International Development of Taiwan’s Information

Industry: An Empirical Study on Human

Resource Strategy of Overseas Subsidiaries

Shang-Jyh Liu, Ti-Lun Huang, and Quang-Hua Chen

Abstract— Since the 1980’s, personal computers (PC’s) and

semiconductors have emerged as Taiwan’s two leading high-technology industries. As of the 1990’s, Taiwan has attained third place among PC manufacturers, and PC’s and peripherals have become Taiwan’s largest export products. Entrepreneur-ial small businesses, fierce competition in the local economy, and efficient industrial networking characterize Taiwan’s PC industry, with flexible production and shortened time to market. This study investigates the human resource strategies of overseas subsidiaries of Taiwan’s information enterprises, primarily the PC production industry. Gaining the comparative advantages of production from foreign resources of labor, materials, and key components are among the prime concerns. Direct access to foreign markets and marketing information constitute that more offices be established abroad. In general, internationalization of Taiwan’s PC industry partakes more of a headquarters-controlled style of global management. Overseas subsidiaries are essentially extensions of Taiwan- and manufacturing-based PC enterprises.

This study integrates theoretical frameworks of the eclectic paradigm and the integration-responsiveness models and explores four strategic patterns of human resource on the basis of two dimensions: consistency with parent-company policy and local responsiveness of a foreign subsidiary. Statistical measures as well as qualitative analysis reveal that both domestic corporate characteristics and overseas local features significantly influence management policy. While Taiwanese information enterprises are increasingly moving toward global expansion, the majority are at a learning stage in international business development. Internalization of Taiwan’s PC industry primarily depends on the manufacturing capability of local headquarters and joint ventures with foreign companies. The manufacturing-based PC industry in Taiwan is moving toward key component production and brand marketing while integrating global resources to compete against established transnational corporations.

Index Terms—Eclectic paradigm, human resources,

integration-responsiveness, internationalization, PC industry, Taiwan.

I. INTRODUCTION: INDUSTRIALDEVELOPMENT AND

PERSONAL-COMPUTERMANUFACTURING INTAIWAN

T

HE industrial policy of Taiwan, Republic of China (R.O.C.), was launched in the 1950’s. During that period, protectionism and import substitution were the key policies, and publicly owned enterprises were the main players in promoting industrial development. During the following decade, Taiwan’s government instituted anexport-Manuscript received June 27, 1996; revised April 22, 1997. Review of this manuscript was arranged by Guest Editors J. K. Liker and D. V. Gibson.

The authors are with the Institute of Management of Technology, National Chiao Tung University, Hsinchu, Taiwan, R.O.C.

Publisher Item Identifier S 0018-9391(98)05436-1.

expansion policy basing growth on the comparative advantage that the Taiwanese industry enjoyed in labor-intensive light industries. Highly export-oriented, labor-intensive industries readily absorbed a massive surplus of labor, thereby reducing the unemployment rate, and very importantly laid the basis for to the emergence of a host of small- and medium-sized enterprises.

The first oil crisis in 1974 jolted Taiwan to turn from labor-intensive industrial development toward more high-technology (high-tech) based industries to meet the challenges of in-ternational markets. The second oil shock, in the 1980’s, profoundly affected Taiwan’s economy. The government advo-cated drastic policy measures to accelerate high-tech industry growth. Strategic industries with high-technology content and added value, as well as large market potential and wide industrial linkages, were favored as national targets for guided technological and economic development. Development of the information industry was prioritized.

Leading the growth of Taiwan’s information industry was personal-computer (PC) manufacturing. Although it is debat-able whether this industry emerged as an intentional act of government planning or rather grew tangentially and acci-dentally owing to the national ban on video-game-machine manufacturing (to be mentioned later), that Taiwan’s govern-ment played an indispensable part in the information industry’s takeoff is undeniable. Public research institutes explored the core technology and spun off trained engineers into private industry; industrial and science parks provided the physical setting for high-tech manufacturing and research; and legal and administrative setups supplied financial preferential treatment [1]. In the mid-1980’s, huge foreign-exchange reserves were accumulated and placed Taiwan in first or second place in the world. Capital accumulation as a governmental goal for industrial policy was relaxed. In addition, ample supplies of well-educated engineers and technicians engendered by specifically designed education programs, as well as small-business entrepreneurship, all contributed to Taiwan’s PC industry’s taking off during the 1980’s [2].

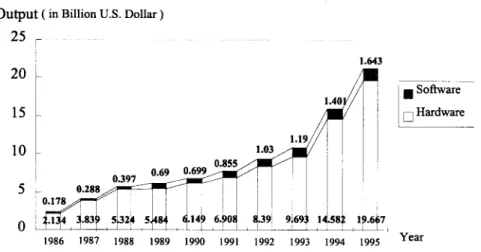

Taiwan’s information industry has experienced further and drastic growth in the recent decade (Fig. 1). The fierce compe-tition of the early 1980’s between Apple Computers Inc. and IBM created many opportunities for other newly industrialized countries such as Taiwan to enter the marketplace. In 1980, IBM plunged into the PC market with its IBM PC 8088. Moreover, to afford maximum penetration, IBM strategically

Fig. 1. Outputs of Taiwan’s information industry.

disclosed its PC’s architecture and openly encouraged the mar-ket to develop IBM PC software. As a result, the technological barriers against imitating IBM PC 8088 designs or those of the 1983 or later models, such as PC/XT, fell away.

In March 1982, the ROC government issued an island-wide ban on the manufacturing of video-game equipment, a highly profitable business at that time. The prohibition drove many manufacturers to produce the Apple PC as a substitute for video games and data-processing units. This government-induced industrial diversion, which had the effect spurring more than a hundred new entrants into PC manufacturing, was deemed an unintentional policy measure to promote the PC industry. This event substantially assisted a rapid expansion in domestic industry and led to Taiwanese PC manufacturers’ creating severe competition both at home and abroad.

The price-cutting war incurred by the IBM PC/XT in 1983 not only enlarged IBM’s leading edge in the market-place but also urged low-cost competitors, such as Taiwanese and Korean corporations, to search out their own market niches. Technological difficulties were encountered by most Taiwanese small firms. Faced with the rapid pace of techno-logical change and the short lifecycle of a PC model, strategic alliances among the government-funded Industrial Technology Research Institute and local firms successfully compensated for insufficient in-house research and development (R&D) investment. The booming growth in PC hardware production led Taiwan’s information industry to assume a new style of vertical integration.

A. Backward Integration

The role of a fast follower, which was what Taiwan adopted in the PC business prior to the 1990’s, rested heavily on modifying basic input/output system (BIOS) design to avoid possible infringements of IBM’s patent claims. By the late 1980’s, Taiwan’s PC industry was in a position of shortening its technical lag behind the leaders in the field. For instance, in November 1988, two local companies developed 32-bit PC’s only two months after Compaq introduced theirs. The overseas supply of key components, primarily from the United States and Japan, had come to pose a great threat to the upgrad-ing of Taiwan’s PC industry. By 1993, key semiconductor

components and devices had become the largest import item, superseding the position oil had occupied during the preceding four decades. To secure a steady supply of such components to fulfill enormous local demands, certain large companies invested in producing static and dynamic random-access-memory (DRAM) chips. They established application-specific integrated circuit (IC) design centers and plants manufacturing IC wafers. In 1993, technological gaps in making PC and key components between Taiwan and advanced countries, such as the United States and Japan, were nearly removed, and Taiwan progressed to become the world’s leading PC and peripherals manufacturer. This power in the technological field has been matched by Taiwan’s mushrooming patenting activities. From 1989 to 1994, Taiwan rose from eleventh to eighth place in the U.S. patent statistics in terms of patent quantity and quality [3]. Moreover, in 1995, Taiwanese information-related patents ranked in third place in the United States. In 1996, Acer, the largest PC producer in Taiwan, achieved the status of cross-licensing patents with IBM. Taiwan’s PC industry grew with the IC industry, where upgrading of IC manufacturing made the upstream supplies of PC components independent from foreign sources. PC growth further automated other traditional industries, for instance, textile and tool equipment, to a more competitive status.

B. Forward Integration

Apart from their technological virtuosity, Taiwanese PC enterprises have adopted a strategic role of original-equipment manufacturing (OEM) during the first decade of development. This has been due to the fact that manufacturing was their core competency and launching into international marketing and operations required a learning process. It was not uncommon for Taiwanese corporations to suffer severe losses in merg-ing or acquirmerg-ing foreign companies in an attempt to satisfy their technology demands in the shortest time. Nevertheless, awareness of international marketing and direct connections with customers have penetrated corporate decision making and have stimulated strong economic incentives for forward integration. Production activities have progressed from OEM to own-design manufacturing and further to own-brand man-ufacturing (OBM). Increasingly, PC companies are setting up

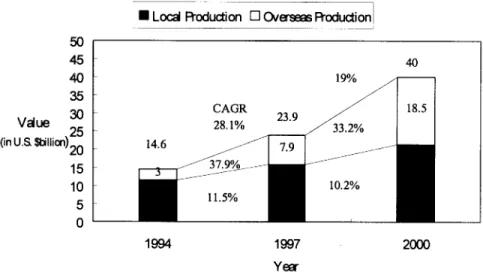

Fig. 2. Anticipated growth and production areas of Taiwan’s PC industry.

foreign branches or subsidiaries to learn and perform inter-national business operations. In the meantime, manufacturing and R&D remain in Taiwan, where the technology base is founded.

In summary, the rapid emergence of Taiwan’s PC industry occurred during 1986–1989. This industry grew nearly ten times, primarily by producing motherboards and monitors, in addition to the keyboards, power supplies, and scanners that were in mass production during 1980–1985. Between 1990 and 1992, the local PC industry faced a jolt when the global economy was in a depression. From 1993, Taiwanese firms learned to integrate vertically and to develop key components. In 1980, the production worth of the information industry was less than $100 million. In 1995, the production worth grew to $19.7 billion without regard to additional several billions in investment to foreign countries. The complex annual growth rate in the last decade was 24%, much higher than that globally. Many Taiwan-made PC products rank in first place in world production, such as monitors, motherboards, keyboards, graphics cards, and scanners.

Internationalization is an unavoidable process with which Taiwan must proceed to promote industrial growth. The Mar-ket Information Center of Taiwan’s Institute for Information Industry estimates that overseas production will compose approximately 40% of Taiwan-controlled information indus-try (Fig. 2). Furthermore, many of the computer peripherals of Taiwan’s PC industry are produced in Southeast Asian countries and China. For instance, in 1995, monitor and graphics-card manufacturing in overseas bases was almost equivalent to that in local plants, and keyboard and power supplies are primarily made in foreign countries.

This study now examines the human resource policy that Taiwan’s PC companies adopted to develop their international operations. Particular attention is paid to evaluating critical factors affecting corporate decisions and to identifying strate-gic patterns derived from accumulative hands-on experience. Factors such as types of industrial organization, transaction costs, and localization, on which the underlying themes of

internationalization theory rest, are culled by reviewing the literature and are assessed in the following pages.

II. INTERNATIONALIZATION: THEORIES AND ANALYTICAL FRAMEWORK

Theories of international operation or internationalization mushroomed in the late 1970’s and 1980’s. These diverse perspectives and observations fall into three main categories: 1) overseas extension of domestic advantages for foreseeable monopolistic or oligopolistic advantages in foreign markets, 2) economic incentives provided by foreign authorities, and 3) transaction costs of governing a foreign organization. Briefly, any competitive strategy or advantage of which a firm may boast, any preferential opportunity the international market-place may offer, and any strategic or operational costs the organizational governance may incur all serve as the founda-tions of internationalization theories.

Industrial organization theory [4] contends that internal-ization, or full control of international organinternal-ization, tends to reduce the transaction costs of preserving a firm’s own-ership advantage. Licensing, joint venture, and other forms of cooperation may be adopted at a cost of jeopardizing the confidentiality and uniqueness of competitive advantages [5]–[7]. Moreover, an enterprise faces the necessity of manag-ing across borders as international operations increase and the uncertainty of the foreign market decreases [8]. International operations of a domestic-based firm are stimulated by its advantage as a quasimonopoly in the foreign market. This status outweighs the disadvantages of operational costs in an uncertain environment. The comparative advantages and imperfect market structure overseas are the strategic motives of going abroad. The ownership advantages are further elab-orated and refined with more specific determinants, such as product differentiation, dominance of markets, administered pricing, managerial skills, financial capability, the economy scale of vertical and horizontal integration, and governmental intervention [9], [10].

of intermediate goods, supply led to a unified control of international subsidiaries. In other words, a fully controlled foreign affiliate can mitigate the risks and as such reduce the costs of acquiring intermediate goods for a company’s direct investment in a foreign country. The intermediate goods of a firm consist of the embodied industrial products, such as half-finished items and key components, as well as valuable intangibles of tacit and codified knowledge, e.g., know-how, trade secrets, patents, and marketing skills.

Internalizing the governance of an international organization is based on the notion of transaction cost economics [11]. The contractual arrangements of joint venturing and licensing with other companies may cause the diffusion of specific knowledge owned by a firm to unintended ends. As opposed to what may apply in a built partnership between two independent firms, fewer transaction costs, in terms of preserving the idiosyncratic assets that are critical for industrial competition, can be rationally expected for running a directly managed and monitored foreign subsidiary.

An eclectic paradigm was later promulgated that incor-porates most of the critical success factors of the proposed theories [12], [13]. This model attempts to postulate a com-prehensive model of internationalization, appending the local-ization theory or local factors of comparative advantages to the existing industrial organization and internalization theories. This internationalization paradigm associates with the concept of strategic planning in that consideration is made of the external environment (location factors), corporate capability (ownership advantages), and feasible strategic action (reduc-tion of transac(reduc-tion costs) to accomplish an analytical model.

As for managing the human resources of international subsidiaries, differing perspectives concerning management style in dissimilar places arise. On the one hand, there is the convergence notion, which assumes that discrepancies among different regions will be overcome by globalized eco-nomic and technological development conducive to a more unified management style. On the other hand is the diver-gence notion, which suggests to the contrary that management style must adjust and adapt to local conditions, recogniz-ing fundamental differences in historical backgrounds and cultures. The divergent perspective, sensitive to the current needs of global integration yet locally responsive, seems more acceptable to the modern concept of a global firm. The integration-responsiveness (IR) framework [14] delineates the strategic alternatives for managing competitive pressures in international markets. This model was applied to investigate commercial operations of international firms [15]. These two dimensions of the IR model, i.e., the global integration or compliance with headquarters’ policy versus local respon-siveness or the constraints of localization, construct strategic patterns of human resource policy of international subsidiaries, e.g., autonomous (multinational), receptive (global), or active (transactional) types. Further studies [16]–[18] conceptualize an enterprise as the organizational networks that connect parent companies and their geographically dispersed affiliates. The interorganizational linkage or dependency contributes to the formation of human resource strategy [19]. Two factors, the dependence on parent-company resources and the dependence

on host institutions, are accordingly incorporated into the following analysis of human resource strategy for overseas subsidiaries.

Evaluating an organization’s performance requires a mul-tifaceted undertaking, such as financial performance, oper-ational performance, and organizoper-ational effectiveness [20]. Each contains a few crucial determinants, such as the return on investment and sales growth to reflect financial perfor-mance; the market share, product quality, introduction of new products, and added value of products to assess operational performance; and the morale, rewards, and career prospects to measure organizational effectiveness. This study adopts five determinants to evaluate the performance of an overseas organ-ization. They are employees’ morale, satisfaction, and turnover rate as the subfactor of organizational effectiveness; and the market share and returns on investment as the subfactor of financial performance. Further aspects relating to employment, education and training, monitoring and auditing, salary and rewards, and the promotion of employees are also considered, along with the institutional determinants of personnel policy.

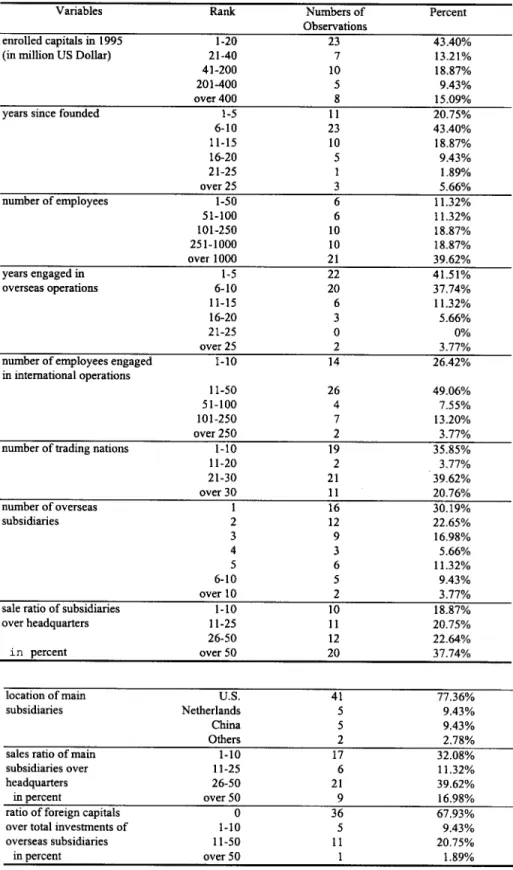

To distinguish those postulates hereafter, the variables in question are classified at three levels (Table I). Issues ad-dressed in the survey are termed “determinants”; the deter-minants that are of relevant contents are designated “sub-factors”; and the four major aspects of internationalization, i.e., ownership advantages, internalization, localization, and organizational dependence, represent the “factors.” As for the two generic concerns of internationalization—integration of a parent company and localization of foreign subsidiaries, representing respectively local compliance to headquarters’ global policy and responsiveness to local needs—these are hence termed the “dimensions.” Terminology is accorded consistent attention throughout this paper.

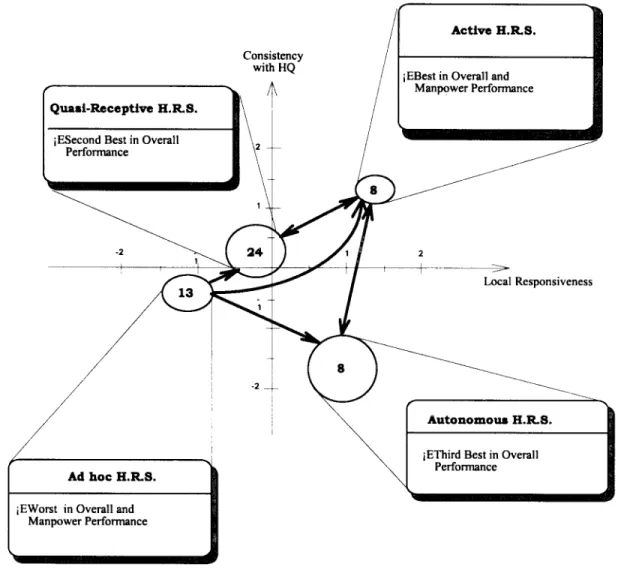

Four distinct patterns of human resources strategy are as-signed: autonomous, quasireceptive, active, and ad hoc. The averages and standard errors of the four are calculated and presented in Fig. 6.

III. EMPIRICAL FINDINGS AND NEEDS OF STATISTICAL JUSTIFICATION

According to developmental history and internationalization theories, Taiwan’s PC industry has entered a stage of global integration. Since the mid-1980’s, Taiwan has encountered increased labor wages, the emergence of environmental pro-tection issues, and growing political openness, as well as shortages of available land. Administrative inefficiency in the government has posed a further critical impediment to industrial growth. Moreover, the limitations of local markets (less than 4% of PC products in total were sold domestically) have constituted a major impetus for Taiwanese firms to export. The island’s small business sector is well known for its entrepreneurial networks. Internationalization for traditional labor-intensive industries is basically a question of pursuing low wages and raw materials in other locations. A considerable number of firms have moved to Southeast Asia and mainland China to begin a second career with their well-established production skills and technology. However, the information

TABLE I

VARIABLES ANDCONTENTS OF THE QUESTIONNAIRE

industry is not totally committed to sharing the same track with traditional enterprises. Although searching for comparative advantages, fundamentally the same for internationalization, the diverse requirements of core competencies among different industries call for a reexamination of the global management of the information industry.

As described in the preceding paragraphs, the commonly recognized process of internationalization follows a sequence of the domestic firm’s first engaging in pure exporting, then in licensing and franchising to foreign localities, and finally setting up the international entity. Taiwan’s PC industry is graduating from passive exporting to more active interna-tional operations through foreign subsidiaries. However, in comparison to most transnational information firms, Taiwanese enterprises primarily comprise relatively small businesses with limited economies of scale, and extending their international organization is mainly to economize the production scale and to gain more direct access to the markets, as well as to seek out comparative advantage in foreign locations. Under such circumstances, it is natural to identify the international

operations of Taiwan’s PC industry with a centrally controlled style of global management, in which the manufacturing capability of headquarters exercises a directing role through vertical integration. Following are issues that will be addressed by quantitative analyses.

1) What are the underlying reasons for Taiwan’s infor-mation industries to go overseas? Could it be to meet the needs of vertical integration for PC and peripherals manufacturing, or for the control of marketing channels, or both?

2) Would factors of ownership advantage, internalization, location, and organizational dependence have significant effects on the internationalization of Taiwan’s informa-tion industry and selecinforma-tion of overseas subsidiaries? 3) Do different patterns of human resource affect

perfor-mance of the overseas offices?

These issues are appraised by a set of quantitative analysis to evaluate the significance of the various factors and determi-nants, as well as to classify the surveyed sample into different

TABLE I (Continued.)

VARIABLES ANDCONTENTS OF THE QUESTIONNAIRE

patterns of human resource strategy. These patterns are then compared and evaluated for performance.

IV. QUANTITATIVEMETHODS AND DATAANALYSIS

Data were collected by mail survey, which consisted of a seven-part questionnaire containing 59 questions using a five-level Likert scale. All 112 PC firms registered for foreign investment with the ROC Ministry of Economic Affairs were surveyed. The effective sampling rate is 47.3%, which was represented by 53 firms. Table II lists the basic data and statistics for the sample. The data reveal that despite PC manu-facturing’s now constituting one of Taiwan’s major industries, most PC firms are of small size in terms of registered capital and workforce; are young companies with limited international experience; and most of their foreign branches are fully owned by Taiwan-based headquarters. The data also show that most of their overseas affiliations are sales and distribution offices in the United States and Europe. A small number have set up production bases in China and Southeast Asia.

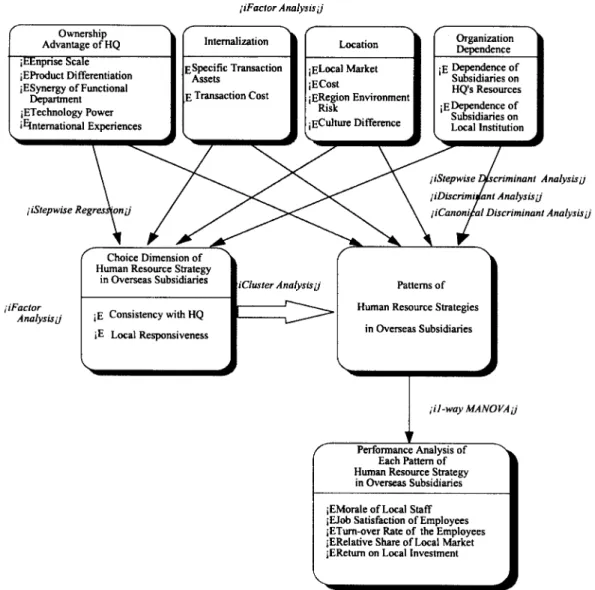

The nature of the interlinkages between human resource strategy and the four major factors, i.e., ownership advan-tages, internalization, local characteristics, and organizational dependence, plus the determinants present within those factors, are examined by five methods of statistical analysis. The organizational patterns are evaluated for performance as well as compared with multivariate statistics [21], [22]. Fig. 3 illustrates the analytical schemes and statistical tools employed along with the internationalization theories advanced.

Factor analysis attempts to verify the internal consistency of the determinants within each of the four major factors. To begin with, covariance test and measure of sampling adequacy are employed, followed by Bartlett’s sphericity test and Kaiser–Meyer–Olkin measurements. For each major factor, variables having a loading value higher than 0.7 with

consistent reliability by Cronbach’s alpha value are selected and grouped into a subfactor term before calculating the scores of subfactors for further application. Factor analysis is also applied to identify the consistent determinants of structural dimensions in the IR framework, i.e., consistent with a parent company and local responsiveness.

To analyze how the four factors influence the IR structural dimensions, a step-wise multiple regression method was used to evaluate significance levels. The linearity between indepen-dent and predicted variables, as well as the homogeneity of variance, independence, and normality of the residuals, are tested before conducting regression analysis.

Differentiating strategic human resource alternatives having IR structural dimensions is achieved by cluster analysis. Inte-gration and localization are taken as two coordinates to divide the samples into clusters. Variables used for cluster analysis are subfactors generated from the above-mentioned factor analysis and evaluated by regression method. The basis is the nearest centroid sorting method and the cubic clustering criterion [23] to establish the four most appropriate clusters (modes) of human resource strategy. Two independent coordinates of IR dimensions were formed and later employed to differentiate Taiwanese PC manufacturing firms by discriminant analysis. A further step is to apply multivariate analysis of variance as the significance test to distinguish the four clusters.

The discriminant analysis method facilitates grouping firms into different clusters. On the one hand, step-wise discriminant analysis assists in selecting the above-mentioned subfactor variables that contribute significantly to form the distinct modes. On the other, canonical discriminant analysis serves for differentiating the variables into the four modes having discriminant functions. Wilk’s lambda test provides the vehicle for assessing the significance of those discriminant functions. With respect to evaluating the performance of overseas

TABLE II

BASIC STATISTICS OFSURVEYEDSAMPLES

subsidiaries, this study proposes to elect again for multivariate analysis of variance (MANOVA). To begin with, one-way MANOVA is employed to test the level of significance among the four patterns. In doing so, the four patterns are viewed as independent variables, and the performance indexes are

employed as dependent variables through principal factor analysis. The performance variables are apportioned to two subsets, i.e., human resource performance and subjective fi-nancial performance. MANOVA provides a significance test of the four modes with two subsets of determinants, whereas the

Fig. 3. Theoretical framework and analytical schemes.

principal factors are presented from the sets of performance determinants.

V. CRITICAL FACTORS ANDSTRATEGICPATTERNS OF

HUMANRESOURCE MANAGEMENT: ANALYTICAL

RESULTS AND PRELIMINARY DISCUSSION

A. Factor Analysis for the Four Major Factors and IR Structural Dimensions

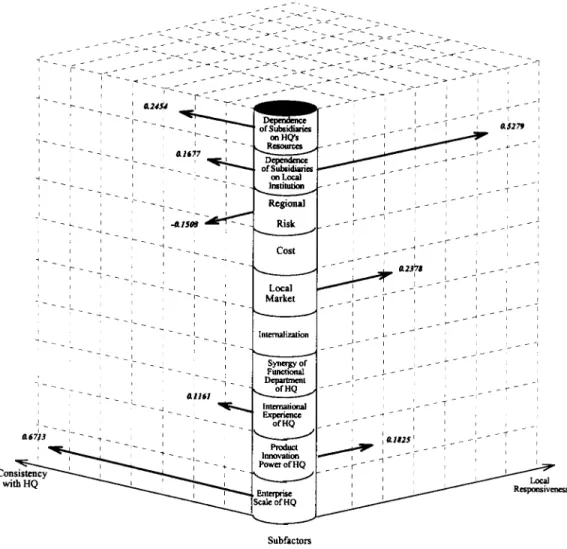

Factor analysis serves as a vehicle for reducing the vari-ables of each major factor. Being selected from the factor loading matrix, determinants of similar performance are cat-egorized into subfactors for each major factor, as applied to the two dimensions of the IR framework. The newly established subfactors differ from the original sets depicted in Table I. Whereas the original subfactors of Table I are singled out by summarizing the important variables out of the internationalization theories, the new sets of subfactors are derived from the statistical test for determinants of similar characteristics. They are, as presented in Fig. 4, the enterprise scale, product innovation, international experience, operational

efficiency of the parent company, internalization aspect due to the concerns of specific assets, resource and production costs of foreign locations, and foreign markets and regional risks, as well as the dependence of overseas subsidiaries on both headquarters’ resources and local institutions.

B. Step-Wise Multiple Regression of Subfactors on the IR Dimensions

Regression analysis yields the results of a significance test for predetermined independent variables that may have appreciable effects on dependent or predicted variables. As Fig. 4 indicates, the scale of the parent enterprise, its in-ternational experience, dependence on local institutions, and dependence on the headquarters’ resources all exert varying degrees of positive and significant influence on the integration dimension. Environmental risk of local business development, on the contrary, has appreciable negative impact on this di-mension. As regards the effects on the localization dimension, the product innovation capability of the parent firm, local market conditions, and dependence on the local institutions are considered critical in a statistical sense. Internalization

Fig. 4. Critical subfactors affecting the human resource strategy of overseas subsidiaries. Legends: 1) Values indicate the standardized regression coefficient ( ); the longer a corresponding line, the higher its absolute value. 2) Subfactors are generated after factor analysis.

of specific assets, as well as the synergistic performance of functional departments of the parent company, have not reached discernible levels of significance in terms of their influences on human resource decisions.

The subfactor of “dependence of subsidiaries on local institutions” exerts significant effects both on the dimension of headquarters’ control (consistency with headquarters) and on local responsiveness. It would appear a reasonable proposition that the more foreign local conditions affect a firm’s branch, the more it must make adjustments or respond to local needs accordingly. Conversely, once those foreign local conditions exercise increasing influence on the operations of an inter-national branch, the parent company tends to strengthen its control by any available measures [24]. Human resource policy is one of the effective tools commonly applied by headquarters to regain its control over affiliates [14].

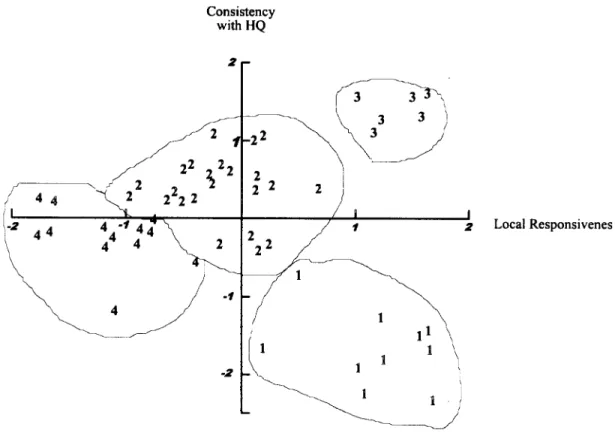

C. Cluster Analysis for Setting up Strategic Patterns of Human Resource on the IR Framework

Integration and localization are taken as two coordinates to divide the samples into clusters. Subfactors constructed from the factor analysis serve as the variables to distinguish

the human resource patterns in the cluster analysis. The use of cubic clustering criterion [23] discloses that the top score (2.563) is reached in the four clusters and confirms that four distinct strategic patterns of human resource are justified when all the critical subfactors and the two IR dimensions are taken into account. Moreover, one-way MANOVA analysis generates outcomes for both the integration and localization dimensions at a significance level of . The centroid of each cluster is not distantly away from those of the others. As indicated in Fig. 5, 53 samples are then allocated to these four patterns according to their average values estimated by this procedure.

Eight firms are included in the autonomous mode that exhibit a higher than average score in “consistency with head-quarters”; however, their score in “localization” is lower than the average. This is similar to the “autonomous” subsidiary as termed by Jarrillo and Martinez [15].

The second type—the most dominant one, consisting of 24 companies—is entitled “quasireceptive.” The quasireceptive pattern is one specially identified in this analysis. Its centroid is extremely close to the origin of the coordinates, although its direction toward the receptive pattern is still distinguishable. Such firms are generally more inclined to be affected by

Fig. 5. Distribution of sampled firms by discriminant analysis. Note: numerals in the figure indicate respective types of human resource strategy.

headquarters’ than by local demands.

The third type of human resource strategy is termed “ac-tive.” The eight companies belonging to this category exhibit higher than average scores than the averages in total for both IR dimensions.

The fourth type, comprising 13 firms, is termed ad-hoc [25] due to its being temporarily established to meet some short-term needs. The companies in this category neither demonstrate apparent consistency with headquarters’ policy nor are designed intentionally to cope with local demands.

D. Discriminant Analysis for Evaluating the Influence of Each Factor on the Four Distinct Modes

Following the cluster analysis that divides the 53 firms into four distinct patterns of human resource strategy, step-wise discriminant analysis employs the subfactors generated in the factor analysis as the criterion’s variables to test the level of significance that differentiates the four patterns (Fig. 5 and Table III). It generates three canonical discrim-inant functions at the level of significance of

and , respectively [Table III(a) and (b)]. The stan-dardized discriminant functions further serve the purposes of justifying the subfactors that significantly contribute to distinguishing the four human resource modes. Headquar-ters’ product innovation capability, enterprise scale, local markets, and dependence of subsidiaries on local institu-tions are all critical in forming the various strategic patterns of human resource in a distinct manner [Table III(c)]. The overall discriminant ratio enumerated equals to 73.58%. The

significance tests of the three canonical discriminant func-tions demonstrate that these selected subfactors are capa-ble of distinguishing one type from another. For instance, the first canonical function [CAN 1 of Table III(b) and (c)] can separate the autonomous mode from the active mode [Table III(b)], where the latter features a larger headquar-ters’ enterprise scale, smaller influence of local markets, and higher dependence of overseas subsidiaries on local institu-tions [Table III(c)].

In addition to differentiating the firms into four patterns of human resource strategy, an inference is also made regarding the dynamic transitions among the patterns. By incorporat-ing Table III(b) and (c), the interrelationships between the critical subfactors and the strategic patterns are depicted in Table III(d). There, the external forces of localized demands and internal forces of strengthened headquarters’ control may cause drifts or shifts between the human resource policies from one to another, a dynamic picture in which the transformation of human resource strategy may be drawn. Initially, the ad hoc type is dominant when a firm lacks the ownership advantages and is unable to make the best use of foreign local factors, or even to take exploratory steps of trial and error in constructing its foreign base. As the firm’s competitive advantages and the foreign influences on its subsidiary increase, the manpower policy of the firm may evolve from a passive mode in any one of various directions, depending on the source and extent of the driving force. If local institutions exert an increasingly significant impact on a foreign company, the human resource policy of the subsidiary may shift from the quasireceptive toward the active mode, or even from

Fig. 6. Patterns of human resource strategy. Legends: 1) Figures in the circles delineate the number of surveyed firms. The centers indicate locations of the average values and the radii represent the magnitudes of standard errors, respectively. 2) Dark arrow lines indicate transformations among respective human resource types.

the active toward the autonomous mode. Nevertheless, the growing competitive advantages of ownership for a parent company may lead to a more active manpower policy, a direction in which the autonomous, quasireceptive, and ad hoc patterns tend to migrate. The transformation from active to autonomous is caused by the pronounced responses to local conditions. The transformation from active to quasireceptive, on the contrary, could result from the enhanced control of the parent company, seeking to cope with enhanced competition in foreign markets.

E. MANOVA for Evaluating the Performance of Different Human Resource Modes

The MANOVA provides a method of comparing per-formances among the four patterns. It demonstrates no significant difference at the level of for overall performance evaluation. Restated, significant differences exist among the four patterns when both personnel (manpower) and financial evaluations are taken into account. Further

tests indicate that the discrepancies arise from the manpower performance among the various modes of human resources strategy. The difference in financial performance among the four patterns does not reach the significance level of

.

The active mode yields the optimal performance for overall evaluation and manpower performance, whereas the ad hoc mode achieves the worst for both manpower and financial evaluation. Accordingly, the latter’s overall performance also ranks last among the four patterns. the autonomous and quasireceptive do not significantly differ in terms of over-all and manpower performance, although the quasireceptive performs slightly better.

In summary, the overall performance of the human resource strategy ranks in the following order: active, quasireceptive, autonomous, and ad hoc. The gaps are primarily generated from their manpower evaluation rather than their financial assessments.

TABLE III

STATISTICALRESULTS OFDISCRIMINANTANALYSIS. (a) SIGNIFICANCETEST OFDISCRIMINANTFUNCTIONS. (b) CLASSMEANS ONCANONICALVARIABLES. (c) POOLEDWITHINCANONICALSTRUCTURE. (d) SUBFACTORS THATAFFECT THEHUMANRESOURCESTRATEGY OFOVERSEASSUBSIDIARY

(a)

(b)

(c)

Subfactor Autonomous Quasi-Receptive Active Ad-hoc

Product Innovation of HQ 0 + 0 Enterprise Scale of HQ 0 + 0 Local Market + + + 0 0 Dependence of Subsidiaries on Local Institutions + + + 0 0

Note: 1. only subfactors of F-ratio > 1 are incorporated. 2.+: positive correlation; 0: negative correlation

(d)

VI. INTERNATIONAL VALUE

ACTIVITIES IN GLOBAL PC INDUSTRY

Globalization of PC production and marketing divides this industry into a few sectors of a value chain. They are 1) mass production of components, parts, and assembly; 2) global management of localized configuration, distri-bution, and assembly in remote markets; and 3) control of sales and service channels in local markets. Among them, Taiwan and Asian nations in general dominate mass production of components and assembly, and Taiwan’s large PC firms share configuration and distribution in remote markets with foreign joint venture. A PC will gradually become a family appliance in the foreseeable future, while commercial applications have dominated in recent decades.

The marketing and sales channels are affected by the following.

1) PC corporations with brand names—e.g., IBM, Ap-ple, and NEC—configure their products from various sources.

2) Global distribution channels and remote market assem-bly are gradually taken by major firms of consumer electronics and on-site competitors, respectively. 3) PC market for family use grows more rapidly than the

traditional market for commercial application.

4) Profit margins for high-end technology, i.e., production of critical key components, as well as the network service for PC purchasing, are much higher than for mass production and assembly of PC and peripherals.

PC’s are essentially a standard product, and the global com-petition results in an apparent international division of labor for this industry.

VII. CORE COMPETENCY OFTAIWAN’SPC INDUSTRY

Taiwan’s PC production heavily relies on manufacturing capability with entrepreneurial flexibility in response and efficiency in time to the markets. Generally speaking, high added values of the PC industry concentrate more on the key component production and marketing channels management rather than PC assembly and IC design. Development of Tai-wan’s PC industry has focused predominantly in engineering technology and mass-production management. Skilled on-site engineers and sophisticated technological infrastructures have promoted the PC industry rapidly from an assembly-dominated status to a supplier of key components. However, the drastic change in marketing channels and technological challenge in producing critical components in the world have exerted a significant impact on Taiwan’s industry. Marketing management faces a revolutionary restructuring that distri-bution channels tend to concentrate in large wholesale and retail stores as well as networked chain stores to substi-tute traditional computer shops, in which the quality, costs, variety, and timing to supply the computers undergo effi-cient control and reach the competitive advantage of cost leadership. As for the critical components, such as thin-film-transistor liquid crystal displays, DRAM, and large-sized monitors, many local and foreign (such as Japanese and U.S.) IC and PC firms are establishing their production plants in Taiwan’s Science Park. The following phenomena indicate the competition era and Taiwan’s challenges for future develop-ment.

1) Manufacturing capability has been the core competency of Taiwan’s PC and IC industries. Nevertheless, the profitability of this activity in the value chain of PC industries is falling significantly behind the marketing control and key components production. Taiwan must move toward distributing OBM products in the foreign markets or supplying the key components.

2) Distribution channels in international markets undergo revolutionary change and local service, and family use become one of the marketing mainstreams. Taiwan ex-cels over other competitors in technological and manu-facturing expertise rather than in international business management.

3) Taiwan’s corporations are relatively smaller than major international competitors. The Acer group, Taiwan’s largest PC corporation, ranks sixth in the global infor-mation industry. Compaq, IBM, Apple, Packard Bell, and NEC all lead Acer in terms of PC production in quantity. In 1995, their production outputs were 5700 K (where K stands for thousand), 4800 K, 4600 K, 3000 K, 2800 K, and 2100 K, respectively, with Hewlett Packard (2000 K) and Dell (1800 K) following. Enhanced industrial concentration ratio demonstrates that the global competition of PC industry heavily relies on scale economy and production efficiency. It is not

considered an advantage to Taiwan’s PC firms that most of them are small and medium businesses on a relative basis.

4) The formation of economic consortia or unions, such as the European Union and the North American Free Trade Agreement, constructs hurdles for international compe-tition and encourages internationalization of domestic firms to overcome the artificial barriers.

5) The rising of Southeast Asian nations and China with lower labor wages and ample production bases poses threats of comparative advantages to Taiwan’s manufacturing-based capability.

VIII. TOWARD MOREACTIVE AND DIVERSIFIED

DIRECTIONS: DISCUSSION AND CONCLUSION

This study provides a set of quantitative and qualitative analyses and yields a strategic algorithm of global expansion for Taiwan’s PC industry. An extensive literature review is undertaken for the theoretical framework of international business. The following findings characterize the globalization of Taiwanese PC corporate sector. While in certain respects they deviate from the established Western model of interna-tionalization to an appreciable extent, the Taiwan model may facilitate a modified paradigm of the dynamic globalization process for smaller firms to compete against large international companies.

1) The majority of Taiwan’s PC manufacturing firms are young and small-sized companies. Many of them have been in existence for less than ten years and are still in a learning process of conducting overseas business. Cautious initial investment and strong links with head-quarters’ policy characterize their internationalization strategy.

2) Overseas subsidiaries are largely extensions of manufacturing-based local headquarters. Taiwanese PC firms establish production plants in Southeast Asian nations and mainland China and institute marketing and sales offices as well as on-site assembly in near market regions. This explains why quasireceptive modes of human resource strategy so dominate in data analysis. Companies of product band names (OBM) often form joint ventures with foreign companies to overcome the barriers that result from protectionism, financial risks, and unfamiliarity of overseas circumstances. This strategy leads to autonomous personnel policy. The underlying reasons for setting up a branch office or a subsidiary have to do with marketing and sales, or local assembly of standard components, and taking comparative advantage of local production factors. The transaction cost of establishing a totally headquarters-controlled overseas branch is much higher than that of instituting a foreign organization jointly ventured with a local company. The competitive advantages of manufacturing and the managerial expertise of Taiwan’s information industry extend forward to control their marketing channels more directly now than

previously. Integration of advanced technology and local production of key components is an emerging competitive competence of Taiwanese enterprise. The overseas offices are predominantly promoting marketing missions and producing labor-intensive products. 3) This empirical study presents a dynamic model of

in-ternational operations for small firms or industries in developing or newly developed countries. The ad hoc and receptive types of organizations gradually evolve into more active or autonomous patterns along with the increase of local activities and responsiveness. This trend indicates that internationalization of Taiwan’s in-formation industry is in a sequential development of exporting and alliances, where the former activity com-prises setting up foreign production bases and the latter results from resource requirements and risk sharing of overseas operations. Furthermore, strategic patterns of human resource reflect internationalization proce-dure status. Ownership advantage or core competency of hardware manufacturing lead to the quasireceptive mode, where control is enhanced, and high resource commitment of international operations result in the autonomous mode, where alliances are undertaken. A corporation may concurrently perform various strategies in different areas and businesses that primarily depend on its ownership advantage and encountered competi-tion.

The propensity to move from the passive modes of ad hoc and receptive to more active overseas subsidiaries, as demonstrated in this study, illustrates that in addition to promoting overseas marketing and production bases while exercising strong control from domestic headquarters, Tai-wanese firms are responding more to global networks with an increase of localized value activities in foreign countries. The Taiwanese experience reflects that the paradigm of in-ternational business development is facing a challenge as a result of emerging newly industrialized countries enterprises and industrial competition in a borderless global village. Internationalization is no longer a static phenomenon or a competitive advantage of industrialized nations only. Compar-ative advantage, which implies the differentiation or division of labor, raw material supply, and production and market structures in different nations or regions, has enormously enlarged its content and meaning. Adhering to the world-wide rapid market and technological change, the interlinkage among the parent firms and their affiliates must attain dynamic equilibrium and make constant adjustments. Conventional expositions of international enterprises with static destination, such as global, transnational, or multinational companies, all of which oversimplify the function and performance of various organizations, may no longer be appropriate to describe an international firm.

REFERENCES

[1] Chung-Hua Institution for Economic Research, Technology Support Institutions and Policy Priorities for Industrial Development in Taiwan.

Taipei, Taiwan: CIER, 1995.

[2] C.-Y. Huang, Taiwan: Republic of Computers (in Chinese). Common-wealth Publishing, 1995.

[3] National Science Council, Indicators of Science and Technology. Taipei, Taiwan: National Science Council, 1995.

[4] S. Hymer, The International Operations of National Firms: A Study of

Direct Foreign Investment. Cambridge, MA: MIT Press, 1976. [5] P. J. Buckley and M. Casson, The Economic Theory of the Multinational

Enterprise, 1st ed. New York: St. Martin’s, 1985, pp. 1–38. [6] C.-H. Chen, “Taiwan’s foreign direct investment,” J. World Trade Law,

vol. 20, pp. 639–664, Nov.–Dec. 1986.

[7] O. E. Williamson, Markets and Hierarchies: Analysis and Antitrust

Implications. New York: Free Press, 1983.

[8] C. A. Bartlett and S. Ghoshal, “Managing across borders: New strategic requirements,” Sloan Manage. Rev., vol. 28, pp. 7–17, Summer 1987. [9] P. J. Buckley, “The limits of explanation: Testing the internalization

theory of the multinational enterprise,” J. Int. Bus. Studies, pp. 181–193, Summer 1988.

[10] S. H. Robock, K. Simmonds, and J. Zwick, International Business

and Multinational Enterprises, rev. Homewood, IL: Irwin, 1977, pp. 40–41.

[11] O. E. Williamson, “Transaction-cost economics: The governance of contractual relations,” J. Law Econ., vol. 22, pp. 233–261, 1979. [12] J. H. Dunning, Multinational Enterprises and the Global Economy, 1st

ed. Reading, MA: Addison-Wesley, 1992, pp. 54–95.

[13] J. H. Dunning, “The eclectic paradigm of international production: A restatement and some possible extensions,” J. Int. Bus. Studies, pp.

1–25, Spring 1988.

[14] C. K. Prahalad and Y. Doz, “An approach to strategic control in MNC’s,” Sloan Manage. Rev., pp. 5–13, Summer 1981.

[15] J. C. Jarillo and J. I. Martinez, “Different roles for subsidiaries: The case of multinational corporations in Spain,” Strategic Manage. J., vol. 11, pp. 501–512, 1990.

[16] C. A. Bartlett and S. Ghoshal, Managing Across Borders: The

Transna-tional Solution. Boston, MA: Harvard Business School Press, 1989. [17] D. A. Heenan and H. V. Perlmutter, Multinational Organization

Devel-opment. Reading, MA: Addison-Wesley, 1979, pp. 18–19.

[18] S. Ghoshal and C. A. Bartlett, “The multinational corporation as an interorganizational network,” Acad. Manage. Rev., vol. 15, pp. 603–625, 1990.

[19] J. I. Martinez and J. C. Jarillo, “Coordination demands of international strategies,” J. Int. Bus. Studies, pp. 429–444, 3rd quarter 1991. [20] N. Venkatraman and V. Ramanunjam, “Measurement of business

per-formance on strategy research: A comparison of approaches,” Acad.

Manage. Rev., vol. 11, no. 4, pp. 801–814, 1986.

[21] J. Stevens, Applied Multivariate Statistics for the Social Sciences, 2nd ed. Hillsdale, NJ: LEA Publishers, 1992.

[22] SAS Procedures Guide: Release 6.03 Edition. Cary, NC: SAS Institute, 1991.

[23] W. S. Sarle, “The cubic clustering criterion,” SAS Institute, Cary, NC, SAS Tech. Rep. A-108, 1983.

[24] D. Cray, “Control and coordination in multinational corporations,” J.

Int. Bus. Studies, pp. 85–98, Fall 1984.

[25] J. V. Sheth and G. S. Eshghi, Global Human Resources Perspectives. New York: South Western Co., 1989.

Shang-Jyh Liu received the B.Sc., M.Sc., and L.L.B. degrees from National Taiwan University, Taiwan, R.O.C., and the Ph.D. degree from the Industrial Engineering Department, Texas A&M University, College Station, in 1984.

He was a Research Engineer and Project Manager with the Chung-Shan Institute of Science and Technology under the Department of Defense of Taiwan, R.O.C., for approximately seven years. He currently is a Professor of technology management and intellectual property rights at the National Chiao Tung University (NCTU), Taiwan. His research interests include high-technology industry competition, technological and managerial innovation, and intellectual property management. Some of his work has been published in the International Journal of Technology Management, Sun Yat-Sen

Management Review, and Taiwan University Law Review. He is a former

Director of the Graduate Institute of Management of Technology and currently is Director of the Legal Center for Enterprise and Entrepreneurship at NCTU.

Ti-Lun Huang received the B.Sc. degree in computer and information science and the M.B.A. degree in management of technology from National Chiao Tung University, Taiwan, R.O.C., in 1993 and 1996, respectively.

She currently is a Project Specialist with Chailease Co., Ltd., Taiwan, where she is involved in leasing and installment finance, as well as factoring and international investments.

As a student, Ms. Huang received many distinguished awards and scholarships from the university and industry. Her master’s thesis also won the first prize of Taiwan’s national M.B.A. thesis awards in human resource management.

Quang-Hua Chen received the M.B.A. degree from Utah State University, Logan, in 1973 and the M.Sc. degree in international business from George Washington University, Washington, DC, in 1982.

He currently is a Professor of management at National Chiao Tung University (NCTU), Taiwan, R.O.C. His research interests primarily focus on industrial policy, marketing, and transportation re-search. Since 1984, he has taken several executive positions in governmental agencies as well as civil foundations to promote the development of national shipping fleets and international cooperation of shipping industry. He is a former Director of the Department of Transportation Engineering and Management of NCTU. He currently is Deputy Sectary General of the Association of Shipping Services, R.O.C.