國

立

交

通

大

學

高階主管管理碩士學程

碩

士

論

文

晶圓代工研究與未來發展分析

IC Foundry Business Research and Future

研 究 生: 張惠林

指導教授: 王文杰教授

陳安斌教授

晶圓代工研究與未來發展分析

IC Foundry Business Research and Future

研 究 生:張惠林 Student:Hui -Lin Chang

指導教授:王文杰 Advisor:Wen-Chieh Wang

陳安斌 An-Ping Chen

國 立 交 通 大 學

高階主管管理

碩 士 論 文

A ThesisSubmitted to Master Program of Management for Executives College of Management

National Chiao Tung University in partial Fulfillment of the Requirements

for the Degree of Executive Master

of

Business Administration

June 2010

Hsinchu, Taiwan, Republic of China

晶圓代工研究與未來發展分析

學生:張惠林

指導教授

:王文杰博士

國立交通大學 高階主管管理學程碩士班

摘

要

我國半導體產業結構與其他國家之最大不同點為我國之專業分工體系,在該 專業分工模式下,我國之半導體產業在全球擁有強勁之競爭力。台灣的晶圓代工 在半導體的產業鏈中,上下游廠商間的垂直分工是半導體產業結構之一大特色, 也是建構台灣高科技產業的技術進步與專業化能力提升之成功關鍵因素。 但是面對全球化晶圓代工,現今晶圓代工廠將採取如何之因應之道,將為本 篇論文之探討。所以將從晶圓代工廠之崛起,發展,成功模式,目前所遇到的挑 戰,與未來可能的走向,來說明之。面對大陸強而有力的山寨文化,成功模式的 複製與發揚光大,是否有機會超越現今的晶圓代工廠,是否可能轉型,來加以探 討。 目前成功之晶圓代工廠,其獨特之成功之道,來自於兩個層面:創新的經營 模式與領先的製程技術。 在創新的經營模式方面:客戶服務導向與技術領先。 在客戶服務導向方面,採取獨特的服務模式,與客戶建立夥伴的關係,如‖你泥 中有我,我泥中有你‖,這樣的經營模式,搭配 IT 技術,不進入 IC 設計,以建 立合作之夥伴的關係模式。在領先的製程技術方面:引用海外歸國學人所帶來的 技術,良率的提升,研發部門精英團隊對製程技術的投入,以及製程探索部門對 未來製程的掌握度,是先進製程技術保持領先的關鍵原因之一。因此有了創新的 經營模式,客戶的信任在加上領先製程,可確定客戶並不會流失,且願意下單。 目前,Global Foundry, 韓系公司, 大陸廠的市占率並不高,有別於目前的現 今晶圓代代工廠有成熟的 12 吋晶圓廠技術,大陸仍是以 8 吋晶圓廠為主。而大 陸晶圓代工,仍是以海外訂單為主,所以將造成與現今晶圓代工互相競爭的狀態。 同樣的,晶圓代工與晶圓設計的緊密關係,製程技術的成熟度,是否具備高良率 生產的條件,是決定自身的競爭力條件。 面對 Global Foundry, 韓系公司, 大陸廠代工之衝擊,可採取保守與突破的兩 個方式。例如增加新事業,轉型,抑或將現今經營模式做進一步的創新。對於大 陸晶圓製程仍落後現今晶圓代工廠的技術,如何不消弭這層技術上的差距,仍保 持領先的姿態 ,牽涉到對於自身技術的保護。半導體產業, 40 年的發展,已 屬於夕陽產業,新事業的發展,將對於已發展純熟的半導體產業,注入一盞強心

劑。

本篇論文將研究晶圓代工之成功之道,對目前晶圓代工廠所造成的衝擊,做 分析與探討。分析的角度分為是否對於晶圓代工的市占率,排名與布局有所改變。 而探討的部分則包括因應之道及採取的策略。總結為晶圓代工廠之何去何從加以 研究。

IC Foundry Business Research and Future

Student:Hui-Lin Chang Advisors:Dr. Wen-Chieh Wang

Master Program of Management for Executives

National Chiao Tung University

ABSTRACT

Taiwan semiconductor foundries led the way in the worldwide semiconductor history by their business models. The top two companies, the Taiwan semiconductor manufacturing company and United microelectronics have driven the vigorous development of scientific parks and owns 80% of the global foundry business.

Many new companies; however, are growing worldwide. The relaxation of the cross-strait policy is threat to shift in the current wafer manufacturing industry. Many factors including the relationship between the wafer foundry and IC design, supply chain, and customer partnerships can determine the success of failure of a wafer manufacture. The technology process breakthrough and goods delivery times also determine customers order volume.

Currently, successful foundries are descried on two levels; innovative business orientation and process technology leadership. TSMC uses a unique service model to establish a partnership relationship with customers, such as ―you have my back and I have yours.‖The foundry business creates a cooperation partnership model by manufacturing the customers‘ designer request and staying away from independent IC design.

Several factors are necessary to maintain the leading process technology in IC areas, including technology competiveness, superior product yield, an elite R & D team, a process exploration sector for the future process, and advanced process technology. Building up customer trust and a innovative business model are the keys to winning customer orders.

Today‘s foundry market is still dominated by Taiwan, the worldwide foundry companies such as Global Foundries, Korean companies, and mainland companies

share the remainder of the market share. The mainland companies still produce 8-inch wafers and their order book is dominated by overseas orders. The core competiveness of foundry business is closely related with designs, the process maturity of the technology and the availability of high-yield production.

Facing global competition, Taiwanese companies can adopt the non-conservative approach by forming an alliance with integrated device manufacturers. Taiwanese companies hold the technology leadership, and know that keeping the technology leadership important. The semiconductor industry has been developing for over 40 years like a sunset industry; a new business model development would revitalize the future semiconductor industry.

This thesis examines the successful pure-play foundries in terms of their business models. The linkage between foundry and upstream/downstream industries is reviewed. We purpose that the non-pure play foundry is a more successful model based on the close relationship between the foundry and IC design; the possibilities of transformation of pure-play foundries to meet future market changes are discussed.

Acknowledgement

I would like to express my sincerest application for my supervisor, Dr. Wen Chieh

Wang who has watched me grow into a business researcher and guided me through the

course of my EMBA work.

I would also like to thank Dr. A. P. Chen, Dr. R. D. Lin and Dr. K. Y. Jeng for being of my thesis committee.

I would like to thank my Undergraduate and PHD supervisors, Dr. K. M. Lin and Dr. C. T. Kuo, for giving me the chance to enter the EMBA program. My professors take care of me since I was their students. Even I have graduated from schools for many years; they still support me when I am in need.

There are an amazing number of people during my EMBA study; I have learned so much from you, Mr. S.W. Luo, Mr. S. L Pang, Mr. L.W. Chan, Mr. Y. C. Chao, Mr. W. Y. Hiseh, Mr. T. C. Wu, Mr. D. L Lin, Miss Karen Tsai and my colleague, Mr. K.S. Lee. I would like to thank Dr. D. K. Sohn, Dr. J.S. Yoon and Dr. E. S. Jung for giving me the chance; I wrote the article in the beautiful place.

I would like to appreciate my principle Dr. M. S. Liang who has touched my life during these years. I‘ve been fortunate to meet and experienced a great time in my life with you. I have learned so much from you.

I own great debt to my family, the wonderful support from my father, Dr. C. T. Chang for showing me the world of innovation, my mother F. Y. Huang, my sisters Dr. Y. Chang, my younger brother Dr. C. Chang for their love.

This thesis is to my lovely Family!

Tables of Contents

Chinese Abstract ... i

English Abstract ... iii

Acknowledgement ... v

Chapter 1 Introduction ... 1

1.1 Background Information and Motivation ... 1

1.2 Research Objective ... 1

Based on the motivation discussed above, this study empirical investigation and analysis to achieve the following purposes: ... 1

First, the complication of the semiconductor industry background, foundry company study, analysis of Taiwan‘s integrated circuit market, marketing, technical development, market opportunities and the current business model. ... 1

Second, organizing the relevant literature, designing a business model, analysis of a foreign semiconductor company, technical development, analysis of market opportunities, and target market selection... 2

1.3 Research Flows ... 2

To achieve the above mentioned research, the study will be divided into several parts to carry out the following steps and processes: ... 2

Step 1: Research themes ... 2

Establishing research questions, research objectives, research scope and limitation 2 Step 2: Literature reviews ... 2

Search and read the relevant literature, information collection, compiling information on wafer foundries in Taiwan and overseas companies market share and operation models. ... 2

Step 3: IC foundry business model ... 2

IC foundry business model mechanism study ... 2

Design business models for wafer foundries based on cutting-edge technology. ... 2

Step 5: Conclusions and recommendations ... 2

Discuss the results and formulate recommendation for future studies. ... 2

Table 1.1 Research steps and architecture ... 2

1.4 Study Area ... 2

First, study semiconductor plants in Taiwan and overseas to determine the main industry operating model. Second, study semiconductor plants in Taiwan and overseas market niches; understand the entrance barriers for new companies and the purpose of a modified business model to enhance worldwide competences. ... 2

Chapter 2 Literature survey ... 3

2.1 Market Development Strategy and Technology Innovation ... 4

Paul Miller presents two possible marketing strategies, including new scientific developments and high technology business. The first one creates a proprietary technology for niche strategy that includes preventing competitors from entering the new niche market the company has created. The second is a broad technology innovation strategy through a solution that meets consumer needs. ... 4

2.2 Global Trend in Semiconductor Industry Development ... 5

2.2.1 Vertical Specialization ... 5

2.2.2 Development of Taiwan's IC Industry ... 6

2.3 Advantages and Disadvantages of Foundries... 9

2.4 Factors Affecting Supply and Demand of the Foundry Industry ... 9

2.4.1. IT in the IC Market ... 10

Information technology has always been the most important semiconductor application. With the popularity of the Internet and other information communication media, the development of related IT products is the main focus of the IC market. PCs and other IT products have provided the greatest growth momentum for the foundry industry in recent years, and most such items use foundries. ... 10

According to MIC statistics, communication applications using semiconductor manufacturing accounts for about 24 % of the global market, which is second only to IT applications. Communication products using semiconductor application include mobile phones, base stations, wireless transmission equipment, LAN, and broadband transmission and switching equipment. ... 10

The PC phone is the largest application consumer in the semiconductor market with the cumulative shipment of mobile PCs tripling in 2009. Mobile phones are a far different market from PCs considering PC peripheral equipment‘s volume of semiconductor consumption, including mobile phones and other functions. Although PC product marketing is shorter, it has a longer life cycle for operational maturity, since the process sectors include the parts suppliers, handset manufacturers, cognition, and the product inventory. PC phones can involve very complex factors including the progress of national/regional infrastructure and regional differences in customs and laws. The service providers or the service subsides can affect the demand for mobile phones. Before an acute hit on the expiration of the first wave of demand for fashion phones occurs, the industry has been waiting for so-called ―replacement wave‖ representation. The highly demand for phones stimulates the foundry phone business. Absent another economic depression, the IC foundry application in fashion or smart phones is crucial to increase profits. ... 10

2.5 Consumer Electronics in the IC Market... 11

The semiconductor industry development over the past years has worked hard to create strong demand for mobile phones and other consumer products in order to create another view of the semiconductor. The demand for IC foundries can be considered a consequence of the continuously growth of electronic devices, such TV games, consoles, digital cameras, PDAs, and boost the foundry business. ... 11

In considering customer demands and other factors affecting demand for foundries, we can categorize foundry customers into direct IC design companies (fables IC design house), integrated device manufactures develop IC products for others as their main business. However, most business have to sell their own brand, usually designed by the foundry on behalf of their customers‘ IC production, such as who are major foundry customers. This type of company

must rely on foundries for production. A few companies, such as Cirrus Logic, Altera, Xilinx, and other foundries can handle larger orders, but most of the IC design firms are small compared to single IDM vendors who handle a large number of small orders. In other words, IDM and similar manufactures have their own fabs, and very good process technology, dependent on the flexibility of the foundry‘s IC fables design, which is better than that of larger companies. Therefore, IC design companies can use foundries in order to provide a more

stable source of transaction and more bargaining chips. ... 11

IC Insights‘ new report show 2009 integrated circuit sales declining the most for cellular-phone base station (-30%) and automotive applications (-26%), while IC revenues grew the most in non-telephony handheld system (+6%), thanks to an estimated 129 % increase in chip sales for electronic book readers. IC sales for personal computers and cell phone handsets- the two largest chip applications in the systems market – declined 9% and 3 % IN 2009, respectively. ... 11

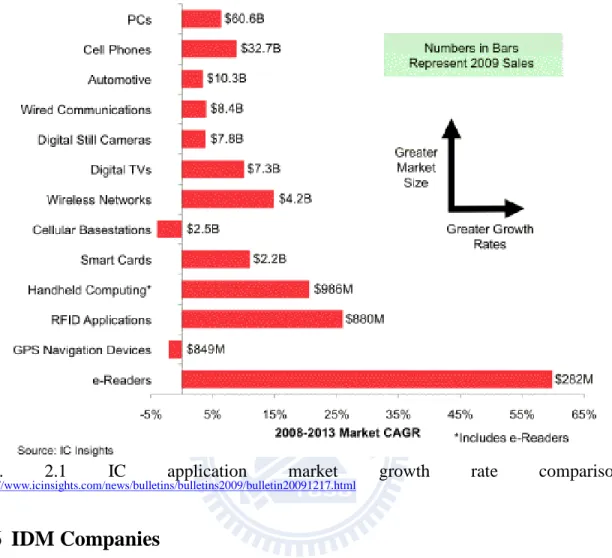

The 2010 IC market drivers report shows e-book readers to be one of the fastest growing product categories in the coming years, with IC sales for e-reader systems rising at a 60% in the 2008-2013 periods. Among other major chip applications, the 2008-2013 compound annual growth rate for IC sales are: 26 % for RFID systems, 21% for non-technology handheld computing devices and 6% for PCs. Figure 2 compares the five-year IC sales for 13 key end-user equipment segments as well as their 2009 market sizes. Figure 2.1 indicates the IC application market growth rate comparisons. ... 11

Fig. 2.1 IC application market growth rate comparison http://www.icinsights.com/news/bulletins/bulletins2009/bulletin20091217.html ... 12

2.6 IDM Companies ... 12

2.7 System Companies ... 13

2.8 IDM and Pure Foundry Growth Rate ... 13

2.9 Evolution of the Semiconductor Industry ... 15

Chapter 3 Research Theory ... 17

3.1 Document Analysis ... 17

3.3 Taiwan's Foundry Industry and the Current Situation ... 17

3.4 Development of Taiwan‘s Integrated Circuit ... 20

3.6 Semiconductor Fabrication ... 22

3.6.1 Electronic Device Technology ... 28

3.6.3 The Revolution in Electronic Devices ... 29

3.7 Semiconductor Industry ... 29

3.7.1 Integrated Device Manufacturer ... 29

3.7.2 IC Foundry ... 30

3.7.3 IDM Outsourcing ... 32

3.8 Taiwan Semiconductor Manufacturing Company ... 34

3.8.1 TSMC Pushes Foundry 2.0 ... 35

3.9 UMC Rank 2nd in the Foundry Industry ... 36

3.10 Intel Corporation ... 38

3.11 Samsung Electronics ... 39

Chapter 4 Research Methods ... 40

4.1 Why Pure-play Foundries Face Potential Issues ... 40

4.1.1 The Characteristics of the Pure play Foundry Business ... 42

4.2 External Competition ... 42

4.3 IC Industry Outlook ... 43

4.4 Professional OEM Advantages ... 44

4.5 The IC Foundry Procedure for a New Process Delivery ... 47

4.6 Foundry and Fabless Comparison ... 48

Chapter 5 Results and Discussion ... 51

5.1 IC Design Business Model ... 51

5.1.1 Technical Capacity ... 52

5.1.2 Supply Capacity ... 52

5.3 The Bottle-neck of IC Foundries ... 54

5.3.1 Moore‘s Law Extension... 54

5.3.2 Process of Increasing Complexity and Difficulty ... 55

5.3.3 Complex Logistics ... 56

5.4 Predicted Business Model of IC Foundry & IC Design in the Future ... 56

5.4.1IC Foundry and Joint Ventures ... 57

5.4.2 Vertical Integration of IDM Integrates Plant and Pure play Foundry ... 59

5.4.3 Virtual Vertical Integration Model ... 60

5.4.4 IC Foundry and IC Design Alliance ... 60

Chapter 6 Conclusion and Future Research ... 62

6.1 Conclusions ... 62

6.2 Future Research ... 63

List of Tables

Table 1.1 Research steps and architecture ... 2

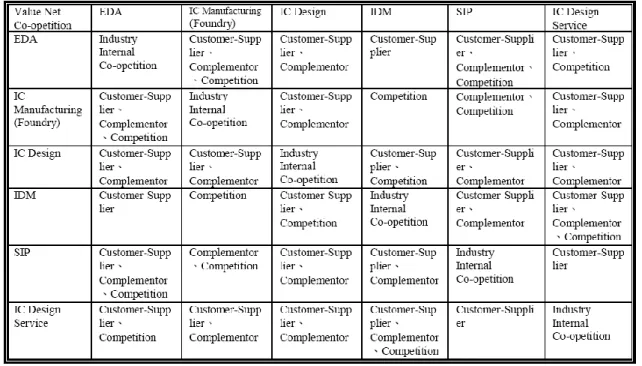

Table 2.1 indicates the Taiwan IC industry value net ... 8

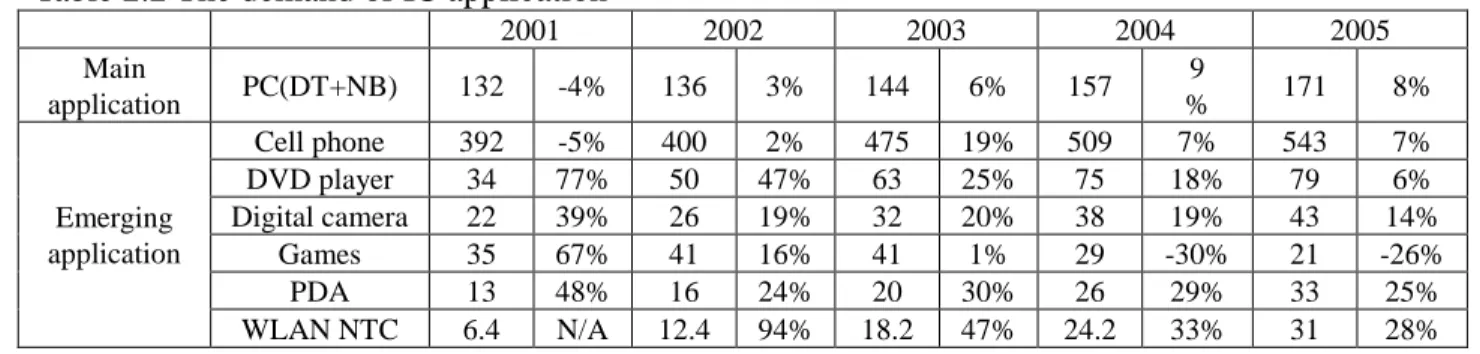

Table 2.2 The demand of IC application ... 10

Table 3.1 Year 2009 IC foundry ranks from IC insights ... 18

Table 3.2 Process flows and description for semiconductor fabrication ... 23

Table 3.3 Semiconductor industry from upstream to downstream ... 27

Table 3.4 Main reasons to support fabless business model ... 33

Table 3.5 The history of TSMC ... 35

Table 4.1 New process delivery for IC foundry ... 48

List of Figures

Fig. 2.1 IC application market growth rate comparison ... 12

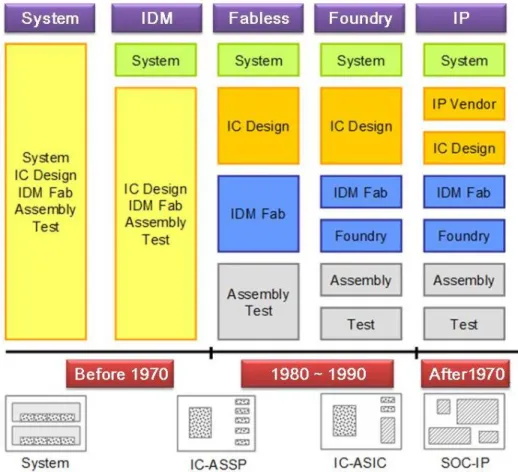

Fig. 2.2 IC industry evolution in the time period of 1970 to 1990 ... 13

Fig. 2.3 2003-2013 IC foundry & IDM sales forecast ... 14

Fig. 2.4 Taiwan semiconductor industry schematic diagram ... 16

Fig. 3.1 Taiwan foundry structure-Conduction-Performance ... 18

Fig. 3.2 Semiconductor upstream and downstream diagram ... 28

Fig. 4.1 Foundry relevance graph ... 43

Fig. 4.2 The global foundry market trends ... 47

Fig. 4.3 Process development against different technological uncertainty (pure-play foundries vs. fabless) ... 48

Fig. 4.4 The global fabless market trends, Unit: billion ... 49

Fig. 5.1 The IC design business model and its relation with downstream industry .... 52

Fig. 5.2 IC industry evolution since 1986 ... 53

Fig. 5.3 Moore‘s law diagram ... 55

Fig. 5.4 Virtual network structure ... 58

Fig. 5.5 Schematic diagram of vertical integration of IDM integrates plant and pure play foundry ... 59

Fig. 5.6 Vertically integrated market structure diagram ... 61

Chapter 1 Introduction

1.1 Background Information and Motivation

Taiwan‘s integrated circuit (IC) history has been developed for more than 40 years with strong government support and the efforts of both industry and academia. Taiwan‘s IC industry‘s maintains an important global presence and cannot be underestimated.

The rise of semiconductor foundries in Taiwan is undoubtedly a topic worth exploring. The growth of Taiwan‘s semiconductor foundries was not easy. Taiwan‘s IC industry had to overcome the problems with the semiconductor process nad the complexity of high technology in just 20 years. The question of how to maintain its current status and pursue long-term development is worthy of study.

Taiwan‘s IC industry is facing tremendous pressure from globalization and the recent entrance of late arriving countries. New companies are being established in mainland China, the USA and Korea.

The Taiwanese semiconductor industry exhibits the unique business model of vertical division. The vertical division of each sector involves upstream raw materials, IC design, mask design, downstream packaging and testing. Intermediate goods are defined to the professional division of production in each sector. Pure-play foundries focus on single production and do not have their own products. The profits depend upon manufacturing cost reduction and product yields. The entrance barriers of the foundry business include technology and manufacturing capability.

The foundry industry is technology and capital intensive with a high entry threshold, high fixed costs, specific assets, economies of scale and other characteristic. Therefore, the wafer foundry industry consists of a small number of firms operating in oligopolistic market structure. An oligopoly market features only few competing manufactures, so the interaction between firms has significant implications.

In this study, we first discuss the business model of a successful foundry company. Next, we examine the factors that can change the model in the future. Finally, we suggest possible future foundry business models.

1.2 Research Objective

Based on the motivation discussed above, this study empirical investigation and analysis to achieve the following purposes:

study, analysis of Taiwan‘s integrated circuit market, marketing, technical development, market opportunities and the current business model.

Second, organizing the relevant literature, designing a business model, analysis of a foreign semiconductor company, technical development, analysis of market opportunities, and target market selection.

1.3 Research Flows

To achieve the above mentioned research, the study will be divided into several parts to carry out the following steps and processes:

Step 1: Research themes

Establishing research questions, research objectives, research scope and limitation Step 2: Literature reviews

Search and read the relevant literature, information collection, compiling information on wafer foundries in Taiwan and overseas companies market share and operation models.

Step 3: IC foundry business model

IC foundry business model mechanism study Step 4: IC foundry business model forecast

Design business models for wafer foundries based on cutting-edge technology. Step 5: Conclusions and recommendations

Discuss the results and formulate recommendation for future studies.

Table 1.1 Research steps and architecture

Research steps and architecture

1 2 3 4 5 Research Themes Literature Review IC foundry business model IC foundry business model forecast Conclusions and Recommendation

1.4 Study Area

First, study semiconductor plants in Taiwan and overseas to determine the main industry operating model. Second, study semiconductor plants in Taiwan and overseas market niches; understand the entrance barriers for new companies and the purpose of a modified business model to enhance worldwide competences.

Chapter 2 Literature survey

In the Wealth of Nations, Adam Smith (1776) indicates that the country‘s wealth depends on its labor productivity. Labor productivity increases from the division of labor and professionalization from the perspective of industrial development and national wealth creation. The improvement in labor productivity occurs in the most profitable, fastest growing industries because these industries have access to the largest surplus through investment, which can naturally lead to further division of labor.

Stigler (1951) points out that the industry and ―vertical integration of the early formation of close‖ because after the development of the industry and the market scale, manufactures form specialized divisions of labor. Ming Chung Chang (2001) points out that the vertical division of labor in an industry according to the upstream and downstream processes is divided into several levels, each firm performs only one level of specialized work.

Hone Xiuwan (2002) observes that in the Taiwan semiconductor industry‘s vertical division of labor, the family home becomes the vertically integrated upstream vendors for the IC design companies, production of intermediate products and then downstream to IC manufactures and producing final goods.

Tirole‘s (1988) industrial organization theory of the downstream firms states that downstream of the IC design companies is the production of intermediate products, while downstream of IC manufactures is the production of the final goods. Tirole (1988) theory of industrial organization on downstream firms is defined as follows: the type of intermediate goods is converted into final goods after they are sold in downstream firms. Huang MingFeng (2003) observed high-tech industries in Hsin-Chu Science park, the vertical division of labor, and the main products of companies outsourcing the production process required raw materials and components of its unit costs and other expenditures to measure the proportion of manufactures of vertical disintegration. Because the outsourcing model enables companies to engage in small-scale competition in the market, while also lowering market entry barriers, it will attract new entrants into the market.

Kuang-Cheng (2000) indicates that vertically integrated firms exhibit four characteristics. First, they eliminate completion in the market caused by finished products, ―combined elements of inefficiency‖, ―double marginalization‖, ―adapting to different customers‖, ―price discrimination‖, and ―vertical integration‖. Second, the instruction is not complete for vendors with specific asset resulting in high transaction costs and incomplete contracts, although vertical integration can reduce transaction costs to correct production of externalities. Third, vertical integration enables the expansion of production systems, and increase production costs, forming barriers to entry for potential competitors. Forth, vertical integration is a means of increasing competitors‘ costs to create their own competitive advantage, resulting in the market foreclosure phenomenon.

Taiwan‘s semiconductor industry is different from those of Europe, the United States, Japan, and Korea in using the semiconductor vertical integration model; in that it adopts an efficient and professional model for the vertical division of labor Xu Jin Yu (2001) points out that the vertical division of labor and vertical integration system is the biggest difference. The former is an open system, accepting different foundry technologies, products, customer orders and focusing on R & D and manufacturing production processes, while the surrounding support of upstream and downstream industries and the supply chain is quite complete, while as far as technology is concerned involves two issues: first, technological security and the second, payment for the rights, patents, and intellectual property. The foundry, TSMC sued SMIC 1992-1993 because of a number of patent infringements and thefts of trade secrets. Tirole (1988) notes the individual industries‘ development in the economic fields relative to the entrance barriers and incubation time.

Greenhut and Ohta (1979) study the access of upstream and downstream by Cournot competition. Downstream firms face a negative slope of the demand function of both final products and intermediate foods, when negotiating with customers. In this assumption, vertical integration is beneficial for manufactures of intermediate goods, and final good price variation, compared to non-vertical integration.

Salinger‘s (1988) model is based on the continuous development of upstream and downstream profits. If the intermediate goods and final goods are homogeneous, the vertical integration degree increase, causing an increase of intermediate goods and final products.

Wu, Ren and Wu ICP (1999) propose the theory of vertical restraints in trading restriction in different downstream behaviors. Based on their theory, the industrialization behavior of vertical restraints is based on the resources of the largest profits difference between the socially optimal choices are crucial.

Vertical restraints and vertical integration have similar behavior in an industry where manufactures are expanding the market in their territory. The biggest differences are in the vertical limits upstream and downstream firms create through market forces to restrain each other‘s behavior, such as price and manufacturer restrictions. The price competition can be divided into two forms: vertical price restraints and vertical flight price limit.

2.1 Market Development Strategy and Technology Innovation

developments and high technology business. The first one creates a proprietary technology for niche strategy that includes preventing competitors from entering the new niche market the company has created. The second is a broad technology innovation strategy through a solution that meets consumer needs.

2.2 Global Trend in Semiconductor Industry Development

2.2.1 Vertical Specialization

In recent years, the semiconductor industry has experienced rapid transformation in the complexity of product functions including precision in the fabrication process and rising costs for production. Therefore, many international integrated Device Manufactures (IDMs) are increasingly outsourcing as the logical alternative. Based on the analysis by the industrial Economics and Knowledge Center (IEK) of the Industrial Technology Research Institute of Electronics (ITRI), packaging and testing companies subcontracted half of their production volume in 2009. The dramatic change has caused IDM to develop specialized ―Fabless‖ and ―IDM-light‖ production models.

After a long development period, Taiwan‘s semiconductor industry has distinguished itself from other industry clusters by integrating process from IC design to manufacturing, to packaging and testing companies. The global industry companies are located primarily in HsinChu and Great Taipei. Most IC fabrication is scattered through Taoyuan, HsinChu, TaiChung, and Tainan, while the first-tier packaging and testing companies are in the central and southern parts of Taiwan. An analysis of the potential business of the semiconductor industry with its complete industry chain and strong technology indicates that Taiwan has many powerful global clients and networks DRAM companies. Samsung has set up its procurement hub and sales center in Taiwan. Some companies joint venture with other companies, such as Hynix and ProMosm Elpidia, PSC, Qimonda and Nanya Technology and Inotera Technology and Winbond.

In the mid-stream semiconductor foundry industry, we can take TSMC, the leading global company, as our example, more than half of the top 20% global semiconductor companies which are TSMC clients, including Intel, the leading foreign business. Eight of the 10 leading global IC design companies order from TSMC, demonstrating TSMC‘s significantly presence in the global semiconductor industry. Even the other two potential foreign businesses in IC design, Xilinx and Sandisk, also order from IC manufactures in Taiwan. These facts show that the Taiwan semiconductor industry has a widespread range of clients from IC manufacture in Taiwan. These facts show that the Taiwan semiconductor industry has a widespread range of clients from IC manufactures in Taiwan.

To address the gaps of the supply chain, the recommended foreign businesses fall into several categories: facility manufactures, like Applied Materials, Tokyo Electron, ASMI, KLA-Tencor, Lam Research, Advantest, Nikon, Novellus System, and Cannon; IC

design companies, like Qualcomm, Broadcom, Nvidia, SanDisk, ATI, Xlins, Marvell. Altera, Conexant, Qligic, CSR, Silicon lab, SST and Solomon systems; IC manufactures, like intel, Samsung, TI, Toshiba, STM, Renesas, Hynix, NXP, Freescake, NEC, Micro, AMD, Infineon, Qimonda, Elpida and IC packaging and testing companies, like Amkor, Stats-ChipPAC, UTAC, Caresem, Shinko and ASAT.

The output value of Taiwan‘s semiconductor industry had reached the goal of NTD 1 trillion in 2005 and the output value is estimated to hit NTD 2 trillion by 2010. Taiwan is the second largest IC design center, behind only the United States. Taiwan‘s IC fabrication continues to grow rapidly with its outstanding performance in profitability and production capability. The silicon foundry service pioneer model, Taiwan Semiconductor Manufacture Company, provides fifty percent of the global market demand with the 65 nanometer (nm) process, and it advancing to the cutting-edge 45 nm and 28 nm process technology. Other than TSMC, United Microelectronics Corporation (UMC) is the second major foundry player in the market, and Powerchip Semiconductor Corp (PSC), ProMos technologies Corp, and Nanya technology Corp. are engaged in DRAM manufacturing production. In line with its very strong IC foundry industry, Taiwan has also risen into a leading position in the world‘s IC packaging and assembly arena. ASE (Advanced Semiconductor Engineering Inc.) group, the world‘s largest provider of semiconductor packaging and assembly services, develops and offers a wide portfolio of technology and solutions including BGA; and flip chip to wafer level packaging. Siliconware Precision Industries Co, (SPIL) holds the third position worldwide in semiconductor packaging and assembly business. The main clients include ATI, Qualcomm International, and Freecale. In IC design, Media Tek has performed impressively in China and is expected to replace Trident TO as a leading IC manufacturer in North America. Their clients include Samsung, LG and Phillips.

In conjunction with design and fabrication segments, upstream silicon-proven IPs, service and EDA tool technology are expanding into Taiwan‘s semiconductor supply chain. Global Unichip Corp. (GUC) which has a close investment partnership with TSMC. Fareday technology Corp., a member of the UMC group, SpringSoft Corp., and Integrated Service Technology Inc. are companies pursuing advanced technology development. In the masking and IC substrate business, Taiwan Mask Corp., Nanya Technology Corp and Phoenix Precision Technology Corp., are conducting business with outstanding performance.

2.2.2 Development of Taiwan's IC Industry

1. Infancy (1964~1974)

National Chiao Tung University established a semiconductor fabrication (hereafter. fab) curriculum in 1964 and identified as primary academic focus. Semiconductor

knowledge cultivation in schools is the key to the success of Taiwan‘s IC industry.

General instrument set up factories in KaoHsing in 1966 for transistor packaging, the first packaging industry in Taiwan, opening the door for foreign investors, such as Texas instruments, Philips, and other factories in Taiwan. The General instrument facility thus laid the foundries for IC packaging, testing, quality control for IC packaging and downstream IC business.

2. Technology introduction (1974~1979)

In 1974, the government begins the development of the domestic electronics industry and continued to gradually transition toward technology-intensive and multi-evaluation businesses. The research center (formerly ITRI electronics research institute) established the IC demonstration plant. RCA technology was introduced from US companies and mask technology was introduced from US IMR (International Materials Research) companies to establish a 7.0 micron CMOS technology, expanding the IC manufacturing capability.

In 1976, the Executive Mr. Li Gounding promotes the science and technology development progress in the HsinChu Science Park, which serves as the ―Silicon Valley‖ in Taiwan IC industry.

3. Technological self-reliance and expansion (1979 to now)

Following the ITRI, the electronics industry established the first demonstration plant for IC projects in 1975~1979, revealing the second phase of the development plan in 1979 – 1983 and the final VLSI development project in 1983-1988. Industrial technology applied the Taiwan semiconductor technology to the stage of VLSI in 1980. UMC derived from ITRI became the first IC manufacturer and began four-inch IC manufacturing. Successful IC production was achieved after five manufacturers officially crossed over into technology development. In 1987, TSMC derived from ITRI began manufacturing six inch IC products. TSMC collaborated with Taiwan Mask Corporation in making the IC products prototype. The Taiwan IC industry in the first 15 years was focus on IC packaging and testing. The following 15 years, 4-inch plants had begun operations and the domestic IC industry began to flourish. From 1993 to 1995, the rise of 8-inch plants stimulated huge investment in IC business. In 2000, investment began in 12-inch plants, initiating the current period of the Taiwan IC industry‘s unprecedented success.

The significant difference between Taiwan and the overseas IC industry is Taiwan‘s adopting the vertical division of labor. In the rapidly changing industrial environment, this unique division of labor model aligns with the trend of rapid development to meet industry demands. The international factories operate in vertical integration models to make the most efficient use of labor has achieved good results based on effective management between upstream and downstream levels. Our business model includes specialized resources and technology orientation.

The wafer fabrication industry has been part of the semiconductor for some time. Before 1995, integrated device manufactures (IDM), such as IBM, Toshiba and others

dominated the IC industry. These manufactures controlled the entire value barrier for outsiders existed due to technology and capital concerns, and so the leading IDM vendors dominated the IC business until 1987, when the professional foundry production model emerged. Our country‘s professional status foundries achieved the top position in the world after the establishment of TSMC and UMC, which expended the production capacity substantially through factory expansion and thus dramatically increased the scale of the Taiwan IC industry.

The riser of professional foundries leads the division of the structure of the semiconductor industry. The foundry masters the key technology, which enables fables IC design and fab light IDM to flourish. The success of structure division highlights the traditional integrated device manufactures‘ lack of flexibility in production design. After the economics depression of 1996, the IDMs reconsidered the pure-play foundry as collaboration partners. Then, in the 2001 global recession, the stagnant demand for the semiconductor industry highlighted the cost pressures of IC wafer manufacturing. To respond to market fluctuations, the professional foundry model is important and the pure-play foundry and fables IDMs are crucial structure in the IC industry.

Table 2.1 indicates the Taiwan IC industry value net

Taiwan wafer foundries have relied on IC designers in the past. Manufacturing IC chips carrier not only a large capital burden but also market risks. Since Taiwan foundries, in contrast, have high yield and low cost advantages, they can have endless business opportunities. Taiwan‘s two leading foundry companies, TSMC and UMC, use different business models. TSMC has a professional dedicated IC foundry, in a specific location, providing customers a full set of products and services with a single development strategy. TSMC adopts the strategy of creating all aspects of the virtual wafer plant, while spreading the investment risks, and sharing the benefits of its operation with the alliance. President Chang asserts that their IC manufacturing grows continuously but with two

major challenges, how to continue to grow and how to sustain profitability. UMC adopts the symbiotic relationship of IC design and foundry by setting the design element for its own products, controlling the testing departments and adopting a market segmentation strategy. UMC does not accept customers‘ design and commissions.

2.3 Advantages and Disadvantages of Foundries

1. Professional OEM advantages: (a) The OEM is not responsible for bearing the cost of product sales and R&D. Since OEMs do not have their own products, the customers are not concerned with technology loss. It is very unlikely that an OEM would become a competitor. (b) Virtual factory: the OEM can maintain a complete foundry plant for manufacturing their products supported by the commission of OEM customers. Their customers can take full advantage of the quality assurance and production status of orders. On behalf of the factory, the foundry can share the operation benefits by joint or co-investment strategies to diversify investment risks.

2. Professional OEM disadvantages: because the OEM does not have listed products, it relies on close cooperation with customers for survival. The semiconductor process is highly complex, and its high entry barriers are also concerns. To achieve Moore‘s law criteria becomes challenging, which limits the foundry profit boundary and business expansion.

3. China foundry: The China foundry includes advanced semiconductor, Grace Semiconductor, Chip Technology, Shanghai Hua Hong NEC, SMIC and others. The mainland China semiconductor industry has achieved success in a very short time. Today, with rise of mainland China semiconductor companies, many firms have begun considering the impacts of global IC supply on the foundry business in the next five years. The semiconductor industry trends are toward specialization. The successful of Taiwan IC industry indicates that the foundry is still the model of the semiconductor industry. The China semiconductor industry has a unique division of labor structure with a strict division lines, the individual sector includes design, manufacture, packaging and testing divisions.

2.4 Factors Affecting Supply and Demand of the Foundry Industry

The main demand for foundry applications from the downstream market include information products, consumer electronics and communication products as shown below. The factors affecting the supply chain and demands upon the foundry industry can be classified into the downstream markets. Table 2.1 lists the demand for IC applications. As shown in Table 2.1, PC and communication products are the major demand, consisting primarily of cell phones, PDAs, NTC, WLAMs, and other digital products.

Table 2.2 The demand of IC application 2001 2002 2003 2004 2005 Main application PC(DT+NB) 132 -4% 136 3% 144 6% 157 9 % 171 8% Emerging application Cell phone 392 -5% 400 2% 475 19% 509 7% 543 7% DVD player 34 77% 50 47% 63 25% 75 18% 79 6% Digital camera 22 39% 26 19% 32 20% 38 19% 43 14% Games 35 67% 41 16% 41 1% 29 -30% 21 -26% PDA 13 48% 16 24% 20 30% 26 29% 33 25% WLAN NTC 6.4 N/A 12.4 94% 18.2 47% 24.2 33% 31 28%

2.4.1. IT in the IC Market

Information technology has always been the most important semiconductor application. With the popularity of the Internet and other information communication media, the development of related IT products is the main focus of the IC market. PCs and other IT products have provided the greatest growth momentum for the foundry industry in recent years, and most such items use foundries.

2.4.2 Communication with the IC Market

According to MIC statistics, communication applications using semiconductor manufacturing accounts for about 24 % of the global market, which is second only to IT applications. Communication products using semiconductor application include mobile phones, base stations, wireless transmission equipment, LAN, and broadband transmission and switching equipment.

The PC phone is the largest application consumer in the semiconductor market with the cumulative shipment of mobile PCs tripling in 2009. Mobile phones are a far different market from PCs considering PC peripheral equipment‘s volume of semiconductor consumption, including mobile phones and other functions. Although PC product marketing is shorter, it has a longer life cycle for operational maturity, since the process sectors include the parts suppliers, handset manufacturers, cognition, and the product inventory. PC phones can involve very complex factors including the progress of national/regional infrastructure and regional differences in customs and laws. The service providers or the service subsides can affect the demand for mobile phones. Before an acute hit on the expiration of the first wave of demand for fashion phones occurs, the industry has been waiting for so-called ―replacement wave‖ representation. The highly

demand for phones stimulates the foundry phone business. Absent another economic depression, the IC foundry application in fashion or smart phones is crucial to increase profits.

2.5 Consumer Electronics in the IC Market

The semiconductor industry development over the past years has worked hard to create strong demand for mobile phones and other consumer products in order to create another view of the semiconductor. The demand for IC foundries can be considered a consequence of the continuously growth of electronic devices, such TV games, consoles, digital cameras, PDAs, and boost the foundry business.

In considering customer demands and other factors affecting demand for foundries, we can categorize foundry customers into direct IC design companies (fables IC design house), integrated device manufactures develop IC products for others as their main business. However, most business have to sell their own brand, usually designed by the foundry on behalf of their customers‘ IC production, such as who are major foundry customers. This type of company must rely on foundries for production. A few companies, such as Cirrus Logic, Altera, Xilinx, and other foundries can handle larger orders, but most of the IC design firms are small compared to single IDM vendors who handle a large number of small orders. In other words, IDM and similar manufactures have their own fabs, and very good process technology, dependent on the flexibility of the foundry‘s IC fables design, which is better than that of larger companies. Therefore, IC design companies can use foundries in order to provide a more stable source of transaction and more bargaining chips.

IC Insights‘ new report show 2009 integrated circuit sales declining the most for cellular-phone base station (-30%) and automotive applications (-26%), while IC revenues grew the most in non-telephony handheld system (+6%), thanks to an estimated 129 % increase in chip sales for electronic book readers. IC sales for personal computers and cell phone handsets- the two largest chip applications in the systems market – declined 9% and 3 % IN 2009, respectively.

The 2010 IC market drivers report shows e-book readers to be one of the fastest growing product categories in the coming years, with IC sales for e-reader systems rising at a 60% in the 2008-2013 periods. Among other major chip applications, the 2008-2013 compound annual growth rate for IC sales are: 26 % for RFID systems, 21% for non-technology handheld computing devices and 6% for PCs. Figure 2 compares the five-year IC sales for 13 key end-user equipment segments as well as their 2009 market sizes. Figure 2.1 indicates the IC application market growth rate comparisons.

Fig. 2.1 IC application market growth rate comparison

http://www.icinsights.com/news/bulletins/bulletins2009/bulletin20091217.html

2.6 IDM Companies

IDM firms in this business have a wafer fabrication facility (fab) well as the design, production, and marketing of its own brand of IC, which is their main business, these include the domestic companies Wombond, Macronix, Mosel Vitelic, etc., and foreign companies like Intel, NEC, IBM, and others. These plants have their own gab for production, and most also have a design capacity for the product, so these IDM foundry outsourcing vendors can not control orders, compared to the much lower bargaining chip design companies. Although orders more difficult for the IDM maker, their output accounts for the global semiconductor market value of Jiucheng described above, and with the future necessitating professional foundries specialized foundry revenues will have a huge impact.

IDM manufactures face risks, including R&D, design, manufacturing, IC packaging and testing, marketing, and others. One of the heaviest burdens on manufactures is the equipment risk. Building a 12-inch plant requires spending $ 3 billion US, and if sufficient orders do not produce the necessary ROI, the companies‘ finances will suffer irreparable harm, therefore, IDM outsourcing has become the dominant current trend.

2.7 System Companies

System operators include personal computers, peripheral systems, a variety of add-in cards, and other products in the information technology industry, or wired and wireless communication products, manufactures, or general consumer electronics like televisions, stereos, video games, and other manufactures. These operators as used in the IC industry may be designed or imposed by the IC design company for the design, then by the foundry industry for mass production, but for now, these operators are not professional foundry manufactures or the main sources of orders. However, demand continues to request in internet communication.

Fig. 2.2 IC industry evolution in the time period of 1970 to 1990

2.8 IDM and Pure Foundry Growth Rate

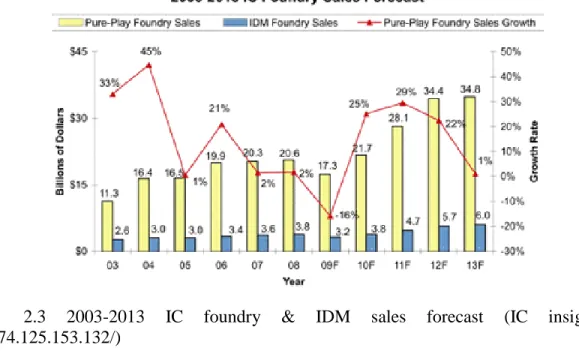

Figure 2.3 shows the 2003-2013 foundry sales forecast. Pure-play foundries dominated the IC foundry. In 2010, the pure-play foundry and IDM are expected to take 21.7 billions and 3.8 billions, respectively. The growth rate of pure-play foundries is estimated to be 25 % in 2010. The revenue of pure-play foundries is seven times that of the IDM foundry.

Fig. 2.3 2003-2013 IC foundry & IDM sales forecast (IC insight, http://74.125.153.132/)

According to recent IC insights, there is vague news, South Korea‘s Samsung Electronics is expanding its foundries annual production, with plans to increase investment to compete with TSMC. Time will tell whether Samsung‘s foundry can beat TSMC.

In Taiwan, the IC foundry industry is progressing smoothly over a period of time. TSMC continues to lead the foundry industry, but suffered yield problems when introducing 40 nm technologies. The company promised a solution in early 2010. In June 2009, TSMC chairman Morris Chang ran for country commissioner, and then returned to the CEO position of TSMC. The problem of advanced technology reflects the company‘s management problems and the change in its organization ensures TSMC‘s remaining at the top of the foundry industry.

However, TSMC also achieved an important victory in 2009, winning the long and intense IP infringement lawsuits against SMIC. SMIC agreed to pay $200 million US in compensation to TSMC, plus stock and warrants in SMIC, even that causes SMIC Founder and CEO Richard Chang to resign.

In China, OEM companies that have reunited to form one company include Shanghai Hua Hong NEC (HHNEC) and Grace semiconductor manufacturing corporation (GSMC).

With the integration of multi-function electronics products, the analog/mixed –signal and RF components are positioned as the next generation growth engine. Only few logic devices companies can continuously fulfill the Moore‘s law pace. Looking to the future, the IC foundry is more concerned about the mainstream market segments other than logic elements. The IC foundry business needs to follow the products trends because innovative technology can return the highest profit in the IC market.

2.9 Evolution of the Semiconductor Industry

The Taiwan semiconductor industry began in 1956, with the establishment of Institute of Electronic Engineering of National Chiao Tung University. Important events include HsinChu Scientific Park being built in 1980, TSMC‘s establishment in 1987 and Taiwan‘s foundry output accounting for 73 % of global production in 2003.

Taiwan‘s semiconductor industry has transitioned through three main stages of growth. The preparatory and seeding stage began in the 1960s when Taiwan positioned its economy for export-led growth, mainly through small and medium private firms involved in contract manufacturing relationships with US and European manufacturing firms. Through the establishment of an export processing zone in 1965, Taiwan attacted contracts from US electrons and semiconductor firms seeking to invest in low-cost manufacturing in Asia as worldwide IC market sales soared. In 1966, US based general instrument microelectronics established a semiconductor packaging business in Taiwan and became the first semiconductor company there. By the 1970S, the seeding phase had taken roots as Taiwan was successfully transferring global technologies into capabilities in its semiconductor industry. The ITRI played significant roles in technology developments. The ERSO was subsequently formed out of the ITRI and charged by the government to promote technology from the world‘s best resources into Taiwan. The government enacted Phase 1 of the electronic industry development project in this area, which closed with ITRI/ERSO spinning off its pilot plant into the private sector, resulting in the creation of UMC in 1980.

Taiwan‘s semiconductor industry went through the diffusion phase from 1981 to 1990. With government sponsorship technologies and new products were diffused to private firms that took on an increasing role in growing the domestic industry. Phase II of the electronic industry development project was enacted in this period to promote the strategic growth of the industry. Various companies including TSMC were spun off from ITRI/ERSO during this era. By the end of this phase, an immature industry cluster had emerged with firms engaged in design, masking, fabrication, and assembly.

The semiconductor industry experienced the burgeoning phase over the subsequent decade following the diffusion phase. Competitiveness in the industry greatly increased along with a rise in prominence of Taiwan‘s semiconductor industry at the global level. An increased partnership between government and industry increased the role of private firms in the industry. By 1995 the cluster was fully developed with over 180 firms and had a large share of the world market. By 1999, Taiwan‘s semiconductor output exceeded $5 billion US, making it the fourth largest producer in the world ahead of industrial giants such as France and the UK. The private firms became more collaborative even as competition among them increased.

Fig. 2.4 Taiwan semiconductor industry schematic diagram

Source: John A. Matthews ―A Silicon Valley of the East: Creating Taiwan‘s Semiconductor Industry‖, California Management Review (1997); Pao-Long Chang and Chiung-Wen Hsu, ―The Development Strategies for Taiwan‘s Semiconductor Industry‖, IEEE Transactions on Engineering Management, Nov 1998 .

Chapter 3 Research Theory

3.1 Document Analysis

The evaluation of the semiconductor industry‘s development history covers its beginnings in Asian and globally and continues through its current status and future projection. The literature analysis includes relevant topics in journal articles, conferences, seminars information, books, and statistical reports to collect, organize and summarize the analysis.

3.2 Research Method

The background and development history of IC factories in mainland China and Asia are selected. The competitive advantages and future of Taiwan foundries are researched. The global foundry layout is discussed. Finally, we propose the business model for the future IC foundry business.

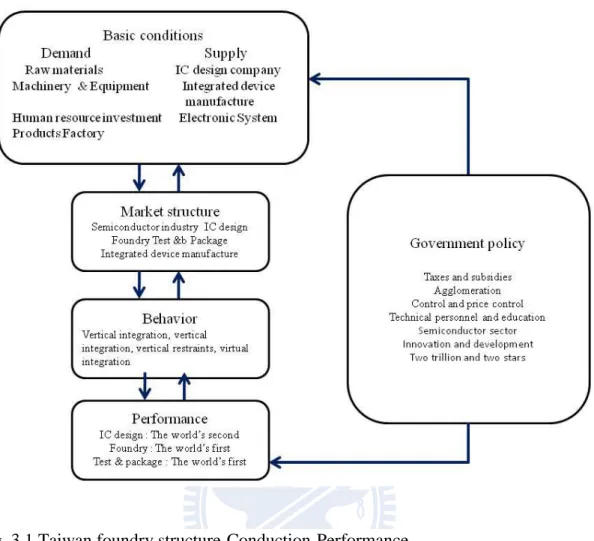

3.3 Taiwan's Foundry Industry and the Current Situation

The structure-conduction-performance is used to describe the effect of market structure on firm performance and behavior. The vertical division of labor is the main operational model in the Taiwan semiconductor IC manufacturing industry. Figure 3.1 indicates the structure-conduction-performance of the Taiwan foundry industry.

Fig. 3.1 Taiwan foundry structure-Conduction-Performance

TSMC and UMC are noted models of the Taiwan IC foundry industry, representing Taiwan high technology companies. TSMC was established in the HsinChu Science Park in 1987, and is the world‘s first professional integrated circuit manufacturing company. The company is service oriented and provides the most advanced manufacturing technology. TSMC offers full services to its customers, the most complete component data libraries, intellectual property, design tools and design flows.

UMC was established in 1970 and headquartered in HsinChu science industrial park. UMC is currently a world-class foundry and plays an important role in Taiwan‘s semiconductor industry. UMC is the second foundry company and first publicly traded semiconductor company. The 2009 IC insights report, ranks TSMC and UMC first and second place, respectively in the foundry business.

According to the 2009 IC insight for market research, the growth rate declined 15 % because of the financial crisis. IC Insights indicates that Taiwanese companies plays

an important role in the foundry business, among the manufactures throughout the Asia-Pacific IC market. The top 17 pure-play foundry rankings in the 2009 global foundry market-to-date are followed by TSMC, UMC, Chartered Semiconductor, Global Foundries, SMIC, East, Advanced, IBM, Samsung, Grace. TSMC remains the most eye-catching with 2009 revenues of nearly $90 billion U.S. reported in IC insight statistics. Global Foundries (GF) divided from AMD shows brilliant performance and it is noteworthy that GF revenue is $1.1 billion U.S. IC insights also indicates that only four integrated device manufactures‘ (IDM) foundries are rank in the top 17 wafer in the top 17 wafer foundries. IBM is the world largest IDM, but its revenue is only about 4 % of TSMC‘s.

Table 3.1 Year 2009 IC foundry ranks from IC insights

2009 Company Foundry type Location 2007 sales ($M) 2008 sales ($M) 2009 sales ($M) 1 Tsmc Pure-play Taiwan 9813 10556 8989

2 UMC Pure-play Taiwan 3430 3070 2815

3 Chartered Pure-play US 1458 1743 1540

4 Global

Foundries Pure-play US 0 0 1101

5 SMIC Pure-play China 1550 1353 1075

6 Dongbu Pure-play South

Korea 510 490 395

7 Vanguard Pure-play Taiwan 486 511 382

8 IBM IDM US 570 400 335

9 Samsung IDM South

Korea 335 370 325

10 Grace Pure-play China 310 335 310

11 He Jian Pure-play China 330 345 305

12 Tower Pure-play Europe 231 252 292

13 HHNEC Pure-play China 335 350 290

14 SSMC Pure-play Singapore 350 340 280

15 TI IDM US 450 315 250

16 X-Fab Pure-play Europe 410 368 223

17 MagnaChip IDM South

3.4 Development of Taiwan’s Integrated Circuit

Dr. Shen Rongqin has divided the Taiwan integrated circuit industry development into the following four stages.

(A) Government Policy

In the classical point of view, the government policy is the most important factor in demining the success of new business in developing countries. The international division of labor is the first stage for developing countries to explore international business. Wade (1990) proposed that the government should use a series of economic policies such as rewards, incentives, management, and a variety of mechanisms to spread risk, together with guidance and resource allocation to promote economic in developing countries. The semiconductor business was a new technology for Taiwan in 1964. The Taiwan government played a vital and unique role in promoting the IC development process. Government set up the semiconductor technology center, technology transfer center, factory building, staff training and technology exploration. The government‘s economic policies dominated the success of high technology business in this stage.

(B) HsinChu Science Park

UMC was established in the HsinChu Science Park in May 1980. The company set up the first factory in the production of electronic devices, computers and a variety of chip used in television and music IC. In order to develop advanced technology, the R & D center was established. The semiconductor business enlarged Taiwan‘s industrial economic scale and foreign purchasers began to order their products from Taiwan.

(C) DRAM Development

In June 1986, there was insufficient production capacity of equipment for developing 1M DRAM, so this technology was sold to South Korea. The state Administration for the VLS project set up R&D results obtained from TSMC, through

the state‘s ability to raise the domestic product circuit design and manufacturing capacity.

(D) IT Domination Country

The Taiwan IC industry was developed very quickly in the 1990s and became the business hub in the IC market. IC was Taiwan‘s core technology and its most value-added business. Taiwan manufacturing has come to dominate IC production, with its IC foundry, packaging and design businesses ranked as the top one and two worldwide.

3.5 Semiconductor

A semiconductor is a material that has an electrical conductivity between that of a conductor and an insulator, that is, generally in the range 103 Siemen/cm to 10-8 S/cm. Devices made from semiconductor materials are the foundation of modern electronics, including radio, computers, telephones, and many other devices. Semiconductor devices include the various types of transistor, solar cells, many kinds of diodes including the light-emitting diode, the silicon controlled rectifier, and digital and analog integrated circuits. Solar photovoltaic panels are large semiconductor devices that directly convert light energy into electrical energy. An external electrical field may change a semiconductor‘s resistivity. In a metallic conductor, current is carried by the flow of electrons. In semiconductors, current can be carried either by the flow of electrons or by the flow of positively-charged ―hole‖ in the electron structure of the material.

Common semiconducting materials are crystalline solids but amorphous and liquid semiconductors are known, such as mixtures of arsenic, selenium and tellurium in a variety of proportions. They share with better known semiconductors intermediate conductivity and a rapid variation of conductivity with temperature but lack the rigid crystalline structure of conventional semiconductor such as silicon and so are relatively insensitive to impurities and radiation damage.

Silicon is used to create most semiconductors commercially. Dozens of other materials are used, including germanium, gallium arsenide, and silicon carbide. A pure semiconductor is often called an ―intrinsic‖ semiconductor. The conductivity, or ability to conduct, of common semiconductor materials can be drastically changed by adding

other elements, called ―impurities‖ to the melted intrinsic material and then allowing the melt to solidify into a new and different crystal. This process is called ―doping‖.

Semiconductor devices are electronic components that exploit the electronic properties of semiconductor materials, principally silicon, germanium and gallium arsenide. Semiconductor devices have replaced thermionic devices (vacuum tubes) in most applications. They use electronic conduction in the solid state as opposed to the gaseous state or thermionic emission in a high vacuum.

Semiconductor devices are manufactured both as single discrete devices and as integrated circuits (ICs), which consist of a number—from a few to millions – of devices manufactured and interconnects on a single semiconductor substrate [1].

3.6 Semiconductor Fabrication

Semiconductor device fabrication is the process used to create the integrated circuits (silicon chips) that are present in everyday electrical and electronic devices. It is a multiple-step sequence of photographic and chemical processing steps during which electronic circuit are gradually created on a wafer made of pure semiconducting material. Silicon is the most commonly used semiconductor material today, along with various compound semiconductors.

The entire manufacturing process from start to packaged chips ready for shipment takes six to eight weeks and is performed in highly specialized facilities called ―fabs‖.

Table 3.2 Process flows and description for semiconductor fabrication

Classification Description

1

Front-end processing Front-end processing refers to the formation of the transistors directly on the silicon. The raw wafer is engineering by the growth of an ultrapure, virtually defect-free silicon layer through epitaxy. In the most advanced logic devices, prior to the silicon epitaxy step, tricks are performed to improve the performance of the transistors to be built. One method involves introducing a straining step wherein a silicon variant such as silicon-germanium (SiGe) is deposited. Once the epitaxial silicon is deposited, the crystal lattice becomes stretched somewhat, resulting in improved electronic mobility. Another method, called silicon on insulator technology involves the insertion of an insulating layer between the raw silicon wafer and the thin layer of subsequent silicon epitaxy. This method results in the creation of transistors with reduced parasitic effect.

Front-end surface engineering is following by: growth of the gate dielectric, traditionally silicon dioxide (SiO2), patterning of the gate, patterning of the source and drain regions, and subsequent implantation or diffusion of dopants to obtain the desired complementary electrical properties. In memory devices, storage cells, conventionally capacitors, are also fabricated at this time, either into the silicon surface or stacked above the transistor.

2 Back end processing Once the various semiconductor devices have been created they must be interconnected to form the desired electrical circuits. This back end of line (BEOL, the latter portion of the wafer fabrication, not to be confused

with back end of chip fabrication which refers to the package and test stages)

Involves creating metal interconnecting wires that are isolated by insulating dielectrics. The insulating material was traditionally a form of SiO2 or a silicate glass, but recently new low dielectric constant materials are being used. These dielectrics presently take the form of SiOC and have dielectric constants around 2.7 (compared to 3.9 for SiO2), although materials with constants as low as 2.2 are being offered to chipmakers.

3 Modules Historically, the metal wires consisted of aluminum. In this approach to wiring often called subtractive aluminum, blanket films of aluminum are deposited first, patterned, and then etched, leaving isolated wires. Dielectric material is then deposited over the exposed wires. The various metal layers are interconnected by etching holes, called vias, in the insulating material and depositing tungsten in them with a CVD technique. This approach is still used in the fabrication of many memory chips such as dynamic random access memory (DRAM) as the number of interconnect levels is small, currently no more than four.

More recently, as the number of interconnect levels for logic has substantially increased due to the large number of transistors that are now interconnected in a modern microprocessor, the timing delay in the wiring has become significant prompting a change in wiring material from aluminium to copper and from the silicon dioxides to newer low-K material. This performance enhancement also comes at a reduced cost via damascene processing that eliminates processing steps. In damascene processing, in contrast to subtractive aluminium technology, the dielectric material is deposited first as a blanket film, and is patterned and etched leaving holes or trenches. In single damascene