管理者持股對公司違約風險之影響:風險敏感度觀點

全文

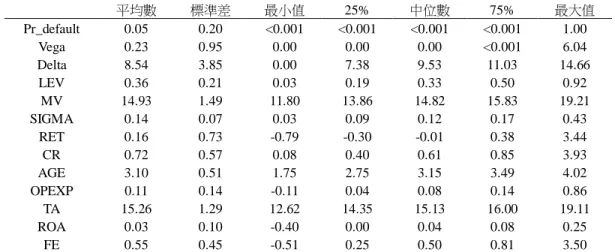

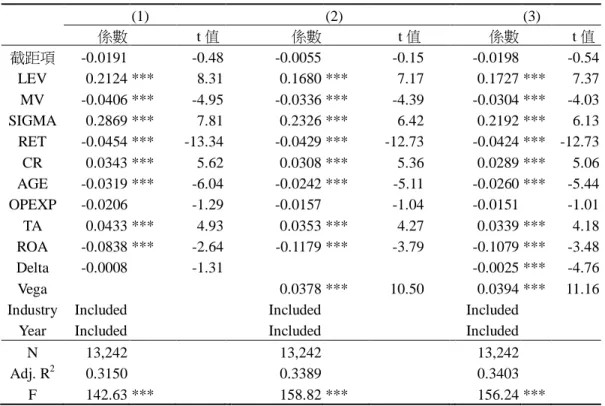

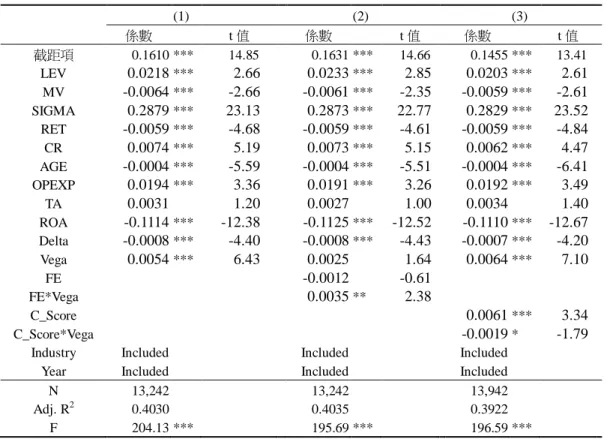

數據

相關文件

Sexual Abuse of Children with Autism: Factors that Increase Risk and Interfere with Recognition of Abuse.... ASD –

{ Title: Using neural networks to forecast the systematic risk..

Referring to the Student Worksheet (p.2) of Activity 2, ask students to identify which situations incur pure risk and speculative risk respectively... Invite students to present

• To achieve small expected risk, that is good generalization performance ⇒ both the empirical risk and the ratio between VC dimension and the number of data points have to be small..

• The existence of different implied volatilities for options on the same underlying asset shows the Black-Scholes model cannot be literally true... Binomial Tree Algorithms for

– 某人因為與上市公司有關連,即內幕人士 (如公司董事、職員或公司的 核數師等)

Therefore, we could say that the capital ratio of the financial structure is not the remarkable factor in finance crisis when the enterprises are under the low risk; the

In addition, the risks which contains in the process of M&A include financial risks, legal risks, moral hazard, market risk, integration risk, and policy risks; the more