商業企劃書-非洲之非營利企管顧問公司 - 政大學術集成

全文

(2) 商業企劃書-非洲之非營利企管顧問公司 Not-for-profit Business Consulting Firm in Africa. 研究生:魏倩儀. Student: Larba Joceline Leocadie Ouedraogo. 指導教授:吳文傑. Advisor: Jack Wu. 國立政治大學. 學. ‧ 國. 立. 政 治 大. ‧. 商學院國際經營管理英語碩士學位學程 碩士論文. er. io. sit. y. Nat. A Thesis. n. a to International MBA Program Submitted iv l C n U NationalhChengchi University engchi. in partial fulfillment of the Requirements for the degree of Master in Business Administration. 中華民國一○二年五月 May 2013.

(3) Dedication To my grandmother Tenga and my uncle Maurice, for all they have given to me. To my father, who cherishes me and invested a lot for my education. To my mother for always intercedes for me. To all my relatives and friends for love, support and prayer they give me.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. i. i n U. v.

(4) Acknowledgement I thank The Lord God, who fills my life every day of his grace. I also thank Taiwan International Cooperation and Development Fund (Taiwan ICDF) and National Chengchi University (NCCU) Office of International Program committee for giving me the opportunity to come here in Taiwan and study this fabulous program. I thank 吳文傑教授 for his patience and his lighten guidance. I also thank the oral examination committee members: 連賢明教授 and 許績天教授 for their help and assistance.. 立. 政 治 大. My warm greetings to 何釐琦 “my lovely 台媽媽” for her assistance and help through whole. ‧ 國. 學. my training process; to 張訓銘“my wonderful 台爸爸” more than being scholarship 專案經 理 ,he took much care of me. He brought to me joy, help & assistance and made those two. ‧. years study a happy unforgettable time of my life.. Nat. sit. y. My big hug to all my 2011 ICDF brothers and sisters; to all my friends and IMBA classmates. io. n. al. er. for those two years knowledge and experience sharing.. Ch. engchi. ii. i n U. v.

(5) Abstract Among the entire continent in the world, Africa is the one with plenty valuable resources and many business opportunities. But African themselves, don’t have enough cash to auto-finance their project or to exploit such resources. With the existing financial crisis in Europeans countries, the slowdown of economic into several part of the world and the higher probability of gain from return on investment opportunity in Africa, many European and Asian choose to go to Africa for their business development. Unlikely, the result in terms of economic and social growth is still negative for many African countries. Taking into consideration the fact. 政 治 大. that many foreign business enterprises which were attracted by Africa business opportunities went to bankrupt after invested a lot of money, and the necessary need of African countries. 立. economic development, we propose to launch a consulting firm to bring our modest. ‧ 國. 學. contribution. Since we have well knowledge of Africa social, political and geographical structure, moreover our knowledge of Asian’s and European’s way of doing business, and our. ‧. experience of developing and running successful foreign business entities in Africa, we. Nat. sit. benefic tool for both foreign investors and African countries.. y. decided to setup our organization. We believe that our organization will be very helpful and a. er. io. Our organization is a not-for-profit organization, which aims to help foreign investors who. al. n. v i n their money and to help African C countries into social and economic growth. To sustain U h e ntogget i h c. plan to go to Africa for business purpose, to avoid them to do wrong investments and lose. our organization, will be charging African governments for each valuable investor will bring to them, our clients for consultancy services through personal contact and later on a dedicated Website click and pay services.. iii.

(6) Table of Contents. African Continent Overview ...................................................................................... 1. 1.2.. Africa in the World Economy .................................................................................... 4. Business Background .......................................................................................................... 6 2.1.. Business Opportunity ................................................................................................. 6. 2.2.. Business Concept ...................................................................................................... 10. 政 治 大 Business Scenario .............................................................................................................. 14 立 Market Overview ...................................................................................................... 10. 3.1.. Company Overview .................................................................................................. 14. 3.2.. Value Proposition ..................................................................................................... 15. 3.3.. Customer Segment .................................................................................................... 16. 3.4.. Key Activities ........................................................................................................... 19. 3.5.. Key Resources .......................................................................................................... 20. 3.6.. Source of Funds ........................................................................................................ 21. ‧. io. y. al. v i n Key Factors of SuccessC ............................................................................................. 22 hengchi U n. 3.8.. Nat. 3.7.. 學. 2.3.. sit. 3.. 1.1.. er. 2.. Introduction ......................................................................................................................... 1. ‧ 國. 1.. Key Partners ............................................................................................................. 23. 3.9.. Our Competitors ....................................................................................................... 24. 3.10.. Marketing Plan ......................................................................................................... 26. 3.10.1.. Pricing............................................................................................................... 26. 3.10.2.. Product .............................................................................................................. 28. 3.10.3.. Place ................................................................................................................. 28. 3.10.4.. Promotion ......................................................................................................... 28. 3.10.5.. Channel ............................................................................................................. 31. 3.10.6.. Customer Relationship ..................................................................................... 31. iv.

(7) 4.1.. Operation Process ..................................................................................................... 33. 4.2.. Project Breakeven Analysis ...................................................................................... 37. 4.3.. Revenue Forecast ...................................................................................................... 38. 4.4.. Cost Structure ........................................................................................................... 38. 4.5.. Project Balance Sheet ............................................................................................... 40. 4.6.. Exit ........................................................................................................................... 41. 政 治 大. References ......................................................................................................................... 42. 立. 學 ‧. io. sit. y. Nat. n. al. er. 5.. Operation ........................................................................................................................... 33. ‧ 國. 4.. Ch. engchi. v. i n U. v.

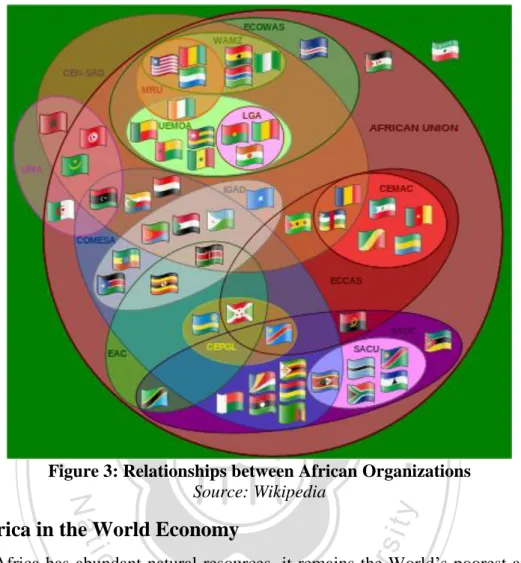

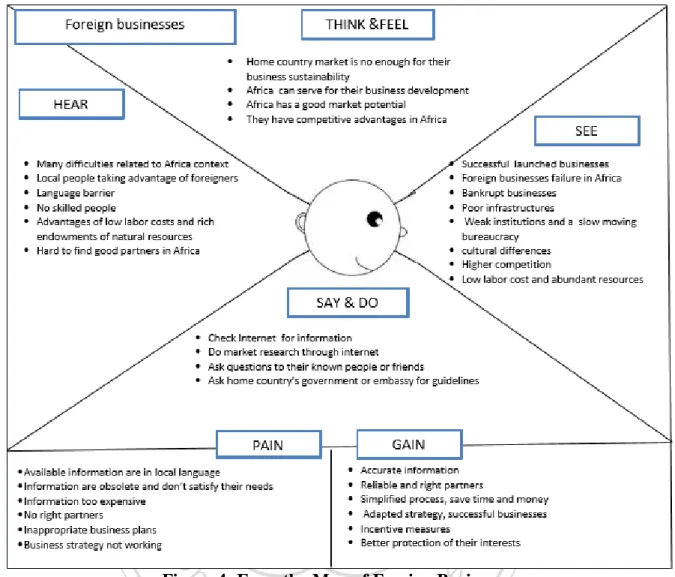

(8) Figures, Graphs & Tables Figures Figure 1: Map of Africa .............................................................................................................. 2 Figure 2: African Areas under the Colonial Powers in 1913 ..................................................... 3 Figure 3: Relationships between African Organizations ............................................................ 4 Figure 4: Empathy Map of Foreign Businesses.......................................................................... 7 Figure 5: Empathy Map of African Governments ...................................................................... 8. 政 治 大 Figure 7: ProBiz’ Business System Components ..................................................................... 21 立 Figure 6: Empathy Map of African Small and Medium Enterprises .......................................... 9. ‧ 國. ‧. Graphs. 學. Figure 8: ProBiz Business Model Canvas ................................................................................ 33. Graph 1: Foreign Investors’ Segmentation Process ................................................................ 17. Nat. sit. y. Graph 2: African Governments’ Segmentation Process ........................................................... 18. n. al. er. io. Graph 3: African Small and Medium Enterprises’ Segmentation Process ............................... 19. i n U. v. Graph 4: ProBiz Marketing Strategy Process ........................................................................... 26. Ch. engchi. Graph 5: ProBiz Scope for Pricing ........................................................................................... 27 Graph 6: ProBiz’ Scope for Promotion .................................................................................... 29 Graph 7: ProBiz Business System Flow Chart for Foreign Investors ...................................... 34 Graph 8: ProBiz Business System Flow Chart for African Governments ............................... 35 Graph 9: ProBiz Business System Flow Chart for Small and Medium Enterprises (SMES) ... 36 Graph 10: ProBiz’ Operations Support Processes .................................................................... 37 Graph 11: Revenue Growth Rate Forecast ............................................................................... 38. vi.

(9) Tables Table 1: Cross-Function Management Team ........................................................................... 15 Table 2: Owners’ Equity Split and Investment ........................................................................ 22 Table 3: ProBiz’ SWOT Analysis ............................................................................................ 25 Table 4: ProBiz Business Services ........................................................................................... 28 Table 5: Breakeven Analysis .................................................................................................... 37 Table 6: Five-year Profit........................................................................................................... 38 Table 7: Cash Flow Statement (All the Figures are in NT Thousand Dollars) ........................ 39. 政 治 大. Table 8: Income Statement ....................................................................................................... 39. 立. Table 9: Balance Sheet (All the figures are in NT thousand dollars) ....................................... 40. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. vii. i n U. v.

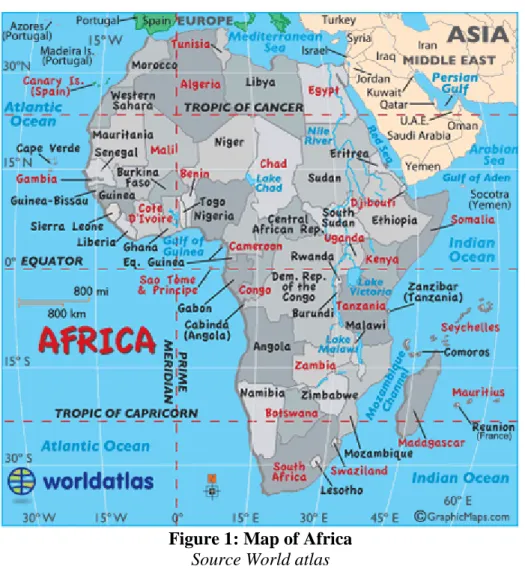

(10) 1. Introduction Currently, Asian and European domestic markets are not enough for their industrial expansion. They are looking for space and new business opportunities. This situation is also influenced by the global economic crisis and the higher competition between developed countries and emerging countries. However, African countries current situation is very promising for foreign investment. We also found that many foreign businesses in Africa at their startup stage encounter difficulties or fail because they ignore African context. That brings bad words of mouth for doing business in Africa and may discourage future investors. To avoid such loss of development opportunities for Africa, and be able to help foreign investors at the same. 政 治 大 to build lucrative company, but to take an active part to Africa economic and social 立. time we have identified here a great business opportunity to build our company. It doesn’t aim. development and to help foreign investors to make better investment decisions. At the early. ‧ 國. 學. stage we’ll be doing personal contact services and later on, we’ll provide online platform services.. ‧. The first part of the present master’s thesis explains our business concept, the second section. Nat. sit. io. n. al. er. operations.. y. describes our business scenario and the systems we will implement; the third part covers our. v. We conclude that our business is feasible and very good to invest in since the benefits go to. Ch. several people located into different continents.. 1.1.. engchi. i n U. African Continent Overview. Africa is the world’s second largest continent with about 30.2 million km² and the second most populous with more than 1.0 billion people and more than thousand languages. It bounded on the east by Indian Ocean and Red Sea, on the north by Mediterranean Sea, the west by Atlantic Ocean. Africa is separated from Asia by Suez Canal and from Europe by the Strait of Gibraltar. From its northernmost point, Cape Blanc to its southern tip, Cap Agulhas it extends on 8050 km. Its maximum width is about 7560 km from Cape Verde to Ras Hafoun. Africa’s natural environment is characterized by large rivers which flow to the sea by spectacular waterfalls. Africa straddles the equator and encompasses numerous climate areas; its northern half is desert, while its central and southern areas contain many vegetation. 1.

(11) patterns. Its highest peak is located at Mount Kilimanjaro area (5895 m Mount Kibo) in Tanzania. Its lowest hollow is located to Lake Assal (153 m below the sea level) in Djibouti. From the early 7th century’s Africa has been victim of slavery practice; Arab slave trade took about 18 million slaves and the Atlantic slave trade took about 12 million slaves to the New World. Africa has 54 fully recognized sovereign countries, 9 territories and three states with limited recognition, and various archipelagoes across five geographic regions.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Figure 1: Map of Africa Source World atlas Africa holds 90% of World cobalt, 90% of platinum, 50% of gold, 98% of chromium, 70% of tantalite, 64% of manganese and one-third of uranium and more than 30% of World diamond reserves with bauxite and petroleum. In 1884-85 at Berlin Conference, European powers set up the political divisions of Africa by spheres of economic interest that still exist now in Africa, only Ethiopia and Liberia remained independent.. 2.

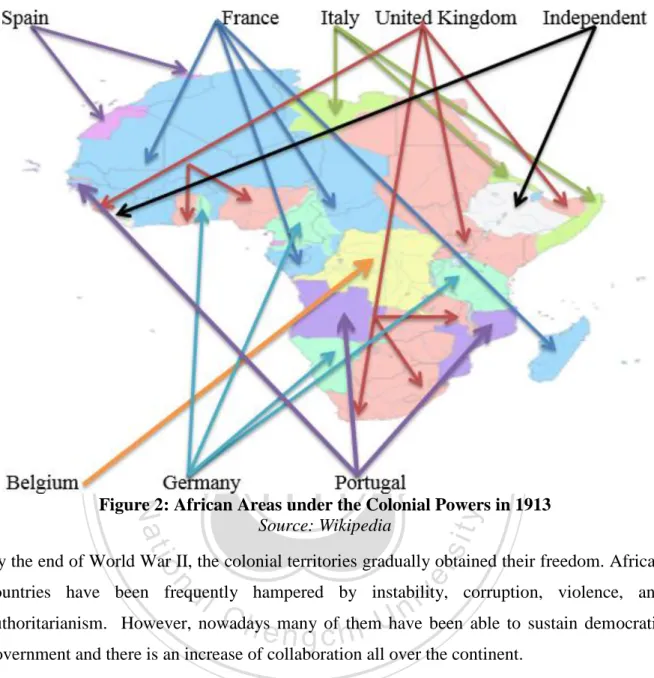

(12) 立. 政 治 大. ‧. ‧ 國. 學 sit. y. Nat. Figure 2: African Areas under the Colonial Powers in 1913 Source: Wikipedia. er. io. By the end of World War II, the colonial territories gradually obtained their freedom. African. al. n. v i n C h many of themUhave been able to sustain democratic However, nowadays engchi. countries have been frequently hampered by instability, corruption, violence, and authoritarianism.. government and there is an increase of collaboration all over the continent.. 3.

(13) 立. 政 治 大. ‧. ‧ 國. 學 y. sit. 1.2.. Nat. Figure 3: Relationships between African Organizations Source: Wikipedia. Africa in the World Economy. io. n. al. er. Although Africa has abundant natural resources, it remains the World’s poorest and the less. i n U. v. developed continent. Many causes that may include the spread of deadly diseases, corrupted. Ch. engchi. governments, human rights violations, social instability, high illiteracy, lack of access to foreign capital, tribal and military conflicts, unsuccessful economic liberalization programs spearheaded by foreign institutions, bad domestic government policy, lack of manufacturing and agriculture development can explain that situation. In 2011 World gross domestic product (GDP) grew by an average of 2.4 per cent, against 3.8 per cent in 2010. In the emerging and developing countries, instead, the expansion continued in 2011, slowing only late in the year and into the first six months of 2012. However, rising food and fuel prices caused Africa’s median inflation rate to increase from 5.8% in 2010 to 7.9% in 2011. Africa economic growth fells back from 5% in 2010 to 3.4% in 2011. With the recovery of North African economies and sustained improvement in other regions, growth across the continent is expected to accelerate to 4.5% in 2012 and 4.8% in 2013. If Europe’s economic crisis worsens, it could. 4.

(14) affect Africa through reduce of demand for African exports of goods, services, banks and tourism, reduce of official development assistance, foreign direct investment and a low external resource inflows including remittances from migrant workers. The forecasts for 2012 indicate considerable differences in economic growth among the developed countries. While fairly rapid growth is expected for Australia (3%), the United States (2.4%, up from 1.7% in 2011) and Japan (2%), a contraction is projected for the euro zone (0.3%), with pronounced disparities among the member countries. The other BRICs (Brazil, Russia, India and China) economic growth expanded by around 8% in 2011, are expected to slow down (5.7%) in 2012. According to the International Money Funds (IMF), Chinese’s economy could become the. 治 政 大 However, 33% of the top 30 Africa, but with considerable disparities across the countries. 立 economies that improved the regulatory environment for business the most over the past five. world’s largest in 2016. 5.4% rate of expansion is forecast for the economies of sub-Saharan. ‧ 國. 學. years were in sub-Saharan Africa and that Africa’s political progress, which had steadily improved over the past 20 years, mirrors economic growth. Nevertheless, both external and. ‧. domestic risks are looming and foreign companies often consider investing in these underdeveloped regions as too risky, which is verified in many cases.. n. er. io. sit. y. Nat. al. Ch. engchi. 5. i n U. v.

(15) 2. Business Background 2.1.. Business Opportunity. There is an untapped potential for foreign investors especially Asians to invest in profitable projects in Africa and for African countries to derive benefits from Asian foreign direct investment, which offers also a great potential for furthering cooperation between the two regions. But, when it comes for foreigners, especially Asians to do business in Africa, most of time they encounter many difficulties because the environment is totally different from their ones. In. 政 治 大. Africa economic environment, foreign businesses face the pressure from the. 立. culture gap, the even-changed economic environment and high competition.. ‧ 國. 學. Most of time there is no dedicated organization which can take care of their specific problems and they have to spend time and resources to try to correct and. ‧. adjust their business model in vain. The external environment makes running. y. Nat. business in Africa more difficult for the foreseen future. They need to reinvent. io. sit. their business model or to work hard to adapt their business strategy to the local. er. environment; they need also to find the right partners for implementing well. n. a. v. l C by reviewing their their business. Foreign investors n i strategy or reinventing their. hengchi U. business model to Africa context can reduce their operation cost and bring back to their company higher profit and Africa development. We found here a great opportunity to serve this demand from foreign businesses and Africa economic sector by building up a company to dedicate our energy and resources with advanced educational background, knowledge of European and Asian culture and way of doing business, and hand-on African market experience. However, we don’t claim to have hand-on the solution at all their problems, we envision with the growth of Asian economy and the new reinvestment of European to create Africa economic growth.. 6.

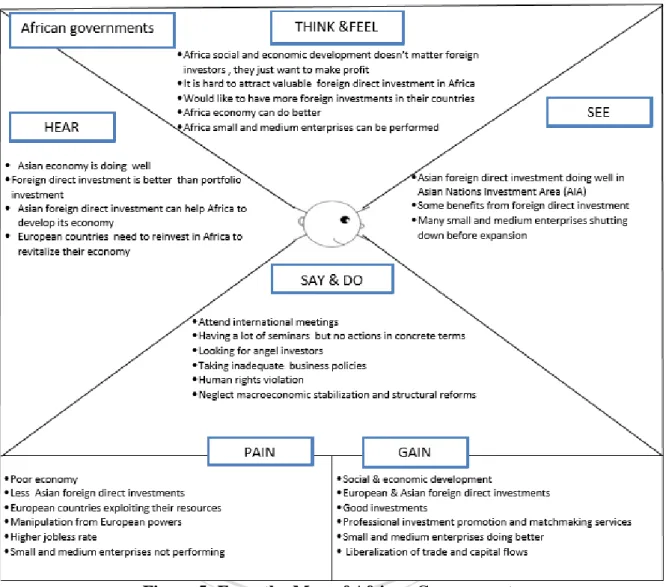

(16) 立. 政 治 大. ‧. ‧ 國. 學 er. io. sit. y. Nat. al. v i n On another hand we found that,Cwith economic crisis effect, African countries h ethenWorld’s gchi U n. Figure 4: Empathy Map of Foreign Businesses. could no more expect great help from European monetary assistance; they need to take care of. themselves, to bring added value to their own businesses. Nowadays foreign direct investment has become a significant source of external finance in developing countries and a useful means of integrating into the global marketplace. But Africa has largely been left out of this process for many reasons, including small market size, poor infrastructures, weak regulatory frameworks, debt problems and, in some cases, political instability. However, over the past decade, there has been considerable progress with reforms in several African economies. As we look to the future, the challenge is to find ways and means of harnessing more investment which contributes to reducing poverty and accelerating economic growth and development in Africa. We find here an opportunity to assist African governments to attract and benefit from. 7.

(17) foreign direct investment, to build their productive capacities and international competitiveness.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Figure 5: Empathy Map of African Governments From a survey, we found that many African governments have identified the small and medium enterprises sector as the means to achieve accelerated economic growth and mitigation of poverty because of its potential to absorb unskilled labor and to nurture and develop entrepreneurial skills. Indeed, small and medium enterprises sector is one of the largest contributors to the African economy (90%). It is responsible for 75% of new jobs through the emergence of new micro enterprises and acts as an absorbent of retrenched people coming from the private and public sector. However, in the African economy, these benefits are not forthcoming due to a high failure rate (80%) (Watson, 2004; Van Niekerk, 2005). Many of them collapse only few months after creation although they start up with promising. 8.

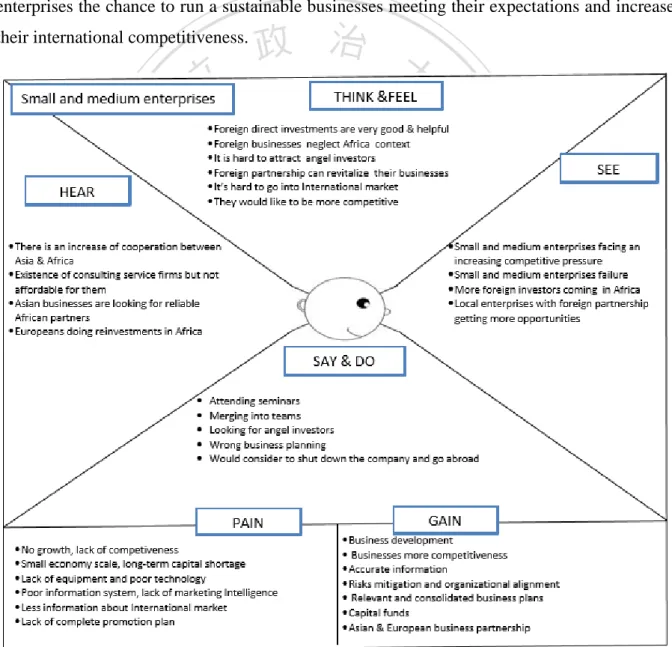

(18) creative and innovative ideas. The reason to these failures after further analysis is that economic sector developers don’t carry out a comprehensive analysis of their business and a clear assessment of opportunities pertaining to the market before starting their activities and throughout their business life. From the surveys we also found that Chinese companies now operating in Africa are mostly small and medium enterprises and their investments have mainly gone into manufacturing, resource extraction, construction, trading and other financial services. We got here an opportunity to help for Africa economic growth through assistance of small and medium size enterprises, by offering to start-up and existing small and medium enterprises the chance to run a sustainable businesses meeting their expectations and increase their international competitiveness.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Figure 6: Empathy Map of African Small and Medium Enterprises. 9.

(19) 2.2.. Business Concept. Creating productive employment for Africa rapidly growing young population is an immense challenge and a key factor for Africa prosperity. Currently in Africa we have increasingly new visionaries who are creating entirely new companies as the old imperial ones crumble mainly by adequate business plan default, we are preoccupied to help them for getting better results. We believe that in a human services context the nature of the task is not trivial and in all likelihood is the reason for the employee being in the sector (Schepers et al., 2005). We setup our organization as a not-for-profit (NFP) business consulting services provider. We rely on a set of values in which extrinsic rewards are not the first consideration. We seek meaning in. 政 治 大 responses including satisfaction in the accomplishment of getting foreign businesses success 立 in Africa and the continent development than only focus on making our own prosperity. Fun. our activity and we more are motivate by the intrinsic rewards which are personal and internal. ‧ 國. 學. and challenge are of greater significance to our managers than external pressures and monetary rewards. As Herzberg (2003), we argue that money is just a “hygiene factor”, and. ‧. cannot be a source of motivation. From surveys, we found that the majority of existing business consulting services providers is essentially concerned with the crowding-out effect of. y. Nat. sit. extrinsic incentives, mainly monetary. We believe that money should not be the most. er. io. important motivator for business consultancy services provider in Africa, over wise it. al. becomes useless and fails to help Africans, because they can’t afford it. We believe that the. n. v i n performance of business consultancy C h services providerUin Africa for the inherent satisfaction e n g c hof ia separable outcome from its performance. of work itself is more worthy than the attainment 2.3.. Market Overview. Africa economic output increased from a gross domestic product (GDP) of $516-billion in 1995, to $1 855-billion in 2011. It continues to recover from the adverse effects of the global crisis and remains amongst the fastest growing regions of the World. This trend is expected to reach $2 545-billion in 2016. However, despite its growth, Africa attracted only 5.5% of World global foreign direct investment projects in 2011. The top investors in Africa are United States, France, United Kingdom, India, and the United Arab Emirates. Singapore, India and Malaysia are the top Asian sources of foreign direct investment in Africa, with investment stocks estimated at about $3.5 billion (cumulative approved flows from 1996 to. 10.

(20) 2004), followed by China, the Republic of Korea and Taiwan with an investment stocks estimated at about $1.9 billion. Meanwhile, African countries increase the number of intraAfrica investments, with foreign direct investment projects growing from 27 in 2003, to 145 in 2011, accounting for 17% of all new foreign direct investment projects on the continent. Foreign direct investment projects in Africa increased about 27% from 675 projects in 2010, to 857 in 2011. Developed markets accounted for 66% of the overall projects while emerging markets were responsible for the remaining 34%. Investing abroad is still a relatively recent phenomenon for many Asian firms, their transaction and information costs are higher when investing in Africa than in other Asian economies, and both host and home country regulatory. 治 政 大 Government began encouraging have evolved, moving and in the late 1990s the central 立 outward foreign direct investment and launched the “going global” strategy. A series of frameworks often impose constraints. Since the early 1980s, China’s policies on outward FDI. ‧ 國. 學. incentive measures accompanied the strategy, such as easy access to bank loans, simplified border procedures, and preferential policies for taxation, imports and exports. Bilateral. ‧. investment treaties have been another facilitation measure adopted not only to attract foreign direct investment but also promote better protection to Chinese companies investing abroad.. y. Nat. sit. Asian foreign direct investment is assuming greater importance, accounting for 10 per cent of. al. er. io. the stock of foreign direct investment in the world. Asian newly industrializing economies. n. have recently become relatively large investors abroad and some Asian firms have grown to. Ch. i n U. v. rank among the top transnational corporations (TNCs) in the world. Indeed, such foreign. engchi. direct investment in Africa is becoming an important and promising facet of the South-South economic cooperation. Asian economies have begun to build up their outward investment stock when they were struck by financial crisis in 1997 and have been growing in all major regions, but still tend to focus on intra-regional foreign direct investment. However, Asian outward foreign direct investment has become significant, and even though these cross border flows have so far remained largely limited to the Asian region, they arouse interest as potential sources of investment in Africa. This interest, which declined somewhat as a result of the Asian financial crisis of 1997-1998, was renewed following the recovery of the crisishit countries and the continuing steady growth of the Chinese and Indian economies. That can be explained by the perception gap that remains between investors with an established presence in Africa, who believed that only Asia represented a more attractive option, and. 11.

(21) those who haven’t yet invest, and perceived Africa in an overwhelmingly negative light. China’s foreign direct investment outflows have been growing rapidly, from an average of less than $100 million per annum in the 1980s to $12 billion in 2005. A large proportion of these outflows have gone to East and South-East Asia as well as Latin America and the Caribbean. Africa accounted for only 3 per cent of China’s total foreign direct investment outflows in 2005, and for about $1.6 billion of Chinese foreign direct investment stock, which has a presence in almost 48 African countries. By 2000, some 500 Chinese foreign direct investment projects were known in Africa, and only 30 of them having investments of over $10 million. While about one third of China’s foreign direct investment projects abroad. 治 政 大 affiliates at least broke even. By comparatively low. Still, more than half of Chinese foreign 立 2005, China signed 117 bilateral investment treaties, including 28 in Africa. Most of the. generated profits and another one-third were at break-even point, in Africa the returns were. ‧ 國. 學. Chinese firms’ investments are in the form of equity joint ventures with African enterprises, though not in the case of recent resource-seeking foreign direct investment. While still small,. ‧. foreign direct investment flows from Asia to Africa reached $1.2 billion annually during the period 2002-2004, and they are set to increase further in the coming years. They invest mainly. y. Nat. sit. in manufacturing, resource extraction, construction, trading and financial services. Asian. al. er. io. small and medium enterprises have also become an important source of the new outward. n. foreign direct investment, as more of them need to invest abroad to maintain and improve. Ch. i n U. v. their competitiveness. Africa being seen as an attractive investment destination is expected to. engchi. improve over the next three years $150-billion by 2015 a survey by advisory services company Ernst & Young (E&Y) has found. Since many African countries have moved toward of participatory democracy, which had in turn decreased armed conflict with significant improvements in trade agreements, regional integration and increasingly infrastructure development, the continent is well placed to press ahead with structural reforms and lay the groundwork for strong and sustainable growth in the medium term and would push it into the top league of foreign direct investments destination. Indeed, the rapid economic growth and industrial upgrading currently taking place in Asia provide ample opportunities for Africa to attract Asian foreign direct investment into both natural resources and manufacturing. With the growing recognition of the successful experience of East and South-East Asia, it is useful for African countries to examine the lessons that could be drawn from the development paths. 12.

(22) followed in that region, and to consider ways and means of strengthening economic cooperation with Asian economies. The fast-growing Asian economies have come to be viewed not only as successful cases that could provide examples of development paths for African economies, but, increasingly, also as economic partners, particularly for trade and investment. Africa could benefit from a rapid expansion of a dynamic, internationally competitive small and medium enterprise sector. However, significant investment opportunities coexist with barriers to investment and international trade. Many initiatives have been undertaken since the late to enhance Africa attractiveness for foreign direct investment, including the creation of commercial dispute resolution mechanisms and export processing. 治 政 大 partner, host government support, Africa point to the importance of finding a suitable African 立 local market-oriented activity and technology transfer. Problems faced by Chinese enterprises zones. The main lessons drawn from experiences of Chinese foreign direct investment in. ‧ 國. 學. operating in Africa are partly due to the economic environment of the host countries, a shortage of skilled workers, restrictions on foreign exchange, and inadequate or inappropriate. ‧. incentives offered. Potential Asian investors are often unaware of incentives offered and agencies concerned with investment in Africa. Nevertheless, additional steps are necessary to. Nat. sit. y. realize the continent’s full potential as a foreign direct investment location, including. al. er. io. improvement of its institutions by introducing legislation to facilitate investment and. n. infrastructure development to support investments, measures to support identified subsectors. Ch. i n U. v. such as technology, market and product development, links and networking.. engchi. 13.

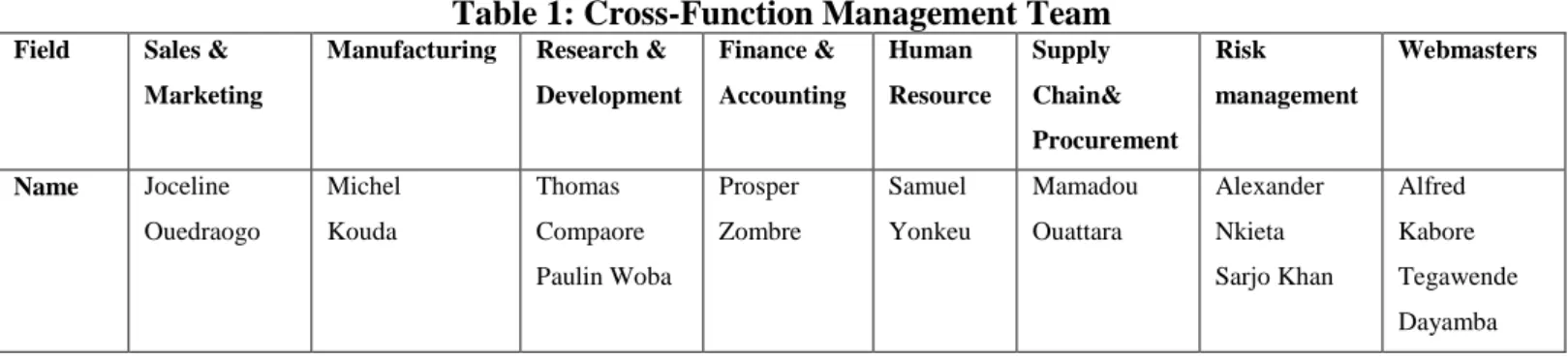

(23) 3. Business Scenario 3.1.. Company Overview. Our company is called ProBiz which derives from “professional businesses”. ProBiz will be registered as a limited liability company, Ltd. Its team members are a group of hard working people all with at least Master Business Administration degree, and Doctorate for some of them. ProBiz team leaders have a solid experience of doing international business and bringing value to small and medium enterprises. Everyone has at least 10+ year experience in his field and is recognized with high positions in his professionalism. ProBiz team members are living in different countries around the world. Indeed, Michel Kouda is from Burkina Faso,. 政 治 大 Cameroun, he is working in立 Quebec as a professor, managing an International informatics and but currently living in Italy where he monitors a lucrative company; Samuel Yonkeu is from. ‧ 國. 學. business school in Ouagadougou and already doing consulting for small and medium enterprises in Africa; Thomas Compaore is a marketing and quality supervisor in an International company in Senegal and he is also teaching marketing and management courses. ‧. in many African countries and has been a doing consulting for several years; Alexander. y. Nat. Nkieta is a tourism board senior with a great entrepreneur skills living in Ghana; Paulin. io. sit. Ouoba is the owner of Non-Profit small enterprise at Niangoloko and a great professor at. er. University of Nasso in Burkina Faso. Among of us, four people are already been exposed to. al. n. v i n Ch U working as a senior manager at graduate by June 2013, Ouattara Mamadou e n gwho c his icurrently Asian culture, especially, Taiwanese ones: Joceline Ouedraogo & Sarjo Khan who will be. commerce ministry in Burkina Faso and Prosper Zombre currently a global market access. specialist for a Taiwanese telecom equipment certification body. The Webmasters, Tegawende Dayamba and Alfred Kabore live at Ouagadougou; all are well experienced in their field. With the effort of these outstanding people, our customers will be equipped with both academic and practical resources in order to full cover each stage of value chain. ProBiz will be Africa based, but at the beginning stage our consultants will work virtually, for reducing the overhead expenses of a rented office space, making services more affordable for our clients, and increasing the ability to start the business with less capital costs.. 14.

(24) Table 1: Cross-Function Management Team Field. Sales &. Manufacturing. Marketing. Research &. Finance &. Human. Supply. Risk. Development. Accounting. Resource. Chain&. management. Webmasters. Procurement Joceline. Michel. Thomas. Prosper. Samuel. Mamadou. Alexander. Alfred. Ouedraogo. Kouda. Compaore. Zombre. Yonkeu. Ouattara. Nkieta. Kabore. Sarjo Khan. Tegawende. Paulin Woba. Dayamba. 3.2.. Value Proposition. Enterprises ability to identify and well manage their core competencies is a critical factor in. 政 治 大. reaching their strategic goals. Moreover, strategic planning that leverages valuable information asset is more apt to deliver the intended outcomes for any business. Then, we. 立. propose to help our customers to leverage their deep understanding from their business core. 學. competencies analysis to plan realistically and executable business strategy and gain strong. ‧ 國. competitiveness. Our organization is Africa foreign direct investments promoter and a not-. ‧. for-profit business consulting services provider, along with concerted efforts to bridge cultural differences. We seek credit enhancement, resources mobilization programs and capacity. Nat. sit. y. development support from International financial institutions to support Africa economy. We raise capital funds from International organization, angel investors or venture capitalists to. io. er. Name. finance local projects. We seek also foreign investors who can bring added value to Africa. n. al. Ch. i n U. v. social and economic development. We help foreign investors to improve their understanding. engchi. about Africa business context and to take advantage of existing business opportunities. We connect them with the right and good local partners. We help enterprises to attain their expected results through a leverage of their strengths and a balance of identifying good opportunities, setting realistic goals, a better understanding of customer needs, formulating field-based marketing and business strategy plans through use of a globalized format, mapping subsidiary incentives, useful synergies realization and aligning corporate goals with country-based objectives. We work closely with African governments and decision makers to create favorable environment and adequate business policies to attract more foreign direct investment. We provide good personal contact business consultancy services that contribute to the formulation and the implementation of concrete measures to bring more foreign direct investment. We negotiate also with African governments to get favorable regulation and. 15.

(25) taxation release for small and medium enterprises during startup stage or when they have financial difficulties. We design and reinvent business model for small and medium enterprises, we develop tailored-made business plan and provide consultancy services at each stage of enterprise value chain. Starting from the third year, we’ll create and launch a website to gain more visibility and respond to the needs of people interested to get quick digital information. The website is intended to be very friendly user and at the same time with high quality customer service.. 3.3.. Customer Segment. 政 治 大. Customer segmentation allows a company to target specific groups of customers effectively and allocate marketing resources for best effects. Traditional segmentation focuses on. 立. identifying customer groups based on demographics and attributes such as attitude and. ‧ 國. 學. psychological profiles. Value-based segmentation, on the other hand, looks at groups of customers in terms of the revenue they generate and the costs of establishing and maintaining. ‧. relationships with them. Usually customer segment drawn are most likely high, medium, low and non- value customers, with higher value customer targeted for more intensive sales and. sit. y. Nat. marketing activity. However, the traditional model fails to consider changes in the overall factors that contribute to the buying decisions. Typically, such gaps in segmentation will. io. n. al. er. include key stakeholders that influence customer decision; needs based segmentation for. i n U. v. instance the channels, content, source and purchase value that drive customer buying decision,. Ch. engchi. future purchase potential-based other influences factors and changing conditions are not clearly classified. Because of these segmentation gaps, the customer targeting and detailing is not enough customized for each segment, rather a “one size fits all” approach is adopted. We find a compelling need to go beyond the traditional and static business intelligence methods to segment our target customers. We take an “outside-in” approach, moving from the traditional “value form the customer” idea to “value for the customer” paradigm; we change the segmentation approach from asking “what was purchased” to asking “what contributed to that purchase decision”. We bring more dominating factors from the customer constituency and personas including behavior, psychographic, attitudes, social influences, promotional responses that contribute to making the final purchase decision. We implemented four key steps in order to increase precision and profitability of our customer portfolio segmentation. 16.

(26) and targeting. We consider our customers’ needs and motivation base on the “value for the customer” along with our organization’s strengths and value proposition; that will help us to align our sales efforts towards our strategy and objectives and allows us to add at any stage of our business other influencing factors on top of the macro-segments to create a new microsegment or multi-dimensional segment as we go ahead with incremental enhancement. This multi-dimensional segmentation may be also a strong competitive advantage to your company. By assigning keys performance indicators and metrics for individual segments we can define tailored journeys for each segment to drive every customer within a particular segment towards the intended path to high profit. By targeting different segments according to their. 政 治 大 Our organization has diversified 立 customers; we serve three unrelated customer segments with needs, we can gain higher and quicker return on our targeting and detailing efforts.. ‧. Foreign investors segment with many rich business entities that are looking for good. y. Nat. business opportunities in Africa or for reliable overseas partners and skilled people to. io. sit. well work with. Those foreign investors may be coming from Europe, Asia, or may be intra-African investors.. n. al. er. . ‧ 國. We have:. 學. very different needs and problems.. Ch. i n U. v. Graph 1: Foreign Investors’ Segmentation Process. engchi. 17.

(27) . African governments segment, which include all countries from Africa looking for angels investors to help their large and poor population to be developed. Graph 2: African Governments’ Segmentation Process. 立. ‧ 國. 學. Small and medium enterprises segment which include firms with 50 to 250. ‧. employees, annual turnover of Euro 7 to 40 million, total assets less than Euro 27 million, and not more than 25 percent ownership by a large corporation and micro-. Nat. sit. y. enterprises that meet 2 of the following 3 criteria: fewer than 10 employees, balance sheet total below Euro 2 million and a turnover below Euro 2 million which are. io. er. . 政 治 大. looking for foreign partners, help and assistance to be able to grow. We focus on local. n. al. Ch. i n U. target market with the following characteristics:. engchi. v. -Start-up businesses looking forward for concrete business advises; -Sensitive businesses looking forward for advanced strategies to build up competences and improve their efficiency within the value chain; -Businesses facing troubles or management issues and looking forward for executable solutions; -Successful businesses looking forward for expansion.. 18.

(28) Graph 3: African Small and Medium Enterprises’ Segmentation Process. 立 Key Activities. ‧ 國. 學. 3.4.. 政 治 大. Marketing opportunities increase when customer groups with varying needs and wants are. sit. y. Nat. -Consultancy. ‧. well recognized. We find an opportunity here to conduct several valuable activities including:. io. er. ProBiz provides consulting services to foreign companies operating or seeking to operate in Africa. We assist foreign investors with local market information, we provide piece of advices. n. al. Ch. i n U. v. for market entry (legal & fiscal) and arrange meetings with the right decision makers. -Public Relations Services. engchi. ProBiz offers its services to foreign companies which want to launch a new product into the African market by helping them to well position their product, by organizing launch events, by arranging advertising campaign in the local media and prequalifying sales leads and key contacts for them. We offer services including: company registration, finding a suitable office space and opening a bank account. In addition, we do copy writing, translation and interpreter services for individuals and organizations in French, in English or in Mandarin. -Sales & Marketing. 19.

(29) We carry international sales and marketing for foreigners who would like to open a branch office in Africa or African who would like to startup a business in Asia or in Europe. We are able to represent our customers’ interests in Africa, Asia & Europe by marketing their company, selling their products and attending important meetings in case if they are unavailable. We attend international business events and take an active part at local trade show organization. We also organize an African worldwide trade show every year. -Trade Missions. 政 治 大 bodies. We seek and recruit立 participants, arrange their travel and accommodation to guarantee. We take an active part at international trade activities in cooperation with trade promotion. ‧ 國. 學. that they meet the correct people at their arrival. We attend those events as much we can. We also do matchmaking services.. ‧. Moral values that support our activities are: entrepreneurship, challenge, value creation, creativity and innovation, pragmatism, humility, integrity, contact, proximity, efficiency,. Nat. sit. n. al. er. Key Resources. io. 3.5.. y. excellence and customer satisfaction.. i n U. v. As a business consulting services provider, our main resources are skills and network and less. Ch. engchi. equipment. ProBiz has proven business model which matches with our customers’ needs. ProBiz managers have over than ten years of hands-on practical business experience, from top leadership roles within corporates to running their own businesses and good knowledge about the process of International business and an in-depth experience in international strategy. We have our International master business administration (MBA) and social network in addition of an extended friendship around the world and excellent network, together with the availability of skilled resources and partnering offerings. We have one of the best databases of Africa businesses contacts. We have excellent relationship with governments’ responsible and key trade organizations in Africa. Because at the starting stage, we’ll be working virtually, we won’t have a dedicated office. Our main equipment includes printers, fax machine, computers and related staff and a Website starting from the third year. As financial resources, we have an. 20.

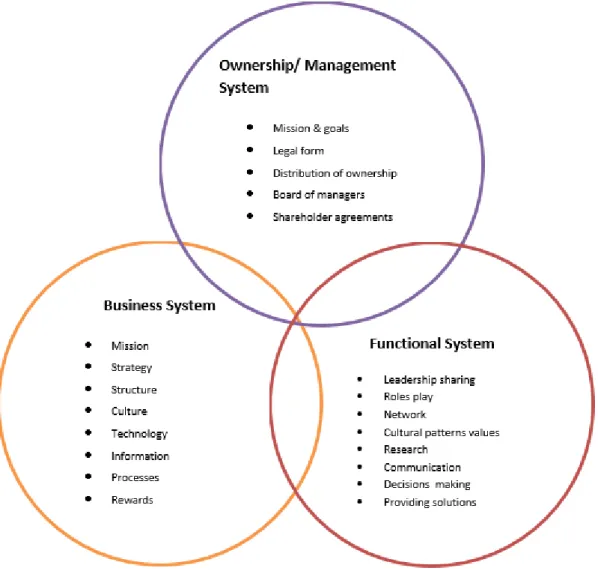

(30) initial investment amount of NT $8,000,000 and a loan of 1,000,000 from the government on the third year. We are expected also to raise funds from International institutions and African economic development trade promotion bodies. By combining skills and knowledge in individual and organizational dynamics and based on interrelated components we help our customers to obtain the maximum results.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Figure 7: ProBiz’ Business System Components. 3.6.. Source of Funds. Our business model will be different from the traditional one to have some set up fee ahead of real revenue incoming. The main reason is because the co-founders won’t take any profit share or salary before company starts earning positively. As a result, there is no operational cost during the first three years. After three years, the reserved profit will be used to install all the needed resources, especially website setup and maintenance.. 21.

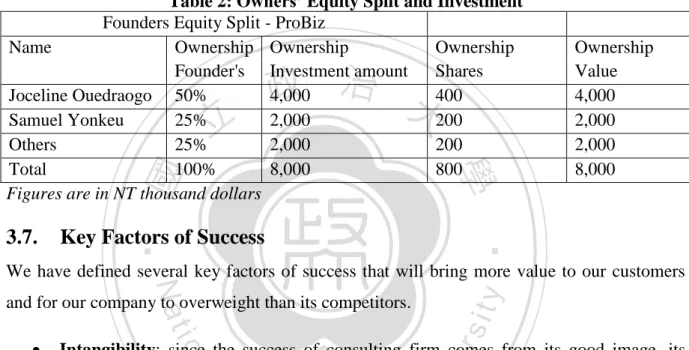

(31) There is no loan from bank. ProBiz will raise NT $8, 000,000 investment amount from founders for star-up funds. ProBiz will loan of NT $1,000,000 from African governments as well from international institutions and the fund will be used for investment for potential African enterprises which want to expand but lack of capital. The profit of the beginning several years will be reserved and partially use to fund future operation expenses. Every partner only bears the limited investment amount liability. Table 2: Owners’ Equity Split and Investment Founders Equity Split - ProBiz Name Ownership Ownership Ownership Founder's Investment amount Shares Joceline Ouedraogo 50% 4,000 400 Samuel Yonkeu 25% 2,000 200 Others 25% 2,000 200 Total 100% 8,000 800 Figures are in NT thousand dollars. 政 治 大. 立. ‧ 國. 學. Key Factors of Success. ‧. 3.7.. Ownership Value 4,000 2,000 2,000 8,000. We have defined several key factors of success that will bring more value to our customers. y. Nat. er. io. . sit. and for our company to overweight than its competitors.. Intangibility: since the success of consulting firm comes from its good image, its. n. al. i n U. v. good word-of mouth reputation, and its professionalism, we’ll put a lot of efforts. Ch. engchi. bringing to our customers the best quality service, the most understandable and practical guidelines in accordance with their needs, and delivering clearly and deeply analytic result. . Inseparability: because of the customers’ consumption and consulting services delivery happen at the same time, to be competitive and efficient, we’ll put more resources to quickly capture our customers’ thoughts, understand their original business model, stand and work closely with them. We’ll partner with our customers during their business turn around process, to ensure that the desired change they seek is sustainable, properly implemented and locked in place to deliver new and improved results.. 22.

(32) . Heterogeneity and perishable: since our customers are diversified and the market multi-side, the service content will be always different and may change along the time, we’ll be looking for consultants who come from different countries and share our vision, moreover we’ll keep bring up-to-date our knowledge and maintain the delivered service level aligned with the business environment change. Moreover, keep providing innovative solutions and new opportunities to our customers and offering capital funds are other important key factors of success.. 3.8.. Key Partners. 政 治 大. As ProBiz positions itself as a reliable foreign investment promotion agency and intra Africa investment advisory service, we cooperate with International institutions among of them,. 立. United Nations Development Program (UNDP), United Nations Economic Commission for. ‧ 國. 學. Africa (UNECA), United States Agency for International Development (USAID), World Trade Organization (WTO), Organization for Economic Co-operation and Development. ‧. (OECD), New Partnership for Africa’s Development (NEPAD), International Centre for the Settlement of Investment Disputes (ICSID), Commonwealth Development Corporation (CDC). sit. y. Nat. and International Finance Corporation (IFC) because they encourage South-South economic cooperation (economic cooperation among developing countries), especially they encourage. io. n. al. er. Asian foreign direct investment in Africa. Since they are having many trade missions in. i n U. v. Africa, we can benefit from their official assistance. We also cooperate with Asia Pacific. Ch. engchi. Economic Cooperation (APEC), Association of Southeast Asian Nations (ASEAN) and European Union (EU). To be able to assist and participate at the harmonization of Africa trade and commerce policies and being able to promote intra-African trade we are in good relation with African governments, investment policy makers, African Associations for development and trade promotion bodies such as Southern African Customs Union (SACU), Southern African Development Community (SADC), African, Caribbean and Pacific (ACP) economic development board, Common Market for Eastern and Southern Africa (COMESA), East African Community (EAC), Economic Community of West African States (ECOWAS). Our key partners are also lawyers and accountants, whose advices make it possible for the region’s businesses to succeed. We are in excellent partnership with industry associations, trading. 23.

(33) associations, small and medium enterprises & administrations in Africa to be able to foster contact and get regular information and communication flows. We have good connection with International business consulting services providers which are operating in different fields. We have partners in International media field among of them National Broadcasting Company news (NBC), Radio France Internationale (RFI), Radio Taiwan Internationale (RTI) and Radio China Internationale (RCI). We have many international and intra-continental widely read magazine providers as partners. We are in good partnership also with local media and business event organizers.. 3.9.. Our Competitors. 政 治 大. African business consulting service is a fragmented market and it’s not well organized yet.. 立. There are many but we don’t have an exact number, we just know that they are categorized by. ‧ 國. 學. size as the following types:. -Independent consultants or micro-type consultancy companies: include the consulting. ‧. companies with less than 10 employees and some entrepreneurs who choose to work as parttime jobs: Makes you think, HHA (PTY) LTD, LABAC (PTY) LTD, HURESMAC (PTY). y. Nat. sit. LTD, PROBEN SERVICES CC, Africa Business Consulting, REGAL3 Corporate. al. er. io. transformation, AMB Consulting, EIGTHY 20, DMC Consulting This type of company may. n. takes 90% of the existing companies.. Ch. engchi. i n U. v. -Small Consultancy Companies with 10 to 100 employees: Nyansa African Business Consultancy limited, Arcus Consultancy Services. They are few in Africa and tend to focus on environmental and energy field. -Government-owned and non-profit consultant companies: Allinkx MI Consultants. - International consultant companies branches: Agri Africa, Mc Kinsey, PURCHGRO, S2 Services SARL, Bearing point, Deloitte, BCG The Boston Consulting Group, INC. -The domestic consulting companies with more than 100 employees, actually they are rare in Africa.. 24.

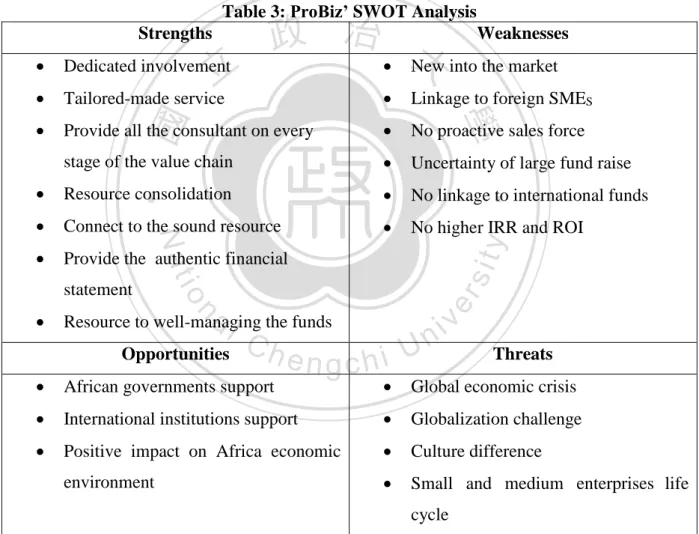

(34) Most of our target customers rely on companies which can offer hand-on advices from word of mouth experts and have good reputation within the industry and can offer the best suitable business plan. We also find that most of the actual key players tend to serve the companies which already have good establishment and stable management histories and avoid start-up companies with limited resources, also because of the higher risk of failure which may jeopardize their reputation or impact negatively their cash flow. In our perspective, the most important element of general competition is what it takes to keep customers to repeat business or to recommend new clients. Table 3: ProBiz’ SWOT Analysis Strengths . Dedicated involvement. . Tailored-made service. . 立. 政 治 大 Weaknesses New into the market. Provide all the consultant on every. . No proactive sales force. stage of the value chain. . Uncertainty of large fund raise. . Resource consolidation. . No linkage to international funds. . Connect to the sound resource. . No higher IRR and ROI. . Provide the authentic financial. n. al. Resource to well-managing the funds Opportunities. y. er. io. . sit. Nat. statement. ‧. ‧ 國. Linkage to foreign SMES. 學. . Ch. . African governments support. . engchi. i n U. v. Threats. . Global economic crisis. International institutions support. . Globalization challenge. Positive impact on Africa economic. . Culture difference. environment. . Small and medium enterprises life cycle. 25.

(35) 3.10. Marketing Plan ProBiz strategy is based on increasing awareness. Graph 4: ProBiz Marketing Strategy Process. 立. 政 治 大. ‧. ‧ 國. 學. n. al. er. io. sit. y. Nat 3.10.1.Pricing. Ch. engchi. i n U. v. Since in our business concept we don’t have a specific targeted profit, we don’t need to deploy cost-plus price in the market. Our prices will be settled below the industry average price to make our services affordable to low income businesses. According to the statistics data, the average charge of existing business consulting companies is NT $30,000 to NT $100,000 per business plan and the average charge for business consulting fee is NT $100,000 per stage. ProBiz average price is NT $5,000 to NT $100,000 per business plan and NT $15,000 to NT $100,000 for consultancy stage. For strategic facilitation our price will go from NT $2,000 to NT $50,000; for texts translation the average price will range from NT $999 to NT $25,000. The training fees will be based on the topic, the duration and the number of people concerned, the average price will range from NT $15,000 to NT $60,000. For any valuable foreign investor we’ll bring, we’ll charge the dedicated government with a minimum. 26.

(36) fee which can go from NT $10,000 to NT $300,000 and we’ll benefit from tax release too. With the website service, will be charging the customers by a click and pay process above NT $98 per click, to access valuable information or for answers at their specific questions. We keep lower price to attract more customers and be able to help many people. Our main concern is to penetrate our target customers and build a strong and good reputation in the market. Once our reputation is increasing, our revenue will increase with the number of resolved cases. Indeed, since there is no operational and direct cost, most of the revenue we’ll be making is automatically turn into net profit. The other major income is coming from international organizations financing and from the return of capital funding. We’ll be taken 5%. 政 治 大 Graph 5: ProBiz Scope for Pricing 立. interest rate on investment loans with local enterprises.. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 27. i n U. v.

(37) 3.10.2.Product ProBiz is dedicated to make a positive change in Africa economic environment. We are committed to deliver practical and efficient business solutions, by providing affordable consulting services and adequate support that give to our customers the tools they need to be successful in running their businesses. Table 4: ProBiz Business Services Business Process. Strategic Facilitation -Strategic management. -Business strategy alignment. -Strategy workshop facilitation. -Business process management. -Operational management -Financial Management -Business partnerships. 立. -Business & process re-engineering 政 治 大 -Operational management. ‧ 國. 學. -Business solutions. -Project standards & procedures. -Human resource development. -Program office &administration. -Culture development. -Translation. -Training. n. al. -Business objective alignment. 3.10.3.Place. Ch. y. sit. -Change coordination. er. io. -Project & program coordination. ‧. Business Management. Nat. Project Management. i n U. v. -Business communication feedback. engchi. Our business will be doing in Africa especially in Southern and western Africa, because those regions are more attractive for foreign direct investments. However, in case of any existing sales opportunity, we’ll be offering our services in northern and East Africa too where we already have some partners.. 3.10.4.Promotion Since our organization is quiet new in Africa market, moreover we are planning to play a leading role and be internationally known we need to emphasize on its implementation. We need to inform our potential clients and get their involvement for our organization, to remind. 28.

(38) them, persuade them and build good relationships with them. For our intended promotion we’ll mainly use integrated marketing communication (IMC) model. Graph 6: ProBiz’ Scope for Promotion. 政 治 大. 立. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. Elements of the model:. engchi. i n U. v. -Source: our company co-founders individually, our sponsors, all the spokesperson that will deliver or encode our message (radio personalities, celebrity endorsers, actors, real people providing testimonials about our services, animated characters). -Encoding: A clear and effective communication remains a core element in developing meaningful exchange; then we have chosen to form message which will be clearly understandable for our customers. We’ll base on our experience of doing international businesses; we’ll be using Afrikaans, French, English and Chinese as communication language to elaborate our message.. 29.

(39) -Message: through several communication elements that we’ll try to control and adjust along our product life cycle: Advertising, Sales promotion, Personal selling, Direct marketing, Public relations, Word of mouth, Marketing aliens. In order to be efficient, our company will base on information we got from the market surveys and our value proposition to elaborate our message for each segment. We’ll use any words, music, scenery, celebrities’ people, and visual elements all that can communicate meaning to our targeted receivers. After a brief presentation of our company, we will use sentences like: “You will never miss good business opportunity” “Get higher return on investment” “Get higher profit” “Expand your product lines into international markets with a think globally, act locally model”. 政 治 大. “Get assistance along all your business process” “You will never be bankrupt”. 立. To make our message more believable, for our advertisement will choose celebrity endorsers. ‧ 國. 學. (successful entrepreneurs) as sources.. -Medium: In an effort to reach our target audiences with widely varying tastes and media. ‧. habits we’ll use several communication vehicle such as traditional medium like radio,. y. Nat. television, newspaper and magazine in addition of non-traditional medium like social media. sit. to transmit our message. We’ll do promotion through International media like: Radio China. n. al. er. io. International (RCI), Radio Taiwan International (RTI), Radio France International (RFI), TV. iv n Business U. commercial and brochure. We’ll also advertise through international and intra-continental. Ch. engchi. widely read magazine like: Jeune Afrique, Africa. Information, Artists Against. (AA419), ABN Africa Business News, Africa Alumni, Africa Budget Watch, Africa Business pages, This is Africa, East African Business Week, through different countries local magazines. (Ghana. Business. news),. through. partners. Website:. Africacalling.com,. AllAfrica.com-Business & Finance and later on our own website. We’ll tend to focus more on word of mouth media and successful accumulated cases. -Receiver: our messages go to foreign investors, African governments, local entrepreneurs and our partners. -Decoding: we’ll make our messages as simple and clear as possible to facilitate the process whereby the receivers assign meaning to our messages, then we can get better understanding from them.. 30.

(40) -Noise: Can occur at any stage in communication process, but we’ll put effort to minimize it by treating with well ranked medium in Africa, Europe and Asia. -Feedback: successful innovation requires a deep understanding of customers, including environment, daily routines, concerns, and aspirations. View the business model through customers' eyes can lead to the discovery of completely new opportunities. After a certain time of communication we’ll get receiver’s reactions to our message. We’ll readjust it and we’ll put a lot of effort to get customers trust and satisfaction. We’ll use our network as a means to develop relationship with the personalities involved in our business and potential customers. We’ll attend international business events as much we can to connect with. 政 治 大 where businessmen go most立 often to meet them, let them know more about our company and. businessmen. We’ll be visiting potential customers at their business units. We’ll go on places. ‧ 國. 學. motivate them to use our services. We’ll start on the first year with three (3) consultancies, ten (10) business plans and two (2) capital funds investment. For the coming years, we believe that our business portfolio will grow by duplication of successful cases.. ‧. 3.10.5.Channel. y. Nat. sit. Our distribution channel objective is to build the image that we share the load of building. al. er. io. Africa economic development and foreign investors’ profit. Because our products are not. n. tangible goods, we can’t simply just put it in any physical shop to wait for customers to come and buy.. Ch. i n U. v. Due to our products are intangible goods, and the consumption happening at the. engchi. same with the delivery, we don’t need a retailer, wholesaler, broker or intermediate agent. The length of our distribution channel doesn’t need to be long. The co-founders will directly deliver the services to our customers. We’ll use personal contact, phone, fax, direct mail, email and website as the tools. We’ll keep in excellent touch with our customers to insure of our services quality. The market coverage is broadly over all parts of Africa; we can go by plane when the country location is far from Burkina Faso or go by car when it is nearby to minimize our cost.. 3.10.6.Customer Relationship The segmentation gives us a powerful key factor in creating superior customer contact. We believe that higher customer contact levels will create more demands for our company.. 31.

(41) According to Kellogg & Chase (1995), the degree of customer contact is determined by three factors: communication time (the length of the interaction), information richness (the value of information shared between the two parties), and the level of intimacy (mutual trust, confidence). Since business consulting services in strategic mimetic and long-term sustainable competitive advantage are hard to achieve as it can be easily copied by our competitors, a central issue in our business model is what type of drivers is able to create superior performance verses our competitors. We’ll focus on two perspectives: the microeconomic (operations/marketing) and the macroeconomic (strategic management).We’ll focus more on elements such as service quality, customization and customer interaction. We’ll use adapted. 治 政 大business portfolio, and analyze the database. We’ll use PARETO law 20/80 to manage our 立 degree to which, each customer segment influences our business performance. We’ll take care software and adequate information management systems to elaborate customer contact. ‧ 國. 學. of every single customer no matter the segment he owns but we’ll tend to give more advantages to foreign investors. As contact, proximity, reliability and efficiency are key. ‧. elements for our organization, changes in three key variables can mainly affect our business evolution: service production complexity, information asymmetry and customers satisfaction;. Nat. sit. y. so we’ll take much care about that. With good customer relationship we can better adjust our. al. er. io. services to customers’ needs, and then they will be willing to use our services, to have more. n. confidence in and to pay good prices; which also will help to create our company good reputation.. Ch. engchi. 32. i n U. v.

(42) 4. Operation 4.1.. Operation Process. Our business has a multi-side market; our business model will be as shown on the model canvas below.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Figure 8: ProBiz Business Model Canvas. 33.

(43) Graph 7: ProBiz Business System Flow Chart for Foreign Investors. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 34. i n U. v.

(44) Graph 8: ProBiz Business System Flow Chart for African Governments. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 35. i n U. v.

(45) Graph 9: ProBiz Business System Flow Chart for Small and Medium Enterprises (SMES). 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 36. i n U. v.

(46) Graph 10: ProBiz’ Operations Support Processes. 政 治 大 To review our project profitability 立 we analyzed the breakeven conditions and related financial 4.2.. Project Breakeven Analysis. indicators. The results show the project payback year is the third year and a positive Net. ‧ 國. 學. Present Value (NPV) of NT$9,980.59 and the Internal Rate of Return (IRR) is 28%.. -8,000. y. -8,000. al. -532. n. 2nd year. Balance. sit. io. 1st year. Amount. er. Net income. Nat. Start-up investment. ‧. Item. Table 5: Breakeven Analysis. 3rd year. Ch. engchi. i n U. v 1,935. -8,532 -6,597. 3,897. -2,700. 4th year. 6,570. 3,870. 5th year. 10,160. 14,030. Investment's internal rate of. return on after four years 12%. (IRR) Internal rate of return after five years (IRR). 28%. Net Present Value (5% Interest rate). $9,980.59. Payback year. 3.1. All the figures are in NT thousand dollars. 37.

(47) 4.3.. Revenue Forecast. The five year sales forecast shows that the revenue is slowly grown from the second year, and then keeps growing year after year as shown below. Table 6: Five-year Profit Year 2 Year 3. Year 1. Year 4. Year 5. Operating revenue. 1,500. 4,100. 6,077. 9,560. 12,885. Operating expense. -2,032. -2,165. -2,180. -2,990. -2,725. 1,935. 3,897. 6,570. 10,160. 0. 0. -5. -5. $6,570. $10,160. 69%. 79%. Operating. gross -532. profit. 治0 政 0 大 0 0. Interest. 0. Net Income. -$532. $1,935. $3,897. -35%. 47%. 64%. ‧ 國. 0. Net profit. 立. 學. Tax. All the figures are in NT thousand dollars. ‧. Nat 600%. sit. 500%. Ch. e n g 537% chi. 400%. i n U. v. Revenue growth rate 305%. 300% 200% 100%. er. al. 759%. n. 700%. io. 800%. Revenue growth rate. y. Graph 11: Revenue Growth Rate Forecast. 173% 100%. 0% Year 1 Year 2 Year 3 Year 4 Year 5. 4.4.. Cost Structure. Our cash flow projection shows that there is no cash outflow from the beginning and start to generate cash in the second year. The major cash spend is on the labor cost, equipment related expenses and business trips. Those expenses will remain in a constant range.. 38.

(48) Table 7: Cash Flow Statement (All the Figures are in NT Thousand Dollars) Year 3. Year 4. Year 5. 3,880 0 0 -2,165 1,715. 5,030 0 0 -2,180 2,850. 8,350 0 -5 -2,990 5,360. 10,000 0 -5 -2,725 7,275. -3,000 0. -250. 0. 0. 0. -3,250. 0. 0. 0 0 0. 0 0 0. 1,000 -83 917. 0 -83 -83. 1,715 6,718 $8,433. 2,850 8,433 $11,283. 6,277 11,283 $17,560. 7,192 17,560 $24,752. 政 治 大. ‧. ‧ 國. 立. Year 2. 學. Year 1 Cash flow from operating activities Revenue 750 Operating cost 0 Interest paid 0 Operating expense -2,032 Net cash from operating -1,282 activities Cash flow from investing activities Website Domain, Google Ads, 0 Equipment maintenance Net cash from investing 0 activities Cash flow from financing activities Investment by owner 8,000 Loan-term debt 0 Loan-term debt principal 0 Net cash from financing 8,000 activities Net increase of cash 6,718 Cash at beginning year 0 Cash at end of year $6,718. Nat. Year 1 1,500. al. n. Operating revenue Operating expense Advertising Website domain, Google Ads, Equipment maintenance Rent Administration Wages Operating gross margin Interest Tax Net income Net profit. 0 0. Ch. -2 -6 0 -532 0 0 -532 -35%. Year 2 4,100. Year 3 6,077. Year 4 9,560. Year 5 12,885. 0. 0 -10. 0 -5. 0 -5. -2 -3 0 1,935 0 0 1,935 47%. -2 -2 0 3,897 0 0 3,897 64%. -2 -1 0 6,565 -5 0 6,570 69%. -2 -1 0 10,155 -5 0 10,160 79%. e n0g c h i. er. io. Table 8: Income Statement. sit. y. Note: Interest paid*: Prime interest rate 2.025%, 10-year loan offer from government. i n U. v. Interest: prime interest rate 2.025%, 10 years loan offer from the government All the figures are in NT thousand dollars. 39.

(49) 4.5.. Project Balance Sheet. Our capital is mainly intangible assets such as skills, consultants experience and good reputation. For tangible assets we only have little equipment for services production. The nature of our business helps us to keep our cost low. The balance sheet shows an increase of Net from the second year that means we’ll have good financial backup for future expansion and investment. Table 9: Balance Sheet (All the figures are in NT thousand dollars) Year 0. 0. 政 6,718治 8,433 大 870 1,600 10,033 1,500. 0 0 0 $7,588. 0 0 0 $11,533. Year 5. 11,283 3,067 14,350 3,750. 17,560 5,143 22,703 5,045. 24,752 7,589 32,341 7,889. 250 -10 240 $18,100. 250 -20 230 $27,748. 250 -30 220 $40,230. 0. 83. 83. sit. n. er. io. Year 4. y. Nat. al. 7,588. Year 3. ‧. ‧ 國. 立0. Year 2. 學. Assets Current Assets Cash Account receivable Total Current Assets Long-term Assets Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets Liabilities and Capital Current Liabilities Current Liabilities Account payable Accrued Liabilities Current portion of long-term debt Tax payable Others Long-term Due Total Current Liabilities Long-term Liabilities Bank Loan Payable Total Long-Term Liability Total Liabilities Shareholder's Equity Owner's Equity Retained Earning Total Liabilities / Shareholder's Equity. Year 1. Ch. i n U. e n0g c h i 0. 0. v. 0. 0. 0. 0. 0. 0. 0. 0. 83. 83. 0 0 0. 0 0 0. 0 0 0. 0 0 0. 125 125 208. 130 130 213. 8,000. 8,000 -532 $7,468. 8,000 1,403 $9,403. 8,000 5,300 $13,300. 8,000 11,870 $20,078. 8,000 22,030 $30,243. $8,000. 40.

(50) 4.6.. Exit. Once we are about to start our project, we expect that adequate resources utilization and a careful debt management, in addition with International organizations help and African government’s contribution and adapted billing will produce very soon a good profit and valuable company.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 41. i n U. v.

數據

Outline

相關文件

• The Health Information Technology for Economic and Clinical H ealth (HITECH) Act seeks to improve American health care deli very and patient care through an unprecedented

CAST: Using neural networks to improve trading systems based on technical analysis by means of the RSI financial indicator. Performance of technical analysis in growth and small

CAST: Using neural networks to improve trading systems based on technical analysis by means of the RSI financial indicator. Performance of technical analysis in growth and small

Meanwhile, the customer satisfaction index (SII and DDI) that were developed by Kuo (2004) are used to provide enterprises with valuable information for making decisions regarding

The exploration of the research can be taken as a reference that how to dispose the resource when small and medium enterprise implement management information system.. The

With a service driven market and customer service being of the utmost importance to enterprises trying to gain and maintain market share, the building and implementing of

After 1995, the competitive environment changed a lot in Taiwan, the cost of employee and land got higher and higher, the medium and small enterprises in Taiwan faced to

The results revealed that the levels of both learning progress and willingness were medium, the feeling of the learning interesting was medium to high, the activities