On: 27 April 2014, At: 18:50 Publisher: Routledge

Informa Ltd Registered in England and Wales Registered Number: 1072954 Registered office: Mortimer House, 37-41 Mortimer Street, London W1T 3JH, UK

Journal of Media Economics

Publication details, including instructions for authors and subscription information: http://www.tandfonline.com/loi/hmec20

Market Competition and the

Media Performance of Taiwan's

Cable Television Industry

Shu-Chu Sarrina Li

Published online: 17 Nov 2009.

To cite this article: Shu-Chu Sarrina Li (2004) Market Competition and the Media Performance of Taiwan's Cable Television Industry, Journal of Media Economics, 17:4, 279-294, DOI: 10.1207/s15327736me1704_3

To link to this article: http://dx.doi.org/10.1207/s15327736me1704_3

PLEASE SCROLL DOWN FOR ARTICLE

Taylor & Francis makes every effort to ensure the accuracy of all the information (the “Content”) contained in the publications on our platform. However, Taylor & Francis, our agents, and our licensors make no

representations or warranties whatsoever as to the accuracy, completeness, or suitability for any purpose of the Content. Any opinions and views

expressed in this publication are the opinions and views of the authors, and are not the views of or endorsed by Taylor & Francis. The accuracy of the Content should not be relied upon and should be independently verified with primary sources of information. Taylor and Francis shall not be liable for any losses, actions, claims, proceedings, demands, costs, expenses, damages, and other liabilities whatsoever or howsoever caused arising directly or indirectly in connection with, in relation to or arising out of the use of the Content.

This article may be used for research, teaching, and private study purposes. Any substantial or systematic reproduction, redistribution, reselling, loan, sub-licensing, systematic supply, or distribution in any form to anyone is

Market Competition and the Media

Performance of Taiwan’s Cable

Television Industry

Shu-Chu Sarrina Li

Institute of Communication Studies National Chiao Tung University, Taiwan

Using industrial organization as the theoretical framework, this study examines the relation between market competition and the media performance of Taiwan’s cable television industry. The media performance of cable television systems is defined as the subscribers’ satisfaction with program service, customer service, and community service. A telephone survey was conducted to collect data for the study. This study’s findings in general support a positive relation between market competition and media performance, which accords with most previous studies.

Although cable television has existed in Taiwan for more than 30 years, it was only after it was legalized in 1993 that its penetration level rapidly increased from 20% in that same year to more than 80% in 2000 (P. H. Chen, 2002; Liu & Chen, 2000). Its development has been very similar to that in the United States. Although origi-nally used as a community antenna, cable television in Taiwan has now become a strong competitor of the four terrestrial television stations. The industry in Taiwan is also heavily integrated both horizontally and vertically, with four multiple sys-tem operators dominating the market.

Taiwan’s Cable Television Law, which took effect in 1993, divided the island into 51 franchise areas. When granting licenses to cable television operators, the Govern-ment Information Office (2002) has tried to issue more than one license in each fran-chise area to prevent a monopoly. However, each franfran-chise area has been too small for cable television system operators to achieve minimum economies of scale, and, thus, system operators have merged operations in many franchise areas to increase Requests for reprints should be sent to Shu-Chu Sarrina Li, Institute of Communication Studies, National Chiao Tung University, 1001 Ta Hsueh Road, Hsinchu City, Taiwan, Republic of China. E-mail: shuchu@cc.nctu.edu.tw

efficiency. Several recent studies have shown that more than half of these areas have become characterized by a monopolistic market structure (C. Y. Chen, 1999; P. H. Chen, 2002). With the number of areas in the cable television industry characterized by a monopolistic market structure that is rapidly increasing, many scholars and policymakers have become concerned with the performance of the cable television system operators in Taiwan. This study examines the relation between market com-petition and the media performance of Taiwan’s cable television industry.

LITERATURE REVIEW Industrial Organization Theory

Industrial organization theory is an approach used to understand the relations be-tween the structure, conduct, and performance of markets. It is a theory containing several models that attempt to explain how firms behave under different market structures, which in turn affect market performance. Industrial organization theory assumes that the structure, conduct, and performance of markets are not only lin-early related, but also interact reciprocally within a market (Albarran, 1996; Van der Wurff, 2002).

The structure of a market is usually dependent on several factors, and the con-centration of sellers is the most important factor because it determines a great deal about the structure of a market. Market conduct refers to a firm’s policies toward its customers and competitors, including price-setting policies and competition poli-cies. Market performance is evaluated based on the ability of a firm to achieve the goals of several criteria such as organizational efficiency or progress (Albarran, 1996; Sherman, 1995). Most scholarly work on the media industry is concerned with media performance, and communications scholars take into account several different dimensions when defining media performance. In addition to market per-formance, there are some scholars who define media performance as the quality of media products, whereas others focus on the diversity of the mass media or on the public interests served by the mass media (Bagdikian, 1985, 1987; Compaine, Sterling, Guback, & Noble, 1982; Dominick & Pearce, 1976; Li & Chiang, 2001; Lin, 1995; Litman, 1979; McQuail, 1992; Rothenbuhler & Dimmick, 1982).

Market Structure and Media Performance

Industrial organization theory posits that media performance is very much affected by the structure of a market. However, media economists disagree among them-selves as to how market structure influences performance. Some scholars claim the existence of a negative relation between market competition and media perfor-mance and believe that it is only in a concentrated market structure that firms have

sufficient financial resources to test different products and develop new products (Burnett, 1992; Schumpeter, 1950). However, other scholars see a positive relation between market competition and performance. These economists argue that, in a concentrated market structure, firms strive to obtain the largest share of a market, and each firm will try to manufacture products that please as many consumers as possible while offending the fewest possible people, a process that leads to homo-geneity. By contrast, in a market with open competition between many firms, such a market is broken into many segments, so that it is impossible for one firm to gain the largest share. The best strategy under these circumstances is to differentiate one’s products to cater to a specific niche, which gives rise to increased product di-versity in the mass-media market (see Coser, Kadushin, & Powell, 1982; Litman, 1979; Peterson & Berger, 1975; Rothenbuhler & Dimmick, 1982; Ryan, 1985). Market Competition Positively Related to Media

Performance

Empirical research has not yet established any conclusive findings regarding the relation between market competition and media performance, although most stud-ies point to a positive relation between them. Many previous studstud-ies investigated the relations between television programming/television news and market compe-tition and found that increased compecompe-tition within a market led to a higher degree of diversity and better quality in either television programs or television news (Atwater, 1984; Dominick & Pearce, 1976; Hellman & Soramaki, 1994; Li, 1999; Litman, 1979).

For example, Wakshlag and Adams (1985) found that the U.S. 1971 Prime Time Access Rule greatly reduced the degree of market competition in the TV industry, which in turn led to a gradual decline in program variety in terms of network prime-time programming. Powers, Kristjansdottir, and Sutton (1994) found that market competition led not only to increased diversity in terms of the news content of Danish television, but also to improvements in the content of state television.

The rapid growth of the U.S. cable TV industry in the late 1980s was expected to promote media performance, and many studies found a positive relation be-tween competition and media performance (Bae, 1999; De Jong & Bates, 1991; Grant, 1994). For example, Chan-Olmsted (1996) found that the increased compe-tition in commercial children’s television in the United States led to more choices available to young American audiences. Barrett (1995) discovered that the exis-tence of direct cable competition resulted in more local programming, better cus-tomer service, and lower prices.

The competition–performance relation was also intensively researched in the newspaper, popular music, and radio industries of the United States. Most studies found that market competition had a positive effect on media performance, includ-ing content diversity and editorial-page vigor (Everett & Everett, 1989; Johnson &

Wanta, 1993; Lacy, 1987, 1988, 1989; Peterson & Berger, 1975; Rogers & Woodbury, 1996; Rothenbuhler & Dimmick, 1982).

Market Competition Negatively Related to Media Performance

Although most studies have shown that market competition has a positive effect on media performance, other studies discovered the opposite (Hellman & Soramaki, 1985; Hvitfelt, 1994; Li & Chiang, 2001; Liu, 1997). Burnett (1992) found a nega-tive relation between market competition and the diversity of the popular music in-dustry. Lin (1995) found that competition led to a decrease in programming diver-sity among the three U.S. networks. Li and Chiang and Liu both analyzed the prime-time schedule of Taiwan’s three TV stations in the 1990s and discovered that programming diversity gradually declined as competition increased.

A few studies failed to come up with evidence of any relation between market competition and media performance or gave rise to mixed results (Lacy, 1988; McCombs, 1988; Van der Wurff & Cuilenburg, 2001). Lacy found that competi-tion from TV, cable TV, and radio did not have an observable effect on newspaper content. Van der Wurff and Cuilenburg discovered that a moderate degree of com-petition in the Dutch television market led to an increase in programming diversity, but strong competition resulted in less diversified programming.

Media Performance of Cable Television Systems

The definition of media performance varies from one study to another, and a close examination of these definitions reveals that most are concerned with certain as-pects of media products (Bagdikian, 1985, 1987; Compaine et al., 1982; Dominick & Pearce, 1976; Li & Chiang, 2001; Lin, 1995; Litman, 1979; McQuail, 1992; Rothenbuhler & Dimmick, 1982). Traditional mass media, such as terrestrial tele-vision, radio, newspapers, and magazines, do not have direct contact with consum-ers. Therefore, scholars tend to focus on the products of these media to measure performance. However, cable television systems differ because providing various services such as installation, repairing, or billing to their subscribers is an impor-tant part of their media performance. Furthermore, cable television systems use many resources from local communities, such as installing coaxial cable or hybrid fiber-coax (HFC) along the roads of the communities, and are thus expected to help with the development of local communities. Therefore, the performance of a cable television system should be evaluated not only on the basis of the products it provides, but also on the services offered to its subscribers and community (C. Y. Chen, 1999; Chipty, 2001; Jacobs, 1995). One way of measuring the performance of a cable television system is to understand the perceptions of its subscribers in terms of its products, customer service, and community service. This study uses

subscribers’ satisfaction with program service, customer service, and community service to measure the media performance of cable television systems in Taiwan.

Research Hypotheses

The literature review on the competition–performance relation shows that (a) previous studies found a positive relation between market competition and media performance, whereas a few discovered a negative relation; and (b) these few stud-ies identifying a negative competition–performance relation were limited to two areas—one being studies that investigated the competition–performance relation in the popular music industry (Burnett, 1992), and the other being studies that ex-amined a market that was too competitive and in which moderate competition, in-stead of strong competition, led to better media performance (Li & Chiang, 2001; Lin, 1995; Van der Wurff & Cuilenburg, 2001).

In terms of the studies in the popular music industry, it was found that it was not market competition, but organizational factors, that affected the degree of music diversity (Burnett, 1992). Taiwan’s cable television did not have organizational factors like those in the popular music industry that induced innovations in their products. Furthermore, Taiwan’s cable television system operators have now merged in most areas to make their operations more efficient with some of the ar-eas having two system operators and others having only one. The market competi-tion in Taiwan’s cable television industry at best reflects only a moderate degree of market competition. Therefore, one would expect a positive relation to exist be-tween market competition and media performance. Three hypotheses are therefore offered:

H1: Subscribers’ satisfaction regarding program service will be higher in the franchise areas where competition exists than in the areas where no compe-tition exists.

H2: Subscribers’ satisfaction regarding customer service will be higher in the areas where competition exists than in areas where no competition exists. H3: Subscribers’ satisfaction regarding community service will be higher in the areas where competition exists than in areas where no competition exists.

RESEARCH METHOD Independent Variables

The independent variable—the degree of market competition in the franchise ar-eas—is operationalized as follows: (a) The researcher used the data provided on the Government Information Office’s (2002) Web site (www.gio.gov.tw) to

tify how many cable systems were operating in each of Taiwan’s 51 franchise ar-eas; (b) research assistants telephoned all of the operators to make sure that the sys-tems were still operating; and (c) the researcher interviewed four experts who were familiar with the current state of Taiwan’s cable television industry to understand the situation regarding competition in each franchise area. Three of the four ex-perts were program managers of cable television system operators, and the other was a professor with expertise in analyzing the media industry market in Taiwan. Four types of market competition in the franchise areas were identified. The first type of market competition is referred to as the monopolistic market because it exists where only one cable television system is operating. The second type is where two operators are providing services, but where the two operators in fact belong to the same Multiple Systems Operator (MSO), and thus is referred to as the noncompeti-tive duopoly market. The third type is referred to as the competinoncompeti-tive duopoly market because the market has two competing cable systems that are independent of each other. The fourth type of market competition is where three cable television systems are competing in the same market and is referred to as the oligopoly market. This study found that, among the 51 franchise areas, 35 areas belonged to the monopolis-tic market, 4 belonged to the noncompetitive duopoly market, 11 belonged to the competitive duopoly market, and only 1 belonged to the oligopoly market. Subscribers’ Satisfaction

This study used two steps to design the questionnaire for the subscribers’ satisfac-tion with program service, customer service, and community service. The first step was to form a focus group that discussed what a cable television system operator should do to be a good citizen in the media industry. The members of the focus group were 10 graduate students in communication studies from a university in the northern part of Taiwan. All of the graduate students had undergraduate majors in mass communications, and half of them had working experience in the media in-dustry for at least 2 years. The focus group discussion lasted about 2 hr and was presided over by one research assistant, with the whole of the discussion later be-ing transcribed and analyzed. The second step was to refer to several studies on subscribers’ satisfaction with cable television in both the United States and Taiwan (Atkin, 1992; C. Y. Chen, 1999; Jacobs, 1995, 1996; LaRose & Atkin, 1988; Liu & Chen, 2000). Using these two steps, this study came up with 19 questions regard-ing subscribers’ satisfaction that included four dimensions—system reliability, program quality, customer service, and community service, with system reliability and program quality being regarded as program service.

Responses to the 19 questions were processed by means of the LISREL pack-age for the confirmatory factor analysis. The results confirm that there were four dimensions of subscribers’ satisfaction in this study, which were consistent with those identified by previous research (see Table 1).

The first dimension, system reliability, contained three items—whether the pic-tures were clear, the system operators were infrequently out of service, and the sys-tem operators infrequently closed certain channels without notice. The second di-mension, program quality, consisted of six items, including a great number of channels, few advertisements, diversified programming, low rerun rates, and pro-gramming quality. The third dimension, customer service, contained five items that included personnel having enough professional knowledge, being nice and po-lite, giving prompt services, solving problems efficiently, and charging reasonable prices. The fourth dimension, community service, was composed of five items that included being active in community activities and community service, being credi-ble, meeting consumers’ needs, and caring about ethics. Following the factor anal-ysis, a composite reliability was calculated for each of the four factors. The scores of composite reliability for the four factors were all above .70, with two of them be-ing higher than .80 and the score of composite reliability for all 19 items bebe-ing .94. The results of the confirmatory factor analysis show that χ2(146, n = 841) =

TABLE 1

Confirmatory Factor Analysis of Subscribers’ Satisfaction

Factors/Items Factor Loading t Value Composite Reliabilitya

System reliability .77

Clear picture .56 15.89*

Out of service infrequently .82 24.62* Channels closed infrequently .77 23.09*

Program quality .74

A great number of channels .49 13.82* Few advertisements .48 13.23* Diversified programming .57 16.18*

Low rerun rate .55 15.71*

Good quality of local programs .61 17.56* Good quality of programs .69 20.56*

Customer service .86

Enough professional knowledge .72 23.25* Being nice and polite .82 28.07*

Prompt services .84 28.89*

Solving problems efficiently .83 28.38*

Reasonable price .48 14.13*

Community service .86

Community activities .92 34.15* Community services .93 34.17*

Being credible .62 19.32*

Meeting consumers’ needs .65 20.51* Caring about ethics .57 17.46*

aInstrument reliability = 0.94.

*p < .05.

1820.10, p = .00, root mean square error of approximation = .117. The significant chi-square value means that this model still differs from the best fit model. How-ever, most of the goodness of fit indexes are above .90 (Comparative Fit Index = .93, Relative Fit Index = .90, Normed Fit Index = .92, Goodness of Fit Index = .81), and, thus, this model is considered to be moderately fit. This study used the sums of the factor scores to come up with four satisfaction variables—namely, system reliability, program quality, customer service, and community service. In addition to conducting a confirmatory factor analysis, this study also performed several one-way analyses of variance (ANOVAs) to examine the relation between market competition and subscribers’ satisfaction.

The Questionnaire

The formal questionnaire contained three sets of questions. The first set of ques-tions involved asking the respondents in which city or county they lived and whether they subscribed to cable television. If the respondents subscribed to cable television, then they would be further asked what the names of their cable televi-sion system operators were. In the event that the respondents could not remember the names of their cable television system operators, telephone interviewers were provided with a sheet on which the names of all cable television system operators in the 51 franchise areas were listed and would mention the names of the system operators based on the locations of the respondents to help them recall the names of their system operators. In this way, this study was able to identify the franchise areas where the respondents were located and the types of market competition.

The second set of questions consisted of the 19 questions that targeted subscrib-ers’ satisfaction with program service, customer service, and community service. The respondents were asked to indicate from 1 (a little bit likely) to 7 (very much likely) their degree of agreement with the statements of the 19 questions. The third set of questions involved asking the respondents for demographic information, in-cluding gender, age, educational level, and income.

Telephone Survey

A telephone survey involving a probability sampling approach was selected and administered in January 2003 with 12 research assistants who conducted the tele-phone interviews. The most recent teletele-phone books for every city and county in Taiwan were used for systematic random sampling. Whenever a number was cho-sen from a telephone book, a “one” was added to the number to avoid any biases that might exist in the telephone directory (Babbie, 1995; Wimmer & Dominick, 2003). After excluding business numbers, disconnected numbers, and no-answers, this study made 2,001 telephone calls and obtained 1,051 valid questionnaires with a response rate of 52.5%. The month-long telephone survey was conducted in a central location and supervised by the researcher.

RESEARCH FINDINGS

This study found that, among the 1,051 respondents, 841 respondents (80%) were cable television subscribers, and the remaining 210 were nonsubscribers. This fig-ure for the cable television penetration rate was almost the same as that found in other studies (P. H. Chen, 2002; Liu & Chen, 2000). The frequency analysis of the study data showed that approximately 34% of the 841 cable television subscribers had completed senior high school, 24% had completed college, 18% had com-pleted graduate school, and 14% had comcom-pleted junior high school. The respon-dents were more or less equally distributed among the different age groups (from 15 to more than 50), with those over the age of 50 having a slightly higher percent-age (18%). Gender was equally distributed as evidenced by male and female cate-gories in the sample. This profile is congruent with that of Taiwan’s population ex-cept that the average educational level in the sample was a little bit higher than that of the general population (Monthly Report from the Executive Yuan of Taiwan, 2002). When the profile of this sample is compared with that of cable television subscribers in other studies, this sample is found to be quite representative of Tai-wan’s cable television subscribers (Li, 2003; Liu & Chen, 2000).

Market Competition and Subscribers’ Satisfaction

The frequency analysis for the market competition variable showed that 477 of the 841 cable television subscribers were from the monopolistic market, 54 respon-dents were from the noncompetitive duopoly market, 298 responrespon-dents were from the competitive duopoly market, and only 12 respondents were from the oligopolistic market. Only 1 of the 51 franchise areas in Taiwan belonged to the oligopolistic market, in which three system operators competed with each other in the market. Twelve respondents in a cell was too small a number to have statistical significance, and, thus, this study decided to combine the 12 respondents with those from the competitive duopoly market, in which two system operators were competing with each other in the market.

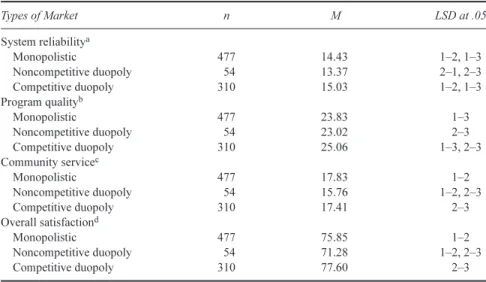

This study performed five one-way ANOVAs to understand the relations be-tween market competition and subscribers’ satisfaction with system reliability, program quality, customer service, community service, and overall satisfaction. The results showed that the types of market competition had a significant effect on subscribers’ satisfaction in terms of system reliability, F(2, 838) = 7.04, p = .001; program quality, F(2, 838) = 5.98, p = .003; community service, F(2, 838) = 3.80, p = .023; and overall satisfaction, F(2, 838) = 4.13, p = .016. Furthermore, this study found that the types of market competition did not exert an effect on subscribers’ satisfaction with customer service, F(2, 838) = .93, p = .40. The post-hoc test—the Least Significant Difference—was performed to better understand how subscrib-ers’ satisfaction with system reliability, program quality, community service, and

overall satisfaction differed in regard to the three types of market competition. The results are summarized in Table 2.

Table 2 indicates that the mean scores of subscribers’ satisfaction with system reliability differed significantly from each other among the three types of market competition, and that the competitive duopoly market had the highest score for subscribers’ satisfaction with system reliability, the monopolistic market had the second highest score, and the noncompetitive duopoly market had the lowest score. The data in Table 2 also demonstrate that the competitive duopoly market had the highest mean of subscribers’ satisfaction with program quality, the monop-olistic market had the second highest mean score, and the noncompetitive duopoly market had the lowest. Furthermore, the mean score of the competitive duopoly market differed significantly from those of the monopolistic and noncompetitive duopoly markets, with these last two not being different from each other. This study found that the monopolistic and the competitive duopoly markets did not sig-nificantly differ from each other in terms of subscribers’ satisfaction with commu-nity service, both of which in turn had significantly higher means than the noncom-petitive duopoly market. In terms of subscribers’ overall satisfaction, this study discovered that the competitive duopoly market had the highest mean for this vari-able, the monopolistic market had the second highest, and the noncompetitive du-opoly market had the lowest. Moreover, this study found that the means of overall satisfaction did not differ from each other in the monopolistic and noncompetitive

TABLE 2

ANOVA Comparison of the Three Types of Market Competition

Types of Market n M LSD at .05 System reliabilitya Monopolistic 477 14.43 1–2, 1–3 Noncompetitive duopoly 54 13.37 2–1, 2–3 Competitive duopoly 310 15.03 1–2, 1–3 Program qualityb Monopolistic 477 23.83 1–3 Noncompetitive duopoly 54 23.02 2–3 Competitive duopoly 310 25.06 1–3, 2–3 Community servicec Monopolistic 477 17.83 1–2 Noncompetitive duopoly 54 15.76 1–2, 2–3 Competitive duopoly 310 17.41 2–3 Overall satisfactiond Monopolistic 477 75.85 1–2 Noncompetitive duopoly 54 71.28 1–2, 2–3 Competitive duopoly 310 77.60 2–3

Note. ANOVA = analysis of variance; LSD = least significant difference.

aF ratio = 7.04, p = .001.bF ratio = 5.98, p = .003.cF ratio = 3.80, p = .023.dF ratio = 4.13, p = .016.

duopoly markets, but both markets had significantly lower means of overall satis-faction than the competitive duopoly market.

DISCUSSION

Competition and Satisfaction With Program Service

The first hypothesis of this study states that subscribers’ satisfaction regarding pro-gram service will be higher in the franchise areas where competition exists than in the areas where no competition exists. This study used system reliability and pro-gram quality to measure propro-gram service. In terms of system reliability, it was dis-covered that the competitive duopoly market had the highest score, the monopolis-tic market had the second highest, and the noncompetitive duopoly market had the lowest. The three types of market competition also significantly differed from each other regarding this variable. The noncompetitive duopoly market was in the fran-chise areas where two system operators belonging to the same MSO were compet-ing with each other. This type of market competition was in fact not real competi-tion. Therefore, the finding that the competitive duopoly market had a significantly higher mean than either the monopolistic market or the noncompetitive duopoly market accords with the prediction of Hypothesis 1. Furthermore, this study also found that the competitive duopoly market had a significantly higher score for pro-gram quality than the monopolistic market or the noncompetitive duopoly market. Hence, the prediction of Hypothesis 1 was supported by the findings regarding system reliability and program quality.

The finding that the noncompetitive duopoly market had a mean of satisfaction with system reliability that was even lower than that for the monopolistic market was unexpected in the study, because both types of market had no competition at all, and there should have been no differences in the satisfaction scores regarding system re-liability. A possible explanation for this finding may be that the respondents in the noncompetitive duopoly market did not know that the two system operators were ac-tually from the same company, and they expected to benefit from competition. Previ-ous studies on subscribers’ satisfaction with cable television showed that satisfac-tion came as a result of a better-than-expected performance (Jacobs, 1995; LaRose & Atkin, 1988). Therefore, it may be that respondents in the noncompetitive duopoly market had a higher expectation than respondents in the monopolistic market be-cause they thought there was competition in their markets.

Competition and Satisfaction With Customer Services

The second hypothesis of the study states that subscribers’ satisfaction regarding customer service will be higher in the franchise areas where competition exists than in the areas where no competition exists. The data analysis shows that the

three types of market competition did not significantly differ from each other in terms of the scores for satisfaction regarding customer service. Therefore, the find-ings of this study do not support the prediction of Hypothesis 2.

When cable television was legalized in Taiwan, system operators put all chan-nels (more than 70 chanchan-nels) including HBO, Cinemax, and so forth into basic ca-ble and only provided basic caca-ble to subscribers. Taiwan’s caca-ble television sub-scribers have been used to having all channels in their basic cable. Furthermore, subscribers are not keen on purchasing addressable converters for pay cable or pay-per-view to work. Cable television system operators have for the past several years tried hard to promote their pay cable and pay-per-view to their subscribers, but they have not succeeded in their efforts, and so now most of the cable system operators in Taiwan operate with only basic cable (Li, 2001; Liu & Chen, 2001). This may be the reason why this study did not find significant differences among the three types of market competition in terms of satisfaction with customer ser-vice, because subscribers with only basic cable did not have a great deal of interac-tion with the customer service personnel. Moreover, the majority of cable televi-sion system operators rely on Taiwan’s many convenience stores, such as 7–11, to collect subscribers’ monthly fees, which has further reduced the chances of sub-scribers interacting with customer service personnel.

Taiwan’s Cable Television Law requires that all system operators complete the establishment of their HFC architecture after obtaining licenses for certain years. Most system operators have replaced their coaxial cable with HFC cable in the past few years, during which time they have had to cut their services for some time or their cable television signals would not have been stable. Some system operators have done a good job in terms of informing their subscribers of possible unreliabil-ity in system services, whereas others have not (Liu & Chen, 2000). This may be a possible reason why subscribers’ satisfaction with system reliability differed sig-nificantly among the three types of market competition, whereas subscribers’ satis-faction with customer service did not.

Competition and Satisfaction With Community Service

The third hypothesis of the study states that subscribers’ satisfaction with commu-nity service will be higher in the franchise areas where competition exists than in the areas where competition does not exist. An analysis of the data shows that the monopolistic market and the competitive duopoly market did not differ in terms of the means of subscribers’ satisfaction with community service, both of which had significantly higher scores than the noncompetitive duopoly market. Therefore, this finding partially supports the prediction of Hypothesis 3.

This study found that the noncompetitive duopoly market had the lowest mean of subscribers’ satisfaction with community service among the three types of mar-ket competition, and that the monopolistic marmar-ket also had only one system

tor in the market, but that it had a much higher score than the noncompetitive duop-oly market in terms of community service. This finding further confirms the reasoning that respondents in the noncompetitive duopoly market had higher ex-pectations regarding the performance of cable television system operators, and, thus, they exhibited a lower mean of satisfaction regarding community service in so far as their system operators were concerned. As stated previously, this study conducted interviews on four experts to identify the types of market competition in Taiwan. These experts mentioned that, in some franchise areas in Taiwan, it looked as if there were two system operators, but as a matter of fact, the two system opera-tors were only one because they belonged to the same MSO. These experts ex-plained that, in this situation, the two system operators were running the cable tele-vision systems in the same manner, including program service, customer service, and community service, because the way in which they were operating the systems was totally controlled by the MSO.

Competition and Subscription Rate

This study employed proportionate stratified sampling that was based on the popu-lation percentage that each county or city had in terms of Taiwan’s popupopu-lation for telephone interviews, which allowed the researcher to calculate the subscription rate of each franchise area. In this study, the researcher performed a chi-square analysis between the subscription rates and the three types of market competition to better understand their relations. The results show that the three types of market competition significantly differed from each other in their subscription rates,χ2(2,

N = 1051) = 11.44, p = .003, with the competitive duopoly market having the est subscription rate (85.2%), the noncompetitive duopoly market the second high-est (84.4%), and the monopolistic market the lowhigh-est (76.6%). The data analysis in-dicates that the competitive duopoly and the noncompetitive duopoly markets did not differ very much in terms of their subscription rates, and both had much higher rates than the monopolistic market. This finding partially supports the prediction of this study that a higher degree of market competition leads to better perfor-mance of cable television system operators.

This finding indicates that, when there was more than one system operator in the market, people were more likely to subscribe to cable television regardless of whether these system operators were really competing with each other. However, there had to be real competition in a market for subscribers to feel satisfied with their cable television.

CONCLUSIONS

This study has examined the relation between market competition and media per-formance in Taiwan’s cable television industry. The media perper-formance of cable

television systems was defined as the subscribers’ satisfaction with program ser-vice, customer serser-vice, and community service. This study’s findings in general support the idea of a positive relation between market competition and media per-formance, which accords with most previous studies. Furthermore, this study also found that there was a positive relation between market competition and media performance when there was a moderate degree of competition in a market, which is consistent with both Li and Chiang’s (2001) study and Van der Wurff and Cuilenburg’s (2001) study. Future studies should try to explore the issue further to see whether too much competition in a market leads to a poor media performance to clarify the relation between market competition and media performance.

Moreover, the researcher suggests that more dimensions of media performance in relation to cable television systems can be explored to better understand the rela-tion between market competirela-tion and the performance of cable television. In addi-tion to subscribers’ satisfacaddi-tion, future studies could analyze the types of channels, the content of local programming, the specific rules that customer service person-nel follow, and the community service activities that cable television system opera-tors actually involve themselves in to better measure the performance of cable tele-vision systems.

This study adopted a telephone survey to collect data for analysis, but the re-sponse rate was only 52.5%. As the Taiwan economy has developed, the use of telephone surveys for marketing, business, or political purposes has become preva-lent in Taiwan. More and more people in Taiwan are reluctant to receive telephone calls for these purposes. Future studies should try to offer telephone interviewers a solid training to improve on the response rates of telephone surveys.

REFERENCES

Albarran, A. B. (1996). Media economics: Understanding markets, industries and concepts (1st ed.). Ames: Iowa State Press.

Atkin, D. J. (1992). A profile of cable subscribers: The role of audience satisfaction variables. Telematics and Informatics, 9, 53–60.

Atwater, T. (1984). Product differentiation in local TV news. Journalism Quarterly, 61, 757–762. Babbie, E. (1995). The practice of social research (6th ed.). Belmont, CA: Wadsworth.

Bae, H. S. (1999). Product differentiation in cable programming: The case in the cable national all-news networks. Journal of Media Economics, 12, 265–277.

Bagdikian, B. H. (1985). The U. S. media: Supermarket or assembly line ? Journal of Communication, 35(5), 97–109.

Bagdikian, B. H. (1987). The media monopoly (2nd ed.). Boston: Beacon.

Barrett, M. (1995). Direct competition in cable television delivery: A case study of Paragould, Arkan-sas. Journal of Media Economics, 8(3), 77–93.

Burnett, R. (1992). The implications of ownership changes on concentration and diversity in the phonogram industry. Communication Research, 19, 749–769.

Chan-Olmsted, S. M. (1996). From Sesame Street to Wall Street: An analysis of market competition in commercial children’s television. Journal of Broadcasting & Electronic Media, 40, 30–44.

Chen, C. Y. (1999, June). The study on the service quality of cable television in Taiwan. Paper presented at the third annual conference of the Chinese Communication Society, Hsinchu, Taiwan.

Chen, P. H. (2002). Who owns cable television? Media ownership concentration in Taiwan. Journal of Media Economics, 15, 44–55.

Chipty, T. (2001). Vertical integration, market foreclosure, and consumer welfare in the cable television industry. Journal of the American Economic Review, 91, 428–453.

Compaine, B. M., Sterling, C. H., Guback, T., & Noble, J. K. (1982). Who owns the media ?: Concen-tration of ownership in the mass communications industry (2nd ed.). White Plains, NY: Knowledge Industry Publications.

Coser, L., Kadushin, C., & Powell, W. (1982). Books: The culture and commerce of publishing (1st ed.). Chicago: University of Chicago Press.

De Jong, A. S., & Bates, B. J. (1991). Channel diversity in cable television. Journal of Broadcasting & Electronic Media, 35, 159–166.

Dominick, J. R., & Pearce, M. (1976). Trends in network prime-time programming. Journal of Commu-nication, 26(1), 70–80.

Everett, S. C., & Everett, S. E. (1989). How readers and advertisers benefit from local newspaper com-petition. Journalism Quarterly, 66, 76–79.

Government Information Office. (2002). The companies and addresses for Taiwan’s cable television system operators. Retrieved December 10, 2002, from http://www.gio.gov.tw/info/radiotv/rad1f.htm

Grant, A. E. (1994). The promise fulfilled ?: An empirical analysis of program diversity on television. Journal of Media Economics, 7(1), 51–64.

Hellman, H., & Soramaki, M. (1985). Economic concentration in the videocassette industry: A cultural comparison. Journal of Communication, 35(3), 122–134.

Hellman, H., & Soramaki, M. (1994). Competition and content in the U.S. video market. Journal of Media Economics, 7(1), 29–49.

Hvitfelt, H. (1994). The commercialization of the evening news: Changes in narrative technique in Swedish TV news. The Nordicom Review of Mass Communication Research, 9(2), 33–41. Jacobs, R. (1995). Exploring the determinants of cable television subscriber satisfaction. Journal of

Broadcasting & Electronic Media, 39, 262–274.

Jacobs, R. (1996). Cable television subscribers: A comparison of complainers and noncomplainers. Journal of Media Economics, 9(3), 37–49.

Johnson, T. J., & Wanta, W. (1993). Newspaper competition and message diversity in urban market. Mass Communication Review, 20(3/4), 136–146.

Lacy, S. (1987). The effects of intracity competition on daily newspaper content. Journalism Quarterly, 64, 281–290.

Lacy, S. (1988). The impact of intercity competition on daily newspaper content. Journalism Quarterly, 65, 399–406.

Lacy, S. (1989). A model of demand for news: Impact of competition on newspaper content. Journal-ism Quarterly, 66, 40–48, 128.

LaRose, R., & Atkin, D. (1988). Satisfaction, demographic, and media environment predictors of cable subscription. Journal of Broadcasting & Electronic Media, 32, 403–413.

Li, S. S. (1999). Market competition and media performance: Examining primetime series in Taiwan. Asian Journal of Communication, 9(2), 1–16.

Li, S. S. (2001). A study on the marketing strategies of interactive cable television services after the digitization of cable television. A project sponsored by the Association for Development of Cable Television and Broadband Network, Taipei, Taiwan.

Li, S. S. (2003, September). Cable television adoption: Examining the differences between the early stage of diffusion and the late stage of diffusion. Paper presented at the annual conference of the Chi-nese Communication Society, Hsinchu, Taiwan.

Li, S. S., & Chiang, C. C. (2001). Market competition and programming diversity: A study on the TV market in Taiwan. Journal of Media Economics, 14, 105–119.

Lin, C. A. (1995). Diversity of network prime-time program formats during the 1980s. Journal of Me-dia Economics, 8(4), 17–28.

Litman, B. (1979). The television networks, competition and program diversity. Journal of Broadcast-ing, 23, 393–409.

Liu, Y. L. (1997). Multiple TV channels and their audiences. Taipei, Taiwan: Shyr-Ying Publishing Company.

Liu, Y. L., & Chen, C. H. (2000). National survey on subscribers’ satisfaction of cable television. Tai-pei, Taiwan, Republic of China: The Association for Development of Cable Television and Broad-band Network.

Liu, Y. L., & Chen, C. H. (2001). National survey on people’s willingness to subscribe to pay cable and pay-per-view. Taipei, Taiwan, Republic of China: The Association for Development of Cable Televi-sion and Broadband Network.

McCombs, M. (1988). Effect of monopoly in Cleveland on diversity of newspaper content. Journalism Quarterly, 65, 740–744.

McQuail, D. (1992). Media performance: Mass communication and the public interest. Newbury Park, CA: Sage.

Monthly Report of the Executive Yuan. (2002). Population distribution in Taiwan. Retrieved December 20, 2002, from http://www.dgbas.gov.tw/dabas03/bs7/Bulltin/se.htm

Peterson, R. A., & Berger, D. G. (1975). Cycles in symbol production: The case of popular music. American Sociological Review, 40, 158–173.

Powers, A., Kristjansdottir, H., & Sutton, H. (1994). Competition in Danish television news. Journal of Media Economics, 7(4), 21–30.

Rogers, R. P., & Woodbury, J. R. (1996). Market structure, program diversity, and radio audience size. Contemporary Economic Policy, 14, 81–91.

Rothenbuhler, E. W., & Dimmick, J. W. (1982). Popular music: Concentration and diversity in the in-dustry, 1974–1980. Journal of Communication, 32(4), 143–149.

Ryan, J. (1985). The production of culture in the music industry: The ASCAP-BMI controversy (1st ed.). Landham, MD: University Press of America.

Schumpeter, J. (1950). Capitalism, socialism and democracy (3rd ed.). New York: Harper Publishing Company.

Sherman, B. L. (1995). Telecommunications management: Broadcasting/cable and the new technolo-gies (2nd ed.). New York: McGraw-Hill.

Van der Wurff, R. (2002). The impact of electronic publishing on the performance of professional infor-mation markets in the Netherlands. New Media and Society, 4, 307–328.

Van der Wurff, R., & Cuilenburg, J. V. (2001). Impact of moderate and ruinous competition on diver-sity: The Dutch television market. Journal of Media Economics, 14, 213–229.

Wakshlag, J., & Adams, W. J. (1985). Trends in program variety and the Prime Time Access Rule. Jour-nal of Broadcasting & Electronic Media, 29, 23–34.

Wimmer, R. D., & Dominick, J. R. (2003). Mass media research: An introduction (7th ed.). Belmont, CA: Wadsworth.