獨立董監之設置決策與績效

全文

數據

Outline

相關文件

Define instead the imaginary.. potential, magnetic field, lattice…) Dirac-BdG Hamiltonian:. with small, and matrix

Stone and Anne Zissu, Using Life Extension-Duration and Life Extension-Convexity to Value Senior Life Settlement Contracts, The Journal of Alternative Investments , Vol.11,

H., Liu, S.J., and Chang, P.L., “Knowledge Value Adding Model for Quantitative Performance Evaluation of the Community of Practice in a Consulting Firm,” Proceedings of

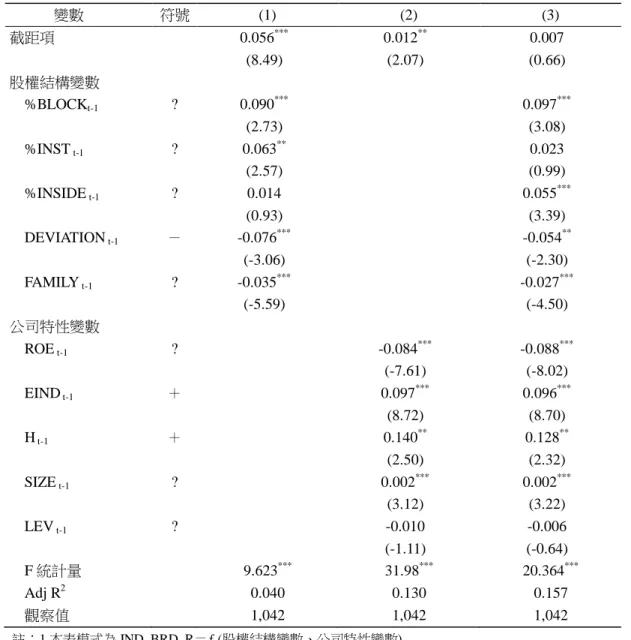

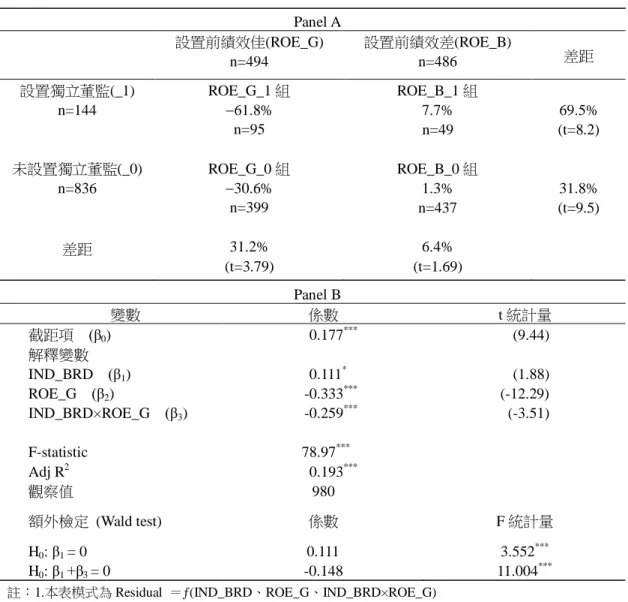

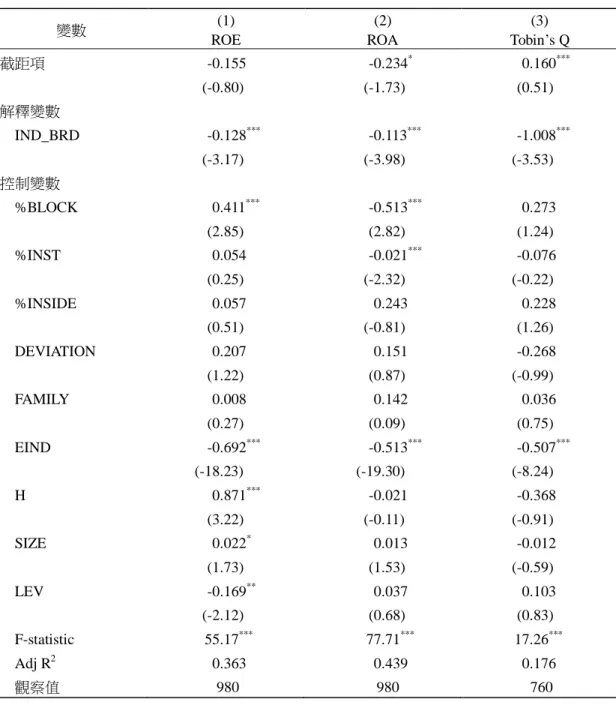

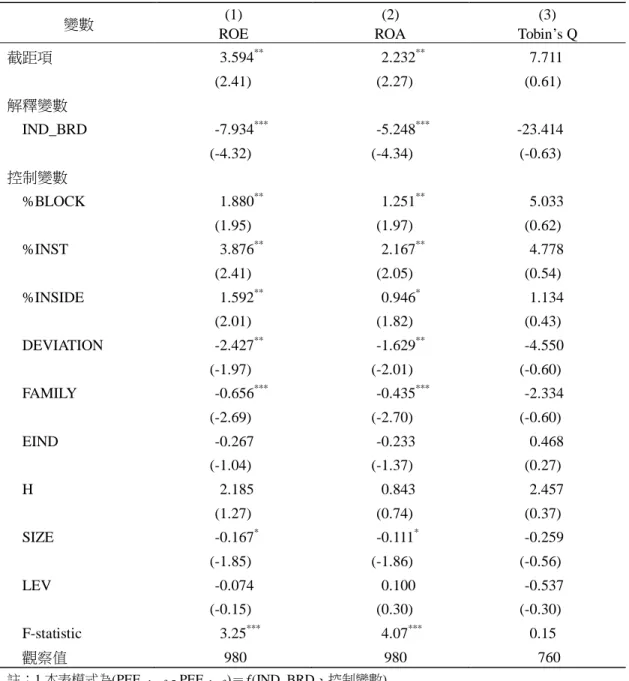

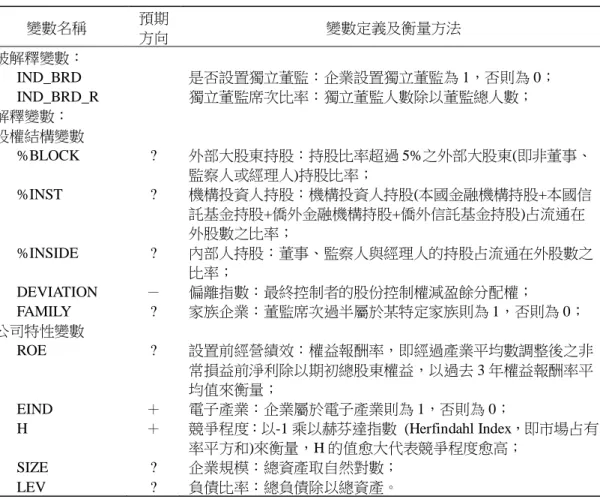

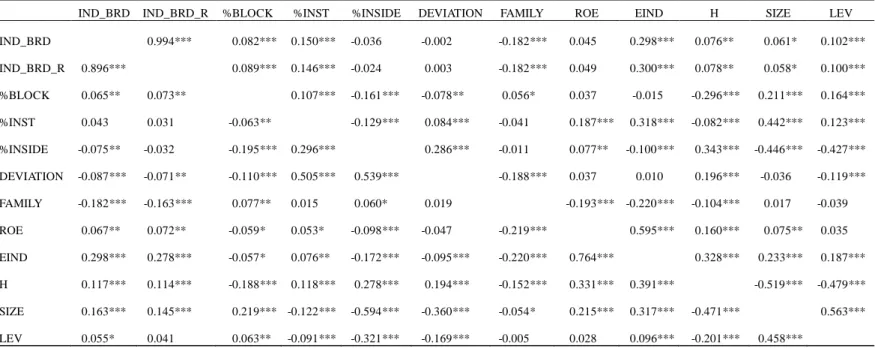

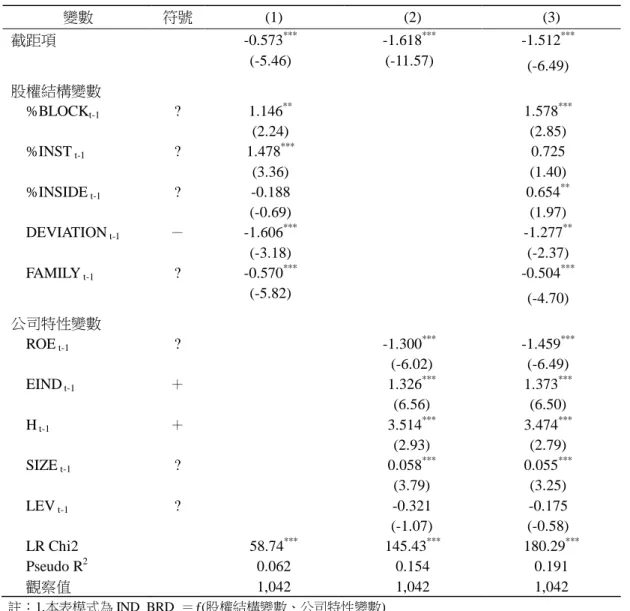

The study explore the relation between ownership structure, board characteristics and financial distress by Logistic regression analysis.. Overall, this paper

Mendenhall ,(1992), “The relation between the Value Line enigma and post-earnings-announcement drift”, Journal of Financial Economics, Vol. Smaby, (1996),“Market response to analyst

– Change of ownership principle in recording trade in goods sent abroad for processing – The term Gross National Product (GNP) is... Capitalisation of research and development

(2000), Valuation: measuring and managing the value of companies, Third Edition, John Wiley and Sons, New York. (2000), “The Dark Side Valuation: Firm with no Earning, no History,

Therefore, we could say that the capital ratio of the financial structure is not the remarkable factor in finance crisis when the enterprises are under the low risk; the