The Trade Frictions Between Japan and

South Korea and Their Implications for

Taiwan: An Economic Perspective

Kristy Hsu

Director, Taiwan ASEAN Studies Center, Chung Hua Institution for Economic ResearchAbstract

In July 2019, Japan announced an amendment to its export control policy and procedures of certain high-tech exports destined to South Korea, and then further downgraded South Korea’s status as a trusted trading partner. South Korea filed a complaint to the World Trade Organization claiming Japan’s tightened policies “unjustifiable” and are out of “political considerations,” in retaliation for South Korean supreme court rulings demanding that Japanese companies should compensate South Korean nationals forced into wartime labor during the second world war. The incidents soon spilled over into security arena as the South Korean government announced that it would not renew an intelligence-sharing agreement with Japan. The trade dispute is the first dispute between two of Asia’s largest and most successful economies after the escalating U.S.-China trade dispute. Japan is widely regarded as adopting unilateral trade measures for non-economic reasons. As Japan is the largest or a major exporter of the three critical chemicals in particular, Japan’s stringent export controls raise important legal issues on the interpretation of the WTO rules. South Korean fears of the disruption of supply chains reflect emerging concerns for economic security if multilateral trade rules are not respected.

Keywords: Trade War, Export Control, Global Supply Chain, WTO, Dispute Settlement

I. Introduction

South Korea and Japan have seen deterioration of their bilateral relations since end of 2018 and face probably the lowest point since diplomatic ties were established between the two countries after World War II. The tensions started with clashes over

two countries’ explanation of the historical issues of Korean forced laborers.

Japan conscripted over 670,000 Koreans as forced laborers during World War II under Japan’s colonialization of the Korean Peninsula. In October 2018, South Korea’s Supreme Court ruled that Mitsubishi Heavy Industries Ltd. and Nippon Steel & Sumitomo Metal Corp., Japanese largest companies, should compensate South Koreans or their descendants conscripted as forced laborers to work for these Japanese companies. Japanese government rejected the rulings and argued that all colonial claims between South Korea and Japan were “completely and finally settled” by a bilateral treaty in 1965 and its related agreements signed between the two sides.

The dispute soon flared into economic and security sphere. In July 2019, Japan decided to tighten restrictions on high-tech exports to South Korea. Japan is the world’s largest or major exporter of three of the controlled materials vital to South Korean semiconductor and computer display manufacturers. In August, Japan further downgraded South Korea’s status as a trusted trading partner. The dispute then escalated into a trade fight and diplomatic crisis between the two countries. In September, after South Korea’s efforts to resolve the issue diplomatically failed, it filed a complaint to the World Trade Organization (WTO), challenging Japan’s tightened policies “unjustifiable” and in violation of World Trade Organization rules. In November, South Korea also removed Japan from its “White List” of export controls. The incidents then spilled over into security as the South Korean government announced that it would not renew an intelligence sharing agreement with Japan.

The Korean public has been furious and started anti-Japan movements in the past few months by refusing to buy Japanese products or visiting Japan. The sentiments, heated by campaigns initiated by young people and social media, have resulted in a significant drop of numbers of Korean tourists to Japan and a decline in Japanese exports to Korea since September. Japan’s unilateral announcement of its tightened export controls also alerted manufacturers of semiconductors in South Korea and companies in the supply chains in other countries, including China and Taiwan companies, of a possible disruption in the Global Supply Chains (GSCs) and the importance of securing a source of strategic technology and materials vital to their businesses. Both Japan and South Korea are among Asia’s largest and most successful

economies. The dispute between the two countries is the first dispute between major economies after the escalating trade dispute between the U.S. and China, Although the dispute is filed with the WTO, awaiting a judicial decision, it is difficult for the dispute to be effectively settled in Geneva because the Appellate Body of the WTO is also in crisis and may cease to function after early 2020. If neither Japan nor South Korea decides to soften their stance and find a mutually accepted resolution, it is possible that the dispute in the WTO may stay for a long time, and may continue to escalate into social and security tensions between the two countries. Even if the best-case scenario happens and the dispute is soon resolved, it will continue to weaken the trust between South Korea and Japan. It will also have persistent effects on countries and the business sector to re-think their long term strategies.

This paper will analyze the trade dispute from an economic perspective. The paper will first introduce the measures and policies at issue and analyze their economic and political implications. The paper will then analyze the policy implications for Taiwan with a focus on Taiwan’s trade policy towards economic security and participation in economic integration.

II. The Japan-South Korea Tensions and the Economic and Political

Analysis of the Related Disputes

1.The Japan-South Korea Tensions and Their Historical Background

Japan and South Korea have a long history of bilateral disputes, ranging from issues related to the Japanese colonialization of the Korean Peninsula (1910-1945) to more recent diplomatic frictions and trade disputes. For example, in the past years, the countries have had heated discussions on the sovereignty of the Dokdo/Takeshima island and on the issues of Korean “comfort women” during the second world war. In November 2018, South Korean President Moon Jae-in cancelled the comfort women agreement which was concluded by Park Geun-hye administration with the Abe government in December 2015.

Figure 1. Victims of Wartime Forced Labor Rally Outside the Supreme Court in Seoul, South Korea

Source: “S. Korean Court Orders Seizure of Mitsubishi Assets for Forced Labor Victims,” Yonhap, March 25, 2019, <http://koreabizwire.com/s-korean-court-orders-seizure-of-mitsubishi-assets-for-forced-labor-victims/134707>.

The current tensions began in October 2018 when the South Korean Supreme Court issued a series of rulings which ordered that Japanese companies, including Japan’s largest companies Mitsubishi Heavy Industries Ltd. and Nippon Steel & Sumitomo Metal Corp., to compensate Korean claimants for their forced labour in Japanese factories during the second world war when their wages were withheld and they experienced psychological suffering.1 A South Korean Court then ordered the

seizure of a Japanese company’s assets in Seoul.

Mitsubishi Heavy Industries Ltd. was ordered to pay as much as $134,000 to each of 10 claimants, while Nippon Steel & Sumitomo Metal Corp. was ordered to pay $88,000 each to four plaintiffs. A South Korean court then ordered the seizure of shares valued at about $356,000 that Nippon Steel has in a joint venture with South Korean steelmaker Posco, a move Tokyo calls unlawful and is trying to block.

On the Japanese side, the Japanese government has always asserted that the decades-long claims were completely and finally settled by the Basic Treaty signed in 1965, which led to normalization of the relations between Japan and South Korea. With the Agreement on the Settlement of Problems Concerning Property and Claims

and on Economic Cooperation signed with the Treaty, Japan claims that all problems

concerning claims between the two countries were confirmed to be “settled completely and finally.” As agreed in this agreement, Japan provided U.S.$300 million in economic assistance to South Korea in grants and U.S.$200 million in loans which would include compensation for the loss of the Korean individuals forced into wartime labour. Japan requested Moon’s administration to intervene in the ruling, but Moon’s administration claimed that the country has an independent judiciary system which had ruled that the 1965 agreement only provided for Japanese government’s obligations to the Korean government, but not to the conscripted Korean laborers.

On July 1, 2019, Japan’s Ministry of Economy, Trade and Industry (METI) announced that, based on the Foreign Exchange and Foreign Trade Act of Japan, Japan would amend its licensing policies and procedures on the export and transfer of certain controlled high-tech products and their relevant technologies destined for South Korea. The tightened procedures then entered into effect on July 4, when Japan began to require all Japanese exporters apply for export licenses for each batch of the listed controlled products destined for South Korea. Japan claimed that the main difference is that no form of “bulk license” is applicable to exports of the identified products and their related technologies when destined for South Korea. However, Korean importers found that applications for individual export licenses were issued under increased scrutiny, causing unnecessary delay and other serious restrictions to the exportation of these products and their related technologies needed in South Korea. Moreover, the amended export licensing policies and procedures also restrict various other forms of international trade destined for South Korea, including investments, licensing or other transfer of intellectual properties, and the supply of certain services relating to technology transfer.

Among the over 900 controlled products, strengthening controls of three specific chemical products and their related technologies—fluorinated polyimide, resist polymers and hydrogen fluoride—immediately raised serious concerns among Korean companies.

These three products are used primarily in the production of semiconductors for smartphones and TV displays. The policies thus put Korean producers, notably leading semiconductor manufacturers such as Samsung and SK Hynix, under risk that their source of imports of the critical materials for production may be disrupted.

Japan is the world’s leading exporter of the above-mentioned chemicals vital to semiconductor related industries and products. According to Reuters, quoting data collected by the Observatory of Economic Complexity, in 2017 Japan exported around U.S.$54.8 million worth of hydrogen fluoride and about 81 percent of the exports went to South Korea. Japan is also the world’s largest producer of fluorinated polyimides, producing about 90 percent of the materials for global consumption. Japan’s unexpected policy changes make it exceptionally difficult for South Korean importers to find alternative suppliers within a short period of time.

Figure 2. Employees Monitor the Production of 300-millimeter Wafers at SK Hynix’s Factory in Icheon, Gyeonggi

Source: “Samsung and SK Hynix suffer semiconductor talent shortage,” Korea Joongang Daily, August 14, 2017, <http://koreajoongangdaily.joins.com/news/article/article.aspx? aid=3037079&cloc=joongangdaily|home|newslist1>.

2. The Social, Economic and Political Impacts of Japan’s Amended Export Controls

Although Japan justified its measures under its national security considerations and claimed that the new measures simply tighten export controls over potentially dual-use materials, Japan’s moves are widely seen as retaliation for the Korean Supreme Court rulings. President Moon Jae-in, noting that each country has core economic competencies, warned Japan against “weaponizing” its leading-edge sectors. He also warned that Japan “will eventually lose international credibility and Japanese companies will suffer from loss of demand,” and that there could be no winners of the dispute. South Korea considered the change of policy was out of Japan’s political considerations to “punish” the Supreme Court’s rulings, instead of being from trade or export control considerations. In September, South Korea returned by also removing Japan from its “white list,” which granted Japanese exporters preferential status in exporting high tech products to Korea. Moreover, on September 11, South Korea filed a request of consultations under the Dispute Settlement Body (DSB) of the WTO for dispute settlement, claiming Japan violated WTO rules and has damaged Korea’s legitimate rights under the trading system. According to the DSB procedures, the dispute case is currently in the process of bilateral consultation. If no mutual acceptable agreement is reached within 60 days after the request is filed, South Korea may proceed to formal panel procedures under the WTO.

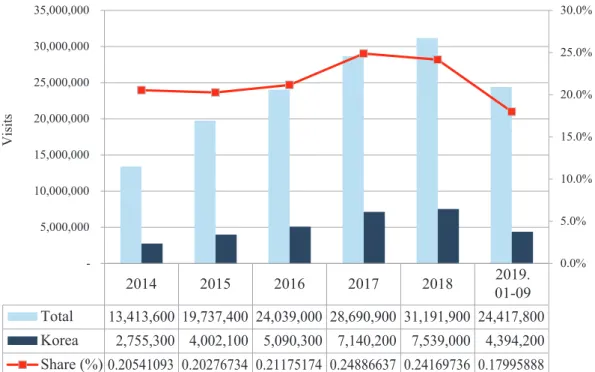

In the meantime, the effects of the trade dispute stemming from long term historical controversies are spilling over into South Korean society, starting from a widespread boycott of Korean citizens refusing to travel to Japan and buying Japanese products and services, such as Japanese beer, automobiles and other brand products. According to the Japan Tourism Agency (JTA), since 2014 South Korea has been the second largest source country of tourists to Japan, only next to China. In 2018, around 7.54 million South Korean tourists visited Japan, accounting for about one quarter of the total foreign tourists visiting Japan. South Korean tourists contributed to around 13 percent of Japan’s total tourism revenue (¥4.5 trillion), also only second to Chinese tourists whose contribution was around 32.2 percent.

According to JTA data, in the first six months of 2019, the number of South Korean tourists to Japan fell by 13.4 percent. The number of airlines between South Korea and Japan was reduced due to significant drop in tourists. It is the first decline in five years and it is expected to worsen in light of the growing tensions with South Korea. The boycott, if it continues, may have an impact on Japan’s plan to attract 40 million foreign tourists in 2020 when the Olympic Game is hosted in Japan (See Figure 3 and Table 1).

2014 2015 2016 2017 2018 2019. 01-09 Total 13,413,600 19,737,400 24,039,000 28,690,900 31,191,900 24,417,800 Korea 2,755,300 4,002,100 5,090,300 7,140,200 7,539,000 4,394,200 Share (%) 0.20541093 0.20276734 0.21175174 0.24886637 0.24169736 0.17995888 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% -5,000,000 10,000,000 15,000,000 20,000,000 25,000,000 30,000,000 35,000,000 Visits

Figure 3. Number and Share of South Korea Tourists in Japan

Sources: Japan Tourism Agency, 〈訪日外客統計 集計 発表〉, October 16, 2019, Japan

Tourism Agency, <https://www.jnto.go.jp/jpn/statistics/data_info_listing/index.html>;

compiled by the author.

Table 1. Growth of Foreign Tourist Arrivals in Japan

2014 2015 2016 2017 2018 01-092019

Total Growth Rate 29.4 47.1 21.8 19.3 8.7 4 Korean Growth Rate 12.2 45.3 27.2 40.3 5.6 -13.4 Sources: Japan Tourism Agency, 〈訪日外客統計 集計 発表〉; compiled by the author.

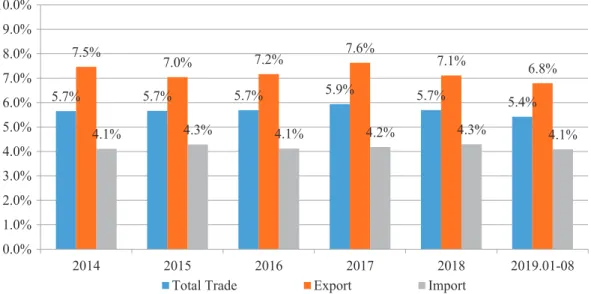

Japan and South Korea have developed close trading relations, being each other’s third largest trading partner. According to Japan’s trade data, Japan’s exports to South Korea between 2014 and 2018 constituted around 7 percent of Japan’s total exports, while imports from South Korea constituted around 4 percent of its total imports.

Figure 4. A National Boycott Campaign Against Japanese Products and Travel to Japan

Source: “S. Korean tourist consumption in Japan declines by over half,” The Hankyoreh, October 3, 2019, <http://www.hani.co.kr/arti/english_edition/e_international/911886.html>.

In 2018, South Korea was Japan’s third largest export destination, only after China and the U.S., and fifth largest import source. According to data from Ministry of Finance, Japan exported U.S.$52.5 billion worth of goods to and imported U.S. $32.1 billion worth of goods from South Korea. However, since early 2019, bilateral trade between the two countries has begun to show a downward trend, partly reflecting the negative impacts of the U.S.-China trade dispute and weakening demand in the international and domestic markets. In the first eight months of 2019, Japan’s exports to South Korea dropped significantly, down to around 6.8 percent of its total exports, reflecting the impact of the new export control procedures (See Figure 5 and Figure 6).

2014 2015 2016 2017 2018 2019. 01-08 Total Trade 84,905,650 70,826,060 71,254,769 81,379,688 84,638,745 51,277,051 Export 51,520,343 44,018,768 46,235,238 53,282,026 52,504,252 31,710,985 Import 33,385,307 26,807,292 25,019,531 28,097,662 32,134,493 19,566,066 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 U.S. Million

Figure 5. Japan’s Bilateral Trade, Export to and Import from South Korea Sources: ITC Trade Map, based on data from Ministry of Finance, Japan; compiled by the author.

5.7% 5.7% 5.7% 5.9% 5.7% 5.4% 7.5% 7.0% 7.2% 7.6% 7.1% 6.8% 4.1% 4.3% 4.1% 4.2% 4.3% 4.1% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 2014 2015 2016 2017 2018 2019.01-08

Total Trade Export Import

Figure 6. Changes to South Korea’s Share in Japan’s Total Trade, Export and Import Sources: ITC Trade Map, based on data from Ministry of Finance, Japan; compiled by the author.

It is worth noting that after Japan adopted the more time consuming export-import paperwork and evaluation processes for tech products such as semiconductors, rubber and plastic, and machine parts, the new procedures affected more than hundred

products destined for South Korea. It would now take about 90 days for screening and approvals, subject to increased scrutiny. For example, according to the latest trade data released by the Ministry of Finance of Japan, in September this year Japan has approved only around 100 kilograms of hydrogen fluoride destined for South Korea, compared with around 3,283 tons of the same product in September 2018. The data confirmed the fears of uncertainties of South Korean companies over their business plans. To cope with Japan’s new policies, these affected companies would have to either curtail production or pay a much higher price to secure controlled materials.

Further to trade implications, Japan’s export controls exposed the industrial vulnerabilities of South Korean and its firms’ heavy dependence on Japanese suppliers. To address the issue, in August, the South Korean government announced that it will put forward a national budget of approximately U.S.$6.4 billion in the next seven years to enhance the “nationalization” of around 100 critical tech products to reduce their dependence on Japanese supply and technologies. The plan aims to help South Korean companies self-source their necessary materials and will also assist companies to source from exporters outside Japan. However, the government needs to respond to increasing calls to fill gaps in short-term supply. The plan also raises questions and concerns over how and when the policy goals can be achieved.

The trade dispute further spilled over from social and economic impacts into international relations and security cooperation. In August, Moon’s administration announced that it would exit from the bilateral General Security of Military Information

Agreement (GSOMIA), an intelligence-sharing pact with Japan. The agreement was

signed in November 2016 and is automatically renewed annually unless one of the countries decides to withdraw. Allowing the two U.S. allies to share sensitive information on missile threats from North Korea, among other things, the agreement was received with high praise from then-U.S. President Barack Obama, for it sent a signal of the achievement of U.S. policy of promoting trilateral security cooperation between the U.S., South Korea and Japan. Given the importance of security cooperation between the three parties, the increasing tensions are already affecting U.S. overall security strategy in the Asia Pacific. It also suggests that U.S. leadership and ability to coordinate inter-governmental affairs among its strategic allies are becoming weaker.

a softer stance towards Japan, considering the upcoming legislative election in April 2020 in South Korea. It also appears that Japan will not move to reverse its decisions on export restrictions. The clashes over historical and other issues between the two countries will have a considerable effect on economic and trade, supply chains, and security cooperation in the region.

3.The Ripple Effects on the Global Trading System and World Trade

The trade dispute also has global implications. South Korea is a key exporter of semiconductors. Not only could China’s technology supply chain be disrupted but also U.S. companies may worry about the potential risks of disruption to the global supply chain which will have huge global implications.

Beyond the supply chains issues, both Japan and South Korea are WTO members. They have consistently pursued trade liberalization and actively participated in the global economy and abided by international trade norms and regimes. For example, both governments have repeatedly expressed explicit support for the global trading system and multilateralism. In September, South Korea filed a request for dispute settlement to the DSB of the WTO. It claimed Japan’s strengthened measures are out of political considerations and violate WTO rules.2

Japan needs to prove to its trading partners and the WTO that its amended policies and procedures against South Korea alone are not arbitrary and not a disguise for its political will or protection of its own industries. However, given the current crisis with the dispute settlement mechanism of the WTO,3 the dispute may take a much

longer time than usual to reach its final ruling.

Korea claimed that Japan’s measures are inconsistent with its obligations under the GATT 1994, the TRIMS Agreement, the TRIPS Agreement, etc. WTO, “Japan - Measures related to the Exportation of Products and Technology to Korea,” September 16, 2019, WT/DS590/1, WTO, <https://web.wtocenter.org.tw/DownFile.aspx?pid=329382&fileNo=0>.

There are 7 Members of the Appellate Body of the WTO. Due to an on-going boycott by the U.S. for naming a new Appellate Body Members to replace Members who have completed their terms, in 2020 there will be only one AB Member and the AB may cease to function. Therefore, if either Japan or South Korea objects to the DSB panel’s decision and decides to go to the Appellate procedures, the case may take years to resolve.

Figure 7. The WTO Secretariat in Geneva, Switzerland

Source: WTO, “Ecuador undergoes a Trade Policy Review and Committee on Technical Barriers to Trade meets,” March 4, 2019, Twitter, <https://twitter.com/wto/status/1102478828847415298>.

Among other possible effects, though the final ruling of the dispute are still unknown, it is widely regarded as the first case following the escalating U.S.-China trade war, after the Trump administration adopted unilateral punitive measures against China. The U.S. has set increasing troubling precedents against the rule-based global trading system and demonstrated to the world that trade measures could be used as effective weapons to meet a national policy. Japan, one of the world’s most highly respected successful economies, also sends a message that trade measures can be used to solve long-standing historical and non-economic issues in its trade sanctions on South Korea. These disputes deliver signals that the global order is under the risk of collapsing.

The Trump government started its unilateral trade sanctions and threatening to increase tariffs on imports from China and other economies. It also “weaponized” trade to try to solve non-economic issues, such as threatening to increase tariffs on Mexico unless the latter enhanced border security. These trade disputes will have ripple effects on global trading system. They have already inspired a new case in

Europe. In August, French President Emmanuel Macron, along with Irish Prime Minister Leo Varadkar, threatened to suspend the Free Trade Agreement between the EU and Mercosur because the Brazilian government refused to deal with the serious fires in the Amazon rain forest. In September, Austria followed to seek to block ratification of the EU-Mercosur FTA unless Brazil changes its environmental policy. When large countries decide to stop playing a global leadership role and handle disputes based on rule of law, global trade will fast deteriorate and world economy further weakened.

III. Policy Implications for Taiwan - Perspectives of Taiwan’s Policy

Towards Participation in Economic Integration

The escalating trade tensions between Japan and South Korea have important policy implications for Taiwan. The tensions, though originating in historical disputes between the two countries, come after the U.S.-China trade war, demonstrating the ripple effects of Trump administration’s unilateralism and tit-for-tat tariffs. It will not be a surprise if more countries choose to follow suit to solve their economic and non-economic issues with other countries.

Furthermore, the dispute also reflects that the global technology sector in today’s protectionist world is increasingly more vulnerable. Trade wars are weakening the global economy and world trade, and threatening the entire global supply chains of technology sector. Therefore, Taiwan needs to review its overall external policy and economic strategy to ensure its national economic interests, and balance trade relations with the rest of the world.

Figure 8. President Trump and President Xi Jinping at Their Bilateral Meeting during the G-20 Leaders Summit in Osaka, Japan, on June 29, 2019 Source: “President Trump and China’s President Xi Jinping pose for a photo ahead of their bilateral

meeting during the G-20 leaders summit in Osaka, Japan, on June 29, 2019,” Reuters, August 7, 2019 , <https://www.washingtonpost.com/business/2019/08/06/us-china-trade-war-is-getting-ugly-is-this-really-most-dangerous-financial-moment-since/>.

1. When Trade Is Used as A Weapon, All Countries Will Suffer. Taiwan Should Carefully Craft and Balance Its External Policy to Avoid Any Potential Trade Disputes and Fights

As the U.S.-China trade war moved into its 16th month, most economies have

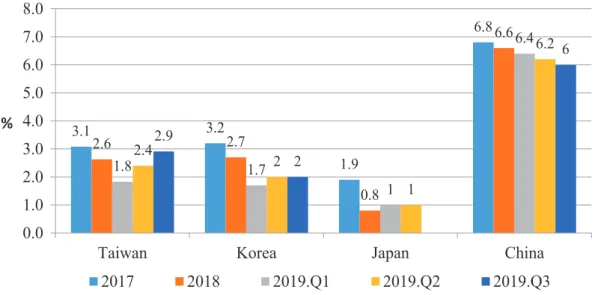

suffered not only from a downward trend but also from increasing uncertainties to trade and business plans and disruption of supply chains. Despite some countries having expected to benefit from a trade conflict between the world’s two largest economies, the results show that neither the U.S. nor China, nor other countries, stand to gain from the trade war, as their economies are closely linked and inter-dependent. Taiwan’s economy is closely linked with the regional economy. The trade conflicts between the U.S. and China and those between Japan and South Korea have both direct and indirect impacts on Taiwan’s economy. According to the latest data, of four

Northeast Asian countries, Taiwan out continued to have mild but stable economic growth from the beginning of 2019. In the first three quarters of 2019, Taiwan enjoyed a GDP growth rate of 1.8 percent, 2.4 percent, and 2.9 percent, respectively. In the same period of time, South Korea shared similar growth rates with Taiwan, while Japan has 1 percent of growth rates in the first and second quarter of 2019. China experienced a significant downturn of its booming economy since 2018, showing negative impacts on its economy since Trump administration put forward tariffs and other non-tariff measures on the country (see Figure 9).

3.1 3.2 1.9 6.8 2.6 2.7 0.8 6.6 1.8 1.7 1 6.4 2.4 2 1 6.2 2.9 2 6 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0

Taiwan Korea Japan China

%

2017 2018 2019.Q1 2019.Q2 2019.Q3

Figure 9. GDP Growth of Taiwan, South Korea, Japan and China

Sources: Statistical Department from 4 countries, Japan has released GDP growth rates of Q2, 2019; compiled by the author.

The increasing trade protectionism and inward-looking policies adopted by larger economies in Asia and other parts of the world pose increasing threats to Taiwan’s economy. Taiwan needs to carefully craft its external relations and trade policies to maintain constructive trade relations with its major trading partners, and to avoid from trade conflicts with them.

2. Taiwan Needs to Review Its Industrial and External Trade Structure and Ensure Economic Security and The Undisrupted Supply of Critical Materials and Technologies, Including Self-Sourcing

The dispute between South Korea and Japan will have important legal implications in how the WTO judiciary system interprets and applies WTO rules on Japan’s amended export controls. Therefore, in September, Taiwan’s mission to the WTO notified the WTO Secretariat that, due to its “substantial trade interest in the exportation of certain controlled products and a substantial systemic interest in the interpretation of the related provisions,” Taiwan requests to participate in the procedure as Third Party.

The dispute has important implications for national security issues. Although the trade value of the three controlled chemicals destined for South Korea is much smaller compared with the trade value of goods targeted by U.S. punitive tariffs under the U.S.-China trade war, South Korea is almost entirely dependent on Japanese sources for its semiconductor and display sectors. The fact that it imports primarily raw materials and technological or manufacturing components from Japan makes it extremely vulnerable to Japan’s unilateral trade measures. By contrast, Japan’s imports of critical high tech materials and components are more diversified throughout other Asian countries. Japan also consistently enjoys a trade surplus with South Korea, and hence stands in a better position when bilateral trade relations deteriorate.

Taiwan needs to review its industrial and external trade structure as well as its access to and control of the critical technologies needed for its economic and industrial development, in order to understand its weaknesses and strengths. Furthermore, Taiwan should put more resources on developing its own technologies, instead of relying on external resources. For example, around 40 percent of Taiwan’s exports are Information Technology and electronics products. The over concentration in certain sectors will put Taiwan at risk when a disruption of supply chains occurs. Taiwan also needs to diversify its external trade and reduce dependence on Chinese markets. It is reported that an increasing number of Taiwan companies are relocating from China to avoid the U.S. punitive tariffs, and search for emerging or replacement markets. The government should provide assistance to companies with a diversification strategy.

3. Taiwan Should Explicitly Support The Global Trade System and Multi-lateralism, and Make All Efforts to Accede to Regional Trade Mechanisms and Bilateral Trade Agreements

Historically, South Korea has seen external power struggles for decades. This geopolitical weakness is reflected in South Korea’s traditional major-country diplomacy, prioritizing external relations with the U.S., China, Japan, and Russia—China, Japan, and Russia being its three largest neighbors surrounding the country, and the U.S. being its most important security partner and the only military ally since independence in 1948.

However, in last few years, South Korea’s relations with China and Japan have experienced a bumpy ride. In 2017, South Korea’s decision to deploy the Terminal High Altitude Area Defense (THAAD) anti-ballistic missile system against North Korea incurred China’s strong protests and resulted in serious economic consequences, including a series of retaliatory action against South Korean companies in China. On the other hand, the traditionally close U.S.-Korean ties face increasing trade tensions, furthered by Trump’s administration’s pressure to increase its financial contribution in defense cost-sharing of the U.S. bases in South Korea.4

Currently, tensions with Japan have not only hampered negotiations of the long awaited China-Japan-Korea FTA (CJKFTA) but have also affected South Korea’s pursuit of participation in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). In February this year, the South Korean government announced that it will hold unofficial preliminary discussions with the major members of the CPTPP. In fact, South Korea has already signed a free trade agreement (FTA) with nine of the eleven member countries of the CPTPP, with only two exceptions— Japan and Mexico.5 As any country seeking admission to the new membership

negotiations requires unanimous support from the existing members, it will be difficult for South Korea to gain Japan’s support for its bid to participate in the trade agreement.

There are about 28,500 U.S. troops stationed in U.S. bases in South Korea.

The eleven members of the CPTPP are Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam. The FTA came into force in December 2018.

Similar to South Korea, Taiwan also has a complex political situation and a difficult relationship with its largest neighbor, China. In January 2002, Taiwan was finally admitted to the WTO after twelve years of accession negotiations. Membership in the global trading system ensures Taiwan of its right to enjoy non-discriminatory treatment granted to all WTO members. Since 2009, Taiwan moved further to pursue bilateral FTAs with its trading partners. As of today, Taiwan has signed an Economic

Cooperation Framework Agreement (ECFA) with China, and Economic Cooperation Agreements (ECA) with Singapore and New Zealand. Taiwan has also developed FTAs

or ECAs with its diplomatic allies in Africa and Latin America.

Figure 10. A Seminar in Taipei Promoting the Services Trade Agreement of the ECFA

Source: 王健全, 〈ECFA 早收落日,工具機產業應有的對策〉, February 10, 2017, National

Policy Foundation, <https://www.npf.org.tw/1/16586>.

It is of utmost interest to Taiwan that the WTO trading system be well-respected and operates based on open and rule-based multilateralism. Taiwan should explicitly support the WTO and its creditability. In the meantime, Taiwan also needs to make

all efforts to accede to regional trade mechanisms and bilateral trade agreements. Currently, the CPTPP is a priority for the governments’ policy goals in regional economic integration. Besides the high-quality FTA, Taiwan also needs to accede to the ASEAN-centric Regional Comprehensive Economic Partnership (RCEP), as the 16-country FTA includes almost all of Taiwan’s major export markets and investment destinations. The Japan-South Korea dispute reveals that political risks may hinder a country’s FTA policy. While China continues to block Taiwan in the international arena, Taiwan needs to re-think its strategy and action plans in order to prevent political interference from hampering its efforts in pursuing participation in economic integration.