外資金融機構佈局中國大陸金融市場之決策研究 - 政大學術集成

全文

(2) 謝 詞 韶光飛逝,六年的光陰說實不算短,當論文得以順利付梓,那剎那間泉湧 般的思緒與感恩盈滿著心裡,在此就讓我先謝天吧! 回想起當初考取之時,其雀躍的心情同於現在,但隨著紥實的課程研修與 嚴謹的學術養成,對於我這年紀稍長,且同時負有工作與家庭承擔與期許的環境 下,這些挑戰確實曾一波波地焠鍊著我,也一次次地挫折著我,然承蒙指導老師 廖四郎教授及吳壽山教授在期間所給予的諄諄教誨與訓勉,得以讓我成長與茁 壯,其不僅止於學術,更汲於待人處世,真的很謝謝您們! 在此也要誠摯地感謝學位考試委員吳中書院長、朱浩民教授及陳芬英教授 鉅細靡遺的審閱,並提供寶貴且實務的建議與指正,以及未來可續以研究的方 向,使其本論文的內容與結構更臻充實與完備;然而更要獻上謝意,給過去學習 課程中所傳道、授業與解惑的師長們,得以讓我在穩健的知識基石上逐步向前。 同時,亦要對那些曾經給予我支持、鼓勵、共勉及協助的學長姐、同學及學弟妹 們道聲謝謝!在這求學期間很榮幸有您們的融入,顯得更加繽紛與溫馨!. 立. 政 治 大. ‧ 國. 學. ‧. 同時也承蒙在這六年中,華南金控集團所賦予我無後顧之憂的求學環境, 以及諸位長官們一直以來的包容、提攜與疼惜,讓我在此求知生涯中得以順遂與 平安,也期許自我在未來貢獻淺薄所學,能為集團盡些棉薄之力。. y. Nat. sit. n. al. er. io. 然在這人生重要之際,心中最感恩的就是家人無怨無悔的支持與包容,在 此特別感謝父親、母親、岳父及岳母的關愛與體諒,讓我心無旁鶩地完成學業; 然我更希望能將這份榮耀獻給我最摯愛的妻子嘉惠,以及兩位甜蜜寶貝雅涵和祐 豪,在太太無悔的付出作為後盾,及孩兒天真的笑容轉化決心,我終於完成學業 了!也真的好愛好愛您們!. Ch. engchi. i n U. v. 今後我將以更謙遜的態度面對新知,以更堅定的毅力迎接未來,孜孜不倦、 築夢踏實! 張惠龍 謹致於 國立政治大學金融學系. 1.

(3) Abstract In recent years China has experienced rapid economic growth that enables the advancement of the local financial industry, which benefited from the strong domestic consumption as well as improvement in average income per capita. The purpose of this paper is to point out an alternative direction for Taiwanese banks by mapping out the future China market expansion strategy, as the Taiwanese banks are facing prolong highly competitive domestic market. This paper applies Cox’s proportional-hazard survival model to analyze the strategic decisions of foreign financial institutions about acquiring equity stakes in Chinese banks. Based on principal component analysis, we extract significant independent variables from Cox’s model and employ a maximum likelihood method to estimate parameters. With the probability of equity stake acquisition, we obtain the optimal probability hazard threshold and treat it as a criterion for the foreign financial institutions to conduct equity stakes acquisition. Our empirical results confirm that the decisions of foreign financial institutions about equity stake acquisitions are to increase the profitability and market values of the target Chinese banks. In general, financial institutions with higher earning ability and better asset quality have stronger motives to take part in the acquisition or disposal of equity stakes.. 立. 政 治 大. ‧. ‧ 國. 學. y. Nat. sit. n. al. er. io. The contingent claim model is applied in this paper to examine the risk and return of foreign financial institutions after acquiring equity stakes of a Chinese bank. The model considers dynamic factors such as individual asset value and exchange rates to achieve the goal of maximizing shareholder value. In addition to analyzing the asset value and factors associated with risk after participation, this paper evaluates the optimal acquiring equity stakes proportion with numerical analyses under capital control. For China banking sector, we discover the overall portfolio risk of foreign financial institution will decrease after acquiring equity stakes when the asset value increases, the debt ratio decreases, and the required risk-weighted asset increases.. Ch. engchi. i n U. v. Overall, these foreign financial institutions have well-diversified currency portfolio and enjoy a better asset quality and surplus earning; therefore, they will likely increase their optimal acquiring equity stakes proportion if the invested Chinese banks are with good assets quality and focused on local business.. 2.

(4) For the analysis of equity stake acquisition in China banks by Taiwanese banks, invested in the joint-stock commercial banks exists the higher intensity than others, and pan-government-owned Taiwanese bank also stands on the better vantage point than private banks. Under the possession of policy advantage for its green channels, the Western China Region is the best district in China for Taiwanese banks. This paper also examines the appropriate time and method to enter the market in China by applying the real options model. Being the market follower, Taiwan banking industry would need to find the right timing when ready entering China sine the market is pretty much laid out by many other foreign financial institutions. Therefore, the paper discovered some salubrious circumstances for Taiwan banking industry to enter the market, for example, the local financial service has not saturated, and initial investment cost is lower or Taiwan businessman demands more service gradually. The paper also confirms the current practice, which is to establish a representative office first and then promote it to a branch, seems to be practical for Taiwanese banks enter the market. Once meet the standard requests and acquire the license to operate RMB business, Taiwanese banks can establish wholly-owned subsidiary bank or take ownership stakes by having the innovation and business strategy in the local financial market.. 立. 政 治 大. ‧. ‧ 國. 學. n. al. er. io. sit. y. Nat. Keywords: equity stake acquisition, contingent claim, capital control, following financial institution, real option. Ch. engchi. 3. i n U. v.

(5) 摘 要 鑑於近年來中國大陸經濟高度成長,當地金融市場在其內需市場強勁,以 及均富水準普遍提升下,更顯得朝氣蓬勃,本論文係以分析過去外資金融機構在 中國大陸相關佈局模式及進行相關實證研究,並續以剖析臺灣銀行業未來佈局中 國大陸市場策略,以作為現階段國內高度競爭金融環境下,拓展另片藍海空間之 策略與方向。 本論文首先說明外資金融機構於近年來在高度發展中國大陸金融市場所扮 演的角色與目標,並應用 Cox 比例強度存活模型,分析採行參股策略方式進入 中國大陸銀行之動機與機率強度,並以主成份分析進行資料萃取及最大概似法估 計模型參數。再者,藉由此參股機率估計值進而求得外資金融機構最適參股機率 強度門檻,可作為日後金融機構(含臺灣銀行業)參股動機之衡量指標。實證研 究顯示,過去外資金融機構採行參股策略之目的主要在於創造被參股對象市場價 值,以增加其參股投資報酬。對於獲利能力及資產品質較佳之外資金融機構,以 及資產品質較佳之中國大陸銀行,則往往具有較高的參股與被參股潛在動機。. 立. 政 治 大. ‧ 國. 學. ‧. 再者,為進一步探討外資金融機構採行參股策略後之風險與報酬關係,本 論文係以或有求償權之模式,同時納入參股外資金融機構與被參股中國大陸銀行 之個別資產價值,以及匯率波動等三項動態因子,在股東權益價值極大化為目 標,及因應風險性資產所導向之資本管制,據以剖析外資金融機構經參股後之資 產價值風險及其影響因素,並以靜態分析所對應之最適參股比例變化情形。其數 值分析研究發現:當參股外資金融機構資產價值遞增、負債比率降低,以及所面 臨法定風險權數增加時,對於其參股後之整體資產組合風險將有所降低。同時, 對於具有高資產品質、獲利佳及多元化幣別資產組合之外資金融機構,以及面臨 資產品質佳且著重本土金融開發之被參股中國大陸銀行,將有助於提高外資金融 機構之最適參股比例。. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. 針對臺灣銀行業參股模式方面,以投資中國大陸股份制商業銀行之動機強 度為最高,其中泛公股銀行相對民營銀行更具有條件優勢,並以具備綠色通道優 惠之大西部地區為佳。研究亦顯示,在外資金融機構已著墨中國大陸金融市場些 許時日下,對於身為追隨性金融機構的臺灣銀行業而言,在當地金融服務未臻飽 和、初始投資成本降低,以及台商業務平均需求成長趨勢下,將有助於降低其進 入門檻。同時,研究中也採行模型論證,對於現階段臺灣銀行業實務上多以先行 成立代表人辦事處後升格分行,並儘速於合規範內取得人民幣業務承做資格方 式,以深根當地金融市場之經營方向,同時研究亦指出臺灣銀行業應具備創新化 業務與利基性策略,方能提高採行成立獨資子銀行或參股之進入動機。 關鍵字:參股、或有求償權、資本管制、追隨性金融機構、實質選擇權. 4.

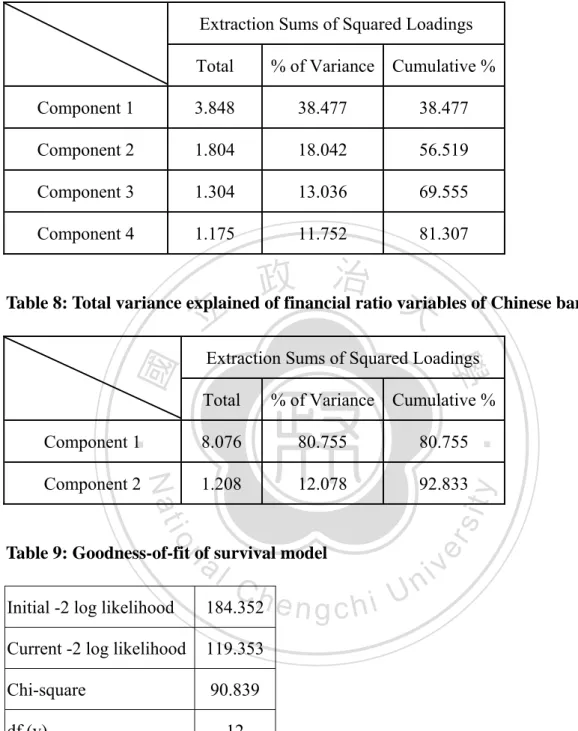

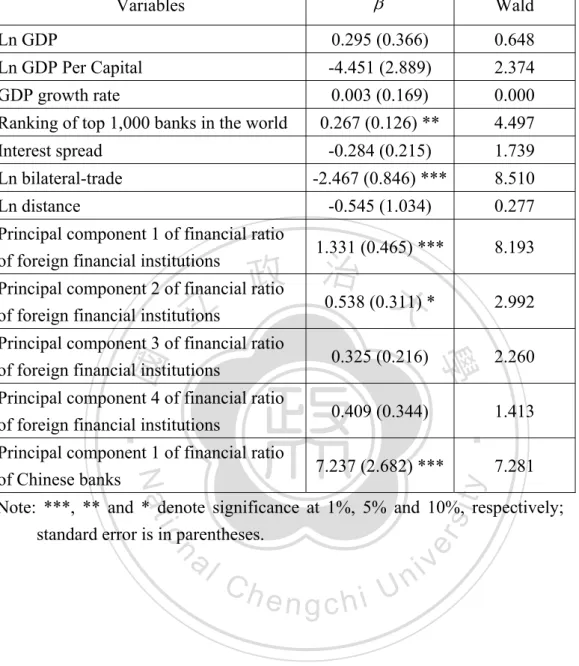

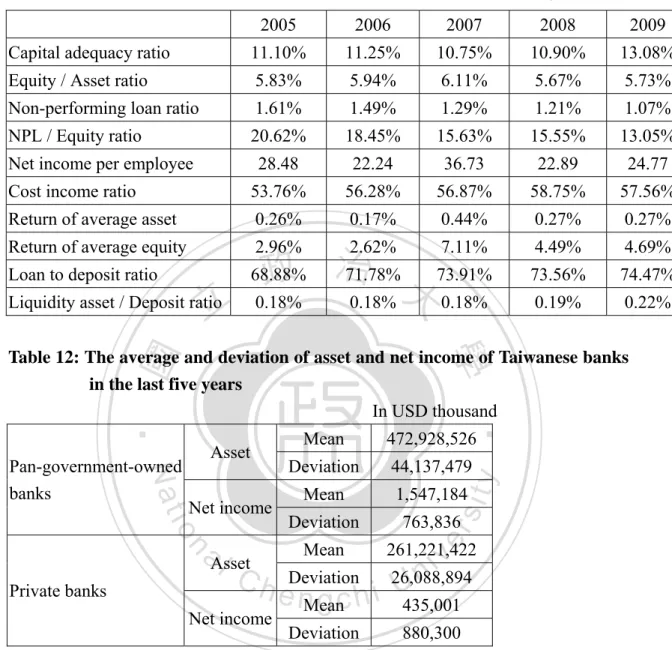

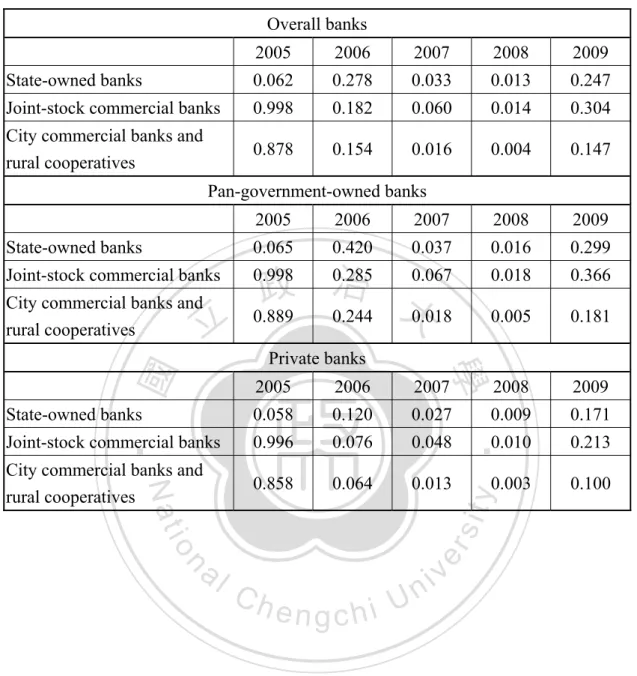

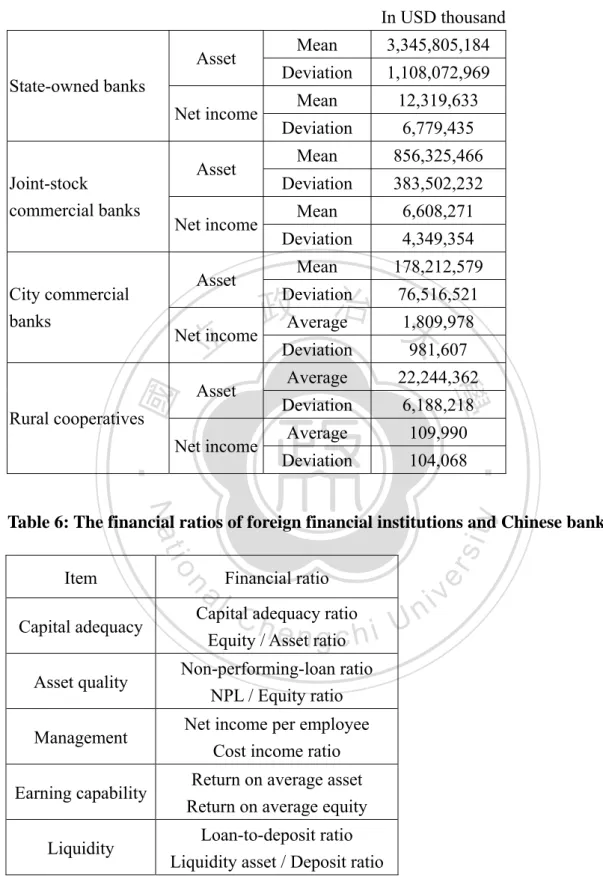

(6) Table of Contents 1. Introduction…………………………………………………………………....…8 1.1 Background……………………………………………………………………8 1.2 Motive…………………………………………………………………..……11 1.3 Objective………………………………………………………………..……12 2. Literature Review………………………………………………………….……15 2.1 Development of China Banking Sector………………………………………15 2.2 Determinants of Foreign Financial Institution Expansions…………………..20 2.3 Merge and Acquisition of Financial Institutions……………………………..23 2.4 Strategy of Entry in China by Taiwanese Banks……………………………..25 3. Equity Stakes Acquisition of Foreign Financial Institutions…………………29 3.1 Proportional Hazard Survival Model and Principal Component Analysis…...29 3.1.1 Cox’s Proportional Hazard Survival Model and Parameters Estimation.30 3.1.2 Principal Component Analysis……………………………....................32 3.2 Optimal Probability Hazard Threshold............................................................33 3.3 Empirical Data………………………………………………………….…….34 3.4 Results and Analysis……………………………………………………….…35 3.4.1 Subtraction of Financial Ratios Using Principal Component Analysis...36 3.4.2 Variables and Probability of Intensity in Equity Acquisition…...…...…36 3.4.3 Financial Performance of Chinese Banks before and after Invested…...37 3.4.4 Optimal Probability Hazard Threshold of Equity Acquisition…………38 3.5 Brief Summary……………………………………………………………….39. 立. 政 治 大. ‧. ‧ 國. 學. er. io. sit. y. Nat. al. n. v i n C h under Maximum Analysis of Strategic Investment e n g c h i U Equity Value……………41 4.1 Measurement of Risk and Return…………………………………………….41. 4.. 4.2 Optimal Acquiring Equity Stakes Proportion under Capital Control………...45 4.3 Result and Analysis…………………………………………………………..46 4.4 Brief Summary.................................................................................................49 5. Timing and Layout in China by Taiwanese Banks……………………………51 5.1 Market Layout in China……………………………………………………...51 5.2 Analysis and Application of Real Option Model.............................................55 5.3 Equity Stakes Acquisition under Optimal Probability Hazard Threshold……61 5.3.1 The Motives of Equity Stake Acquisitions by Taiwanese Banks………61 5.3.2 The Types and Regions of Invested Chinese Banks……………………62 5.4 Brief Summary.................................................................................................65. 5.

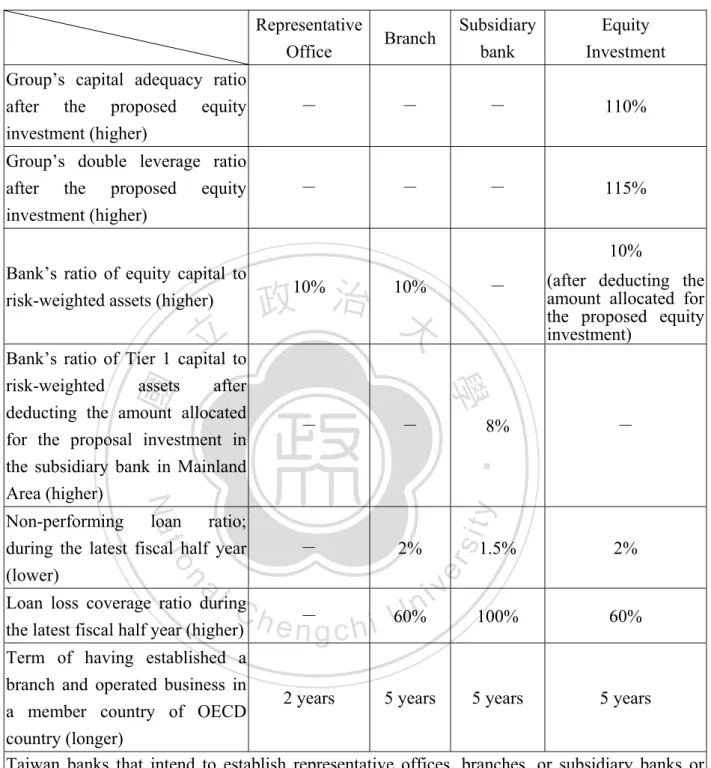

(7) 6. Conclusion…………………...…………………………………………………..67 Bibliography………………………………………………………………………...72 Appendixes……………………….……………………………………………….…76 Appendix A………………………………………………………………………..…76 Appendix B…………………………………………………………………………..77 Index of Tables Table 1: Number of legal entities and staff of the banking institutions in China (As of end-2011)…………………………………………………………...78 Table 2: Total assets of banking institutions in China (2009-2011)………………….79 Table 3: Profit after tax of banking institutions (2009-2011)………………………...79 Table 4: Entry model and location of Taiwanese bank in China……………………..80 Table 5: The average and deviation of assets and net income of invested Chinese banks in the last five year………………………………………….………81 Table 6: The financial ratios of foreign financial institutions and Chinese banks…...81 Table 7: Total variance explained of financial ratio variables of foreign financial institutions……………….......……………...………………………..…….82 Table 8: Total variance explained of financial ratio variables of Chinese banks…….82 Table 9: Goodness-of-fit of survival model……………………………………….…82 Table 10: The fitted result of Cox’s proportional hazard survival model…………….83 Table 11: The average financial ratios of Taiwanese banks………………………….84 Table 12: The average and deviation of asset and net income of Taiwanese banks in the last five years………..……………………………………………...84 Table 13: The probability of intensity of Taiwanese banks taking into the type of invested Chinese banks………..……...………………………………….85 Table 14: The probability of intensity of Taiwanese banks taking into the district of China…………...………………………..………………………….....86 Table 15: The statutory requirement for approval to entry model in Mainland China for Taiwan financial holding company and bank………………..…87 Table 16: The regulatory requirement for entry models in China……………………88 Table 17: The commitments of the Mainland side on liberalization of financial sector on the “Annex IV: Sectors and Liberalization Measures Under the Early Harvest for Trade in Services” of Cross-Straits Economic Cooperation Framework Agreement………………….…………………..93. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 6. i n U. v.

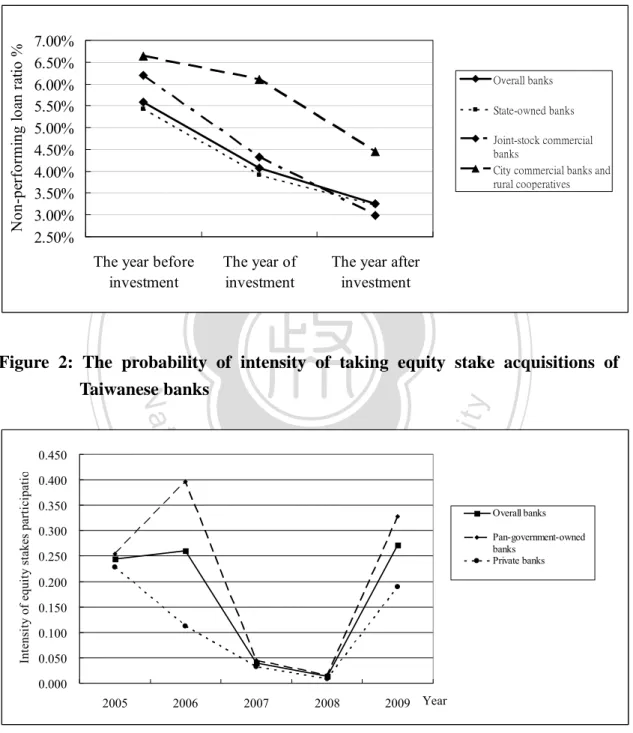

(8) Index of Figures Figure 1: The trend of asset quality (non-performing loan ratio) of invested Chinese banks……………………………………………………………..95 Figure 2: The probability of intensity of taking equity stake acquisitions of Taiwanese banks…………………………………………………………..95 Figure 3: Relationship of asset return volatility and asset value of foreign financial institution………………...............................................………..96 Figure 4: Relationship of asset return volatility and liability of foreign financial institution………..………………………………………………………...96 Figure 5: Relationship of asset return volatility of foreign financial institution and risk weight……….……...…………………………………………....97 Figure 6: Relationship of optimal acquiring equity stakes proportion and invested Chinese bank asset value………………………..………………………..97 Figure 7: Relationship of optimal acquiring equity stakes proportion and liability in proportion of invested Chinese bank asset value……………..…..……98 Figure 8: Relationship of optimal acquiring equity stakes proportion and asset return volatility of invested Chinese bank……………...………………...98 Figure 9: Relationship of optimal acquiring equity stakes proportion and asset return volatility of foreign financial institution…………………………...99 Figure 10: Relationship of optimal acquiring equity stakes proportion and exchange rate volatility……………………………………....…………..99 Figure 11: Relationship of optimal acquiring equity stakes proportion and correlation coefficient of asset value between foreign financial institution and invested Chinese bank………………………………...…100 Figure 12: Relationship of optimal acquiring equity stakes proportion and correlation coefficient between exchange rate and asset value of foreign financial institution…………………….………………………100 Figure 13: Relationship of optimal acquiring equity stakes proportion and correlation coefficient between exchange rate and asset value of invested Chinese bank………………………………………………….101. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 7. i n U. v.

(9) 1. Introduction Since open-door policy was implemented in the 1980s, the China government undertook major reforms and deregulation of the financial system. Various types of financial institutions were established and transformed, and foreign financial institutions started to return to the Chinese market, resulting in a great leap in the development of financial market during the last ten years. Foreign financial institutions started to enter the market by taking the forms of mergers and acquisitions and establishing branches, subsidiaries, or sole ownership when China government promised to completely open the financial market after it joined the WTO. As a result of the signing the Memorandum of Understanding (MOU) between China and Taiwan and the ongoing negotiations related to the supplementary agreement of Economic Cooperation Framework Agreement (ECFA), it is expected that cross-strait financial exchanges will become increasingly frequent. Opportunities to develop Chinese businesses in order to solve the problem of fierce competition that causes narrowing profit margins in Taiwan will be the most important goals and issues facing the domestic financial institutions today.. 立. 政 治 大. ‧. ‧ 國. 學. 1.1 Background. Nat. y. sit. n. al. er. io. With the booming economy and rapidly growing domestic consumption market, together with a commitment to foster a healthy operating environment, foreign financial institutions have been taking the approach of operating the Chinese market on a local basis, where the local unit assumes the responsibilities of operating and investment of the decision-making process. The rationale behind the market growth strategies is based on its own competitive advantage, motive behind the expansion, target profit, and the deregulation process. The vast Chinese market has caused the various economic zones to grow rapidly, and thus, foreign financial institutions have also been active in accelerating its growth to achieve the economies of scale. Initially foreign financial institutions focused on its own customers by offering corporate loans, foreign exchange, treasury, and derivative products to maintain their competitive advantage. However, the extensive spread in loans and deposits and improvement in people’s livelihood has meant that foreign financial institutions today have adopted the approach of becoming a sole ownership, taking equity stakes or formed a strategic partnership with local banks to capture the retail and wealth management businesses opportunities.. Ch. engchi. 8. i n U. v.

(10) Additionally, the wealthy level of local citizen in China has been cumulated to significant level under high-speed economic development in recent year, and the whole wealthy management market grows up rapidly and leap enormously more than 15% growth rate of million wealth family. With the more diversification of wealth management, tendency of development in district of non-along the coast, raise in the middle bourgeoisie gradually, and importance of asset portfolio in offshore, foreign financial institutions should take this opportunity to develop relative business scope under the consideration of advantage and disadvantage in oneself, and expand to the non-traditional niche banking market further. The participation of foreign financial institutions in China’s financial market has resulted in improvement of depth and width of financial services offered, asset quality, risk management, capital adequacy, operating structure, and corporate governance. Allowing foreign financial institutions to take a strategic stake in Chinese banks, the gaps between Chinese local banks and foreign financial institutions have narrowed under healthy operating environment, and the performance and profitability of Chinese banks have since improved sharply.. 立. 政 治 大. ‧ 國. 學. ‧. There are four types of Chinese banks: stated-owned commercial banks, joint-stock commercial banks, city commercial banks, and rural cooperatives. Four state-owned banks take up sixty percent of market shares; the market shares increase to more than eighty-five percent if joint-stock commercial banks are considered. Due to the poor performance of Chinese banks in the early years, including the high rate of non-performing loans and meeting of certain threshold of capital adequacy ratio required by the regulatory body, many banks utilize the advantages of vast customer base and large scale of operations to invite foreign financial institutions to take a minority equity stake. The move also benefits foreign financial institutions due to lower funding costs and the opportunity to develop new products that match the market demand, and to be the supplement of other entry model such as establishment of wholly-owned subsidiary bank or branch with in the face of defect that local business and network is hard to expand rapidly in short-term.. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Moreover, China's 12th five-year plan, which is ready to implement a deeper reform on economic development transformation and proceed to make a comprehensive well-off society, will open its financial market and become a trend and main driving force to continue growing the China’s economy. Most foreign financial institutions, along with local regulations, proceed with different strategies and objectives according to their own advantages and choose the most effective way to enter the market by building networks and developing multi-services. Therefore, any. 9.

(11) institution that wishes to make a fine performance and be profitable in a competitive market will need a comprehensive plan to move ahead. China has recently became world's fastest-growing emerging market, and many foreign financial institutions, including Taiwan’s, have targeted it as the next primary expansion market as matter of course. Other than following the relevant laws and regulation, investors make full use of their own advantages actively, and utilize the advantages to achieve a breakthrough on existing scale of operations in order to make maximum profit possible in the market in China. Looking at the new trends and future development cross strait, as the topics of Economic Cooperation Framework Agreement continues to ferment and China keeps on expanding its domestic demands and accelerates the financial development, the financial economics and trading across strait will expect to be an interactive and two-way development. Taiwanese banks hence believe investing in China is necessary to grow business and make profit, in order to be the regional financial institutions in the near future.. 立. 政 治 大. ‧. ‧ 國. 學. As compared to the saturated financial market in Taiwan, China’s financial market and the economy has shifted its development focus from the coastal area in early years to the more potential inland area in recent years. In addition as the economy advances it also improves the average income per capita in first tier cities in China, thus it is foreseeable in the near future that consumer finance and wealth management offered by the banks will be in hot demand. Since both Taiwan and China are sharing the same languages and cultures, it is expected that there will be room for Taiwanese banks to tap into the potential personal financial services in China with the precondition that the Taiwanese player must adjust its own strategy and their operation to fit into China’s vast geographical and cultural differences.. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. In consideration of Taiwanese banks are mainly focusing on serving Taiwan-based companies doing business locally in China, the business scope would be limited if banks only continue with the same customer structures when going west. Looking at the recent change of Chinese economics structure, core operating entity has gradually transformed from state-owned enterprises into more balanced development between state-owned and medium and small-sized enterprises. Meanwhile, China authority aims to increase the domestic demand and reduce the disparity between urban and rural areas development is advantageous for Taiwanese banks giving that are more familiar with the financial services of SMEs. It is essential for Taiwanese banks to transform their services to local enterprises and consumers rather than serving Taiwan businessman merely in order to create unique opportunity, produce additional profit, and expand its foothold in China in the long run.. 10.

(12) Taiwanese banks currently face potential challenges on planning strategic schemes in China. Other than rigorous financial regulations between Taiwan and China, limitations, such as slow expansion on operating sites, lacking sound personnel training and management system and having a considerable degree of compliance risk make Taiwan’s banking sector in general is deficient in meeting the risk-based capital ratio and maintaining sufficient capital reserves than the international standards. The abovementioned problems hence restrict Taiwan banking sector in promoting business. In other words, the overall scale of operation and competitive ability of Taiwan banking sector are relative weaker than local Chinese banks and foreign financial institute congenital. If Taiwanese banks maintain the same operating mode and enter China as individuals, banks will likely to face the same situation in which having excessive competition with the same nature in one cluster area, and, in other words, not having sustainable developments. Eventually, the performance and profit would be damage once the market shows obvious overlapping on banking products and targeted customers.. 立. 政 治 大. al. er. io. sit. y. Nat. 1.2 Motive. ‧. ‧ 國. 學. In summary, as China has risen to become the world’s largest emerging economy, both foreign and Taiwan financial institutions all target China as their next breakthrough market. In order to create optimal market entry strategy, therefore it is vital for all institutions to reassess their competitive advantages to achieve maximum operational efficiency.. n. As china experienced rapid economic growth with strong domestic consumption and rising average income per capita in recent years, together with China’s entry to the WTO and subsequent granting market access to foreign players, foreign financial institutions based on their own strategic focus and growth plan has adopted different market entry strategy for the last ten years. Hence as Taiwan closing its ties with China follow by deregulation and the signing of Economic Corporation Framework Agreement in recent years, it is important to undertake thorough research on the condition and external factors that influenced the decision on how the foreign financial institutions entered the Chinese market. For Taiwanese financial instructions that wish to expand into the Chinese market can then use the result of the paper as a reference in shaping their own market entry strategy.. Ch. engchi. i n U. v. The purpose of this paper is to analyze the strategy of taking ownership stakes in Chinese banks by foreign financial institutions, which can be served as an example of Chinese financial market entry approach. Furthermore, the paper will attempt to. 11.

(13) understand the individual factors and the motivations behind the strategy. In addition, the paper will explore the financial and operational synergies and the impact on the local banking sector after the bank’s ownership stakes was acquired by the foreign financial institutions. The paper will further explore the risk and rewards on the foreign financial institutions that acquired ownership stakes in Chinese banks. The paper will discuss the risk factors of the asset valuation and changes using static analysis in order to comply the Basel accord and the rules governing the risk weighted assets. In order to achieved maximum shareholder value after acquiring the ownership stakes in the Chinese banks, the conclusion will arrived by offering the ideal acquisition target under optimal portfolio risk. Finally the paper will further explore Taiwanese bank’s approach in entering the Chinese market by considering the bank’s own financial and both internal and external variables. By using the motivation and strength of the strategy in taking ownership stakes in the Chinese banks, it can act as a reference for entering the Chinese market. In addition, the paper will explore the options of establishing representative office, branch, subsidiary and taking ownerships stakes in Chinese banks, by considering the cost and time value variables to suggest the ideal timing of entry.. 立. 政 治 大. ‧. ‧ 國. 學. io. sit. y. Nat. 1.3 Objective. n. al. er. Most major commercial banks in China gradually transform from local to cross-region operation, with being listing on the stock market as the optimal goal. Further, some banks look for the opportunity to cooperate by bringing in foreign financial institutions to participate in acquiring equity stakes to increase international visibility and opportunities overseas as business agents enhance the risk-control and capital adequacy to meet local statutory requirements. There were 25 foreign financial institutions, as the results, taking equity stakes of 34 Chinese banks during 2001 to 2011, and explained Chinese market is the main merges and acquisition (M&A) target market for foreign financial institutions in the last decade. Furthermore, current regulations to become listed on the stock market permit total foreign ownership of a Chinese bank up to 25 percent and no more than 20 percent held by a single entity. As such, cooperation mainly focuses on debt consolidation, cross-region operations, and compliance with all rules. Meanwhile, local banks can dominate in bank operating as well as exercise their rights in board meetings.. Ch. engchi. 12. i n U. v.

(14) From the foreign financial institution’s perspective, it is viable to adopt the subsidiary’s approach when entering the Chinese market. However, detail research into the potential profitability must be taken into careful consideration. As the barrier to set up such subsidiary and the following branch network expansion are relatively higher compare to other entry option. Normally it will take the foreign financial institution 3 to 4 years to breakeven when taking the subsidiary approach. Moreover the rationales behind the decision in taking ownership stakes in the Chinese banks are: building brand awareness, intra regional expansion, mixed operation, internationalization strategy, enhancing market competitiveness, raising risk management capabilities and enriching human resources. However, the Taiwanese bank’s China current operation was only limited in serving the Taiwanese customers. Since both Taiwan and China shares the same languages and cultural background, Taiwanese banks should expand beyond their current operation scope by tap into the lucrative local market. As to whether the Taiwanese banks should take the approach of taking ownership stakes in the Chinese banks, the decision must be based on individual bank’s strategy and their market share target. As Taiwanese bank’s asset size are relatively smaller compared to the Chinese state owned and joint-equity commercial banks, plus it will not be viable in the short term for the state owned banks in Taiwan to take ownerships stakes in the Chinese banks. Therefore whether the privately owned Taiwanese banks has the capabilities to take ownerships stakes in the Chinese banks remains to be seen.. 立. 政 治 大. ‧. ‧ 國. 學. sit. y. Nat. n. al. er. io. This paper will discuss the strategic participation in China banking sector by foreign financial institutions, and analyze the affected variables of equity stakes acquisition and its relative intensity. Meanwhile, the optimal acquiring equity stake proportion and portfolio risk for foreign financial institutions will be analyzed further under the regulatory capital control and objective of maximizing equity value. In the last, we will discuss the best timing and entry model of Taiwanese bank in China financial market.. Ch. engchi. i n U. v. Therefore, we first have empirical study in Chapter 3 about the equity stakes acquisition of foreign financial institutions in China banking sector with history data, and then adopt Cox proportional survival model with consideration of relative variables such as macroeconomic of home country of foreign financial institutions, interaction between foreign financial institutions home country and China and both of financial ratios for foreign financial institutions and invested Chinese banks. Besides figuring out the significance level respectively, we also discuss the optimal probability hazard threshold to be as determination to take strategy of equity stakes acquisition or. 13.

(15) not for foreign financial institutions, including Taiwanese banks, in the near future. Furthermore, it shall be necessary to comply with regulatory capital control for those foreign banking institutions under the Basel Accord. With this point of view, to analyze the optimal investment return with constraint to reasonable possession of risk is cardinal importance. In Chapter 4, we will assume the dynamics of the asset value of foreign financial institution and invested Chinese bank individually, and the dynamics of the exchange rate, and evaluate the optimal acquiring equity stakes proportion to achieve the goal of maximizing shareholder value under the limitation and bridle of risk exposure and appetite and have static analysis further. We will stretch the research to the Taiwanese banking sector finally in Chapter 5. Except for the accordance to the model set up in Chapter 3 to estimating the respective intensity of equity stakes acquisition for Taiwanese banks in different types and located districts of Chinese banks, this paper also deliberates further in pan-government-owned banks and private banks separately. Moreover, as political and economic relationships of Taiwan and China getting in depth recently, China financial market is became main business scope for Taiwanese banks. When this market is pretty much laid out by foreign financial institutions as leading, we will adopt the real option approach to analyze the business strategy of the following financial institutions such as Taiwanese banks and discuss its optimal operating demand threshold. In addition, this paper will also involve the further discussion of current regulatory entry models respectively.. 立. 政 治 大. ‧. ‧ 國. 學. io. sit. y. Nat. n. al. er. There are six chapters in this paper, including this introduction. In Chapter 2, the extant literatures about development of China banking sector, determinants of foreign financial institution expansions, merge and acquisition of financial institutions and strategy of entry in China by Taiwanese banks will be reviewed. The equity stakes acquisition of foreign financial institutions, the analysis of strategic investment under maximum equity value and timing and layout in China by Taiwanese banks are analyzed in Chapter 3, Chapter 4 and Chapter5 respectively, and offer conclusion and suggestion in Chapter 6.. Ch. engchi. 14. i n U. v.

(16) 2. Literature Review On the premise of analyzing developing in China market by the foreign financial institutions and Taiwanese banks, we will discuss about the China banking sector in advance and relevant researches emphasized on its earning performance and management strategy in this chapter. Furthermore, the papers of studying on the determinants of oversea expansion and entry tactic in China financial market will be reviewed for the coordination with understanding the direction of business development for foreign financial institutions, including Taiwanese banks. In the end of this chapter, the relevant articles about analyzing the synergy of M&A in financial institutions will be reviewed, and to see if either the financial synergy or management synergy exists.. 政 治 大 2.1 Development of China Banking Sector 立. ‧. ‧ 國. 學. To view the development of China banking sector, China government unify and dominates definitely all strategy and operation, and the People’s bank of China acts as central role before 1979. The banking sector was classified as fiscal unit without the realistic function and independent operation during the Great Cultural Revolution. Under the open up with economic reform, the financial system strides forward modern frame from the highly centralized gradually, and tends to the individual regulation separately in the sector of banking, security and insurance after 1979. Garcia-Herreto et al. (2009) points out that the better capitalized banks tend to be more profitable. The same is true for banks with a relatively larger share of deposits. In addition, a less concentrated banking system increasing bank profitability, which basically reflects that the four state-owned commercial banks has been the main drag for system’s profitability. Also, more market-oriented banks, such as joint-stock commercial banks, tend to be more profitable, which again points to the influence of government intervention in explaining bank performance in China. Wu (2002) finds the serious problem of vacancy of owners existing in state-owned banks. Without the sound board of directors system and the standard to appoint and remove the chief of bank procedure, the state-owned banks are viewed as only like unit of administrative organization in name only. It also finds that the managers are barely on the administrative responsibility and the efficiency of operating for banks declines in general without encouraging environment.. n. er. io. sit. y. Nat. al. Ch. engchi. 15. i n U. v.

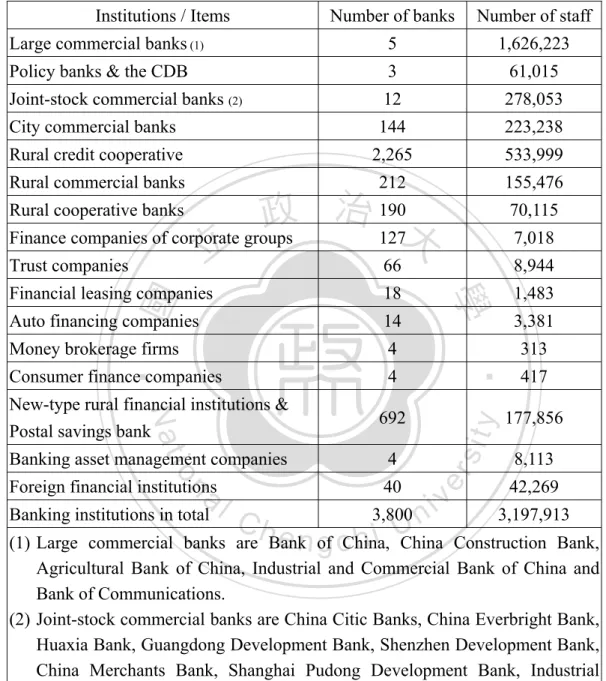

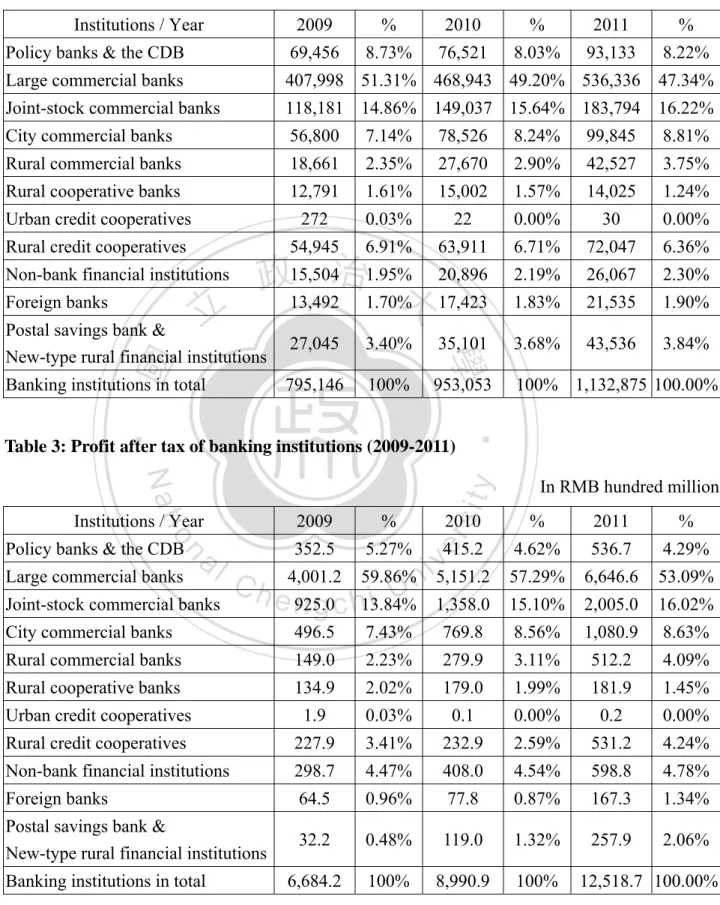

(17) According to the CBRC annual report, the Chinese banking sector comprises policy banks and China Development Bank, large commercial banks, joint-stock commercial banks, city commercial banks, rural commercial banks, rural cooperative banks, rural credit cooperatives postal savings bank, and so on by the end of 2011. There were total of 3,800 banking institutions and 3.2 million employees, listed in Table 1, working in this sector. Total assets of entire banking institutions as of the end of 2011 were RMB 113.29 trillion, an increase of 18.87% or RMB 17.98 trillion compared to previous year. Financial institutions distinguished by asset types and sorted by asset size, in Table 2, were large commercial banks (47.34%), joint-stock commercial banks (16.22%), city commercial banks (8.81%), and policy banks and China Development Bank (8.22%). As of end-2011, the outstanding balance of deposits maintained by entire banking sector increased by RMB12.1 trillion to RMB73.3 trillion as to the beginning of the year, among which the household savings deposits grew the most by 16.01%. The outstanding balance of loans maintained by entire banking sector went up by 19.7% to RMB50.9 trillion, among which the balance of short-term loans were RMB17.1 trillion, medium-to-long term loans were RMB30.5 trillion, and consumer loans were RMB7.5 trillion. Three types of loans were increased by 13.1%, 29.5% and 35.5% respectively compared to last year.. 立. 政 治 大. ‧ 國. 學. ‧. A report, 2011 China Banking Sector Survey, published by KPMG (2011) indicated that in order to provide better services to SMEs on financing, the local bank authority encouraged the large and joint-stock commercial banks to set up a special department to supple customers with independent credit limits, managements and operation teams, along with differentiated credit review policies and procedures to help SME on expansion and capital increased. Chu (2009) pointed out in the report that the services Chinese banks provided were substantially identical because Chinese banks were largely homogeneous. However, despite the keen competition, banks in China were still very profitable and were not affected by the different cost of capital as the lending interest rates were regulated by the government policy with fixed basis points.. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Forbes and China Construction Bank issued the “Private Banking White Paper 2011” and stated the liquidation dominated the China’s capital and real estate market so it could recover rapidly from the Financial Crisis. Meanwhile, the wealth of UHNW (Ultra High Net Worth) individuals increased largely. The UHNW individual accounted for a total of 53% in Guangdong, Zhejiang, Jiangsu, Beijing and Shanghai in Chinese market. The study also found that those individuals who had smaller asset size were more interested in investing in real estate. However, this proportion. 16.

(18) dropped significantly as their asset size expanded. Additionally, overseas investment also became a trend. The report noted that 22.6% of the UHNW individuals held offshore assets, and Hong Kong was the first choice for these Chinese UHNW individuals’ allocated offshore assets. Furthermore, most of researches about the performance of China banking sector are focused on the state-owned banks in the early phase. Lardy (1999) showed the capital adequacy ratio, loan loss coverage ratio, return of equity and non-performing loan of major four types of China banks were deteriorated during 1985 to 1997 and lower than the average international level. Li et al. (2001) adopted the financial data of 15 representative China banks to analyze the management performing. The result showed that the return of asset and return of equity of joint-stock commercial banks is higher than state-owned banks, but possessed lower leverage ratio to bear less operating risk. Garcia-Herrero et al. (2009) also found that joint-stock commercial banks have more elasticity of business operating and expanding to increase profit due to higher privatization than others. It also had result that the reason of lower earning in China banking sector is caused by the un-ideal management performance of the state-owned banks.. 立. 政 治 大. ‧ 國. 學. ‧. According to the CBRC’s 2011 annual report, after tax profit of China’s banking industry was RMB 1,251.87 billion (See Table 3), representing an increase of 39.24% as 2010. Large commercial banks accounted for the highest, 53.09%, in the entire market, and following by the joint-stock commercial banks, 16.02%, city commercial banks, 8.63%, and policy banks and the State Development Bank, 4.29% accordingly. The overall ROA and ROE of the entire banking sector were 1.0% and 17.5%, respectively. Moreover, commercial banks (including large commercial banks, joint-stock commercial banks, city commercial banks, rural commercial banks and foreign banks) had 1.1% of ROA and 19.2% of ROE, better performance than the entire financial institutions. As for the asset quality, the year end outstanding balance of NPLs stood at RMB 1.24 trillion, a decline of RMB 169.6 billion from the beginning of year 2011. The NPL ratio of the entire banking sector was 2.44%, 0.89 bps lower than the beginning of year 2011. From the view Commercial banks, the average NPL ratio was 1.1% with 217.7% coverage ratio, an increase of 64.5 bps compared to the beginning of year 2011. Besides foreign banks, joint-stock commercial banks preformed and improved the most among all in asset quality. The NPL ratio was 0.7% and coverage ratio was 277.6%. Furthermore, the capital strength and adequate level of Chinese banks were significantly improved. The overall weighted average CAR of China’s commercial banks was -2.98%, however, the. n. er. io. sit. y. Nat. al. Ch. engchi. 17. i n U. v.

(19) number had turned to positive in 2004. By the end of 2011, the CAR went up to 12.2% and Tier I also reached 10.1%. Short (1994) pointed out that the ownership structure of company played an important role on operating performance. As for the agency theory, when a firm had more dispersed shareholdings, it would result in lack of effective control on managers’ behavior, which may not efficiently enhance corporate performance. Dewenter and Malatesta (2001) made a comparison on profitability, labor intensity and debt levels between state-owned and private enterprises, and found out state-owned enterprises did not perform as well as private enterprises in many evaluation indicators. La Porta et al. (2002) also examined the performance on banks whose equity are held by the government do not perform as good as the private banks on financial and operating results. A study based on 92 countries’ actual data discovered that when the government of a country holds higher stakes on the banking sector, its’ financial development is far less compatible than those who do not.. 立. 政 治 大. ‧. ‧ 國. 學. Bonin et al. (1998) started an empirical research in the emerging countries in Eastern Europe and learned that although the state-owned banks' profitability is lower compared to the private banks, but the efficiency is not inferior to private banks. The article also pointed out that the privatization of state-owned banks must coordinate with other methods, in stead of only in pure privatization as a start. However, research also found on state-owned Chinese bank general performs negatively in banking operation and development in the similar theory. Tu (2000) noted a wholly-state-owned bank would be more politicization in operating, fiscal in financial, and administration in organization, and thereby affecting the profitability performance.. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Wang (2002) suggested in order to effectively reach a permanent cure for state-owned banks reform, it must proceed from the changing the property system which included property ownership resulting in dualistic business objectives, legal system not working properly, restraint on alienation and encumbrance causing failure of economic incentive and restraint mechanisms, and property misallocation creating asymmetric situations in the responsibility and relationship. Lu (2006) studied the ownership structure among the non-commercial banks, state-owned banks, joint-stock commercial banks and city commercial banks, and came up conclusions that the higher proportion of share held by the central government, the lower the profitability it does, whereas the same method does not apply to local government-owned banks. The same research also found joint-stock and city commercial banks will perform better when the ownership structure are more diversified from local governments,. 18.

(20) state-owned enterprises and private enterprises, along with fewer share held by government. In view of high degree of internationalization and economic growth, the China government further requires banking industry to strengthen transparency in the management and accept inspection by the investors and publics in the near future. Meanwhile, the Chinese banks should begin to participate in international competition actively in order to consider their own competitiveness in international market. With continuously expansion on operational scales and profitable source as the goal, banks should extend the territory by establishing more institutions or M&A to implement internationalization strategy. As a result, 84 Chinese banks were nominated to The Banker's Top 1000 World Banks in 2011 as compared to 31 in 2007, which near double in 4 years. In addition, the four Chinese state-owned banks placed top 10 largest global banks in market capitalization.. 政 治 大 Young et al. (2006) stated while the degree of internationalization of China's 立 banking sector are low, other than strengthen the overseas expansion outside of China, ‧. ‧ 國. 學. they should start to look for developing in new market and personnel training, strengthen government oversight ability and implementation on business management direction in order to enhance its level. Chang et al. (2006) believed the Chinese multinational companies remain highly growth by following their customers to locate and globally, which could be the successful key to be cross-nationalized. Huang et al. (2009) indicated that the main key influence Chinese banking industry to expand internationalize effectively will be through overseas direct investment and exports. This paper also found that the Chinese banking industry tends to follow growth trends as the local enterprises do to be internationalized when investing oversea directly. The large-scale commercial banks in China had established 89 business institutions, 5 branches and 7 representative offices in is Asia, Europe, the Americas, Africa and Oceania, in addition to acquire or take ownership stake of 10 business institutions as the end of 2010. General speaking, there are two major considerations guide Chinese banks to set up overseas presence; one is that the areas have the prosperity through direct investment and global trading with the intention of provide customers with full services. Another is the area should be the global or regional financial center so as to have the latest financial information, management know-how and financial talents to develop and enhance operational efficiency.. n. er. io. sit. y. Nat. al. Ch. engchi. 19. i n U. v.

(21) 2.2 Determinants of Foreign Financial Institution Expansions With the accelerated pace of global economics growth, the international investment trend has shown the signs of scale of globalization. Many financial institutions are facing an important challenge to develop strategies and approaches to expand to all over the world with the aim to increase the number of income sources and profits. Hill and Hoskisson (1987) believed when institutions expand globally, the adopt methods would be differed depends on their strategies, and the results will be varied according their methods. Sullivan (1994) employed three measures concerned with performance, structure and attitude, as well as nine indicators to evaluate the degree of internationalization. He suggested institutions should apply multiple measurements to ensure the degree of internationalization. Contractor et al. (2003) reached the three-stage theory of international expansion and found an inverse relation between the degree of internationalization and performance at the first stage, positive relation at the middle sage, and inverse relation, again, at the last stage, or so-called the “S-Curve” theory. Lin (2001) believed the diversification strategy and the degree of. 立. 政 治 大. ‧ 國. 學. ‧. internationalization might be helpful on increasing the overall operating income, bank's financial performance, however, does not see the similar impact. Ramaswamy (1995) noted that the company should apply financial performance indicator to show their oversea operating performance with value chain activities, and obtain the relative. y. Nat. sit. n. al. er. io. competitive advantage with cost reduced and core competitiveness made. Chang et al. (2010) examined that Taiwan's commercial banks do not have significant improvement on operating performance, but have better enhancement in risk control to the degree of internationalization. In addition, she considered the performance had inverse relation with oversea sales and diversification strategy.. Ch. engchi. i n U. v. Multinational financial institutions can be considered as an international enterprise. Start from the local and develop by owning or control through the overseas branches to engage in international matters in order to expand the scale of business from local operation toward global enterprise. Multinational financial institutions generally contain four characteristics. First, the creation of multinational organization would be derivation. In other words, it will see the multinational investment as outward expansion tool with sufficient capital and the appropriate scale of operation as premise. Second, the base operations of multinational financial institutions should be supranational, meaning establishing various types of branches in different countries and regions. Then, the business multinational financial institutions operate should be less native, so they will achieve the expansion purpose and business. 20.

(22) diversification when operating. Last, the strategy of multinational financial institutions should be globally in order to involve with the international investment activities. The academic research often referred the theory of international trade, such as gravity model and comparative advantage theory, as well as the theory of international business, such as Follow the Customers hypothesis and eclectic theory when institutions considering about the oversea expansion. They analyzed in the light of the country of its origin, the oversea host country, and multinational financial institutions themselves to determine the factors of expansion. The gravity model of bilateral trade and economic scale with geography and culture relation analyzing was first introduced by Tinbergen (1962). Di Giovanni (2005) stated that overseas investment is proportional to the size of the economy, but is inversely proportional to the geographical distance under the gravity model. The author also believed the information, trading activity, degree of financial deepening and common language will stimulate bank to adopt cross-border mergers and acquisitions action. The comparative advantage theory analyzed the market size, trade and economic development, inflation, exchange rate and general economic factors between the home country and the host country's to decide whether the bank would adopt overseas expansion strategy. Esperanca and Gulamhussen (2001) used single host country bank expansion to overseas territory as the study model and found the larger the scale of the financial markets of the home country, and the greater the motivation of the local financial institutions would like to go overseas. Focarelli and Pozzolo (2005) indicated when the market shown good economic growth, stable exchange rate and continued expansion of the financial markets, then the banks of OECD countries would be willing to invest cross-nationally.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Williams (2002) shown that Follow the Customers hypothesis could be regarded as a defensive expansion to avoid interruption and assure adhesion with customers. Additionally, Grosse and Goldberg (1991), Esperanca and Gulamhussen (2001), Huang and Nguyen (2004) and Chou et al. (2009) also agreed with the same hypothesis. However, Seth et al. (1998) studied loan activities of six foreign banks in the United States and found some customers of these foreign banks didn’t limit from their original home country. As a result, the application of the hypothesis still showed some conditions and limitations. Dunning (1977) argued the multinational corporations could compete with the host country enterprises when three advantages are satisfied, namely uniqueness, location and internalization-incentive in the eclectic theory. Piscitello (2003) pointed out the unique advantages included assets size,. 21.

(23) volume of deposits and loans, financial performance, degree of internationalization and product differences. The location advantages included the economic size of the host country, the level of development of the financial industry, the whether the location is at the international financial center, regulatory environment, as well as the degree of economic and trade exchanges between two countries, plus the internalization advantages of the local country. Outreville (2007) research found the asset size, cultural, and human capital of the world's top 50 financial institutions had indeed a significant impact to their internationalization degree under the analysis of the location advantages. In addition, the overseas expansion motivation could be further analyzed from the overall and individual environment. First, we can look at the regulatory factors impact in the overall environment. Levine (2002) suggested the good regulations could strengthen the financial environment and economic development, and be the excellent support for corporate to develop overseas. Slager (2006) believed the regulations on either host or original home country could impact overseas expansion behavior of multinational financial institutions. As for the economic environment, Goldberg and Johnson (1990) stated that conditions of economic development, such as trade volume and GDP, on both host and original home countries could affect banks strategies on going abroad. Chou et al. (2009) discovered the expansion and investment behavior of multinational banks at China, Taiwan, and Hong Kong had a positive relation on GDP of original home country. Finally, we examine the motivation to go overseas on the social, cultural and technological environment factors. Sebastian and Hernansanz (2000) researched the advances of Spanish banks in Latin America and found geographically adjacent, similar to the common language, history and culture were contributed to the development of overseas business. Outreville (2007) indicated the quality level of human resources was also the key factor for multinational financial institutions to consider going overseas, other than culture itself. Slager (2006) showed information technology could have two effects on degree of internationalization on banking sector. First, the information technology could shorten the processes of branch operations and investment, and provide services at regional centers. Second, information technology could reduce the monitoring cost of overseas expansion, and then consolidate its business scale.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. We also look at different aspects on individual circumstances, for example industry competition, customer demand and supplier bargaining that could influence multinomial national institutions to invest overseas. The industry competition contained existing competitors, potential entrants, and substitute products. Buckley. 22.

(24) (1988) believed that strong organizational structure is the competitive advantages of a company, and it could be best utilized by foreign direct investment and market internalization. Piscitello (2003) used financial indicators as the proxy variables to the model, and discovered the financial scale and overseas expansion had a positive relation. As for the customer demand, many studies showed empirical description on multinational financial institutions had a positive and significant impact with Follow the Customers hypothesis when expanding overseas. In addition, the difference between borrowing and lending rates of financial institutions would affect their overseas expansion decisions. Aliber (1984) indicated financial institutions had higher motivation to overseas development when their affiliated countries having lower capital costs and spreads. Slager (2006) also believed seeing as the main source of profit for banks was coming from interest income; it would motivate the local banks to adopt overseas expansion strategy when the home country spreads became narrower.. 立. 政 治 大. 2.3 Merge and Acquisition of Financial Institutions. ‧ 國. 學. ‧. The economy was deeply impact by the subprime mortgage crisis, the global financial crisis and the euro zone crisis for the past few years. Therefore, the global mergers and acquisitions in financial institutions sector became a new wave after successive crises. Companies hoping they can rapidly expand their operations scale, scope of business, economic and investment value under the risk appetite by M&A or reinvestment. First, the companies can share research and development, human and marketing resources to reduce the associated operating costs after through the interbank M&A or reinvestment. Moreover, companies can strengthen the operational risk and stable earning in different business cycle when forming a strategic alliance with different business sectors.. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Several researchers have stated ideas on the motivations of merger and acquisition (M&A) or in reinvesting to maximize shareholder value, with cost savings and efficiency analysis. Scherer (1980) believed merging was mainly does to reduce the cost on facilities and reinvestment to obtain efficient production and reach its economies of scale and operating synergies. However, M&A would tend to be less useful once the market reaches its smooth operations. Radecki et al. (1997) supposed that technology is the main key to expand economies of scale and enhance financial innovation. Vander (1997) found oligopoly could gain control on pricing power and then increase market share if banks adopted horizontal mergers. Pilloff et al.’s (1998) research found that the reasons for successful M&A in the banking sector include. 23.

(25) large-scale banks that have superior professional management capacity and structure knowledge, which could help banks with relatively low efficiency and profit to escape their predicament. Hennart and Park (1993) showed that companies with higher levels of diversification and lower levels of R&D intensity would likely use mergers as the main approach to increase operations and earnings in the market. In addition, for companies looking for M&A or reinvesting that did not seek maximize shareholder value, Halpern (1983) argued that once the merging company found that internal information was originally not reachable by an outsider, they could utilize the information better on production efficiency than could the merged company, thereby reducing the cost of bankruptcy. Fama and Jensen’s (1983) research found that a company’s management ownership and rights could be controlled via internal mechanisms when the controlling power was granted by merging. When management does not perform and stock prices decline, then share acquisitions could be foreseen, if the management level wanted to maximize shareholder value. Marcus (1982) pointed out that management level could adopt a diversified acquisition strategy to stabilize the operating performance and reduce fluctuations in personnel performance, thus, reduce the risk of bankruptcy while also reducing staff employment and reinvestment risk. Anderson et al.’s (1997) study showed that merging could urge the merging company with the existing network directly without rebuilding it.. 立. 政 治 大. ‧. ‧ 國. 學. n. al. er. io. sit. y. Nat. Brealey and Myers (1988) pointed out that the added value of economic profit and activity on merged or acquired companies would be greater than the sum of each individual combined, or synergy. Synergy normally includes company mergers through acquisitions or reinvestments to improve current operating earnings and reach operating synergy so the company could have higher cash flow and lower capital cost of financial synergy. Smith and Triantis (1995) indicated traditional discounted net cash flow does not fully reflect the intrinsic value in the acquisition process. The value includes developing opportunities with better comparative advantages and invests timing and any other conditions that could increase the M&A synergies. Childs et al. (1998) also found that capital inflow injected into the merged party could be treated as the time value of an option premium when evaluating the merging effectiveness with a real option model. Further, Leland (2007) discovered that merging could improve solvency of a company. Additionally, the degree of financial synergy depends on taxation, bankruptcy cost and scale, level of cash flow, and its correlation. For example, a merged company with a high bankruptcy risk and cost would likely end up with a negative financial synergy value. Liao et al. (2005) discussed multinational corporations merging, which would have a negative financial. Ch. engchi. 24. i n U. v.

(26) synergy if both parties were in a similar degree of interest rate and foreign exchange risk exposures. Conversely, companies with unequal size and risk exposures would tend to have positive corporate synergy. Regarding the researches on financial institutions M&A or reinvestment, Moore (1997) adopted Multinomial logistic regression analysis to investigate the relevance between financial performance and M&A probability on US banks. The result showed that banks did not perform as well caused the lending business restricted had higher possibility to be merged. Besides those small banks mainly concentrated on SME financing did not prove to have synergy on M&A, most other banks often show positive results. Houston et al. (2001) examined major bank merger cases during 1985 to 1996 and found both acquirers and acquirees had positive impact on stock prices after merging. Another issue would like to be stated is surplus mainly coming from cost down instead of profit earned. Zollo and Singh (2004) noted having sufficient knowledge on M&A could perform better than having past experience, on the premise that the senior management of acquirees would maintain during the M&A process.. 學. ‧ 國. 立. 政 治 大. 2.4 Strategy of Entry in China by Taiwanese Banks. ‧. The timing for Taiwan's banking industry to expand into Chinese market is behind foreign financial institutions as they had layout in mainland China for a period of time. Especially, most Taiwanese enterprises have working with the local Chinese banking since the early time. Although, it is difficult for Taiwan's banks to operate and compete with the advanced foreign banks in Chinese market, we can utilize the advantages on language and culture similarities to expand the market by providing professional services, successful SME business experience, and well-appointed risk management systems to build our completed strengths. With positive political interaction and the increasingly frequent contact on economic and trade, Taiwanese banks can definitely find the self niche advantages in the market.. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. For Taiwan's banking industry to expand it foothold to China, it first needs to obtain the approval from the competent authority domestically, then in accordance with the China norms and accords signed to apply and getting the approval from China. A report, Foreign Banks in China, published by PwC Taiwan (2010) supposed EFCA would stimulate the business contact between Taiwan and China. In the one way, lager-sized Chinese banks could expand their business territory by establishing branches in Taiwan. Furthermore, Taiwanese banking could also enter the market, start the RMB business and acquire equity stakes in Chinese banks more rapidly on the other way. Ultimately, a substantial increase in numbers of foreign investors could. 25.

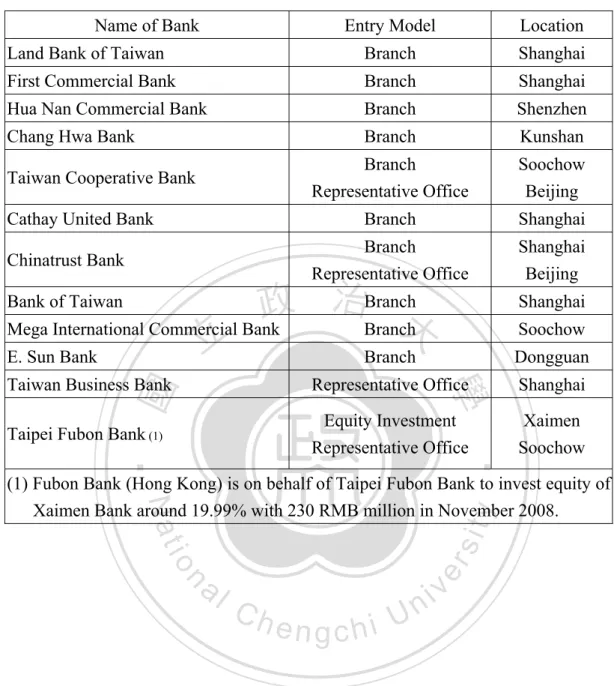

(27) help to reach perfect competition among foreign investors when entering the mainland market. Chang (2001) believed Taiwan's banking industry has a sound financial system and regulations to facilitate using own advantages and selecting specialty skills developing and competing in the Chinese market. Meanwhile, Taiwanese banks can carefully choose complementary peers when proceeding mergers and strategic alliances to make up shortfall of their own the business. The exiting processes to enter the mainland Chinese financial market for foreign financial institutions include establishing a representative office, a branch, a wholly-owned subsidiary bank, acquiring equity stakes in Chinese banks, and forming strategic partnership. Foreign institutions will decide the right processes according to their business development strategies and operating conditions to enter the market and expand to overseas. Taiwan banks establish footholds in the Chinese market in succession as table four listed. The establishment procedure is mainly followed the ECFA which is after the representative office established for one year and transformed to a branch to operate the business as the main mode for Taiwan banks. Simultaneously, Taiwan banks can apply to operate the RMB business for Taiwanese-funded enterprises in China after running the branch for a year with surplus earnings.. 立. 政 治 大. ‧. ‧ 國. 學. n. al. er. io. sit. y. Nat. Lee (2009) noted Taiwanese banks could enter the mainland market through the coordination of non-governmental organizations from both sides, and then choose Hong Kong branch, if available, as the bridge of cross-strait cooperation to build a financial supervision unit under the structure of WTO eventually. Lee (2002) believed Taiwanese banks have inherent advantages on language, culture and practice compared with other developed western investors. Even with the advantages on relative modern financial dealing ability than Chinese banks and having many Taiwanese companies that have invested in China, Taiwanese bank still face a challenge market with unfamiliar financial system and thus should be cautious with the plans to avoid potential risks and then create the maximum value of effort.. Ch. engchi. i n U. v. For the business location in China, most of Taiwanese banks choose the Yangtze River Delta as first priority such as Shanghai, Soochow and Zhejiang in the consideration of continuing the Taiwan local customers’ service and higher economic development around coastal cities. Ju et al. (2007) pointed out although Taiwanese banks focused on providing the service of small merchant enterprises in Taiwan under customer-following theory, they should apply the present infrastructure and management of financial holdings into the China banking sector on the base of mixed operation in China in the near future. Additionally, besides of the policy inducement. 26.

數據

Outline

相關文件

21 Article 6(x): Where the financial sector is unduly protected from normal commercial and financial risks, serious prejudice in the sense of paragraph (c) of Article 5 shall

開發投資合夥者( Joint Venture Partner ) 資金投資管理者( Managing Equity. Investor , or

(The New York Times)、 《華盛頓郵報》(The Washington Post)、 《英國金融時報》(The Financial Times)、 《日本產經新聞》(産経

三十一、 履約保證金應由廠商以現金、金融機構簽發之本票或支票、保付

為加入歐盟,土國長期以來執行與歐盟經貿市場調和政 策,歐盟亦成為土國最大外資來源、最大外銷市場。土 歐於

Understanding and inferring information, ideas, feelings and opinions in a range of texts with some degree of complexity, using and integrating a small range of reading

讓短期資金需求由短期負債來融通、長期資金需求由長期負債或權益資金來融通。同

中國春秋時期 (The period of Spring and Autumn in China) (770-476BC).. I am from the state of Lu in the Zhou dynasty. I am an official and over 60 years old. Her name is Yan