Discovering Important Factors of Firm Value by Association Rules

Yu-Hsin Lu

1*, Chih-Fong Tsai

2, David C. Yen

31

Department of Accounting and Information Technology National Chung Cheng University Taiwan, ROC

*

+886-5-2720411#24506 lomahsin@gmail.com

2

Department of Information Management National Central University Taiwan, ROC

3

Department of Decision Sciences and Management Information Systems Miami University Oxford, Ohio 45056 USA

Abstract

It is very important for investors to understand the critical factors affecting the value of firms before making investments. In knowledge-based economy, the method for creating firm value transfers from traditional physical assets to intangible knowledge.

As intangible assets value is an important part of firm value, valuation of intangible assets becomes a widespread topic of interest in the future of economy.

This paper applies association rules, one data mining technique, to discover critical factors affecting firm value in Taiwan and to provide a more flexible model than the traditional regression method. The results indicate that R&D intensity, family, participation in management, pyramids, profitability, and dividend are the important factors, in which some are consistent with significant important variables in prior literature, but most of them are unique for Taiwan, one emerging economy.

Keywords: Firm value; intangible assets value;

Tobin’s Q; data mining; association rules

1. Introduction

The market value of a firm's shares ultimately reflects the value of all its net assets. In the industrial era, physical assets, such as land, capital, and labor are critical factors to judge a firm’s value. However, in recent years, the internet lets the knowledge-based economy era evolve and makes the value of the knowledge industry to increase rapidly. Organization for Economic Co-operation and Development (OECD) (2004) indicate that knowledge economy is possession, distribution, production, and use of knowledge as a critical resource in economics.

Therefore, the important successful factors for companies are the capability and the efficiency in creation, expansion, and application of knowledge (Kessels, 2001).

The method for creating firm value transfers

from traditional physical production factors to intangible knowledge. In this situation, a large part of a firm's value may reflect its intangible assets. Not only consider the tangible assets, but also respect the power of intangible assets (i.e. the difference between the market value and book value of a company) when we evaluate a firm’s value. (Chan et al., 2001;

Eckstein, 2004)

Intangible assets are firm’s dynamic capability created by core competence and knowledge resource, including organization structure, employment expert skills, employment centripetal force, R&D innovation capability, customer size, famous brand, and market share. Many researchers (Edvinsson and Malon, 1997;

Stewart, 1998; Bukh et al., 2001) indicate that intangible assets also can be represented by intellectual capital (IC) of a company and focus on the measurements and components of IC which are human capital, structure capital, etc. in some specific industry. Other studies (Wiwattanakantang, 2001;

Lang et al., 2003; Fukui and Ushijima, 2007) investigate various types of impact factors in intangible assets value. However, research to date provides mixed evidence on the various factors affecting the firm value.

Different studies, focusing on different domain problems, discover different factors that affect a firms’ value. This paper reviews related literature from diverse domains including accounting, finance, management, and marketing to understand six categories impact factors of firm value and use Association Rule (AR) (Sánchez et al., 2008) one of the data mining techniques to discover related factors for evaluating the value of firms in Taiwan. This is because there is not a deep understanding of what factors affect a firms’ value in Taiwan. In related work, the regression models usually assume that the relationship between dependent variables and independent variables are linear. In order to get deeper insight of firm value, this paper employs

association rules, one data mining technique, to explore the relationship between firm value and other critical factors with no linear assumption.

Because of less regulations and disclosure in intangible capital, the financial reporting cannot reflect intangible assets value. The problem with the traditional financial accounting framework is that reporting lacks the recognition of intangible capital value and creates an information gap between insiders and outsiders. (Vergauwen et al., 2007) Therefore, we expect that the empirical results can provide other information for investors or creditors when they evaluate the investment opportunities or loans.

The remainder of the paper is organized as follow. Section 2reviews the literature about firm value and related to various impact factors. Section 3 describes the research methodology, and Section 4 presents the experimental results and discussion.

Finally, a conclusion is provided in Section 5.

2. Literature Review 2.1 Firm value

With the arrival of knowledge-based economy era, the implementation and the application of knowledge and information technology have become the most crucial issues and competitive advantages of every organization. The primary method for creating firm value is based on transferring from traditional physical production-factors to intangible knowledge (Roos and Roos, 1997; Eckstein, 2004).

Intangible assets are firm’s dynamic capability created by core competencies and knowledge resources, including organization structure, employment expert skills, employment centripetal force, R&D innovation capability, customer size, brand recognition, and market share. It represents the future growth opportunities and profitability toward firm value. Therefore, when we evaluate a firm’s value, we not only consider the tangible assets, but also respect the power of intangible assets (Chan et al., 2001; Eckstein, 2004).

2.2 The impact factors of firm value 2.2.1 Intangible capital

Many empirical models (Rao et al., 2004; Black et al. 2006; Gleason and Klock, 2006; Fukui and Ushijima, 2007) use the firm value as a forward-looking performance measure. This value represents the market’s valuation of the expected future stream of profits which are based on an assessment of the return that can be generated from a firm’s tangible and intangible assets. Therefore, any intangible investment increases firm’s value in the same fashion that tangible assets increase value (Choi et al., 2000). R&D and advertising expenses are viewed as investments which can increase a firm’s intangible assets with predictably positive effects on future cash flow and firm value (Gleason and Klock, 2006; Xu, 2009). Each of them, over the past few

decades, has had a strong impact on the relationship between firm performance and intangible capital stocks (Klock and Megna, 2000; Gleason and Klock, 2006; Fukui and Ushijima, 2007) although the direction are not always consistent with the expected direction.

2.2.2 Ownership structure

Unlike the companies in some developed countries (e.g. US, UK, and Japan), the firms in emerging countries including Taiwan are under single common administrative and financial control of few wealthy old families and their ownership is concentrated on family members (i.e. controlling shareholders) (La Porta et al., 1999). Recently, many studies (Claessens et al., 2002; La Porta et al. 2002) indicate that the voting rights of controlling shareholders are high or higher than their cash flow rights; hence, controlling shareholders could extract wealth from the firm, but only bear a little cost with holding low cash flow rights.

One way to mitigate the problem of controlling shareholder entrenchment is to increase the controlling shareholder’s cash flow capability (Fan and Wong, 2005). Higher cash flow right in the firm means that it will cost more to reduce the value of the corporation and entrench the minority shareholders’

benefit. It accrues an alignment effect, which lets the agency conflict between controlling shareholder and minority shareholders minimize, and then firm value increases (Claessens et al., 2002; La Porta et al.

2002).

In business groups, the situation of entrenchment is more serious (Morck and Yeung, 2003; Silva, et al. 2006) because of pyramid ownership structure, different kinds of stocks, and cross-shareholdings. By such structures, they make the gap between voting rights and cash flow rights larger and the incentive of entrenchment stronger, and then the value of firm decreases (Wiwattanakantang, 2001).

2.2.3 Corporate governance

When the agency problem arises in companies, which can affects firm value; corporate governance may play an important role (Lins, 2003). These monitoring mechanisms are usually based on the board of directors (Xie et al., 2003). Because boards are charged with monitoring management to protect shareholders’ interests, they avoid firm value being entrenched. Especially, the empirical evidence on the efficacy of the monitoring that outsiders provide (proxy for board independence) appears in many studies (Oxelheim and Randoy, 2003; Xie et al., 2003).

Otherwise, large shareholders or institutional shareholders are other general monitoring mechanisms. Jung and Kwon (2002) and Lins (2003) show that institutions, external, or large non-management shareholder are incentivized to monitor their management and protect their assets.

Wiwattanakantang (2001) indicates that firms with

more than one controlling shareholder have higher return on assets by monitoring each other to reduce agency cost, related to firms with no controlling shareholder.

Oxelheim and Randoy (2003) suggest that foreign exchange listing signals a firm’s commitment to the higher disclosure standards prevailing in the market in which it lists. Board representatives for large foreign shareholders are presumably

‘‘outsiders’’ who will not use their influence as board members to obtain benefits that do not accrue to other shareholders (Stulz, 1999). No matter ranking on the list in foreign exchange or foreign shareholders entry as owners, both of them will be expected to increase the value of the firm.

2.2.4 Firm characteristics

A firm’s value may be affected directly or indirectly by factors related to the nature of the firm (Galbreath and Galvin, 2008). Sales growth is a proxy for growth opportunities which increase firm value, but the firm size is likely to be inversely related to expected growth opportunities (Gleason and Klock, 2006; Fukui and Ushijima, 2007). Rao et al. (2004) find that firms with higher growth opportunities have lower leverage. However, previous research (e.g. McConnell and Servaes, 1990) shows that firms with higher leverage can enjoy a tax benefit because they can deduct the interest costs, which results in greater cash flow and thus a positive relationship with firm value. Capital intensity also affects firm value, because it is a proxy for investment opportunities (Trout, 1979). Allayannis and Weston (2001) indicate that if management forgoes investment projects as they are not able to obtain the necessary financing, the firm’s Tobin’s Q ratio may remain high since they undertake only positive net present value (NPV) projects. If a firm pays a dividend, it is less likely to be capital constrained and may thus have a lower Q.

In general, a profitable firm triggers expectations among investors of higher cash flow potential and drives intangible value. Furthermore, there are evidences that higher intangible values are significantly associated with higher profitability (Allayannis and Westom, 2001; Rao et al., 2004).

Older firms have better disclosure, more liquid trading, more attention from analysts, and more diversified activities leading to lower risk of financial distress and then higher firm value. However, younger firms may have more growth opportunities and likely be faster growing and perhaps more intangible asset intensive (Black et al., 2006).

Diversification leads to lower risk of financial crisis and higher firm value. However, Allayannis and Westom (2001) indicate that industrial diversification is an outgrowth of agency problem between managers and shareholders, thus reducing value.

Internationalization theory notes that foreign direct investment occurs when a firm can increase its value by internationalizing markets form some of its

intangible assets, such as production skills or consumer goodwill. On the other hand, Allayannis and Westom (2001) find that multi-nationality is positively related to firm value.

2.2.5 Industry characteristic

The degree of industry concentration should affect the firm’s relative bargaining power. When an industry is fragmented and concentration is low, the degree of competition in the industry is likely to be more intense and the firm’s bargaining power is decreased. Therefore, prior research indicates that higher concentration can provide more market power which can lead to a higher firm value (Anderson et al., 2004). On the other hand, many literatures argue that a higher firm value reflects better market efficiency rather than market power. The effect of the concentration index on firm value is negative (Rao et al., 2004).

For the traditional manufacturing industry, land, capital, and labor are critical factors to judge a firm’s value. However, in the knowledge-intensive industry (e.g. high-technology industry) knowledge and innovation are the dominating resources and are far more important than physical assets (Tseng and Goo, 2005). Therefore, intangible assets determine a large part of a firm's value. Klock and Megna (2000) show that the market value is about ten times higher than book value. But in traditional industries, most firms’

Tobin’s Q is nearly equal to one or less than one.

Firm value varies by industry.

2.2.6 Reactions of analysts and customers

Lang et al., (2003) indicate that more analysts follow means that more information is available, the firm’s information environment is better, and the cost of capital is reduced. Analysts are one of outside users of financial statements and own professional domain knowledge; therefore, improving firm value by increasing the cash flows that accrues to shareholders (Lang et al., 2003). However, the link for analyst to follow and the value is not necessarily positive. For example, if analysts primarily gather private information, their activities could actually increase cost of capital by raising transactions costs and discouraging uninformed investors from purchasing shares (Diamond and Verrecchia, 1991).

Although such an effect on valuation might be offset by an increase in investor interest, reduced uncertainty, and reduced agency conflicts within firms, the relation between analyst following and valuation is not clear.

In marketing theory, a firm’s market share within its industry may react to customer satisfaction, bring profitability, and thus affect firm value. Black et al. (2006) and Morgan and Rego (2009) show that market share is positively related to Tobin’s Q proxy for firm value.

Regarding related literature from diverse domains including accounting, finance, management, and marketing, the above six categories as the impact factors of firm value are classified and discussed.

Different domain problems only focus on some of these impact factors. Therefore, this paper is the first study which aims at collecting related factors affecting firm values of Taiwan.

3. Methodology 3.1 Association rule

The association rule (AR) is a well-known data mining technique; also know as knowledge discovery in databases. The aim of data mining is to discover useful information or patterns in large databases containing thousands to millions of records, where conventional statistical analysis is not feasible (Berry and Linoff, 1997; Roiger and Geatz, 2003). AR is usually adopted to discover variables relationships in database, and each relationship (also known as an association rule) may contain two or more variables.

These relationships are found by analyzing the co-occurrences of variables in the database. Therefore, an association rule may be interpreted that when the variable A (i.e. antecedent) occurs in a database, the variable B (i.e. consequent) also occurs and is defined as an implication of the form A => B.

In addition, two measures are generally used to decide the usefulness of an association rule: support and confidence. Support measures how frequently an association rule occurs in the entire set, and confidence measures the reliability of a rule. In AR, rules are selected only if they satisfy both a minimum support and a minimum confidence threshold (Goh and Ang, 2007).

In the firm value literature, the regression model as the conventional method is generally used for empirical investigations (Lang et al., 2003;

Anderson et al., 2004; Black et al., 2006; Fukui and Ushijima 2007). Unlike the regression model, AR is a non-parametric model without linear relationship assumption and pre-defined relationships between dependent variables and independent variables.

Therefore, it is more flexible in model specification.

This paper considers using AR to find out the affecting factors of firm value especially for firms in Taiwan as the emerging market.

3.2 Variables measurement 3.2.1 Firm value -Tobin’s Q

According to prior literature, this paper uses Tobin's Q as a proxy for firm value. Tobin's Q is widely used as a measure of firm value in academic literature (La Porta et al., 2002; Lins, 2003; Fukui and Ushijima, 2007). Tobin’s Q means the differences between the market value of the firm and the replacement cost of the tangible assets represents the value of intangible assets. In other words, a firm that creates a market value that is greater than the replacement cost of its assets is perceived as using its resources, which is knowledge especially, more effectively (Anderson et al., 2004).

The construction of the Tobin’s Q involves more complicated issues and choices. The standard

definition Q is the market value of all financial claims on the firm divided by the replacement cost of assets (Tobin, 1969). There are practical problems associated with implementing this definition because neither of these variables are observable. This paper use a modified approach adopted by Gleason and Klock (2006) as a proxy for Q.

When the Q ratio of firm is more than one, it represents that firm value is greater than the book value of its assets. Hall (2001) and Anderson et al.

(2004) indicate that this excess value is due to intangible assets. In this paper, the Q is a dummy variable, taking the value of 1 if the Q ratio is more than 1, otherwise it is 0.

3.2.2 Antecedent variables

According to prior related literature, this paper uses R&D intensity and advertising intensity to proxy intangible capital. R&D intensity is measured by research and development expenditures to total assets, and advertising intensity is measured by advertising expenditures to total assets.

In ownership structure variables, this study is similar to Wiwattanakantang, (2001) by using three types of controlling shareholders: family, government, and foreign investor which are dummy variables, indicating if the firm has a controlling shareholder who is an individual, government, and a foreign investor, respectively. On the other hand, ownership structure variables include cash flow right measured by the cash flow right of controlling shareholders, divergence measured by using voting rights of controlling shareholders minus cash flow rights; the participation in management dummy variable, indicating if the controlling shareholder and his family are present among management;

nonparticipation in management is set equal to 1 if controlling shareholders are not management;

management owners measured by cash flow rights of controlling shareholders who are also management;

the pyramids dummy variable, indicating if there exists pyramids ownership structure and/or cross-shareholdings, and business group dummy variable, taking the value of 1 if the firm belongs to one of the 100 largest business groups in Taiwan (Claessens et al., 2002; La Porta et al., 2002; Lins, 2003; Black et al., 2006).

In corporate governance variables, this paper uses board size measured by the number of directors on the board; board independence measured by the percentage of independent outsider directors;

blockholder, a dummy variable is defined that if the percentage of shares of the second largest shareholder is more than 5% adapted by Jung and Kwon (2002) that the variable is 1, otherwise is 0; the multi control dummy variable, if the firm has more than one controlling shareholder as proxy for corporate governance mechanisms. This paper uses more than 10% voting right hold by shareholder to determine if company exist controlling shareholder including one or more than one (La Porta et al., 1999). Because of

the data about the detail information of foreign shareholders is unavailable in Taiwan, we just involve a list in foreign exchange as the research variables. foreign listing is a dummy (value 1 for foreign listing, 0, otherwise) used to identify firms that are listed or traded on one or more foreign exchanges, such as NYSE, NASDAQ, USA OTC(ADRs).

About firm characteristics variables, sale growth measured by growth rate in sales size measured by log total assets. We use the ratio of total debt to total assets of the firm as a measure of leverage. In this paper, fixed capital (i.e. property plant and equipment) to total sales ratio is the measure of capital intensity. According to Allayannis and Weston (2001), we use a dividend dummy, which equals 1 if the firm paid a dividend in the current year to proxy for the ability to access markets. We calculate profitability as the ratio of net income to total assets. We use the years since establishment as a measurement of age. Diversification is measured by the number of subsidiary companies. We use the ratio of export sales to total sales as a continuous measure of multi-nationality in the paper, and export to name it.

In industry characteristics variables, we measured concentration using the herfindahl–hirschman index (hhi), which is the sum of the squared market shares of the firms in the industry (Anderson et al., 2004; Rao et al., 2004).

Industry is a dummy variable for four-digit industries or two-digit industries traded on Taiwan stock exchange or gretai securities market.

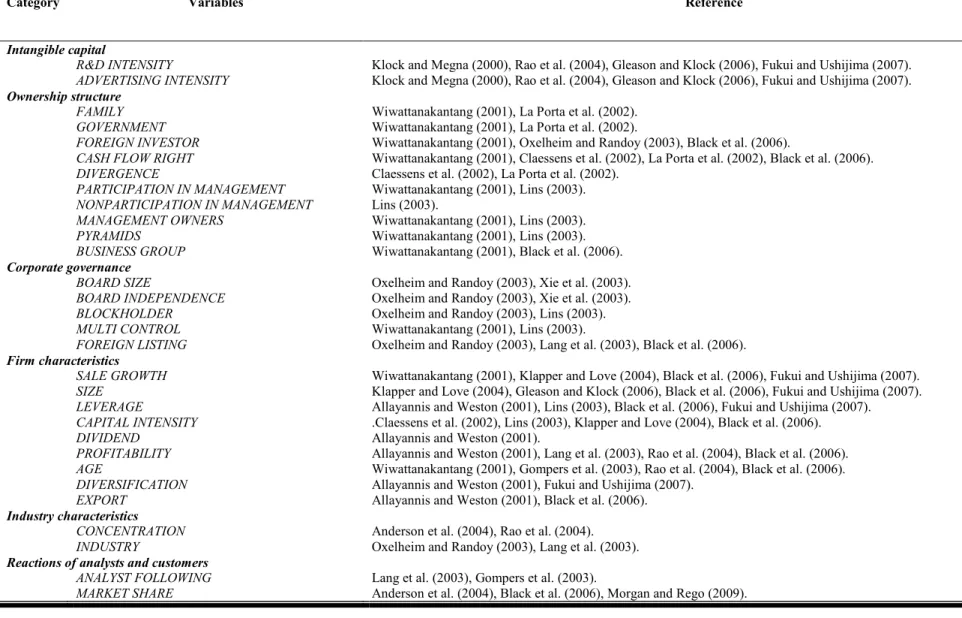

On the other hand, in reactions of analysts and customers variables, we use a number of analysts that report estimates for each firm to measure. Market share is measured by firm’s share of total sales by all firms in the same four-digit industries or two-digit industries traded on the Taiwan stock exchange or gretai securities market. All the 30 variables are summarized in table 1.

****** Insert Table 1 ******

3.3 Sample selection

In this paper, we use sample firms from manifold industries in Taiwan except regulated utilities and financial institutions due to the unique aspects of their regulatory environments. We hope to take the Taiwan economy as a lesson and learn some lessons about the business practice for applying to Chinese cases.

In order to increase the accessibility of the sample data, this study considers listed companies with December 31 fiscal year-ends and draw from Taiwan Economic Journal (TEJ) database. The controlling shareholder’s ownership structure data is accessed from corporate governance database and the financial data it received from financial database in TEJ. The period of the data is from 1996 to 2007.

After excluding missing data, in total, 9,027

observations are used for the final analysis.

4. Results and Discussion 4.1 The result of association rule

To apply association rules, sliding support and confidence values are used, starting initially at 80%

and reducing 10% gradually until the final threshold value of 30% is reached or none of the rule arisen.

The number of rules of the antecedent variables is limited to 5 to simplify the rule (Goh and Ang, 2007), and the number of association rule is determined in the maximum value 100.

We decide two higher support and confidence threshold values (50% / 80% and 50% / 70%) as the representative result shown in Table 2. The Panel A of Table 2 shows the result of 50% / 80% (i.e. support / confidence) including 5 association rules. The result indicates that profitability, pyramids, family, and participation in management are critical factors affecting firm value. Especially, profitability > 4.429 toward high Tobin’s Q owns the highest confidence, and this rule is found in 89% of sample firms. The result provides that when the company’s ROA is higher than 4.429, it may own higher firm value.

Otherwise, if a firm exists pyramids ownership structure and/or cross-shareholdings, has a controlling shareholder who is an individual, or the controlling shareholder and his/her family are present among management, the value of firm will be affected.

****** Insert Table 2 ******

On the other hand, the lower value of support and confidence, the lager the number of rules generated, holding other parameters constant (Goh and Ang, 2007). Therefore, in Panel B, the result contains 7 association rules. The first five rules are the same as Panel A, but R&D intensity is a new appearance. It indicates that when firms invest in R&D it will influence firm value significantly.

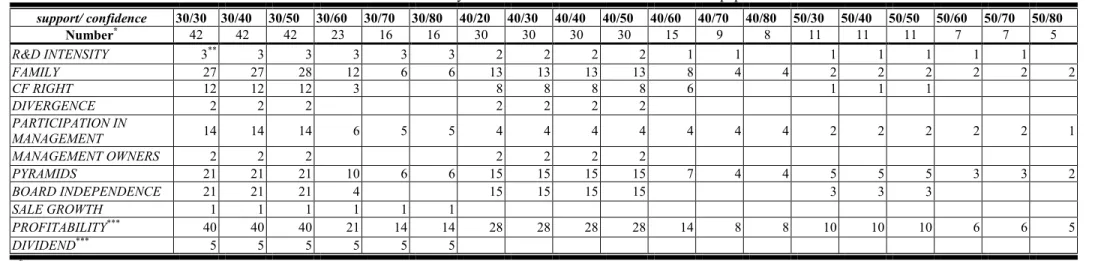

Besides these five factors, in order to find out other critical factors affecting firm value, this paper tries many models to verify the results, and shows them in Table 3.

Regarding Table 3, the results are consistent with prior literature, and the generated association rules are dependent on the minimum support and confidence threshold values. Therefore, when these values become larger, the number of rules generated decreases. The results of all test threshold value in this paper are similar to the above result that the appearance number is either large or persistent, except dividend. However, although dividend exists in each model with lower support value, it is not only appearance persistent, but also emergence in the first association rule of the model with different confidence values (i.e. from low to high). The result shows that dividend may be another important factor.

Therefore, in summary, we can find out six critical factors affecting firm value from our sample

including R&D intensity, family, participation in management, pyramids, profitability, and dividend.

****** Insert Table 3 ******

After reviewing related literature, Allayannis and Weston (2001) provide that if the management is hedgers, they would use foreign currency or derivative financial products to avoid the risk, and then affect the firm value. Therefore, we add the hedger dummy variable, indicating if the firm uses any financial techniques to avoid the risk as another antecedent variable in additional test. Otherwise, since the data of hedger is unavailable before the year of 2005, the final sample is reduced to 1,789 observations, and then the period is from 2005 to 2007. Although adding the hedger variable will decrease the sample size, we can verify the result from different periods by additional test. The results (untabled) indicate that the critical factors are similar to prior main results.

4.2 Discussion

4.2.1 The critical factors from Taiwan

From the sample firms in Taiwan, this paper discovers six critical factors with either persistent appearance in difference threshold value model or emergence in the first association rule of the model.

The variables are R&D intensity, family, participation in management, pyramids, profitability, and dividend, respectively. After comparing the results with prior related researches (untabled), some critical variables are also significantly important variables in prior literature, but the majority is not in our case.

The mass of prior studies (Gleason and Klock, 2006; Fukui and Ushijima, 2007) provide that R&D investment has statistically significant positive effects on future cash flow and firm value. These results show that in a knowledge-based economy, enormous competitive pressure always push the firms to produce innovation products through investing more and more R&D expenditures, and then create larger market and meet more consumer's demands. Similar to majority related literature, the result of this paper indicate that R&D intensity is associated with Tobin’s Q as a proxy for firm value. It means that innovation is an important factor affecting firm value in knowledge economy.

The discussion of agency problem from family controlling shareholder always appears in emerging countries researches (e.g. La Porta et al. 2002; Morck and Yeung, 2003), although some results of studies are not significant. Claessens et al., (2000) provide about half of the sample firms of Taiwan pyramids, and 79.8% firms indicate that the controlling shareholder and their respective family’s are present among management. Otherwise, the firms have a controlling shareholder who is an individual or family member with about 65.6% of sample firm.

These results show that the problems form

controlling shareholder may exist in many firms and influence firm value. Therefore, among the ten ownership structure variables we find out family, participation in management, and pyramids are more important variables affecting firm value.

Generally, a profitable firm is expected to have higher cash flow potential and drive intangible value by investors, and then influence investors to evaluate the firm. However, in prior literature, not all studies have significant association between profitability and firm value (e.g. Lang et al., 2003; Black et al., 2006).

Through data mining technique, we discover that profitability is an important factor because of its persistent occurrence in model with difference threshold value and appearance in the first association rule of the models. Otherwise, although less literature examines the relation between dividend and firm value, we find that if a firm pays dividends it is an important reference for investors to valuate the firm, since its appearance in the first association rule of the models.

Summary of the above discussion some variables are consistent with prior literature, but some are difference. We expect that the empirical results can provide other information for investors or creditors not only in Taiwan, but also in other emerging countries including China when they evaluate a firm value.

4.2.2 Difference from Prior literature

According to the results, the antecedent variables belong to corporate governance, industry characteristics, and reactions of analysts and customers are less or never occur in association rules.

Fan and Wong (2005) indicate that the conventional corporate control systems (e.g. boards of directors and institutions) in developing countries do not have a strong governance function, since they have weaker legal environments. Therefore, in these countries, outside corporate control system (e. g. auditors) may play a more critical role for corporate governance, and then conventional corporate control systems may not be more important in emerging countries.

Otherwise, the industry characteristics and reactions of analysts and customers are not related to firm value. Industry situation and reaction of customers could give management some advice.

When they want to increase firm value they may pay much attention to produce high value-added products or to care about industry trend, not focus on extending the market share only. The unimportance of the analyst variable may vary since the analysts focus on “big corporations” which may not be a firm with high firm value when they forecast.

5. Conclusion

With the arrival of knowledge-based economy era, the implementation and the application of knowledge and information technology have become the most crucial issue and competitive advantage of every organization. Because of the method for

creating firm value transfers from traditional physical assets to intangible knowledge, it is commonly found that the market values of knowledge based firms are much higher than the book values. Therefore, valuation of intangible assets becomes a widespread topic of interest in the new economy.

This paper aims at understanding the determinants of firm value in Taiwan. In particular, related literature is reviewed over various domains and six categories of impact factors of firm value are found including Intangible capital, Ownership structure, Corporate governance, Firm characteristics, Industry characteristics, and Reactions of analysts and customers. Next, a data mining technique, association rules, is applied to discover critical factors affecting the value of firms in Taiwan. The results indicate R&D intensity, and then family, participation in management, pyramid in ownership structure, otherwise, profitability, and dividend are important antecedent variables for Tobin’s Q as a proxy for firm value.

After comparing the results of prior researches, we find out that R&D intensity is consistent with prior literature (Rao et al., 2004; Gleason and Klock, 2006; Fukui and Ushijima, 2007). However, family, participation in management and pyramid are unique factors for emerging countries. On the other hand, profitability and dividend are verified to be important factors affecting firm value.

Data mining techniques have been applied in many business fields, but none in valuating the firm value. We expect this method can provide a more flexible model than traditional statistics method and then these empirical results can provide other new information for investors or creditors to help them evaluate the investment opportunities or loans.

References

1. Anderson, E. W., Fornell, C., and Mazvancheryl, S. K. “Customer Satisfaction and Shareholder Value,” Journal of Marketing, 68(4), 172-185 (2004).

2. Allayannis, G. and Weston, J. P. “The Use of Foreign Currency Derivatives and Firm Market Value,” The Review of Financial Studies, 14(1), 243-276 (2001).

3. Berry, M. J. and Linoff, G. Data mining techniques: for marketing sale and customer support. John Wiley and Sons, Inc., Canada, 1997.

4. Black, B. S., Jang, H., and Kim, W. “Does Corporate Governance Predict Firms’ Market Values? Evidence from Korea,” The Journal of Law, Economics, & Organization, 22(2), 366-413 (2006).

5. Bukh, P. N., Larsen, H. T. and Mouritsen, J.

“Constructing Intellectual Capital Statements,”

Scandinavian Journal of Management, 17(1), 87-108 (2001).

6. Chan, L. K. C., Lakonishok, J., and Sougiannis,

T. “The Stock Market Valuation of Research and Development Expenditures,” The Journal of Finance, 56(6), 2431-2456 (2001).

7. Claessens, S., Djankov, S. and Lang, L. H. P.

‘The separation of ownership and control in East Asian corporation,” Journal of Financial Economics, 58(1-2), 81-112 (2000).

8. Claessens, S., Djankov, S. Fan, J. P. H., and Lang, L. H. P. “Disentangling the incentive and entrenchment effects of large shareholdings,”

The Journal of Finance, 57(6), 2741-2771 (2002).

9. Diamond, D. W. and Verrecchia, R. E.

“Disclosure, Liquidity, and the Cost of Capital.,”

Journal of Finance, 46(4), 1325-1359 (1991).

10. Eckstein, C. “The Measurement and Recognition of Intangible Assets: Then and Now,”

Accounting Forum, 28(2), 139-158 (2004).

11. Edvinsson, L. and Malone, M. S. Intellectual Capital:Realizing Your Company’s True Value by Finding Its Hidden Roots. New York, NY:

Harper Business, 1997.

12. Fan, J. P. H. and Wong, T. J. “Corporate ownership structure and the informativeness of accounting earnings,” Journal of Accounting and Economics, 33(3), 401-425 (2002).

13. Fan, J. P. H. and Wong, T. J. “Do external auditors perform a corporate governance role in emerging markets? Evidence form East Asia,”

Journal of Accounting Research, 43(1), 35-72 (2005).

14. Fukui, Y. and Ushijima, T. “Corporate diversification, performance, and restructuring in the largest Japanese manufacturers,” Journal of the Japanese and International Economies, 21(3), 303-323 (2007).

15. Gleason, K. I. and Klock, M. “Intangible capital in the pharmaceutical and chemical industry,”

The Quarterly Review of Economics and Finance, 46(2), 300-314 (2006).

16. Goh, D. H. and Ang, R. P. “An introduction to association rule mining: An application in counseling and help-seeking behavior of adolescents,” Behavior Research Methods. 39(2), 259-266 (2007).

17. Hall, R. E. “Struggling to understand the stock market,” American Economic Review, 91(2), 1-11 (2001).

18. Jung, K. and Kwon, S. Y. “Ownership structure and earnings informativeness Evidence from Korea,” The International Journal of Accounting, 37(3), 301-325 (2002).

19. Kessels, J. Verleiden tot kennisproductiviteit, Enschede, Universiteit Twente, 2001.

20. Klapper, L. F. and Love, I. “Corporate governance, investor protection, and performance in emerging markets,” Journal of Corporate Finance, 10(5), 703-728 (2004).

21. Klein, A. “Audit committee, board of director characteristics, and earnings management,”

Journal of Accounting and Economics, 33(3), 375-400 (2002).

22. Klock, M. and Megna, P. “Measuring and valuing intangible capital in the wireless communications industry,” The Quarterly Review of Economics and Finance, 40(4), 519–532 (2000).

23. Klosgen, W. and Zytkow, J. M. Handbook of data mining and knowledge discovery. Oxford:

Oxford University Press, 2002.

24. La Porta, R., Lopez-de-Silanes, F., and Shleifer, A. “Corporate ownership around the world,”

Journal of Finance, 54(2), 471-517 (1999).

25. La Porta, R., Lopez-de-Silanes, F., Shleifer, A., and Vishny, R. “Investor protection and corporate valuation,” Journal of Finance, 57(3), 1147-1170 (2002).

26. Lang, M. H., Lins, K. V., and Miller, D. P.

“ADRs, Analysts, and Accuracy: Does Cross Listing in the United States Improve a Firm's Information Environment and Increase Market Value?,” Journal of Accounting Research, 41(2), 317-345 (2003).

27. Larcker, D. F., Richardson, S. A., and Tuna, I.

“Corporate Governance, Accounting Outcomes, and Organizational Performance,” The Accounting Review, 82(4), 963-1008 (2007).

28. Lemmon, M. L. and Lins, K. V. “Ownership structure, corporate governance, and firm value:

Evidence from the East Asian financial crisis,”

Journal of Finance, 58(4), 1445-1468 (2003).

29. Lins, K. V. “Equity Ownership and Firm Vaiue in Emerging Markets,” Journal of Financial and Quantitative Analysis, 38(1), 159-184 (2003).

30. McConnell, J. J. and Servaes, H. ”Additional Evidence on Equity Ownership and Corporate Value,” Journal of Financial Economics, 27(2), 595-612 (1990).

31. Morck, R. and Yeung, B. “Agency problems in large family business group,” Entrepreneurship Theory and Practice, 27(4), 367-382 (2003).

32. Morgan, N. A. and Rego, L. L. “Brand Portfolio Strategy and Firm Performance,” Journal of Marketing, 73(1), 59-74 (2009).

33. OECD. The Role of National Qualifications Systems in Promoting lifelong learning.

Guidelines for country background reports.

Netherlands, OECD, 2004.

34. Oxelheim, L. and Randoy, T. “The impact of foreign board membership on firm value,”

Journal of Banking and Finance, 27(12), 2369-2392 (2003).

35. Rao, V. R., Agarwal, M. K., and Dahlhoff, D.

“How Is Manifest Branding Strategy Related to the Intangible Value of a Corporation?,” Journal of Marketing, 68(4), 126-141 (2004).

36. Roiger, R. J. and Geatz, M. W. Data mining: a tutorial–based primer. Boston MA: Addision Wesley, 2003.

37. Roos, G. and Roos, J. “Measuring Your

Company’s Intellectual Performance,” Long Range Planning, 30(3), 413-426 (1997).

38. Sánchez, D., Serrano, J. M., Blanco, I., Martín-Bautista, M. J., and Vila, M. “Using association rules to mine for strong approximate dependencies,” Data Mining and Knowledge Discovery, 16(3), 313-348 (2008).

39. Servaes, H. “Tobin's Q and the Gains from Takeovers,” Journal of Finance. 46(1), 409-419 (1991).

40. Schmalensee, R. “Using the H-Index of Concentration with Published Data,” Review of Economics and Statistics, 59(2), 186-193 (1977).

41. Silva, F., Majluf, N., and Paredes, R. D. “ Family ties, Interlocking Directors and Performance of Business Groups in Emerging Countries: The Case of Chile,” Journal of Business Research, 59(3), 315-321 (2006).

42. SPSS. Clementine (Computer software).

Retrieved July 2, 2005, from

www.spss.com/clementine/.

43. Stewart. T. A. Intellectual Capital:The New Wealth of Organizations. New York, Doubleday Dell Publishing Group, 1997.

44. Stulz, R. “Globalization, corporate finance and the cost of capital,” Journal of Applied Corporate Finance, 12(3), 8-25 (1999).

45. Tseng, C.Y. and Goo, Y. J. J. “Intellectual Capital and Corporate Value in an Emerging Economy:

Empirical Study of Taiwanese Manufacturers,”

R&D Management, 35(2), 187-201 (2005).

46. Tobin, J. “A general equilibrium approach to monetary theory,” Journal of Money, Credit, and Banking, 1(1), 15-29 (1969).

47. Vergauwen, P., Bollen, L., and Oirbans, E.

“Intellectual capital disclosure and intangible value drivers: an empirical study,” Management Decision, 45(7), 1163-1180 (2007).

48. Wiwattanakantang, Y. “Controlling shareholders and corporate value: Evidence from Thailand,”

Pacific-Basin Finance Journal, 9(4), 323-362 (2001).

49. Xie, B., Davidson III, W. N., and Dadalt, P. J.

“Earnings management and corporate governance: the role of the board and the audit committee,” Journal of Corporate Finance, 9(3), 295-316 (2003).

Table 1 The factors affecting firm value

Category Variables Reference

Intangible capital

R&D INTENSITY Klock and Megna (2000), Rao et al. (2004), Gleason and Klock (2006), Fukui and Ushijima (2007).

ADVERTISING INTENSITY Klock and Megna (2000), Rao et al. (2004), Gleason and Klock (2006), Fukui and Ushijima (2007).

Ownership structure

FAMILY Wiwattanakantang (2001), La Porta et al. (2002).

GOVERNMENT Wiwattanakantang (2001), La Porta et al. (2002).

FOREIGN INVESTOR Wiwattanakantang (2001), Oxelheim and Randoy (2003), Black et al. (2006).

CASH FLOW RIGHT Wiwattanakantang (2001), Claessens et al. (2002), La Porta et al. (2002), Black et al. (2006).

DIVERGENCE Claessens et al. (2002), La Porta et al. (2002).

PARTICIPATION IN MANAGEMENT Wiwattanakantang (2001), Lins (2003).

NONPARTICIPATION IN MANAGEMENT Lins (2003).

MANAGEMENT OWNERS Wiwattanakantang (2001), Lins (2003).

PYRAMIDS Wiwattanakantang (2001), Lins (2003).

BUSINESS GROUP Wiwattanakantang (2001), Black et al. (2006).

Corporate governance

BOARD SIZE Oxelheim and Randoy (2003), Xie et al. (2003).

BOARD INDEPENDENCE Oxelheim and Randoy (2003), Xie et al. (2003).

BLOCKHOLDER Oxelheim and Randoy (2003), Lins (2003).

MULTI CONTROL Wiwattanakantang (2001), Lins (2003).

FOREIGN LISTING Oxelheim and Randoy (2003), Lang et al. (2003), Black et al. (2006).

Firm characteristics

SALE GROWTH Wiwattanakantang (2001), Klapper and Love (2004), Black et al. (2006), Fukui and Ushijima (2007).

SIZE Klapper and Love (2004), Gleason and Klock (2006), Black et al. (2006), Fukui and Ushijima (2007).

LEVERAGE Allayannis and Weston (2001), Lins (2003), Black et al. (2006), Fukui and Ushijima (2007).

CAPITAL INTENSITY .Claessens et al. (2002), Lins (2003), Klapper and Love (2004), Black et al. (2006).

DIVIDEND Allayannis and Weston (2001).

PROFITABILITY Allayannis and Weston (2001), Lang et al. (2003), Rao et al. (2004), Black et al. (2006).

AGE Wiwattanakantang (2001), Gompers et al. (2003), Rao et al. (2004), Black et al. (2006).

DIVERSIFICATION Allayannis and Weston (2001), Fukui and Ushijima (2007).

EXPORT Allayannis and Weston (2001), Black et al. (2006).

Industry characteristics

CONCENTRATION Anderson et al. (2004), Rao et al. (2004).

INDUSTRY Oxelheim and Randoy (2003), Lang et al. (2003).

Reactions of analysts and customers

ANALYST FOLLOWING Lang et al. (2003), Gompers et al. (2003).

MARKET SHARE Anderson et al. (2004), Black et al. (2006), Morgan and Rego (2009).

Table 2 Support and Confidence for association rules

No. Association Rule Support Confidence

Panel A* (The number of association rules: 5)

1 PROFITABILITY > 4.429 => Q 50.15% 89.00%

2 PYRAMIDS ^ PROFITABILITY > 4.202 => Q 50.04% 88.00%

3 FAMILY ^ PROFITABILITY > 3.349 => Q 50.02% 84.00%

4 FAMILY ^ PYRAMIDS ^ PROFITABILITY > 3.097 => Q 50.01% 84.00%

5 PARTICIPATION IN MANAGEMENT ^ PROFITABILITY > 2.013 => Q 50.01% 81.00%

Panel B**(The number of association rules: 7)

1 PROFITABILITY > 4.429 => Q 50.15% 89.00%

2 PYRAMIDS ^ PROFITABILITY > 4.202 => Q 50.04% 88.00%

3 FAMILY ^ PROFITABILITY > 3.349 => Q 50.02% 84.00%

4 FAMILY ^ PYRAMIDS ^ PROFITABILITY > 3.097 => Q 50.01% 84.00%

5 PARTICIPATION IN MANAGEMENT ^ PROFITABILITY > 2.013 => Q 50.01% 81.00%

6 PARTICIPATION IN MANAGEMENT ^ PYRAMIDS ^ PROFITABILITY > 1.573 => Q 50.01% 80.00%

7 R&D INTENSITY >0.811 => Q 50.09% 78.00%

*Support threshold value is 50%; Confidence threshold value is 80%.

**Support threshold value is 50%; Confidence threshold value is 70%.

Table 3 The summary of results of all test threshold value in the paper

support/ confidence 30/30 30/40 30/50 30/60 30/70 30/80 40/20 40/30 40/40 40/50 40/60 40/70 40/80 50/30 50/40 50/50 50/60 50/70 50/80

Number* 42 42 42 23 16 16 30 30 30 30 15 9 8 11 11 11 7 7 5

R&D INTENSITY 3** 3 3 3 3 3 2 2 2 2 1 1 1 1 1 1 1

FAMILY 27 27 28 12 6 6 13 13 13 13 8 4 4 2 2 2 2 2 2

CF RIGHT 12 12 12 3 8 8 8 8 6 1 1 1

DIVERGENCE 2 2 2 2 2 2 2

PARTICIPATION IN

MANAGEMENT 14 14 14 6 5 5 4 4 4 4 4 4 4 2 2 2 2 2 1

MANAGEMENT OWNERS 2 2 2 2 2 2 2

PYRAMIDS 21 21 21 10 6 6 15 15 15 15 7 4 4 5 5 5 3 3 2

BOARD INDEPENDENCE 21 21 21 4 15 15 15 15 3 3 3

SALE GROWTH 1 1 1 1 1 1

PROFITABILITY*** 40 40 40 21 14 14 28 28 28 28 14 8 8 10 10 10 6 6 5

DIVIDEND*** 5 5 5 5 5 5

*The number of association rule.

**The number which appearance in association rules.

***Appearance in the first association rule of each model.

****In order to simplify the table, we delete the variables which are never appearance in association rules.