernment, the IT industry has become the most internationalized industry in Taiwan. According to data from the Institute for Information Indus-try (III), Taiwan-made IT products have domi-nated the worldwide market in many categories. More than half of these products have gained over 50% global market share (Table 1). Pres-sured by continuous cost reduction requirements, Taiwanese IT companies have been forced to move their manufacturing sites to foreign coun-tries where wages are lower. In the 1980s, South-east Asian countries, such as Thailand, Indonesia, and Malaysia, were the major destinations for Taiwanese IT companies to establish their over-seas manufacturing sites. After Taiwan’s govern-ment lifted the curfew of politics in 1987, with the advantages of linguistic and geographical proxi-mity, mainland China has become the largest overseas manufacturing site of the Taiwanese IT industry.

Based on the database of a well-known Taiwa-nese business magazine, Business Weekly, 434 IT companies were included in the top 1000 manu-facturers in 2002. Among them, 56 were in the top 100 and accounted for over 60% of the total IT sales. The survey result generated from these 56 companies is considerably representative of the status of the Taiwanese IT industry. Therefore,

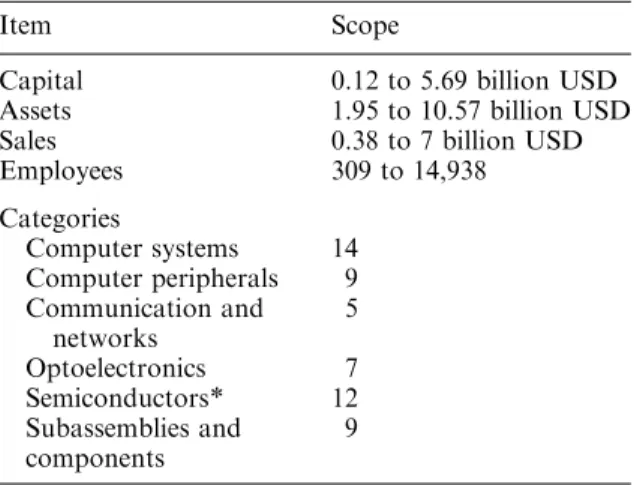

these 56 companies were chosen as the sample population of this study. The demographical characteristics of these companies are shown in Table 2.

A survey and in-depth interviews were used in this study. After several intensive discussions with academic experts and experienced practitioners, a questionnaire was designed for the survey, which was sent to R&D directors or managers of these selected companies. To encourage participation, all of the informants were assured that their responses would be held strictly confidential and only be shown in aggregated forms. Forty-eight responses were collected after several follow-up e-mails or phone calls. To achieve a complete investigation, the data of the remaining eight companies were collected from multiple sources, such as their competitors and people who are familiar with these companies. The data collected include the answers to the following questions. Does the company have R&D units in mainland China? Why did the company establish R&D units in mainland China? Which city or area did the R&D units locate to in mainland China? What is the operational model of the R&D units in mainland China?

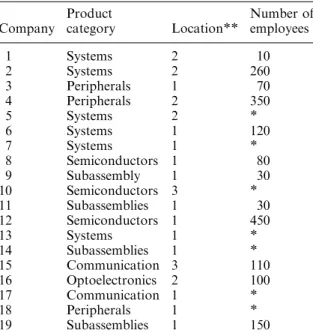

After collecting and analyzing the survey data, the result shows that 19 out of 56 companies have established R&D units in mainland China. Quan-titative data of these 19 companies are shown in Table 3, but company names are not disclosed as this was promised in the questionnaire. Twelve of these 19 companies accepted follow-up interviews with their top management or R&D managers. The purposes of the interviews are to further explore the genuine motives of extending R&D in mainland China, the reasons behind the location

Table 1. 2002 IT production in Taiwan.

Product Revenue (US$M) Volume (K units) Worldwide Share (%) Notebook PC 13,847 18,380 61 Desktop PC 6,974 24,959 23 Motherboard 5,635 86,554 75 CDT monitor 4,544 42,910 51 LCD monitor 5,646 18,254 61 CD/DVD/RW drive 3,146 79,409 45 Digital camera 1,003 8,753 39

Source: MIC/ITIS, March 2003

Table 2. Demographics of sampled companies in 2002.

Item Scope

Capital 0.12 to 5.69 billion USD Assets 1.95 to 10.57 billion USD Sales 0.38 to 7 billion USD Employees 309 to 14,938 Categories Computer systems 14 Computer peripherals 9 Communication and networks 5 Optoelectronics 7 Semiconductors* 12 Subassemblies and components 9

Exchange rate NTD:USD¼ 1:35

decision, the details of the operational pattern, and the challenges of managing R&D in mainland China. Due to the tight schedule of senior man-agement in the IT industry, a semi-structured interview guideline was developed and sent to interviewees in advance in order to improve the efficiency of the interview. Sections 4 and 5 present the findings.

US patent data is used to analyze the contribu-tion of the host R&D units to the home company. The USA is a major market for Taiwanese IT companies. Filing important inventions for a US patent is a common practice. This is the reason why US patents are chosen for analysis. The importance of a US patent is confirmed through interviews and also supported by prior literature (Almeida, 1996). Many Taiwanese IT companies award employees with higher incentives on US patents than on Taiwanese patents.

The database of the US Patent Office (www.uspto.gov) was thoroughly searched. As-signee name (AN) and inventor country (ICN) are used to search all patents granted for each com-pany. The authors used CN (China) for ICN to count the number of patents invented by R&D units in mainland China (A), and to identify the earliest filed date (T day) of these patents. The T day is then used to count the number of patents filed and granted to that company (B) since then. Number A is divided by number B to calculate the percentage of US patents that is contributed by

the host R&D units in mainland China. This percentage is used as a proxy for technological capability of the host R&D unit.

4. Motives and location decision

4.1. Motives for establishing R&D in

China

The motives for establishing R&D abroad men-tioned in the literature can be revisited, consider-ing the relative competitive advantage and complementary factors. In the competitive busi-ness environment, companies are always seeking to gain advantages over industry competitors. Gaining relative competitive advantages in tech-nology is the basic objective of extending R&D abroad. When the host owns the complementary factors that a company needs which the home does not have, the company establishes R&D units in the host country to acquire these plementary factors and to gain the relative com-petitive advantages. These complementary factors can be categorized into technology-related and non-technology related factors. Technology-re-lated factors include local technology excellence and local skilled talents. Non-technology related factors include local ‘touch’ to the market, im-mediate local support, and local effective human capital.

The local technology excellence factor offers technological strength such as leading local scien-tific and technical community in the particular industry sectors. The supply-side factor, technol-ogy-driven (von Zedtwitz and Gassmann, 2002), HBA (home-base-augmenting; Kuemmerle, 1997, 1999), Type 1, and Type 3 (Patel and Vega, 1999; Le Bas and Sierra, 2002) strategies are closely related concepts of companies seeking a comple-mentary factor in local technology excellence. The local skilled talent factor offers well-experienced and well-educated local human capital. Compa-nies seeking a complementary factor in local skilled talents are expressed in Florida (1997) as having ‘secure access to scientific and technical human capital’.

The local ‘touch’ to the market factor provides a cultural instinct and local market experience that allows companies to adapt products, pro-cesses, and services to meet local market require-ments. The immediate local support factor provides a speed advantage as a result of proxi-mity to local manufacturing sites and customers that technical teams at a remote home site could

Table 3. Quantitative data of the 19 companies.

Company Product category Location** Number of employees 1 Systems 2 10 2 Systems 2 260 3 Peripherals 1 70 4 Peripherals 2 350 5 Systems 2 * 6 Systems 1 120 7 Systems 1 * 8 Semiconductors 1 80 9 Subassembly 1 30 10 Semiconductors 3 * 11 Subassemblies 1 30 12 Semiconductors 1 450 13 Systems 1 * 14 Subassemblies 1 * 15 Communication 3 110 16 Optoelectronics 2 100 17 Communication 1 * 18 Peripherals 1 * 19 Subassemblies 1 150

*: Companies are reluctant to disclose the data.

**: 1, Shanghai, Beijing, Shenzhen; 2, suburb of Shanghai and Shenzhen; 3, other cities.

not otherwise achieve. The demand-side factor, market-driven (von Zedtwitz and Gassmann, 2002), HBE (home-base-exploiting; Kuemmerle, 1997, 1999), Type 2, and Type 4 (Patel and Vega, 1999; Le Bas and Sierra, 2002) strategies are similar concepts of companies seeking a comple-mentary factor in the local ‘touch’ to the market and immediate local support. The local effective human capital factor provides resources and effectiveness that is associated with ample supply, low wages, and the convenience of communica-tion from local human capital.

Local technology excellence, local skilled ta-lents, local ‘touch’ to the market, and immediate local support are the dominant complementary factors for companies in the triad countries seek-ing to gain their relative competitive advantages. However, these factors are regarded as minor in the survey and not much mentioned in the in-depth interviews except for the immediate local support factor. The development of Taiwan’s IT industry is ahead of that in mainland China, although mainland China is gradually taking a more important role in this regard. The need for Taiwan’s IT industry to tap into mainland Chi-na’s technologies is not immediately observed, nor do Taiwanese IT companies need to rely on mainland China’s skilled and experienced talents in this sector. Most Taiwanese IT companies focus on the OEM (original equipment manufac-turing) and/or ODM (original development man-ufacturing) business with major global IT companies. Only a few Taiwanese IT companies promote their brand products in mainland China. To most Taiwanese IT companies, mainland China’s market offer big potential, but has not been the major market to them. Moreover, main-land China and Taiwan have linguistic proximity. Therefore, product and service localization is not a big issue to Taiwanese IT companies. Immedi-ate local support is the main factor that comes to the surface. Taiwanese IT companies have already established manufacturing bases in mainland China for years, and R&D units close by manu-facturing sites does help on local support even though manufacturing support is not R&D’s major function.

Ha˚kanson and Zander (1988) find that one of the factors for the increasing geographical decen-tralization of R&D is the difficulty in recruiting qualified technical expertise in Sweden’s tight labor market. From the survey of 56 major Taiwanese IT companies, this study also shows that local effective human capital provided by the host (mainland China) is the major

complemen-tary factor for their R&D extension. This com-plementary factor can be further divided into three points. The first is the availability of well-educated local engineers in mainland China. The second is the cost effectiveness of these engineers. The third is the convenience of communication, as Taiwan and mainland China are originated from the same culture and use a similar language. Mainland China offers Taiwan geographical and linguistic proximities.

Taiwan’s IT industry has achieved excellent performance over the past two decades. Well-trained and skilful engineers have played one of the key success factors of this remarkable achieve-ment. The success of Taiwan’s IT industry has helped existing companies prosper and stimulated these companies to grow bigger. Moreover, new companies are fuelled with venture capital funds and are continuously being established. This prosperity of the IT industry has broken the balance of human capital. The overall demand to technical-oriented human capital has increased tremendously, but the supply, nevertheless, has not grown with the demand. In contrast, main-land China has a huge and rapidly growing pool of young engineers. These young engineers are well-educated, although cannot yet be categorized as skillful or experienced in the IT industry. All interviewees express the same consideration – mainland China offers plenty of engineers that Taiwanese companies need, but lack, in order to continue their success in their businesses. The complementary factor in this case is the young and well-educated technical human capital.

Due to the tough competition in the global IT industry, most Taiwanese IT companies have already set up their manufacturing facilities in mainland China to gain advantages over the labor, material, and management costs. The suc-cess of gaining advantages in manufacturing efficiency evolves quite naturally into gaining advantages in R&D cost. Young engineers in mainland China receive lower wages compared to those in Taiwan, and this cost advantage increases the motivation of Taiwanese companies to establish R&D units in mainland China. How-ever, this cost advantage has been gradually vanishing recently.

Taiwan and mainland China are geographically close to each other. Even though separated poli-tically for more than 50 years since 1949, Taiwan and mainland China still use a similar language. These geographical and linguistic proximities further increase the incentive of Taiwanese IT companies to establish R&D units in mainland China.

In summary, the availability of well-educated local engineers, cost effectiveness of local engi-neers, and geographical and linguistic proximity have attracted Taiwanese IT companies to estab-lish R&D units in mainland China. Typical com-plementary factors needed by the triad – USA, Europe, and Japan – in internationalizing R&D, such as market or technology, are considered less by Taiwanese IT companies. Taiwanese compa-nies seeking a complementary factor in local effective human capital can be seen as adopting a ‘capital-augmentation’ strategy. This human-capital-augmentation strategy exploits capable yet cost effective local engineers with the addi-tional benefit of linguistic proximity. It is worth noting that the cost effectiveness of local engi-neers is labelled in Gassmann and von Zedtwitz (1998) as ‘lower R&D personnel costs’ under the efficiency-oriented category. Similarly, availabil-ity of well-educated local engineers can be put under the input-oriented category. Geographical and linguistic proximity are properly put under the political and socio-cultural category.

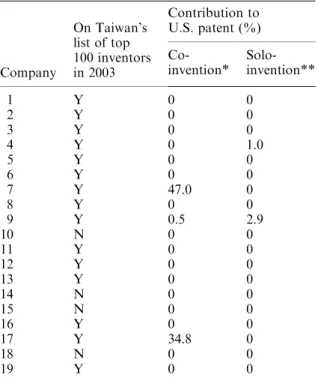

The result of the US patent analysis further suggests that the motive for setting up R&D units in mainland China is due to human-capital-aug-mentation instead of local technology excellence. Table 4 indicates that only four (out of 19) R&D units in mainland China have made a

contribu-tion to patents granted in the USA. Fifteen companies have no US patents invented by their R&D units in mainland China. The percentage of solo patents invented by R&D units in mainland China is rather small, showing only two compa-nies with their percentages at 1.0% and 2.9%, respectively. The other two companies show a significant contribution from their R&D units in mainland China, but all of these patents are co-invented by engineers from Taiwan and mainland China. This information provides additional evi-dence that the motive of setting up R&D units in mainland China is not for local technology excellence.

4.2. Location decision

Survey results indicate that R&D units estab-lished by Taiwanese IT companies are concen-trated in three areas – Shanghai, Shenzhen, and Beijing. Location decision factors are identified and classified in the in-depth interviews that follow the survey. The three major decision fac-tors are: access-to-engineers, proximity-to-manu-facturing-site, and competition-avoidance.

Access-to-engineers attracts companies to lo-cate where young engineers would like to stay. Metropolitan areas that offer a better lifestyle are good choices for young engineers and companies hunting for them. In addition, metropolitan areas offer relatively complete technology infrastruc-ture such as universities, research centres, and industrial vendors. Potential knowledge spillover from vendors and competitors is another asso-ciated benefit. Shanghai, Shenzhen, and Beijing are the locations that provide these advantages. The survey data discloses that 12 out of 19 companies locate their R&D units in this category (see Table 3).

Proximity-to-manufacturing-site is a typical location decision factor elaborated upon in the R&D internationalization literature. Companies seeking a complementary factor for immediate local support select locations close to their man-ufacturing sites. When R&D units are situated in such a location, manufacturing sites get immedi-ate technical support and the associimmedi-ated technol-ogy spillover from R&D units. In return, R&D units receive administrative support. Shanghai and Shenzhen suburban areas are major locations for companies seeking immediate local support. Five out of nineteen companies locate their R&D units based on this factor.

Table 4. Patent analysis of the 19 companies.

Company On Taiwan’s list of top 100 inventors in 2003 Contribution to U.S. patent (%) Co-invention* Solo-invention** 1 Y 0 0 2 Y 0 0 3 Y 0 0 4 Y 0 1.0 5 Y 0 0 6 Y 0 0 7 Y 47.0 0 8 Y 0 0 9 Y 0.5 2.9 10 N 0 0 11 Y 0 0 12 Y 0 0 13 Y 0 0 14 N 0 0 15 N 0 0 16 Y 0 0 17 Y 34.8 0 18 N 0 0 19 Y 0 0

*: co-invented by R&D unit in Taiwan and in mainland China **: solo invented by R&D unit in mainland China

Competition-avoidance is a strategy that sec-ond-tier companies commonly adopt. Companies around the world, not to mention major Taiwa-nese IT companies, compete for limited technical talents in mainland China’s metropolitan areas. A CEO of a communications company said that ‘We are not a first-tier company, and encountered difficulty in recruiting top-notch engineers in Taiwan. When we extended R&D to mainland China, we decided to locate far away from me-tropolitan areas’. Second-tier companies seek talents in non-metropolitan areas where good universities are located, because this strategy allows them to secure talent without head-to-head competition from global conglomerates. Xian and Chengdu are the locations selected under this consideration. Two out of nineteen companies locate their R&D units due to this reason.

5. Operational patterns

Operational patterns discussed in the R&D inter-nationalization literature are mostly concluded from data of the triad. The particular environ-mental context between mainland China and Taiwan demonstrates different patterns. One dif-ference in activities is D&D rather than R&D. According to Medcof (1997), research is defined as ‘the process of discovering new scientific knowledge which has the potential to act as a platform for the subsequent development of com-mercially viable products and manufacturing pro-cesses’. Development is defined as ‘the process of creating new products and processes that do have commercial value, through the application of currently available platforms or scientific knowl-edge’. The triad countries do both research and development, while Taiwanese IT companies, on the other hand, do very little research.

New product design and process development in the nature of generating commercial value constitute the Taiwanese IT companies’ major activities. This finding is consistent with the con-clusion of Forbes and Wield (2000). The role of R&D in newly-industrialized countries is not research and development, but design and devel-opment. Hence, the categorization of operational patterns based on D&D rather than R&D activ-ities is more appropriate for this study. Three patterns of managing D&D activities between home units in Taiwan and host units in mainland China are identified.

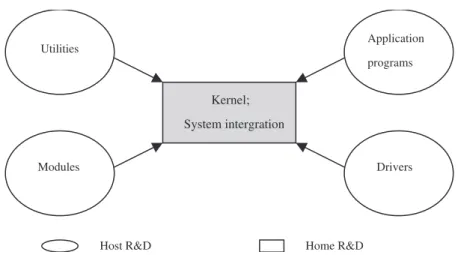

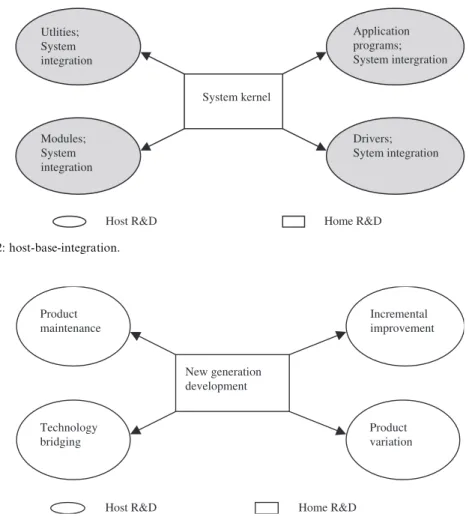

5.1. Pattern 1: home-base-integration

The first operational pattern is labelled as ‘kernel protection, home-base-integration’. Home R&D units define the product specifications, design the system structures, and integrate system compo-nents to the final products. To protect the intel-lectual property rights (IPR), the development of the system kernel is implemented at the home R&D units, while host R&D units are responsible for the implementation of sub-modules. Home R&D units also provide the encrypted system kernel to the host R&D units for preliminary testing. After testing, host R&D units send back the sub-module designs to the home R&D units for final system integration. These sub-modules vary among human interface modules, panel dis-play modules, keypad input modules, hardware diagnostic modules, utility programs, drivers, etc. The kernel is the core technological competency of a company. Examples of a kernel are the core of a micro-controller, firmware of a device, color management algorithm of a digital camera, motherboard of a personal computer, etc.

Avoiding the knowledge spillover to competi-tors is the major consideration of those compa-nies that adopt this operational pattern. Pioneering R&D units usually hire the most capable engineers and spend resources to train these engineers. Once engineers learn the secret of the kernel and become skillful, competitors often offer abnormal salaries to recruit them from these pioneering R&D units. One of the informants said, ‘We spend lots of effort to train engineers from scratch. Unfortunately, competitors recruit our engineers by offering double the pay once they become capable. We do not want to be a training centre for other companies’. When the trust in the host R&D unit has not been built, the home R&D unit usually takes a conservative approach on technology transfer. Keeping the system kernel in encrypted form is the best way to protect a company’s IPR. A kernel protection strategy is applied especially to the situation where the technology barrier is not high or the kernel can be easily imitated.

5.2. Pattern 2: host-base-integration

The second type of operational pattern is ‘kernel protection, host-base-integration’. This is similar to pattern 1, but the system integration is done at the host R&D units. Caused by the shortage of human resources in the home base, the home

R&D units concentrate mainly on the kernel development. The system integration along with other development tasks is distributed to the host R&D units. For some computer systems compa-nies, the home R&D units are responsible for hardware platform development, while the host R&D units port the software to the hardware platform and integrate the system. For several peripheral device companies, the home R&D units develop the hardware and firmware of the device, and then the host R&D units are responsible for driver development and system integration.

The rationale behind this kind of arrangement is twofold. First, the hardware platform is the major intellectual property and core competence of these companies. Second, software is licensed from third parties and is not the unique technol-ogy of these companies. Host-base-integration requires a more complete host organization func-tion and is more demanding on the engineers’ technical capabilities. Some companies start their R&D operation in the pattern of home-base-integration, but then evolve to a host-base-inte-gration after engineers are trained and the orga-nizations become stable. Host-base-integration relieves the load of the home R&D units on trivial but resource hungry tasks such as preparing various language versions. Home R&D units can therefore focus on improving the kernel technology. One senior R&D manager men-tioned, ‘At the beginning, we tried to develop a driver program simultaneously in mainland China and in Taiwan. When the technological capability in mainland China was good enough, we completely released the development of drivers to mainland China. Now, R&D in Taiwan con-centrates on the kernel technology. All tasks of

driver porting are transferred to R&D in mainland China, because we can hire enough engineers there’.

5.3. Pattern 3: product life cycle

The third type is ‘product life cycle’, which is similar to Ronstadt’s (1977, 1978) findings. Home R&D units are responsible for the development of advanced technologies. The old generations of a product are transferred to the host R&D units for incremental improvement or variation develop-ment. Due to the rapid change of IT products, a product’s lifespan can be as short as six months. To provide various products for different market segments in the global market, much R&D re-sources are needed. Young and well-educated human capital in mainland China can comple-ment the resource shortage in Taiwan. This allows experienced engineers in Taiwan to concentrate on the development of new generation of pro-ducts in order to maintain the competitive ad-vantages. Product maintenance requires engi-neering resources, and once customer feedback presents bugs, engineers need to debug and per-form a thorough test. For the old generation of products, incremental improvement is still needed to keep the market share, and these tasks of a maintenance nature can be allocated to the host R&D units. Take one scanner manufacturer as an example, when a new scanner product adopted a USB (universal serial bus) interface and its reso-lution increases to 4800 dpi (dots per inch), the home R&D unit then dedicated its effort to this advanced model, while the old generation of using a parallel interface and having 1200 dpi resolution was transferred to the host R&D unit for learn-ing, trainlearn-ing, and maintenance.

Kernel; System intergration Application programs Modules Utilities Drivers

Host R&D Home R&D

6. Discussion and conclusion

Comparing to well-developed countries, Taiwa-nese R&D activities are less globalized. In-depth interviews reveal the fact that mainland China and the USA are the two major countries with Taiwanese overseas R&D units. US technology leads Taiwan in general, and Taiwanese overseas R&D activities in the USA are consistent with the technology seeking strategy defined by Le Bas and Sierra (2002). However, the main motive of extending R&D activities in mainland China is to access the local human capital there. This is defined as the ‘human-capital-augmentation’ strategy. Abundant and cost-effective local engi-neers with benefits of linguistic and geographical proximities are the major considerations for Tai-wan’s IT companies to set up R&D units in mainland China. Niosi and Godin (1999) point out similar cultural and geographical proximities phenomena in a study on Canadian overseas R&D.

6.1 Managerial implications

Several managerial implications for different groups can be highlighted. For Taiwanese IT companies, this study provides manageable op-erational patterns for those companies who are considering extending their D&D to mainland China. Companies seeking growth can select a pattern suitable for them and accelerate their expansion accordingly. Taiwanese IT companies have good market knowledge and strong imple-mentation technology, as well as established con-nections with global conglomerates. Limited by a small home market, Taiwan is now only playing the role of a standard follower rather than a standard creator. Further cooperation with main-land China allows it access to the abundant hu-man capital there, and coupled with the market knowledge and manageable D&D operations, the future could be very promising.

For mainland China, FDI in R&D from Tai-wan is important for the commercialization of

System kernel Application programs; System intergration Modules; System integration Utlities; System integration Drivers; Sytem integration

Host R&D Home R&D

Figure 2. Pattern 2: host-base-integration.

New generation development Incremental improvement Technology bridging Product maintenance Product variation

Host R&D Home R&D

technology development. Young and well-edu-cated engineers can be trained with not only the technology, but also the entrepreneurial spirit embedded in the Taiwanese companies. This will help mainland China in gradually transferring from a ‘world production factory’ to a ‘regional innovation centre’. Policies to encourage FDI in the nature of innovation creation are necessary for the long-term growth of the mainland Chinese economy. IPR protection is one of the major concerns for foreign companies to extend their R&D activities in mainland China. The PRC government should take actions to establish po-licies and laws to gain trust from foreign compa-nies. Once the trust is built, more advanced R&D tasks could be allocated to mainland Chinese R&D units, and the national technological level will significantly improve.

For developed countries, a kernel protection pattern can be a good reference in protecting IPR. Being superior in technology, home-base-exploit-ing, and market-oriented motives are the major drivers to extend R&D activities in mainland China. The huge potential market and the abun-dance of engineering resources in mainland China are very attractive. Their motives and location decision might be different from that of Taiwa-nese IT companies, but the kernel protection pattern mentioned in this paper can be a good reference for developed countries to protect their valuable IPR.

For developing countries, internationalization is the trend of national development. The coop-eration between Taiwan and mainland China in the IT industry has mitigated the impact of the Asian crisis to Taiwan in the late-1990s, and also significantly contributed to the remarkable growth of mainland China’s IT industry. Taiwan and mainland China are tied closely in geography, history, and culture. Several advantages that Taiwanese companies have in mainland China may not apply to other countries. However, the operational pattern of D&D in mainland China can be a good reference for other NIEs who plan to establish R&D units in mainland China. Furthermore, the competition avoidance consid-eration can be one of the better choices for SMEs.

6.2 Suggestions for future research

The result of this study suggests general directions for companies from developing countries seeking to establish their R&D activities in mainland China. Some further studies can be conducted.

First, this study is an exploratory investigation of R&D activities of 19 Taiwanese IT companies and reports the status of R&D units of these companies. A future study can be extended to involve more companies (both IT and non-IT) to explore Taiwanese companies’ R&D activities in mainland China on a wider scope. Second, this study examined the status of R&D units in main-land China. Although this topic is the major focus of the present issue, further investigation of Taiwanese IT companies’ R&D activities in other countries can help draw a more complete picture of Taiwanese R&D internationalization. Third, organizational tension between home and host can be generated for all three operational pat-terns. Both ‘home-base-integration’ and ‘host-base-integration’ have kernel protection as the major organization concern. Kernels are released in en-crypted form. In ‘product-life-cycle’ pattern, the home releases only old technologies to the host. Limited technology transfer restricts the capability of the host and eventually limits the contribution of the host to the organization. How companies main-tain a balance between protecting core technology and maximizing the contribution of the host R&D units is an interesting subject for further study.

In summary, this study enriches the understand-ing of R&D internationalization and makes a contribution to the area of operational patterns in internationalized D&D. The availability of capable local engineers, cost effectiveness of local engineers, as well as linguistic and geographical proximities have attracted Taiwanese IT companies to establish R&D units in mainland China. Access to engineers, proximity to manufacturing site, and competition avoidance are the major location decision factors. Three operational patterns – ‘home-base-integra-tion’, ‘host-base-integration’ and ‘product life cycle’ – typify the R&D activities of Taiwanese IT com-panies in mainland China.

Acknowledgement

The authors would like to thank the editors and four anonymous referees for their insightful com-ments on earlier drafts of this paper. Both authors contribute equally to this paper.

References

Almeida, P. (1996) Knowledge sourcing by foreign multinationals: patent citation analysis in the US semiconductor industry. Strategic Management Jour-nal, 17, 155–165.

Asakawa, K. (2001) Organizational tension in interna-tional R&D management: the case of Japanese firms. Research Policy, 30, 735–757.

Beckmann, C. and Fischer, J. (1994) Einflufaktoren auf die Internationalisierung von Forschung und En-twicklung in der Chemischen und Pharmazeutischen Industrie. Zeitschrift fu¨r Betriebswirtschaftliche For-schung, 46, 7/8, 630–657.

Cantwell, J. and Janne, O. (1999) Technological glo-balisation and innovative centres: the role of cor-porate technological leadership and locational hier-archy. Research Policy, 28, 119–144.

Cheng, J.L.C. and Bolon, D.S. (1993) The management of multinational R&D: a neglected topic in interna-tional business research. Journal of Internainterna-tional Business Studies, 24, 1, 1–18.

Chung, W. and Alcacer, J. (2002) Knowledge seeking and location choice of foreign direct investment in the United States. Management Science, 48, 12, 1534–1554.

Dalton, D.H. and Serapio, M.G. (1999) Globalizing Industrial Research and Development. US Depart-ment of Commerce, Technology Administration, Office of Technology Policy.

Dunning, J. (1994) Multinational enterprises and the globalization of innovatory capacity. Research Pol-icy, 23, 67–88.

Dunning, J. and Narula, R. (eds) (1996) The investment development path revisited. some emerging issues. Foreign direct investment and governments. Cataly-sis For Economic Restructuring. London: Routledge. Florida, R. (1997) The globalization of R&D: results of a survey of foreign-affiliated R&D laboratories in the USA. Research Policy, 26, 85–103.

Forbes, N. and Wield, D. (2000) Managing R&D in technology-followers. Research Policy, 29, 1095– 1109.

Frost, T.S. (2001) The geographic sources of foreign subsidiaries’ innovations. Strategic Management Journal, 22, 101–123.

Gassman, O. and von Zedwitz, M. (1998) Organization of industrial R&D on a global scale. R&D Manage-ment, 28, 3, 147–161.

Gassmann, O. and von Zedtwitz, M. (1999) New concepts and trends in international R&D organiza-tion. Research Policy, 28, 231–250.

Gerybadze, A. and Reger, G. (1999) Globalization of R&D: recent changes in the management of innova-tion in transnainnova-tional corporainnova-tions. Research Policy, 28, 251–274.

Granstrand, O., Hakanson, L. and Sjolander, S. (1992) Technology Management and International Business: Internationalization of R&D and Technology. New York: John Wiley.

Ha˚kanson, L. and Zander, U. (1988) International management of R&D: the Swedish experience. R&D Management, 18, 3, 217–226.

Herbert, E. (1989) Japanese R&D in the United States. Research Technology Management, November– December, 11–20.

Kuemmerle, W. (1997) Building effective R&D cap-abilities abroad. Harvard Business Review, March– April, 61–70.

Kuemmerle, W. (1999) Foreign direct investment in industrial research in the pharmaceutical and elec-tronics industries – results from a survey of multi-national firms. Research policy, 28, 179–193. Kumar, N. (2001) Determinants of location of overseas

R&D activity of multinational enterprises: the case of US and Japanese corporations. Research Policy, 30, 159–174.

Le Bas, C. and Sierra, C. (2002) ‘Location versus home country advantages’ in R&D activities: some further results on multinationals’ locational strategies. Re-search Policy, 31, 589–609.

Medcof, J.W. (1997) A taxonomy of internationally dis-persed technology units and its application to man-agement issues. R&D Manman-agement, 27, 4, 301–318. MIC/ITIS. (2003) 2002 Marketing Research of the

Taiwanese IT Industry. Taipei: Market Intelligence Center/Institute for Information Industry.

Mutinelli, M. and Piscitello, L. (1998) The entry mode choice of MNEs: an evolutionary approach. Re-search Policy, 27, 491–506.

Niosi, J. (1999) The internationalization of industrial R&D. From technology transfer to the learning organization. Research Policy, 28, 107–117.

Niosi, J. and Godin, B. (1999) Canadian R&D abroad management practices. Research Policy, 28, 215–230. Patel, P. and Vega, M. (1999) Patterns of internationa-lisation of corporate technology: location vs. home country advantages. Research Policy, 28, 145–155. Pearce, R.D. (1989) The Internationalization of

Re-search and Development by Multinational Enterprises. London: Macmillan.

Pearce, R.D. (1999) Decentralised R&D and strategic competitiveness: globalised approaches to generation and use of technology in multinational enterprises (MNEs). Research Policy, 28, 157–178.

Pearson, A., Brockhoff, K. and von Boehmer, A. (1993) Decision parameters in global R&D manage-ment. R&D Management, 23, (3), 249–262.

Porter, M.E. (1990) The Competitive Advantage of Nations. Free Press, New York.

Ronstadt, R.C. (1977) Research and Development Abroad by US Multinationals. New York: Praeger. Ronstadt, R.C. (1978) International R&D: the

estab-lishment and evolution of research and development abroad by seven US multinationals. Journal of Inter-national Business Studies, 9, 7–24.

Serapio, M.G. and Dalton, D.H. (1999) Globalization of industrial R&D: an examination of foreign direct investments in R&D in the United States. Research Policy, 28, 303–316.

Shan, W. and Song, J. (1997) Foreign direct investment and the sourcing of technological advantage: evidence

from the biotechnology industry. Journal of Interna-tional Business Studies, 28, 2, 267–284.

Teece, D. (1986) Profiting from technological innova-tion: implications for integration, collaboration, licen-sing, and public policy. Research Policy, 15, 285–305. von Zedtwitz, M. and Gassmann, O. (2002) Market versus technology drive in R&D internationalization:

four different patterns of managing research and development. Research Policy, 31, 569–588.

Zander, I. (1999) How do you mean ‘global’? An empirical investigation of innovation networks in the multinational corporation. Research Policy, 28, 195–213.