Chiao Da Management Revi酬, Vol. 29 No. 2, 2009

pp.163一 199

股價報酬與經濟成長的關像是否會消

失?跨國橫斷面的實詮分析

Is the Relationship Between Stock Returns and Economic

Growth

Di

sappearing? A Cross-Sectional Analysis

李源、明 Yuan-Ming Lee 南台科技大學財務金融系

Department of Finance, Southern Taiwan University 黃柏農 Bwo-Nung Huang

中正大學經濟學系令國際經濟研究所

Department ofEconomics & Graduate Institute ofInternational Economics, National Chung-Cheng University

王冠閔 I Kuan-Min Wang f喬光科技大學財務金融系

Department of Finance, Overseas Chinese University

摘要:本文利用 49 個國家 1960 年至 2003 的橫斷面資料,建構門繼迴歸 (Threshold Regressi間; TR)模型,重新檢驗 Binswanger (2004) 的發現, ~f 股價報酬與經濟

成長之間關你可能會消失 。 實證結呆發現,利用不同的樣本期間進行檢驗,不 僅發現高所得國家股價報酬與經濟成長之間同樣具有顯著的正相闕,低所得國 家也會有相同的現象 。 因此我們認為, Binswanger (2004) 利用線性模型進行估計 與檢定,發現股價報酬與經濟成長之間相關性消失的現象並不完全正確,從本 文的實詮結果可驗證兩者之間關餘的消失,僅出現在高所得國家的體制內 。 關鍵詞﹒橫斷面資料 ; 股價報酬;經濟成長;門繼迫歸模型

I Co叮esponding au出or : Dep扭扭lent of Finance, Overseas Chinese Uruv回回妙, Chiao Kwang Road, Taichung Ci旬, Taiwan. E-mail: wkminn@ocu.edu.tw

164 Js the Relationship Befween Srock RelUrnS Qnd E.ωnomÎc Growlh Disappeari啥? A Cross-Sectional Analysis

Abstract : By employing the cross-sectional data of 49 coun甘ies from 1960 to 2003 and ∞nstructing the threshold regressive

(T

R) model,

this study re引amines the finding of Binswanger (2004) that the relationship between the stock returns and economic growth is disappearing. Our empirical results from various s街nple periods indicate that the significantly positive relationship between the stock returns and economic growth exists in both high-income and low-income countries. From our findings we conclude that the empirical result from a linear estimation ofBinswanger(2004) 的 only partially correct. Our findings show that the disappearing relationship onlyex悠悠 in high-income countries

Keywords: Cross-Sectional Data; Stock Returns; Economic Growth; Threshold

Regressive 恥10del

1.

Introduction

Different countries or regions have their own unique economic conditio肘, which in turn, creates distinct financial markets in each area. Generally speaking, most stock markets are efficient in some ways. To maintain this efficien句, the financial surrounding and the financial supervision system must collaborate with each other. 1 In an efficient market

,

the current price of a stock reflects not only the discounted values of the sum of the future stock dividends and capital gains, but also the investors' expectations of the company's future. From the macroeconomic view point,

.the performance of the stock market reveals the hωre of the economy,

and stock returns are highly correlated with the economic performan∞ In general, the 間的on why the stock markct is 叫 led "the window of 由e economy" is that the stock returns could be viewed as 由巴 leading indicator ofthe economic growthMost studies exammmg the relationship between the stock retums and economic growth use time-series data of the individual economy. For instance,

2 Please refer 10 Fama (1965, 1970) for 也e 出eoretical and empirical explanations of the E佰clent

Chiao Da Managem酬11Review Vol. 29 No. 2, 2009 165

Fama

(1

990) and Schwert (1990) focus on the U.S., Choi, Hauser, KopeckJ'(1

999) and Sarantis (2001) focus on the G 7 coun仙的, and Hassapis (2003) uses the Canadian data only. Some of the recent articles on this area using data of the EU,

OECD countri郎, or the Asian emerging markets (including Singapore, Korea,

the Philippines,

Malaysia,

Indonesia,

and Taiwan). Ex缸nples of the researches include Aylward and Glen (2000), Mauro (2003), Henry, Olekal 肘, Thong(2004) and Huang and Yang (2004), and most of these studies find that there is significant relationship between the stock returns and economic growthEmploying the lin巴ar VECM model, Bingswinger (2004) obtains an interesting empirical finding that the originally significant relationship between the stock returns and economic growth disappears in the beginning ofthe 1980s in the G 7 countri的, and this phenomenon is expanding to other major economic areas in the world. Domian and Louton

(1

997), Sarantis (2001), and Henry, Olekal 肘, Thong(2004) employ the time-series data and study the similar topic as Bingswinger (2004). These authors suggest that the relationship bet、'Ieen the stock returns and economic growth should be investigated by using the nonlinear model and that the linear estimation would result in the model specification problem.Several economic theories offer explanations to the nonlinearity of the relationship between the stock returns and economic growth. The Keynesian economists believe that the investment is the primary factor causing business cycles. As we mentioned before, the stock market is the window of the economy;

therefore, the stock market will fluctuates prior to the economy does. The stock market index is composed with the trading prices and volumes of listed

comp個 ies. The CEOs of the listed corporations make investment decisions based on their expectations of the economic growth. The private-sector investment is the sum of the investments of all corporations in the economy and it is the private-sector investment that triggers the so-called multiplier-accelerate effect Therefore, the overall performance of the corporations ref1ects the economic growth in the fu仙惚. 3 Since the economic growth is characterized by its

3 羽田 multiplier effect indicates 出e increased income caused by an increase of 出e mvestment.

while 出e accelerate e悅目的品sociated with the increased investment derived by the increased income. These two effects could reinforce each 。由er

166 Is the Relationship Bern1een SlOck RelUrnS and Economic Growlh Disappearing?

A Cross-Seclional Analysis

nonlinearity and the

stock

market is part

of

the

economy

,

the

two (the economic

growth

and the

stock

market) are nonlinearly correlated

.

4

In

addition

to the

Keynesian

theory

,

a popular

explanation

to the nonlinearity

of

the relationship

between the

stock

retums and

economic growth

is about the tinancial

development and tinancial deepening

.

Researches like King and Levine

(1

993)

tind that tinancial

indices 缸esigniticantly and

positively

correlated with

economic growth

indices

,which

indicates 出attinancial development

or

tinancial

deepening

could

fuel the

economic growth

.

Wachtel (2003

)

holds the

same

conclusion.

The

stock

market is the milestone of the modem tinancial

development and the

crucial

tinancing

channel

for most

corporations.

Deidda and

Fa泣。叫1

(2002)

tind that the relationship between the

stock

retums and

economic

growth

has the property

of asymmetry

As

to 由eutilization

of

the nonlinear

estimation on

this field

,

Domian

and

Louton

(1

997) construct the threshold autoregressive

(TAR)

model with the

industrial production

as

the explained

variable

,

the lag industrial

production 缸ldlag

stock

retums as the

explanatory variables

,and the lag

stock

retums

as

the

threshold variable

.

The authors find that there

exists

the nonlinear threshold

effect

between the

stock

retums and real

economic

activities.

Sarantis (2001) employs

the

stock

retums

as

the threshold variable to

estimate

a

smooth

transition

autoregressive (STAR)

model and tinds that the

stock

retum has

the

property

of

nonlinear. Henry

, Olekal肘,Thong(2004) discover that when the economy is in

the expansion

stage of

a business

cycle

,

the

stock

retums

cannot

be used to predict

• A complete

business

cycle expe

,;ences four stages

:

trough

,expansion

,peak

,and

depression

.

The

business-cycle-di伍IsÎon ind閥割。ror the

business-

c

ycle-composite

indicalor

could be employed

to investigale the

cycle

,and the

growth of

an

e∞nomyis largely

affecled

by the business

cycle

η1e identifi阻tion

of

the turning

points

of 出ebusiness cycle of a specific economy or

the

world

ìs

Dot

easy

.

For

instance, 也eway

the

Nation剖 B世間uEconomic Research

(NBER)

identifies

出e

business

cycle

turning

poin阻抽出roughthe discussions

of

many

economists

and

specialists

with

references

of 出e da回 ofU

.

S

.

income

, produ叩開,sales

,and

employments

.

From

the

published dat

a,

the

U

.

S

.

has

experienced 10 times of business cycles in

the

pe,;od of

1945 個200

1.ln

December

2008

,NBER

identified 出atDecember

2007 時也epeak of

tbe most recent

business cycle

.

As

10

11且W帥, 也eturning points

of

bu

s

iness

cycles are

determioed

by 也eCouncil for

Economic

Planning and Development

of

the

Executive Yuan of Taiwan

.

Since

economic growth

is highly affecled

by 出ebusiness

cycle

, itis easily

unde凹loodthal 由eprocess

Chiao Da Managel17enl Review Vol. 29 No. 2, 2009 167

the production growth; however

,

when the economy is in the depression period of a business cycle, then the stock retums could precisely predict the productiongrowth. Lee, Chen and Wang (2008) utilize 出e bi-variate threshold model and

obtain similar empirical results. Regarding other related articl郎, utilizing the data

of ten Asian countries, Lee and Wang (2009) 巴mploy the financial development as

the threshold variable to construct a nonlinear threshold model and re-examine the

empirical findings of Rousseau and Vuthipadadom (2005). The authors find that in the high financial development regime, the financial development could fuel

economic growth in most countri的, a finding consistent with the result of

Rousseau and Vuthipadadom (2005)

,

but the direction of the impact of the financial development on the investment cannot be determined. In the low financial development regime,

the financial development is negatively correlatedwith the investmen

t,

a finding contradictory with the result of Rousseau and Vuthipadadom (2005),

and the direction of the impact of the financial development on the economic growth cannot be deterrnined.The above researches all employ the time-series data to conduct empirical

studies and most of the papers conclude that the stock retum is nonlinearly correlated with the economic growth. The advantage of using the time-series data is that the empirical results could reveal the economic devolvement process and characteristics of the specific country; however

,

this research method could not be used to investigate the overall development of the whole economic region or area Researches including Barro (1991), Mankiw, Romer, Weil (1992), and King andLevine (1993) employ annually averaged cross-sectional data to study

intemational economic growth related issues. The advantage of the data is 出 at

one could avoid the noise from the short-run business cycles and the problem of simultaneous variables. Summarizing from the above discussion we decide to utilize the multinational cross-sectional data and construct the threshold regressive (TR) model to re-examine the finding of Binswanger (2004) that the relationship between the stock retums and economic growth is disappearing. 5

Moreover, Aylward and Glen (2000), Mauro (2003), and Henry, Olekalns,

5 刊 e di臼erence between the TR model and TAR model is 出at the former does not contain 108 variables in the regressors. To avoid confusi凹, we name the former the TR model

168 Is the Relationship BefWeen Slock Relurns and Economic Gro圳h Disappearing?

A Cross-Sectional Analysis

Thong(2004) find that the correlation between the stock retums and economic gro、叫h is higher in high

.

income developed coun甘 ies,as

wellas

in some emerging markets. Because of this, we will construct a b卜regime TR model to differentiate between high- and low-income countries. In this w旬, we could examine whether the relationship between the stock retums and economic growth would vary withincome levels

We utilize the mean of the per-capita real GDP

as

the threshold variable. 6Our empirical results indicate that the stock retums and economic growth are significantly and positively correlated in most countries, and this relatior的 hip is not disappearing

as

Binswanger (2004) suggests. The disappearing relationship phenomenon is found only in some high-income countries in the expansion stage of the business cyclesThis paper is organized

as

follows. Section 1 is the in廿oduction of our research motivation and purpose. Section 2 is the literature review. The empirical models and data are explained in section 3. Section 4 is the discussions of empirical results and economic significances. The conclusion is listed in section5

2. Literature review

Utilizing the U.S. data, Fama (1990) examines the relationship between the current stock retums and fu仙re output growth and finds 由at when this relationship is significant and positive, then one could predict output f1uctuations with the change of the current stock retums. Schwert (1990) employs the annual,

quarterly

,

and monthly U.S. data from 1889 to 1989 and constructs a variety of linear models to investigate the relationship between the real stock retums and output. The author finds that these two variables are significantly and positively correlated.6 The real GDP per capita is calculated from the purchasing power parity r且1 GDP quoted in U.S

dollars. The data come from the Penn World Data (www.bized.ac.uk/dataserv/penndata/peruthome.htm)

Chiao Da Managemenl Review 均1. 29 No. 2, 2009 169

Using the data of G7 coun仙的, Choi, Hauser, Kopecky (1999) exarnine

whether the change of real stock return is ahead of 出e tluctualions of economic

activities. The authors find 出 at exc巴 pt for Italy

,

there are significant and long-runequilibriums between the two variables in the rest six countries, and that one could predict the outcomes of fu仙re e∞nomic activities with the stock returns

Utilizing the time-series analysis

,

Domian and Louton (1997) construct the linear autoregressive model and the TAR model with the stock returns as the threshold variable 10 investigate the relationship between the stock retums and theeconomic activities in U.S. Empirical results suggest that there is the nonlinear threshold effect between these two variables. When the stock return is negative

,

itcan be used to efficiently predict the future economic activities; when the stock

retum is positive, then it cannot predict well

Aylward and Glen (2000) employ twenty three countries

,

incJuding the G7countn郎, to exarnine whether the stock retum could effectively predict GDP,

consumption

,

and investment. The empirical findings show that the predictioneffectiveness ofthe stock retum does not exit in every sarnple ∞untry. Among the

sarnple coun別的, the prediction performance of the stock retums is better in most

of 由e G 7 countries than in the emerging countries.

Mauro (2003) constructs the panel data set with quarterly and annual data

of multiple countries to investigate the relationship between the output growth

and stock retums. The estimation results of the annua1 panel data indicate that in the uni-variate model, except for Indi

a,

the positive relationship of the two variables exist in the rest countries. The significant coefficient ratio is 62.5% in the emerging countries and 58.8% in the developed countries. In the bi-variate model,

the significant coefficient ratio is 50% in the emerging countries and 58.8% in the developed countries. The empirical results of the quarterly panel data show that the significant coefficient ratio is 33.3% in the emerging countries and 50% in the developed countries. In addition,

the significant and positivecorrelation between the economic growth and stock retums exists in a11 coun制的,

both emerging and developed ones

Employing quarterly data of twenty seven countries from the second quarter

170 Is the Relationship Berween Stock Relurns and Economic Growlh Disappear;r,嗯? A Cross-Seclional Analysis

whether the stock retum could predict 出 e economic growth. The estimation results of the nonlinear model include the following three points. First

,

the stock retum is nonlinearly correlated with the output growth. If one estimat自由的relationship with a linear model, then there will be the model misspecification problem. Second

,

the signi日 cant and positive relationship between the two variables exists in the OECD countries and five southeast Asian countries. Third, the nonlinear estimation results show 由at only in the recession period,

the stock retum fluctuations are ahead of the economic growth changes.Binswanger (2004) employs the qu訂terly data of the G7 countries from 1960 to 1999 and divides the s剖nple into three sub-sample periods (the whole sample period

,

1960 to 1982,

and 1983 to 1999) to investigate whether the relationship between the stock retums and real economic activities still exists. The empirical findings show that in the whole sample period 街Jd in the period of 1960 to 1982, the lag stock retums could explain the current real economic growth in U.S., Canada,

Jap徊, and the integrated European countries (data for theintegrated European ∞untries are the weighted averages of 出e macroeconomlC data of Gerrnany, Fran倪, Jtaly, and U.K.). However, in the sample periods of

1983 to 1999 and 1989 to 1999

,

the 1ag stock retums carmot explain the current real economic growth. Concluding from the empiric剖 results the author believes that the once existed relationship of the stock retums and real economic growth disappeared in the early 1980s and this phenomenon might have expanded to them句。re∞nomlc 紅eas in the world

Emp10ying fóur Asian countries (Jap仰, Taiw仰, Kore

a,

and Malaysia) as the s街np1e, Le唔, Chen and Wang(2008) investigate the asymme甘ic causality between the stock retums and output growth with the time-series data and the bi-variate threshold vector autoregressive mode1. The empirical findings show that in the bad-news regime, the stock retum is the leading factor of the output,while in the good-news regime, there is not significant relationship between the two factors

Many researches on this area using the cross-sectional dat

a,

for example,Chiao Da Management Review 均/. 29 No. 2, 2009 171

Barro (1991) and Mankiw

,

Romer,

Weil (1992) find that the predictions of the endogenous growth theory cannot be supported by the empirical data. King and Levine (1993) utilize the averaged annual data of eighty countries from 1960 to 1989 and cons甘 uct a cross-sectional Iinear model to investigate the relatio的hip between the financial development and economic growth. The authors use four indicato悶, incIuding the ratio of the current liability to GDP, to proxy the financial development and the pcr capita real GDP growth rate to proxy the economic growth. The empirical results show that the financial development could significantly fuel the economic growthEmploying the sarne data set as King and Levine (1993) do

,

Deidda and Fattouh (2002) construct a nonlinear model and use the income level as the 出resho1d variable to discuss the relationship between the economic growth and financial deepening. The authors find that the high-income regime is associated with more advanced fmancial deepenin皂, which indicates that 由e economlC growth is high1y correlated with the financial deepening in the high-income regime. In the low-in∞me regime,

the relationship between these two variables is not that significant. The findings of this study suppo吋 the economic growth theories and reveal the advantages of using 伽e nonlinear model.3. The empirical model and the data

3.1

The methodologyGenerally speakin皂, there are two ways to construct a nonlinear model. One is the pie∞wise-in-time method that uses time as the structure-change point to investigate the relationship between the dependent and explanatory variables

Another is the piecewise-in-variable method proposed by Tong (1978) and Tong and Lim (1980). This method is to construct a unit-variate TAR model using the characteristic of the variable as the structure-change point to study the correlation of the dependent and explanatory variables

172 Is lhe Relationship Beru1een Slock Relurns and Economic Growlh Disappearing? A Cross-Seclional Analysis

change point is subjectively determined by the researcher (for exarnple, Chow,

1960), so the conclusion might be biased. The piecewise-in-variable method has

the advantage of avoiding the subjective problem. The nonlinear threshold model

utilizes the minimum estimated value of the sum square of error (SSE) as the

criterion and the grid se紅ch method to obtain the optimum threshold value as the

structure change point. The threshold value also serves as the critical value

dividing the model into several regimes

This paper uses the cross-sectional data and constructs a bi-regime TR

model. Data of all the variables are the time averages of individual coun甘 ies and

there is no 1咚 term in the model, which makes our model structure different from

that of the T AR model using time-series data. Our TR model is specified as follows:

y= 仇 XJ(q;

>

y)+ 仇 X,I 旬,主 y) +1>;where

Y

=

(Y

I>'Y

'

..,Y

p) is the dependent variable vector; i=

1, 2, ..., p, and p isthe observation (individual countries) number; X i = (1,

x'

.j ,..., Xk .}) is theexplanatory variable vector; k is the number of the explanatory variables;

dJ =(40.JJL尸 ,Øk,i) is the vector of the estimated parameters; j is the number

of the regimes, and j = 1, 2; 尺﹒ ) is an index function, and I( .) = 1 when the regime holds; q is the threshold variable; y is the threshold value

3.2 The empirical model

This paper utilizes the country level cross-sectional data to investigate the

relationship between the stock retums and the economic growth. To avoid the

omlSSlon-oιrelevant-variable problem, we follow the methodologies employed in

King and Levine (1993) and Huang and Yang (2004) that include the following

variables in our empirical model (in addition to the growth rate of per capita real

Chiao Da Managemenl Review Vol. 29 No. 2, 2009 173

ratio of gross 日xed capital fo口nation to G DP

,

the inflation rate,

and the ratio of intemational trade to GDP, These four variables are added as the explanatoryvariables. The functional expression ofthe unit-variate cross-sect的nal model is 7

CALYG = j(CALSR,CAGOV,CAINV,CAPl,CATRD) ( 1 )

The functional relation ofthe bi-regime unit-variate TR model is

CALYG=

(川lρα臼肌枷心叫恥h叫+卅αa,口2ρ仰αωG肌糾INV肌川川V仇川叫+卅叫叩αq"ρ川"CAρ凶川αω叫叫PlplI

+E

a,扭o +a訕2,CALSR+ α,~CAGOV+a,且,CAINV+ α2且4CAPl+ α2且,CATRlο3νl尺(q 歪 r)

(2)

Jn equations (1) and (2), LYG is the growth rate ofreal GDP per capita; LSR is the

stock return; GOV is the ratio of govemment consumption to GDP; lNV is the ratio of gross fixed capital formation to GOP; PI is the inflation rate; TRD is the ratio of intemational trade to GDP. Variable names with the notation

“

CA" in front of them indicate that the corresponding variables are the time averaged ones. For instance, CALYG is the time average of the annual growth rates of real GDP per capita. 1(.)

is the index function and 1(.)

= 1 when the regime holds. q is the threshold variable; y is the threshold value;a's

are the coefficients to be estimated;c

is the error term 3.3 The dataBelow we introduce the definitions of the variables and explain why we add them into the model. ln the following

,

items (1) and (2) are the primary dependent variables (the growth rate of per capita_real GOP and the rate of stock returns) and7 Since problems assoc旭ted wi自由e dynamic threshold model could not be completely solved

( see Henry et al., 2004),也is study employs the method combining 出e 血reshold model and the static panel data to conduct empirical studies. Researches including Barro (1991), Mankiw et al.

(1992), and King and Levien (1993) employ the same es包matlOn me出od 自 well. Deidda and Fatto曲 (2002) utili扭曲e same cross-sectionaJ da阻扭曲at of King and Levine (1993) and

construct a nonlinear model with income level as the threshold variable to investigate topics such 扭曲e economic growth and fin血cial d間perung 甘lerefore, the variables we employ here a11 have theorerical supports

174 1s the Relalionship Between Slock RelUrnS and Econom;c Growth Disappearing? A Cross-Seclional Analysis

items (3) to (6) are the explanatory variables in the TR model. 8

(1) Real GDP growth rate

(LYG):

This variable is proxied by the growth rate ofreal GDP per capita that is the log difference ofthe ratio ofreal GDP (nominal GDP divided by the GDP deflator) to total population. The primary reason

why we calculate the economic growth rate like this is that the growth rate of

per capital real_GDP could avoid the noise from price and population fluctuations.

(2) Rate of stock returns (LSR): This variable is obtained by taking log difference

。fthe stock market indices. 9

(3) The ratio of govemment consumption to GDP (GO 內: This ratio could reveal both the impact of the government consumption on the whole economy and

the strength of the demand side of the economy. This ratio is also used in De

Gregorio and Guidotti

(I

995) and Bekae此, Harvey, Lundblad (2001)(4) The ratio of gross fixed capital forrnation to GDP (/Nη: This ratio is the proxy of the capital stock and is the explanatory variable on the production

side of the economy. The reason why we add this ratio to our regression is that

as King and Levine (1993) point out, the financial development could fuel the

economic growth through capital accumulation

(5) Inflation rate (PJ): The inflation rate is calculated by taking log difference of

the consumer price index (CPI). Jones and Manuelli (1993) argue that the inflation rate negatively impacts the output through distorting the investment level and reducing the investrnent e在iciency. Hung (2001) points out that the

8 Most of our stock retum data comc from thc IFS data base of lME The rest are the stock market

indi臼s of individual countries 甘1e stock retum is a nominal variable. Except for the inflation

rate, 出e rest explanatory variables are expressed as the ratio to nominal GOP and are nominal

variables. Researches including King and Levien (1993), Oeidda and Fano曲 (2002), and Huang and Yang (2004) employ the same method

9 Except for Taiw個 (the Weighted Stock Index), Germany (German OAX index), Hong Kong (Hang Seng index), and U.K. (FTSE 100 index) whose stock retum da個缸.e obt血 ned from 出e叮

stock market indices because of 出e data availability and length , 出e da旭 of 出e rest ∞凹的 es come from 由e IFS CO ROM ofIMF (code 62, the stock index) 甘1e IFS stock indices are the

percentages of individual stock market indices. For example, the U.S. stock index 自由e

percentage of the Oow Jones !ndustrial !ndex. F or the four exception countries, we take percentages of their st凹k market indices before using them

ChiaoDa λfanagement Review Vol. 29 No. 2, 2009 175

high inflation hurts both the economic growth and the stock market. Because ofthese reasons

,

we add the inflation rate in our regression.(6) The ratio of international trade to GDP (TRD): This ratio is the sum of impo吋S

and exports to GDP, and could be viewed as an indicator of the openness of an economy. For large open economies like U.S. and Japan or international-trade oriented economies like the four Asian tigers and the southeast Asian emerging

markets, the international trade plays an impo付ant role in their economic

developments; therefore, we add this ratio to our regression. Literatures including King and Levine (1993) and Bekaert et al. (2001) also employ this ratio in their empirical models

The reason why we employ the annual data to conduct the empirical study is as follows. The GDP and national income data of most countries are quarterly or annual, so using annual data helps enlarge our sample size and length. In addition, we bel ieve that the fo口nation of the interaction between the stock returns and economic growth takes tim巴; therefore, the annual data reveal this

property better than other frequency data could. Researches including Fama

(1990)

,

Schwert (1990),

and Mauro (2003) use annual data in their studies as well Our sample includes forty night countries from 1960 to 2003. Not every country has the same data length. The longest one is 44 years and the shortest one contains only 12 years. There are twenty eight countries whose data lengths are greater than or equal to 30 years, eight countries whose data lengths are between 20 and 30 years, and thirteen countries whose data lengths are less than 20 years. Please refer to Appendices 1 and 2 for the data codes and data sources. In additi凹,we also so叫 the countries according to their per capita real income. The result

shows that there are twenty seven countries belonging to the high-income

category, six countries belonging to the medium-to-high-income category, ten

countries belonging to the medium

.

to-Iow-income catego旬, and six countries10

belonging to the low-income category

10 According to 出em∞me categories specified by the World Bank in 2003, low-income counnies

ìndicate the ones whose per capita annul incomes are lower 曲曲 US$ 765,

medium-to-low-incomes countries whose per capi個 armual incomes are between US$ 766 and US$ 3,035, medium-to-high-income counnies whose per capita armual incomes are between

176 Js Ihe Relalionship Befween Slock Retums and Economic Growth Disappearing? A Cross-Sectional Analysis

4. The empirical study and analysis

Many studies employing the time-series data to examine the relationship

between the stock returns and economic growth

,

such as Aylward and Glen (2000),

Mauro (2003), and Henry, Olekal肘, Thong(2004), find that this relationship is

significant in most high-income as well as other income level countries. In this paper, we employ the cross-sectional data and construct the bi-regime TR model to investigate whether income levels could impact the relationship between these two variables11 Since our data is cross-sectional data without the time factor

,

there is no lag variable in the regression and we could not discuss the causality between these two variables. Moreover, our sample contains more than thirtycountries so we can directly estimate the model without worrying about the

small-sample problem. In additi凹, since the data lengths of our sample countries

are not the same, we divide our sample period into three sub-sample periods,

according to the available data lengths

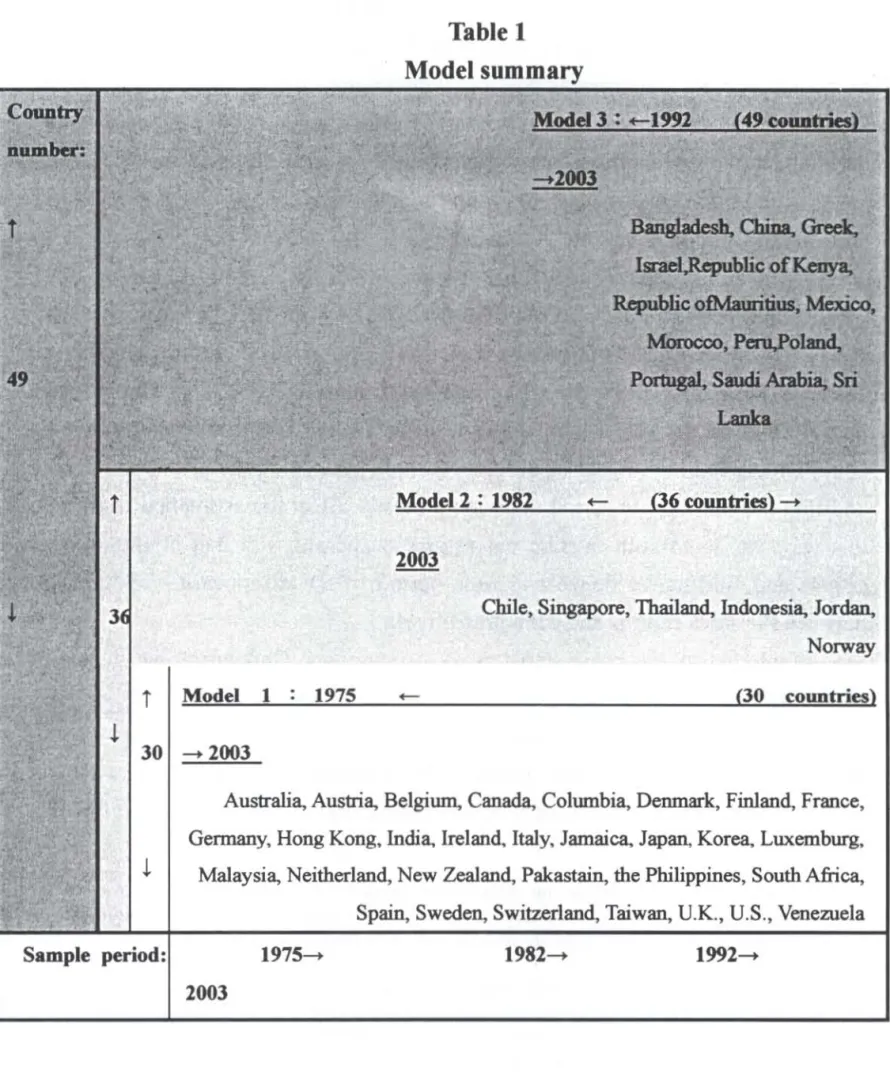

Table 1 lists the three models corresponding to the three different sample periods and the countries included or added in the three models. The sample period of Model 1 is from 1975 to 2003 and Model 1 contains thirty sample countries. The sample period of Model 2 is from 1982 to 2003 and Model 2

US$ 3,036 and US$ 9,386, and high-income cOW1tries whose per capita annua1 incomes 缸e higher than US$ 9,386η1e categorizing method used by the World Bank is s凹1i lar to the one used by the United Nations 也at divides the ∞untries Înto two categories: developed countries

and developing cOW1tries. In our opuu凹 categorizing cOW1tries by income levels has the

advantage of finely grouping ∞ untries into several, 間也叮曲曲。叫Y two, categories, which

helps researchers utili扭曲e information on studies and analyses

IIThe re品on wby we employ dollar quoted per capita real GDP 扭曲e threshold variable is that we would Iike to differentiate sarnple cOW1tries between high- and low-income ones. n白s threshold

variable c田mot retlect the world business cycles. The only way 血e 也reshold variable could

achieve this p田pose is through the changes of the threshold values. For ins祖n凹, 自由e s血nple

period approaching 出e year 2003, we could s自由 at 出e optimal threshold value is increasing

m出 time. In Model 1 (con恤ns 30 coW1tries), 也e optimal 血reshold value is US$ 14,286; in

Model 2 (con旭ins 36 countries), the optimal threshold value is US$ 15,114; in Model 3

(con囚的 49 coW1tries),由 e optimal threshold value is US$ 21,968 叮叮 impli自由at 由e real per

capita GDP ofboth high and low income countries are increasing, which indicates 出at the world e∞nomy IS growmg

Chìao Da Managemenl I?evìew 均1. 29 No. 2, 2009 177

contains thirty six sample countries. The sample period of Model 3 is from 1992 to 2003 and Model 3 contains forty nine countries.

Table 1 Model summary C個!ltry "

.

M叫e13 :• 1992 (49鍾盟鐘韓a allJllbC前T

••

~. h崢esb,函Dl,Gr地 h世,RqJUbIiC ofK眉,可 R早敞的必岫i!!us.~ Mar悶悶,Pau,Po1aI凶, h嘲,句啥th曲風甜 J..anb Model 2 : 1982 。- 。6 個 untri國】→ 主盟主Chile, Singapo間, Thail阻止Indonesia, Jor也見

Norway

t

I

Model 1 1975 • (30 <0盟單單l301 → 2ω3

•

A閣官到ia, Aus出a, Belgiu血, C祖ada, Colu血bia, Den血ark, F血I阻止 France, Gennany. Hong K。嗯. Indi

a,

Irel祖d.I個ly.J缸naica, Jap曲. Kor,曲. Luxemb凹-g, Malaysia,

Neitherland, New Zealand, Pak扭扭血,也ePhilippines. Sou也 A壹i咽, Sp且且, Swede且, Switzerl阻止 Taiw血,U.K., U.S., VenezuelaSample period: 1975• 1982

•

1992•178 Is lhe Relalionship Between Slock RelUrns and Ecol1omic Growlh Disappearing?

A Cross-Sectional Analysis

The primary purposes that we divide our sample among the three

sub-sample periods are as follows. First, in this way, we could prolong our sample periodω28 years (Model 1); otherwise

,

we would have the whole sample periodof only 12 years as in Model 3. Second

,

in this way we could enlarge our sampleto include as many countries as possible without any missing value. I2 Third, our

sample period could overlap with that of Binswanger (2004). Fou口h, when

dividing among sub-samples, many studies use ten years as a window. 13

In addition

,

we derive six sub-models from Model 1: Model 1 82 (sub-sample period: 1982 to 2003),

Model 1_92 (sub-sample period: 1992 to2003), Model 1_7581 (sub-sample period: 1975 to 1981), Model 1_8291

(sub-sample period: 1982 to 1991)

,

Model 1_7584 (sub-sample period: 1975 to1984)

,

and Model 1_8594 (sub-sample period: 1985 to 1994). From Model 2,

wederive Model 2_92 with sub-sample period from 1992 to 2003. The primary

pu巾。se that we derive sub-models from Models 1 and 2 is that by doing this we could understand the impact of different sample periods on the estimation results

and find the sub-sample period that would mostly a仔ect the estimation results. 1n

this way, we could both overlap our estimation period with that of Binswanger

(2004) and find the evid巳nce and time period of the disappearing relationship

between the stock returns and economic growth

Table 2 lists the basic statistics of all variables. Comparing the means of

CALSR (the stock retum) and CALYG (the economic growth) in the three models,

one could see that in Models 1 and 2

,

the means and minimums are positive and the standard deviations do not change a lot. It seems that although there are sixmore countries added into the sample of Model 2 and the sample period of Model

I2

The primary reason we divide 0叮 S 剖nple into severaJ sub-sample periods is to avoid 出e

possible biased estimation. If we did not do th悶, there are missing values for the coun的 es WI出

shorter data lengths. When there are rnissing vaJues in 出e cross-sectional da恤, the 自bmatJOn

resuIts rnight be biased

13 Although we employ the cross-se叫ional da恤, there are some “dynamic" elements in 0盯

empirical studyη1TOUgh changing 出e sample periods, we ∞附加ct several derived models,

for example, Models 1一位,一位,一7584, _8594, and 2_92. We could compare di叮叮.ent derived

or sub-models to anaJyze a specific ∞m旬's performances in djlferent time periods, and we

could, as well, utilize 出e estlma臼00 results of the sub-models to re-examine 出e findings of Binswanger (2004)

Chiao Da Management Reνiew Vol. 29 No. 2, 2009 179

2 is 7 years shorter, the basic statistics of these two variables in the two models

are not influenced much by the sample size and length. In Model 3, there are

thirteen more countries added into the sample and the sample period is only 12

years. One can see that the basic statistics ofthe two variables have more

Table 2

8asic statistics of the variables

1975102003 CALSR CALYG CAGOV CAINV CAPI CATRD

Mean 9.25 2.15 16.51 22.06 7.00 74.61 Maxirnum 22.51 6.93 27.51 31.72 23.83 238.96 Minimum 3.00 -1.86 7.80 16.57 2.41 18.42 Range 19.51 8.79 19.71 15.15 21.42 220.54 Standard devialion 4.09 1.66 4.69 3.64 4.95 51.13 Skewness ∞effici目前 1.58 0.67 。 33 1.02 2.02 1.67 Kurtosis coe間cient 6.08 4.57 2.79 3.87 6.72 5.56 Observations 30 30 30 30 30 30

1982102003 CALSR CALYG CAGOV CAINV CAPI CATRD

Mean 9.88 2.20 16.38 22.67 6.45 82.87 Maxim山訂 29.13 6.04 27.72 36.24 26.96 293.70 加1ini mum 2.97 -2.24 8.08 16.44 1.42 19.34 Range 26.16 8.28 19.64 19.8 25.54 274.36 Standard deviation 5.29 1.63 5.08 4.61 5.24 61.30 Skewness coefficient 1.75 。 12 0.36 1.18 2.26 1.90 Kurtosis coe而cient 6.51 3.70 2.36 3.87 8.35 6.41 Observarions 36 36 36 36 36 36

1992 10 2003 CALSR CALYG CAGOV CAlNV CAPI CATRD

Mean 8.13 2.09 16.27 22.30 5.59 81.42

Maxirnum 29.97 7.68 29.16 36.48 32.49 279.60

Minimwn -5.80 -2.82 4.67 15.54 。 26 18.95

Range 35.77 10.5 24.49 20.94 32.23 260.65

Slandard devialion 7.12 1.78 5.55 4.96 5.84 58.61

180 Js the Rel叫iOl1ship ßefWeen Slock Relurns and Economic Growlh Disappearù啥? K叫tOSJS coe侃Clent Observations 4.28 49 5.12 49 2.59 49 3.84 49

A Cross-Sectional Analysis

10.53 49

6.99 49

significant changes. For instance, the minimums switch to negative values

,

the means decrease, and the standard deviations increases a lot. Summarizing

from these analyses we can say that because there are more changes to the sample

of Model 3, the basics statistics of CALSR and CALYG become more complicated

However, the changes of the characteristics of CALSR and CALYG head toward

the same directions

As to other exogenous explanatory variables

,

the largest means of CAGOVand CAPl are in Model 1, of CAINV and CATRD in Model 2. The largest standard deviations of all explanatory variables are in Model 3, except for that of CATRD

(Model 2). The statistics of ranges also reflect the same phenome悶, which

indicates that as the sample period gets shorter and the sample size gets larger, all variables

,

including CALSR and CALYG,

fluctuate more4.1

The TR modelWe first construct the single regime model and then we conduct the linearity test. According to equation (2), the single regime model is as follows

CALYG; =

C

+ø

CALSR ; +βjCAGOV; + β2CAINV,+

ß3CAPl ;+

ß4CATRD ;+

ê; '(3)

where C is the constant term;

ø

and β's are the coefficients;e

is the error terrn; idenotes the ith country. When estimating equation (3)

,

to avoid theove叩arameterization problem, we simpli

fY

the regression by reserving only the variables with significant coefficients. In addition, to examine the existence ofthe nonlineari旬, we use the economic growth as the dependent variable and the stockretums and other variables as the explanatory variables to construct the

Chiao Da Management Review 的/. 29 No. 2, 2009 181

the bi-regime-unit-variate TR model to examine the relationship between the 14

stock retums and economic growth,

Table 3

Summary of the linearity test results and the optimal threshold 、'alues Dependeot variable: economic growth

Tbreshold variable:percapita real GDP(US$) Threshold

Sample Model specification (explanatory variabl的) F statistic P value

period value

Model1 Observations: 30

1975 to 2003 Constant tenn, CALSR, CAJNV, CAPJ 14286.45 5.67" (0.03)

1982 to 2003 Constant te口n, CALSR, CAINV, CAPJ 15800.69 4.59' (0.06)

1992 to 2003 Conslant tenn, CALSR, CAGOV, CAPI 21968.20 9.31" (0.00)

1975 to 1981 CODstaot term, CALSR, CAINV, CAPI 14784,50 2,54 (0.44) 1982 to 1991 Constant tenn, CALSR, CAINV; CAPI 18382.79 1.65 (0.74)

1975 to 1984 Constant tenn, CALSR, CAGOV, CAJNV 5828.28 10.13" (0.00)

1985 to 1994 Conslant tenn. CALSR, CAGOV 8020.56 6.04" (0.04)

峙10del2 Observations: 36

1982 to 2003 Constant tenn, CALSR, CAGOV, CA凹, CAmD 15114.03 5.31" (0.02)

199210 2003 Cons個nt tenn. CALSR, CAGOV, CAJNV, CAPI 2.1968.20 8.01" (0.00)

Model3 Observations: 49

1992 to 2003 Constant tenn, CALSR, CAGOV, CAJNV, CA月 21968.20 3.76' (0.07)

Note: Numbe悶 in the parentheses are the p values ofthe Iinearity test statistics ofthe TR model. " and

• indicate 出e 5% aod 10% significanc肘, respectively

ln this paper

,

we utilize the U.S. dollar quoted averaged per capita real GDP as the threshold variable 10 di缸erentiate between high- and low-income regimes and to construct the TR model. The Tsay (1989,

1998) linearity test associated14 For detailed explanations of the estimation pr凹e目的 of the nonlinear models with cross-sectJ on叫 data,please refer to Oeidda and Fatto曲 (2002)

182 15 Jhe Relatìonship Be何'een Srock Relurns and Economic Growrh Disappearing?

A Cross-Seclional Analysis

with lag period setting cannot be applied he悶; therefore, we employ the Sup LM

linearity test proposed by Hansen (1996)15 In addition, to compare the estimation

robustness among models, we specif扯 ten different models according to the

sub-sample periods for the following uses.

Table 3 repo口 5 the linearity test results. Under the 10% significant value

,

thenull hypothesis is rejected in eight models: Model 1, Model 1_82, Model 1_92,

Model 1_7584, Model 1_8594, Model 2, Model 2_92, and Model 3. This result

suggests that we could employ the b 卜regime TR model in those eight models. As

to Model 1_7581 and Model 1_8291

,

since the linearity hypothesis cannot berejected in these two models

,

we discard them in the following discussions4.2 The empirical results and analyses

Table 4 lists the estimation results of the TR model. In the following

,

we 16exp1ain and discuss our findings of each model Model 1:

The threshold value is US$ 14,286. In regime 1, the high-income regime,

the stock retum is positively and significantly correlated with the economic growth. In regime 2

,

the low-income regime,

the two variables are positively correlated but the correlation is not significant. These findings indicate that in the 29 years, the relationship between the two variables is signi日 cant and positive only in high-income coun甘 ies. This result is consistent with the conclusions of Aylward and Glen (2000), Mauro (2003), and Henry, Olekal肘, Thong(2004) that15 The critical valu目。f the large-sample linearity test 缸.., highly sensitive to 也e nwsance

P缸ameter. Hansen (1996) sugges扭曲at one could 回nsfonn the test statistic with the

large-sample distribution, and tbe transfom祖d statistic foJlows the large sample uniform

distribution (U(O, 1)) under the null hypothesis. ln this way, the critical values will not be influenced by tbe nuisance par目neter.

16 Norman (2008) finds 伽t the estimation result of 伽 smaJl-sarnple threshold model could be biased. To reconfirm tbe robustness ofthe estirr>ation result in Table 4, we utilize 出e suggestlon

of Nonnan (2008) and 出e b∞ts回ps method to obtain eight cri臼 cal values of the estim副d

coe伍 cients of the threshold model. Please refer to Appendix 3 for de回 led information. The results show 也at except for 出e significant levels of SQme coefficients, the whole estimation results are not atfected by tbe small-sample problem, whicb indicates 也 at 0叮 estimation results are robust

ChÎao Da Management RevÎew ~色1. 29 No. 2, 2009 183

use time-series data to investigate the same question. As to the outcome of regime 2, we believe that the reason for the insignificance of this relationship is as

follows. Although there are some high-income countries like the Asian emerging

industrial econom記s, there are other low- and medium-Iow income ones. Since our data are averaged on郎, this might weaken the significance of the relationship between the two variables in high-income coun甘 ies of regime 2 and lead to the insignificance in regime 2.

As we can see in Table 3, the threshold effect is significant in four of the derived models of Model 1, including Model 1一位, Model 1一位, Model 1_7584, and Model 1 8594. In the followin臣, we discuss the

“

sample period" impact through the derived modelsModell 82:

The sub-sample period of Model 1_82 is from 1982 to 2003 and there are 30

observations in the model. The threshold value reported in Table 4 is US$ 15

,

800 In regime 1,

the relationship between the stock retums and economic growth is positive and significant; in regime 2,

the positive relationship between the two variables is not significant. Comparing the estimation results of Model 1 and Model 1 一位, we can see that in regime 1 of Model 1_82, the significance level of the relationship between the two variables is reduced,

while the significance level in regime 2 時間的ed. The major reason of the significance-Ievel f1uctuation between the two models might be that the data length is 7 years shorter in Model1 82

Modell 92:

The sample period of Model 1_92 is shortened

,

from 1992 to 2003. There are30 observations and the threshold value is US$ 21

,

968. The positive andsignificant relationship between the stock retums and economic growth is

disappeared in regime 1 but shown up in regime 2. It is very obvious that because

the sample period of Model 1_92 is 17 years shorter than that of Model 1, the

relationship between the two variables 的 no longer the same. It seems that when

the sample period chang的, the originally positive and significant relationship

184 Is the Relalionship Betw'een Slock Relurns and E.ωnomic Growlh Disappear;ng?

A Cross-Seclional Analysis

more specific impact of the sample period on the estirr>ation result, we ∞mpare

the following two derived models.

Table 4

Estimation results of the TR model

Modell 且mple period: 1975 個 2003 (30 observalions) US$ 14,286.45 Constant terrn CALSR CAINV CAPI Countries included in the regime ReFme 1 Obs Coef P value 18 -1.67 (0.29) 0.24 (0.03) 0.09 (0.08) -0.11 (0.56) Luxemburg, U.S., Swi包er1and, Denm訂k,

Canada, Australia, Jap曲, Sweden, Netherland, Belgiwn, France, Hong Kong, Gerrnany, Austria,

U.K., Italy, FinJand, New

Zealand

Regime2

Obs Coef P value

12 1.95 (0.56)

0.11 (0.29)

。 13 (0.37)

-0.33 (0.00) Spain, Ireland, Taiw凹, Korea, Venezuel

a,

South Africa,

Malaysia,

Col山nbia. 出e Philippin間,

Jarnaica, India, Pakistan

Modell_82: sarnple period: 1982 個 2003 (30 observations) US$ 15,800.69

Regime 1 Regime2

Obs Coef P value Obs Coef Pvalue

Constant tenn 18 -0.93 (0.53) 12 2.91 (0.22) CALSR 0.10* (0.08) 0.07 (0.22) CAINV 0.09 (0.13) 0.07 (0.53) CAPI -0.03 (0.87) -0.28 (0.00)

Model 2: sarnple period: 1982 to 2003 (36 ob盟問臼 ons)

US$ 15,114.03

Regime 1 Regime 2

Obs Coef P value Obs Coef P value

Constant term 21 0.54 (0.45) 15 8.77 (0.00) CALSR -0.13 (0.35) 0.12** (0.02) CAPI 0.30 (0.24) -0.35 0.00) threshold value Adj叫edR' 0.56 Residual swn 1.10 Residual swn 26.40 。fsquares Log likelihood -40.65 threshold value Adjusted R' 0.52 Residual sum 1.08 Residual sum 25.51 of squares Log likelih∞d -40.14 threshold value A吐üusted R' 0.61 Residual sum 1.02 Residual sum 27.19 of squares

Chiao Da Managemenl Review Vol. 29 No. 2, 2009 185 CAGOY CAT,他〉 0.02 0.01 (0.65) (0.00) -0.29 0.00 (0.00) Log likelihood -46.03 Countries included in the regime Luxemburg, U.S二Z Switzerland,

lN

orwayj Denmark, Canada,Austral悶, Jap曲, Sweden,

Netherland, Belgium, Franc池, Hong Kong, Ge口nany. Austria. U.K.,

ingapor<j, Italy, Finland,

New Zealand, Ireland

(0.50) Spain, Taiwan,__Korea. Venezuela, IChilel, South

Africa. Malavsia.

Colurnbia. rrhailand

區區巫山he Philippines,

Jamaica, [Indo叫eS1司, India, Pakistan

The six 呵uared

countnes are 出eones not included in 出e

組mple of Model 1

Note: Regime 1 corresponds to the case 出at the income is greater 也叩出e threshold value, while regime 2 coπesponds to the case that the income is smaller th個 the threshold value

Nurnbers in 出e parentheses 訂e 出e p values. •• and * indicate 出e 5% and 10%

significances, respectively

Table 4 (continued)

Modell_7584: sarnple period: 1975 to 1984 (30 observations)

US$ 5,828.27 Constant terrn CALSR CAGOY CAINY Regime 1 Obs Coef. P value 22 4.41 (0.17) 0.14* (0.05) -0.16 (0.19) -0.05 (0.44 ) Luxemburg, U.S., Switzerland, Canada, Denmark, Japan, Hong

Kong, Aus甘ali a, Sweden, France, Genna呵,

Belgium, Austria, Netherland, ltaly, U.K.,

F inland, N ew Zealand,

Sp詛咒Ireland,

Venezuela, So叫出 A面值

Regime 2 Obs Coef. 8 -2.65 。 37處* 句0.85** 0.61** lndia, Pakist曲,出e Philippines, Jarn副 ca, Columb悶, Malaysia, Taiw甜. Korea

Modell_8594: sarnple period: 1985 個 1994 (30 observations)

threshold value P AR 2 djusted 0.69 value (0.26) Residual 1.22 surn Residual (0.00) surn of 33.01 squ訂閱 (0.00) Log -44.00 likelihood (0.00) AIC 3.47 threshold

186 ls Ihe Relaliol1ship Belween Slock RelUms and Economic Growlh Disappearing? value: US$ 8,020.56 Constant tenn CALSR CAGOY Regime 1 Obs Coef P value 23 3.51 (0.19) 0.08 (0.58) -0.12 (0.27) Luxemburg, U.S., SwÌ包erl個d,C祖ada, Denmark, Japan, Hong

Kong, Austral恤. Sweden.

France. Gennany.

Belgium, Austri

a,

Netherland, ltaly, U.K.,

F ilÙand, N ew Zealand,

Spain, Ireland, Taiwan,

Kore

a,

South A岳lcaR置。dell 7584: Regime 2 Obs Coef 7 -10.95 0.11 0.91 Indi

a,

Pakis個n,也ePhilippines, Jam剖 ca,

Columbi

a,

Malaysia,Venezuela

A Cross-Seclional Analysis

P value (0.15) (0.11) (0.07) An2 司Justed R Residual sum Residual sumof squares Log likelihood -0.01 2.28 124.89 -63.96 AIC 4.66

The sample period ofModel 1_7584 is from 1975 to 1984 and there are 30

observations. This sample period is in the first one third of the 29-year period and through the estimation results of th的 model, we could understand the impact of this lO-year period on the relationship between the stock returns and economic

growth. The empirical findings show that the threshold value is

US$

5,828 and therelationship between the two variables is positive and significant in both regimes

The only difference between the estimation results of the two regimes is that the

Chiao Da Management Review Vol. 29 No. 2. 2009 187

Table 4 (continued)

Modell_92: sample period: 1992 to 2003 (30 observations) 出reshold

value: US$ 21968.2

Regime 1 Regime 2

Obs Coe( P value Obs Coe( P value

Constant 15 lenn -0.73 (0.44) 34 9.17 (0.00) Adjusled R' 。 68 CALSR 0.09 (0.30) 0.12' (0.09) Residllal 。 97 sum Residual CAGOY 0.06 (0.03) -0.34 (0.00) sum of 20.86 squ缸es CAPJ 0.34 (0.42) -0.38 (0.00) Log -37.12 likelihood AIC 3.01

ModeI2_92: sample period: 1992102003 (36 ob自rvations) threshold

value: US$ 21,968.2

Remmel Re島ime2

Obs Coef P Obs Coef P value

value Conslant 15 -7.49 (0.01) tenn 34 8.91 (0.00) Adjusted R' 。 62 CALSR 0.13 (0.12) 0.13" (0.03) Residual 1.04 sun> Residual CAGOY 。 16 (0.01) -0.35 (0.00) S山ηof 2803 squares CAINY 。 21 (0.01) 0.01 (0.81 ) Log -46.58 likelihood CAPJ 0.52 (0.14) -0.37 (0.00) AIC 3.14

Model3: sample period: 1992102∞3 (49 ob盟問ations) threshold

value: US$ 21.968.2

Regmel Regime 2

Obs Coef P Obs Coef Pvalue

value Constant 15 le口n -7.49 (0.00) 34 2.03 (0.41) Adjusted R' 0.42 CALSR 0.13" (0.10) 0.10" (0.05) Residual 1.36 sum Residual CAGOY 。 16 (0.00) -0.13 (0.06) sum of 71.65 squares

188 Js the Relationship Befween Srock Relurl1s and Economic Growlh Disappearing? CAINY CAPl Countries included in 出e regune 。 21 (0.00) 。 52 (0.12) Luxemburg, U.S., Norway, Switzerland,

Hong Kong, Denmark,

Canad

a,

Japan, Singapore,Aus回Ji a,Netherland,

Austria, Belgium,

Germany, Sweden

Model 1 8594:

A Cross-Sectional Analysis 。 14

-0.25

(0.03)

(0.00)

U.K., France, 1taly, Fi叫阻止

lreland, New Zealand,

Log likelihood A1C -78.84 3.63 羽田 thirteen squared

countIÌes are the ones

not included in the

sample of Model 2

The sample period of Model 1_8594 is from 1985 to 1994 and there are 30

observations. This sample period is in the middle of the 29-year period. The

threshold value is US$ 8

,

020.56. The estimation result shows that the relationship between the stock returns and economic growth is positive but insignificant in both regim俗, which is con甘ary to the estimation result of Model 1 7584. Thisempirical finding seems to indicate that in this period, there may exist some

factors that would redu∞ the significance of the relationship between these two

variables. Our findings also reflect both the phenomenon pointed out by

Binswanger (2004) that the relationship between the stock retum and economic

growth was disappearing and the timing of this very phenomenon

We summarize our estimation results of Models 1 82 and 1 92 as follows.

Because of the change of the sample periods, the originally positive and

significant relationship between the stock returns and economic growth in regime

1 of Model 1_82 starls to fade after 1982. Till 1992

,

this relationship becomes insignificant. This significance-fading pattem is confirmed by the estimationresults ofModels 1_7584 and 1_8594. During the 10 years of 1975 to 1984, the relationship is significant in both regimes. In the 10 years of 1985 to 1994

,

Chiao Da Mal7agement Review Vol. 29 No. 2, 2009 189

however, the significant relationship disappears in both regimes

,

which indicatesthat the economic environments in these two 10 years are very different

Using 1980 as the switching point, we discover the disappearing

relationship phenomenon first observed by Binswanger (2004). The estimation

results of regime 1 in all the sub-models of Model 1 confirm the finding of

Binswanger (2004). We believe that this phenomenon could not be completely

examined by the linear model and the reason is as follows. From our above findings, the positive and significant relationship between the stock returns and economic growth does exist. However

,

during some period,

this positive and significant re\ationship would switch from regime 1 to regime 2 in the whole sample periodModel2:

The sample period of Model 2 is from 1982 to 2003 and there are 36 observations. Since there are six more countries (Norw呵, Singapore, Ch 巾,

Thailand, Jordan, and lndonesia) in the sample, compared to that of Model I一位, we could view Model 2 as the derived model of Model 1_82 and the comparison of the estimation results of the two models could give us an idea about the impact of the sample size. 17

The estimation results of Model 2 are reported in Table 4. The threshold value is US$ 吟,114, higher than that of Model 1. Different from the estimation result of Model 1_82

,

in Model 2,

the stock return is positively and significantly correlated with the economic growth in regime 2 and the correlation is negative in regime 1, which indicates that after adding six more countries into the sample, the significance level in regime I is reduced while that in regime 2 is raised. The two countries added in regime 1 are Singapore and Norway and the four ∞ untnes17 Since 1984, the averaged economic grow出 rate of Chile w品 about 6.5%刊e rate was 6.7% in 1996, while in 1997,也e rate dropp叫個 negative. Chile started to recover in 2000. The averaged growth rate in 出e recent 10 ye缸s is 6010 η1e averaged economic growth rate of Jordan between

1981 血d 1985 was II %. Starting from August 1990, 也e First Gulf W盯 period, , Jord曲's economy declined. Jordan participated the World Trade Organization in 1999. The averaged economic growth rate between 1999 and 2002 w由 around 3% and 4%. As to Indonesi

a,

its primary export is oil 刊e averaged economic growth rate between 1985 個d 1994 was over 5% ln 1997,由e rate dropped from 7% to -13%190 Js the Relationship Between Sfock Returns and Economic Growth Disappearù啥?

A Cross-Seclional Analysis

added in regime 2 are Chi峙, Thailand, Jordan, and Indonesia. In addition to these

four ∞ un別的, part of the original countries in regime 2 are Asian emerging

industrial coun甘ies, including Korea, Taiwan, the Philippines, Thailand, Indonesia,

and Malaysia. 18 Same as the findings of Model 1 一位, the relationship disappearing phenomenon discovered by Binswanger (2004) also appears in regime 1 of Model 2. To examine the impact of the sample periods

,

we derived Model 2_92 whose sample period is 10 years shorter than that of Model 2.19Model2 92:

The sample period of Model 2_92 is from 1992 to 2003 and there are 36

observations. The threshold value is US$ 21

,

968. The relationship between thestock retums and economic growth is positive and significant in regime 2

,

positive and insignificant in regime 1. Comparing the estimation result of Model 2_92 with that of Model 2

,

we find that the significance level of the relationship between the two variables is higher in regime 1 of Model 2_92 (the p value ischanged from 0.35 in Model 2 to 0.12 in Model 2_92) and the direction of the

relationship is switched from negative in Model 2 to positive in Model 2_92. We believe the primary reason of the estimation result difference in regime 1 of the two models is that the sample period of Model 2 is 10 years shorter. As to the disappearing relationship phenomenon found in Binswanger (2004), the phenomenon does not show in our estirr>ation. The relationship between the stock

retums and economic growth is positive and signi日cant in regime 2.

18 In也e 1980s, the European and American high-income countries grew at low bul stable rates,

and the stock markets ofthose countries perfonned well. ln that period, only eastem A別扭曲d

Pacific region economies had high economic grow出 rates. ln 出c pcriod of 1985 to 1994, 也e

growth rates of Hong Kong, Singapore, Thailand, Kore

a,

Malaysia,個d lndonesia were over 50/0China and India bo出 had surprising 目onomic perfonn聞自s 刊e financial, stock. and exchange

rate markets of Asian emerging indus甘ial economies grew at high speed. For detailed

information about economic growth data of these ∞untnes

19 The way we divide between the two regimes is based on the endogenously produced threshold

value by the model, not by 0叮 subjec包 ve decisions. Becau阻 of 出e limit number of the

ob盟rvatlO悶, we have only two regim自由e high-income regime (regime 1) and the low.income [1句 me (regime 2). This classification m訕。d creates slightly different results from

出e classification of the World Bank. For instance, in 0叮 classification, Taiwan and Korea

belong to regime 2, the low-income regime. Even 出ough th叮e IS 也is kind of classification

Chiao Da Management Re叫ew 叫 29 No. 2, 2009 191

Model3:

The sample period of Model 3 is from 1992 to 2003 and there are 49

observations, the largest number of observations and the shortest sample period in

all models.20 Model 3 could be viewed as the derived model of Models 1 92 and

2_92 by adding more observations. The estimation results show that the threshold

value is US$ 21

,

968 and the relationship between the stock retums and economic growth is positive and significant in both regimes 1 and 2. The significantlypositive correlation finding is consistent with the conclusions of many time-series

studies, including Aylward and Glen (2000), Mauro (2003), and Henry, Olekalns,

Thong(2004)

,

that the relationship between the stock returns and economicgrowth is positive and significant in high-income as well as other income level

countries. For comparison convenience

,

we summarize our empirical findings inTable 5

From above estimation results we could see that when the sample period is from 1960 to 2003, the relationship between the stock retums and economic growth is positive and significant in high-income countries. Why is that? We

believe the m句。r reason is that the financial markets in high-income countries are

more complete and regulated

,

and therefore,

the markets could maintain theirefficiency and the stock prices could reveal the fundamental values of the

economic growth of the corresponding countries. ln other words

,

the financialmarkets of these countries are less susceptible to the impacts of other econom此,

financ划, or political factors so that stock retum ofthese financial markets would

not lose their ability of predicting the economic growth. King and Levine (1993)

find that the financial development could fuel the economic growth and the two variables are positively and significantly correlated. The major factor contributes to the positive and significant correlation is the complete, efficient, and regulated

financial environment. Moreover

,

in our empirical study,

when we use a shorter20 There are thirteen newly added countries in Model 3, including Israel, Portugal, Gr自ce,

Mauritius, Saudi Arabia, Mex.ico, Poland, Peru, Morocco, Sri Lanka, China, Bangladesh, and Kenya. Among them, Mex.i∞ experienced the so-called Peso crisis in 1994 阻d 1995, and the economy started to grow in 1996. China's economic grow也 speeds up after 也e econorruc refonn