Client influence on valuation: does language matter?

A comparative analysis between Taiwan and SingaporeThe Authors

Fong Yao Chen, Department of Land Economics, National Chengchi University, Taipei, Taiwan Shi Ming Yu, Department of Real Estate, National University of Singapore, Singapore

Abstract

Purpose – The purpose of this paper is to attempt to analyze client influence on valuation in both Taiwan and Singapore. Both countries are chosen because of the similar level of economic development as well as professionalism amongst valuers. However, although both are Chinese-dominated by population, the culture and language used are substantially different.

Design/methodology/approach – The study uses a survey questionnaire to sample valuers' response to client influence in both Taiwan and Singapore. The questionnaire is organized into five parts: social economic data, client influence situation, potential factors, influence method, and influence abilities. The survey findings were analyzed using SPSS and subjected to a number of standard procedures to check for missing values and multivariate normality. Mean difference and F-test were used to judge whether the valuers in the two countries have significantly different views on client influence.

Findings – The results show that client influence on valuation practices does exist in both Taiwan and Singapore. This is despite the differences in the market structures,

development background and modes of doing business. Furthermore, the study finds that the degree and extent of the problem are different. These differences, as reflected in the differing views and opinions on the causes and factors leading to client pressure, are largely due to the systemic differences in the two countries, particularly, in the way businesses are conducted as well as the medium of communication being used.

Originality/value – The paper contributes to the research on client influence on valuation through a comparative study of two countries with substantially different business

environments and language of communication. These differences seem to have an impact on how valuers view client influence despite their similar economic, educational and professional backgrounds.

Keyword(s): Real estate; Asset valuation; Language; Business environment; Taiwan; Singapore.

Journal: Journal of Property Investment & Finance Volume: 27

Number: 1 Year: 2009 pp: 25-41

Copyright ©Emerald Group Publishing Limited ISSN: 1463-578X

1. Introduction

Investment decision, transaction, taxation, compensation for compulsory acquisition, mortgage, securitization, etc., all require real estate valuation, which can be only undertaken by licensed and trained valuers who need to be experienced, ethical, and informed to be able to provide objective and fair real estate valuation.

Most of the literature on real estate valuation focuses on valuation techniques which reduce valuation error and enhance valuers' professional skills. Besides valuation skills, fairness and being ethical are also critical in the undertaking of market valuations. According to the International Valuation Standard (IVS), valuers should pursue honest, unbiased, and independent conduct when undertaking valuation duties. All valuations done should be psychologically and behaviorally independent. Rule 16 of the Real Estate Valuers Act in Taiwan provides that when a valuer is working for clients on real estate valuations he should be honest and fiduciary, and should not have undue process to or other irresponsible conduct. The self disciplinary covenant of Real Estate Appraiser Association of R.O.C. (ROCREAA) also provides that valuers should be fair, objective and independent when working on real estate valuations, and should not provide false reports. In Singapore, all licensed appraisers are required to comply with the code of conduct and ethics of the Singapore Institute of Surveyors and Valuers (SISV). In fact, in the provision of valuation services worldwide, integrity and fairness and avoiding unethical practices to maintain a certain level of professional standard in their conduct is an essential requirement for professionalism amongst valuers.

Issues of objectivity and fairness arise because valuation is not only a science but also an art. This could allow valuers the opportunity to be influenced by client from opinion shopping to permitting client to review draft report prior to formalization.(Fletcher and Diskin, 1994; Kinnard et al., 1997; Levy and Schuck, 1999, 2005; Gallimore and Wolverton, 1997; Chang, 2004; Smith, 2002; Chen, 2006)

This paper attempts to analyze client influence on valuation in both Taiwan and Singapore. Both countries are chosen because of the similar level of economic development as well as professionalism amongst valuers. However, although both are Chinese dominated by population, the culture and language used are substantially different. In Taiwan, the level of Westernisation is arguably lower given its strong Chinese domination; in fact, culturally and linguistically, Taiwan in a Chinese society. Singapore, on the other hand, is a

multi-racial society and uses English as its language for commerce. In terms of the business environment, international surveys have shown that there is a substantial difference between the two countries. The Transparency Index (Table I) shows that the Corruption Perceptions Index score for Singapore is 9.3 for 2007, which ranks it equal fourth. Taiwan, on the other hand, has a score of 5.7 and is ranked 34th. Given these similarities and differences between the two countries, it would be interesting to examine if indeed these have an impact on valuation practices.

2. Literature review

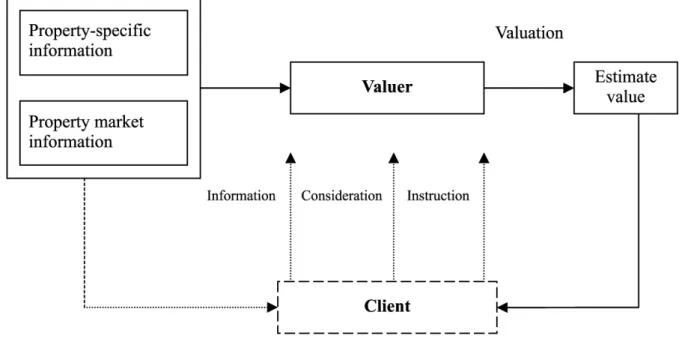

Brunswik (1956) first uses the lens model of perceptual theory to show that people do not possess the direct information required to perceive objects in the environment. Applying the model to a market approach, Gallimore and Wolverton, 1997 show that using transaction prices to estimate market value will lead to bias. Further, Levy and Schuck (1999) show that when additional information is used, in addition to the property-specific information and property market information, it will cause bias from the market value. This additional information includes the effect of prior valuations in familiar and

unfamiliar geographical areas, valuers' use of heuristics, prior knowledge and experience, and the selection of comparables. In this context, we also believe that client influence is additional information as shown in Figure 1.

Fletcher and Diskin (1994) show that client influence existed in mortgage valuation; borrowers have motivation to maximize loan to value ratio, and lenders threaten valuers by losing business or re-evaluation. Smith (2002) indicates that 98 percent of American valuers have the experience to provide higher valuation according to lender's requirement, especially in the boom market. The lender can control valuers by opinion shopping to find a valuer willing to provide the desired value, or threaten to withhold payment for a low valuation. The lender can, as small valuation firms fear, threaten to cut off future business if a value is not high enough to make a given loan. Smolen and Hambleton (1997) find that almost 80 percent of the respondent valuers in their study agreed with the statement that “valuers are sometimes pressured by clients to alter their values". Rushmore (1993) examines the ethical issues involved with performing valuation services for hotels and points out that some lenders are more interested in inflated valuations rather than those that are based on an unbiased, objective study. The pressures, exerted by the clients, on the

valuers can sometimes be subtle and indirect, while occasionally they can be obvious and abusive.

Levy and Schuck (1998) confirm the widely belief that valuations are indeed influenced by clients in their study through in-depth interviews with practicing valuers in New Zealand. Their study found that the primary factors affecting the degree to which clients influence valuations are, the type of client, the characteristics of valuers and valuation firms, the purpose of a valuation, the information endowments of clients and valuers. One important issue highlighted is the ethical dilemma faced by valuers as a result of relying on

client-supplied information, which could be bias through omission, intentionally or otherwise.

Chen (2006) induces that factors influencing Taiwan's valuers are the business characteristics, consequential characteristics, ability characteristics, subjectivity

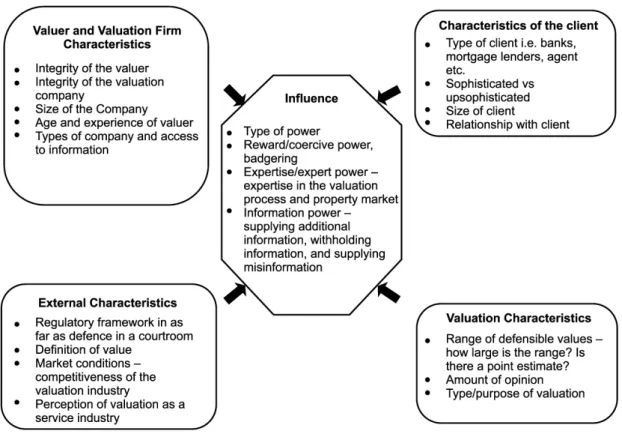

characteristics and environment characteristics. The result is similar to Levy and Schuck (1999). Amidu and Aluko (2007) only surveyed the valuer and valuation firm

characteristics and client characteristics in Lagos, Nigeria. Integrity of valuer or valuation firm, importance of the valuation outcome to the client and client size are the most significant influencing factors. However the size of firm, amount of experience, valuer's education, and their perception on clients' influencing factors is insignificant (see Figure 2).

Chang (2004) indicates that a client, who is not familiar with the valuation industry, tends to use further business or no business to threaten valuers. Clients who are familiar with the valuation industry may use business pressure, changing valuation purposes, providing transaction data, giving land development and architecture know-how, and financial expertise to influence valuers. For instance, the client may provide information on the subject property, such as transaction details, development cost, and project duration cut off, to the valuer. The valuer may give a preliminary estimate to the client before deciding on the valuation. If the client is not satisfied with the value, he can terminate the service until he gets the value he wants. The valuer will not follow the appropriate process but try to obtain information that supports the pre-estimated value. Gallimore and Wolverton, 1999 also show that American valuers tend to find the information to support a given sale price instead of providing market value. Levy and Schuck (1999) find that some valuers permit client to review draft reports prior to their formalization. This process could be regarded as a check point before final report, but it will give the client a chance to influence the

valuation outcome. This inappropriate behavior is predictable and irresistible. Kinnard et al. (1997) indicate that the use of opinion shopping was prevalent in the appraisal industry and the valuer may lose business if he insists on his own result.

Concluding on the previous studies, we can identify the events where client influence is strongest during the valuation process. This is shown in Figure 3. These include opinion

shopping which happens before the valuation engagement, value indications during the process, and permitting client to review draft valuation prior to formalization. Valuers who can get full, timely, and accurate information may result in a well market value and lower client influence.

Levy and Schuck (1999, 2005), argue that access to information could also be a factor affecting a valuer's perception of the market, which in turn could affect potential client pressure. For example, some valuation firms work within a multi-disciplinary environment that provides access to timely market information including specific details of individual transactions. This may affect valuers' perceptions of the market by supplying more in-depth information on individual transactions and may give them more confidence in their initial perception of value and thus reduce the amount of potential client influence. Indeed, this is also supported by Gallimore (1994) who finds that comparison between the USA and UK practices reveals that there is less client influence in the former as a result of greater information transparency as compared with the latter where valuers tend to work within a more restrained information environment. In our proposed comparison between Taiwan and Singapore, the difference in the information environment between them may prove to be crucial. The degree of information transparency in different countries may have a significant impact on the ability of clients to exert influence on valuers.

3. Methodology

This study uses survey questionnaire to sample valuers' response to client influence in both Taiwan and Singapore. Given the different language used, the Chinese version was used in Taiwan while the English version was used in Singapore. The respondents were drawn from the valuation service firms in both countries. As they are all licensed valuers

registered with the respective professional body, the contact addresses are easily available. Taiwan, with a much higher number of valuers, a total of 32 responses were obtained representing 16.3 percent. In Singapore, given the smaller pool, a much higher response rate of 70.2 percent with 31 positive replies. Both samples meet the lowest requirement for the testing of a normally distributed population. Nevertheless, it is more important for this study to obtain some factual views than to achieve a higher response rate.

The questionnaire is organized into five parts, social economic data, client influence situation, potential factors, influence method, and influence abilities. To avoid social expectation bias, the survey is anonymous and the questions are asked in the context of the industry rather than personal perspectives. The survey findings were analyzed using SPSS and subjected to a number of standard procedures to check for missing values and

multivariate normality. Mean difference and F-test was used to judge if the valuers in the two countries have significant different views on client influence.

4. Data

Information was also collected about the respondent's age, gender, education and income. The 32 Taiwan respondents were randomly drawn from a population of 196 certified valuers. Most of the ages are between 30 to 40 and 40 to 50. Three respondents are female and 29 are male. Half of them have Bachelor degree, and the other 50 percent have a Master's degree, All are working full-time as valuers, and 78.1 percent of them have more than five years' experience, of which 50 percent have more than ten years of experience. In terms of the size of the firm, 48.4 percent of the respondents have more than five valuers in their firms, 45.2 percent are with firms with fewer than five valuers. And two firms with only one valuer.

The Singapore sample comprises valuers from the main valuation service firms. Most of the respondents are under 40 (64.5 percent) with the others from the 40 to 50 age group. In total, 20 respondents were female and 11 were male. The majority of them have a Bachelor degree, and only 16.7 percent have a Master's degree. All were working full-time as valuers, and 74.2 percent of them have more than five years experience, of which 58.1 percent have more than ten years of experience. In terms of the size of the firm, 74.2 percent of the respondents have more than five valuers in their firms, only 25.8 percent are firms with fewer than five valuers.

Both samples seem to be representative of the overall structure of the valuation industry in both countries. As this paper is primarily concerned with the issue of client influence, no further analysis of the sample profiles is carried out.

5. Findings

The main findings of the study are summarized under the main headings arranged in the questionnaire.

5.1 Valuation environment

Our first main finding is that indicative valuations are quite prevalent in both countries. The responses to both asking for, and the provision of, indicative valuations are the highest amongst the various statements on the valuation environment. On the contrary, the

response in both countries is also the lowest to the statement on whether valuation firms would adjust the final value to meet the client's request. This seems to imply that while the practice in both countries generally accepts indicative valuations as a means to attract and satisfy clients, they are less open to adjusting values according to clients' requests. In between, the responses to clients asking for adjustment to value and informing them of the value before submission of final report are significantly different between the two

for adjustment to the final value as well as informing the clients of the final value before submitting the report. In Singapore, although valuers also agree to both statements, the response to both is significantly lower. Although it is difficult to draw further conclusions from these observations, prima facie, client pressure seems to exert a stronger influence in Taiwan than in Singapore. This may be due to the different modes of business

undertakings in the two countries (see Table II). 5.2 Potential client influence

The extent of client influence on valuation is a result of various factors including the characteristics of valuers and their clients as well as the external environment. 5.2.1 Valuer characteristics

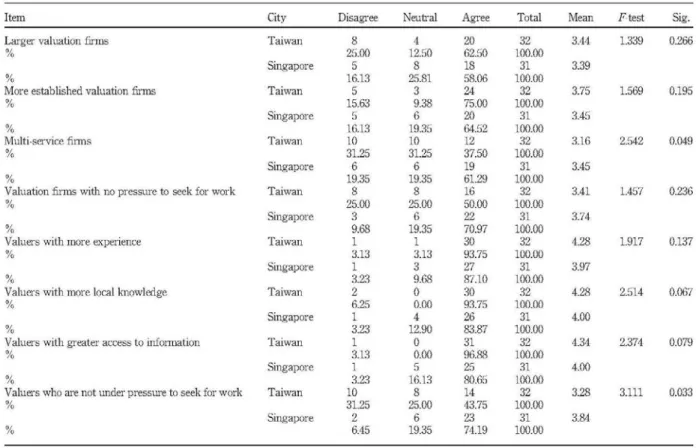

The responses to the impact of the various characteristics of valuers and their firms on potential client influence are generally positive in both countries as seen in Table III. The three characteristics with the highest responses are “with greater access to information", “with more local knowledge", and “with more experience", which seem to provide confidence to valuers to resist client influence. These characteristics pertain more to the individual valuer than the firms and it is interesting to note that valuers in Taiwan believe in these individual characteristics more than their counterparts in Singapore. It seems to suggest that the valuation practice in the former tends to be more about the individual valuer as compared with Singapore where clients tend to engage the firm rather than the individual. This could be due to the different development of valuation practice in both countries. As for the other characteristics pertaining to the firms, responses between the two countries are mixed. Valuers in Taiwan feel that the larger and more established firms are better able to resist client influence while valuers in Singapore feel that multi-service firms (i.e. part of a larger service consultancy) and firms under no pressure for work are better able to resist client influence. Again this could be due to the development and evolvement of the valuation practices in both countries.

5.2.2 Client characteristics

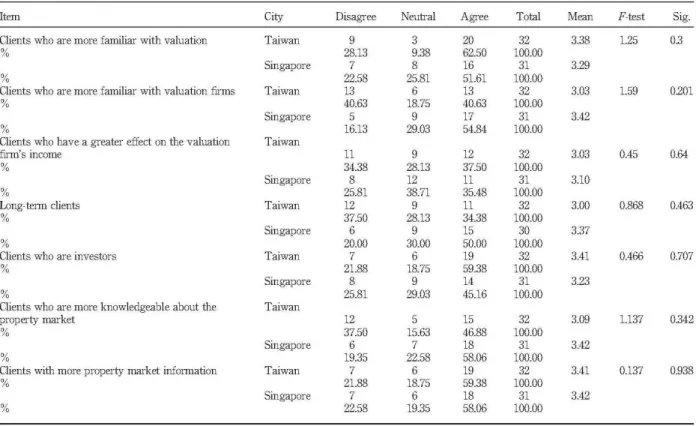

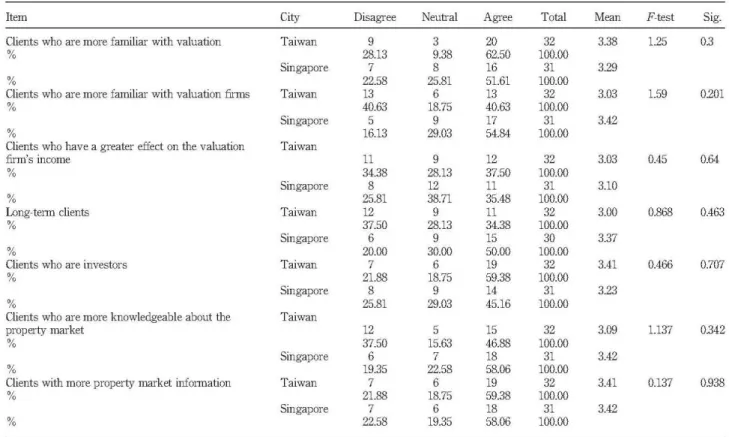

While valuers in both countries tend to agree that client characteristics do have an impact on potential client influence, the difference in opinions between them is statistically significant for three characteristics. Valuers in Singapore feel that long term clients, and clients who are more familiar with the firms and more knowledgeable about the property market, tend to exert stronger pressure. This could be due to the smaller market structure and yet longer development history in Singapore as compared to Taiwan. The responses to the other client characteristics are not statistically different between the two countries, especially for clients who have greater effect on the valuation firm's income, where the response is the lowest in both countries. This indicates clearly that, first, clients, no matter in which country, would behave in the same manner, and second, valuers are professional enough to not concede to clients who might have an important bearing on their profitability.

The responses from the Taiwan valuers also show that clients with more information and clients who are investors tend to exert more influence compared to the other characteristics. Again this could reflect the different market conditions in these countries (see Table IV). 5.2.3 Valuation characteristics

As for valuation characteristics, it is interesting to note that Taiwanese valuers feel that valuation for mortgage purposes and properties with clear market information are the two factors that likely to have potential client influence rather than other valuation purposes and the amount of valuation fees. The first factor is understandable as typically one would expect borrowers and lenders to ask for higher valuations. The second implies that with greater information transparency, there are less opportunities for the clients to ask for adjustment. On the other hand, valuers in Singapore feel that clients who pay higher fees, including those for asset pricing purposes are also strong reasons for client influence. This is not surprising given the recent surge in the number of real estate investment trusts being listed in Singapore (see Table V).

5.2.4 External environment

While Kinnard et al. (1997) conclude that American regulations cannot reduce the cliental effect, our results, which are similar with Chang (2004) and Levy and Schuck (1999) show that regulations can reduce the cliental effect in Taiwan and Singapore. However, there is a significant difference in these results: the Taiwanese valuers are much less convinced than their Singaporean counterparts. The responses to the other factors considered under the external environment, such as presence of valuation guidelines, higher volume of work, commensurate fees and transparent market data are equally high in both samples. The response to the last factor is particularly high from the Taiwanese sample which seems to indicate that to curb client influence, it is better to have clear transparent data than the constraints of rules and regulations. Again, this seems to indicate the different level of development of the maturity of the market as well as the profession in these two countries (see Table VI).

5.3 Sources of client pressure

On the various sources of client pressure, both samples are in agreement with the least common and the most common source. As information is power, clients would use their knowledge of market transaction data to attempt to influence the valuation. This appears to be the most common source of client pressure. On the other end, promises of increase of fees do not seem to have an impact, implying that valuers in both countries are very professional in their conduct. Besides these two sources, there are differences in opinions in both samples on the other sources. For example, Taiwanese valuers feel that the promise of future jobs is a big source of pressure while Singaporean valuers do not think so. This also explains why the latter feel that familiar clients are a constant source of pressure; jobs are assured but the clients would use their familiarity with the firm to add pressure. The

table below also reveals that going through senior staff and using personal relationship are more prevalent in Singapore than in Taiwan, which is to be expected given the smaller market in Singapore (see Table VII).

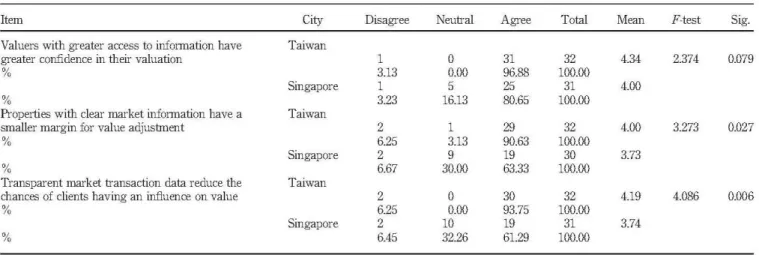

5.4 Transparent information and client influence

Table VIII shows that more than 80 percent of the valuers surveyed in both countries agreed that with greater access to information valuers would have greater confidence in their valuation. Similarly, both samples also strongly agree that properties with clear market information have a smaller margin for value adjustment and that transparent market transaction data reduce the chances of clients having an influence on value. However, in all three statements, mean value is higher for the Taiwan sample. This seems to imply that the difference could be due to the different existing market conditions. With lesser

transparency, valuers in Taiwan would, as expected, feel that improvements in this area would greatly reduce the potential of client influence.

As for the percentage of mortgage valuations being influenced by clients, there is a

significant difference between the two countries as shown in Table III. More than a quarter of the valuers surveyed in Taiwan think that more than 10 percent of all mortgage

valuations are subject to client influence whereas only 13.8 percent in Singapore think so. There is also a larger number of valuers in Singapore who think that there is no client influence than in Taiwan. The quantum of adjustment is also much higher in Taiwan than in Singapore. Table IV shows that the quantum of valuation adjustment for mortgage valuations is typically around 1 percent to 5 percent. However, more than half of the Taiwan sample think that the quantum of adjustment is more than 5 percent as compared with 34.5 percent in Singapore. This seems to imply that the problem of client influence in valuation is of much greater concern in Taiwan than in Singapore (see Tables IX and X).

6. Conclusion

As with other studies, client influence on valuation practices seems to exist in both Taiwan and Singapore. This is despite the differences in the medium of communication, stage of market development and market structure. The main indication of client influence is the prevalent practice of the asking and provision of indicative valuations, which is similar to opinion shopping highlighted by Kinnard et al. (1997). However, unlike the latter, our study finds that the main factor is not so much the result of indicative valuations but rather the lack of transparent market information. This is especially so in Taiwan where the seemingly lack of transparency has been generally identified as the biggest problem causing client influence. Without clear market information, clients tend to take advantage of the subjectivity in valuations and often demand an adjustment of up to 10 percent. The second main conclusion from our study is that different market structures, development background and modes of doing business have an impact on the factors

causing client influence. Although both Taiwan and Singapore could be considered development market economies, valuers in these countries have quite different views with regard to client influence. In terms of valuer characteristics, the individual rather than the firm seems to be the bigger factor in determining whether there is client influence from the Taiwanese perspective. Clients in both countries also tend to exhibit different tendencies in exerting influence. In Singapore, perhaps as a result of the smaller market and the

domination of the bigger valuation firms, long-term clients who are familiar with the firms tend to have stronger influence, a view not shared by the Taiwanese sample. On the external environment, it is interesting to note that the Taiwanese valuers do not think that rules and regulations would help to deter client pressure.

Finally, our study suggests that although client influence exists in both countries, the degree and extent of the problem are different. Both the percentage of mortgage valuations subject to value adjustments and the quantum of adjustments are much higher in Taiwan. These differences as reflected in the differing views and opinions on the causes and factors leading to client pressure are largely due to the systemic differences in the two countries, particularly, in the way businesses are conducted as well as the medium of communication being used.

Figure 2Factors affecting client influence as reported by valuers

Table II. Valuation environment and the impact on client influence

Table IVClient characteristics and their impact on client influence

Table VIExternal environment characteristics and their impact on client influence

Table VIIITransparent information and client influence