國 立 交 通 大 學

企業管理碩士學位學程

碩 士 論 文

智慧型手機的平台策略之生態

Platform Strategy in the Smartphone Ecosystem

研 究 生:

倪崔富

指導教授:唐瓔璋

Platform Strategy in the Smartphone Ecosystem

研 究 生:倪崔富

Student: Trevor Newhook

指導教授:唐瓔璋

Advisor: Dr. Yingchan Edwin Tang

國 立 交 通 大 學

管理學院

企業管理碩士學位學程

碩 士 論 文

A Thesis

Submitted to Master Degree Program of Global Business Administration College of Management

National Chiao Tung University In partial Fulfillment of the Requirements

For the Degree of Master

in

Business Administration June 2011

Hsinchu, Taiwan, Republic of China 中華民國一百年六月

i

Platform Strategy in the Smartphone Ecosystem

Chinese Abstract

智慧型手機是一台結合手機功能與便攜式電腦功能的產品。他充分地改變了人們使用 電腦的方式。 這樣的改革源自於那些喜歡擁有最新科技的手機用戶,進而使智慧型手機也開始將其 會議室功能拓展到了廚房。所以現在,不管是在嶄新的市場上還是產業先驅都對此產 業的發展有著不同的計畫。然而,在這新新產業之中卻只有少量的研究,且以現在產 業先驅之營收作為範本的更是寥寥可數。 回顧先前的研究,我們發現目前的研究僅對於智慧型手機的產業結構、手機生態及平 台領導者做一個概述,但尚未有任何研究是針對智慧型手機產業應運平台架構來做深 入的探討。此研究綜合智慧型手機的產業結構、手機生態及運用平台架構來顯示最適 合智慧型手機市場的平台策略。研究顯示,雖然封閉性策略將會為單一的公司帶來龐 大的利潤,但是開放性策略則可為數家公司帶來更多的利潤。 研究可幫助公司找出有利於該公司智慧型手機的生態系統發展決策。ii

Platform Strategy in the Smartphone Ecosystem

English Abstract

The smartphone, a combination cell phone and handheld computer, has revolutionized computing in many different ways. Starting with prosumers, the people who “need to have” the latest gadgets, the smartphone expanded its reach –from the boardroom to the kitchen. This is a relatively new market with new industry leaders, each with a very different idea of where the industry is going. Little research has been done in this new industry, and even less has been done on the business and revenue models used by the current market leaders.

Previous studies have been done on the structure of the smartphone industry, the mobile ecosystem, and on platform leadership in general, but nothing has been done to apply a platform framework to the smartphone industry. This study combines the two ideas, and uses a framework to show the platform strategy most appropriate for the smartphone market. Research shows that one strategy will make more money for a single company, while another strategy will make more money for a group of companies, and more money overall.

These findings can help managers decide which development ecosystem would be more beneficial for their company.

iii

Dedication

This thesis is dedicated to my fiancée Whitney, who has supported me and given me the time to write. Her love and patience throughout this whole process, as well as her translation help, was essential.

iv

Acknowledgements

I would like to thank Professor Edwin Tang for his ideas, suggestions, advice, and critique throughout the process of working on this paper. The feedback and suggestions received from the members of my internal review committee, as well as the members of my panel of external reviewers, who helped to refine and improve this project, is much appreciated. I would also like to thank all of the other people who gave me ideas, suggestions, and criticisms throughout the entire process. Last of all, I would like to thank God, Who has brought me to Taiwan, and has helped me through this entire project.

v

Table of Contents

English Abstract ... ii

Dedication ... iii

Acknowledgements ... iv

List of Tables ... vii

List of Figures ... vii

I. Introduction ... - 1 -

1.1 Summary & Overview ... - 1 -

1.2 Definition of Terms ... - 2 -

1.3 Significance of study ... - 3 -

II. Literature Review ... - 5 -

2.1 Platform leadership ... - 5 -

2.2 eBay ... - 7 -

2.3 Smartphone Industry Ecosystem ... - 9 -

2.3.1 Blackberry ... - 10 - 2.3.2 Windows Phone 7 ... - 11 - 2.3.3 Palm ... - 12 - 2.3.4 Symbian ... - 12 - 2.3.5 Apple ... - 13 - 2.3.6 Google ... - 14 - III. Methodology ... - 16 - 3.1 Proposition Summary ... - 16 - 3.2 Research Questions: ... - 16 - 3.3 Propositions: ... - 17 - 3.4 Trends ... - 18 -

3.4.1 Google’s Platform Strategy ... - 19 -

3.4.2 Apple’s Platform Strategy ... - 20 -

3.4.3 App Store ... - 22 -

3.4.4 Developer ... - 23 -

3.4.5 Network Effects ... - 24 -

3.4.6 Advertising... - 25 -

3.5 Financial Data ... - 26 -

3.5.1 Apple’s Revenue Model ... - 26 -

vi

3.5.3 Summary ... - 29 -

IV. Results ... - 31 -

V. Conclusion & Limitations ... - 36 -

Tables ... - 38 - Bibliography ... - 39 - TREVOR K. NEWHOOK... - 46 - Objective ... - 46 - Profile ... - 46 - Education ... - 46 - Accomplishments ... - 46 - Experience ... - 46 - Skills ... - 47 -

vii

List of Tables

Table 1: Apple Mobile Revenue (Units in Millions USD ... 38

Table 2: Google Mobile Revenue ... 38

-List of Figures

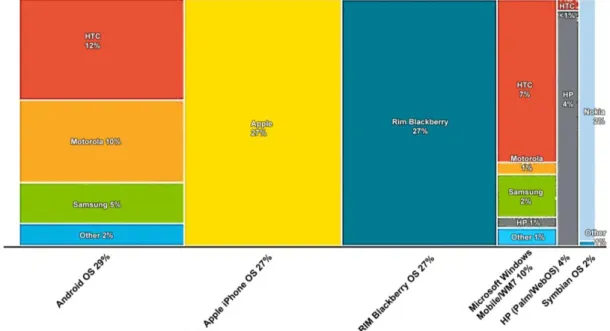

Figure 1: 2010 US Smartphone Market Share (Nielsen) ... 9Figure 2: Smartphone Industry Value Network [28] ... 10

Figure 3: Blackberry Value Network [28] ... 10

Figure 4: Windows Phone 7 Value Network [28] ... 11

Figure 5: Nokia Value Network [28] ... 12

Figure 6: Apple's Value Network [28] ... 13

Figure 7: Google Value Network [28] ... 14

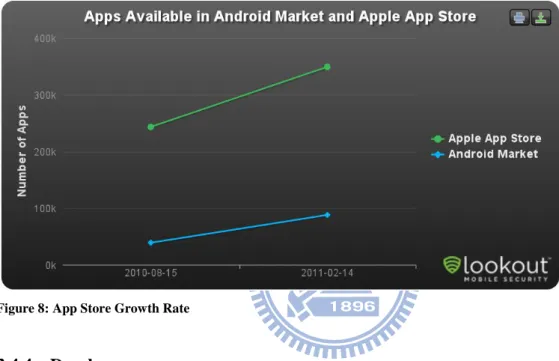

-Figure 8: Conceptual Framework ... Error! Bookmark not defined. Figure 9: App Store Growth Rate ... 23

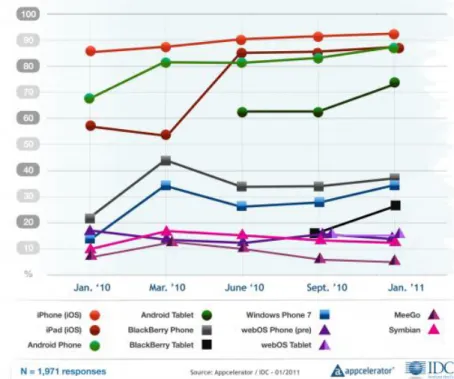

Figure 10: „Very Interested in Developing for each platform (IDC) ... 24

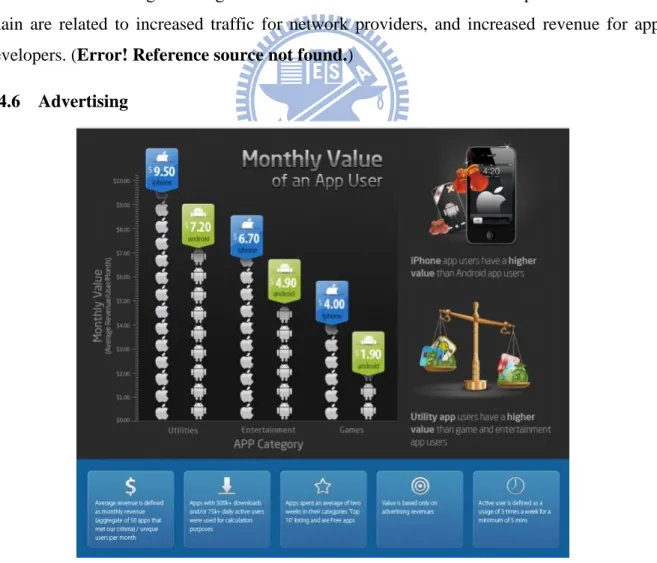

Figure 11: Monthly Value of App User (Moboclip Index 1/2011) ... 25

Figure 12: iPhone sales per quarter ... 26

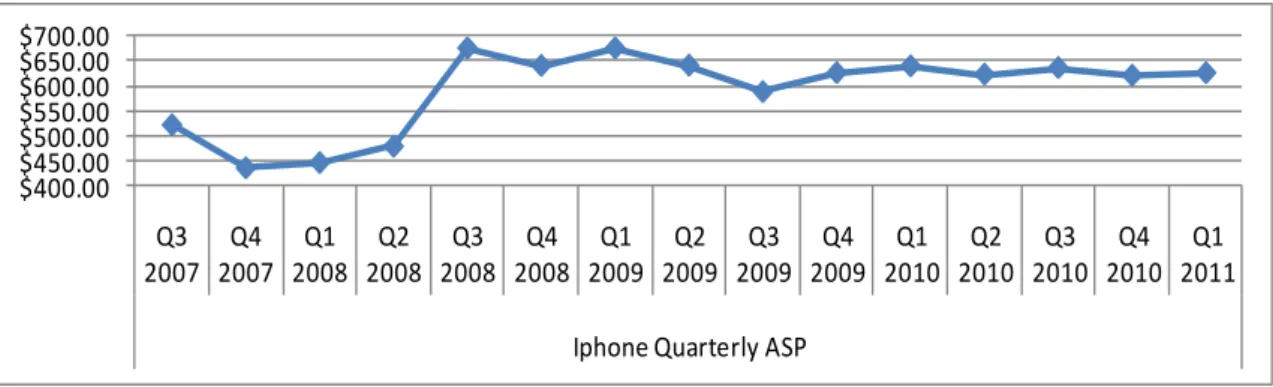

Figure 13: iPhone Average Selling Price (Apple Quarterly Investor Calls) ... 26

Figure 14: App Store Revenue ... 27

Figure 15: Revenue Share by Monetization Type ... 28

Figure 16: Mobile Ad Impressions Market Share ... 29

Figure 17: Worldwide Mobile Communications Device Sales to End Users (Gartner) ... 32

Figure 18: Worldwide Smartphone Market Share by OS (Gartner) ... 32

-- 1 --

I. Introduction

1.1 Summary & Overview

Smartphones are a relatively new invention, combining the personal data assistants (PDAs) of the late 1990s (Palm, Blackberry) with cellular phones, and adding features such as multimedia and customizable applications. There are currently 6 main players in the smartphone market, although Apple‟s iOS and Google‟s Android are dominating the market. [1] Other major players include Symbian, Palm, RIM‟s Blackberry, and Microsoft‟s Windows Mobile.

Although smartphones have been around for more than a decade, it was only with the introduction of Apple‟s iPhone that the reach of the smartphone expanded from business applications to “prosumers”, and eventually to the normal, budget-conscious consumer. The dramatic shift in this market was due to the business model that Apple used, which opened up the phone to developers and online services. Smartphones were now able to do whatever a developer could imagine, limited only by the hardware constraints of the phone.

This paper will examine the current status and trends of the smartphone market. The main focus is on platform strategy, using the smartphone as the market, and Apple and Google as case studies. By examining two direct competitors, one with a primarily vertical business model, the other with a primarily horizontal business model, we will determine which model will make more money for its parent company.

Apple is focused on both hardware and software, using its knowledge of both markets and industries to create a seamless system that is simple and easy to use. The iPhone appeals to people who have had a positive experience with Macintosh computers or iPods, and who have already invested in the iTunes music store. Its revenues are based on sales of the software and hardware as a single system, with additional revenue from in-app ads and commission on applications sold in the iPhone store.

Google, on the other hand, has decided to build an operating system, and works with other hardware developers and programmers, using these two entities as separate strategies to bring people to the system. Android appeals to people who already use Google‟s online products;

- 2 -

such as Gmail, Google search, and YouTube. Its revenues are based on advertising from searches, in-app ads, and commission on Android Marketplace sales.

1.2 Definition of Terms

Openness is the degree to which a platform owner controls the platform, the limits it places on the other players in the platform ecosystem, and the amount of information it shares with those players.

Innovation is „invention‟ + „introduction‟. The creation of new methods, ideas, or products is not useful until it is shared with others. This requires two different sets of resources – one to create the product, and another to reproduce and share it.

A Smartphone is a mobile phone which includes functions similar to those found on personal computers. Smartphones provide a solution for information management, media consumption, mobile calls, and Internet access in one device.

An App Store is a mobile application that allows users to download and pay for other smartphone applications from first- and third-party developers.

A Business Model is the manner by which the enterprise delivers value to customers, entices customers to pay for value, and converts those payments to profit. [2]

A system has Network Effects when the network‟s value to each user depends on the number of other users. [3]

The Open Handset Alliance, formed by Google in 2007, is the organization that released the open-source Android platform. In early 2011 it consisted of 80 companies.

A Vertical Business Model is one in which a single company controls the entire value chain, whereas a Horizontal Business Model is one in which different companies control each section of a value chain.

- 3 -

A Two-Sided business provides a platform that enables two distinct but related groups of customers to obtain value.

In the software industry, a platform is a program or piece of hardware that can then be used to support other software or hardware. In business, a platform is a type of business that allows multiple complementors to interact with each other in a new way. For example, Google‟s search engine lets advertisers and customers interact through its adWords program.

1.3 Significance of study

The smartphone market is still very new, with the iPhone being released within the last 5 years, and Android within the past 3 years. As a result, there hasn‟t been sufficient time to perform in-depth research on the different factors affecting this market. The entrance of the smartphone puts several large, strong companies in competition in a new market.

Each of these companies became successful by focusing on one thing. Some of them, such as Nokia and AT&T, have been part of the mobile ecosystem for several years. Nokia focused on hardware, while AT&T focused on providing network access. Others became successful in a totally different industry, such as Google (with search, online services and advertising) and Apple (with computers and consumer electronics).

The end result of this is that several large companies, all with significant resources, find themselves in different places within this rapidly evolving industry. The traditional heavyweights are being forced to evolve with the advent of new competitors who play by different rules and have different goals.

The purpose and significance of this paper is to predict the evolution of the smartphone market in the next 3-5 years. Using a set of propositions, this paper seeks to determine which approach will be more successful and appropriate to this market.

This paper is divided into several sections. The next section gives a review of platform leadership research, as well as information about the smartphone industry and other companies in this industry. The third section analyzes the future of the smartphone industry, while the fourth section applies this analysis to Apple‟s and Google‟s strategies. The

- 4 -

concluding section discusses the results of the research, limitations, and direction of future study.

- 5 -

II. Literature Review

2.1 Platform leadership

Two requirements, tipping and coring, are required in order to become a platform. [4] Tipping is the set of activities or strategic moves that companies can use to shape market dynamics and win a platform war when at least two platform candidates compete. An example could be the market‟s switch to Sony‟s Blu-ray disc when it was competing with Toshiba to be the next-generation video storage medium after the DVD.

Coring is the set of activities a company can use to identify or design an element (a technology, a product or a service) and make this element fundamental to a technological system as well as to a market. Google engaged in coring when it found a way to bring advertisers and users together, leveraging its expertise and huge market share as a search engine provider into advertising revenue.

Two-sided platform supporters have a „catch-22‟. Nobody will support the platform until they are sure there are enough users on the other side of the platform. To get around it, one side of the platform is often subsidized. In some instances, platform providers may also become users on one side of the platform. For example, Microsoft has released its own games for the Xbox platform.

Two characteristics of platforms are that they are useless without complementors, who are partners that offer goods and services which add value to the platforms offering, and also have to continually fight off competitors. The four levers of platform management: scope, technology, external relationships and internal organization have to work together in order for the platform to be successful. Platform providers also have to solve three major problems: First, the company needs to know how to keep the platform integrated, while considering future innovation. Second, it also needs to maintain compatibility with past complements, and lastly, it needs to maintain platform leadership while other companies are eager to take its place. [5]

Simply having complementors is not enough. The platform leader then needs to share the overall returns of the innovation in order to create a positive reinforcing cycle. This cycle is

- 6 -

often termed “network externalities.” This builds up economies of scale, and makes it more difficult for competitors to replace the platform leader.

There are several different forms of platform structures. Some platforms are proprietary, while others are shared. Shared platforms have many different levels of leadership. Two factors that favor proprietary platforms rather than shared platforms are investment size and stability. For projects that are large and expensive, while having multiple investors can be good in terms of project investment, it is often better for one company to take the lead and assume responsibility for failure as well as success. In a given market, proprietary and shared networks coexist when users worry about lock-in.

If one sponsor has a clear lead, it should choose a proprietary platform model. Proprietary providers have an inherent advantage over shared platform counterparts when significant investments in user subsidies or centralized infrastructure are required to develop a new platform. „Free rider‟ problems can come when some (usually smaller) companies that are part of the project group don‟t contribute to the financial or intellectual capital resources of the project.

If a project is designed to be shared, as in a future technology standard, a firm should choose a sponsorship platform model. The sponsor company would invite other companies to join it, form the framework of the project, design the standard, and then release it to the public. A famous example of this is the Firefox browser. Primarily supported by the Mozilla Foundation, it was first released as open source software in November, 2004, and allows users to modify the program and build their own extensions.

An example of a joint venture could be the Symbian operating system, which powers the majority of feature phones in the world. It was championed by Nokia, and was also supported by Sony-Ericsson, Motorola, Matsushita, Siemens, and Psion. Joint ventures are advantageous when two companies have mutually beneficial resources, such as IP or technological knowledge. In some situations, such as when a company goes into a new market, joint ventures may be legally required. It‟s sometimes advantageous to form a joint venture with another company for a particular project, such as a product cross-promotion.

- 7 -

Apple can be described as having “full integration” with its platform, with “strict control over every aspect of the distribution model”, from manufacturing to OS development to app development. Google can be described as having “portal integration”, in which it runs the Android Store, and works with other hardware and software developers to build the hardware and apps that integrate with the OS [6].

There are three ways for platform providers to capture value. The first is to limit the size of the provider peer group; the second is to allow platform providers to earn license fees from contributed IP, and the third is to gain profit from implementation, or to make money from products implementing its standard.[3] Android uses the second and third methods, whereas Apple uses all of them.

As the network grows, the network not only becomes more desirable to buyers and sellers, but network efficiency drops as network participants have to spend more time to find each other (as in a dating network) or communication slows down (as in the case of a wireless network).

Some authors have split the mobile ecosystem into 3 parts: technology, services, and network [7]. The technology section includes device manufacturers and network equipment vendors. Services include applications, content, and payment providers. Network providers, such as mobile network operators and ISPs, connect the other two sections. Platforms interact with all 3 sections, and are changing how organizations who define their business by this model position themselves in the future.

2.2 eBay

The auction business, sometimes referred to as „the world‟s second oldest profession‟, started in ancient Mesopotamia and Babylon, although today‟s modern auctions trace their history to the Roman Empire. Auctions require two parties: a buyer and a seller. Buyers won‟t come if there are no sellers, and vice versa. Started in 1995, eBay now operates in 35 countries, is part of the S&P 500, and is the world‟s largest auction company. eBay‟s competitive advantage is its size. Any auction site can copy the features that eBay offers, but few give sellers the same level of exposure and historical data.

- 8 -

eBay‟s success can also be traced back to its dedication to its two long-term goals: “becoming the world‟s largest consumer to consumer online auction house” and “building out each of the five core strategies”. These are 1) to build up a larger customer base, 2 )to concentrate on local and global trading, 3) to create a strong brand, 4) to broaden the trade platform, and 5) to maintain a strong community affinity.

The platform currently has 5 major parts. The original and largest part of the business is the auction site. This allows any member to both buy and sell items. eBay makes its profit off of commission charged on each transaction, as well as various fees for add-ons. Any given auction can have both a bidding price, and a Buy It Now price. The bidding price can change, through additional bids by users, whereas the Buy It Now price ends the auction immediately, and sells the item at a predetermined price.

Unlike many other auction formats, each user can be both a seller and a buyer, with a separate rating as a buyer and a seller. This gives each user motivation to trust each other, even though they are only identified by their screen names.[8] eBay also offers a buyer protection program for items bought through PayPal.

As a natural extension to its auction platform, eBay offers a virtual storefront to its sellers. This is a specific place that sellers can drive users, who then buy products and send commission and fees to eBay. Sellers use eBay‟s storefront tools for payment processing, inventory management, promotion and customer tracking. [9]

eBay has released an application program interface (API) to allow developers to interact with the site, and to build external sites, programs and widgets that drive traffic to specific stores and listings, allowing people to buy and sell without going directly to eBay.com. Programmers have built apps that help buyers and sellers with every aspect of running a business, from bookkeeping to marketing to shipping. As of Nov. 2010, there are over 50 apps in the eBay Apps Center. Others have built browser add-ons, mobile platform apps, and plug-ins for various other platforms. These complementors give eBay the power to retain its dominant position in the online auction market [5]

- 9 -

Figure 1: 2010 US Smartphone Market Share (Nielsen)

eBay also has two options for classified ads, [10,11] where sellers can list their products on either ebay.com, or on ebayclassifieds.com. Similar to a normal newspaper classified ad, they have the product information, contact info, and an optional picture. eBay.com classifieds appear with other auctions, and are designed for products which can be bought and sold anywhere. People‟s information is connected to their user account, and buyers can assess their feedback record. The eBay Classifieds site is designed similar to Craigslist, in which people sell products and services to local people via face-to-face meetings. It‟s a completely different site from eBay, and is simpler and more anonymous than eBay.

PayPal is a platform that allows people and companies to send and receive payments with an email address. This system has many of the same characteristics of a credit card, although it is designed to be more secure. as PayPal serves as a representative for both parties. It requires buyers and sellers to work together and trust each other without sharing sensitive information. PayPal also has an API that lets third-party developers and users interact with the system.[8]

- 10 - There are currently 6 platforms powering smartphones [12]. These are: Google Android, Apple iOS, RIM Blackberry, Windows Mobile, Palm (HP), and Nokia Symbian. Components of this ecosystem include hardware developers, such as component and device developers; software developers, such as application

and platform makers, and content and network providers, among others. The platform owner (usually the OS developer) is the central part of the system, as they create the standards and specifications for both hardware and software.

According to researchers, [13] there are 5 major levels of a smartphone “stack”: Network, Online Services, Native Applications, Operating System, and Handsets. All smartphones work on this stack, but in each smartphone value chain, sponsors operate on different levels.

2.3.1 Blackberry

Research in Motion (RIM)‟s Blackberry, one of the first smartphones to market, has been a standard in corporate environments ever since it was released in 1999 as a pager, and in 2002 as a smartphone. Companies valued it for its security and push technology. Users

valued it for its QWERTY keyboard and convenience. Blackberries also work seamlessly with major corporate email systems, such as Microsoft Exchange, Lotus Domino, and Novell GroupWise.[14]

RIM has built a group of proprietary protocols, and an encrypted network that acts as a VPN (virtual private network), allowing the phone to be operated securely no matter what connection it uses.[15] This has caused controversy, as certain governments have forced RIM to create workarounds to allow the government to eavesdrop on conversations and emails. RIM has been under pressure in the last few years, as competitors such as Android and iOS

Figure 2: Smartphone Industry Value Network [28]

- 11 -

have been gaining ground. While competitors have moved ahead and designed touch keyboards, Blackberry has struggled with whether or not it should focus on a physical keyboard or a touch screen.

In response to threats from the iPhone and the Android platforms, RIM released an app store (AppWorld) in 2010. It currently has over 10,000 apps, which is a sign that developers are starting to commit to the platform.[16] RIM is also planning a middle-ware platform that lets users easily use desktop applications on their phones.[17] Blackberry operates on the handset, operating system, application and online services layers of the smartphone stack [13].

2.3.2 Windows Phone 7

Windows Phone 7, released in October 2010, originated as the Pocket PC 2000 operating system and was the successor to Windows Mobile 6.5. It‟s designed to be similar to Windows 7, integrating some of the programs familiar to Windows desktop users, such as Office, Internet Explorer, and Windows Media Player. [18] Windows Phone 7 only operates on the OS layer of the smartphone stack [13], in a similar structure as its desktop and server business.

Microsoft makes money through licensing the software to handset developers, and charges developers for development tools, as well as the Mobile2Market certification program. Major hardware manufacturers that produce phones for Windows Mobile include HTC, Samsung, Dell, and LG.[19,20]

In the last few years, however, Microsoft‟s share of the smartphone market has been shrinking. Faced with integrated hardware/software devices such as Blackberry and iPhone on the upper end, and free, open source devices such as Linux and Android on the lower end, Microsoft has been struggling to solidify its position in the smartphone market, and hasn‟t yet been able to carve out its own niche.

- 12 - 2.3.3 Palm

Palm, now a division of HP, was the first company to dominate the PDA market. Originally releasing the Palm Pilot in 1996, USRobotics‟ Palm quickly became synonymous with PDAs. It then released its Palm.net service, allowing users to access specially formatted web pages. Within a few years of its initial success, however, competitors started flooding the market with cheaper and better products. For example, Microsoft released its Windows CE in 1996, boasting 65000 colors, when Palm‟s PDAs only had 256 colors.

While the Palm name has continued to survive in the marketplace, even after being sold over and over again, it never enjoyed its initial success and built up a dominant platform, or release a product that wasn‟t quickly imitated and bettered by another product.[21] Palm launched an app store in October 2009, but only had 6000 apps as of March, 2011.[22] HP bought Palm in April 2010 for 1.2 billion, and has plans to integrate Palm‟s WebOS into its line of tablet computers and smartphones. Palm has its own hardware, operating system, and native applications. Palm operates on the native applications, operating system, and handset layers of the smartphone stack. [13]

2.3.4 Symbian

Symbian started as a joint venture between Nokia, Sony-Ericsson, Motorola, Matsushita, Siemens, and Psion as an open-source platform for 3G mobile devices. It was designed to be a direct competitor to Windows Mobile. Although it started as a

mobile device OS, it was soon sidelined to a mobile phone OS.[23] Nokia released the Ovi app store in 2009 [24], allowing devel-opers to build and distribute Java- and Flash-based appli-cations and widgets. In Nov, 2010, Nokia claimed 3 million downloads per day, and 165 million users.[25]

As Nokia was the dominant mobile phone developer worldwide, Symbian quickly rose to dominate the cell phone OS market, at one point reaching 88% of total market share.[26] It

- 13 -

Figure 6: Apple's Value Network [28]

also opened an app store in 2009. However, when other options, such as the iPhone and Android, were released, the OS quickly lost its luster. Nokia had planned a follow-up OS, called MeGo, but announced that they had abandoned those plans in Feb 2011, deciding to put Windows Mobile 7 on its phones [27]. Nokia operates on the native applications, operating system, and handset layers of the smartphone stack. [13]

2.3.5 Apple

Apple has positioned itself as a device maker and vendor, OS owner and service platform maker [28], operating on the online services, native applications, operating system, and handsets layers of the smartphone stack [13]. The Apple iPhone operating system follows a system that is closed in many

ways by including the operating system, hardware, built-in appli-cations, and online services in its strategy. One advantage of this is maximum compatibility and efficiency between hardware &

software components. This gives developers a more focused approach, as they don‟t need to worry about multiple hardware and software configurations from multiple companies, each with their own limitations and interfaces.

All applications written for the iPhone/iOS are hosted by Apple. The App Store allows developers to focus on writing, and give marketing & distribution task to Apple. Apple receives a commission of 30% of the cost of the app. The App store is the only way to download iPhone apps. This ensures that Apple is able to control the quality of the applications released for the iPhone.

Apple‟s chief core competence is innovative design and technology. It has also turned computer equipment into an “experience”. Even though it often isn‟t a first mover, it is able to look at existing products in a new way [29]. Apple also is able to understand what users want and like, and build products built around those needs. Examples include: simplicity, product design, and marketing.

- 14 -

Because of the “experience” mentality, the hardware is the core of the company. Apple is applying the „razor-and-blade‟ strategy in reverse. The add-ons, such as the iTunes Store, App Store, etc, don‟t make the company nearly as much money as the initial hardware. For example, analysts estimate that Apple nets about $0.10 off of each song sold in the iTunes store.[30] While the iTunes store generated 4.1 billion in revenue in FY2010, considering Apple‟s total $65 billion revenue, it isn‟t a large part of their income stream.

2.3.6 Google

Google‟s core competences are to “organize the world„s information and make it universally accessible and useful” [31], and to sell advertising. Google currently leads in search and advertising revenue on the

Web. While Google has had success with its various applications, such as Google Docs, Maps, etc, the main goal is to create more opportunities to display advertising.

The position of Google‟s

business model is that of an OSV (operating system vendor), an application aggregator, and an online services provider [28], and operates on the online services, native applications, operating system layers of the smartphone stack [13]. Google bought Android, Inc. in 2005, and released the Android OS on Nov. 5, 2007. Hardware vendors are free to download and modify most of the OS for their own phones, and software developers are free to download the SDK and build Android apps. Google‟s goal is to be able to run Android on any handset by any manufacturer, and to be used on any wireless network.

In addition, Google handles user accounts, but doesn‟t restrict apps and transactions to its network. Google often (though not always) acts as the broker between the user and the app developers through the Android Store.[32]

By open-sourcing the Android platform, Google has given hardware companies and service providers resources that would take large amounts of money to develop in-house. As a result, different hardware companies have created their own “flavors” of Android interfaces. For

Figure 7: Google Value Network [28]

Services Platform OS Device Maker

Device Vendor Application Developer Content Provider Customer

- 15 -

example, HTC has created the Sense, Motorola the Blur, Samsung the TouchWiz, and Sony Ericsson the UX.

An advantage of this strategy is that Google has multiple companies working to build and distribute Android phones. It works on multiple networks, and as many companies are releasing phones with Android, its market share is consistently growing.

- 16 -

III. Methodology

3.1 Proposition Summary

The design of this thesis uses a set of 9 propositions to examine the current smartphone market in the United States, and the applicability of two particular business models to this market. It uses an adapted & simplified version of an ecosystem framework designed by Yamakami [33]. The entities included in this thesis are users, app developers, and platform providers. The factors in this study are market share, network effects, and platform elements, such as network effects, app stores and advertising. Agencies studied are restricted to smartphones using either iOS or Android. This study will then compare these factors with Google and Apple‟s business strategies and effect on the market to analyze the probable near-term trends.

This thesis uses propositions rather than hypotheses for a few reasons. The most significant reason is the fact that the focus of the thesis is a projection of the future. As such, it is not empirically testable. This situation leads itself to a qualitative rather than quantitative study, which has the purpose of “generating understanding of a social phenomenon”. [34] This is useful in situations where a study cannot be extracted from its context.

I also wanted to give a broad overview of the smartphone industry, and give a foundation for future research [35] to investigate more specific topics. I also chose a format that allowed me to use multiple sources and forms of input, rather than a limited sample.

3.2 Research Questions:

1. What is the evidence that Google‟s strategy is to sell advertising? 2. What is the evidence that Apple‟s strategy is to sell hardware? 3. Is the smartphone industry able to support multiple platforms?

4. How do the platform leaders‟ roles affect the evolution of the industry? 5. What complementors have platform leaders chosen to work with? 6. What have the platform leaders done to share “returns on innovation”? 7. In what ways have the platform leaders captured value?

8. Are there market forces that would prevent or enable tipping?

- 17 - 3.3 Propositions:

1. The “open” platform leader‟s (Google) strategy is to give away an "element" of the platform, the store, and generate value through traffic and profits through advertising.

2. The “closed" platform leader's (Apple‟s) strategy is to sell an "agency" of the platform, such as hardware, to boost traffic and access to the platform.

3. The "mother" platform (smartphone industry) can support multiple platforms. 4. The multiple roles of the new platform leaders have forced the traditional

platform leaders to evolve.

5. Platform leaders have chosen to work with integral complementors (app developers) and supplementary complementors (advertising providers).

6. Ways that platform leaders have chosen to share returns on investment are financial (app and ad commission) and elemental (advertising viewers).

7. Ways that platform leaders have captured value include both consumer investment (hardware, apps), and complementor investment (app developers, advertisers)

8. The smartphone industry is not prone to tipping, as investment reduces the chance of users changing platforms.

- 18 - 3.4 Trends

The emergence of the smartphone – initially with the iPhone, and later with the Android, marks a turning point in the smartphone market from a group of companies organized on strictly delineated roles, with the telecom company as the platform leader, to a more „fuzzy‟ market, in which one company may have multiple roles. For example, Apple has worked with the network provider (AT &T) and app developers, and has also sold directly to users. The carriers are being pushed into a more supplementary role, and are struggling to adjust to a market in which they provide less value and wield less power than they have in the past.

As smartphones are similar to small computers with added connectivity functions, such as phone and internet, the value chain is similar in many ways to the computer industry, with different companies acting as hardware, software, and operating system vendors. However, there is one significant difference that has made the entire smartphone value chain different from that of a PC. The presence of mobile service companies, such as AT&T and Verizon, has changed the position of the platform leader, setting up the current clash between the business model used by traditional network providers with the business models used by today‟s smartphone platform sponsors.

The next section will examine several trends in the market. These trends are divided into three sections. These are: Platform/Operating Systems, App Stores, and Advertising. Each section will be examined in terms of revenue, profit, and usage.

According to Gartner [36], Nokia was the dominant smartphone company worldwide until the middle of 2010. However, with the rise of Android, that dominance faltered, and in January 2011, there were more Android phones than Symbian phones. Apple has grown slowly, going from 10% to 15% market share over the last few years. While the iPhone has been a hugely successful product, its competitors are catching up in quality and functionality, and the premium price tag has been harder to justify. Google has had the most significant improvement. Starting from a base of roughly 3-4% of the market in Sep 2009, Google has leapfrogged to the front, overtaking both Apple and Research in Motion (RIM) in 2010. Projections indicate that by the end of 2011, Android may account for 49% of the smartphone market.

- 19 -

One of the most important parts of any platform is its partnerships. Evaluating the possible partnerships from the perspective of the 5-level stack will show each company‟s strategy, along with their similarities and differences.

3.4.1 Google’s Platform Strategy

Google‟s coring strategy has hinged on controlling part of the Android OS, while opening other parts. Core apps that integrate with Google‟s services, such as Gmail, Google Maps, and YouTube are proprietary. The core part of the OS, while officially open, is controlled by Google, as improvements to the code is reviewed and approved by Google.[37]

Google has also had to keep the platform integrated, while considering future innovation. It also needs to maintain compatibility with past complements, and maintain platform leadership while other companies, are eager to take its place.[5] Since Android is relatively new, Google hasn‟t had many challenges in this area. Although it has released several versions, they are all relatively minor upgrades, allowing all apps to function on the new software. As previously mentioned, Android‟s rapid release schedule have kept possible competitors off-balance, minimizing the risk of leadership challenges.

On the network level, Google is network agnostic, working with hardware manufacturers that support different wireless technologies. For example, Verizon and Sprint use CDMA technology, while AT&T, Cellular One, and T-Mobile use GSM. All of these service providers have Android phones available for their customers.

Google offers its own online services, letting users access Gmail, Google Maps, YouTube, etc. through applications and widgets. In addition, developers can access their own services through either Google‟s API libraries or through web sites optimized for mobile devices. Google has developed native applications for many of its services, and has worked to make the operating accessible to third parties through the API libraries and the release of an SDK (Software Development Kit) for internal applications and external access to services. The SDK and APIs are freely available, and anyone who wants to can build an Android application and put it on the Android Store, or on their own site.[38]

The Android operating system is the core of the entire platform. Released by the Open Hand-set Alliance (OHA), the first version of Android was made public with the release of the HTC

- 20 -

G1 in November 2008. From a software perspective, Android is similar to Apple‟s iOS, but also differs in many ways. While the OS is officially open source, Google wields the majority of power and in the OHA. Google has received criticism for controlling the core OS too tightly, [37,39] and the OHA has started to show signs of trouble as many companies develop their own proprietary features.

Google has developed Android at an amazing speed, with 4 major versions made in the space of 15 months [40]. This has created issues with manufacturers, as different phones are released at different times, with different versions of Android. Manufacturers are responsible for releasing OS updates for their phones, and while some manufacturers have consistently released upgrades in a reasonable period of time, others haven‟t done so well.[41] With significant work needed for each update, and each company releasing multiple phones each year, the ROI for many of updates isn‟t worth the investment. This has given Google a de facto control of the phone, as handset manufacturers face a high rate of software updates, along with significant customization costs. They don‟t want to be „left behind‟ when the next version of the software is released, so they don‟t put as much effort into software development and customization that they otherwise would. [42]

Barriers to entry for Android are small to none. There is a small ($25USD) fee for each developer for inclusion in the Android Marketplace, but once that is paid, it is free to develop and release apps. However, Google takes a 30% commission of apps sold in the Android Marketplace. Android apps are written in Java, and development tools are available on many different platforms. Google is trying to keep the app and hardware development in order to be able to offer a wide selection of apps and phones.. This is the motivation to draw more users and eventually tip the market.

3.4.2 Apple’s Platform Strategy

Apple‟s coring strategy has been very clear. The company is involved in every part of the ecosystem, from hardware to software to network to apps. The majority of the ecosystem, including hardware design, OS design, and app design, is under the exclusive control of Apple. This strategy has served Apple by allowing it to ensure that the entire iPhone “experience” works exactly the way Apple intents, with a minimum of unexpected issues.

- 21 -

Apple has also overcome the challenges outlined by Cusamamo and Gower [5] in the same way, by ensuring it remains a significant influence in every part of the ecosystem.

On the network level, Apple has chosen to „lock‟ the iPhone, which means that only carriers with agreements with Apple are allowed to sell the iPhone. “Jailbreaking” or unlocking the iPhone to be used with other carriers voids the user‟s warranty. In most countries, there are only one or two carriers that Apple has chosen to work with [43]. In others, there are several. Apple offers one online service, MobileMe, which allows digital content to be shared among various Apple products (iPhone, iPad, Mac). The company also uses the iTunes to sell music and movies.

Apple has also released an SDK that allows anyone to create native applications. Once an app has been developed, the programmer has to go through Apple‟s approval process, in which the app is checked for bugs, objectionable content, and other issues. If approved, the app will then appear in the iPhone app store. Apple also has a set of its own native applications, such as iTunes, email, and YouTube.

The iOS operating system is proprietary software that is only distributed for use on Apple‟s hardware, such as the iPhone, iPad, and iPod touch. It is designed to work with Apple‟s other software, such as iTunes and MobileMe. iOS is unique in that it is designed to work on a very small set of hardware, and is able to be optimized for that hardware. This is in contrast with most other operating systems, such as Windows, Linux, and Android, which are relatively generic programs that are compatible with a broad set of hardware.

Apple‟s iPhone handset is the core of its entire platform. All of the other layers are designed to support this hardware. The iPhone is the product that Apple used to launch its app ecosystem, and remains part of the core of its mobile strategy. In 2010, Steve Jobs, Apple‟s founder and CEO, was quoted as saying “Apple is a mobile devices company - that's what we do. [44]” Although the company has launched other mobile devices, such as the iPad, the iPhone and related products remain the most significant part of Apple‟s income, with over 38% of total revenues in 2010.

- 22 -

Apple‟s barriers to entry are more significant than other platform providers‟ in several different ways. Apple has reserved the right to determine which networks and telecom companies sell the iPhone[45], although there have been some issues with this policy[46]. Apple has chosen to control the operating system and handset, meaning that there is little to no opportunity for possible cooperators.

The barrier to entry that has generated the most controversy is Apple‟s approach to its App Store. Compared to other platforms, it has strict requirements for inclusion, and a very stringent review process. Apple reserves the right to accept or reject any applications to the App Store, which has created some controversy [47,48]. iOS apps are only available for sale through Apple‟s proprietary channels. There have also been issues with Apple creating rules or changing guidelines to exclude possible competitors. iOS apps use the Objective C language, and development tools are only available on the Mac OS. Apple requires a USD $99 annual registration fee, and takes a 30% commission of all App Store sales.

3.4.3 App Store

The ability to run small programs called „apps‟ is the most significant change from previous „feature phones‟. Apps are the factor that has turned the smartphone into a two-sided market. Ways to measure the popularity of an app ecosystem are through measurements of apps, (downloads, number of apps) developers, (number of developers, interest in developing) and network effects (complementors, competitors).

The strength of an app store has significant implications. As a store hosts more apps, more customers will be attracted to the platform. The more users are attracted to the platform, the more developers want to write programs for the platform, creating a sustainable cycle that is difficult to challenge.

Apple‟s iPhone wasn‟t the first smartphone on the market. However, it was the first one to open its app store to access by outside developers. With the opening of the App Store, Apple gave developers a platform that was much more open than previously available. Google took that model, and gave developers even more freedom, allowing them to sell or host their apps however and wherever they wanted to.

- 23 -

The app store is the primary element that will determine which platform is more successful. As of March, 2011, consumers had downloaded 10 billion apps from Apple‟s App Store, which hosted 350,000 different apps for the iPhone[49], while over 4 billion apps[50] had been downloaded from Android‟s library of almost 200,000[51].

In early 2011, the iPhone app store was the largest by far, although the Android Marketplace was growing at a faster pace, and was projected to host more apps than Apple‟s store by mid-2012[52]. (Figure 8: App Store Growth Rate)

Figure 8: App Store Growth Rate

3.4.4 Developer

According to researchers, there are 2 main ways that developers decide to work for a specific platform: dedication factors and constraint factors.[53] Dedication factors describe why a programmer wants to build apps for a specific platform, while constraint factors describe why a programmer feels like he has to develop for that platform. Three dedication-based areas that affect a developer‟s loyalty and willingness to develop for a platform are economic, resource, and social. Constraint based factors include switching costs and relative attractiveness over alternatives.

Ways that application developers benefit economically from their applications is through direct revenue from sales of apps and in-app add-ons, and through indirect revenue from ads embedded in the app. Resource benefits include SDKs and forums, ways for programmers to interact with the platform developer. Social benefits include the “culture, policy, and climate” of the platform, or how comfortable a programmer is with the platform environment.

- 24 -

According to surveys, interest in developing for Android and iOS have remained fairly constant over the past year, with a great majority of developers interested in developing for both platforms. A survey in early 2011 says that a greater majority of developers favor the long-term outlook of Android, compared with surveys in early 2010.[54] (Error! Reference source not found.)

3.4.5 Network Effects

As each network grows, the value to each user increases. More platform complementors, such as apps and phones with different capabilities, mean more options for users. This, in turn, motivates more users to join the network [3]. Another effect of this network growth is the increased investment of

each user. The more a user invests in learning about the platform, finding and buying apps, and building an online presence with a particular platform, the less likely he is to switch platforms. This section will examine the network effects of each platform.

There are two main ways that companies can

leverage the advantages of Android apps. By developing low-priced apps that become popular, companies can make significant revenues. For example, Rovio‟s Angry Birds generated 2.5 million paid downloads in its first 5 months [55], or revenues of $1.7 million USD. The ad-supported Android version was projected to earn revenues of $1 million per month [56].

Other companies, such as Amazon and GetJar, have built their own app stores for Android, Blackberry, Palm, and other platforms. This gives application developers of each platform

- 25 -

additional ways to promote and distribute their apps. Each store has different guidelines and requirements, with Amazon‟s app store being more like Apple‟s store, and GetJar only offering free, ad-supported, and demo apps.

Network effects that are unique to Google include the marketing and R&D investment of phone manufacturers. Companies such as LG, Motorola, and HTC have invested significant resources in hardware and software development, sales and marketing. Google has also given network service providers such as AT &T, Verizon, T-Mobile, and Sprint an alternative platform to use for customers that either don‟t want to buy, or don‟t have access to the iPhone. This gives the carriers data revenues that they wouldn‟t otherwise have if they could only offer feature phones.

Since Apple has direct or indirect control of much of the network value chain, the network effects aren‟t as strong as Google‟s. The main network effects that are part of the iPhone chain are related to increased traffic for network providers, and increased revenue for app developers. (Error! Reference source not found.)

3.4.6 Advertising

Advertising is used more extensively in the Android marketplace than the Apple App Store,

- 26 - $400.00 $450.00 $500.00 $550.00 $600.00 $650.00 $700.00 Q3 2007 Q4 2007 Q1 2008 Q2 2008 Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Iphone Quarterly ASP

Figure 12: iPhone Average Selling Price (Apple Quarterly Investor Calls)

with a majority of Android apps being free, while a majority of iPhone apps are paid [57]. Apple has restricted third-party ad providers and “only allows ad networks whose sole business is delivering mobile ads to collect data from those ads” [58], while Android doesn‟t have those restrictions.

3.5 Financial Data

3.5.1 Apple’s Revenue Model

Apple‟s iPhone-related revenue comes from three different sources. First of all, Apple makes money from hardware, from the physical handset itself. According to analysts, the iPhone‟s gross margin was 62% in 2007[59], 55% in 2008[60], and 58.4% in 2009[61]. Apple saw gross margins of at least 61% in 2010[62], although that number dropped a bit to 36% in the first quarter of 2011[63]. Gross profits from the iPhone (in billions) were estimated to be $0.39 in 2007, $3.7 in 2008, $7.6 in 2009, and $15.4 in 2010. Initially, Apple used a revenue

- 27 -

sharing model. In this agreement, service providers like AT&T subsidized the phone in order to get exclusive distribution of the iPhone, paying the upfront fee that users paid back over time. This agreement was based on how many iPhones were sold by the telecom company. Apple sold 1.4M iPhones in 2007, 11.6M in 2008, 20.7M in 2009, and 40.0M in 2010. (Error! Reference source not found.). The average selling price (ASP) has been going up since its introduction in 2007, going from $522.22 in Q3 2007 to $620 in Q4 2010(Error! Reference source not found.).

Apple also makes money from the App Store, taking a 30% commission from the sale of each app. In addition, Apple requires a 30% commission on in-app purchases that extend an app‟s functionality. Apple was estimated to make $15-18 Million in commission in 2008 [64], $237 million in 2009, and $534.6 million in 2010. Research firm Garner has estimated that Apple might make as much as $600 million from the App Store in 2011.[65]

Apple has also launched an advertising program called iAd, which inserts advertisements within applications. While Apple receives a 30% commission from the App Store, it receives 40% from total iAd revenue[66]. Analysts estimate that developers could have received earned $815 million in 2010 from iAd,[67] leaving Apple with $543 million. One analyst is quoted as saying that “we believe the iAd platform could generate an incremental $2.5 billion in revenue."[68] Analysts estimate that in-app payments accounted for half of all paid app income in 2010. (Error! Reference source not found.).

- 28 - 3.5.2 Google’s Revenue Model

While the majority of Apple‟s revenue is from hardware, Google‟s main source of revenue is from advertising, either from web search, or from ads embedded in apps. It also receives a 30% commission on apps sold in the Android marketplace. In 2009, Google only made $3.3 million in app commission, although that number increased to $30.6 million in 2011. Google is rolling out an in-app payment method in May, 2011[69]. Google‟s ad revenue was estimated to be over $68 million in 2009[70], $850 million in 2010, and $1 billion by 2012[71]. Before 2009, there wasn‟t a very big consensus on the size or the growth of the mobile advertising market[72].

Because Google has released Android as open source, it does not get direct revenue from sale of the OS. Google apps, such as Google Search, Gmail, and Google Maps, are included in Android, making Google the default app provider, and exposing users to ads.

As Google looked at the growth of the mobile market, it realized that it needed a presence in the mobile space, or else it risked Apple or another hardware manufacturer using one of Google‟s competitors, such as Microsoft or Yahoo, as the default search provider and advertising supplier. Andy Rubin, vice president of engineering at Google, made the company‟s goal clear: “Our primary business is advertising… a superphone [like Nexus One]

Figure 14: Revenue Share by Monetization Type

- 29 -

is a great way to access the Web, and that… supports our whole business model, which is advertising,” he said. The new phone and store represent “the next front of our core business,” he added.

Google is not trying to make a profit on sales of the Nexus, said Rubin. Instead, it’s trying to “make sure we have great access to Google services… and the best possible Web experience,” he explained. “You buy this and the advertising model takes off [73].

Eric Schmidt, Google‟s former CEO, has stated that Google has made a significant amount of money off of Android: “Trust me that revenue is large enough to pay for all of the Android

activities and a whole bunch more.”[74] Schmidt has also said that “The evidence we have is that people who use Android search twice as much as everything else. So, clearly, there is more revenue associated with those searches.”[75] Google‟s ad impressions are significantly

larger than Apple‟s (Figure 15), indicating that Google is achieving its advertising goals.

Figure 15: Mobile Ad Impressions Market Share

3.5.3 Summary

Financial data shows that the majority of Google‟s revenue is through ad impressions, while the majority of Apple‟s revenue is through hardware. Over the last 4 years, Apple has made over $42 billion from iPhones, $786 million from App Store commission, and $1.2 billion from advertising. Since 2009, Google has made $918 million from advertising and over $33 million from Android Marketplace commission. However, the entire Android ecosystem is

0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 Android iOS RIM Windows Mobile Other

- 30 -

growing, and will become larger than the iPhone ecosystem. As more app developers, hardware providers, and telecom companies sell and use Android-based phones, the entire ecosystem will grow, and Android will end up becoming dominant.

- 31 -

IV. Results

Research Question 1) What is the evidence that Google‟s strategy is to sell advertising? Proposition: The “open” platform leader‟s (Google) strategy is to give away an "element" of the platform, the store, and generate value through traffic and profits through advertising.

The evidence that Google‟s strategy is to sell advertising is primarily through its revenue model. Google doesn‟t charge for the use of the Android OS, and only charges developers a small one-time fee of $25 for the privilege of publishing in the Android Marketplace. 96% of Google‟s revenue from Android is through advertising, with the rest of it from Android Marketplace commission. Company leadership has also made it clear in no uncertain terms that the purpose of Android is to drive advertising revenue back to Google [73].

Research Question 2) What is the evidence that Apple‟s strategy is to sell hardware?

Proposition: The “closed" platform leader's (Apple‟s) strategy is to sell an "agency" of the platform, such as hardware, to boost traffic and access to the platform.

The strongest evidence of Apple‟s strategy to sell an "agency" of the platform (hardware) to boost traffic access to the platform is the fact that Apple doesn‟t sell its software independently from its hardware. In order to use Apple‟s software, a consumer must buy Apple hardware. 94% of Apple‟s revenues in the iPhone ecosystem are from hardware sales. Over the last 4 years, a majority of Apple‟s entire profit and revenues has been from sales of the iPhone, with 38% of Apple‟s revenue and 60% of its profit coming from hardware sales in 2010. (Error! Reference source not found.). This pattern is also evident in Apple‟s other products, as the iPod and iTunes ecosystem follows the same model [30].

Research Question 3) Is the smartphone industry able to support multiple platforms?

Proposition: The "mother" platform (smartphone industry) can support multiple platforms.

There are currently 6 major players in the smartphone platform market: Apple, Google, HP, Microsoft, Research in Motion, and Nokia. This market, as a whole, is growing in absolute numbers, with each of these manufacturers growing in sales over the past 3 years. This trend

- 32 -

will continue in the near future, as smartphones become more affordable (Figure 16). Each of these platforms has their own network effects, such as app stores and partnerships, to keep users on their system. Even though some of the weaker smartphone makers may merge or leave the market, the market will remain competitive as the market share of the stronger players continues to grow (Figure 17).

0 200000 400000 600000 2007 2008 2009 2010 2011 2012 2015 Android Research In Motion iOS Microsoft Other

Figure 16: Worldwide Mobile Communications Device Sales to End Users (Gartner)

0% 10% 20% 30% 40% 50% 60% 2007 2008 2009 2010 2011 2012 2015 Android Research In Motion iOS Microsoft Other

Figure 17: Worldwide Smartphone Market Share by OS (Gartner)

Research Question 4) How do the platform leaders‟ roles affect the evolution of the industry? Proposition: The multiple roles of the new platform leaders have forced the traditional platform leaders to evolve.

As a result of Apple and Google‟s entrance into the smartphone market, each layer of the ecosystem has had to adjust to the business models of the new competitors. As people are able to fulfill all their functionality needs from the various app stores, the network providers

- 33 -

are being pushed into the role of data providers, without any added functionality. However, with the advent of the smartphone, the network providers are profiting from the enormous increase in data traffic.

With Android, hardware providers have been given a new tool to develop their own smartphones without having to develop their own OSs. Each manufacturer has tried to differentiate its product line, but with the same operating system, and the rapid release of new hardware, some feel that Android would reduce differentiation between manufacturers.[42]

The biggest effect of iOS and Android is in the software industry. These two operating systems have created and entire industry of programmers willing to build software for these platforms. Revenue from these apps, both in terms of advertising and purchases, has been significant. The advent of the smartphone has also affected how many people consume information. (Error! Reference source not found.)

Research Question 5) Which complementors have platform leaders chosen to work with? Proposition: Platform leaders have chosen to work with integral complementors (app developers) and supplementary complementors (advertising providers).

Each platform leader has chosen to work with a different set of complementors. This depends on their position within the smartphone ecosystem. Apple works with network providers, app developers, content providers, and advertisers Google works with app developers, content providers, device makers, and advertisers. [28]. Both companies have their own advertising network, although Apple is more stringent on which external advertising networks are allowed within apps [58].

Research Question 6) What have the platform leaders done to share “returns on innovation”? Proposition: Ways that platform leaders have chosen to share returns on investment are financial (app and ad commission) and elemental (advertising viewers).

The ways that both Apple and Google have shared returns on innovation for their partners depend on the partners‟ position in the ecosystem, and the company‟s relationship with them. For example, Apple had a revenue sharing agreement with AT&T, while Google did not have

- 34 -

a relationship with the network providers. Both companies share the majority of app and ad revenue with the respective app developers, and provide app developers with various resources to help with the software design process. However, Apple‟s barriers to entry are significantly higher than Android‟s, thereby reducing the returns on investment for many of the less-popular apps.

Research Question 7) In what ways have platform leaders captured value?

Proposition: Ways that platform leaders have captured value include both consumer investment (hardware, apps), and complementor investment (app developers, hardware developers, advertisers)

Of the three methods mentioned by Eisenmann, [3] two methods are employed by smart-phone platform sponsors. Apple limits the size of the provider peer group through its various barriers to entry, and restrictions on all partners, including app developers, advertising partners, and network providers. Both Apple and Google profit from the implementation of their respective platforms in several ways. Apple profits through methods such as hardware sales, commission on app stores, advertising, and revenue sharing. Google profits through commission on app stores, advertising, and partnerships with hardware manufacturers.

Research Question 8) Are there market forces that would prevent or enable tipping?

Proposition: The smartphone industry is not prone to tipping, as investment reduces the chance of users changing platforms.

Tipping is unlikely for 3 reasons. As users and developers invest more time and money in a particular platform, they are less likely to abandon their investment. As the smartphone market as a whole grows, all smartphone platform providers will be focused more on capturing part of the new market, rather than taking share from competitors. This will allow platforms to grow, and the network effects to become stronger. Also, there are no strong motivations to buy one particular platform – e.g. a „killer app‟ that is only available on one platform. More developers are starting to release their products on multiple platforms, and all platforms have the same general functionality.

![Figure 3: Blackberry Value Network [28]](https://thumb-ap.123doks.com/thumbv2/9libinfo/8521108.186534/19.892.117.781.492.907/figure-blackberry-value-network.webp)

![Figure 4: Windows Phone 7 Value Network [28]](https://thumb-ap.123doks.com/thumbv2/9libinfo/8521108.186534/20.892.108.794.405.726/figure-windows-phone-value-network.webp)

![Figure 5: Nokia Value Network [28]](https://thumb-ap.123doks.com/thumbv2/9libinfo/8521108.186534/21.892.122.782.335.1063/figure-nokia-value-network.webp)

![Figure 6: Apple's Value Network [28]](https://thumb-ap.123doks.com/thumbv2/9libinfo/8521108.186534/22.892.118.791.396.721/figure-apple-s-value-network.webp)

![Figure 7: Google Value Network [28]](https://thumb-ap.123doks.com/thumbv2/9libinfo/8521108.186534/23.892.110.770.441.679/figure-google-value-network.webp)