施行IFRS9對台灣壽險業的影響 - 政大學術集成

全文

(2) . 施行IFRS9對台灣壽險業的影響 The Impact of IFRS9 on the Life Insurance Industry of Taiwan. 研究生:李麗芬. Student: Nicole Lee. 指導教授:蔡政憲. 立. Advisor: Jason Tsai 治 政 大. ‧ 國. 學 國立政治大學. ‧. 商學院國際經營管理英語碩士學位學程. y. A Thesis. n. a. er. io. sit. Nat. 碩士論文. v. i l to Submitted C International MBAnProgram. i U. h. e n g c hUniversity National Chengchi. in partial fulfillment of the Requirements for the degree of Master in Business Administration. 中華民國一〇三年七月 July 2014.

(3) . Abstract The Impact of IFRS9 on the Life Insurance Industry of Taiwan By Nicole Lee IFRS 9 divides all financial assets into two categories - measured at amortized cost and measured at fair value (through profit or loss and through OCI). Equity instrument could be. 政 治 大. measured at fair value either through profit or loss or OCI. Debt instruments could be. 立. measured at amortized cost if the objective of the business model is collect contractual cash. ‧ 國. 學. flows and the cash flows of debt instruments pass cash flow characteristic test.. ‧. Under IFRS 9, assets reclassification is permitted only when the company changes its business model for managing its financial assets. Such changes are expected to be infrequent.. n. er. io. al. sit. y. Nat. Any reclassifications should be accounted for prospectively.. i n U. v. An insurance company’s major objective is managing their assets and liabilities in a way that. Ch. engchi. seeks to match cash out flows to existing policyholders with inflows from investments and from new policyholders.. In according to the proposed IFRS 4 phase II, the present value of insurance liabilities would be updated at each reporting period, and the changes would be reported in profit or loss or OCI for the period. Classification of financial instruments should be evaluated carefully, otherwise accounting mismatch will exist.. Keywords: IFRS 9, Financial Assets Classification, IFRS4 Phase II, Cash Flows Characteristic Test, Accounting Mismatch i.

(4) . TABLE OF CONTENTS 1.. Introduction ....................................................................................................................... 1. 2.. Accounting Standard Review ........................................................................................... 3. 2.1.. History of IFRS 9 ....................................................................................................... 3. 政 治 大. 2.1.1. Original Publication .................................................................................................. 3. 立. 2.1.2. Limited Amendments to IFRS 9 ............................................................................... 4. ‧ 國. 學. 2.2.. Overview of IFRS 9.................................................................................................... 5. ‧. 2.2.1. Initial Measurement of Financial Instruments .......................................................... 5. sit. y. Nat. io. n. al. er. 2.2.2. Subsequent Measurement of Financial Assets .......................................................... 5. i n U. v. 2.2.3. Embedded Derivatives .............................................................................................. 8. Ch. engchi. 2.2.4. Reclassification ......................................................................................................... 9. 2.2.5. Business Model Test.................................................................................................. 9. 2.2.6. Major Differences between IAS 39 and IFRS 9 ..................................................... 10. 2.3.. The Impact of IFRS 9 in Moving to IFRS 4 Phase II ............................................... 15. 2.3.1. Current Accounting under IFRS 4 Phase I .............................................................. 15. ii.

(5) . 2.3.2. The Latest Draft of IFRS 4 Phase II........................................................................ 15. 2.3.3. The Relationship between IFRS 9 and IFRS 4 Phase II ......................................... 16. 3.. Industry Review from Assets Classification Perspective ............................................. 18. 3.1.. Insurance Company’s Assets Allocation before Adopting IFRS 9 ........................... 18. 3.2.. Financial Assets Reclassification Analysis ............................................................... 19. 學. ‧ 國. 3.3.. 政 治 大 Insurance Company’s Main Challenges of Adopting IFRS 9 .................................. 20 立. 3.3.1. Contractual Cash Flows Characteristics Assessment .............................................. 20. ‧. 3.3.2. Business Model Assessment ................................................................................... 21. y. Nat. al. er. io. sit. 3.3.3. The Consequence Effect of Adopting IFRS 4 Phase II ........................................... 21. v. n. 3.3.4. The Development and Implementation of Solvency II ........................................... 22. Ch. engchi. i n U. 3.3.5. The Impact on the Assets that Have Been Reclassified Before Adopting IFRS 9 .. 23. 3.3.6. Reclassification Is Prohibited under IFRS 9 ........................................................... 24. 4.. Case Study........................................................................................................................ 25. 4.1.. Business Model Test ................................................................................................. 25. 4.1.1. Business Model ....................................................................................................... 25. 4.1.2. F Company’s Business Model ................................................................................. 25 iii.

(6) . 4.2.. Cash Flow Characteristics Test ................................................................................. 26. 4.2.1. The Details of the Financial Assets as of 2013/12/31 and the Classification Assessment ....................................................................................................................... 27. 4.2.2. Financial Assets Classification after Adopting IFRS9 ............................................ 32. 5.. Conclusions and Suggestions .......................................................................................... 35. 政 治 大. References................................................................................................................................ 37. 立. ‧. ‧ 國. 學. Appendixes .............................................................................................................................. 39. n. er. io. sit. y. Nat. al. Ch. engchi. iv. i n U. v.

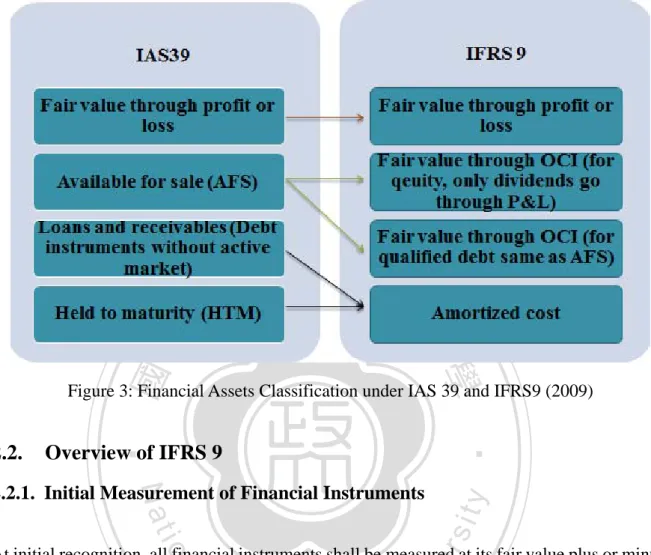

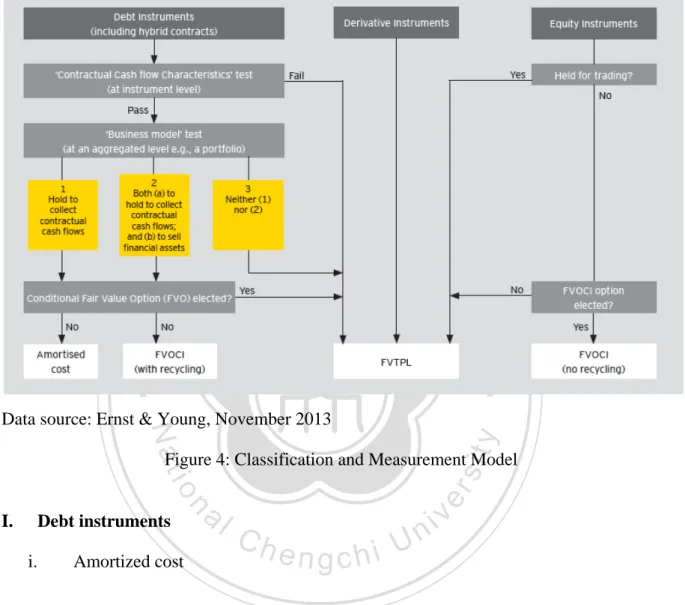

(7) . List of Figures and Tables Figure 1: Financial Assets Classification under IAS 39 and IFRS9 (2009) ............................... 3 Figure 2: IFRS 9(2009 version) Financial Asset Classification and Measurement Flow Chart. 4 Figure 3: Financial Assets Classification under IAS 39 and IFRS9 (2009) ............................... 5 Figure 4: Classification and Measurement Model...................................................................... 6 Figure 5: Illustration of the Building Blocks of the Insurance Liability .................................. 16. 政 治 大. Figure 6: Total IFRS insurance liability ................................................................................... 17. 立. Figure 7: Overlaps and Differences between Solvency II and IFRS 4 phase II ....................... 23. ‧ 國. 學. Figure 8: Organization Chart .................................................................................................... 26 Figure 9: Financial Assets Allociation under Scenario 1 .......................................................... 33. ‧. Figure 10: Financial Assets Allociation under Scenario 2........................................................ 34. Nat. n. al. er. io. sit. y. Figure 11: IFRS9 and IFRS 4 Phase II Implementation Roadmap .......................................... 36. i n U. v. Table 1: The Breakdown of Investment of Taiwan Major Life Insurance Companies............. 18. Ch. engchi. Table 2: The Summary of Financial Assets Reclassification in Taiwan Sine Financial Crisis 19 Table 3: Asset Classification under IAS39 and and IFRS9 ...................................................... 27 Table 4: The Financial Assets Classification under Scenario 1 ................................................ 33 Table 5: The Financial Assets Classification under Scenario 2 ................................................ 34. v.

(8) . 1. Introduction Asset-liability management is challenging to the life insurance industry after adopting IFRS 91 and IFRS 42 phase II. Under IFRS 4 phase I, the insurance liability is booked at historical discount rate, based on International Accounting Standards Board (IASB)’s proposals of IFRS4 phase II, the changes in the discount rate derived from life insurance contract liabilities should be consider and the changes will go through profit or loss or other comprehensive income (OCI).. 政 治 大. The volatility in profit or losses and equity would be mitigated and will be highly influenced by. 立. the financial assets classification.. ‧ 國. 學. According to current accounting standard, IAS 39 (Financial Instruments, Recognition and. ‧. Measurement), all changes in market value should be reflected in equity if the financial assets are classified as “Available for Sale (AFS), but the changes in market value could be ignored for. y. Nat. er. io. sit. debt held to maturity (HTM). During the period of the global financial crisis, from 2007 to 2012, many insurance companies reclassified the financial assets for the purpose to luck-in the. n. al. Ch. i n U. v. depreciation of debt instruments. The consequence of the reclassification is that all of the. engchi. company’s HTM investment must be reclassified into AFS if the company sells a held-to-maturity investment other than in insignificant amounts or as a consequence of a non-recurring, all of its other held-to-maturity investments must be reclassified as available-for-sale for the current and next two financial reporting years, so-call tainting rule.. Under current accounting standard IAS39, there are four measurement categories:. a. Financial assets at fair value through profit or loss (FVTPL): measured at fair value. 1 2. Financial Instruments Insurance Contract. 1.

(9) . b. Available for sale (AFS) financial assets: measured at fair value with unrealized gains or losses going through “other comprehensive income” (OCI). c. Loans and receivables (L&R): measured at amortized cost. d. Held to maturity (HTM): measured at amortized cost. However, according to IFRS 9, there are three categories of financial assets---measured at fair value through profit or loss, fair value through OCI and amortized cost. Financial asset’s. 政 治 大. classification is based on the company’s business model and the contractual cash flows. 立. characteristics.. ‧ 國. 學. The main challenge of an insurance company is not only how to design the assets’ classification but also no more assets reclassification, unless the business model changes. According to. ‧. IAS39, financial assets’ classification is mainly upon the management’s intention. Therefore,. y. Nat. sit. during the economic crisis in Europe, the management could change their intentions of the. n. al. er. io. financial assets that measured at fair value, either FVTPL or AFS and reclassified the financial. i n U. v. assets into other categories to mitigate or avoid the volatility on the income statements and. Ch. engchi. balance sheets. Or reclassify the financial assets from HTM to AFS for the purpose of increasing the flexibility to liquidate its debt instruments.. Due to the composition of the assets backing insurance liability are varied by insurance companies, the accounting mismatch could exist in some insurance companies or some assets portfolios. Assets classification shall be critical; particularly after QE ends the interest rate is expected to increase.. 2.

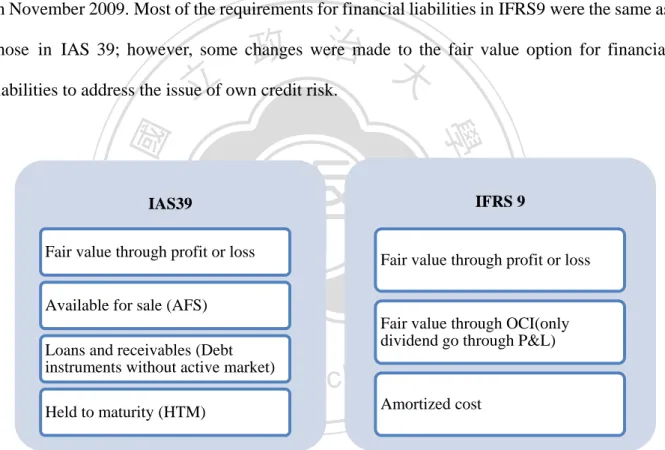

(10) . 2. Accounting Standard Review 2.1.. History of IFRS 9. 2.1.1. Original Publication IAS 39 has been widely criticized due to the complexity and difficulty to apply. IASB decided to reduce the complexity of accounting standard for financial instruments and published IFRS9 in November 2009. Most of the requirements for financial liabilities in IFRS9 were the same as. 政 治 大. those in IAS 39; however, some changes were made to the fair value option for financial. 立. liabilities to address the issue of own credit risk.. ‧. ‧ 國. 學 IFRS 9. IAS39. Nat. y. Fair value through profit or loss. io. sit. Fair value through profit or loss. Fair value through OCI(only dividend go through P&L). n. al. er. Available for sale (AFS). Ch. Loans and receivables (Debt instruments without active market). engchi. i n U. v. Amortized cost. Held to maturity (HTM). Figure 1: Financial Assets Classification under IAS 39 and IFRS9 (2009). 3.

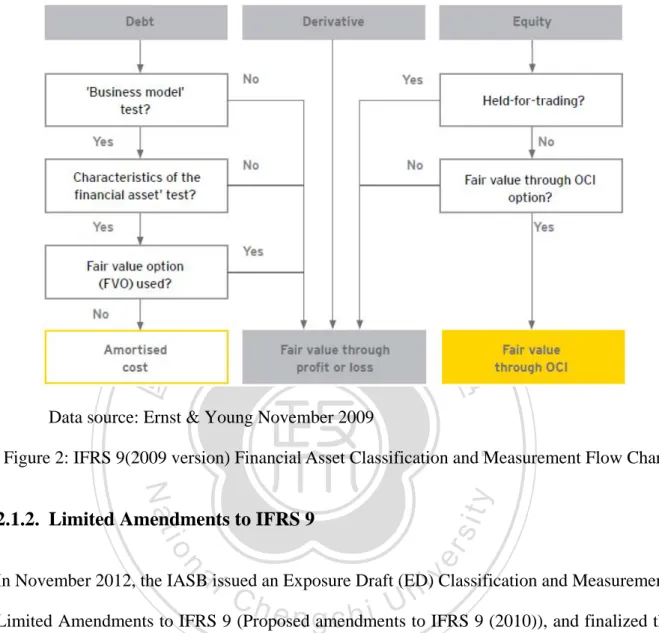

(11) . 立. 政 治 大. ‧ 國. 學. Data source: Ernst & Young November 2009. ‧. Figure 2: IFRS 9(2009 version) Financial Asset Classification and Measurement Flow Chart. sit. y. Nat. io. n. al. er. 2.1.2. Limited Amendments to IFRS 9. i n U. v. In November 2012, the IASB issued an Exposure Draft (ED) Classification and Measurement:. Ch. engchi. Limited Amendments to IFRS 9 (Proposed amendments to IFRS 9 (2010)), and finalized the limited amendments to the classification and measurement requirements. The ED introduced a new category that qualified debt instruments should be measured at fair value through other comprehensive income. (For detail introduction, see 2.2 Overview of IFRS9).. The IASB also tentatively decided to require an entity to apply IFRS 9 for annual periods beginning on or after 1 January 2018.. 4.

(12) . 立. 政 治 大. ‧ 國. 學. Figure 3: Financial Assets Classification under IAS 39 and IFRS9 (2009). ‧. 2.2.. Overview of IFRS 9. Nat. er. io. sit. y. 2.2.1. Initial Measurement of Financial Instruments. At initial recognition, all financial instruments shall be measured at its fair value plus or minus,. n. al. Ch. i n U. v. in the case of a financial asset or financial liability not at fair value through profit or loss,. engchi. transaction costs that are directly attributable to the acquisition or issue of the financial asset or financial liability. [IFRS 9, paragraph 5.1.1]. 2.2.2. Subsequent Measurement of Financial Assets IFRS 9 divides all financial assets that are currently in the scope of IAS 39 from four categories (financial assets at fair value through profit or loss, available-for-sale financial assets, loans and receivables and held-to-maturity investments) into two categories - measured at amortized cost and measured at fair value( through profit or loss and through OCI). Classification is made at. 5.

(13) . the time the financial asset is initially recognized. [IFRS 9, paragraph 4.1.1]. 立. 政 治 大. ‧. ‧ 國. 學 sit. y. Nat. Data source: Ernst & Young, November 2013. io Debt instruments i.. al. n. I.. er. Figure 4: Classification and Measurement Model. Amortized cost. Ch. engchi. i n U. v. A debt instrument asset shall be measured at amortized cost if both of the following conditions are met: [IFRS 9, paragraph 4.1.2]:. (a). Business model test: The asset is held within a business model whose objective is to hold assets in order to collect contractual cash flows.. (b) Cash flow characteristics test: The contractual terms of the financial asset give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount 6.

(14) . outstanding. ii.. Fair value through profit or loss (FVTPL). The debt instruments that do not meet the conditions shown in i(a) and (b) must be measured at fair value through profit or loss (FVTPL). [IFRS 9, paragraph 4.1.4]. iii.. Fair value option. 政 治 大 could be eliminated, the company can choose to measure the financial instruments at 立. If the financial instruments are measured at FVTPL for which accounting mismatch. ‧. ‧ 國. (b).. 學. FVTPL even if the instruments meet the two amortized cost tests shown in i(a) and. IFRS 9 contains an option to designate a financial asset as measured at FVTPL if. y. Nat. sit. doing so eliminates or significantly reduces a measurement or recognition. n. al. er. io. inconsistency (accounting mismatch) that would otherwise arise from measuring. i n U. v. assets or liabilities or recognizing the gains and losses on them on different bases.. Ch. [IFRS 9, paragraph 4.1.5]. iv.. engchi. No more “available-for-sale” and ”held-to-maturity”. The available-for-sale and held-to-maturity categories currently in IAS 39 are eliminated in IFRS 9.. II.. Equity instruments. 7.

(15) . i.. Fair value through profit or loss. All equity investments are to be measured at fair value. The value changes are recognized in profit or loss.. ii.. Other comprehensive income option. If the equity investments are not held for trading, at initial recognition, an entity may. 政 治 大 and only dividend income shell be recognized in profit or loss.[IFRS9, 5.7.5~6] 立. make an irrevocable election to report value changes in other comprehensive income. ‧ 國. 學. iii.. There is no 'cost exception' for unquoted equities.. ‧. Even though no cost category, IFRS9 stated that “cost may be an appropriate estimate. sit. y. Nat. of fair value” , that may be the case if insufficient more recent information is. io. al. er. available to measure fair value, or if there is a wide range of possible fair value. n. measurements and cost represents the best estimate of fair value within that. Ch. range.[IFRS9,B5.4.14]. engchi. i n U. v. III. Derivatives. All derivatives are measured at fair value, value changes shall be recognized in profit or loss unless the entity has elected to treat the derivative as a hedging instrument, in which case the accounting treatment shell be follow hedge accounting.. 2.2.3. Embedded Derivatives An embedded derivative is a component of a hybrid contract that also includes a non-derivative 8.

(16) . host, with the effect that some of the cash flows of the combined instrument vary in a way similar to a stand-alone derivative. For example, callable bonds that allows the issuer of the bond to retain the privilege of redeeming the bond at some point before its maturity date. IFRS 9 removed separate accounting in financial host instruments within the scope of IFRS9. In other word, the hybrid contract in its entirety is measured at amortization cost of fair value, depending on the company’s business model and the characteristic of cash flow.. 政 治 大. 2.2.4. Reclassification. 立. ‧ 國. 學. Financial assets’ classification are made at initial recognition, reclassification is required only when the company changes it business model for managing its financial assets. Such changes. ‧. are expected to be infrequent. Any reclassifications should be accounted for prospectively. The. sit. n. al. er. A change in business model. io. I.. y. Nat. following is the examples of change and no change in business model:. i n U. v. A bank decides to shut down its retail mortgage business and actively markets its mortgage loan for sale II.. Ch. engchi. No change in business model A transfer of financial instruments between existing business model. 2.2.5. Business Model Test Companies have to determine the business model objectives, the objectives could be “to collect contractual flows”, “to sell financial assets” or both. The determination is made on the basis of. 9.

(17) . how the company manages its business; it is not made at the level of an individual financial instrument. The company’s business model is not therefore a choice and does not depend on management’s intentions for an individual financial instrument.. 2.2.6. Major Differences between IAS 39 and IFRS 9 IAS 39 . Financial assets classification. IFRS 9. Fair Value Through Profit. 政 治 大. . Fair Value Through Profit &. & Loss (FVPL). 立Available-for-sale (AFS) Held-to-maturity (HTM). . Loan and Receivable. Fair Value Through Other Comprehensive Income. ‧. (FVTOCI). (LAR). y. sit. io. n. al. Intention to hold till maturity,. Ch. engchi U. trading for short term profits,. FVTPL is the residual category.. er. AFS is the residual category.. Basis of classification. Amortized Cost (AC). . Nat. Residual category. . . 學. ‧ 國. . Loss (FVTPL). vClassification based on business i n. derivative, loan or receivable, or. model and the contractual cash flow characteristics. intentional designation subject to certain restrictions Measured at amortized cost if. - debt instruments. classified as held-to-maturity or. (AC) if business model. as loan or receivable.. objective is to collect the. Other classifications are. contractual cash flows and the. 10. . Measurement. Measured at amortized cost.

(18) . IAS 39. IFRS 9. measured at fair value.. contractual cash flows represent solely payment of principal and interest on the principal amount outstanding. . 立. Measured at FVTOCI if the business model objectives are. 政 治 大. both collect contractual flows and for sales and the. ‧ 國. 學. contractual cash flows represent solely payment of. ‧. principal and interest on the. y. Nat. n. al. . Debt instruments meeting the. v. above criteria can still be. er. io. sit. principal amount outstanding.. Ch. engchi. i n U. measured at fair value through profit or loss (FVTPL) if such designation would eliminate or reduce accounting mismatch.. Measurement. Measured at fair value.. Measured at fair value through. - equity instruments. Exception: Unquoted equity. profit or loss.. investments are measured at cost. An entity can irrevocably designate. where fair valuation is not. at initial recognition as fair value. 11.

(19) . IAS 39. IFRS 9. sufficiently reliable.. through other comprehensive income, provided the equity investment is not held for trading.. Embedded. Embedded derivatives are. derivatives. separated from the hybrid. No bifurcation of asset.. FVPL.. entirety as to the contractual cash flows and if any of its cash flows do not represent either payments of. ‧. principal or interest then the whole asset is measured at FVPL.. An entity can designate a. n. al. Ch. er. io. sit. y. Nat Fair value option. The financial asset is assessed in its. 學. ‧ 國. 政 治 大 contract 立 and are measured at. n U engchi. financial asset to be measured at. A financial asset can be designated. iv. as FVTPL on initial. fair value on initial recognition.. recognition only. The entity has the freedom to do. if that designation eliminates or. so and need not satisfy any other. significantly reduces an accounting. criteria. mismatch had the financial asset been measured at amortized cost.. Reclassifications. Reclassification between the. If entity’s business model objective. - debt instruments. various four categories allowed. changes, reclassification is. under specific circumstances. permitted. Such changes should be. 12.

(20) . IAS 39. IFRS 9. with the gain/loss being treated. demonstrable to external parties. differently depending upon the. and are expected to be very. movement between the. infrequent.. classifications.. Reclassifications are applied. Reclassification from. prospectively from the first day of. held-to-maturity (HTM) is. reporting period following a change. viewed seriously if does not fall. in business model. Any previously. 立. 政 治 大. recognized gains, losses or interest. 學. ‧ 國. within the permitted exceptions.. would not be restated.. Reclassification is permitted. Reclassification between FVPL and. - equity instruments. between the FVPL and AFS.. FVOCI not permitted as FVOCI. Nat. y. ‧. Reclassifications. FVPL, unrealized gain/loss is. irrevocable designation of the entity. er. n. al. sit. classification is done at the. io. When transferred from AFS to. i vas such. n U. recognized in P&L based on fair value.. Ch. engchi. Only dividend income is recognized in P&L of assets. When transferred from FVPL to. designated as FVOCI.. AFS, no reversal of gain/loss recognized as unrealized is. Even on disposal of such assets, the. permitted.. gain/loss is not transferred from equity, but remains permanently in. However all gain/loss on disposal of AFS are recognized. 13. equity..

(21) . IAS 39. IFRS 9. in P&L by transferring from equity.. Tainting rule. If an entity sells a. No tainting rule under IFRS 9.. held-to-maturity investment. However, some sales of financial instruments before maturity, and. amounts or as a consequence of a non-recurring, isolated event. the determination of the business. beyond its control that could not. model.. the sale is infrequent, will impact. ‧. ‧ 國. other than in insignificant. 學. 立. 政 治 大. y. Nat. n. al. i n U. investments must be reclassified. Ch. engchi. as available-for-sale for the. current and next two financial reporting years. [IAS 39.9] Held-to-maturity investments are measured at amortized cost. [IAS 39.46(b)] Data source: revised R. Venkata , November 2009. 14. er. io. its other held-to-maturity. sit. be reasonably anticipated, all of. v.

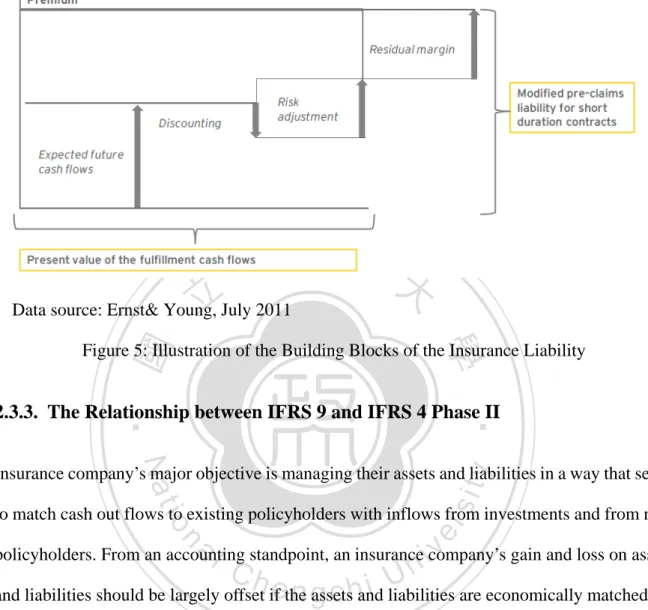

(22) . 2.3.. The Impact of IFRS 9 in Moving to IFRS 4 Phase II. 2.3.1. Current Accounting under IFRS 4 Phase I In Taiwan, insurance liabilities are measured on a locked-in basis. Insurance liabilities are established at inception using discounted future cash flows and provisions for possible deviation from expectation, but these liabilities are not subsequently updated for changes in market interest rate or other assumptions.. 政 治 大. 2.3.2. The Latest Draft of IFRS 4 Phase II. 立. ‧ 國. 學. The objective of IFRS 4 phase II is to establish a consistent recognition and measurement model under IFRS. In the ED on IFRS 4 Phase II, the IASB proposed that insurance liabilities. ‧. are measured by using a model based on the present value of the fulfilment cash flows, plus a. sit. y. Nat. residual margin that eliminates profit at initial recognition (see Figure 4). The expected cash. io. al. n. reporting period.. er. flows discount rate and the risk adjustment will be updated for current assumptions at each. Ch. engchi. i n U. v. Before 2014, the proposed accounting treatment of the changes in discount rate was required to reflect in OCI. However, in IASB’s meeting held in March, 2014, the staff proposed to permit an accounting policy election to recognize the effect of changes in discount rates either in equity or profit/loss at portfolio level and the accounting policy is not irrevocable.. 15.

(23) . 立. 政 治 大. Data source: Ernst& Young, July 2011. ‧ 國. 學. Figure 5: Illustration of the Building Blocks of the Insurance Liability. ‧. 2.3.3. The Relationship between IFRS 9 and IFRS 4 Phase II. y. Nat. sit. Insurance company’s major objective is managing their assets and liabilities in a way that seeks. n. al. er. io. to match cash out flows to existing policyholders with inflows from investments and from new. i n U. v. policyholders. From an accounting standpoint, an insurance company’s gain and loss on assets. Ch. engchi. and liabilities should be largely offset if the assets and liabilities are economically matched.. However, under IFRS 4 phase I, the liabilities of insurance contracts are not required to reflect current assumptions, such as discount rate, in the measurement at each balance sheet date. In the proposed IFRS 4 phase II, an insurer would be required to reflect current assumptions, the present value of insurance liabilities would be updated at each reporting period, and the changes would be reported in profit or loss or OCI for the period.. 16.

(24) . According to the above accounting scheme, insurance companies may wish to mitigate profit or loss and capital volatility. Classification of financial instruments should be evaluated carefully, the proposed accounting treatment of insurance liabilities under IFRS 4 phase II should be taken into consideration as well. Figure 5 illustrates the components of insurance liabilities.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Data source: Tamsin Abbey, Deloitte, November 2013. Figure 6: Total IFRS insurance liability. 17.

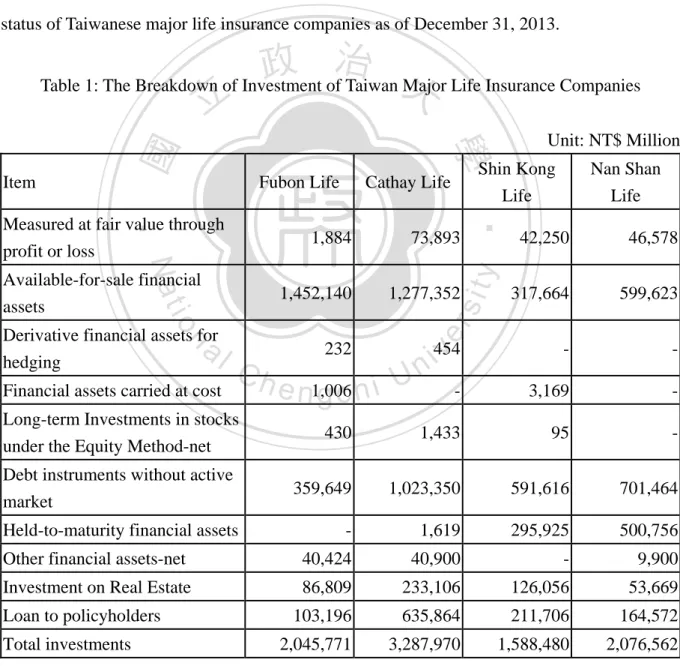

(25) . 3. Industry Review from Assets Classification Perspective 3.1.. Insurance Company’s Assets Allocation before Adopting IFRS 9. The financial assets classification under IAS 39 is based on the company’s intention and ability to hold the financial assets and available- for-sale is the residual category if the financial asset cannot be classified into any defined categories. Table 1 is the financial assets classification status of Taiwanese major life insurance companies as of December 31, 2013.. 治 政 Table 1: The Breakdown of Investment of Taiwan 大 Major Life Insurance Companies 立 Fubon Life. Measured at fair value through profit or loss. Shin Kong. Cathay Life. Nan Shan Life. Life. 46,578. 317,664. 599,623. 454. -. -. -. 3,169. -. 430. 1,433. 95. -. Debt instruments without active market. 359,649. 1,023,350. 591,616. 701,464. Held-to-maturity financial assets. -. 1,619. 295,925. 500,756. Other financial assets-net. 40,424. 40,900. -. 9,900. Investment on Real Estate. 86,809. 233,106. 126,056. 53,669. 103,196. 635,864. 211,706. 164,572. 2,045,771. 3,287,970. 1,588,480. 2,076,562. 1,452,140. 1,277,352. al. n. Derivative financial assets for hedging. Financial assets carried at cost. Ch. Long-term Investments in stocks under the Equity Method-net. 232. e n1,006 gchi. sit. er. io. Available-for-sale financial assets. Total investments. 73,893. y. Nat. 42,250. Loan to policyholders. 1,884. ‧. ‧ 國. 學. Item. Unit: NT$ Million. i n U. Data Source: www.mops.twse.com.tw, access on 2014/5/30. 18. v.

(26) . 3.2.. Financial Assets Reclassification Analysis. As addressed in 3.1, under IAS 39, financial assets’ classification is based on the company’s intention and ability to hold the assets. Before the financial crisis derived from the accumulated losses on US subprime mortgages, IAS 39 did not permitted reclassify non-derivative financial assets held for trading to be reclassified and available-for-sale financial assets to be reclassified to loans and receivables categories, however, in response to the financial crisis, the IASB. 政 治 大 the company to reclassify the financial assets from FVTPL to other categories and AFS to 立. amended the principle in 2008, Taiwan also amended the accounting principle that permitted. ‧ 國. 學. “Inactive investment”(Loans and Receivables in Taiwan) if the entity has the intention and ability to hold that financial asset for the foreseeable future. During financial crisis, Taiwanese. ‧. insurance companies also took the benefit from the above accounting standard, see Table2.. y. Nat. n. al. er. io. Year. sit. Table 2: The Summary of Financial Assets Reclassification in Taiwan Sine Financial Crisis. Reclassification type. Ch. AFS to HTM AFS to NAT 2008. 2009 2010. FVTPL to AFS. engchi U. 1.5. Taiwan Life. 6.8. Mercuries Life. 3.2. Shin Kong Life. 12.5. Taiwan Life. 1.6. FVTPL to HTM. Taiwan Life. 4.4. HTM to AFS. Shin Kong Life. 198.9. AFS to HTM. Fubon Life. 101.6. AFS to HTM. Nan Shan Life. 173.5. AFS to NAT. Nan Shan Life. 28.2. 19. Amount NT$ Billion. China Life. v ni. Company.

(27) . HTM to AFS 2011. Cathay Life. AFS to HTM AFS to NAT. 2012. HTM to AFS AFS to HTM. 2013. 3.3.. AFS to NAT. 590.6. Shin Kong Life. 55.1. Nan Shan Life. 256.3. Nan Shan Life. 95.3. Fubon Life. 19.2. China Life. 384.8. Mercuries Life. 161.5. Nan Shan Life. 42. Nan Shan Life. 292.6. Taiwan Life. 政 治 大 Insurance Company’s Main Challenges of Adopting IFRS 9 立. 37.2. ‧ 國. 學. 3.3.1. Contractual Cash Flows Characteristics Assessment Contractual cash flows characteristic should be assessed by instrument level, the process of. ‧. assessing Vanilla Bond3 may be simple but structured instruments should go through complex. y. Nat. sit. process. Under IFRS 9, structured instruments that the payments are contractually linked to the. n. al. er. io. payments received on a pool of other instruments, such as mortgage-backed securities, should. i n U. v. be assessed by using a” look through” approach. The approach looks at not only the terms of the. Ch. engchi. instruments itself but also through the pool of underlying instruments. Insurance company should assess the term based on the conditions at initially recognition date and only the instruments that pass the contractual cash flows characteristics test could be book at amortized cost.. If the insurance company has difficulty to conclude that the contractual cash flows of an financial instrument is solely the principal and interest, the interests are the time value of money and credit risk associated with the principal outstanding during a specific period for could ,the 3. A bond with no unusual features, paying a fixed rate of interest and redeemable in full on maturity. 20.

(28) . financial asset must be measured at fair value through profit or loss.. 3.3.2. Business Model Assessment The business model assessment is based on how key management actually manages the business instead of their intention for specific financial assets, a company may has multiple business model, one portfolios for collect contractual cash flows and other one for trading to realize capital gains. However, the insurance company manages cash flows, insurance. 政 治 大. liabilities and assets together upon asset-liability management concept, to maximize its. 立. financial results and match cash outflows to policyholders with inflows from investment and. ‧ 國. 學. from new policyholders. The business model assessment requirement under IFRS 9 did not reflect the linkage between assets and liabilities from an asset-liability management approach.. ‧ sit. y. Nat. In addition, assets-liability matching is not always achievable; the financial assets of sufficient. io. al. er. duration assets are not available, especially in Taiwan. The insurance company may have the. n. difficulty to make their assets and liabilities economically matched, nevertheless, the accounting mismatch.. Ch. engchi. i n U. v. 3.3.3. The Consequence Effect of Adopting IFRS 4 Phase II IFRS4 phase II may drive the desired classification under IFRS9, in order to minimize accounting mismatches and profit validity. Insurance companies should consider the impact of adopting IFRS 4 phase II.. Based on the latest development of IFRS 4 phase II, insurance companies have the option to reflect the changes in discount rate in profit or loss or OCI at portfolio level, however, insurance. 21.

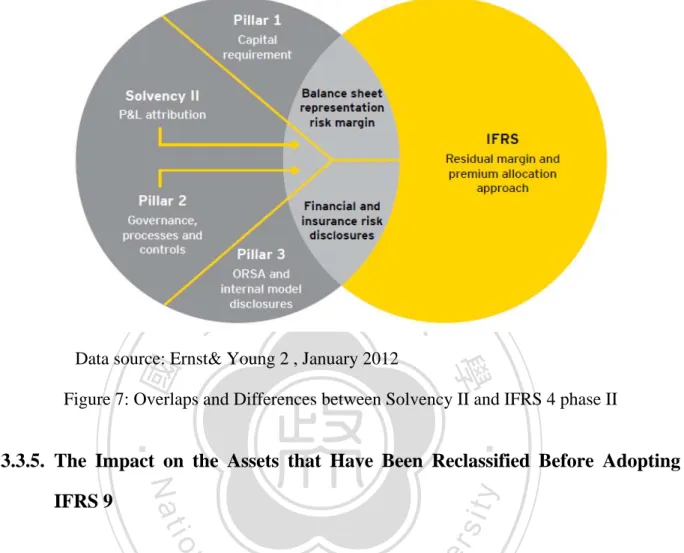

(29) . companies do not use simple debt or equity instruments to match insurance liability, the asset portfolios may include two or more type of assets classifications, furthermore derivative instruments may be used to diversify the foreign exchange rate risk. Assets-liability management strategy should be evaluated and reestablished carefully.. 3.3.4. The Development and Implementation of Solvency II A risk-based capital regime came into force in Taiwan in 2003; Taiwan is expected to come. 政 治 大. up with a regulation that will require insurers to do an Own Risk and Solvency Assessment. 立. (ORSA). Likewise, there have been discussions on the possible development of an economic. ‧ 國. 學. capital model for the insurance industry.. ‧. Solvency II started with the intention of building upon measurement rules of the future IFRS. sit. y. Nat. for insurance contracts. The different IFRS and Solvency II timelines place insurance. io. er. companies in a conflicting position. There are some overlaps and differences between. al. Solvency II and IFRS 4 phase II (see figure 7). Insurance company should consider the. n. v i n C hIFRS 4 phase II and consequence effect of adopting e n g c h i U have to evaluate the dependencies with Solvency II.. 22.

(30) . 立. 政 治 大. ‧ 國. 學. Data source: Ernst& Young 2 , January 2012. Figure 7: Overlaps and Differences between Solvency II and IFRS 4 phase II. ‧. 3.3.5. The Impact on the Assets that Have Been Reclassified Before Adopting. er. io. sit. y. Nat. IFRS 9. al. v i n C h will be qualified date of application. Some financial assets e n g c h i U to be recorded at amortized cost but n. Insurance companies have to access and design the classification of financial assets at the initial. some should be measured at fair value. IFRS 9 should be applied retrospectively at the first adoption date; assets reclassification may have impact on the company’s equity. For instance, AFS investment be reclassified to amortized cost, thus, unrealized capital gain recognized on OCI should be reversed, the company’s equity will reduce simultaneously.. 23.

(31) . 3.3.6. Reclassification Is Prohibited under IFRS 9 A company is required to reclassify all effected financial assets when its business model change and such changes should be infrequent. Before adopting IFRS9, Taiwanese insurance companies reclassified the financial assets to mitigate the volatility of shareholder’s equity; however, it is questionable whether the reclassification is a way for window - dressing financial reports or not. This reclassification is prohibited under IFRS9; insurance companies should. 政 治 大 company could meet the criteria of change the business model and reclassify its financial assets. 立 classify the financial assets at initial recognition, only in rare circumstance that an insurance. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 24. i n U. v.

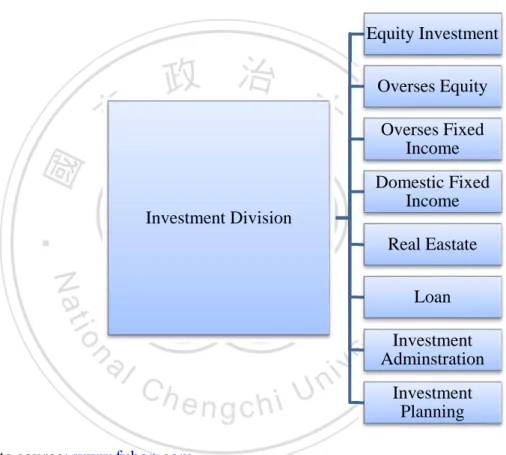

(32) . 4. Case Study 4.1.. Business Model Test. 4.1.1. Business Model According to IFRS9 ED, business model must consider all objective evidence, such as:. I.. How the performance of the business is reported to the key management. 治 政 III. The frequency, timing and volume of sales in prior 大 period 立 II. How managers of the business are compensated. ‧ 國. From performance management perspective. ‧. I.. 學. 4.1.2. F Company’s Business Model. Nat. sit. y. Based on the organization chart of F Company, see Chart1,the company managed the assets. n. al. er. io. based on the product type, such as fixed income, equity investment, real estate and so on. Each. i n U. v. department sets up the performance goal; managers were compensated upon the performance. Ch. engchi. of the managed assets and the performance of the company as a whole.. II. The business model objective. According to current asset classification standard, financial assets classification is based on the management’s intention. The company’s financial assets, which are measured at fair value through profit or loss, are for the purpose of selling or repurchasing in the near term and available for sales. In addition, the company also recognized significant amount of capital gains in prior period.. 25.

(33) . As a result, the company’s business model could apply to “department” level, including debt instrument and equity; and the objectives of some portfolio could be are both to collect contractual cash flows and to sale in each department but for some portfolio could be to collect contractual cash flows only.. Equity Investment. 立. 政 治 大. Overses Equity. ‧ 國. 學. Overses Fixed Income. Domestic Fixed Income. ‧. Investment Division. Real Eastate. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Loan. Investment Adminstration Investment Planning. Data source: www.fubon.com Figure 8: Organization Chart. 4.2.. Cash Flow Characteristics Test. IFRS 9 requires an entity to assess the contractual cash flow characteristics of a financial asset. Only the financial instruments with contractual cash flows of principal and interest on principal could be qualified for amortized cost measurement or PVTOCI for the qualified debt. 26.

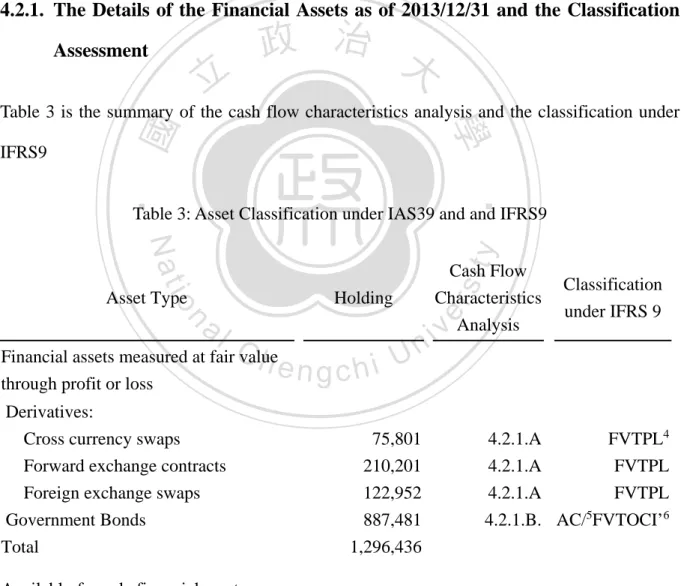

(34) . instruments. IFRS 9 describes interests are consideration for the time value of money and credit risk associated with the principal outstanding during a specific period.. The company’s business model objectives are both to collect contractual cash flows and too sale; as a result, the debts that pass the cash flow characteristics test should be measured at FVTOCI.. 4.2.1. The Details of the Financial Assets as of 2013/12/31 and the Classification. 政 治 大. Assessment. 立. ‧. ‧ 國. IFRS9. 學. Table 3 is the summary of the cash flow characteristics analysis and the classification under. Table 3: Asset Classification under IAS39 and and IFRS9. Holding. n. Ch. engchi. Financial assets measured at fair value through profit or loss Derivatives: Cross currency swaps. i n U. 75,801. Forward exchange contracts Foreign exchange swaps Government Bonds Total. er. io. al. sit. y. Nat Asset Type. Cash Flow Characteristics Analysis. 210,201 122,952 887,481 1,296,436. v. 4.2.1.A. Classification under IFRS 9. FVTPL4. 4.2.1.A FVTPL 4.2.1.A FVTPL 5 4.2.1.B. AC/ FVTOCI’6. Available-for-sale financial assets 4. FVTPL: fair value through profit or loss AC: amortized cost 6 FVTOCI’: fair value through other comprehensive income (cumulative fair value gains and losses recognized in OCI would be recycled to profit or loss upon derecognition) 5. 27.

(35) . Stocks Government Bonds Corporate Bonds Financial bonds Beneficiary certificate Asset securitization beneficiary Total Financial assets carried at cost Stock of non-listed companies. 200,375,331 341,814,562 208,877,077 8,696,974 153,461,970 836,965 914,062,879. 4.2.1.C 4.2.1B 4.2.1.D 4.2.1.D 4.2.1.E 4.2.1.F. FVTOCI AC/FVTOCI’ AC/FVTOCI’ AC/FVTOCI’ FVTPL FVTPL. 692,373. 4.2.1.C. FVTOCI7. 4.2.1.I 4.2.1.N 4.2.1.F 4.2.1.L 4.2.1.B 4.2.1.D 4.2.1.J 4.2.1.M 4.2.1.K. FVTPL FVTPL FVTPL FVTPL A/CFVTOCI’ AC/FVTOCI’ AC/FVTOCI’ AC/FVTOCI’ AC/FVTOCI’. Debt instruments without active market. 政 治688,000 大 1,030,280. n. Ch. engchi. y. sit. io. A. Derivatives. er. Nat. al. 2,861,066 1,305,255 2,825,164 8,378,562 188,677,006 1,136,100 30,498,163 247,399,596. ‧. ‧ 國. 立. 學. Preferred stock Structured notes Asset securitization beneficiary Assets-backed securities(CDO) Corporate bonds Financial bonds Zero-coupon bonds Negotiable certificates of deposit Mortgage-backed securities(MBS) Total. i n U. v. All derivatives are measured at fair value through profit or loss (FVTPL), unless they are qualified and are designated for hedge accounting. Since the accounting treatment of derivative is not different, all the derivatives of F Company should be measured at FVTPL. B. Government Bonds In addition, the contractual cash flows of government bonds are solely the principal and interest, the interests are the time value of money and credit risk associated with the principal outstanding during a specific period. Thus, it pass the cash flow characteristics test 7. FVTOC: fair value through other comprehensive income (only dividend are recorded in profit or loss). 28.

(36) . C. Stocks The equity investments are not held for trading, thus, the stocks should classified as be FVTOCI, and only recognize profit or loss when the Company has the right to receive dividends from invested companies.. D. Corporate and financial Bonds i.. The corporate and finance bonds would have no derivative embedded, otherwise the. 政 治 大 derivative shall be separated from the host contract (bond) and booked at fair value, 立 entire instrument would be measured at fair value through profit or loss, or the. ‧ 國. ii.. 學. according to IAS39.. In market practice, the bond holders have prepayment option that protect the bond. ‧. holders against credit deterioration of the issuer, or a change in control of the issuer; or. sit. y. Nat. the holder or issuer against changes in relevant taxation or law; and the prepayment. io. er. amount substantially represent unpaid amounts of principal and interest, sometimes that include reasonable compensation for early termination. Under this circumstance,. al. n. v i n Cstill characteristics test. the debt instrument could the cash flow U h epass i h ngc E. Mutual funds. The company mainly invested in equity funds. According to IFRS 9, equity instruments shall be measured at fair value, the value changes are recognized in profit or loss.. F. Asset securitization beneficiaries The company only invested in REITs, it is a security that sells like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages. REITs 29.

(37) . meet the definition of equity instrument defined in IAS 32 paragraphs 16A and 16B or paragraphs 16C and16D (see Appendix 3); therefore, it shall be measured at fair value.. G. Derivative financial assets for hedging The company has interest rate swaps as of December31, 2013. According to IFRS9, all derivatives shall be measured at fair value through profit and loss. H. Financial assets carried at cost. 政 治 大. The company only has stock of non-listed companies, the equity investments are not held for. 立. trading, thus, the stock of non-listed investments should classified as be FVTOCI, and the. ‧ 國. 學. company only recognized profit or loss when the Company has the right to receive dividends from non-listed companies.. ‧ sit. y. Nat. I. Preferred stocks. io. er. Preferred stock can be exchanged for stock, also is host embedded derivatives. According to. al. IFRS9, we should analyze the preferred stock in its entirely. The return of preferred stock is. n. v i n linked to the value of the equity ofCthe the contractual cash flows are not payment of hissuer, e n gthus, chi U principal and interest because the yield does not reflect only consideration for the time value of money and the credit risk.. J. Zero-coupon bonds A zero-coupon bond is a bond that makes no periodic interest payments and is sold at a deep discount from face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date.. IFRS 9 describes interest as consideration for the time value of money and the credit risk. 30.

(38) . associated with the principal outstanding during a particular period of time. The return of zero-coupon bonds represents the time value of money and the credit risk associated with the principal amount outstanding before redemption date.. Based on the above analysis, the contractual cash flows of zero coupon bonds shall pass cash flow characteristics test and are qualified for amortized cost accounting.. K. Mortgage-backed securities. 政 治 大. The company mainly invested in agency pass-through securities with principal and interest. 立. guaranteed by a government sponsed agency. An agency reduces the risk of default to the. ‧ 國. 學. pass-through holder by guaranteeing payment. According to the Q&A issue by Taiwan Account Research and Development Foundation, the government pass-through securities have no credit. ‧. risk, in addition, based on the prospectus of MBS, the redemption price is 100% of the principal. y. Nat. sit. amount plus accrued interest, therefore, (see APPENDIX 1), the cash flow characteristic of the. er. io. securities are payments of principal and interest on the principal amount outstanding only.. n. al. L.. i n C Assets-backed securities-- Collateralized obligation h e n gdebt chi U. v. A synthetic collateralized debt obligation (CDO) structure typically invest in highly rated bonds while also writing a credit default swap (CDS) over a portfolio of assets outside of the vehicle (SPE). The derivative neither reduces the cash flow variability of the portfolio of assets nor aligns the cash flows from the assets portfolio with those of the issued beneficial interest; the contractual flows are not solely the payment of principal and interest. (See APPENDIX 2). M. Negotiable certificates of deposit i.. Negotiable certificates of deposit are fixed deposit receipts that can be sold in a secondary market. The terms related to this type of investment normally provide for 31.

(39) . interest payments to be applied every six months, up to the point that the security reaches maturity. Deposit interest, or the money paid as an incentive for saving or investing is calculated using a straightforward formula where the balance is multiplied by the percentage of the interest expressed as a decimal. ii.. Because a negotiable certificate of deposit can be sold repeatedly, an owner can choose to offer the asset on a secondary market as a means of generating quick cash in the event of an emergency.. iii.. 政 治 大. Based on the above analysis, the interest of NCD are the considerations for the time. 立. value of money and the credit risk associated with the principal amount outstanding. ‧ 國. 學. during a particular period of time. Therefore, qualify for amortized cost accounting.. ‧. N. Structured Deposits. sit. y. Nat. The deposit contracts are recorded at cost, and the interest revenue thereof is calculated at the. io. er. normal market rate plus finance index (secondary market rate of commercial paper, London Inter-Bank offered Rate (Libor)), and Constant Maturity Swap (CMS).. n. al. Ch. engchi. i n U. v. Interest is defined in IFRS 9 as consideration for credit risk and the time value of money. The interest rate is the normal market interest rate plus financial index. It is clear that the contracture cash flow of the structured deposit could be more than insignificantly different than bench market cash flows (time deposit). It would not be qualified for amortized cost treatment.. 4.2.2. Financial Assets Classification after Adopting IFRS9 After adopting IFRS9, the company’s financial assets would be mainly classified at amortized cost or similar to current classification under the following scenarios:. 32.

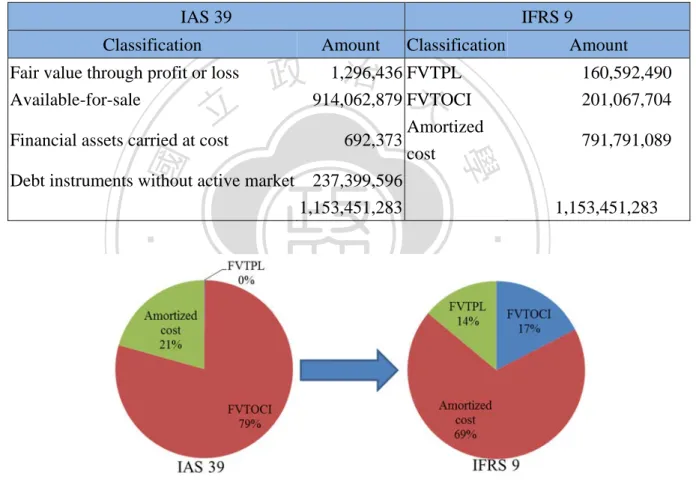

(40) . I.. Scenario 1: The business model objective was collecting contractual cash flows only.. Under this scenario, the company probably chooses to recognize the changes in insurance liabilities in OCI.. Table 4: The Financial Assets Classification under Scenario 1 IAS 39 Classification. Amount. Fair value through profit or loss Available-for-sale. IFRS 9. 立. Classification. 治 FVTPL 政 1,296,436 大 914,062,879 FVTOCI 692,373. Debt instruments without active market. 160,592,490 201,067,704. Amortized cost. 791,791,089. 學. ‧ 國. Financial assets carried at cost. Amount. 237,399,596 1,153,451,283. 1,153,451,283. ‧. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Figure 9: Financial Assets Allociation under Scenario 1. II.. Scenario 2: The business model objectives were collecting contractual cash flows and sales Under this scenario, it is better that the company reflects the effects of interest rate changes in OCI.. 33.

(41) . Table 5: The Financial Assets Classification under Scenario 2 IAS 39. IFRS 9. Classification. Amount. Fair value through profit or loss Available-for-sale Financial assets carried at cost Debt instruments without active market. 立. Classification. 1,296,436 FVTPL 914,062,879 FVTOCI 692,373 FVTOCI' 237,399,596 1,153,451,283. Amount 160,592,490 201,067,704 791,791,089 1,153,451,283. 政 治 大. ‧. ‧ 國. 學 sit. y. Nat. n. al. er. io. Figure 10: Financial Assets Allociation under Scenario 2 Note:. Ch. engchi. i n U. v. FVTOCI, only dividends recognized in P&L FVTOCI’, gain/loss on disposal of AFS are recognized in P&L by transferring from equity. 34.

(42) . 5. Conclusions and Suggestions IAS39 will be replaced by IFRS9 due to the complexity of implementation. The aim of IFRS 9 is to simplify the standard. However, the application to insurance company would be more complex while implement IFRS4 Phase II simultaneously.. The drivers of assets allocation strategies include 1) liability profile and trends, 2) current. 治 政 大are not only the economic profit or adopting IFRS9, the challenges to insurance companies 立 losses but also the “paper” performance represented to the shareholders.. global market environment, 3) regulatory constraints, and 4) capital requirement. After. ‧ 國. 學. Under current accounting standard, insurance company could change the accounting policy to. ‧. avoid or mitigate the fluctuation in profit or losses or the capital in certain economic events,. Nat. sit. y. however, the IFRS 9 do not permit to change the accounting policy due to the global market. er. io. environment change, unless the company change its business model as well.. al. n. v i n Insurance companies do not useC simple debt instruments to match insurance liabilities. The hengchi U assets strategies involve risk diversification, including interest rate, foreign exchange rate, and duration geographic/country and so on. Therefore, the hedge cost should be considered as well.. However, the business model approach does not consider the impact of the risk. diversification.. IFRS 9 should be applied retrospectively, the level of volatility in financial results caused by accounting mismatches and changes in economic circumstance will be highly related to the interaction with the structure and measurement of insure liabilities. The market environment. 35.

(43) . is dynamic, and the management could only make decision on the business model and choose the accounting policy based on the view of the financial market.. IFRS 9 and IFRS4 phase II may take a number of years to be complete; Figure 11 is the road map for implementation.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Data source: Ernst & Young, March 2012 Figure 11: IFRS9 and IFRS 4 Phase II Implementation Roadmap. 36.

(44) . References PwC, 2010, Practical guide to IFRS-IFRS9,”Financial instruments”. Tamsin Abbey, Deloitte, November 2013 ,IFRS 4 Phase 2 Practical Implications. Deloitte, December 2012, IFRS in Focus / IASB issues proposal for limited amendments to IFRS 9. 治 政 大 Are you lost? Deloitte, August 2012, IFRS9 Classification and Measurement 立 ‧ 國. 學. Deloitte, January 2012, Facing the challenge/ Business implication of IFRS 4,9 and Solvency II for insurers. ‧ sit. y. Nat. Deloitte, 2008, IFRS in Real Estate. n. al. er. io. Ernst & Young, March 2014, IASB makes use OCI optional and confirms unlocking of the Contractual Service Margin. Ch. engchi. i n U. v. Ernst & Young, March 2013, IFRS Outlook, Insights on IFRS for Executives and Audit Committees. Ernst &Young, November, 2012, The IASB proposes limited amendments to IFRS9 classification and measurement model. Ernst &Young 1, January 2012, IFRS9: New mandatory effective date and transition disclosures. Ernst &Young 2, January 2012, Facing the challenge Business implications for IFRS 4, 9 and 37.

(45) . Solvency II for insurers. Ernst & Young, March 2012, Limited improvements to IFRS classification and measurement /The impact for insurance and next steps,. Ernst & Young, May 2012, Financial Instruments: classification and measurement — the GAAP differences continue to narrow. 政 治 大. Ernst &Young, July, 2011, Measure by measure Synchronising IFRS 9 and IFRS 4 Phase II. 立. for Insurers. ‧ 國. 學. Ernst &Young, November 2009, IASB publishes IFRS9: Phase 1 of new standard to replace IAS 39. ‧ sit. y. Nat. European Financial reporting Advisory Group, 17 June 2013, Classification and measurement. io. n. al. er. of financial assets results of the field test conducted by EFRAG,ANC,ASCG,FRC and OIC. i n U. v. R. Venkata, November 2009, Salient differences between IAS 39 and IFRS 9. Ch. engchi. 38.

(46) . Appendixes 1.. Extracts prospectus of MBS The bonds, and interest thereon, are not guaranteed by the United States and do not constitute a debt or obligation of the United States or of the agency or instrumentality thereof other than Fannie Mae.. Certain Securities Terms. 立. 政 治 大. Title: step rate bonds due August 24,2023. B.. Form: Fed book-entry securities. C.. Specified PaymentCurrncy Interest: USD. ii.. Principal: USD. Issue date: August 24, 2011. E.. Matunity date: August 24, 2023. io. D.. n. al. er. sit. y. Nat. i.. ‧. ‧ 國. 學. A.. Ch. engchi. i n U. v. Amount payable on matunity date: 100% of principal amount F.. Subject to redemption prior to maturity date In whole or in part, at our option on the 24th of each Febuary, August and November commencing Febaury 24, 2012 at a redemption price of 100% of the principal amount redeemed, pls accured interest thereon to the date of redemption.. G.. Interest catgory: step rate securities. H.. Interest i.. Frequency of interest payment: semiannully. ii.. Interest payment dates: the 24th of each February and August 39.

(47) . 2.. iii.. First interest payment date: Feruary 24,2012. iv.. The interest ate on the outstanding principal amount will be as follows:. Extracts Prospectus of CDO A.. Series number: 533 Tranche number: 1. B.. Interest basis: fixed rate Provided that the fixed rate will be subject to adjustment in accordance with special. 政 治 大. condition (D) (5). 立. Interest will cease to accrue on the notes as from the schedule maturity and no. ‧ 國. 學. further interest will be payable on the notes in respect of any period after schedule maturity date, whether or not the schedule maturity date is postpone until the. ‧. extended maturity date (see special condition F). y. n. al. er. io. sit. Redemption/Payment basis: Condition 10.1 (schedule redemption) is applicable to the notes. D.. Nat. C.. i n U. v. Change of interest or redemption/payment basis: the fixed rate will be subject to. Ch. engchi. adjustment in accordance with special condition (D)(5) E.. Alternative Quotations Upon receipt of a Substitution Information Notice by the Portfolio Manager in accordance with sub-paragraph (2) above, the Portfolio Manager will within the Alternative Quotation Window attempt to obtain from Eligible Dealers (which shall include the Determination Agent or one or more of its Affiliates) firm quotations in respect of both the Removed Reference Entity and any New Reference Entity, in each case, as specified in the relevant Substitution Request (each such quotation, an "Alternative Quotation"). Any such Alternative Quotation in relation to a Removed 40.

(48) . Reference Entity (which shall be expressed as a percentage per annum (the "Alternative Offer Spread")) or any such Alternative Quotation in relation to any New Reference Entity (which shall be expressed as a percentage per annum (the "Alternative Bid Spread")) shall be requested promptly upon receipt of the Substitution Information Notice from the Determination Agent and obtained on the basis that that the Eligible Dealer will enter into a single name physically settled credit default swap with the CDS Counterparty documented on market standard. 政 治 大. terms as at such time (including, if appropriate, an Applicable 2003 Master. 立. Confirmation) and any non standard trading terms agreed between the. ‧ 國. 學. Determination Agent and the Portfolio Manager under paragraph 2(i) above) referencing any New Reference Entity or, as the case may be, the Removed. ‧. Reference Entity where:. y. Nat. the CDS Counterparty is buyer of credit protection if the quotation is. sit. (i). n. al. er. io. requested in relation to the Removed Reference Entity or the CDS. i n U. v. Counterparty is seller of credit protection if the quotation is requested. Ch. engchi. in relation to any New Reference Entity; (ii). the floating rate payer calculation amount of such credit default swap is equal to. (iii). the Substitution Quotation Amount applicable to the Removed Reference Entity or, as the case may be, the New Reference Entity, in each case as specified in the relevant Substitution Information Notice; and. (iv). the period to the scheduled termination date of such credit default swap is the period to the Scheduled Maturity Date; 41.

(49) . such swap, an "Alternative Quotation Swap".. For the avoidance of doubt, the quotation given either by the Determination Agent or an Affiliate or, as the case may be, an Eligible Dealer in respect of a New Reference Entity shall be a bid side quotation (the most favourable of any quotation given, being the "Bid Spread") and the quotation given in respect of a Removed Reference Entity shall be an offer side quotation (the most favourable of any. 政 治 大. quotation given, the "Offer Spread").. 立. Credit events:. 學. i.. ‧ 國. F.. Conditions to settlement (i). At any time after the Determination Agent has determined in its sole. ‧. and absolute discretion that an applicable Credit Event has occurred in. y. Nat. sit. relation to a Reference Entity, the Determination Agent may during the. n. al. er. io. Notice Delivery Period give a Credit Event Notice and a Notice of. i n U. v. Publicly Available Information to the Issuer, which shall constitute. Ch. engchi. satisfaction of the Conditions to Settlement. The Credit Events applicable to each Reference Entity comprising the Reference Portfolio will be the market standard Credit Events applicable to such Reference Entity (determined, if appropriate, in accordance with the Applicable 2003 Master Confirmation) as of the date on which such Reference Entity was included in the Reference Portfolio, as determined by the Determination Agent in its sole and absolute discretion. The Issuer shall promptly notify the Noteholders in accordance with Condition 19 (Notices) of the satisfaction of the Conditions to Settlement. 42.

(50) . (ii). In relation to a Credit Event that is a Restructuring the Determination Agent may deliver multiple Credit Event Notices with respect to such Restructuring Credit Event, each such Credit Event Notice setting forth the Reference Entity Notional Amount to which such Credit Event Notice applies (the "Exercise Amount") (which shall be (A) no greater than the Reference Entity Notional Amount of such Reference Entity and (B) in a minimum amount equal to 1,000,000 units of the currency. 政 治 大. in which the Reference Entity Notional Amount is denominated or an. 立. integral multiple thereof).. ‧ 國. 學. G.. Determination of Loss Amount. On each occasion that a Credit Event occurs with respect to a Reference Entity. ‧. i.. and all the Conditions to Settlement have been satisfied with respect to such. y. Nat. er. io. sit. Credit Event, (a) the Determination Agent will determine the Loss Amount, the Loss Settlement Amount, and the Loss Settlement Percentage, (b) the. n. al. Ch. i n U. v. Reference Entity shall, on the relevant Loss Settlement Date (subject to Condition (D)(1) ii.. engchi. be removed from the Reference Portfolio and the Reference Portfolio Notional Amount shall be reduced by an amount equal to the Reference Entity Notional Amount of such Reference Entity, and (c) the Reference Portfolio Ledger shall be amended accordingly.. 3. 16A. IAS 32 paragraphs 16A and 16B or paragraphs 16C and16D A puttable financial instrument includes a contractual obligation for the issuer to. repurchase or redeem that instrument for cash or another financial asset on exercise of the put. 43.

(51) . As an exception to the definition of a financial liability, an instrument that includes such an obligation is classified as an equity instrument if it has all the following features: (a) It entitles the holder to a pro rata share of the entity’s net assets in the event of the entity’s liquidation. The entity’s net assets are those assets that remain after educting all other claims on its assets. A pro rata share is determined by: (i). dividing the entity’s net assets on liquidation into units of equal amount; and. (ii). multiplying that amount by the number of the units held by the financial instrument holder.. 立. 政 治 大. (b) The instrument is in the class of instruments that is subordinate to all other classes of. ‧ 國. 學. instruments. To be in such a class the instrument:. has no priority over other claims to the assets of the entity on liquidation, and. (ii). does not need to be converted into another instrument before it is in the class. ‧. (i). y. Nat. sit. of instruments that is subordinate to all other classes of instruments.. n. al. er. io. (c) All financial instruments in the class of instruments that is subordinate to all other. i n U. v. classes of instruments have identical features. For example, they must all be puttable,. Ch. engchi. and the formula or other method used to calculate the repurchase or redemption price is the same for all instruments in that class. (d) Apart from the contractual obligation for the issuer to repurchase or redeem the instrument for cash or another financial asset, the instrument does not include any contractual obligation to deliver cash or another financial asset to another entity, or to exchange financial assets or financial liabilities with another entity under conditions that are potentially unfavourable to the entity, and it is not a contract that will or may be settled in the entity’s own equity instruments as set out in subparagraph (b) of the definition of a financial liability. 44.

(52) . (e) The total expected cash flows attributable to the instrument over the life of the instrument are based substantially on the profit or loss, the change in the recognized net assets or the change in the fair value of the recognized and unrecognized net assets of the entity over the life of the instrument (excluding any effects of the instrument).. 16B. For an instrument to be classified as an equity instrument, in addition to the instrument. having all the above features, the issuer must have no other financial instrument or contract. 政 治 大 total cash flows based substantially on the profit or loss, the change in the recognized net 立. that has: (a). ‧ 國. 學. assets or the change in the fair value of the recognized and unrecognized net assets of the entity (excluding any effects of such instrument or contract) and. ‧. (b) the effect of substantially restricting or fixing the residual return to the puttable. sit. y. Nat. instrument holders. For the purposes of applying this condition, the entity shall not. io. er. consider non-financial contracts with a holder of an instrument described in paragraph 16A that have contractual terms and conditions that are similar to the contractual terms. al. n. v i n C h contract that might and conditions of an equivalent e n g c h i U occur between a non-instrument. holder and the issuing entity. If the entity cannot determine that this condition is met, it shall not classify the puttable instrument as an equity instrument. Instruments, or components of instruments, that impose on the entity an obligation to deliver to another party a pro rata share of the net assets of the entity only on liquidation. 16C. Some financial instruments include a contractual obligation for the issuing entity to. deliver to another entity a pro rata share of its net assets only on liquidation. The obligation arises because liquidation either is certain to occur and outside the control of the entity (for 45.

(53) . example, a limited life entity) or is uncertain to occur but is at the option of the instrument holder. As an exception to the definition of a financial liability, an instrument that includes such an obligation is classified as an equity instrument if it has all the following features: (a) It entitles the holder to a pro rata share of the entity’s net assets in the event of the entity’s liquidation. The entity’s net assets are those assets that remain after deducting all other claims on its assets. A pro rata share is determined by: (i). dividing the net assets of the entity on liquidation into units of equal amount;. 政 治 大. and. 立. multiplying that amount by the number of the units held by the financial. 學. ‧ 國. (ii). instrument holder.. (b) The instrument is in the class of instruments that is subordinate to all other classes of. ‧. instruments. To be in such a class the instrument:. y. Nat. (ii). does not need to be converted into another instrument before it is in the class. n. al. er. sit. has no priority over other claims to the assets of the entity on liquidation, and. io. (i). i n U. v. of instruments that is subordinate to all other classes of instruments.. Ch. engchi. (c) All financial instruments in the class of instruments that is subordinate to all other classes of instruments must have an identical contractual obligation for the issuing entity to deliver a pro rata share of its net assets on liquidation.. 16D. For an instrument to be classified as an equity instrument, in addition to the instrument. having all the above features, the issuer must have no other financial instrument or contract that has:. 46.

(54) . (a) total cash flows based substantially on the profit or loss, the change in the recognized net assets or the change in the fair value of the recognized and unrecognized net assets of the entity (excluding any effects of such instrument or contract) and (b) the effect of substantially restricting or fixing the residual return to the instrument holders. For the purposes of applying this condition, the entity shall not consider non-financial contracts with a holder of an instrument described in paragraph 16C that have contractual. 政 治 大. terms and conditions that are similar to the contractual terms and conditions of an. 立. equivalent contract that might occur between a non-instrument holder and the issuing. ‧ 國. 學. entity. If the entity cannot determine that this condition is met, it shall not classify the instrument as an equity instrument.. ‧. n. er. io. sit. y. Nat. al. Ch. engchi. 47. i n U. v.

(55)

數據

相關文件

By kinematic constraints, we mean two kinds of constraints imposing on the 4-momenta of the invisible particles: the mass shell constraints and the measured missing transverse

coordinates consisting of the tilt and rotation angles with respect to a given crystallographic orientation A pole figure is measured at a fixed scattering angle (constant d

Akira Hirakawa, A History of Indian Buddhism: From Śākyamuni to Early Mahāyāna, translated by Paul Groner, Honolulu: University of Hawaii Press, 1990. Dhivan Jones, “The Five

and Jorgensen, P.l.,(2000), “Fair Valuation of Life Insurance Liabilities: The Impact of Interest Rate Guarantees, Surrender Options, and Bonus Policies”, Insurance: Mathematics

The study explore the relation between ownership structure, board characteristics and financial distress by Logistic regression analysis.. Overall, this paper

The difference resulted from the co- existence of two kinds of words in Buddhist scriptures a foreign words in which di- syllabic words are dominant, and most of them are the

To complete the “plumbing” of associating our vertex data with variables in our shader programs, you need to tell WebGL where in our buffer object to find the vertex data, and

The evidence presented so far suggests that it is a mistake to believe that middle- aged workers are disadvantaged in the labor market: they have a lower than average unemployment