企業內部稽核人員之道德決策程序之

探討

The Moral Decision-Making Process of Corporate

Internal Auditors

盧正宗1 Cheng-Tsung Lu

國立臺中科技大學會計資訊系

Department of Accounting Information, National Taichung University of Science and Technology

祝道松 Dauw-Song Zhu

國立東華大學企業管理學系

Department of Business Administration, National Dong Hwa University 張允文 Yeun-Wen Chang

國立臺中科技大學財政稅務系

Department of Public Finance and Taxation, National Taichung University of Science and Technology 摘要:2002 年時代雜誌選出的年度風雲人物之一為世界通訊內部稽核主管, 雖然世界通訊最終仍面臨破產,但內部稽核主管基於其職業道德,主動將企 業不法事件舉發給董事會。換言之,內部稽核人員比外部稽核對整體企業營 運方針與作業流程有更深入的瞭解。然而有關稽核人員道德決策之研究,大 部分係以外部稽核為分析標的,甚少有研究探討內部稽核的道德決策程序。 本文以Rest (1986) 的道德發展模式為基礎,整合稽核議題面(道德強度)、 組織面(上級壓力)及個人面(道德成熟度)之影響因素,進而探討內稽人 員之道德決策程序。本研究以臺灣上市、上櫃公司內部稽核人員作為研究對

1 Corresponding author: Department of Accounting Information, National Taichung University of Science and Technology, Taichung City, Taiwan. E-mail:ctlu@nutc.edu.tw

Acknowledgment: The authors would like to thank the Ministry of Science and Technology of Taiwan (R.O.C) for financially supporting this research (NSC 99-2410-H-035-043), and we also thank the English translation from Professor Shaio-Yan Huang (Department of Accounting and Information Technology, National Chung Cheng University).

52

The Moral Decision-Making Process of Corporate Internal Auditors

象,計回收157 份有效問卷,採用結構方程式模式來驗證本研究假說。實證 結果發現:(1)在稽核議題面因素上,道德強度會正向影響內稽人員之道德 判斷;(2)在個人面因素上,稽核人員的道德成熟度亦是影響道德判斷的前 置因素。(3)於組織面因素中,負面的上級壓力會對內稽人員之道德認知與 道德判斷呈現影響。(4)道德認知會影響道德判斷,而道德判斷會影響內稽 人員之道德決策意圖,本研究結果與Rest (1986) 的道德發展模式一致。 關鍵詞:道德決策程序;道德強度;道德成熟度;上級壓力

Abstract: The “Persons of the Year” chosen by Time Magazine in 2002 were three whistle-blowers, one of whom was the internal audit manager of WorldCom. Although WorldCom eventually declared bankruptcy, the internal audit manager had disclosed the illegal practice of the company and reported to the board of directors. Compared with external auditors, internal auditors have significantly better understandings of the familiarity with operation processes. Most of the studies on auditors’ moral decision making focus on external auditors, few studies have examined the moral decision-making development of internal auditors. Based on the moral development model of Rest (1986), this study involves audit issues (moral intensity), contextual factors (obedience pressure), and personal factors (moral maturity) to discuss the determinants affecting the moral decision-making of internal auditors. The research subjects are internal auditors of companies listed on the Taiwan Stock Exchange and Taiwan OTC Exchange. One hundred fifty-seven response questionnaires were collected, and the hypotheses were verified by structural equation model. Empirical results show that: (1) moral intensity has a positive effect on moral judgment; (2) moral maturity is also a critical factor affecting moral judgment; (3) obedience pressure has a negative effect on moral recognition and moral judgment; (4) moral perception affects moral judgment, and moral judgment affects moral intention of internal auditors. Our result is consistent with the moral development model proposed by Rest (1986).

Keywords: Moral decision-making process; Moral intensity; Moral maturity; Obedience pressure

1. Introduction

Since 1997, the Asian Financial Crisis has caused recurrence of fraud in several Asian countries. In the U.S., the Sarbanes-Oxley Act of 2002 was enacted after the bankruptcy of Enron, with the aim to enhance corporate governance, increase the criminal responsibility of stakeholders, and increase the transparency of financial operations. In response, governments of Asian countries also paid much attention to corporate governance, such as the revision of the “Securities and Exchange Act2”, and the “Regulations Governing Establishment of Internal Control Systems by Public Companies3”. In spite of flawless and complete legal regulations and supervision of authorities, serious asset stripping or accounting frauds were reported at short intervals in Asian countries such as Japan, Korea, and Taiwan (Singhapakdi et al., 2008; Oh, Chang and Martynov, 2011; Wang, 2011). However, the reported companies were listed companies with accounts to audit relevant files, independent directors, and complete internal control. Hence, no matter how strong the supervision mechanism or how strict the regulation is, these factors have no immediate and effective prevention effect. On the other hand, the “Persons of the Year” chosen by Time Magazine in 2002 were three whistle-blowers, one of whom was Cynthia Cooper, the internal audit manager of WorldCom (Kelly, 2002). Although WorldCom eventually declared bankruptcy, Cooper had disclosed the illegal practice of the company in an internal audit report and further reported to the board of directors. The company was forced to declare bankruptcy because the whistle-blowing was not given much attention (Kelly, 2002). At last, related parties4 had to fulfill their legal obligation due to the financial fraud. Only the whistle-blower escaped unharmed, free from any legal obligation. Related studies indicate that there must be clues for any kind of fraud. Once fraudulence is spotted, only with active and timely disclosure of

2 The regulation stipulates the implementation of independent director and audit committee. 3 The regulation specifies the design of internal control details, requirements for internal auditor,

and the level of disclosure of “confirmative audit items”.

4 The related parties include the management, accounting manager, financial manager, and even external auditors.

54

The Moral Decision-Making Process of Corporate Internal Auditors

fraudulence from auditors can a company’s loss be reduced (Brennan and Kelly, 2007; Sweeney, Arnold and Pierce, 2010).

In light of the disclosure of fraudulence, auditors are entitled to acquire access, audit a company’s accounts, and evaluate if the processes are reasonable and fair (Christopher, Sarens and Leung, 2009). Compared with accountants (external auditors), internal auditors, hired as employees in a specific department of a company, have significantly better understandings of the familiarity with operation processes, frequency of the internal control assessment, access to confidential data, and the participation degree of major operation and management conferences (Dezoort, Houston and Peters, 2001; Morrill and Morrill, 2003). Besides financial audits, activity auditing, compliance auditing and project audit are also part of internal auditing, and thus plays a supervision role in internal control (Houston and Howard, 2000; Ni, Chuang and Chiou, 2006; O'Leary and Stewart, 2007). In other words, internal auditors should act as the role that prevents the occurrences of fraud in companies and reveals fraud to minimize the loss after frauds appear (Xu and Ziegenfuss, 2008). Unfortunately, there are barely any auditors in Asia who dare to reveal the illegal activities of companies like Cooper did. The main reason for this is not about insufficient expertise, but rather the pressure of not losing the job severely affects auditors’ professional ethics and thus leads to reduced audit quality acts since auditors are hired by companies (Arnold and Ponemon, 1991; Coram et al., 2008). Hence, it is suggested to explore the predisposing factor of whistle-blowing by internal auditors in light of the perspective on moral decision-making development.

Most of the studies on auditors’ moral decision making focus on accounting firms, few studies have examined the moral decision-making development of internal auditors. Based on the moral development model by Rest (1986), past studies consider there are a few steps of moral development process which are “moral perception”, “moral judgment” and “moral intention”. However, Rest’s moral decision-making model is a generalized model ignoring the ethical issues under various environments (like the ethical issues in auditing), and

lacking the determinants affecting different moral steps (Windsor and Ashkanasy, 1996; O'Leary and Stewart, 2007).This study introduces the Issue-Contingent Model proposed by Jones (1991) to inspect the “moral intensity” from the audit issues. Because moral intensity would affect internal auditing quality depend on different types of audit issues. This study integrates the “moral intensity” concept to supplement the inadequacy of past studies. Additionally, some studies inspect the mentioned research issue from personal factors, including demographic variables5. Kohlberg (1984) suggests that these factors affected personal ethics, both innate and acquired. That is to say, “moral maturity” depends on educational learning and the cultivation of social experience. Moral maturity is a person’s conscientiousness to execute or reject a certain behavior (Kurland, 1995). Through literature review and inferential procedures, this paper considers moral maturity as the major cause affecting every step in the moral decision-making process. We employ this factor because previous research ignores its importance. In addition, from the contextual factor, this paper suggests that internal auditors will face negative pressure from whistle-blowing (Brehm and Kassin, 1990; Lord and DeZoort, 2001), which includes the pressure of losing one’s job suggested by Arnold and Ponemon (1991). Therefore, the “obedience pressure” would affect the internal auditors’ moral decisions. This paper also integrates the mentioned views as the determinants affecting moral decision-making process.

To conclude, most of the previous studies target on external auditors from accounting firms, while studies probing into the internal auditors’ moral decision-making development remain scanty. This paper aims at developing amoral decision-making model of internal auditors, and further designs the measurements suitable for moral decision-making process including audit issues aspect, personal aspect and contextual aspect. Based on the moral development model of Rest (1986), we integrate the “moral intensity” affecting audit issues by Jones (1991) to supplement the inadequacy of past studies because the influence

5 Demographic variables include gender (Eynon, Hill and Stevens, 1997; Bernardi and Arnold, 1997) experience (Ponemon, 1995), educational level (Armstrong, 1987; Lampe and Finn, 1992) and personality (Tsui and Gul, 1996).

56

The Moral Decision-Making Process of Corporate Internal Auditors

of moral intensity of the audit issues was always missing. From a contextual aspect, we investigate how obedience pressure affects the moral decision-making process. On the personal aspect, we discuss the influence of “moral maturity” on moral decision-making process. Hence, the empirical results not only serve as the guidance for internal auditors who face moral dilemmas but also act as references for internal auditing associations to strengthen bulletin of norm of professional ethics related to internal auditing. The framework of this paper is to review literature and form hypotheses in Section 2, and describe the methodology in Section 3; at last we propose our research contributions.

2. Literature Review and Research Hypotheses

2.1 Internal Auditing

According to the Standards for the Professional Practice of Internal Auditing announced by The Institute of Internal Auditors (IIA), internal auditing is defined as “an independent, objective assurance and consulting activity designed to add value and improve an organization’s operations. It helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes”. Furthermore, IIA explains in the “Statement of Responsibility of Internal Auditor” that internal auditing is an independent assessment to evaluate accounting, finance, and other operations to provide value to senior management as independent advice. It is a management control which aims at evaluating the efficacy of other control operations. In addition, internal auditing is an independent function in an organization, and its purpose is to evaluate and review the activities of an organization and provide management control services to ensure the efficacy of all control mechanisms (Liao, 2004; Xu and Ziegenfuss, 2008; Christopher, Sarens and Leung, 2009).

Practice of Internal Auditing, the purpose of internal auditing is to assist organizational members in achieving their responsibilities. Internal auditing provides analyses, evaluations, advice, consultation, and information on activities of auditees. Also, internal auditors are responsible for providing information on the appropriateness and efficacy of internal control systems and performance quality. From the academic perspective, scholars have clearly pointed out that the control mechanisms of internal auditing should include the following steps: (1) evaluate if accounting, finance and other operation activities conform with the principle of adequacy, effectiveness and economy; (2) protect the security of assets and record accordingly to avoid losses; (3) assess the level of compliance; (4) assure the reliability of managerial information; (5) conduct a performance assessment of each department and (6) provide advice aimed at improving the operation (Arnold and Ponemon, 1991; Gramling and Myers, 1997 ; Morrill and Morrill, 2003; Chung et al., 2009). In summary, the area of internal auditing includes all activities in a corporation. Abbott, Parker and Peters (2012) suggest that the role of internal auditors should change from traditional auditors to management consulting auditors assisting in the improvement of process, introduction of information system, risk management, and performance measurement.

2.2 Moral Decision-Making Model

2.2.1 Relevant Studies on Moral Decision-Making Model

Early studies of the moral decision-making model mainly focus on marketing ethics (Ferrell and Gresham, 1985; Hunt and Vitell, 1986). In subsequent studies, the moral decision-making model proposed by Rest (1986) is more complete. Rest (1986) discusses the clear stages of the moral decision-making process including the ability to recognize or identify the ethics issues in a management event and judge the moral responsibility of the event then triggering moral intention, and finally generating moral behavior. However, the model proposed by Rest (1986) may not consider the pre-factors from different aspects while compared with the study of Hunt and Vitell (1986), which considers the moral philosophy as the pre-factor of marketing ethics. Nevertheless, most

58

The Moral Decision-Making Process of Corporate Internal Auditors

literatures are based on the concepts of Rest (1986), and “personal factors” are considered as the determinants of the moral decision-making model. These pre-factors include demographic variables (Ponemon, 1995; Eynon, Hill and Stevens, 1997). Some researches may explore this issue from “contextual factors” that include the ethical culture of an organization (Jeffrey and Weatherholt, 1996; Windsor and Ashkanasy, 1996; Bernardi and Arnold, 1997), firm size (Sweeney and Roberts, 1997). To this end, previous studies inspect the moral decision-making process of auditors in individual aspects (“ethical issues in auditing”, “personal”, and “contextual” factors). However, there is no integrated view to be applied in the subject area. Furthermore no complete moral decision-making model is proposed and not much literature address the moral decision-making of internal auditors.

2.2.2 Moral Decision-Making Process of Internal Auditors

Internal auditors are specialists who are hired by organizations to audit if internal control mechanism is implemented effectively. Compared with auditors in the accounting firms, their independence is easily questioned (Arens, Elder and Beasley, 2003). It is more obvious when there is serious malpractice in internal control, there may be flaws existed in the decision-making processes because of ethical dilemmas. On the other hand, most studies only focus on the individual development stages which lack an integrated moral decision-making framework. Arnold and Ponemon (1991) investigate the internal auditor’s “perceptions” of whistle-blowing; results find that internal auditors with lower moral reasoning are less likely to disclose the wrongdoings of the company. Larkin (2000), on the other hand, focuses on the factors affecting “moral judgment”. The empirical results find that female auditors have better judgment of appropriate behaviors than male auditors do, and senior auditors are more sensitive to wrongdoings.

In short, this paper proposes that when any critical internal control fault or fraudulence is discovered, internal auditors tend to recognize whether such a fault or fraudulence causes relevant ethical issues (Arnold and Ponemon, 1991). Then they will judge the event in all aspects, which includes the evaluation of the

influence of such findings and the level of influence of the corporation after disclosure, and they even consider the ethical results of not revealing such an event. So, internal auditors begin their moral judgment to assess the right and wrong of their moral decision. Moral intention will be caused after the judgment (Rest, 1986). Thus, the moral decision-making process of internal auditors also includes moral perception, moral judgment, and moral intention. The hypotheses of this study are as follows:

H1: Moral perception, moral judgment, and moral intention in the moral decision-making model have a positive influence on each other when internal auditors face an ethical situation.

H1a: When internal auditors face an ethical situation, moral perception in the moral decision-making model has a positive influence on moral judgment.

H1b: When internal auditors face an ethical situation, moral judgment in the moral decision-making model has a positive influence on moral intention.

2.3 Relation between Moral Intensity and the Moral

Decision-Making Process

Jones (1991) proposes an issue-contingent model explaining that ethical decisions will differ depending on managerial issues. Hence, “moral intensity” is the degree of relevance over moral or social responsibility that shown in the “management issue itself”. When the potential impact of the issues is higher, there is a higher moral intensity. A higher moral intensity implies that the possibility of illegal practice is lower. For example, when internal auditors discover the misrepresentation of financial statements is beyond materiality and has a serious impact, they will disclose the issue in the internal audit report with a higher moral intensity. Jones (1991) indicates six factors composing moral intensity:

(1) Magnitude of consequences: It is the magnitude of consequences of how a person handles managerial issues. When the magnitude is higher, moral

60

The Moral Decision-Making Process of Corporate Internal Auditors

intensity is positively affected.

(2) Social consensus: The social consensus climbs higher if a person’s action is closer to the social standard (e.g. law, morality) when facing an ethical dilemma. A higher social consensus means a higher moral intensity. For example, internal auditors should disclose any wrongdoings according to the internal control system and then provide suggestions. This is an ethical decision that meets the social consensus.

(3) Probability of effect: The moral intensity of a managerial issue is higher if the probability of a negative result is higher. Assuming the auditors find that the liabilities of a corporation are greater than its assets, the probability of discontinuance of business is higher, meaning the managerial issue will cause a higher moral intensity of the auditors.

(4) Temporal immediacy: The moral intensity caused is higher when the interval between “occurrence time” and “process time” of a managerial issue is smaller. For instance, if the behavior has no harm in a short period of time, its temporal immediacy is lower. When the immediacy of damage is higher, that means the managerial issue can cause a higher moral intensity of the auditor. (5) Proximity: This is a moral agent’s solicitude for sufferer on recognition of

managerial issues. Higher proximity means higher moral intensity.

(6) Concentration of effect: Assuming the seriousness of the result is unchanged, higher concentration of the effect means higher moral intensity. For example, the effects of stealing $10,000 cash from a certain person are the same as the effects of swindling 100 people out of $100 each; but the former has a higher concentration, so the moral intensity caused will be higher.

Coram et al. (2008) indicate that the moral intensity is founded on a proportionality basis6. We should then focus on the moral responsibilities and the magnitude of consequences of decreased audit quality of auditors. For instance, inappropriate audit opinion causes higher moral intensity, because such behavior

6 For example, the good and evil of moral responsibilities, urgency, influence and probability of results, etc.

may affect the decisions of stakeholders. For this reason, moral intensity will control the auditors with their professional ethics. Internal audit issues with higher moral intensity indicate the influence of the damage is higher; the probability of occurrence, immediacy, and concentration of the effect are higher; or there is a higher proximity between the social norm and sufferer. Hence, the internal auditor’s moral perception of such an issue is affected. The internal auditor will then ponder the magnitude of consequences of inappropriate auditing reports and one’s legal and moral responsibilities (judgment). The moral intention generated will be higher. Thus, the hypotheses are as below:

H2: When internal auditors face an ethical situation of the audit issue, moral intensity will affect each stage of the moral decision-making process.

H2a: The higher the moral intensity of the audit issue, the higher the moral perception of internal auditors.

H2b: The higher the moral intensity of the audit issue, the higher the moral judgment of internal auditors.

H2c: The higher the moral intensity of the audit issue, the higher the moral intention of internal auditors.

2.4 The Influence of Moral Maturity on Moral Decision-Making

Process

Moral maturity is the recognized responsibility of a person on executing or rejecting a certain behavior (Kurland, 1995). It is affected by congenital and acquired factors like age, education, experience, and social values (Kohlberg, 1984). A person with higher moral maturity has basic moral responsibilities and has better judgment on the choice of good and evil. Moral maturity reflects the various principles of a person’s judgment of right and wrong. People with higher moral maturity have prosocial behavior, so they usually make decisions that adhere to moral rules. Conversely, people with lower moral maturity are

62

The Moral Decision-Making Process of Corporate Internal Auditors

self-interested people who only focus on their own interests and well-being (Kurland, 1995).

This paper infers that internal auditors with higher moral maturity will obey the auditing standards, laws and regulations; they also will evaluate audit results in an honest, objective and unprejudiced manner. Compared with internal auditors with lower moral maturity, these more morally mature auditors pay attention to the moral perception of audit issues. Their moral judgment considers all interested parties rather than solely the interests of themselves or employers (Lampe and Finn, 1992). Thus, internal auditors with high moral maturity will survey the influence of reducing audit quality, which then positively affects their moral judgment. High moral maturity also decreases the intention of unethical behaviors. These auditors tend to act properly as a result of their moral intention. Thus, the hypotheses are as below:

H3: When internal auditors face an ethical situation of the audit issue, moral maturity will affect each stage of the moral decision-making process.

H3a: Higher moral maturity of internal auditors has a positive influence on their moral perception.

H3b: Higher moral maturity of internal auditors has a positive influence on their moral judgment.

H3c: Higher moral maturity of internal auditors has a positive influence on their moral intention.

2.5 The Influence of Obedience Pressure on Moral

Decision-Making Process

From the contextual aspect, relevant studies point that external auditors from accounting firms might exhibit dysfunctional behaviors when facing various negative pressures (Ponemon, 1992; Windsor and Ashkanasy, 1995; Tsui and Gul,

1996; DeZoort and Lord, 1997). These negative pressures mainly come from supervisors (DeZoort and Lord, 1997). Obedience pressure occurs when supervisors issue inappropriate commands or instructions due to their authority that then affect the behavior of their subordinates. Otley and Pierce (1996) find that supervisors might meddle in the time budgeting of external auditors in order to reduce the auditing costs. The object of analysis for the current paper is internal auditors who are hired by corporations. Though their process standards are prescribed by regulations, the supervision department (e.g. the board of directors) can meddle in the contents of internal audit reports so as to prohibit the disclosure of any mistakes to maintain the corporation’s image, interests, and stock price (Liao, 2004). Due to asymmetric information, the stakeholders apply the internal control statement to understand the effectiveness of control environment, risk assessment, information and communication, supervision, and control activities; and such a statement can be a reference of future decision-making (Xu and Ziegenfuss, 2008). So, the Obedience pressure of the internal audit department has a more significant influence on the stakeholders than the accounting firm. In a word, there will be dysfunctional behavior if supervisors give negative pressure or cover up any mistakes in the internal audit reports. The moral perception of internal auditors on the audit issues will be affected negatively; auditors will believe they should cover up the mistakes of internal control to maintain the company’s image and interests.

The invisible, indirect potential pressures (the possibility of unemployment, losing the chance of promotion) will force internal auditors to eliminate audit reports that are unfavorable to corporations. Coram et al. (2008) point out auditors might reduce the audit quality, such as reducing the sampling ratio, rejecting (no sampling) awkward-looking items, and reducing the collection of audit evidence. The audit reports avoid the importance and dwell on the trivial, which makes the design and execution of internal control look good. In fact, the inference is similar to most of the fraud that happened in Taiwan, because the internal control statements of these corporations were positive before fraudulence was exposed. Asset stripping and fraud happen overnight, thus significant deficiency for a long time has been discovered. To conclude, this paper infers that the professionalism

64

The Moral Decision-Making Process of Corporate Internal Auditors

of internal auditors is not the major reason for this situation (positive statement of internal control, but serious fraud happens); internal auditors may reduce the audit quality due to the potential obedience pressures mentioned above. Under this circumstance, internal auditors seem to lack the sufficient moral perception on “audit issues”. Hence, this paper puts forth the below hypothesis H4a.

H4a: Higher obedience pressure of internal auditors affects their moral perception.

DeZoort and Lord (1997) conduct an experiment of 146 auditors and found that obedience pressure directly affected their professional judgment during auditing, including the confirmation process of accounts receivable and observation of stocktaking. Hence, obedience pressure would affect the auditing judgment. This study infers that when the internal auditors face these negative pressure (the possibility of unemployment, losing the chance of promotion), the invisible pressures will also force internal auditors to make inappropriate auditing procedures, such as reducing the sampling ratio (DeZoort and Lord, 1997), rejecting (no sampling) awkward-looking items, and reducing the collection of audit evidence (Coram et al., 2008). In other words, obedience pressure has deeply influenced the internal auditors’ moral judgment. Thus, the hypotheses are as below:

H4b: Higher obedience pressure of internal auditors affects their moral judgment.

3. Research Methodology

3.1 Conceptual Research Framework

The purpose of this paper is to investigate the moral decision-making model of internal auditors. This paper discusses the factors affecting the moral

H3a

decision-making process from the audit issue, personal factors, and contextual factors. Based on the moral decision-making model of Rest (1986) and the “audit issue” proposed by Jones (1991), this paper integrates “moral intensity” to inspect its influence on the moral decision-making process. From the contextual factor, this paper enhances the shortcomings of previous studies caused by the ignorance of “obedience pressure”. From the personal factor, this paper focuses on the influence of “moral maturity” on the stages of moral decision-making. The overall conceptual research framework is illustrated as Figure 1.

Figure 1

Conceptual Research Framework

3.2 Research Design and Sampling

This paper collects data by two methods: (1) empirical analysis is conducted through the use of a “questionnaire survey”; (2) the author interviews the internal audit managers and auditors after the questionnaire survey and statistics analysis. Research object is the internal auditors of companies listed in Taiwan Stock Exchange and Taiwan OTC Exchange. We have conducted a

H2c H2a H3c H4a H2b H1b H1a H3b Obedience Pressure Moral Maturity Moral Perception Moral

Judgment Intension Moral

Moral Intensity H4b

66

The Moral Decision-Making Process of Corporate Internal Auditors

pre-test of our questionnaire on 15 internal auditors from different listed companies. The major purpose is to adjust and clarify any ambiguous measurement items as an adjustment reference for formal questionnaire. Later, the questionnaire is sent to the research objects directly and a follow-up process is carried out via phone calls and emails after 3 weeks. This paper refers to the suggestion and assistance of the Taiwan Branch of IIA; we sent out 800 questionnaires and collected 176. Eliminating 19 invalid questionnaires, 157 of them are effective, and the response ratio is 19.63%. Table 1 shows the demographics analysis result of this research.

3.3 Operational Definition and Measurement of Research

Variables

3.3.1 Moral Intensity

Moral intensity is the divergence on the moral perception on different managerial issues, which includes six elements: magnitude of consequences, social consensus, probability of effect, temporal immediacy, proximity, and concentration of effect (Jones, 1991). This paper modifies the six measure items of Singhapakdi, Vitell and Kraft (1996) and integrates the job nature of internal auditors suggested by Arnold and Ponemon (1991) and audit issues suggested by Coram et al. (2008) as our test situations. We then measure the respondents’ moral intensity on following audit issues. The issues are described below:

“Internal auditing is an independent, objective assurance and consulting activity designed to add value and improve an organization’s operations. So, internal auditing is part of the management control system, and its duties include: (1) assess whether or not the financial reports, operating activities, and compliance is executed according to the internal control; (2) determine whether there is any independent evaluator for the internal control self-assessment; (3) carry out internal auditing activities as the senior managers request; (4) Other managerial consulting services. Although internal auditors are hired by corporations, they have to report and declare the internal audit reports to the

competent authorities. Taking the sustainable development into consideration, the internal audit report should be divided into two categories (“internal use” and “external use”). The ‘internal use report’ is the report based on the real audit results or project audit for top management. It aims to provide a reference for real operation rather than disclosing to the public. On the contrary, the ‘external use report’ is to meet the requirements and regulations of the competent authorities. Only auditing samples that meet the requirements are chosen, or only those operation activities or accounts that can avoid major mispresentation are chosen for audit. Thus, external use report only audits the surface of activities instead of the nature of facts. In other words, the ‘external use report’ only discloses part of the minor mistakes of the corporation, or states the internal control is under regulations in order to protect the corporation’s interests.”

There is a non-judgmental assumption in the aforesaid discourse, please answer the following questions based on the previous statement: (1) If the mentioned behavior will cause any losses, I think the internal auditors will cause a huge damage to the shareholders; (2) I think most of the people in society disagree with what the internal auditor does, mentioned before (social consensus); (3) I think the probability of causing damage by the internal auditor’s behavior is not high; (4) I think the behavior will have any damage to the others in short-term; (5) I think the internal auditor should understand his behavior is wrong when facing the shareholders or creditors of a corporation; (6) I think if damage is caused because the stakeholders believe in the information on an internal audit report, the behavior will only cause negative impact to the minority (reverse question). The Likert seven-point scale is employed in this study; this scale asks the respondents to circle from 1-7 to represent their level of agreement. Singhapakdi, Vitell, and Kraft (1996) also use this scale to measure the moral intensity proving it has a high internal consistency (Cronbach’s α = 0.75).

68

The Moral Decision-Making Process of Corporate Internal Auditors

Table 1

Demographics Analysis(N=157)

Attribute Description Number of Samples Percentage

Gender Male 57 36% Female 100 64% Age Below 30 13 8% 31-40 72 468% 41-50 53 348% Above51 19 128% Education Level

Below vocational school 8 5%

College 113 72% Master or above 36 23% Job Category Traditional manufacturing 53 33% Service 18 12% Trading 12 8% High technology 62 39% Others 12 8% License None 58 37% CIA 92 58% CPA 1 1% Others 7 4% 3.3.2 Moral Perception

Moral perception means the moral decision-makers start to realize the existence of ethical issues (Rest, 1986). This paper assesses moral perception according to the previously mentioned “ethical issues of internal audit.” Hence, we modify the items suggested by Rest (1986): (1) I think in the previous statement, the internal auditor has already involved the controversial issues on moral values; (2) I think the nature of the aforementioned internal auditing is closely related to morality. Likert seven-point scale is employed in this scale,

which asks the respondents to circle from 1-7 to represent their level of agreement.

3.3.3 Moral Judgment

Moral judgment is the overall assessment or the degree of recognition of the ethics decision-maker when one realizes there is an ethical issue (Rest, 1986). This should include multiple dimensions of measurement items such as moral/immoral, right/wrong, and good/evil (Reidenbach, Robin and Dawson, 1991). This paper judges according to the previously mentioned “ethical issues of internal audit” and modifies the scales developed by Rest (1986) and Reidenbach, Robin, and Dawson (1991). The items include: (1) I think the behavior of the internal auditor is wrong; (2) I think the behavior of the internal auditor is immoral; (3) I cannot agree with the behavior of the internal auditor. The Likert seven-point scale is employed here; this scale asks the respondents to circle from 1-7 to represent their level of agreement.

3.3.4 Moral Intention

Moral intention is the inclination and intention of whether or not to act following a moral judgment when one is made (Jones, 1991). This paper relies on the judgment result of the previous mentioned “ethical issues of internal audit” and integrates the scales developed by Rest (1986) to inspect the moral intention. The items include: (1) I have once chosen samples which meet the internal control and regulations to protect the corporation’s interests (reverse question); (2) I think I should avoid auditing the operation activities or accounts that may have major misrepresentation due to the sustainable development of the corporation (reverse question); (3) I should audit justly to fulfill the interests of the external interested parties (e.g. shareholders, creditors); (4) Overall, I can report and disclose all audit results honestly and completely. The Likert seven-point scale is employed here; this scale asks the respondents to circle from 1-7 to represent their level of agreement.

3.3.5 Obedience Pressure

This paper defines obedience pressure as that experienced by a person who alienates themselves from supervisors, or top management on the job, or comes into conflict with these people, and further causes their own perceptual load

70

The Moral Decision-Making Process of Corporate Internal Auditors

(Ponemon, 1992; Windsor and Ashkanasy, 1995). The measurement items of obedience pressure are modified from Lord and DeZoort (2001). They include (1) supervisor requests the auditing department to adjust the inappropriate terms and contents in the internal audit reports; (2) supervisor will turn back any internal audit reports that have negative descriptions of the corporation; (3) Overall, supervisor is very concerned with the negative auditing items reported to the competent authorities; (4) I am worried about “my promotion” if I show any auditing reports that are against the corporation’s interests; (5) I am worried about my “job protection” if I show any auditing reports that are against the corporation’s interests. The Likert seven-point scale is employed here; this scale asks the respondents to circle from 1-7 to represent their level of agreement. 3.3.6 Moral Maturity

Moral maturity is one’s recognized conscientiousness to execute or reject a certain ethical behavior (Kurland, 1995). The measurement items are based on Defining Issues Test (D.I.T.) suggested by Rest (1986) to test the moral maturity of the respondents. Moral maturity is assessed by three stories that the respondents have to answer. There are two parts: one is rating of importance, and the other is ranking of importance. There are seven grades for the “rating of importance.” For the “ranking of importance,” respondents are asked to choose from “the first importance” to “the least importance” according to their degree of importance. The moral maturity is scored by weighted scoring. The D.I.T. scale has always been employed by auditing researchers, including Arnold and Ponemon (1991), Lord and DeZoort (2001), and Coram et al. (2008), to inspect the moral maturity of auditors.

4. Empirical Results Analysis

4.1 Descriptive Statistics Analysis

coefficient analysis, respectively. The averages are above 4.07, and the standard deviation is between 0.42 and 1.39. For the Pearson correlation coefficient, the coefficient of each variable is below 0.5, which is roughly the same as our hypotheses’ direction. There is no major collinearity problem (Kerlinger, 1986).

Table 2

Descriptive Statistics Analysis

Variable Mean Standard Deviation

Moral Perception 6.23 0.42 Moral Judgment 5.76 0.58 Moral Intention 5.88 0.55 Obedience Pressure 4.07 1.39 Moral Intensity 5.94 0.46 Moral Maturity 6.01 0.45 Table 3

Pearson Correlation Coefficient Matrix

(A) (B) (C) (D) (E) (F) Moral Perception(A) 1.000 Moral Judgment(B) 0.402 *** 1.000 Moral Intention(C) 0.477 *** 0.330 *** 1.000 Obedience Pressure -0.032 *** -0.079 -0.188 ** 1.000 Moral Intensity(E) 0.485 *** 0.239 *** 0.309 *** -0.024 1.000 Moral Maturity(F) 0.414 *** 0.189 ** 0.451 *** -0.070 0.344 *** 1.000 Note:*p < 0.1;** p < 0.05;*** p < 0.01

72

The Moral Decision-Making Process of Corporate Internal Auditors

Table 4

Confirmatory Factors Analysis

Variable Item Factor Loading (λ) Measurement Error (ε) Composite Reliability Variance Extracted Cronbach’s α Moral Perception 1 0.80*** 0.36 0.81 0.52 0.80 2 0.84*** 0.30 3 0.56*** 0.69 4 0.65*** 0.58 Moral Judgment 1 0.50*** 0.762 0.51*** 0.84 0.50 0.50 0.61 Moral Intention 1 0.61*** 0.63 0.76 0.54 0.75 2 0.64*** 0.59 3 0.73*** 0.47 4 0.64*** 0.59 Obedience Pressure 1 0.66*** 0.57 0.90 0.69 0.90 2 0.66*** 0.57 3 0.97*** 0.06 4 0.96*** 0.08 Moral Intensity 1 0.72*** 0.49 0.85 0.65 0.84 2 0.71*** 0.50 3 0.80*** 0.36 4 0.80*** 0.36 5 0.50*** 0.75 6 0.53*** 0.82 7 0.60*** 0.64 Moral 1 0.66*** 0.57 0.61 0.54 0.61 2 0.57*** 0.68 3 0.51*** 0.74 Note :*p < 0.1;**p < 0.05;***p < 0.01

4.2 Reliability and Validity Analysis

This paper employs the Cronbach’s α coefficient to analyze the reliability between the variable scales. Moreover, we adopt the suggestion of Cuieford (1965) and Nunnally (1978). If Cronbach’s α coefficient is greater than 0.7, there is high internal consistency; on the contrary, if the Cronbach’s α coefficient is lower than 0.35, the internal consistency is low. A coefficient between 0.35 and 0.7 shows fair reliability. The coefficient for moral judgment is 0.61, moral maturity is 0.61, and others are above 0.70. This paper also analyzes the composite reliability and variance extracted by Confirmatory Factor Analysis (CFA). As shown in Table 4, the composite reliability of variables in this paper is above the 0.6 acceptable level, and variance extracted is also above the 0.5 level (Fornell and Larcker, 1981). Hence, the analysis result implies the internal consistency is within the acceptable range.

For the validity, good convergent validity should have: (1) factor loading above 0.5 and should reach the significance level; (2) composite reliability should exceed 0.6; (3) variance extracted should exceed 0.5 (Fornell and Larcker, 1981). After eliminating items with factor loading lower than 0.5, the result shows one load-factor. The first-order factor analysis for the model displays that the goodness of fit for this model are GFI=0.90, AGFI=0.89, NFI=0.89, CFI=0.92 which are all above 0.89. This implies that the convergent validity for all variables is within the acceptable range (Bagozzi and Yi, 1988).

4.3 Overall Model Analysis

This paper employs Amos 16.0 to conduct the structure equation modeling (SEM) in order to understand the causal relationship of the structure model and goodness of fit for the research model. The SEM has two basic models, which are the measured model and the structural model. Measured model is also known as Confirmatory Factor Analysis (CFA). Its purpose is to assess the reliability and effect between measured variables and latent variables and predict the significance level of parameters. Structural model is also known as the causal model which is a multivariate statistics technique based on regression. Its purpose

74

The Moral Decision-Making Process of Corporate Internal Auditors

is to inspect the causal relationship between patent variables. Under these two models, researchers are able to obtain the most suitable causal model by repeated tests when they fail to obtain the needed observed information for their models. 4.3.1 Model Fit Analysis

According to the suggestion of Bagozzi and Yi (1988), the fitness analysis of the model includes preliminary fit criteria, overall model fit, and fit of internal structure of model.

Preliminary fit criteria should meet the following: (1) the measurement error (ε) should not be negative; (2) factor loading (λ) should be within 0.5 and 0.95; (3) factor loading should reach the significance level (Bagozzi and Yi, 1988). Table 4 shows that the factor loading for each variable falls between 0.50 and 0.95, and there is no negative in measurement error. Overall, it is within the acceptable range.

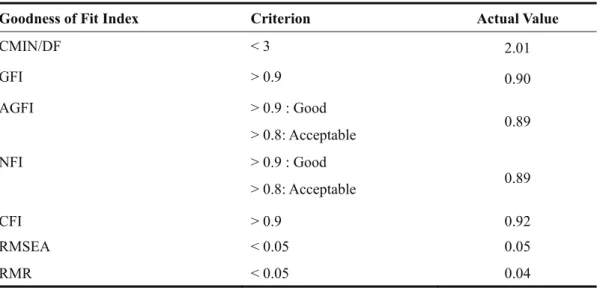

The main purpose is to assess the model fit between the overall model and observed data. As shown in Table 5, the actual values of this paper are close to or within the standard. So this paper has reasonable overall model fit.

Table 5 Overall Model Fit

Goodness of Fit Index Criterion Actual Value

CMIN/DF < 3 2.01 GFI > 0.9 0.90 AGFI > 0.9 : Good > 0.8: Acceptable 0.89 NFI > 0.9 : Good > 0.8: Acceptable 0.89 CFI > 0.9 0.92 RMSEA < 0.05 0.05 RMR < 0.05 0.04

According to Bagozzi and Yi (1988), the fit of internal structure of the model should have: (1) factor loading greater than 0.5 and reaches significance level; (2) composite reliability greater than 0.6; (3) variance extracted greater than 0.5. Table 4 shows that factor loading for each variable falls between 0.50 and 0.95, the composite reliability is greater than 0.6, and variance extracted is greater than 0.5. Hence, the internal structure is within the acceptable range.

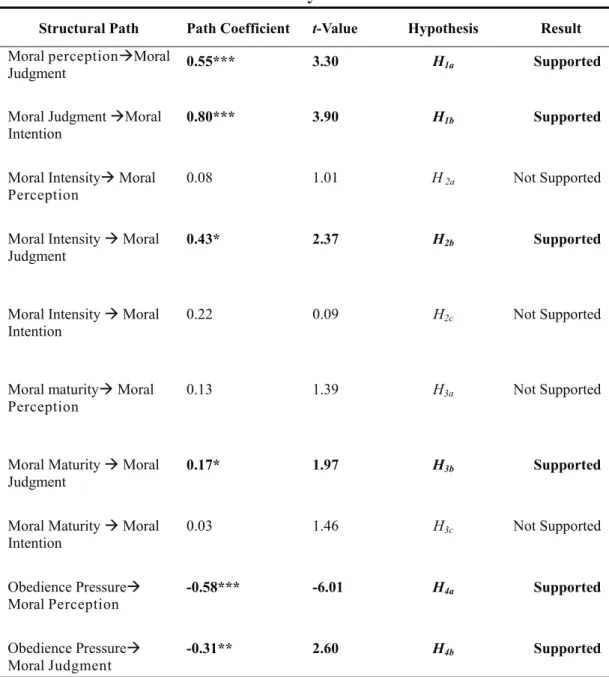

4.3.2 Path Analysis

Table 6 presents the analysis result for the paths of each variable. Figure 2 displays the analysis result for SEM.

(1) Correlation between moral perception, moral judgment, and moral intention In accordance with the path analysis result of Table 6, moral perception has a significant positive relation with moral judgment (path coefficient = 0.55), and moral judgment also has a significant positive relation with moral intention (path coefficient = 0.80). The empirical result proves that internal auditors have higher moral judgment on audit issues if they recognize the importance and magnitude of consequences of the issues. Similarly, when they have higher moral judgment on ethical issues, internal auditors are able to come up with a behavior intention that is appropriate for this judgment. Hence, hypotheses H1a and H1b are

supported. The empirical result proves the propositions of Rest (1986), and O’Leary and Stewart (2007).

(2) Correlation between moral intensity and moral decision-making model

Table 6 presents moral intensity only having a positive effect on moral judgment (path coefficient = 0.43). Empirical results find that when internal auditors have higher moral intensity on audit issues, the degree of damage of these issues, probability of happening, and immediacy are closely related. If internal auditors confront an audit issue that relates to the interests of the entire society, their legal and moral responsibilities (judgment) are heavier. This means higher moral intensity would strengthen the standard of the internal auditor’s moral judgment. So hypothesis H2b is supported. However, moral intensity has no

direct influence on moral perception (path coefficient = 0.08) and moral intention (path coefficient = 0.22). To infer its reason, this paper believes this is

76

The Moral Decision-Making Process of Corporate Internal Auditors

caused by the heavier legal and moral responsibilities of auditors in all countries (Sweeney, Arnold, and Pierce, 2010). Hence, moral intensity directly affects the moral judgment factors in the moral decision-making process.

(3) Correlation between moral maturity and moral decision-making model

Similar to the previous hypothesis testing of moral intensity on the moral decision-making model, moral maturity only has positive influence on moral judgment (path coefficient = 0.17), so hypothesis H3b is supported. Empirical

results find that internal auditors with higher moral maturity also have prosocial behavior. They tend to make behavioral decisions which conform to the social norms. So they will think twice about the impact of “reducing audit quality” which affects their moral judgment positively. Nevertheless, moral maturity has no significant and direct influence on moral perception (path coefficient = 0.13) and moral intention (path coefficient = 0.03). The possible reason may be that internal auditors try to cover up their perception of the ethical issues to avoid hurting others when there are any controversial issues. Moral maturity has no significant influence on moral intention because people with higher moral maturity tend to be considerate of the interests of others in order to prevent hurting another person. So, moral intention is derived from the moral judgment s t a g e . H y p o t h e s i s H3 i s n o t s u p p o r t e d .

(4) Correlation between obedience pressure and moral decision-making model For the correlation between obedience pressure and moral recognition, the result shows that obedience pressure has a significant negative relation with moral recognition (path coefficient = -0.58), so hypothesis H4a is supported. The result

also explains that internal auditors tend to eliminate audit reports that are unfavorable to the corporations when they are under invisible, indirect potential pressure, which includes the chance of promotion, job relocation, and abolishment controlled by supervisors (Coram et al., 2008). For this reason, internal auditors may reduce the audit quality. Therefore, internal auditors must have sufficient moral perception when facing “audit issues.” Besides, obedience pressure also has a significant negative relation with moral judgment (path coefficient = -0.31),

hypothesis H4b is supported. The result also explains that negative obedience

pressure would force internal auditors to make inappropriate auditing judgments. When the internal auditors could not implement the normal audit program, it will result in avoiding discovering any deficiency (normal judgment). The empirical result confirms the finding of DeZoort and Lord (1997).

Figure 2

Conceptual Research Framework

0.13 0.03 0.17*

-0.58*** 0.55*** 0.80***

-0.31** 0.08 0.43* 0.22

Significant Path CMIN/DF=2.01 GFI=0.90 AGFI=0.89 Not Significant Path NFI=0.89 CFI=0.92 RMSEA=0.05 RMR=0.04

*p < 0.1;** p < 0.05;*** p < 0.01 Obedience Pressure Moral Perception Moral Judgment Moral Intention Moral Maturity Moral Intensity

78

The Moral Decision-Making Process of Corporate Internal Auditors

Table 6 Path Analysis Results

Structural Path Path Coefficient t-Value Hypothesis Result

Moral perceptionÆMoral

Judgment 0.55*** 3.30 H1a Supported Moral Judgment ÆMoral

Intention 0.80*** 3.90 H1b Supported Moral IntensityÆ Moral

Perception 0.08 1.01 H 2a Not Supported

Moral Intensity Æ Moral

Judgment 0.43* 2.37 H2b Supported

Moral Intensity Æ Moral

Intention 0.22 0.09 H2c Not Supported

Moral maturityÆ Moral

Perception 0.13 1.39 H3a Not Supported

Moral Maturity Æ Moral

Judgment 0.17* 1.97 H3b Supported Moral Maturity Æ Moral

Intention

0.03 1.46 H3c Not Supported

Obedience PressureÆ

Moral Perception -0.58*** -6.01 H4a Supported Obedience PressureÆ

Moral Judgment -0.31** 2.60 H4b Supported Note :*p < 0.1;** p < 0.05;*** p < 0.01

5. Conclusions

This paper aims at developing a moral decision-making model for internal auditors. We design and develop measurement items that are suitable for each stage of the moral development process. Past studies mainly employed the moral decision-making model of Rest (1986) which is a generalized model ignoring the ethical issues under various environments (i.e., the ethical issues in auditing), and lacking the determinants affecting different moral steps. To bridge the gap, this study proposes a complete moral decision-making model for internal auditors that integrate “contextual” factors, “audit issues,” and “personal” factors. This paper further investigates the factors affecting the moral decision-making process of internal auditors with the help of literatures and hypothetical inferences. Empirical results show that during the moral development process, moral perception, moral judgment, and moral intention can take place. This also verifies the results of O’Leary and Stewart (2007). Further, this paper classifies the determinants affecting the moral decision-making process into moral intensity of audit issues, obedience pressure in contextual aspect, and moral maturity in personal aspect. For the audit issues aspect, this paper uncovers that higher moral intensity of internal auditors will has a positive effect on moral judgment. Internal auditors with higher moral maturity also have higher moral judgment. In other words, the major reasons affecting moral judgment are moral maturity and moral intensity, which are related to the audit issues or personal virtue. This finding has never been discussed in previous research, which is one of our contributions of this study. Besides, the obedience pressure affects the moral perception of internal auditors in a negative way, so it is easier to cause inappropriate behavior intention. Their perception on acting in accordance with ethical standards is lower. This finding is another theoretical contribution of this paper. Finally, the obedience pressure has a negative effect on moral judgment. The finding verifies the results of DeZoort and Lord (1997).

80

The Moral Decision-Making Process of Corporate Internal Auditors

academic implication in regards to IIA, internal auditors, and government. Because internal auditors have different moral development situations on the ethical issues, we suggest the IIA should enhance the promotion of moral training of internal auditors and the Code of Professional Ethics. As a result, internal auditors are encouraged and regulated to establish righteous, objective, fair, and careful characteristics. Besides, internal auditing has been played as an important role in a corporation, and its function and benefits have been receiving much attention. However, internal auditing is facing pressure from business owners because of the stakes of the company. This paper suggests internal auditors to seek the help from auditing managers or top management (e.g. audit committee, independent director) when they are facing moral dilemmas or pressure from the organization so as to clarify the responsibility of the particular audit issue. Moreover, this paper suggests that business owners should respect the importance and influence of internal audit reports. Internal audit reports are not only documents that disclose the company’s defects; the audit findings should be given the needed attention. This is simply because the purpose of internal auditors is to protect the company’s interests, rather than to whistle-blow (Bowrin, 2004; Chung

et al., 2009).

Finally, there are few suggestions for the government. To enhance the moral responsibilities of internal auditors, this paper suggests establishing guidelines for internal control in related laws and regulations. If internal auditors fail to work from the viewpoint of internal control, it is necessary to set up a rule or law to avoid internal auditing not bringing its control mechanism into full play. On account of the enhancement of law, internal audit reports should maintain their legal force so that the business and competent authorities will respect them. Besides, the government should not only disclose such information as the change of internal audit managers, but also the change of internal auditors. This can protect the rights of the interested parties, and it can also resolve the invisible pressure given to internal auditors for a long time so that they can keep their independence during auditing.

There are several limitations in this paper. We only discuss the correlation among research variables rather than setting up a fictitious moral situation to measure the variables; that is, to explore the factors of moral decision-making model of internal auditors by “simulation situational script.” Abbott, Parker and Peters (2012) situational script standardizes the social stimulus of respondents, which presents their decision-making factually. Hence, this paper suggests using experimental design to examine the causal relation among variables in the future. Secondly, this paper employs six items to measure moral intensity and is proved to have fair reliability. However, some of them have insufficient factor loading, which is one of our limitations. The research of Tsalikis, Seaton, and Shepherd (2008) can be a reference for future studies, because they employ the conjoint analysis to examine the importance of moral intensity in the moral decision-making model. This method conducts tests regarding each dimension of moral intensity in order to obtain an accurate assessment. Finally, we use a questionnaire, which limits our data collection, because there may be a “halo” effect, or false answers from the respondents. It is suggested that future studies may use case study to conduct interviews in person in order to have a more objective research result.

References

Abbott, L. J., Parker, S. and Peters, G. F. (2012), “Audit Fee Reductions from Internal Audit-Provided Assistance: The Incremental Impact of Internal Audit Characteristics,” Contemporary Accounting Research, 29(1), 94-118. Arens, A., Elder, R. and Beasley, M. (2003), Auditing and Assurance Services: An

Integrated Approach, New York, NY: Prentice Hall.

Armstrong, M. B. (1987), “Moral Development and Accounting Education,”

Journal of Accounting Education, 5(1), 27-43.

Arnold, D. F. and Ponemon, L. A. (1991), “Internal Auditors’ Perceptions of Whistle-blowing and the Influence of Moral Reasoning: An Experiment,”

82

The Moral Decision-Making Process of Corporate Internal Auditors

Bagozzi, R. P. and Yi, Y. (1988), “On the Evaluation of Structural Equation Models,” Journal of the Academy of Marketing Science, 16(1), 74-94.

Bernardi, R. A. and Arnold, D. F. (1997), “An Examination of Moral development within Public Accounting by Gender, Staff Level, and Firm,”

Contemporary Accounting Research, 14(4), 653-668.

Bowrin, A. R. (2004), “Internal Control in Trinidad and Tobago Religious Organizations,” Accounting, Auditing & Accountability Journal, 17(1), 121-152.

Brennan, N. and Kelly, J. (2007), “A Study of Whistleblowing among Trainee Auditors,” The British Accounting Review, 39(1), 61-87.

Brehm, S. S. and Kassin, S. M. (1990), Social Psychology, Boston, MA: Houghton Mifflin Co.

Christopher, J., Sarens, G. and Leung, P. (2009), “A Critical Analysis of the Independence of the Internal Audit Function: Evidence from Australia,”

Accounting, Auditing & Accountability Journal, 22(2), 200-220.

Chung, S. H., Ni, F. Y., Su, Y. F., Chiou, B. C. and Su, C. C. (2009), “The Impact of Strategy Type on the Relationships among Broad Scope Management Accounting System, Job Information Perceptions, and Managerial Performance,” Chiao Da Management Review, 29(2), 47-82.

Coram, P., Glavovic, A., Juliana, N. and Woodliff, D. R. (2008), “The Moral Intensity of Reduced Audit Quality Acts,” Auditing: A Journal of Practice

& Theory, 27(1), 127-149.

Cuieford, J. P. (1965), Fundamental Statistics in Psychology and Education, New York, N Y: McGraw-Hill.

Dezoort, F. T., Houston, R. W. and Peters, M. F. (2001), “The Impact of Internal Auditor Compensation and Role on External Auditors' Planning Judgments and Decisions,” Contemporary Accounting Research, 18(2), 257-281.

DeZoort, F. T. and Lord, A. T. (1997), “A Review and Synthesis of Pressure Effects Research in Accounting,” Journal of Accounting Literature,16(1), 28-85.

Eynon, G., Hill, N. and Stevens, K. (1997), “Factors that Influence the Moral Reasoning Abilities of Accountants: Implications for Universities and the Profession,” Journal of Business Ethics, 16(12/13), 1297-1309.

Ferrell, O. C. and Gresham, L. G. (1985), “A Contingency Framework for Understanding Ethical Decision Making in Marketing,” Journal of

Marketing, 49(3), 89-96.

Fornell, C. and Larcker, D. F. (1981), “Evaluating Structural Equation Models with Unobeservable Variables and Measurement Error,” Journal of

Marketing Research, 18(3), 39-50.

Gramling, A. A. and Myers, P. M. (1997), “Practitioners' and Users' Perceptions of the Benefits of Certification of Internal Auditors,” Accounting Horizons, 11(1), 39-53.

Houston, R. W. and Howard, T. P. (2000), “The UniCast Company: A Case Illustrating Internal Auditor Involvement in Consulting,” Issues in

Accounting Education, 15(4), 635-655.

Hunt, S. D. and Vitell, S. J. (1986), “A General Theory of Marketing Ethics,”

Journal of Macromarketing, 6(1), 5-16.

Jeffrey, C. and Weatherholt, N. (1996), “Ethical Development, Professional Commitment, and Rule Observance Attitudes: A Study of CPAs and Corporate Accountants,” Behavioral Research in Accounting, 8(1), 8-31. Jones, T. M. (1991), “Ethical Decision-making by Individual in Organization: An

Issue-contingent model,” The Academy of Management Review, 16(2), 366-395.

Kelly, J. (2002), “The Year of the Whistle-blowers,” Time, 160 (27/1), 8.

Kerlinger, F. N. (1986), Foundations of Behavioral Research, 3rd ed., New York, NY: Holt, Rinehart and Winston.

Kohlberg, L. (1984), The Psychology of Moral Development, San Francisco, CA: Harper and Row.

Kurland, N. B. (1995), “Ethical Intentions and the Theories of Reasoned Action and Planned Behavior,” Journal of Applied Social Psychology, 25(4), 297-313.

84

The Moral Decision-Making Process of Corporate Internal Auditors

Lampe, J. C. and Finn, D. W. (1992), “A Model of Accountants’ Ethical Decision Processes,” Auditing: A Journal of Practice & Theory, 11(Supplement 1), 33-59.

Larkin, J. M. (2000), “The Ability of Internal Auditors to Identify Ethical Dilemmas,” Journal of Business Ethics, 23(4), 401-409.

Liao, L. C. (2004), “A Study on the Relationship of Internal Auditors' Role Stress and Job Satisfaction with the Internal Audit Quality,” Journal of

Contemporary Accounting, 5(2), 235-269.

Lord, A. T. and DeZoort, F. T. (2001), “The Impact of Commitment and Moral Reasoning on Auditors’ Responses to Social Influence Pressure,”

Accounting, Organizations and Society, 26(3), 215-235.

Morrill, C. and Morrill, J. (2003), “Internal Auditors and the External Audit: A Transaction Cost Perspective,” Managerial Auditing Journal, 18(6/7), 490-504.

Ni, F. Y., Chuang, Y. K. and Chiou, B. C. (2006), “Perceived Task Uncertainty, Organizational Commitment, Managerial Accounting Systems and Their Three-Way Interaction Effects on Managerial Performance,” Journal of

Management & Systems, 13(1), 1-14.

Nunnally, J. C. (1978), Psychometric Theory, New York, NY: McGraw-Hill. Oh, W. Y., Chang, Y. K. and Martynov, A. (2011), “The Effect of Ownership

Structure on Corporate Social Responsibility: Empirical Evidence from Korea,” Journal of Business Ethics, 104(2), 283-297.

O'Leary, C. and Stewart, J. (2007), “Governance Factors Affecting Internal Auditors' Ethical Decision-Making: An Exploratory Study,” Managerial

Auditing Journal, 22(8), 787-808.

Otley, D. T. and Pierce, B. J. (1996), “The Operation of Control Systems in large Audit Firms,” Auditing: A Journal of Practice & Theory, 15(2), 65-84. Ponemon, L. A. (1992), “Ethical Reasoning and Selection-Socialization in

Ponemon, L. A. (1995), “The Objectivity of Accountants’ Litigation Support Judgments,” The Accounting Review, 70(3), 467-488.

Reidenbach, R. E., Robin, D. P. and Dawson, L. (1991), “An Application and Extension of a Multidimensional Ethics Scale to Selected Marketing Practices and Marketing Groups,” Journal of the Academy of Marketing

Science, 19(2), 83-93.

Rest, J. R. (1986), Moral Development: Advances in Research and Theory, New York, NY: Praeger.

Singhapakdi, A., Gopinath, M., Marta, J. and Carter, L. (2008), “Antecedents and Consequences of Perceived Importance of Ethics in Marketing Situations: A Study of Thai Businesspeople,” Journal of Business Ethics, 81(4), 887-904. Singhapakdi, A., Vitell, S. J. and Kraft, K. L. (1996), “Moral Intensity and Ethical

Decision-Making of Marketing Professionals,” Journal of Business

Research, 36(3), 245-255.

Sweeney, J. T. and Roberts, R. W. (1997), “Cognitive Moral Development and Auditor Independence,” Accounting, Organizations and Society, 22(3/4), 337-352.

Sweeney, B., Arnold, D. and Pierce, B. (2010), “The Impact of Perceived Ethical Culture of the Firm and Demographic Variables on Auditors’ Ethical Evaluation and Intention to Act Decisions,” Journal of Business Ethics, 93(4), 531-551.

Tsalikis, J., Seaton, B. and Shepherd, P. (2008), “Relative Importance Measurement of the Moral Intensity Dimensions,” Journal of Business

Ethics, 80(3), 613-626.

Tsui, J. and Gul, F. (1996), “Auditors' Behaviour in an Audit Conflict Situation: A Research Note on the Role of Locus of Control and Ethical Reasoning,”

Accounting, Organizations and Society, 21(1), 41-51.

Wang, Y. (2011), “Mission-Driven Organizations in Japan: Management Philosophy and Individual Outcomes,” Journal of Business Ethics, 101(1), 111-126.

Windsor, C. A. and Ashkanasy, N. M. (1995), “The Effect of Client Management Bargaining Power, Moral Reasoning Development, and Belief in a Just

86

The Moral Decision-Making Process of Corporate Internal Auditors

World on Auditor Independence,” Accounting, Organizations and Society, 20(7/8), 701-720.

Windsor, C. A. and Ashkanasy, N. M. (1996), “Auditor Independence Decision Making: The Role of Organizational Culture Perceptions,” Behavioral

Research in Accounting, 8(Supplement 1), 80-97.

Xu, Y. and Ziegenfuss, D. E. (2008), “Reward Systems, Moral Reasoning, and Internal Auditors’ Reporting Wrongdoing,” Journal of Business and