Corporate Distress Prediction Models Using Governance and Financial Variables: Evidence from Thai Listed Firms during the East Asian Economic Crisis

全文

(2) 274. Piruna Polsiri and Kingkarn Sookhanaphibarn. board involvement by controlling shareholders reduce the probability of corporate financial distress. This evidence supports the monitoring/alignment hypothesis. Finally, our results suggest evidence of the benefits of business group affiliation in reducing the distress likelihood of member firms during the East Asian financial crisis. Keywords: corporate distress, prediction model, corporate governance, neural networks, East Asian economic crisis JEL classification: G01, G33, G34. 1. Introduction. Predicting corporate distress and business failure can contribute significantly to the economy. Early-warning systems developed from distress and/or failure prediction models have proven to reduce the chance that a company gets into corporate distress or even goes bankrupt. This should in turn prevent the systemic collapse of a country’s economy. A good example that a lack of effective early warning systems may lead to a catastrophe of the history is the collapse of the Thai financial and banking sector in 1997-1998. During the recent East Asian economic crisis, 58 out of 91 finance companies were suspended in the second half of 1997, and a further 12 finance companies in 1998. After all, 56 finance companies were closed in 1997. In relation to banking, six banks were suspended in 1998, followed by one more in 1999. Out of the 15 domestic banks operating in 1994, one was closed down, three were merged into government owned banks, two were taken over by the government and three became foreign owned during the crisis. Although the main cause of this crisis is not the lack of sound early warning systems, the adverse impacts of the crisis might have been lower if Thailand had such effective warning systems. Not only financial and banking sectors, corporate sectors in Thailand were also severely negatively affected by the 1997 East Asian economic crisis. Considering companies traded on the stock market, there have been many non-financial listed firms that experienced financial difficulties as a result of the East Asian crisis. During the period 1998-2001, the number of non-financial firms that were ordered to delist by the Stock Exchange of Thailand is 28, while the number of non-financial listed firms that entered “rehabilitation sector” is as high as 102. On the bright side,.

(3) Corporate Distress Prediction Models Using Governance and Financial Variables. 275. however, the economic crisis enables us to examine corporate distress and develop prediction models of such distress for listed companies in an emerging market economy, which we believe only little evidence has been provided. Other than the opportunity to explore the prediction of corporate financial distress, Thai firms are also of interest due to their concentrated ownership structure. Such characteristic is common among most of economies around the world, but different from the US where extensive research on corporate financial distress prediction has been conducted. To empirically investigate the effects of corporate governance regarding ownership and board structures on firms, the literature has typically focused on linking ownership and board characteristics and performance.1 In this study, however, we aim to investigate the effects of corporate governance, particularly ownership and board structures, on the likelihood of corporate distress.2 We consider several aspects of governance characteristics regarding ownership and board structures. In companies with concentrated ownership, conflicts of interests arise between controlling shareholders and minority shareholders, rather than between management and shareholders since controlling shareholders are more likely to control and monitor management (Shlefier and Vishny, 1997). The power to control a corporation entrenches the controlling shareholders’ status and provides them with an opportunity to expropriate corporate resources for their private benefits at other stakeholders’ expenses (Shleifer and Vishny, 1997; La Porta et al., 1998, 1999; Bebchuk, 1999; DeAngelo and DeAngelo, 2000; Johnson et al., 2000b). Hence, the presence of controlling shareholders should be detrimental to the firms and may increase the likelihood of corporate distress. The expropriation problem caused by controlling shareholders tends to be more severe when controlling shareholders own more voting rights relative to their cashflow rights and when controlling shareholders also serve as managers or executive directors (Shleifer and Vishny, 1997; La Porta et al., 1998, 1999; Bebchuk et al., 2000; Claessens et al., 2002). We conjecture that the expropriation by controlling shareholders not only deteriorate corporate value and firm performance but also 1 See, for example, Wiwattanakantang (2001), Claessens et al. (2002), Mitton (2002), Volpin (2002), Anderson and Reeb (2003), Cronqvist and Nilsson (2003), Joh (2003), Lemmon and Lins (2003), Lins (2003), and Baek et al. (2004). 2 Not until recently have studies documented significant effects of governance variables on the probability of bankruptcy/failure (Bongini et al., 2001; Becchetti and Sierra, 2003; Claessens et al., 2003) or distress (Bongini et al., 2000, 2001; Lee and Yeh, 2004)..

(4) 276. Piruna Polsiri and Kingkarn Sookhanaphibarn. increase the likelihood of corporate financial distress. More precisely, the greater the difference between voting and cash-flow rights held by controlling shareholders and the higher the fraction of board seats occupied by controlling shareholders increase the probability of financial distress. We also expect to find a positive relation between the participation of controlling shareholders in top management and the probability of financial distress. Nevertheless, controlling shareholders are valuable if they perform important governance functions. Since controlling shareholders own a substantial fraction of a firm’s residual claims, they have strong incentives to effectively monitor managerial decision-making to ensure that it is consistent with value-maximizing strategies (Shleifer and Vishny, 1986; Admati et al., 1994; Burkart et al., 1997). Moreover, when controlling shareholders possess a large proportion of the firm’s cash-flow rights, they will internalize more of the costs of expropriation actions that involve some loss of firm value. Consequently, they are less likely to extract private benefits (Bennedsen and Wolfenzon, 2000). Significant cash-flow rights held by controlling shareholders can also serve as a credible commitment that controlling shareholders will not expropriate minority shareholders (Gomes, 2000). Hence, a larger ownership stake may better align their interests and minority shareholders’ interests (Claessens and Fan, 2002). As a result of the monitoring/alignment effects of controlling shareholders, the presence of controlling shareholders may reduce the probability of corporate distress.3 In this study, we use the data from Thailand. Our sample includes non-financial companies listed on the Stock Exchange of Thailand that were financially distressed during the period 1998-2001 of which data are available, and control firms that are matched by size and industry. The techniques we employ are a popular traditional statistical approach, namely a logit regression, as well as a recently developed approach, namely a neural network. Both different techniques are constructed to check the robustness of our prediction models. The results from our logit models suggest that governance variables play an important role in predicting the odds of corporate distress. More precisely, we find that non-financial listed firms in which controlling shareholders exist are less likely. 3 Bongini et al. (2001) hypothesize that financial institutions in which influential families are the largest shareholders will be less likely to be closed due to the family’s political connection..

(5) Corporate Distress Prediction Models Using Governance and Financial Variables. 277. to be in distress. Moreover, active board involvement by controlling shareholders reduces the distress likelihood. These findings support the monitoring/alignment hypothesis of controlling shareholders.4 We also find evidence of the benefits of top business group affiliation in decreasing the probability of corporate distress. On the other hand, as expected, traditional financial variables perform well in forecasting the probability of corporate distress. Specifically, our results indicate that firms with excessive use of debt, poor operating performance, and small market capitalization tend to experience corporate distress. These results are consistent with what have been found in previous studies. Overall, our distress prediction models show high accuracy rates. For the logit prediction models, more than 85% of the sample firms are correctly classified with the Type I error of about 9%. Similarly, the neural network prediction models appear to have good results. That is, on average, the accuracy of the four neural network prediction models ranges from around 84% to 787% while the average Type I error rages from around 10% to 16%. These results thus suggest that our prediction models can serve as efficient early warning systems. We add to the literature on corporate governance by examining a possible relation between corporate governance, concerning ownership and board structures, and corporate distress. Moreover, as far as we concern, no studies on the neural network prediction models that incorporate characteristics of ownership and board structures have been documented. Therefore, the neural network models we develop will be a contribution to the literature on corporate distress prediction. The rest of the study is structured as follows. Section 2 reviews the impact of corporate governance attributes, i.e., ownership and board structures, on the likelihood of financial distress. This section also reviews the effects of typically documented financial variables that help predict the likelihood of distress. A brief overview of corporate distress/failure prediction models widely applied in the existing literature is also provided. Section 3 discusses the data, sample design, and methodology used in this study. Section 4 describes corporate governance and financial characteristics of the distressed firms in our sample and compares them with those of non-distressed counterparts. This section also investigates the effects. 4 However, it is also possible that controlling shareholders may intend to prolong the expropriation honeymoon. Hence, they attempt to prevent financial distress from happening during an economic crisis..

(6) 278. Piruna Polsiri and Kingkarn Sookhanaphibarn. of ownership and board structures on the likelihood of financial distress. In addition, the section examines the empirical results from our developed distress prediction models. Finally, Section 5 concludes the study.. 2 Governance and Financial Variables and the Likelihood of Corporate Distress 2.1 The Impact of Governance Variables on the Likelihood of Corporate Distress 2.1.1 Controlling Shareholder and the Likelihood of Corporate Distress Concentrated ownership may be either detrimental or beneficial to the firm and its minority shareholders. Due to their substantial claims upon the firm’s future cash flows, controlling shareholders have an incentive to bear the costs involved in monitoring management (Shleifer and Vishny, 1986; Admati et al., 1994; Burkart et al., 1997). For this reason, the monitoring hypothesis states that the presence of controlling shareholders is beneficial to the firm and to minority shareholders. If controlling shareholders own a substantial fraction of the rights to the firm’s cash flows, they will assume a similarly substantial fraction of any deadweight losses associated with their attempts to expropriate minority shareholders (Bennedsen and Wolfenzon, 2000). Owning high cash-flow rights can also provide a commitment that controlling shareholders will not extract private benefits (Gomes, 2000). Hence, high ownership stake held by controlling shareholders can align interests between controlling and minority shareholders (Claessens and Fan, 2002). This is so-called the interest alignment hypothesis. However, high degrees of ownership concentration may diminish the efficiency of some significant governance instruments that protect shareholder rights. The most important and widely documented agency cost of concentrated ownership occurs when. controlling. shareholders. expropriate. minority. shareholders.. The. expropriation/entrenchment hypothesis predicts that concentrated ownership has an unfavorable impact on firm value and minority shareholder wealth. The adverse effects of the agency conflict between controlling and minority shareholders are.

(7) Corporate Distress Prediction Models Using Governance and Financial Variables. 279. exacerbated when significant shareholders can gain a higher proportion of a firm’s voting rights than the cash-flow rights associated with the proportion of shares that they hold. Even though there exists much evidence on the relation between the presence of controlling shareholders and firm value or performance, little has been known about the relation between the presence of controlling shareholders and the likelihood of corporate financial distress.5 In this study, we conjecture that if the monitoring/alignment hypothesis holds, firms in which controlling shareholders exist will be less likely to encounter corporate financial distress than firms in which no controlling shareholder exists. On the other hand, if the expropriation/ entrenchment hypothesis holds, particularly when the value of their control is greater than the gain from associated ownership, the likelihood of corporate financial distress will be greater in firms with controlling shareholders and especially with a larger disparity between cash-flow and voting rights held by controlling shareholders. 2.1.2 Multiple Large Shareholders and the Likelihood of Corporate Distress Large outside shareholders have both the incentives to monitor and the power to act against the firm’s controlling shareholder, and hence suggest a lower incidence that the controlling shareholder will extract firm value for his or her personal objectives. Furthermore, although having multiple blockholders might cause a free-riding problem in monitoring management, firm value is generally enhanced since this free-riding reduces excessive monitoring by a single substantially concentrated shareholder (Pagano and Roell, 1998; La Porta et al., 1999). Sharing voting rights among many large shareholders also helps to reduce the excessive power of one controlling shareholder as it necessitates the formation of an alliance among several blockholders to gain sufficient control over a company. Likewise, the presence of other large shareholders forces a controlling shareholder to accumulate a bigger ownership stake to stay in control. By holding a greater. 5 For example, Bongini et al. (2001) show that privately-owned financial institutions are more likely to be in distress during the East Asian crisis. In addition, they find that financial institutions in which a foreigner is the largest shareholder have a lower probability of distress..

(8) 280. Piruna Polsiri and Kingkarn Sookhanaphibarn. equity stake, the controlling shareholder reduces his or her incentive to expropriate other shareholders (Bennedsen and Wolfenzon, 2000). Nevertheless, the presence of multiple large shareholders may deteriorate firm value. Large outside shareholders do not always effectively monitor a firm’s controlling shareholder. In fact, these blockholders may collude with the controlling shareholder to divert corporate resources for their own interests. Burkart et al. (1997) argue that having a very large shareholder is value increasing if he or she performs an effective function in monitoring and disciplining management. This shareholder might, nevertheless, collaborate with managers in expropriating outside shareholders. In firms with several large shareholders, the same problem could arise if these shareholders delegate their voting rights to one shareholder. That is, the delegated shareholder may collude with managers and then share private benefits between the whole controlling group and management. Therefore, according to the multiple-blockholder monitoring hypothesis, firms that also have other large shareholder(s) should be less likely to experience corporate financial distress when compared with firms that have no other large shareholder but the controlling shareholder. However, collusion and disagreements among blockholders can be detrimental to a firm. Hence, the impact of multiple large shareholders on the likelihood of distress or bankruptcy is open for empirical testing. 2.1.3. Business Group Affiliation and the Likelihood of Distress. The evidence from existing studies on the costs and benefits associated with business group affiliation have been mixed. One of the advantages brought by group affiliation is that business groups provide internal markets among member firms which enable the groups to actively shift resources and risk throughout their structure. This advantage explains why business groups are more pronounced in emerging economies. Due to a high degree of information asymmetries, a lack of intermediary institutions, and imperfections in capital, product as well as labor markets, firms in emerging economies find it costly to acquire essential resources and also to establish corporate reputation and credibility (Khanna and Palepu, 2000). Business groups can help mitigate these problems through their internal markets..

(9) Corporate Distress Prediction Models Using Governance and Financial Variables. 281. However, the complicated ownership and control structures of business groups may increase the severity of any agency problems (Lins and Servaes, 2002; Claessens et al., 2006). Since business groups typically consist of firms ultimately controlled by a family or an ultimate owner, linked together via pyramids or crossshareholdings, the major conflicts arise between controlling and minority shareholders. Large scale and scope of business groups and high informational asymmetries facilitate the expropriation of outside minority shareholders by ownermanagers. The problems tend to be more acute in emerging economies where governance mechanisms are less effective. A greater opportunity to exploit corporate resources for personal purposes allows controlling shareholders of business groups in emerging markets to accomplish empire building or maximize their own or the group’s wealth, rather than the value of individual firms (Jensen, 1986; Stulz, 1990). Inefficient transfers of resources across group members and unproductive investments in a business group are related to the agency issues described above (Scharfstein, 1998; Shin and Stulz, 1998; Rajan et al., 2000; Scharfstein and Stein, 2000). Hence the likelihood of corporate distress should be greater in firms in a business group. Nevertheless, if controlling shareholders of business groups effectively and vigorously get involved in managerial decision-making that enhance firm value, group firms should be less likely to be financially distressed, relative to non-group firms. Moreover, if the risk sharing among group firms and the utilization of internal markets within a diversified business group assist the group firms to avoid financial distress, group affiliation can have a negative impact on the distress likelihood of firms that belong to a business group. Alternatively, group affiliation could allow investment policies that inefficiently hold up affiliated firms in distress, through resources from relatively steady firms.6 This may result in a lower probability of financial distress in group affiliated firms. Several studies document that business groups or conglomerates are likely to systematically support their poorly performing member firms or subsidiaries (Lamont, 1997; Claessens et al., 2002). In contrast, if group connected firms are subject to higher degree of misallocation, the likelihood. 6 This might reduce value of other affiliated firms in a group, even though it is favorable to value of the distressed firms..

(10) 282. Piruna Polsiri and Kingkarn Sookhanaphibarn. of financial distress may be greater in group connected firms than stand-alone firms (Bongini et al., 2000 and 2001). Empirical studies on the relation between group affiliation and firm value exist, although the results are inconclusive. In contrast, studies on the impact of group affiliation on the likelihood of corporate distress or bankruptcy are limited. Becchetti and Sierra (2003) report that group-affiliated firms have a lower probability of failure than non-affiliated firms. Similarly, Claessens et al. (2003) find a negative relation between business group dummy and the probability of bankruptcy filings by distressed firms during the East Asian crisis. On the other hand, Bongini et al. (2000) find that connected financial institutions are more likely to distress due to their likely higher degree of misallocation. 2.1.4. Board Structure and the Likelihood of Corporate Distress. A board of directors is generally perceived as a crucial internal governance mechanism. A key factor that determines the effectiveness of board monitoring power is the degree of board independence. In general, a board of directors becomes more independent as the fraction of outside directors in the board increases. However, in firms with concentrated ownership, controlling shareholders are usually actively involved in the board of directors. As a result, the degree of board independence might be lower in such firms. There is a growing body of literature in the area of board independence and its impact on firm value. For example, Rosenstein and Wyatt (1990) document positive excess returns around the days that firms announce an appointment of outside directors. They then interpret that this appointment is related to an increase in shareholder wealth. Similarly, Borokhovich et al. (1996) find that the proportion of independent outside directors on a board is positively associated with the likelihood that a CEO will be replaced, and that such replacement is beneficial to shareholders. Empirical evidence that does not support the monitoring and disciplining role of independent outside directors is also provided. Baysinger and Butler (1985), Hermalin and Weisbach (1991), Merhan (1995), Klein (1998), and Bhagat and Black (2002) document no significant relation between the fraction of outside directors on the board and firm performance. They argue that if a board is optimally.

(11) Corporate Distress Prediction Models Using Governance and Financial Variables. 283. weighted between insiders and outsiders, such relation might not be observed at the equilibrium. In addition, it could be difficult to determine the efficiency of governance functions performed by outside directors on “day-to-day” operations. Regarding the impact of board structure on the likelihood of corporate distress, the entrenchment hypothesis predicts that when controlling shareholders also occupy board seats, they are more entrenched and less constrained by board monitoring. Consequently, firms in which controlling shareholders actively participate as directors are more likely to encounters corporate financial distress than firms in which controlling shareholders are not active in board participation. Lee and Yeh (2004) find the evidence that supports this view. On the other hand, the interest alignment hypothesis predicts that if controlling shareholders own a significant portion of the cash-flow rights, their interests will be aligned with those of minority shareholders. Hence, when the controlling shareholders and their associates actively participate in the board, they should be able to influence major managerial decision making. According to this hypothesis, firms in which controlling shareholders actively occupy board seats will be less likely to be in distress. Moreover, the fact that controlling shareholders also serve as top management, having a significant portion of directors associated with controlling shareholders on board reinforces the power of top management team. When the top management team has high power, the levels of affective conflict will be lower (Finkelstein, 1992; Buchholtz et al., 2005). This effect will in turn reduce top management team deterioration that may hurt firm performance especially in bankruptcies (Hambrick and D’Aveni, 1992). Therefore, the affective conflict view predicts that the greater the portion of directors associated with controlling shareholders, the lower the likelihood of distress.. 2.2 The Impact of Financial Factors on the Likelihood of Corporate Distress The literature on corporate distress/failure prediction has extensively documented that financial variables are significant factors that determine the likelihood of financial distress and bankruptcy. Shivaswamy et al. (1993) review 13 studies and.

(12) 284. Piruna Polsiri and Kingkarn Sookhanaphibarn. summarize the frequency of financial variables applied in the studies. They conclude that the most commonly used financial ratios are those proxied for leverage, profitability, and liquidity. Likewise, Altman and Narayanan (1997) survey prediction models constructed worldwide and document that there is a similarity in selecting financial ratios as predictors. The commonly chosen financial predictors include leverage, past and present performance, liquidity, solvability, and efficiency – depending on the sampling approach – size and industry. Therefore, to precisely investigate the effects of governance characteristics on corporate distress and to develop effective distress prediction models, financial characteristics are introduced as explanatory variables in our models. Following the literature, we use financial variables that measure leverage, profitability, liquidity, and size of the sample firms to construct the models. Leverage and the likelihood of distress Prior research of corporate distress/failure prediction commonly includes some measure of a firm’s use of financial leverage. For highly leveraged firms, a slight decrease in firm value may lead to default on debt obligation. Obviously, the research suggests that a firm’s level of leverage is expected to increase its likelihood of being distressed and/or going bankrupt (for example, Altman, 1968; Platt and Platt, 1990; Lee and Yeh, 2004). In this study, we measure leverage as the ratio of total debt to total assets. Profitability and the likelihood of distress Firms that perform poorly are expected to be more likely to encounter financial difficulties. The empirical evidence shows that firm performance significantly affects the probability of corporate distress and/or failure (for example, Altman, 1968; Bongini et al., 2000; Claessens et al., 2003; Lee and Yeh, 2004). Here, we measure a firm’s profitability by the ratio of earning before interest and taxes (EBIT) to total assets. We use this measure to focus on the firm’s operational profitability and control for the impact of capital structure and taxes. Liquidity and the likelihood of distress Firms with more liquid assets are generally less financially constrained. This suggests low demand for external sources of funds to finance losses in firms with high liquidity, at least in the short run. Accordingly, the probability that these firms will be financially distressed might be smaller. For Thai firms, Tirapat and.

(13) Corporate Distress Prediction Models Using Governance and Financial Variables. 285. Nittayagasetwat (1999) show that more liquid firms are less likely to experience distress during the East Asian crisis. Therefore, our distress prediction models will also include a variable representing financial liquidity, measured as the ratio of current assets to current liabilities. Size and the likelihood of distress Evidence from previous studies reveals a negative relation between firm size and the incidence of corporate distress. Because large firms are well established with large asset bases that can be used as collateral, they usually have a better access to external sources of funds. Moreover, larger firms are better able to avoid financial distress by using public equity markets or by exercising market power. In addition, size has frequently been included in early warning and bankruptcy prediction studies as a proxy for “too-big-too-fail” situations. Such situations are widely found especially in the case of emerging market economies. In this study, we measure firm size by the natural logarithm of the firm’s stock market capitalization.. 3 3.1. Data and Methodology Sample Selection. Our sample includes non-financial companies listed on the Stock Exchange of Thailand that were in distress during the period 1998-2001 of which data are available, and control firms that are matched by size and industry on two-to-one basis. Banks and other financial institutions are not included due to the ownership restrictions imposed on banks and financial institutions by the Bank of Thailand.7 The control firms are chosen in the following manner. We listed all the sample firms in each of the 19 industries under the Standard Industrial Classification (SIC) codes. Then we ranked the firms in each industry according to their total assets at the end of the year prior to the year when our distressed firms experienced financial distress. Firms that belong to the same industry and are closest in terms of total assets but do. 7 A shareholder is not allowed to own more than 5 percent and 10 percent of shares in commercial banks and finance (and securities) companies, respectively (Commercial Banking Act B.E. 2505 and Act on the Undertaking of Finance Business, Securities Business, and Credit Foncier Business B.E. 2522)..

(14) 286. Piruna Polsiri and Kingkarn Sookhanaphibarn. not encounter financial distress during the sampling period are then selected. The final sample contains 80 distressed firms and 121 control firms. In this study, we define distressed firms as firms that were ordered by the Stock Exchange of Thailand to delist or submit rehabilitation plans during the period 19982001. In such a period, many firms in the Thai stock market became financially distressed due to the economy-wide crisis. This will give us a sufficiently large sample size.. 3.2. Data Collection. 3.2.1 Data on Governance Variables We construct comprehensive ownership and board databases of non-financial companies for the period 1996-2000. The main source of ownership and board information is the I-SIMS database. This database provides information on the shareholders with at least 0.5% of a firm’s outstanding shares and a list of a firm’s board members. Additional information on ownership and board data, including a list of a firm’s affiliated companies and shareholdings owned by these companies, as well as relationships among major shareholders and board members, is manually collected from company files (FM 56-1) available at the SET library and website. Given that all members of a related family are treated as a single shareholder, family relationships beyond their surnames are traced through various documents that provide a genealogical diagram of influential Thai families in our sample. 8 Furthermore, the BOL database provided by BusinessOnLine Company Limited is used to search for owners of private companies that appear as corporate shareholders of the sample firms. As a result, our study is based on a unique and more comprehensive data set of ownership than used elsewhere.. 8. See the list of data sources in Polsiri and Wiwattanakantang (2006)..

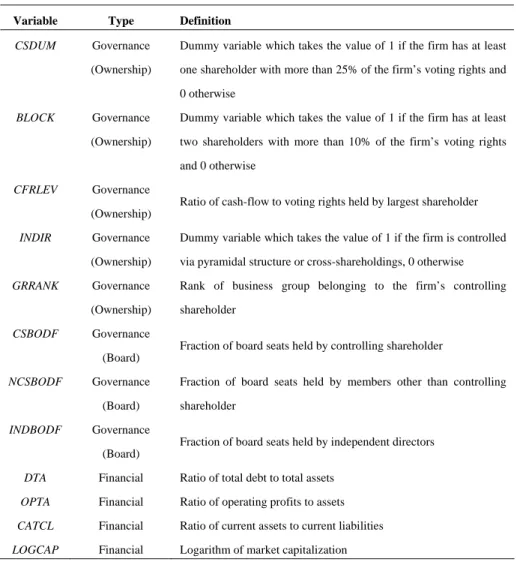

(15) Corporate Distress Prediction Models Using Governance and Financial Variables. 287. 3.2.2 Data on Financial Variables Similar to the governance data, the financial data are obtained mainly from the ISIMS database. This database contains financial information on Thai listed companies, including financial statements, notes to financial statements, auditors’ reports, released on a quarterly basis, and stock prices. For companies where such data are not available from the I-SIMS database, annual disclosure forms (FM 56-1) submitted to the SET are used instead.. 3.3 Explanatory Variables: Governance versus Financial Variables Unlike most of previous studies of which financial distress prediction models are based on financial variables, we develop prediction models using two types of variables: our main focus, governance variables, in relation to ownership and board structures, and commonly used financial variables. Our governance variables can be classified to five ownership structure variables and three board structure variables. The ownership structure variables include CSDUM, which is the dummy variable indicating if a firm has a controlling shareholder, BLOCK, which is the dummy indicating if a firm has at least two blockholders, INDIR, which is the dummy variable indicating if a firm is controlled via pyramidal structure or cross-shareholdings, CFRLEV, which is the ratio of cashflow rights to voting rights held by a firm’s largest shareholder, and GRRANK, which is the rank of business group belonging to a firm’s controlling shareholder. The board structure variables include CSBODF, which is the fraction of board seats held by controlling shareholders and their associates, NCSBODF, which is the fraction of board seats held by members other than controlling shareholders and their associates, and INDBODF, which is the fraction of board seats held by outside independent directors. On the other hand, the financial variables (ratios) include DTA, which is the ratio of total debt to total assets, as a proxy for “leverage”, OPTA, which is the ratio of operating profits to total assets, as a proxy for “profitability”, CATCL, which is the ratio of current assets to total assets, as a proxy for “liquidity”, and LOGCAP,.

(16) 288. Piruna Polsiri and Kingkarn Sookhanaphibarn. which is the logarithm of market capitalization, as a proxy for “size”. The definition of all explanatory variables is presented in Table 1. Table 1: Definition of variables Variable. Type. Definition. CSDUM. Governance. Dummy variable which takes the value of 1 if the firm has at least. (Ownership). one shareholder with more than 25% of the firm’s voting rights and 0 otherwise. BLOCK. Governance. Dummy variable which takes the value of 1 if the firm has at least. (Ownership). two shareholders with more than 10% of the firm’s voting rights and 0 otherwise. CFRLEV. Governance Ratio of cash-flow to voting rights held by largest shareholder (Ownership). INDIR. GRRANK. CSBODF. Governance. Dummy variable which takes the value of 1 if the firm is controlled. (Ownership). via pyramidal structure or cross-shareholdings, 0 otherwise. Governance. Rank of business group belonging to the firm’s controlling. (Ownership). shareholder. Governance Fraction of board seats held by controlling shareholder (Board). NCSBODF. Governance (Board). INDBODF. Fraction of board seats held by members other than controlling shareholder. Governance Fraction of board seats held by independent directors (Board). DTA. Financial. Ratio of total debt to total assets. OPTA. Financial. Ratio of operating profits to assets. CATCL. Financial. Ratio of current assets to current liabilities. LOGCAP. Financial. Logarithm of market capitalization. In sum, there are two groups of explanatory variables. The first group contains variables that represent major governance characteristics of ownership and board structures of firms in an economy where concentrated ownership is common. The second group of explanatory variables consists of financial variables that are well documented to have a significant impact on the likelihood of corporate distress. These explanatory variables are measured as of the base year, i.e., one year prior to.

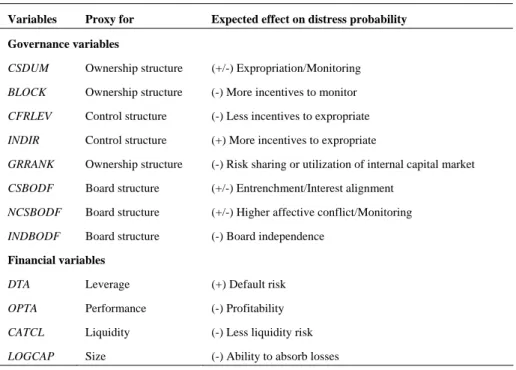

(17) Corporate Distress Prediction Models Using Governance and Financial Variables. 289. the distress year. Consequently, we associate a firm’s corporate distress incidence with its prior year governance and financial characteristics. The expected effects of these explanatory variables on the likelihood of corporate distress are summarized in Table 2. Table 2: Explanatory variables and their expected effects on the probability of corporate distress Variables. Proxy for. Expected effect on distress probability. Governance variables CSDUM. Ownership structure. (+/-) Expropriation/Monitoring. BLOCK. Ownership structure. (-) More incentives to monitor. CFRLEV. Control structure. (-) Less incentives to expropriate. INDIR. Control structure. (+) More incentives to expropriate. GRRANK. Ownership structure. (-) Risk sharing or utilization of internal capital market. CSBODF. Board structure. (+/-) Entrenchment/Interest alignment. NCSBODF. Board structure. (+/-) Higher affective conflict/Monitoring. INDBODF. Board structure. (-) Board independence. Financial variables DTA. Leverage. (+) Default risk. OPTA. Performance. (-) Profitability. CATCL. Liquidity. (-) Less liquidity risk. LOGCAP. Size. (-) Ability to absorb losses. 3.4. Methodology. 3.4.1. Logit Regression. Traditional failure prediction models have employed statistical techniques. Such models were pioneered by Beaver (1966)’s univariate tests and Altman (1968)’s multivariate discriminant analysis (MDA). Statistical techniques used to developed prediction models also include linear probability model (LPM), logit regression approach, probit regression approach, cumulative sums (CUSUM) procedure, and partial adjustment process (Aziz and Dar, 2004). Nevertheless, the most widely-used.

(18) 290. Piruna Polsiri and Kingkarn Sookhanaphibarn. techniques are MDA and a logit regression (Altman and Narayanan, 1997; Atiya, 2001). Following the existing literature, we apply binary logit regression to develop the dichotomous prediction models. Binary logit provides significant tests on the parameter estimates and allows us to generate the probability of corporate distress for each firm in order to investigate the classification accuracy. The probability of distress can be viewed as an approximation of the corporate distress risk for each firm. A logit model is estimated using the maximum likelihood method. The logit prediction model used in this study is as follows. Prob(Yi = 1) =. 1 1 + exp(− Z i ). (1). where Zi = α + ∑ β j X j, i + ε i. (2). Yi is the dependent categorical variable assigned the value of 1 if a firm i is in. distress (as defined in Section 3.1), and zero otherwise; Z i is a linear function in which α is the estimated intercept, X j , i is the explanatory variable j for the ith firm; β j is the coefficient of X j , i ; and ε i is the unknown parameter j . Prob(Yi = 1) is the probability with which firm i will be in distress. If the computed. probability exceeds 0.5, the firm is classified as being in distress. We construct four logit models that are different in terms of corporate governance variables while the set of financial variables remains the same in all models. In Model 1, the governance variables consist of CSDUM, BLOCK, INDIR, GRANK, CSBODF, and INDBODF. In Model 2, we replace INDIR with CFRLEV. The reason of doing so is to investigate the effect of the magnitude of the separation between ownership and control on the distress likelihood. In Models 3 and 4, the difference of governance variables from those of Models 1 and 2 lies on the board structure variables. This is to test whether directors who are not associated with the controlling shareholders but at the same time they are not really “outside” independent directors have a significant impact on the probability of distress. That is in Model 3, the governance variables consist of CSDUM, BLOCK,.

(19) Corporate Distress Prediction Models Using Governance and Financial Variables. 291. INDIR, GRANK, and NCSBODF. Similar to Models 1 and 2, in Model 4, we replace INDIR in Model 3 with CFRLEV. 3.4.2. Neural Networks. Not until 1990 have neural network approaches been introduced in the field of failure/bankruptcy prediction.9 Salchenberger et al. (1992), Coats and Fant (1993), Fernandez and Olmeda (1995), and Zhang et al. (1999) compare between neural networks and some traditional statistical approaches. Their experimental results show that NN significantly outperforms the other methods. To the best of our knowledge, no neural network application to corporate distress prediction during an economy-wide crisis has been documented. In principle, neural networks can process any computable function. In this study, we concentrate on a specific type of neural networks, the multilayer feedforward neural network. The architecture of the multilayer feedforward neural network specifies the number of layers, the number of neurodes in which each layer contains, and how the neurodes are interconnected. Especially anything that can be represented as a mapping between vector spaces can be approximated to arbitrary precision by the multilayer feedforward neural network applied in this study. The multilayer feedforward neural network consist of three layers: the input layer, the hidden layer with the arbitrary number of hidden neurodes, and the output layer. Each layer performs a specific function (Caudill and Butler, 1990). Particularly, the input layer receives an input signal and then distributes it to all the neurodes in the hidden layer. The input layer, however, does not perform any processing on the input signal. The neurodes in the hidden layer act as the attribute detectors encoding in their weights an illustration of the attributes that are existent in the input layer. The choice of output neurons depends on the nature of the research study. In our study, a single output neuron is dichotomous and categorical that can be expressed in binary terms (i.e., 0 and 1). Similar to the way we construct the logit models, we also develop four different neural network models. The number of input and output neurons depends on the 9 See Atiya (2001) for a review of neural network application to the bankruptcy prediction, and comparison between statistical and NN approaches in bankruptcy prediction models..

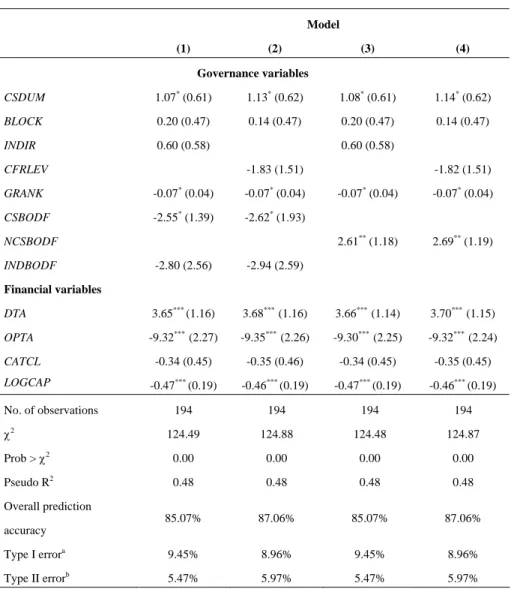

(20) 292. Piruna Polsiri and Kingkarn Sookhanaphibarn. solving problem. Thus, in each model, we define the input neurons standing for each explanatory variable as well as the two output neurons standing for the scores to decide if a firm belongs to distressed or non-distressed classifications.10 As a result, in Model 5, the input neurons include CSDUM, BLOCK, CFRLEV, GRANK, CSBODF, INDBODF, DTA, OPTA, CATCL, and LOGCAP. In Model 6, the input neurons include CSDUM, BLOCK, INDIR, GRANK, CSBODF, INDBODF, DTA, OPTA, CATCL, and LOGCAP. In Model 7, the input neurons include CSDUM, BLOCK, CFRLEV, GRANK, NCSBODF, DTA, OPTA, CATCL, and LOGCAP. Finally, in Model 8, the input neurons include CSDUM, BLOCK, INDIR, GRANK, NCSBODF, DTA, OPTA, CATCL, and LOGCAP. The number of neurons in the hidden layer is set in range [3, 10] as discussed in Sivanandam, Sumathi, and Deepa (2006).. 4. Empirical Results Analysis. 4.1. Results of Logit Models. The results of our logit models are presented in Table 3. Overall, the models produce good prediction accuracy. Specifically, 85.07% of the sample firms are correctly classified in Models 1 and 3 that use INDIR as an explanatory variable. In Models 2 and 4 where we replace INDIR with CFRLEV, the overall prediction accuracy has slightly increased to 87.06%. Compared with the models developed by Lee and Yeh (2004) who also study the effects of corporate governance on the distress likelihood of Taiwanese firms, our models appear to perform as well as theirs. Considering the Type I error (the misclassification of distressed firms as nondistressed) and the Type II error (the misclassification of non-distressed firms as distressed), we find that for Models 1 and 3, the Type I error is 9.45% while the Type II error is 5.47%.11 For Models 2 and 4, the Type I error has declined to 8.96% while the Type II error has increased to 5.97%. Compared with other prediction models which include only financial variables, our models appear to perform. 10 11. Here, we use the “Winner takes all” rule. Type I error is more costly than Type II error..

(21) Corporate Distress Prediction Models Using Governance and Financial Variables. 293. relatively well. These results suggest that the models that incorporate both governance and financial variables can be used as an effective early warning system. The results of the logit models also suggest that not all governance variables are statistically significant in predicting corporate distress. Regarding ownership variables, Table 3 shows that only the controlling shareholder dummy and the business group rank have a marginally significant impact on the likelihood of distress. The variables concerning the presence of other blockholder(s) and the use of control-enhancing mechanisms (as measured by either the indirect control dummy (Models 1 and 3) or the ratio of cash-flow to voting rights (Models 2 and 4)) are insignificant in determining the distress likelihood. More precisely, all models show that firms in which a controlling shareholder exists appear to be less likely to experience distress. This evidence tends to support the monitoring/alignment hypothesis of controlling shareholders. The negative relation between the business group rank dummy and the probability of corporate distress suggests that firms affiliated with a top business group are less likely to be in distress than non-group firms. This finding supports the argument that owners of business groups may actively get involved in managerial decision-making that enhance firm value. Alternatively, the risk sharing and the utilization of internal markets within a business group might help the member firms to avoid financial distress. It is also possible that a business group uses resources from relatively steady firms to prop affiliated firms in distress. This is consistent with Lamont (1997) and Claessens et al. (2002) who show that business groups tend to support their poorly performing members. Claessens et al. (2003) also report a negative relation between business group affiliation and the likelihood that distressed firms will file for bankruptcy during the East Asian economic crisis. Moreover, our logit prediction models show an insignificant relation between the multiple blockholders dummy and the incidence of corporate distress. In other words, the monitoring role played by large shareholders other than the controlling shareholder is not important. One explanation can be due to the fact that for Thai firms, controlling shareholders hold much higher voting and cash-flow rights than the second largest shareholder. Consequently, other blockholders may not have sufficient power and/or incentives to perform an efficient monitoring role..

(22) 294. Piruna Polsiri and Kingkarn Sookhanaphibarn. Table 3: Logit estimations of the effects of governance and financial variables on the likelihood of corporate financial distress Model (1). (2). (3). (4). Governance variables *. CSDUM. 1.07 (0.61). 1.13* (0.62). 1.08* (0.61). 1.14* (0.62). BLOCK. 0.20 (0.47). 0.14 (0.47). 0.20 (0.47). 0.14 (0.47). INDIR. 0.60 (0.58). CFRLEV. 0.60 (0.58) -1.83 (1.51). *. *. GRANK. -0.07 (0.04). -0.07 (0.04). CSBODF. -2.55* (1.39). -2.62* (1.93). NCSBODF INDBODF. -1.82 (1.51) *. -0.07 (0.04). -0.07* (0.04). 2.61** (1.18). 2.69** (1.19). -2.80 (2.56). -2.94 (2.59). DTA. 3.65*** (1.16). 3.68*** (1.16). 3.66*** (1.14). 3.70*** (1.15). OPTA. -9.32*** (2.27). -9.35*** (2.26). -9.30*** (2.25). -9.32*** (2.24). CATCL. -0.34 (0.45). -0.35 (0.46). -0.34 (0.45). -0.35 (0.45). Financial variables. LOGCAP No. of observations. -0.47. ***. (0.19). -0.46. ***. (0.19). -0.47. ***. (0.19). -0.46*** (0.19). 194. 194. 194. 194. 124.49. 124.88. 124.48. 124.87. Prob > χ2. 0.00. 0.00. 0.00. 0.00. Pseudo R2. 0.48. 0.48. 0.48. 0.48. 85.07%. 87.06%. 85.07%. 87.06%. 9.45%. 8.96%. 9.45%. 8.96%. χ2. Overall prediction accuracy Type I errora. 5.47% 5.97% 5.47% 5.97% Type II errorb a is the misclassification of distressed firms as non-distressed. b is the misclassification of non-distressed firms as distressed. Note: The sample consists of non-financial firms listed on the Stock Exchange of Thailand that were ordered by the Stock Exchange of Thailand to delist or submit rehabilitation plans during the period 1998-2001 and control firms matched by size and industry. Numbers in parentheses are the standard errors. ***, **, and * indicate significance at the 1%, 5%, and 10% levels, respectively.. Finally, the logit models suggest that the use of control-enhancing mechanisms by controlling shareholders has no significant impact on the distress likelihood. This.

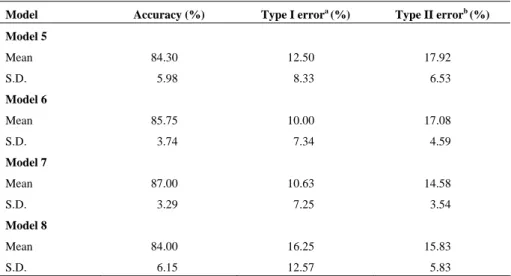

(23) Corporate Distress Prediction Models Using Governance and Financial Variables. 295. result is rather not surprised since the use of control-enhancing mechanisms in Thai listed firms is relatively low when compared with their counterparts in other Asian countries (Claessens et al., 2000; Khanthavit et al., 2003). As for board structure variables, Models 1 and 2 of Table 4 show that the greater fraction of board seats occupied by directors who are associated with controlling shareholders decreases the distress likelihood. In line with the result of ownership structure variables, this finding suggests that the interest alignment effects of having a controlling shareholder. The finding is also consistent with the affective conflict view. Our result, however, is in contrast with that reported in Lee and Yeh (2004). Considering board involvement by non-controlling shareholders, Models 3 and 4 exhibit that the involvement of directors who are not controlling shareholders’ associates is positively related with the probability of distress. The result supports what we find using the percentage of directors associated with controlling shareholders in Models 1 and 2. Moreover, Models 1 and 2 also show that outside independent directors play no important role in determining whether a firm will be in distress. Table 4: Results for the neural network models Model. Accuracy (%). Type I errora (%). Type II errorb (%). Model 5 Mean. 84.30. 12.50. 17.92. S.D.. 5.98. 8.33. 6.53. Mean. 85.75. 10.00. 17.08. S.D.. 3.74. 7.34. 4.59. Mean. 87.00. 10.63. 14.58. S.D.. 3.29. 7.25. 3.54. 84.00. 16.25. 15.83. Model 6. Model 7. Model 8 Mean. S.D. 6.15 12.57 5.83 a is the misclassification of distressed firms as non-distressed. b is the misclassification of non-distressed firms as distressed. Note: The sample consists of non-financial firms listed on the Stock Exchange of Thailand that were ordered by the Stock Exchange of Thailand to delist or submit rehabilitation plans during the period 1998-2001 and control firms matched by size and industry..

(24) 296. Piruna Polsiri and Kingkarn Sookhanaphibarn. On the other hand, the financial variables appear to have a significant impact on the probability of corporate distress as shown by the following results. As expected, firms with a higher debt ratio are more likely to experience corporate distress whereas firms with a higher operating return on assets ratio are less likely to be in distress. Regarding firm size, larger firms have a lower probability of distress than smaller firms. This result is expected as well. Finally, we find that the liquidly ratio is not related with the likelihood of corporate distress. Our results are mostly consistent with those found in previous studies.. 4.2. Results of Neural Network Models. Following the logit models, we also construct neural network models to predict the probability of corporate distress. Our neural network distress prediction models are built by using feed-forward architecture and trained with back-propagation method. To teach the neural networks, the training set consists of 60 distressed and 97 nondistressed firms (which is equivalent to 157 data points). As discussed in the previous section, the dimensions of data points are the same sets of governance and financial variables used to develop our logit models. Consistent with the logit models, the neural network models vary in terms of governance variables while the financial variables are the same in all models, which are DTA, OPTA, CATCL, and LOGCAP. Specifically, in Model 5, the governance variables consist of CSDUM, BLOCK, INDIR, GRANK, CSBODF, and INDBODF. In Model 6, the governance variables consist of CSDUM, BLOCK, CFRLEV, GRANK, CSBODF, and INDBODF. In Model 7, the governance variables consist of CSDUM, BLOCK, INDIR, GRANK, and NCSBODF. Finally, in Model 8, the governance variables consist of CSDUM, BLOCK, CFRLEV, GRANK, and NCSBODF. The ratio of the number of distressed data points to the number of nondistressed data points is approximately 0.6 for both training and testing sets. In the back-propagation training, the procedure of selecting a training set is repeated until the optimal values of learning parameters and then the training set are determined. Here the number of iterations is set to 100 by experiments. Table 4 shows the results of the neural network models. Each model runs on data sets 1-10. The rows of the table report the average accuracy, Type I and Type II errors, and their standard.

(25) Corporate Distress Prediction Models Using Governance and Financial Variables. 297. deviations of neural network prediction models testing of 10 data sets. Each data set consists of different pairs of training and testing sets. There are no overlapped companies in the training and the testing sets. Note again that we run the models with the following neural network parameters: maximum epochs are equivalent to 100 and training error is 0.005. The performance of a neural network model is considered in two phases: (1) testing and (2) training. Overall, the results suggest that Model 7 seems to outperform other models in terms of the average accuracy, standard deviation, and Type I error of the testing data sets. In contrast, the performance of Model 8 seems to be the poorest when considering the testing data sets. Nevertheless, this model shows the best performance for the training data sets. Findings from neural networks models suggest the robustness of our prediction models across different classification methods.. 5. Conclusions. In this study, we investigate the effects of corporate governance regarding ownership and board structures on the likelihood of corporate distress and develop distress prediction models using logit and neural networks. Our focus is firms in an emerging economy in which legal and regulatory frameworks are weak and concentrated ownership is common. In this environment, many scholars have argued that controlling shareholders may be likely to expropriate corporate assets. As further contribution to the literature on the effects of corporate governance on firm performance in the time of economic crisis, we investigate how corporate governance affects the likelihood that a firm experiences corporate distress during an economic crisis. We use the data from Thailand to study this issue. Thailand provides a natural research setting because it shares a number of governance characteristics among most economies around the world, and it was the first hit by the East Asian economic crisis in July 1997. We develop logit and neural network models to predict corporate financial distress of Thai listed non-financial firms. The results show that in an economy where ownership concentration is common and the legal environment is not really investor-friendly, corporate governance -- in addition to well-documented financial.

(26) 298. Piruna Polsiri and Kingkarn Sookhanaphibarn. variables -- appears to play an important role in determining the likelihood of distress. The results are consistent with the view that concentrated ownership structure of East Asian firms has contributed to the East Asia economic crisis (Johnson et al., 2000a; Mitton, 2002; Lemmon and Lins, 2003). Specifically, we find that the presence of controlling shareholders and the board involvement by controlling shareholders reduce the probability of corporate financial distress. This evidence supports the monitoring/alignment hypothesis. However, it is also possible that controlling shareholders may prevent corporate failure from happening during an economic crisis in order to prolong the expropriation honeymoon (Friedman et al., 2003). Our findings also support the benefits of business group affiliation. More precisely, we find that being affiliated with a top business group decreases the likelihood of corporate distress. This result can be interpreted in several ways. First, controlling shareholders of top business groups may effectively and actively get involved in managerial decision-making that enhances firm value. Second, the lower distress likelihood may be due to risk sharing among group firms and the utilization of internal markets within a group. Third, group affiliation could allow investment policies that inefficiently support affiliated firms in distress, through resources from other firms in the group (Lamont, 1997; Claessens et al., 2002). The extensively used financial variables appear to have significant effects in determining the likelihood of corporate distress, and hence point out financial weaknesses of Thai firms before the East Asian crisis. The models suggest that excessive use of debt, poor operating performance, and small market capitalization lead to a higher distress likelihood of non-financial listed firms. This evidence is consistent with the view that Thai firms had been financially vulnerable since a few years before the 1997 crisis (Claessens et al., 1998). Our prediction models show good predictive power. Such findings indicate that the models serve as sound early warning signals and could thus be useful tools adding to supervisory resources. Specifically, in the logit models, more than 85% of non-financial listed firms are correctly classified in our models. When we consider the Type I error, on average the models have the Type I error of about 9%. Likewise, the neural network prediction models appear to have good results. Specifically, the.

(27) Corporate Distress Prediction Models Using Governance and Financial Variables. 299. average accuracy of the neural network prediction models ranges from approximately 84% to 87% with the average Type I error raging from around 10% to 16%. Overall, using both statistical and computational approaches our results suggest that corporate governance factors, in particular ownership and board structures, contribute significantly in constructing sound corporate distress prediction models. In other words, in addition to financial variables that have been widely recognized, incorporating corporate governance variables should be considered when developing distress prediction models in future research, especially in an economy where ownership concentration is common. Also, for policy makers to improve the efficiency of an early-warning system, corporate governance factors should not be ignored, and to reduce the likelihood of financial institution failures, corporate governance mechanisms should be strengthened. Moreover, the empirical results of this study may shed some light on the effects of corporate governance on the likelihood of corporate distress for other countries. Finally, our research also helps explain that there might be significant weaknesses contributing to individual corporate distress prior to the East Asian crisis.. References Admati, A., P. Pfleiderer, and J. Zechner, (1994), “Large Shareholder Activism, Risk Sharing, and Financial Market Equilibrium,” Journal of Political Economy, 102, 1097-1130. Altman, E. I., (1968), “Financial Ratios, Discriminant Analysis and the Prediction of Corporate Bankruptcy,” Journal of Finance, 23, 589-609. Altman, E. I. and P. Narayanan, (1997), “An International Survey of Business Failure Classification Models,” Financial Markets, Institutions & Instruments, 6, 1-57. Anderson, R. and D. Reeb, (2003), “Founding-Family Ownership and Firm Performance: Evidence from the S&P 500,” Journal of Finance, 58, 1301-1327. Atiya, A., (2001), “Bankruptcy Prediction for Credit Risk Using Neural Networks: A Survey and New Results,” IEEE Transactions on Neural Networks, 12, 929935..

(28) 300. Piruna Polsiri and Kingkarn Sookhanaphibarn. Aziz, M. and H. Dar, (2004), “Predicting Corporate Bankruptcy: Whither Do We Stand?” Unpublished Working Paper. Baek, J. S., J. K. Kang, and K. S. Park, (2004), “Corporate Governance and Firm Value: Evidence from the Korean Financial Crisis,” Journal of Financial Economics, 71, 265-313. Baysinger, B. and H. Butler, (1985), “Corporate Governance and the Board of Directors: Performance Effects of Changes in Board Composition,” Journal of Law, Economics, and Organization, 1, 101-124. Beaver, W., (1966), “Financial Ratios as Predictors of Failure,” Journal of Accounting Research, 4, 71-111. Bebchuk, L., (1999), “A Rent-Protection Theory of Corporate Ownership and Control,” NBER Working Paper, No.7203. Becchetti, L. and J. Sierra, (2003), “Bankruptcy Risk and Productive Efficiency in Manufacturing Firms,” Journal of Banking and Finance, 27, 2099-2120. Bennedsen, M. and D. Wolfenzon, (2000), “The Balance of Power in Closely Held Corporations,” Journal of Financial Economics, 58, 113-139. Bhagat, S. and B. Black, (2002), “The Non-Correlation between Board Independence and Long-Term Firm Performance,” Journal of Corporation Law, 27, 231-273. Bongini, P., S. Claessens, and G. Ferri, (2001), “The Political Economy of Distress in East Asian Financial Institutions,” Journal of Financial Services Research, 19, 5-25. Bongini, P., G. Ferri, and T. S. Kang, (2000), “Financial Intermediary Distress in the Republic of Korea: Small is Beautiful?” Policy Research Working Paper, No. 2332. Borokhovich, K., R. Parrino, and T. Trapani, (1996), “Outside Directors and CEO Selection,” Journal of Financial and Quantitative Analysis, 31, 337-355. Buchholtz, A. K., A. C. Amason, and M. A. Rutherford, (2005), “The Impact of Board Monitoring and Involvement on Top Management Team Affective Conflict,” Journal of Managerial Issues, 17, 405-422. Burkart, M., D. Gromb, and D. Panunzi, (1997), “Large Shareholders, Monitoring, and the Value of the Firm,” Quarterly Journal of Economics, 112, 693-728..

(29) Corporate Distress Prediction Models Using Governance and Financial Variables. 301. Caudill, M. and C. Butler, (1990), Naturally Intelligent Systems, Cambridge: The MIT Press. Claessens, S., S. Djankov, J. P. H. Fan, and L. Lang, (2002), “Disentangling the Incentive and Entrenchment Effects of Large Shareholdings,” Journal of Finance, 57, 2741-2771. Claessens, S., S. Djankov, and L. Klapper, (2003), “Resolution of Corporate Distress in East Asia,” Journal of Empirical Finance, 10, 199-216. Claessens, S., S. Djankov, and L. Lang, (1998), “Corporate Growth, Financing, and Risks in the Decade before East Asia’s Financial Crisis,” Policy Research Working Paper Series, No. 2017. Claessens, S. and J. P. H. Fan, (2002), “Corporate Governance in Asia: A Survey,” International Review of Finance, 3, 71-103. Claessens, S., J. P. H., Fan, and L. Lang, (2006), “The Benefits and Costs of Group Affiliation: Evidence from East Asia,” Emerging Markets Review, 7, 1-26. Coats, P. and L. Fant, (1993), “Recognizing Financial Distress Patterns Using a Neural Network Tool,” Financial Management, 22, 142-155. Cronqvist, H. and M. Nilsson, (2003), “Agency Costs of Controlling Minority Shareholders,” Journal of Financial and Quantitative Analysis, 38, 695-719. DeAngelo, H. and L. DeAngelo, (2000), “Controlling Stockholders and the Disciplinary Role of Corporate Payout Policy: A Study of the Times Mirror Company,” Journal of Financial Economics, 56, 153-207. Fernandez, E. and I. Olmeda, (1995), “Bankruptcy Prediction with Artificial Neural Networks,” Lecture Notes in Computer Science, 930, 1142-1146. Finkelstein, S., (1992), “Power in Top Management Teams: Dimensions, Measurement, and Validation,” Academy of Management Journal, 35, 505-538. Friedman, E., S. Johnson, and T. Mitton, (2003), “Propping and Tunneling,” Journal of Comparative Economics, 31, 732-750. Gomes, A., (2000), “Going Public without Governance: Managerial Reputation Effects,” Journal of Finance, 55, 615-646. Hambrick, D. C. and R. A. D’Aveni, (1992), “Top Team Deterioration as Part of the Downward Spiral of Large Corporate Bankruptcies,” Management Science, 38, 1445-1466..

(30) 302. Piruna Polsiri and Kingkarn Sookhanaphibarn. Hermalin, B. and M. Weisbach, (1991), “The Effects of Board Composition and Direct Incentives on Firm Performance,” Financial Management, 20, 101-112. Jensen, M., (1986), “Agency Costs of Free Cash Flow, Corporate Finance, and Takeovers,” American Economic Review, 76, 323-329. Joh, S. W., (2003), “Corporate Governance and Firm Profitability: Evidence from Korea before the Economic Crisis,” Journal of Financial Economics, 68, 287322. Johnson, S., P. Boone, A. Breach, and E. Friedman, (2000a), “Corporate Governance in the Asian Financial Crisis,” Journal of Financial Economics, 58, 141-186. Johnson, S., R. La Porta, F. Lopez-de-Silanes, and A. Shleifer, (2000b), “Tunneling,” American Economic Review, 90, 22-27. Khanna, T. and K. Palepu, (2000), “Is Group Affiliation Profitable in Emerging Markets? An Analysis of Diversified Indian Business Groups,” Journal of Finance, 55, 867-891. Khanthavit, A., P. Polsiri, and Y. Wiwattanakantang, (2003), “Did Families Lose or Gain Control? Thai Firms after the East Asian Financial Crisis,” In: Fan, J. P. H., M. Hanazaki, and J. Teranishi, (eds.), Designing Financial Systems in East Asia and Japan-Toward a Twenty-First Century Paradigm, London: Routledge. Klein, A., (1998), “Firm Performance and Board Committee Structure,” Journal of Law and Economics, 41, 275-303. Lamont, O., (1997), “Cash Flow and Investment: Evidence from Internal Capital Markets,” Journal of Finance, 52, 83-109. La Porta, R., F. Lopez-de-Silanes, A. Shleifer, and R. Vishny, (1998), “Law and Finance,” Journal of Political Economy, 106, 1113-1155. La Porta, R., F. Lopez-de-Silanes, and A. Shleifer, (1999), “Corporate Ownership around the World,” Journal of Finance, 54, 471-517. Lee, T. S. and Y. H. Yeh, (2004), “Corporate Governance and Financial Distress: Evidence from Taiwan,” Corporate Governance: An International Review, 12, 378-388. Lemmon, M. and K. Lins, (2003), “Ownership Structure, Corporate Governance, and Firm Value: Evidence from the East Asian Financial Crisis,” Journal of Finance, 58, 1445-1468..

(31) Corporate Distress Prediction Models Using Governance and Financial Variables. 303. Lins, K., (2003), “Equity Ownership and Firm Value in Emerging Markets,” Journal of Financial and Quantitative Analysis, 38, 159-184. Lins, K. and H. Servaes, (2002), “Is Corporate Diversification Beneficial in Emerging Markets?” Financial Management, 31, 5-31. Mehran, H., (1995), “Executive Compensation Structure, Ownership, and Firm Performance,” Journal of Financial Economics, 38, 163-184. Mitton, T., (2002), “A Cross-Firm Analysis of the Impact of Corporate Governance on the East Asian Financial Crisis,” Journal of Financial Economics, 64, 215241. Pagano, M. and A. Roell, (1998), “The Choice of Stock Ownership Structure: Agency Costs, Monitoring, and the Decision to Go Public,” Quarterly Journal of Economics, 113, 187-225. Platt, H. D. and M. B. Platt, (1990), “Development of a Class of Stable Predictive Variables: The Case of Bankruptcy Prediction,” Journal of Business Finance and Accounting, 17, 31-51. Polsiri, P. and Y. Wiwattanakantang, (2006), “Thai Business Groups: Crisis and Restructuring,” In: Chang, S. J. (ed.), Business Groups in East Asia: Financial Crisis, Restructuring, and New Growth, New York: Oxford University Press. Rajan, R., H. Servaes, and L. Zingales, (2000), “The Cost of Diversity: The Diversification Discount and Inefficient Investment,” Journal of Finance, 55, 35-80. Rosenstein, S. and J. Wyatt, (1990), “Outside Directors, Board Independence, and Shareholder Wealth,” Journal of Financial Economics, 26, 175-191. Salchenberger, L., E. Cinar, and N. Lash, (1992), “Neural Networks: A New Tool for Predicting Thrift Failures,” Decision Sciences, 23, 899-916. Scharfstein, D., (1998), “The Dark Side of Internal Capital Markets II: Evidence from Diversified Conglomerates,” NBER Working Paper, No.6352. Scharfstein, D. and J. Stein, (2000), “The Dark Side of Internal Capital Markets: Divisional Rent-Seeking and Inefficient Investment,” Journal of Finance, 55, 2537-2564. Shin, H. and R. Stulz, (1998), “Are Internal Capital Markets Efficient?” Quarterly Journal of Economics, 113, 531-552..

(32) 304. Piruna Polsiri and Kingkarn Sookhanaphibarn. Shivaswamy, M., J. P. Hoban, Jr., and K. Matsumoto, (1993), “A Behavioral Analysis of Financial Ratios,” The Mid-Atlantic Journal of Business, 29, 7-24. Shleifer, A. and R. Vishny, (1986), “Large Shareholders and Corporate Control,” Journal of Political Economy, 94, 461-488. Shleifer, A. and R. Vishny, (1997), “A Survey of Corporate Governance,” Journal of Finance, 52, 737-783. Sivanandam, S. N., S. Sumathi, and S. N. Deepa, (2006), Introduction to Neural Networks using MATLAB 6.0, New Delhi: Tata McGraw-Hill. Stulz, R., (1990), “Managerial Discretion and Optimal Financing Policies,” Journal of Financial Economics, 26, 3-27. Tirapat, S. and A. Nittayagasetwat, (1999), “An Investigation of Thai Listed Firms’ Financial Distress Using Macro and Micro Variables,” Multinational Finance Journal, 3, 103-125. Volpin, P., (2002), “Governance with Poor Investor Protection: Evidence from Top Executive Turnover in Italy,” Journal of Financial Economics, 64, 61-90. Wiwattanakantang, Y., (2001), “Controlling Shareholders and Corporate Value: Evidence from Thailand,” Pacific-Basin Finance Journal, 9, 323-362. Zhang, G., M. Hu, B. Patuwo, and D. Indro, (1999), “Artificial Neural Networks in Bankruptcy Prediction: General Framework and Cross-Validation Analysis,” European Journal of Operational Research, 116, 16-32..

(33)

數據

Outline

相關文件

Ma, T.C., “The Effect of Competition Law Enforcement on Economic Growth”, Journal of Competition Law and Economics 2010, 10. Manne, H., “Mergers and the Market for

The study explore the relation between ownership structure, board characteristics and financial distress by Logistic regression analysis.. Overall, this paper

Financial Reporting),及英國研究企業管治財務範 疇的委員會(Committee on the Financial Aspects of Corporate Governance),又稱「坎特伯里委員

Microphone and 600 ohm line conduits shall be mechanically and electrically connected to receptacle boxes and electrically grounded to the audio system ground point.. Lines in

This study intends to bridge this gap by developing models that can demonstrate and describe the mechanism of knowledge creation activities from the perspective of

This research sets different backgrounds as variables of consumers of Miaoli County residents and whether their different life styles and corporate social

Finally, discriminate analysis and back-propagation neural network (BPN) are applied to compare business financial crisis detecting prediction models and the accuracies.. In

In this study, the impact of corporate social responsibility to corporate image, service quality, perceived value, customer satisfaction and customer loyalty was explored