19thBled eConference eValues

Bled, Slovenia, June 5 - 7, 2006

A Hybrid Modeling Approach for Strategy

Optimization of E-business Values

Chien-Chih Yu

National ChengChi University, Taipei, Taiwan, ROC ccyu@mis.nccu.edu.tw

Abstract

Value proposition, creation, and maximization are essential corporate objectives in business planning and operations, and thus constitute central tasks of the e-business strategic management. The goal of this paper is to provide a hybrid modeling approach that integrates the dynamic programming and the balanced scorecard models for strategy optimization of e-business values. Values from the market, supply chain, business organization, and customer perspectives are identified first based on a generic e-business model framework. In the subsequent value-based strategic planning stage, strategies with objectives and metrics for value creation in different perspectives are outlined. In the mean time, a multi-period, multi-dimensional dynamic programming model is formulated for optimizing the expected total business value. In the value-based performance measurement stage, an adapted balanced scorecard model is developed to hold a balanced view for evaluating strategy performances regarding all value perspectives. The proposed modeling approach aims at providing e-business firms with clear and well-structured guidelines for efficiently and effectively handling complex decision and management activities including business model design, value identification, strategy formulation, as well as performance measurement.

Keywords: strategic management, e-business values, dynamic programming

1 Introduction

In recent year, due to the fast advancement of Internet and web technologies as well as the wide diffusion of e-commerce (EC) and e-business (EB) applications, business companies in almost every sector have been forced to adopt innovative business models and strategies for creating values, leveraging corporate performances, and sustaining competitive advantages. Researchers in EC and EB fields view business model (BM) as an architecture for the product, service and information flows within which business actors, potential benefits, and sources of revenues are identified (Timmers, 1998); or as a method for building and managing resources to provide better customer values and make money in return (Afuah and Tucci, 2001). On the other hand, performance measurement (PM) is noted as a process of quantifying the efficiency and effectiveness of actions that lead to organization performance, and the PM system enables a close-loop

deployment of organization strategies (Pun and White, 2005). Several surveys show that a variety of PM models and systems have been applied to measure business performances, and some well-publicized PM models include the balanced scorecard (BSC), the economic value added (EVA), and the European Foundation for Quality Management (EFQM) Excellence Model (Gates, 2000; Marr and Shiuma, 2003; Wongrassamee et al, 2003; Pun and White, 2005). These reports also point out that although the PM models and methods stand by themselves empirically and/or theoretically, they all have constraints and limits borne with their application domains. The shortcomings of current PM approaches have led to a growing demand on the development of a paradigm for integrating strategic planning and performance measurement processes in organizations. Also in the research literature, value has been specified from various angles such as. business value, customer value, supplier value, relationship value (e.g. buyer-seller value and manufacturer-supplier value), product value, stakeholder value, shareholder value, market value, supply chain value, information technology (IT)/information system (IS) value, as well as innovation and intellectual property values etc (Kirchhoff et al., 2001; Walter et al., 2001; Ulaga, 2003). Values and performances have been evaluated differently by using either financial or non-financial measures or the mix involving cash flow, return on capital investment, and economic profit as the quantitative indicators, as well as customer satisfaction, product innovation, and management capabilities as the qualitative indicators (Gates, 2000; Grey et al., 2003). Nevertheless, value has mainly been recognized as not only a core component of the BM but also a measurement construct of the BM effectiveness (Osterwalder and Pigneur, 2002; Yu, 2005). It has also been realized that value proposition and creation are central strategic tasks in EB planning and management, and that performance measurement is a prerequisite to strategic management and should focus on value creation (Sharma et al., 2001; Hackney et al., 2004). Meanwhile, value maximization has been noted as the major organizational objective for creating long-term market values and must be complemented by corporate strategies (Jensen, 2001). It can be seen that business modeling, value creation and maximization, strategic planning and management, performance measurement and control are strongly connected issues. Taking a unified view and building an integrated framework is no doubt necessary for efficiently and effectively handling the entire optimal planning and control process of EB strategies and performance measures. However, previous research works regarding the construction of a value-centered business model and strategic performance framework, the planning and control of optimal business models and strategies, as well as the linkage of strategy formulation with performance measurement are very rare. Issues, problems and solution approaches related to this critical research topic have been addressed from different perspectives and have reached no consensus. Furthermore, although optimality in business model, values and strategies has been indicated as a hope and desire, the optimization process for designing and implementing the business model and strategies associated with appropriate performance measures is still considered as an unclear concept and thus remains as a great challenge for both academics and practices. Therefore, the development of a EB strategic framework and models is needed for identifying and measuring values and performances from an integrated BM perspective. The value-based strategic framework and models should be able to direct the planning of effective strategies, to facilitate the measurement and management of strategy performances, as well as to ensure the optimization of

strategic objectives with respect to maximal business values and performances. The goal of this paper is to provide a hybrid modeling approach that integrates the dynamic programming (DP) and the balanced scorecard models for strategy optimization of e-business values. Values from the market, supply chain, business organization, and customer perspectives are identified first based on a strategic e-business model framework. Then, in the subsequent value-based strategic planning stage, strategies with objectives and metrics for value creation in different perspectives are outlined. In the mean time, a period, multi-dimensional dynamic programming model is formulated for optimizing the expected total business value. In the value-based performance measurement stage, an adapted balanced scorecard model is developed to hold a balanced view for evaluating strategy performances regarding all value perspectives. The proposed modeling approach aims at providing e-business firms with clear and well-structured guidelines for efficiently and effectively conducting complex decision and management activities including business model design, value proposition, strategy formulation, as well as performance measurement. The rest of this paper is organized as follows. A literature review of related works is provided in section 2. The value-based e-business model framework and derived strategies are proposed and described in section 3. In section 4, the dynamic programming model for financial business value optimization is presented. The adapted balanced scorecard model for performance measurement is illustrated in section 5 followed by discussions and concluding remarks in the final section.

2 Literature Review

In this section, previous research works related to business models, value creation, strategic planning, as well as performance measurement are briefly described.

2.1 E-business models, values and strategies

Among the previous works related to business models and strategies, Timmers (1998) addresses the issue of emerging business models by providing a framework for business model classification. Eleven business model types such as shop, e-auction, and value chain service provider have been identified in his work. He also points out that, beyond the classification view of business models, there is a need to identify marketing strategy of the business actors in order to assess the commercial viability and competitive advantages. Boulton et al. (2000) present an asset-based business model and associated asset-portfolio strategies for linking combinations of tangible and intangible assets to value creation. They argue that the ultimate success of the company depends on its ability in optimizing all assets that make up its business model. Feeny (2001) notes that combining three e-opportunity domains, i.e. the e-operations, the e-marketing, and the e-services, can provide a platform for exploring the new business strategies. Osterwalder and Pigneur (2002) introduce an e-business model ontology that is composed of four dimensions: the product innovation, the infrastructure management, the customer relationship, and the financials. They state that the product innovation and customer relationship shall maximize revenue; the infrastructure management shall minimize costs, and therefore optimize the profit model of the financials. Morgan et al. (2002) indicate that although marketing performance has been noted as a critical factor of corporate performance, the creation of marketing performance measures and models is still a relatively undeveloped field. They suggest using marketing expenses, levels of investment, quality, effort, and

allocation of overhead, as input indicators, as well as sales, market share, cash flow, and profits as output indicators for measuring and maximizing marketing performances. Focusing on examining the formulation of supply chain strategies, Kotzab et al. (2003) propose an e-based supply chain strategy optimization model (e-SOM) that focuses on strategy formulation, creation of supply chain relations, optimization of resources, and optimization of business processes. Yu (2005) links the BSC to e-business models for providing an integrated framework and a systematic approach to facilitate value identification and value-based strategic planning processes. Identified value-based e-business strategies include market strategy, supply chain/value chain strategy, enterprise strategy, and customer strategy. Bergendahl (2005) indicates that there is evidently a need to develop principles for investment in EC emphasizing on profitability analysis and financial considerations. He suggests models for profitable investment in EC that focus on investment outlays for IT and marketing to generate larger net revenues and to gain substantial savings in operating costs.

2.2 Value assessment and performance measurement

Business values have been measured by financial profits involving cost reduction and market revenues, or by non-monetary benefits such as brand awareness, competitive gains, social relationships, and management capabilities. For instance, Walter et al. (2001) indicate profit, volume, safeguard, innovation, resource-access, scout, and market-signaling as the direct and indirect value functions in a buyer-supplier relationship. Ulaga (2003) points out eight dimensions of value creation in manufacturer-supplier relationships, namely, product quality, service support, delivery, supplier know-how, time-to-market, personal interaction, direct product costs, and process costs.

As for the strategic PM domain, previous literature has roughly grouped emerging PM systems into two distinct categories including those emphasizing on self-assessment and those focusing on helping managers to improve business strategies and operations (Wongrassamee et al., 2003; Pun and White, 2005). Gates (2000) conducts a survey of 113 US and European companies on the strategic PM practices. The results show that the top financial measures used include cash flow, return on capital employment, economic profit, total shareholder return, operating margin, revenue, and EPS, and the top non-financial measures cited are customer satisfaction, market share, new product development, and quality. He also compares two strategic performance measurement systems based on the EVA and the BSC frameworks respectively and further concludes that the ideal model and system for strategic PM need to reconcile and integrate the best aspects of the EVA and BSC approaches. Wongrassamee et al., (2003), on the other hand, compare the BSC with another popular PM model, i.e. the EFQM Excellence Model, from five central issues relating to objectives, strategies and plans, target setting, reward structure, and information feedback loops. They conclude that both approaches seem to be developed from similar concepts, and it is difficult to find a perfect match between a company and a PM framework. They anticipate further research to be taken concentrating on the implementation issue of the strategic performance frameworks in specific types of organization. Pun and White (2005) in addition compare ten emerging PM systems with respect to three sets of criteria addressing performance dimensions, performance measure characteristics, and the requirements of PM system development process. They indicate that these systems stand by themselves but all have constraints and should

be seen as mutually supportive. They conclude that there is a need to develop a paradigm for linking strategies and performances of organizations.

Focusing on issues regarding the adoption of the BSC approach, the lacks of specific targets for performance levels and explicit methods for successful implementation are major drawbacks often mentioned. Basically, the BSC is a management instrument to measure business performance from four balanced perspectives, namely, the financial, the internal process, the customer, and the learning and growth perspectives (Kaplan and Norton, 1996). According to Marr and Schiuma (2003), the BSC is the most influential concept in the business PM field. Nevertheless, they report that there is a significant lack of theoretical foundation as well as body of knowledge in the BSC and PM research areas. Jensen (2001) also points out that the BSC model is flawed because it presents managers with a scorecard which gives no single-value score for value maximization, and provides no information on the tradeoffs between performance measures. Among those applying the BSC approach in the EC and EB domains, Hasan and Tibbits (2000) argue that there is a need to constructively adapt and enhance the original BSC to suit the emerging BM of EC. Their modified scorecard perspectives for EC performance include value of the business, relationships, internal process and structures, and human and intellectual capital. As for incorporating other quantitative analysis techniques to improve the usability of the BSC, Youngblood and Collins (2003) use the multi-attribute utility theory (MAUT) to weight the relative importance of the BSC performance metrics, and address the issues of trade-offs between these metrics. Rickards (2003) indicates that the BSC clearly confronts managers with an extraordinarily complex optimization problem and lacks a mechanism to specify mathematical-logical relationships among the individual scorecard items. Considering the data envelopment analysis (DEA) as a helpful method, he presents an example of using DEA to evaluate BSC results with selected performance indicators.

Among very few attempts that truly present computational PM models with optimal objectives, Wen, et al. (2003) propose a measurement model based on the DEA for evaluating e-commerce efficiency. In their DEA model, three input variables (web technology investment, operating costs, and number of EC staff) and five output variables (sales, capital utilization, capacity, systems utilization, and EC site quality) are specified. Efficiency is defined as the ratio of the sum of weighted outputs to the sum of weighted inputs. The objective of the DEA model is to determine the set of weights that maximize the efficiency of a specific organizational decision-making unit (DMU).

Summarizing findings from the literature, several issues can be identified. First, the objectives of business strategies should focus on creating values as well as optimizing business performances and financial profits. Second, business models pave the way for better understanding and formulation of value-based business strategies including marketing strategy, supply chain strategy, asset-portfolio strategy, and customer strategy. Third, both the measurement metrics and optimization models are critical for evaluating and leveraging the performance of business strategies, but very few computational optimization models eventually exist for carrying out the optimal strategic planning and performance control processes. Fourth, a strategic optimization framework is needed for linking strategies and performances, and incorporating the BSC approach with a suitable optimal model may be a potential solution for handling both the quantitative value maximization and the qualitative performance measurement tasks.

3 The Value-Based Strategic Framework

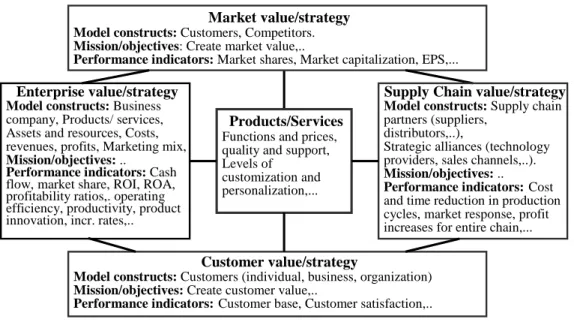

For fulfilling the research needs, a value-based strategic framework with identified values and associated value-based strategies is illustrated in Figure 1 and described in the following subsections.

3.1 The e-business strategic framework and values

Towards optimizing e-business performances, benefits and interests of business organization, customers, shareholders, and supply chain partners should all be taken into account. Based on four major dimensions of identified values, i.e. the market, supply chain, enterprise, and customer values, the value-based e-business strategies include market strategy, value chain strategy, enterprise strategy, and customer strategy (Yu, 2005). Values and related factors are described below.

Market value: Market values refer to the external view of business values that is

perceived by the market and shareholders. Market values are created when a company properly allocates assets and resources to targeted markets, provides value-added productsand servicesto meetcustomers’needs,createscompetitive advantages to increase market share and make profits, as well as leverages market capitalization to deliver shareholder values and sustain business continuity.

Markets are operation and trading environments for buyers and sellers to process transactions and payments and to exchange value objects. Markets can be classified in terms of scope, customer types, transaction functions and processes, and product and service categories. Markets are battle fields in which companies compete with their competitors to capture market and customer shares.

Supply chain value: Supply chain values refer to the information sharing,

operational efficiency, cost and time reductions and profit gains of the supply chain partners and strategic alliances in a supply chain network. Supply chain values are created from sharing market, customer, and production information, as well as integrating production, selling, payment, and distribution cycles.

Supply chain partners and strategy alliances are market players that include direct and indirect materials suppliers, sales channel and marketplace providers, distribution and delivery services providers, as well as payment and related financial services providers.

Figure 1: The value-based strategic framework for e-business

Enterprise value/strategy Model constructs: Business

company, Products/ services, Assets and resources, Costs, revenues, profits, Marketing mix,

Mission/objectives: ..

Performance indicators: Cash

flow, market share, ROI, ROA, profitability ratios,. operating efficiency, productivity, product innovation, incr. rates,..

Market value/strategy Model constructs: Customers, Competitors. Mission/objectives: Create market value,..

Performance indicators: Market shares, Market capitalization, EPS,...

Customer value/strategy

Model constructs: Customers (individual, business, organization) Mission/objectives: Create customer value,..

Performance indicators: Customer base, Customer satisfaction,.. Products/Services

Functions and prices, quality and support, Levels of

customization and personalization,...

Supply Chain value/strategy Model constructs: Supply chain

partners (suppliers, distributors,..),

Strategic alliances (technology providers, sales channels,..).

Mission/objectives: .. Performance indicators: Cost

and time reduction in production cycles, market response, profit increases for entire chain,...

Enterprise value: Enterprise-oriented business values refer to organization

capabilities, resources, and deliveries to sustain business operations, create business excellence, and capture market opportunities. Business values reside in assets, human resources, organization culture and structure, IT/IS infrastructure, domain knowledge and intellectual property, products and services, brand name and publicity, as well as organizational capabilities in learning and innovation, management and control, marketing and process improvement. Business values are created through asset allocation and financial management, business operation and process improvement, human resources and knowledge management, information system development and operation, product and service innovation, and marketing plan implementation and control. Focusing on product and service values, they refer to competitive features and qualities that outperform

competitors’offers and thus win customers’actual orders and satisfaction. Key

product and service features include content and functions, prices and supports, quality and warranty, as well as customization and personalization flexibilities. Enterprises refer to business companies that provide products and services in specific markets to create business values. Strategic and operational activities include assets and resources allocation, cost and financial management, products and services development, supply chain establishment, marketing mix planning and implementation, infrastructure building and management, and transactions and payments handling, etc. To be more specific, assets are major business resources to support and sustain continuous business operation. Costs are necessary expenditures for starting up and continuously operating businesses. Major cost accounts include products and services development, infrastructure and information systems implementation, as well as marketing, purchasing, inventory, distribution, transaction processing, human resources, Internet and

other intermediary services, investment and acquisition, and goodwill

amortization, etc. Revenue sources include products, services, and advertising sales, as well as transaction fees and trading commissions etc. Profits are net earnings that equal to the difference between total revenues and total costs. Marketing mix plans are strategic marketing decisions and actions incorporating all products, prices, promotions, and places factors.

Customer value: Customer value is generally defined as the trade-off between

costs and benefits in the market exchange process of products and services. Focusing on customer’s perception, customer values can be interpreted as the product and process values that are proposed to the customers to activate actual buying transactions with lower costs and higher satisfaction. From the business viewpoint, customer values refer to the benefits derived from business efforts in attracting and retaining customers, as well as managing customer relationships. Customers are buyers of the markets that pay the prices in exchange of products and services. Customer types include individuals, businesses, and communities.

3.2 The e-business strategies

Guiding by the proposed e-business strategic framework and identified values, the e-business strategies can be formulated in a structured and systematic way. Major e-business strategies under consideration include market strategy, value chain strategy, enterprise strategy, and customer strategy,

Market strategy: The market strategy aims at identifying factors and processes to

facilitate market selection, segmentation, integration, and globalization, as well as specifying targeted customer base and market shares to create market values.

Value chain strategy: The value chain strategy focuses on outlining objectives,

factors, and processes for supply chain/value chain establishment, partner selection, as well as system and network management and operation. Also considered include information sharing, value sharing, and production and infrastructure integration.

Enterprise strategy: The enterprise-level organization strategy intends to set up

goals and action plans for improving internal structures and processes, leveraging organizational learning and innovation capabilities, achieving decision and management efficiency and effectiveness, developing value-added products and services, and ultimately creating business values and financial profits. The global enterprise strategy can be further decomposed into specific sub-strategies including asset and financial strategy, product and service strategy, information system and web site strategy, learning and innovation strategy, marketing strategy, and profit strategy. The asset and financial strategy aims at directing the ways for optimal capital acquisition and asset allocation. The product and service strategy focuses on identifying the key characteristics and features of products and services

for better matching customers’needs and preferences. The information system and

web site strategy is to decide on the technology adoption policies, the budgeting and the implementation schedule for developing and providing web-based infrastructure, systems and services. The learning and Innovation strategy is to specify and leverage organizational capabilities and competitive advantages by means of training and education, knowledge management, as well as product, process, and technology innovations. The marketing strategy illustrates marketing decisions and policies with respect to corporate brand and image building, products and services positioning, as well as 4P (i.e. product, price, place and promotion) mix planning. The profit strategy is to specify cost, revenue and profit sources and structures, as well as short-term, mid-term, and long-term plans to increase market and customer shares, generate more sources and volumes of revenues, as well as to ensure optimal profits and sustain high profitability.

Customer strategy: The customer strategy is to specify approaches for improving

and enhancing customer attraction and retention, customer clustering and classification, personalization and customization service operations, as well as customer relationship management in order to capture customer values.

4 The Dynamic Programming Model

Aiming at optimizing strategic objectives with respect to financial, marketing and supply chain decisions, we formulate the desired optimal strategic planning model as a dynamic programming model. Variables and functions are identified based on the e-business strategic framework presented in the previous section. The proposed DP model can then be used as a mechanism to assist in optimal planning and control of EB strategies such as asset strategy, profit strategy, supply chain strategy and marketing strategy.

The multi-period, multi-dimensional DP model can be characterized by a time

index t, a state vector St, a decision vector Dt, an influence vector It, a revenue

function Rt, a return functional Zt, a balance equation with a transition function Tt,

as well as a recursive equation with a profit functional Ft.

The state vector:

siltis the level of asset l allocated to market i at time period t, and silt> 0. n is the total number of markets that the company has conducted business. L is the total number of asset types selected for consideration.

T is the total number of time periods selected for strategic planning.

The decision vector:

Dt = (At,.Bt, Ct, Wt, Pt, Vt), t=1,2,…..,T

At = (a1t,...,ant), aitis the capital to be raised and allocated to market i at time t. Bt c= ((0,b12t,…,b1nt),…..,(bn1t,...,bnn-1t,0)), where (bi1t,...,bint) represents the

asset-portfolios transferred from market i to other markets at time t.

Ct = (c1t,...,cnt), citis the budgetary cost expenditure allocated to market i at time t.

Wt = ((w11t,…,w1mt),…..,(wn1t,...,wnmt)), (wi1t,...,wimt) specifies the weighting

program of cost spending over m cost accounts (e.g. operation, advertising, production, and inventory costs) in market i at time period t.

Pt = ((p11t,…,p14t),…..,(pn1t,...,pn4t)), where (pi1t,...,pi4t) represents the 4P (i.e. product, place, price, and promotion) marketing mix plan to be launched in market i at time t.

Vt = ((v11t,…,v14t),…..,(vn1t,...,vn4t)), where (vi1t,...,vi4t) represents the 4-level (i.e. suppliers, manufacturers, distributors, and customer regions) supply chain network plan to be implemented in market i at time t.

The constraints are ait> 0, cit> 0, bijlt> 0, wi1j> 0, and sum(silt,…, siLt) > cit, sum(wi1t,...,wimt)=1, as well as silt > sum(bi1lt,...,binlt) for all I, l and t. In addition,

pi4t and vi1t indicate, for instance, the promotion portfolio plan for market i, and

production/procurement portfolio plans for selected suppliers in market i, etc.

The influence (impact) vector:

It = (i1t,...,int), t=1,2,…..,T

iitindicates the uncertain total market demand/sales of market i at time t.

In specific cases, It can be assessed by (Ct, Wt, Pt, Vt) according to some previously

developed marketing and supply chain models. That is: It = It(Ct, Wt, Pt, Vt), t=1,2,…..,T

Or, it can be estimated by previously fitted distribution functions using historical data.

The revenue function Rt:

Rt = (r1t,...,rnt) , t=1,2,…..,T

ritindicates revenues generated from market i at time period t.

Rtdepends on Ct, Wt, Pt, Vt,.and It, i.e. Rt = Rt(Ct, Wt, Pt, Vt,.It).

The return functional Zt:

Zt indicates the return on asset, investment and operation that is gained from

market i at time t.

Ztdepends on St, At, Ct,.and Rt, i.e. Zt = Zt(St, At, Ct,.Rt), t=1,2,…..,T.

For a simple case, Ztcan be expressed as follows:

Zt= Zt(St, At, Ct,.Rt) = (Rt- Ct)at’+ (St+ At)bt’.

where atand bt are 1 by n coefficient vectors that indicate deduction and gaining

The balance equation with transition function Tt:

St+1 = Tt(St, At, Bt, Ct, Rt) = St+ At+ BtG - Ct+ Rt,

where G is an nnL by n transfer matrix indicating asset flows among markets.

The transition function Tt shows how St+1 is derived from previous state St,

strategic decisions At, Bt, Ct,and subsequent (Wt, Pt, Vt) made, as well as revenues

Rtgained in time period t.

The recursive equation with profit functional Ft:

Ft(St) = OPT[E [Zt(St, At, Ct,.Rt)+ Ft+1(St+1)]], i.e.

Ft (St) = OPT[E [Zt (St, At, Ct, Rt (Ct, Wt, Pt, Vt,.It))+ Ft+1(Tt (St , At , Bt , Ct , Rt (Ct, Wt, Pt, Vt,.It)))]].

Ft (St) is the global objective functional indicating the optimal profit obtained at

state Stof time period t.

The OPT indicates the optimization objective of the DP model.

E[..] indicates the expected value of Zt + Ft+1,since both depends on an unknown

influence vector It.at time period t.

To optimize Ft (St) is to determine the optimal decision vector Dt, i.e. the (At,.Bt,

Ct, Wt, Pt, Vt), that optimizes the subtotal profit gained from the current state Stto

the end state of the time horizon ST.

The final goal of the DP model is to determine a sequence of decision vectors D1,

D2,…..,DT, i.e. the strategic plan, to optimize the total profits of the entire time

horizon under planning considerations. In addition, associated with the generation of a multi-period strategic plan is the development of a control policy. It is useful but hard to directly generate a control policy from the state vectors. In other words,

it is not easy to reflect the functional dependencies between Dt and St for all t.

Therefore, performance control is made by re-running the DP model and modifying the strategic plan when feedback data and state data are collected and updated over the time periods.

The formulation of marketing mix plans, supply chain policies, and revenue functions is critical for efficiently and effectively carrying out the computational process of the DP model. As a result, adopting or developing appropriate marketing and supply chain models that link planning elements to performance measures become necessary tasks to be done. As the revenue functions have been specified using some marketing decision models, the major activities in the solution procedure of the stochastic DP model include the estimation of the expected influence vector, the optimization of the decision vector, the

approximation of the optimal objective functional Ft, and the construction of

strategic plans and control policies. The major concerns and contributions of the proposed DP modeling approach are to structurally represent the interactive relationships among the e-business model constructs and value dimensions, to tightly link business models and values to strategic plans, as well as to optimize the planning and control processes.

5 The Value-Based Balanced Scorecard

In this section, an adapted BSC model for EB performance measurement and strategic management is presented based on the proposed strategic framework, values and strategies and the DP planning model, as well as the collected key

performance indicators from the literature. Corresponding missions, strategic objectives, and performance indicators in four aligned BSC perspectives (as also shown in Figure 1) are described below.

5.1 The market perspective

Markets provide opportunities for business to make profits but also fill with risks to loss. The mission in this aspect is to create market value and deliver values to shareholders.

Strategic objectives of the value-based market strategy include clarifying success factors of market selection and segmentation, identifying market opportunities and risks, specifying targeted levels on profit gains, market shares, market capitalization, and other market related values.

Value metrics and performance indicators of the market strategy include market revenues and profits, market share, market capitalization, market-oriented return on investment, earning per share, level of market competitiveness, as well as increasing rates of these indicators.

5.2 The value chain perspective

In a value chain, strategic partners coordinate closely in the integration of transaction, production and distribution cycles, the management and distribution of critical information and resources, as well as creation and sharing of market and financial values. The mission in this perspective is to create and share supply chain-related information and values through established network relationships. Strategic objectives of the value chain strategy are to direct the partner selection and supply chain establishment activities, to facilitate resource and transaction management processes, and to develop information and value sharing policies. Value metrics and performance indicators of the value chain strategy include cost and time reductions in information, production and transaction processing, time reduction in response to market demand and integration of production and distribution cycles, revenue and profit increases for all value chain participants, as well as the level of customer satisfaction with respect to time and location conveniences attained from the value chain.

5.3 The business structure and process perspective

The business structure and process refer to the organizational structure, product and service classes, IT/IS infrastructure, as well as internal and business operating processes that are established by the EB companies for conducting business in the targeted markets. The mission in this perspective is to create business values including product and service values for sustaining competitive advantages and continuous business operations. Product and service values are generated when

the proposed product and service features match customers’needsand preferences

and eventually activate the transaction and payment processes.

The enterprise-level strategic objectives are to leverage organizational capabilities in productivity and innovation, to achieve efficiency and effectiveness of business decisions and operations, to improve internal communications and processes, to create business image and brand awareness, to develop value-added products and services, to provide transaction systems and processes, and ultimately to create business values and make profits.

Business value metrics and performance indicators related to the enterprise strategy include return on asset (ROA), asset utilization measures, cash flow ratios,

operating efficiency metrics, human resource skill levels and productivity ratios, return on IT/IS investment, IT/IS usability measures, innovation effectiveness metrics, profitability ratios, and related increasing rates. In addition, specific product and service value indicators include function level, price level, quality level, as well as levels of supports, customization, and customer satisfaction.

5.4 The customer perspective

Customers are buyers of products and services in the markets. The mission of the EB company with respect to the customer perspective is to create customer values and to gain customer shares by satisfying their needs with better quality levels than that of the competitors.

Strategic objectives of the value-based customer strategy include specifying customer clustering and classification rules, enforcing personalization and customization products and services, as well as generating customer values from business process improvement and customer relationship management.

Value metrics and performance indicators related to customer strategy include number of registered customers, customer profitability levels, customer shares, customer satisfaction levels, and associated increasing rates.

6 Discussions and Concluding Remarks

Integrating concepts and methods of business models and values, strategy formulation and performance measurement is critical to the success of e-business management. In the literature, it is still lacking of a strategic framework and optimal models for guiding and facilitating the entire process integration of planning and control. In this paper, we provide a hybrid modeling approach that integrates the DP and the BSC models for optimizing strategic management of e-business values and performances. A strategic framework, specific value dimensions and related strategies, a DP optimal planning model, and a BSC performance measurement model have been presented subsequently. There are several advantages for applying this integrated approach: (1) This approach is flexible in dealing with different types of EB problems, for instance, the B2C marketing-oriented e-retailing and the B2B e-supply chain problems. Only number of dimensions and decision functions need to be changed. (2) This approach groups multiple financial-oriented strategic objectives from market, supply chain, enterprise, and customer aspects into one single-value total profit measure to ensure the value maximization purpose. (3) The DP planning results can serve as target values and be placed in various BSC perspectives to incorporate with other non-financial and qualitative indicators for maintaining a balanced view in the performance measurement and control process.

For illustrating the business implication of applying this approach, we take an e-shop model in the B2C domain as an example. A commercial web portal may try to reallocate assets withdrawn from a money-losing toy market to a new on-line job market in pursue of creating business profits. In addition to the asset strategy, proper planning on cost, marketing, and supply chain strategies are needed to optimize the total profits of business operations. On the other hand, for demonstrating the consistency and flexibility of using this approach, an example with controlled scenarios in the B2B supply chain domain is used. As a simplified

single market case, the asset-based state vector St = (s1t,...,sLt) represents a set of

inventory levels of products and materials for suppliers, manufacturers, and

contains the 4-level SC decision portfolios that indicate production volumes of materials for suppliers, production volumes of products and purchase quantities of materials for manufacturers, order quantities of products for distributors and their

delivery quantities of products to the customer channels. The influence vector It

indicates the uncertain total market demand at time t, and can be further decomposed into demands of multiple customer channels. The objective is to minimize the total chain cost including the production, purchasing, holding, shortage, and surplus costs for supply chain participants of all levels. It is also feasible to formulate this supply chain problem as a total profit maximization model. The DP model for the supply chain application has been rigorously formulated and fits well in the supply chain context. The algorithm for running the DP model has been developed, however, the actual implementation is still in progress.

Future research directions include conducting surveys, case studies, and cross-business comparative analyses to validate the efficiency and effectiveness of the proposed strategic framework and hybrid models, as well as developing weighting scheme for selecting key performance indicators to suit both the BSC and the DP models. Also important is to compare the performances of this modeling approach with other attempts that integrate the BSC with an optimization model.

References

Afuah, A. and Tucci, C. L., (2001): “Internet Business Models and Strategies:

Text and Cases,”McGraw-Hill.

Bergendahl, G., (2005): Models for investment in electronic commerce—financial perspectives with empirical evidence, Omega, Vol. 33, No. 4, pp. 363-376. Boulton, R. E. S., Libert, B. D., and Samek, S. M., (2000): A business model for

the new economy, Journal of Business Strategy, Vol. 21, No. 4, pp. 29-35. Feeny, D., (2001): Making business sense of the e-opportunity, Sloan

Management Review, Vol. 42, No. 2, pp. 41-51.

Gates, S., (2000): Strategic performance measurement systems: translating strategy into results, Journal of Applied Corporate Finance, Vol. 13, No. 3, pp. 44-59.

Grey, W. et al., (2002): An analytic approach for quantifying the value of e-business initiatives, IBM Systems Journal, Vol. 42, No. 3, pp. 484-497. Hackney, R., Burn, J., and Salazar, A., (2004): Strategies for value creation in

electronic markets: towards a framework for managing evolutionary change, Strategic Information Systems, Vol. 13, No. 2, pp. 91-103.

Hasan, H. and Tibbits, H., (2000): Strategic management of electronic commerce: an adaptation of the balanced scorecard, Internet Research: Electronic Networking Applications and Policy, Vol. 10, No. 5, pp. 439-450.

Jensen, M. C., (2001): Value maximization, stakeholder theory, and the corporate objective function, European Financial Management, Vol. 7, No. 3, pp. 291-317.

Kaplan, R. S. and Norton, D. P., (1996): Using the balanced scorecard as a strategic management system, Harvard Business Review, Vol. 74, No. 1, pp. 75-85.

Kirchhoff, B. A., Merges, M. J., and Morabito, J. A., (2001): Value creation model for measuring and managing the R&D portfolio, Engineering Management Journal, Vol. 13, No. 1, pp. 19-22.

Kotzab, H., Skjoldager, N., and Vinum, T., (2003): The development and empirical validation of an e-based supply chain strategy optimization model, Industrial Management and Data Systems, Vol. 103, No. 5, pp. 347-360. Marr, B. and Schiuma, G., (2003): Business performance measurement –past,

present and future, Management Decision, Vol. 41, No.8, pp. 680-687. Morgan, N. A., Clark, B. H., and Gooner, R., (2002): Marketing productivity,

marketing audits, and systems for marketing performance assessment: integrating multiple perspectives, Journal of Business Research, Vol. 55, No. 5, pp. 363-375.

Osterwalder, A. and Pigneur, Y., (2002): An e-business model ontology for

modeling e-business, Proceedings of the 15th Bled Electronic Commerce

Conference, Bled, Slovenia, June 17-19, pp. 139-146.

Pun, K. F. and White, A. S., (2005): A performance measurement paradigm for integrating strategy formulation: a review of systems and frameworks, International Journal of Management Reviews, Vol. 7, No. 1, pp. 49-71. Rickards, R. C., (2003): Setting benchmarks and evaluating balanced scorecards

with data envelopment analysis, Benchmarking: An International Journal, Vol. 10, No. 3, pp. 226-245.

Sharma, A., Krishnan, R., and Grewal, D., (2001): Value creation in markets: a critical area of focus for business-to-business markets, Industrial Marketing Management, Vol. 30, No. 4, pp. 391-402.

Timmers, P., (1998): Business models for electronic markets, Electronic Markets, Vol. 8, No. 2, pp. 3-8.

Ulaga, W., (2003): Capturing value creation in business relationships: a customer perspective, Industrial Marketing Management, Vol. 32, No. 8, pp. 677-693. Walter, A., Ritter, T., and Gemunden, H. G., (2001): Value creation in buyer-seller relationships, Industrial Marketing Management, Vol. 30, No. 4, pp. 365-377.

Wen, H. J., Lim, B., and Huang, H. L., (2003): Measuring e-commerce efficiency: a data envelopment analysis (DEA) approach, Industrial Management and Data Systems, Vol. 103, No. 9, pp. 703-710.

Wongrassamee, S., Gardiner, P. D., and Simmons, J.E.L., (2003): Performance measurement tools: the balanced scorecard and the EFQM excellence model, Measuring Business Excellence, Vol. 7, No. 1, pp. 14-29.

Youngblood, A. D. and Collins, T. R., (2003): Addressing balanced scorecard trade-off issues between performance metrics using multi-attribute utility theory, Engineering Management Journal, Vol. 15, No. 1, pp. 11-17.

Yu, C. C., (2005): Linking the balanced scorecard to business models for value-based strategic management in e-business, Lecture Notes in Computer Science, Vol. 3590, pp. 158-167.

Zhu, K. and Kraemer, K. L., (2002): E-commerce metrics for net enhanced organizations: assessing the values of e-commerce to firm performance in the manufacturing sector, Information Systems Research, Vol. 13, No. 3, pp. 275-295.