- 1 -

D&O Insurance, Corporate Governance and Mandatory Disclosure:

An Empirical Legal Study of Taiwan

Abstract

The purpose of this paper is to test the signal effect of Directors and Officers (D&O) insurance and to analyze the necessity of mandatory disclosure of D&O insurance in Taiwan. D&O insurance is usually viewed as a signal mechanism of insured firms’ corporate governance and thus its mandatory disclosure has been argued. However, there is no complete mandatory disclosure of D&O insurance in the United States and other countries. This issue is not only popular in common law worlds but also sprouting in civil caw jurisdictions such as Taiwan.

In the first part of this research, the signal effect of D&O insurance in Taiwan will be empirically tested. The evidence suggests that the information about D&O insurance in Taiwan could statistically and significantly signal the qualities of corporate governance of insured firms. Then, this study addresses the mandatory disclosure of D&O insurance by comparative law and law & economic approaches. This paper compares the regulation about D&O insurance disclosure in the United States, Canada and Taiwan, and find out the reasons affecting the mandatory disclosure of D&O insurance. The Cost and benefit analysis is also applied to discuss whether or not the Canadian mandatory disclosed system should be transplanted. It concludes that the D&O insurance can signal the information of insured firms’ corporate governance, and mandatory disclosure is required and justified. Such interdisciplinary research will provide through recommendations for the Taiwan and other emerging countries in Asia.

Keywords: D&O insurance, corporate governance, mandatory disclosure, empirical study, Taiwan

- 2 -

1. Introduction

In recent literature, Directors and Officers (D&O) insurance is usually viewed as a signal mechanism of insured firms’ corporate governance and thus its mandatory disclosure has been argued. In Canada, the disclosure of D&O insurance is mandatory. Empirical research indicates that the information regarding D&O insurance can signal the qualities of insured firms’ corporate governance. Hence, this mandatory disclosure can help investor discretion and even stimulate insured firms to improve their corporate governance. However, there is no complete mandatory disclosure of D&O insurance in the United States or other countries. Proponents argue that the U.S. Securities and Exchange Commission (SEC) should follow Canada and mandate the disclosure of D&O insurance. This issue is not only popular in Common Law worlds but is also sprouting in Civil Law countries, such as Taiwan. The purpose of this paper is to test the signal effect of D&O insurance and to analyze the necessity of mandatory disclosure of D&O insurance in Taiwan.

In structure, this paper contains two main parts. In the first part, the signal effect of D&O insurance in Taiwan will be empirically tested. It is controversial as to whether D&O insurance can signal the qualities of insured firms. After testing this issue in Taiwan, the role of D&O insurance in corporate governance will be clarified. The second part of this paper addresses the mandatory disclosure of D&O insurance in Taiwan by comparative law and law & economic approaches. If the information regarding D&O insurance is a public good and there is market failure, it would be necessary for the government to mandate the disclosure. This issue is also related to the concern about the economic productivity of D&O insurance. Productive policy is the policy that can correct market failure and enhance social welfare.1 D&O insurance can, perhaps, reflect the status of insured firms. If, however, D&O insurance is merely a device to generate a separating equilibrium without enhancing social welfare, then it is merely costly, and perhaps it should not be promoted. In contrast, if D&O insurance could generate more social welfare, then it is productive and worth more promotion. This paper uses economic analysis to discuss whether or not the Canadian mandatory disclosed system should be transplanted. In other words, this paper looks at whether or not the information about D&O insurance should be mandatorily disclosed. The costs and benefits of mandatory disclosure of D&O insurance are

1 Harry de Gorter et al.,Productive and Predatory Public Policies: Research Expenditures and Producer Subsidies

- 3 -

discussed. This paper will ultimately conclude that the mandatory disclosure in Taiwan could be justified from an economic perspective.

2. Literature review

2.1 Signal effect of D&O insurance

Directors’ and officers’ liability insurance is an agreement to indemnify corporate directors and officers against judgments, settlements, and fines arising from negligence suits, shareholder actions, and other business-related lawsuits.2 Like other insurance, D&O insurance has the fundamental function of indemnification. In addition to corporations themselves,3 D&O insurance can provide protection for directors and officers,4 and thus let them concentrate on management without worrying about potential liability or fearing the risk associated with becoming a director or officer of a corporation.5 Also, based on the risk management nature of the insurer, the insurer will decrease the loss as much as possible, and thus protect the interests of

2 See B

LACK'S LAW DICTIONARY 364 (2009). In fact, directors’ and officers’ liabilities could be managed in two

main different ways: indemnification and D&O liability insurance. Indemnification is a protection provided by company for employee against the suits. VonFeldt v. Stifel Financial Corp., 714 A.2d 79, 84 (Del. 1998). These two both can indemnify the losses but they are different. The main difference between indemnification and D&O liability insurance is that the former transfers risk to the company, whereas the latter transfers risk to the third party insurer. Besides, risks for events which have all ready occurred or known risks are usually covered by company compensation, but not by D&O liability insurance. Dir. & Off. Liab § 4:2.

3 In general, D&O policy can be classified as three types with separate functions. First, coverage A (Side A

coverage), or the individual side coverage, reimburses officers and directors for losses that they have suffered as a result of their wrongful acts for which they are not indemnified by the company. Secondly, coverage B (Side B coverage), or company reimbursement coverage, reimburses the company for the expense of indemnifying its directors and officers as a result of claims made against them. Third, coverage C (Side C coverage), or entity coverage, provides coverage for a corporation's losses which separates from the losses of directors and officers. Jensen v. Snellings, 841 F.2d 600, 611 (5th Cir. 1988). Tom Baker & Sean J. Griffith, The Missing Monitor in

Corporate Governance: The Directors' and Officers' Liability Insurer, 95 GEO.L.J. 1795, 1842 (2007). Hence, under the coverage B and C, the loss of company will be compensated.

4 However, because D&O liability insurance is paid by shareholders to protect directors, some consider D&O

liability insurance to protect the shareholders’ wealth more than the directors’. M. Martin Boyer, Directors' and

Officers' Insurance and Shareholder Protection 8-9 (Mar. 2005), available at SSRN:

http://ssrn.com/abstract=886504 (last visited Jul. 10, 2015).

5

IAN YOUNGMAN,DIRECTORS’ AND OFFICERS’ LIABILITY INSURANCE:AGUIDE TO INTERNATIONAL PRACTICE 3 (2nd Woodhead Pub. 1999). Hence, the most commonly cited reason for the purchase of D&O insurance is the recruitment and retention of qualified officers and directors. Tom Baker & Sean J. Griffith, Predicting Corporate

Governance Risk: Evidence from the Directors' & Officers' Liability Insurance Market, 74 U. CHI.L.REV. 487, 502 (2007). More discussion about the development of the market for directors' and officers' liability insurance, see also Dan L. Goldwasser, Directors' and Officers' Liability Insurance 1994, 692 PLI/COMM 9, 12-13 (1994).

- 4 -

the stakeholders.6 In other words, this is not only because insurers assume responsibility for losses but also because this assumption of responsibility makes them more credible providers of loss-prevention services than alternative governance institutions.7 The underwriting information is helpful for the market to understand the status of corporate governance. For example, when underwriting is in progress, insurers may examine the financial status of insured companies, which will thus allow outside investors to understand more about the financial situation of company. D&O insurance can both transfer risk and offer incentives for insured companies to improve their corporate governance. In addition, insurers will force poor quality corporations to pay higher D&O premiums than high quality corporations; and the insured corporations will endeavor to improve corporate governance to decrease insurance premiums.8 Therefore, it is believed that D&O insurance can signal the qualities of insured firms. According previous literature, the relation with the information of D&O insurance and the qualities of insured firms can be developed from following perspectives:

2.1.1 Premiums

The insurance premium, the price that a company pays for D&O insurance, will convey important information about the quality of corporate governance of the insured corporations.9 Generally, the firms with higher risk and poor governance have to pay more in insurance premiums.10 Thus, the disclosure of insurance premium is helpful for investors to evaluate the quality of the insured firms.

2.1.2 Amounts

In addition to premiums, the amount of D&O insurance, including the policy’s retentions and limits, can also provide information about the corporate governance of the insured companies.11 This information is important to specify what insurers are willing to pay and enables comparison between companies.12

6 Baker & Griffith, supra note 3,at 1796. 7 Id., at 491.

8

Id., at 489.

9 Sean J. Griffith, Uncovering a Gatekeeper: Why the SEC Should Mandate Disclosure of Details concerning

Directors' and Officers' Liability Insurance Policies, 154U.PA.L.REV.1147,1024(2006). 10 Id. at 1185.

11 Id. 12 Id.

- 5 - 2.1.3 Type of coverage

It is argued by literature that the amount of side A overage can convey the signal about the confidence of the managers concerning the liability risk they might face.13 In contrast, side B and C overage provides information regarding the extent to which managers use corporate capital to enhance their personal compensation packages.14

2.1.4 The identity of Insurers

Different insurers may have different reputations for screening governance risk.15 The investors may draw different conclusions from whether the insurer is a market leader, unknown or cute-rate insurer.16

2.1.5 Exclusions

Exclusions in D&O insurance policies are also important for monitoring function. Moral hazard is typically referred to the tendency to reduce incentives to protect against loss or to minimize the cost of a loss.17 In order to mitigate moral hazard18 and control risk, there are exclusion clauses in insurance policies to exclude uninsured risk. As the same as general insurance policies, there are exclusions in almost all D&O insurance policies. The most common exclusions include personal injury exclusions, personal conduct exclusions, insured v. insured exclusions, and pollution exclusions.19 Claims for personal injury or bodily injury are excluded by most D&O policies.20 These losses are covered by other types of insurances, such as commercial general liability (CGL). Insured v. insured exclusions indicate that the insurer is not liable for the damage which is brought by one insured against another insured.21 The purpose is to avoid

13 Id.

14 Id. at 1024-25. 15

Id. at 1025.

16 Id. In order to win more market share, cute-rate insurer may lower the premium and thus less concern corporate

governance factor. Hence, the D&O insurance information should be considered more diligently if contracted with such insurer.

17T

OM BAKER,INSURANCE LAW AND POLICY:CASES AND MATERIALS 4 (2nd ed. 2008).

18 More discussion about moral hazard in insurance, Tom Baker, On the Genealogy of Moral Hazard, 75 T

EX.L. REV. 237, 247 (1996).

19 Travis S. Hunter, Ambiguity in the Air: Why Judicial Interpretation of Insurance Policy Terms Should Force

Insurance Companies to Pay for Global Warming Litigation, 113PENN ST.L.REV. 267, 275 (2008).

20 Joseph P. Monteleone & Emy Poulad Grotell, Symposium: Coverage for Employment Practices Liability under

Various Policies: Commercial General Liability, Homeowners', Umbrella, Workers' Compensation, and Directors' and Officers' Liability Policies, 21W.NEW ENG.L.REV.249 (1999).

21 National Union Fire Insurance Co. v. Seafirst Corp., 662 F. Supp. 36, 38 (WD Wash. 1986). Foster v. Kentucky

- 6 -

conflictions among the insureds.22 Essentially, in order to avoid unpredictable risk, damages caused by pollutions or catastrophes are also usually excluded.

Among these exclusions, what is more related with corporate governance is conduct exclusions.23 Usually, the insurer is not liable for the intentional behavior of the insured. In other words, if the insured cause the occurrence of the insured accidence intentionally, the insurer is not liable for indemnification. The substance of insurance is to protect unpredictable risk, and the occurrence of accidence caused by intentional behavior is obvious not unpredictable. Indemnification to such accident is contrary to the substance of insurance which is also contrary to public policy. In addition, in order to decrease moral hazard, it is also necessary to decline the indemnification for the fraud or intentional behavior. In D&O insurance, cases of fraud and gross negligence are usually excluded as well.24 Hence, if the insured commits the exclusions above, he or she will not get compensation from his or her D&O insurer. This can create deterring effect and thus secure corporate governance of the insured companies.

2.2 Mandatory disclosure system for D&O insurance

If D&O insurance has signal effect, would insured firms like to disclosure their insurance voluntarily? Is it necessary to disclose this information mandatorily? There are some clues to be found regarding these issues in the argument concerning the mandatory disclosure in security market. There are two primary arguments about this issue. The “Chicago School,” headed by Professors Easterbrook and Fischel, argue for less regulation. In contrast, the “Harvard School,” represented by Professor Seligman, proposes more regulations.25 Professor John C. Coffee also argues that a mandatory disclosure system can be justified by four claims in securities market. First, security information has the characteristics of a public good. Without mandatory disclosure,

22 There is no applicable for this exclusion when derivative actions brought by shareholders against directors and

officers or actions brought by a receiver or bankruptcy trustee. This is because these entities are deemed to act for the benefit of the corporation's creditors but not for the corporation’s. The Metropolitan Corporate Counsel, Project:

Corporate Counsel - Law Firms; D&O Insurance: Now You See It, Now You Don't (Jun. 2005), available at http://www.metrocorpcounsel.com/articles/5509/project-corporate-counsel-law-firms-do-insurance-now-you-see-it-now-you-dont (last visited Jul. 10, 2015).

23 Wallace Wang, The Relationship between the Deterrence Effect of D&O insurance and Corporate Governance,

156 TAIWAN L.REV.141,156(2008).

24http://www.generali.com/Generali-Group/Governance/corporate-bodies/D-and-O-Policy/, last visited on Sept. 15,

2011.

25 David J. Schulte, The Debatable Case for Securities Disclosure Regulation, 13J.C

- 7 -

such information will be underprovided.26 Second, a lack of mandatory disclosure will cause more inefficiency. Mandatory disclosure of D&O insurance information can minimize the social cost caused by individual investigation.27 Third, the theory of self-induced disclosure proposed by Professors Easterbrook and Fischel has limited validity.28 Because of strong incentives, managers have high probability to convey false signal to the market.29 Fourth, even if the market is efficient, mandatory disclosure of D&O insurance is still helpful for investors to optimize their securities portfolios.30

Professor Sean J. Griffith further discusses the issue of mandatory disclosure of D&O insurance. He argues that the signal effect of D&O insurance could convey the information about the insured firms’ qualities.31 However, American firms usually do not voluntarily disclose the D&O insurance information.32 Following Easterbrook and Fischel’s arguments, Professor Sean J. Griffith developed three bullets supporting the reasons why voluntary disclosure of D&O insurance fails in the United States. First reason is free-rider effect. Because D&O insurance information is beneficial for firms to evaluate competitors, this may let on that the firm would like to do so first. Firms’ disclosing D&O insurance will allow competitors to become free riders on their efforts without any rewards.33 Second, information about firms should be comparable and let investors figure out the relative status of a particular firm. In other words, information is valuable when several firms make similar disclosures. This will prevent any firm from wanting to be the first to disclose. In the end, information disclosure may be worthless, but may inversely benefit its competitors.34 Third, disclosure of information may just benefit the investors of other firms that they cannot charge.35 Under the risk of damaged reputation without substantial rewards, firms are reluctant to release information anyway. Any one of the above situations will cause the failure of the voluntary disclosure system.36

26 John C. Coffee, Market Failure and the Economic Case for a Mandatory Disclosure System, 70V

A.L.REV.722 (1984). 27 Id. 28 Id. 29 Id. 30 Id.

31 Griffith, supra note 9,at 1182-85. 32 Id. at 1185.

33 Id. at 1187. 34 Id.

35 Id. at 1187-88. 36 Id. at 1188.

- 8 -

According to Professor Sean J. Griffith, the first and foremost feature of D&O insurance information is purely comparative.37 Firms’ insurance premiums, coverage, retentions, etc are more meaningful when compared with those of similar firms.38 However, firms are reluctant to be the first to disclose this information, because this will benefit other firms that do not pay for it. Similarly, investors and shareholders are also reluctant to let their firms disclose information first. Such a dilemma will prevent firms from being the first to disclose information, and the supply of D&O insurance information would be underprovided.39 Another concern is that once firms are asked to disclose their D&O insurance mandatorily, this situation will induce a plaintiff’s lawyer to file litigation and seek settlement in policy limit.40 However, Professor Sean J. Griffith argues that it is common sense that almost all American firms have D&O insurances, and the average policy limit is no secret.41 They can estimate firms’ D&O insurance coverage within a fairly accurate range.42 In the litigation process, firms’ D&O insurance policies will be disclosed after the claim has been filed and prior to discovery.43 Professor Sean J. Griffith argues that the mandatory disclosure of D&O insurance will not significantly add to the incentives for claims and increase litigations.44

3. Empirical test of signal effect of D&O insurance

This paper follows the structure of Professor Sean J. Griffith’s researches – analyze signal effect of D&O insurance first, and then discuss mandatory disclosure policy of D&O insurance. In this section, signal effect of D&O insurance in Taiwan will be tested, and analysis regarding mandatory disclosure will be developed in the following sections.

37 Id. 38 Id. 39 Id. 40 Id. 41 Id. 42 Id. 43 Id. 44 Id. at 1187.

- 9 -

3.1 Variables and hypothesis development

Professor Sean J. Griffith argues that the following information about D&O insurance conveys an important signal concerning insured firms’ qualities of corporate governance: the amount of coverage, identity of insurer, type of D&O insurance, and price.45 Like previous research, this paper hypothesizes that more insurance coverage should emit positive signal to the market and thus would attract more foreign investments. In addition, as Sean J. Griffith suggests, the identity of the D&O insurer could also be an important signal.46 Different insurers may have different reputations and risk criteria of risk assessment.47 Being covered by a prestigious D&O insurer means that the insurer would like to ensure the loss of insured firms by his estate and reputation, and good signal is implied. In contrast, a cut-rate insurer may have worse risk management and less security. As a result, being covered by a cut-rate D&O insurer may not be good news to the market. Taking this into account, this paper uses the identity of the insurer as another proxy variable of D&O insurance information. Currently, there are 16 D&O insurers in the Taiwan market. Because the top five insurers occupy more than 90% market share,48 for simplicity, they are the only ones considered in regressions.49

In sum, because of the availability, this paper will use D&O insurance purchase, coverage, number and identity of insurer as the proxy variables of D&O insurance information.50 And, such information about D&O insurance is set as the independent variables in the regression analysis. Regarding the calculation of D&O insurance coverage, it is common that one insured firm may purchase D&O insurance from more than one insurer. In other words, multiple insurers may coinsure insured firms. Under this circumstance, the amount of each insurance policy will be calculated by proportion of coinsurance.

45

Griffith, supra note 9, at1204-06.

46

Id.at1205.

47 Id.

48 According to the dataset complied in this research, the top five D&O insurers are the Chartis Taiwan Insurance

Company, Fubon Insurance Company Ltd., Insurance Company of North America, Federal Insurance Company and Cathay Century Insurance Company.

49 This paper also put all 16 D&O insurance as 16 dummy variables in regressions. However the insurers ranked

from 6 to 16 are almost not significant.

50 In Taiwan, D&O insurance information about insurance purchase, insurance coverage and insurer are public, but

the type of insurance policy and premium are not. Even though the importance of D&O insurance premium is also emphasized by Sean J. Griffith, it would not be considered in this paper because of availability. Similarly, the type of D&O insurance policy firms purchased is also not available. Except for Canadian market, this situation also happens in the United States where D&O insurance information is not mandatory disclosed. Griffith, supra note 9, at1203.

- 10 -

Foreign investments, including the number of shares of foreign juristic person and foreign financial juristic person, are set as dependent variables. This is to further test the signal effect of D&O insurance: how D&O insurance emits signal to the market and, consequently, whether foreign investors are attracted or repelled. Meanwhile, variables about firms’ corporate governance are set as control variables in regressions. Considering the argument that firms with better corporate governance usually have more independent director, 51 the number of independent director is included in this research. Whether chairman of board of directors should be distinct from CEO is still controversial in corporate governance, especially about the tradeoff between avoiding overconcentration of power and improving efficiency.52 Thus, the variable dual is set up to capture this. Because the governance function of audit committee has been more emphasized after the passing of Sarbanes-Oxley Act,53 the variable munauditing is applied to capture the size of audit committee. Ownership structure may affects agency costs and is thus important for corporate governance and investor. 54 The variables smh and sd indicate the percentage of shares held by major shareholders and directors separately. Return on equity (ROE) and debt-asset ratio of firms are considered as proxy variables of financial performance. The variables used in this paper are presented in table 1. In conclusion, two hypotheses are presented from the discussion above:

H1: D&O insurance purchase will attract more foreign investments

H2: more D&O insurance coverage will attract more foreign investments

H3: being insured by a prestigious insurer will attract more foreign investments

Table 1 Table of variables

Factor Variables Definition

51 James D. Cox & Randall S. Thomas, Mapping the American Shareholder Litigation Experience: A Survey of

Empirical Studies of the Enforcement of the U.S. Securities Law, in CORPORATE GOVERNANCE MODELS AND THE

LIABILITY OF DIRECTORS AND MANAGERS 82(2010).

52Z

ABIHOLLAH REZAEE,CORPORATE GOVERNANCE POST-SARBANES-OXLEY:REGULATIONS,REQUIREMENTS, AND

INTEGRATED PROCESSES 509-10(2007).

53A

NNE M.MARCHETTI,SARBANES-OXLEY ONGOING COMPLIANCE GUIDE:KEY PROCESSES AND SUMMARY

CHECKLISTS 34(2007).

54 Wallace Wen-Yeu Wang & Carol Yuan-Chi Pang, Minority Controlling Shareholders: An Analytical Framework

- 11 - Dependent

variables

FJP The number of shares of foreign juristic person

FFJP The number of shares of foreign financial juristic person Independent variables D&O insurance information

purchase Dummy variable. This equals 1 when firms with insurance and 0 otherwise.

coverage D&O insurance coverage

numofinsurer Number of D&O insurer of specific insured firm

Insurer Identity of D&O insurer. Five dummy variables, insurer 1 to 5, denote the six categories of D&O insurers, the top 5 insurers, and other insurers.

Corporate governance

dual Dummy variable. This equals 1 if chairman of board of directors is identical to CEO and 0 otherwise.

roe Return on equity of firms

indptdirector The number of independent directors munauditing The number of members of audit

committee.

smh The percentage of shares held by directors (%)

sd The percentage of shares held by major shareholders (%)

daratio Debt-asset ratio of firms

3.2 Data and method

The data on D&O insurance purchases made by listed companies in Taiwan was obtained from the Taiwan Economic Journal (TEJ)55 and Market Observation Post System (MOPS).56 In addition to the websites of listed companies, basic information and financial data regarding them was obtained from the TEJ and Taiwan Stock Exchange Corporation (TSCE).57 Because of

55 http://www.tej.com.tw/twsite/, last visited on Jul. 10, 2015.

56 http://emops.twse.com.tw/emops_all.htm, last visited on Jul. 10, 2015.

- 12 -

availability, the data from 2008 to 2014 was used in this paper. Regressions with ordinary least square (OLS) and panel data are applied to estimate the relationship between dependent variables and independent variables. In the analysis of panel data, F-test is conducted to test if fixed-effects regression has better effect than OLS regression, and Breusch and Pagan Lagrangian multiplier test is carried out to test if random-effects GLS regression has better effect than OLS regression.58 Then, Hausman test is used to test which appropriate between fixed-effects regression and random-effects GLS regression.59 Because it is found that fixed-effects regression is more appropriate in models in this study, estimation with Driscoll-Kraay standard errors is reported to provide more robust result even in the presence of autocorrelation and heteroscedasticity.60 For robustness check, this paper uses different proxy variables about foreign investments in respective panels, including the number of shares of foreign juristic person and foreign financial juristic person. In conclusion, the basic regression is presented below and detailed descriptions of variables are presented in the appendix.

= + & + +

(1)

3.3 Empirical result and analysis

There are four main specifications in empirical analyses. D&O insurance purchase, coverage, number of insurer and identify of insurer are considered in panels in order.

3.3.1 Panel 1 and 2

In the first panel, when the dependent variable is the number of shares held by foreign juristic person, the D&O insurance purchase is positively and statistically significant. This demonstrates the positive correlation between foreign investment and D&O insurance purchase. Considering other control variables, ROE and number of auditing committee members are positively

58J

EFFREY MWOOLDRIDGE,ECONOMETRIC ANALYSIS OF CROSS SECTION AND PANEL DATA 299(2010).

59D

IMITRIOS ASTERIOU &STEPHEN G.HALL,APPLIED ECONOMETRICS 420-21(2011).

60A

DRIAN COLIN CAMERON &P.K.TRIVEDI,MICROECONOMETRICS USING STATA 268(2009).JOÃO PEDRO

AZEVEDO ET AL.,FISCAL ADJUSTMENT AND INCOME INEQUALITY:SUB-NATIONAL EVIDENCE FROM BRAZIL 12-13 (2014).

- 13 -

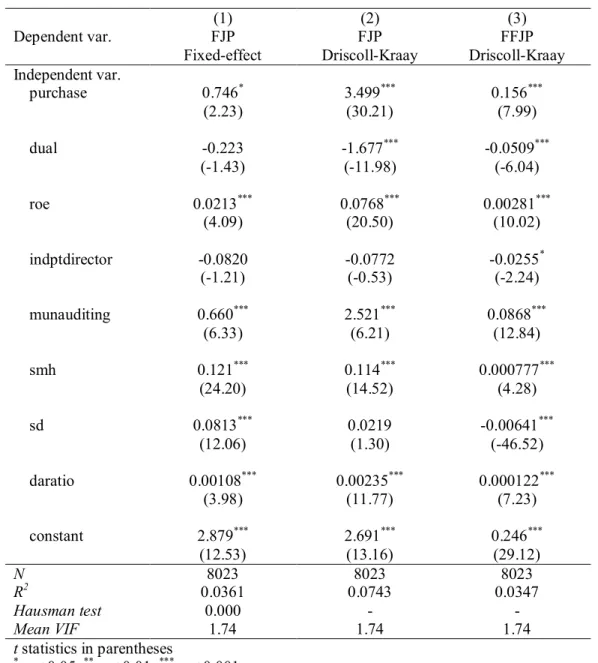

significant, supporting perceptions that they are positive factor in corporate governance. Also, the variable dual is negatively significant, supporting the concern that quality of corporate governance is more problematic when chairman of board of directors is identical to CEO. As a whole, the empirical result demonstrates the positive effect of D&O insurance purchase. D&O insurance purchase is also positively significant when the number of shares held by foreign financial juristic person is used as dependent variable, supporting the hypothesis proposed in this research again. The detailed result can be found in the table 2.

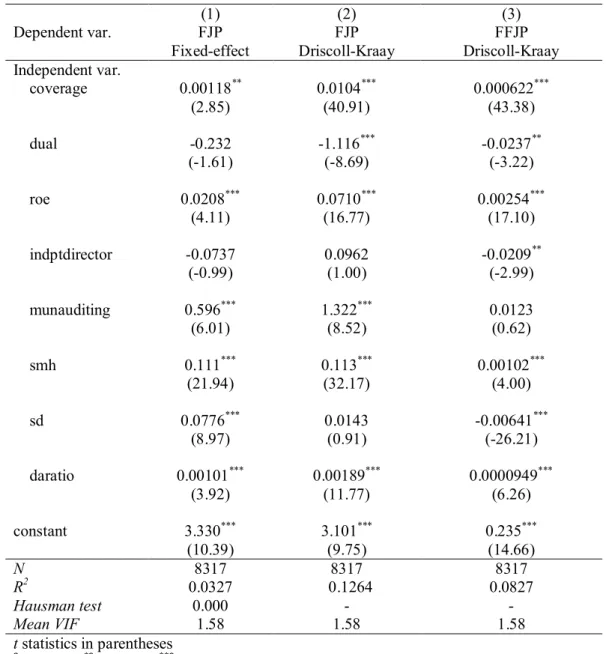

In the second panel, insurance coverage is used as the proxy variable of D&O insurance information. It can be found that when the dependent variable is the number of shares held by foreign juristic person, D&O insurance coverage is positively significant. This result indicates D&O insurance coverage is positively related to the shares held by foreign juristic person, and thus the positive signal effect of D&O insurance is implied. Similarly, when the dependent variable is the number of shares held by foreign financial juristic person, the variable D&O insurance coverage is still positively significant. Thus, the positive signal effect of D&O insurance coverage may be supported again. This result demonstrates that the more D&O insurance coverage purchased, the more investments there are from foreign financial juristic person. This would be strong evidence of the positive effect of D&O insurance, implying that D&O insurance can emit positive signal and attract more foreign investments.

- 14 -

Table 2 The test of signal effect of D&O insurance information: D&O purchase

This table presents the first test of the effects of D&O insurance information in Taiwan from 2008-2014. The proxy variables of signal effect of D&O insurance are the number of shares hold by foreign juristic person and foreign financial juristic person. The D&O insurance information tested in this model is purchase of insurance. Other independent variables about insured firms’ corporate governance are used as controlled variables. In the first two specifications, the number of shares hold by foreign juristic person is used as dependent variable. The result of panel data with fixed-effect is reported in the first column, and the result of using Driscoll-Kraay standard errors is reported in the second column. The third specification, where the number of shares hold by foreign financial juristic person is used as dependent variable and regression is estimated by using Driscoll-Kraay standard errors, is reported in the third column.

(1) (2) (3)

Dependent var. FJP FJP FFJP

Fixed-effect Driscoll-Kraay Driscoll-Kraay Independent var. purchase 0.746* 3.499*** 0.156*** (2.23) (30.21) (7.99) dual -0.223 -1.677*** -0.0509*** (-1.43) (-11.98) (-6.04) roe 0.0213*** 0.0768*** 0.00281*** (4.09) (20.50) (10.02) indptdirector -0.0820 -0.0772 -0.0255* (-1.21) (-0.53) (-2.24) munauditing 0.660*** 2.521*** 0.0868*** (6.33) (6.21) (12.84) smh 0.121*** 0.114*** 0.000777*** (24.20) (14.52) (4.28) sd 0.0813*** 0.0219 -0.00641*** (12.06) (1.30) (-46.52) daratio 0.00108*** 0.00235*** 0.000122*** (3.98) (11.77) (7.23) constant 2.879*** 2.691*** 0.246*** (12.53) (13.16) (29.12) N 8023 8023 8023 R2 0.0361 0.0743 0.0347 Hausman test 0.000 - - Mean VIF 1.74 1.74 1.74 t statistics in parentheses * p < 0.05, ** p < 0.01, *** p < 0.001

- 15 -

Table 3 The test of signal effect of D&O insurance information: D&O coverage

This table presents the second test of the effects of D&O insurance information in Taiwan from 2008-2014. The proxy variables of signal effect of D&O insurance are the number of shares hold by foreign juristic person and foreign financial juristic person. The D&O insurance information tested in this model is insurance coverage. Other independent variables about insured firms’ corporate governance are used as controlled variables. In the first two specifications, the number of shares hold by foreign juristic person is used as dependent variable. The result of panel data with fixed-effect is reported in the first column, and the result of using Driscoll-Kraay standard errors is reported in the second column. The third specification, where the number of shares hold by foreign financial juristic person is used as dependent variable and regression is estimated by using Driscoll-Kraay standard errors, is reported in the third column.

(1) (2) (3)

Dependent var. FJP FJP FFJP

Fixed-effect Driscoll-Kraay Driscoll-Kraay Independent var. coverage 0.00118** 0.0104*** 0.000622*** (2.85) (40.91) (43.38) dual -0.232 -1.116*** -0.0237** (-1.61) (-8.69) (-3.22) roe 0.0208*** 0.0710*** 0.00254*** (4.11) (16.77) (17.10) indptdirector -0.0737 0.0962 -0.0209** (-0.99) (1.00) (-2.99) munauditing 0.596*** 1.322*** 0.0123 (6.01) (8.52) (0.62) smh 0.111*** 0.113*** 0.00102*** (21.94) (32.17) (4.00) sd 0.0776*** 0.0143 -0.00641*** (8.97) (0.91) (-26.21) daratio 0.00101*** 0.00189*** 0.0000949*** (3.92) (11.77) (6.26) constant 3.330*** 3.101*** 0.235*** (10.39) (9.75) (14.66) N 8317 8317 8317 R2 0.0327 0.1264 0.0827 Hausman test 0.000 - - Mean VIF 1.58 1.58 1.58 t statistics in parentheses * p < 0.05, ** p < 0.01, *** p < 0.001

- 16 -

3.3.2 Panel 3 and 4

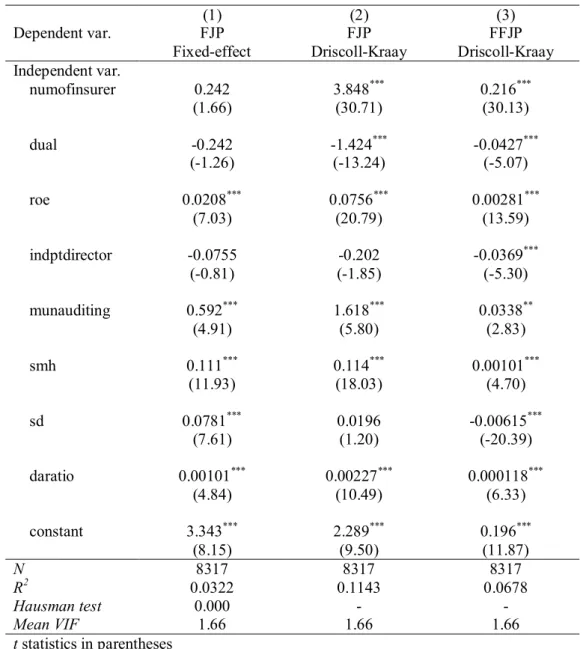

For the signal effect of D&O insurer, this research uses the number of insurer and identity of insurer to capture this. The panel 3 uses the number of the D&O insurer as the proxy variable of D&O insurance information. Theoretically, signal effect of number of insurers is suspicious. On the one hand, obtaining D&O insurance from more insurers, usually implying more protection, more demand for risk diversification from the insured, and more insurers are willing to trust insured firms’ qualities and thus offer coverage. However, it is also possible that insured firms are not good enough to obtain sufficient coverage from single insurer. The empirical result shows that number of insurer is positively significant, implying its positive correlation to foreign investment. This result is also similar to the previous mentioned insurance purchase and coverage, suggesting that they can be positive signal to the market.

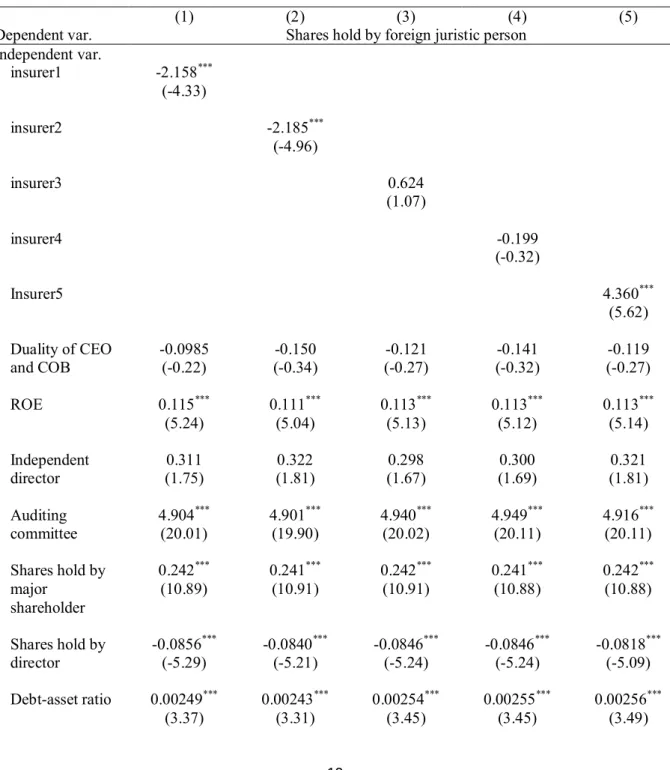

The panel 4 uses the identity of the D&O insurer as the proxy variable of D&O insurance information. Five dummy variables, insurer 1 to 5, denote the six categories of D&O insurers, the top 5 insurers, and other insurers.61 This will further test Professor Sean J. Griffith’s theory in Taiwan. He argues that the identity of the insurer can convey the signal concerning insured firms’ qualities. Taking this into account, the reputation and quality of insurers should be positively related to the qualities of insured firms. Many of the variables about insurers are insignificant. When the dependent variable is the number of shares held by foreign natural person, all insurers are not significant. This is similar to the result of the first panel. When the dependent variable is the number of shares held by foreign juristic person, insurer 1 and 2 are negatively. This result indicates that being insured by these market leaders is associated with fewer foreign investments. This implies that they may convey negative signal to the market. However, insurer 5 is positively significant, implying that being insured by this insurer may associate with better attraction to investors.

This result is a little different from the argument of Professor Sean J. Griffith: being insured by prestigious insurers may emit positive signal to the market. In Taiwan, the identity of the insurer may also emit some signal. It may be because insurer 5 indeed has better underwriting and quality, and thus their coverage is more valuable than other insurers. Another possible reason may be that these insurers, indeed, have larger market shares, but this also means that they accept

61 If a categorical variable has n levels, not n but n-1 dummy variables each with two levels are required. D

AVID

- 17 -

offers from varieties of insured firms. And, the volatility of the qualities of governance of insured firms is implied. This concern worries investors and even decreases their investments. Even though the tendency of the effect of the identity of the insurer is different from what the literature states, the existence of such a signal makes it worthwhile to discuss further disclosure of D&O insurance information, even mandatory disclosure.

- 18 -

Table 4 The test of signal effect of D&O insurance information: number of D&O insurer

This table presents the third test of the effects of D&O insurance information in Taiwan from 2008-2014. The proxy variables of signal effect of D&O insurance are the number of shares hold by foreign juristic person and foreign financial juristic person. The D&O insurance information tested in this model is the number of D&O insurer. Other independent variables about insured firms’ corporate governance are used as controlled variables. In the first two specifications, the number of shares hold by foreign juristic person is used as dependent variable. The result of panel data with fixed-effect is reported in the first column, and the result of using Driscoll-Kraay standard errors is reported in the second column. The third specification, where the number of shares hold by foreign financial juristic person is used as dependent variable and regression is estimated by using Driscoll-Kraay standard errors, is reported in the third column.

(1) (2) (3)

Dependent var. FJP FJP FFJP

Fixed-effect Driscoll-Kraay Driscoll-Kraay Independent var. numofinsurer 0.242 3.848*** 0.216*** (1.66) (30.71) (30.13) dual -0.242 -1.424*** -0.0427*** (-1.26) (-13.24) (-5.07) roe 0.0208*** 0.0756*** 0.00281*** (7.03) (20.79) (13.59) indptdirector -0.0755 -0.202 -0.0369*** (-0.81) (-1.85) (-5.30) munauditing 0.592*** 1.618*** 0.0338** (4.91) (5.80) (2.83) smh 0.111*** 0.114*** 0.00101*** (11.93) (18.03) (4.70) sd 0.0781*** 0.0196 -0.00615*** (7.61) (1.20) (-20.39) daratio 0.00101*** 0.00227*** 0.000118*** (4.84) (10.49) (6.33) constant 3.343*** 2.289*** 0.196*** (8.15) (9.50) (11.87) N 8317 8317 8317 R2 0.0322 0.1143 0.0678 Hausman test 0.000 - - Mean VIF 1.66 1.66 1.66 t statistics in parentheses * p < 0.05, ** p < 0.01, *** p < 0.001

- 19 -

Table 5 The test of signal effect of D&O insurance information: D&O insurer

This table presents the fourth test of the effects of D&O insurance information in Taiwan from 2008-2014. The proxy variables of signal effect of D&O insurance are the number of shares hold by foreign juristic person and foreign financial juristic person. The D&O insurance information tested in this model is the identity of insurer. Because top 5 D&O insurers occupy more than 90% market share, only them are tested in regressions. Variables Insurer 1 ~ 5 are dummy variables. Other independent variables about insured firms’ corporate governance are used as controlled variables. Pooled OLS regression with cluster–robust standard errors is applied here and time effect is controlled by dummy variables of years.

(1) (2) (3) (4) (5)

Dependent var. Shares hold by foreign juristic person Independent var. insurer1 -2.158*** (-4.33) insurer2 -2.185*** (-4.96) insurer3 0.624 (1.07) insurer4 -0.199 (-0.32) Insurer5 4.360*** (5.62) Duality of CEO and COB -0.0985 -0.150 -0.121 -0.141 -0.119 (-0.22) (-0.34) (-0.27) (-0.32) (-0.27) ROE 0.115*** 0.111*** 0.113*** 0.113*** 0.113*** (5.24) (5.04) (5.13) (5.12) (5.14) Independent director 0.311 0.322 0.298 0.300 0.321 (1.75) (1.81) (1.67) (1.69) (1.81) Auditing committee 4.904*** 4.901*** 4.940*** 4.949*** 4.916*** (20.01) (19.90) (20.02) (20.11) (20.11) Shares hold by major shareholder 0.242*** 0.241*** 0.242*** 0.241*** 0.242*** (10.89) (10.91) (10.91) (10.88) (10.88) Shares hold by director -0.0856*** -0.0840*** -0.0846*** -0.0846*** -0.0818*** (-5.29) (-5.21) (-5.24) (-5.24) (-5.09) Debt-asset ratio 0.00249*** 0.00243*** 0.00254*** 0.00255*** 0.00256*** (3.37) (3.31) (3.45) (3.45) (3.49)

- 20 - constant -11.70*** -10.90** -11.92*** -11.73*** -12.79*** (-3.37) (-3.12) (-3.38) (-3.34) (-3.67) N 5949 5949 5949 5949 5949 R2 0.2528 0.2534 0.2507 0.2505 0.2552 t statistics in parentheses * p < 0.05, ** p < 0.01, *** p < 0.001

- 21 -

4. Discussion of mandatory disclosure of D&O insurance information

The previous empirical analysis provides preliminary evidence for the generally positive effect of D&O insurance information in Taiwan. In this way, firms should have incentive to disclose this information and mandatory disclosure is not required. However, due to the sensitivity and public good characteristics of insurance information, this study argues that voluntary disclosure is not successful and mandatory disclosure is suggested.

4.1 Public goods and free-rider effect

Is the information regarding D&O insurance a public goods? Because public goods should be provided by the state due to the free-rider problem,62 the mandatory disclosure of D&O insurance might be justified if the information regarding D&O insurance is a public good.63 Public goods have two characteristics developed from Samuelson’s analysis64: they are not excludable and rival in consumption.65 Public goods are not excludable because it is difficult to exclude multiple individuals from benefitting from it.66 In addition, the consumption of public goods by one individual would not affect other people’s opportunities to consume it.67 Due to the nonexclusive character of a public good, once it is provided to one person, it is also provided to everyone. In this way, any self-interested person will avoid making voluntary payment for it.68 This will create the problem of free rider. In this way, producers may find it more difficult to get exact payment from consumers, and the market will underprovide public goods.69 In the extreme, if every person were self-interested, public goods would not be provided in any private market.

62 T

HOMAS J.MICELI,THE ECONOMIC APPROACH TO LAW 198 (2009).

63 S

CHULTE, supra note 25, at 546.

64

RAYMOND G.BATINA &TOSHIHIRO IHORI,PUBLIC GOODS:THEORIES AND EVIDENCE 10(2005).

65

N.GREGORY MANKIW,PRINCIPLES OF ECONOMICS 218(2011).

66

STEVEN C.HACKETT &MICHAEL C.MOORE,ENVIRONMENTAL AND NATURAL RESOURCES ECONOMICS:THEORY,

POLICY, AND THE SUBSTANTIAL SOCIETY 50(2011).

67

MACMILLAN,PUBLIC FINANCE AND PUBLIC POLICY 170(2004).

68

GORDON C.WINSTON &RICHARD F.TEICHGRAEBER,THE BOUNDARIES OF ECONOMICS 45(1988).

69

- 22 -

They would then need to be provided by the state, and citizens would have to pay for them via taxation.70

As argued by Professor John C. Coffee and Griffith, the information regarding firms’ D&O insurance is a public good; this paper also argues that this is true in Taiwan. Information about D&O insurance is apparently not excludable and rival in consumption. Once the information about D&O insurance is out, it is very difficult to exclude others from knowing or benefiting from it. The distribution of D&O insurance information would not affect the opportunity of others to use it. Because of these characteristics, firms may be reluctant to provide D&O insurance information, and such information would be underprovided. In addition to theoretical reasoning, this argument is further supported by the empirical evidence in the next section.

4.2 Evidence of market failure in Taiwan

As Professor Sean J. Griffith argues, information about D&O insurance is a public good. Because the characteristics of a public good and the free-rider effect, firms would be unwilling to provide this information, voluntary disclosure system will fail, and mandatory disclosure will, therefore, be required. A similar situation also happened in Taiwan. Evidence can be found in the difference of D&O insurance information before and after 2008. Taiwan Stock Exchange Corporation requested firms to disclose their D&O insurance information from 2008.71 Before 2008, the number of firms that voluntarily disclosed their D&O insurance information was very limited. For example, there were merely 17 firms disclosing D&O insurance information on Market Observation Post System.72 However, more than 1300 firms did so in 2008. This was more than 90% of all public firms in Taiwan at that time. This evidence proves that there are free-rider and market failure problems concerning the D&O insurance information in the Taiwan market. The rare firms that voluntarily disclosed D&O insurance information indicated the failure of the voluntary disclosure system. In contrast, a high percentage of firms that disclosed D&O insurance information in 2008 demonstrated that state regulation indeed worked to correct market failure problems. In fact, the current database used in this paper is the fruit of mandatory disclosure. Furthermore, more sensitive information, like premium and specific exclusions, are

70 Id.

71 http://reader.chinatimes.com/forum_35696.html, last visited on Jul. 10, 2015. 72 http://mops.twse.com.tw/mops/web/t135sb03, last visited on Jul. 10, 2015.

- 23 -

still not disclosed. This situation also echoes the argument of Professor Sean J. Griffith: mandatory disclosure is critically important for research concerning D&O insurance.73

4.3 Experience of other jurisdictions

Professor Sean J. Griffith argues that under the circumstance where D&O insurance has signal effect but firms lack incentives to release D&O insurance information to the market the authorities should mandate the disclosure of D&O insurance in laws or regulations.74 However, federal law and most state laws in the United States fail to require this. An exception is New York Business Corporation Law. Section 726(d) of the New York Business Corporation Law concerns the disclosure of firms’ D&O insurance:

“The corporation shall, within the time and to the person provided in paragraph (c) of section 725 (Other provisions affecting indemnification of directors or officers), mail a statement in respect of any insurance it has purchased or renewed under this section, specifying the insurance carrier, date of the contract, cost of the insurance, corporate positions insured, and a statement explaining all sums, not previously reported in a statement to shareholders, paid under any indemnification insurance contract.”

However, New York Business Corporation Law does not require firms to disclose the limits, retentions and coinsurance amounts of D&O insurance, and, as a consequence, such information is largely unavailable.75 In addition, the type of D&O insurance policy is also not available.76 This may cause difficulty in analyzing and comparing D&O insurance data.

It is well known that Canada mandates the disclosure of D&O insurance. The information of firms’ purchases of D&O insurance can be found in their proxy circulars at the System for Electronic Document Analysis and Retrieval (SEDAR) database. 77 Take “Communique Laboratory Inc.,” for example; its D&O insurance can be found in the information circular for

73 Griffith, supra note 9, at1202-03. 74 Id.at 1190.

75 Id.at 1195. 76 Id.

- 24 -

the Annual and Special Meeting of Shareholders that was held on Tuesday March 15, 2011. 78 Such information contains policy limits, type of policy, deductibles and premiums, but it does not state the identity of the insurer. The availability of premiums facilitates relevant researches and makes inter-firm comparisons possible.79 The content of Communique Laboratory Inc.’s disclosure of D&O insurance is presented below:

“DIRECTORS AND OFFICERS LIABILITY INSURANCE The Company has obtained directors and officers liability insurance which covers the legal liability for any director or officer for a wrongful or alleged wrongful act. The policy limits are

$10,000,000 for any one occurrence and $10,000,000 in the aggregate during the policy period. The amount of the deductible is "Nil" for each director or officer, $25,000 for each corporate reimbursement claim, $25,000 for each employment practices claim and $50,000 for each securities claim. The premium paid for the annual coverage is $38,350 (plus applicable taxes).”

In Taiwan, the disclosure of D&O insurance is not mandatory but was voluntary before 2008. From 2008, Taiwan Stock Exchange Corporation requested that firms disclose their D&O insurance information.80 Firms have to update record of D&O insurance purchases made that year by January 15th of the following year. Relevant information is public on the Market Observation Post System (MOPS).81 Currently, the disclosed information includes the purchase of D&O insurance (Yes/No), insured person, the identity of the insurer, coinsurer and coinsurance rate (if any), limit, retention, insurance period and status (new case or renewal). The Taiwanese system provides more detailed information, such as coinsurer and coinsurance rate, insurance period and status. However, insurance premiums, the type of insurance policy and specific exclusions of firms are not available on MOPS. Like other signals, D&O insurance premiums can also be converted to the proxy of the qualities of insured firms.82 First of all, information about insurance limit and retention is more meaningful when premium is available.83

78http://www.sedar.com/CheckCode.do;jsessionid=0000Oiaf3i-t1fOxiQtqxo9lKPp:-1, last visited on Jul. 10, 2015. 79 Griffith, supra note 9, at1203.

80http://reader.chinatimes.com/forum_35696.html, last visited on Jul. 10, 2015. 81 http://emops.twse.com.tw/emops_all.htm, last visited on Jul. 10, 2015. 82 Griffith, supra note 9, at 1184.

- 25 -

Comparison between firms is also more possible when premium is disclosed. For example, assuming two firms have equal insurance limits with identical insurers, their qualities of governance may be totally different if their premiums are significant different. Second, premium also correlates to the business of firms.84 Some industries may have higher rates. Third, premium may correlate to firms’ capitalization.85 The premium is critical in assessing the significance of D&O insurance and its effect. In addition, the type of D&O insurance can be an important signal to the market. Side A only benefits individuals, but Side B and C benefit the entire firm.86 Firms which only purchase Side A may suffer fewer agency costs than those which purchase Side B and C.87 The type of D&O insurance can be a proxy for agency costs.88 Such omissions may add to the difficulty in evaluating insured firms’ insurance packages and comparing them with those of other firms.

4.4 Cost and benefit analysis of mandatory disclosure

There are two issues unsettled for the current Taiwan market. Is the current mandatory disclosure system justified? Furthermore, shall more complete mandatory disclosure be promoted? Should insurance premiums and policy types also be mandatorily disclosed? This section will develop more discussions from the perspective of cost-benefit analysis to support the completely mandatory disclosure system in Taiwan.

4.4.1 Cost

4.4.1.1 Characteristic of Taiwanese litigation system mitigates the litigation-inducing risk

According the previous literature review, the major counterargument to the mandatory disclosure system is no more than the concern that mandatory disclosure will induce a greater number of litigations. However, as Professor Sean J. Griffith suggests, the differences between the United States litigation system and those of other countries may play an important role in this issue.89 84 Id. 85 Id. 86 Id.at1183. 87 Id. 88 Id. 89 Id.at1201-02.

- 26 -

Without contingency fee system, class actions, derivative suits, and a punitive damage system, all of which are popular in the United States,90 a mandatory disclosure system of D&O insurance is not worth too much worry with regard to the litigation-inducing risk. Similarly, this paper argues that the difference between the Taiwanese litigation system the United States litigation system would mitigate the potential concern of litigation-inducing risk.

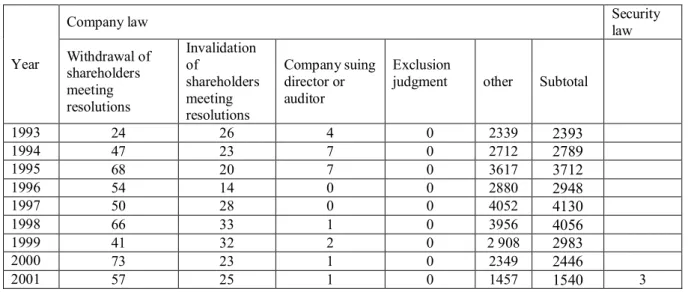

4.4.1.1.1 Shareholders’ and securities litigation

Shareholders’ litigation and securities litigation are important sources of litigation risk for corporations and directors,91 but these practices are not so popular in Taiwan. In the United

States, shareholders’ litigation can be divided into two forms, direct suit and derivative suit. Direct suit is used to redress harms inflicted on the shareholders directly. In contrast, derivative suit92 enables shareholders to obtain redress for harms inflicted on the corporation, typically by

corporate management.93 The prevalence of shareholders’ litigation and securities litigation94 causes directors and corporations to be at high risk to be sued. This provides substantial incentive to purchase D&O insurance,95 and thus to develop insurers as external monitors. However, the maturity and popularity of shareholders’ litigations in Taiwan are not the same as the United States.

In Taiwan, there is no specific rule for direct suit and thus standard tort law will be applied.96 Derivative suits were established in 1966 in Article 214 in Taiwanese Company Law.97 Shareholders who have been continuously holding 3% or more of the total number of the

90 Id. 91

For more discussion about empirical studies on the prevalence and effects of shareholder suits, Curt Cutting,

Turning Point for Rule 10b-5: Will Congressional Reforms Protect Small Corporations, 56 OHIO ST.L.J. 555, 564 (1995).

92

In the United States, derivative suits are based on the common law principles, and can be traced back to a case in 1882, Hawes v City of Oakland, 104 US 450 (1882).

93

Jones v. H.F. Ahmanson & Co., 460 P.2d 464, 470 (Cal. 1969).

94

Cutting, supra note 91, at 564.

95

Once corporations buy D&O insurance, the risk of shareholder litigation shifts, in whole or in part, to a third-party insurer. Griffith, supra note 51, at1173.

96

Taiwanese Company Law art. 23, § 2 (2009). “If the responsible person of a company has, in the course of conducting the business operations, violated any provision of the applicable laws and/or regulations and thus caused damage to any other person, he/she shall be liable, jointly and severally, for the damage to such other person.”

97

This system comes from the derivative suit in the United States. Taying Liaow, Examining Corporate

Management and Directors' Liability: A Review of Stockholders' Derivative Suits under Taiwan's Company Law, 37

- 27 -

outstanding shares of the corporation over one year may request in writing the supervisors of the corporation to institute, for the corporation, an action against a director of the corporation. In case the supervisors fails to institute an action within 30 days after having received the request, then the shareholders filing such request may institute the action for the corporation.98

However, some flaws in the legislation decrease the incentive for filing derivative litigation. When suing shareholders win the lawsuits, the benefits belong to corporations instead of shareholders.99 In Taiwan, where a lawsuit is found by a final judgment to be based on facts

apparently true, the defendant director shall be liable to compensate the shareholders who instituted the action for the loss or damage resulting from such an action.100 Till now, whether

attorney fees and litigation fees are included in this compensation or not is still controversial. Hence, there are weak incentives for shareholders to file such suit.

In addition, unlike the United States, contingency fees are not allowed in Taiwan. It is obvious that incentive for litigation would be much less. What is more, shareholders are liable if shareholder litigation has no apparent basis. When the suing shareholders lose the lawsuits and thus cause damage to the corporations, the suing shareholders shall be liable for indemnifying the corporation for such damage.101 When a lawsuit is instituted and is found by a final judgment

to be based on facts apparently untrue, the shareholders who instituted the action shall be liable to compensate the defendant director for loss or damage resulting from such an action.102 With risk of loss and weak beneficial incentive, it is difficult to expect shareholders to ignore these potential liabilities to file a suit. In the end, this legislation not only decreases the incentives to file a suit, but also limits the development of shareholders’ litigation. All these factors increase the difficulty of litigation and the litigation risk of directors and officers.

Furthermore, Hirschman’s exit-voice paradigm103 may shed more light on this issue. In this model, participants can choose to exit from the organization, or stay and voice their dissents.104

98

Taiwanese Company Law art. 214 (2009).

99

A similar situation also takes place in Japan. The shareholders in Japan have less reason than shareholders in the United States to bring suit, because even the winners do not result in increases in shareholder wealth. Mark D. West,

Why Shareholders Sue: The Evidence from Japan, 30 J.LEGAL STUD. 351, 381 (2001).

100

Taiwanese Company Law art. 215, § 2 (2009).

101

Taiwanese Company Law art. 214, § 2 (2009).

102

Taiwanese Company Law art. 215, § 1 (2009).

103

ALBERT O.HIRSCHMAN, EXIT,VOICE, AND LOYALTY:RESPONSES TO DECLINE IN FIRMS,ORGANIZATIONS, AND

STATES 30 (1970).

104

Salil K. Mehra & Meng Yanbei, Against Antitrust Functionalism: Reconsidering China's Antimonopoly Law, 49

- 28 -

In corporate law, “voice” refers to the rights of shareholders in firms’ decision making, and “exit” denotes that the dissenting shareholder may exit corporate by appraisal, buyout or other mechanisms.105 Anglo-American countries tend to emphasize “voice”, but European regimes tend to emphasize “exit”.106 Such difference may cause different emphasis on the duty of director and litigation, and then affect the development of D&O insurance. This may explain the discrepant development of D&O insurance in the United States and Taiwan.

4.1.1.1.2 Ownership structure

The difference in the development of D&O insurance in Taiwan and the United States may be also caused by divergence of ownership structure. Generally, Anglo-American countries have dispersed ownership structure.107 In contrast, concentration of ownership in public companies is prevalent in East Asia, including Taiwan.108 In such circumstance,109 because firms is generally under the control of controlling shareholders, minor shareholders are less likely to file a litigation,110 and controlling shareholders have less incentive to lead a litigation against directors

who are nominated by themselves. This causes less popularity of shareholder litigation in Taiwan, and thus the incentive based on real demand to purchase D&O insurance is even less. Concentrated ownership structure provides explanation for limited litigation risk, and implies there may be reasons other than substantial demand for D&O insurance purchase in Taiwan. Also, cross shareholding between D&O insurer and insured may cause limited monitoring function of D&O insurance in Taiwan. For example, in 2010, Taiwan Life purchased D&O insurance from TLG Insurance, which is 100% invested by Taiwan Life Financial Group.111 In

105

Katharina Pistor et al., The Evolution of Corporate Law: A Cross-Country Comparison, 23U.PA.J.INT'L ECON. L. 791 (2002).

106

Janis Sarra, Corporate Governance in Global Capital Markets, Canadian and International Developments, 76 TUL.L.REV.1691,1721-23 (2002).

107

Anke Weber, An Empirical Analysis of the 2000 Corporate Tax Reform in Germany: Effects on Ownership and Control in Listed Companies, 29INT'L REV.L.&ECON.57, 57 (2009).

108

Wang & Pang, supra note 96, at83-84. Yu-Hsin Lin, Overseeing Controlling Shareholders: Do Independent

Directors Constrain Tunneling in Taiwan?, 12SAN DIEGO INT'L L.J.363, 368-69 (2011).

109

In addition, Rafael La Porta elaborates the competing ownership structure, dispersed and concentrated, and its correlation to investor protection. Rafael La Porta et al., Corporate Ownership around the World, 54J.FIN.471, 511 (1999).

110

Marco Ventoruzzo, Freeze-Outs: Transcontinental Analysis and Reform Proposals, 50VA.J.INT'L L.841, 882-83 (2010). George T. Washington, The Corporation Executive's Living Wage, 54HARV.L.REV.733, 763-64 (1941).

111

- 29 -

such case, it may be not easy to expect D&O insurer will exert monitoring function which is proposed in literature.

4.4.1.1.3 Burden of proof

In the United States, the “business judgment rule” is a limited presumption of correctness in corporate directors’ decisions.112 Unless corporate directors acted fraudulently, illegally, oppressively, or in bad faith, they are protected by the rule no matter how poor their business judgment is.113 Normally, the business judgment rule protects directors from shareholder suits for corporate losses.114 In contrast, plaintiffs have to collect evidence to overrule this rule to sue directors.

In the United States, because litigation is prevalent and almost all corporations have D&O liability insurance, a majority of suits are closed by settlement. For plaintiffs, the risk of wasting time and money serve as strong incentives for them to settle. Because defendants usually have D&O liability insurances, if plaintiffs choose to settle within the coverage, they can get compensation in a short time rather than spending more time in litigation. For plaintiffs’ attorneys, their primary concern is compensation,115 and not whether the case is settled or litigated. For corporations and directors, with the protection of insurance, they have no incentive to litigate or to decrease compensation. Settlement is a good way for them to get out of trouble. For insurers, they usually like to settle within coverage, rather than spend more time on litigation and suffer more uncertain outcomes.116 This also leads to the prevalence of litigation and D&O liability insurance.

However, there is nothing like the business judgment rule to balance liability of directors and corporate management in Taiwan. This causes the liability of directors to be more uncertain. In Taiwan, claims against directors or the responsible person117 of a corporation is based on Article

112 Aerospace Accessory Service, Inc. v. Abiseid, 943 So. 2d 866 (Fla. Dist. Ct. App. 3d Dist. 2006). 113 In re Bal Harbour Club, Inc., 316 F.3d 1192 (11th Cir. 2003).

114 William Scott Biel, Whistling past the Waste Site: Directors' and Officers' Personal Liability for Environmental

Decisions and the Role of Liability Insurance Coverage, 140 U.PA.L.REV.241, 247 (1991).

115 John C. Coffee, Reforming the Securities Class Action: An Essay on Deterrence and Its Implementation, 106

COLUM.L.REV.1534, 1581 (2006).

116 Bernard Black et al., Outside Director Liability, 58 S

TAN.L.REV. 1055, 1100-02 (2006).

117 In Taiwanese Company Law, “responsible persons” denotes shareholders conducting the business or representing