外國人在台創業成功因素之探討

全文

(2) The Determinants of Success of Businesses Run by Foreigners in Taiwan. Advisor: Kao Lan-Feng, PhD. Department of Finance National University of Kaohsiung Student: Lisa Allègre International Master of Business Administration National University of Kaohsiung. ABSTRACT. This paper develops a model to identify and investigate the critical success factors practiced by foreign small and medium sized enterprises in Taiwan. A literaturebased selection of variables examines the direct effects of owner-manager characteristics (age, education and industry experience), management practices (business strategy, staffing, market research, and marketing) and Capital (Initial investment, debt) on small and medium foreign firms’ profitability. The empirical test of the model is based on survey data and uses non-financial measures. These measures are combined with the owner’s subjective assessment of the performance of his/her firm. The paper presents some dissimilarities with previous research: 1) it uses exclusively non-financial variables and measures to assess a firm’s profitability. 2) It uses the direct perceptions and experience of the entrepreneur to assess a foreign firms’ critical factors to achieve profitability in Taiwan. 3) It develops a model based on previous literature and adapts it to the environment targeted. The sample consists of 33 companies established by foreign expatriates in Taiwan, all industry types included. The results show that the three factors affect directly profitability to some extent. However, the variables affecting the performance differ from previous researches, indicating that the environment of Taiwan responds to different criteria to be entered successfully in. Key words: owner-manager, foreign small and medium firms, profitability, management practices, Taiwan..

(3) TABLE OF CONTENTS List of Figures. …………………………………………………………….iii. List of Tables. …………………………………………………………….iv. List of Appendices. …………………………………………………………….v. Acknowledgements. …………………………………………………………….vi INTRODUCTION………………………………………………1. Chapter 1 1.1. Research motivation…………………………………………….1. 1.2. SMEs in Taiwan………………………………………………...3. 1.3. Research objectives: detect Possible Factors Influencing SMEs Performance……………………………………………………..6. 1.4. Main contributions………………………………………………7 LITERATURE REVIEW………………...……………………..9. Chapter 2 2.1. Theoretical perspectives of firm performance…………………..9. 2.2. Owner-manager characteristics………………………………...14. 2.3. Management practices and SME performance…………………19. 2.4. Capital and SME performance…………………………………24. 2.5. Environment and SME performance…………………………...25 METHODOLOGY………………………........………………..29. Chapter 3 3.1. Research model………………………………………………...29. 3.2. Variables definition…………………………………………….31. 3.3. Measures …..…………………………………………………...33. 3.4. Data analysis……………………………………………………35. 3.5. Source data and collection.……………………………………..36 RESULTS………………………………………………………39. Chapter 4 4.1. Descriptive statistics……………………………………………39. i.

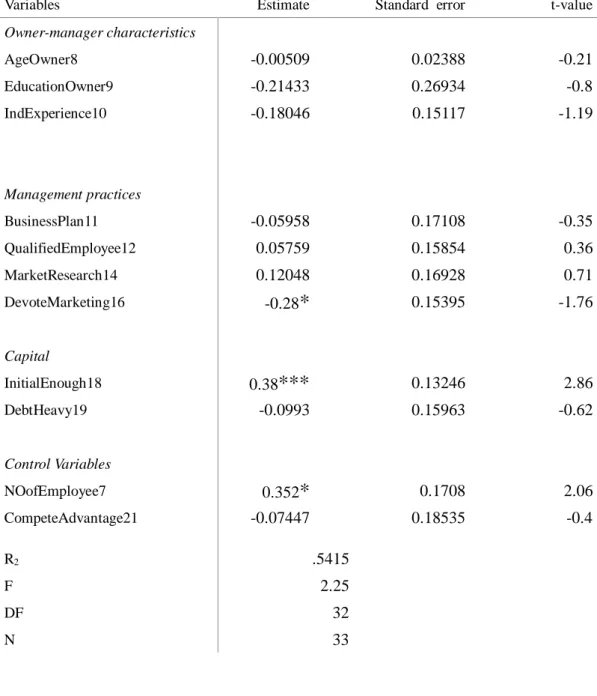

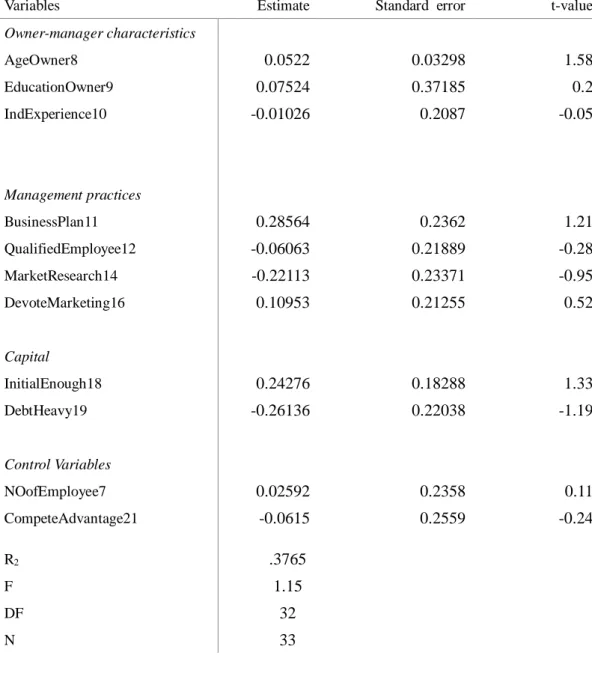

(4) 4.2. Empirical results………………………………………………...48. 4.2.1. Achievement of a firm’s purpose of creation……...……………48. 4.2.2. Payback Capital………..………………………………………..49. 4.2.3. Profits above industry average………………………………….51 CONCLUSION…………………………………………………52. Chapter 5 5.1. Summary and interpretation of the results………………….......52. 5.2. Discussions and further researches …………………………….54. References……………………………………………………………………………56 Appendices…………………………………………………………………………...70. ii.

(5) LIST OF FIGURES. Figure 1.. Research model……………………………………………………64. iii.

(6) LIST OF TABLES. Table 1.. Measurement of variables…………………………………………....65. Table 2.. Descriptive statistics………………………………………………….66. Table 3.. Pearson’s product correlation results…………………………………63. Table 4.. OLS regression: Achievement of the firm’s purpose of creation…….67. Table 5. Logistic regression, Payback investment…………………………….68. Table 6. OLS regression. Profits more than industry-average………………...69. iv.

(7) LIST OF APPENDICES. Appendix 1.. Survey questionnaire…………………………………………..70. Appendix 2.. Variables definition……………………………………………73. v.

(8) ACKNOWLEDGEMENTS. First of all, I would like to thank all the people that have patiently stayed by my side during this journey in Taiwan. I would like to personally thank all my family, specially Christine and Marinette, S. from Paris, Jean-Jacques, Marianne waiting for me at Home, my partner for supporting me day by day, and of course, my other half, cheering me up from Scotland.. I am immensely grateful to my advisor Kao Lan-Feng, who guided, advised and encouraged me through the achievement of this work. Thank you for your patience and the time you have lend me.. To all my dear classmates, it has been my pleasure to study these two years with you. Thank you for all the help and joy you brought me. My gratitude also goes to the National University of Kaohsiung, especially to Ruth, who supported us through every step of our student life.. To Taiwan, thank you for giving me the chance and financial support to learn and discover so much, thank you for your generosity, for your kindness and your valuable teaching.. vi.

(9) CHAPTER 1 INTRODUCTION. 1.1 Research motivation The creation of a country’s wealth and dynamism depends upon the competitiveness of its firms and this, in turn, relies fundamentally on the capabilities of its entrepreneurs and managers. In developed countries as well as developing countries, small-and-medium enterprises (SMEs) generally have the biggest share in their economies. According to studies (Ghobadian and Gallear, 1996; Ladzani and Van Vuuren, 2002), SMEs are the most dynamic businesses in any country and they exert a strong influence on the economies of all nations. They are major job creators, innovators and considered as vehicles for technology diffusion (Piech, 2004) as well as a source of growth (Lussier and Pfeifer, 2001). More than 90% of enterprises in the Asian productivity organization (APO) member countries are SME and they account for about 75 % of the Gross Domestic Product.. This thesis focuses on small foreign FDI for several reasons. Taiwan’s business landscape is mainly influenced by its dramatic number of small-and-medium sized companies. 98% of the companies in Taiwan are SMEs and the government has set up rigorous laws to encourage their development. The island is one of the few countries in the world where small businesses actually have influence and are shaping the business environment. As Taiwan’s market has been gaining more international recognition during the last 30 years, Taiwan’s foreign communities have been growing. 1.

(10) and gaining more importance in the local market. Many expatriates gather into communities to share their knowledge and experiences on the island. A common characteristic which emerges from these groups is a strong desire to identify and pursue entrepreneurial activities in Taiwan.. Due to the rapid development of foreign investments on the island, many young expatriates who already spend some time in Taiwan decide to take their chances and open their own business.. Even if Taiwan is renowned for its favorable economic and political environment, the success rate of local SMEs dramatically surpass foreign small investments’. While a few number of foreign SMEs meet with a great success in Taiwan, the rest generally go bankrupt within a few years after their creation.. Due to their small number (around 2% of the total population: 485,308, in December 2013), expatriates have built strong communities in which information is shared and available to all its members. Stories about successful foreign ventures rapidly spread among foreign expatriates communities, which gave birth to a common belief of Taiwan being a thriving land of opportunities for entrepreneurs.. It is interesting to notice that on one side, local SMEs are prospering and their numbers keep growing, while on the other side, foreign SMEs in Taiwan register a high number of failures (closures). Moreover, a huge gap exist between a few numbers of fortunate foreign SMEs that meet with immediate success and the others which are struggling to survive. This study aims at understanding the components that shape this gap. I am also interesting in the reasons that are preventing many foreign SMEs to enter. 2.

(11) the Taiwanese market successfully despite the SME-friendly policies the government has been implemented during the past years.. Finally, SMEs are as beneficial for a country as they are dangerous. Ripsas (1998) states that despite their potential to create jobs faster than bigger firms, SMEs also eliminate them faster because of their high failure rates. Small companies’ failure is damaging and costly to a free-market economy (Gaskill, Auken and Manning, 1993; Storey, Keasey and Watson, 1987; Watson and Everett, 1996).. 1.2 SMEs in Taiwan. Small firms, by definition, have limited resources and capabilities and are unlikely to possess substantial ownership advantages. They also have a limited capacity to influence and shape the development of markets, market structure and technological change (Ernst, 1998).. Due to their singular organizational design, the success keys of SMEs lie in different areas. The owner-manager or partners are the focal point of all operations: they have complete control over the business operations of the firm: therefore, the most critical determinant of a small firm’s performance lie in its owner-manager. In many cases, the management of an SME is unplanned, reacts and adapts itself based on the market evolution. Management in large-firm is well-planned and follow the long-term objectives of the corporation, which has defined a clear strategic plan. The performance of large companies is influenced by a various number of general factors. SME generally do not formulate any kind of strategy and are more likely to “break the rules” to create a competitive advantage. They face constraints such as technological backwardness,. 3.

(12) lack of human resources, skills, weak management systems, lack of financial resources, unclear or lack of strategy orientation, entrepreneurial capabilities, insufficient use of professional advice, etc.. The competitive powers of SMEs are weaker than those of large firms and their strengths are found in different areas.. Taiwan’s business environment occupies a special place on the international stage. The island is a key player in the global information and communications technology industry, but it also acts as a bridge to the huge Chinese market. Coupled with pro-business government policies, robust intellectual property protection, and one of the lowest corporate tax rates in Asia, the island has become a choice location for many multinationals as their regional headquarters or regional hubs (Dexter Chang, PwC Taiwan). Along with the rapid industrialization and economic growth of the island during the latter half of the twentieth century, the government introduced aggressive programs to encourage investment by domestic as well as foreign companies. As a result, the number of SMEs in Taiwan broke the record of 1.3 million in 2012, while revenues totaled NT$11.38 trillion (US$379.3 billion).Taiwan is considered as opened in term of international business cooperation as China, and offer even more opportunities for foreigners in terms of investment policies than its giant neighbor. However, the business environment of Taiwan has to be assessed carefully before being entered. The largest foreign investors in Taiwan are the United States, British Overseas Territories in the Caribbean, the Netherlands and Japan. The business environment of those countries are characterized by a high hierarchical recognition, as well as Taiwan. However, Taiwan business environment belongs to a group-oriented culture while western countries tend to carry individualistic purposes. While western countries are more task-oriented, Taiwanese do business with people rather than companies. They are also by nature non-confrontational. Assessing the performance of SME needs to. 4.

(13) take into consideration the influence of external factors emerging from the environment. In Taiwan and western countries, the political, economic and cultural factor shape different types of environment (hostile vs benign for instance). I may be lead to conclude that each environment studied needs a customize research structure in order to get relevant results about the firms’ performance. However, Ghosh and Kwan (1996) conducted a cross-national inter-sectoral study and identify common key success factors of 152 SMEs in Singapore and Australia. Additionally, Taylor (1997) explored high-growth medium-sized firms in the UK, Germany and the US, and presented significant results.. Therefore, although countries ‘environments differ in terms of political, culture and economic market, all SMEs are influenced by generic internal and external factors affecting their performance, that can be identified. The variables of Lussier (1995) contain such generic characteristics that allow us to apply them to my performance evaluation in Taiwan.. Taiwan is renowned for the outstanding performance of its SMEs; about 98 per cent of the enterprises in Taiwan are small or medium size. They have nurtured the country’s economic growth and have played a vital role in integrating its economy into the global world. Taiwan’s SMEs have modified their network structures to meet the requirements of the changing environment in the past 20 years. Organizational studies have also showed that the degree of fit between the business environment and organizational design affects a company’s performance. A stricken business behavior present in many Asian countries is their ability to form strategic alliance in respond to environment’s changes and competitiveness. Japan forms Keiretsu, an alliance of. 5.

(14) different actors (manufacturers, supply chain partners, distributors and financiers) who remain financially connected to ensure each other’s success; South Korea’s Chaebol is a business conglomerate that involves global multinationals owing numerous international enterprises, controlled by a chairman who has power over all the operations. Taiwan’s SME form informal peer groups, for instance, classmates (especially in elite schools) and former colleagues form tight networks that can be used to get information or form new business contracts. This type of organization combines the scale advantages of large firms with the speed and flexibility of smaller firms. SMEs can also have access to vital components and resources at a lower price than the one they would pay on the market.. Many businesses owned or managed by Western people face some challenges due to the lack of understanding of political, economic and cultural barriers. Although American and European businesses have acknowledged the importance of Guanxi, many still do not fully understand the other mechanisms shaping the Taiwanese business environment. My study aims at identifying those mechanisms to improve foreign firm performance and to help the local government to formulate policies more adapted to FDI current needs.. 1.3 Research objectives: Detect Possible Factors to Influence SME Performance. In order to explore the factors affecting the performance of small FDI, I define performance as the survival and growth of the foreign SMEs. I choose to focus on survival for most small businesses are built around the owner-manager (Cooper, Gimeno-Gascon and Woo, 1994; Roper, 1999), and for whom the company very often is the main source of income (d’Amboise and Muldowney, 1988). For him or her,. 6.

(15) ensuring a stable revenue to cover his or her living expenses may be the sole objective of the company. On the other hand, due to a very suitable environment for business expansion and a large consumer market still spared from mass internationalization, some cases of tremendous growth and success have been observed among foreign FDI. As SMEs may be reluctant to provide financial data on their performance (Dess and Robinson, 1984) and due to the fact that it may take several years before a new venture becomes profitable (Biggadike, 1979), I use subjective assessment of the entrepreneur to determine a firm’s success or failure (Powell, 1992a; Robinson and Pearce, 1988) instead of financial statements. Moreover, there is no generally accepted definition of performance and the literature is divided in the subject.. There is no generally accepted list of variables to assess a firm’s performance. Lussier (1995) includes 15 variables related to owner-management characteristics, management know-how, capital and environment. I based my study on the result of Lussier and include the work of Maes, Sels and Roodhooft (2003) who found two endogenous inter-related factors having significant effects on small firm’s profitability. My model includes the following factors: owner-manager characteristics, management practices and Capital.. Based on this list of factors, I have design a survey questionnaire to collect data from foreign SMEs in Taiwan.. 1.4 Main contributions. The field of research in SMEs performance is fragmented and divided. Indeed, most studies on firm performance have been focusing on large-scaled corporations. The. 7.

(16) previous literature assessing large firm is dense and more unified than studies evaluating smaller firms performance. While some argues that the performance of small firms could be evaluated from a limited set of selected variables, some disagree and attempt to depict a more holistic model. Moreover, some studies may only focus on the effects of a single specific or narrow factor to assess SME performance, such as age, size or single industry sector for instance (Eisenhardt, 1999). However, as Storey (1994) argues, the effects of external factors must be taken into account in assessing performance; the firm’s internal characteristics alone aren’t enough to explain the effects of environment on the firm. Other authors have identified several attributes related to large-firm success, however, he argues that those characteristics are distinctive capabilities that cannot be replicate by other firms.. Therefore, a holistic perspective of firm performance would identify factors specific to a single firm and non-relevant for the development of a generic strategy. Even though the subject of SMEs’ performance has been explored (Bates, 1990); Cooper et al., 1994; Lussier, 1995; Lussier and Pfeifer, 2001; Roper, 1999), few studies have investigated the effects of interrelated factors on SME’s success (Gadenne, 1998). I merge the previous results of Lussier (1995); Lussier and Pfeifer (2001) and Maes, Sels and Roodhooft (2003) to identify the different factors and their variables that affect the firm’s performance. This study contributes in the harmonization of SME performance researches by testing the relevance of a set of limited variables in explaining small and medium firm performance. I will apply the variables of Lussier (1995) combined with literature-based selection of interrelated factors on foreign SMEs performance in the Taiwanese market. Finally, my study provides insight about the performance of small foreign direct investments in Taiwan. 8.

(17) CHAPTER 2 LITERATURE REVIEW. 2.1 Theoretical perspectives of firm performance Definition of performance a. Success Firm performance, in business researches takes on a multitude of different forms: there is no universally accepted definition of “success”, and “business success” has been defined in many ways (Foley and Green, 1989); Morel d’Arleux, 1997). On the strategic level, firm performance is often defined as firm success or failure (Dess and Robinson, 1984; Ostgaard and Birley, 1994); in a general conception, “success” is referred as the achievement of the firm’s objectives or one’s own goals in whatever fields of life. However, in business studies, “success” is very often referred to a firm’s financial performance.. Due to the central role of an entrepreneur in a small firm, Jennings and Beaver (1997; 1995) argues that it would be accurate to consider the entrepreneur -the owner- and how he/she might define “success” or “failure” in the context of his/her firm. Success can be assessed in different ways: survival, profit, return on investment, sales growth, number of employees, reputation and so on (Vesper, 1990). There are at least two important dimensions of success: i). financial vs other success. ii). short vs. long-term success. 9.

(18) Performance is harder to measure in the case of small SME’s for several reasons. First, the main objectives of the firm may be other than financial, depending on the owner-manager’s expectations. Second, due to the fact that it is not compulsory for firms of this size to publish the financial data sheets, it is difficult to obtain reliable information concerning the financial situation of an SME. Moreover, in family businesses (and even in the case of a single owner-manager), it is difficult to take into account the individual inputs and expenses of the ownership that are not recorded following an appropriate accounting system. Third, SMEs may be very reluctant to provide financial data on their performance (Dess and Robinson, 1984). Finally, it may take several years before a new venture becomes profitable (Biggadike, 1979).. The main goal and objectives of the small and medium firms can be other than financial or can change frequently over the time. Rather than maximizing the financial performance of the firm, the owner-manager may seek for independence, financial comfort (without huge amount of revenues) and/or a particular style of life (Jennings and Beaver, 1995; Koiranen, 1998) for instance. Therefore, the influence of an entrepreneur’s values and expectations are very important in the definition of a firm’s purpose, success (achievements of goals) and failure (non-achievement of the goals). However, in the long-run, even firms with non-financial goals should reach and maintain at least a minimum profitability in their operations; incomes should exceed costs to ensure the continuity of the operations. A firm’s profitability can be a useful measure of performance in the case of large companies.. b. Failure There are several definitions of business failure (Watson and Everett, 1996; 1993). Firm failure has been described with many terms: bankruptcy, insolvency,. 10.

(19) liquidation, death, deregistering, discontinuance, ceasing to trade, closure and exit (Storey, 1994). Each of these terms have different meanings in different countries. It is important to notice that not all firms that go out of business do so as a result of failure, and those that do not should be separated from failure (Pasanen, 2003). For instance, the ultimate business failure for Lockett and Thompson (2001) happens when a business is liquidated or sold. However, I should make a distinction between optional and nonoptional sales or liquidations. When there are no option for the owner-manager, the ceasing of the activities of the firm can be defined as failure. Hence, in this study, a failed firm is defined as a firm which has closed because of lack of necessary resources to maintain its activities. On the other hand, a business which is sold because, for instance, the owner-manager wants to realize a profit, is not considered as a failure. Firm performance approaches Firm performance is influenced by both the firm and its environment (Johnson and Scholes, 1993; Powell, 1992a; Hrebiniak and Joyce, 1985), performance can then be approached from an internal (firm) or an external (environment) viewpoint.. a. Resource-based view The most popular recent approach used in the field of performance assessment has been the resource-based view (Wernerfelt, 1984; Barney, 1991) and its extension, the knowledge-based view of the firm (Kogut and Zander, 1992; Spender and Grant, 1996).. The resource-based view (RBV) of the firm can be based on Penrose’s (1959) idea of viewing a firm as a bundle of resources. The theory argues that the resources hold by a firm (brand names, trade contracts, in-house knowledge of technology,. 11.

(20) employment of skilled personnel, machinery, efficient procedures, capital…) can be combined in some extent to create a competitive advantage (in terms of customer loyalty or technology leads for instance). “What a firm wants is to create a situation where its own resource position directly or indirectly makes it more difficult for others to catch up.” (Wernerfelt, 1984). In many studies later (Cooper, 1995; Cooper and Gimeno-Gascon, 1992; Cooper, Gimeno-Gascon, and Woo, 1994; Dunkelberg, Cooper, Woo, and. Dennor Jr., 1987; Woo, Cooper, and Dunkelberg, 1988; Woo, Cooper, and. Dunkelberg, 1991; Woo, Cooper, Dunkelberg, Daellenbach, and Dennis, 1989), it was then proved that the resources of a firm (capital, human, management skills) directly influence its performance and can be used as a way to overcome adverse obstacles for start-up ventures. Undoubtedly, the RBV is crucial in determining small firm success; however in a continuously changing market, the RBV is not enough to predict foreign SMEs success or failure; too simplistic, it cannot be applied alone to new ventures and medium companies (Eisenhardt and Martin, 2000).. b. External viewpoint The opposite approach, the external viewpoint, emphasized the influence of environmental forces and tries to explain organizational behavior based on environmental constraints. As a general term, environment refers here to all those arenas the firm is operating in and is attached to: it is defined by the PESTE frame as political, legal, economic, socio-cultural, technological and ecological factors which have indirect connections with firms. The firm interacts with its environment, additionally, the environment and its components affect firm performance directly and indirectly, in many ways.. Environment supports the survival of the fittest and destroy the less fitted. 12.

(21) ones. (Gimeno, Cooper and Woo, 1997). The environment carries needs and expectations (market opportunities) which the firm tries to match with its resources, capabilities and strategies. According to the contingency theory (Burns and Stalker, 1961), firm performance is the result of a proper match between the firm’s design and the environment it operates in. The better the match, the better the success.. As the environment is changing all the time, there is a continuous need for adjustment of the fit between the firm and its surrounding environment.. c. Strategic choice perspective However, many theoretical constructions have been created based on empirical findings made from the observations of large firms. For the context of small firms, the business conception of Normann (1976) is seen to be the most fitted approach. Strategic choice perspective. A strategic choice approach (Child, 1972; 1997) assumes that firms are in a state of continuous change, which is directed according to the actors’ subjective interpretations of the situation and their preferences (Vesalainen, 1995). There are some external and internal constraints, but management keeps certain freedom regarding strategy formulation. According to Astley and Van de Ven (1983), the strategic choice approach emphasized on individuals and their interactions, social network constructions, autonomy and choices, as opposed to the constraints of their work responsibilities and functional interrelationships in the firm’s system. Both environment and structure are considered to influence and direct the actions of individuals.. This approach gives a pro-active role to entrepreneurs and a determinant role for the environment. Their choices are viewed as autonomous, and their actions. 13.

(22) are considered as energizing forces that shape the future of their firms.. 2.2 Owner-manager characteristics a. The Entrepreneur Shane and Venkataraman (2000) emphasize that entrepreneurship emerges from two processes: i) the discovery of entrepreneurial opportunities, and ii) the exploitation of such opportunities. Shane (2000) poses the question: why some people discover opportunities and others do not?. He argues that people have different stocks of information and everyone’s way of acquiring information depends on how they live. More precisely, it plays a vital role in transforming incoming information into potential sources of opportunities. Therefore, one with higher human capital quality should be able to identify an opportunity in a new economic activity and use his capital to exploit this activity successfully. For instance, prior knowledge influences social networks, which in turn influences entrepreneurial alertness and finally lead to the core process of opportunity recognition.. I define an entrepreneur (following Zhao, Seibert and Lumpkin, 2010) as the founder, owner and manager of a small firm. He/she is a capitalist who provides the main resources and capital for the new-venture, and a manager. As a manager, he/she supervises the organization’s activities, builds up the firm’s reputation and a system of cooperation within the organization.. There is no market for “opportunities”, therefore, an entrepreneur must. 14.

(23) previously develop his or her capabilities to obtain resources, discover and exploit opportunities (education, experience...). ( Lussier (1995) ) emphasizes on the general background of the entrepreneur in terms of knowledge that could lead to higher productivity and potential access to knowledge.. b. Human Capital Many researches indicate that the work history and experience of the entrepreneur are crucial for entrepreneurship success (Bruno and Tyebjee, 1985; Hisrich and Peters, 2002; Roberts, 1991; Sandberg and Hofer, 1987; Starr and MacMillan, 1990). Human capital is also the result of experiences and practical learning that takes place on the job, as well as non-formal education, such as specific training courses that are a part of traditional formal educational structures. Industry-specific knowledge and experience is also central in measuring performance. This knowledge is mostly tacit and costly to build up if the entrepreneur has no previous experience from the industry where the business is established. This view supports the strategic choice perspective in evaluating firm performance.. The firm founder’s performance is determined not only by his talent, the conditions of the environment but also by his human (experience and education), social and management capabilities. Bates (1990) and Lussier and Pfeifer (2001) have found education to be a significant predictor of business success. Roper (1999) found a positive effect of owner-manager education on both growth and profitability, while the age of the owner-manager had a positive effect on profitability (Maes, Sels and Roodhooft, 2003). Education and prior experience in business have been seen as critical success factors for small firms (Yusuf, 1995); Wijewardena and Cooray, 1996). The most recurring directly observable characteristics of the owner-manager in business. 15.

(24) performance literature are age, education, management, technical ability and management experience (Havaleschka, 1999; Lussier, 1995).. Start-up resources involve the core resources of the entrepreneur (ownermanager) and additional resources provided by third parties –capital-; Becker (1964) argues that broad labor market experience, as well as specific vocationally oriented experience is theoretically expected to increase human capital.. Oh et al. (2004) have studied the possibilities of social capital in the form of networks ties and the way its effects are influenced by human capital in the form of local language ability. This possibility is an important factor to consider in my study since the building of social network for foreign expatriates is mediated by the local language.. This would imply that expatriates that speak several languages or at least the local language will have larger social capital and, as a result, they will be able to identify more opportunities and mobilize more resources. Similarly, an expatriate that has better financial skills or managerial skills, can demonstrate his skills, attract and enter into a relationship with potential shareholders, or people who own bigger and more prestigious establishments from whom the entrepreneur would draw knowledge and/or resources. Researchers acknowledge that entrepreneurial activity is embedded in network relationships that direct resource flows to entrepreneurs who are better connected (Aldrich and Zimmer, 1986; Hoang and Antoncic, 2003).. In the case of Taiwan, psychic distance is the main obstacle to the firm’s adaptation to the local environment. When interacting with people from different. 16.

(25) cultures, it is natural to interpret their actions through the observer’s own culture’s standards, phenomenon which also occurs at the firm’s level due to the central influence of the entrepreneur. However, doing so can cause misunderstandings. When conducting business in foreign environment, misunderstandings could be avoided by recognizing cultural differences, such as communication styles, religious beliefs, power structures and attitudes toward time and work.. c. Social capital Moreover, significant resources must be in place to produce success (Deeds and Hill, 1996; Teece, 1986). The important role played by social networks in the process of new venture creation was first studied by Birley (1985). Social capital theory refers to the ability of actors to extract resources from their social structures, networks, and memberships (Lin, Ensel and Vaughn, 1981; Portes, 1998). By personal network, I mean the family members, friends, and business contacts with whom an entrepreneur is directly connected and the indirect relations between them (Dubini and Aldrich, 1991). Maurer and Ebers (2006) also argue that social relationships or connections or ties are critical to the development of small firms. Since start-ups are initially often small in size and tend to fail at a very high rate as compared to established companies, building relationships with these entities are often determinants on their likelihood to survive and thrive.. Network connections enable entrepreneurs to identify new business opportunities, obtain resources below the market price, and secure legitimacy from external stakeholders.. As I stated before, the small firm is focused around its entrepreneur: they are. 17.

(26) more involved in daily firm operations, have greater discretion in decision-making, and more frequently perform key roles (Hite and Hesterly, 2001). Therefore, the individuallevel social capital embedded in entrepreneurs’ personal networks may thus importantly influence small firm performance.. Social networks are theorized to supplement the effects of education, experience, and financial capital. Social capital is multidimensional and occurs at both the individual and the organizational levels. In this study, I focus on social capital in terms of social exchange to examine the effects of exchange ties on small firm’s performance. Social capital includes the actual and potential resources accessible through an actor’s network of relationships.. The nature of these exchanges may range from the provision of concrete resources, such as a loan provided by a relative to intangible resources such as information (which is crucial in a country like Taiwan where information is limited and detained by few members). Networks (whether personal and relation-based networks or strategic alliances) are also crucial in the acquiring of complementary resources and capabilities.. The strength of the “tie” or connections with individual increases the willingness and ability of an entrepreneur’s network contacts to provide needed resources. Uzzi (1997) shows that frequent and close interactions facilitates trusted resource exchanges and tacit knowledge transfer.. Social capital allows “asset parsimony”, which refers to the effort needed to acquire the minimum quantity of assets at the lowest possible cost. It is also a strategy. 18.

(27) often used in Taiwan to achieve a competitive advantage. Rather than paying the market price for resources such as labor, materials, and advice, social transactions through network ties can play an important role in acquiring resources at lower values. Social capital can be a useful resource both by enhancing internal organizational trust through the bonding of actors, as well as by bridging external networks in order to provide resources.. The high-tech industry in Taiwan has numerous examples of successful SMEs that are using their networks to avoid high costs and grow. For instance, small and medium Taiwanese computer firms possess a very narrow knowledge base due to their small size and lack of resources. In order to gain the most important resource in this industry, “knowledge”, they are using their networks as external source of knowledge and cooperate with other bigger organizations and firms to create what is called “inter-organizational knowledge creation”.. Social capital and the nature of networks are multidimensional. In Taiwan’s environment, a certain structure of multiple, volatile and short-term links can create “temporary spider-web” arrangements where limited financial and technology are exchanged for the duration of a particular project. This helps the firm to gather resources and knowledge at a minimum cost and in a flexible way (Ernst, 1998). I thus believe that a strong social capital greatly influence the performance of a foreign firm.. 2.3 Management practices and SME performance Another important variable or factor explaining SMEs’ success and or failure are the internal factors related to management practices. Ghosh and Kwan (1996), Yusuf. 19.

(28) (1995), and Wijewardena and Cooray (1996) also argues that effective management is an important success factor for an SME. Authors have found that firms that have a diversified range of management skills and competence (Various management functions covered by different individuals regrouped in management team) have a significantly greater chance to survive.. a. Organizational design One of the most elementary decisions a small firm owner or manager has to make is the design of the firm’s organization. As soon as a small firm hires one or more employees, some kind of organization structure develops. The actual design of this organizational structure is a mix between intended, deliberate choices and unconscious, emergent developments. Who decides on what, who is responsible for what, and how do we coordinate these decisions and responsibilities effectively? The outcome of the organizational design process is unmistakably an important determinant of the performance of firms. Many authors agree that the lack of managerial experience or practice lead to small business failure (d’Amboise and Muldowney, 1988). Organizational structure is also highlighted as a relevant factor in the regulation of a firm’s information processing demands and capabilities. Research on start-ups indicates that developing and implementing an adequate structure is one of the most important challenges. Entrepreneurs struggle with it, and wrong choices may lead to exits. The most important reason for managerial problems is the non-professionalism in the management. The business ownership in the SMEs and management are implemented by the same person: the business owner is the unique authorized (for most cases) in the decision making process and due to the limited applications of professional consultancy, problems often occurred in the management process. Another aspect of managerial problem refers to the development and ambition of the entrepreneurs.. 20.

(29) b. Management experience Sometimes, owner-managers do take decisions that go against the firm’s development. For instance, they may refuse to leave the management to another actor such as professional managers or fail to take into consideration the risks they may encounter if they carry out with a production with limited capacity. It is not easily accepted when entrepreneurs, who directly established the company by great endeavors and sacrifices to reach the point when they have to institutionalize their business which until now has been very personal. Enterprises that delay this decision and do not hand over the management have faced difficulties. Many SMEs do not make any periodical plans and do not have any estimation about the resources necessary to carry out the activities, their future is very uncertain and this uncertainty is costly.. Management know-how focuses on the entrepreneur’s previous experience with general management tasks. It is about tacit knowledge acquired through learning from observing or by actually performing management tasks. The knowledge-based view argues that top management has the ability to select, retain and develop critical capabilities. Management’s tasks is to fit the strengths and capabilities of the firm to the resources to create a future. The core capabilities which are created in the firm serve as a basis for its growth.. Among managerial practices, there is no generally accepted list of variables to use in assessing business performance (Lussier, 1995), some researches though mention similar variables such as planning sophistication (Lussier, 1995), capital structure and intensity (Cooper et al., 1994; Lussier, 1995), service level or product quality (Roper, 1999), use of information systems, record keeping (Lussier, 1995) and. 21.

(30) the use of professional advice (Lussier, 1995). Gadenne (1998) has studied the effect of various management practices on small firm performance by studying 369 small businesses in cross-sectoral industries. He insisted in recognizing the importance of wider management practices in an organization at least as much as owner-manager characteristics.. c. Human resource management In most companies, the personnel is a central resource. Due to the size of an SME, the employee may perceive the individual contribution of his work on the firm performance more clearly than in a large company. Consequently, employees may be more motivated to work for small-sized firms than for large companies and are more likely to be highly-productive and out produce workers in big facilities. Human resources that have not been planned carefully represent also an obstacle for the efficiency of the company. In the situation where each staff carry out an activity where terms of reference have not been set and with the absence of hierarchical structure and a lack of professional advice in the organizational design, structural problems occurs within the firm which dramatically reduce the firm efficiency and waste resources.. In such environment, failing to retain employees lead to staff circulation where staff members are looking for new jobs and the continuation of the work is interrupted. Moreover, due to the fact that the business owners and their relatives are generally making the decisions, studies have found that they may not take into consideration the opinions and proposals of the staff. Therefore, lack of communication and production problems could often be observed.. d. Business Strategy. 22.

(31) Finally, management practices also include the formulation of some business strategies. Strategy is the direction and scope of an organization over the long term: resources are match to the firm’s environment, and more importantly its markets, customers or clients so as to meet stakeholder expectations”. Additionally, strategy is needed to cope with changes in the firm’s external environment but also to cope with the firm’s internal changes, growth for instance.. Strategic management has often been defined as business concepts that affect firm performance. Strategic choices include the following questions: i) what are my goals? ii) Do I have the right strategy? And iii) Can I execute the strategy?. In order to achieve high performance, firms need to adapt their strategies to their environment. Strategy is often associated with top management’s plans to attain outcomes consistent with the organization’s missions and goals. Strategy can be seen as a plan to attain objectives and goals but also as a plot against competitors. Using strategy makes it possible to change the firm’s position in the market and adapt to different kinds of situations and environments. Pasanen (2003) resumes strategy as a firm’s own way of doing business. Strategy may be described as the synergy between the different functions of the organization. Business strategy choices are likely to be critical for small firms but in small firms are often informal and non-written forms.. SMEs that do not have an accurate business plan and strategic orientation have more chances to fail. Entrepreneurial orientation can be viewed as the business strategy or business plan of a firm, adapted to SMEs, since they are centered on the owner-manager or the entrepreneur. Entrepreneurial orientation constitutes an organizational phenomenon that reflects a managerial capability by which firms takes. 23.

(32) on proactive and aggressive initiatives to influence the competitive environment to their advantage.. Small firms should also keep and use current financial data for making key decisions.. 2.4 Capital and SME performance. Many studies point out the important role of financial management; it is an important factor which affects the firm’s performance from the date of creation and throughout the firm’s life. The absence of business plan and a lack of financial management is one of the biggest obstacles for SMEs’ development: the lack of knowledge and financial information is a big handicap. The study conducted by Gadenne (1998) revealed that the only common success factor for small firms belonging to different industries was financial leverage.. a. Initial investment In general, SMEs tend to be more successful if there have sufficient financial resources either providing by the owner or generated from profits and cash flows from operations (Yusuf, 1995).Therefore, it is expected that the larger the amount of capital invested at start-up the more likely the new business will survive. Financial capital act as a buffer against unexpected difficulties which may arise from poor management, environmental changes, etc… (Cooper et al., 1994). It also facilitates the necessary changes caused by market changes –or the arrival of new competitors- and increases the innovation and flexibility capacities of the firm.. 24.

(33) Therefore the larger the capital available, the higher the probability of survival and more importantly, the higher probability of growth.. b. Financial Management Financial management is important because of its effects on the firm’s profitability and risk, and of course the firm’s value. For instance, on the one hand, maintaining a high inventory prevent the firm any eventual scarcity of products, reduce supply costs and protect against price fluctuations. On the other hand, granting trade credits –practice only possible when a minimum capital is saved- increases customers’ satisfaction and favors the firm’s sales in various ways. SMEs must set up an appropriate financial management team able to manage the assets of the firm according to its needs and its environment. As the owner-manager is generally in charge of the management of the capital, there is no appropriate financial department to take proper investment measures. Moreover, it has been observed that family-owned SMEs spend a part of the firm’s revenues –not profits- to cover their living expenses which makes the capital management irregular and an important part of the firm’s available capital is soaked up.. 2.5 Environment and SME performance a. Competitive Advantage Firm performance on the market depends on its competitive advantage. Competitive advantage is based on the firm’s (owner-manager) understanding of the market needs, social codes and the understanding of its own organization’s strength and opportunities (SWOT analysis). The interactions between firms and their competitive. 25.

(34) environment can be seen as market-dependency and resource-dependency. The firm’s environment is one of the sources of competitive advantage. A firm can create a competitive advantage by interpreting and responding to the needs of customers and local market segments better than its competitors do.. The core of strategy consists of adapting the firm’s strength or critical success factors to an environment’s needs. Critical success factors are those activities that must be given special attention so that they go well and bring high performance; (Johnson and Scholes, 1993; Ghosh et al., 2001).. It has been found that only a few of the success factors have a substantial impact on firm performance. For generating a sustainable competitive advantage, Barney (1991) has assessed four criteria to be applied to resources: value, rareness, inimitability and substitutability. Firms can also attain competitive advantage through networks and good relationships with local firms. There are numerous sources of competitive advantages for a firm that knows how to identify them: low costs, knowledge -and in the case of Taiwan- strong network relationships. Network relationships are shaped by the cultural characteristics of the environment, and how the firm interpret and adapt to them. From an external perspective, the rules of competition and competitive advantage are shaped by the structure of an industry which also determines the strategic choices available to firms. The strength of competitive factors from the environment influences the power of competitive advantage of the firms, and thus influence also the concentration of firms in the industry.. However, due to the continuous change of the market conditions, a firm should continuously renew and innovate to maintain competitiveness as the conditions. 26.

(35) for success change. A dynamic view of strategy is required.. b. Flexibility of Resources Flexibility of resources affects the success rate of responding to environmental changes. The more flexible the resources, the better chances for the implementation of changes (Pasanen, 2003). Flexibility can be segmented into different parts: input, output, internal flexibility, and flexible network relations.. SMEs are considered as flexible because of their simple organizational structures. Hierarchical levels are limited and short chains of command are set which allow a rapid and uncomplicated decision-making. The firm should find a market position which is unique in some extent (Pasanen, 2003). Uniqueness can be found in products, services or in the ways of doing business. In market conditions characterized by over demand, it may be sufficient for the firm to imitate its competitors. Competitive advantage is achieved whenever it has neither competitors nor close substitutes.. Firms that usually operate in market characterized by continuous competition between firms should have some relational competitive advantage, such as the case of Taiwan. A firm has to reach a better market position than its competitors have so that it is valued in some ways by customers. Strategic core capabilities start with the customer: the identification and satisfaction of their real needs. In Taiwan’s environment in particular, an important success factor is to be able to respond to changes in customer ’s needs.. Five dimensions that are related to successful firms are: i) Speed (or the ability to respond quickly to customer or market demands and to incorporate new ideas. 27.

(36) and technologies quickly into products) ii) consistency (or the ability to produce a product that satisfies customers ‘expectations), iii) acuity (or the ability to see the competitive environment clearly and thus to anticipate and respond to customers’ evolving needs and wants, iv) agility (or the ability to adapt simultaneously to different environments, v) innovativeness (or the ability to generate new ideas and to recombining a set of existing elements to create new sources of value.. c. Cultural issues SME’s resources for acquiring information about the market are limited. Often, SMEs do not know their customers and their real needs which can cause tensions between the firm and its environment which may explain some failures. This case applies well to foreign SMEs; if the owner-manager fail to understand the cultural difference of the local market, a psychic distance divides them from the local customers. However, Ghosh and Kwan (1996), Wijewardena and Cooray (1996) found that good customer relationships and customer service have been found to be the most important factor contributing to SME success.. 28.

(37) CHAPTER 3 METHODOLOGY. 3.1 Research Model. In this paragraph, I will focus on the specific factors and variables included in my model.. Several models appearing in the literature can be distinguished by the sizes of businesses to which they apply and the type of data they use to predict failure. Many researches in which purpose is to assess large firm performance are based on financial data and ratios. However, when it comes to assessing SME performance, the usefulness of such ratios have been questioned. Storey et al. (1987) argue that qualitative data can assess performance at least as good as financial ratios or data. Moreover, since financial data is less available and less reliable in the context of small-to-medium-sized firms, models based on financial ratios are not really relevant.. This study adopts the strategic choice perspective to approach and evaluate SME performance. Both firm’s internal and external viewpoint are considered. Firm performance has been assessed based on the entrepreneur’s interpretations, actions and decisions, taking into consideration the effects of political, economic, and cultural environment on both the firm and its entrepreneur.. The model formulated by Maes, Sels and Roodhooft (2003) is my starting point; the author identifies two endogenous factors affecting small firm performance:. 29.

(38) 1) Owner-manager human capital, and 2) Management practices. Within the researches focusing on explaining small-and-medium firm performance, I also observe authors who look for factors at the entrepreneur’s level, internal or management-related factors, and factors related to finance and capital. Many researches have focused on the individual characteristics of the owner-manager to explain the success and/or failure of SMEs. I have already emphasized on the importance and the influence exerted by the entrepreneur on their firms (d’Ambroise and Muldowney, 1988); within this area, authors were concerned with traits of personality, job experience, social history and connections, etc specific to the owner-manager…. Other series of researches are centered on internal factors related to management practices. Many authors attribute the failure of small-and-medium sized companies to the lack of managerial experience, and inefficient practices (d’Ambroise and Muldowney, 1988). The environment exerts strong influence on the entrepreneur’s interpretations and decision-making, and consequently also changes the management orientation, the strategies and actions to cope with the competition. A general overview of the environment foreign SME face in Taiwan has been drawn from the entrepreneurs’ perceptions.. However, following my theoretical perspective in assessing small firm performance, I assume that the external environment also greatly influence the development of a firm. Thus, I also need to consider its effects on the entrepreneur’s individual interpretation, judgment, the management and competitive strategies. To finalize this aspect, I look back at the empirical study of Lussier and Pfeifer (2001) which, based on previous studies, uses both endogenous and external variables to predict firm performance. Based on the previous researches, I expect firm performance. 30.

(39) to be affected by three endogenous factors: 1) Owner-manager characteristics, 2) Management practices and 3) Capital. The research model is shown on figure 1.. 3.2 Variables definition. In this study, I refer to four dependent variables to measure success (assessed by performance). As I stated earlier, this study is using non-financial data to measure a firm’s performance, consequently, the nature of the dependent variables are nonfinancial and based on the individual perception of the owner-manager.. A successful firm would be considered as being efficient enough to survive and/or to grow. Owners were asked four questions –corresponding to the four dependent variables: 1) whether the company is still in activity or not – which I could either classify as “fail to survive” or “succeed to survive”. There are without doubts many reasons for a company to stop its activities, (liquidation, lack of financial resources or a capital gain from the sale of the business), therefore other measures have to be included; 2) whether the initial investment has or has not been already paid back –which would indicate an financially autonomous or dependent start-up. 3) Whether the company makes (or was making) more profits than the industry-average –which clearly indicates a good performance of the firm (growth) or a lack of efficiency–. Nonetheless, a firm cannot be considered successful as long as its purpose hasn’t been met. Therefore, I consider a firm “successful” having achieved its purpose of creation and met its entrepreneur’s expectations.. The predictor variables focus on facts, practices and perceptions of facts proper to the firm. Following Hambrick and Mason’s (1984) upper-echelon model, the. 31.

(40) first predictor variable related to the owner-manager is the age. According to Lussier and Pfeifer (2001), “younger people who start a business have a greater chance of failing than older people starting a business”; I will measure this variable according to the number of years of the owner.. According to Lussier and Pfeifer (2001), Cooper, Gascon and Woo (1994) , I believe that education –the second independent variable– is an important factor affecting firm performance: “people without any college education who start a business have a greater chance of failing than people with one or more years of college education” (Lussier and Pfeifer, 2001).. Industry experience is my third predictor variable. I expect entrepreneurs with industry experience to achieve higher performance and profits than those who do not have any experience in their firm’s industry.. I evaluate management practices considering four components or predictor variables. The fourth variable, “business strategy” is expected to be positively related to firm performance; firms which do not formulate any strategy or plans have greater chance of failure than the ones who do.. The entrepreneurs were also asked to assess. their ability to attract and retain qualified employees which refer to the fifth variable “Staffing”. Firms that fail to retain qualified employees are expected to face difficulties due to the frequent rotation of the staff . Moreover, I believe “market research” to be fundamental to evaluate foreign firms’ degree of preparation and understanding of the local environment and consequently, have a positive effect on firm performance. The marketing ability of the. 32.

(41) firm is the seventh component of the “management practices” factor. According to previous studies, marketing is the main tool used by successful SMEs to face the competition, therefore, business owners without marketing skills have a greater chance of failure than owners with marketing skills (Lussier and Pfeifer, 2001). Due to their small size, the lack of financial resources and expertise is the main challenge that SMEs face.. Capital variables. Entrepreneurs have evaluated their firm’s financial situation on two aspects: the initial investment (eighth independent variable) and the debt of the firm. They were required to assess the following statements: 1) the initial investment was enough to cover the initial expenses and support the activities of your firm during the payback period; 2) your company’s debts are heavy and absorb an important part of the company’s revenues. Businesses which start undercapitalized have greater chance of failure than firms that start with adequate capital. Moreover, a heavy debt may absorb an important part of the firm’s resources which will slow down its ability to compete in the market.. To examine the relationship between those factors and firm performance, I follow Maes, Sels and Roodhooft (2003) to control for the company’s size. Previous studies have found that company size is a significant predictor of corporate failure. Companies with larger numbers of employees have a higher survival probability. The table 2 shows in detail the different variables and their definition.. 3.3 Measures. In thus section, I will briefly introduce the measures of the variables used in. 33.

(42) the model. I construct operationalization of the measures in two steps; 1) for the variables selected from my main source (Maes, Sels and Roodhooft, 2003), the measures were used as long as they provided acceptable measurement quality with minor changes to fit the respondents and the Taiwanese context. 2) For the variables that has not been measured, I developed operational measures (score range) based on previous studies methods of evaluation.. Dependent variables. When it comes to assess the firms’ performance, I do not use financial statements for different reasons. Most importantly, Lussier and Pfeifer (2001) called for a totally non-financial approach to valuing SMEs which can lead to a more accurate assessment. A “successful firm” is determined on four criteria (or four dependent variables): the payback of the investment (0=not paid back, 1= paid back), if the firm is still in activity (0= no, 1= yes), if the company has made more profits than industry-average (1 to 5 where 1=strongly disagree and 5= strongly agree), and whether the purpose of creation has been achieved (1 to 5 where 1=strongly disagree and 5= strongly agree).. Owner-manager characteristics. Concerning this factor, the measures have been selected as follow (score range in brackets): age (number of years of the ownermanager), education (1 to 4; where 1= Primary school and 4= higher education), industry experience (0 to 3; where 0= No experience and 3= Ample experience).. Management practices. All the variables of this factor (business strategy, staffing, market research, marketing) have been measured through a Likert scale, ranging from 1 to 5, where 1=strongly disagree and 5= strongly agree. The degree of accuracy of the business strategy is also evaluated by the owner via a scale from 1 to 5.. 34.

(43) Capital. In order to draw an appropriate financial situation of the firm, two variables where used: sufficient initial investment (1 to 5 where 1=strongly disagree and 5= strongly agree) and debt (1 to 5 where 1=strongly disagree and 5= strongly agree).. Control variables. Company size is measured by the number of employees (0= 0 employees, 1= 1 to 3 employees, 2= 4 to 7 employees, 3= 8 to 15 employees, 4= more than 16 employees), and product competitiveness (1 to 5 where 1=strongly disagree and 5= strongly agree).. 3.4 Data analysis. This empirical research is using two different models to examine the effects of the four factors –Owner-manager characteristics, management practices, capital and environment- on foreign SMEs performance, and analyze the primary data collected: Ordinary Least Square regression and Logistic regression.. The research model is comprised of four dependent variables (YACT, YPAY, YPRO, YACH) to measure success: activity status of the firm –close or still in activity- (0, 1), YACT; the payback situation –the investment has been paid back or not (0, 1), YPAY; profits above industry-average- (score range 1 to 5), YPRO; and the achievement of the firm’s purpose of creation (score range 1 to 5), YACH.. Our first 2 dependent variables – YACT and YPAY– present binary outcomes – firm active or not, investment paid back or not. When Y is a binary variable, predicted Y values estimate the probability that Yi=1 (for a case i), when probabilities range. 35.

(44) between 0 and 1. I choose to use the Logistic regression analysis to measure the relationship between a categorical dependent variable and one or more independent variable by using probability scores as the predicted values of the outcome variable. The variables measured through score range values have been analyzed under Ordinary Least Square regression (OLS regression) model.. 3.5 Source data and collection This study uses a survey to gather primary data about the foreign ownermanager’s background, perceptions of the local market in terms of competitiveness, cultural asymmetries and the actual management practices in small-and-medium scaled firms in Taiwan.. In general, this study can be said to follow the subjectivist rather than the objectivist approach. Hence, one of the assumption of this study is that reality is subjective and the participants in this study may see it in different ways, based on their cognitions. Perceptions are important because they are the basis for entrepreneurs’ actions ( Pasanen (2003) ). My perspective follows the one of Pasanen (2003):“I believe that the world can be understood only from the point of view of the individuals directly involved in the activities in question”. The owner-manager is then seen as the most appropriate informant, and the research method used is believed to provide valid information about the object of the research. A questionnaire was designed and send to foreign owners of small-to-medium- scale companies in Taiwan. According to their expectations, previous experiences and the nature of their interactions with the local environment, the entrepreneurs assess the performance, strengths or weaknesses of their. 36.

(45) firm. Therefore, it is necessary that the owners or executives officers complete the questionnaire themselves.. An important step in the data collecting process is gaining direct access to the firm’s original owners. As I stated earlier, the community of foreign expatriates in Taiwan having grown during the past few years, is still rather small, compared to other countries (such as China or Japan). Consequently, they tend to gather into small social groups where members present common characteristics and experiences. The use of social networks is stronger among such small groups, especially when living abroad. On the first hand, I used online social networks –Facebook- and e-mails to personally contact foreign entrepreneurs and collect questionnaires. On the second hand, I conduct personal interviews with 6 foreign owner-managers, which helps improve the reliability level of the survey answers. All of the interviewees were owners of restaurants and come from Asian cultures (Philippines, Korea and Thailand).. The questionnaire was designed to cover the four factors expected to influence firm performance, with one or more questions covering each type of variable. Refer to appendix 1 for a complete version of the questionnaire. To assess the validity and accuracy of the survey items, the questions were pre-tested and refined by 5 foreign owners of SMEs and students chosen from the IMBA program of the National University of Kaohsiung.. The selection of the sample has been made without any restriction regarded the type of industry; I target foreign entrepreneurs gathered in common social groups on online networks.. 37.

(46) The sampled firms are all owned by foreigners settled in Taiwan for a period of at least 4 months and present all the following features: 1) they employed fewer than 20 persons; 2) they are all located in Taiwan, on the main island or the peripheral small island belonging to Taiwan; 3) Performance: the performance of the SME sampled varies from closure to high profitability and long survival; 4) they are all owned by foreign expatriates living in Taiwan, in sole proprietorship or in partnership (no more than 2 partners).. The age of the owners range from 23 to 60 years old and the reasons for expatriation are diverse, such as work, study, travel and/or business purposes. Except for one respondent, all foreign entrepreneurs have reached at least the beginner level in mandarin proficiency at the opening of their businesses.. Among the 33 respondents, one company has ceased its activities. The sampled firms’ countries of origin vary from western cultures such as Europe (France, 8 firms, Spain 3 firms, and Belgium, 1 firm), North America (United States, 4 firms; Canada, 3 firms), South America (Mexico, 1 firm) to South Africa (4 firms) and a few numbers from Asia (Philippines, 6 firms; Korea, 1 firm and Thailand, 2 firms).. 38.

(47) CHAPTER 4 EMPIRICAL RESULTS. 140 questionnaires were sent via email or online social networks and 33 valid answers were collected. The response rate is about 25%. 37% of the firm sampled belong to the restaurant industry, 21% to the retail industry, 15 % to the service industry, 12% from the wholesale industry, 6 % belong to the Technology and Communication industry, furthermore, 1 production company, 1 manufacturing company and 1 company from bar and nightclub industry also took part in the survey. Additionally, 6 foreign owners from restaurants industry in Taiwan were personally interviewed and asked what were the main challenges of the creation and development of their firms. The survey sampled firms located mainly in Kaohsiung, but also cover area the north (Taipei, Hsinchu) and the East coast (Taichung). All the interviewees’ businesses are located in Kaohsiung.. Among the firms sampled, 21 have been created the last three years, 7 are 5year-old or older, and 5 have been opened for 10 years or more. 25 % of them declared making more profits than industry-average, 45% of them considered making reasonably good profits while 30% estimate making poorer profits.. Based on the individual expectations of the owners, 51.5% declared having almost achieved or are very close to complete the purpose of creation of their business. More detailed information are given in the descriptive statistics.. 4.1 Descriptive statistics. 39.

數據

相關文件

“A manager of a school shall, at least once in every 12 months, make to the incorporated management committee of the school a written declaration which (a) states the particulars

classroom management skills and the application of good teaching practices in both reading and

The results indicated that packaging of products which reflects local cultural characteristics has a direct and positive influence on consumers’ purchase

本研究除請教於學者專家外,在 1998 年版天下雜誌調查發布 在台灣地區 1000 大企業中,台鹽排名 414,在最賺錢的 50 家公 司中排名 13,但在最會賺錢的 50

competitive strategy to explore in order to provide some of the domestic banking wealth management business recommendations, and thus enhance the stability of domestic

The impact of human resource management practices on turnover, productivity, and corporate financial performance. Understanding human resource management in the contexe

E., “Characteristics of Supply Chain Management and Implication for Purchasing and Logistics Strategy”, The International Journal of Logistics Management,1993. “Quantifying

The purpose of the study is to explore the relationship among variables of hypermarkets consumers’ flow experience and the trust, the external variables, and the internal variables