賭博與避險:選擇權交易動機之研究 - 政大學術集成

全文

(2) 誌. 謝. 就讀政大財管所的兩年中,受到許多人的幫助,本篇論文才得以順利完成。 首先要感謝的是周冠男老師,每每在我遭遇瓶頸時給予適時的提點,也在我遭遇 低潮時包容論文進度停滯不前。另外也要感謝口試委員徐之強老師、劉祥熹老師、 何耕宇老師撥冗指導並惠予論文修改建議,讓我的論文能臻於完整。 財管所同學中,最先要感謝的是士豪。每當 SAS 的 coding 遇到疑難雜症時 和你討論總能獲得啟發;謝謝同門夥伴彥銘、欣頤,和你們一起討論進度讓我時. 政 治 大 凱軒,和你們打嘴炮、喝酒、吃宵夜永遠都是最快樂的時光,邊打嘴炮邊抱怨論 立 時鞭策自己,不致因外務而荒廢論文;謝謝好友穎緻、劍洲、韋丞、鈞元、宗霈、. ‧ 國. 學. 文進度的日子我會永遠記得;對於大學同窗堯貞、和明、仲堯、冠學、丁文、呈 彰、盈秀、皓娸、潔萱、凱丰、陳葦、雅茵、芷華等人沒有因為我讀研究所忙於. ‧. 課業及實習就忘了我的存在,仍時時相約出遊,也深深感謝。. y. Nat. sit. 感謝 Eastspring Investments 林宜正協理包容我利用實習的空閒時間跑 data;. n. al. er. io. 感謝 Dr. Finance 謝劍平董事長、林祖儀執行長體諒我同時實習、上課、寫論文的. i n U. v. 辛勞;謝謝中山大學郭修仁老師、黃振聰老師悉心的教導,啟發我對財管的興趣. Ch. 也建立財務相關的基礎知識。. engchi. 最後要特別感謝洪曉妤。在我讀財管所的兩年當中,容許我把時間花在念書、 工作、寫論文、讀書會上,犧牲了許多和妳約會的時間。. 蘇育賢 謹識於 國立政治大學財務管理研究所 中華民國一百零二年六月.

(3) Abstract In this paper, we construct two hypotheses, institutions hypothesis and hedging hypothesis to investigate 1) which types of investors have price impact in options market? 2) motives for investors to trade options, respectively. Thanks to a unique dataset obtained from Taiwan Futures Exchange, we can decompose the overall net buying pressure into net buying pressure initiated by each investor type. Empirical. 政 治 大. results show that both individual investor and foreign institutions have price impact in. 立. Taiwan options market. Besides, we also demonstrate that motives for individual. ‧ 國. 學. investors to trade options could contain gambling desire, hedging demand, and. ‧. substitution effect; however, motives for foreign institutions to trade options do not. Nat. io. sit. y. contain gambling desire. Furthermore, we conclude that only trading volume of. er. lottery-style stocks affects NBP from domestic institutions among two gambling. al. n. v i n proxies. This result suggest C that be one of the motives for domestic h gambling e n g ccould hi U. institutions to trade options, but lottery and options are not substitution goods. After all, it is non-sense that domestic institutions gamble by buying lotteries.. Keywords: net buying pressure, gambling desire, hedging demand, substitution effect. i.

(4) Table of Contents List of Tables ............................................................................................................... iii I.. Introduction ..........................................................................................................1. II. Literature Review and Hypotheses .....................................................................4 II.1 Options Volatility Smile ...................................................................................................... 4 II.2 Behavioral Bias ................................................................................................................. 5 II.2.1 Overconfidence ..................................................................................................................... 7 II.2.2 Sensation Seeking (or Gambling) .......................................................................................... 8. II.3 Hypotheses ...................................................................................................................... 11. III. Data, TAIFEX, TAIEX Options, and Lottery..................................................13. 政 治 大 III.1.1 Futures Market ................................................................................................................... 13 立 III.1.2 Options Market .................................................................................................................. 13. III.1 The Trading Mechanism of the TAIFEX and TAIEX Options ............................................. 13. ‧ 國. 學. III.1.3 Lottery Market ................................................................................................................... 14. III.2 Data Description ............................................................................................................. 15. ‧. IV. Methodology .......................................................................................................19 IV.1 Institutions Hypothesis .................................................................................................... 19. y. Nat. er. Empirical Results ...............................................................................................27. io. V.. sit. IV.2 Hedging Hypothesis ........................................................................................................ 22. al. n. v i n Ch V.2 Hedging Hypothesis ......................................................................................................... 35 U i e h n gc V.3 Robustness Test ................................................................................................................ 40 V.1 Institutional Hypothesis .................................................................................................... 27. VI. Conclusion ...........................................................................................................41 VII. Reference .............................................................................................................43. ii.

(5) List of Tables Table I. Moneyness Category Definitions.................................................................... 16 Table II. Trading Volume Of Taifex Options During Year 2002 To 2007 .................... 17 Table III. Basic Characteristics of Lottery-Style Stocks .............................................. 24 Table IV. Summary of Regression Results of Change in Each Type Implied Volatility for Taifex Options Traded on the Taiwan Futures Exchange during the Period January 2002 through December 2007........................................ 28 Table V. Numbers of Call Option Contracts Traded for Hedging Purpose by Trader Type during the Period January 2002 through December 2007 ............. 31 Table VI. Numbers of Put Option Contracts Traded for Hedging Purpose by Trader Type during the Period January 2002 through December 2007 ............. 33. 政 治 大 Regression Results of Net Buying Pressure from Individual Table VII. Summary of立 ‧. ‧ 國. 學. Investors in Each Moneyness for TAIFEX Options Traded on the Taiwan Futures Exchange during the Period January 2002 through December 2007. ....................................................................................................... 37. Table VIII. Summary of Regression Results of Net Buying Pressure from Foreign. al. er. io. sit. y. Nat. Institutions in Each Moneyness for TAIFEX Options Traded on the Taiwan Futures Exchange during the Period January 2002 through December 2007. ...................................................................................... 38. n. Table IV. Summary of Regression Results of Net Buying Pressure from Domestic Institutions in Each Moneyness for TAIFEX Options Traded on the Taiwan Futures Exchange during the Period January 2002 through December 2007. ...................................................................................... 39. Ch. engchi. iii. i n U. v.

(6) I.. Introduction. Kahneman and Tverskey (1979) propose the prospect theory to describe people’s decision processes under risks and build the foundation of behavioral finance. These days, behavioral finance has become one of the most important branches in the field of finance. Abundant of market anomalies cannot be solved by modern finance were properly explained by behavioral finance.. 政 治 大 Among all market anomalies, options volatility smile/smirk is one of the most 立. ‧ 國. 學. famous one. Implied volatility observed in options market is different from what Black. ‧. and Scholes (1973) derived, a constant value, but a changing number as strike price. sit. y. Nat. differs. To the best of our knowledge, mainly existing investigations demonstrate this. n. al. er. io. anomaly in two points of view, which are model assumption error and market. Ch. i n U. v. microstructure effect. Nevertheless, among those papers who demonstrate this anomaly,. engchi. most of them examine the relation between implied volatility and net buying pressure derived from entire market, rather than decomposing net buying pressure by trader types. Therefore, one of our main purposes in this study is testing which type of investors has the price impact in options market. Besides, studies (e.g. Bollen and Whaley (2004), Chan, Cheng, and Lung (2004, 2006)) propose that institutional investors trade options to cover their physical positions and thus lead the increase in. 1.

(7) net buying pressure and implied volatility. Few papers investigate the relation between net buying pressure of options and behavioral biases. Thus, another main objective in this study is to test whether behavioral biases affect the net buying pressure of options.. Thanks to a special account-level dataset obtained from Taiwan Futures Exchange, we can divide net buying pressure into three types by their originations, oriented from individual investors, foreign institutions, and domestic institutions. By. 政 治 大. tracing back the origination of net buy pressure, we can build a regression model to. 立. measure the price impact from each type of traders. Also, this feature of our dataset. ‧ 國. 學. allows us to test the motives of trading options.. ‧. sit. y. Nat. Empirical results show that options demand of individual investors can affect. n. al. er. io. the change in implied volatility of both call options and put options, but demand of. i n U. v. foreign institutions and domestic institutions can impact change in implied volatility of. Ch. engchi. put exclusively. Our results show inconsistence with previous studies; first, existing investigations argue that hedging demand of institutional investors leads options supply demand imbalance, but our results suggest that not only institutional investors but also individual investors have price impact to options; second, we present the trading volume of each investor type and find that options trading volume related to hedging purpose is relatively low compared to the overall market volume for all types of traders. Thus, we are interested in other motives to trade options for investors. 2.

(8) In the second empirical rest, results suggest that gambling desire and hedging demand can significantly explain the net buying pressure from individual investors, yet net buying pressure from foreign institutions cannot be affected by gambling desire. These results provide strong evidence demonstrating that motives for trading options of individual investors and domestic institutions contain both hedging demand and gambling desire, yet foreign institutions are less impacted by behavioral biases while trading options.. 立. 政 治 大. The paper proceeds as follows. Section II reviews previous studies in behavioral. ‧ 國. 學. finance and options implied volatility smile, and builds research hypotheses we. ‧. concern in this paper. Section III describes the sample data used in the analyses and. y. Nat. al. er. io. sit. basic descriptive statistics of our dataset. Section IV presents the research. v. n. methodologies used in this study. Section V provides the empirical results of our major. Ch. engchi. i n U. concerns in this study, and Section VI summarizes the main results of the paper.. 3.

(9) II.. Literature Review and Hypotheses. II.1 Options Volatility Smile Options volatility smile/smirk is one of the most puzzling phenomena in modern financial market. There are mainly two schools of thought to explain how the implied volatility changes with the exercise prices of options. The first argues that the. 政 治 大. underlying process is not what Black-Scholes Model assumed, log-normal distribution,. 立. and tries to build more advanced models to describe volatility. The second argues that. ‧ 國. 學. the reason for volatility pattern is microstructure of options market.. ‧. To explain the nonconstant implied volatilities in the Black-Scholes option. y. Nat. al. er. io. sit. pricing model, studies ease the assumptions or modify the stochastic model. Dupire. v. n. (1998) allows the volatility to be time-dependent by inducing a new diffusion process.. Ch. engchi. i n U. Anderson, Benzoni, and Lund (2002) extend the volatility process of asset returns to encompass Poisson Jumps and negative relationship between returns and volatility. Bates (2000) also incorporates jumps in the volatility process. Christofferson, Jacobs, and Mimouni (2010) suggest that the best volatility specification is one with linear rather than square root diffusion for variance.. Another school of thought demonstrates that market imbalance is the main reason of volatility smile. Bollen and Whaley (2004) propose net buying pressure 4.

(10) hypothesis (NBP hypothesis) and suggest that the implied volatility smile is driven by a supply and demand imbalance in options market; the imbalance exists when institutional investors buy large amounts of OTM options, especially OTM index puts, in a short period, and thus cause the net buying pressure up. And reason for which institutional investors tend to buy OTM index puts is hedging for the underlying assets. Chan, Cheng, and Lung (2004, 2006) follow Bollen and Whaley (2004), and test the. 政 治 大. NBP hypothesis with Hong Kong index options and provide the similar empirical. 立. results. Besides, Larkin, Brooksby, Lin, and Zurbruegg (2012) separate their sample. ‧ 國. 學. period, September 1, 2006 to November 28, 2008, into two sub-periods and define. ‧. them bullish and bearish market respectively to test whether volatility pattern changes. Nat. io. sit. y. in different market situation. The empirical results suggest that net buying pressure. er. from market participants appears to be a source of mispricing in the case of OTM puts. al. n. v i n C hpronounced duringUthe bull period. with excess demand particularly engchi II.2 Behavioral Bias. However, investors are not fully rational. Studies have shown evidence demonstrating that some portion of trading motivation is driven by behavioral biases, such as overconfidence and sensation seeking. Kumar (2009) shows that behavioral biases do exist in financial market and that individual investors exhibit stronger. 5.

(11) behavioral bias when stocks are more difficult to value and when uncertainty is higher. Besides existing, behavioral biases can also affect markets. Barber, Odean, and Zhu (2009) suggest that uninformed traders’ trade can move the market, and these overpricing and underpricing cannot be fully eliminated by risk-averse informed traders due to limits of arbitrage.. Also, when selecting individual stocks, some investors do not rely on. 政 治 大. fundamental valuation model, for example, dividend discount model or free cash flow. 立. discount model. They pick those stocks to trade probably on other reasons, such as. ‧ 國. 學. level of media exposure and large price moves. Busse and Green (2002) show that. ‧. when Maria Bartiromo1 mentions a stock during the Midday Call on CNBC, trading. y. Nat. al. er. io. sit. volume will then dramatically increase in the minute following her mention. Barber. v. n. and Odean (2007) use news flow, unusual trading volume, and extreme returns as. Ch. engchi. i n U. proxies for attention to test whether individual investors buy stocks which can catch their attention; the result supports Barber and Odean’s prediction. Consequently, following shall further discuss theories and prior evidences of biases which inspire our thought in this paper, overconfidence and sensation seeking.. 1. Maria Bartiromo is a financial famous economic journalist in the U.S. She discusses both positive and negative news in Midday Call on CNBC, and Midday Call is perhaps the most prominent and powerful financial economic television show in North America. 6.

(12) II.2.1 Overconfidence. Overconfident people tend to be unreasonably optimistic about their actual ability. For example, when asked about their driving ability (Svenson 1981), a vast majority of people say they are above the average. But this is not the case; there are only half can be above the average. In financial market, overconfident investors overestimate the precision of their private information. Garvais and Odean (2001). 政 治 大. document that traders infer their ability from prior successes and failures; in the. 立. ‧ 國. 學. inferring process, such traders take too much credit in their successes and therefore become overconfident. Benos (1998) documents that overconfident investors lead. ‧. higher transaction volume, larger depth, more volatile, and more informative prices.. sit. y. Nat. io. n. al. er. Nevertheless, majority of overconfident investors are more aggressive in trading and. i n U. v. thus use market order; in this way, they may make higher profit due to earlier orders.. Ch. engchi. However, it is important to note that level of overconfidence is difficult to measure empirically. It is hard to judge an investor overconfident only by his/her own trading history; hence, approachs measuring overconfidence are important. Barber and Odean (2001) use gender as the proxy for overconfidence and suggest that people with higher degree of overconfidence tend to trade more frequent than those with lower degree of overconfidence do. Biais, Hilton, Mazurier, and Pouget (2005) use an. 7.

(13) experiment to observe investor’s behavior under asymmetric information. They suggest that miscalibrated traders2 tend to underestimate the uncertainty of asset value. Glaser and Weber (2007) use an internet questionnaire which was designed to measure various facets of overconfidence from approximately 3,000 broker investors. Glaser and Weber (2007) find that investors who think they are better than average in terms of performance and skills trade more.. 政 治 大. II.2.2 Sensation Seeking (or Gambling). 立. ‧ 國. 學. Sensation seeking is another common behavioral bias in individual investors. Zuckerman (1994) is one of the founders of this concept; he describe sensation seeking. ‧. as “…a trait defined by the seeking of varied , novel, complex, and intense sensations. sit. y. Nat. io. n. al. er. and experiences, and the willingness to take physical, social, legal, and financial risks. i n U. v. for the sake of such experience” and foster a set of measurement scale for sensation. Ch. engchi. seeking. Sensation seeking can be observed in behaviors. Horvath and Zuckerman (1993) indicate that sensation seeking is positively correlated to risky behaviors, including real or imagined physical, social and financial risks. Grinblatt and Keloharju (2009) document that sensation seeking trait can generate behaviors, such as risky driving, risky sexual behavior, frequent career changes, drug and alcohol abuse, participation in certain types of sports and leisure activities (like bungee jumping or 2. Traders with miscalibration, volatility underestimation, and better than average effect are all considered overconfident. 8.

(14) roller coaster riding), and gambling, which are seemingly not so related to sensation seeking.. Grinblatt and Keloharju (2009) use a special dataset from Finland to investigate the relationship between sensation seeking, overconfidence, and trading activity. They demonstrate that the correlation between sensation seeking and overconfidence is very low, so both behavioral biases should have independent influence on trading. Besides,. 政 治 大. they suggest that investors who are most prone to sensation seeking and those who are. 立. most overconfident trade the most.. ‧ 國. 學. Previous Papers, such as Shefrin and Statman (2000) and Statman (2002),. ‧. sit. y. Nat. emphasize the potential role of gambling in investment decision. Barberis and Huang. n. al. er. io. (2008) further apply cumulative prospect theory3 to describe investors’ behavior when. i n U. v. pricing stocks with idiosyncratic positive skew. They suggest that, in a financial. Ch. engchi. market with cumulative prospect theory investors, those skewed securities will be overpriced relative to the price predicted through expected utility function, and thus, earn negative average returns. This result holds when market exists short selling mechanism; they suggest that while expected utility investors try to exploit the. 3. Tversky and Kahneman (1992) proposed cumulative prospect theory to modify their previous theory, prospect theory, by applying the probability weighting function to the cumulative probability distribution, rather than the probability density function. By doing so, they ensure that cumulative prospect theory does not violate first-order stochastic dominance, a flaw of the original version of prospect theory, and also allow the new model being applied to gambles with any number of outcome, not just two. 9.

(15) overpricing by selling short in skewed securities, there are risks and transactions costs, and this limits the impact of expected utility investors’ trading. Financial market puzzles such as low long-term return of IPO stocks, low returns of distressed stocks, and options volatility smile could be caused by cumulative prospect theory investors.. Besides economic model, empirical investigations also show similar results as Barberis and Huang (2008). Kumar (2009) names securities with positive idiosyncratic. 政 治 大. skew as “lottery-type stock” and concludes that individual investors prefer lottery-type. 立. stocks more than institutional investors do based on a special dataset from a security. ‧ 國. 學. house. In addition, he also shows that individual investors’ preference for lottery-type. ‧. stocks are stronger among socioeconomic groups that are known to exhibit strong. y. Nat. al. er. io. sit. preferences for state lotteries and portfolios of individual investors who overweigh. v. n. lottery-type stocks significantly perform worse than those of who do not overweigh lottery-type stocks.. Ch. engchi. i n U. Barber, Lee, Liu, and Odean (2009) suggest that individual investors in Taiwan suffer systematic and economic large losses due to transaction costs from aggressive orders and high turnover. They also propose that such high trading frequency is probably owing to individual traders’ sensation seeking behavior in stock market.. Options could be another sensation seeking instrument because they are highly. 10.

(16) leveraged and downside protected. Besides, compare to their underlying assets, options are cheaper investing instrument since the prices of options, particularly out-of-the-money (OTM) ones, measured in dollar magnitude, could be much lower than those of underlying assets. In this way, investors might see OTM options as kinds of sensation seeking or gambling vehicles and this behavior might cause buying pressure and further brings volatility smile/smirk. Hence, this study investigates the. 政 治 大. relationship between gambling and options trading through their volume. Additionally,. 立. Gao and Lin (2011) suggest that when the amount of jackpot of lotteries exceeds 500. ‧ 國. 學. million Taiwan Dollar, the number of shares traded by individual investors decreases. ‧. 5.4% to 7% among stocks with gambling characteristics, but this phenomenon does not. Nat. io. sit. y. exist in sizeable firms. Based on their discoveries, they suggest that substitution effect. n. al. er. is preserved when the lottery sales and the size of the jackpot are employed as. Ch. engchi. alternative instruments for gambling.. i n U. v. II.3 Hypotheses Previous studies, such as Bollen and Whaley (2004), Chan et al. (2004, 2006), investigate the reason causes options volatility smile, and most of them conclude that daily changes in the implied volatility of an option series are significantly related to net buying pressure. This result is opposed to the learning hypothesis but has a strong. 11.

(17) support to limit of arbitrage hypothesis. In this study, our dataset combines with the unique account-level data; thus we are enabled to further examine the changes of implied volatility is impacted by which trader type. To summarize the previous, our first hypotheses are as follow: 1. Institutions hypothesis H0: Implied volatility is affected by either institutional investors, or individual investors.. 立. 政 治 大. Besides, Bollen and Whaley (2004) suggest that institutional investors hedge. ‧ 國. 學. their spot positions through OTM options and thus increase the buying pressure.. ‧. However, Gao and Lin (2011) suggest that when the amount of jackpot of lotteries is. y. Nat. al. er. io. sit. higher, the trading volume of stocks goes lower. In view of this, we are interested in. v. n. whether investors see options a gambling instrument and in whether hedging demand. Ch. engchi. i n U. of options cause the buying pressure goes up. Hence, we use the lottery data and the trading volume of lottery-type stocks to test if trading options is a form of gambling, and use the futures trading volume to measure the relationship between options buying pressure and hedging. 2. Hedging hypothesis H0: Net buying pressure from each type of investors is affected by hedging demand only. 12.

(18) III. Data, TAIFEX, TAIEX Option, and Lottery In this chapter, we describe the trading mechanism of the Taiwan Futures Exchange (TAIFEX), Taiwan lottery market, and the datasets used in this study. Section III.1 describes the options, futures and lottery markets in Taiwan. Section III.2 presents the detail information and features of our dataset.. III.1 The trading mechanism of the TAIFEX and TAIEX options. III.1.1 Futures market. 立. 政 治 大. ‧ 國. 學. The TAIFEX is an order-driven electronic market in which there are no. ‧. designated market makers; hence futures prices are determined by orders submitted by. sit. y. Nat. traders and executed under a price and time priority system. The TAIFEX futures. n. al. er. io. market was operated under an automated (10-s) batch-call system before July 29, 2002,. Ch. i n U. v. but it was transferred to a continuous auction system thereafter. Trading is conducted. engchi. from 8:45 a.m. to 1:45 p.m., no noon-break, each trading day (Monday through Friday, excluding public holiday), and the price limits are +/- 7%. of the previous day’s. closing price (for more details, please check on http://www.taifex.com.tw).. III.1.2 Options market. The TAIEX options market is a hybrid system; current bid and ask prices of the market makers are shown and people are also allowed to submit limit orders. Other 13.

(19) mechanisms are similar to TAIFEX. Trading is conducted from 8:45 a.m. to 1:45 p.m. Monday through Friday, excluding public holiday, and the price limits are +/- 7%. of. the underlying closing price on previous day.. III.1.3 Lottery Market. We employ two major lotteries in Taiwan, including Lotto and Big Lotto. Lotto was introduced on January 22, 2002 and Big Lotto was introduced on January 05, 2004.. 政 治 大. Price per ticket for both Lotto and Big Lotto are 50 Taiwan Dollars. Things worth. 立. ‧ 國. 學. mentioning are that Lottery was operated by Taipei Bank4 during year 2002 to 2006, and Chinatrust took over the Lottery business since 2007 till now. Therefore, details. ‧. before 2007, such as sales volume and jackpot size, are not accessible. Under this. sit. y. Nat. io. n. al. er. backdrop, we construct a dummy, which is given unity if lottery drafts in the specific. i n U. v. day and equals zero otherwise, to measure the gambling desire of investors. Lotto draft. Ch. engchi. on Tuesdays and Fridays from its inception to March 24, 2006; draft on Mondays, Wednesdays, and Fridays from March 25, 2006 to December 29, 2006; draft on Mondays and Thursdays from January 1, 2007 to January 21, 2008. Besides, Big Lotto draft on Mondays and Fridays from its inception to March 24, 2006; draft on Tuesdays and Thursdays from March 28, 2006 to December 28, 2006; draft on Tuesdays and Fridays from January 2, 2007 to present. 4. Fubon Bank merged Taipei Bank and changed its name into Taipei Fubon Commercial Bank Co., Ltd. in year 2005. 14.

(20) III.2 Data description The account-level futures and options data used in this paper is obtained from TAIFEX. This dataset contains all transaction and order records, providing the trader account number, trader type, transaction price, order price, product type, order time, transaction time, type of options (call/put), option characteristics (strike price and expiration date), trading and order directions (buy/sell); and the sample period covers. 政 治 大. all trading days from 17 January 2002 to 31 December 2007. Besides, the TAIEX spot. 立. ‧ 國. 學. prices index closing price, individual stocks closing prices, risk-free rate, daily implied volatility and delta of each option are collected from Taiwan Economic Journal (TEJ). ‧. database, a local data vendor.. sit. y. Nat. n. al. er. io. One of the special features of our dataset from TAIFEX is that this dataset can. Ch. i n U. v. link the options market and futures market. In Taiwan security market, investors trade. engchi. options and futures with the same account; therefore, we can trace each investor’s trading record to observe whether investors use options to hedge their futures positions. Another unique feature is that each transaction record can be identified for different investor classes; hence, this dataset allows us to classify the net buying pressure into three trader types5: individual investors, foreign institutions, and domestic institutions.. 5. Traders in TAIFEX option market can be roughly divided into four types, individual investors, foreign institutions, domestic institutions, and market makers. Yet, market makers provide liquidity and make profits through bid-ask spread. Therefore, market makers barely affect option prices and thus we do not 15.

(21) Table I Moneyness Category Definitions Listed are category numbers, labels and corresponding delta ranges of options in our sample. Options with absolute deltas below 0.02 and above 0.98 are excluded. Category. Labels. Range. 1. Deep in-the-money call (DITMC). -0.875 < ∆𝐶 <= 0.98. 2. In-the-money call (ITMC). -0.625 < ∆𝐶 <= 0.875. 3. At-the-money call (ATMC). -0.375 < ∆𝐶 <= 0.625. 4. Out-of-the-money call (OTMC). -0.125 < ∆𝐶 <= 0.375. 5. Deep out-of-the-money call (DOTMC). -00.02 < ∆𝐶 <= 0.125. 6. Deep out-of-the-money put (DOTMP). -0.125 < ∆𝑃 <= -0.02. 7. Out-of-the-money put (OTMP). -0.375 < ∆𝑃 <= -0.125. 8. At-the-money put (ATMP). -0.625 < ∆𝑃 <= -0.375. 治 政 In-the-money put (ITMP) 大 立in-the-money put (DITMP) Deep. 9. 0-0.98 < ∆𝑃 <= -0.875. 學. ‧ 國. 10. -0.875 < ∆𝑃 <= -0.625. ‧. By classifying net buying pressure into different trader types, we can examine the price. er. io. sit. y. Nat. impact of each type of traders.. We follow Bollen and Whaley (2004) to measure moneyness using the option’s. n. al. Ch. engchi. i n U. v. delta, as shown in table I. Delta is sensitive to the volatility of the underlying asset and option’s time to maturity. Delta ranges from zero to one, and can be loosely interpreted as the risk-neutral probability that the option will be exercised at maturity date. Based on options’ delta, we exclude the extreme values and place them into ten moneyness categories. In table II, we provide the trading volume during sample period, year 2002 to 2007, of each moneyness category. Trading volume of each option series varies.. consider market makers when calculating net buying pressure. 16.

(22) Table II Trading Volume of TAIFEX Options during Year 2002 to 2007 This table reports the trading volume and relative volume of each series of options during the sample period, year 2002 to 2007. Numbers presented in this table are numbers of contracts traded in each year of a specific moneyness options; numbers in brackets are corresponding percentages over entire market volume, i.e., trading volume of a specific moneyness in a particular year over the sum of trading volume of all series options in that particular year. Panel A: Call Options 2. 3. 4. 5. 0,016,450. 00,085,035. 00,281,559. 00,366,733. 00,093,023. (1.95). 2003. (10.09). ,0246,030. 01,130,655. (2.07). 2004. 2005. 1,250,617. ,0121,399. 03,766,703. 3,076,114. 13,927,409. Nat (13.00). 2003. 01,046,242 (11.49). 2004. 03,319,985 (19.38). 2005. 2006. 2007. 05,336,322. (25.87). 37,857,700 (31.26). (7.59). 03,139,199 (13.39). 05,240,027 (12.20). 00,435,367. (36.21). (14.64). 16,845,915. 07,336,257. (43.17). (18.80). 49,089,221. 17,144,591. (40.54). (14.16). al. 7. 8. 000316,945 C h e n g c00,183,494 hi U (48.55). 04,471,170. (28.10). 02,859,460. (49.10). 07,790,070. (31.40). 04,431,334. (45.47). 13,711,103. (25.86). 08,508,727. v n i 0055,597. 0011,982. (8.52). (1.84). 9. 0621,143 (6.82). 1,256,268 (7.33). 2,396,068. 10. 0,108,961 (1.20). 0335,955 (1.96). 0747,388. (17.38). (44.66). (27.72). (7.80). (2.43). 00387,063. 00578,507. 00709,175. 0187,990. 0046,728. (20.27). (30.30). (37.14). (9.85). (2.45). 10,147,549 (31.15). 2002-2007. 10,093,681. 00,900,718. 01,076,480. (35.98). (11.50). n. 00,084,870. 01,069,679. (35.92). (11.04). sit. io. 2002. 6. 15,421,703. (33.99). (9.65). (2.54). Moneyness. 14,595,084. (42.70). ‧. ,0981,111. Panel B: Put Options. 06,430,098. 10,014,315. (32.38). (9.09). (2.51). 2002-2007. (9.57). ,00270,247. (4.08). 2007. 07,592,728. (45.20). 學. 2006. (35.60). (14.98). ‧ 國. (2.91). 05,364,075. 政 治 大. 02,244,671. 立. (43.51). 04,224,969. (9.53). ,0460,507 (1.96). (33.41). y. 2002. 1. er. Moneyness. 20,322,031 (22.07). 13,766,018. 06,209,599. (42.26). 40,633,813. (19.06). 22,901,789. (44.13). (24.87). 17. 1,826,612 (5.61). 6,343,678 (6.89). 0625,518 (1.92). 1,876,532 (2.04).

(23) Among all option series, a large portion of trading volume is contributed by at-the-money (moneyness 3 and 8) options and out-of-the-money (moneyness 4, 5, 6 and 7) options. Trading volume of out-of-the-money options (moneyness 4 and 7) counts more than fifteen times over that of deep-in-the-money options (moneyness 1 and 10).. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 18. i n U. v.

(24) IV. Methodology In this section, we construct two regression models to examine the hypotheses. Section IV.2 and Section IV.3 would show the methodologies we constructed in this paper.. IV.2 Institutions Hypothesis. 政 治 大. To examine the relation between daily change of implied volatility and net. 立. buying pressure, we regress the daily change in the average implied volatility of. ‧ 國. 學. options in a specific moneyness category on contemporaneous measures of its. ‧. underlying asset return, its underlying asset trading volume, lagged change of implied. y. Nat. n. er. io. al. sit. volatility, and net buying pressure of three trader types.. i n U. v. Volatility is well accepted to have a strong relation with movement in stock. Ch. engchi. price and trading volume, so we add underlying asset return and underlying asset trading volume as variables to control the leverage effect and mixture of distribution hypothesis. A wealth of studies, such as Black (1976), suggest that stock return volatility is negatively correlated to stock return; this phenomenon is well known as leverage effect. Besides, Epps and Epps (1976) and Tauchen and Pitts (1983) provide empirical evidence shows that the more new information flowing into the market, then greater the trading volume and return volatility. 19.

(25) In addition, lagged change in implied volatility is also included in the regression model as a control variable. Under the limits to arbitrage hypothesis, changes in implied volatility will reverse as market maker has the opportunity to rebalance its position; therefore, change in implied volatility should be reversely related to lagged change in implied volatility. Limits to arbitrage hypothesis suggests that implied volatility of different option series need not move together as they are impacted by. 政 治 大. their own series’ own demand as well. Bollen and Whaley (2004) provide empirical. 立. evidence to support limit to arbitrage hypothesis, and thus we include the lagged. ‧ 國. 學. change in implied volatility as a control variable.. ‧. To measure the price impact of each type of investors, we follow the approach. y. Nat. al. er. io. sit. proposed by Bollen and Whaley (2004) to measure the buying pressure of options.. v. n. Bollen and Whaley (2004) define buyer-motivated trades as the number of contracts. Ch. engchi. i n U. traded during the day at prices higher than the prevailing bid/ask price midpoint, and define seller-motivated trades as the number of contracts traded during the day at prices below the prevailing bid/ask price midpoint. And the net buying pressure is the difference between buyer-motivated trades and seller-motivated trades times the absolute value of the option’s delta.. With our unique dataset, we can trace the origination of each order. Therefore, when we do the calculation of buyer-motivated trades and seller-motivated trades of 20.

(26) each option in each trading day, we can further recognize the identification of traders who place the buying order of a buyer-motivated trade and of traders who place the selling order of a seller-motivated trade. Hence, we can classify net buying pressure into three categories by trader types, net buying pressure from individual investors, net buying pressure from foreign institutions, and net buying pressure from domestic institutions.. 政 治 大. This methodology differs from past investigations in several ways. First, we. 立. separate trading into five types of both call and put on a series-by-series basis, rather. ‧ 國. 學. than seeing aggregate trading volume across all call and all put options series as a. ‧. whole. Second, in addition to examining trading volume, we examine the net buying. y. Nat. al. er. io. sit. pressure for each option series as previously defined to directly observe the impaction. v. n. of market demand/supply. Third, by distinguishing the origination of net buying. Ch. engchi. i n U. pressure, we can test the price impact of each trader type. These three differences allow us to study the relationship between options implied volatility and market situation.. With these variables, we can control the affection which is not concerned in this study and build a regression model to assess the price impact of each identity of investors. The regression specification is as follow:. ∆𝜎𝑖,𝑡 = 𝛽0 + 𝛽1 𝑅𝑆𝑡 + 𝛽2 𝑉𝑆𝑡 + 𝛽3 ∆𝜎𝑖,𝑡−1 + 𝛽4 𝑁𝐵𝑃𝐼 𝑖,𝑡 + 𝛽5 𝑁𝐵𝑃𝐹 𝑖,𝑡 + 𝛽6 𝑁𝐵𝑃𝐷 𝑖,𝑡 +. 21.

(27) 𝛽7 𝑁𝐵𝑃2𝐼 𝑖,𝑡 + 𝛽8 𝑁𝐵𝑃2𝐹 𝑖,𝑡 + 𝛽9 𝑁𝐵𝑃2𝐷 𝑖,𝑡 + 𝜀𝑖,𝑡. (1). Where ∆𝜎𝑖,𝑡 is the change in implied volatility of moneyness i option in time t; RSt is the underlying asset return in time t; VSt is the log trading volume of underlying asset in time t; NBP_Ii,t is the net buying pressure from individual investor of moneyness i option in time t; NBP_Fi,t is the net buying pressure from foreign institutions of moneyness i option in time t; NBP_Di,t is the net buying pressure from domestic. 政 治 大. institutions of moneyness i option in time t; NBP2_Ii,t is the net buying pressure from. 立. individual investor of ATMP (moneyness 8) in time t6; NBP2_Fi,t is the net buying. ‧ 國. 學. pressure from foreign institutions of ATMP (moneyness 8) in time t; NBP2_Di,t is the. ‧. net buying pressure from domestic institutions of ATMP (moneyness 8) in time t. But. y. Nat. al. er. io. sit. if the dependent variable is the change in implied volatility of ATMP, NBP2 would. n. then change into the net buying pressure of ATMC (moneyness 3). And the ∆𝜎𝑖,𝑡−1 is. Ch. engchi. i n U. v. the lagged change in implied volatility of moneyness i option in time t.. IV.3 Hedging Hypothesis We are curious about whether investors trade options due to hedging demand only and thus construct hedging hypothesis to examine it. To assess the relation between net buying pressure and trading purpose, we regress the net buying pressure. 6. Bollen and Whaley (2004) argue that net buying pressure of ATMP contains information and expectation of investors and therefore would have affection to each type of option. 22.

(28) of three types of investors in a specific moneyness category on contemporaneous measures of market returns, market trading volume, lottery-style stock trading volume, lottery drawing dummy, and futures trading volume.. We include market returns and market trading volume to control the leverage effect and mixture of distribution hypothesis respectively as mentioned in previous section. The other variables can be differentiated into two kinds, measuring gambling. 政 治 大. behavior and measuring hedging demand. Lottery-style stock trading volume and. 立. lottery drawing dummy are proxies for investors’ gambling behavior, and futures. ‧ 國. 學. trading volume represents hedging need of investors and substitution effect.. ‧. sit. y. Nat. Following the method proposed in Kumar (2009), we pick lottery-style stocks. n. al. er. io. from all stocks traded in TWSE and GTSM7. Three stock characteristics are considered. i n U. v. to identify stocks that might be perceived as lotteries: (i) stock specific or idiosyncratic. Ch. engchi. volatility, (ii) idiosyncratic skewnwss, and (iii) stock price. The idiosyncratic volatility measure is the variance of the residual obtained by fitting a four-factor8 model to the daily stock returns in time-series. The idiosyncratic skewness is measured through the third moment of the residual obtained by fitting a two-factor model to the daily stock returns time series, where the two factors are the excess market returns and the squared excess market return. We suppose that stocks in the highest 50th idiosyncratic volatility 7 8. GTSM (GreTai Securities Market) is Taiwan’s OTC stock market. Four factors are excess market return, firm size, Book to market price ratio, and momentum factor. 23.

(29) Table III Basic Characteristics of Lottery-Style Stocks This table reports the mean monthly characteristics of lottery-style stocks traded in Taiwan Stock Exchange, measured during year 2002 to 2007 sample period. Lottery-Style. Nonlottery-Style. Others. Nunber of stocks. 119. 125. 367. Stock Price. 9.18. 37.77. 18.56. Monthly Volume. 2593.5. 6012.1. 4008.95. Percentage of the Market. 3.60%. 82.19%. 14.20%. Monthly Turnover Rate. 17.4. 15.1. 17.53. CAPM Beta. 1.18. 0.86. 0.98. 2406.16. 54906.1. 9488.2. 0.34. 0.59. 0.66. 1.09. 0.09. -0.10. 0.06. Momentum Beta. -0.27. 0.06. 0.02. Idiosyncratic Volatility. 27.97. 0.62. 1.24. Idiosyncratic Skewness. 2.21. 0.56. 1.3. Market Cap (million) SMB Beta Book to Market Ratio. 立. 01.00%. Broad and Supervise Members Hold(%). 20.95%. Nat. 28.31%. 04.12%. 02.43%. 24.67%. 24.14% 35.76%. 48.15%. n. al. percentile, the highest 50. th. er. io. sit. Institutional Investors Hold(%). ‧. Dividend Yield (%). 學. ‧ 國. HML Beta. 政 治1.18 1.46 大. y. Measure. v i n idiosyncratic skewness percentile, and the lowest 50 Ch engchi U. th. stock. price percentile are perceived as lottery-style stocks. Next, we obtain the trading volume from TEJ as one of our gambling proxies. Table III reports the basic characteristics of lottery-style stocks, and the summary statistics are very similar to the results provided in Kumar (2009). We are also interesting in the relation between lottery and net buying pressure of options since lottery could be a direct measure of investors’ gambling desire. Gao. 24.

(30) and Lin (2011) suggest that large jackpot dummy and lottery trading volume and significantly negative related and thus conclude that lottery and stocks are complement. But we could not obtain the detail jackpot numbers and trading volume through our entire sample period; thus we define a “lottery dummy” equals unity if lottery drafts in the specific day and equals zero otherwise.. Besides measuring gambling behavior, we consider hedging as another reason. 政 治 大. for trading options as well. If investors see options as an instrument of hedging its. 立. underlying asset, investors shall trade options after building futures position. Therefore,. ‧ 國. 學. options net buying pressure should be positively correlated to futures volume, so we. ‧. use futures trading volume of each options series as the proxy of hedging demand.. y. Nat. al. er. io. sit. However, Frechette (2001) suggests that futures and options are treated as substitute. v. n. goods; thus trading volume of options and futures should be negatively correlated.. Ch. engchi. i n U. Hence, futures trading volume could measure hedging demand by investors and substitution effect as well. Next, we construct the regression model to test hedging hypothesis through the five variables discussed beforehand. The model specifications are as follow: 𝑁𝐵𝑃𝑖,𝑗,𝑡 = 𝛼0 + 𝛼1 𝑅𝑆𝑡 + 𝛼2 𝑉𝑆𝑡 + 𝛼3 𝐿𝑆𝑉𝑡 + 𝛼4 𝐿𝐷𝑡 + 𝛼5 𝐹𝑉𝑡 + 𝜀𝑖,𝑗,𝑡. (2). 𝑁𝐵𝑃𝑓,𝑗,𝑡 = 𝛽0 + 𝛽1 𝑅𝑆𝑡 + 𝛽2 𝑉𝑆𝑡 + 𝛽3 𝐿𝑆𝑉𝑡 + 𝛽4 𝐿𝐷𝑡 + 𝛽5 𝐹𝑉𝑡 + 𝜀𝑓,𝑗,𝑡. (3). 𝑁𝐵𝑃𝑑,𝑗,𝑡 = 𝛾0 + 𝛾1 𝑅𝑆𝑡 + 𝛾2 𝑉𝑆𝑡 + 𝛾3 𝐿𝑆𝑉𝑡 + 𝛾4 𝐿𝐷𝑡 + 𝛾5 𝐹𝑉𝑡 + 𝜀𝑑,𝑗,𝑡. (4). 25.

(31) where 𝑁𝐵𝑃𝑖,𝑗,𝑡 , 𝑁𝐵𝑃𝑓,𝑗,𝑡 , and 𝑁𝐵𝑃𝑑,𝑗,𝑡 are net buying pressure from individual investors, from foreign institutions, and from domestic institutions of moneyness j options respectively; 𝑅𝑆𝑡 is the market returns in time t; 𝑉𝑆𝑡 is the market trading volume in time t; 𝐿𝑆𝑉𝑡 is the trading volume of lottery-style stocks in time t; 𝐿𝐷𝑡 is the lottery dummy in time t; 𝐹𝑉𝑡 is the futures trading volume in time t.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 26. i n U. v.

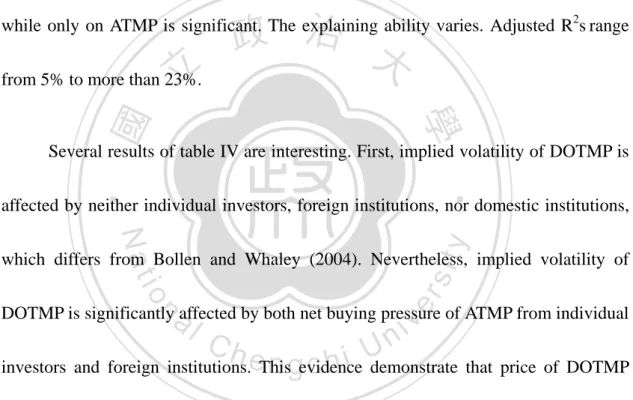

(32) V.. Empirical Results. V.1 Institutional Hypothesis9,10 Table IV contains a summary of the regression results of (1) for each series options. For the underlying asset return, the coefficients on all series options are significantly negative except DIMC; the coefficients on all series options are positive. 政 治 大. while only on ATMP is significant. The explaining ability varies. Adjusted R2s range. 立. from 5% to more than 23%.. ‧ 國. 學. Several results of table IV are interesting. First, implied volatility of DOTMP is. ‧. affected by neither individual investors, foreign institutions, nor domestic institutions,. y. Nat. al. er. io. sit. which differs from Bollen and Whaley (2004). Nevertheless, implied volatility of. v. n. DOTMP is significantly affected by both net buying pressure of ATMP from individual. Ch. engchi. i n U. investors and foreign institutions. This evidence demonstrate that price of DOTMP contains information, which is consistent with the results founded by Bollen and Whaley (2004).. 9. Before we proceed to the empirical test, we first employ unit-root tests to make sure the variables in our empirical models are stationary. We adopt both Augmented Dickey-Fuller (ADF) test and Phillip-Perron (PP) test (to save space, details of the results are not reported in table). Results from both ADF test and PP test show that all variables contained in (1) are stationary. 10 We also calculate correlation coefficients of the variables in (1) to avoid multicollinearity (to save space, details of the results are not reported in tables). Highest one is 0.3511, NBP for moneyness 7 options from individual investors and market return; lowest one is -0.5324, NBP for moneyness 6 options from domestic institutions and NBP for moneyness 8 options from domestic institutions. The rest of other correlation coefficients between variables are close to zero. Thus, we believe that multicollinearity should not be a major concern in this empirical model. 27.

(33) Table IV Summary of Regression Results of Change in Each Type Implied Volatility for TAIFEX Options Traded on the Taiwan Futures Exchange during the Period January 2002 through December 2007 We report the coefficients and corresponding t-value of (1) in this table. The regression specification underlying the results reported in this table is: ∆𝜎𝑖,𝑡 = 𝛽0 + 𝛽1 𝑅𝑆𝑡 + 𝛽2 𝑉𝑆𝑡 + 𝛽3 ∆𝜎𝑖,𝑡−1 + 𝛽4 𝑁𝐵𝑃𝐼 𝑖,𝑡 + 𝛽5 𝑁𝐵𝑃𝐹 𝑖,𝑡 + 𝛽6 𝑁𝐵𝑃𝐷 𝑖,𝑡 + 𝛽7 𝑁𝐵𝑃2𝐼 𝑖,𝑡 + 𝛽8 𝑁𝐵𝑃2𝐹 𝑖,𝑡 + 𝛽9 𝑁𝐵𝑃2_𝐷𝑖,𝑡 + 𝜀𝑖,𝑡 where ∆𝜎𝑖,𝑡 is the change in implied volatility of moneyness i option in time t; RSt is the underlying asset return in time t; VSt is the trading volume of underlying asset in time t; NBP_Ii,t , NBP_Fi,t , NBP_Di,t are the NBP from individual investors, foreign institutions, and domestic institutions of moneyness i option in time t respectively; NBP2_Ii,t , NBP2_Fi,t, NBP2_Di,t are the NBP from individual investors, foreign institutions, and domestic institutions of ATMP in time t respectively. But if the dependent variable is the change in implied volatility of ATMP, NBP2 would then change into the NBP of ATMC. And the ∆𝜎𝑖,𝑡−1 is the lagged change in implied volatility of moneyness i option in time t.. 立. 政 治 大 𝑁𝐵𝑃_𝐼 𝑁𝐵𝑃_𝐹 𝑁𝐵𝑃_𝐷. 𝑅𝑆𝑡. 𝑉𝑆𝑡. ∆𝜎𝑖,𝑡−1. 𝑁𝐵𝑃2_𝐼𝑖,𝑡. 𝑁𝐵𝑃2_𝐹𝑖,𝑡. 𝑁𝐵𝑃2_𝐷𝑖,𝑡. adj-R2. DITMC. -0.0387* (-0.60). 00-3.9077*** (-0.35). 0.2064* (0.58). -0.1248*** (-8.60). 0-0.6060*** (-0.17). --5.6286*** (0.75). -19.6917*** (0.62). -2.5418*** (1.13). -0.9219*** (0.19). -0.0751 (-0.02). 0.0511. ITMC. -0.0156* (-0.56). 0-23.5247*** (-4.72). 0.0827* (0.54). -0.1178*** (-7.84). 0-1.4263*** (-1.70). --0.4601*** (-0.20). -- 5.7351*** (1.10). -0.0289*** (0.03). -3.0127*** (1.45). -1.6261 (0.44). 0.0623. ATMC. -0.0307* (-1.24). 0-31.2926*** (-7.92). 0.1669* (1.43). -0.2598*** (-10.86). 0-0.7647*** (-1.37). --1.5886*** (0.96). - -8.1957*** (1.53). -0.1274*** (-0.16). -0.9106*** (0.52). -0.5664 (-0.20). 0.1301. OTMC. -0.0359* (-1.80). 0-33.9679*** (-9.00). 0.1944* (1.78). -0.2603*** (-11.37). --1.2241*** (1.73). --1.9267*** (1.22). - -4.3823*** (0.71). -0.4861*** (0.70). -1.7547*** (1.15). -1.2727 (-0.49). 0.1713. DOTPC. -0.0309* (-1.35). 0-44.3133*** (-10.70). 0.1687* (1.34). -0.2570*** (-11.33). -10.9253*** (2.14). --5.8391*** (0.43). - -1.5011*** (-0.02). -1.1051*** (1.45). -2.2692*** (1.38). -0.0990 (0.04). 0.2049. DOTMP. -0.0241* (-1.03). 0-49.9962*** (-11.71). 0.1306* (1.02). -0.2473*** (-10.87). --2.8527*** (0.46). --8.8201*** (1.21). -20.9025*** (0.82). -2.6765*** (3.42). -4.7723*** (2.68). -1.8642 (0.20). 0.1773. OTMP. -0.0186* (-0.90). 0-52.4559*** (-13.47). 0.0980* (0.87). -0.2694*** (-12.01). n C h --2.6679 --4.5823 i U -11.5380 e ch (2.78) n g (3.10) (2.58) ***. ***. ***. -1.6197*** (2.20). -3.1680*** (1.90). -2.7759 (-0.94). 0.2115. ATMP. -0.0397* (-1.74). 0-58.1901*** (-13.48). 0.2150* (1.72). -0.2695*** (-12.36). --1.7973*** (2.10). --4.4312*** (2.28). 0-4.0397*** (-1.26). -0.8478*** (-1.41). -0.2187*** (0.12). -0.9315 (-0.16). 0.2081. ITMP. -0.0523* (-1.57). 0-71.8136*** (-12.04). 0.2859* (1.56). -0.3455*** (-15.89). --0.8438*** (-0.44). --1.9040*** (-0.63). -01.3001*** (0.24). -2.6726*** (2.25). -3.4627*** (1.32). -5.5620 (-1.18). 0.2346. DITMP. -0.1043* (-1.19). -111.1775*** (-7.38). 0.5635* (1.17). -0.3364*** (-16.01). --1.7418*** (-0.25). -20.7870**** (-1.82). -01.4524*** (0.05). -6.4642*** (2.15). -2.2928*** (-0.37). -6.1893 (-0.56). 0.2120. 𝑖,𝑡. n. y. sit. er. io. 28. 𝑖,𝑡. ‧. Nat. al. 𝑖,𝑡. 學. ‧ 國. 𝛽0. iv.

(34) Secondly, price impact from foreign institutions and domestic institutions for call and put seem not asymmetric. Buying pressure from foreign institutions significantly impact implied volatility of OTMP, ATMP, and DITMP but does not impact any series of call options. Results of buying pressure from domestic institutions shows similar phenomenon. Domestic institutions significantly affect implied volatility of OTMP but do not affect any series of call options. Third, not the main concern in this study but. 政 治 大. still worth mentioned, the coefficients of lagged change in implied volatility are. 立. negatively significant on all series of options, which peovides a strong support to limits. ‧ 國. 學. to arbitrage hypothesis and has similar results to Bollen and Whaley (2004).. ‧. The last one is that change in implied volatility could be affected by both. y. Nat. al. er. io. sit. individual investors and foreign institutions. Previous investigations suggest that. v. n. institutional investors trade options to hedge their spot positions and thus lead the. Ch. engchi. i n U. market supply/demand imbalance as well as volatility smile. However, our results demonstrate that change in implied volatility not only can be affected by institutional investors but also individual investors. Thus, we may infer that factors causing volatility smile/smirk proposed by existing papers could be imperfect due to following reasons. 1) Institutional investors indeed have price impact on options, but other factors besides hedging demand could also impact motives for institutional investors to trade options. 2) Individual investors have price impact on options as well; previous 29.

(35) investigations do not provide explanations to demonstrate the reason for individual investors to trade options however. Under these backdrops, we build up our second hypothesis, hedging hypothesis, to examine the motives to trade options for each trader type.. Before proceeding to empirical results of next hypothesis, we present the numbers of call/put options contracts traded for hedging purpose as a percentage of. 政 治 大. total trading volume in a specific option series by each trader type in table V and table. 立. VI. The results in table V and table VI could somewhat provide support of our. ‧ 國. 學. inference. In table V and VI, we report the numbers of contracts traded for hedging. ‧. purpose as a percentage of trading volume of all series of options. We define call (put). y. Nat. al. er. io. sit. options traded for hedging purpose as the call (put) traded by a particular trader. v. n. account with open position of short selling (long) in TAIFEX in the same trading day.. Ch. engchi. i n U. As shown in table V and VI, numbers of contracts traded for hedging purpose of all series of options initiated by all types of investors count relatively low portion of overall market volume. Since trading volume initiated by domestic institutions in entire sample period of all series of options count less than 0.2% of corresponding market volume, the volume is too low to move the market; therefore, we consider foreign institutions only. For call options, volume initiated by foreign institutions count 0.51% to 2.30% over corresponding market volume; for put options, volume initiated 30.

(36) Table V Numbers of Call Option Contracts Traded for Hedging Purpose by Trader Type during the Period January 2002 through December 2007 In this table, type is the moneyness of call options; Quantity is the numbers of call options contracts traded for hedging purpose in the corresponding period in each panel;. 政 治 大 traded for hedging purpose as the call traded by a particular trader account with open position of short selling in TAIFEX in the same trading day. 立 Panel A: Year 2002 2. 3. 4. Quantity. 149. 1393. 4667. 6208. %tage. 0.91. 1.64. 1.66. 1.69. Domestic Institutions. 5. 1. 2. 3. 4. 5. 1. 2. 3. 4. 5. 526. n.a. n.a. 502. 601. n.a. n.a. 2. 680. 563. n.a. 0.57. n.a. n.a. 0.18. 0.16. n.a. n.a. 0.00. 0.24. 0.15. n.a. ‧. 1. Foreign Institutions. 9727. 51658. 66591. 5136. Nat. 21. 3957. 65116. 54973. 1601. 36. 323. 1479. 1467. 298. %tage. 0.94. 0.86. 1.22. 1.24. 0.57. a l 0.01 Ch. 0.35. 1.54. 1.02. 0.18. 0.01. 0.03. 0.04. 0.03. 0.03. 192471. 52997. 158. 317. 6025. 6156. 2354. n. Panel C: Year 2004. 5557. sit. y. 2323. Panel B: Year 2003. io. Quantity. er. Type. Individual Investors. 學. Trader. ‧ 國. %tage is the numbers of call options contracts traded for hedging purpose as a percentage of total market volume for a specific moneyness option. We define call options. i n U. i e 30959 n g c h118421. v. Quantity. 5020. 40576. 165611. 201335. 50441. %tage. 1.09. 1.81. 2.18. 2.01. 1.61. 1.21. 1.38. 1.56. 1.92. 1.69. 0.03. 0.01. 0.08. 0.06. 0.07. Panel D: Year 2005 Quantity. 22728. 186164. 403175. 376905. 71158. 5361. 29640. 147797. 217971. 30556. 883. 1886. 16514. 15098. 2617. %tage. 1.82. 2.90. 2.76. 2.44. 1.36. 0.43. 0.46. 1.01. 1.41. 0.58. 0.07. 0.03. 0.11. 0.10. 0.05. 31.

(37) Panel E: Year 2006 Quantity. 1713. 3827. 21248. 14094. 1161. n.a. 369. 13596. 2703. 1340. n.a. 36. 316. 1269. n.a. %tage. 1.41. 1.42. 1.99. 1.31. 0.27. n.a. 0.14. 1.27. 0.25. 0.31. n.a. 0.01. 0.03. 0.12. n.a. 218520. 225. 3450. 13229. 16219. 9690. 2.98. 0.02. 0.09. 0.13. 0.10. 0.13. Panel F: Year 2007 16794. 83225. 241181. 365260. %tage. 1.71. 2.21. 2.39. 2.17. 學. Panel G: Year 2002 - 2007. ‧ 國. Quantity. 治 政 108966 4772 29610 259714大 659916 1.49 立0.49 0.79 2.57 3.92. 48727. 324912. 887540. 1030393. 237388. 15711. 94535. 605146. 1128635. 305014. 1302. 6014. 38243. 40772. 14959. %tage. 1.58. 2.33. 2.34. 2.10. 1.38. 0.51. 0.68. 1.60. 2.30. 1.78. 0.04. 0.04. 0.10. 0.08. 0.09. ‧. Quantity. n. er. io. sit. y. Nat. al. Ch. engchi. 32. i n U. v.

(38) Table VI Numbers of Put Option Contracts Traded for Hedging Purpose by Trader Type during the Period January 2002 through December 2007 In this table, type is the moneyness of put options; Quantity is the numbers of put options contracts traded for hedging purpose in the corresponding period in each panel;. 政 治 大 traded for hedging purpose as the put traded by a particular trader account with open long position in TAIFEX in the same trading day. 立 Panel A: Year 2002 9. Quantity. 680. 6542. 3523. 143. %tage. 0.80. 2.06. 1.92. 0.26. 6. 7. 8. 9. 10. 6. 7. 8. 9. 10. 55. 4458. 6473. 11100. n.a. n.a. 11. 27. 10. n.a. n.a. 0.46. 5.25. 2.04. 6.05. n.a. n.a. 0.01. 0.01. 0.01. n.a. n.a. 5795. 31009. 7685. 157. n.a. 240. 1613. 1195. 67. 225. 0.69. 0.27. 0.03. v. n.a. 0.02. 0.04. 0.04. 0.01. 0.21. 19089. 4980. 3379. 8968. 3314. 270. 150. 2.12. 1.52. 1.48. 0.10. 0.12. 0.07. 0.02. 0.04. Quantity. 13047. 52240. 34943. 5805. Nat. 10. %tage. 1.25. 1.17. 1.22. 0.93. 0.40. Panel B: Year 2003. y. 8. io. 438. n. a l 0.55 Ch. Panel C: Year 2004. 46835. sit. 7. Domestic Institutions. ‧. 6. Foreign Institutions. i n U. i e187339 n g c h94037. Quantity. 53179. 156933. 114423. 22612. 5548. %tage. 1.60. 2.01. 2.58. 1.80. 1.65. 1.41. 2.40. er. Type. Individual Investors. 學. Trader. ‧ 國. %tage is the numbers of put options contracts traded for hedging purpose as a percentage of total market volume for a specific moneyness option. We define put options. Panel D: Year 2005 Quantity. 112217. 275535. 160344. 48413. 14759. 107550. 254271. 183432. 19336. 1309. 6953. 19388. 10639. 2048. 529. %tage. 2.10. 2.01. 1.88. 2.02. 1.97. 2.02. 1.85. 2.16. 0.81. 0.18. 0.13. 0.14. 0.13. 0.09. 0.07. 33.

(39) Panel E: Year 2006 Quantity. 3881. 5301. 13061. 4382. 731. 18438. 84692. 9241. 1170. n.a. 36. 292. 110. 116. n.a. %tage. 1.00. 0.92. 1.84. 2.33. 1.56. 4.76. 14.64. 1.30. 0.62. n.a. 0.01. 0.05. 0.02. 0.06. n.a. 8192. 15468. 33938. 16508. 1379. 98. 1.31. 0.15. 0.25. 0.27. 0.08. 0.02. Panel F: Year 2007 Quantity. 196028. 307899. 160376. 36111. 8769. %tage. 1.93. 2.24. 2.58. 1.98. 1.40. ‧ 國. 學. Panel G: Year 2002 - 2007. 治 政 363688 855292 227034大 26084 立3.58 6.21 3.66 1.43. 379032. 804450. 486670. 117466. 30300. 546764. 1419076. 532529. 65836. 14481. 26087. 64226. 31776. 3880. 1002. %tage. 1.87. 1.98. 2.13. 1.85. 1.61. 2.69. 3.49. 2.33. 1.04. 0.77. 0.13. 0.16. 0.14. 0.06. 0.05. Nat. n. al. er. io. sit. y. ‧. Quantity. Ch. engchi. 34. i n U. v.

(40) by foreign institutions count 0.77% to 3.49% over corresponding market volume. 2.30% and 3.49% may not be high enough to move the market price; thus that options volatility smile/smirk is led by hedging demand of institutional investors seems imperfect, and we therefore can infer that some other motives besides hedging demand are concerned by investors while trading options.. V.2 Hedging Hypothesis11,12. 政 治 大. In table VII, table VIII, and table IX, we report the results of (2), (3), and (4). 立. ‧ 國. 學. respectively. For individual investors, adjusted R2 of the regression model vary, and most of them lay around 5% to 19%. However, adjusted R2 of the regression model for. ‧. foreign institutions are much lower. Most of the R2 for foreign investors are around 1%. sit. y. Nat. io. n. al. er. to 6%. Furthermore, for domestic institutions, only R2 of DOTMP is higher than 1%;. i n U. v. the others are all lower than 1%. When looking into each variable, more results can be. Ch. engchi. documented. First, net buying pressure from individual investors of DITMC, ITMC, ATMC, DOTMP, OTMP, ATMP, ITMP, and DITMP are significantly affected by either lottery-style stock trading volume or lottery dummy, which means that motives for trading options of individual investors are driven by gambling desire. Nonetheless, 11. Before we proceed to the empirical test of (2), (3), and (4), we first employ unit-root tests to make sure the variables in our empirical models are stationary. We adopt both Augmented Dickey-Fuller (ADF) test and Phillip-Perron (PP) test (to save space, details of the results are not reported in table). Results from both ADF test show that all variables contained in (2), (3), (4) are stationary. 12 We also calculate correlation coefficients of the variables in (2), (3), (4) to avoid multicollinearity (to save space, details of the results are not reported in tables). Results are similar to that of previous section; most of the correlation coefficients of (2), (3) and (4) are close to zero. Therefore, we believe that multicollinearity should not be a major concern in this empirical model. 35.

(41) results of foreign institutions show the opposite extreme. Coefficients of both lottery-style stock trading volume and lottery dummy in all series options are not significantly different from zero. This result provides a strong evidence showing that motives for foreign institutions to trade options are not driven by gambling desire. The results for domestic institutions are similar to those for individual investors; gambling proxies also affect net buying pressure significantly. Second, hedging demand and. 政 治 大. substitution effect also show two opposite extreme in individual investors and foreign. 立. institutions. Coefficients of OTMP and DOTMP for individual investors are. ‧ 國. 學. significantly negative, but coefficients of ITMP and DITMP for individual investors. ‧. are significantly positive. On the other hand, coefficients of DOTMP and OTMP and. Nat. io. sit. y. ATMP for foreign institutions are significantly positive, and coefficients of ITMP and. er. DITMP for foreign institutions are significantly negative. We thus can conclude that. al. n. v i n C h as substitution goods out-of-the-money put are treated e n g c h i U for individual investors, which is used to hedge stock market positions, but could be treated as hedging instruments for foreign institutions to hedge their futures positions. Conversely, in-the-money put are possibly considered as hedging instruments for individual investors to hedge their futures positions but as substitution goods for foreign institutions. To sum up, we conclude that factors for trading options of individual investors and domestic institutions are mixed; gambling desire, hedging demand, and 36.

(42) Table VII Summary of Regression Results of Net Buying Pressure from Individual Investors in Each Moneyness for TAIFEX Options Traded on the Taiwan Futures Exchange during the Period January 2002 through December 2007 We report the coefficients and corresponding t-value of (2) in this table. The regression specification underlying the results reported in this table is:. 𝑁𝐵𝑃𝑖,𝑗,𝑡 = 𝛼0 + 𝛼1 𝑅𝑆𝑡 + 𝛼2 𝑉𝑆𝑡 + 𝛼3 𝐿𝑆𝑉𝑡 + 𝛼4 𝐿𝐷𝑡 + 𝛼5 𝐹𝑉𝑡 + 𝜀𝑖,𝑗,𝑡 where 𝑁𝐵𝑃𝑖,𝑗,𝑡 is the net buying pressure from individual investors of moneyness j in time t; RSt is the underlying asset return in time t; VSt is the trading volume of underlying asset in time t; 𝐿𝑆𝑉𝑡 is the trading volume of lottery-style stocks in time t; LDt is the lottery dummy in time t; FVt is the futures trading volume in time t.. 政 治 大 𝑉𝑆 𝐿𝑆𝑉. 𝛼0. 𝑅𝑆𝑡. DITMC. 0-684.78*** (-1.13). 00-33.72*** (-3.56). ITMC. -2660.24*** (2.62). ATMC. 立-056.69. 𝐿𝐷𝑡. 𝐹𝑉𝑡. adj-R2. -64.55*** (2.60). -52.63*** (-1.19). 0.0162. -87.46*** (2.00). -95.06*** (-1.23). 0.0555. -40.15*** (0.74). -82.11*** (-0.86). 0.1207. 0-2.91*** (0.07). 0.1798. -07.85*** (1.19). 0.1393. -12.11*** (-2.45). -0-3.21*** (2.13). 0.0858. --20.05*** (-0.68). 100.85*** (1.97). 0.1109 0.0541. -151.06*** (-2.10)*. -044.64*** (1.19). -1463.91*** (0.35). . -245.65*** (-12.26). 0-82.52*** (-0.92). -073.03*** (1.69). OTMC. -2459.62*** (-2.61). .-230.16*** (-15.99). -116.05*** (1.81). -026.47*** (0.80). -18.24*** (-0.27). DOTMC. 0-448.18*** (-2.88). 00 -30.57*** (-13.11). -017.60*** (1.69). -007.05*** (1.31). 024.00*** (2.15). DOTMP. 0-108.05*** (0.91). 00--18.92*** (10.22). OTMP. -1184.17*** (1.65). 126.40*** (11.46). ATMP. -1513.01*** (1.65). - 60.47*** (4.31). ---42.61*** (0.68). -162.34*** (-4.98). --22.93*** (0.60). 273.10*** (4.08). -1116.37*** (0.19) -1238.59*** (-2.59). -10.89*** (-1.15) -56.58*** (-7.85). -036.42*** (1.66) -103.46*** (3.22). 0-53.71*** (-2.46) 0-43.66*** (-2.63). --37.22*** (1.45) --44.42*** (2.18). -242.63*** (5.39) -160.66*** (4.64). io. er. ‧. Nat. -005.81 a l 0-11.19 (-1.39) (1.38) iv n C 0-39.00 0-39.07U he i (-0.80) n g c h (-1.67). n. DITMP. ‧ 國. .-114.31*** (-7.02). ITMP. ***. 學. (1.37). 0-25.46*** (-1.18). y. 𝑡. sit. 𝑡. ***. ***. ***. ***. 37. 0.0292 0.0753.

(43) Table VIII Summary of Regression Results of Net Buying Pressure from Foreign Institutions in Each Moneyness for TAIFEX Options Traded on the Taiwan Futures Exchange during the Period January 2002 through December 2007 We report the coefficients and corresponding t-value of (3) in this table. The regression specification underlying the results reported in this table is:. 𝑁𝐵𝑃𝑓,𝑗,𝑡 = 𝛼0 + 𝛼1 𝑅𝑆𝑡 + 𝛼2 𝑉𝑆𝑡 + 𝛼3 𝐿𝑆𝑉𝑡 + 𝛼4 𝐿𝐷𝑡 + 𝛼5 𝐹𝑉𝑡 + 𝜀𝑓,𝑗,𝑡 where 𝑁𝐵𝑃𝑖,𝑗,𝑡 is the net buying pressure from foreign institutions of moneyness j in time t; RSt is the underlying asset return in time t; VSt is the trading volume of underlying asset in time t; 𝐿𝑆𝑉𝑡 is the trading volume of lottery-style stocks in time t; 𝐿𝐷𝑡 is the lottery dummy in time t; 𝐹𝑉𝑡 is the futures trading volume in time t.. 政 治 大 𝑉𝑆 𝐿𝑆𝑉. 𝛼0. 𝑅𝑆𝑡. DITMC. -1288.13*** (-4.72). 028-4.12*** (-0.97). ITMC. -2517.69*** (6.07). ATMC. 立0-67.90 𝑡. 𝐿𝐷𝑡. 𝐹𝑉𝑡. adj-R2. -02.95 (0.26). 0 24.14*** (1.22). 0.0182. 0-9.55 (-0.56). 57.47** (1.90)*. 0.0279. -26.08 (1.44). -- 7.11*** (0.22). 0.0024. -26.84 (1.60). 0.0185. 0-2.07 (-0.85). 0.0088. -03.73 (0.89). -15.85*** (2.18). 0.0330. 1-1.36 (-0.07). -48.18*** (-1.41). 0.0388 0.0075. 𝑡. -143.88*** (-5.08). -05.07 (0.34). 00-11.85*** (-0.03). -1211.33*** (1.69). 0019.35*** (0.65). -21.14 (-1.36). OTMC. -1674.24*** (-4.12). -0423.80*** (0.61). -113.05*** (4.10). -21.92 (-1.53). y. --1.70** (-0.06)*. DOTMC. 0-166.68*** (-2.89). -0090.74*** (0.86). -011.36*** (2.95). 0-2.41 (-1.21). -01.53*** (1.67). DOTMP. 0-430.81*** (-4.30). 007-2.14*** (-1.37). -021.28*** (3.13). -03.34 (0.94). OTMP. -2825.19*** (-6.02). 28-27.67*** (-3.83). ATMP. -1258.47*** (-2.92). 23-13.99*** (-2.12). -071.72*** (2.44). -00.50 (0.03). -9.59 (-0.51). --8.11*** (-0.26). -0317.33*** (0.84) -0313.10*** (1.06). -2937.25*** (6.47) -3340.16*** (9.16). 0-28.33*** (-1.11) 0-28.14*** (-1.43). 013.37 (1.01) -13.84 (1.36). -16.82 (-1.08) -1377 (-1.10). -97.25*** (-3.56) -112.68*** (-5.30). Ch. 15.11U i e n g c h(0.31). -157.23*** (4.91). 38. er. n. al. ‧. io. DITMP. Nat. ITMP. ‧ 國. 028-5.03*** (-0.79). 學. (-3.67). 0-4.67 (-0.48). sit. ***. v ni. 0.0342 0.0787.

(44) Table IX Summary of Regression Results of Net Buying Pressure from Domestic Institutions in Each Moneyness for TAIFEX Options Traded on the Taiwan Futures Exchange during the Period January 2002 through December 2007 We report the coefficients and corresponding t-value of (4) in this table. The regression specification underlying the results reported in this table is:. 𝑁𝐵𝑃𝑑,𝑗,𝑡 = 𝛼0 + 𝛼1 𝑅𝑆𝑡 + 𝛼2 𝑉𝑆𝑡 + 𝛼3 𝐿𝑆𝑉𝑡 + 𝛼4 𝐿𝐷𝑡 + 𝛼5 𝐹𝑉𝑡 + 𝜀𝑑,𝑗,𝑡 where 𝑁𝐵𝑃𝑖,𝑗,𝑡 is the net buying pressure from domestic institutions of moneyness j in time t; RSt is the underlying asset return in time t; VSt is the trading volume of underlying asset in time t; 𝐿𝑆𝑉𝑡 is the trading volume of lottery-style stocks in time t; 𝐿𝐷𝑡 is the lottery dummy in time t; 𝐹𝑉𝑡 is the futures trading volume in time t.. 政 治 大 𝑉𝑆 𝐿𝑆𝑉. 𝛼0. 𝑅𝑆𝑡. DITMC. --210.48*** (0.16). 028-0.74*** (0.73). ITMC. -2179.85*** (1.07). ATMC. 立0-64.75. 𝐿𝐷𝑡. 𝐹𝑉𝑡. adj-R2. 0-0.47 (-0.17). 0 25.60*** (1.17). 0.0042. 0-4.33 (0.62). - 48.81*** (3.97)*. 0.0099. 2-7.56 (-0.46). - 7.45*** (0.81). 0.0013. 2-6.17 (-1.46). 0.0044. 0-0.38 (0.72). 0.0147. -01.39 (1.01). -012.95*** (5.39). 0.0316. 1-6.05 (0.94). 0-33.18*** (2.91). 0.0114 0.0023. 14-5.20*** (-0.45). 0--5.62*** (-0.94). 0-103.14*** (-0.82). -18-2.82*** (-1.47). 0012.99*** (0.35). --23.09*** (0.69). OTMC. 6-195.06*** (-1.91). -04-2.11*** (-1.35). -111.18*** (1.61). -2-1.04*** (-0.29). --14.61** (-1.97). DOTMC. 1607.74*** (0.62). 009-0.02*** (-0.10). -0 -0.40*** (-0.48). -0-0.03*** (-0.08). 00-3.20*** (-3.54). DOTMP. 00-32.61*** (-0.98). 007-0.65*** (-1.26). -023.11*** (1.39). -0-1.72*** (-1.47). OTMP. 28-79.63*** (-0.51). 282-1.65*** (-0.69). ATMP. 1-250.50*** (-1.06) -0145.18*** (0.62) -0368.89*** (0.66). engchi U. er. n. Ch. ‧. io. DITMP. Nat. ITMP. ‧ 國. 028-4.37*** (-1.69). al. ***. 學. (1.06). 0--6.31*** (-2.70). y. 𝑡. sit. 𝑡. v ni. -116.68*** (1.57). --15.24*** (-2.75). 231-5.50*** (-1.52). -027.97*** (1.73). --17.37*** (-2.06). -7.80 (0.80). -0--8.86*** (-0.51). -2914.54*** (4.09) -3341.56*** (1.00). 0-21.16*** (-1.34) 0-12.54*** (-1.79). -016.35*** (1.99) -10.59*** (2.93). 1-4.17 (-0.43) 1-0.68 (-0.15). 0-54.21*** (-3.21) 00-2.99*** (0.40). 39. 0.0167 0.0042.

(45) substitution effect can impact net buying pressure. Yet, net buying pressure from foreign institutions are not affected by gambling desire.. V.3 Robustness Test In section V.2, we provide the regression results to demonstrate how gambling desire, hedging demand, and substitution effect impact investors’ net buying pressure. 政 治 大. to options, but some may concern that the variable we use to assess hedging demand. 立. and substitution effect, futures trading volume, cannot fully measure the hedging. ‧ 國. 學. motives of each type of investors since the trading volume is derived from the entire. ‧. market rather than a specific identification. We thus derive the net futures transaction. y. Nat. er. io. sit. positions of each trader type in each day to replace trading volume of entire market. In other words, we change the 𝐹𝑉𝑡 in (2) into net futures transaction positions of. n. al. Ch. engchi. i n U. v. individual investors, change the 𝐹𝑉𝑡 in (3) into net futures transaction positions of foreign institutions, and change the 𝐹𝑉𝑡 in (4) into net futures transaction positions of domestic institutions. Similar results (not reported to save space) show that hedging demand and gambling desire significantly affect net buying pressure from individual investors and domestic institutions, but net buying pressure from foreign institutions are not affected by gambling desire.. 40.

(46) VI. Conclusion Implied volatility smile/smirk has become one of the most puzzling market anomalies in modern finance field. Most of the existing studies examine this phenomenon in two schools of thought, either inappropriate assumptions or market structure. However, none of the first school of thought presents a completely satisfactory explanation, and none of the second thought could provide direct evidence. 政 治 大. to show that volatility smile/smirk is led by the supply demand imbalance due to. 立. ‧ 國. 學. institutional investors’ hedging demand.. ‧. Thanks to a unique dataset from TAIFEX, we can explore price impact initiated. sit. y. Nat. by different trader types. In the first hypothesis, institutional hypothesis, empirical. n. al. er. io. results show that individual investors and foreign institutions can both affect options. Ch. i n U. v. implied volatility in Taiwan options market. Besides, we document that options trading. engchi. volume driven by hedging purpose counts relatively small portion comparing to trading volume of overall option market; the net buying pressure initiated by hedging purpose seems not strong enough to move the market. Therefore, there could be other factors affecting motives for trading options and thus lead investors’ demand imbalance.. According to previous papers, we purpose that gambling desire could be another 41.

(47) reason for trading options. Therefore, we construct two variables, lottery-style stocks trading volume and lottery dummy, as proxies for investors’ gambling desire to test the second hypothesis, hedging hypothesis. We also adopt futures trading volume to measure hedging demand and substitution effect in our regression model. Result shows that net buying pressure from individual investors is significantly affected by both futures trading volume and gambling desire. Nonetheless, motives for foreign. 政 治 大. institutions to trade options contain hedging demand, either to hedge spot positions or. 立. futures positions, only. These results are consistent with other researches in behavioral. ‧ 國. 學. finance field – trading motives for individual investors are affected by behavioral. ‧. biases more than that for foreign institutions. Besides, results for domestic institutions. Nat. io. sit. y. are also interesting. Although motives for domestic institutions to trade options contain. er. both gambling desire and hedging demand, only trading volume of lottery-style stocks. al. n. v i n C hrather than lotteryU dummy. This result suggest that affects the dependent variables engchi gambling could be one of the motives for domestic institutions to trade options, but. lottery and options are not substitution goods. After all, it is non-sense that domestic institutions gamble by buying lotteries.. 42.

數據

相關文件

Teachers may consider the school’s aims and conditions or even the language environment to select the most appropriate approach according to students’ need and ability; or develop

Robinson Crusoe is an Englishman from the 1) t_______ of York in the seventeenth century, the youngest son of a merchant of German origin. This trip is financially successful,

fostering independent application of reading strategies Strategy 7: Provide opportunities for students to track, reflect on, and share their learning progress (destination). •

Courtesy: Ned Wright’s Cosmology Page Burles, Nolette & Turner, 1999?. Total Mass Density

where L is lower triangular and U is upper triangular, then the operation counts can be reduced to O(2n 2 )!.. The results are shown in the following table... 113) in

在選擇合 適的策略 解決 數學問題 時,能與 別人溝通 、磋商及 作出 協調(例 如在解決 幾何問題 時在演繹 法或 分析法之 間進行選 擇,以及 與小組成 員商 討統計研

多年以來,我們發現同學針對交換生或訪問學生的規劃有幾種類 型:(1) 選擇未來行將深造的國家與學校; (2) 選擇一個可以累積壯遊行 旅的大陸; (3)

The inverted page table is sorted by physical addresses, whereas a page reference is in a logical address. The use of Hash Table