The Development Strategies for

Taiwan’s Semiconductor Industry

Pao-Long Chang and Chiung-Wen Hsu

Abstract— Taiwan’s integrated circuit (IC) industry develop-ment process can be separated into three stages: the initiation stage, consisting of obtaining technology and facilitating set-up of domestic companies; the burgeoning stage, consisting of the formation of manufacturer’s R&D abilities; and the growth stage, consisting of further raising an industry’s international competitive levels. In each stage this article examines the de-velopment strategy from the perspective of interactions among the government, research institute, and the domestic industry in terms of technology selection, R&D activities, technology transfer, and industry development results. Finally, factors underlying success, issues arising from the case, and suggestions for newly industrialized countries are discussed.

Index Terms— Government-supported R&D project, industry development strategy, industry technology research institute (ITRI), integrated circuit (IC), spinning-off new company, Taiwan, technology transfer.

I. INTRODUCTION

T

HE importance of industrial technology development to the competitiveness of high-tech industries has been widely recognized by government policy-makers. Many coun-tries provide incentives for induscoun-tries to invest in high-tech R&D activities in which the private sector underinvests or practices delayed investment. Underinvestment or delayed investment can reduce productivity and hence competitiveness in world markets. The response of most policy-makers to underinvestment or delayed investment is to support R&D in order to improve the development of industrial technology.The development of the high-tech industry in industrializing countries often takes advantage of low-cost labor, land, or raw materials. This makes the industrializing country a favorable choice for multinational enterprises wishing to set up overseas manufacturing sites or issue calls for the government to intro-duce high-tech industries established by foreign enterprises. Therefore, high-tech industries in industrializing countries are often guided by foreign investments, making for an other-dominated development system. As the industrializing country gradually evolves toward a newly industrialized country (NIC) status, it gradually loses its low-cost labor or land advantages. Thus, it must then move toward technology-intensive

indus-Manuscript received November 23, 1995; revised November 1996. Review of this manuscript was arranged by Guest Editors J. K. Liker and D. V. Gibson.

P.-L. Chang is with the Institute of Management Science, National Chiao Tung University, Taipei, Taiwan, R.O.C.

C.-W. Hsu is with the Industrial Technology Research Institute, Taiwan, R.O.C.

Publisher Item Identifier S 0018-9391(98)08045-3.

tries, and establishing self-reliant high-tech industries becomes an important issue.

High-tech development strategies have been widely dis-cussed in the literature [1], [3], [4], [9], [12], [13]. Most of these studies focus on industrialized countries whose high-tech industries have long histories and whose industrial devel-opment discussions therefore often center on competitive strategies. Most high-tech industries in those industrialized countries have possessed the ability or willingness to develop technology themselves. Therefore, in industrial technology development the main performer is the industry, and the strat-egy of developing technology may be divided into in-house development, technology cooperation (with academia, inter-or intranational industries, inter-or research institutes, finter-or example), and technology introduction. The role that government plays is being a sponsor to build a nice infrastructure to facilitate industries to conduct R&D activities. But the findings of these studies cannot necessarily be generalized to NIC industries that have yet to be fully established. Therefore, making the domestic industry possess industrial technology for developing high-tech industry is the first step for the government. From the government’s point of view, the strategies for NIC industries to possess the technologies are mainly: supporting the domes-tic industries to conduct technology development; supporting nonprofit research institutes to perform R&D activities and then transferring the research results to the domestic industry; and inducing the multinational enterprises for driving domestic high-tech industries’ development.

In Taiwan, the predominance of small- and medium-sized firms in the industrial structure of the country may be a hand-icap to developing high-tech sectors, especially where large R&D expenditures are required. At the same time, there are few academic institutions performing basic research. In order to build new high-tech industries or upgrade current indus-trial technologies, the government elects to support nonprofit applied-research institutes to develop industrial technology then transfer it to the domestic industry. The government supports nonprofit research institutes which act as a bridge between academia and industry. Those research institutes conduct the technology that is underinvestment or delayed investment by the industry, and they will influence the major local industry development. Sponsorship of nonprofit research institutes comes from R&D budgets supplied by the Ministry of Economic Affairs (MOEA) and contracted as projects to nonprofit research institutes, which then develop applied industrial technologies and transfer them to domestic industries for commercialization.

Taiwan’s integrated circuit (IC) industry is a successful ex-ample of a high-tech industry that made use of an MOEA R&D project. As Chang et al. [5] described in detail, in 1975 IC technology from the U.S.-based company RCA, strategically selected by the government, was introduced by the Industrial Technology Research Institute (ITRI) and then transferred to the private industrial sector, after being assimilated and improved, to initiate the IC industry. By 1990, Taiwan had produced a rough industry infrastructure for the IC industry including design, masking, fabrication, and assembly facilities. However, Taiwan’s IC industry had just been formed and had little R&D background. In order to upgrade the tech-nical ability of the IC industry, the government contracted with ITRI to perform a five-year (1990–1995) project aimed at development of submicron fabrication technology, with DRAM/SRAM products to be used as the primary vehicles for testing the feasibility of the fabrication technology [16]. The success of the submicron project makes Taiwan the 5th country in the world (following the United States, Japan, Germany, and Korea) able to independently develop 16Mb DRAM’s [7]. This also attracted a record (1994–1997) three-year investment of over NT $200 billion in 8-in memory-product-wafer IC manufacturing plants.

Due to the high risk, high investment, and high technology intensity of the IC industry, supporting Taiwan’s IC industry in increasing its competitiveness in world markets has become the main focus at present. This article examines Taiwan’s IC industry development strategy that is based on an industry development process by separating it into three stages: initia-tion, burgeoning, and growth. In each stage, the strategy that supports nonprofit research institutes to perform R&D activ-ities and transfer technology for technological development is discussed; this includes technology selection, technology development activities, and transfer to the domestic industries. Finally, it discusses the role of research institutes, specifically ITRI, in R&D and technology-transfer contributions to the entire development process of Taiwan’s IC industry. It also identifies those key factors during the development process as a reference for Taiwan and those similar industrial situations of other NIC’s in a developing high-tech industry.

II. THE INITIATION OF THE INDUSTRY

The initiation of Taiwan’s IC industry has been studied by the authors [5]. In order to describe the entire development process of the IC industry in Taiwan, this section presents a short overview. In the early 1970’s, Taiwan’s government and local and foreign scholars recognized that Taiwan, an island country with scant natural resources and a limited domestic market, should set up an export-oriented strategy for eco-nomic development and should develop high-tech industries to sustain economic growth. However, in the 1970’s it was anticipated that no existing industry in Taiwan could lead the way in developing future high-tech industries for more than ten years. In order for the domestic industry to gain the fundamental expertise required for high-tech development, the government had to assist in the initial development of high-tech industries.

The government hoped that the local electronics industry would develop in the direction of technology-intensive prod-ucts, and government advisors suggested developing IC design and manufacturing technology in order to stimulate innovation throughout the island’s electronics industry.

By the mid-1970’s, IC process technology in the United States had advanced to LSI (large scale integration), while in Taiwan, apart from a few IC assembly companies, only National Chiao Tung University had experience in operating a semiconductor laboratory for the fostering of engineering in this field. There was no other local experience with or knowledge of planning industrial technology for IC manu-facturing and design. After a consensus was achieved among representatives of industry, government, academia, overseas scholars, and expert consultants, the following decision was made: establish a technology advisory committee (TAC) to take responsibility for planning and introducing technology from abroad to quickly develop an industrial base. The job of executing the introduction, assimilation, and improvement was commissioned to ITRI.

Many types of IC technology were developed during the 1970’s. The members of the TAC discussed the technologies available and then decided to obtain low power, high-density technology that would provide submicron development po-tential. Due to the complementary metal-oxide semiconductor (CMOS) technology which possessed low power and high den-sity, CMOS was selected as the technology to be developed.

By the mid-1970’s, U.S. IC process technology had ad-vanced to the 3.0- m stage, but only 7.0- m technology was available for technology transfer. This was because in ad-vanced countries, 7.0- m technology was a mature industrial technology with the advantages of high consistency, complete technical documentation, a wealth of skilled technicians, and effective operating equipment, making it a suitable transfer technology for countries without prior experience such as Tai-wan. Also, as products manufactured with 7.0- m technology had already been introduced into the market, feedback was available concerning process technologies, product develop-ment and design technology, and marketing channels to help Taiwan learn about all aspects of IC technology, from R&D to commercialization.

In 1979, ITRI ended its government-supported IC technol-ogy development project and successfully introduced 7.0- m fabrication technology. For the next nine years, ITRI continued technology development by taking charge of the government’s two IC-technology development projects.

1) Between 1979 and 1983 NT $670 million was invested to upgrade from 7.0- m to 3.0- m technology. In the area of IC design technology, computer simulation pro-grams were introduced, as well as an ITRI-developed logic simulation program and an automated mask-design program to enhance the product design speed. Mask-ing technology was introduced and independent mask capability was developed.

2) Between 1983 and 1988 a total of NT $245 million was invested in upgrading process technology from the 3.0 m to the 1.0 m level. In addition, a very large scale integration (VLSI) laboratory was built. A

com-mon design center was promoted to diffuse application-specific integrated circuit (ASIC) design technology. Furthermore, optical masking capability was upgraded to incorporate electron-beam masking technology. ITRI also made use of every possible method of technology diffusion to transfer new technologies to industry for applica-tion. These methods included transferring technology, spinning off new companies, offering seminars, accepting design com-missions from manufacturers, training technical staff, sending newsletters, etc. The spin-off companies in particular prompted the establishment of related business corporations. The United Microelectronics Corporation (UMC) was the first IC manu-facturer established in Taiwan as a result of ITRI’s technology and technical staff-transfer program. In October 1979, UMC became the first company to apply to enter the Science-Based Industrial Park. UMC commenced pilot runs in April 1982 and had reached the break-even point by November 1982 [11].

In IC design, the Syntek Semiconductor Co., Ltd. was established by staff from the Digital Circuit Design Depart-ment of the Electronics Research and Service Organization (ERSO)/ITRI in 1982. Many other companies were also es-tablished in a similar way, such as Wel Trend Semiconductor Inc. and the Silicon Integrated Systems Corp. (SIS). In order to speed up the transfer of IC design technology, ITRI col-laborated with universities and colleges to foster IC design expertise and established a small-scale common design center. With the help of computer-aided design (CAD) software and circuit-design tools, the center trained industry personnel in the development and design of ASIC products using computer workstations to promote the development of Taiwan’s IC design industry [6].

Since the establishment of UMC in 1979, it remains the only domestic IC manufacturing firm in fabrication in Taiwan. In order to meet the production demands of the IC design indus-try, ITRI completed a VLSI laboratory via technology transfer activity in 1987 and spun off the Taiwan Semiconductor Man-ufacturing Company (TSMC), whose only goal was to provide foundry services to IC design companies. Around 150 techni-cal support personnel were transferred to TSMC from ITRI, and the VLSI laboratory was rented to TSMC as a foundry.

The establishment of TSMC, along with continuous in-vestment in IC design by local industry, resulted in the establishment of large numbers of ASIC design houses. By 1990, more than 56 IC design houses had been established. This resulted in a large demand for masking, thus the Industrial Technology Investment Corporation (established by ITRI in order to transfer ITRI’s technology to local industry) organized related industries to set up the Taiwan Mask Corporation (TMC) to transfer personnel, technology, and business from the mask operation originally owned by ERSO/ITRI. Thus Taiwan evolved from IC assembly operations in 1975 to development of a local IC industry consisting of IC fabrication, design, and mask companies by 1990.

III. THEBURGEONING OF THE INDUSTRY

Although by 1990 Taiwan’s IC technology had reached the 1.0- m level, companies in developed countries such as

the United States and Japan had already begun development of submicron technology by the end of the late 1980’s. If Taiwan did not upgrade its technology to submicron levels, it could soon expect to lose competitiveness, perhaps as early as 1995. Due to a lack of qualified personnel and insufficient financial resources on the part of local companies, none could single-handedly develop submicron technology. And obtaining submicron technology from other countries proved difficult, so the government decided to support upgrading the industry’s technical capabilities [16]. The following section discusses the strategy at this point of development from the following per-spectives: technology selection; industry involvement; R&D activities; technology transfer; and industrial development results.

A. Technology Selection

Taiwan’s semiconductor industry, with its weak private-sector R&D base, was not able to produce competitive DRAM/SRAM for PC’s and peripherals even by 1990. With 1.0- m technology and 256K DRAM products, there was little competitiveness. The only way for local manufacturers to get involved in the global DRAM/SRAM market was to acquire the submicron technology necessary for mass production of DRAM’s and SRAM’s. This was crucial for Taiwan’s information industry, since most RAM’s were supplied by Japan and Korea, whose information industries competed directly with Taiwan’s. Failure to develop RAM products would mean placing the Taiwanese information industry at the mercy of Japanese and Korean semiconductor suppliers. Such understanding by the government, research institutes, and the semiconductor industry enabled the continued growth of the Taiwanese semiconductor industry.

It was then decided that between 1990 and 1995 a total of NT $7 billion would be invested to develop submicron technology. The outline of the development project was as follows: development of submicron technology with estab-lishment of an 8-in wafer submicron lab; development of 0.5- m fabrication technology, with the establishment of 4-Mb SRAM and 16-Mb DRAM designs, testing, and preproduction capabilities; development of 0.35- m technology modules; establishment of complete micropollution control techniques; and finally, fostering of high-level technical expertise and developers to meet the needs of the semiconductor industry [16].

B. Industry Involvement

In 1990, when the government decided to support upgrading the industry’s technical capability to submicron levels and contracted with ITRI to carry out the submicron technology development project, there were altogether eight IC fabrication firms and 56 design firms in the private sector. ITRI had just completed the transfer of about 150 technical personnel to the newly established TSMC. The following question thus arose: how would ITRI be able to efficiently proceed with the devel-opment of submicron technology? ITRI’s upper management then decided that since most of the technical personnel had been shifted to private industry, and the purpose of ITRI’s

technology development was transfer to industry, there was no reason companies could not participate in ITRI develop-ment projects to avoid the manpower shortage problems. At the same time, this would also facilitate and speed up the technology transfer process. The question then became how to persuade companies to willingly send their most talented people to take part in this submicron project. This gave rise to the “Submicron Working Consortium.” The idea was that if companies submitted one-ninth of the total project budget, they would be able to receive the entire submicron technology transfer from ITRI. This made it certain that the industry would send their best people to ITRI in order to share in the technology transfer.

Six IC fabrication firms demonstrated interest in joining the project before it started, yet by 1990 when the project officially began, many firms refused to join due to the large, high-risk investment required, and also because rights to the transferred technology were not exclusive. To ensure that the project proceeded, the government included it in its own budget, while any money invested by participating firms had to be remitted entirely to the government. Thus problems involving individual firms would not impede the entire project. At the same time, it was expected that as the project progressed, the decreasing risk factor would attract other firms to participate when the advantages became more obvious.

In 1992, TSMC, UMC, and ITRI formed the Submicron Working Consortium. Each company was required to invest NT $129 million over five years and send technical personnel to directly join in ITRI’s R&D effort, for which each would receive a complete transfer of development results. Not long after, other companies gradually applied to join in the project. These included Mosel Vitelic Inc., Winbond Electronics Corp., Macronix International Co. Ltd., Holtek Microelectronics Inc., Etron Technology Inc., and First International Computer Co., Ltd. Besides receiving information from ITRI, these compa-nies could also ask ITRI to test-produce their own designs at additional cost.

C. R&D Activities

The first batch of 16-Mb 8-in wafer DRAM’s was suc-cessfully test-produced in the submicron lab by ITRI in April 1993. In the same year, 4-Mb SRAM’s were successfully test-produced [15]. During the implementation of the submicron project, the MOEA called upon 12 to 15 representatives from industry, the government, academia, and research institutes to form the “Submicron Advisory Committee,” which was chaired by ITRI’s chairman Chang. Each year, two to four meetings were held to provide advice and counseling on the goals, content, progress, and results of the submicron development project.

The submicron project was performed by ERSO/ITRI. ITRI was able to reach the goal in time by recruiting capable persons as project leaders, as well as completely commissioning all responsibilities of the ERSO director to the project leader. The project leader was able to concentrate all participants’ attention on the project goals, set precise milestones, and give incentives to participants to enhance team spirit by

continuous revision and timely modification of the project contents.

During the submicron project’s planning stage wafer size was set at 6 in. All required equipment was also devoted to produce 6-in wafers. Although IBM possessed 8-in wafer pro-duction technology, the equipment in use was modified from the original 6-in wafer production equipment. Thus, Taiwan naturally held 6-in wafers as the target for development. By the beginning of the second year of the project, with the Japanese IC equipment manufacturers ready to accept 8-in wafer production equipment purchase orders, the project leader applied to the committee for a change of target from 6-in to 8-in wafers. Since the primary concern was to develop fully competitive submicron technology by 1995, technologies developed by ITRI would still require technology transfers and investment for production-site buildups. Therefore, the industry might not be fully willing to accept a transfer of less up-to-date technology; besides, converting a completed submicron lab to 8-in wafer production would require a far greater investment than converting it at the current stage. With these considerations in mind, the committee agreed to shift the project goal to 8-in wafers, add an additional NT $1.2 billion to the current budget (making the total budget NT $7 billion), and extend the schedule by half a year. These changes were later approved by the MOEA.

The firms’ investments and participation in the submicron R&D process not only assisted the government in monitoring the implementation of the project, but also enabled the com-panies to obtain the newest technology developed by ITRI in the shortest possible time. Therefore, the project advanced and was completed on time.

D. Technology Transfer

At each stage of the implementation of the submicron project, ITRI worked to transfer all technical data to the firms in the Submicron Working Consortium in the shortest amount of time possible; even the most advanced 0.5- m fabrication technology was immediately transferred for use by firms, enabling UMC and TSMC, for example, to make use of ITRI technology transfers to develop 0.6- m fabrication technology. ITRI also provided design rules for DRAM and SRAM logic to design companies in the Submicron Working Consortium for advanced product designs such as 16-Mb DRAM’s and 4-Mb SRAM’s [14].

Meanwhile, the MOEA made use of the developed submi-cron fabrication technology and related purchased equipment and talents and targeted the much-needed key component—the DRAM—as the choice for assisting local firms to raise their competitive levels through production in the domestic private sector. Thus the MOEA used the submicron lab equipment, technology, and human resources in collaboration with private companies to form professional production companies devoted to DRAM’s. This was carried out in the form of a solid plan to apply submicron fabrication technology, commencing with the selection of suitable private corporations to participate in the plan. The spin-off of a new company from the submicron project was done in the most open and fair manner—by

publicly seeking investment partners. The open bidding at-tracted 13 local companies, headed by TSMC in September 1994. These 13 companies included suppliers, at various levels of the information and electronics industries, as well as funding institutions. The new company was named Vanguard International Semiconductor Corp. (VISC), and its primary goal was the production of DRAM’s. Initial capitalization was NT $18 billion. The MOEA, possessing the submicron lab, equipment, and technology, took 32% of the company stock right away, making this the fastest return on investment ever among MOEA R&D projects. ITRI completed the transfer by the end of 1994 and transferred a total of 330 people to VISC. E. Industry Development Results

Although DRAM’s are key components in computer man-ufacture, exceeded in importance only by microprocessors, large investment requirements, technology-intensive nature, and variable market factors restrained the Taiwanese semi-conductor industry from making decisive moves to become involved in this market. Apart from Mosel Vitelic, which began producing 6-in wafer DRAM’s in 1991, by 1993 locally supplied DRAM’s still accounted for less than 6% of the total used. By the end of 1991, Texas Instruments-Acer Inc., a company founded as the result of collaboration between Texas Instruments and Acer, started production. The resulting products were entirely marketed by Texas Instruments. Even so, most local manufacturers avoided the rough battle expected in the DRAM market. Due to the successful establishment of Taiwan’s first 8-in wafer submicron lab, the semiconductor industry grew ever more confident of being able to establish 8-in wafer facilities. In addition, the experience from previous efforts at wafer facility establishment allowed reduced timing in further buildup of production sites. Currently TSMC, UMC, Mosel Vitelic Inc., Macronix International Co., Ltd., Chia Hsin Livestock Co., Ltd., Nan Ya Plastics Corp., Umax Data System Inc., and Texas Instruments-Acer Inc. have already established or are in the process of planning for the establishment of 8-in wafer production sites. These are all expected to begin operation by 1997. The total investment capital involved is approximately NT $231 billion.

IV. FUTURETECHNOLOGY DEVELOPMENT

How Taiwan’s government should proceed with the next step in IC technology development is still under discussion. Some believe that developing the IC industry is a never-ending process and the government must continue supporting development of next-generation technology; others believe that after 20 years of development, Taiwan’s semiconductor indus-try has acquired the capability to independently obtain new technologies. However, as the semiconductor industry is risky, costly, and technical, it makes the large investments local manufacturers have put into R&D efforts seem insignificant in the international arena. Additionally, each industrialized country gives various forms of aid to its own semiconductor industry to increase competitive levels. For example, in 1987 the U.S. federal government aided in the establishment of semiconductor manufacturing technology (SEMATECH) to

ensure U.S. leadership in the world semiconductor industry [9]; in 1989, semiconductor industries in countries in Europe financed the formation of the Joint European Submicron Silicon (JESSI) project so that they would not have to depend on the United States and Japan for semiconductor technologies [3], [17].

Semiconductor technology development will evolve into a more advanced and more costly high-end technology, beyond the ability of a single company or companies in a single country to carry through entire projects alone; in fact, it is evolving into a form of strategic international alliance [2], [8], [10]. Upcoming efforts to strengthen the competitiveness of Taiwan’s semiconductor industry require the industry to become involved in the production of wafer-material, de-signs, wafer fabrication, packaging, testing, as well as the related chemical and industrial-gas technologies that form a complete industrial structure. At the same time, Taiwan’s National Science Council is also planning the development of collateral and support industries for IC development, such as collaborative efforts between universities and colleges and industry to conduct research into semiconductor fabrication equipment beginning in 1997. The purpose is to build up a complete development environment for the IC industry. In adopting MOEA’s R&D project mechanism, the government, ITRI, and industry have come to a consensus which calls for ITRI to gather resources from industry through consortia and use available lab facilities to support advanced fabrication-module development and integration of parts fabrication. For example, ITRI formed the Deep Submicron Consortium among local manufacturers, and together they developed 0.25–0.16 m-level technology, then transferred the results to industry. Apart from diffusion of technical data, collaborative efforts between ITRI and specific manufacturers to develop specific products and the licensing of patents will be the major forms of technology transfer.

V. THE ROLE OF RESEARCH INSTITUTES

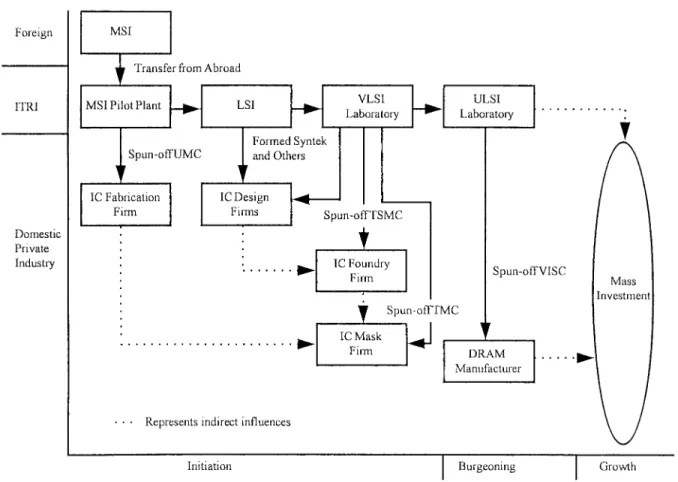

Taiwan’s IC industry, under government supervision, has gradually developed from rough, undeveloped beginnings into the flourishing industry it is today. Throughout this develop-ment process, ITRI has been involved in the planning and performing of R&D activities and the technology transfers to the IC industry (see Fig. 1). In each of these three stages (the initiation stage, consisting of obtaining technology and facilitating setting up domestic companies; the burgeoning stage, consisting of formation of manufacturers’ R&D abilities; and the growth stage, consisting of further raising industry’s international competitive levels) the roles of ITRI were some-what different from one another.

In the initiation stage, ITRI transferred the technology from abroad then assimilated and processed it through in-house R&D activities. After it came into full possession of the technology, ITRI spun off new companies and transferred relevant technology and technical staff to industry, so that companies existed to conduct manufacturing and marketing activities. This initiated the rough outlines of an industry.

Fig. 1. The Taiwan IC industry development process.

In order for Taiwan’s semiconductor companies to become more or less self-sufficient in R&D activities, research in-stitutes, industry, and the government collaborated to select much-in-demand DRAM key technologies—the submicron fabrication technology—to be developed by ITRI under gov-ernment sponsorship. Industry also invested funds and sent personnel to participate in the R&D activity to speed up technology transfer timeliness and efficiency. Thus, ITRI was able to periodically produce technical data or receive con-tracts from private businesses for developing specific product technologies throughout the entire project life cycle in such a manner that the technology transfer was complete. It was also supposed that at the end of a project a spun-off new company would be formed to accept the transfer of DRAM/SRAM technologies and specialize in DRAM production so that Taiwan’s semiconductor technology could be upgraded from VLSI to the ultralarge-sized IC (ULSI) technology level. At the same time, investment in DRAM was encouraged to expand Taiwan’s semiconductor industry into the domain of RAM development.

As businesses begin to gain the ability to do independent R&D, industry must take control of technology development and do their own R&D. Since new technologies are developed at rather rapid rates in high-tech industries, R&D activities conducted by independent businesses often do not achieve the most efficient results. Collaborative R&D efforts aimed at technologies of common interest can achieve the same R&D results at only a fraction of the total investment cost per

com-pany. To promote collaborative R&D efforts among businesses and to increase overall competitiveness, the government may support the development of commonly required technologies. Industry and ITRI will jointly select technologies that are up to date with those under development in industrialized countries and jointly develop the chosen technologies. ITRI will also transfer these technologies via technical data diffusion or co-development of specific products with various companies. It is expected that companies will gain efficiency and in turn increase Taiwan’s industrial competitiveness in international markets.

VI. DISCUSSION

This section discusses strategies for government support of nonprofit research institutes that conduct R&D activities and transfer technology to domestic industry. The information here provided is intended to serve as a reference for Taiwan and other NIC’s presently developing their high-tech industries. Three aspects are considered: factors underlying success; issues arising from this case; and suggestions for NIC’s. A. Factors Underlying Success

As this case study shows, Taiwan’s IC industry was success-fully developed over a 20-year period. Several factors have made the IC industry successful, most important of which has been the government’s strategy in supporting ITRI to develop IC technology and to transfer relevant research results

to the private sector, thus commercializing the products. Since Taiwan’s industry is dominated by small- and medium-sized firms, most companies are unable to afford expensive high-tech research.

Besides government support for ITRI, other factors have contributed to the successful development of the IC industry in Taiwan. First, the government and ITRI chose appropriate “vehicle products,” such as the 16-Mb DRAM, to develop submicron fabrication technology, to test the technology’s feasibility, and to establish marketing potential. It is clear that once a market is captured, related private sector industries can survive and can grow step by step.

Second, the research project leaders themselves were in-strumental in overcoming obstacles. During the initial stages of the project, local professors and experts thought that Taiwan did not have the capacity to develop in such high-tech areas as the IC industry; there was much criticism and a great deal of pressure. However, these pressures forced the research project participants to focus on specific problems and thus contributed to making the research successful. Third, ITRI adopted the “spin-off” method to allow the successful transfer of technology and talent to industry.

Finally, the government provided incentives to promote private sector investment in the IC industry. For example, the government established the Hsin-Chu Science-Based Industrial Park and the electronic technology training program of Chiao Tung University. Moreover, overseas Chinese experts in elec-tronics technology were recruited, a strategic investment loan and tax benefit package was developed, and a channel was established to transfer the technology from abroad.

B. Issues Arising from This Case

The government supported ITRI’s plan to introduce 7.0- m technology, then to upgrade to 3.0- m, then 1.0- m, and finally to in-house development of 0.5- m fabrication tech-nology. In terms of efficiency, although Taiwan’s IC industry has been established successfully, whether government support could have been reduced or whether Taiwan’s IC industry could have been developed more successfully are interesting questions for discussion. However, this case study mainly focuses on examining the development strategies of the gov-ernment’s support rather than evaluating the performance efficiency of that support. Nonetheless, two issues need to be considered.

First, Taiwan’s IC industry investment in R&D activities is insufficient; this may be because the government didn’t push the industry to devote itself to R&D activities. But although local industries are now dependent on government support for the development and transfer of technology, this pattern seems to be changing. For instance, in 1990 the government sup-ported ITRI to develop submicron technology and requested participating industries to share the R&D expenses. Although this approach has been embraced by local industry, it seems clear that more could have been done earlier, especially with those industries that devote relatively greater profits to R&D activities.

Second, although Taiwan has been developing its IC indus-try since 1976, it was not until 1990 that our industries began

to manufacture high value-added memory products such as DRAM/SRAM. The main reasons for this are that Taiwan’s IC industrial technology development started later than developed countries such as the United States and Japan, and because the scale of Taiwan’s R&D expenditure is proportionately very small. Even today, R&D investment is quite low. For example, in 1994 total R&D expenditure in Taiwan was about U.S. $4371 million, which is approximately 2.53% of U.S. R&D expenditure. Since the scale of R&D in Taiwan is very small, one of the most pressing issues related to high-tech development is how to focus on special technologies and leverage R&D benefits.

C. Suggestions for NIC’s

When most of a country’s industries are small- and medium-sized firms that lack big enterprises or foundations to support R&D works, R&D expense is usually insufficient. Moreover, the research results of academia are often difficult to link with industrial production. Under such conditions, one feasible technology development strategy is for government to support nonprofit research institutes to develop technologies, and then to transfer the results to local industry.

Nowadays, the life cycles of technologies are shorter than in the past, the costs of developing new technologies are higher, and the risks associated with technology development are far greater. To function in this new environment, many countries are increasingly turning to international technology coopera-tion and/or consortia as a means of increasing opportunities for research and development.

Moreover, multinational enterprises have also changed their operation strategies; they have begun to establish research laboratories abroad. These and other changes necessitate new developmental strategies, including support for nonprofit re-search institutes that cooperate with foreign multinational enterprises to accelerate technology development. It is also imperative that governments share the risks associated with technology development.

After all, if the decision-makers of a NIC’s government wish to root technology domestically, they must necessarily support nonprofit research institutes that conduct R&D activities and transfer the results to the industries.

VII. CONCLUSION

After 20 years of development, Taiwan’s semiconductor industry has become Taiwan’s principal high-tech industry. With assistance and investment from the government and development and transfer of technology by nonprofit research institutes in the early stages, the structure of an IC fabrication, design, and masking industry was gradually established until it expanded into the RAM domain. This encouraged industry to join in the manufacturing of wafer materials and talent from academia to train and participate in R&D of semiconductor manufacturing equipment. All of this demonstrates the roles of government, research institutes, and industry in the initiation, burgeoning, and growth stages when a newly industrialized country such Taiwan is establishing high-tech industrial de-velopment strategies. As the industry grows, what government

can do is create a favorable environment, while technical issues can be guided by industry, and research institutes can facilitate technical collaboration between companies to maintain efficiency in R&D activities. As the industry grows stronger, it will be up to the schools to train people so they possess the capabilities to participate in basic research.

REFERENCES

[1] H. E. Aldrich and T. Sasaki, “R&D consortia in the United States and Japan,” Res. Policy, vol. 24, pp. 301–316, Mar. 1995.

[2] J. A. Alic, “Cooperation in R&D,” Technovation, vol. 10, no. 5, pp. 319–332, 1990.

[3] W. R. Boulton, M. J. Dowling, and J. Lohmeyer, “Technology develop-ment strategies in Japan, Europe and the United States,” Technovation, vol. 12, no. 2, pp. 99–118, 1992.

[4] M. J. Breheny and R. McQuaid, Eds., The Development of High

Technology Industries: An International Survey. New York: Croom Helm, 1987.

[5] P. L. Chang, C. T. Shih, and C. W. Hsu, “The formation process of Taiwan’s IC industry-method of technology,” Technovation, vol. 14, no. 3, pp. 161–171, 1994.

[6] , “Taiwan’s approach to technological change: The case of integrated circuit design,” Technol. Anal. Strategic Manage., vol. 5, no. 2, pp. 173–177, 1993.

[7] Electronics Research & Service Organization, Year-Book of Taiwan’s

Semiconductor Industry (in Chinese). Hsinchu, Taiwan: Industrial Technology Research Institute, 1994.

[8] V. P. George, “Globalization through interfirm cooperation: techno-logical anchors and temporal nature of alliances across geographical boundaries,” Int. J. Technol. Manage., vol. 10, no. 1, pp. 131–145, 1995. [9] J. E. Gover, “Strengthening the competitiveness of U.S.

microelectron-ics,” IEEE Trans. Eng. Manag., vol. 40, pp. 3–13, Feb. 1993. [10] J. R. Howells, “Going global: The use of ICT networks in research and

development,” Res. Policy, vol. 24, pp. 169–184, Mar. 1995. [11] Industrial Economics Research Center, The Impact of Government’s

Research Projects on Taiwan’s Semiconductor Industry (in Chinese).

Hsinchu, Taiwan: Industrial Technology Research Institute, 1987. [12] P. M. S. Jones, “Cost benefit and public policy issues,” R&D Manage.,

vol. 19, no. 2, pp. 127–134, 1989.

[13] D. E. Kash and R. W. Rycroft, “U.S. federal government R&D and commercialization: You can’t get there from here,” R&D Manage., vol. 25, no. 1, pp. 71–89, 1995.

[14] Industrial Technology Research Institute, “The Annual Report of Indus-trial Technology Research Institute,” Hsinchu, Taiwan, 1994. [15] Industrial Technology Research Institute, “The Executing Report of

Sub-micron Fabrication Technology Development Project,” Hsinchu, Taiwan, 1994.

[16] Industrial Technology Research Institute, “The Plan of Sub-micron Fabrication Technology Development Project,” Hsinchu, Taiwan, 1990. [17] T. A. Watkins, “A technological communications costs model of R&D consortia as public policy,” Res. Policy, vol. 20, pp. 87–107, Jan. 1991.

Pao-Long Chang was born in Taiwan in 1949. He received the Bachelor’s degree in mathematics in 1971 from Fu Jen University, Taiwan, and the Ph.D. degree from the University of Washington, Seattle, in 1980.

He is presently a Professor at the Institute of Management Science, and he is Dean of the College of Management at National Chiao Tung University, Taipei, Taiwan. His research focuses on technology management, quality management, and operations research. His published work has appeared in the

Journal of the Operational Research Society, Quality Engineering, Total Quality Management, Technovation, International Journal of Technology Man-agement, and Technology Analysis and Strategic ManMan-agement, among others.

Chiung-Wen Hsu was born in Taiwan in 1959. She received the Bachelor’s degree in industrial management from the National Taiwan Institute of Technology in 1983, the M.S. degree in manage-ment science from National Chiao Tung University, Taipei, Taiwan, in 1985, and the Ph.D. degree in 1994, also from National Chiao Tung University.

In 1985 she joined the Industrial Technology Research Institute’s Offices of Planning, Hsinchu, Taiwan, where she currently works as a Researcher. Most of her research had been in the area of technology transfers and project management.