國 立 交 通 大 學

企業管理碩士學位學程

碩 士 論 文

運用新的企業單位管理新的創新:高通子公司 Mirasol 的顯示

器個案研究

Managing a New Innovation Using a New Business Unit: Case Study of

Qualcomm’s Mirasol Display

研 究 生:Alfonso Martínez

指導教授:劉芬美

運用新的企業單位管理新的創新:高通子公司 Mirasol 的顯示器個

案研究

Managing a New Innovation Using a New Business Unit: Case Study of

Qualcomm’s Mirasol Display

研 究 生:馬爾峰

Student: Alfonso Martínez

指導教授:劉芬美

Advisor: 劉芬美

國 立 交 通 大 學

管理學院

企業管理碩士學位學程

碩 士 論 文

A ThesisSubmitted to Master Degree Program of Global Business Administration College of Management

National Chiao Tung University In partial Fulfillment of the Requirements

For the Degree of Master

in

Business Administration December 2011

Hsinchu, Taiwan, Republic of China 中華民國一百年十二月

i

Abstract

A radical innovation can assist a company in maintaining a competitive advantage in the market place. The concept of disruptive innovation and radical innovation is explored in this paper, along with complimenting terms, and supporting literature. The objective of this research are to use the disruption criteria to evaluate Qualcomm’s new Mirasol Display as well as to asses Mirasol as a radical innovation and provide managerial suggestions using articles and journals from scholars who also found this topic of interest. The impact of potentially disruptive and radical innovation are explored with regards to the value it creates, its value chain, value network, business model and underlying processes and its key success factors by analyzing successful and unsuccessful companies and their successes and failures, and from this newly acquired knowledge, drawing recommendations and key points.

A conceptual framework is introduced and is used to analyze the fate of some firms and to help new business units or entirely new firm management to assess the efficiency of their business model and their processes.

ii

Acknowledgements

I would first like to thank God for providing me with the opportunity to further my studies, to improve my life and providing the right set of people to allow me to complete this stage in my life. I would like to thank my advisor, Prof. Liou who has been there guiding me from scratch to completion of my thesis. I hope that this accomplishment brings as much pride to her as it does to me. I would like to specially thank Desi Rosado who has provided me with an opportunity to improve my life and proved to be more than a friend, but mentor since we’ve been acquainted. Finally I’d like to thank Marissa Mathurin, my best friend and greatest source of strength and support, who has been key in the completion of thesis, and during my time at NCTU. A heartfelt thank you goes out to the aforementioned, without whom, this would have not been possible.

Contents

List of Figures ... 1 Chapter 1-Introduction ... 1 1.1 Research Background ... 1 1.2 Motivation ... 4 1.3 Objectives ... 4 1.4 Methodology ... 6 1.5 Research Questions ... 71.6 History of Qualcomm and Introducing Qualcomm Micro ElectroMechanical System (MEMS) Technology, QMT ... 8

Chapter 2 - Literature Review ... 10

2.1 Definitions of Disruptive Technology ... 10

2.2 Types of Disruptive Technology ... 12

2.3 Examples of Everyday Disruptive Innovation ... 15

2.4 Advantages and Disadvantages of Disruptive Innovation ... 16

Chapter 3 - Developing and Applying a Model to analyze the efficiency of Business Models and Business Processes ... 17

3.1 Defining a Business Model ... 17

Chapter 4- Case Analysis ... 25

Mirasol as a Disruptive Innovation ... 25

4.1 New Market Disruption ... 26

4.2 Low End Disruption ... 26

4.2.1 Low-end customers’ willingness to purchase products with less performance ... 26

4.2.2 The ability to earn profits at discount prices to win low-end customers ... 31

4.3 A disruptive feature aiming at non-high-end market segments ... 32

4.4 The Ability of a Business Model to Target Existing Customers in Main-Stream Markets ... 33

4.5 Qualcomm’s Strategy In Managing Mirasol ... 35

Chapter 5 - Conclusion: Managerial Suggestions and Future potential ... 46

List of Figures

Figure 1: Christensen’s Disruptive Innovation Model 16

Figure 2: Apple’s Carbon Footprint 24

Figure 3: Alpha Framework 25

Figure 4: Qualcomm’s Business Model 28

Figure 5: Illustration of Power consumption for Motorola Razr. 31

Figure 6: The Power Gap = Convergence 32

Figure 7: Energy Consumption for Handset Activity 33 Figure 8: Comparison of Mirasol display vs AM-OLED and TFT-LCD 34

1

Chapter 1-Introduction

1.1 Research Background

The development of technology has changed the face of the entire world and the way we view the world as individuals. Innovation in technology has brought about a great change in our everyday lives and human lifestyles by providing us with a new level of ease and comfort. Technology (Dictionary.com, LLC, 2011), is defined as “the branch of knowledge that deals with the creation and use of technical means and their interrelation with life, society, and the environment, drawing upon such subjects as industrial arts, engineering, applied science, and pure science.” Living in this day and age, the word ‘technology’ has been more affiliated to just the computer or internet realm. It is important to distinguish here between the actual meaning and everyday use of the word ‘technology’ because several examples that will be discussed occurred way before the internet became as profound as it is to date. This thesis deals with managing disruptive innovation, so of course to begin, let’s define the term. “Disruptive technology” is a term used by Christensen (1997) to refer to “a new technology that unexpectedly

displaces an established technology.” It is “an innovation that helps create a

new market and value network, and eventually goes on to disrupt an existing market and value network (over a few years or decades), displacing an earlier technology there” (Christensen

1997).

Before we go any further into the concept of disruptive technology, let us first understand that there exist two different categories of technology, as outlined by Christensen (1997); sustaining and disruptive. Sustaining technology “relies on incremental improvements to an already

2

but instead, continues to evolve established ones with better value, by making improvements. Disruptive technology, on the other hand “lacks refinement, often has performance problems

because it is new, appeals to a limited audience, and may not yet have a proven practical application”. A practical example would be Alexander Graham Bell's "electrical speech

machine," presently referred to as the telephone.

This paper also delves into an idea stated by Christensen (1997) as the "technology mudslide hypothesis", which states that “an established firm fails because it doesn't "keep up

technologically" with other firms”, whereby, in this hypothesis, companies are considered to be

climbers on grounds where it takes a great amount of constant upward-climbing effort, and the slightest hint of complacency, causes a rapid downhill slide. Christensen (1997) went on to show that this simplistic hypothesis is wrong and unrealistic. Good companies are often conscious of new ideas, but their business environment prohibits pursuit when the idea first arises, either due to the lack of profitability or because of the fear of stealing already scarce resources from sustaining innovations. Large corporations are designed to work with sustaining technologies. They excel at knowing their market, staying close to their customers, and having a mechanism in place to develop existing technology, but they experience difficulty exploiting the potential efficiencies, cost-savings, or new marketing opportunities brought forward by new disruptive technologies. Disruptive technology has been around for longer than people going through their everyday lives seem to notice. There have been several industries, over the course of time, that have had a disruptive technology sneak in while incumbents, whether realizing the disruptive technology or not, choose to ignore such disruptive companies. This failure to address such companies and products of disruptive nature has gained significant market share over time, and in several cases has kicked the incumbents completely out of their once dominated market.

3

Products and companies that have developed and become successful, starting up as a disruptive force include but are not limited to: Amazon.com, Bloomberg L.P., Black & Decker, Cisco, Charles Schwab, Canon Photocopiers, Dell Computer, Honda motorcycles, Flat panel displays, Kodak and Kodak Funsaver, minicomputers, Sony etc. While most companies listed here utilize the internet that provided its form of disruptive force, there exist companies like Sony and Canon that did not use the internet as a means to promote or implement its disruptive technology in their own separate industry.

Qualcomm MEMS Technologies, Inc. (QMT) , a business unit of Qualcomm, has developed the industry's first MEMS (Micro Electromagnetic System) display for mobile devices - a true technological innovation that offers low power consumption and superb viewing quality in a wide range of environmental conditions, including bright sunlight. The display works by reflecting light so that specific wavelengths interfere with each other to create color. The phenomenon that makes a butterfly's wings shimmer is the same process used in Qualcomm's Mirasol displays. Qualcomm MEMS Technologies, Inc. supports Qualcomm's overall strategy of increasing the capabilities of mobile devices while minimizing power consumption.

4

1.2 Motivation

Christensen’s (1997; 2003) arguments about disruptive innovation are interesting to examine the effects of a new technology; how a company creates value for its customers by strategically managing a disruptive product. Academic research papers have been based on hindsight of a problem and provide reasons for that problem and explore solutions which could have been used. Some literature cited show that the reason for a problem may simply pertain to or may lie in a company’s business model. This thesis applies Christensen’s methodology and that of other past scholars, to examine the features of Mirasol Display, a new technology as well as a new business unit, and to predict its potential to disrupt markets, potentially displace incumbents, and provide pre-project suggestions for management.

1.3 Objectives

This paper attempts to provide managerial suggestions for managing a completely new product, a new technology and a new business unit, and potential pitfalls and problems that may occur in the early onset of the products life as well as evidence that supports the need for such a technology and the future potential for Qualcomm. We will use a disruptive innovation criteria created by Christensen and Raynor (2003), to justify whether or not Mirasol Display fits the criteria of the disruptive innovation, and explore other areas where disruptive innovation was not considered or thought possible. The paper will use several cases as examples to prove that it is possible that disruptive innovation can exist in high-end and mainstream markets. The ideas that

5

Christensen (2003) lacked but later realized where and what the problem was, will be expanded in this paper which will come up with its own framework that will be used to analyze past cases to support the framework and apply it to Mirasol display.

6

1.4 Methodology

Yin (1993) identified some specific types of case studies: Exploratory, Explanatory, and Descriptive. Stake (1995) included three others:

- Intrinsic - when the researcher has an interest in the case;

- Instrumental - when the case is used to understand more than what is obvious to the observer;

- Collective - when a group of cases is studied.

This study is intrinsic, as it was inspired by Christensen’s book, “The Innovator’s Dilemma” followed by his sequel, “The Innovator’s Solution”. Questionnaires were unnecessary because this paper is qualitative rather than being quantitative. Journals, articles and book information were analyzed and the theories found and supporting documents were applied to create a framework to investigate the disruptive potential of Mirasol display technology and to analyze the efficiency of a business model and underlying processes.

7

1.5 Research Questions

• Mirasol as a Disruptive Technology - New Market Disruption

1. Is there a large population of people who historically have not had the money, equipment or skill, to do this thing for themselves, and as a result gone without it altogether or have needed someone with more expertise to do it for them?

2. To use this product or service, do customers need to go to an inconvenient, centralized location?

- Low End Disruption

1. Are there customers at the low end market who would be happy to purchase with less (but good enough) performance, if they could get it at a lower price?

2. Can we create a business model that enables us to earn attractive profits at the discount prices required to win the business of these over served customers at the low end?

- Is the innovation disruptive to all of the significant incumbent firms in the industry? • Can a business be introduced to target existing customers?

8

1.6 History of Qualcomm and Introducing Qualcomm Micro ElectroMechanical

System (MEMS) Technology, QMT

Dr. Irwin Jacobs, along with Franklin Antonio, Adelia Coffman, Andrew Cohen, Klein Gilhousen, Irwin Jacobs, Andrew Viterbi and Harvey White came together in July, 1985 to discuss the idea and possible development of “Quality Communications”. This idea grew and of it was born one of the telecommunication industry’s greatest successes: Qualcomm Incorporated.

Qualcomm initially provided contract research and development services, with very little product manufacturing, for wireless telecommunications. One of the team’s first commercial accomplishments was the OmniTRACS® satellite which provided a locating and messaging service, used by long-haul trucking companies, which was built off a product called Omninet that specialized integrated circuits for digital radio communications. Since its introduction in 1988, OmniTRACS has grown into the largest satellite-based commercial mobile system for the transportation industry today.

In 1989, the Telecommunications Industry Association (TIA) recognized a digital technology called Time Division Multiple Access (TDMA) and in 1990, Qualcomm began the design of the first CDMA (Code Division Multiple Access)-based cellular base station a superior technology for wireless and data products, using calculations from the CDMA-based OmniTRACS satellite system. In a matter of about two years, Qualcomm had begun manufacturing CDMA cell phones, base stations, and chips and the first CDMA technology was standardized as IS-95. Since then, Qualcomm has assisted with the development of the CDMA-2000, WCDMA, and LTE cellular standards.

9

Qualcomm CDMA Technologies (QCT) is the world's largest fabless semiconductor producer and the largest provider of wireless chipset and software technology, which powers the majority of all 3G devices commercially available today.

During 2004 Qualcomm also acquired Iridigm Corporation to form Qualcomm MEMS (Micro Electromechanical System) Technologies (QMT) to develop low power reflective displays for mobile applications by reflecting light so that specific wavelengths interfere with each other to create color (Mirasol). These reflective displays offer significant reduction in power consumption, sunlight readability and video capability to mobile devices without sacrificing color.

10

Chapter 2 - Literature Review

2.1 Definitions of Disruptive Technology

As aforementioned, a disruptive technology is one that, when introduced, either radically transforms markets, creates entirely new markets or destroys existing markets for other technologies. It refers to drastic innovations in current practices such that they have the potential to completely transform a practice as it currently exists by creating a more efficient or effective method to go about solving the same problem and can significantly improve a product or a service in a way that the market does not expect. The term “disruptive technology” was first brought forward by Christensen (1997). He defined it as radical breakthrough advances and often times, brought about advanced products at a significantly low cost to the market. Christensen (2003) replaced the term ‘disruptive technology’ with ‘disruptive innovation’ because he believed that few technologies possess the ‘disruptive’ or ‘sustaining’ character; but instead, it is the business model that the technology empowers that creates the disruptive or sustaining impact and then goes on to further define the disruptive innovation as “a product or service designed for a new set of customers.” Disruptive Technologies often display certain features, for example, most times they do not enter the market successfully. Other times they are seldom seen as a worthwhile opportunity by big established companies because large corporations are much more comfortable with sustaining technologies.

Disruptive technologies, as opposed to sustaining technologies, create a new market and value network, and eventually go on to disrupt an existing market and value network displacing an earlier technology there (Christensen 1997). Disruptive technologies occur less frequently, but

11

when they do, they can cause the failure of highly successful companies who are only prepared for sustaining technologies.

In essence, disruptive technology can create a sudden, radical change, as opposed to sustaining technology which does not significantly affect the market.

Radical innovation is based on different set of engineering and scientific principles and often opens up whole new markets and potential applications (Dess and Beard, 1984; Ettlie, Bridges and O’Keefe, 1984; Dewar and Dutton, 1986).

The difference here is that a disruptive innovation is ONLY disruptive when it overtakes incumbent firms. This is important to note because a new product, which is introduced initially, might not be “disruptive” since it will take time to be the industry’s dominant design but can create major difficulties for incumbent firms (Cooper and Schendel, 1976; Daft, 1982; Rothwell, 1986; Tushman and Anderson, 1986) and can be the basis for the successful entry of new firms or even the redefinition of an industry (Henderson and Clark, 1990). This is when the radical innovation transitions to one of a disruptive nature.

12

2.2 Types of Disruptive Technology

Disruptive Technology can be further broken down into two sub-categories; new market and

low- end (Christensen 1997).

● The new-market disruptive technology focuses on meeting demand for a breakthrough product. These are the disruptions that create a new “value network” targeting customers who have needs that were previously not served by existing incumbents. It occurs when a product fits a new or emerging market segment that is not being served by existing incumbents in the industry.

● The low-end disruptive technology targets customers for whom cost is a primary concern using low-cost business models aimed at picking off the least attractive of the established firms’ customers. It targets customers who do not need the full performance valued by customers at the high end of the market. In low-end disruption, the disruptor is focused initially on serving the least profitable customer, who is happy with a good enough product and customer is not willing to pay premium for enhancements in product functionality.

Christensen envisaged the difference between the two disruption types. His disruption diagram is made up of three axes:

13

Figure 1: Christensen’s Disruptive Innovation Model Source: Christensen, C.M. (1997).

1. Y-axis: represents the dominant product performance metric 2. X- axis: represents time

3. Z-axis: represents consumer segments with different needs.

The dimensions time and performance refer to a particular product which customers purchase and for whatever purpose. An example of a time-performance trajectory is the increase of the USB flash drive’s data storage capacity that went up from 8 MB in 2000 to 8 GB in 2007. The third or z-axis represents either new customers who previously were deficient in the money or

14

skills to buy and use the product or customers whose needs can now be fulfilled because they have discovered that product is versatile. As product performance increases, it eventually exceeds the customer expectations and creates a void into which simpler and more convenient customer offerings can thrive.

Because the low-end disruptions use low-cost business models they tend to perform far worse along one or two dimensions of performance that are particularly important to customers, but may migrate upwards into the mainstream market. New value networks create a shift in consumption and competition and create a different set of performance measures compared to that which was valued in the original value network. When new-market disruptions take place, they create new value networks creating a new vertical axis for each network, which represents a product’s performance given a particular context.

15

2.3 Examples of Everyday Disruptive Innovation

Below are some common everyday disruptive innovations that are so basic that we overlook them. This is a classic example of how important disruptive innovation is to our everyday lives, some of which we cannot imagine our lives without.

● Digital cameras, which are destroying the market for photographic film, but at the same time creating markets for storage devices and photo printers.

● Railways, which displaced many forms of transport such as canals while creating demand for fuel, steel and other materials they needed. They also encouraged the emergence of new services.

● Video recorders and television hugely reduced the cinema industry, but the film industry benefited from new income streams.

● Telephones which replaced telegraphy but soon may be competing with mobile phones which are slowly creeping in.

● Plastics, whose use was initially restricted to electric insulation and its advantage was low cost. New forms of advantages such as transparency, elasticity and combustibility were introduced with the discovery of the versatility of the product. Nowadays, plastics can be used for nearly all household items previously made of metal, wood and glass.

● Electricity, which is used not only to power up electronic devices, but also was disruptive to the candle.

● The Internet

● Flight, as opposed to hot air ballooning

16

2.4 Advantages and Disadvantages of Disruptive Innovation

For a company or investor, disruptive innovation represents both an opportunity and a threat. Opportunity presents itself for those who bring the technology to the market. Enabling disruptive innovation equals new wealth creation.

Advantages

● Innovators who come up with new ideas rely on sustaining technology to make enhancements and improvements, and market them as ‘upgrades’. Disruptive innovation provides an alternative to sustaining technology by providing new capabilities in a shorter development period (Kulkarni, 2006).

● Provides profitability for small firms which acquire disruptive innovation and support creative innovation. When using the technology in a relevant environment it can support profitability and fast financial growth for the business (Walsh & Kirchhoff, 2000).

● Enables businesses to implement new technology at a reduced cost (Patki, 2006).

● Allows small risk-taking businesses quick entry into the market while simultaneously offering a growth opportunity to companies who recognize the potential of the technology presented (Walsh & Kirchhoff, 2000).

Disadvantages

● Disruptive Innovation is not supported by current manufacturing practices, and new production processes and new technology must be acquired for manufacturing of new disruptive innovation because they are not supported by manufacturing processes or mainstream software (Walsh & Kirchhoff, 2000).

● Risk of failure on the market presenting financial concerns (Walsh & Kirchhoff, 2000). ● New marketing strategies need to be developed (Walsh & Kirchhoff, 2000).

17

Chapter 3 - Developing and Applying a Model to analyze the

efficiency of Business Models and Business Processes

3.1 Defining a Business Model

The term business model is often used. With the exception of the definition presented by KMLab, Inc., which states, “a Business Model is a description of how your company intends to create value in the marketplace. It includes that unique combination of products, services, image and distribution that your company carries forward. It also includes the underlying organization of people, and the operational infrastructure that they use to accomplish their work”, the term is seldom defined explicitly (Chesbrough & Rosenbloom, 2002).

Zott, Amit, and Massa (2010) revealed that of 103 published reviews on business models 37% do not define the concept at all, 19 % refer to other scholars work and 44% explicitly define and conceptualize by enumerating the its main components. Listed below is one such example.

The functions of a business model (Chesbrough & Rosenbloom, 2002) should be:

● Articulate the value proposition, that is, the value created for the users by the offering ● Identify a market segment, that is, the users to which the offering is useful and for what

purpose

● Define the structure of the value chain required by the firm to create and distribute the offering and determine the complementary assets needed to support the firm’s position in the chain. This includes the firm’s suppliers and customers, and should extend from raw materials to the final customer.

18

● Specify the revenue generation mechanism for the firm, and estimate the cost structure and profit potential of producing the offering, given the proposition and the value chain structure chosen.

● Describe the position of the firm within the value network (also referred to as an ecosystem) linking suppliers and customers, including the identification of potential complementors and competitors.

● Formulate the competitive strategy by which the innovating firm will gain and hold advantage over rivals.

As we can see there exist an enormous amount of scholars writing journals on this topic. What is more a debacle is that there still has not been a scholar to provide one universally accepted definition of what a business model is. This is where a lot of confusion is found due to lack of a unified definition (Zott, Amit, Massa, 2010).

Proof to this exists, as can be seen as how the term business model has been referred to as a statement (Stewart & Zhao 2000), a description (Applegate, 2000; Weill & Vitale, 2001), a representation (Morris, Schindehutte, & Allen, 2005; Shafer, Smith EtLinder, 2005), an architecture (Dubosson-Torbay, Osterwalder, & Pigneur, 2002; Timmers, 1998), a conceptual tool or model (Osterwalder, 2004; Osterwalder, & Pigneur, & Tucci, 2005; Teece, 2010), a structural template (Amit & Zott, 2001), a method (Afuah & Tucci, 2001), a framework (Afuah, 2004), a pattern ( Broussean & Penard,2006), and as a set (Seelos & Mair, 2007).

In order to proceed, there must be a basis of what a business model is. For this we use Teece’s (2010) definition: “A business model articulates logic, the data and other evidence that support a

19

value proposition for the customer, and a viable structure of revenues and costs for the enterprise delivering that value.” With set definition to base our analysis on, we can avoid other definitions.

A business process is defined as “a structured, measured set of activities designed to produce a specific output for a particular customer or market. It implies a strong emphasis on how work is done within an organization, in contrast to a product focus’s emphasis on what. A process is thus a specific ordering of work activities across time and space, with a beginning and end, and clearly defined inputs and outputs: a structure for action. Taking a process approach implies adopting the customers’ point of view. Processes are the structure by which an organization does what is necessary to produce value for its customers.” (Davenport, 1993).

A business model is reinforced by its business processes because each function of the business model is in itself a process. As the processes become more efficient, they strengthen the business model. The first two processes, as mentioned in the functions of a business model, would be to clearly define the value created for the users and the users being targeted. Take for example the Microsoft Kinect, which provided value for gamers, in which it made them able to make the game more lifelike. The Kinect’s possibilities have now become limitless. It is being used by scientists for robotics (Bloomberg, 2011) and engineers for visual aid (Dashhacks Inc., 2011) This shows that the process of defining value created for consumers is continuously evolving and therefore, the target market is also continuously evolving. Now that processes are evolving, the business model also evolves and expands to encompass new target markets and subsequently new competitors. Let us bring these processes back to the Mirasol display. The value it provides for its users is lower power consumption and the ability to see the displays from mobile devices

20

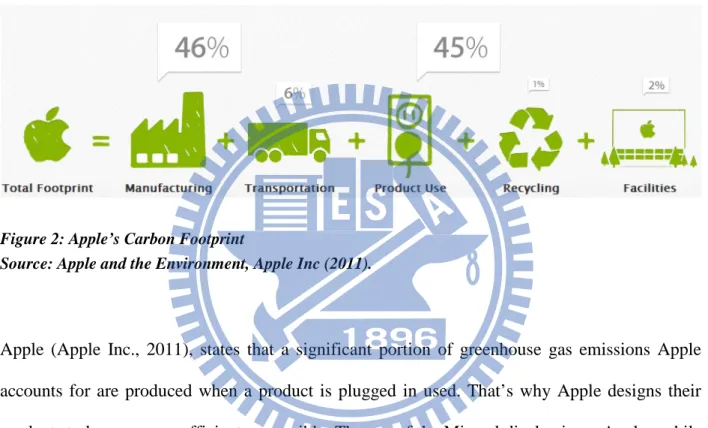

in bright sunlight without glare. The market segment for this product is mobile device carriers and manufacturers. The power saving property may be the most valuable of the properties of the display because of its environmental impact which helps large companies improve their image and brand. The world is trying to go green, and saving energy is first and foremost on the minds of activists all over the world. Below is Apple’s Environmental Footprint.

Figure 2: Apple’s Carbon Footprint

Source: Apple and the Environment, Apple Inc (2011).

Apple (Apple Inc., 2011), states that a significant portion of greenhouse gas emissions Apple accounts for are produced when a product is plugged in used. That’s why Apple designs their products to be as energy efficient as possible. The use of the Mirasol display in an Apple mobile device, for example, in an iPad, could further reduce charge time thereby strengthening its environmental impact and adding value to the company by being social responsible.

This innovation is disruptive to LEDs for mobile devices and has the potential to displace them also in other panel displays like TVs or large digital signs. It would create value not only for mobile device users and e-reader owners, but energy saving value for families, and bright outdoor displays for digital advertising, creating benefit both to the company being advertised, and to the advertisement company. As the value provided increases, the target market and

21

carrying market (the companies who will use the Mirasol display technology in their products) also increase, and have to be redefined. This redefining of the target market and carrying market also commences the redefining of the value chain. New competitors and complementors have to be addressed and taken into account. The processes continue to evolve and strengthen each other until the business model becomes efficient, thus proving that the business model relies heavily on its underlying processes. This framework can be represented using two rotating wheels that can be seen in the figure below.

Figure 3: Alpha Framework Source: This Research (2011).

When one wheel moves, it moves the other, and the faster one rotates, the faster the other rotates, creating an efficient, effective, well-oiled machine.

Business Process Business

22

Reinforcing the business model aspect of the framework is not difficult since many scholars have addressed this situation, (eg Christensen, Johnson and Kagermann, 2008 and Chesbrough & Rosenbloom, 2002.) Lucas & Goh (2009) addressed Kodak’s issue which was also previously mentioned and presented a problem as a culture. “A pattern of shared basic assumptions invented, discovered, or developed by a given group as it learns to cope with its problems of external adaptation and internal integration that have worked well enough to be considered valid and therefore, to be taught to new members as the correct way to perceive, think and feel in relation to those problems” as explained by Schein (1992). Ravasi and Schultz (2006) state that organizational culture is a set of shared mental assumptions, that guide interpretation and action in organizations, by defining appropriate behavior for various situations. Both definitions provide evidence that culture is a process itself. It is molded through the organization as well as other processes and is developed by a company’s business model.

Addressing Kodak, their problem was two-fold. They encountered a problem with their business model, as to how they would generate income and the demands of the market, which in essence is, the second part of the equation, the business process. The perception of themselves and their culture was the pitfall for Kodak. Christensen (2003) offered suggestion in having a separate business unit for such innovation to avoid the process oriented problems. This is right, as was addressed above but simply having a different unit isn’t a guarantee to success.

Qualcomm (Qualcomm Inc., 2011), views the company’s corporate structure as a long row boat, with nine people each with an ore, helping to row the boat. Each person represents a business unit. The only way for the boat to move, is for everyone to row together, meaning that the only way for the company to progress, and keep progressing, is for each business unit to correctly manage their innovations and the processes specific to it, so that they do not interfere with other

23

processes of other divisions. This eliminates the problem of having one company manage too many innovations and processes, and not being able to decide which innovations fit the “company culture”. If the innovation has its own business unit, that unit can not only manage its own processes, but create its own culture that does not interfere with the overall culture of the company or with the cultures of the other sub units. Imagine one person having to paddle nine ores by himself. The boat might move, eventually, but not very far and not effectively or efficiently. While Christensen (2003) was right that the company needed a new set of processes, organizational culture is also a form of process that was not addressed. Maybe, if Kodak had realized this culture is a process along with the new business unit, their fate may have been a different story. Johnson, Christensen, Kagermann (2008) believed that processes are an element of business models. They, however, explained how Hilti and Tata needed better processes and business models to support their research. A process cannot be a part of the business model because of the way a company operates. Its initial business model is not set in stone and is changing continuously. This is the problem that is addressed with the “Alpha Framework.” When the business model is more defined, only then can the processes be clear. The model in turn becomes more efficient and then can benefit the company in several areas like; saving time to market, lower costs etc. Displayed in figure 4 is Qualcomm’s business model.

24

Figure 4: Qualcomm’s Business Model

Source: Business Model |Investor Relations | Qualcomm, QUALCOMM Incorporated.

The company business model is viewed as an infinite loop, strengthened by its processes. When processes become clear and more defined, they begin to link with other processes and strengthen each other, thus strengthening the entire business model, which then continues to loop faster and more efficiently.

25

Chapter 4- Case Analysis

Mirasol as a Disruptive Innovation

Christensen (2003) draws our attention to what he calls the “Three Litmus Tests”. Litmus, from a more scientific background is a universal indicator, used as criteria to measure the pH of a solution, as to whether it fell into the category of acids or bases. These tests are called “Litmus Tests” as an indicator to whether the innovation falls into the “disruptive” or “sustaining” category.

Now we begin evaluating Qualcomm’s Mirasol Technology. In answering the first two questions of the Litmus test to prove that QMT’s Mirasol Display technology is a disruptive product. The “Yes” answer is only needed for anyone of the questions.

To determine whether an idea, product or model has “disruptive potential”, we first test whether it can develop into a “new market disruption” by answering the New Market Disruption questions:

26

4.1 New Market Disruption

The first two questions are to determine whether or not the new product is for a new market. This we can see that, display panels are already in “new market” existence and the market that Qualcomm is after is not one of “non-consumers.” The term ‘non-consumers’, means that the product is targeting customers, mobile device companies and manufacturers; that are not using any display panels. This is not where Qualcomm is focused; therefore, we need not to answer the first set of questions associated with this segment.

4.2 Low End Disruption

To evaluate the second set of questions we again only need to answer “Yes” to any one of the two.

4.2.1 Low-end customers’ willingness to purchase products with less

performance

Looking at the first question of the second set, “Are there customers at the low end market who would be happy to purchase with less (but good enough) performance, if they could get it at a lower price?” the answer is “Yes.”

27

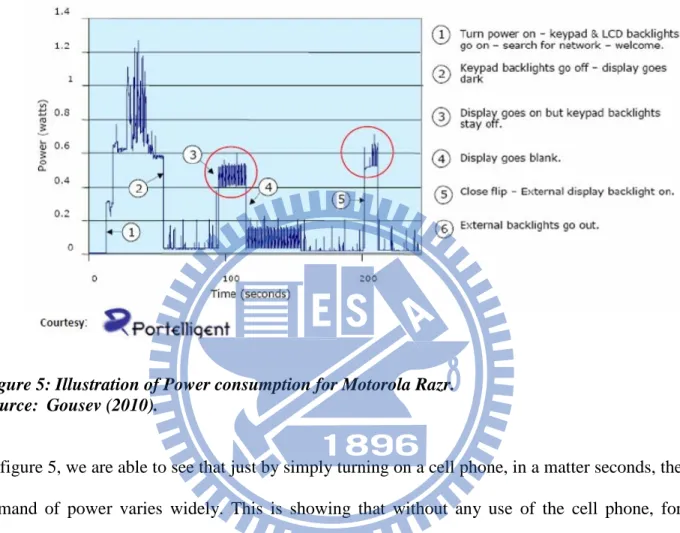

Figure 5: Illustration of Power consumption for Motorola Razr. Source: Gousev (2010).

In figure 5, we are able to see that just by simply turning on a cell phone, in a matter seconds, the demand of power varies widely. This is showing that without any use of the cell phone, for example: sending a text message, taking or watching photos with your cell phone, making a call etc., but simply by turning it on, the power is being consumed without any actual use of the functions of the phone by the consumer.

28

Figure 6: The Power Gap = Convergence Source: Gousev (2010).

In figure 6, we can see that the demand for power in hand held devices is increasing. It is increasing more so that the ability of the power provided through the battery alone is not sufficient. This study done is evidence that more and more over time, mobile device users are using, or at least want to use, their product more and are hindered because the battery cannot keep up with their demand. This causes severe inconvenience to mobile phone users who have device that they cannot optimally use because the battery of the mobile device is constantly ‘dead’.

29

Figure 7: Energy Consumption for Handset Activity Source: Qualcomm MEMS Technologies, Inc, (2010)

As technology improves the phone usage and capabilities, the demand will also increase. The gap between the capacity of 3G phone batteries and non-3G is growing. Video calls, video streaming, as well replaying stored videos and web browsing is a huge burden to the battery. The current solution to aid in this problem would be a bigger battery. A bigger battery, of course, has its trade-offs. The trade-offs include: the product becoming heavier to support this apparent ‘solution’. The device will become thicker because a bigger battery means more space needed to have the battery inside such device. Other trade-offs would include non-style support and, what will decrease profit margins, more cost. Is this then the right solution for the evident problem at hand? The answer is definitely NO. This solution creates no ‘cure’ to the ‘disease’ of the device using more and more power. What is needed are better products that reduce the amount of power used. This supports our hypothesis, that there exist large populations of companies who had the money and the equipment, but lacked the skill to create this type of technology, making the Mirasol display technology the first of its kind. These companies have realized that there is a

30

power gap that needs to be filled. These companies have also done enough research and development to find suitable solutions but failed. This is where Mirasol becomes a disruptive product and a threat to incumbents.

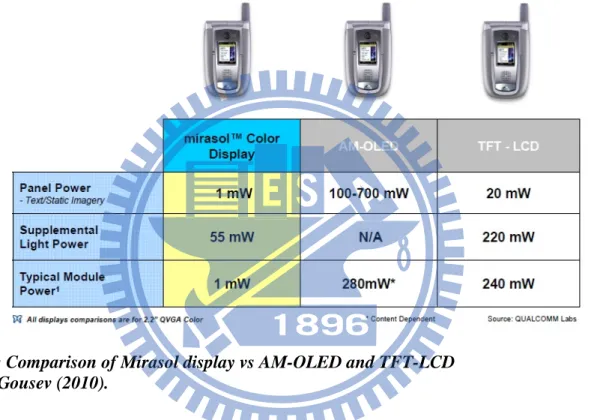

Figure 8: Comparison of Mirasol display vs AM-OLED and TFT-LCD Source: Gousev (2010).

In research done in Qualcomm labs, Mirasol has proved to use less energy that AM-OLED and TFT- LCD displays on similar products. From figure 5 above, there is quantifiable proof that Mirasol display uses less energy. As noted the results were from the 2.2 inch model, thus using an iPhone or any tablet, where the screen is a lot larger, the demand for power using other displays will be much greater.

Mirasol is the first full-color, video-capable display which reflects light as opposed to transmitting it like and LCD screen. It uses electrically charged, flexible membranes, laid over a

31

mirrored surface to mimic the reflective properties of biological crystals, naturally found in insect wings, bird feathers and fish scales. These crystals reflect lights at different angles, causing wavelengths to interfere with each other, which results in bright, luminous colors which seem to change when viewed from different angles, a property called iridescence. Mirasol is the first display technology to ever mimic nature, a process they call “bio mimicry”. Customers need not move to any inconvenient location. They are free to use this product in the displays of their e-readers, and maybe in the future even in TV screens or large digital signs without being hindered from glare provided by light from the sun!

Mirasol answers “yes” to the first question, that there are customers (businesses) at the low end of the market who would be willing to purchase if they could get it at a lower price and has already proven that it is a “low end disruption”.

4.2.2 The ability to earn profits at discount prices to win low-end customers

Can we create a business model that enables us to earn attractive profits at the discount prices required to win the business of these over served customers at the low end?

As of present, there is no way to accurately determine whether Mirasol’s business model will enable the company to earn attractive profits at discounted prices. This does not present a setback because only one of the two questions needed to be answered to advance to question 3.

32

4.3 A disruptive feature aiming at non-high-end market segments

So we move on to the final question. Mirasol answers yes to the final question. It is disruptive to all significant incumbent firms in the industry because nothing like this has ever been done before. This is not an improvement or an enhancement or an upgrade. With this we have established Qualcomm’s Mirasol Technology as a disruptive innovation. Important to note at this point is the understanding that Mirasol fits Christensen’s (2003) framework of what a disruptive innovation is, completely disregarding mainstream market and high-end market segments.

Mirasol, as compared to present incumbents, presents a business model problem as well as a technology problem. As described previously, Mirasol’s unique design presents issues for present mobile display manufacturers, which equates to incumbents (Cooper and Schendel, 1976; Daft, 1982; Rothwell, 1986; Tushman and Anderson, 1986) and can be the basis for the successful entry of new firms or even the redefinition of an industry (Henderson and Clark, 1990) because of the way it allows one to view contents of the devices. A radical product innovation is a product that incorporates a substantially different core technology and provides substantially higher customer benefits relative to previous products in the industry (Chandy and Tellis, 1998). As mentioned before, Radical innovation is based on different set of engineering and scientific principles and often opens up whole new markets and potential application (Dess and Beard, 1984; Ettlie, Bridges and O’Keefe, 1984; Dewar and Dutton, 1986). They both encompass the same basic principles which both support the fact that Mirasol Display is a radical innovation.

The value that is created from this innovation cannot be measured quantitatively but qualitatively. Value created from Mirasol benefits both mobile device manufacturers as well as end users. This amplifies the reason that Mirasol is indeed a potential threat to all incumbents.

33

4.4 The Ability of a Business Model to Target Existing Customers in

Main-Stream Markets

Christensen (2006) describes disruption as a process not an event. He also claims that disruption is a relative phenomenon. “It is a business model problem, not a technology problem,” admits Christensen (2006) but what happens if an innovation proves to be both a business model AND a technology problem.

Netflix as a business has proven to be very disruptive to Blockbuster using the internet to deliver its service. This was, with the use of the internet, a new business model and caused the incumbent tremendous problems. Netflix’s business model allowed them to reach a wider range of customers, charged a lower price and also cut cost for customers with “no late fees”, as compared to the incumbent Blockbuster. Netflix attacked Blockbusters’ existing customers. A business model is diverse and is not only subjective to customer, but also to a revenue model, value proposition etc.

Did Netflix business model not target mainstream customers? This is not supported by Christensen’s (2003) framework using the “Litmus Test.” This leaves to question, ‘Can this disruptive innovation, Netflix’s business model, be considered a disruptive innovation focusing on mainstream customers?’

The new value for customers created by Netflix allowed the customers to be in the comfort of their own homes to find the movies they would like to watch, free delivery, no late fees and an easier way to return the product. The net utility threshold for a disruptive innovation (Abner 2002) seems to be lower in high-end or, in this case, mainstream segments since these customers can use the internet in order to lower overall expenses and save in time to search for movies as well as convenience as mentioned. The use of the internet here is embedded in the business

34

model that also allowed them to provide movies online also for streaming purposes. This came at a higher cost but due to the business model and value created to the customers Netflix was able to account for all this and more.

To show how disruptive innovation was able to attack from high-end market segments Sandstrom (2010) explored the possibilities of technologies having disruptive like qualities but the companies found themselves in the high-end segment. Sandstrom (2010) also expressed that future review should be done on Christensen’s framework as to where disruptive innovation takes place.

With the past work of Christensen (1997) and Sandstrom (2010) along with Netflix we see that disruption can take place in any market segment. Scholars should make note and further improve the theory of disruption to be inclusive of all elements since proof exists to support them all through rigorous research done by these scholars as well as the numerous others that contributed to further refining this theory.

35

4.5 Qualcomm’s Strategy In Managing Mirasol

Managing a new product completely different from what once was a company’s core advantage creates a problem. “The Innovator’s Solution” as well as “The Innovator’s Dilemma” cites both companies that had decided to have a separate business unit and companies which kept it under the corporate division. This leads us to the question of “How should Qualcomm strategically manage this new product?”

Having a separate business unit has its advantages, especially for a disruptive technology.

Firstly, shifting responsibility for the technology to an autonomous sub unit can frame the innovation as an opportunity and focus on it (Christensen 2003). In these self-contained planning units, discrete business strategies can be developed and tasks specific to the product can be carried out. This unit has its own strategy, objectives, processes and competitors which would most likely differ from the parent company.

Secondly, a separate business unit is a good idea because it becomes well distinguished not only from the parent company but from other companies and businesses as well because it serves a distinct external market where management may go forward with their own strategic planning specifically designed for the product and its market. The unit would at this time be large and standardized enough to exercise control over strategic factors affecting the performance of the product.

Another reason is that some executives worry that a product might endanger the established brand if it proves to be either unsatisfactory or a failure altogether (Christensen, 2003). This problem is avoidable by strategically attaching a second word to the corporate brand. This is referred to as a purpose brand because it refers to a specific circumstance, job or task that the disruptive product should perform. If customers acquire a disruptive product and it is

36

unsatisfactory, inefficient, ineffective or unreliable, it will disappoint and thereby tarnish the corporation’s brand. On the other hand, if the product acquired is reliable and performs well, it will please the customer and therefore strengthen the corporate brand.

Of course, simply having a separate business unit does not equate to success. One example of how this type of corporate restructuring failed is Kodak. This can be seen from an excerpt of Lucas & Goh, (2009) as follows.

“Kodak was founded by George Eastman originally as Eastman Kodak Company in 1880 and developed the first snap shot camera in 1888. For Kodak, consumables provided the vast majority of revenue compared to cameras. The idea behind this was that the consumers spend a lot on the actual film than the actual purchasing of a camera. This made Kodak invest heavily in film and when color photography was introduced, it was one of the few companies that had the knowledge and processes to succeed. Kodak’s photofinishing process became the industry standard for quality. Thus, most of the power of the corporation centered on its massive film-making plant, and historically CEOs came from manufacturing jobs at the factory (Gavetti et

al.,2004).

Paul Porter, Kodak’s Director of Design and Usability said: We were way ahead of the curve

in digital even though we were pretty much a film and chemical company. We did a lot of

research in digital because we knew at some point in time the world would change. We invented the digital camera.”

The corporate culture and beliefs run deep within an organization. These are what make corporations competitive and successful but is the same reason why established firms fail. These same corporate culture and beliefs are what hinders firms from advancing or transitioning with the available technologies provided, either within a firm or external to it.

37

The same article by Lucas & Goh, (2009) continued as follows:

‘Steven Sasson, The inventor of the digital camera at Kodak, recognized the difficult position Kodak was in and remarked: “We were sort of in an odd position where we were certainly

supporting Silver Halide photography for all our customers, but we were also doing

advanced research into digital imaging. You know, Kodak made the first megapixel imager in

the mid-1980. We were doing image compression research and even making products using, what we call, DCT compression back in the mid 1980’s. And we made some of the first cameras. You might be surprise that a Kodak digital camera went abroad the 1991 space shuttle mission.”

Kodak went through a number of restructurings and at times had a separate digital organizational unit. In 1994, Fisher, CEO, separated digital imaging from silver-halide photographic decision to create digital and applied imaging division (Gavetti et al., 2004). However, it appears that it was not separate enough as there was infighting between the traditional film business and the digital photography unit. Kodak tried a number of organizational structures for the digital business, as an example:

In the fall of 2000 Kodak reorganized to bring digital and applied imaging and consumer imaging under one organization, in order to end the internal war between the film and digital segments (Rochester Business Journal, 12/8/2000).’

Kodak, whether they followed Christensen (2003) or not, had different business units as was suggested but still had enormous problems. Aside from the Resource Process Value (RPV) framework from Christensen (2003), there is still a separate component that Christensen did not take into consideration which was corporate culture, which has been addressed by Dan Yu and Chang Chieh Hang (2009). From the Kodak example, while restructuring was increasing, corporate culture was not being addressed. Culture is an effective way of controlling and

co-38

coordinating people without elaborate and rigid formal control systems (Tushman and O’Reilly 2002). Organizational culture generates cultural inertia and the difficulty to overcome this has been linked as a key reason why managers have failed often to introduce timely and substantial change (Christensen and Raynor 2003; Henderson 2006; Tushman and O’Reilly 2002)

Qualcomm’s QMT division might face these challenges. Qualcomm is historically known for their CDMA technology. Employees might feel a conflict in the tradition of the company and what Qualcomm is about to venture into. It is highly unlikely that Qualcomm’s QMT employees will face these challenges. QMT division is a new division and the employees that are hired under it have no ‘relation’ to Qualcomm’s core business. Qualcomm, in this year 2011, acquired Sollink, the company responsible for producing the Mirasol panels. These employees have no culture under the traditional CDMA technology or any of Qualcomm’s other divisions. Another reason why this would be unlikely, is that this is not the first time Qualcomm is creating a new business unit. As much as internal issues may exist, the management of Qualcomm Incorporated is quite capable of resolving them, because they have passed their trial and error phase and have proven that they are capable of not only successfully managing, but also maintaining their divisions. Listing a couple but not going into the details of these divisions are: Qualcomm Internet Services (QIS), responsible for aiding in the transition from mobile voice and data to mobile content and experiences and Qualcomm Enterprise Services (QES), which provides integrated wireless systems and services to businesses around the world. Management has the experience and expertise to address issues that inevitably arise and solve them in a Qualcomm manner.

This new business unit also presents a possibly new problem. Qualcomm is a “fabless” semi-conductor manufacturer. Mirasol display will be the first time Qualcomm will have a fabrication

39

plant. This supports the reason to have a separate business unit. When a ‘fab-related’ problem arises, how should Qualcomm address the situation? Again, Qualcomm’s core product has never encountered such an issue because there has never been a ‘fab’. While the employees are arguably very intelligent, they have no experience or expertise in addressing ‘fab-related’ problems and if left under Qualcomm Incorporated, the methods of solving problems, the processes of the core product, will not be suitable and is a recipe for early disaster.

Mirasol provides Qualcomm with both opportunity and potential problems. Managing this new unit will require the right people. This is where new value chains and new networks and distribution channels are created. Sales personnel differ significantly from its previous personnel. Distribution channels are in a way amplified to provide Qualcomm’s customers with an additional product. Qualcomm ships its semiconductors to many companies. These companies include but are certainly not limited to: LG, HTC, Samsung, Blackberry etc. From the studies that have been done about the power gap of the phones, Qualcomm provides exceptional potential with this technology. Not only would Qualcomm provide semiconductor chipsets to these companies, but also it could possibly provide a solution to the increasing gap of consumer power demanded and battery power supply. All these companies stand to gain by utilizing Mirasol in its product. Mirasol will enable these companies to design thinner products that consumers could enjoy for longer periods of time.

When designing a new product the initial purpose is usually seen, but this allows businesses to suffer from myopia. This is not to say the executives are not smart nor cannot see long term. However, they are successful companies that have experienced such difficulties and they have found ways to solve them but no two companies are the same. What conclusions we can draw

40

from this is, when and if Qualcomm is faced with such issues, they should react and look into the possibility of utilizing the product in other areas not previously seen.

Looking at “Honda’s Invasion of The North American Motorcycle Industry” extracted from “The Innovator’s Dilemma,” we will see how Honda’s original product, “Supercub”, entered the US market and failed.

“Honda’s executives were eager to exploit the company’s low labor costs to export motorbikes to North America, but there was no equivalent market there for its popular Japanese “Supercub” delivery bike. Honda’s research showed that Americans used motorcycles primarily for over-the-road distance driving in which size, power and speed were the most highly valued product attributes. Accordingly, Honda engineers designed a fast, powerful motorcycle specifically for the American market, and in 1959 Honda dispatched three employees to Los Angeles to begin marketing efforts. To save living expenses, the three shared an apartment, and each brought with him a Supercub bike to provide cheap transportation around the city.

The venture was a frustrating experience from the beginning. Honda’s product offered no advantage to prospective customers other than cost, and most motorcycle dealers refused to accept the unproven product line. When the team finally succeeded in finding some dealers and selling a few hundred units, the results were disastrous. Honda’s understanding of engine design turned out not to be transferable to highway applications, in which bikes were driven at high speeds for extended periods: the engines sprung oil leaks and the clutches wore out. Honda’s expenses in air-freighting the warrantied replacement motorcycles between Japan and Los Angeles nearly sunk the company.”

Kichachiro Kawashima, the executive in charge of the North American venture, decided to vent his frustrations by taking his Supercub into the hills east of Los Angeles.” This helped him to

41

feel better and did returned again a few weeks later. He then invited his colleagues and soon people started to inquire as where they could buy these bikes. And thus, the market for the dirt bike industry was formed. The Los Angeles team “convinced corporate management in Japan that while the company’s large bike strategy was doomed to failure, another quite different opportunity to create a totally new market segment merited pursuit,” Christensen (1997).

Looking at this example one might think that this was so long ago and that there is no way that companies, especially in this modern day learned from this example. Maybe so, but they are also proof that companies, extremely large and successful, still suffer the same myopia.

In a more recent article, “Microsoft’s Ambivalence About Kinect Hackers (Bloomberg L.P, 2011),” we note Microsoft in the same dilemma, where Microsoft hesitated in capitalizing on the infinite and unbound potential of the Microsoft Kinect. The Kinect is a motion sensing input device developed by Microsoft for the Xbox 360 console, allowing users to interact with a video game using gestures, movements and spoken commands, negating the use of a controller. It served to make the gaming experience more lifelike and interactive. Microsoft knew that with gaming enthusiasts around the world, the Kinect would be a hit and it sold millions worldwide. The Kinect actually holds the Guinness World Record for the “fastest selling consumer electronics device” (Guinness World Records, 2011).

What Microsoft did not plan for, is what is referred to as the “Open Kinect Project” (Bloomberg L.P, 2011), an effort backed by thousands of hackers worldwide, who have cracked and studied the Kinect and its software, and learnt to program it for all kinds of new uses, ranging from controlling robots to sexual interaction with avatars. Microsoft responded to this outrage by publicly stating that it “does not condone the modification of its products" (Bloomberg L.P, 2011) and vowed to work with law enforcement "to keep Kinect tamper-resistant”.

42

Unknown to them at the time was Dan Barry, a former astronaut who made use of a hacked Kinect to solve problems in robotics. He used the Kinect to teach the robot the difference between a picture of a person and the actual person. He went on to say that, “it is packed with technology that would otherwise be difficult to replicate or expensive to buy”. With its cameras and depth-perception software, the Kinect is the most feasible and worthwhile replacement for expensive equipment typically used in robotics.

Other examples of Kinect’s uses include, but are not limited to the control of a vacuum cleaner by the wave of a hand, done by attaching the Kinect to a Roomba (Bloomberg L.P, 2011). Other users use it to play games not designed for the Xbox, like World of Warcraft (Bloomberg L.P, 2011), which is a computer game. Players use the Kinect to control their characters with their bodies, as opposed to their keyboards. Some developers projected virtual puppets onto a wall and controlled them with hand gestures. A group of MIT developers have perfected a way to navigate web pages using the Kinect and Javascript (PSFK, LLC, 2011). One is now able to scroll through tabs, up and down pages, click on links, zoom and pan around pages and go back and forward. Granted that it’s not as fast as using a mouse, it suggests the possibility of using Kinect for other applications that run in a web browser, and maybe soon enough, in any core operating system. One of the most impressive applications for the Kinect so far has been its use by Navi (Navigational Aids for the Visually Impaired) developers who use the Kinect’s webcam and sensors as a means of detecting the surroundings of a visually challenged individual and audibly describing it to them, mapping out indoor routes, making navigation easy, without using a traditional “white cane”(Dashhacks Inc., 2011).

On Feb.21st Craig Mundie, Microsoft’s chief research and strategy officer, and Don Mattrick, president of Microsoft’s Interactive Entertainment Business finally announced the release of

43

their “Starter Development Kit” (SDK) for developers in a non-commercial form, targeting researchers and enthusiasts alike (Microsoft Corporation, 2011). It give users access to deep Kinect system information such as audio, system application-programming interfaces, and direct control of the Kinect sensor, so that developers can legitimately take advantage of the Kinect's potential. Microsoft hints that a commercial version of the SDK would be released after extensive testing of the non-commercial trial. The point being that Microsoft can now capitalize on the product and entertain the amazing idea of a “Kinect App Store”.

These are examples that stems from the 1970s to present day that companies primary purpose of their product has been altered. These changes enabled companies to explore the possibilities and results of their products, when not only being used for the primary goal. It also, promotes the creativity of the world to see how to utilize certain technology to make the world we live in more convenient.

On a different note, Qualcomm’s new product does possess the potential to overthrow their incumbents in the display market for mobile devices. A retrospective reading of the history of technology indicates that not all radical technological innovations are equivalent in terms of their impact on the various value creation activities of a firm and that differential effects may help explain incumbent survival and performance (Freeman & Soete, 1997; Tripsas 1997). Clark & Wheelwright (1993) stated that radical technologies diminish the value of the accumulated R&D knowledge of an incumbent. Since they also typically require new production processes, the value of the established production processes also may be diminished. Mirasol has the potential to diminish the R&D knowledge value of its incumbents by being the first with this revolutionary “biomimicry” technology which far surpasses the capabilities both in resolution and in power capacity of the incumbents, showing now that the future lies not with LEDs and

44

AMO-LEDs, but with this new, nature friendly way of harnessing light from the sun to create interference which in turn produces power saving displays. But while radical technologies diminish the upstream value chain activities of incumbents, it does not follow however, that the new technology will simultaneously diminish the value of the downstream activities, particularly in marketing, sales, after-sales, service and support (Abernathy & Clark, 1985). If the downstream value chain activities of incumbents retain their value, incumbents may then be in a position to benefit from the radical technology via interfirm co-operation with new entrants (Rothaermel, 2001; Teece 1992). To create an eminent and profound impact on the incumbents, the impact must not only be made on the upstream value chain activities like R&D and procurement, but a significant impact must also be made on the downstream activities to inhibit the value of the incumbents. If the incumbents are significantly affected both upstream and downstream, Mirasol stands a better chance of being the forerunner on the market, and may even advance to displace its incumbents altogether.

These companies might not put up a fight in this market for reasons such as low profit margins and resource allocation necessities to provide for more prosperous markets Christensen (1997, 2003). These markets would be, but are not limited to, the TV display and computer screen display markets. If the margins are low, it makes more financial sense to leave the market and focus on the higher profit margin markets.

TV’s are becoming more and more advanced. Recently, television sets are becoming capable of 3-D viewing. This is significant for panel manufacturers. This advancement in television viewing capability makes other display manufacturers have to keep up with their competition and also try to provide the same product. By doing this, resource allocation becomes a concern. Organizations then have to decide where the resources go. “Resources are the most visible of the

45

factors that contribute to what an organization can and cannot do. Resources include people, equipment, technology, product designs, brands, information, cash and relationships with suppliers, distributors and customers,” Christensen (1997). This leads to question where the display companies, should place their resources in the present 3-D panels or mobile device panels?