Transfers, Trade Taxes, and Endogenous Capital Flows:

With Evidence from Sub-Saharan Africa

Subhayu Bandyopadhyay*

Department of Economics, West Virginia University, U.S.A. Jonathan Munemo

World Bank, U.S.A.

Abstract

Sub-Saharan Africa (SSA) is highly dependent on imported capital goods that are used in the import competing industrialized sector. The exporting sector focuses on primary products where land and labor are predominantly used. We build a two-good general equilibrium model, where the import competing sector uses imported capital input. Transfers induce changes in commodity terms of trade, which in turn affects capital inflows and the price of imported capital. The welfare effect of transfers is considered in the context of induced changes in these variables. In the context of an exogenous export tax, we find that endogenous capital flows aggravate the transfer problem that exists under trade taxation. When trade liberalization is tied to transfers, we find that the tying of aid may worsen or alleviate the transfer problem, depending on how the existing export tax compares with the optimum. We complement our theoretical analysis with an empirical analysis of the transfer problem in the context of endogenous capital inflows. This is done by estimating a regression model with fixed effects for a panel of 14 countries in SSA. Our findings substantiate the concerns raised by the theoretical analysis.

Key words: transfers; trade taxes; endogenous capital flows; welfare JEL classification: F1; O1

1. Introduction

Multilateral resource flows to Sub-Saharan Africa (SSA) are the most important source of external finance that supports policy reforms. The objective of these policy reforms is to achieve sustained growth in per capita income that would provide much needed welfare gains. The issue of whether or not international transfers can change welfare was at the center of the debate between Keynes (1929)

Received July 14, 2005, revised May 12, 2006, accepted June 19, 2006.

*Correspondence to: Department of Economics, P.O. Box 6025, B & E Building, West Virginia

University, Morgantown, WV 26506-6025, U.S.A. E-mail: bandysub@mail.wvu.edu. The views expressed here are those of the authors and should not be attributed to the World Bank.

and Ohlin (1929) on German reparation payments after World War I. It became clear that international transfers could have price effects that may paradoxically affect recipient welfare. Samuelson (1947) showed that in a competitive, two-good, two-country, and distortion-free general equilibrium model that assumes market stability, the recipient gains and the donor loses from international transfers. Later contributions of Bhagwati et al. (1983), Kemp and Kojima (1985), Schweingerger (1990), and Kemp (1995) among others show that recipient immiserization is possible if one departs from the context of Samuelson (1947).

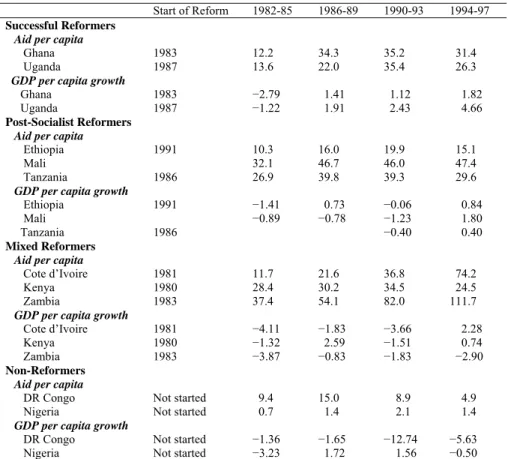

The fact that policy reforms in SSA seek to create competitive markets and get rid of distortions (among other things) means that until such reforms have been successfully implemented, multilateral transfers may not improve welfare. In addition, the fact that multilateral aid is often tied to policy reform measures such as liberalization, stabilization, and privatization raises the possibility of recipient immiserization based on the arguments advanced by Kemp and Kojima (1985) and others. Could these be some of the reasons why SSA has still not seen growth in per capita income despite more than two decades of reforms? Our paper addresses this question. We should note that a World Bank (2001) study on aid and reform in SSA classifies 10 countries into four groups: successful reformers, post-socialist reformers, mixed reformers, and non-reformers. Table 1 shows that most of the aid was given to the successful reformers, post-socialist reformers, and mixed reformers. It also shows that with the exception of Uganda, GDP per capita did not improve for other countries in these three groups just as it did not improve for the non-reforming countries. Group categories therefore do not tell us much about economic performance. Different starting points of reform and hence different durations of reform (see Table 1) could be important in explaining differences in GDP per capita growth.

A crucial structural factor that affects the performance of SSA that has not been explicitly considered by the literature in this area is that investment and production are highly dependent on imported capital goods such as machinery and transport equipment. Country studies by Wangwe (1983), Green and Kadhani (1986), and Davies and Rattso (1993) report a high degree of import dependency. Sub-Sahara-wide studies by Moran (1989) and Ndulu (1991) also find a high degree of import dependency. The study by Ndulu (1991) finds that the ratio of capital goods imports to investment for the whole of SSA has been stable at around 36%. This translates to very high ratios at the country level. For example, Green and Kadhani (1986) find that the ratio of capital goods imports to investment ranges between 65-75% for the manufacturing sector in Zimbabwe.

We present a general equilibrium model to capture this stylized feature of an SSA nation. We build a two-good general equilibrium model, where the import competing sector uses imported capital input. Transfers induce changes in commodity terms of trade, which in turn affects capital inflows and the price of imported capital. The welfare effect of transfers is considered in the context of induced changes in these variables.

Table 1. Aid Per Capita (U.S. dollars) and GDP Per Capita Growth (%) for Selected Countries in SSA, 1982-97

Start of Reform 1982-85 1986-89 1990-93 1994-97 Successful Reformers

Aid per capita

Ghana 1983 12.2 34.3 35.2 31.4 Uganda 1987 13.6 22.0 35.4 26.3

GDP per capita growth

Ghana 1983 −2.79 1.41 1.12 1.82 Uganda 1987 −1.22 1.91 2.43 4.66 Post-Socialist Reformers

Aid per capita

Ethiopia 1991 10.3 16.0 19.9 15.1

Mali 32.1 46.7 46.0 47.4

Tanzania 1986 26.9 39.8 39.3 29.6

GDP per capita growth

Ethiopia 1991 −1.41 0.73 −0.06 0.84 Mali −0.89 −0.78 −1.23 1.80

Tanzania 1986 −0.40 0.40

Mixed Reformers

Aid per capita

Cote d’Ivoire 1981 11.7 21.6 36.8 74.2 Kenya 1980 28.4 30.2 34.5 24.5 Zambia 1983 37.4 54.1 82.0 111.7

GDP per capita growth

Cote d’Ivoire 1981 −4.11 −1.83 −3.66 2.28 Kenya 1980 −1.32 2.59 −1.51 0.74 Zambia 1983 −3.87 −0.83 −1.83 −2.90 Non-Reformers

Aid per capita

DR Congo Not started 9.4 15.0 8.9 4.9 Nigeria Not started 0.7 1.4 2.1 1.4

GDP per capita growth

DR Congo Not started −1.36 −1.65 −12.74 −5.63 Nigeria Not started −3.23 1.72 1.56 −0.50 Notes: Data on aid per capita is from World Bank (2001). GDP per capita growth figures are from World Development Indicators, World Bank (2002).

The export sector produces a primary commodity using labor and land. An export tax is in place. We already know from Brecher and Bhagwati (1982) that in the presence of trade taxes, transfers may be recipient immiserizing. We show that endogenous capital inflows induced by such transfers may aggravate this transfer problem. When a transfer worsens the terms of trade, it expands the import competing sector. As in Brecher and Bhagwati (1982), this leads to a misallocation of resources by contracting trade further compared to the free trade outcome. In addition, the expansion of the import competing sector raises the demand for capital and its rate of return. More is paid to foreign capital which is a terms of trade loss in the factor market. In response to the higher return on capital, inflows occur, further expanding the import competing sector. Thus, both the value effect (higher price of imported capital) and the volume effect (greater inflow of capital) tend to reduce the welfare of the SSA nation. Finally, if the transfer is tied to liberalization of trade, then if the existing export tax is below its optimal level, an additional loss may be

incurred. The theoretical model is presented in Section 2. Section 3 complements the theory with empirical analysis. Section 4 concludes.

2. The Theory: Transfers, Taxes, and Endogenous Capital Flows

Let there be two nations, A (developing, aid-receiving nation) and B (developed, donor nation). They produce goods 1 and 2 using constant returns to scale (CRS) technology. Good 1 is a primary commodity (like cocoa) and is produced using labor and land. Good 2 is a manufactured product and uses labor and capital in production. We assume it to be the numeraire good. A exports good 1 to B and imports good 2 from it. Also, A imports physical capital (i.e., I

K in equation (2)

below) from B for use in the import competing sector (i.e., good 2). Suppose B gives a transfer to A of an amount T . The effect of this transfer on A’s terms of trade (i.e., p, the international price of good 1) and its welfare is considered below. Let t be

the ad valorem export tax on good 1 imposed by A. Let A

K and K be the capital B

endowments of nations A and B, respectively. We assume that the utility levels of A and B are A

U and UB , respectively. These reflect the utility levels of a

representative consumer for the respective nations.

We present a dual trade model along the lines of Dixit and Norman (1980). The expenditure function of A is represented by A{ (1 ),1, A}

E p −t U . Similarly, B’s

expenditure function is B( ,1, B)

E p U because B is assumed not to use a trade tax.

Under CRS and competitive profit-maximizing conditions, A’s national income can be represented by its revenue function A{ (1 ),1, A I}

R p −t K +K , which is a function

of its domestic prices and the factor endowment vector. Similarly, B’s national income is represented by its revenue function B( ,1, B I)

R p K −K . Using the

envelope properties of these functions, we note that the first partial of the expenditure function of nation j with respect to its domestic price of good 1 yields

its Hicksian demand for the good. Similarly, the partial of nation j’s revenue

function with respect to the price of good 1 is its supply function of the good. In addition, the partial of the revenue functions with respect to the respective endowment vectors yields the respective factor reward vectors. We will use the convention that for any function f( )⋅ , fi( )⋅ is the partial derivative of the function

with respect to the ith argument. Similarly, ( )fij ⋅ is the partial derivative of the

function ( )fi ⋅ with respect to the j th argument.

Relation (1) below is the requirement that at a trading equilibrium a nation’s expenditure must equal the sum of its production revenues (at domestic prices), tariff revenues, and transfer receipts minus the (net) payments on foreign investments. Alternately, (1) can be reduced to the trade balance condition for nation A. Similarly, B’s expenditure-revenue identity is presented in (2):

{

(1 ),1,}

{

(1 ),1,}

( 1 1 ) 3 A A A A I A A A I E p −t U =R p −t K +K +tp R −E + −T R K (1) 3 ( ,1, ) ( ,1, ) B B B B I A I E p U =R p K −K − +T R K . (2)Capital is imported by A from B until the rewards for capital in the two nations are equalized. Therefore:

{

}

3 (1 ),1, 3( ,1, )

A A I B B I

R p −t K +K =R p K −K . (3)

The market clearing equation for good 1 is:

{

}

1 (1 ),1, 1 ( ,1, ) A A B B E p −t U +E p U{

}

1 (1 ),1, 1 ( ,1, ) A A I B B I R p t K K R p K K = − + + − . (4)Equations (1) through (4) determine A

U , U , p , and B K as functions of the export I

tax (i.e., t ) and the transfer level (i.e., T ). For simplicity, we solve the model recursively in the following manner. Relations (1), (2), and (3) implicitly define (5), (6), and (7) below, respectively:

( , , , ) A A I U =U p t K T (5) ( , , , ) B B I U =U p t K T (6) ( , ) I I K =K p t . (7)

Using (5), (6), and (7) in (4) we have:

{

}

{

}

1 (1 ),1, ( ) 1 ,1, ( ) A A B B E p −t U ⋅ +E p U ⋅{

}

{

}

1 (1 ),1, ( ) 1 ,1, ( ) A A I B B I R p t K K R p K K = − + ⋅ + − ⋅ . (8) Relation (8) defines: ( , ) p=p t T . (9)From (9) we obtain the terms of trade p as a function of the exogenous variables (i.e., t and T). Substituting for p , we solve for I

K from (7). Finally, we can solve

for A

U and B

U from (5) and (6), respectively. Differentiating (5) we have:

1 2 3 4

A A A A I A

dU =U dp U dt U dK+ + +U dT. (10)

It is useful to discuss the components of the right hand side of (10). Note that:

1 ( 1 1 ) (1 )( 11 11) 31(1 ) 0 A A A A A I A A U =⎡⎣ R −E +tp −t R −E −K R −t ⎤⎦ D > 3 13 0 A A A D =E +tpE > . (11)

For simplicity, consider a fall in price of good 1 (i.e., a fall in p ). The first term on the right hand side of the first equation in (11) is the utility loss from exporting the existing level of exports at a lower price. The second term measures the losses in tax

revenue from the reduction of exports (in response to declining export price). The last term depends on the effect of p on the price of capital. Note that good 1 is made by labor and land and good 2 by labor and capital. A fall in the price of good 1 will contract that sector and expand sector 2. The demand for capital will rise and so will its rate of return. Therefore a fall in p will raise the price of capital imports and cause a welfare loss through this third term. The direct effect of the export tax on

A U (i.e., 2A U ) is negative:

{

}

2 ( 11 11) 31 0 A A A I A A U = p tp E −R +K R D < . (12)A rise in the export tax (for a given p ) causes the usual production and consumption distortions by reducing the domestic price of good 1 and also leads to a rise in the return to capital. The latter effect compounds the costs of export taxation. The direct effect of capital imports is measured by:

3 ( 31 33)

A A I A A

U = tpR −K R D . (13)

This effect is ambiguous. A capital inflow reduces the production of good 1, aggravating the existing trade distortion. On the other hand, the fall in return to capital (due to the inflow) reduces the payment on foreign capital and is welfare enhancing. Finally, the direct effect of a transfer (for a given p , t , and I

K ) is

positive:

4 1

A A

U = D . (14)

Noting that p and I

K are endogenous, we use (7), (9), and (10) to obtain:

1 2 4 ( ) ( ) A A dU = αp +β dt+ αp +U dT, (15) where 1 3 1 A A I U U K α = + and 2 3 2 A A I U U K

β = + . If t is exogenous, (15) reduces to:

1 3 1 2 4

( )

A A A I A

dU dT= U +U K p +U . (16)

The first term on the right hand side of (16) reflects the terms of trade effect of the transfer. The change in terms of trade is:

{

}

2 ( 13 ) ( 13 ) A A B B p = E D − E D MLC, 3 B B D =E , (17)where MLC is the slope of the global excess supply function and is positive to ensure stability. We assume that the marginal propensity to consume the primary commodity is higher in B compared to A. This is generally true for primary product exporting nations. For example, cocoa producing nations consume very little cocoa and the market lies mostly in developed nations. Using (17) we can inspect (16) and find that the sign of the welfare effect is ambiguous. The standard two-country transfer problem has been compounded by two factors. First, an exogenous

distortion in the form of an export tax is present. Second, a capital inflow occurs in response to the terms of trade change and this in turn affects welfare. To throw further light on this problem, we reduce (16) to:

{

( 1 ) 2 1}

3 1{

31(1 ) )}

2A A A A A I I A A

dU dT=⎣⎡ Exp +θ p + D ⎦ ⎣⎤ ⎡+ U K − K R −t D ⎤⎦p . (18)

The first term on the right hand side of (18) is the standard welfare effect of a transfer in the presence of a fixed export tax. Brecher and Bhagwati (1982) show that in the presence of import tariffs, transfers can be immiserizing if they lead to an expansion of the protected sector. In a related context, Bandyopadhyay and Majumdar (2004) analyze a three-country export taxation model and find a similar result. The second term is the effect of the endogenous capital flows and can be shown to be strictly negative. This effect aggravates the transfer problem that exists under trade taxation.

Let us explore in greater detail how the endogenous capital inflows reduce welfare. There are three distinct effects to be considered. First, the rise in the return to capital (due to a fall in p ) is an adverse terms of trade effect (for a capital-importing nation) in the factor market and is welfare reducing. Next, there is a second-order effect of the induced capital inflow. It reduces the return on capital and this is welfare augmenting. Finally, the inflow of capital expands the protected sector and aggravates the trade distortion. The first and third effects dominate, and therefore the capital inflow is welfare reducing.

Often donor nations or agencies tie the provision of aid to liberalization of trade. This may be captured in our model through a negative relation between t and T .

We can reduce (15) to:

1 2 4

( )( ) ( )

A A

dU dT= αp +β dt dT + αp +U . (19)

The first term on the right hand side reflects the standard welfare effect of a trade tax. The term α measures the terms of trade gain from a trade tax, while β measures p1

the efficiency loss from the trade tax. If the trade tax is optimally set, the term 1

p

α + is zero, and the analysis is unchanged. However, if the tax is too low β (relative to the optimal), then αp1+ is positive, and trade liberalization tied to β

transfers will aggravate the transfer problem. Thus, depending on the level of the existing export tax (as it compares to the optimum), the tying of aid may worsen or alleviate the transfer problem.

3. Data Description and Empirical Analysis

It is important to note that due to data problems we use import tariffs rather than export taxes in the empirical analysis. However, by virtue of the Lerner symmetry theorem, there is no harm in treating them similarly because a reduction of an export tax or an import tariff has analogous effects on prices, trade volumes and welfare. Here, we estimate the relations implied by equations (5), (7), and (9) of

Section 2. From (5) we know that A

U is a function of p , t , I

K and T . For the

purpose of empirical analysis, we linearize it as:

0 1 2 3 4 1

A I

U =a +a p+a t+a K +a T+ , e (20)

where e is the error term. Similarly, (7) and (9) are linearized as: 1

0 1 2 2 I K =b +b p b t+ + e (21) 0 1 2 3 p=c +c t+c T+ . e (22) Since A

U represents the utility level of A, we use A’s real GDP as a proxy. We

were unable to obtain data on imports of capital goods. However, we know from Ndulu (1991) that the ratio between real imports of capital goods and real investment for SSA was stable at around 36% over the 1980s. Based on this ratio and using data on real gross capital formation for real investment, we calculated real imports of capital goods ( I

K ). Since our data set covers mostly the 1980s, estimated

data on real capital goods imports should be close to the actual data. Foreign investment is calculated as the change in real imports of capital goods ( I

K

Δ ). We measure p using the terms of trade. The terms of trade data provides the ratio of the export price index to the corresponding import price index. T is real aid

disbursed by multilateral institutions; it is based on the World Bank’s (1998) new approach to measuring aid flows called Effective Development Assistance (EDA). EDA is an aggregate measure of aid flows combining total grants and the grant equivalents of all official loans. For details about EDA, see Chang et al. (1998). The GDP deflator was used to calculate real disbursements of multilateral EDA.

Average tariff rates (unweighted) were obtained from the World Bank’s International Trade and Development dataset. Data on multilateral aid is from Chang et al. (1998). The rest of the data were obtained from the World Bank’s Global Development Network Growth dataset and World Development Indicators’ (2002). Data is available for 14 countries in SSA for the period 1980-1995. These countries are: Burkina Faso, Cameroon, Cote d’Ivoire, Ghana, Kenya, Malawi, Madagascar, Mauritius, Mali, Nigeria, Senegal, Uganda, Zambia, and Zimbabwe.

Rodrik (1998), Helleiner (1994), and Ghai (1987) suggest that there are important idiosyncratic or country specific factors as well as aggregate factors that affect income in SSA. To account for this heterogeneity across countries and through time, we use a two-factor model for panel data. We assume fixed effects. The two-way or two-factor model with fixed effects can be estimated by OLS. The estimation procedure creates dummy variables that capture the fixed effects.

There are three endogenous explanatory variables in the model: aid, terms of trade, and foreign investment. In the theoretical model presented in Section 2, aid is assumed to be exogenous. This assumption may not hold empirically as shown by Frey and Schneider (1986). In the estimation, we use instrumental variables to avoid the problem of endogeneity bias. For terms of trade and foreign investment, we use lagged terms of trade and lagged foreign investment as instruments. These two

instruments have the desirable properties of being highly correlated with the endogenous variables of concern and not correlated with the residuals. Population is used as an instrument for foreign aid. This is because small economies receive relatively more aid than large ones, for both political and structural reasons. Also, population has been found to be a suitable instrument to use in the literature (Boone, 1996). The correlation between foreign aid and population is 0.5, and population is uncorrelated with the residuals in the relevant equations.

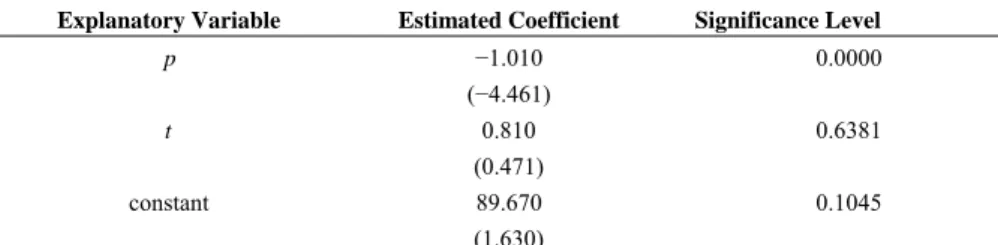

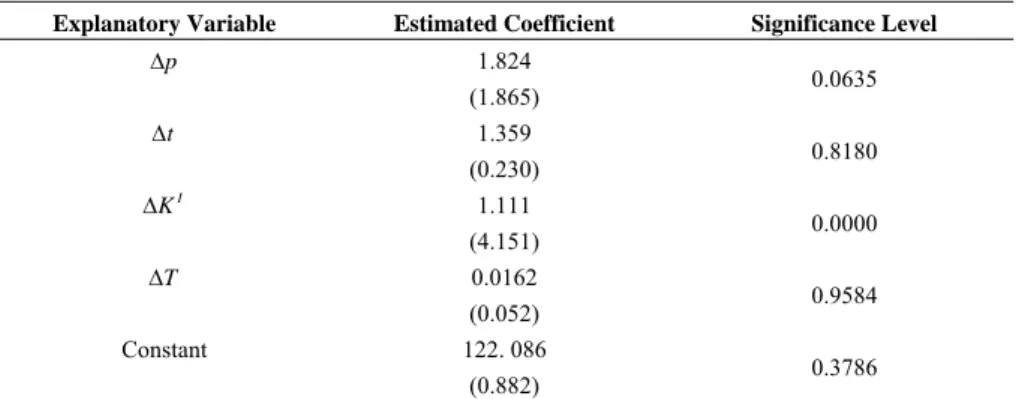

Table 2 reports the results obtained for equation (22). Foreign aid causes a significant reduction in the terms of trade as predicted by theory. The results also show that tariffs reduce the terms of trade. This is paradoxical because one would normally expect trade taxes to either improve the terms of trade or leave them unchanged (if there is negligible market power). Results for equation (21) are shown in Table 3. The terms of trade are significant and negatively affect capital inflows as predicted by the theoretical model. Tariffs have a positive effect on capital inflows. The reason is that higher tariffs encourage domestic production of importable goods. Since production of importables requires foreign capital, there is an increased inflow of foreign capital goods to expand production of the importable goods. The effect of tariffs on capital inflows is however insignificant. Table 4 reports the results for equation (20), with all variables measured in changes (first differences) rather than levels. This approach offers superior statistical properties in the estimation process and is more in line with the empirical literature in this area.

Table 2. Equation (22) with Two-Way Fixed Effects (Dependent Variable = p)

Explanatory Variable Estimated Coefficient Significance Level

T −0.00654 (−12.066 ) 0.0000 t −0.346 (−0.822) 0.4120 constant 225.495 (18.909) 0.0000 Notes: Adjusted R-squared = 0.68. t-statistics are in parentheses.

Table 3. Equation (21) with Two-Way Fixed Effects (Dependent Variable = I

K

Δ )

Explanatory Variable Estimated Coefficient Significance Level

p −1.010 (−4.461) 0.0000 t 0.810 (0.471) 0.6381 constant 89.670 (1.630) 0.1045

Notes: Adjusted R-squared = 0.08. t-statistics are in parentheses.

An improvement in terms of trade raises welfare and is significant. Liberalizing trade by reducing export taxes has a negative effect on welfare as expected. The

effect is however insignificant. Inflows of foreign capital are significant and they raise welfare. This result is not consistent with the theoretical prediction of the model, which could be due to the fact that we are using an aggregate measure of capital inflows. Using disaggregated data on foreign investment going into the protected sector would be more ideal for estimating the model; however, data on disaggregated foreign investment were not available. Foreign aid has a positive effect on welfare as expected. The income effect is, however, not significant.

Table 4. Equation (20) with Two-Way Fixed Effects (Dependent Variable = ΔGDP)

Explanatory Variable Estimated Coefficient Significance Level

p Δ 1.824 (1.865) 0.0635 t Δ 1.359 (0.230) 0.8180 I K Δ 1.111 (4.151) 0.0000 T Δ 0.0162 (0.052) 0.9584 Constant 122. 086 (0.882) 0.3786

Notes: Adjusted R-squared = 0.25. t-statistics are in parentheses.

Robustness checks were performed by testing for multicollinearity and analyzing the effect of dropping some countries from the analysis. The correlation matrices of exogenous variables for the different estimations show that multicollinearity is not a problem. According to the World Bank (2001), Uganda’s growth has been stronger than other reforming SSA countries. We exclude it from the sample and find that the results are robust. Excluding larger countries like Nigeria also does not overturn the results. It does not appear therefore that certain countries are driving the results. The results for multicollinearity checks and sensitivity to country selection are not reported, but are available upon request.

Overall, the following empirical results are statistically significant. Multilateral transfers reduce terms of trade. A reduction in terms of trade is associated with increased foreign capital inflows. Increased capital inflows improve welfare, while terms of trade deterioration offsets the welfare gains from multilateral transfers. The results appear to be more or less consistent with the theoretical analysis, except for the effect of capital inflows on welfare which is not easy to verify using aggregate data on capital inflows, and are robust.

4. Conclusion

SSA is highly dependent on imported capital goods that are used in the import competing industrialized sector. The exporting sector focuses on primary products where land and labor are predominantly used and trade taxes exist. We build a

two-good general equilibrium model to capture these stylized facts. The theoretical analysis suggests that there are valid reasons to worry about the possible deleterious effects of foreign aid. The empirical analysis complements these concerns.

References

Bandyopadhyay, S. and B. Majumdar, (2004), “Multilateral Transfers, Export Taxation and Asymmetry,” Journal of Development Economics, 73, 715-725. Barro, R. J., (2000), “Inequality and Growth in a Panel of Countries,” Journal of

Economic Growth, 5(1), 5-32.

Bhagwati, J. N., R. A. Brecher, and T. Hatta, (1983), “The Generalized Theory of Transfers and Welfare: Bilateral Transfers in a Multilateral World,” American

Economic Review, 73, 606-618.

Boone, P., (1996), “Politics and the Effectiveness of Foreign Aid,” European

Economic Review, 40, 289-329.

Brecher, R. A. and J. N. Bhagwati, (1982), “Immiserizing Transfers from Abroad,”

Journal of International Economics, 13, 353-364.

Chang, C. and E. Fernandez-Arias, and L. Serven, (1998), “Measuring Aid Flows: A New Approach,” World Bank Policy Research Working Paper 2050.

Corbo, V. and S. Fischer, (1995), “Structural Adjustment, Stabilization and Policy Reform: Domestic and International Finance,” in Handbook of Development

Economics, Vol. III, Chapter 44, Elsevier Science.

Davies, R. and J. Rattso, (1993), “Zimbabwe,” in The Rocky Road to Reform:

Adjustment, Income Distribution and Growth in the Developing World, L.

Taylor ed., Cambridge, MA: MIT Press.

Dixit, A. K. and V. Norman, (1980), Theory of International Trade, Cambridge University Press.

Frey, B. and F. Schneider, (1986), “Competing Models of International Lending Activity,” Journal of Development Economics, 20, 225-245.

Ghai, D., (1987), “Successes and Failures in African Development: 1960-82,” OECD Seminar on “Alternative Development Strategies.”

Green, R. H. and X. Kadhani, (1986), “Zimbabwe: Transition to Economic Crises, 1981-1983: Retrospect and Prospect,” World Development, 14, 1059-1083. Helleiner, G. K., (1994), “Structural Adjustment and Long-Term Development in

Sub-Saharan Africa,” Paper Presented at the Workshop on Alternative

Development Strategies in Africa, Oxford.

Kemp, M. C., (1995), The Gains from Trade and the Gains from Aid: Essays in

International Trade Theory, New York, NY: Routledge.

Kemp, M. C. and S. Kojima, (1985), “Tied Aid and the Paradoxes of Donor Enrichment and Recipient-Impoverishment,” International Economic Review, 26, 721-729.

Keynes, J. M., (1929a), “The German Transfer Problem,” Economic Journal, 39, 1-7.

Keynes, J. M., (1929b), “The Reparations Problem: A Discussion. II: A Rejoinder,”

Economic Journal, 39, 179-182.

Keynes, J. M., (1929c), “Mr. Keynes’ Views on the Transfer Problem. III: A Reply from Mr. Keynes,” Economic Journal, 39, 404-408.

Moran, C., (1989), “Imports under a Foreign Exchange Constraint,” World Bank

Economic Review, 3, 279-295.

Ndulu, B., (1991), “Growth and Adjustment in Sub-Saharan Africa,” in Economic

Reform in Sub-Saharan Africa, A. Chibber and S. Fischer eds., Washington,

DC: World Bank.

Ohlin, B., (1929a), “The Reparations Problem: A Discussion. Ι: Transfer Difficulties, Real and Imagined,” Economic Journal, 39, 172-178.

Ohlin, B., (1929b), “Mr. Keynes’ Views on the Transfer Problem. II: A Rejoinder from Professor Ohlin,” Economic Journal, 39, 400-404.

Rodrik, D., (1998), “Trade Policy and Economic Performance in Sub-Saharan Africa,” NBER Working Paper No. 6562.

Sachs, J. D. and A. M. Warner, (1995), “Economic Reform and the Process of Global Integration,” Brookings Papers on Economic Activity, 1, 1-118.

Sachs, J. D. and A. M. Warner, (1997), “Sources of Slow Growth in African Economies,” Journal of African Economies, 6, 335-376.

Samuelson, P. A., (1947), Foundations of Economic Analysis, Cambridge, MA: Harvard University Press.

Savvides, A., (1995), “Economic Growth in Africa,” World Development, 23, 449-458.

Schweinberger, A. G., (1990), “On the Welfare Effects of Tied Aid,” International

Economic Review, 31, 457-462.

Stiglitz, J. E., (1998), “Towards a New Paradigm for Development: Strategies, Policies and Processes,” 9th Prebisch Lecture Delivered at UNCTAD, Geneva. Wangwe, S. M., (1983), “Industrialization and Resource Allocation in a Developing

Country: The Case of Recent Experiences in Tanzania,” World Development, 11, 483-492.

Wheeler, D., (1984), “Sources of Stagnation in Sub-Saharan Africa,” World

Development, 12, 1-23.

World Bank, (2001), “Aid and Reform in Africa: Lessons from Ten Case Studies,” Washington, DC.