EVALUATING ONLINE AUCTION STRATEGY:

A THEORETICAL MODEL AND EMPIRICAL EXPLORATION

WANN-YIH WU BINSHAN LIN CHENG-FENG CHENG National Cheng Kung University Louisiana State University - Shreveport Asia University

Tainan 701, Taiwan Shreveport, LA 71115 Wufeng 41354, Taiwan

ABSTRACT

This paper attempts to develop a theoretical model and associated method for researching the interrelationship among the elements embraced in the context of online auction strategy, and their influences on the online bidder satisfaction. This study utilizes the concept of standard normal distribution function to develop a theoretical model that conforms to the prospect theory.

The empirical method for examining the interrelationship is large- scale filed study. The empirical study collected primary data from customers that have experience with bidding on the online auction sites. Our findings of theoretical model support that the online bidder is inclined to adopt higher-price-oriented bidding strategy at the beginning of auction. In addition, we found the optimal guideline of online auction strategy to determine the allocation of resources. The results of the empirical exploration support the intermediary roles of price and hedonic value in the relationship between quality strategy and online bidder satisfaction.

Keywords: Information System Quality, Online auction, Auc- tioneer, Bidder satisfaction, Prospect theory, Internet, Strategy.

INTRODUCTION

Among the most popular Internet applications are online auctions [10, 21, 39]. Recently, online auctions have been rapidly growing in popularity, thus have been receiving a lot of attention from academics and practitioners. Many scholars have noted that online auction has proved to be fertile ground for new auctioneer models [9, 13, 28, 32, 33, 37]. Pinker et al. [29] noted that the auction-based electronic markets best represent the changes to auctioneer inherent in electronic commerce.

There has been a growing stream of research on online auction strategy and bidder behavior. Research has focused on the impact of characteristics of auctioneers or providers on online bidder behavior. Although Saeed et al. [32] had developed a conceptual model to integrate the main factors that influence online bidder behavior involving information-system quality and service quality. Nevertheless, there has been little attempt to date to synthesize work on the impact of intermediary variables such as auction price or hedonic value on the online customer. Information system quality describes the user perceptions concerning the characteristics of the Web site content and the effectiveness of system attributes, whereas service quality describes the customer perceptions concerning their service experience [11,15].

However, the importance of the intermediary variable and price, can be expounded in several ways. First, quality, price, hedonic value and online bidder satisfaction can be major elements which need to be considered when making marketing decisions.

Numerous studies have examined the impact of these elements

on market share or performance, and customer behavior [25, 39].

Second, one major difference between online auction strategy and traditional marketing strategies is pricing [30]. The price of goods or services is decided by the customers rather than vendors.

Namely, the customer bids against others for the vendors’ goods or services, and the final transaction price is the amount that the winning customer bids. Accordingly, the price may vary across context. The complicated prices thus encompass complex influences on customer behavior.

Moreover, online auction pricing has implications for how online auction strategies are managed. The amount of price is associated with the risk attitude of customer. According to prospect theory, risk attitudes are determined not solely by the utility function but also by the value of deviation from the reference point. The risk attitudes of the bidder should be risk aversion in the domain of gains but risk seeking in the domain of losses.

Specifically, the hedonic value function will be convex when the auction price is greater than the price on the reference point of the bidder, whereas the hedonic value function will be concave when the auction price is smaller than the price on the reference point of bidder. Therefore, the relationship between price and the hedonic value varies. This relationship further underlines the critical roles of the intermediary variables such as price and hedonic value.

Consequently, the intermediary variables involving auction price or reserve price should be closely examined.

This paper attempts to develop a theoretical model and associated method for researching the interrelationship among the elements embraced in the context of online auction strategy, and their influences on the online bidder satisfaction. The proposed model is intended to support an examination of the interrelationships among information-system quality, service quality, and bidder satisfaction in the context of online auction. In addition, the intermediary variables including auction price and hedonic value may complicate the relationships between quality and satisfaction in online auctions.

The remainder of this paper is structured as follows. First, it begins by conducting literature reviews relevant to online auction and deriving the major hypotheses. Second, on the basis of prospect theory, the conceptual model is developed and online auction strategies are evaluated. Third, empirical research is undertaken and our findings are presented. Finally, the implications of this work for research and practices are offered. The theoretical model outlines offers insights and provides a road map for future online auction research

LITERATURE REVIEW AND HYPOTHESES Several researchers have stressed a great interest in online auction or bidder behavior. Improved quality has become an

essential component for successful competition, and further suggested that the main factors to assess quality included information-system quality and service quality [5, 6, 14, 18, 23, 25, 29, 31, 37, 38]. Negash et al. [25] noted that information- system quality focused on the system and its output as products or services. They further reported that information quality is a function of the value of the output produced by a system perceived by the customer, whereas system quality is a measure of the information processing system itself. Xu and Koronios [38] suggested that the information quality should be perceived as a corporate asset that has the ability to enhance the competitive position in the electronic marketplace. Chakrabarty et al. [5] argued that service quality can be defined as the conformance to customer requirement in the service delivery, and it has been shown to result in significant benefits to firm. Lin [23] further proposed that information quality affected perceived usefulness, while system- quality and service quality influenced both perceived ease of use and perceived usefulness of virtual communities. Furthermore, Kardes et al. [20] argued that customers frequently assume that price and quality are highly correlated. Price can mediate the level of quality in physical or online environments in that the price level reflects the value of the goods. Customers with asymmetric information thus rely on price to appraise the value of the goods, especially when they cannot physically examine objects, as in the online context. Several studies proposed that the relationship between quality and price was positive, and concluded that an easier assessment of quality would reduce price sensitivity and enhance online customer’s value [20, 39]. Namely, if the online bidders are able to easily perceive the quality of goods presented on a website, they are more likely to bid and raise the auction price in an attempt to win the auction. For example, if the website is stable and speedy (i.e., system quality), the description and photo of goods are definite and clear (i.e., information quality), and the way of delivering goods to customer is convenient and secured (i.e., service quality), the bidders are willing to pay more.

Using the preceding reasoning as a basis, this study develops the following hypotheses.

H1: The information-system quality is positively related to the auction price offered by the online bidder.

H2: The service quality is positively related to the auction price offered by the online bidder.

The bidder or consumer value is a complicated construct including various elements, such as quality and price, which is categorized into utilitarian value and hedonic value [2, 8, 35, 39].

Chiu et al. [8] further proposed that customer’ perception of the utilitarian value was positively related to his or her perception of the hedonic value. In terms of the quality, numerous studies found a positive impact of information-system quality and service quality on online bidder’s hedonic value [3, 25, 32]. In other words, higher quality will lead to higher hedonic value, and this hedonic value in turn influence their subsequent behaviors. If the online bidders perceive that the specific auctioneer is able to offer the online information-system quality and service quality, bidders will further perceive higher levels of ease of use, usefulness, and enjoyment [23, 32]. In this regard, online bidder will feel that the product is easily acquired and be willing to bid in online auction, which induce both utilitarian value and hedonic value [2]. Bauer et al. [3] suggested that technical quality, reliability, and responsiveness were associated with the enjoyment in online market. Additionally, Negash et al. [25]

focused on the impact of quality on online customer’s value and further suggested that quality, including information-system quality and service quality, had a positive association with online customer’s value.

In terms of the price, online auction price is determined in the vying process that consumers bid to overtake other’s prior price in order to win the chance to buy the product. This kind of bidding process will evoke the hedonic response [2], and thus bring forth the hedonic value. Since the pioneering article on prospect theory by Kahneman and Tversky [19], most marketing scientists have made considerable progress in developing optimization models to analyze the impact of online auction price on bidder’s hedonic value [4, 13, 28]. However, the relationships between price and hedonic value are still vague. Price can be not only an indicator of the level of quality but also an indicator of the amount of sacrifice above the competitive price. Higher price represents higher quality, and this enhances hedonic value. Conversely, higher price implies bidder must pay additional amount to win the bid. Thus, higher price also represents a higher sacrifice, and that reduces bidder’s hedonic value. Generally speaking, bidders should be able to raise the auction price to win the auction when they perceive higher quality, but the higher auction price can also harm bidder’s hedonic value. This is the nature of the paradox between auction price and hedonic value. Since the auction price is decided by bidders themselves, they may face the dilemma of unduly raising the auction price to win or forgoing the auction for fear of hurting bidder’s hedonic feeling. Thus, the relationship between auction price and hedonic value in the context of online auction should be clarified. Drawing from these arguments, this study proposes the following hypothesis.

H3: Information-system quality enhances bidder’s hedonic value in the online auction.

H4: Service quality enhances bidder’s hedonic value in the online auction.

H5: Higher price reduces bidder’s hedonic value in the online auction.

Hedonic value is closely related to online bidder satisfaction.

They both belong to perspectives of subjective and personal.

However, there are two ways to distinguish between them. First, hedonic value comes from bargain-related hedonic responses [2], whereas satisfaction is related to a specific transaction [27]. No matter win or loss the bid, online auction can provide bidder’s hedonic value in several ways. In other words, increased arousal, perceived freedom, fantasy fulfillment, and bidding process all may represent a hedonically valuable auction experience.

Second, customers require experience with a product to determine how satisfied they are with it while hedonic value can be perceived without the actual consumption experience [2].

Customers usually sense hedonic through expectation prior to actual consumption. Prior studies have proposed that satisfaction is related to hedonic value, in that incidents of satisfaction over time result in perceptions of hedonic value [3, 8, 36]. Bauer et al. [3] argued that enjoyment positively influenced customer satisfaction. Satisfaction with experiential services such as leisure travel was driven by perceptions of fun, enjoyment, and pleasure.

Chiu et al. [8] further suggested that the customer’s perception of the hedonic value was positively related to his or her behavior such as loyalty or satisfaction. Consequently, we propose in the following hypothesis that hedonic value is a predictor of bidder satisfaction in the online auction.

H6: Hedonic value enhances bidder’s satisfaction in the online auction.

THEORETICAL MODEL

Shugan [34] strictly proposed that mathematics, as the language of science, allows interplay between empirical and theoretical research. This study utilizes the concepts of natural logarithms and standard normal distribution function to develop a conceptual model that conforms to the law of diminishing marginal utility and prospect theory. Based on the literature review, information-system quality and service quality would reduce price sensitivity and enhance hedonic value. According to the law of diminishing marginal utility, the degrees of impacts of quality on price and hedonic value must decrease. Thus, we assume that either information-system quality (Q) or service quality (SQ) is a logarithmic function of price (P) and hedonic value (H). Simultaneously, hedonic value is also a logarithmic function of online bidder satisfaction (BS). Moreover, bidders should be able to raise the auction price to gain the auction when they perceive higher quality, but the higher auction price is also able to harm hedonic value. According to prospect theory, this study assumes that price is a standard normal distribution function of hedonic value.

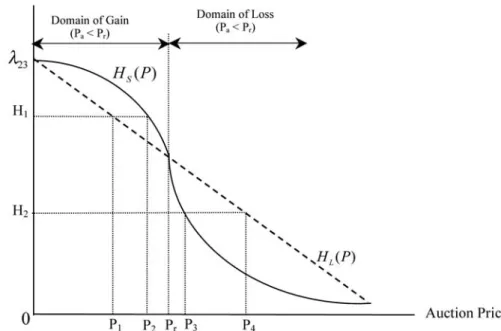

With regard to the prospect theory, the S-shaped value function is defined as deviations from the reference point, it is steeper for losses than for gains, and it is generally characterized as concave for gains and convex for losses [19]. When online bidders can win the bid at the price lower than the reference price, they will feel that they can obtain more consumer surplus through online auction. In contrast, online bidders will feel that they obtain less consumer surplus when they win the bid at the price higher than the reference price. Hence, this study specifies that the gain is the state when the auction price is lower than the reference price, whereas the loss is the state when the auction price is higher than the reference price. Based on the above discussion,

standard normal distribution function is employed to reflect the inverse S-shaped hedonic value function (see Figure 1) [17]. As shown in Figure 1, the bidder‘s hedonic value (H) is performed as diminishing marginal hedonic increase in the domain of gain and enlarging marginal hedonic decrease in the domain of loss.

Following economics principle of consumer behavior, the bidder will only submit bids below the reserve price. In other words, the auction price should not be higher than the reserve price. Moreover, bidder’s hedonic value should be lowest when the auction price equals to the reserve price. This should be especially true if a bidder has researched the product or service through traditional channels to find the known market price or the price reference point, Pr, that is the best price from nonauction channels before bidding in the online auction. According prospect theory, the hedonic value function must be defined on deviations from the reference price. Since standard normal distribution function is defined on deviations from the standard normal variable (z) equals to one, the S-shaped value function is defined as deviations from the reference point, it is steeper for losses than for gains, and it is generally characterized as concave for gains and convex for losses

With regard to the prospect theory, this study replaces standard normal variable (z) by the ratio of auction price (P).

With this regard, let the ratio of auction price (P) be equal to, where Pa is the auction price and Pr represents the price on re- ference point of the bidder. Therefore, this study has proposed that the influence of price on hedonic value in the online auction follows the standard normal distribution and that will equal to l P2

—— exp (- ——), where is the measurement parameter. For the

√ 2p 2

l

purpose of parsimonious analysis, we replace —— by l23, √

2p

where l23 is the parameter that represents the degree of impact of ratio of auction price on hedonic value. Figure 1 illustrates that the bidder will gain when the auction price is less than the

Figure 1: The Relationship between Online Auction Price and Hedonic Value.

Pa Pr,

price at the reference point, Pr, otherwise bidder will experience a loss. Therefore, this study can derive the proposition 1 and proposition 2. The proofs are in appendix A.

Proposition 1. When the auction starts or auction price is less than the price of the reference point, the online bidder is inclined to adopt a higher-auction-price- oriented bidding strategy.

Proposition 2. The online bidder is risk aversion when auction price is less than the reference price.

Accordingly, online bidder is willing to pay additional amount of price in order to avoid the risk (i.e., risk premium). The risk premium will be equal to (l23 - H)Pr

(21n(l23) - 21N(H))1/2 - ——————— . l23 [1-exp(-1/2)]

According to prospect theory, the attitudes toward risk should be risk aversion when auction price is less than the reference price. In this case, the certainty equivalent of the auction price of the online bidder equals P2 (see Figure 1), and the expected value of the price is P1. The difference between P2 and P1 (i.e., P20P1), which is equal to

(l23 - H)Pr (21n(l23) - 21N(H))1/2 - ——————— , l23 [1-exp(-1/2)]

denotes the additional amount that the risk aversion online bidder is willing to pay in order to avoid the risk. For instance, when hedonic value is equal to l23 or l23/2, the additional amount that the risk aversion online bidder is willing to pay in order to avoid the risk will be equal to zero or . Comparatively, the difference between P4 and P3 (i.e., P40P3), which is equal to the value of

(l23 - H)Pr

——————— - (21n(l23) - 21N(H))1/2, l23 [1-exp(-1/2)]

implies the degree of risk that the risk seeker would rather assume than pay more.

In addition, production possibility theory represents the combinations of the different quantities of two goods or services that a manager could efficiently produce with limited productive resources. Thus, the production possibility theory implicates that firm should employ the optimal quality strategy combining different proportion of information-system quality with service quality in the most efficient way given limited productive re- sources. The concave transformation curve or production possi- bility curve illustrates the principle of increasing cost and the marginal rate of transformation. Based on production possibility theory, the auctioneer should pursue maximal bidder satisfaction (BS) but is subject to the condition that the relationship between information-system quality and service quality conforms to the concave property. The condition can be defined mathematically as

(SQ)

1n(Q) ————— ≤ g ,

[

1 + 1n(SQ)]

where g is the parameter of fixed resources. Therefore, we can model this problem mathematically as follows:

(SQ)

Max BS subject to 1n(Q) —————

[

1 + 1n(SQ) ≤ g ,]

And then, the Lagrange function (L) in this study can be written as:

L = l30+l311n{l20+l211n(Q)+l221n(SQ)+l23exp{-1/2[l10+ l111n(Q)+l121n(SQ)]2}

Thus, the optimal values of information-system quality and service quality, Q* and SQ*, will be

l11(Ag+l22)-l12l21 l12 l11(Ag+l22)-l12l21 Exp ———————— + —— and ————————,

[

]

Al11(SQ) l11 A[l111n(Q) - l12] respectively. Thus, proposition 3 characterizes the optimal guideline of quality strategy on the online auction.

Proposition 3. The optimal guideline of quality strategy is that the auctioneer must focus on the information- system quality strategy to gain the optimal bidder satisfaction if, and only if, the value of

l11(Ag+l22)-l12l21 l12

Exp ———————— + —— is more than the

[

]

Al11(SQ) l11

l11(Ag+l22)-l12l21

value of ———————— . Otherwise, the A[l111n(Q)-l12]

auctioneer must focus on the service quality strategy.

EMPIRICAL RESEARCH Sampling Frame and Sample

In order to examine the applicability of the proposed theoretical model, we collected primary data from customers that have experience with bidding on the online auction sites, such as eBay or Yahoo auction. Representative sampling of online auction customers is difficult; we produce a randomly stratified sample. The final valid sample consisted of 327 respondents.

More than 80% of the respondents were female, more than 58%

of the respondents were single, more than 81% of the respondents were 26 to 35 years old, more than 88% of the respondents were undergraduates, about 78% of the respondents earned less than USD 21K dollars per year and about 86% of the respondents had 3 to 6 times of bidding experiences in online auction.

Measure Development

To assess the hypotheses, it is necessary to operationalize four key concepts. Integration of previous studies and theories were made to formulate the key concepts of in online auction.

To integrate the construct, this study used information-system quality strategy (Q), service quality strategy (SQ), price (P), hedonic value (H), and online bidder satisfaction (BS) as the research variables. The questionnaire was conducted using the Likert 7-point scale.

Quality strategy. Information quality is defined as a function of the value of the output produced by a system perceived by the customer [25], whereas system quality is a measure of the information processing system itself. They noted that information and system qualities focused on the system and its output as products or services. By an integration of literature review, this

study takes various input factors, including accuracy, relevance, rapid access, and interface layout from the online environment to measure the construct of information-system strategy.

Furthermore, service quality is a measure of how well the service level delivered matches customer expectations [26]. Parasuraman et al. [27] found that the criteria used by consumers in assessing service quality falls into tangibles, reliability, responsiveness, assurance, and empathy. For the sake of simplicity, this paper uses the three discrete areas (i.e., tangibles, reliability, and responsiveness) from SERVQUAL to measure service quality (SQ).

Price. In terms of intermediary variables, price is a monetary amount given up for the getting of goods or services. Aila wadi et al. [1] claimed that price consciousness is one way to measure price that is composed of comparing prices, getting the best price, checking prices, and making extra effort to gain lower prices.

According to prospect theory [19], the amount of prices, including auction price, reserve price, and the reference point price, are associated with the risk attitudes of the customer. Therefore, the respondents were asked to recollect the last online auction they participated in and to write down the auction price, reserve price, and the reference point price in that auction. The auction price represents the one that respondents bid last in that auction; the reserve price represents the highest amount that the respondents were willing to pay; the reference point price represents the base price derived from non-auction channels [4, 13].

Hedonic value. Various studies supported that hedonic value is an outcome related to natural responses that are more personal and subjective [2, 8]. Hedonic value derives more from fun and enjoyment than from task completion and are non-instrumental experiential and affective [8]. Stoel et al. [35] suggested that shoppers who were enjoying exploration of new products, who were shopping to escape, or who were shopping just for sake of shopping that were seeking hedonic value from shopping.

To capture the hedonic value (H) in online auction, this study employs enjoyment, excitement, captivation, escapism, and spontaneity based on two influential studies [2].

Online bidder satisfaction. Satisfaction is a summary psychological state resulting when the emotion surrounding disconfirmed expectations is coupled with the customer’s prior feelings about the consumption experience. Numerous studies support the idea that overall assessment of satisfaction with the online auction is the main dimension to measure the bidder satisfaction [7, 12, 22, 24]. McKinney et al. [24] showed that overall satisfaction of the bidder is an affective state representing

an emotional response to the auction experience. Similarly, Kohli et al. [22] measured customer satisfaction as an overall assessment of satisfaction with the online purchase. Consequently, bidder satisfaction in this study is measured by the main dimension of overall satisfaction through indexes of quality satisfaction and price satisfaction in the online auction.

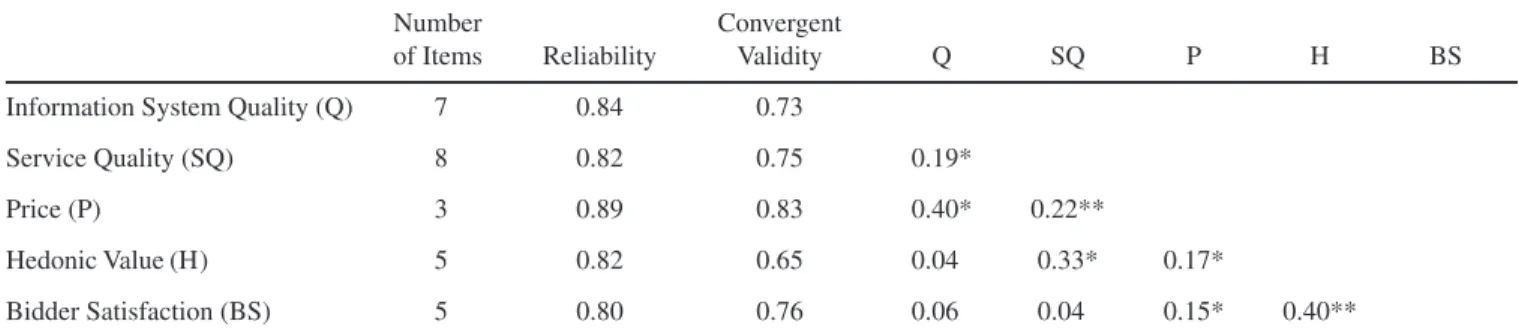

Correlations, reliabilities and validities for the constructs are shown in Table 1. The reliability of the measurement items were verified by Cronbach’s alpha coefficients. The alpha values were 0.84, 0.82, 0.89, 0.82, and 0.80 for quality, auction price, hedonic value, and bidder satisfaction, respectively. Following Hair et al. [16], these high alpha values suggest that the five research constructs all have high internal consistency among the research items. The validity of the construct was measured by the explained variance of each factor from factor analysis. Table 2 represents the results of factor analysis. The moderate to high explained variance suggested that the results of explained variance for all research constructs has been converged with those of previous studies. The low correlation coefficients between factors of different constructs suggest that the discriminate validity of each research construct is appropriate. Therefore, tests of hypotheses were undertaken while using factors of these constructs in assessing the interrelationships among the research variables.

RESULTS

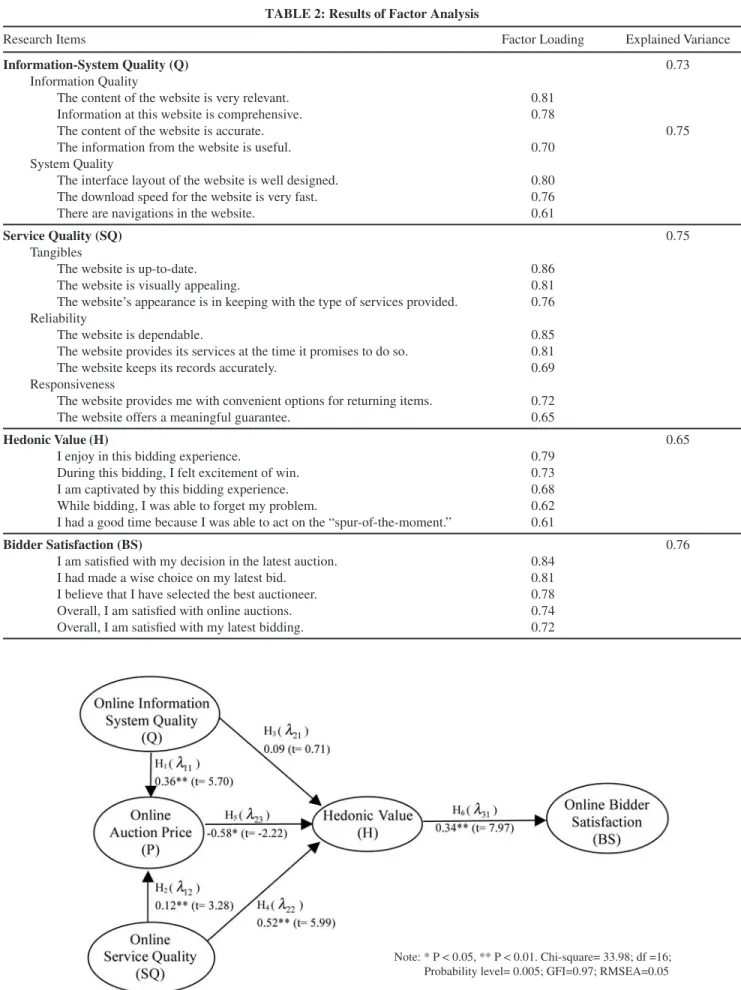

This study develops a theoretical model based on the prospect theory to evaluate online auction strategy. In order to assess the structure of the model and obtain the values of the parameters of the equations above, this study used path analysis. Regarding path analysis, we viewed the theoretical model as a structural equation model (SEM) implemented in AMOS 5 system and the results were shown in Figure 2. The chi-square for the tested model is 33.98 with 16 degrees of freedom, which is not significantly different from the measurement model, and the remaining fit indices are little changed from the confirmatory model. Furthermore, an excellent overall fit of the measurement model was suggested by comparative fit index (CFI = 0.98) and goodness-of-fit index (GFI = 0.97). Residual index such as root mean square error of approximation (RMSEA = 0.05) was less than 0.05. These results suggest an adequate fit of the proposed model to the data [16].

Figure 2 represents that the path coefficients of information- system quality and service quality relate to online auction price are 0.36 (l11, t =5.70, p<.01) and 0.12 (l12, t =3.28, p<.01),

TABLE 1: Correlation, Reliabilities, and Validities of Constructs Number Convergent

of Items Reliability Validity Q SQ P H BS

Information System Quality (Q) 7 0.84 0.73

Service Quality (SQ) 8 0.82 0.75 0.19*

Price (P) 3 0.89 0.83 0.40* 0.22**

Hedonic Value (H) 5 0.82 0.65 0.04* 0.33* 0.17*

Bidder Satisfaction (BS) 5 0.80 0.76 0.06* 0.04* 0.15* 0.40**

Note: * correlation significant at P < 0.05, and ** correlation significant at P < 0.01. Reliability figures are calculated by the formula of k S2T - SS21

Cronbach (1949): a = —— ———— . Validity figures are calculated by the explained variance of each factor from confirmatory

[ ][ ]

k-1 S2T factor analysis.

TABLE 2: Results of Factor Analysis

Research Items Factor Loading Explained Variance

Information-System Quality (Q) 0.73

Information Quality

The content of the website is very relevant. 0.81

Information at this website is comprehensive. 0.78

The content of the website is accurate. 0.75

The information from the website is useful. 0.70

System Quality

The interface layout of the website is well designed. 0.80

The download speed for the website is very fast. 0.76

There are navigations in the website. 0.61

Service Quality (SQ) 0.75

Tangibles

The website is up-to-date. 0.86

The website is visually appealing. 0.81

The website’s appearance is in keeping with the type of services provided. 0.76 Reliability

The website is dependable. 0.85

The website provides its services at the time it promises to do so. 0.81

The website keeps its records accurately. 0.69

Responsiveness

The website provides me with convenient options for returning items. 0.72

The website offers a meaningful guarantee. 0.65

Hedonic Value (H) 0.65

I enjoy in this bidding experience. 0.79

During this bidding, I felt excitement of win. 0.73

I am captivated by this bidding experience. 0.68

While bidding, I was able to forget my problem. 0.62

I had a good time because I was able to act on the “spur-of-the-moment.” 0.61

Bidder Satisfaction (BS) 0.76

I am satisfied with my decision in the latest auction. 0.84

I had made a wise choice on my latest bid. 0.81

I believe that I have selected the best auctioneer. 0.78

Overall, I am satisfied with online auctions. 0.74

Overall, I am satisfied with my latest bidding. 0.72

Note: * P < 0.05, ** P < 0.01. Chi-square= 33.98; df =16;

Probability level= 0.005; GFI=0.97; RMSEA=0.05 Figure 2: The Value of Parameters in Conceptual Framework

respectively. Therefore, H1 andH2 are supported and demonstrate significant effects of online information-system quality strategy and online service quality strategy on auction price in online environment. H3 andH4 predict positive effects of information- system quality and service quality on hedonic value. H4 is supported by a significant positive path estimate of 0.52 (l22, t =5.99, p<.01), but H3 (l21 = 0.09, t =0.71, p=.47) was unsupported by empirical analysis. Since the path coefficient of online auction price on hedonic value is -0.58(l23, t =-2.22, p<.05), H5 is supported in the sense that higher online auction price will inhibit bidder’s hedonic value. Likewise, H6 (l31 = 0.34, t =7.97, p<.01) is also supported that demonstrates a significant effect of hedonic value on online bidder satisfaction by empirical analysis. In other words, both information-system quality and service quality strategies can enhance online auction price. Service quality strategy enhances hedonic value and a higher online auction price decreases hedonic value. In addition, hedonic value enhances bidder satisfaction in the online environment.

Furthermore, if we replace the symbols of the mathematical model with the values of the coefficients from empirical analysis, the value of coefficients stemming from empirical analysis can also be substituted for the symbols of the mathematical equations.

Therefore, the optimal guideline of quality strategy is that the auctioneer must focus on information-system quality strategy to gain the optimal bidder satisfaction if, and only if, the value of 0.36(Ag+0.52) 1

Exp —————— + — is more than the value of

[

]

0.36A(SQ) 3 0.36(Ag+0.52)

————————. Otherwise, the auctioneer must focus on A[0.361n(Q)-0.12]

service quality strategy in the online auction.

CONCLUSIONS

The combination of theory outlined here and the empirical research contribute to the evaluation of online auction strategies.

Our study gives a rigorous and robust explanation of the impact of quality strategies, and develops the optimal decision model for online auction strategies to probe online bidder satisfaction.

This study also applied the prospect theory to analyze the types of risk attitude to obtain the dominant bidding strategy and the risk premium of the online bidder. Second, we leaned the optimal values of information-system quality (Q*) and service quality (SQ*). Online auctioneers or providers can use the formula to calculate the optimal portfolio of quality strategies. In addition, the optimal values imply that l12, l22, and g enhance the optimal values of information-system quality, whereas l11 and l21 reduce Q*. Likewise, l11, l21, and g increase the optimal values of service quality, whereas, l12 and l22 decreases SQ*. Third, according to production possibility theory, we found the optimal guideline to determine the allocation of resources.

The results of the structural equation model support the intermediary roles of price and hedonic value in the relationship between quality strategy and online bidder satisfaction.

Accordingly, price and hedonic value can fill the theoretical gap among information-system quality, service quality and online bidder satisfaction. Although the impact of information- system quality on hedonic value is not significant, the pattern is consistent with our expectations. Furthermore, service quality can enhance price and hedonic value. Our findings are consistent with

the positive relationship between information-system quality and service quality in that both possess a similar influence on price.

Consequently as in production possibility theory, different quality strategies are not mutually exclusive, and hence can be pursued simultaneously.

MANAGERIAL IMPLICATIONS

The findings of this study have several managerial implications on online auction. First, proposition 1 represents that the online bidder is inclined to adopt a higher-auction-price- oriented bidding strategy when the auction starts or auction price is less than the price of the reference point that implies that online bidder is willing to pay more. This result provides conflicting implications on managerial perspective. From the online seller’s perspective, it must set lower starting bid to engage online bidder bid, which is consistent with Weinberg and Davis [37]. Online auction website owner or manager must also encourage the online seller to set lower starting bid. On the other hand, since online bidder is willing to pay more in this stage, seller must provide higher starting bid to obtain the better profit of online auction. From the online auction website manager or owner, online auction website gains mostly by listing fee and commission that are paid by the seller and by charges set as a portion of the online auction price. In other words, online seller must pay some of the earnings from bidders to the online auction website manager or owner. Accordingly, higher seller’s profit also represents higher listing fees and commissions that need to be paid by the seller. In other words, it also implies that seller must pay more to participate in online auction. Hence, online auction website manager or seller must not always focus on the lower starting bid strategy to gain the optimal profit in the online environment. In addition, proposition 2 indicates the risk premium of the online bidder that implies the additional amount that the risk aversion online bidder is willing to pay in order to avoid the risk. Online seller can employ starting bid, charge for bidder, or other auction strategy to expropriate risk premium of online bidder.

Second, according to the optimal guideline of quality strategy on the online auction, online auction website manager or seller can use the formula to calculate the optimal portfolio of online auction strategy and revise the combination of information- system quality and service quality to gain the optimal bidder satisfaction under the given resources in the online environment.

In other words, online auction website manager should integrate a combination of auction quality strategy which enhances bidder satisfaction under the given resources based on these guidelines.

Third, both information-system quality and service quality are significant positively to the auction price offer from the online bidder. These results suggest that auctioneer can engage in the online auction price by enhancing quality strategies. In terms of information-system quality strategy, the accuracy and relevance of the information on the online auction website including eBay or Yahoo are the responsibility of the seller and the rapid access and interface layout are the responsibility of the website manager or owner. Therefore, online auction website manager or owner must encourage the seller provide the more accurate and relevant information to enhance the online auction price offer from the online bidder. Since in the specific empirical validation in his study, the effect of information-system quality on online auction price is larger than that of service quality, l11=0.36 (t=5.70, p<.01) > l12 = 0.12 (t=3.28, p<.01), auctioneer can provide more information-system quality such as accuracy, relevance, rapid

access, and interface layout from the online environment to gain the higher auction price.

Forth, the information-system quality strategy does have a significant positive causal effect on hedonic value. That is, the online bidder focuses more on service quality than on information- system quality to gain larger hedonic value in a risky environment, which is consistent with Saeed et al. [31] and Babin et al. [2]. In this regard, auctioneer must provide more service quality such as tangibles, reliability, and responsiveness to gain the higher bidder’s hedonic value. Furthermore, the parameter of fixed resources enhances both the optimal value of information-system quality and service quality. Therefore, the online auctioneer should look for more available resources or efficient approaches.

LIMITATIONS AND FUTURE RESEARCH DIRECTIONS

As in most studies, the research presented here was limited by the measures used. Because strong assumptions produce powerful models [34], some assumptions are needed. However, assumptions of mathematical model represent one of the major limitations of this study. Many specific assumptions were made in driving the general results. According to prospect theory, the special standard normal distribution function form is employed to reflect the inverse S-shaped hedonic value function [17]. In addition, based on production possibility theory, the combination of information-system quality and service quality, which can provide by using all of its resources in the most efficient way, should be concave. Specifically, both first order differentiation and second order differentiation are less than zero. Hence, the condition in this study can be defined mathematically as the specific function form.

This study suggests the following future research directions.

First, future research may wish to develop other dimensions more precisely to improve online auction strategies, such as vendor, channel, or production characteristics. Second, further research may employ another specific function form to development the mathematical model and further compare the optimal guideline of quality strategy on the online auction. Third, in many online auction web sites including eBay or Yahoo, seller, and bidder are major participators on online auction. Research may revise the theoretical model for advancing understanding the optimal strategic guideline for all these participators and extend the study in competitive environment. As an example, future research can apply dynamic game theory or behavior decision theory to further analyze the optimal guideline on online auction strategy.

REFERENCES

1. Ailawadi, K.L., Neslin, S.A., and Gedenk, K. “Pursuing the value-conscious con sumer: store brands versus national brand promotions?” Journal of Marketing, 65:1, 2001, pp. 71-89.

2. Babin, B.J., Darden, W.R., and Griffin, M. “Work and/or fun:

Measuring hedonic and utilitarian shopping value”, Journal of Consumer Research, 20:4, 1994, pp. 644-656.

3. Bauer, H.H., Falk, T., and Hammerschmidt, M. “eTransQual:

A transaction process-based approach for capturing service quality in online shopping”, Journal of Business Research, 59:7, 2006, pp. 866-875.

4. Carr, S.M. “Note on online auctions with costly bid evaluation”, Management Science, 49:11, 2003, pp. 1521-1528.

5. Chakrabarty, S., Whitten, D., and Green, K. “Understanding

service quality and relationship quality in IS outsourcing:

Client orientation & promotion, project management effec- tiveness, and the task-technology-structure fit,” The Journal of Computer Information Systems, 48:2, 2007/2008, pp. 1- 15.

6. Chen, J.V., Chen, C.C. and Yang, H.H. “An empirical evaluation of key factors contributing to Internet abuse in the workplace” Industrial Management & Data Systems, 108: 1, 2008, pp.87-106.

7. Chen, Y.H. and Barnes, S. “Initial trust and online buyer behaviour,” Industrial Management & Data Systems, 107:1, 2007, pp. 21-36.

8. Chiu, H.C., Hsieh, Y.C., Li, Y.C., and Lee, M. “Relationship marketing and consumer switching behavior”, Journal of Business Research, 58:12, 2005, pp. 1681-1689.

9. Choi, J.H. and Han, I. “Combinatorial auction based collab- orative procurement,” The Journal of Computer Information Systems, 47:3, 2007, pp. 118-127.

10. Chong, B. and Wong, M. “Crafting an effective customer retention strategy: a review of halo effect on customer satisfaction in online auctions,” International Journal of Management and Enterprise Development, 2:1, 2005, pp. 12- 26.

11. Claver-Cortes, E., Pereira-Moliner, J., Tari, J.J., and Molina- Azorin, J.F. “TQM, managerial factors and performance in the Spanish hotel industry,” Industrial Management & Data Systems, 108:2, 2008, pp.228-244.

12. Dardan, S., Stylianou, A., and Kumar, R. “The impact of customer-related IT investments on customer satisfaction and shareholder returns,” The Journal of Computer Information Systems, 47:2, 2006/2007, pp. 100-111.

13. Ding, M., Eliashberg, J., Huber, J., and Saini, R. “Emotional bidders-analytical and experimental examination of consum- ers’ behavior in a priceline-like reverse auction”, Management Science, 51:3, 2005, pp. 352-364.

14. Frye, D.W. and Gulledge, T.R. “End-to-end business process scenarios,” Industrial Management & Data Systems, 107:6, 2007, pp. 749-761.

15. Green, K.W., Rudolph, L. and Stark, C. “Antecedents to service quality in a service centre environment,” International Journal of Services and Standards, 4:2, 2008, pp.167-181.

16. Hair Jr., J.F., Anderson, R.E., Tatham, R.L., and Black, W.C.

Multivariate data analysis, 6th, Prentice-Hall, Inc. Upper Saddle River, NJ, 2006.

17. Harrar, S.W., Seneta, E., and Gupta, A.K. “Duality between matrix variate t and matrix variate V.G. distributions”, Journal of Multivariate Analysis, 97:6, 2006, pp. 1467-1475.

18. Hauser, R. and Paul, R. “IS service quality and culture:

An empirical investigation,” The Journal of Computer Information Systems, 47:1, 2006, pp. 15-22.

19. Kahneman, D. and Tversky, A. “Prospect theory: an analysis of decision under risk”, Econometrica, 47:2, 1979, pp. 263- 291.

20. Kardes, F.R., Cronley, M.L., Kellaris, J.J., and Posavac, S.S.

“The role of selective information processing in price-quality inference”, Journal of Consumer Research, 31:2, 2004, pp.

368-374.

21. Kim, Y. “The effects of buyer and product traits with seller reputation on price premiums in e-auction,” The Journal of Computer Information Systems, 46:1, 2005, pp. 79-91.

22. Kohli, R., Devaraj, S., and Mahmood, M.A. “Understanding determinants of online customer satisfaction: a decision

process perspective”, Journal of Management Information Systems, 21:1, 2004, pp. 115-135.

23. Lin, H.F. “The role of online and offline features in sustaining virtual communities: an empirical study”, Internet Research, 17:2, 2007, pp. 119-138.

24. McKinney, V., Yoon, K., and Zahedi, F.M. “The measurement of web-customer satisfaction: an expectation and disconfirma- tion approach”, Information Systems Research, 13:3, 2002, pp. 296-315.

25. Negash, S., Ryan, T., and Igbaria, M. “Quality and effectiveness in web-based customer support systems”, Information &

Management, 40:8, 2003,pp. 757-768.

26. Parasuraman, A., Zeithaml, V.A., and Berry, L.L. “A con- ceptual model of service quality and its implications for future research”, Journal of Marketing, 49:3, 1985, pp. 41-50.

27. Parasuraman, A., Zeithaml, V.A., Berry, L.L. “SERVQUAL:

A multiple-item scale for measuring consumer perceptions of service quality”, Journal of Retailing, 64:1, 1998, pp. 12-40.

28. Pinker, E.J., Seidmann, A., and Vakrat, Y. “Managing online auctions: current auctioneer and research issues”, Management Science, 49: 11, 2003, pp. 1457-1484.

29. Phusavat, K and Kanchana, R. “Competitive priorities for service providers: perspectives from Thailand”, Industrial Management & Data Systems, 108:1, 2008, pp.5-21.

30. Raymond, L. and Bergeron, F. “Enabling the business strategy of SMEs through e-business capabilities: a strategic alignment perspective,” Industrial Management & Data Systems, 108:5, 2008, pp.577-595.

31. Saeed, K.A., Hwang, Y., and Yi, M.Y. “Toward an integrative

framework for online consumer behavior research: a meta- analysis approach”, Journal of End User Computing, 15:4, 2003, pp. 1-26.

32. Saura, I.G., Frances, D.S., Contri, G.B., and Blasco, M.F.

“Logistics service quality: a new way to loyalty,” Industrial Management & Data Systems, 108:5, 2008, pp.650-668.

33. Shih, D.H., Huang, S.Y. and Lin, B. “Linking secure reverse auction with web service,” International Journal of Services and Standards, 2:1, 2006, pp. 15-31.

34. Shugan, S.M. “Editorial: Marketing science, models, mo- nopoly models, and why we need them”, Marketing Science, 21:3, 2002, pp. 223-228.

35. Stoel, L., Wickliffe, V., and Lee, K.H. “Attribute beliefs and spending as antecedents to shopping value”, Journal of Business Research, 57:10, 2004, pp. 1067-1073.

36. Turkyilmaz, A. and Ozkan, C. “Development of a customer satisfaction index model: an application to the Turkish mobile phone sector,” Industrial Management & Data Systems, 107:5, 2007, pp. 672-687.

37. Weinberg, B.D. and Davis, L. “Exploring the WOW in online- auction feedback”, Journal of Business Research, 58:11, 2005, pp. 1609-1621.

38. Xu, H. and Koronios, A. “Understanding information quality in e-business,” The Journal of Computer Information Systems, 45:2, 2004/2005, pp. 73-82.

39. Yang, K.C.C. “Consumers’ attitudes toward regulation of Internet auction sites: A third-person effect perspective”, Internet Research, 15:4, 2005, pp. 359-377.

APPENDIX A 1. Proofs of the proposition 2.

In Figure 1, standard normal distribution function (HS(P)) and linear function (HL(P)) of hedonic value and price are equal P2 1-exp(-1/2)

l23 exp(- — ) and l23 -l23 ————— P, we can obtained that

( )

2 Pr

P2 1-exp(-1/2) (l23 - H)Pr H (P) = l23 exp(- — ) P ] P = (21n(l23 )-21n(H)1/2, and H (P) = l23 1 - ————— P ] P = ——————— .

( )

2 Pr l23[1 - exp(-1/2)]

When the auction starts or auction price is less than reference points, the certainty equivalent of H (P) is greater than H’ (P). The difference (l23- H)Pr

between P2 and P1, which equals to (21n(l23) - 21n(H))1/2 - ——————— , is great than zero. Therefore, online bidder inclines to adopt l23[1 - exp(-1/2)]

higher-auction-price-oriented bidding strategy. Comparatively, the difference between P4 and P3, which equals to, (l23- H)Pr

——————— - (21n(l23) - 21n(H))1/2, implies the degree of risk that the risk seeker rather assumes than pays more. Furthermore, the l23[1 - exp(-1/2)]

risk premium equals to the extra return or reward for holding a risky investment rather than a risk-free one. Therefore, The risk premium of (l23- H)Pr

online bidder is equal to (21n(l23) - 21n(H))1/2 - ——————— . l23[1 - exp(-1/2)]