A Study on the Termination Behaviors

of Residential Mortgages in Taiwan

*

Tsoyu Calvin Lin

**Abstract

Key Words: mortgage termination, default, prepayment, competing risks model JEL classification: G21, R51

Traditionally, mortgage default or prepayment behaviors are mostly studied individually through non-competing risks models in Taiwan, which have been criticized as misleading. This study is the first to construct a unified model to explore the mortgage prepayment and default behavior in Taiwan. The competing risk model (CRM) is employed to investigate factors influencing mortgage termination. Empirical results show that such elements of mortgage contracts as loan to value (LTV) ratio, payment to income (PTI) ratio, and regional variation are crucial elements to mortgage termination. Some macro factors, such as unemployment, divorce rates, and distinctive decline of macro economy are significant to mortgage default. Furthermore, two option variables, i.e., changes in interest rates and housing prices, are critical to mortgage prepayment and default, respectively.

* The author is grateful to the financial support from the National Science Foundation

NSC91-2626-H-025-001 of Taiwan, and data provision of Taiwan Bank and Taiwan Land Bank.

** Associate Professor, Department of Public Finance and Taxation, National Taichung

A Study on the Termination Behaviors

of Residential Mortgages in Taiwan

Tsoyu Calvin Lin

I. Introduction

After the passage of “The Financial Asset Securitization Act” in late 2002, cash flows from mortgages have become the focus of the banking and security industries for mortgage pricing in the secondary mortgage markets in Taiwan. Since both default and prepayment behavior may significantly affect the stability of mortgage cash flows, therefore, factors influencing mortgage termination have become increasingly important for the pricing of mortgage-backed securities (MBS).

Traditionally, studies on mortgage default or prepayment are mostly analyzed individually in Taiwan. However, the mortgage termination behavior should be considered as a whole since as the mortgagors default, they also give up the option to prepay, and vice versa. Therefore, this study employs the competing risks model instead of using the traditional non-competing model, e.g., Probit model and Logit model, to investigate the simultaneous interrelationship of default and prepayment behavior.

Following Deng et al. (1996), Deng (1997), and Deng et al. (2000), this study collects residential mortgage data in Taiwan and employs competing risks model in order to test the significance of various mortgage parameters and macro economic factors. The current paper is organized as follows: Section 2 reviews the literature investigating mortgage termination. Section 3 describes the competing risks model and data collection. Section 4 is the descriptive statistics. Section 5 presents the empirical analysis. Section 6 is the conclusion.

II. Literature Review

There are many factors influencing the prices of mortgage-related securities. Many of them can be attributed to prepayment and default. Lawrence et al. (1992) concluded that mortgagors’ credit history and age, contract maturity, loan to value (LTV) ratio and the ratio of mortgage payments to family income are crucial to the likelihood of default. Peristiani et al. (1997) also indicated that borrowers with lower credit and lower LTV tend to have less likelihood to prepay. Deng et al. (1996) showed that the present value of mortgage payments and the characteristics of family economy are significant to mortgage default. Green and Shoven’s (1986) empirical analysis of California Savings and Loans Associations indicated that the difference between the mortgage face value and market value to the house market value will significantly affect the default possibility on fixed-rate mortgages (FRMs). Kau and Keenan (1999) applied the options pricing approach and concluded that LTV and market house price are significant factors affecting the likelihood of mortgage default. Archer et al. (1996) also showed that the residential mortgage terminations are affected by household income and collateral (house) value.

Deng et al. (1996, 2000) and Deng (1997) firstly employed competing risks model (CRM) to explore mortgagors’ default and prepayment simultaneously. Their results showed that the LTV ratio and home equity are significant to default, and such trigger events as unemployment rates and divorce rates are crucial to default and prepayment, respectively. Ambrose and Capone (2000) also applied the competing risks model to examine the relative hazards of prepayment and first and second defaults. Their results showed that the hazard of the second default is significantly different from that of first default, and the second-default rates cannot be predicted in the same manner as first defaults. Ciochetti et al. (2001) constructed a competing risks model and modified different originators’ bias to analyze the default likelihood of commercial mortgages. Their results indicated that the LTV ratio is positively related to default, and the debt coverage ratio (DCR) is more significant than LTV in affecting default. If the net operating income (NOI) is sufficient to cover the debt service, then default

would not occur. In other words, the default decision factors of commercial mortgages may be different from those of residential.

Pavlov (2001) used a competing risks model to show that refinancing risk is highly sensitive to interest-rate changes. Ambrose and Sanders (2001) employed a competing risks model to examine the default and prepayment behavior of commercial mortgage-backed securities (CMBS). Their results also showed that the changes of interest rates have direct impact on mortgage termination, but the LTV’s effect is not significant, different from those of residential mortgages. Calhoun and Deng (2002) employed the multi-nominal Logit model and indicated the continuous statistical significance of aforementioned variables on mortgage terminations.

In comparison to the international literature, most studies related to mortgage termination in Taiwan focused on either prepayment or default independently. Lu and Kuo (2000) and Lin and Liu (2003) both employed the Logit model for the analysis of residential mortgage default. Their results both showed that education, marital status, income, credit history, and collateral’s location are significant factors affecting default behavior. Liu and Chang (2001) used the Logit model and showed that prepayment behaviors in Taiwan are significantly affected by marital status, age, education, occupation, income, housing age, region location, housing type, loan-to-value, and mortgage contract rate. Their results also predicted that the prepayment probability for the residential mortgages in Taiwan ranges from 46% to 71%. Lu and Kuo (2000) applied the Logit model to analyze the determinants of prepayment and delay payment behaviors separately for Taiwan residential mortgages. Their results showed that prepayment is affected by financial factors, such as mortgage premium, borrower equity, interest rate and house price. However, delayed payment behavior is associated with non-financial factors, such as mortgage types and payment methods.

In spite of some previous studies on mortgage prepayment or default behaviors, no research simultaneously focusing on the prepayment and default behavior can be found in Taiwan, partly due to limited data resources from the banking industries. The current study thus collects data from the Taiwan Bank and Taiwan Land Bank, the two largest banks with mortgage business, attempting to construct a unified competing risks model to simultaneously

investigate the effects of determinants regarding lending contracts, borrowers’ characteristics and macro economic factors on mortgage prepayment and default behavior in Taiwan. The result of this study may show whether if the effects of these variables affecting terminations of residential mortgages are consistent with those in the U.S. or cross-cultural.

III. Research Methodology

A. The Competing Risks Model

Traditionally, studies on dependent variables with discrete choices mostly employed the Logit model or Probit model. They can investigate the significance of independent variables, but they cannot evaluate the time-dependent effects. Pavlov (2001) indicated that the traditional non-competing risks estimation of the overall mortgage termination risk is misleading. The competing risks model, one of the survival-time models, can simultaneously examine two or more events. As an example of mortgage payment, the competing risks model can both explore default and prepayment behavior.

Survival model assumes that the time for the event occurrence, T , is a random variable with a continuous distribution of f(t), and t is the time that the event occurs. The cumulative distribution function (c.d.f.) of the event occurrence can be written as:

} Pr{ ) ( ) ( 0f sds t t t F =

∫

t = ≤ . (1)The survivor function can be given by:

) ( 1 ) Pr( ) (t T t F t S = > = − , (2)

Therefore the hazard function can be defined as: ) ( ) ( ) | Pr( lim ) ( 0 S t t f t t T t t T t t h t ∆ = ≥ ∆ + < ≤ = + → ∆ . (3)

and the probability density function (p.d.f.) is:

dt t dS dt t dF t f()= ()=− (). (4)

The hazard function can be written as:

=

∑

= n i i i t h t h 1 0()exp ) , ( υ βυ (5)where υ is the independent variable affecting default or prepayment; i h0 is the baseline

hazard function, indicating the probability of default of prepay under homogeneous circumstances (i.e., all independent variable υ=0 ); and βi=

(

β1,β2,L,βs)

are thecoefficients of υ . i

The competing risk model can simultaneously analyze two events, given by:

=

∑

= n i i i j ij t h t h 1 0 ()exp ) , ( υ βυ i=1,2 (6)This implies the probability of occurrence of j event of the i th mortgage after the survival time t, where j=1 is the event of prepayment, and j=2 is default. The total hazard rate of these two events is given by:

∑

= j ij t h t h() () j=1,2 (7)In order to measure the prepayment or default rates under homogeneous circumstances, and explore their relation with mortgage age, this study assumes that the base-line function follows log-logistic distribution, which is shown as:

γ γ λ λ λγ γ λ ) ( 1 ) ( ) ; ; ( 1 0 t t t h j + = − (8)

It is worth noting that as γ >1, the prepayment or default rates will reach the peak at

∗ t : λ γ 1γ * =( −1) t (9)

B. The Censoring Concept

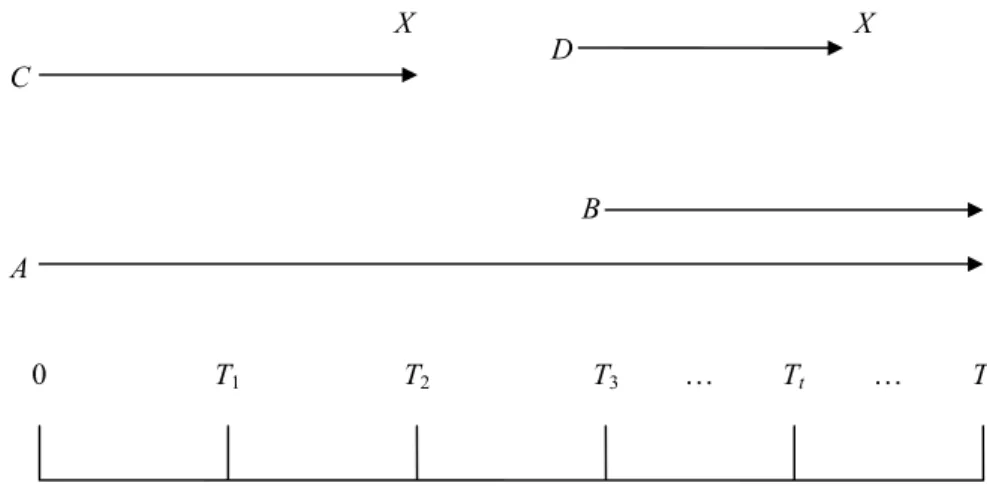

The estimation of survival time is critical in the application of competing risk model (CRM) or proportional hazard model (PHM) models on survival analysis. For example, the A and B observation values in Figure 1 represent the concept of right censoring, implying that the timing of event occurrence extends over a certain observation time. In this study, the right censoring is defined as the occurrence timing of prepayment or default extending the observation timing (i.e., year 2001). The survival time terminates at this point. The C and D values are uncensored, indicating that mortgagors prepay or default during the research period, and thus terminate the mortgage contract. The survival time terminates at the timing of the event occurrence. For example, the survival time of C and D in Figure 1 are T2 and Tt−T3,

respectively. Further, if the event occurred before the observation initiates, it is defined as left censoring. It is worth noting that as mortgagors prepay, it is unlikely for them to default. Therefore, the default observation value is censored, and vice versa. The data of this study all initiated from 1991, and the observation time is 2001, so that this study focuses on right-censored or uncensored data.

Note: X is the timing of termination; A and B are right-censored; C and D are uncensored.

Figure 1 Illustration of the Censoring Concept

C. Partial Likelihood Estimation (PLE)

There are two regression models in the application of survival analysis. One is parametric regression, and the other is semi-parametric regression. The former applies the Maximum Likelihood Estimation (MLE) for parameters estimation; and the latter uses Partial Likelihood Estimation (PLE). The current study employs the PLE to estimate equation (6). The PLE is shown as:

) ( i L β

∏ ∑

∈ = i t R j i i i i i) ( ) exp( ) exp( υ β υ β , (10)where the term R(ti) is the mortgage risk at time t. According to equation (6) and equation (10), the hazard of prepayment and default can be estimated respectively. Note that in estimating prepayment (default) behavior, default (prepayment) and normal-performing cases

T1 T2 T3 Tt Tk 0 X A B C D … … X

are treated as censoring cases. In order to estimate prepayment rates, for instance, this study uses 354 prepayment and 1217 censoring cases (including 205 default and 1012 normal-performing cases) to construct the CRM. The calculation of the estimation of partial likelihood function is illustrated in appendix A.

D. Variables Selection

According to the aforementioned literature, studies on mortgage termination mostly employed such characteristics as loan contracts and mortgagors, regional variation, macro economic and demographic variables, and option-theoretic predictors (i.e., mortgage premium value and borrowers’ equity position) to evaluate prepayment or default behavior. Most of them have been tested significant internationally. Therefore, this study attempts to select and reorganize these variables to analyze their significance on the mortgage prepayment and default behaviors in Taiwan. Variables and their impacts on default and prepayment are briefly discussed as follows.

a. Loan size

In general, the loan size is positively related to the borrowers’ economic ability and credit quality. The larger the loan size, the more likely default would occur as the macro economy fluctuates or borrowers’ income decreases. Without taking into account of loan to value (LTV) ratio and payment to income (PTI) ratio, Lu and Kuo (2000) concluded that the loan size is positively related to default. However, loan amounts that banks grant are positively related to borrowers’ ability to repay or collaterals’ value, this study therefore attempts to test the significance of loan size on default.

b. Loan to value ratio (LTV)

low cost to borrowers. Yet the high LTV may lead to low prepayment likelihood due to the borrower’s ability to afford the loan. This study expects that the LTV may show higher significance than loan size.

c. Mortgage term

As the mortgage term lengthens, such uncertain factors as macro economic environment, housing market prices and unemployment rates may change, affecting borrowers’ asset value and ability to pay. In contrast, the payment load (i.e., principals and interests) decreases as the mortgage term lengthens. Therefore, the effects of mortgage term on default or prepayment is not certain.

d. Payment-to-income ratio (PTI)

PTI is the ratio of mortgage monthly payments to the borrower’s monthly income, which can indicate the pressure of the affordability to borrowers. It is expected that the higher the PTI, the more likely the default, and the less likely the prepayment would occur.

e. Regional variation

Lu and Kuo (2000) concluded that the default behavior tends to be more significant in rural areas than in urban areas in Taiwan, but the prepayment is not obvious. This study subjectively groups the mortgage data located in Taipei and Kaohsiung city (the largest two metropolitans in Taiwan) as urban area, others as rural areas. It is expected that mortgages located in urban areas are less likely to default due to the relatively slight decrease of housing prices during the slump economy, but the impact on prepayment is uncertain. This factor is treated as a dummy variable. If a house is located in Taipei or Kaohsiung, the variable’s value is 1; and for other areas, it is 0.

f. Trigger events

According to the empirical results of Ambrose and Capone (2000), Deng et al. (1996, 2000), Deng (1997) and Pavlov (2001), trigger events have significant effect on default and prepayment behavior. Trigger events imply that the unexpected events that families may encounter after mortgages originate, such as unemployment and divorce. These two events may affect mortgagors’ willingness or ability to complete the repayment. However, such mortgagors’ information as marital and employment status are not easy to obtain individually in Taiwan, so that the current study attempts to collect the macro data regarding divorce and unemployment rates to test their impact on mortgage termination. It is expected that the unemployment rate and divorce rate will positively influence on default, and negatively influence on prepayment in Taiwan.

g. Option Predictors

According to Deng et al. (1996), the POPTION is the probability that the borrower will prepay, which is defined as the ratio of the present value of the unpaid mortgage balance at the current market interest rate to the value discounted at the contract interest rate. The larger the POPTION, the higher is the incentive for the borrowers to prepay. The PNEQ is the probability that the borrower’s home equity ratio is negative, which is defined as the difference between the present value of the unpaid loan balance and the purchasing house price at the time of loan origination. These two option variables have never been examined simultaneously for mortgage termination in Taiwan, so this study attempts to test their significance on prepayment and default behavior.

Due to limits on quarterly data available in Taiwan, this study modifies the POPTION discounted by quarterly rate in Deng et al. (1996) as the monthly rate, which is illustrated as follows:

∑

∑

∑

− = + − = − = + + + − + = l i i l I L l i i l term t k t l term T term t l t l t k l mktrate mopipmt noterate mopipmt mkrate mopipmt poption τ τ τ τ τ 1 1 1 ) 1200 / 1 ( ) 1200 / 1 ( ) 1200 / 1 ( + − × + − × − = − + − i l i l i l i term k l term l mktrate noterate noterate mktrate τ τ τ τ λ 1200 / 1 1 1 1200 / 1 1 1 1 , , (11)where terml is the mortgage loan term, and τ is the loan age, i kl is the loan

origination time, mopipmtl is the monthly principal and interest payment, noteratel is

the mortgage note rate, mktratekl+τi is the current market interest rate, origamtl is the

original loan amount. The PNEQ is defined as follows:

− = +i kl e mktvaluel pdvunpblcl ncdf PNEQ τ 2 ) log( ) log( (12)

where ncdf is the cumulative standard normal distribution function, pdvunpblcl

is the discounted present value of the unpaid loan balance,

mktvalue

is the housing market value, and ekl+τ2i is the estimated volatility of the housing price index inTaiwan.

This study adopts these two option predictors to test the impact of the change of interest rates and housing prices on default and prepayment behavior in Taiwan. Explanations of these parameters and expected influential directions on prepayment and default are listed in Table 1 and Table 2.

Table 1 Parameters and Brief Explanations

Parameters Explanation

Loan Size Original loan size in the contract; individual data.

Loan to Value (LTV) Ratio The ratio of “original loan size” to “original housing price”; individual data.

Mortgage Term The mortgage maturity stated in the contract; individual data. Payment to Income Ratio

(PTI)

The ratio of mortgagors’ “monthly payment” to “monthly income”; individual data.

Regional Variation (Urban Areas)

Dummy variables; 1 for the house located in such urban areas as Taipei and Kaohsiung, 0 for other areas; individual data.

Trigger Events

Unemployment Rate Macro data. Divorce Rate Macro data.

Option Predictors

POPTION The ratio of the present value of the unpaid mortgage balance at the current market interest rate to the value discounted at the contract interest rate, measuring the probability that the borrower will prepay; individual data.

PNEQ The difference between the present value of the unpaid loan balance and the purchasing house price at the time of loan origination, measuring the probability that the borrower’s home equity ratio is negative; individual data.

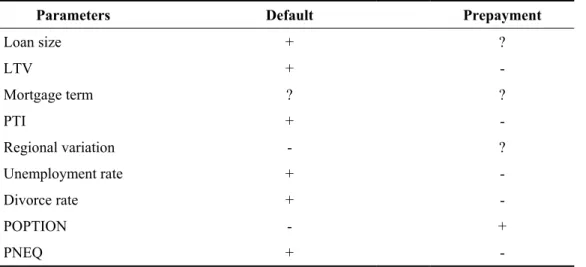

Table 2 Parameters and the Expected Influence Directions

Parameters Default Prepayment

Loan size + ? LTV + - Mortgage term ? ? PTI + - Regional variation - ? Unemployment rate + - Divorce rate + - POPTION - + PNEQ + -

E. Sources of data

a. Mortgage data

Mortgage data1 collected in this study are all individual, level-payment,

fully-amortized residential loans and are originated in 1991 with maturities from 10 to 30 years. The censoring period ranges from 1991 to 2001. Data are collected from

1 Before 2003, mortgage contracts in Taiwan were mostly nominated adjustable rates.

During the late 1990s, the market interest rates spiraled down. However, the overall banking industries in Taiwan tended not to mark down mortgage rates in order to earn extra spread to cover the substantial mortgage losses. Therefore, mortgages in Taiwan could virtually be treated as fixed-rate before 2001.

Taiwan Bank and Land Bank, the largest two banks in Taiwan. There are 1,571 monthly data, including 205 defaulted, 354 prepaid, and 1,012 normal-performing records during the observance period.

b. Housing price index

The current study adopts the Sin-Yi housing price index from 1991 to 2001 as the index for real estate markets. The Sin-Yi Realtor is a publicly-traded corporation, and its housing index is currently considered as the most consistent index in Taiwan.

c. Unemployment and divorce rates

The unemployment rate is collected from Taiwan Economic Journal (TEJ). The divorce rate is collected from the Monthly Statistics Report published by the Interior Department of Taiwan from 1992 to 2001.

d. Market interest rates

The market interest rates of the option predictor POPTION are calculated as the average mortgage rates of the largest five banks in Taiwan, ranging from 1991 to 2001.

IV. Descriptive Statistics

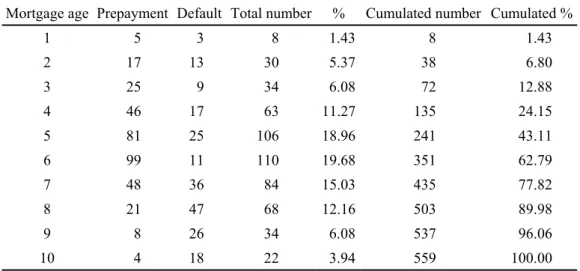

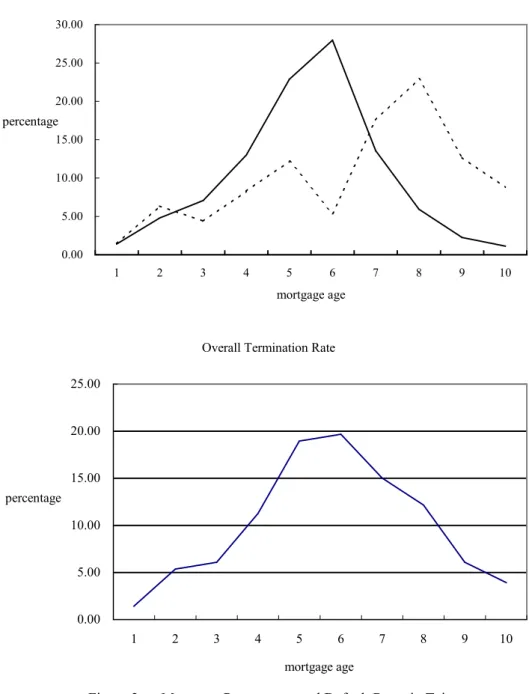

Table 3 shows the descriptive statistics of all the sampled data. It is obvious that prepayment behaviors mostly occurred from the fourth to seventh year after mortgage origination, with a number of 274, or 77.4% of all prepaid mortgages. Default mostly occurred from the seventh to ninth year, with a number of 109, or 53% of all defaulted mortgages, as most Asian countries encountered the financial debacle from 1997 to 2000. The prepayment and default rates versus the mortgage ages are plotted in Figure 2. The upper panel shows that the prepayment rates firstly increased along the mortgage age, and then

decreased after the sixth year. The default rates tended to fluctuate in the beginning, and then reached the peak during the seventh to eighth year. The lower panel shows the overall termination percentage of all sample mortgages. It reaches the peak at the fifth and sixth year. The mortgage industries should pay attention to the moving trend of mortgage termination. Table 3 Statistics of Mortgage Prepayment and Default

Mortgage age Prepayment Default Total number % Cumulated number Cumulated %

1 5 3 8 1.43 8 1.43 2 17 13 30 5.37 38 6.80 3 25 9 34 6.08 72 12.88 4 46 17 63 11.27 135 24.15 5 81 25 106 18.96 241 43.11 6 99 11 110 19.68 351 62.79 7 48 36 84 15.03 435 77.82 8 21 47 68 12.16 503 89.98 9 8 26 34 6.08 537 96.06 10 4 18 22 3.94 559 100.00

V. Empirical Results

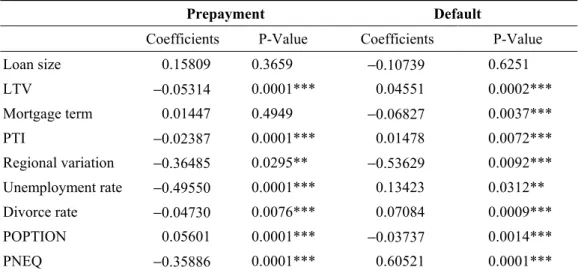

A. Default determinants

Table 4 shows the coefficients of the parameters. Most of them are consistent with expected estimation of default and prepayment. Loan size is not a significant determinant in either prepayment or default, amending the conclusion of Lu and Kuo (2000). The LTV, PTI, unemployment rate, divorce rate and PNEQ have significant positive effects on default.

0.00 5.00 10.00 15.00 20.00 25.00 30.00 1 2 3 4 5 6 7 8 9 10 mortgage age percentage

Overall Termination Rate

0.00 5.00 10.00 15.00 20.00 25.00 1 2 3 4 5 6 7 8 9 10 mortgage age percentage

Figure 2 Mortgage Prepayment and Default Rates in Taiwan (Sampled Mortgages Originated in 1991)

The mortgage term, regional variation, and POPTION have a significant negative relation to default. These empirical results show that the banking industries in Taiwan can prudently evaluate the impacts on default of such factors as LTV, PTI, mortgage term and regional differential. Correct prediction of the moving trends of macro economy, interest rates and real estate markets, and divorce rates may also assist to reduce the default rate. As real estate markets slump, the default rate tends to increase. Banks may give advice to borrowers regarding the importance of credit, lengthen the mortgage term, or provide payment alternatives (i.e., interest-only payment for certain periods) in order to reduce the default behavior.

Table 4 Estimated Coefficients of Parameters

Prepayment Default

Coefficients P-Value Coefficients P-Value

Loan size 0.15809 0.3659 −0.10739 0.6251 LTV −0.05314 0.0001*** 0.04551 0.0002*** Mortgage term 0.01447 0.4949 −0.06827 0.0037*** PTI −0.02387 0.0001*** 0.01478 0.0072*** Regional variation −0.36485 0.0295** −0.53629 0.0092*** Unemployment rate −0.49550 0.0001*** 0.13423 0.0312** Divorce rate −0.04730 0.0076*** 0.07084 0.0009*** POPTION 0.05601 0.0001*** −0.03737 0.0014*** PNEQ −0.35886 0.0001*** 0.60521 0.0001***

Note: 1. *means significance of 10%; **significance of 5%; *** significance of 1%.

2. The regression coefficients are estimated through equation (6) with PLE, where the likelihood ratio (LR) of prepayment is 610.08; and the LR of default is 112.84. 3. This study employs 1571 monthly data to estimate the parameters, including 205

defaulted, 354 prepaid, and 1012 normal-performing records during the observance period.

B. Prepayment determinants

Table 4 also shows the relationship of independent variables and prepayment. The LTV, PTI, regional variation, unemployment rate, divorce rate and PNEQ have a significant negative relation to prepayment. POPTION has significant positive impact on prepayment. It is worth noting that these variables’ influence directions on prepayment are mostly opposite to default. Only mortgage term shows insignificant effect on prepayment, and the regional variation factors has the impact of negative direction for both prepayment and default. This result indicates that the regional variation will not change borrowers’ prepayment or default behaviors.

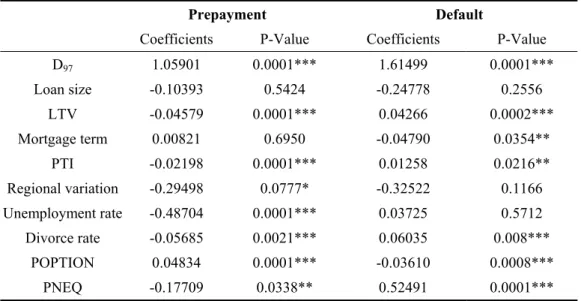

C. The impact of 1997 Asian Financial Debacle on

mortgage termination

During the observation period from 1991 to 2001, the macro economy in Taiwan encountered a major structural change in 1997---Asian Financial Debacle. This event caused a great number of companies in Asia bankruptcy, and consequently led the asset value to slide down and raised the unemployment rate. It would be worthwhile to test the impact of this event on the termination of residential mortgage, especially default. The current study thus adds a dummy variable, D97, to represent the macro economy situation in Taiwan. As D97

equals 1, implying that the mortgage termination data are dated after 1997; others are dated before 1997. The empirical results are shown in Table 5. It is worth noting that the 1997 Financial Crisis have significant effect on both default and prepayment. The results show that the distinctive decline of macro economy may have significant impact on mortgage default behavior, due to the drop of economy and asset value and the rise of unemployment rate. For prepayment, it is also reasonable for mortgagors to speed up prepaying the outstanding loan balance due to the continuing decrease of interest rates. The effects on other variables mostly remain consistent.

Table 5 Estimated Coefficients of Parameters with the Variable of 1997 Asian Financial Crisis

Prepayment Default

Coefficients P-Value Coefficients P-Value

D97 1.05901 0.0001*** 1.61499 0.0001*** Loan size -0.10393 0.5424 -0.24778 0.2556 LTV -0.04579 0.0001*** 0.04266 0.0002*** Mortgage term 0.00821 0.6950 -0.04790 0.0354** PTI -0.02198 0.0001*** 0.01258 0.0216** Regional variation -0.29498 0.0777* -0.32522 0.1166 Unemployment rate -0.48704 0.0001*** 0.03725 0.5712 Divorce rate -0.05685 0.0021*** 0.06035 0.008*** POPTION 0.04834 0.0001*** -0.03610 0.0008*** PNEQ -0.17709 0.0338** 0.52491 0.0001***

Note: 1. *means significance of 10%;**significance of 5%;*** significance of 1%. 2. The regression coefficients are estimated through equation (6) with PLE, where the

likelihood ratio (LR) of prepayment is 610.08; and the LR of default is 112.84. 3. This study employs 1571 monthly data to estimate the parameters, including 205

defaulted, 354 prepaid, and 1012 normal-performing records during the observance period.

VI. Conclusions and Implications

Results of this study show that loan to value ratio, payment to income ratio, unemployment rates, divorce rates, negative housing equity, and major structural change in macro economy (e.g., regional financial crisis) have a significant positive effect on borrowers’ default; and that mortgage term, regional variation and the change of interest rates have a significant negative impact on prepayment. This implies that several elements in the mortgage contract, as well as such macro factors as unemployment rates, divorce rate, and

distinctive decline of macro economy are essential to default. The banking industries can scrutinize these determinants and predict the movement of macro economy in order to reduce the default behavior as originating loans. Furthermore, two option predictors are critical to the default behavior. As the real estate markets slump and the house value declines, borrowers tend to exercise their default option to minimize losses. Banks should pre-act to educate borrowers regarding the importance of credit. As the market interest rates decline, borrowers tend not to default, due to the relief of mortgage payments. These results are mostly consistent with those of Deng (1997).

For prepayment behavior, results show that the loan to value ratio, payment to income ratio, regional variation, unemployment rates, divorce rates and negative housing equity have significant negative impact on prepayment; and the decrease of market interest rates have positive influence on prepayment behavior. The influence directions of variables on prepayment are mostly opposite against default. The only differences are that mortgage term shows insignificant positive impact on prepayment, and that regional variation shows significant negative impact on both prepayment and default. This might indicate that the borrowers in urban areas in Taiwan tend to neither prepay nor default, due to heavy burdens of housing affordability and comprehension of the importance of credit. Furthermore, the loan size is not a significant factor, however, other elements in the loan contract, such as LTV and PTI, have shown their effects.

The contribution of this study is that it is the first research to employ the competing risks model to simultaneously analyze the residential mortgage default and prepayment behavior in Taiwan, modifying some previous empirical findings made solely through the Logit model. Results of this study are mostly consistent with previous international researches, indicating that factors effecting residential mortgage terminations and their directions may be cross-cultural. Furthermore, this study integrates the effects of several borrowers’ heterogeneity discussed by Deng et al. (2002), e.g., borrowers’ ability (payment-to-income ratio, PTI) and housing value appreciation/depreciation. This may add new contributions to previous findings. Finally, the empirical results of this study may be adopted by industries for making lending decisions and issuing MBSs, and by investors for pricing reference in Taiwan.

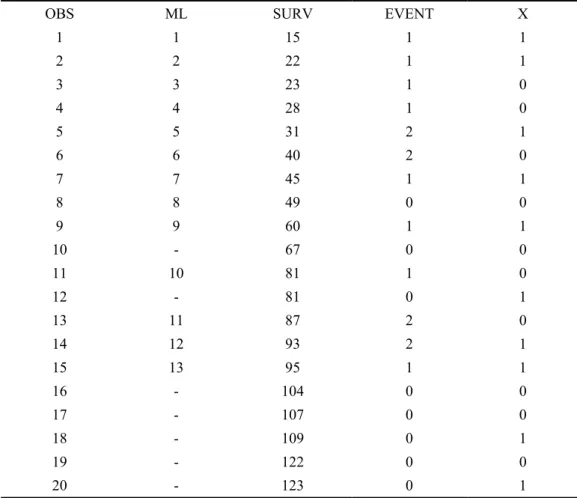

Appendix A

Suppose that Table A illustrates some observations in this study, and if we consider the prepayment events, so the other events (i.e., default cases) must be treated as censored. The partial likelihood function can be constructed for some situations. First, the partial likelihood function L1 is the hazard for mortgage loan 1 at month 15 divided by the sum of the hazard

for all mortgage loans at the same month

) 15 ( ) 15 ( ) 15 ( ) 15 ( 20 2 1 1 1 h h h h L L + + = , (A.1)

where the hi(⋅) is the hazard function, which can be presented as exp(βxi), and the xi is

the value of the explanatory variable (namely, X, in this case) for the ith observation, and β is the parameter of explanatory variable.

Second, if the mortgage loan terminates at month 22, then L2 can expressed as

) 22 ( ) 22 ( ) 22 ( ) 22 ( 20 3 2 2 2 h h h h L L + + = , (A.2)

note that since the mortgage loan 1 has already terminated, it no longer bears the risk of termination. Therefore, the hazard for mortgage loan 1 is removed from the denominator. In the same vein, each partial likelihood function can be estimated. Further, if one proceeding point has been censored, then we have to delete the hazard form the denominator. For example, the OBS 10 was censored at month 67, so the hazard does not appear in the denominator of L10. On the contrary, if a survival time is the same as a censoring time (i.e.

OBS 11 and OBS 12), the convention is to assume that the censored observation was still at risk at that time. Thus, OBS 12 which was censored in month 81 does show up in the denominator of L10.

Table A An Example of Survival Analysis

OBS ML SURV EVENT X

1 1 15 1 1 2 2 22 1 1 3 3 23 1 0 4 4 28 1 0 5 5 31 2 1 6 6 40 2 0 7 7 45 1 1 8 8 49 0 0 9 9 60 1 1 10 - 67 0 0 11 10 81 1 0 12 - 81 0 1 13 11 87 2 0 14 12 93 2 1 15 13 95 1 1 16 - 104 0 0 17 - 107 0 0 18 - 109 0 1 19 - 122 0 0 20 - 123 0 1 Note: The SURV presents the survival time of each observation. The ML presents mortgage

loans. The EVENT 1 presents prepayment; EVENT 2 presents default; and EVENT 0 presents normal-performing. The X (dummy variable) presents one of the explanatory variables.

Finally, the likelihood function to the 13th mortgage loan which occurred to the 15th OBS in month 95 is: ) 95 ( ) 95 ( ) 95 ( ) 95 ( 20 16 15 15 13 h h h h L + + + = L (A.3)

where all the hazards in the denominator (except for the first one) are mortgage loans censored in months later than 95.

Similarly, we can apply this approach to calculate the partial likelihood function of default cases, and then estimate the parameters of explanatory variables of prepayment and default, respectively.

(收件日期為 93 年 3 月 15 日,接受日期為 93 年 10 月 1 日。)

References

1. Ambrose, B. W. and C. A. Capone, 2000, “The Hazard Rates of First and Second Defaults,”

Journal of Real Estate Finance and Economics, 20(3): 275-293.

2. Ambrose, B. W. and A. B. Sanders, 2001, Commercial Mortgage-backed Securities: Prepayment and Default, Paper presented at the 2001 Cambridge / Maastrict Conference. 3. Archer, W. R., D. C. Ling and G. A. McGill, 1996, “The Effect of Income and Collateral

Constraints on Residential Mortgage Terminations,” Regional Science and Urban

Economics, 26: 235-261.

4. Ciochetti, B. A., G. Lee, J. Shilling and R. Yao, 2001, A Proportional Hazards Model of Commercial Mortgage Default with Originator Bias, Unpublished working paper.

5. Calhoun, C. A. and Y. Deng, 2002, “A Dynamic Analysis of Fixed- and Adjustable-rate Mortgage Terminations,” Journal of Real Estate Finance and Economics, 24(1/2): 9-33. 6. Deng, Y. H., J. M. Quigley and R. Van Order, 1996, “Mortgage Default and Low

Downpayment Loans: The Costs of Public Subsidy,” Regional Science and Urban

Economics, 26: 263-285.

7. Deng, Y. H., 1997, “Mortgage Termination: An Empirical Hazard Model with Stochastic Term Structure,” Journal of Real Estate Finance and Economics, 14: 309-331.

8. Deng, Y. H., J. M. Quigley and R. Van Order, 2000, “Mortgage Terminations, Heterogeneity and the Exercise of Mortgage Options,” Econometrica, 68(2): 275-307. 9. Follain, J. R., W. V. Huang and J. Ondrich, 1999, “Stay, Pay or Walk Away: A Hazard Rate

Analysis of FHA-insured Multifamily Mortgage Terminations,” Unpublished working paper.

10.Green, J. and J. B. Shoven, 1986, “The Effects of Interest Rates on Mortgage Prepayments,”

Journal of Money, Credit, and Banking, 18(1): 41-59.

11.Kau, J. B. and D. C. Keenan, 1999, “Patterns of Rational Default,” Regional Science and

Urban Economics, 29: 765-785.

12.Lawrence, E. C., L. D. Smith and M. Rhoades, 1992, “An Analysis of Default Risk in Mobile Home Credit,” Journal of Banking and Finance, 16: 299-312.

13.Lee T. H. and M. H. Lu, 2000, “The Credit Rating Model of Banking Industry---The Application of Logistic Regression,” Taiwan Financial Quarterly, 1: 1-20 (in Chinese). 14.Lin T. C. and C. K. Liu, 2003, “The Application of Logit Model on the Default Behavior of

Consumers’ Loans in Taiwan,” Paper presented in the 2003 Conference of Chinese Society of Housing Study (in Chinese).

15.Liu, J. H. and C. O. Chang, 2001, “Mortgage Borrowers’ Prepayment Behavior in Taiwan,”

Journal of Housing Studies, 10(1): 29-49 (in Chinese).

16.Lu, C. L. and T. L. Kuo, 2000, “Prepayment and Delay Payment of Taiwan Residential Mortgages,” Paper presented at the 2000’s Conference of Taiwan Financial Study (in Chinese).

17.Pavlov, A. D., 2001, “Competing Risks of Mortgage Termination: Who Refinance, Who Moves, and Who Defaults?” Journal of Real Estate Finance and Economics, 23(2): 185-211.

Creditworthiness on Mortgage Refinancing,” Federal Reserve Bank of New York Economic

Policy Review, 83-103.

19. Seuyoshi, G., 1992, “Semiparametric Proportional Hazard Estimation of Competing Risks Model with Time-varying Covariates,” The Journal of Econometrics, 51, 25-58.