Turning Point of Hong Kong Apparel Industry: Knowledge for New Challenge

全文

(2) [2] (Barnes & Lea-Greenwood, 2006). Mass communication allows consumers access to up-to-date information about trends and styles. Responding to changes in customers’ life style and preference, the characteristics of fashion items have a short life cycle, high volatility, low predictability, and high impulse purchasing [5, 3] (Christopher M, Lowson R & Peck H 2004; Bruce & Daly, 2006). The product life cycle of fashion items, according to the US National Retail Federation [19], is approximately 10 weeks. The result is a fashion industry characterized by extensive and diverse sources of uncertainty due to fluctuating demand from fashion and seasonal changes and large variances in style preferences. In response to market instability, apparel firms need to act or react to the changes in customer preference quickly and with high flexibility in costs, variety, quality, and prompt delivery.[7] (Duclos, Vokurka & Lummus 2003). To meet the demands of the market, companies in the apparel industry are increasingly using time as a factor for enhancing competitiveness. Shortening the product development cycle, therefore, has become an important business target. “Agility” is a means of achieving competitive advantage for apparel firms. In fact, the success of many Asian New Industry Countries (NIC) firms has been their capacity for meeting changing demand volumes, prompt and precise commercialization of new styles, and fast and timely delivery. Responding to the demand for fast fashion in the global apparel market is another business strategy. Companies in the Far East are becoming increasingly adept at moving from the OEM to incorporating design [3] (Bruce & Daly, 2006). The fast fashion business trend, for example in the UK, takes more than 12% of the market share [2] (Barnes & Lea-Greenwood, 2006). This new business model, indeed, has potential to grow because retailers have an opportunity to keep a low inventory level. Christopher and Towill’s study also reflects an effective solution to fast fashion by establishing an agile supply concept [4] (Christopher, Towill 2001). The market winners, particularly for unpredictable situations, should manage the short lead time to supply products in order to sustain competitiveness [13] (Mason-Jones, Naylor, Towill 2000). Research work by Tyler, Heeley and Bhamra [17] (2006), identified seven significant blocks which have influence on new product development in fashion: fabric trade shows, availability of fabric, forecasting, late-stage product changes, geographical proximity to markets, fashion trends, and inventory. The study done by Simatupang, Sandroto, and Lubis indicates that [15] (2004) the deficiency of a product development process comprises an uncertainty of fabric performance matched with the working board of a design and specifications that conform to engineering requirements. With these deficiency factors, the design process is prolonged. This is due to the remaking of prototype samples several times and therefore creating a process that requires 21 weeks before the selection of designs is complete and ready for production. In other words, the product development process requires streamlining by eliminating duplicate processes and setting collective specifications and approval standards between designers/brand houses and textiles suppliers, and between designers/brand houses and garment manufacturers, in order to compress design development time. These studies offer implications to the Hong Kong apparel industry to formulate a new business model in future. 3.2 Critical Successful Factors for Future Business In Jin’s study of the apparel industry in East Asian NICs, he. presents three critical factors to respond to this new business challenge: global brand supply, global sourcing on behalf of buyers, and agility [12] (Jin 2004). Apparel is a buyer-driven commodity [11] (Geriffe 1999). The principal profits are mainly in marketing, retailing, and design-activities typically retained in core countries. The Hong Kong apparel industry has formulated their business model to offer prompt delivery under the OEM business mode for decades. Since the 1980’s, in order to fit the demand, the industry extensively increased their production facilities overseas. With a central proximity in East Asia, the trading activities have been actively placed in a key position to help overseas buyers to globally source materials, trimming, and finished goods. Now the keen competition is keeping business transformation at a non-stop pace. The agile supply requires postponed fulfillment and a flexible response to the apparel market [4] (Christopher & Towill 2001). Timeliness has become an important element. To provide postponed fulfillment, lean production is a solution. Other necessary components include helping buyers to shorten product development cycles in order to minimize the risk of market change and eliminate lengthy forecasting. As Jin’s research mentioned, sources of profit in the apparel industry are designs, service, and marketing. The Hong Kong apparel industry in the last few decades has built well-developed production facilities, labour force, and sourcing services. For future development, providing one-stop buying solutions, such as offering product development services in order to release the buyers’ time for focusing on marketing matters, may also strengthen the whole business supply chain activity. The global division of labour, consequently, could be refined to an optimum position. 3.3 Knowledge Management Model for a new Business Ecology With the new business ecology, the existing knowledge, mainly in production operations, quality management, and sourcing, is insufficient to deal with this new challenge [8] (Enright et al 1997). New knowledge, such as product development management with the contents of design, engineering, alteration of product configuration for fitting different market needs, market knowledge, and management skills for handling different issues among the diversified ethics locations; should be acquired. Apart from these, the production process experience and sense of preference of products should be retained. To cope with new business activities, such as the diversification of division of labour in the globalizing production environment, language and general competency, such as problem-solving skills, creativity, and ability to learn independently are important human capital. Education institutes can provide explicit knowledge, which embraces product knowledge, language, and operation management. Tacit knowledge, which is gained through experiential knowledge obtained in the workplace, production process experience, and the development of a sense of product preference, needs an effective knowledge management system in order to acquire and retain existing knowledge that could be lost after the production base transfers to other lower labour cost locations. 4. Methodology In order to draw a general picture of the future development of the apparel industry and the need for knowledge, an eclectic approach is adopted which is comprised of a variety of qualitative and quantitative methods to collect data from the major stakeholder: the employers..

(3) 4.1 Quantitative Data Collection An industry survey conducted aims to: capture the industry’s future development from a company employee perspective, solicit the industry’s view of the knowledge most needed to match their future development, determine the commitment of the industry to prepare for change, if any. To construct knowledge variables, the human knowledge capital model established by Van der Heijden [18] (2002) was adopted. The model suggests five dimensions to identify the knowledge required for work. They are professional knowledge, meta-cognitive knowledge, working skills, social recognition, and flexibility. The randomly selected sample was from the Hong Kong establishments list, which included apparel manufacturers in woven and knitted items and apparel trading companies. The Hong Kong Census and Statistics Department provided the list of establishments. Ninety–one establishments returned useable questionnaires including 51 from manufacturers and 40 from trading firms. Researchers applied factor analysis to identify the knowledge dimension most needed by the industry for its future development and distributed questionnaires followed by two rounds of telephone follow-up. The questionnaire was composed of four sections: 1. respondent’s business background and nature 2. importance of knowledge and skills for satisfying customers’ needs using a Likert five-point scale (5 = very important, 1 = absolutely unimportant) 3. staff development to acquire knowledge for future development 4. size of firm 4.2 Qualitative Data Collection Participatory evaluation approach [6, 11] (Cousins and Earl, 1995; Hansen, 2005) was adopted for the study. Three focus groups with eighteen participants and sixteen individual interviews explored in depth the issues of: business strategies for future development, the expectations of textile and clothing specialisation graduates who will deal with the future development of the industry in the region. 5. Findings and Discussion 5.1 Industry Future Development 5.1.1 One-stop buying solution The findings indicate that the apparel industry intends to sustain its competitiveness by changing its manufacturing strategies from carrying out operations in NICs and extending to offer value-added service. Although some respondents in the study indicated that they had expanded their business to retail in Mainland China, the majority reflected that they have more confidence in transforming their business nature by providing a one-stop buying solution. The company would therefore provide product design and production capacity in different locations in which the price, quality performance, production capacity, and delivery time would fit the needs of their industry buyers. This implies that the business mode has extended from offering labour force and production technology to include market analysis and product development. The industry survey also indicates that although merchandising, sourcing, and production coordinating,. are still major functions of their business activities in Hong Kong offices, nearly half of the respondents from the manufacturing sector are involved in product development and offer designs for their industry buyers. Similarly, over 90 percent of respondents from the trading sector show that their business activities have changed from purely buying and selling commodities to offering more value-added activities, such as directly manufacturing products, providing product development services, and market research information to their clients. Table I illustrates the major business nature of respondents from both sectors. Table I Business nature of Respondents from Manufacturing and Trading Sectors Business Nature Manufacturing Trading CMT* 3 n/a*** OEM 12 n/a ODM** 23 n/a Control Centre 10 n/a Supporting 1 2 5 Trade activities 1 Trade with value-added activities n/a 31 Did not answer 3 Total 53 * Cut, Make, Trim ** Original Design Manufacturing *** Not applicable. nil 38. 5.1.2 Integrating trading and manufacturing business functions The keen competition has led the industry to revitalize itself through the transformation of its business nature. In Section 5.1.1, the findings highlight that both the manufacturing and trading sectors have adjusted their business strategies. The manufacturing sector has tended to add value by offering multiple choices of production location, service related to product development, sourcing, and marketing analysis. Trading firms, on the other hand, have extended their service to provide manufacturing facilities and design for their industry buyers. Both sectors, indeed, tend to lean toward a one-stop buying solution business model. In the focus group discussion, participants from trading firms pointed out that the services of helping their clients source and manage suppliers are insufficient to make the purchase of final products effective. There is a definite need for additional services, such as the provision of market information and new product development and design. In order to keep clients interested in their services, some of the respondents reflected that they had established their own production facilities to satisfy customer need for prompt delivery. The industry survey also indicated that the business functions of the Hong Kong office in both sectors are blurred. In other words, the employees’ capability and required knowledge of work in these two sectors is interchangeable. Table II illustrates the major business functions of the two sectors. The χ2 statistics show that there is no significant difference in the business functions between the two sectors..

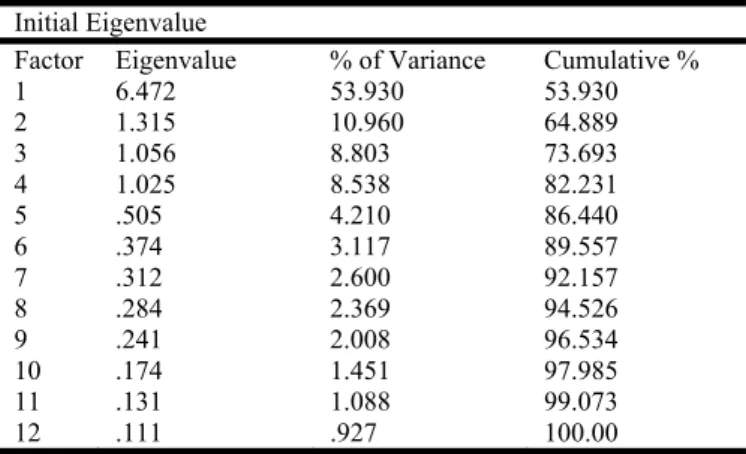

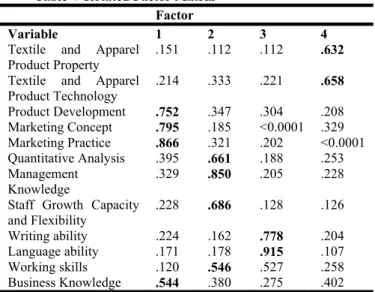

(4) Table II % of respondents’ Hong Kong Office Business Functions# Business Function Manufacturi Trading χ2 ng statistic Merchandising 92.2 90 0.027 Purchasing 86.3 82.5 0.086 Order Processing 84.3 75 0.547 Production 82.4 75 0.364 Coordinating Quality Management 58.8 72.5 1.471 Product Development 49 55 0.355 Market Research 29.4 27.5 0.065 # Offices of respondents may carry out more than one function. 5.1.3 Centre of product development Before the raising of the issue of the phasing out of the quota system, Hong Kong was the centre of OEM and had a business strategy focused on price. The confirmed cancellation of the quota system by 2005 required the formulation of different strategies. Relocation of production facilities was the major strategy in the mid-nineties [14] (Moon et al 1999). The industry, however, reconsidered the appropriateness of the strategy. A revitalization study conducted by the Textile Council [16] (1999) highlighted that developing Hong Kong into a fashion centre is one way to sustain Hong Kong’s competitiveness. The comparative advantages of the Hong Kong Apparel Industry are in production, international trade, and knowledge of the international apparel market [8] (Enright et al 1997). Adler [1] (2004) argues that the liberalization of international trade and globalization processes have restructured the global apparel industry and that industrialized countries are better at retailing business functions while new industrial countries are more cost effective at production. The Hong Kong apparel industry, on the other hand, has acquired more knowledge in product engineering and international trade. It is possible to raise productivity if the division of labour is at an optimum, for example if each location carries out its best comparative advantage. In the focus group discussion, a large American brand house, that originally carried out the work of design and product engineering at home and only contracted out the production operations offshore, has established a new business model that all product development move to Hong Kong in order to save time and costs. A large trading firm has built up a similar business model by offering complete product lines and market analysis for their overseas buyers. Similarly, in individual interviews, fourteen out of sixteen have established their product development centre in Hong Kong. Half of them have their own brand name. Product development centres indeed have the momentum to grow. 5.2 Knowledge for New Business Model With the change in business environment, the industry needs new knowledge to support its repositioned business role. Besides, the formulation of an appropriate knowledge management system, under this situation, it has become important to sustain the lead position of supplying apparel products to the world fashion market. 5.2.1 Knowledge to enhance performance An industry survey regarding contribution to business performance enhancement identified 12 knowledge variables. All have no significant difference at a 0.01 statistical probability level of the homoscedasticity Levene test. A further study in factor analysis adopted all of the variables.. Table III Knowledge Variables Homoscedasticity Levene Test Variabl Description e V1 Textile and Apparel Product Property V2 Textile and Apparel Product Technology V3 Product Development V4 Marketing Concept V5 Marketing Practice V6 Quantitative Analysis V7 Management Knowledge V8 Staff Growth Capacity and Flexibility V9 Writing Ability V10 Language Ability V11 Working Skills V12 Business Knowledge. Statistics P-value 0.733 0.493 0.397 0.789 0.797 0.746 0.478 0.336 0.041 0.143 0.576 0.355. Researchers used factor analysis to uncover the knowledge factor dimension considered by industry as the important contributor to business performance. Four factors were determined with the criterion of an initial eignvalue of more than one and a shared varience of 82.231% of the total variance. The factor analysis results of total variance explained are shown in Table IV. According to the factor loading of the knowledge variables, four factors were named: Product Knowledge, Language Ability, General Competency and Marketing Knowledge. Table V illustrates the factor matrix. Table IV Factor Eigenvalue of Knowledge Variables Initial Eigenvalue Factor Eigenvalue % of Variance Cumulative % 1 6.472 53.930 53.930 2 1.315 10.960 64.889 3 1.056 8.803 73.693 4 1.025 8.538 82.231 5 .505 4.210 86.440 6 .374 3.117 89.557 7 .312 2.600 92.157 8 .284 2.369 94.526 9 .241 2.008 96.534 10 .174 1.451 97.985 11 .131 1.088 99.073 12 .111 .927 100.00 Extraction Method: Maximum Likelihood.

(5) Table V Rotated Factor Matrix Factor Variable 1 2 3 Textile and Apparel .151 .112 .112 Product Property Textile and Apparel .214 .333 .221 Product Technology Product Development .347 .304 .752 Marketing Concept .185 <0.0001 .795 Marketing Practice .321 .202 .866 Quantitative Analysis .395 .188 .661 Management .329 .205 .850 Knowledge Staff Growth Capacity .228 .128 .686 and Flexibility Writing ability .224 .162 .778 Language ability .171 .178 .915 Working skills .120 .527 .546 Business Knowledge .380 .275 .544 Extraction Method: Maximum Likelihood. Rotation Method: Varimax with Kaiser Normalisation. converged in 5 iterations.. 4 .632 .658 .208 .329 <0.0001 .253 .228 .126 .204 .107 .258 .402 Rotation. The factor score mean of the four factors, with the Likert five-point scale (5 = very important, 1 = absolutely not important to business performance) are shown in Table VI. Obviously, product knowledge is the most important knowledge to contribute to business performance. Most of respondents deal with international business, and therefore, language ability is the second most important. On the other hand, marketing knowledge is the least important. Table VI Factor Score Factor Description 1 Product Knowledge 2 Language Ability 3 General Competency 4 Marketing Knowledge. Mean 66.97 65.77 55.26 46.34. The multi-variate analysis shows that there is a statistically significant difference between the respondents, including both trading firms and apparel manufacturers. The respondents who carry out value-added business activities, such as providing product development service and market information, and manufacturers involved in design and product development, indicate the importance of marketing knowledge as 55.20 and 47.92 respectively; higher than the population mean. 5.2.2 Knowledge for future development In the interviews, interviewees reflected that the operation processes are mainly offshore. Their human resource strategy is to employ staff with a technical background locally at the production facility location while employees in Hong Kong require the competency to provide value-added business activities, such as marketing and product development in order to provide a one-stop buying solution to their clients. Therefore, the employees in the Hong Kong office should have marketing knowledge. The industry survey also reflects product knowledge as still the most important knowledge for retention. The findings are very similar to the business model strategy suggested by Adler [1] (2004) that states that even if production is outsourced, product knowledge is still the key factor for the business. The findings also show that marketing knowledge is the second most. important knowledge acquisition for future development. Table VII illustrates the score for the four knowledge dimensions. In the interviews, interviewees pointed out that offering product development, which is inclusive of product design, market analysis, product engineering, and quality management at the stage of developing a new product, is the major trend to compete in the market. With a long history of being OEMs, the Hong Kong apparel industry retains rich tacit knowledge in production operations while it lacks human resources in marketing and product development. Table VII Knowledge for future development Factor Description Weighted score 1 Product Knowledge 187 2 Language Ability 114 3 General Competency 80 4 Marketing Knowledge 119 5.2.3. Employers’ commitment to pursue the new knowledge for change The industry survey indicates that approximately 40 percent of respondent company employees had participated in training related to the employers’ major business activities, such as quality management and production processes, in the last twelve months. Among the training activities, approximately thirty percent of respondents reflected that they had arranged internal training for their employees. Fifty-nine and fifty-seven out of ninety-one indicated that they would prepare resources for frontline and managerial employees respectively in order that they acquire knowledge. The χ2 likelihood probability indicates that there was no significant difference between the manufacturing and trading sectors in terms of knowledge acquisition for their employees. The high percentage of the companies committed to pursuing the new knowledge reflects two important messages from the industry: demand for new technology is high and investing in human resources is paramount. 6. Conclusion The Hong Kong apparel industry is at a cross road of new business ecology. To maintain a substantial share in the global apparel market, the industry needs to formulate a new business strategy to add value to the services provided. This study indicates that the industry intends to improve services in order to offer one-stop buying solutions, apart from those who have established a world brand strategy. The total sourcing solution is becoming a major business strategy. Under the change, new dimensions of knowledge, which include both tacit knowledge, which is the sense of buyers’ product preferences as well as the experience of production process management; and explicit knowledge, such as product knowledge, language, etc., should be managed in a new manner. Agility and lean concepts are needed to integrate into the new knowledge management model. The commitment of the industry to train employees to deal with the new business environment is high. The stakeholders such as industry, educational institutes, and policy makers may need to collaborate in order to formulate a holistic knowledge and human resource management plan for this new challenge..

(6) Acknowledgements We are grateful to all the respondents from the industry who shared their views in this study. Our thanks also extend to the Advisory Committee of the Institute of Textiles and Clothing, The Hong Kong Polytechnic University, who gave us their full support and insightful opinions. References [1] Adler U, Structural change, The dominant feature in the economic developemtn of the German textile and clothing industries, Journal of Fashion Marketing and Management, 8(3), pp300-319, (2004). [2] Barnes L, Lea-Greenwood, Fast fashioning the supply chain: shaping the research agenda, Journal of Fashion Marketing and Management, Vol 10 No. 3 pp259-271, (2006) [3] Bruce M, Daly L, Buyer behaviour for fast fashion, Journal of Fashion Marketing and Management, 10(3) pp329-344, , (2006). [4] Christoper M, Towill D, An intergrated model for the design of agile supply chains, International Journal of Physical Distribution & Logistics Management, 31(4), pp235-246 (2001). [5] Christopher M, Lowson R & Peck H, creating agile supply chains in the fashion industry, International Journal of Retail & Distribution Management, 32(8) pp367-376, (2004) [6] Cousins, B., Earl, L., Theory and practice. The Evaluation Exchange, 1 (3/4), assessed on 1st February. 2007, http://www.gse.harvard.edu/hfrp/eval/issue2/theory.html, (1995). [7] Duclos L K, Vokurka R J & Lummus R R, A conceptual model of supply chain flexibility. Industrial Management & Data Systems, 136(6), pp446-456 (2003). [8] Enright M. J., Scott E E & Dodwell D., The Hong Kong. advantage, Oxford, (1997). [9] Ferdows K, Lewis M A & Machuca J, Rapid-Fire Fulfillment, Harvard Business Review, 82(11), pp104-110, (2004). [10] Gereffi G, International Trade and industrial upgrading in the apparel commodity chain, Journal of International Economics, 48, pp37-70, (1999) [11] Hansen. H., Choosing evaluation models. Evaluation, 11(4), pp447-461, (2005). [12] Jin B, Apparel industry in East Asian newly industrialized countries, Competitive advantage, challenge and implications, 8(2), Journal of Fashion Marketing and Management, pp 230-244, (2004). [13] Mason-Jones, Naylor B, Towill D, Engineering the leagile supply chain, International Journal of Agile Management Systems, 2/1 pp54-61, (2000). [14] Moon, Leung, Chang and Yeung, MFA in transition: manufacturers’ marketing approaches and their perceptions of the future prospects of the Hong Kong clothing industr, Journal of Fashion Marketing and Management, 3(2), pp. 157-165, (1999). [15] Simatupang T M, Sandroto I V, Lubis SB, A coordination analysis of the creative design process, Business Process Management Journal, 10(4), pp430-444, (2004). [16] Textile Council, A vision beyond 2005, The textiles and garment industry of Hong Kong, (1999). [17] Tyler D, Heeley J, Bhamra T, Supply chain influences on new product development in fashion clothing, Journal of Fashion Marketing and Management, 10(3), pp. 316-328, (2006). [18] Van der Heijden, Stimulating lifelong professional growth by guiding job characteristics, 4(2), Human Resource Development International, pp. 173-198, (2001): [19]http://www.nrf.com/content/default.asp?folder=home&file=m ain.htm accessed 20 Nov 2006..

(7)

數據

相關文件

(1) principle of legality - everything must be done according to law (2) separation of powers - disputes as to legality of law (made by legislature) and government acts (by

More than 90% of the leaders reported that the Panel Chair was also expected to ensure that all teachers followed curriculum guidelines, and to review evidence of teaching

An electronic textbook is a comprehensive and self-contained curriculum package with digital print-on demand contents and electronic features (e-features include multimedia

To ensure that Hong Kong students can have experiences in specific essential contents for learning (such as an understanding of Chinese history and culture, the development of Hong

The individual will increase the level of education consumption because the subsidy will raise his private value by the size of external benefit, and because of

The new academic structure for senior secondary education and higher education - Action plan for investing in the future of Hong Kong.. Hong Kong: Education and

Hong Kong: The University of Hong Kong, Curriculum Development Institute of Education Department. Literacy for the

Hong Kong: The University of Hong Kong, Curriculum Development Institute of Education Department. Literacy for the