人壽保險公司與退休基金之違約風險,負債評價與資產配

置

研究成果報告(精簡版)

計 畫 類 別 : 個別型 計 畫 編 號 : NSC 99-2410-H-004-093- 執 行 期 間 : 99 年 08 月 01 日至 100 年 08 月 31 日 執 行 單 位 : 國立政治大學風險管理與保險學系 計 畫 主 持 人 : 張士傑 計畫參與人員: 碩士班研究生-兼任助理人員:蕭聿恩 報 告 附 件 : 出席國際會議研究心得報告及發表論文 公 開 資 訊 : 本計畫涉及專利或其他智慧財產權,2 年後可公開查詢中 華 民 國 100 年 11 月 01 日

信用市場之系統性風險,導致帳列資產價值大幅減損,主管機 關為兼顧審慎監理及市場穩定原則,因此採行資本監理寬容措 施,而如何有效執行清償監管機制以達到保險市場財務穩健之 目的,避免引發市場道德風險,不僅涉及現有之保險人,同時 對於欲進入保險市場之競爭者而言,成為相當重要之研究議 題。

本文回顧 Grosen 與 J&;oslash;gensen(2002)及 Chen 與 Suchanecki(2007)之架構,引用巴黎式選擇權分析人壽保險市場 中政府監理寬容措施與被保險人保證承諾之間關係,研究結果 發現,(1)主管機關以公司資產負債比作為退場標準,符合差異 化管理之監理措施;(2)保險人之財務槓桿增加時,單位資產所 承擔之保證給付價值增加;(3)寬容措施期間增加或退場標準降 低時,單位資產之保證給付價值降低,但寬容期間超過一定長 度或啟動標準低於一定水準時,對於單位資產之保證給付影響 趨緩。

英文摘要: Due to the global financial crisis in 2008 that resulted in systematic risks in the equity, asset and credit market, it creates significant deprecation in the life insurer’s balance sheet. In order to retain prudent supervision and market stability, the authority has

announced capital temporal relief plan. Hence maintaining solvency standard becomes critical issue in order to avoid moral hazard for the market players and the potential new entrants, enforcing them to be competent based on a prudent regulation framework.

Adding to Grosen and J&;oslash;gensen (2002) and Chen and Suchanecki (2007), we explicitly calculate the guarantee benefits based on the regulatory forbearance through Parisian option. Intervention criterions are compared through measuring the impact on the guarantees benefits. We find that (1) the relevant intervention criterion is more sensitive to the financial leverage than the other; (2) increasing the leverage ratio of the insurer results in increasing guarantee benefit per asset; (3) extending the relief plan and reduced the intervention standard results in decreasing

guarantee benefit per asset. These impacts reduce if the forbearance duration or the minimal intervention standards reaches certain levels.

1

行政院國家科學委員會專題研究計畫精簡報告

計畫編號: NSC NSC 99-2410-H-004-093

計畫名稱:

人壽保險公司與退休基金之違約風險,負債評價與資產配置

執行期限: 2010/08/01 ~ 2011/08/31 日

計畫主持人:張士傑 國立政治大學風險管理與保險學系教授 AbstractIn This study investigates the bankruptcy cost when a financially troubled life insurer is taken over by a regulatory authority. First, the framework proposed in Grosen and Jögensen (2002) and Chen and Suchanecki (2007) is adopted to measure the impact of government intervention on the minimal guarantee values of policyholders. Then the cost of covering claim obligations to policyholders in the event of insurer insolvency from the insurance guaranty fund is investigated. The embedded Parisian option due to regulatory forbearance on fair premiums under the ex-ante prefunding scheme is fully explored.

Results show that the leverage ratio, asset volatility, and intervention criterion influence default cost. Asset volatility has a significant effect on the default option, while leverage ratio and intervention criterion have shown relatively minor influence. Analysis indicates that the fair premium for the insurance guaranty fund is risk sensitive and hence a risk-based premium scheme should be implemented to ease the moral hazard.

Keywords: financially troubled, minimal guarantee; risk premium; Parisian option

一、 計畫緣由

A financial crisis resulting in the massive fall of security prices might cause financial institutions to face severe difficulties in asset-liability management. As the major investors in the financial markets, life insurers were of course negatively affected by the crisis as the values of a broad range of assets in their investment portfolios tumbled. While most insurers are quite resistant against the crisis, not all insurance market participants followed a prudent strategy (Eling and Schmeiser, 2010). When the financial distress problem occurred in life insurance companies, the claims of policyholders were influenced. To ease the financial distress of those institutions during the crisis and their capital restructuring schemes, a regulatory authority might consider adopting temporary capital relief plans, i.e., reducing the standard of solvency requirements or providing temporary capital injection.

On the other hand, in order to protect the rights of policyholders, the regulatory authority could adopt certain regulatory schemes to deal with the financial problems of insolvent insurers. There is either ex ante or ex post assessment schemes utilized when covering the claim obligations of insolvent insurers. According to work in Ligon and Thistle (2007), they observed that the ex ante scheme gives

2 shareholders less incentive for risk-taking behavior than the actual ex post assessment scheme observed most frequently in practice. Since guaranty funds create a put-option-like subsidy to shareholders (Cummins, 1988; Lee et al., 1997), a fair premium in a competitive market is an important prerequisite for a guaranty fund (see Eling and Schmeiser, 2010). Most countries have ex ante assessment schemes to protect the obligations of debt holders of financial institutions, such as the Taiwan insurance guaranty fund (TIGF) system. The mission of the TIGF is to protect the interests of the insured and their beneficiaries, as well as maintain financial stability. Moreover, TIGF provides last-resort protection to policyholders when insurers become insolvent and are not able to fulfill their commitments. Since TIGF protects the beneficiaries of the policyholders, the fund has to cover a guaranteed ratio of the total amount owed to the beneficiary in the event that the company fails. In other words, we could regard TIGF as a reinsurer; therefore, how to price the fair premium becomes crucial. In the current setting, the premiums are 0.1 % and 0.2% of the total yearly premium income for life and nonlife insurance companies respectively. However, because firm size and leverage ratio are important determinants in evaluating the financial strength of the insurer; we are interested in investigating how regulatory intervention, leverage ratio, grace period, monitoring ratio, and the volatility of assets affect the fair premium.

Furthermore, in order to ease the influence of a financial crisis, the government attempts to reduce financial regulatory standards or so called regulatory forbearance. Regulatory forbearance means that regulators extend the

grace period of capital injection plans or increase the risk tolerance to insurance companies facing financial difficulties. While a run on an unhealthy insurance company is not necessarily a bad thing - it can discipline the performance of managers and owners – there is a risk that runs on bad companies can become contagious and spread to good or well-run companies. (Saunders and Cornett, 2006) Regulatory forbearance employed by the government often induces moral hazard and causes the life insurance industry to face possible contagion risks (related studies see Lee, Mayers and Smith, 1997; Lee and Smith, 1999; Angbazo and Narayanan, 1996; Miller and Polonchek, 1999; Bernier and Mahfoudhi, 2010). To maintain its routine operations when facing financial difficulties, troubled insurers often offer insurance policies with higher guaranteed rates in the market. However, though this risk-taking strategy allows insurers to survive, it significantly worsens their balance sheets and brings out an adverse selection problem. Therefore, the fair premium is affected by the regulatory forbearance mechanism.

二. 計畫目的

In this paper, we emphasize the influence of the fair premium of the TIGF under regulatory forbearance. Before we estimate the fair premium of TIGF, we have to measure the value of life insurance for policyholders when liquidation happens, which is a kind of default problem. The financial literature on the bankruptcy problem has recently extended to insurance issues (see Briys and de Varenne (1994, 1997), Grosen and Jøgensen (2002), Bernard et al. (2005a, 2006)). Beginning in 1990, studies indicate that bankruptcy and liquidation may not coincide. A debt holder is

3 likely to attempt to renegotiate the terms of notable outstanding debts with a debtor. In literature related to insurance, Chen and Suchanecki (2007) generalized the work in Grosen and Jøgensen (2002) to allow for Chapter 11 bankruptcy. Their approach adopts a Parisian barrier option feature instead of the standard knock-out barrier option. They found that the option values increased as the grace period lengthened. Our study further extends their works through developing a quantitative measure under regulatory forbearance defined as the residual value (RV) of the policyholder upon liquidation.

RV with embedded Parisian options in our problem can be determined through several numerical methods. (see Andersen and Brotherton-Ratcliffe (1996); Chesney et al. (1997); Avellaneda and Wu (1999); Haber et al. (1999); Stokes and Zhu (1999); Costabile (2002); Bernard et al. (2005b)). In order to gain numerical accuracy and computational efficiency, the Laplace transformation method and the numerical approximation proposed in Labart and Lelong (2009) is employed.

This paper contributes to the literature in several ways. First, we study the bankruptcy cost of a financially troubled life insurer incorporating the regulatory forbearance mechanism. Then the principle of equal treatments in financial supervision is defined and the intervention criterions are compared through measuring their impact on the residual value of the policyholders. Second, and most importantly, the cost of covering claim obligations to policyholders in the event of insurer insolvency from the insurance guaranty fund is investigated. The embedded Parisian option due to regulatory forbearance is fully explored. Finally, we show that increasing the

leverage ratio raises the liability of the insurer and the guaranteed benefit. When the grace period lengthens or the monitoring ratio decreases, the RV decreases. Nevertheless, when the grace period reaches a certain level and the monitoring ratio is lower than its given constant, the options received upon bankruptcy converge to a constant. Our work is further extending to examine a practical problem to determine the fair premiums of the TIGF.

This paper is organized as follows: Section 2 presents the basic structure of a life insurance company, the definition of RV and the regulatory intervention criteria, and the option pricing method used in this paper. Section 3 performs the numerical study of the RV based on plausible scenarios. In Section 4 the study is further extended to determine the fair premium of TIGF. Finally, Section 5 concludes the study.

三、計畫成果自評

Sound insurance supervision is important for financial stability since the financial crisis might cause life insurers facing severe financial distress problems. Ex-ante assessment schemes such as TIGF are efficient to protect the obligations of policyholders. In this paper, we used the embedded Parisian option to price the fair premium of TIGF with regulatory forbearance schemes and investigated the affects under several important parameters.

Comparing with Chen and Suchanecki (2007), firstly, we define RV to measure the residual value of an insurance company for policyholders when liquidation happens. We investigate the impacts of regulatory forbearance, leverage ratio, grace period, and guaranteed rate on RV. Numerical results suggest that RIC is better than AIC in

4 accordance with the principal of equal treatments in financial supervision.

Secondly, we compute the ex ante premiums of the insurance guaranty fund in our basic model in order to investigate the moral hazard problem. The results show that the volatility of investment performance has a greater effect on premiums than other factors. Numerical analysis shows that financial leverage and government intervention have a similar effect on premiums. The results indicate that the fair premium for TIGF is risk sensitive and hence risk-based premium scheme should be implemented to ease moral hazard.

四、參考文獻

Andersen, L. and R. Brotherton-Ratcliffe, 1996, “Exact exotics,” Risk 9, 85–89.

Angbazo, L.A. and R. Narayanan, 1996, “Catastrophic shocks in the property-liability insurance industry: evidence on regulatory and contagion effects,” Journal of Risk and Insurance 63, 619-637.

Avellaneda, M. and L. Wu, 1999, “Pricing Parisian-style options with a lattice method,”

International Journal of Theoretical and Applied Finance 2, 1–16.

Bernard, C., O. Le Courtois and F. Quittard-Pinon, 2005a, “Market value of life insurance contracts under stochastic interest rates and default risk,”

Insurance: Mathematics and Economics 36, 499–

516.

Bernard, C., O. Le Courtois and F. Quittard-Pinon, 2005b, “A new procedure for pricing Parisian options,” Journal of Derivatives 12, 45-53. Bernard, C., O. Le Courtois and F. Quittard-Pinon,

2006, “Development and pricing of a new participating contract,” North American

Actuarial Journal 10, 179–195.

Bernier, G. and R.M. Mahfoudhi, 2010, “On the economics of postassessments in insurance guaranty funds: a stakeholders' perspective,”

Journal of Risk and Insurance 77, 857-892.

Black, F. and M. Scholes, 1973, “The pricing of options and corporate liabilities,” Journal of

Political Economy 81, 637-654.

Briys, E. and F. de Varenne, 1994, “Life insurance in a contingent claim framework: Pricing and regulatory implications,” Geneva Papers on Risk

and Insurance Theory 19, 53-72.

Briys, E. and F. de Varenne, 1997, “On the risk of insurance liabilities: Debunking some common pitfalls,” Journal of Risk and Insurance 64, 673-694.

Chen, A. and M. Suchanecki, 2007, “Default risk, bankruptcy procedures and the market value of life insurance liabilities,” Insurance:

Mathematics and Economics 40, 231-255.

Chesney, M., M. Jeanblanc-Picqué and M. Yor, 1997, “Brownian excursions and Parisian barrier options,” Advances in Applied Probability 29, 165-184.

Costabile, M., 2002, “A combinatorial approach for pricing Parisian options,” Decisions in Economics

and Finance 25, 111-125.

Cummins, J.D., 1988, “Risk-based premiums for insurance guaranty funds,” Journal of Finance 43, 823-839.

Eling, M. and H. Schmeiser, 2010, “Insurance and the credit crisis; impact and ten consequences for risk management and supervision,” The

Geneva Papers on Risk and Insurance – Issues and Practice 35, 9-34.

Grosen, A. and P.L. Jøgensen, 2002, “Life insurance liabilities at market value: An analysis of insolvency risk, bonus policy, and regulatory intervention rules in a barrier option

5 framework,” Journal of Risk and Insurance 69, 63-91.

Haber, R.J., P.J. Schonbucher and P. Wilmott, 1999, “Pricing Parisian options,” Journal of Derivatives 6, 71–79.

Labart, C. and J. Lelong, 2009, “Pricing Parisian options using Laplace transforms,” Bankers,

Markets & Investors 99, 29-43.

Lee, S.J., and M.L. Smith, Jr., 1999, “Property-casualty insurance guaranty funds and insurer vulnerability to misfortune,” Journal of Banking

and Finance 23, 1437-1456.

Lee, S.J., D. Mayers, and C.W. Smith, 1997, “Guaranty funds and risk-taking evidence from the insurance industry,” Journal of Financial

Economics, 44: 3-24

Ligon, J.A., and P.D. Thistle, 2007, “The organization structure of insurance companies: the role of heterogeneous risks and guaranty funds,”

Journal of Risk and Insurance 74, 851-861.

Miller, R.K. and J. Polonchek, 1999, “Contagion effects in the insurance industry,” Journal of Risk

and Insurance 66, 459-475.

Saunders, A. and M. Cornett, 2006, “Financial institutions management: a risk management approach.” McGraw-Hill International Edition, 5th Edition. NY.

Stokes, N. and Z. Zhu, 1999, “A finite element platform for pricing path-dependent exotic options,” Proceedings of the Quantitative Methods in Finance Conference, Australia.

1

第 15 屆亞太風險與保險學會(APRIA)年會紀實

張士傑

國立政治大學風險管理與保險學系

2011

年 8 月 8 日

一. 參加會議經過 第 15 亞太風險與保險學會年會於 2010 年 7 月 31 日至 8 月 3 日由日本明治大學 (Meiji University)舉辦。此次會議共有約 100 篇論文發表,與會學者專家分別來自 亞洲各國,美洲,澳洲及歐陸等國家,採論文口頭報告的方式,分 5 個平行的議 場進行。此外大會特別邀請日本金融廳保險長官 Katsunori Mikuniya 與 IAIS 秘書 長 Yoshihiro Kawai 專題演講金融風暴後的保險業經營發展,同時大會安排多場圓 桌專題討論,多位理論與實務界專家討論地震巨災、退休金與保險風險管理等監 理與實務議題,下午集會中並對於亞太風險與保險學會組織及未來的發展進行確 認,透過與會成員廣泛的討論,達成多項未來發展的共識。 筆者的論文報告排在議程第 1 天下午第 1 場之風險模型建構及第 2 天健康保險 場次之主持人,論文報告為與共同作者楊尚穎博士之研究論文,內容有關於受到 2008 年全球性金融海嘯影響,人壽保險業因資本、資產及信用市場之系統性風 險,導致帳列資產價值大幅減損,主管機關為兼顧審慎監理及市場穩定原則,因 此採行資本監理寬容措施,而如何有效執行清償監管機制以達到保險市場財務穩 健之目的,避免引發市場道德風險,不僅涉及現有之保險人,同時對於欲進入保 險 市 場 之 競 爭 者 而 言 , 成 為 相 當 重 要 之 研 究 議 題 。 本 文 回 顧 Grosen 與2

Jøgensen(2002)及 Chen 與 Suchanecki(2007)之架構,引用巴黎式選擇權分析人壽保 險市場中政府監理寬容措施與被保險人保證承諾之間關係,研究結果發現,(1) 主管機關以公司資產負債比作為退場標準,符合差異化管理之監理措施;(2)保險 人之財務槓桿增加時,單位資產所承擔之保證給付價值增加;(3)寬容措施期間增 加或退場標準降低時,單位資產之保證給付價值降低,但寬容期間超過一定長度 或啟動標準低於一定水準時,對於單位資產之保證給付影響趨緩。(英文內容摘 要: This study investigates the bankruptcy cost when a financially troubled life insurer is taken over by the supervision authority. Specifically, the framework proposed in Grosen and Jögensen (2002) and Chen and Suchanecki (2007) is adopted to measure the impact of the government intervention on the minimal guarantee values of the policyholders. Then the cost of covering the claim obligations to policyholders in the event of insurer insolvency from the insurance guaranty fund is investigated. The embedded Parisian option due to regulatory forbearance on the fair premium under the ex-ante prefunding scheme is fully explored. This study adds to the previous works of Cummins (1988) and Duan and Yu (2005) by explicitly solving the embedded default options incorporating regulatory forbearance mechanisms. Results show that the relative intervention criterion is better than the absolute intervention criterion in accordance with the fairness principle in financial supervision. The results also indicate that leverage ratio, asset volatility, and intervention criterion influence the default cost. Asset volatility has a significant effect on the default option, while leverage ratio and intervention criterion have shown relatively minor influence. Analysis indicates that the fair premium for the insurance guaranty fund is risk sensitive and hence risk-based premium scheme should be implemented to ease the moral hazard.

3 二. 會議內容及心得 此次會議主要由亞洲太平洋風險與保險學會(APRIA)主辦,其中亞太風險與保險 學會為區域性的國際組織,此次會議除選舉學會主席、副主席、秘書等重要學會 工作人員,並且選舉 26 位理事,分別代表不同的與會國家,初步將以促進區域 了解與推動風險管理與保險教育與研究為主要宗旨。本次會議分別就多項子議題 進行討論,依序 Hunsoo Brian KIM 教授(Soonchunhyang University, Korea)並於本 學會擔任下一屆(2011-2012)主席。 筆者參與年會整天的學會會議,積極參與國際事務與學術研究,本人並選擇保險 財務監理,保險計價理論,危險理論,社會保險與退休金計畫,汽車保險,人壽 保險計價及座談討論等項目進行聆聽,收穫相當豐富。 三. 考察參觀活動 本次大會提供具有特色且與風險保險相關之議題討論,令與會來賓收穫不少。 四. 建議 風險管理與保險的研究發展在國內近年來已快速成長,筆者亦曾擔任此學會主席, 相較於歐美各國於金融保險的發展,台灣已有不錯的論文發表,宜持續強化風險 管理與保險領域之研究,學術及實務活動,下一屆(2012)年會將由韓國成均館大 學(Sungkyunkwan University)舉辦,相信能夠更提升與整合此領域之知名度與學術 研究地位。 五. 攜回資料名稱及內容 攜回大會光碟片包含所有論文及相關參考資料。

4

The Bankruptcy Cost of Life Insurance Industry under

Regulatory Forbearance: an Embedded Option Approach

Shih-Chieh Bill Chang

Professor, Department of Risk Management and Insurance, National Chengchi University, Taipei, Taiwan. R.O.C.

E-mail: bchang@nccu.edu.tw

Shang-Yin Yang

Ph.D., Department of Risk Management and Insurance, National Chengchi University, Taipei, Taiwan. R.O.C.

E-mail: 94358505@nccu.edu.tw

The Bankruptcy Cost of Life Insurance Industry under

Regulatory Forbearance: an Embedded Option Approach

Abstract

This study investigates the bankruptcy cost when a financially troubled life insurer is taken over by the supervision authority. Specifically, the framework

proposed in Grosen and Jögensen (2002) and Chen and Suchanecki (2007) is adopted to measure the impact of the government intervention on the minimal guarantee values of the policyholders. Then the cost of covering the claim obligations to policyholders in the event of insurer insolvency from the insurance guaranty fund is investigated. The embedded Parisian option due to regulatory forbearance on the fair premium under the ex-ante prefunding scheme is fully explored. This study adds to the previous works of Cummins (1988) and Duan and Yu (2005) by explicitly solving the embedded default options incorporating regulatory forbearance mechanisms.

Results show that the relative intervention criterion is better than the absolute intervention criterion in accordance with the fairness principle in financial supervision. The results also indicate that leverage ratio, asset volatility, and intervention criterion influence the default cost. Asset volatility has a significant effect on the default option, while leverage ratio and intervention criterion have shown relatively minor influence. Analysis indicates that the fair premium for the insurance guaranty fund is risk sensitive and hence risk-based premium scheme should be implemented to ease the moral hazard.

5

JEL classification: G13; G22; G38

Keywords: financially troubled, minimal guarantee; risk premium; Parisian option.

Introduction

A financial crisis such as the stock market crash resulting massive fall of the security prices might cause the financial institutions facing severe difficulties in managing their balance sheets. As major investors in the financial markets, life insurers were of course negatively affected by the crisis as the values of a broad range of assets in their investment portfolio tumbled. While most insurers are quite resistant against the crisis, not all insurance market participants follow the prudent strategy (Eling and Schmeiser, 2010). They formulate ten consequences for risk management and insurance regulation after the credit crisis. Baluch et al. (2011) study the impact of the financial crisis on insurance marketsand the role of the insurance industry in the crisis. To ease the financial distress of those institutions during the crisis and their capital restructuring schemes, supervisory authority might consider adopting temporary capital relief plans, i.e., reducing the standard of solvency requirements or providing temporarily capital injection.

For instance, to avoid the extreme impact of systematic risk during the period of subprime crisis, the U.S. government took regulatory action to rescue financial institutions in 2008. The Federal Reserve System injected capital into American International Group (AIG) to assist the company avoiding bankruptcy. Ever since the intensifying of the global financial crisis in October 2008, it seriously endangers the balance sheet and generates significant unrealized losses for the life insurers in Asia countries. For example, the stock market index fell more than 40% in Taiwan. Hence the asset holding by life insurers had fell sharply during the financial crisis. Except for a few life insurance companies, the majority of financial institutions played their intermediation role effectively on the back of adequate capital levels. (CBC, 2009) At that time, the Taiwan Financial Supervisory Commission (FSC) announced provisional relaxation measures to reduce the capital requirements for life insurers.

The government attempts to reduce financial supervisory standards are called regulatory forbearance in academia. Regulatory forbearance means the regulators extending the grace period in capital injection plan or increasing the risk tolerance to insurance companies facing the financial difficulty. While a run on an unhealthy

6

insurance company is not necessarily a bad thing - it can discipline the performance of managers and owners – there is a risk that runs on bad company can become contagious and spread to good or well-run companies. (Saunders and Cornett, 2006) Regulatory forbearance employed by the government often induce moral hazard and cause the life insurer industry facing possible contagion risks (related studies see Lee, Mayers and Smith, 1997; Lee and Smith, 1999; Angbazo and Narayanan, 1996; Miller and Poloncchek, 1999; Bernier and Mahfoudhi, 2010 and others). To maintain its routine operations when facing financial difficulties, the troubled insurers often offer insurance policies with higher guaranteed rate in the market. However, though the risk-taking strategy allows the insurers continuing to survive, it significantly worse their balances sheets and bring out the adverse selection. Since liquidation of an insurance company involves enormous restructuring cost, properly evaluating the capital relief plans become vital in solvency control.

A great deal of attention has focused on the bankruptcy problem through the risk-based insurance program. Merton (1973, 1974) used a contingent claim model to investigate the corporate bankruptcy problem. He suggested that risky debt should be modeled as risk free debt and a put option and equity as a call option on firm assets, while regulatory forbearance is not fully incorporated in his work. Merton (1977, 1978, and 1989) later extended his work to discuss default issues such as deposit insurance and other financial intermediaries. Black and Cox (1976) extended Merton’s approach to a general case in which ruin may strike at any instant. Subsequent researches include Mello and Parsons (1992), Leland (1994), Goldstein et al. (2001), and Morellec (2001).

The financial literature on the bankruptcy problem has recently extended to insurance issue. Briys and de Varenne (1994) modeled the risk of insurer default at maturity through an option triggered by shareholders with limited liability in insurance contracts. They analyzed the effects of factors such as leverage ratio, return volatility and minimal guarantee on asset and liability. Briys and de Varenne (1997) extended the model by adopting a Vasicek (1977) type stochastic interest rate framework. Grosen and Jøgensen (2002) used the Black and Cox framework to model the default risk of insurance companies at any time. Later Bernard et al. (2005a, 2006) built on Grosen and Jøgensen's work by evaluating the solvency

7

problem of an insurer in a stochastic interest rate environment.

Beginning in 1990, studies indicating that bankruptcy and liquidation may not coincidence. Debt holder is likely to attempt renegotiate the terms of notable outstanding debts with debtor. Anderson and Sundaresan (1996), Mella-Barral and Perraudin (1997), and Fan and Sundaresan (2000) considered the out-of-court renegotiation of outstanding debt. Their works assume that renegotiation involves no cost, relieving the firm’s debt problem. Since liquidation might incur significant costs in reality, liability holders inevitably suffer certain losses. This creates the option of a strategic default, meaning that the debtor can only receive the residual values of the insurer. Hence, the option framework is employed to measure the renegotiation value.

Beside out-of-court negotiation, another approach is through the court. These negotiations differ in many aspects that affect the firm value. Franks and Torous (1989) and Longstaff (1990) considered bankruptcy problems in U.S. bankruptcy code Chapter 11. They found evidence that the renegotiation process is complex, lengthy, and costly. Later Longstaff (1990) used the concept of compound option to model debt value under Chapter 11 with the right to extend the maturity date of the debt. The longer this extension, the less valuable it is to bondholders, and hence the credit spread on corporate debt becomes larger.

In literature related to insurance, Chen and Suchanecki (2007) generalized the work in Grosen and Jøgensen (2002) to allow for Chapter 11 bankruptcy. Their approach adopts a Parisian barrier option feature instead of the standard knock-out barrier option. They found that the option values increased as the grace period lengthened. Our study further extends their works through developing a quantitative measure under regulatory forbearance defined as the minimal guarantee value

(MGV), i.e. the residual value of the policyholder upon liquidation. Because firm size

and leverage ratio are important determinants in evaluating the financial strength of the insurer, we also investigate how the regulatory intervention affected by these factors. Two kinds of regulatory intervention criteria, i.e., relative intervention criterion and absolute intervention criterion, are defined to evaluate their impacts. The sensitivity analysis of leverage ratio, guarantee interest rate, and grace period on MGV is performed.

8

The embedded Parisian options in our problem can be determined through several numerical methods. (see Andersen and Brotherton-Ratcliffe (1996); Chesney et al. (1997); Avellaneda and Wu (1999); Haber et al. (1999); Stokes and Zhu (1999); Costabile (2002); Bernard et al. (2005) and others). In order to gain the numerical accuracy and computational efficiency, the Laplace transformation method and the numerical approximation proposed in Labart and Lelong (2009) is employed.

This paper contributes to the literature in several ways. First, we study the bankruptcy cost of a financially troubled life insurer incorporating the regulatory forbearance mechanism. Then the fairness principle in financial supervision is defined and the intervention criterions are compared through measuring their impact on the minimal guarantee values of the policyholders. Second, and most importantly, the cost of covering the claim obligations to policyholders in the event of insurer insolvency from the insurance guaranty fund is investigated. The embedded Parisian option due to regulatory forbearance is fully explored. Finally, we show that increasing the leverage ratio raises the liability of the insurer and the guarantee benefit. When the grace period lengthens or the monitoring ratio decreases, the MGV decreases. Nevertheless, when the grace period reaches certain level and the monitoring ratio is lower than given constant, the options received upon bankruptcy converges to a constant. Our work is further extending to examine a practical problem to determine the fair premiums of Taiwan insurance guaranty fund (TIGF).

This paper is organized as follows: Section 2 presents the basic structure of the life insurance company, the definition of MGV, and the option pricing method used in this paper. Section 3 defines the regulatory intervention criteria, including relative intervention criterion, absolute intervention criterion and the fairness principle. Section 4 performs the numerical study of the MGV based on plausible scenarios. In Section 5 the study is further extended to determine the fair premium of TIGF. Finally, Section 6 concludes the study.

Basic Framework

This section reviews the basic setting and model of the life insurers, and then defines a quantitative measure under regulatory forbearance called the MGV, and

9

introduces the numerical method in determining these values.

Basic Model of Insurance Firms

Based on the framework of Briys and de Varenne (1994, 1997) and Grosen and Jørgensen (2002), we assume that the policyholder is the only debt holder of the insurance company. The policyholders who pay the initial premiums of the insurance contract are assumed to be unique liability creditors and the policy reserves are

denoted by , .

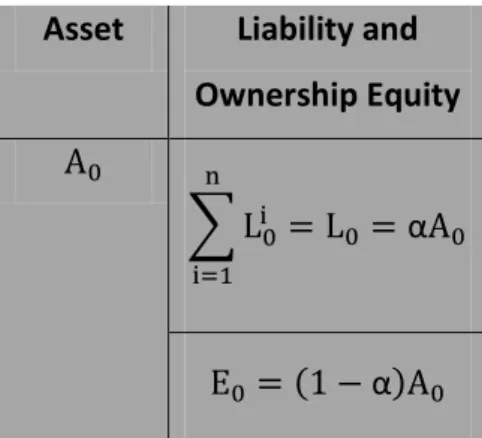

Table 1 Balance Sheet of Insurance Company Asset Liability and

Ownership Equity

The term represents the initial assets financed by the equity holder at time t=0. The policyholders who pay the initial premiums of the insurance contract are assumed to be unique liability creditors and the policy reserves are denoted by

, where is the aggregated liability portfolio with n

lines of business. The assets are invested in equities, corporate bonds, real estate or others.

The insurance market has recently offered significant amount of with-profit life insurance policies that contain an interest rate guarantee (see Briys and de Varenne (1994, 1997), Grosen and Jøensen (2002)). The insurer is required to provide the policyholder a minimal compounded return . The guarantee payment to the policyholder at maturity is , where T is the maturity date. In addition to the minimal guarantee provided by the policy, the policyholder receives the bonus option based on the investments performance of the insurer. The payoff of the bonus is written as . This means that if the total value of the policyholder’s share in the balance sheet exceeds the guaranteed payment at maturity, they can participant the returns given the participation rate . However, if

10

the policyholder could only receive the residue value of runoff the insolvent insurance company at maturity. Therefore, the payoff to the policyholder at maturity, , is

as illustrated by the following figure.

Total payoff to the policyholder Bonus option Guarantee fixed payment Put option

Figure 1 the payoff to the policyholder at maturity

This payment consists of two components. The first component, on the right-hand side, is a bonus option. The second component is the minimal value of the firm and guaranteed insurance benefits at maturity. This second component of payoff at maturity consists of two parts, a guaranteed fixed payment, which includes the accumulated premiums compounded at the credit rate, and a short position of a put option due to the limited liability of the shareholder.

According to Chen and Suchanecki (2007), an insurance company facing liquidation returns a rebate payment , to the policyholder at time . The rebate term implicitly depends on the parameter in triggering the intervention. The trigger condition is formulated in the following inequality

where is the regulatory barrier. Note that the rebate corresponds to the asset value . A regulatory barrier is used to place the insurance company under conservatorship or receivership.

Given the above structure, supervisory authority monitors the liability dynamics in controlling the bankruptcy cost within the grace period. The regulatory authority triggers the intervention once the MGV of the life insurer is below certain limit.

Market Framework

11

market imperfections. Using the equivalent martingale measures, the asset dynamics on the insurer’s balance sheet follow a geometric Brownian motion

, (4) where r denotes the deterministic interest rate, represents the deterministic volatility of , and is an equivalent -martingale process. The

asset price dynamics can be solved as the following equation

(5) The liability process is formulated as where g is the minimal guarantee rates.

Following Chen and Suchanecki (2007), the concept of a Parisian option is employed to measure the MGV. A Parisian option has three characteristics: up or down, in or out, and call or put. Combining these characteristics makes it possible to distinguish eight types of Parisian options. For example, PDIC denotes a Parisian Down and In Call, whereas PUOP denotes a Parisian Up and Out Put. Since MGV represents the residual value of the insolvent insurer, it consists of two options which are the present value of the residual value at maturity and the present value of rebate payment at the defaulted time. Parisian option is employed in our study to allow the grace period. In the standard Parisian down-and-out option framework, the final payoff is only paid if the following technical condition is satisfied: (6)

where

with where denotes the last time before at which the value of the assets reaches the barrier . The term represents the first time at which an excursion below regulatory barrier lasts more than d units of time. In fact, is the liquidation date of the company if . Note that the condition in Eq. (6) is equivalent to

(7) where

12

and is a martingale under a new probability measure 1 defined by the

Radon-Nikodym density

(8)

. The following derivation clarifies this equivalence argument:

The P measure is an equivalent measure satisfy (i.e., P is equivalent to Q). According to the explanation above, the excursion ofthe value of the assets below the exponential barrier is an event in which the excursion of the Brownian motion is below a constant barrier ".

Therefore, under the Q measure, the maturity benefit can be expressed as

follows:

, (9)

This can be rephrased as follows:

, (10)

where is the asset process under P which can be expressed as follows:

(11)

Minimum Guarantee and Regulatory Forbearance

It is important to have a clear idea about how the bankruptcy concerning the policyholder is affected through measuring the MGV. M(0) expressing the present value of the residual value when liquidation happens at time zero is defined as follows: 1

13

Note that MGV includes three parts: 1. A deterministic guaranteed part

the assets has not stayed below the barrier for a time longer than; 2. A Parisian down-and-out put option with strike ;

3. A rebate paid immediately when the liquidation occurs.

Before showing the detail calculations, several notations, definitions, and propositions are introduced.

Definition 1 (Laplace Transform) The Laplace transform of a function for all

is the function defined by

Definition 2 (Inverse Laplace Transform) The inverse Laplace transform of a Laplace

transform is

where .

Propositions 1-82 are the basic statements which depend heavily on the Laplace and inverse Laplace transformation to explicitly formulate the Parisian options in this paper. The proof, or intuition, of each proposition is also given.

Proposition 1 BSP is the Black and Scholes (1973) put option price, which can be

expressed as

Proof: The result can be obtained following the work in Black and Scholes (1973).

2

14

The Digital Parisian Down and In Call option is denoted by .

Proposition 2 The Laplace transform of is given by the

following formula

where and is the cumulative distribution function of the standard normal distribution.

Proof: See Appendix A.

Proposition 3 The Laplace transform of a Parisian Up and In Call option is denoted by

. It is given by

For any and for we have

r g e m b d d m e dm m m d m e d m m m d e b d e m e d d d d m m e m d m m d d d d for , r g e m b d m e dm m d m m d e b d d e m m m

Proof: See Labart and Lelong (2009).

15

r g r g

r g r g

r g r g

r g r g

Proof: See Labart and Lelong (2009).

Proposition 5 e r g m b b = e r g m b b e p r g m b r g m d

Proof: See Appendix A.

Proposition 6

e p m

b e

m b m de m d

m d Proof: See Appendix A.

Proposition 7 e p m b b e m b e p b d m b d m e p d m b d m d Proof: See Appendix A.

Proposition 8 e p m b b b emb e p b d m b m d e p dm dm d b dm d

Proof: See Appendix A.

16

Theorem 1 The guarantee benefit of the policyholder at time zero, M(0), i.e., the

present value of the residual value when liquidation happens, is explicitly formulated as follows: For , e r r g S r g r g e r g m b b e m b m de m d m d for , e r r g S r g r g e r g m b b e m b e p b d m b d m e p d m b d m d e r g m b b emb e p b d m b m d e p dm dm d b dm d

Proof: See Appendix A.

The Laplace transform of and e r g m b

b are formulated

in Theorem 1 and then the Laplace inversion is employed to find M(0).

Relative and Absolute Intervention Criterion

M(0) can be rewritten as a linear function of asset or liability. Leverage ratio is

defined as , and then MGV can be expressed as

e r e r g m e em b

e r m be p m

17 e r eg e r g m e em b e r m be p m b min e g b e b g b b e r g e r g m e em b e r m be p m b min e g b e b g b b e r g e r g m e em b e r m be p m b min e g b e b g b b ,(13) and e r g e r g m e em b e r m be p m b min e g b e b g b b (14)

The equation above illustrates the linearity of MGV. The linear relationship can be used to evaluate the intervention criteria. In the following discussion, two intervention criteria are defined, i.e., the relative intervention criterion (RIC) and the absolute intervention criterion (AIC). Hence we are able to examine and compare the efficiency of the existing regulatory intervention mechanisms.

Definition 3 (Monitoring Ratio) the monitoring ratio R is a benchmark set by a

regulatory authority to intervene the operation of an insurance company. This ratio satisfies

(15) where is the trigger standard of the government intervention. Therefore, as the minimal capital requirement increases, the monitoring ratio also increases. According to the definition of the MGV, higher monitoring ratios increase both the rebate payments of the policyholder and their MGV.

Definition 4 (RIC and AIC) Under the RIC, the regulatory authority determines a

given constant multiplier of the liability of the insurer, i.e., , as a benchmark to trigger the intervention. While under the AIC, the regulatory authority chooses a positive tolerance value Y and set up a liability lower bound as a benchmark to trigger the intervention.

18

represented through measuring the MGV per asset value called the minimal guarantee index (MGI). Hence the MGI of RIC is defined as , and the MGI of AIC

is .

It is important to identify the unintended consequences of regulation and avoid the pitfalls of one-size-fit-all regulation. The fairness principle is defined to investigate the proposed micro-prudential regulatory approaches (i.e., regulation targeting an individual company’s economic soundness).

Definition 6 (The Fairness Principle) the fairness principle assumes a hypothetical

regulatory rule that the financial regulator maintains the MGI of each insurer to be the same based on the same financial status, i.e., asset volatility, guarantee rates, and leverage ratio.

Corollary 1 demonstrates the preliminary results linking the guarantee benefit of the policyholder with the fairness of the micro-prudential regulatory approaches.

Corollary 1 Given the same MGI, the RIC is more consistent with the fairness

principal than the AIC.

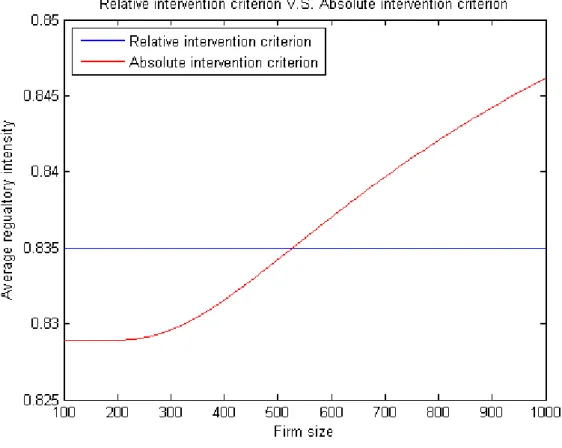

First consider the condition of only one company. In Fig. 2, the MGI of the RIC is fixed, and will not change as the initial liability fluctuates. In contrast, the MGI of the AIC varies, and changes based on initial liability. On the other hand, when a regulatory authority adopts the AIC, the larger insurance companies will suffer more attentive by a regulatory authority, but this kind of situation will not happen in RIC.

19 Figure 2 Relationship between and MGI

:blue, :red, with parameters

8 r g 5 d 5 9 5 5 Two sample companies are selected to clarify the fairness principle. For

Company 1, assume its initial asset level is and its initial liability is . The term

is the MGV of RIC for Company 1 and is the MGV of AIC for Company

1. For Company 2, adopt a similar definition. If other factors are fixed, i.e., these two insurance companies have the same r g and . Based on the definition of RIC, the larger leverage ratio would cause the higher monitoring ratio and the higher MGV

. Indeed, . This indicates that the insurer

with a higher leverage ratio will experience more stringent monitoring from the regulatory authority. For the condition of , even if these insurers have different amount of assets and liabilities in their balance sheets, they are supervised under the same standard.

Under the AIC, given that the two insurers have same r g and , the monitoring ratio raise as the asset increases. If is larger than , then

20

insurer with higher asset values, even if these insurers have the same leverage ratio, guaranteed rate, and other factors. Hence the discussion suggests that the AIC is less consistent with the principal of fairness comparing with the RIC.

Numerical Illustrations

This section provides an improved method in Labart and Lelong (2009) adding to the work in Bernard et al. (2005b). The comparison of the numerical methods is summarized in Appendix B. The sensitivity analysis is also performed to investigate the MGV under various market scenarios.

Appropriateness of the MGV

It shows that MGV is an increasing function of the monitoring ratio and a decreasing function of the grace period. Since intervention criterion heavily influence the security of the holding assets, the guarantee benefits can be regarded as a benchmark in measuring the regulatory intensity.

Table 2

The MGV with parameter:

。

Grace period Monitoring Ratio

50% 60% 70% 80% 90% 100% 0 82.89 82.89 82.89 82.99 84.40 91.61 0.25 82.89 82.89 82.89 82.93 83.69 88.37 0.5 82.89 82.89 82.89 82.92 83.50 87.34 1 82.89 82.89 82.89 82.91 83.29 86.17 1.5 82.89 82.89 82.89 82.90 83.17 85.45 2 82.89 82.89 82.89 82.90 83.10 84.94 5 82.89 82.89 82.89 82.89 82.94 83.59 10 82.89 82.89 82.89 82.89 82.89 83.03 15 82.89 82.89 82.89 82.89 82.89 82.90 20 82.89 82.89 82.89 82.89 82.89 82.89

Table 2 shows that MGV is an increasing function of monitoring ratio and is a decreasing function of grace period. A longer grace period and a lower monitoring

21

ratio result a lower MGV. The results further show that the MGV converges to a fixed value as the monitoring ratio decreases.

Effects of Riskless and Guarantee Rate

The interest rate is a crucial factor in determining the insurance premium. We employ the MGV to measure the efficiency of the regulatory forbearance given various riskless rates and guarantee rates. Tables 2 and 3 show the results based on the scenarios when the riskless rates are equal or less than the guarantee rates, i.e., and . The results show that the MGV of the insurer are higher given .

Table 3

The MGV of the condition with parameters:

Grace period Monitoring Ratio

50% 60% 70% 80% 90% 100% 0 88.59 88.59 88.60 88.69 89.88 95.00 0.25 88.59 88.59 88.59 88.64 89.30 92.83 0.5 88.59 88.59 88.59 88.62 89.14 92.11 1 88.59 88.59 88.59 88.61 88.96 91.25 1.5 88.59 88.59 88.59 88.60 88.86 90.71 2 88.59 88.59 88.59 88.60 88.79 90.32 5 88.59 88.59 88.59 88.60 88.64 89.22 10 88.59 88.59 88.59 88.59 88.60 88.73 15 88.59 88.59 88.59 88.59 88.59 88.61 20 88.59 88.59 88.59 88.59 88.59 88.59 Table 4

The MGV of the condition with parameters:

Grace period Monitoring Ratio

50% 60% 70% 80% 90% 100%

0 93.16 93.16 93.16 93.24 94.11 97.32

0.25 93.16 93.16 93.16 93.19 93.69 96.03

22 1 93.16 93.16 93.16 93.17 93.44 95.03 1.5 93.16 93.16 93.16 93.17 93.36 94.67 2 93.16 93.16 93.16 93.16 93.31 94.41 5 93.16 93.16 93.16 93.16 93.20 93.64 10 93.16 93.16 93.16 93.16 93.16 93.27 15 93.16 93.16 93.16 93.16 93.16 93.17 20 93.16 93.16 93.16 93.24 94.11 97.32

The MGV in Tables 3 and 4 are higher than those in Table 2. It suggests that the regulatory authority should enhance monitoring intensity given lower riskless and higher guarantee rates. Tables 2 to 4 show that lower riskless rates result higher MGV.

Effects of Intervention Criteria

The MGI is employed to explain which relative intervention criteria best fits the principle of fairness. Table 5 shows the numerical results of MGI for various intervention criteria. The firm size changes the MGI in the AIC. The results indicate that the firm size will significantly cause different regulatory actions when the AIC is adopted. This agrees with the findings that the RIC is the best supervisory intervention criterion. Table 5 shows that if the grace period is long enough, the MGI converges to a steady state.

Table 5

The MGI for different intervention criteria with parameters: Average regulatory intensity in the

relative intervention criterion

Average regulatory intensity in the absolute intervention criterion Grace

period

Firm size Grace

period Firm size 600 700 800 900 1000 600 700 800 900 1000 0 0.844 0.844 0.844 0.844 0.844 0 0.848 0.854 0.859 0.863 0.867 0.25 0.837 0.837 0.837 0.837 0.837 0.25 0.840 0.843 0.846 0.849 0.851 0.5 0.835 0.835 0.835 0.835 0.835 0.5 0.837 0.840 0.842 0.844 0.846 1 0.833 0.833 0.833 0.833 0.833 1 0.834 0.836 0.838 0.840 0.841 1.5 0.832 0.832 0.832 0.832 0.832 1.5 0.833 0.834 0.836 0.837 0.838 2 0.831 0.831 0.831 0.831 0.831 2 0.832 0.833 0.834 0.835 0.836

23

5 0.829 0.829 0.829 0.829 0.829 5 0.830 0.830 0.830 0.831 0.831 10 0.829 0.829 0.829 0.829 0.829 10 0.829 0.829 0.829 0.829 0.829 20 0.829 0.829 0.829 0.829 0.829 20 0.829 0.829 0.829 0.829 0.829

Fair Premium in Ex-ante Assessment

There is either ex ante or ex post assessment schemes in covering the claim obligation of insolvent insurers. According to work in Ligon and Thistle (2007), they observed that ex ante gives the shareholders less incentive for risk-taking behavior than the actual ex post assessment scheme observed most frequently in practice. Since guarantee funds create a put-option-like subsidy to shareholders (Cummins, 1988; Lee at al, 1997), a fair premium in a competitive market is an important prerequisite for a guaranty fund (see Eling and Schmeiser, 2010).

Hence we extend the previous work to determine the fair premium through ex-ante funding scheme in the TIGF. TIGF provides last-resort protection to policyholders when insurers become insolvent and are not able to fulfill their commitments. In guaranty fund research, Cummins (1988) provided a risk-based guaranty fund premium to reflect the risk of the insurer. Duan and Yu (2005) extended the work in Cummins (1988), using a Monte Carlo method to incorporate interest rate uncertainty and RBC regulation in pricing guaranty fund premium. Basically, Cummins (1988) and Duan and Yu (2005) assume a US bankruptcy code Chapter 7 framework.

In this study, the ex ante premiums of the insurance guaranty fund are measured given regulatory forbearance. The results show that leverage ratio, performance stability, and government intervention are crucial determinants in an ex ante assessment. Consider a hypothetical insurer whose initial asset is 100 monetary units and the guaranteed rate of liability portfolio is 2%. The minimal compensation ratio of the insurance guaranty fund is 90% of the policy reserve. Since the insurance guaranty fund is to protect the beneficiaries of the policyholders, the fund cover 90% of the total amount owed to the beneficiary in the event that the company fails.

The fair premium is formulated as:

24

The first term on the right represents the bankruptcy cost when the time of the insurer becoming insolvent is within the grace period. The second term on the right means the bankruptcy cost at maturity. It can be formulated through the following equation. Note that the fair premium consists of two parts:

(1) A Parisian down-and-in put option with strike when insurers have defaulted before maturity.

(2) A Parisian down-and-out put option with strike ;

We employ the inverse Laplace transform in numerical computations to investigate the fair premium, and compare the results by leverage ratio, asset volatility, and intervention criterion.The financial leverage of a company is used to measure its ability to meet financial obligations. While asset volatility measures the investment behavior of the insurer and intervention criterion measures the regulatory intensity and forbearance through the grace period. Intuitively, as the leverage ratio and asset volatility of the insurer increases and the intervention criterion of government become more intensive, the fair premium increases. This study presents numerical results to explore the relationship between these factors.

Finding and Observation

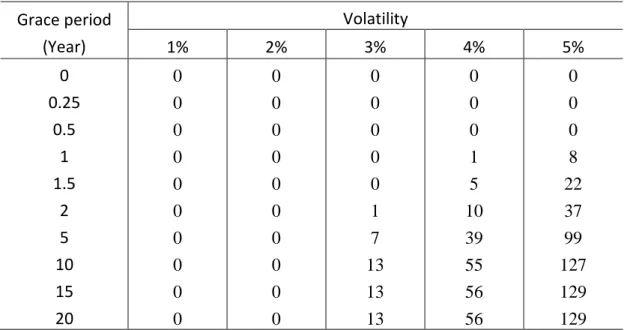

Tables A, B, and C summarize the fair premiums based on various scenarios. The risk free interest rate is set at 2%. In Table A, the trigger point of government intervention is 100% of the liability and the leverage ratio is 95%. The volatilities of asset portfolio form 1% to 5%. In Table B, the trigger points of government intervention are 80%, 85%, 90%, 95%, and 100%. The leverage ratio is 95% and the volatility of asset portfolio is 3%. In Table C, the trigger point of government

25

intervention is 100% and the asset portfolio volatility is 3%. The leverage ratios of the insurer are 91% to 95%.

Table A Fair Premium of Insurance Guaranty Fund in Basis Points

ote: when the volatility of an insurer’s asset portfolio changes from 1% to 5%, the fair premiums increase from 0 b.p. to 129 b.p., while the premiums increase almost twelve times at 5% from one-year to five-year grace period.

Grace period (Year) Volatility 1% 2% 3% 4% 5% 0 0 0 0 0 0 0.25 0 0 0 0 0 0.5 0 0 0 0 0 1 0 0 0 1 8 1.5 0 0 0 5 22 2 0 0 1 10 37 5 0 0 7 39 99 10 0 0 13 55 127 15 0 0 13 56 129 20 0 0 13 56 129

26

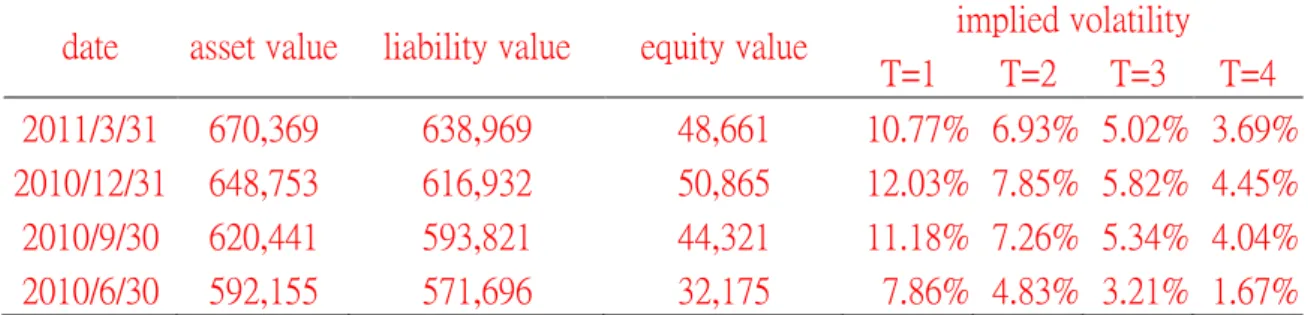

In Merton (1974), the equity value ( ) of a firm can be described as a European call option with strike price of the debt. According to Black and Schole (1973) pricing formula, the European call option is expressed as follows:

Where

Using the market value of equity and the book value of asset and liability, we can find the implied volatility of the asset value. The following table shows an empirical example of a Taiwan insurance company. The implied volatility is from 1.67% to 12.03% with different maturity and different market condition of the reference insurance company. Comparing the assumptions of the volatility in table A, it can infer the investor’s holding period of the stock is probability about 3 to 4 years.

Table A-1 implied volatility

This table describes the implied volatility of a Taiwan insurance company with different maturity assumption. Data source: Taiwan Economic Journal (TEJ).

date asset value liability value equity value implied volatility

T=1 T=2 T=3 T=4

2011/3/31 670,369 638,969 48,661 10.77% 6.93% 5.02% 3.69%

2010/12/31 648,753 616,932 50,865 12.03% 7.85% 5.82% 4.45%

2010/9/30 620,441 593,821 44,321 11.18% 7.26% 5.34% 4.04%

27

Table B Fair Premium of Insurance Guaranty Fund in Basis Points

Note: when the ratio of monitoring changes from 100% to 80%, the fair premiums increase from 0 b.p. to 17 b.p.. The premiums converge to 13 b.p. when the length of grace periods increase to 20 years. Grace period (Year) Rate of Monitoring 80% 85% 90% 95% 100% 0 15 17 0 0 0 0.25 14 16 11 0 0 0.5 14 16 13 0 0 1 14 15 15 2 0 1.5 14 15 15 5 0 2 14 15 15 7 1 5 13 14 15 13 7 10 13 13 14 14 13 15 13 13 13 13 13 20 13 13 13 13 13

Table C Fair Premium of Insurance Guaranty Fund in Basis Points

Note: when the leverage ratio of the insurer changes from 91% to 95%, the fair premiums increase from 0 b.p. to 13 b.p., while the premiums increase more than ten times at 95% from two-year to ten-year grace period.

Grace period (Year) Leverage Ratio 91% 92% 93% 94% 95% 0 0 0 0 0 0 0.25 0 0 0 0 0 0.5 0 0 0 0 0 1 0 0 0 0 0 1.5 0 0 0 0 0 2 0 1 1 1 1 5 3 4 5 6 7 10 5 7 8 10 13 15 6 7 9 11 13 20 6 7 9 11 13

This study investigates the determinants of fair premium due to life insurer insolvency. The determinants include financial leverage, performance stability, and government intervention which impede the fair premium of the TIGF. Regulatory

28

forbearance might cause the wrong incentives for the managers and significantly increase the cost of the guaranty fund by increasing the volatility of the insurer’s asset portfolio. Comparing the premium rates, i.e., 10 basis points for life insurers in TIGF, with the results in Table C, it shows that the asset volatility should be controlled less than 3% within five-year grace period.

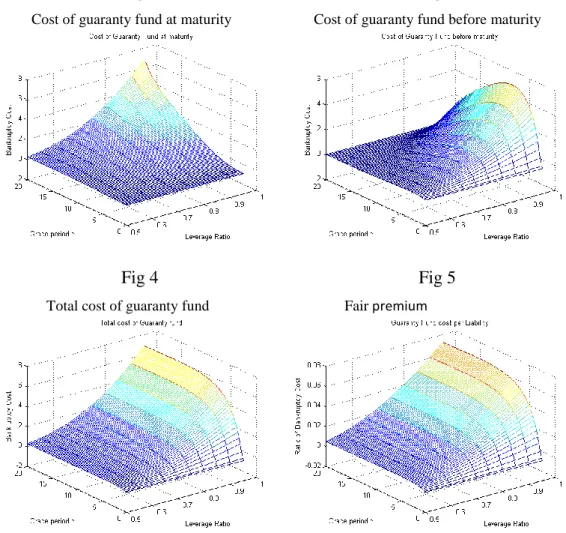

Figures 2-5 The fair premium given leverage ratios and grace periods

These figures show the cost of the guaranty fund at maturity, before maturity, total cost, and fair premium. The initial asset is assumed to be 100 monetary units. The risk free interest rate is set at 2%. The guaranteed rate is 1.5% and the minimal compensation ratio is 90%. The trigger point of government intervention is 100% of the liability. The volatility of asset is 10% and the time horizon is 20 years.

Fig 2 Fig 3

Cost of guaranty fund at maturity Cost of guaranty fund before maturity

Fig 4 Fig 5 Total cost of guaranty fund Fair premium

Figures 2-5 show the fair premium given leverage ratios and grace periods. These figures show the cost of the guaranty fund at maturity, before maturity, total cost, and fair premium. The initial asset is assumed to be 100 monetary units. The risk free interest rate is set at 2%. The guaranteed

29

rate is 1.5% and the minimal compensation ratio is 90%. The trigger point of government intervention is 100% of the liability. The volatility of asset is 10% and the time horizon is 20 years.

Figures 2 through 5 compare the fair premium based on various leverage ratios and grace periods.In our setting, the intervention criterion is set at =1.The results in Fig. 2 show that as leverage ratio or grace period increases, the fair premiums increase. This indicates that the grace period is significantly influenced when the insurer maintains high leverage ratio.

Figure 3 shows that the fair premiums increase if the insurer increases leverage ratio.When we increase the length of grace periods, the fair premiums first increase and then decrease. This behavior can be explained by the ruin probability of the insurer, which initially exhibits an increasing trend and then turns a downward trend as the grace period increases.

Figures 4 and 5 plot the fair premium. The figures show a shape similarity to those in Fig. 3. When the grace period reaches a certain length, the fair premiums converge to a stable value. The fair premium in Fig. 5 falls from 0% to 7.24%, indicating that different leverage ratios and grace periods have result diverse default costs.

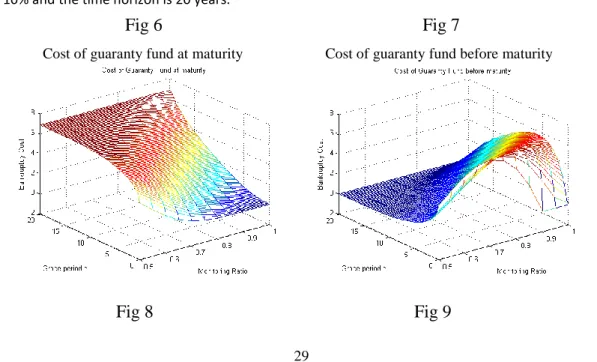

Figures 6-9 The fair premium given different leverage ratios and grace periods

The figures show the fair premium at maturity, before maturity, total cost, and fair premium. The initial asset is assumed to be 100 monetary units and the liability is 95. The risk free interest rate is set at 2%. The guaranteed rate is 1.5% and the minimal compensation ratio is 90%. The volatility of assets is 10% and the time horizon is 20 years.

Fig 6 Fig 7

Cost of guaranty fund at maturity Cost of guaranty fund before maturity

30

Total cost of guaranty fund Fair premium

Figures 6 to 9 compare the fair premium for different monitoring ratios and grace periods. The monitoring ratio equals the initial liability and the monitor barrier. The leverage ratio is set to be 0.95, which nears the average leverage ratio in Taiwan life insurance industry. Figure 6 indicates as the ratio of monitoring decreases or the grace period increases, the fair premium increases. These results show that the monitoring ratio and the grace period have a similar effect. In Fig. 7, with a decrease in the grace period, when the monitoring ratio increases, the cost of the guaranty fund increases. Given a shorter grace period, the difference between the minimal compensation ratio and ratio of monitoring has a significant effect on the fair premiums. Figure 7 shows that when the monitoring ratio increases more than the minimal compensation ratio increases (or exceeds this ratio), the cost of the guaranty fund decreases.

Figure 7 shows that as the grace period increases, the fair premium first increases, and then decreases. This concludes the guaranty fund trend as the grace period increases. Figures 8 and 9 illustrate the fair premium. Though the similarity to Fig. 7, the grace period in these figures increases before the fair premium becomes stable. The fair premium in Fig. 9 ranges from 0% to 7.66%. This shows that the monitoring ratio and the grace period have diverse effects.

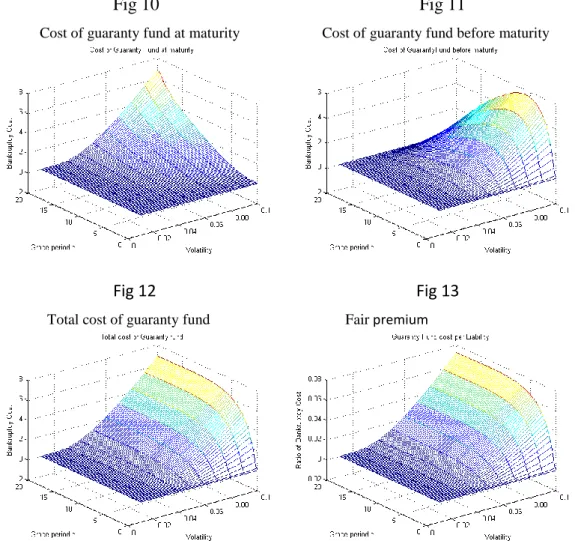

Figures 10-13 The fair premium given different volatilities and grace periods

These figures show the cost of guaranty fund at maturity, before maturity, total cost, and cost of bankruptcy per written liability. The initial asset is assumed to be 100 monetary units and the liability is 95. The risk free interest rate is set at 2%. The guaranteed rate is 1.5% and the minimal

31

compensation ratio is 90%. The trigger for government intervention is 100% of the liability. The time horizon is 20 years.

Fig 10 Fig 11

Cost of guaranty fund at maturity Cost of guaranty fund before maturity

Fig 12 Fig 13 Total cost of guaranty fund Fair premium

Figures 10 to 12 show how the fair premium of the guaranty fund affects volatility and grace period. In the sample scenario, the leverage ratio is 0.95 and monitoring ratio is 1, since 0.95 is the normal leverage ratio in the Taiwanese life insurance industry. The liability monitoring value is set at 100% to represent basic minimal compensation for the policyholder. In Fig. 10, if the volatility or the grace period increases, the fair premium increases. Results show that the grace period has a significant influence when the asset volatility increases. In Fig. 11, the volatility increase causes an increase in the fair premium. Figure 11 shows that the premium initially increases and then decreases as the grace period increases. Figures 12 and 13 present the fair premium. These figures show a similar pattern to that in Fig. 3, but the grace period increases before the cost of bankruptcy stabilizes. The fair premiums are in Fig. 13 ranging from 0% to 7.24%. This shows the diversity of default costs due to various asset volatility and grace period.