國 立 交 通 大 學

企業管理碩士學位學程

碩 士 論 文

台灣零售業虛實整合商業模式研究: 以 7-11 與 7net 為例

A Case Study of Click-and-Mortar Retail Business: 7-11 and 7net in

Taiwan

研 究 生:沈愛玲

指導教授:韓復華

A Case Study of Click-and-Mortar Retail Business: 7-11 and 7net in

Taiwan

研 究 生:沈愛玲

Student: Irene Ai-Ling Shen

指導教授:韓復華

Advisor: Dr. Anthony F. Han

國 立 交 通 大 學

管理學院

企業管理碩士學位學程

碩 士 論 文

A Thesis

Submitted to Master Degree Program of Global Business Administration College of Management

National Chiao Tung University In partial Fulfillment of the Requirements

For the Degree of Master

in

Business Administration

June 2011

Hsinchu, Taiwan, Republic of China

National Chiao Tung University

Global MBA Program

Thesis

台灣零售業虛實整合商業模式研究:

以 7-11 與 7net 為例

A Case Study of Click-and-Mortar Retail Business:

7-11 and 7net in Taiwan

Student: Ai-Ling Shen

Advisor: Prof. Anthony F. Han

i 摘要 資策會研究顯示,2005 年起台灣 B2C 電子商務市場規模,每年以倍數成長,由於 進入門檻較實體通路低,競爭趨向白熱化,除了既有網路公司,實體零售業也開始發展 虛擬通路,成立自有購物網站以擴大客源。統一超商於 2010 年正式推出購物網站自有 品牌--7net,定位為雲端超商,至此,7net 挾著統一超商完整的物流資源及多年累積之 品牌優勢跨足電子商務市場,成為台灣第一個虛實整合(click-and-mortar)零售商。 本研究旨在探討 7-11 與 7net 的虛實整合商業模式,兩種通路如何相互配合,為供 應商及消費者創造其獨特價值。本個案採質性研究法,從文獻及訪談所彙整之資料,先 回顧統一超自成立以來,逐漸發展至電子商務的沿革,再以五力分析探討 B2C 外部市 場的趨勢與競爭程度。以商業模式的觀點來剖析 7net 之核心能力與價值,再由內部與外 部分析歸結出 SWOT,探討 7net 面臨的機會與挑戰,作為其它實體零售商進入電子商 務市場之參考。

本研究發現,7-11 與 7net 的商業模式具備 Charles Steinfield 2002 年提出的四種虛實 整合模式可能達成的優勢:低成本、加值服務、消費者信賴度、及地理性與客群延伸, 是個體質健全的虛實整合模式。此外,7net 破除 7-11 店面限制,將貨架無限延伸;另一 方面,7-11 密集的店面成為 7net 與消費者溝通的管道;以虛擬擴充實體、以實體支援虛 擬,相輔相成產生綜效。然而,目前 7net 處於發展初期,知名度與產品項仍不足;市場 上除既有的各大競爭對手,未來還可能有更多實體量販通路商跨足網路。面臨這些困難 與挑戰,7-11 與 7net 須盡快找出目前最適合的市場定位發展品牌策略,才有機會在台灣 B2C 網購市場永續經營。 關鍵字:統一超、電子商務、虛實整合、零售業、商業模式、五力分析、SWOT。

ii

Abstract

According to the research by Market Intelligence and Consulting Institute, B2C

e-commerce market in Taiwan is growing exponentially since 2005. Because of the low

barriers of entry, more players are joining the competition and thus the rivalry in virtual

channels becomes high. Besides the existing dot-com companies, physical retailers are

establishing own-branded shopping websites to expand their customer segments. 7-11

launched its own-branded shopping website—7net. By leveraging 7-11‘s logistics system and

the brand awareness, 7-11 and 7net become the first click-and-mortar retailers in Taiwan.

The thesis aims to study the click-and-mortar business model of 7-11 and 7net and how

the two channels cooperate to create unique values for vendors and consumers. This

quantitative research is based on secondary and primary data to review the early development

and c-commerce strategies of 7-11. Further, it analyzes the external market with Porter‘s Five

Forces model, and depicts 7net‘s business model with Osterwalders and Pigneur‘s Business

Model Canvas, along with its core competence and values. A SWOT follows to analyze the

opportunities and challenges 7net may face, to serve as a reference for the other physical

retailers that plan to go online.

The thesis finds that 7-11 and 7net possess the four potential benefits of a

click-and-mortar business may achieve (Charles Steinfield, 2002): low cost, value-add service,

trust, and expansion of geography and segments, indicating 7-11 and 7net have a robust

click-and-mortar constitute to grow and create synergy. On the other hand, as a new comer,

7net must build up its clear market position to compete against both existing and potential

players, to obtain sustainability in B2C Internet market.

Key Words: E-commerce, Click-&-Mortar, Retailer, 7-11, Business Model, Five Forces,

iii 謝詞 在老師的指導與同儕的互相扶持下,學業終於告一段落。兩年來,在交大 GMBA 的學習所 得,是人生中一段充實且特別的回憶,豐富了我的知識與心靈,更是開啟了今後成長與職業生 涯嶄新的探索之旅。 本論文能順利完成,首先要感謝我最敬佩的指導教授 韓復華老師,對「韓家班」傾囊相授, 給予清晰的邏輯思考、正確的研究態度,是我這兩年來最大的收穫;書審與口試期間,感謝 任 維廉教授、 林亭汝教授、與 吳武明教授提供許多寶貴意見,使本論文更臻完備。 撰寫論文期間,感謝經管所 楊千老師,在我苦思論文題目時啟發了我,並且熱心協助資料 蒐集;感謝資管所江瑋屏學姐鼎力相助,百忙之餘仍願意提供許多第一手資料與建議;感謝同 學 Peggy, Eva, Sean 在寫作的過程中互相加油打氣,讓我能克服重重關卡,如期完成學業前最重 要的一步,沒有你們,我真的畢不了業。 最後,感謝最疼愛我、包容我的父母,28 年來,始終毫無保留地體諒且支持我所有決定, 並且時時刻刻肯定我、鼓勵我。我真的是很幸運的女兒。我畢業了,願他們與我一起分享這份 喜悅! 愛玲 中華民國一百年六月二十六日 於台北

iv Table of Contents 摘要 ... i Abstract ... ii 謝詞 ... iii Table of Contents ... iv List of Tables ... vi

List of Figures ... vii

I. Introduction ... 1

1.1 Motivation ... 1

1.2 Purpose ... 2

1.3 Framework ... 4

II. Literature Review ... 7

2.1 Competitive Strategies ... 7

2.2 Five Forces Analysis ... 7

2.3 SWOT Analysis ...10

2.4 E-Commerce ... 11

2.4.1 B2C Online Shopping ...15

2.5 Business Model ...16

2.6 Click-and-Mortar Business Model ...19

III. 7-11 Background Introduction ...22

3.1 7-11‘s Brick-and-Mortar Evolution in Taiwan ...22

3.2 7-11‘s Early Development of Corporate Shopping Website ...25

3.3 7-11‘s New Attempt for Own-Branded Shopping Website: 7net.com.tw ...26

IV. E-commerce Market Analysis ...30

4.1 Domestic Online Shopping Market Overview ...30

4.2 Three Main e-Business Models in the Market ...33

4.3 Major Players in B2C Market ...36

4.3.1 Yahoo! Shopping ...36

4.3.2. PChome Online Shopping ...38

4.3.3. Other Platforms ...39

4.4 External Environment Analysis ...40

v

5.1 Product Innovation ...44

5.2 Infrastructure Management ...46

5.3 Customer Relationship ...47

5.4 Financial Aspects ...49

5.6 Opportunities and Challenges for 7net ...52

VI. Conclusions and Recommendations ...57

6.1 Conclusions ...57

6.2 Recommendations ...58

References ...60

vi

List of Tables

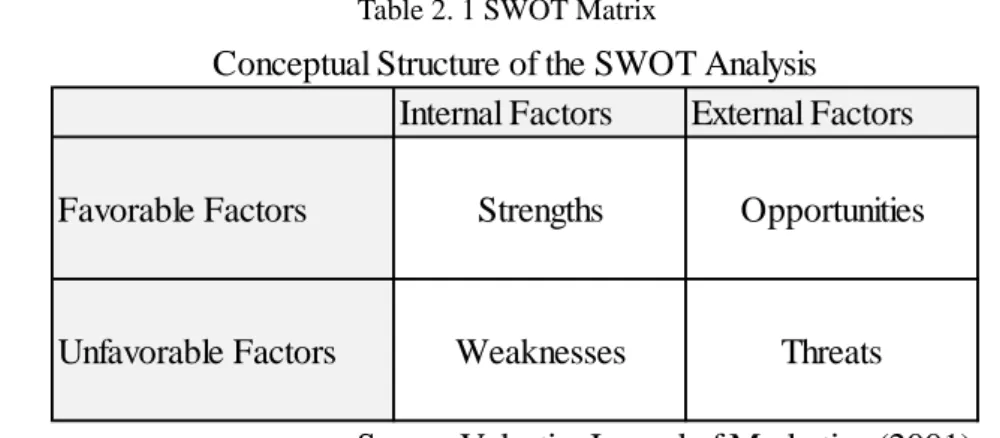

Table 2. 1 SWOT Matrix ... 11

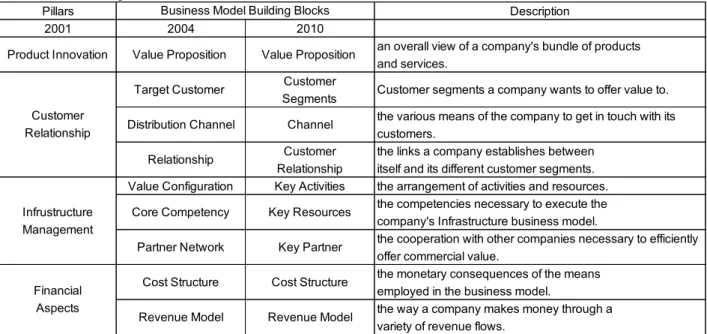

Table 2. 2 The Development of Osterwalder and Pigneur's Busines Model ...18

Table 4. 1 Three Forms of E-business Model in Taiwan ...32

Table 4. 2 B2C Online Market Scale In Taiwan, 2005-2009 ...32

vii

List of Figures

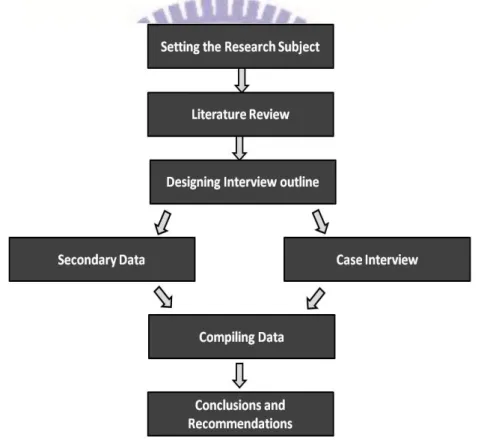

Figure 1. 1 The Process of the Case Study ... 5

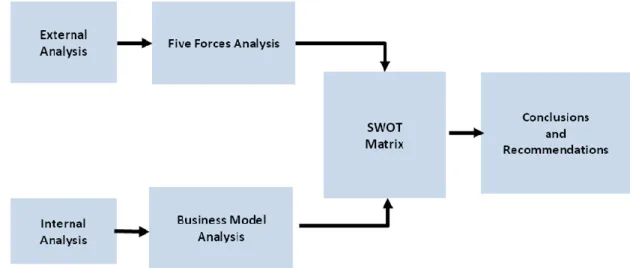

Figure 1. 2 The Framework of External and Internal Analysis ... 6

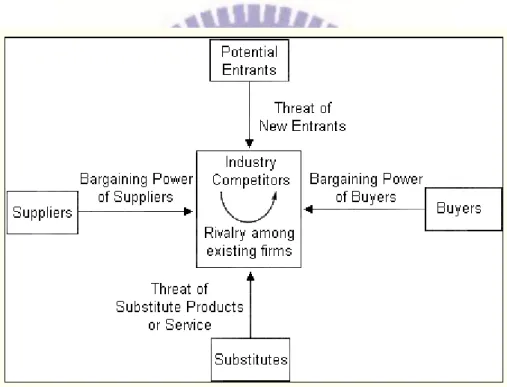

Figure 2. 1 Five Forces in the Market ... 8

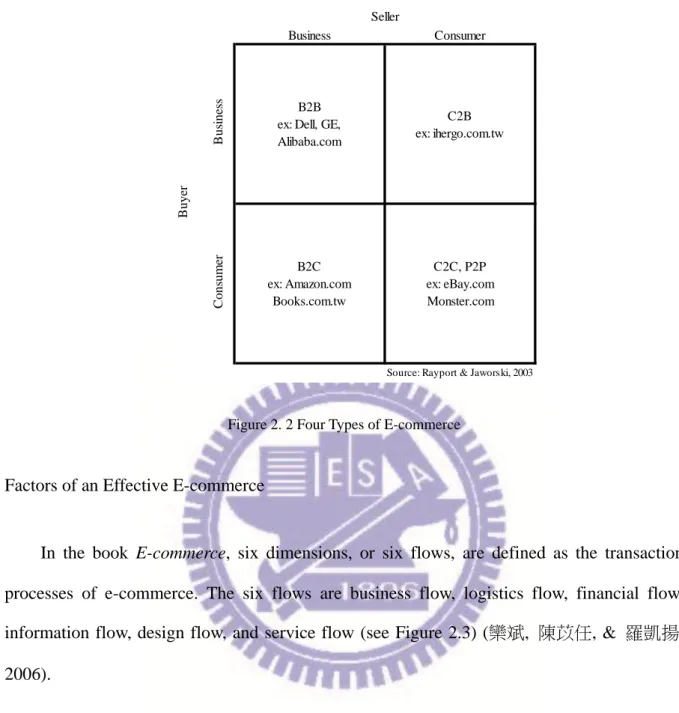

Figure 2. 2 Four Types of E-commerce ...13

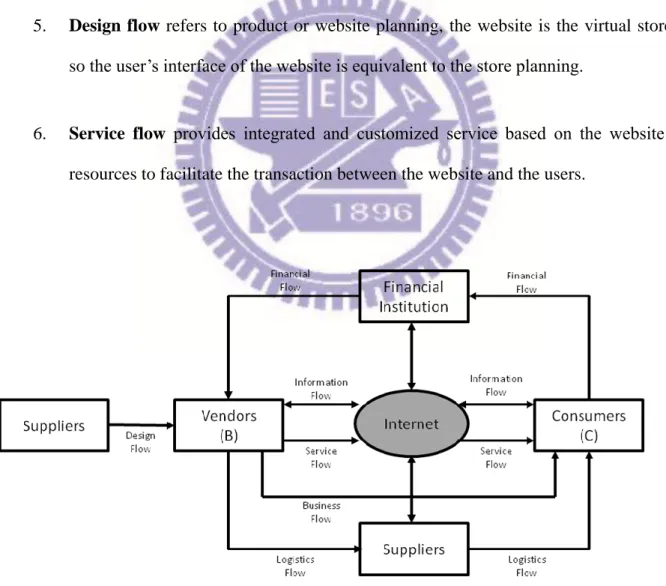

Figure 2. 3 Six Flows of an E-commerce Model ...14

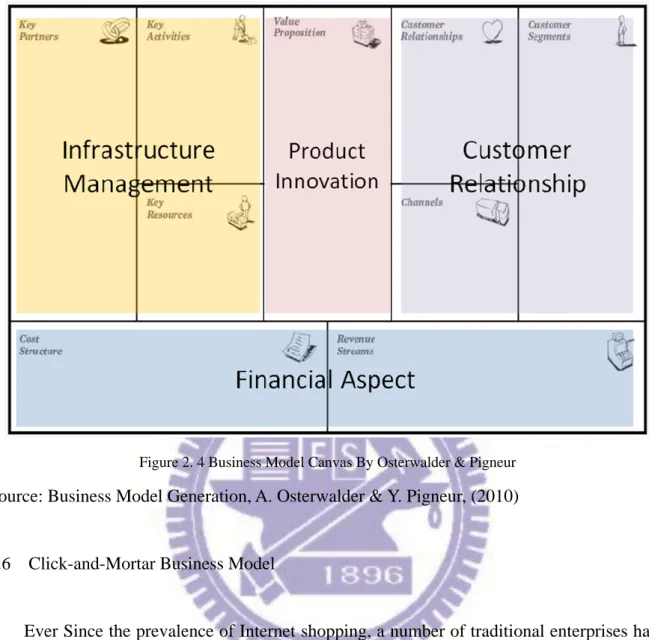

Figure 2. 4 Business Model Canvas By Osterwalder & Pigneur ...19

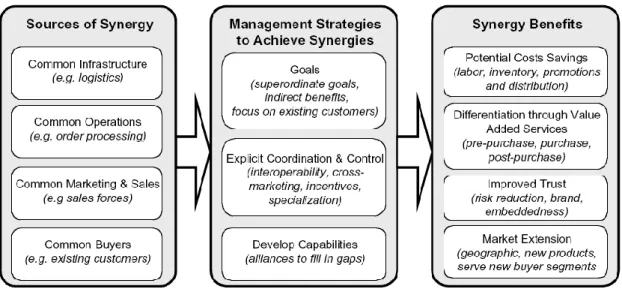

Figure 2. 5 Sources, Management Requirements, and Benefits of Click and Mortar Synergies. ...21

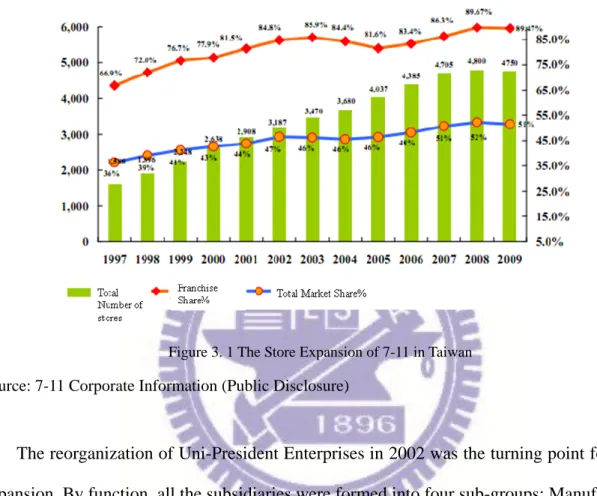

Figure 3. 1 The Store Expansion of 7-11 in Taiwan ...23

Figure 3. 2 Homepage of 7net.com.tw ...27

Figure 3. 3 7net.com.tw‘s Division of Labor ...28

Figure 3. 4 Flexible Methods Provided by 7net ...28

Figure 4. 1 B2C Online Market Scale and Growth Rate in Taiwan (2005-2009) ...32

Figure 4. 2 Common Logistic Flows for B2C Platform in Taiwan ...35

Figure 4. 3 Homepage of Yahoo! Shopping (http://buy.yahoo.com.tw/) ...37

Figure 4. 4 PChome Shopping Homepage (http://shopping.pchome.com.tw/) ...38

Figure 4. 5 The Five Forces Analysis ...40

Figure 5. 1 Paragraph Allocation Based on Business Model Canvas ...43

Figure 5. 2 7net‘s Commission Models for Vendors ...50

1

I. Introduction

1.1 Motivation

As the Internet infrastructure is expanding at a fast pace in Taiwan, more consumers are

willing to make purchase online. Among all types of virtual retail channels, including mail

orders and TV shopping channels, online shopping is growing much faster than the others.

According to the research made by MIC and FIND.org (資策會), the total market revenue of

domestic online shopping has grown up to NTD311.6 Billion in 2010 (B2C and C2C

combined), with a growth rate of 30.4% compared to that of 2009 (資策會 MIC, 2009). In

2011, the market revenue is expected to reach NTD430 Billion. Besides the total market size

is growing steadily, the average amount spent by individual consumer is growing as well,

indicating that consumers have more confidence and trust toward online shopping.

Although a young and booming market as it seems, the competition in the market is

fierce. MIC finds that more than 50% of the online stores in Taiwan have yet reached their

breakeven points (資策會 MIC, 2009) Since the barriers to entry are lower than those of the

conventional physical channels, almost everyone can start its own business online. However,

among all the players, some possess their advantages to capture a larger market share. For

example, Yahoo! Taiwan (雅虎台灣) and PChome (網路家庭) are the most dominant

business-to-customer (B2C) shopping websites in Taiwan as they are the two top portal sites

in the local market. As typical pure play companies, they run businesses without physical

store exposure.

However, the market is not only reserved for pure-play companies. The significant

2

change their brick-and-mortar business models to adapt the new market (賴麗秋, 2011). In

July 2010, 7-Eleven Convenience Store (also known as President Convenience Store Chain,

PCSC, TWSE: 2912), the giant of the physical retail store in Taiwan, has set up its

own-branded shopping website www.7net.com.tw (hereinafter 7net), and is prepared to compete against existing e-commerce top players( 王 貞 曄 , 2010). It is the first

brick-and-mortar retailer going online; whether it can successfully make it to the market will

result in a new hybrid, click-and-mortar retail business model in Taiwan.

Although a late comer in domestic B2C online shopping market, 7net possesses its

unique advantages to catch up with the competitors. Its abundant resources, including its

physical stores that cover almost 50% market share in Taiwan, its efficient logistics capability

supported by 7-11‘s sub-companies, the well-acknowledged brand name of 7-11, and many

affiliates under its mother company, Uni-President Enterprise, are the resources 7Net can

utilize to become a fledging rival against the major B2C pure-play competitors. How 7net can

utilize these physical resources to gain for share and sustain its business in the Internet market

has made this case unique, interesting and worthwhile investigating.

1.2 Purpose

The purpose of this case study is aimed to assess the internal and external environments

of 7Net and make well founded conclusions and recommendations. The external part adopts

Michael E. Porter‘s Five Forces Analysis; the internal assessment focuses on the Alexander

Osterwalder and Yves Pigneur‘s Business Model Canvas analysis, how 7Net runs its business

and brings in profit, and then to summarize its strengths and weaknesses. A SWOT analysis

will follow the case study and draw recommendations. In short, the case study is made to find

out where 7Net stands in the market and which direction it can lead to; the final notes in the

3 go online.

There are three main business models in e-commerce market in Taiwan: B2C, B2B2C,

and C2C; 7Net belongs to the B2C market. As a new player, 7net needs to create unique

values different from those of the competitors and make its position. From the data collected,

one can find that household goods, such as food, beverage and other commodities, are still

new to end-users to shop online. 7net‘s mother company, Uni-President Enterprise, is the

leading company of food and beverage products in Taiwan and therefore brings 7net a large

and unique opportunity in the market. On the other hand, since 7net is still young in the

B2C market, it must strive to expand its product mix to provide one-stop shopping service to

end-users in order to compete with the current top players and obtain a significant the market

share.

In this case study, the results conclude that 7net, as a new B2C shopping website, highly

relies on its physical resources to support its virtual business. Its logistics capability and

density of 7-11 stores are the main advantages for 7Net to compete against the other B2C

platforms. Also, based on observation, the characteristics of 7net align with the four potential

benefits a click-and- mortar business model should achieve: Low Cost, Value-add Service,

Trust, and Geographic and Product Market Extension. Therefore, as the first

click-and-mortar retailer in Taiwan, 7net has a healthy constitution and should be able to grow

and sustain its business steadily. Although cannibalization or channel conflict is the main

concern of a click-and-brick business model, 7-11 and 7net‘s co-existence should create

synergy instead, because the channel cooperation extends in both directions. For the

physical side 7-11, there is no more geographic boundary to approach customers; as long as

consumers have Internet access, they can purchase from 7-11, either by store pick-up or

4

promote the website‘s existence; walk-in customers of 7-11 also become the potential

customers of 7net. The cooperation between the two will expand the businesses of both sides.

After the internal and external analysis, the case observes 7net‘s opportunities and

challenges for its business development. First, due to the keen competition in B2C market,

7net should improve the weaknesses proactively in order to strengthen consumers‘ confidence

and build up the website‘s reputation. Secondly, to effectively expand its membership base,

7net may consider implementing the available e-services in the physical 7-11 stores to

strengthen its differentiation from other B2C shopping websites. Finally, a single profit

model (commission from vendors) seems weak for a growing B2C platform. Diversifying it

profit model, for example selling advertisement service and crossover market campaign with

7-11‘s affiliates, should be a feasible strategy to increase 7net‘s profit.

Through this case study, one can find that an effective logistics network is essential for

both virtual and physical retailing business. Although e-commerce retailers market their

product and reach their consumers on the Internet, the back-end delivery is the key to build up

customers‘ satisfactory.

1.3 Framework

The case study starts with the secondary data collected from journals, previous academic

theses and government publications. Michael E. Porter‘s (1985) Five Forces Analysis model, the Nine-Block Business Model Canvas by Alexander Osterwalder and Yves Pigneur (2004,

2010), and Heinz Weihrich ‗s SWOT Analysis (1982) are the core analysis tools used in this

case study. Five Forces analysis is the main framework for the external analysis; each force in

B2C marketing in Taiwan is assessed. With the secondary data collected and compiled, a

5

data. Through the interview, the website‘s business model is depicted in details, including

the definition of the nine blocks (Key Activities, Key Resources, Key Partners, Value

Preposition, Customer Segments, Channels, Customer Relationship, Cost Structure, and

Revenue Streams) in the visual template.

Five forces (external) and business model analysis (internal) are followed by a SWOT

matrix analysis. Based on the result, recommendations are drawn for managerial implications;

hopefully, this brief case study can be reviewed as a starting point of the further researches on

click-and-mortar retailer business model in this ever-changing e-commerce market in Taiwan.

6

7

II. Literature Review

2.1 Competitive Strategies

Michael E Porter defines competitive strategy as how a company competes in a particular

business. Competitive strategy is concerned with how a company can gain a considerable

profit through a distinctive way of competing (Porter, 2001). Porter found three generic types

of competitive strategies; a company will adopt one or more to maximize its profits and seek

for sustainability.

Overall Cost Leadership: a strategy that allows a company to provide the similar

products to its customers at a lower cost.

Differentiation: a strategy that allows a company to provide one or more unique

products or services to consumers. The value of the products or services is hard to copy and

therefore customers are willing to buy such products or services at a higher price.

Niche Market: a strategy allowing a company to exclusively focus on a single market

and fulfill its market need. This certain market can be defined either by geography, customer

segments, or product categories. A company that adopts niche market strategy will only focus

on a limited range of product categories, and usually are able to respond to market change

faster than larger-sized companies. Such a company is more likely to possess advantages on

the cost, quality, and features of the product or service.

2.2 Five Forces Analysis

8

based on the conditions. It was first form by Michael E Porter of Harvard Business School in

1979. The five forces include threats of new entrants, bargaining power of buyers, bargaining

power of suppliers, threats of substitute products or suppliers and competitive rivalry among

existing firms (See Figure 2.1).

Porter believed that these five forces belong to micro economic aspects instead of

macro economics, and they will have strong influences on the structure and the competition in

the industry, Also, they have impact on a firm‘s profitability and management style; any

change occurred among the five forces may induce an exit or entry of this firm.

Figure 2. 1 Five Forces in the Market

Source: Michael E. Porter: ―Competitive Strategy: Techniques for Analyzing Industries and

Competitors‖

Five forces are described as follows:

1. The bargaining power of buyers (also described as the market of outputs): it

9

volume of the product, it will have stronger bargaining power. Also, if the customers

possess more knowledge on the product, or if there are quite a few suppliers to fulfill the

need (meaning customers have to pay little switching cost), the customer will hold

stronger bargaining power.

2. The bargaining power of suppliers (also known as the market of inputs): the main

factors to shape the bargaining power of suppliers are the number of the existing

suppliers in the market, and the exclusivity of the product or service they offer. Suppliers

will have stronger bargaining power if they possess abilities integrate toward upstream.

3. The threat of the entry of new competitors: new competitors bring new capacity into

the market, and take away resources and market share from the existing firms. Aaker

(1984)thinks that any company that tries to expand its product lines, implement vertical

integration, or possess unique capacity to compete in the same industry may be

considered as new competitors. However, for the new competitors, there may be barriers

to entry in the market, which may include exclusive resources of the existing firms,

economic scale of the existing firms, or regulations of the government.

4. The threat of substitute products or services: substitute products or services determine

the maximum profit of a product. If the product price exceeds the limit, the customers

will switch their demand to substitute products or services. When the substitute can

replace most of the features of the product, it will form a considerable threat to the

existing market.

5. The intensity of competitive rivalry: when there are many existing firms in the market,

the rivalry among them are strong. It will get stronger if they can replace each other, or if

10

barriers to entry and exit may also determine how strong the rivalry is.

2.3 SWOT Analysis

As one of the most commonly used analytical approaches, SWOT analysis can be used to

scrutinize an organization‘s advantages and disadvantages, and optimize its resources to seize its best opportunities. The approach was initialed by Heinz Weihrich in the 60s; ever since it

has been widely researched and became the foundation for many studies. It also gives

direction and serves as a basis for the development of marketing plans. SWOT analysis

separates the information into internal (Strengths and Weaknesses) and external

(Opportunities and Threats) issues (see Table 2.1); also, it indicates something that will assist

the organization or the plan in accomplishing it objective (Strengths and Opportunities) as

well as obstacles that have to be overcome or minimized (Weaknesses and Threat) (Danca,

1999).

Johnson (1989) stated that SWOT analysis is a general tool designed to be used in the

preliminary stages of decision-making and as a precursor to strategic planning in various

kinds of applications. Balamuralikrishna and Dugger in Iowa State University (1997) find that

in order to be most effectively used, a SWOT analysis needs to be flexible. Situations change

with the passage of time and an updated analysis should be made frequently.

There are four strategies derived from SWOT matrix:

1. S-O Strategy: Combining the organization‘s internal strength and external

opportunities to create a niche, in order to optimize the organization‘s advantages.

2. S-T Strategy: When the organization is facing threats from external environments, it

11

the threats are to be minimized or eliminated.

3. W-O Strategy: Through leveraging the opportunities from the external environments,

an organization‘s weaknesses may be improved.

4. W-T Strategy: To minimize both an organization‘s weaknesses and threats to reach

its growth target.

Table 2. 1 SWOT Matrix

Internal Factors External Factors

Favorable Factors Strengths Opportunities

Unfavorable Factors Weaknesses Threats

Source:Valentin, Journal of Marketing (2001) Conceptual Structure of the SWOT Analysis

2.4 E-Commerce

Electronic commerce, also known as e-commerce or EC, consists of the transaction of

products and services over electronic systems such as the Internet. Although the history of

E-commerce is short, merely no more than 20 years since the advent of the Internet in 1990,

there are already abundant researches about e-commerce. Jeffrey F. Rayport and Bernard J.

Jaworski formally define e-commerce as technology-mediated exchanges between parties

(individuals or organizations) as well as the electronically based intra- or inter-organizational

activities that facilitate such exchanges (Rayport & Jaworski, 2001). Therefore, in the general

category, electronic banking or TV shopping by phone can be a type of e-commerce as well.

However, since the subject of this case study closely relates to Internet shopping, the

12

Rayport and Jaworski further define four distinct categories of e-commerce with a matrix

with different combinations of buyers and sellers (see Figure 2.2). The e-commerce conducted

between businesses is referred to as business-to-business or B2B. Alibaba.com is a recent

example for businesses to search for and purchase the products and services they need from

the others. E-commerce that is conducted between business and consumers is referred to as

business-to-customers or B2C. Although it is usually much smaller than B2B transactions,

B2C may be considered the most common type of e-commerce (Lin & Wang, 2008).

As 7net belongs to this category, this paper will further describe its details in Paragraph

2.4.1. Well-known B2C shopping websites include Amazon.com, Books.com.tw, and

Buy.yahoo.com.tw. From the consumer‘s side, another type of e-commerce is referred to as

consumer-to-business or C2B. Under this category, consumers can join together as a

purchase group and make deals with businesses, mainly to get a discount from the business

with larger demand. Groupon.com and ihergo.com.tw are the examples of this type.

Consumer-to-consumer, C2C, or peer-to-peer e-commerce involves transactions between and

among consumers. C2C websites play the role as a third-party platform to facilitate such

transaction and sometimes charge for services such as online exposure and advertisements.

Examples are auction websites such as eBay.com or Yahoo! Auction and recruiting websites

13 Business Consumer B us ine ss B2B

ex: Dell, GE, Alibaba.com C2B ex: ihergo.com.tw C ons um er B2C ex: Amazon.com Books.com.tw C2C, P2P ex: eBay.com Monster.com Seller B uye r

Source: Rayport & Jaworski, 2003

Figure 2. 2 Four Types of E-commerce

Factors of an Effective E-commerce

In the book E-commerce, six dimensions, or six flows, are defined as the transaction

processes of e-commerce. The six flows are business flow, logistics flow, financial flow,

information flow, design flow, and service flow (see Figure 2.3) (欒斌, 陳苡任, & 羅凱揚,

2006).

1. Business Flow indicates the transaction between businesses and consumers, mainly

selling and buying and should occur in all four types of e-commerce.

2. Logistic flow in e-commerce is similar to that in the physical channels; except for

the virtual products such as software and the other digital products, deliveries to

consumers relies largely on a physical logistic system.

3. Financial flow in e-commerce may involve credit or debit cards as a tool for

14

gaining trust from consumers is vital to a successful shopping website. As online

shopping market is growing, websites may develop alternatives such as ATM

transaction and paying cash on-site that lowers the risks consumers may have to

bear.

4. Information flow is a two-way communication between the sides; businesses and

consumers exchange their information via the Internet. Businesses may be able to

collect sufficient consumers‘ profiles for data mining and further marketing analysis.

5. Design flow refers to product or website planning, the website is the virtual store,

so the user‘s interface of the website is equivalent to the store planning.

6. Service flow provides integrated and customized service based on the website‘s

resources to facilitate the transaction between the website and the users.

Figure 2. 3 Six Flows of an E-commerce Model Source: E-commerce (5th Edition), 欒斌、陳苡任,2006

15 2.4.1 B2C Online Shopping

B2C online shopping, or Internet shopping, is the process whereby consumers directly

buy goods or services from a seller real-time over the Internet (Rayport & Jaworski, 2001).

It is one rapidly growing market ever since the advent of the Internet. A large body of research

made efforts to draw the definition and classification of B2C online shopping, key success

factors, e-business models, and consumers‘ behavior.

B2C online shopping is defined as businesses, including manufacturers, wholesalers, and

retailers, provide an online platform and display their products and services to the consumers,

and allow the consumers to directly purchase the items on the platform without the limits of

opening hours or locations (欒斌, et al., 2006).

The design of the users‘ interface may be one of the keys to draw customers‘ attention and expand its customer base (Elliott & Speck, 2005). To improve performance, B2C

shopping websites must more assiduously attend to every aspect of execution and optimize

the sites for easiest flow of information to an increasingly sophisticated customer. Michael T.

Elliot and Paul Surgi Speck in University of Missouri –St. Louis (2005) find that there are

five important factors can strengthen consumers‘ favorable attitude toward the shopping website: 1.) ease of use; 2.) product information; 3.) entertainment; 4.) trust; 5.) currency.

These factors positively relate to consumers attitude toward the site, purchase intent, shopping

likelihood, site loyalty, and confidence in brand belief.

Rayport & Jaworski concluded that there are seven essential elements for an effective

users‘ interface, which is the virtual representation of a firm‘s chosen value proposition. It is referred to as the 7Cs framework: Context, Content, Community, Customization,

16 2.5 Business Model

Timmers (1998) defines a business model as “an architecture for the product, service

and information flows, including a description of the various business actors and their roles;

and a description of the potential benefits for the various actors; and description of the

sources of revenues‖. Weill and Vitale (2001) define a business model as ―a description of the

roles and relationships among a firm’s consumers, customers, allies and suppliers that identifies the major flows of product, information, and money, and the major benefits to

participants‖ (Osterwalder & Pigneur, 2002).

Many of the researches about business models actually focus on the business model

based on rapidly growing information and technologies. Most agree that they tend to

transform traditional business models or develop new ones that better exploit the

opportunities enabled by technological innovations. The models involved in technologies,

especially the Internet, are referred to as e-business models. Rayport and Jowarski (2001)

describe four components of an e-business model: (1) a value proposition or value cluster for

targeted customers; (2) an online offering, which could be product, service, information, or all

three; (3) a unique, defendable resource system; and (4) a revenue model.

Alexander Osterwalder and Yves Pigneur (2001) conclude that an e-business model is

composed of four main pillars, which are Product Innovation, Infrastructure Management,

Customer Relationship and Financial Aspect (Osterwalder & Pigneur, 2002). In 2004,

Osterwalder further decomposed the four pillars into the nine blocks: Value Proposition,

Target Customer, Distribution Channel, Relationship, Value Configuration, Core Competency,

Partner Network, Cost Structure. In 2010, the nine blocks are slightly changed into Value

Proposition, Customer Segment, Distribution Channel, Customer Relationship, Key Partner,

17 elaborated as follows:

Product Innovation covers all product-related aspects; Osterwalder and Pigneur

conclude that elements are value proposition a firm wants to offer to specific customer

segments and the capabilities a firm has to be able to assure in order to deliver this value.

Value Proposition is the only block belonging to this pillar and may consider the most

important factor of all in a dissected business model. Keeney commented that in e-commerce,

the value proposition provided by a website must include the value proposition of the product

eventually purchased (Keeney, 1999). For instance, a customer is buying a book online; he or

she knows exactly what to expect when the product is delivered, but the process of buying it,

including users interface, the payment method, and the delivery lead time will enhance or

worsen the customer‘s buying experience. Later in the Business Model Canvas by

Osterwalder and Pigneur, this pillar, or factor, is put in the center of the canvas as the core

value a company can bring to its customers.

Infrastructure Management describes the value system configuration necessary to

deliver the value proposition. This comprises the Value Configuration of the firm, the Core

Competency, and the firm‘s Partner Network, indicating the tangible and intangible assets a

company possesses to run the business. In the Business Model Canvas, this pillar represents

Key Partner, Key Resources, and Key Activities on the left side.

Customer Relationship describes how the firm communicates with its customers and

maintains their relationship in order to build up customer loyalty and repetitive purchase. It

comprises Target Customer (or Customer Segment), Distribution Channel, and Customer

Relationship. In the Nine-block Canvas, they represent the three blocks on the right side.

Financial Aspects represents how a firm employs its monetary resources to run its business

18 Model.

In 2010, the concept of a nine-block business model is published as Business Model

Generation, a handbook introducing five different business models that mainly are related to

e-commerce, which are Unbundling, Long-tail, Multi-sided Platform, Freemium, and Open.

Sometimes a business may match the characteristics of two or more models. In this handbook,

the four pillars are no longer emphasized, but the core concept still aligns.

Table 2. 2 The Development of Osterwalder and Pigneur's Busines Model

Source: Osterwalder, Pigneur, and Tucci, (2005, 2010)

Osterwalder and Pigneur's Business Model

Pillars Description

2001 2004 2010

Product Innovation Value Proposition Value Proposition an overall view of a company's bundle of products and services.

Target Customer Customer

Segments Customer segments a company wants to offer value to. Distribution Channel Channel the various means of the company to get in touch with its

customers.

Relationship Customer

Relationship

the links a company establishes between itself and its different customer segments. Value Configuration Key Activities the arrangement of activities and resources.

Core Competency Key Resources the competencies necessary to execute the company's Infrastructure business model.

Partner Network Key Partner the cooperation with other companies necessary to efficiently offer commercial value.

Cost Structure Cost Structure the monetary consequences of the means employed in the business model.

Revenue Model Revenue Model the way a company makes money through a

variety of revenue flows. Business Model Building Blocks

Customer Relationship Infrustructure Management Financial Aspects

19

Figure 2. 4 Business Model Canvas By Osterwalder & Pigneur Source: Business Model Generation, A. Osterwalder & Y. Pigneur, (2010)

2.6 Click-and-Mortar Business Model

Ever Since the prevalence of Internet shopping, a number of traditional enterprises have

moved to integrate e-commerce into their channel mix, using the Internet to supplement

brick-and-mortar retail channels (Steinfield, 2010). Such a combination of physical and web

channels is a distinct e-commerce business model and commonly referred to as ―clicks and

mortar,‖ ―bricks and clicks,‖ ―surf and turf,‖ ―cyber-enhanced retailing,‖ and ―hybrid

e-commerce.‖ Mahadevan (2000) further defined of this term does not include organizations

that have merely set up some websites displaying information on the products that they sell in

the physical world (Mahadevan, 2000). Only those firms that conduct commercial

transactions with their business partners and buyers over the net are considered.

20

that the Internet-using population has grown large enough to become a potential market size

for any business to set up a shop on web, there are some synergy benefits that traditional

enterprises can obtain from such a new business model. Steinfield, Adelaar, and Lai (2002)

identify four categories of synergy potential benefits for click-and-mortar businesses to

achieve, which are (see Figure 2-5):

1. lower costs, meaning cost savings may occur in labor, inventory, marketing, and

distribution;

2. differentiation through value-added services, which may include loyal program to

be provided either online or in store, or additional product information aids for

consumers;

3. improved trust, which means established firms are able to leverage their familiar

name to make it easier for consumers to find and trust their affiliated online

services;

4. geographic and product market extension; firms may add new revenue generating

21

Figure 2. 5 Sources, Management Requirements, and Benefits of Click and Mortar Synergies. Source: Steinfield, Thomas Adelaar, and Lai (2002)

Many marketing theorists recognize that channel conflicts or cannibalization may occur

when the traditional physical companies start to provide an alternative channel for consumers,

and it makes sense that when a retailer introduce its own e-commerce capability, it potentially

threatens to cannibalize sales from its own physical operations. Because the on-line arena

represents a new distribution channel, conflicts may arise with other, more traditional,

distribution channels. For example, a middleman distributor may protest at having to now

compete with direct sales over the Internet (Otto & Chung, 2000). Thererfore, in practice,

many conventional companies tend to operate its e-commerce channels independently from its

existing physical channels, attempting to gain additional advantages from the Internet without

too much extra costs. However, there are some resources in a company that can be shared

by both physical and Internet channels, such as logistics systems, IT infrastructures,

marketing and sales assets such as product catalogues or advertisement (Steinfield, 2010). If

the company can run its e-commerce channel properly and provide different values in the two

22

III. 7-11 Background Introduction

As the leading convenience store in Taiwan, 7-11, or PCSC (President Chain Store

Corporation), has been a popular research subject in both commercial and academic field. Its

diversified product offerings have been well-acknowledged in the market; many of them were

first-movers and have successfully boosted up sales in a short period of time. The following

paragraphs review its early development and its recent expansion, and how it has built up the

back-end resources sufficient to transit from conventional brick-and-mortar convenience store

to a brick-and-click business model. The history of 7-11 is long and complicated since it

involves more than 40 subsidiaries and affiliates. This chapter, however, will mainly focus on

those milestones that are related to its early e-commerce development and 7Net.com, the

own-branded shopping website that plays an important role in its click-and-brick business

model.

3.1 7-11‘s Brick-and-Mortar Evolution in Taiwan

7-11 Taiwan was a subsidiary company of Uni-President Enterprises Corporation,

established in 1978. Back to the 80s, when the economy was still in early developing stage, it

was not easy to sustain a convenience store business in the local market. Starting from the

first year, 7-11 was at loss in consecutive seven years and was once merged back to

Uni-President Enterprise as a only a department of the mother company in 1982. After a series

of policy adjustment and implementation of its channel management, 7-11 was back on the

right track; it had expanded to 100 stores in 1986 and reached it break-even point for the first

time. In 1990, with revenue of NTD 10.8 billion, 7-11 has officially become the leading

23

franchises has grown exponentially ever since; it reached its first 1000 stores in 1995, Since

then, 7-11 has expanded at a pace of approximately 1000 stores every 3 year . In 2006, there

are over 4380 stores in Taiwan; in 2011, the number has reached 4750 (See Figure 3-1).

Figure 3. 1 The Store Expansion of 7-11 in Taiwan

Source: 7-11 Corporate Information (Public Disclosure)

The reorganization of Uni-President Enterprises in 2002 was the turning point for 7-11‘s

expansion. By function, all the subsidiaries were formed into four sub-groups: Manufacturing,

Logistics, Trading and Holdings. 7-11 becomes the leading company among the 42

companies in Logistics Sub-group, integrating retail and logistics-related subsidiaries to share

all the resources and create synergy. The Logistics Sub-Group mainly comprises of four

different types of companies: Supportive, Retailers, Non-Retailers, and Overseas Holdings

(林盈芊, 2008). Retail Support International (RSI), Wisdom Distribution Service, UPCC and

PLIC are the major couriers/logistics sub-companies to support 7-11 and ensure the deliveries

are on time. Since then, 7-11 were able to provide innovative services to consumers by

leveraging these sub-companies, mainly related to e-commerce. For instance, 7-11 started to

24

this: Books.com.tw places buffer stocks in RSI; after consumers confirm order on

Books.com.tw and designate which chain store they would like to pick up the purchases, RSI

completes sorting and packaging, and then Wisdom Distribution Service delivers the orders to

the 7-11 stores designated by consumers. Consumers no longer need to pay by credit card or

ATM in advance; the flow allows consumers to pay cash when picking up the purchase in the

store. Since then, Books became the first online bookstore that offers ―cash upon pick-up at

convenience store.‖ In the past, online payment mechanism were mainly through ATM and credit card, which might cause information leak and therefore consumers would have to bear

the risk when transacting online. This innovative service has solved consumers‘ concern about

privacy issue, and made consumers more willing to try online shopping. Consumers are not

the only people benefit from this service; this new partnership between Books.com.tw and

7-11 also created a win-win situation: Books gained more sales through this new channel;

7-11 gained more walk-in potential consumers in its physical stores. The pick-up service was

a success; later in 2007, 7-11 started to expand its partnership to non-affiliated e-retailers (林

寬宜, 2009). Until now, 7-11 has cooperated with over 250 e-retailers and provided them pick-up service, including many sellers at Yahoo or PChome ("7-11 Official Homepage,"

2011). This cross-platform system has made ―cash upon pick-up at convenience store‖ service

more widely accepted by consumers. With such a new business model, 7-11 is no longer only

a physical convenience store; it becomes a solution provider for other retail businesses. What

it offers to consumers is no longer only physical products, but also intangible services.

Innovative marketing strategies of 7-11 are widely acclaimed by media and the

government. In 2004, 7-11 has been awarded as ―the Leading Enterprise‖ by Common Wealth

Magazine for consecutive 10 years. In 2004, 7-11 launched its I-Cash prepaid card product;

consumers can top-up and refill cash into a plastic IC card for future transaction in 7-11. This

25

market; up till now, 7-11 has released 9.2 millions of ICash cards; total revenue transacted by

ICash has reached 11 Billion (盧諭緯 & 羅之盈, 2010).

3.2 7-11‘s Early Development of Corporate Shopping Website

Within 20 years, 7-11 has gained full experiences in physical chain store management in

Taiwan. From 2008, 7-11‘s market share in Taiwan has reached 51%, followed by Family

mart, Hi-life, and OK Convenience Stores (2010 台灣連鎖店年鑑, 2010). With such a large

scale, 7-11 has to continuously diversify its revenue model to maintain its growth in a

saturated market. Since it has dominated the conventional physical retail market, there is little

room left for 7-11 to grow significantly (蔡薇欣, 2009). It seems to make sense that 7-11

starts to move on to the e-commerce and find new revenue streams online. In fact, 7-11 did

attempt to start its click-and-mortar business model early; back to 1992, 7-11 developed a

mail order catalog named Uni-mall and set up a simple website in 2000 named 7eShop.com as

its online channel, mainly sold women apparels. Ten years ago, while online shopping

market was still underdeveloped, Uni-mall may be considered one of the first movers and

could have seized its market share. Besides, it had 7-11 as its channel to promote the

shopping website and expand its customer base. However, due to the lack of brand

recognition and clear positioning, the sales has been gloomy for years and could not compete

with the rapidly-growing shopping websites such as Yahoo and PChome. The poorly-managed

website was criticized by the users; reviews about its bad quality of customer services can be

easily found on the online forums (台灣研究院-搜尋引擎優化與行銷, 2009). Without

efficient business model or clear product offering, Uni-mall could not survive in the

ever-changing e-commerce market in Taiwan, even if it had strong back up of its mother

company. In December 2009, Uni-mall shopping website was shut down and became

26 7-11.

3.3 7-11‘s New Attempt for Own-Branded Shopping Website: 7net.com.tw

Uni-mall‘s failure did not stop 7-11 from approaching the B2C e-commerce market in

Taiwan. After a series of internal review, 7-11 decided to make a new plan to go back to the

Internet. In July 11th 2010, the new 7-11‘s shopping website 7Net.com.tw is launched. 7net

becomes the new brand name that is easier for consumers to associate with 7-11 (盧諭緯 &

羅之盈, 2010). The Chief Operating Officer of 7-11, Chien-Nan Hsieh, commented on this new website, ―We have a very clear positioning for our new website, which is the extension, or complementary platform of our physical 7-11 stores. 7-11 will move on to a ―Net Store‖

model; the store is the foundation, while the net is on top of it. 7-11 is no longer only a shop,

but a click-and-mortar platform. In the past, a physical convenience store can display about

3000 items; now, with a virtual extension platform, 7-11 can expand its capacity unlimitedly;

there will be no boundaries between physical and virtual stores for consumers anymore. 7net

will be the gateway to a new brick-and-mortar business model (方巧文, 2010).‖

Currently, 7net has a membership size of around 200 thousands; average spending per

customer transaction is about NT700 (方巧文, 2010). Unlike the previous platform Uni-mall,

which focused on women apparel, 7net.com mainly focuses household goods and wholesale

food and beverage, along with 3C products, women‘s apparel and accessories, and exclusive mail order brands from Japan such as Nissen and Cecil (王貞曄, 2010). There are over 100

thousands of items available online, The main slogan under 7net‘s logo is ―Order Today; Pick Up Tomorrow‖, conveying an appeal of fast delivery. Utilizing the advantages of the dense

7-11 store networks in Taiwan, each store becomes the hub for 7net‘s consumers to pick up

their order from, without minimal purchase amount. Besides convenient delivery method,

27

card when shopping on 7net, as long as consumers have a card reader linked to the internet.

This becomes another unique feature of 7net that no other B2C websites can offer.

Tu-Chang Tsai, the General Manager of Marketing of 7-11, commented on its

membership base, ―the size of the membership base is the key to revenue growth. In the past, Unimall could not successfully gain membership base growth; therefore, it was difficult to hit

the expected revenue. Now, 7net, with clear positioning and innovative marketing strategies,

the membership base is growing ever since (方巧文, 2010).‖

The management team holds great expectation for 7net. According to the press release,

7net‘s estimated revenue in 2011 is NT2 Billion, 4 times of that in 2010. As for product offering, the management team expects to increase its product lines from 100 thousands to 1

millions. In the midterm, 7net aims to reach its accumulated revenue of NT5 Billion in the

upcoming three years.

Figure 3. 2 Homepage of 7net.com.tw Source: 7net.com.tw

28

Figure 3. 3 7net.com.tw‘s Division of Labor Source: Interview with Internal Staff of 7net.com

Figure 3. 4 Flexible Methods Provided by 7net Source: 7net.com.tw

29

Table 3. 1 Chronicle of events of 7-11‘s Development

Year Events

1978 President Chain Store Corporation (統一超商股份有限公司) was established 1983 Started its 24-hour business model

1985 Launched microwave foods and finger food products 1986 Reached the first 100 stores and its break-even point

1990 Became leading retailer in Taiwan (revenue reached NTD10.8 Billion)

1990 Cooperated with Japan and established RSI, the exclusive distribution center for 7-11 1996 Unimall shopping website was launched

1998 Cooperated with China Telecom (中華電信) to launch the first in-store bill collectionTaiwan.

1999 Wisdom Distribution Service (大智通文化行銷股份有限公司) was established

2000 Launched pick-up services with Books.com.tw, later became the main shareholder of Books.com.tw

2002 Re-organization of mother company Uni-President Enterprises; four groups are developed.

2003 Co-funded with Japan and Established Muji Rouhin Taiwan (台灣無印良品股份有限公司)

2004 Launched Icash Prepaid IC card

2006 Launched ibon kiosk, providing in-store service such as printing, scanning, paying bills, ticketing, etc.

2007 Partnered with e-retailers

2008 Rakuten.com.tw (樂天市場) was established 2009 Unimall is closed

2010 Launched 7Net.com.tw as 7-11's own-branded shopping website Chronicle of Events of 7-11's development

30

IV. E-commerce Market Analysis

In the following paragraphs will elaborate current market status and the characteristics

of the main business models in details. A few names will be mentioned frequently, such as

―platform‖, ―e-store‖, and ―online shopping website‖; they all refer to the same thing, which is virtual interface on the Internet for selling and buying products in real-time.

A five-force analysis will follow the market overview as the external analysis and will

be the background of the Opportunities and Threats in SWOT analysis.

4.1 Domestic Online Shopping Market Overview

After the burst of the dotcom bubble in 2000, the online shopping market is booming in

the recent 10 years. According to the research made by MIC, in 2010, the scale of online

shopping market in Taiwan was up to NTD358.3 Billion; this year it is expected to reach

NTD430 Billion. Besides the overall market size, the average spending of individual

consumers has also grown over years. In 2006, the average spending of each consumer on

B2C shopping websites was NTD9103; in 2010, it has increased to NTD9671 (資策會 MIC,

2011). Such a market growth may result from several factors: first of all, the ever-growing

Internet infrastructure has made ―getting online‖ become a daily routine of many and therefore they are willing to try online shopping as a new channel; second, the development of

information security has made consumers more willing to bear the risks it may cause while

paying by credit card online. Moreover, as the market is expanding, more paying

mechanisms are available for consumers; except paying by credit card, consumers can choose

31

or by cash upon pickup in a convenience store. Among the methods, cash upon pickup in store

has been widely accepted; in 2010, the growth rate of this method is 10.7% (MIC, 2010), the

greatest growth among all the methods.

However, not everyone in the competition can dig for gold. Among all the players, only

28.6% can make profits from their online business; 54.9% are still in the red (MIC, 2010).

This may result from the fact that price comparison online is so easy for consumers that the

websites have no choices but to follow the transparent market price. Besides, online forums

and social networks allow consumers to exchange and share their comments freely; very little

information can be hidden on the business side and therefore the profit margin remains low.

To stand out in this perfect competition market, a website has to differentiate itself by

providing add-on services.

Some product categories are rather mature online. Publications (including books and

magazines), accessories and apparels for women, beauty products, computer and peripherals

and 3C mobile devices are the most popular categories selling online (MIC, 2009). These

products have lower average selling price, and are usually standardized. The business model

of an e-store determines how it generates revenue and makes profit. In general, there are three

main business models in Taiwan e-commerce retail market: B2C, B2B2C, and C2C (see Table

4-1). B2C e-stores, or platforms, sell products or services to consumers directly, mostly by

mid-to-large businesses with brand awareness. C2C e-stores are often run by small scale

business or individuals; B2B2C platforms are often comprise of many small-scale e-stores.

32

Table 4. 1 Three Forms of E-business Model in Taiwan

Source: MIC (2009)

Table 4. 2 B2C Online Market Scale In Taiwan, 2005-2009

(Billion NTD) 2005 2006 2007 2008 2009

B2C Market Revenue 60.5 82.4 106.8 133.4 168.9

Growth Rate n/a 36.23% 29.65% 24.89% 26.58%

Market Share 66.11% 61.49% 57.99% 55.82% 54.19%

Share in the whole

retailing industry 1.90% 2.60% 3.30% 3.70% 4.20%

Source: TIE Professional Report for Virtual Retail Industry, 2010/2

2005 2006 2007 2008 2009 B2C 60.5 82.4 106.8 133.4 168.9 Growth Rate 0 36.23% 29.65% 24.89% 26.58% 0% 5% 10% 15% 20% 25% 30% 35% 40% 0 20 40 60 80 100 120 140 160 180 R e ve n u e (B ill io n N TD )

B2C Online Market Scale and Growth Rate in Taiwan (2005-2009)

33

Source: TIE Professional Report for Virtual Retail Industry, 2010/2

4.2 Three Main e-Business Models in the Market

B2C platform

A Business-to-Customer (B2C) platform has a business model analogous to a

brick-and-mortar department store. The trading occurs between the consumers and the B2C

platform; the invoices should be issued to the consumers by the B2C platform, instead of the

product brand name or vendor. A successful B2C platform should have diverse product lines

also a user-friendly interface to provide convenient one stop shopping experience to

consumers. Staffs of a B2C platform are usually positioned as product managers; they may be

in charge of communicating with vendors, optimizing the web pages, designing e-flyers

(eDM), and planning for marketing campaign. In a dominant B2C platform, a product

manager may have to manage up to 20 thousands types of products per quarter. To sell a

product on a B2C platform, a brand name or a vendor usually has to pay the platform a

commission equal to a certain percent of the total revenue or the end-user price. The B2C

platform basically provides product exposure and up front communication with end-users, but

may not be necessarily in charge of logistics.

To look into the logistics of a B2C platform, it can be divided into 2 models (See Figure

4-2): Distribution Center Delivery and Direct Delivery. The former one may be seen as a total

solution for vendors, and will costs higher than the latter since the platform has to bear extra

cost for the distribution center and the rest steps of the logistics such as sorting, packing, and

delivery. If the vendor decides to go with the former model, very likely it will store some

buffer stocks in the platform‘s distribution centre (usually consignment). Based upon consumers‘ requests, the distribution center will deliver the order to door or the designated

34

convenience store. Delivery lead time is usually well controlled, with enough buffer stocks,

many B2C platforms now can guarantee the delivery lead time to be within 24 hours.

From the vendor‘s point of view, since it will be too large an investment to build up its own logistic capability, it tend to outsource logistic flow to the platform; all it has to do is to

make sure there are enough buffer stocks in the distribution center. However, as convenient as

it seems, not every platform is able to provide such model. Renting or building up a

distribution center may be an expensive cost to the platform, so the platform needs a customer

base large enough to support such a cost.

For the vendors that have less business flow or smaller business scale, they might choose

the second model, Direct Delivery. In this model, the platform plays a much simpler role; it

only provides product exposure on the website, and transfers the purchase order to the

vendors. Vendors have to control the inventory, fulfill and pack the order, and handle the

to-door delivery by themselves. Some vendors provide cash upon pickup in a convenience

store. They may have to pay the convenience store partner NTD 20-30 each order from

consumers. If the vendor chooses this service model with the platform, the upfront cost it has

to pay to the platform may seem less, but it has to deal with a few other counterparts such as

35

Figure 4. 2 Common Logistic Flows for B2C Platform in Taiwan Source: Interview with Internal Staff

B2B2C Platform

A B2C2C platform may be considered a domain or a cluster of individual e-stores. It can

be analogous to a physical shopping mall, with a lot of independent stores dealing with

consumers directly. Small-to-mid businesses may set up their own e-stores under the domain

by paying a fixed annual maintenance fee, and a commission equal to certain percent of their

total revenue. A B2B2C platform may give instruction or consulting services, and provide a

basic framework for the stores, but the stores have to design their websites, control their

inventories, and handle logistics by themselves. PCHome Mall is the most popular B2B2C

platform in Taiwan; 30% of the e-stores have their physical stores as well, for instance

well-known bakeries and branded women‘s apparel (MIC, 2009).

36

Customer-to-customer (C2C) e-stores in Taiwan are mainly auction websites. Formally a

platform for selling second hand products, nowadays auction platform has become an e-store

for small businesses or individuals to participate. Most of the C2C platforms in Taiwan

provide services at low cost or free of charge; everyone can post their product information

under the domain.

Rating system is one of the typical features of a C2C platform. Both seller (business) and

buyer (consumer) can rate the other and place comments. Rating system influences customers

decision significantly; sellers with higher rates are considered to be more trustworthy and are

able to draw larger customer base. Yahoo! Auction (75.1%) and Ruten Auction (21.9%) are

the dominant platforms in C2C market (insightxplorer, 2009).

4.3 Major Players in B2C Market

To understand where 7net stands in domestic B2C market, one has to fully understand

those benchmark players. These are the leading B2C platforms that have been in the market

for long and possess their own competitive advantages.

4.3.1 Yahoo! Shopping

Yahoo! Shopping (buy.yahoo.com.tw, hereinafter ―Yahoo Shopping Taiwan) was

established in 2002, formerly known as Monday Technologies; it is acknowledged as a mega

virtual department stores. As the survey made by MIC in 2007, Yahoo Shopping Taiwan is

ranked as ―the Most Frequently Visited Website‖ by the Internet users in consecutive four years. It carries over 400 thousands of products, 13 product categories, and cooperates with

over 2500 vendors (7-11 official website). To keep the fixed cost light, Yahoo Shopping

37 vendors only.

Under the domain name of Yahoo Taiwan, the most popular domestic portal website,

Yahoo Shopping Taiwan enjoys the greatest reach among all the domestic B2C platforms.

According to Alexa.com, Yahoo.com has a daily reach about 25 worldwide (meaning every

day there are 25% of the global Internet users browsing Yahoo.com); 0.2% of the users visit

Yahoo Shopping Taiwan, meaning that on the average, per day there are 0.0498% of the

global Internet users visiting Yahoo Shopping Taiwan. The total number of global Internet

With such a large traffic, Yahoo Shopping Taiwan seizes a large share of B2C online shopping

market in Taiwan.

38 4.3.2. PChome Online Shopping

PChome Online Shopping is the second most popular portal website in Taiwan

(Alexa.com). Established in 2000, PChome Shopping is the first B2C platform. As a large

scale domestic B2C shopping website, PChome Shopping carries all types of products that are

similar to those of Yahoo Shopping Taiwan, but it claims to be the largest 3C products channel

in Taiwan. According to Alexa.com, on the average there is 0.016% of the total global Internet

users browse Pchome Shopping, about one third of that of Yahoo Shopping Taiwan (Pchome

Shopping official website).

In 2007, PChome launched its ―delivery within 24 hours‖ to distinguish itself with the

competitors. To control its strict lead time, PChome rents a distribution center in Taoyuan,

Taiwan. The total operating cost may be much heavier than that of Yahoo Shopping Taiwan,

but the logistics quality can be closely monitored; sufficient buffer stocks, organized sorting

systems, and scheduled delivery shifts minimize bottlenecks and reduce errors in the flow.

39 4.3.3. Other Platforms

Momo (momoshop.com.tw) was established in 2004, the first TV shopping channel

expanding to B2C e-stores and physical stores. Founded by Fubon Finance, Momo

aggressively started its retail business by building its TV shopping channels, publishing its

mail order catalogs, and setting up its B2C shopping website in 2005. In 2008, Momo

expanded to physical chain stores; it has become the only retail store that covers both virtual

and physical channels (Momoshopping Official website).

Momo TV Shopping specifically targeted at housewives and office ladies over 30

years old, which is a target audience completely different from the Internet shoppers in

Taiwan. After entering to B2C e-stores market, Momo strives to seize younger segment. With

sufficient experience in TV shopping, Momo has become one of the major B2C players and

considered a direct threat to 7Net. In terms of traffic, currently Momoshop.com.tw ranks as

26th website in Taiwan, 3rd B2C shopping website (after Yahoo Shopping Taiwan and PChome

Shopping) (Alexa.com).

Books.com.tw was established in 1995 and was the first online bookstore in Taiwan and

Greater China (Books.com.tw official website) In 1999, it started to run its own distribution

center; in 2001, 7-11 invested a large share in Books.com.tw and became the biggest

shareholder. The website is considered a subsidiary of 7-11 since then.

Books.com.tw started with selling only publications (books, magazine, and audio, video

products) online, but now it has expanded to carry over 4.2 million types of products, from

beauty products, 3C products to e-ticketing. However, publication still holds the largest share

of its revenue. For its constant lower price compared to brick-and-mortar bookstores,