人壽保險公司之資產配置與破產成本分析

研究成果報告(精簡版)

計 畫 類 別 : 個別型

計 畫 編 號 : NSC 100-2410-H-004-052-

執 行 期 間 : 100 年 08 月 01 日至 101 年 07 月 31 日

執 行 單 位 : 國立政治大學風險管理與保險學系

計 畫 主 持 人 : 張士傑

報 告 附 件 : 出席國際會議研究心得報告及發表論文

公 開 資 訊 : 本計畫可公開查詢

中 華 民 國 101 年 10 月 13 日

要安全機制,本研究針對事後收費的保險安定基金費率進行

研究。如何有效執行資本監管機制以達到保險市場財務穩健

之目的,避免引發市場道德風險,不僅涉及現有之保險人,

同時對於欲進入保險市場之競爭者而言,成為相當重要之研

究議題。本文依續 Cummins (1988)架構,研究人壽保險人財

務槓桿、政府監理寬容措施與被保險人保證給付之關係,引

用巴黎式選擇權分析監理寬容對保證給付之影響。

中文關鍵詞: 保險安定基金、資本監理寬容、寬限期、風險基礎模型

英 文 摘 要 : Insurance guaranty funds have been adopted in many

countries to compensate policyholders for losses

resulting from insurers‘ insolvencies. Risk-based

premiums in ex ante insurance guarantee scheme reduce

shareholders‘ incentive for risk-taking behavior

(Cummins, 1988). This study develop a risk-based

model to measure the fair premium charged by the

insurance guaranty fund in a setting that

incorporates financial leverages, risky asset

allocation, early closure, and capital forbearance on

grace period. The impacts of the key factor in the

model on the guaranty fund premium are examined

numerically. The numerical analyses provide valuable

insights for the regulators to make the regulation

policy and insurance guaranty scheme.

英文關鍵詞: insurance guaranty fund, capital forbearance, grace

period, risk-based model

行政院國家科學委員會補助專題研究計畫

成果

報告

人壽保險公司之資產配置與破產成本分析

計畫類別:V 個別型計畫 □整合型計畫

計畫編號:NSC

100-2410-H-004-052

執行期間: 100 年 8 月 1 日至 101 年 7 月 31 日

執行機構及系所:

國立政治大學風險管理與保險學系

計畫主持人:

張士傑教授

共同主持人:

計畫參與人員:

成果報告類型(依經費核定清單規定繳交):v 精簡報告 □完整報告

本計畫除繳交成果報告外,另須繳交以下出國心得報告:

□赴國外出差或研習心得報告

□赴大陸地區出差或研習心得報告

v 出席國際學術會議心得報告

□國際合作研究計畫國外研究報告

處理方式:除列管計畫及下列情形者外,得立即公開查詢

□涉及專利或其他智慧財產權,□一年□二年後可公開查詢

中 華 民 國 101 年 10 月 10 日

行政院國家科學委員會專題研究計畫精簡報告

計畫編號: 100-2410-H-004-052

計畫名稱: 人壽保險公司之資產配置與破產成本分析

執行期限: 2011/08/01 ~ 2012/07/31

計畫主持人:張士傑 國立政治大學風險管理與保險學系教授

中文摘要及關鍵詞

保險安定基金已成為各國預防保險公司發生清 償危機時的重要安全機制,本研究針對事後收 費的保險安定基金費率進行研究。如何有效執 行資本監管機制以達到保險市場財務穩健之目 的,避免引發市場道德風險,不僅涉及現有之 保險人,同時對於欲進入保險市場之競爭者而 言 , 成 為 相 當 重 要 之 研 究 議 題 。 本 文 依 續 Cummins (1988)架構,研究人壽保險人財務槓 桿、政府監理寬容措施與被保險人保證給付之 關係,引用巴黎式選擇權分析監理寬容對保證 給付之影響。 關鍵字:保險安定基金、資本監理寬容、寬限 期、風險基礎模型英文摘要及關鍵詞

Insurance guaranty funds have been adopted in many countries to compensate policyholders for losses resulting from insurers' insolvencies. Risk-based premiums in ex ante insurance guarantee scheme reduce shareholders' incentive for risk-taking behavior (Cummins, 1988). This study develop a risk-based model to measure the fair premium charged by the insurance guaranty fund in a setting that incorporates financial leverages, risky asset allocation, early closure, and capital forbearance on grace period. The impacts of the key factor in the model on the guaranty fund premium are examined numerically. The numerical analyses provide valuable insights for the regulators to make the regulation policy and insurance guaranty scheme.

Keywords: insurance guaranty fund, capital

forbearance, grace period, risk-based model

一、 計畫緣由

Life insurers are highly leveraged firms whose major debt capital is the premiums paid by the policyholders. Thus, life insurers are obligated to pay claims. In order to protect policyholders’ rights, the regulatory authority could adopt

certain regulatory schemes to deal with the financial problems of insolvent insurers. Either ex ante or ex post assessment scheme is utilized when covering the claim obligations of insolvent insurers. The choice between the two types of funding schemes varies from country to country based on the differences in failure rate and market structure. For example, France, Germany, Japan and Taiwan adopt the ex ante scheme. No form of funding scheme is better than the other overall, strictly speaking, according to Oxera (2007); while Ligon and Thistle (2007) observe that the ex ante scheme gives shareholders less incentive for risk-taking behavior than the actual ex post assessment scheme observed most frequently in practice.

This study fully investigates the Taiwan Insurance Guaranty Fund (TIGF) that adopts the ex ante funding scheme to protect the obligations of policyholders. Since guaranty funds create a put-option-like subsidy to shareholders (Cummins, 1988; Lee et al., 1997), a fair premium in a competitive market is an important prerequisite for a guaranty fund (see Eling and Schmeiser, 2010). Cummins (1988) extends the work on deposit insurance premiums to price the single-period premiums for insurance guaranty funds. Duan and Yu (2005) develop the multiperiod model to measure the cost of the guaranty fund incorporating the risk-based capital regulations. However, the recent financial crisis resulting in the massive fall of security prices causes

financial institutions to face severe difficulties in asset-liability management. As the major investors in the financial markets, life insurers were, of course, negatively affected by the crisis as the value of many assets in their investment portfolios tumbled. While most insurers are resistant against the crisis, not all insurance market participants followed a prudent strategy (Eling and Schmeiser, 2010). The life insurance companies’ financial distress influenced their policyholders’ claims. To ease the financial distress of those institutions during the crisis and their capital restructuring schemes, a regulatory authority might consider adopting temporary capital relief plans, i.e., reducing the standard of solvency requirements or providing temporary capital injection.

二. 計畫目的

In this study, we perform the impact analysis on the fair premium when the government adopts the regulatory forbearance policy to reduce financial regulatory standards, i.e., the regulators extend the grace period of capital injection plans or increase the risk tolerance to insurance companies facing financial difficulties. While a run on an unhealthy insurance company is not necessarily a bad thing – it can discipline the performance of managers and owners – there is a risk that runs on bad companies can become contagious and spread to good or well-run companies (Saunders and Cornett, 2006). Regulatory forbearance employed by the government often induces moral hazard and causes the life insurance industry to face possible contagion risks (for related studies, see Lee, Mayers and Smith, 1997; Lee and Smith, 1999; Angbazo and Narayanan, 1996;

Miller and Polonchek, 1999; Bernier and Mahfoudhi, 2010). To maintain their routine operations when facing financial difficulties, troubled insurers often offer insurance policies with higher guaranteed rates in the market. However, though this risk-taking strategy allows insurers to survive, it significantly worsens their balance sheets and brings out an adverse selection problem. Therefore, the fair premium collected by the guaranty fund is affected by the regulatory forbearance mechanism.

In this paper, we emphasize the influence of the fair premium of the TIGF under regulatory forbearance. To solve the default option problem we have to measure the value of life insurers for policyholders when liquidation happens. The financial literature on the bankruptcy problem has recently extended to insurance issues (see Cummins, 1988; Briys and de Varenne, 1994, 1997; Grosen and Jøgensen, 2002; Bernard et al., 2005a, 2006; Duan and Yu, 2005). Chen and Suchanecki (2007) generalized the work in Grosen and Jøgensen (2002) to allow for Chapter 11 bankruptcy, which considered the grace period for the insolvent financial firms. They adopted a Parisian barrier option approach and found that the option values increased as the grace period lengthened.

Our model and numerical results illustrate that the volatility of risky asset return has a significant impact on the fair premium. The premium increases with the higher volatility. Moreover, the financial leverage ratio and asset allocation strategy are critical in determining the impact of the volatility of risky asset on the fair premium. As expected, higher leverage ratio and more risky investment strategy would deteriorate the negative influence of the

volatility of risky asset. Furthermore, the fair premium goes up with the higher minimum guaranteed interest rate. Finally, the regulation of forbearance mechanism greatly increases the cost for the insurance guaranty fund to take over the insolvency life insurers.

This paper is organized as follows: Section 2 introduce the financial structure and the contract specification of life insurers. This section also derives the fair premium of insurance guaranty fund under contains the regulatory forbearance. Section 3 presents a number of numerical studies of the premium of insurance guaranty fund. Finally, Section 4 concludes the study.

三、計畫成果自評

We assume the financial markets are in a continuous-time frictionless economy with a perfect financial market, no tax effects, no transaction costs and no other imperfections. Following the setup in Briys and Varenne (1994, 1997), Grosen and Jøensen (2002) and Chen and Suchanecki (2007), at time

t

=

0

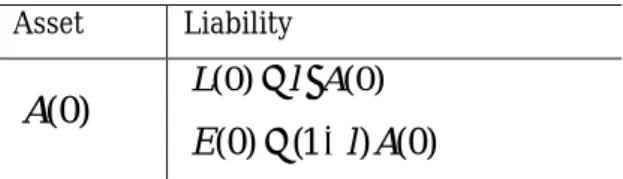

of the insurer is assumed to have a capital structure of assets and liabilities shown in the following table:Table 1 Capital Structure of Life Insurer Asset Liability

(0)

A

(0)

(0)

L

≡ ⋅

l A

(0)

(1

) (0)

E

≡ −

l A

In order to simplify the model, we assume that the representative policyholder, the unique liability holder, at the beginning of the contract of its payment that constitute the liability of

insurance companies, denoted by

L

(0)

≡ ⋅

l A

(0)

,l

∈

[0,1]

the leverage ratio,and the representative equity holder whose

equity is accordingly denoted by

(0)

(1

) (0)

E

≡ −

l A

. Through their initialinvestments in the company, acquire a claim on the firm's assets for a payoff at maturity (or before maturity).

The asset mix holding by the insurer could be modeled through formulating a given typical asset allocation according to its risk preference and tolerance. For simplicity, we assume the insurer’s assets invest only in the risk-free underlying

B t

( )

and the risky assetS t

( )

. Moreover, we set up a Black-Scholes-Vasicek model to describe stock price and interest rate dynamics. Letw t

( )

denotes the portfolio shares of risky asset at timet

. The price processes of assets evolve according to:( ) ( ) ( ) dB t r t dt B t = (1) 1 2 ( ) ( ) ( ) ( ) r S dS t dt dW t dW t S t =µ +σ +σ (2) ( ) 1 2 ( ) ( ) ( ) ( ) (1 ( )) ( ) ( ) ( ) ( ) ( )( ( )) ( )( r( ) S( )) dA t dS t dB t w t w t A t S t B t r t w t µ r t dt w t σdW t σdW t = + − = + − + + (3)

where

r t

( )

denotes the instantaneous short rate and it follows the dynamics process( ) ( ( )) r r( )

dr t =

κ θ

−r t dt+σ

dW t (Vasicek, 1977)with the force of mean-reversion

κ

, the level of mean-reversionθ

and the interest rate volatilityσ

r .W t

r( )

andW t

S( )

are twoindependent Weiner processes under the physical probability measure

P

. The risky assetS t

( )

follows Black-Scholes dynamics with an instantaneous rate of returnµ

>

0

and a constant volatility2 2

1 2

0

σ

+

σ

>

. The second equality in Eq.(3) results from Eq.(1) and Eq.(2). Thus, the degree of insurer's

leverage increases with the value

w t

( )

.Let the correlation coefficient of

dS t

( )

and( )

dr t

beρ

( )

t

, thenρ

( )

t

can describe thecorrelation of the risky asset and interest rate

1 2 2 1 2 ( )t corr dS t dr t( ( ), ( ))

σ

ρ

σ

σ

= = + .Similarly,

w t

( ) ( )

ρ

t

describes the correlation of the insurer asset and interest rate at timet

.1.1 Contract specification

In this section, we set up the standard assumption in computing the liability

L t

( )

of life insurer in its balance sheet. Since the minimal interest rate guarantee and the contribution principle which entitles the policyholder to participate in the insurer's performance are common features of life insurance contracts, the proposed simplified version of a participating life insurance contract incorporating all these features are considered. The averaged credit rateg t

( )

is assumed to be plowed back into the liability baseL t

( )

. The insurer's reserveL t

( )

for theenforce policies increase in 0 ( )

t

g t dt

e∫

. Thefollowing notations are used for the specification of the insurance contract:

T

=

the maturity date0

( ) (0) exp( T( ( ) ) )

L T =L

∫

r t +g dt=the guaranteed at maturity

δ

=

the participation rateFrom the regulator's point of view, the supervision authority will concern on the policyholder protection in the event of a life insurance company being unable to meet its liabilities to its policyholders. Since the ruin of the life insurers might cause negative social

perception and result in the financial instability. The financial supervision authorities must find a suitable intervention mechanism to reduce the policyholder losses once the insurer faces the insolvency and liquidity problem.

Based on the given criteria, the insurance supervision authority for the payment at maturity, might not focus on the bonus promised by the insurer, but would carefully monitor the guarantee payment of the insurance contract. Therefore, the total payoff to the policyholder of such an insurance contract at maturity,

ψ

L(

A

T)

, is given by:[

]

[

]

[

]

(

[

]

)

( ) min , L T T T T T T T T T T A A L L A A L L L Aψ

δ α

δ α

+ + + = − + = − + − − (5)Notice that the payment consists of two parts: first part is a bonus option paying to the policyholder an additional benefit rate of the positive difference of the actual performance of the insurance company's portfolios net the guaranteed amount at maturity and second part is the minimal value of the firm value and the guaranteed insurance benefits at maturity. The second part of payoff at maturity can further be divided into two terms, a guaranteed fixed payment which is the accumulated premiums compounded at the credit rate and a short position of a put option due to the limited liability of the shareholder. In Chen and Suchanecki (2007), a rebate payment

( ) min{ , }

Lτ L Aτ τ

Θ = is return to the policyholder

at time

τ

when the insurance company faces the liquidation. The rebate term implicitly depends on the parameterη

in triggering the intervention. The trigger condition can be formulated in the following inequality:Aτ <ηLτobserved that for

η

≤

1

, the rebate corresponds to the asset valueA

τ. Clearly, inthe case of

A

τ<

η

L

τ, all the asset value goes tothe policyholder.

However, under the insurance guaranty scheme and regulatory forbearance, the payoff to the policyholder and the cost of the insurance guaranty fund are more complicated.

1.2 Valuation of regulatory forbearance

When the insurance companies face the financial distress, the government authority sometimes would allow certain grace period

ε

for the insolvent insurance companies to inject required capital. Within the given grace period, the insurance companies must maintain liquidity and we need to employ the concept of the Parisian option to calculate the cost in choosing the proper standard to trigger the intervention. In this subsection, the fundamental option pricing method is used to estimate the value of embedded options given regulatory forbearance.In our setting, we consider the regulatory authority cannot continuously monitor the insurer's balance sheet due to the audit cost. They repeat the audit at regular time intervals to examine the insurer's asset value. However, the insurer in the financial crisis may become insolvent in the audit window period. The insurer's default is modeled as the event that the insurer is unable to pay back the maintain working capital including in volatile premium income. For simplicity, we assume a basic maintain asset level,

η

L t

( )

. Upon the under performance of the insurer's investment atτ

, the insurer is already default when( )

( )

A t

<

η

L t

. The termination timeτ

can beconstructed as the first time that the insurer's

assets fall below or cross the maintain working capital level.

{

}

in ft A t( ) L t( )

τ= <η (6) Notice that if

τ

is not greater than the auditing timeT

, the insurer goes out of business or be taken over. From the view of TIGF, whether the insurer closes down or is taken over, the amount of liquidation of insurers premium needs to restore to the asset values. Moreover, we assume thatγ

is the compensation ratio covered by the insurance guaranty fund once the insurer is taken over by the authority. We assumeP

represents the payoff of the insurance guaranty fund. In this early insolvency situation,P

( )

τ

can be formulated as(

γ η

−

) ( )

L

τ

.If the insurer operates until the auditing time

T

, then the regulatory authority examines the insurer's balance sheet at this time. We allow for the capital forbearance incorporated in a manner similar to Duan and Yu (1999). The regulator offers the insure capital forbearance and the grace periodε

if the asset value cannot meet the minimal capita standard( )

L T

α

, but not fall below the capitalforbearance

β

L T

( )

, whereβ

is greater thanη

, otherwise the capital forbearance loses itsmeaning.

The insurer in financial stress is able to extend its operation until another time of auditing

T

+

ε

if the insurer's agent promises to restorethe asset to the insurer's outstanding reserve

L T

( )

. On the other hand, once the insurer's value drops below the capital forbearance threshold,β

L T

( )

at timeT

or(

)

L T

+

ε

at timeT

+

ε

, the regulator will takeover the insurer. Then, the cost of the insurance guaranty fund at time

T

,P T

( )

, can be expressed as: 0 ( ) ( ) ( ) ( ) ( ) ( ) ( ) ( ) ( ) otherwise L T A T P T F T L T A T L T L T A T α β α γ ≤ = ≤ < − (7)Notice that

P T

( )

is not equal to 0 if( )

( )

A T

<

α

L T

. It contains two parts: (1) theimmediately taken-over cost,

γ

L T

( )

−

A T

( )

, and (2) the forbearance cost,F T

( )

, which denotes the value from the capital forbearance and the grace period ε.F T

( )

can be regarded as a put option in which the time to maturity is the grace period ε and the strike price is insurer's outstanding liabilitiesL T

(

+

ε

)

. The option's payoff at T + ε can be characterized as0 ( ) ( ) ( ) , ( ) ( ) if L T A T F T L T A T if otherwise ε ε ε γ ε ε + ≥ + + = + − + (8)

So, the value of

F T

( )

can be expressed as( ) ( ) ( ) , ( ) , T T r s ds Q E e F T A T B T ε ε + − ∫ + where

E

Q[ ]

⋅

denotesthe expected value under

Q

measure.When the insurer operate until the auditing time T, but its asset value is lower than the capital forbearance threshold at time T, the insurance guaranty fund still pay the difference between

γ

L T

( )

andA T

( ).

If insurer's asset value at time T is betweenα

L T

( )

and( ),

L T

β

the regulator give the insurer anotherchance (capital forbearance and grace period ε). When the asset value cannot rise over

(

)

L T

+

ε

at timeT

+

ε

,

the claim amount isthe difference between

γ

L T

(

+

ε

)

and(

).

A T

+

ε

Therefore, the payoff of insurance guaranty fund, P, can be characterized as: P=(γ η− )+L( )τI{τ≤T}+(γL T( + −ε) A T( +ε))+I1+(γL T( )−A T( ))+I2 (9) where I1=I{T<τ β, L T( )≤A T( )<αL T( ), (A T+ <ε)L T(+ε)} and { } 2 T , ( )A T L T( ),

I

=

I

<τ <βnotice that

I

D is theindicator function which is 1 when event D occurs and 0 otherwise.

The insurer pays the premium to the insurance guaranty fund. For simplicity, we assume that the insurance guaranty fund receives an upfront premium for providing the security to the insurance company. The upfront premium corresponds to the present value of the insurance claim on the shortage of cash flows for the insolvent insurer. In this article, the expected discount payment under the risk-neutral measure Q. To obtain the formula, we first express the underlying asset processes under Q. The risk-neutral processes of interest rate and insurer's assets evolve according to:

( ) ( ( )) Q( ) r r dr t =

κ θ

−r t dt+σ

dW t(10)

1 2 ( ) ( ) ( )( ( ) ( )) ( ) Q Q r S dA t r t dt w t dW t dW t A t = + σ +σ(11)

where

κ κ λ σ= + ( )t,

( )t κθ θ κ λ σ = +and

( ) ( ) ( ) Q S S dW t =dW t +σλ t dt, in which

λ

( )

t

denotes the market price of interest rate

process. We specify

λ

( )

t

with a constant

λ and we have

( ) ( ) ( ) Q S S r t dW t dW t µ dt σ − = +.

In order to investigate the risk attitude

of the insurer to the fair premium,

w t

( )

=

w

is assumed to be constant for every time

t

.

The solution to the stochastic differential

equation formulated in Eq. (11) is

expressed as:

2 2 2 1 2 1 2 0 1 ( ) (0 )ex p ( ) ( ) ( ( ) ( )) . 2 t Q Q r S A t =A r s d −s w σ +σ t+wσW t +σ θW t ∫

(12)

The risk-based premium paid by the

insurer to the insurance guaranty fund is

the expected discounted insurance payoff

under

Q

measure:

{ } { } 1 1 (0 ) Q ( ) ( ) Q ( ) ( ) , T T P =E Bτ −Pτ Iτ≤ +E B T−P T Iτ> (13)

where

E

Q[ ]

⋅ denotes the expected value

under

Q

measure. The closed-form

solution can be expressed as follows:

{

}

( ) ( ) ( ) ( ) ( ) ( ) 2 6 1 2 3 4 5 6 7 8 1 1 5 1 3 2 6 2 7 3 ( ) ( ) ( ) ( ) ( ) ( ) ( ) (0) ( ) ( ) ( ) ( ) ( , , ) ( , , ) ( , , ) ( , , ) (0) ( , , ) (0) B gT B B g B L c e c Le c c e c c A c c e c c Le N d e N d e e N d e N d e A N d e P ε γ η γ γ δ δ δ δ δ − − − − Φ + Φ Φ −Φ − Φ −Φ + − Φ −Φ − Φ −Φ − − − + − − = ( N d(11,e3, )δ) e−B(N d e( 9,4, )δ N d(12,e4, )δ) − − (14)

where Φ(x) represents a standard normal

cumulative density function. N(x, y, z)

denotes a standard bivariate normal

cumulative density function, and

ln

,

(0)

L

B

gT

A

η

=

+

1ln

,

(0)

L

B

gT

A

α

=

+

2ln

,

(0)

L

B

gT

A

β

=

+

and

3ln

(

).

(0)

L

B

g T

A

γ

ε

=

+

+

2 1,

B

aT

c

bT

−

=

2,

B

aT

c

bT

−

=

2 32

,

B

B

aT

c

bT

−

−

=

4,

B

aT

c

bT

− −

=

2 5,

B

aT

c

bT

+

=

6,

B

aT

c

bT

+

=

T

,

T

δ

ε

=

+

2 72

,

B

B aT

c

bT

−

+

=

and

8.

B aT

c

bT

− +

=

1 1,

B

aT

d

bT

−

=

2,

B

aT

d

bT

−

=

1 32

,

B

B aT

d

bT

−

−

=

4,

B aT

d

bT

− −

=

2 5,

B

aT

d

bT

−

=

2 62

,

B

B aT

d

bT

−

−

=

1 7,

B

aT

d

bT

+

=

d

8B

aT

,

bT

+

=

1 92

,

B

B aT

d

bT

−

+

=

d

10B aT

,

bT

− +

=

2 11,

B

aT

d

bT

+

=

and

12 22

.

B

B

aT

d

bT

−

+

=

3 1(

)

,

(

)

B

a T

e

b T

ε

ε

−

+

=

+

3 22

(

)

,

(

)

B

B

a T

e

b T

ε

ε

−

−

+

=

+

3 3(

)

(

)

B

a T

e

b T

ε

ε

+

+

=

+

and

3 42

(

)

.

(

)

B

B a T

e

b T

ε

ε

−

+

+

=

+

The detailed derivation is provided in Appendix. There is no existing closed-form pricing formula with stochastic interest rate in the literature which can be employed straight forward to evaluate the risk-based premium of insurance guaranty fund. The above closed-form solution (14) in fact can be regarded as a general form of calculating formula of insurance guaranty fund premium under considering audit window period and capital forbearance.

The structure shown by Eq. (14) allows us to analysis the risk-based premium in a manner similar to that of Lee et al. (2005). The risk-based premium under considering insurer's bankruptcy can be decomposed into an audit window component (Pa),

a capital forbearance component (Pc) and a grace period component (Pε), i.e. P = Pa + Pc + Pε. The first term Pa of Eq. (14) is regarded as the audit window component because the insurer reaches the default barrier

η τ

L

( )

at τ before the auditing timeT. The insurance guarantee scheme, thus, cannot but

implement the bankruptcy process. The insurer is taken over by the authority, and the insurance guaranty fund compensates for the difference between the insured asset level

γ τ

L

( )

and the basic maintain asset levelη τ

L

( ).

Pa describes this premium from early closure. Its closed-form presentation is defined as:[

2 6]

( ) ( ) B ( )

a

L

P = γ η− Φc + Φe c

The second term of Eq. (14) can be identified as the capital forbearance component because its value is like the value of a down-and-out put option whose strike price is capital forbearance

β

L T

( )

and maturity time, the time of auditing T. Although the insurer may not go bankrupt, it touches the regulatory closure pointβ

L T

( ).

The insurance company is taken over and its asset has an infusion of a rebate based on the difference between the insured asset levelγ

L T

( )

and the real asset level( ).

A T

The rebate should be reflected in the premium as Pc. Its closed-form presentation is expressed as:( ( )1 ( )2) ( ( )3 ( )4) (0 )( (5) (6)) ( (7) (8)) .

c gT B c c B c c

P =γLe Φc − Φc −e− Φc − Φc −A Φ −Φ −e Φ −Φ

The third term Pεof Eq. (14) can be identified as the risk premium of regulatory delay. The premium results from the fact that the insurer is allowed to operate during the grace period ε to improve its asset level. Its closed-form presentation is identified as: ( ( 1, 1, ) ( 5, 1, )) ( ( 3, 2, ) ( 6, 2, )) g B Pε=γLeε N d e δ −N d e δ −e− N d e δ −N d e δ

[

7 3 11 3]

[

9 4 12 4]

(0 ) ( , , ) ( , , ) B ( , , ) ( , , ) . A N d e δ N d e δ e N d e δ N d e δ − − − − In this paper, we investigate the risk-based fair

premium of the insurance guaranty fund under pre-assessment scheme with the regulatory forbearance. In practice, if an insurance company temporarily insolvent, it is difficult for the regulator to deal with the troubled insurer well and immediately. Moreover, insurers usually have either cost or information advantages over the guaranty fund in claim settlement. In such situations, there exists some room for capital forbearance if the deficit is not too serious. Similar situations have occurred in deposit insurance. In Lee et al. (2005) capital forbearance is allowed until capital standards are satisfied and the closure policy is considered later on.

We devote to derive the pricing formula to determine the fair premium. The early closure, financial leverage and risky asset allocation are involved in our risk-based model. The numerical experiments show the influence of the vital parameters. Firstly, the premium is larger under regulatory forbearance than the traditional Merton’s put which means the cost of regulatory forbearance is enormous. Secondly, we find that the premium increases with the higher financial leverage and the more risky asset allocation. As the financial leverage and risky asset allocation strategy play important role in the solvency risk of insurance company, the more risk reflect more insurance premium. Moreover, the volatility of risky asset return is an important parameter under the fair premium pricing. The premium increases with the higher volatility. Thus, we suggest that the regulator should charge the different premium of the insurance guaranty fund according the life insurer’s financial structure and risky investment strategy.

Subsequently, minimal interest rate guarantee policy accounts most portions of the

life insurance products. In the numerical results, we find that the fair premium goes up with the higher minimum guaranteed interest rate. Thus, the insurers should set the reasonable minimum guaranteed interest rate to reduce the probability of financial distress. At last, the premiums rise as the values of forbearance threshold drop and this remind the regulatory to set the reasonable forbearance threshold.

To sum up, our model improves contribute to the line with considering the regulatory forbearance into the premium pricing of insurance guaranty fund with the ex-ante assessment scheme. The numerical analyses provide valuable insights for the regulators to make the regulation policy and insurance guaranty scheme.

四、參考文獻

Cummins, J.D., 1988, “Risk-based premiums for insurance guaranty funds,” Journal of Finance 43, 823-839.

Duan, J.C, and M.T. Yu, 1999, “Forbearance and pricing deposit insurance coverage under GARCH,” Journal of Banking and Finance 23, 1691-1706.

Duan, J.C, and M.T. Yu, 2005, “Fair insurance guaranty premia in the present of risk-based capital regulations, stochastic interest rate and catastrophe risk,” Journal of Banking and

Finance 29, 2435-2454.

Han, L.M., G.C. Lai, and R.C. Witt, 1997, “A financial-economic evaluation of insurance guaranty fund system: An agency cost perspective,” Journal of Banking and Finance 21, 1107-1129.

Lee, S.C., J.P. Lee, and M.T. Yu, 2005, “Bank capital forbearance and valuation of deposit insurance,” Canadian Journal of Administrative

Sciences 22, 220-229.

Ligon, J.A., and P.D. Thistle, 2007, “The organization structure of insurance companies: the role of heterogeneous risks and guaranty funds,” Journal of Risk and Insurance 74, 851-861.

Merton, R.C., 1977, “An analytic derivation of the cost of deposit insurance and loan guarantees,”

Journal of Banking and Finance 1, 3-11.

Oxera, 2007, Insurance guarantee schemes in the EU: Comparative analysis of existing schemes, analysis of problems and evaluation of options.

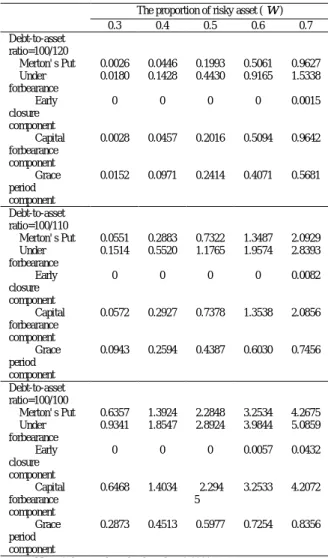

Table 1: Insurance guaranty fund premium under

g

=

100

b.p. The proportion of risky asset (w)0.3 0.4 0.5 0.6 0.7 Debt-to-asset ratio=100/120 Merton' s Put 0.0026 0.0446 0.1993 0.5061 0.9627 Under forbearance 0.0180 0.1428 0.4430 0.9165 1.5338 Early closure component 0 0 0 0 0.0015 Capital forbearance component 0.0028 0.0457 0.2016 0.5094 0.9642 Grace period component 0.0152 0.0971 0.2414 0.4071 0.5681 Debt-to-asset ratio=100/110 Merton' s Put 0.0551 0.2883 0.7322 1.3487 2.0929 Under forbearance 0.1514 0.5520 1.1765 1.9574 2.8393 Early closure component 0 0 0 0 0.0082 Capital forbearance component 0.0572 0.2927 0.7378 1.3538 2.0856 Grace period component 0.0943 0.2594 0.4387 0.6030 0.7456 Debt-to-asset ratio=100/100 Merton' s Put 0.6357 1.3924 2.2848 3.2534 4.2675 Under forbearance 0.9341 1.8547 2.8924 3.9844 5.0859 Early closure component 0 0 0 0.0057 0.0432 Capital forbearance component 0.6468 1.4034 2.294 5 3.2533 4.2072 Grace period component 0.2873 0.4513 0.5977 0.7254 0.8356

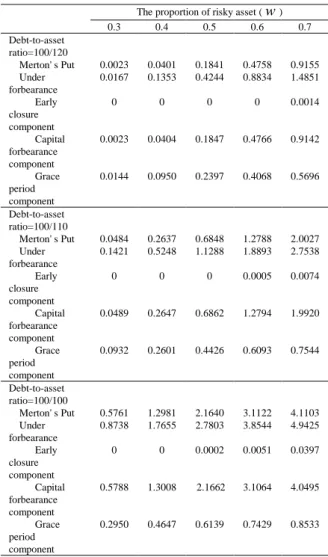

Table 2: Insurance guaranty fund premium under

g

=

50

b.p. The proportion of risky asset (w)0.3 0.4 0.5 0.6 0.7 Debt-to-asset ratio=100/120 Merton' s Put 0.0023 0.0401 0.1841 0.4758 0.9155 Under forbearance 0.0167 0.1353 0.4244 0.8834 1.4851 Early closure component 0 0 0 0 0.0014 Capital forbearance component 0.0023 0.0404 0.1847 0.4766 0.9142 Grace period component 0.0144 0.0950 0.2397 0.4068 0.5696 Debt-to-asset ratio=100/110 Merton' s Put 0.0484 0.2637 0.6848 1.2788 2.0027 Under forbearance 0.1421 0.5248 1.1288 1.8893 2.7538 Early closure component 0 0 0 0.0005 0.0074 Capital forbearance component 0.0489 0.2647 0.6862 1.2794 1.9920 Grace period component 0.0932 0.2601 0.4426 0.6093 0.7544 Debt-to-asset ratio=100/100 Merton' s Put 0.5761 1.2981 2.1640 3.1122 4.1103 Under forbearance 0.8738 1.7655 2.7803 3.8544 4.9425 Early closure component 0 0 0.0002 0.0051 0.0397 Capital forbearance component 0.5788 1.3008 2.1662 3.1064 4.0495 Grace period component 0.2950 0.4647 0.6139 0.7429 0.8533

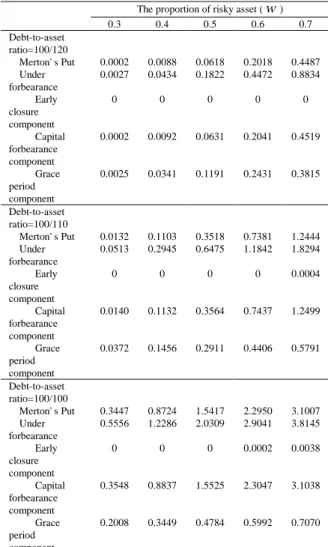

Table 3: Insurance guaranty fund premium under

σ

=

25%

The proportion of risky asset (w)

0.3 0.4 0.5 0.6 0.7 Debt-to-asset ratio=100/120 Merton' s Put 0.0002 0.0088 0.0618 0.2018 0.4487 Under forbearance 0.0027 0.0434 0.1822 0.4472 0.8834 Early closure component 0 0 0 0 0 Capital forbearance component 0.0002 0.0092 0.0631 0.2041 0.4519 Grace period component 0.0025 0.0341 0.1191 0.2431 0.3815 Debt-to-asset ratio=100/110 Merton' s Put 0.0132 0.1103 0.3518 0.7381 1.2444 Under forbearance 0.0513 0.2945 0.6475 1.1842 1.8294 Early closure component 0 0 0 0 0.0004 Capital forbearance component 0.0140 0.1132 0.3564 0.7437 1.2499 Grace period component 0.0372 0.1456 0.2911 0.4406 0.5791 Debt-to-asset ratio=100/100 Merton' s Put 0.3447 0.8724 1.5417 2.2950 3.1007 Under forbearance 0.5556 1.2286 2.0309 2.9041 3.8145 Early closure component 0 0 0 0.0002 0.0038 Capital forbearance component 0.3548 0.8837 1.5525 2.3047 3.1038 Grace period component 0.2008 0.3449 0.4784 0.5992 0.7070

Note: 0 denotes the value less than 0.0001.

Table 4: Insurance guaranty fund premium under an alternative capital

threshold

Capital Forbearance Threshold (β)

1 0.97 0.95 0.9 0.8 Debt-to-asset ratio=100/120 Under forbearance 0.4567 0.9162 1.1512 1.5338 1.7699 Early closure component 0.0015 0.0015 0.0015 0.0015 0.0015 Capital forbearance component 0.2917 0.6563 0.8151 0.9642 0.6311 Grace period component 0.1635 0.2585 0.3346 0.5681 1.1373 Debt-to-asset ratio=100/110 Under forbearance 1.3984 1.9805 2.2936 2.8393 3.2253 Early closure component 0.0082 0.0082 0.0082 0.0082 0.0082 Capital forbearance component 1.2027 1.6641 1.8757 2.0856 1.5045 Grace period component 0.1875 0.3082 0.4098 0.7456 1.7126 Debt-to-asset ratio=100/110 Under forbearance 3.4498 4.0701 4.4227 5.0859 5.6326 Early closure 0.0432 0.0432 0.0432 0.0432 0.0432 component Capital forbearance component 3.2258 3.7175 3.9557 4.2072 3.3244 Grace period component 0.1808 0.3095 0.4237 0.8356 2.2651

第

16 屆亞太風險與保險學會(APRIA)年會

張士傑

國立政治大學風險管理與保險學系

2012 年 8 月 1 日

一. 參加會議經過

第

16 亞太風險與保險學會年會於 2012 年 7 月 22 日至 25 日由韓國成均館大學

(Sungkyunkwan University)舉辦。此次會議共有超過一百篇論文發表,與會學者專

家分別來自亞洲各國,美洲,澳洲及歐陸等國家,採論文口頭報告的方式,分

5

個平行的議場進行。此外大會特別安排保險監理座談,由新南威爾斯大學

Michael

Sherris 主持,IAIS 秘書長 Kawai Yoshihiro 先生、巴西監理機構 Ligia Maura Costa

先生與美國喬治亞大學 Thomas R. Berry-Stoelzle 教授分析金融風暴後的保險業

經營發展,同時大會安排多場圓桌專題討論,多位理論與實務界專家討論退休金

與保險風險管理等監理與實務議題,下午集會中並對於亞太風險與保險學會、的

組織及未來的發展進行確認,透過與會成員廣泛的討論,達成多項未來發展的共

識。

筆者的論文報告排在議程第 2 天第 1 場之風險管理 B,論文報告為與共同

作者逢甲大學風險管理與保險學系黃雅文助理教授與逢甲大學財金系吳仰哲助

理教授之研究論文

Asset Allocation, Early Intervention and Capital Forbearance on

the Fair Premium of Ex Ante Life Insurance Guarantee Schemes,內容有關於保險公

風險定價,考量監理寬容的影響進行深入分析與實際數值計算,英文摘要內容

(Insurance guaranty funds have been adopted in many countries to compensate

policyholders for losses resulting from insurers' insolvencies. Risk-based premiums in

ex ante insurance guarantee scheme reduce shareholders' incentive for risk-taking

behavior (Cummins, 1988). This study develop a risk-based model to measure the fair

premium charged by the insurance guaranty fund in a setting that incorporates financial

leverages, asset allocation, early closure, and capital forbearance on grace period. The

impacts of the key factors in our model in deciding the fair premium of the guaranty

fund are examined numerically. The results of our analyses could provide valuable

insights for the regulators in revising regulation policies and insurance guaranty

schemes.)

二

. 會議內容及心得

此次會議主要由亞洲太平洋風險與保險學會

(APRIA)舉辦,亞太風險與保險學會

為區域性的國際組織,此次會議除選舉學會主席、副主席、秘書等重要學會工作

人員,並且選舉

26 位理事,分別代表不同的與會國家,初步將以促進區域了解

與推動風險管理與保險教育與研究為主要宗旨。本次會議分別就多項子議題進行

討論,依序

Takau YONEYAMA 教授(日本一橋大學)並於本學會擔任下一屆

(2012-2013)主席。

筆者參與年會整天的學會會議,積極參與國際事務與學術研究,本人並選擇保險

財務監理,保險計價理論,危險理論,社會保險與退休金計畫,汽車保險,人壽

保險計價及座談討論等項目進行聆聽,收穫相當豐富。

三. 考察參觀活動

本次大會提供具有特色且與風險保險相關之議題討論,令與會來賓收穫不少。

四. 建議

風險管理與保險的研究發展已快速成長,筆者亦曾擔任此學會主席,相較於歐美

各國於金融保險的發展,台灣已有不錯的論文發表,宜持續強化風險管理與保險

領域之研究,學術及實務活動,下一屆

(2013)年會將由美國聖約翰大學舉辦,相

信能夠更提升與整合此領域之知名度與學術研究地位。

五. 攜回資料名稱及內容

攜回大會光碟片包含所有論文及相關參考資料。

日期:2012/10/11