Full Length Research Paper

Historical research on corporate governance: A

bibliometric analysis

Chiung-Yao Huang

1,2and Yuh-Shan Ho

2,3*

1Department and Graduate Institute of Accounting, National Yunlin University of Science and Technology, Yunlin 64002, Taiwan.

2Trend Research Centre, Asia University, Taichung 41354, Taiwan.

3Department of Public Health, College of Public Health, China Medical University, Taichung 40402, Taiwan.

Accepted 6 September, 2010

Bibliometric analysis provides historical information on research of trend and performance. A publication analysis was carried out using the related literature in the Social Science Citation Index (SSCI) from 1992 - 2008, collected from the web of Science databases of the Institute for Scientific Information (ISI). Articles of such literature were concentrated on the analysis by the scientific output and distribution of subject categories and journals. The author’s keywords were also analyzed to evaluate the research hotspots. The results from this analysis indicate that, yearly, production of the related scientific articles increased steadily over the investigation period and that in the year 2008, there was a peak. “Ownership structure”, “board of directors” and “executive compensation” were the three most used author’s keywords. In addition, the agency theory in historical corporate governance research was also discussed.

Key words: Corporate governance, scientometrics, finance business, economics.

INTRODUCTION

The devastating economic effects of the “Asian financial crisis” of 1997 - 1998 have affected all the “emerging markets” open to capital flows and investment opportu-nities (Johnson et al., 2000; Lemmon and Lins, 2003). Besides, corporate financial scandals involving Enron, Worldcom, Arthur Andersen and others have heightened awareness of the need to revisit corporate accountability and to strengthen corporate governance provisions (Khatri et al., 2006). Recently, the financial crisis of 2007 - 2009 has inflicted severe loss of confidence on investors (Zingales, 2009). These international events have resulted in increasing the attention to the reforms of corporate governance. This paper briefly reviews the internationally historical events related to corporate governance.

Bibliometrics is a research method used in library and information sciences. It is also applied to the historical research analysis (Hurt, 1983; Tempest, 2008). One

*Corresponding author. E-mail: ysho@asia.edu.tw. Tel: 866 4 2332 3456 ext. 1797. Fax: 866 4 2330 5834.

common way of conducting bibliometric research is to use the Social Science Citation Index (SSCI), which traces publications of the Institute for Scientific Information (ISI). The SSCI has been used for the biblio-metric analysis of the social science topics (Sarafoglou, 1998; Li and Ho, 2008). Topics in the business-related field have also been studied by using bibliometric methods; for instance, the patterns of productivity in the finance literature (Chung and Cox, 1990), the bibliometric analysis of six economics research groups (Nederhof and Van Raan, 1993), the changes in the intellectual structure of strategic management research (Ramos-Rodríguez and Ruíz-Navarro, 2004) and the profile of the history, participants, knowledge stock and flows was investigated (Biemans et al., 2007). Evaluating the performance of each research topic is necessary for indicating the impact and contribution of authors in their respective fields. The authors attempted to bibliometrically evaluate the SSCI literature on corporate governance. This study might provide some additional insights into the current state of corporate governance research during the time span from 1992 to 2008. The characteristics of research activities, publication patterns and research hotspots were performed.

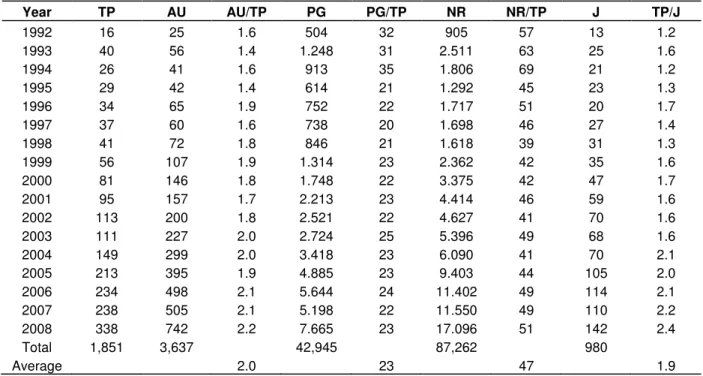

Table 1. Characteristics of corporate governance scientific articles from 1992 to 2008. Year TP AU AU/TP PG PG/TP NR NR/TP J TP/J 1992 16 25 1.6 504 32 905 57 13 1.2 1993 40 56 1.4 1.248 31 2.511 63 25 1.6 1994 26 41 1.6 913 35 1.806 69 21 1.2 1995 29 42 1.4 614 21 1.292 45 23 1.3 1996 34 65 1.9 752 22 1.717 51 20 1.7 1997 37 60 1.6 738 20 1.698 46 27 1.4 1998 41 72 1.8 846 21 1.618 39 31 1.3 1999 56 107 1.9 1.314 23 2.362 42 35 1.6 2000 81 146 1.8 1.748 22 3.375 42 47 1.7 2001 95 157 1.7 2.213 23 4.414 46 59 1.6 2002 113 200 1.8 2.521 22 4.627 41 70 1.6 2003 111 227 2.0 2.724 25 5.396 49 68 1.6 2004 149 299 2.0 3.418 23 6.090 41 70 2.1 2005 213 395 1.9 4.885 23 9.403 44 105 2.0 2006 234 498 2.1 5.644 24 11.402 49 114 2.1 2007 238 505 2.1 5.198 22 11.550 49 110 2.2 2008 338 742 2.2 7.665 23 17.096 51 142 2.4 Total 1,851 3,637 42,945 87,262 980 Average 2.0 23 47 1.9

TP: Number of articles; AU: Number of authors; PG: Page count; NR: Cited reference count; J: Number of journals; AU/TP: The average author count per article; PG/TP: The average page count per article; NR/TP: The average cited reference count per article; TP/J: The average number of articles published per journal.

METHODOLOGY

Documents used in this study were based on the online database of the Social Science Citation Index (SSCI) retrieved from the ISI web of Science, Philadelphia, USA. “Corporate governance” was used as the keyword to search titles, abstracts, and keywords from 1992 to 2008. The impact factor of a journal was determined for each document as reported in the JCR (2007). Document information included title, publication year, keywords, subject categories, abstract, document type, number of cited references and pages and names of journals publishing the articles. The records were downloaded into Microsoft Excel software and precisely analyzed.

RESULTSANDDISCUSSION

There were 2,792 publications that met the selection criteria previously mentioned and they include 10 document types. Article (1,851) was the most-frequently used document type comprising 66% of the total production, followed distantly by proceedings papers (373; 13%) and reviews (262; 9.4%). Others showing less significance were book reviews (175), editorial materials (109), letters (73), notes (6), corrections (4), meeting abstracts (3) and news items (2). As journal articles represented the majority of document type that was also peer-reviewed within this field, 1,851 articles were iden-tified and further analyzed in this study. The emphasis of the following discussion was to determine the pattern of scientific production and distribution of journals, subject categories and author key words.

Characteristics of corporate governance scientific articles

The publication output of current corporate governance research during the time span of 1992 through 2008 was summarized in Table 1. In the last 17 years, the annual number of journal articles published and the number of journals devoted to corporate governance research increased more than twenty-one-fold and eleven-fold, respectively, that is, the number of articles increased from 16 in 1992 to 338 in 2008, with also an increase in the number of journals (Table 1). The average number of authors per article rose from 1.6 authors per article in 1992 to 2.2 in 2008. The average page count per article has been decreased slightly, which indicates an overall average length of 23 pages. There were 1.2 articles published per journal in 1992, compared with 2.4 papers per journal in 2008.

The historical events and the trend of publications

Annual publications were displayed in Figure 1. Along with the occurrence of internationally financial events, corporate governance research continually grew in this period. The publication of articles has significantly increased by 25, 38 and 64 papers, separately, in the year 2000, 2004 and 2005 as compared with that in the previous year. Also, in the year 2008, increment in

Figure 1. World SSCI publications on corporate governance since 1992 to 2008.

publication came to its peak by 98 papers compared with the previous year. The relationship between internatio-nally critical events and researches related to corporate governance in the study period has been traced.

In July 1997, the “Asian financial crisis” was a period of financial crisis that gripped much of Asia and raised fears of a worldwide economic meltdown; meanwhile, cor-porate governance has attracted an interest in Western and Eastern Europe, Latin America and Asia and has taken on the favour of reforming the global financial architecture (Johnson et al., 2000; La Porta et al., 2000). The literature showed that firms with weaker governance structures generally had greater agency problems and performed worse (Core et al., 1999; Johnson et al., 2000). Firm-level differences in variables related to corporate governance had a strong impact on firm performance during the East Asian financial crisis of 1997 - 1998 (Mitton, 2002). Then, there were major corporate scandals in the period of 2001 - 2002 and a worldwide stock-market bubble burst over this same period, while the renewed interest in the corporate governance practices of modern corporations appeared. In 2002, the U.S. Securities and Exchange Commission introduced a new corporate governance structure, the qualified legal compliance committee, as part of the professional standards of conduct for attorneys mandated by the Sarbanes-Oxley Act of 2002, intending to restore public confidence in corporate governance (Fisch and Gentile, 2003; Chhaochharia and Grinstein, 2007). Particularly, the Sarbanes-Oxley Act of 2002 was considered by many

to have made the most sweeping changes affecting corporate governance since the Securities and Exchange Acts of 1933 and 1934 (Valenti, 2008). The OECD principles of corporate governance were first issued in 1999, which soon gained worldwide recognition as an international benchmark for sound corporate governance and which was revised in 2004 to respond to corporate governance developments (Jain and Rezaee, 2006). The waves of irregularity and various amendments to guidelines and regulations mentioned above led to abundant subject matters and particularly, attention is paid to discussing the effect of ownership concentration, the role of independent directors, the conduct of audits, disclosure quality and the implications for corporate governance innovation (Mitton, 2002; Deakin and Konzelmann, 2004; Hogan, 2004; Aguilera, 2005; Chhaochharia and Grinstein, 2007). Recently, the second financial crisis occurred and inflicted severe loss of confidence on investors. Investors in the world pay close attention to the issue of corporate governance again. In summary, there has been a decrease in the span of researches for corporate governance that lag behind the vital events.

Publication patterns: Subject categories

In the research topic of corporate governance, there were 57 subject categories identified by ISI. The use of statistics in any scientific discipline could be considered a

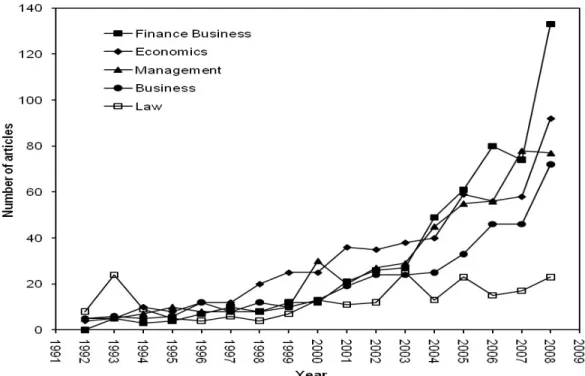

Figure 2. Top 5 subject categories with the most publications from 1992 to 2008.

key element in evaluating its degree of maturity (Palmer et al., 2005). Figure 2 provided the development trend of top 5 subject categories with most of the publications from 1992 to 2008 of the research emphasis on this topic. Finance business was expanded quite slowly before 2000, while it has almost taken the lead since 2004. Above all, the publications of finance business grew far considerably than those of all the other subjects in 2008. Economics and business with quite a stable growth were in the second and fourth place separately in the whole period of the study. Comparatively, the close attention paid by management to corporate governance was a little unsettled. Finally, law has kept showing little growth except in 1993.

Publication patterns: Journals

In total, 1,851 articles were published in 388 journals. The journals were listed in descending order by the number of articles received. Bradford’s Law of Scattering (Bradford, 1934) was applied and the journals were divided into three “zones”. Zone 1 represented the most productive third of the total articles, which contained 9 journals or 2.3% of 388 journals. Zone 2 represented the next most productive third of the total articles, which contained 60 journals or 15% of 388 journals. Zone 3 represented the least productive third of the total articles, which contained 319 journals or 82% of 388 journals. Table 3 shows the nine Bradford’s core journals with their impact factors, the number of papers, the category and the percentage of total articles. As the flagship journal of

this research field, Corporate Governance-an

International Review published the most articles with 182

(10%) published papers. Journal of financial economics ranked second with 94 (5.1%) papers. These two journals were ranked as the top two of all journals. Moreover, the journal of finance with 50 published articles had the highest impact factor (3.353). The top one journal with the most publications belongs to the subject category of management and others are mostly the subject categories of finance business, economics and business. Business lawyer journal is classified to law alone. These distributions are basically consistent with the trend of category pattern analyzed previously. A conjecture can be made that corporate governance research in the field of finance business has continuously developed to a matured state.

Distribution of author key words analysis

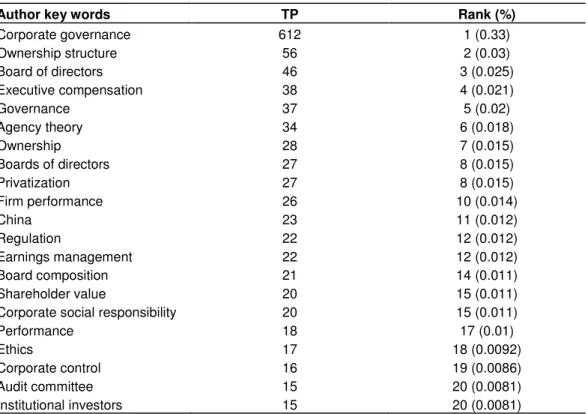

The source titles and author keywords supply “reasonably”, details of the articles’ subject (Garfield, 1990). The author keywords analysis could offer the infor-mation of research hotspot which is concerned by most researchers. Bibliometric method can use the author keyword to analyze the trend of research (Xie et al., 2008; Li et al., 2009). The technique of statistical analysis of keywords aims at discovering directions of science and proves important for monitoring the development of science and programs. Examination of author keywords in this study period revealed that 2,163 author keywords were used. Among them, 1,703 keywords appeared only

Table 2. Top 20 frequency of author keywords used.

Author key words TP Rank (%)

Corporate governance 612 1 (0.33) Ownership structure 56 2 (0.03) Board of directors 46 3 (0.025) Executive compensation 38 4 (0.021) Governance 37 5 (0.02) Agency theory 34 6 (0.018) Ownership 28 7 (0.015) Boards of directors 27 8 (0.015) Privatization 27 8 (0.015) Firm performance 26 10 (0.014) China 23 11 (0.012) Regulation 22 12 (0.012) Earnings management 22 12 (0.012) Board composition 21 14 (0.011) Shareholder value 20 15 (0.011)

Corporate social responsibility 20 15 (0.011)

Performance 18 17 (0.01)

Ethics 17 18 (0.0092)

Corporate control 16 19 (0.0086)

Audit committee 15 20 (0.0081)

Institutional investors 15 20 (0.0081)

TP: publications in the study period; Rank (%): the rank and percentage of the author keyword.

once and 202 keywords appeared twice. The large number of once-only author keywords probably indicated a lack of continuity in research and a wide disparity in research focuses (Chuang et al., 2007). Most of the research articles were not considered to be mainstream corporate governance research by their authors. Author keywords that appeared in the articles referring to corporate governance from 1992 to 2008 were calculated and ranked by the total 17 years study time period. Also, author keywords that had appeared and are been equal to or above 15 times were displayed in Table 2, while research focus could be roughly found. Except for “corporate governance” which was the searching keyword in this study, the three most frequently used keywords were “ownership structure”, “board of directors” and “executive compensation”. The three keywords were also the basis of all corporate governance research in the world, in which “ownership structure” is the source of capital and “board of directors” and “executive compensation” is the decision core of a company. These findings correlate with the definition of corporate governance defined in the Cadbury Report (1992) as “the system by which companies are directed and controlled. Boards of directors are responsible for the governance of their companies. The shareholders’ role in governance is to appoint the directors and auditors and to satisfy themselves that an appropriate governance structure is in place.”

Theories to the topics of corporate governance

From the results of distribution of author keywords, theories to account for the phenomenon of corporate go-vernance were found, for example agency theory (Beatty and Zajac, 1994; Rediker and Seth, 1995), institutional theory (Zajac and Westphal, 2004; Ocasio, 1999) and stakeholder theory (Hill and Jones, 1992; McGuire et al., 2003) theories. Particularly, applying or adapting agency theory has been increasing in the span of this study (Figure 3).

Agency theory is directed at the ubiquitous agency rela-tionship, in which one party (the principal) delegates work to another (the agent), who performs the work. The focus of the theory is to determine the most efficient contract that governs the principal-agent relationship (Eisenhardt, 1989). Furthermore, from its roots in information econo-mics, agency theory has developed along two lines: positivist and principal-agent (Jensen and Roeback, 1983). The line of positivist has concern, first, with identi-fying situations in which the principal and agent are likely to meet conflicting goals and then with describing the governance mechanisms that limit the agent’s self-serving behaviour. On the other hand, the line of principal-agent has focused on determining the optimal contract between the principal and the agent and behaviour versus outcome of the managers (Eisenhardt, 1989).

Table 3. Bradford’s core journals on corporate governance, including the ranking, and respective percentages.

Journal TP (%) IF Subject category Position

Corporate Governance-an International Review 182 (10) 1.590 Management 25/81 Journal of Financial Economics 94 (5.1) 2.988 Finance business Economics 5/191 3/45 Journal of Corporate Finance 77 (4.2) 1.354 Finance business 9/45 Journal of Business Ethics 73 (3.9) 0.538 Business Ethics 55/72 16/28

Journal of Finance 50 (2.7) 3.353 Finance business 1/45

Journal of Banking and Finance 42 (2.3) 0.753 Finance business Economics

22/45 82/191

Business Lawyer 37 (2) 1.100 Law 40/101

Strategic Management Journal 35 (1.9) 2.829 Business Management 6/72 6/81 Journal of Accounting Research 21 (1.1) 2.115 Finance business 6/45 Journal of Financial and Quantitative Analysis 21 (1.1) 1.342 Finance business Economics 37/191 10/45

TP (%): total published articles; (percentage of all articles); IF: impact factor.

Figure 3. Applying or adopting agency theory of publications.

Since Berle and Means (1933) raised the issue of separation of ownership and control and highlighted its impact in corporations, literature has suggested various mechanisms of corporate governance to align managers’ selfish incentives with firm value maximization (Jensen

and Meckling, 1976; Fama, 1980; Fama and Jensen, 1983). Besides, the costs of large shareholdings and entrenchment are formalized in the model of Stulz (1988). In the model, as managerial ownership and control in-crease, the negative effect on firm value that is associated

N um be r of C ita tio ns

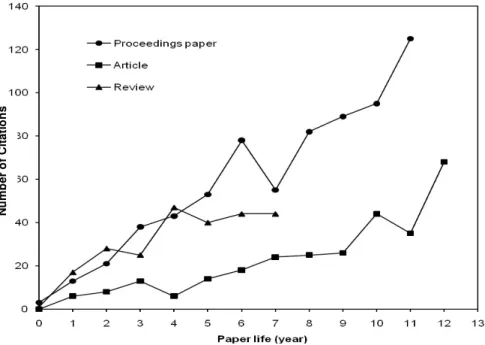

Figure 4. The citation history of the most frequently cited papers.

associated with the entrenchment of manager-owners starts to exceed the incentive benefits of the managerial ownership. However, there is a competing argument that the fundamental agency problem is not the Berle and Means conflict between the outside investors and the managers, but rather between the outside investors and the controlling shareholders, which is related to the agency problem described by Jensen and Meckling (1976) (Shleifer and Vishny, 1997; La Porta et al., 2000).

Facing the problems of moral hazards or adverse selection between the principal and the agent, much empirical research has examined the role of the board and explored its attributes and the firm’s performance (Fama, 1980; Fama and Jensen, 1983; Yermack, 1996; Core et al., 1999). Also, it emphasizes the efficacy of alternative ownership structures (Stulz, 1988; Claessens et al., 2002). In summary, the assumptions of the agency theory include people of self-interest, bounded rationality, risk aversion, organizations with goal conflict among members and information as purchasable. The agency theory offers unique insight to explain phenomena of corporate governance, particularly, in the aspect of the principle-agency problems of conflicts between the outside investors and the managers and expropriation of minority shareholders by the controlling shareholders (Eisenhard, 1989). The major contributions of agency theory to thinking over and reforming corporate governance are the ideas of risk, outcome uncertainty, incentives and information systems. The study conjectures that applying agency theory to the topics of corporate governance is still increasing, because it frequently tries to explain the actual events happening in the world.

Most frequently cited corporate governance papers

The time dependence of the citations might be information for tracing the impact of an article. Number of citations per year versus time was presented for article life. Article history was viewed by the “sales figure” in publications of Solid State Communications (Marx and Cardona, 2003). Article history has been investigated by percentage of cited papers (Chiu and Ho, 2005) and citation per publication (Li and Ho, 2008) versus time. Similarly, the time dependence for the most frequently cited papers that is related to Patent Ductus Arteriosus research has also been reported. Among corporate governance related papers, the most frequently cited proceedings paper was “a survey of corporate governance”. This paper, in 1997 by Shleifer and Vishny from USA, was published in the Journal of Finance and has been cited 695 times since its publishing to 2008. Regarding the original articles, “higher market valuation of companies with a small board of directors” (in 1996 by Yermack from New York University), was the most frequently cited. This was published in the Journal of Financial Economics and had been cited 287 times to 2008. In 2001, “from state to market: a survey of empi-rical studies on privatization” which was cited 246 times was the most frequently cited review and was published in the Journal of Economic Literature by Megginson and Netter from USA. The citation history of the most frequently cited papers that included proceedings paper, article and review for corporate governance was shown in Figure 4.

The impact of these three papers is still increasing at present. Compared with the review paper which has the

shorter period of publication, the proceedings and article papers significantly varied in the cited times. Shleifer and Vishny (1997) paid special attention to the importance of legal protection of investors. Yermack (1996) presented the evidence that companies with small boards are more effective. The citations of the former reached an oblivious jump after 6 years of publication, when a series of corporate financial scandals happened. As a result, plenty of corporate governance regulations were substantially revised and applied in 2002. Moreover, both of them reached the peak position in 2008 (11th year for the former and 12th year for the later after their publications separately), while the second financial crisis broke. Figure 4 showed the relationship between the paper life and the number of citations in a year.

Conclusion

In this study, dealing with corporate governance public-cations in journals listed in SSCI, some significant results on the worldwide research characteristics and trends throughout the period from 1992 to 2008 were obtained. A trend of publication was figured and the significant growth in the recent year of 2008 was illuminated. The mainstream of corporate governance research was in finance business, economics, management and business fields, whereas research in the law category somewhat played a less important role. Corporate Governance-an

International Review published the most corporate

governance-related articles. “Ownership structure” headed the most frequently used author keywords and was followed by “board of directors” and “executive compensation”. Finally, the “agency theory” is the most applied or adopted theory to corporate governance research and it shows continual increment.

REFERENCES

Aguilera RV (2005). Corporate governance and director accountability: An institutional comparative perspective. Brit. J. Manage. 16:

S39-S53.

Beatty RP, Zajac EJ (1994). Managerial incentives, monitoring, and risk bearing - A study of executive-compensation, ownership, and board structure in initial public offerings. Adm. Sci. Q., 39: 313-335. Berle A, Means G (1932). The modern corporation and private property.

New York: Macmillan.

Biemans W, Griffin A, Moenaert R (2007). Twenty years of the Journal of Product Innovation Management: History, participants, and knowledge stock and flows. J. Prod. Innovat. Manage., 24: 193-213. Bradford SC (1934). Sources of information on specific subjects. Brit. J.

Eng., 137: 85-86.

Chhaochharia V, Grinstein Y (2007). Corporate governance and firm value: The impact of the 2002 governance rules. J. Financ., 62: 1789-1825.

Chiu WT, Ho YS (2005). Bibliometric analysis of homeopathy research during the period of 1991 to 2003. Scientometrics, 63: 3-23.

Chuang KY, Huang YL, Ho YS (2007). A bibliometric and citation analy-sis of stroke-related research in Taiwan. Scientometrics, 72: 201-212. Chung KH, Cox R (1990). Patterns of productivity in the finance litera-ture: A study of the bibliometric distributions. J. Financ., 45: 301-309.

Claessens S, Djankov S, Fan JRH, Lang LHP (2002). Disentangling the incentive and entrenchment effects of large shareholdings. J. Financ., 57: 2741-2771.

Core JE, Holthausen RW, Larcker DF (1999). Corporate governance, chief executive officer compensation, and firm performance. J. Financ. Econ. 51: 371-406.

Deakin S, Konzelmann SJ (2004). Learning from Enron. Corp. Gov., 12: 134-142.

Eisenhardt KM (1989). Agency Theory: An assessment and review. Acad. Manage. Rev., 14: 57-74.

Fama EF (1980). Agency problems and the theory of the firm. J. Polit. Econ., 88: 288-307.

Fama EF, Jensen MC (1983). Separation of ownership and control. J. Law Econ., 26: 301-325.

Fisch JE, Gentile CM (2003). The qualified legal compliance committee: Using the attorney conduct rules to restructure the board of directors. Duke Law J., 53: 517-584.

Garfield E. (1990). KeyWords Plus: ISI’s breakthrough retrieval method. Part 1. Expanding your searching power on current contents on diskette. Curr. Contents, 32: 5-9.

Hill CWL, Jones TM (1992). Stakeholder-Agency Theory. J. Manage. Stud. 29: 131-154.

Hogan JM (2004). Corporate governance update: Changes in the boardroom after Enron. Secur. Regul. Law J., 32: 4-55.

Hurt CD (1983). A comparison of a bibliometric approach and an historical approach to the identification of important literature. Inform. Process. Manage., 19: 151-157.

Jain PK, Rezaee Z (2006). The Sarbanes-Oxley Act of 2002 and capital-market behavior: Early evidence. Contemp. Account. Res., 23: 629-654.

Jensen, M, Roeback, R (1983). The market for corporate control: Empirical evidence. J. Financ. Econ., 11: 5-50.

Jensen MC, Meckling WH (1976). Theory of the firm: Managerial behavior, agency costs, and capital structure. J. Financ. Econ., 3: 305-350.

Johnson S, Boone P, Breach A, Friedman E (2000). Corporate gover-nance in the Asian financial crisis. J. Financ. Econ. 58: 141-186. Khatri N, Tsang EWK, Begley TM (2006). Cronyism: A cross-cultural

analysis. J. Int. Bus. Stud. 37: 61-75.

La Porta R, Lopez-De-Silanes F, Shleifer A, Vishny R (2000). Investor protection and corporate governance. J. Financ. Econ. 58: 3-27. Lemmon ML, Lins KV (2003). Ownership structure, corporate

governance, and firm value: Evidence from the East Asian financial Li LL, Ding GH, Feng N, Wang MH, Ho YS (2009). Global stem cell research trend: Bibliometric analysis as a tool for mapping of trends from 1991 to 2006. Scientometrics, 80: 39-58.

Li Z, Ho YS (2008). Use of citation per publication as an indicator to evaluate contingent valuation research. Scientometrics, 75: 97-110. Marx W, Cardona M (2003). The impact of Solid State Communications

in view of the ISI Citation data. Solid State Commun., 127: 323-336. McGuire J, Dow S, Argheyd K (2003). CEO incentives and corporate

social performance. J. Bus. Ethics, 45: 341-359.

Mitton T (2002). A cross-firm analysis of the impact of corporate governance on the East Asian financial crisis. J. Financ. Econ., 64: 215-241.

Nederhof AJ, van Raan AFJ (1993). A bibliometric analysis of six economics research groups: A comparison with peer review. Res. Policy. 22: 353-368.

Ocasio W (1999). Institutionalized action and corporate governance: The reliance on rules of CEO succession. Admin. Sci. Q., 44: 384-416.

Palmer AL, Sese A, Montano JJ (2005). Tourism and statistics - Bibliometric study 1998-2002. Ann. Tour. Res., 32: 167-178.

Ramos-Rodríguez AR, Ruíz-Navarro J (2004). Changes in the intellectual structure of strategic management research: A bibliometric study of the Strategic Management Journal, 1980-2000. Strateg. Manage. J., 25: 981-1004.

Rediker KJ, Seth A (1995). Boards of directors and substitution effects of alternative governance mechanisms. Strateg. Manage. J. 16: 85-99.

Sarafoglou N (1998). The most influential DEA publications: A comment on Seiford. J. Prod. Anal., 9: 279-281.

Shleifer A, Vishny RW (1997). A survey of corporate governance. J. Financ., 52: 737-783.

Stulz RM (1988). Managerial control of voting rights: Financing policies and the market for corporate control. J. Financ. Econ., 20: 25-54. Tempest D (2008). The development of microbiology and the Institut

Pasteur: An historical bibliometric analysis. Res. Microbiol., 159: 27-30.

Valenti A (2008). The Sarbanes-Oxley Act of 2002: Has it brought about changes in the boards of large US corporations? J. Bus. Ethics, 81: 401-412.

Xie SD, Zhang J, Ho YS (2008). Assessment of world aerosol research trends by bibliometric analysis. Scientometrics, 77: 113-130.

Yermack D (1996). Higher market valuation of companies with a small board of directors. J. Financ. Econ., 40: 185-211.

Zajac EJ, Westphal JD (2004). The social construction of market value: Institutionalization and learning perspectives on stock market reactions. Am. Sociol. Rev., 69: 433-457.

Zingales L (2009). The future of securities regulation. J. Account. Res., 47: 391-425.