DRAFT

Banking (Liquidity) Rules

Banking (Liquidity) Rules Contents

Section Page

Part 1

Preliminary

1. Commencement ... 5

2. Interpretation ... 5

3. Application ... 9

4. Designation of category 1 institution ... 9

Part 2 Minimum LCR, Notifiable Matters concerning LCR and Monetization of HQLA in Certain Financial Circumstances : for Category 1 Institution 5. Minimum LCR applicable to category 1 institution ... 10

6. Category 1 institution must notify Monetary Authority of any matter which will or may cause it to maintain LCR less than as required under section 5 ... 11

7. Monetization of HQLA in certain financial circumstances ... 11

Part 3 Minimum LMR and Notifiable Matters concerning LMR : for Category 2 Institution 8. Minimum LMR applicable to category 2 institution ... 11

9. Category 2 institution must notify Monetary Authority of any matter which will or may cause it to maintain LMR less than as required under section 8 ... 11

Part 4 Valuation of Assets, etc., at Fair Value and Bases of Calculation for Purposes of LCR and LMR 10. Valuation of assets, liabilities, off-balance sheet items and cash flows measured at fair value ... 12

11. Calculation of LCR or LMR on Hong Kong office basis and unconsolidated basis, etc. ... 12

12. Calculation of LCR or LMR of authorized institution incorporated in Hong Kong on consolidated basis ... 13

13. Calculation of LCR or LMR of authorized institution incorporated in Hong Kong on basis other than those under sections 11 and 12 ... 14

Part 5 Reporting Requirements 14. Authorized institution must notify Monetary Authority of certain matters concerning its associated entities ... 14

Section Page

15. Prescribed notification requirements for purposes of section 97I of Ordinance ... 14

16. Category 2 institution must notify Monetary Authority of change of business plans, etc., that may cause it to fall under Part 1 of Schedule 1 ... 15

Part 6 Action that may be taken by Monetary Authority when notified of Certain Relevant Liquidity Event and Decisions to which Section 101B(1) of Ordinance applies 17. Conditions that Monetary Authority may impose on category 1 institution when it gives notice under section 15(1) of relevant liquidity event that falls within paragraph (a)(ii) of definition of relevant liquidity event ... 16

17A. Decisions to which section 101B(1) of Ordinance applies ... 17

Part 7 Calculation of LCR Division 1—General 18. Interpretation – Part 7 ... 17

19. Assets, etc., must not be double counted in calculation of LCR ... 18

20. Calculation of LCR on Hong Kong office basis ... 18

21. Calculation of LCR on unconsolidated basis ... 18

22. Calculation of LCR on consolidated basis ... 18

23. Calculation of LCR on unconsolidated or consolidated basis, etc. when there are different liquidity regulations between Hong Kong and host jurisdictions ... 18

24. Treatment of liquidity transfer restrictions in calculation of consolidated LCR ... 19

25. Treatment of liquidity transfer restrictions in calculation of unconsolidated LCR, etc. ... 20

Division 2—Requirements that Asset, etc., must Satisfy, etc., before it can be included in HQLA for purposes of Calculation of LCR 26. Requirements that must be satisfied before asset can be included in HQLA for purposes of calculation of LCR ... 20

27. Exclusion of non-qualifying asset from HQLA ... 21

28. Management, etc., of HQLA and any related foreign exchange risk ... 21

29. HQLA must have diversification of classes of assets, etc. ... 21

30. General exclusion of assets from HQLA, etc. ... 22

31. Specific exclusion of assets from HQLA, etc. ... 22

32. Provisions supplementary to section 26... 22 Division 3—Determination of HQLA - general

Section Page

33. General requirements applicable to determination of HQLA ... 23

34. Calculation of total weighted amount of HQLA (without reversal of relevant securities financing transaction) ... 23

35. Calculation of total weighted amount of HQLA (if there is relevant securities financing transaction) ... 24

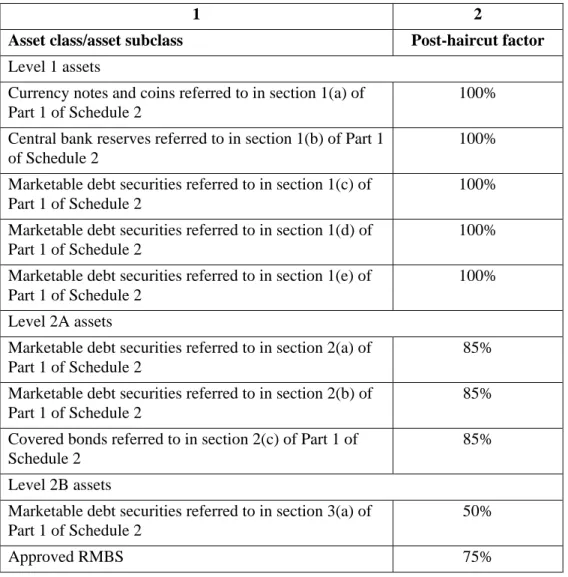

36. Haircuts ... 25

Division 4—Determination of HQLA—requirements applicable to category 1 institutions that use HQLA denominated in foreign currencies to cover portion of total net cash outflows denominated in Hong Kong dollars 37. Interpretation—Division 4 ... 26

38. Circumstances and requirements under which category 1 institution may use HQLA denominated in foreign currencies to cover HKD LCR mismatch ... 27

39. Application of foreign exchange haircuts ... 28

Division 5—Calculation of Total Net Cash Outflows 40. Interpretation—Division 5 ... 28

41. Calculation of total net cash outflows... 33

42. Calculation of total expected cash outflows ... 33

43. Calculation of total expected cash inflows ... 37

Part 8 Calculation of LMR Division 1—General 44. Interpretation—Part 8 ... 38

45. Assets, etc., must not be double counted in calculation of LMR ... 40

46. Calculation of LMR on Hong Kong office basis ... 41

47. Calculation of LMR on unconsolidated basis ... 41

48. Calculation of LMR on consolidated basis ... 41

Division 2—Calculation of average LMR, liquefiable assets, qualifying liabilities, etc. 49. Calculation of average LMR in each calendar month ... 41

50. Requirements that must be satisfied before asset can be included in liquefiable assets for purposes of calculation of LMR ... 42

51. Management of liquefiable assets and related risks by category 2 institution ... 43

52. General exclusion of assets from liquefiable assets, etc. ... 43

53. Specific exclusion of assets from liquefiable assets, etc. ... 44

Section Page

54. Calculation of net weighted amount of qualifying liabilities (after deductions) ... 44 Schedule 1

Grounds for Designating Authorized Institution as Category 1 Institution and Exceptions to those Grounds ... 45

Schedule 2

Classes of Assets which may be included in HQLA for Calculating LCR and Qualifying Criteria applicable to those Classes ... 47

Schedule 3

Characteristic requirements that Asset must Satisfy before it can be included in HQLA for purposes of Calculation of LCR ... 54

Schedule 4

Operational requirements that Category 1 Institution and Asset must Satisfy before Asset can be included in HQLA for purposes of Calculation of LCR ... 55

Schedule 5

Liquidity Conversion Factors Applicable to Assets and Liabilities in Calculation of LMR ... 57

Banking (Liquidity) Rules

(Made by the Monetary Authority under section 97H of the Banking Ordinance (Cap. 155), as amended by section 8 of the Banking (Amendment) Ordinance (No. 3 of 2012) after consultation with

the Financial Secretary, the Banking Advisory Committee, the Deposit-taking Companies Advisory Committee, The Hong Kong Association of Banks and The Hong Kong Association of Restricted

Licence Banks and Deposit-taking Companies)

Part 1 Preliminary

1. Commencement

These Rules come into operation on [1 January 2015].

2. Interpretation (1) In these Rules—

associated entity ( ) has the meaning assigned to it by section 97H(4) of the Ordinance;

bank ( ) has the meaning assigned to it by section 2 of the Capital Rules;

Capital Rules ( ) means the Banking (Capital) Rules (Cap. 155 sub. leg. L);

category 1 institution ( ) means an authorized institution designated under section 4(1) as a category 1 institution;

category 2 institution ( ) means an authorized institution which is not a category 1 institution;

central bank ( ) means—

(a) the central bank of a country; or

(b) an authority of a country that performs in the country functions similar to the functions performed by the Monetary Authority under section 5A(2) of the Exchange Fund Ordinance (Cap. 66);

class ( ) includes a subclass;

code of practice ( ) means an approved code of practice, referred to in Part XVIC of the Ordinance, that is in force;

currency notes and coins ( ), in relation to an authorized institution, means legal tender notes or other notes, and coins, representing the lawful currency of a country or Hong Kong held by the institution;

consolidated group ( ), in relation to an authorized institution incorporated in Hong Kong that has one or more specified associated entities, means—

(a) the institution’s Hong Kong office;

(b) the institution’s overseas branches (if any); and (c) the institution’s specified associated entities;

convertible ( ), in relation to a currency (other than Hong Kong dollars) held by an authorized institution, means the ability of the institution to exchange funds held in that currency into Hong Kong dollars through—

(a) an active foreign exchange market; or

(b) an established exchange and clearing arrangement operated by the central bank that issues the currency (or operated by a person appointed by the central bank for that purpose);

corporate ( ) means—

(a) a company; or

(b) a partnership, or any other unincorporated body,

that is neither a public sector entity nor a financial institution;

customer ( ) includes a counterparty;

debt securities ( ) means any securities other than—

(a) equities;

(b) securities that can be converted into equities; or (c) import or export trade bills;

determine ( ) includes calculate;

EF debt security ( ) means—

(a) an Exchange Fund Bill;

(b) an Exchange Fund Note; or

(c) any other debt security issued by the Government for the account of the Exchange Fund under the Exchange Fund Ordinance (Cap. 66);

Exchange Fund Bill ( ) means any instrument described as such as issued by the Government for the account of the Exchange Fund under the Exchange Fund Ordinance (Cap. 66);

Exchange Fund Note ( ) means any instrument described as such as issued by the Government for the account of the Exchange Fund under the Exchange Fund Ordinance (Cap. 66);

fair value ( )—

(a) in relation to an asset (whether an on-balance sheet or off-balance sheet asset), means the amount for which the asset could be exchanged between knowledgeable, willing parties in an arm’s length transaction; or

(b) in relation to a liability (whether an on-balance sheet or off-balance sheet liability), means the amount for which the liability could be settled between knowledgeable, willing parties in an arm’s length transaction;

financial institution ( ) has the meaning assigned to it by section 157A(3) of the Capital Rules;

guidelines ( ) means guidelines under the Ordinance that are published in the Gazette and in force;

Hong Kong office ( ), in relation to an authorized institution, means the institution’s principal place of business in Hong Kong and its local branches (if any);

Hong Kong office basis ( ), in relation to an authorized institution’s calculation of its LCR or LMR, means the basis referred to in section 11(1)(a);

HQLA ( ), in relation to a category 1 institution, means the institution’s stock of high quality liquid assets, as determined in accordance with Part 7, that the institution is permitted to include in the calculation of its LCR;

LCR ( ) means liquidity coverage ratio;

LCR period ( ), in relation to a category 1 institution’s LCR, means the period of 30 calendar days immediately following the day on which the LCR is calculated;

level 1 assets ( ) means any assets specified in section 1, Part 1 of Schedule 2;

level 2A assets ( ) means any assets specified in section 2, Part 1 of Schedule 2;

level 2B assets ( ) means any assets specified in section 3, Part 1 of Schedule 2;

liquefiable assets ( ), in relation to a category 2 institution, means the institution’s stock of liquefiable assets, as determined in accordance with Part 8, that the institution is permitted to include in the calculation of its LMR;

liquidity coverage ratio ( ), in relation to a category 1 institution, means the ratio, expressed as a percentage, of the amount (calculated in Hong Kong dollars) of the institution’s HQLA to the amount (calculated in Hong Kong dollars) of the institution’s total net cash outflows, as calculated in accordance with Part 7;

liquidity maintenance ratio ( ), in relation to a category 2 institution, means the ratio, expressed as a percentage, of the amount (calculated in Hong Kong dollars) of the institution’s liquefiable assets to the amount (calculated in Hong Kong dollars) of the institution’s qualifying liabilities (after deductions), as calculated in accordance with Part 8;

liquidity transfer restriction ( ), in relation to an authorized institution, means any regulatory, legal, tax, accounting or other restriction or impediment that inhibits, or may potentially inhibit, the transfer of assets or the flow of funds between the institution’s Hong Kong office, and any of its associated entities and overseas branches ;

LMR ( ) means liquidity maintenance ratio;

marketable debt securities ( ) means debt securities that have an established secondary market in or outside Hong Kong in which they can be monetized readily;

monetize ( ), in relation to an asset of an authorized institution, means converting the asset into cash by—

(a) a direct sale of the asset;

(b) entering into a repo-style transaction that is collateralized by the asset; or (c) any other means;

pledged deposit ( ), in relation to an authorized institution, means a deposit placed with the institution by a customer (other than a bank) that is contractually pledged to the institution as collateral to secure a loan from the institution;

prescribed instrument ( ) has the meaning assigned to it by section 137B(1) of the Ordinance;

principal amount ( )—

(a) in relation to an on-balance sheet item of an authorized institution—

(i) if the item is measured at fair value, means the value of the item determined in accordance with section 10; or

(ii) if the item is not measured at fair value, means the book value (including accrued interest) of the item; or

(b) in relation to an off-balance sheet item of an authorized institution, means—

(i) subject to subparagraphs (ii) and (iii), the contracted amount;

(ii) in the case of an undrawn facility, the amount of the undrawn facility; or (iii) in the case of a partially drawn facility, the amount of the undrawn portion;

relevant financial activity ( ), in relation to an associated entity of an authorized institution, means—

(a) an activity which is ancillary to a principal activity of the institution, including—

(i) owning and managing the institution’s property; and

(ii) performing information technology functions for the institution;

(b) lending, including—

(i) the provision of consumer or mortgage credit;

(ii) factoring;

(iii) forfaiting; and

(iv) the provision of guarantees and other financial commitments;

(c) financial leasing;

(d) money transmission services;

(e) issuing and administering a means of payment, including—

(i) credit cards;

(ii) travellers’ cheques; and (iii) bank drafts;

(f) trading for the associated entity’s own account, or for accounts of the entity’s customers, in—

(i) money market instruments;

(ii) foreign exchange;

(iii) financial instruments which are traded on an exchange;

(iv) OTC derivative transactions; or (v) transferable securities;

(g) participating in securities issues, including the provision of services relating to the issues;

(h) the provision of—

(i) advice to undertakings on capital structure or industrial strategy, including any matter relating to capital structure or industrial strategy; or

(ii) advice and services relating to mergers and the purchase of undertakings;

(i) money broking;

(j) portfolio management and the provision of advice in relation to portfolio management; or

(k) custodial and safekeeping services;1

relevant liquidity event ( ) has the meaning assigned to it by section 15(3);

residential mortgage-backed security ( ) means a debt security—

(a) that is issued by a special purpose entity or another company; and

(b) the payments in respect of which are secured by a pool of underlying residential mortgage loans originated by banks or other financial institutions;

RMBS ( ) means one or more residential mortgage-backed securities;

securities financing transaction ( ), in relation to a category 1 institution, means –

1 “Custodial and safekeeping services” is added to the definition of “relevant financial activity” in order to reflect a similar change now being introduced in Banking (Capital) (Amendment) Rules 2014, which is under consultation.

(a) a repo-style transaction; or (b) a margin lending transaction;

sovereign ( ) means—

(a) the Government; or

(b) the central government of a country;

specified associated entity ( ), in relation to an authorized institution incorporated in Hong Kong, means an associated entity of the institution that is the subject of a notice given to the institution under section 12(1) that is in force.

(2) A reference in these Rules to a table or formula followed by a number (including an alphanumeric number) is a reference to the table or formula, as the case may be, in these Rules bearing that number.

(3) If, under a provision of these Rules, the prior consent or approval of the Monetary Authority is required by an authorized institution in respect of any matter, the institution must seek the prior consent or approval, as the case may be, by making an application in the specified form (if any) to the Monetary Authority.

(4) If, under a provision of these Rules, the Monetary Authority is required to give, or may give, notice of any matter to all authorized institutions, or to a class of such institutions, it is sufficient compliance with that provision if the Monetary Authority publishes the notice in the Gazette.

(5) If any matter specified in a provision of these Rules is qualified by the word “adequate”,

“appropriate”, “consistent”, “material”, “relevant” or “significant”, then, for the purposes of assisting in ascertaining the nature of such qualification in so far as it relates to the matter, regard must be had to any guidelines or codes of practice that are applicable to the provision.

(6) If a term used in these Rules is defined in section 2(1) of the Capital Rules but not in these Rules, that section applies to the interpretation of the term as used in these Rules as it applies to the interpretation of the term as used in the Capital Rules.

(7) A reference in a provision of these Rules to a liability or asset of an authorized institution is a reference only to an on-balance sheet liability or on-balance sheet asset, as the case may be, of the institution unless the provision expressly states otherwise.

(8) A reference in a provision of these Rules to an application that may be made by an authorized institution to the Monetary Authority means an application in a specified form (if any) to the Monetary Authority.

3. Application

(1) Subject to section 97K(6) of the Ordinance, these Rules, in so far as they relate to LCR, apply to category 1 institutions only.

(2) Subject to section 97K(6) of the Ordinance, these Rules, in so far as they relate to LMR, apply to category 2 institutions only.

(3) Subsections (1) and (2) are not to be construed to prevent a provision of these Rules from applying both to category 1 institutions and category 2 institutions if the provision relates both to LCR and LMR.

4. Designation of category 1 institution

(1) The Monetary Authority may, by notice in writing to an authorized institution, designate the institution as a category 1 institution if the Monetary Authority is satisfied that, in relation to the institution—

(a) (whether on application by the institution) there are one or more grounds specified in Part 1 of Schedule 1; or

(b) (only on application by the institution) there are one or more grounds specified in Part 2 of the Schedule.

(2) A notice under subsection (1) must specify—

(a) the date from which the designation takes effect; or

(b) the occurrence of the event from which the designation takes effect.

(3) If the Monetary Authority is satisfied that an authorized institution meets the conditions specified in Part 3 of Schedule 1, the Monetary Authority may elect not to designate the institution as a category 1 institution.

(4) If an authorized institution (the relevant institution) has been designated as a category 1 institution, whether on application by the relevant institution, the Monetary Authority may, by notice in writing to the institution, revoke the designation on being satisfied that no such designation would be made if the relevant institution were not a category 1 institution.

(5) A notice under subsection (4) must specify—

(a) the date from which the revocation takes effect; or

(b) the occurrence of the event from which the revocation takes effect.

(6) To avoid doubt—

(a) the reference in subsection (1) to authorized institution includes a reference to a category 2 institution which was formerly a category 1 institution; and

(b) an authorized institution must comply with the provisions of these Rules applicable to it (including any approval granted to it under these Rules) despite any period of financial stress that it is undergoing.

Part 2

Minimum LCR, Notifiable Matters concerning LCR and Monetization of HQLA in Certain Financial Circumstances : for Category 1 Institution

5. Minimum LCR applicable to category 1 institution

(1) Subject to subsection (3), a category 1 institution must, on and after 1 January 2019, at all times maintain an LCR of not less than 100%.

(2) Subject to subsection (3), a category 1 institution must—

(a) during the year of 2015, at all times maintain an LCR of not less than 60%;

(b) during the year of 2016, at all times maintain an LCR of not less than 70%;

(c) during the year of 2017, at all times maintain an LCR of not less than 80%; and (d) during the year of 2018, at all times maintain an LCR of not less than 90%.

(3) A category 1 institution does not contravene subsection (1) or (2) if the institution’s failure to maintain an LCR of not less than the level set out in subsection (1) or (2) is due only to the institution’s monetization of its HQLA as provided for in section 7.

6. Category 1 institution must notify Monetary Authority of any matter which will or may cause it to maintain LCR less than as required under section 5

(1) If a category 1 institution has reason to believe that a likely increase in its total net cash outflows or a likely reduction in its HQLA (or any combination of the increase and the reduction) will cause, or could reasonably be construed as potentially causing, whether by itself or in conjunction with any other event, the institution to maintain an LCR less than as required under section 5, the institution must—

(a) as soon as is practicable notify the Monetary Authority of the matter; and

(b) provide the Monetary Authority with any particulars of the matter that the Monetary Authority requests.

(2) To avoid doubt, subsection (1) does not apply in the case of a relevant liquidity event.

7. Monetization of HQLA in certain financial circumstances

If a category 1 institution is undergoing significant financial stress and its financial circumstances are such that, in order to meet its financial obligations as they fall due, it has no reasonable alternative other than to monetize its HQLA to the extent necessary to meet those obligations despite the fact that this might cause it to maintain an LCR less than the level set out in section 5, it may monetize its HQLA to that extent in order to meet those obligations.

Part 3

Minimum LMR and Notifiable Matters concerning LMR : for Category 2 Institution

8. Minimum LMR applicable to category 2 institution

A category 2 institution must maintain an LMR of not less than 25% on average in each calendar month.

9. Category 2 institution must notify Monetary Authority of any matter which will or may cause it to maintain LMR less than as required under section 8

(1) If a category 2 institution has reason to believe that a likely increase in its qualifying liabilities (after deductions) or a likely reduction in its liquefiable assets (or any combination of the increase and the reduction) will cause, or could reasonably be construed as potentially causing, whether by itself or in conjunction with any other event, the institution to maintain an LMR less than as required under section 8, the institution must—

(a) as soon as is practicable notify the Monetary Authority of the matter; and

(b) provide the Monetary Authority with any particulars of the matter that he requests.

(2) To avoid doubt, subsection (1) does not apply in the case of a relevant liquidity event.

Part 4

Valuation of Assets, etc., at Fair Value and Bases of Calculation for Purposes of LCR and LMR

10. Valuation of assets, liabilities, off-balance sheet items and cash flows measured at fair value

(1) If an authorized institution measures any asset, liability, off-balance sheet item or cash flow at fair value, for the purposes of calculating its LCR or LMR, the institution must establish and maintain valuation systems, controls and procedures that are effective to ensure that the valuation of any such asset, liability, off-balance sheet item or cash flow is prudent and reliable.

(2) For the purposes of subsection (1), an authorized institution must make adjustments, where appropriate, to the valuation of any asset, liability, off-balance sheet item or cash flow that is measured at fair value to account for—

(a) the limitations of the valuation model or methodology and the data used by the institution in the valuation process;

(b) the liquidity of the asset, liability, off-balance sheet item or cash flow; and

(c) other relevant factors that might reasonably be expected to affect the prudence and reliability of the valuation of the asset, liability, off-balance sheet item or cash flow.

(3) To avoid doubt, adjustments made by an authorized institution in accordance with this section may exceed adjustments made by the institution in accordance with the financial reporting standards adopted by the institution.

11. Calculation of LCR or LMR on Hong Kong office basis and unconsolidated basis, etc.

(1) An authorized institution must calculate its LCR or LMR—

(a) on the basis that the business of the institution includes all of its business in Hong Kong (being its principal place of business in Hong Kong and its local branches (if any)); and

(b) (if the institution is incorporated in Hong Kong and has an overseas branch) subject to subsection (3), on an unconsolidated basis (being the basis referred to in paragraph (a) with the inclusion of the business of the institution’s overseas branches but not its associated entities).

(2) An authorized institution may apply to the Monetary Authority for approval to exclude the business of its overseas branch from the calculation of its LCR or LMR on an unconsolidated basis as referred to in subsection (1)(b).

(3) On the application under subsection (2), the Monetary Authority may, by notice in writing to the institution, determine the application by—

(a) granting approval to the institution to exclude the business of its overseas branch from the calculation of its LCR or LMR on an unconsolidated basis as referred to in subsection (1)(b) if the institution demonstrates to the satisfaction of the Monetary Authority that the liquidity risk associated with the business is immaterial; or

(b) refusing the institution’s application if the Monetary Authority is not satisfied as specified in paragraph (a).

(4) A notice under subsection (3) must specify—

(a) for paragraph (a), the date, or the occurrence of an event, from which the approval takes effect; or

(b) for paragraph (b), the reasons why the Monetary Authority is not satisfied as specified in subsection (3)(a).

(5) If an authorized institution has been granted an approval under subsection (3)(a), whether on the application by the institution, the Monetary Authority may, by notice in writing to the institution , revoke the approval to the extent that the approval relates to the business of an overseas branch of the institution in respect of which the Monetary Authority is satisfied that, if the business were not the subject of the approval, he would not grant an approval under subsection (3).

(6) A notice under subsection (5) must specify the date, or the occurrence of an event, from which the revocation takes effect.

12. Calculation of LCR or LMR of authorized institution incorporated in Hong Kong on consolidated basis

(1) Subject to subsections (4) and (6) and without prejudice to the generality of section 13, the Monetary Authority may, by notice in writing to an authorized institution incorporated in Hong Kong that has one or more associated entities, require the institution to calculate its LCR or LMR on a consolidated basis (being the basis with the inclusion of all the business of the institution and one or more of its associated entities as specified in the notice).

(2) A notice under subsection (1) must specify the date, or the occurrence of an event, from which the requirement takes effect.

(3) An authorized institution must comply with the requirements of a notice given to it under subsection (1).

(4) Without prejudice to the generality of subsection (1), the Monetary Authority may, for the purpose of deciding which associated entities of an authorized institution incorporated in Hong Kong to specify in a notice under subsection (1), have regard to—

(a) the respective liquidity risks that the entities pose to the institution; and

(b) whether the respective activities of the entities fall within one or more relevant financial activities.

(5) An authorized institution may apply to the Monetary Authority for approval to exclude the business of a specified associated entity of the institution from the calculation of its LCR or LMR on a consolidated basis as referred to in subsection (1).

(6) On the application under subsection (5), the Monetary Authority may, by notice in writing to the institution, determine the application by—

(a) granting approval to the institution to exclude the business of a specified associated entity of the institution from the calculation of its LCR or LMR on a consolidated basis as referred to in subsection (1) if the institution demonstrates to the satisfaction of the Monetary Authority that the liquidity risk associated with the business is immaterial; or

(b) refusing the institution’s application if the Monetary Authority is not satisfied as specified in paragraph (a).

(7) A notice under subsection (6) must specify—

(a) for paragraph (a), the date, or the occurrence of an event, from which the approval takes effect; or

(b) for paragraph (b), the reasons why the Monetary Authority is not satisfied as specified in subsection (6)(a).

(8) If an authorized institution has been granted an approval under subsection (6)(a), whether on the application by the institution, the Monetary Authority may, by notice in writing to the institution, revoke the approval to the extent that the approval relates to the business of a specified associated entity of the institution in respect of which the Monetary Authority is satisfied that, if the business were not the subject of the approval, he would not grant an approval under subsection (6)(a).

(9) A notice under subsection (8) must specify the date, or the occurrence of an event, from which the approval takes effect.

13. Calculation of LCR or LMR of authorized institution incorporated in Hong Kong on basis other than those under sections 11 and 12

(1) Where an authorized institution is incorporated in Hong Kong, if the Monetary Authority, after taking into account the liquidity risk associated with a part of the institution’s business in or outside Hong Kong, is satisfied that it is prudent and reasonable to do so, the Monetary Authority may, by notice in writing to the institution, require it to calculate its LCR or LMR on the basis of that part by itself, or in conjunction with any other part of the institution’s other business as specified in the notice.

(2) A notice under subsection (1) must specify the date, or the occurrence of an event, from which the requirement takes effect.

(3) An authorized institution must comply with the requirements of a notice given to it under subsection (1).

Part 5

Reporting Requirements

14. Authorized institution must notify Monetary Authority of certain matters concerning its associated entities

(1) An authorized institution that calculates its LCR or LMR on a consolidated basis as referred to in section 12(1) must give notice in writing to the Monetary Authority of any of the matters specified in subsection (2) as soon as is practicable after the institution is, or ought to be, aware of the matter.

(2) The matters referred to in subsection (1) are :

(a) an associated entity of the institution having ceased to be its associated entity;

(b) an entity having become an associated entity of the institution;

(c) the principal activities of an entity specified in paragraph (b); and

(d) any significant change to the principal activities of the institution or any of its associated entities (including an entity specified in paragraph (b)).

15. Prescribed notification requirements for purposes of section 97I of Ordinance

(1) For the purposes of section 97I of the Ordinance an authorized institution must immediately notify the Monetary Authority of a relevant liquidity event and provide the Monetary Authority with any particulars of the event that the Monetary Authority requests.

(2) If an authorized institution notifies the Monetary Authority under subsection (1) of a relevant liquidity event that falls within paragraph (a)(i), (ii) or (iv), or paragraph (b), of

the definition of relevant liquidity event in subsection (3), the institution must, at the same time as it gives the notification, also give the Monetary Authority an assessment of its liquidity position, including—

(a) the factors contributing to it having to give the Monetary Authority the notification;

(b) the measures it has taken or will take to deal with the event; and

(c) the potential duration of the event based on the institution’s reasonable expectations.

(3) In this section—

relevant liquidity event ( )—

(a) in the case of a category 1 institution, means—

(i) if the institution is not the subject of a notice under section 17(1) or (2) that is in force, a failure by the institution to comply with section 5 that does not arise from it taking action under section 7 to monetize its HQLA to meet its financial obligations as they fall due;

(ii) if the institution is not the subject of a notice under section 17(1) or (2) that is in force and is taking, or is about to take, action under section 7 to monetize its HQLA to meet its financial obligations as they fall due such that the action will cause, or could reasonably be construed as potentially causing, the institution to maintain its LCR at less than the level set out in section 5;

(iii) if the institution is the subject of a notice under section 17(1) or (2) that is in force, a failure by the institution to satisfy one or more of the conditions specified in the notice; or

(iv) if the institution is a section 38 institution within the meaning of section 37, a failure by the institution to comply with section 38(d); or

(b) in the case of a category 2 institution, means a failure by the institution to comply with section 8.

16. Category 2 institution must notify Monetary Authority of change of business plans, etc., that may cause it to fall under Part 1 of Schedule 1

(1) Subject to subsection (2), if a category 2 institution’s business plans, or particular circumstances, change, or are expected to change, in a manner that may be likely to cause one or more grounds specified in Part 1 of Schedule 1 to arise in relation to the institution, the institution must—

(a) as soon as is practicable notify the Monetary Authority of the matter; and

(b) provide the Monetary Authority with any particulars of the matter that the Monetary Authority requests.

(2) A category 2 institution must comply with subsection (1) irrespective of whether Part 3 of Schedule 1 may apply to it.

Part 6

Action that may be taken by Monetary Authority when notified of Certain Relevant Liquidity Event and Decisions to which Section 101B(1) of

Ordinance applies

17. Conditions that Monetary Authority may impose on category 1 institution when it gives notice under section 15(1) of relevant liquidity event that falls within paragraph (a)(ii) of definition of relevant liquidity event

(1) Where a category 1 institution notifies the Monetary Authority under section 15(1) of a relevant liquidity event that falls within paragraph (a)(ii) of the definition of relevant liquidity event in section 15(3), the Monetary Authority may, by notice in writing to the institution (subsection (1) notice), require the institution to comply with the conditions specified in the subsection (1) notice that relate to the institution’s LCR and with which the Monetary Authority is satisfied that, in the circumstances of the case, it is prudent and reasonable that the institution must comply.

(2) Where a category 1 institution is the subject of a subsection (1) notice, the Monetary Authority may, at any time, by notice in writing to the institution (subsection (2) notice) do one or more of the following as the Monetary Authority thinks proper—

(a) amend any conditions specified in the subsection (1) notice (including amending by specifying new conditions in the subsection (1) notice); or

(b) cancel any conditions specified in the subsection (1) notice (including conditions specified in the subsection (1) notice pursuant to a prior subsection (2) notice).

(3) A notice under subsection (2) must specify the date, or the occurrence of an event, from which the amendment or the cancellation takes effect.

(4) Without prejudice to the generality of subsection (1) or (2), conditions specified in a subsection (1) or (2) notice given to a category 1 institution may include any one or more of the following—

(a) a condition that the institution must at all times maintain an LCR of not less than the percentage specified in the notice (which percentage is not more than the percentage set out in section 5);

(b) a condition that the institution must submit to the Monetary Authority a plan, within such period (being a period which is reasonable in all the circumstances of the case) as specified in the notice, satisfying the Monetary Authority that, if the plan is implemented by the institution, it would maintain, within a period which is reasonable in all the circumstances of the case, an LCR not less than the level set out in section 5;

(c) a condition that the institution must implement the plan referred to in paragraph (b) with effect from the date, or the occurrence of an event, specified in the notice;

(d) a condition requiring the institution to reduce its liquidity risk exposures in such manner, or adopt such measures, as are specified in the notice which, in the opinion of the Monetary Authority, will cause the institution to maintain, within a period reasonable in all the circumstances of the case, an LCR not less than the level set out in section 5; or

(e) a condition that the institution must make such reports regarding its LCR to the Monetary Authority as are specified in the notice

(5) A category 1 institution must comply with the requirements of a notice given to it under this section.

17A. Decisions to which section 101B(1) of Ordinance applies

A decision made by the Monetary Authority under section 4(1) or (4) or 17(1) or (2)(a) is a decision to which section 101B(1) of the Ordinance applies.

Part 7

Calculation of LCR Division 1—General

18. Interpretation – Part 7

In this Part and Schedules 2 to 4—

approved RMBS ( ) means RMBS that falls within section 3(b) of Part 1 of Schedule 2;

central bank reserves ( ), in relation to a category 1 institution, means any funds placed by the institution with the Monetary Authority for the account of the Exchange Fund that are repayable on demand and any of the following funds placed by the institution with a central bank—

(a) funds required to be so placed by virtue of the central bank’s reserve requirements but only to the extent that those funds are allowed by the central bank to be drawn down by the institution in times of financial stress;

(b) funds that are repayable on demand;

(c) term funds that are explicitly and contractually repayable on notice (which expires on the first day of the LCR period) from the institution; and

(d) term funds against which the institution can borrow from the central bank a loan on a term basis, or on an overnight but automatically renewable basis, as long as the term funds concerned are still placed with the central bank but, if the amount of the loan that the institution may borrow from the central bank against the term funds concerned and the amount of the funds are different, only the lower of those 2 amounts;

covered bond ( ) means a bond, issued by a financial institution or any of its associated entities—

(a) which is subject to relevant laws or regulations that are specially designed to protect the holder of the bond; and

(b) the proceeds from the issue of which must, in conformity with those relevant laws or regulations be invested in assets which, during the whole period of the validity of the bond, are capable of covering claims attached to the bond and which, in the event of the failure of the issuer of the bond, would be used on a priority basis for the reimbursement of the principal and payment of the accrued interest;

general wrong-way risk ( ) is to be construed in accordance with section 226E(3)(b) of the Capital Rules;

host jurisdiction ( ), in relation to a category 1 institution incorporated in Hong Kong, means a jurisdiction outside Hong Kong in which any of the institution’s overseas branches operates or any of its associated entities is incorporated;

HQLA qualifying asset ( ) means an asset referred to in section 26(a);

relevant securities financing transaction ( ) means a securities financing transaction that falls with section 35(1)(a);

retail deposit ( ) has the meaning assigned to it by section 40;

small business funding ( ) has the meaning assigned to it by section 40.

19. Assets, etc., must not be double counted in calculation of LCR

(1) A category 1 institution must not, in the calculation of its LCR, double count any asset, liability, off-balance sheet item, or associated cash flow, that is included in that calculation.

(2) Without prejudice to the generality of subsection (1), a category 1 institution must not, in the calculation of its LCR, include, in its total net cash outflows, any cash inflow associated with an asset included in its HQLA for the purposes of that calculation.

20. Calculation of LCR on Hong Kong office basis

A category 1 institution must, in the calculation of its LCR on a Hong Kong office basis, determine—

(a) its HQLA held in its Hong Kong office; and (b) the total net cash outflows of its Hong Kong office, as if its Hong Kong office were a single legal entity.

21. Calculation of LCR on unconsolidated basis

Subject to sections 23 and 25, a category 1 institution incorporated in Hong Kong must, in the calculation of its LCR on an unconsolidated basis—

(a) determine the aggregate of its HQLA held in its Hong Kong office and its overseas branches;

(b) determine the aggregate of the total net cash outflows of its Hong Kong office and its overseas branches; and

(c) ensure that all inter-branch balances with, and transactions between, its Hong Kong office and its overseas branches are offset in that calculation.

22. Calculation of LCR on consolidated basis

(1) Subject to sections 23 and 24, a category 1 institution incorporated in Hong Kong must, in the calculation of its LCR on a consolidated basis—

(a) determine the aggregate of its HQLA held by the members of its consolidated group;

(b) determine the aggregate of the total net cash outflows of the members of its consolidated group; and

(c) ensure that all inter-branch or inter-company balances with, and transactions between, the members of its consolidated group are offset in that calculation.

(2) A category 1 institution must comply with subsection (1) as if the members of its consolidated group were a single legal entity.

23. Calculation of LCR on unconsolidated or consolidated basis, etc. when there are different liquidity regulations between Hong Kong and host jurisdictions

(1) Subject to subsections (2) to (6), a category 1 institution incorporated in Hong Kong that calculates its LCR on an unconsolidated basis, consolidated basis or on the basis specified in a notice to the institution under section 13 (if applicable), must, in so far as that calculation relates to the retail deposits and small business funding of the

institution’s overseas branch (if any) or its specified associated entity (if any) incorporated outside Hong Kong, apply the liquidity regulations equivalent to LCR adopted by the relevant banking supervisory authority in the host jurisdiction concerned that are applicable to those types of deposits and that type of funding instead of the requirements of these Rules applicable to those deposits and that funding.

(2) If the relevant banking supervisory authority in the host jurisdiction of a category 1 institution’s overseas branch (if any) or specified associated entity incorporated outside Hong Kong (if any) has no equivalent to LCR, the institution must apply, in the calculation of its LCR in so far as the calculation relates to the retail deposits and small business funding of that overseas branch or associated entity, as the case may be, the requirements of these Rules applicable to those deposits and that funding.

(3) Subsection (5) applies if the relevant banking supervisory authority in the host jurisdiction of a category 1 institution’s overseas branch (if any) or specified associated entity incorporated outside Hong Kong (if any) has an equivalent to LCR but, for the purposes of the calculation of that equivalent to LCR in so far as it relates to retail deposits and small business funding, it has not adopted and applied any liquidity regulations .

(4) Subsection (5) applies if the Monetary Authority—

(a) is satisfied that the relevant banking supervisory authority in the host jurisdiction of a category 1 institution’s overseas branch (if any) or specified associated entity incorporated outside Hong Kong (if any) has an equivalent to LCR but, for the purposes of the calculation of that equivalent to LCR in so far as it relates to retail deposits and small business funding, it has adopted and applied liquidity regulations that are less stringent than the requirements of these Rules in the calculation of a category 1 institution’s LCR in so far as the calculation relates to retail deposits and small business funding; and

(b) gives that category 1 institution a notice in writing stating, in respect of the institution’s overseas branches and specified associated entities incorporated outside Hong Kong specified in the notice, that it is satisfied as referred to in paragraph (a).

(5) If this subsection applies to a category 1 institution’s overseas branch or specified associated entity by virtue of subsection (3) or (4), the institution must apply, in the calculation of its LCR in so far as the calculation relates to the retail deposits and small business funding of that overseas branch or associated entity, as the case may be, the requirements of these Rules applicable to those deposits and that funding.

(6) Subsection (1) does not apply to a category 1 institution’s overseas branch or specified associated entity incorporated outside Hong Kong unless the relevant banking supervisory authority in the host jurisdiction concerned has issued regulations for the purposes of implementing the LCR and has prescribed liquidity regulations applicable to retail deposits and small business funding that reflect the standards issued by the Basel Committee for such deposits and funding.

(7) If subsection (1), (2) or (5) applies to a category 1 institution, the institution must construe, with all necessary modifications, the other requirements of these Rules in a manner consistent with the application of that subsection to it.

24. Treatment of liquidity transfer restrictions in calculation of consolidated LCR

(1) A category 1 institution incorporated in Hong Kong that has one or more specified associated entities must not, in the calculation of its LCR on a consolidated basis—

(a) include the HQLA held by a member of its consolidated group except to the extent that the total net cash outflows of that member is also included in the calculation;

and

(b) include surplus HQLA unless—

(A) the surplus HQLA is at all times freely transferable from the member of the institution’s consolidated group that holds the surplus HQLA to any other member of the group; and

(B) without prejudice to the generality of the foregoing but subject to subsection (2),—

(i) the transfer of the surplus HQLA from the jurisdiction in which it is held by the member concerned of the institution’s consolidated group to any other member of the group is not subject to any liquidity transfer restriction; and (ii) there is no reasonable doubt as to whether the surplus HQLA will at all times

be freely transferable from the jurisdiction in which it is held by the member concerned of the institution’s consolidated group to any other member of the group.

(2) For the purposes of subsection (1)(b)(B), when assessing the transferability of assets, a category 1 institution—

(a) is only required to take into account applicable laws, regulations and supervisory requirements of the jurisdiction in which the surplus HQLA concerned is held; and (b) must at all times have in place and maintain adequate processes to identify and

monitor the applicable laws, regulations and supervisory requirements referred to in paragraph (a).

(3) In this section—

surplus HQLA ( ), in relation to a member of a category 1 institution’s consolidated group, means any of the institution’s HQLA held by the member that is more than it is required to hold by prevailing regulations applicable to it.

25. Treatment of liquidity transfer restrictions in calculation of unconsolidated LCR, etc.

Section 24 applies, with all necessary modifications—

(a) to a category 1 institution incorporated in Hong Kong that calculates its LCR on an unconsolidated basis as that section applies to a category 1 institution incorporated in Hong Kong that calculates its LCR on a consolidated basis; and

(b) to a category 1 institution incorporated in Hong Kong that calculates its LCR on the basis specified in a notice given to it under section 13 as section 24 applies to a category 1 institution incorporated in Hong Kong that calculates its LCR on a consolidated basis.

Division 2—Requirements that Asset, etc., must Satisfy, etc., before it can be included in HQLA for purposes of Calculation of LCR

26. Requirements that must be satisfied before asset can be included in HQLA for purposes of calculation of LCR

A category 1 institution must not, in the calculation of its LCR, include an asset in its HQLA unless—

(a) subject to sections 30 and 31, the asset falls within a class of assets specified in Schedule 2 and meets the qualifying criteria (if any) specified in that Schedule for an asset that falls within that class;

(b) the asset satisfies all the characteristic requirements specified in Schedule 3 that are applicable to the asset;

(c) the asset satisfies all the operational requirements specified in Schedule 4 that are applicable to the asset; and

(d) the institution satisfies all the operational requirements specified in Schedule 4 that are applicable to the institution in so far as those operational requirements relate to the asset.

27. Exclusion of non-qualifying asset from HQLA

If an asset included in a category 1 institution’s HQLA ceases to satisfy one or more requirements of these Rules applicable to the inclusion of an asset in HQLA (including any case where the institution fails to satisfy one or more operational requirements specified in Schedule 4 that is applicable to the institution in so far as the operational requirement concerned relates to the asset), the institution must—

(a) subject to paragraph (b), exclude the asset from its HQLA not later than 30 calendar days after the date of the cesser; or

(b) exclude the asset from its HQLA immediately if it only becomes aware of the cesser after the 30 calendar days.

28. Management, etc., of HQLA and any related foreign exchange risk

(1) A category 1 institution must have in place and maintain adequate systems and procedures for the on-going assessment and management of its HQLA in order to ensure that—

(a) each asset included in the HQLA satisfies all the requirements of these Rules that are applicable to its inclusion in the HQLA;

(b) an asset included in the HQLA which ceases to satisfy one or more requirements of these Rules applicable to its inclusion in the HQLA is identified as soon as is practicable; and

(c) without prejudice to the generality of section 27, prompt action is taken to exclude from the HQLA an asset identified as referred to in paragraph (b).

(2) A category 1 institution must have in place and maintain adequate systems to manage the foreign exchange risk associated with its HQLA, including—

(a) managing the institution’s ability to access relevant foreign exchange markets for the transfer of liquidity from one currency to another;

(b) managing the institution’s HQLA so that the HQLA is able to generate liquidity to meet the institution’s total net cash outflows in different currencies; and

(c) subject to Division 4, managing the composition of its HQLA by currency so that the HQLA is broadly consistent with the distribution of the institution’s total net cash outflows by currency.

29. HQLA must have diversification of classes of assets, etc.

(1) A category 1 institution must—

(a) have in place and maintain adequate policies and limits to control the level of concentration of HQLA within asset classes with respect to type of asset, type of issue, type of issuer and, without prejudice to the generality of section 28(2)(c), type of currency; and

(b) subject to subsection (2), ensure that its HQLA is well diversified within each of the asset classes comprising the HQLA.

(2) Subsection (1)(b) does not apply to a level 1 asset included in a category 1 institution’s HQLA if the asset falls within any of the following types of asset—

(a) qualifying debt securities issued by the sovereign or central bank of the jurisdiction in which the institution is incorporated;

(b) qualifying debt securities issued by the sovereign or central bank of the jurisdiction in which the institution operates;

(c) central bank reserves;

(d) currency notes and coins; or (e) EF debt securities.

30. General exclusion of assets from HQLA, etc.

(1) The Monetary Authority may, by notice in writing to all category 1 institutions, specify that a category 1 institution must not include in its HQLA, with effect from the date, or the occurrence of an event, specified in the notice, an asset, or a class of assets, of the type specified in the notice, on the ground that the Monetary Authority is satisfied that that type of asset or class of assets, as the case may be, is not, or is no longer, sufficiently liquid in private markets or readily monetizable by other means to be included in any category 1 institution’s HQLA.

(2) Every category 1 institution must comply with the requirements of a notice given to it under subsection (1).

31. Specific exclusion of assets from HQLA, etc.

(1) The Monetary Authority may, by notice in writing to a category 1 institution, require the institution, with effect from the date, or the occurrence of an event, specified in the notice—

(a) to cease to include in its HQLA the asset specified in the notice on the ground that the Monetary Authority is satisfied that it no longer satisfies, or has never satisfied, the liquidity requirement rule specified in the notice that is applicable to the inclusion of that asset in its HQLA; or

(b) without prejudice to the generality of sections 28(2) and 29(1), to make the changes specified in the notice to its HQLA on the ground that the Monetary Authority is satisfied that those changes are necessary in order to mitigate the risks associated with the institution’s failure, specified in the notice, to comply with section 28(2) or 29(1).

(2) A category 1 institution must comply with the requirements of a notice given to it under subsection (1).

32. Provisions supplementary to section 26

(1) The Monetary Authority may, after consultation with the Financial Secretary, the Banking Advisory Committee, the Deposit-taking Companies Advisory Committee, The Hong Kong Association of Banks and The DTC Association, and if satisfied that it is prudent and reasonable to do so in the prevailing financial circumstances, by notice in writing to all category 1 institutions, specify that a category 1 institution may include in its HQLA, with effect from the date, or the occurrence of an event, specified in the notice, a relevant asset specified in the notice if the institution and the relevant asset comply with—

(a) the prevailing banking supervisory standards issued by the Basel Committee relating to the inclusion of the relevant asset in HQLA; and

(b) the conditions (if any) specified in the notice relating to the inclusion of the relevant asset in HQLA.

(2) If a category 1 institution includes a relevant asset in its HQLA in accordance with a notice under subsection (1), the institution must construe, with all necessary modifications, the other requirements of these Rules in a manner consistent with the inclusion of that asset in its HQLA.

(3) In this section—

relevant asset ( ) means an asset (which may be an off-balance sheet asset), or an asset which falls within a class of assets (which may be a class of off-balance sheet assets), of a type which—

(a) under the prevailing banking supervisory standards issued by the Basel Committee relating to the inclusion of assets in HQLA, may be included in HQLA; and

(b) the other provisions of these Rules do not presently permit to be included in HQLA.

Division 3—Determination of HQLA - general

33. General requirements applicable to determination of HQLA

Subject to sections 34 to 39, a category 1 institution must determine the total weighted amount of its HQLA—

(a) subject to paragraphs (b), (c) and (d), as the sum of the total weighted amounts of its level 1 assets, level 2A assets and level 2B assets, calculated in accordance with section 36;

(b) if any of its level 1 assets, level 2A assets or level 2B assets are not available to the institution on the first day of the LCR period concerned, by excluding the asset concerned from its HQLA for that period and irrespective of the asset’s remaining maturity;

(c) so that the sum of—

(i) the total weighted amount of level 2A assets; and (ii) the total weighted amount of level 2B assets,

does not exceed 40% of the total weighted amount of its HQLA (40% ceiling);

and

(d) so that the total weighted amount of level 2B assets does not exceed 15% of the total weighted amount of its HQLA (15% ceiling).

34. Calculation of total weighted amount of HQLA (without reversal of relevant securities financing transaction)

(1) Subject to section 35, a category 1 institution must, for the purposes of section 33, calculate the total weighted amount of its HQLA by the use of Formula 1.

Formula 1

Calculation of total weighted amount of HQLA

Total weighted amount of HQLA = total weighted amount of level 1 assets + total weighted amount of level 2A assets + total weighted amount of level 2B assets – adjustment for 15% ceiling – adjustment for 40% ceiling

Where—

adjustment for 15% ceiling = Max (level 2B assets – 15/85* (level 1 assets + level 2A assets), level 2B assets – 15/60* level 1 assets, 0);

adjustment for 40% ceiling = Max ((level 2A assets + level 2B assets – adjustment for 15% ceiling) – 2/3* level 1 assets, 0);

level 1 assets = total weighted amount of level 1 assets calculated in accordance with section 36(1)(a);

level 2A assets = total weighted amount of level 2A assets calculated in accordance with section 36(1)(b); and

level 2B assets = total weighted amount of level 2B assets calculated in accordance with section 36(1)(c).

(2) To avoid doubt, a category 1 institution must comply with subsection (1) only after all haircuts required by section 36 have been made to the institution’s HQLA.

35. Calculation of total weighted amount of HQLA (if there is relevant securities financing transaction)

(1) Subsection (2) applies to a category 1 institution if—

(a) the institution has entered into a securities financing transaction that matures within the LCR period concerned and the transaction involves the exchange, during that period, of an HQLA qualifying asset of the institution for another HQLA qualifying asset from the counterparty to the transaction;

(b) the HQLA qualifying asset from the counterparty satisfies, or will satisfy when it is given to the institution, all the requirements of section 26(b) and (c) applicable to the asset; and

(c) the institution satisfies, or will satisfy when it is given the HQLA qualifying asset from the counterparty, all the requirements of section 26(d) applicable to the institution in so far as those requirements relate to that asset.

(2) If this subsection applies to a category 1 institution by virtue of subsection (1), the institution must—

(a) by the use of Formula 2, calculate the total weighted amount of HQLA after the reversal of the relevant securities financing transaction concerned; and

(b) take the lower amount of the 2 amounts calculated under section 34 and paragraph (a) as the total weighted amount of HQLA for the purposes of section 33.

Formula 2

Calculation of total weighted amount of HQLA (adjusted for the reversal of any relevant securities financing transaction)

Total weighted amount of HQLA = total weighted amount of level 1 assets + total weighted amount of level 2A assets + total weighted amount of level 2B assets – adjustment for 15% ceiling – adjustment for 40% ceiling,

Where—

adjustment for 15% ceiling = Max (adjusted level 2B assets – 15/85* (adjusted level 1 assets + adjusted level 2A assets), adjusted level 2B assets – 15/60*

adjusted level 1 assets, 0);

adjustment for 40% ceiling = Max ((adjusted level 2A assets + adjusted level 2B assets – adjustment for 15% ceiling) – 2/3*adjusted level 1 assets, 0);

adjusted level 1 assets = total weighted amount of level 1 assets adjusted for the reversal of any relevant securities financing transaction involving the exchange by the category 1 institution of any level 1 asset, level 2A asset or level 2B asset for receipt by the category 1 institution from the counterparty of any level 1 asset within the LCR period concerned;

adjusted level 2A assets = total weighted amount of level 2A assets adjusted for the reversal of any relevant securities financing transaction involving the exchange by the category 1 institution of any level 1 asset, level 2A asset or level 2B asset for receipt by the category 1 institution from the counterparty of any level 2A asset within the LCR period concerned; and

adjusted level 2B assets = total weighted amount of level 2B assets adjusted for the reversal of any relevant securities financing transaction involving the exchange by the category 1 institution of any level 1 asset, level 2A asset or level 2B asset for receipt by the category 1 institution from the counterparty of any level 2B asset within the LCR period concerned.

(3) To avoid doubt, a category 1 institution to which subsection (2) applies must comply with that subsection only after all haircuts required by section 36 have been made to the institution’s HQLA.

36. Haircuts

(1) Subject to section 39, for the purposes of section 33—

(a) the total weighted amount of level 1 assets is the sum of the weighted amount of assets that fall within each of the asset subclasses specified in column 1 of Table 1 under the asset class of level 1 assets, calculated by multiplying the principal amount of assets that fall within each of those asset subclasses by the post-haircut factor specified in the second column of Table 1 in relation to each of those subclasses;

(b) the total weighted amount of level 2A assets is the sum of the weighted amount of assets that fall within each of the asset subclasses specified in column 1 of Table 1 under the asset class of level 2A assets, calculated by multiplying the principal amount of assets that fall within each of those asset subclasses by the post-haircut factor specified in the second column of Table 1 in relation to each of those subclasses; and

(c) the total weighted amount of level 2B assets is the sum of the weighted amount of assets that fall within each of the asset subclasses specified in column 1 of Table 1

under the asset class of level 2B assets, calculated by multiplying the principal amount of assets that fall within each of those asset subclasses by the post-haircut factor specified in the second column of Table 1 in relation to each of those subclasses.

Table 1 Post-haircut Factors

1 2

Asset class/asset subclass Post-haircut factor

Level 1 assets

Currency notes and coins referred to in section 1(a) of Part 1 of Schedule 2

100%

Central bank reserves referred to in section 1(b) of Part 1 of Schedule 2

100%

Marketable debt securities referred to in section 1(c) of Part 1 of Schedule 2

100%

Marketable debt securities referred to in section 1(d) of Part 1 of Schedule 2

100%

Marketable debt securities referred to in section 1(e) of Part 1 of Schedule 2

100%

Level 2A assets

Marketable debt securities referred to in section 2(a) of Part 1 of Schedule 2

85%

Marketable debt securities referred to in section 2(b) of Part 1 of Schedule 2

85%

Covered bonds referred to in section 2(c) of Part 1 of Schedule 2

85%

Level 2B assets

Marketable debt securities referred to in section 3(a) of Part 1 of Schedule 2

50%

Approved RMBS 75%

(2) Subject to subsection (3), the principal amount of all subclasses of assets listed in Table 1 is the fair value of the subclass concerned.

(3) The principal amount of the asset subclasses of currency notes and coins and central bank reserves listed in Table 1 is the book value of the subclass concerned.

Division 4—Determination of HQLA—requirements applicable to category 1 institutions that use HQLA denominated in foreign currencies to cover portion of

total net cash outflows denominated in Hong Kong dollars

37. Interpretation—Division 4 In this Division—