企業併購對顧客關係管理的影響 - 政大學術集成

全文

(2) Acknowledgement It was a toilsome when writing the thesis during the past one year, but it let me obtain a lot of knowledge and develop logical thinking in this process. Eventually, at this moment, I could heartily enjoy the delights of the harvest of the research. I would like to express my appreciation to several people who offered me support during the research period.. First and foremost I offer my sincerest gratitude to my advisor, Dr. Shari S.C. Shang, who has supported me throughout my thesis with her patience and guidance. Without her inspiring guidance, I could not accomplish this hard work. Her guidance gave me. 政 治 大 attend international academic 立conference which truly gave the greatest opportunity for through the difficulties and confusion of the research. She also encourages me to. ‧ 國. 學. me to broaden my horizon by presenting paper and self-traveling. I am really glad that I could have the chance to get along with her in my graduate life.. ‧. I would also like to thank Dr. Minder Chen and Dr. Eldon Y. Li. They provided. Nat. sit. y. valuable comments and suggestions on the thesis. Their advices made this research. io. er. become more complete and substantial in content. In addition, I am greatly appreciative of representatives interviewed, without their help, I can’t finish my. al. n. thesis.. Ch. engchi. i n U. v. Finally, I would like to express my heartfelt gratitude to my family and friends for their encouragement and support when I am disappointed and depressed. I would like to share the joy and gratification with all of them.. Yun-Chen Yu July, 2012 Taipei, Taiwan. I.

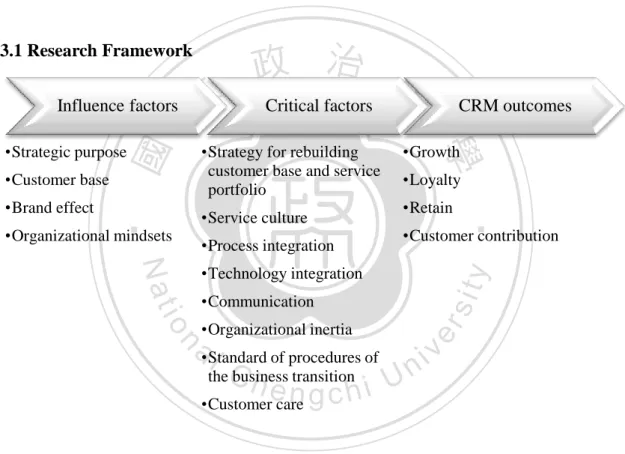

(3) Abstract Mergers and acquisitions (M&A) represent a strategic approach for businesses to acquire resources and build competitive advantages. Many studies have investigated the process and results of the resource integration between two firms. Some cases have revealed satisfactory results in building asset portfolios and some cases uncovered a downside to merger due to conflicts in cultural and system integration. One of the key objectives of business acquisition is to expand business operations in providing customers with superior products and services. However, there is limited. 政 治 大 merged enterprise should be able to leverage the assets and knowledge in growing and 立. understanding about how customers react to the post-merger services. In theory, the. retaining customers, but in reality the customer relationships may not be well. ‧ 國. 學. managed because of a lack of synergy between the merged organizations. The. ‧. objective of this study is to examine the effect of mergers and acquisitions on. sit. y. Nat. customer relationship management (CRM), and we select the credit card business in. io. er. the banking industry as our focus of study. Finance industries, especially consumer banks, rely heavily on CRM for targeting customers, promoting services, building. al. n. v i n C hrevenue. M&A isUthe most applied approach in generating engchi. deep knowledge, and. increasing business scope and enhancing services for engaging more customers.. Based on the literature about M&A and CRM, this study builds a framework for data collection, and the study is conducted in two stages. First, we collect data on CRM performance of credit card business in banks in Taiwan that have experienced M&A in the past eight years, and we compare CRM performance before and after mergers. Second, we do in-depth case study on selected cases regarding possible causes for CRM success in post-merger. The research results not only verified and enhanced the list of critical factors for CRM success but also discovered influential factors that can II.

(4) affect the effectiveness of CRM after merger. The critical factors are: strategy for rebuilding customer base and service portfolio, service culture, process integration, technology integration, communication and organizational inertia, standard of procedures of the business transition and customer care after the merger.. The. additional influential factors are: strategic purpose, customer base, brand effect, and organizational mindsets. It is hoped that we can learn from these cases about managing customer relationships after a merger and help companies develop effective plans for building synergy in CRM after M&A.. 政 治 大 Keywords: mergers and acquisitions, post-merger, customer relationship management, 立. credit card services.. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Note: This thesis is the final version of the paper “AN INVESTIGATION OF CUSTOMER RELATIONSHIP MANAGEMENT IN POST-MERGER” which was accepted as oral presented paper and published in the Proceedings of 12th Annual Hawaii International Conference on Business, May 24 to 27, 2012, Honolulu, Hawaii. III.

(5) 中文摘要 企業透過併購為了要獲得更多資源以建立競爭優勢的策略。過去很多研究關 注在兩家公司之間的流程與資源整合,而忽略合併後因為文化與系統整合的衝突 而產生對顧客關係管理的影響。理論上,合併後的公司除了獲得更多資源之外也 要能夠獲得更多的顧客,但是實際上因為兩家公司組織間擁有不同的企業流程、 文化與資訊系統,有可能無法維持顧客關係的水準。本研究的目的希望了解企業 併購對顧客關係管理的影響以及希望找出影響顧客關係管理的成功因素。本研究 選擇金融產業的信用卡業務作為研究對象,因為在金融產業裡消費金融是一項需. 政 治 大. 要依賴顧客關係管理,才能維繫顧客忠誠度與獲得更多的顧客。. 立. ‧ 國. 學. 本研究透過文獻蒐集找出可能影響顧客關係管理的關鍵因素,建立研究架構。 並透過兩階段驗證與及擴充研究架構。第一階段,我們先定義出與顧客關係管理. ‧. 相關的信用卡指標,然後蒐集台灣過去八年有從事合併活動的銀行在信用卡業務. sit. y. Nat. 上的資料,並透過指標分析以了解銀行在合併前至合併後的顧客關係管理成效,. al. er. io. 目的是希望了解企業在併購後顧客關係管理的維繫。第二階段,我們針對所選的. v. n. 個案去做深度的跨個案研究,目的是希望了解企業可以維持顧客關係的重要成功 因素。. Ch. engchi. i n U. 本研究結果透過跨個案分析驗證我們在文獻中發現的關鍵因素,並說明這些 因素如何影響顧客關係。此外還發現可能會影響管理顧客關係的其他影響因素。 本研究發現關鍵因素分別為 1.顧客重整與服務調整 2.服務文化調整 3.流程整合 4.資訊整合 5.溝通 6.組織慣性改變 7.企業轉換時標準程序的建立 8.合併後的顧 客關懷。而影響併購後顧客關係管理的因素分別為 1.策略目的 2.客群的規模 3. 品牌效益 4.組織心態。透過本研究可了解併購後維繫顧客關係的重要性,並提. IV.

(6) 供影響顧客關係管理的成功因素,以幫助企業維繫顧客忠誠度與獲得更多的顧 客。. 關鍵字:併購、合併後、顧客關係管理、信用卡服務. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. V. i n U. v.

(7) CONTENT ACKNOWLEDGEMENT ........................................................................................... I ABSTRACT ................................................................................................................. II 中文摘要..................................................................................................................... IV CONTENT ................................................................................................................. VI TABLES .................................................................................................................. VIII FIGURES ................................................................................................................... IX CHAPTER 1: INTRODUCTION ............................................................................... 1 1.1 Research Motivation ............................................................................................ 1. 政 治 大 2.1 What Do We Know About CRM and M&A? CRM in M&A .............................. 4 立 2.2 Managing M&A Projects for Maintaining Customer Relationships.................... 5. CHAPTER 2: LITERATURE REVIEW ................................................................... 4. ‧ 國. 學. CHAPTER 3: RESEARCH METHODOLOGY .................................................... 12. ‧. 3.1 Research Framework ......................................................................................... 12 3.2 Selected Industry and Studied Services ............................................................. 13 3.3 Research Process ................................................................................................ 14. y. Nat. sit. CHAPTER 4: FINDINGS FROM THE EMPIRIC AL ANALYSIS ..................... 22. n. al. er. io. CHAPTER 5: FINDINGS FROM THE CROSS-CASE STUDIES ...................... 25. i n U. v. 5.1 Cross-Case Analysis........................................................................................... 25 5.2 Discussion .......................................................................................................... 32 5.2.1 Strategy for Rebuilding Customer Base and Service Portfolio .................. 32 5.2.2 Service Culture ............................................................................................ 32 5.2.3 Process Integration ..................................................................................... 33 5.2.4 Technology Integration ............................................................................... 34 5.2.5 Communication ........................................................................................... 34. Ch. engchi. 5.2.6 Organizational Inertia ................................................................................ 35 5.3 Other Factors ...................................................................................................... 35 5.3.1 Standard of Procedures of the Business Transition .................................... 36 5.3.2 Customer Care ............................................................................................ 36 5.3.3 Strategic Purpose ........................................................................................ 37 5.3.4 Customer base ............................................................................................. 38 5.3.5 Brand Effect ................................................................................................ 39 5.3.6 Organizational Mindsets ............................................................................. 39 VI.

(8) CHAPTER 6: CONCLUSION.................................................................................. 41 6.1 Summary ............................................................................................................ 41 6.2 Research Contribution ....................................................................................... 42 6.3 Limitation and Future Research ......................................................................... 43 REFERENCES ........................................................................................................... 44 APPENDIX 1 .............................................................................................................. 50 APPENDIX 2 .............................................................................................................. 57 APPENDIX 3 .............................................................................................................. 61. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. VII. i n U. v.

(9) TABLES TABLE 3-1: CRM MEASURES IN CREDIT CARD SERVICES ....................... 15 TABLE 3-2: THE SELECTED SERVICES ............................................................ 17 TABLE 3-3: FIVE CASES ........................................................................................ 18 TABLE 3-4: FACTORS ABOUT MANAGING CUSTOMER RELATIONSHIPS IN M&A ...................................................................................................................... 19 TABLE 3-5: INFORMATION FROM INTERVIEWS .......................................... 20 TABLE 4-1: CRM PERFORMANCE IN THE MERGED CREDIT CARD SERVICES .................................................................................................................. 23 TABLE 5-1: STRATEGY FOR REBUILDING CUSTOMER BASE AND SERVICE PORTFOLIO ........................................................................................... 26. 政 治 大 TABLE 5-2: SERVICE CULTURE 立 .......................................................................... 27. ‧ 國. 學. TABLE 5-3: PROCESS INTEGRATION................................................................ 28 TABLE 5-4: TECHNOLOGY INTEGRATION ..................................................... 29. ‧. TABLE 5-5: COMMUNICATION ........................................................................... 30 TABLE 5-6: ORGANIZATIONAL INERTIA ........................................................ 31. n. er. io. sit. y. Nat. al. Ch. engchi. VIII. i n U. v.

(10) FIGURES FIGURE 3-1 RESEARCH FRAMEWORK ............................................................ 12 FIGURE 3-2: RESEARCH PROCESS .................................................................... 14. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. IX. i n U. v.

(11) CHAPTER 1: INTRODUCTION 1.1 Research Motivation Business mergers and acquisitions (M&A) refers to situations in which two or more companies combine into one. The M&A activity involves integration of company entities, functions, subsidiaries, systems, and other resources (Samet, 2010; Ojala, 2005). In the 1990s, enterprises applied the cross-border M&A (Platt, 2004) due to industry deregulation in globalization. In the 2000s, companies invested in M&A more to obtain various resources, including financial capital, core assets, technology,. 政 治 大 2010), in order to build economies of scale, reduce costs, provide new products, and 立 skills, channels, market position, knowledge, and other capabilities (Al-Laham et al.,. expand customer base (Shrivastava, 1986; Weber & Dholakia, 2000; Pautler, 2003;. ‧ 國. 學. Tompkins, 2005; Holliday, 1995).. ‧. sit. y. Nat. There are successful M&A cases that exhibit strategic achievements and. io. er. improved performance in product profile, customer services, and generating stronger position in the market. For instance, Walt Disney Corporation bought Capital. al. n. v i n build Cexpanded distribution h e n g c h i U systems,. Cities/ABC (1995) to. including filmed. entertainment, cable television, broadcasting, and telephone wires to provide a full spectrum of entertainment services to customers (Ramaswamy, 1997; Santoro, 1995). This M&A led Disney’s shares to rise from $1.25 to $58.625 (Fabrikant, 1995). IBM acquired Lotus (1995) to provide a wider range of applications, including a spreadsheet, a word processor, and a database manager (Weekly Corporate Growth Report, 1995) to attract customers in the small and medium enterprise market. IBM’s customer base of Lotus Notes was increased to 1 million, and the annual attrition rate dropped from 11% to 6% after the merger (Ramaswamy, 1997; Burke 1995; Boslet, 1995; Philippidis, 1995; Rifkin 1998). While the merger between Chase Manhattan 1.

(12) Bank and Chemical Bank (1996) expanded the branch services into more than 50 countries (Euromoney, 1997), the overall savings increased due to new deposit lines, and the merger saved costs of $1.5 billion (Ramaswamy, 1997; Laabs, 1995).. However, there are unsuccessful cases in M&A. Novell Inc. acquired WordPerfect Corp. in 1994 (Harper, 1998) with a hope of increasing its product offering with word processing capability. But Novell’s comprehensive efforts to assert control and impose the Novell personality on WordPerfect’s operations sparked intense culture clashes. 政 治 大 integration on track, key product launches fell behind schedule. WordPerfect’s sales 立 that sidetracked the company. While Novell was preoccupied with trying to keep. sank 17% in fiscal year 1994, the year of the merger (Vestring et al., 2004), and. ‧ 國. 學. Novell’s performance and stock price dropped sharply. Another case was BMW’s. ‧. acquisition of Rover (1994). BMW expected to emerge into smaller and lower-budget. y. Nat. car markets with decreased production costs (Coursework.info, 2006), but both. er. io. sit. companies were deeply rooted in their own national cultures (Fuller-Love 2008). So, the merged company ended up losing $6 billion over six years (Andrews, 2000).. al. n. v i n C h Bank in 1996 Uexpecting to increase customer Wells Fargo acquired First Interstate engchi. base and service lines, but due to customer data loss and system problems in the front line and labor issues in the back office, the results were a decreased customer base, a lower stock price, and a $180 million operational loss in one quarter (Anthes, 1998).. Although capital gain is important for M&A and past cases may have shown a boost in stock performance, customers are still the vital requirement of businesses. In theory, the merged enterprise should be able to leverage the assets and knowledge in acquiring and retaining customers, but in reality the customer relationships may not be well managed because of a lack of synergy between the merged organizations. 2.

(13) There is a need for understanding the impact of M&A on the merged market. Are customers of both merged firms satisfied with the services after the merger? Do customers spend as much as they did before? Do customers of both companies remain as loyal to the merged firm as before? In what ways is the practice of customer relationship management (CRM) affected by the M&A? And, finally, what are the factors affecting the effectiveness of CRM?. The objective of this study is to build a deep understanding of CRM post-merger. The. 政 治 大 Can enterprises retain the same quality of CRM after the M&A? 立. key questions are: . How do organizations retain the quality of CRM after the M&A?. 學. ‧ 國. . By analyzing CRM performance before and after M&A of eight consumer banking. ‧. cases in the past eight years in Taiwan, we formed a clearer understanding of the. sit. y. Nat. pattern of M&A’s effects on CRM performance. Also, by in-depth case studies of. io. er. CRM successes and failures, we identify factors that affect the performance of CRM. The paper reports the patterns of CRM performance after M&A and finds critical. al. n. v i n success factors in the in-depth C study of multiple cases. h e n g c h i U It is hoped that we can learn from the cases about managing customer relationships after a merger and help companies develop effective plans in building synergy in CRM after M&A.. 3.

(14) CHAPTER 2: LITERATURE REVIEW 2.1 What Do We Know About CRM and M&A? CRM in M&A Customer relationship management is an enterprise approach that extensively employs information technology, particularly database and Internet technologies, to achieve understanding of customer characteristics and to track customer behavior in order to provide appropriate products and services (Wu, 2010; Rigby et al., 2002; Chen et al., 2010), to satisfy customer requests, to directly communicate with customers, and to maintain a satisfied and profitable customer base (Huang et al.,. 政 治 大 (Chattopadhyay, 2001), automate customer-service 立. 2005; Zeng et al., 2003; Xu et al., 2002). It is vital for companies to coordinate all service functions. operations. (Karimi et al., 2001), restructure business processes (Bull, 2003; Couldwell, 1998;. ‧ 國. 學. Chen & Popvich, 2003; Gurau et al., 2003), and present a unified view to customers.. er. io. sit. y. Nat. and retain customers with high loyalty (Hosseini et al., 2010).. ‧. The purpose of CRM is to acquire more customers, generate more from customers,. With continuous communications and interactive activities, businesses accumulate. al. n. v i n C h preferences andUconsuming behavior. Based on customer knowledge about customer engchi. analyzed customer data, businesses provide services and products tailored to customers’ changing needs and customized services that fit customers’ shopping behavior (Zeithaml et al., 1990). By fulfilling customer needs and cross-selling products or services, businesses increase customer contribution. By providing quality services and innovative products, businesses acquire and retain customers (Conway et al., 1999; Levesque et al., 1996; Xu et al., 2002). It was reported (Reichheld et al., 1990) that by reducing defections 5% businesses can boost profits from 25% to 85% and increase company competitiveness. On the other hand, customers can easily switch to competitors because of disliked customer services or defective products or 4.

(15) systems (Childs, 2007; Samet, 2010). Some M&A projects (Weber et al., 2000; Kotler, 2006; Raman et al., 2006; Rigby et al., 2002) succeed due to carefully reviewed customer data integration, service refinement, and strategic planning for merged services. For instance, during the merger between Chase Manhattan Bank and Chemical Bank clients were kept informed about every decision, and consequently there was no fall-off in clients, revenue, or business (Ramaswamy, 1997; Euromoney, 1997). Therefore, their customer data integration experienced fewer obstacles because they emphasized customer relations in the strategic planning.. 政 治 大 By word-of-mouth on the Internet, customers share positive as well as negative 立. opinions quickly about their experience with the services (Siddiqi, 2011; Hofstede,. ‧ 國. 學. 2001; File & Prince, 1992). Thus, it can be a critical factor for many companies,. ‧. especially those with integrated operations after the merger, to carefully review the. er. io. sit. y. Nat. merged customer profiles and plan effective strategy to retain and acquire customers.. 2.2 Managing M&A Projects for Maintaining Customer Relationships. al. n. v i n Past studies have addressed theC challenges and difficulties h e n g c h i U of M&A, analyzing M&A projects from the perspective of pre-merger activities, merging strategies, and. post-merger implementations. There are a few areas of concern that can lead to the success (Mayoff & Cherba, 1998; Levine, 2011; Davidson, 2011; Childs, 2007) or failure (Harper, 1998; van de Vliet, 1997; Mayoff & Cherba, 1998; McKiernan et al., 1995) of merging projects. By focusing on post-merging results with respect to CRM, we identify a few critical areas of managing M&A projects for CRM.. Strategy for Rebuilding Customer Base and Service Portfolio 5.

(16) The term “strategy” means the company’s goals and directions for business integration. The strategic calculation and implementation of the integration can affect the results greatly. There are two sets of strategies that firms would need to scrutinize in order to make a smooth transition in customer services post-merger. The first strategy concerns refining and maintaining customer base. The planning session provides the chance to consider the quality of the merged customer base and plan for the removal of customers of bad quality and the retaining of good-quality customers. This assessment provides the opportunity for understanding customer characteristics. 政 治 大 strategy concerns refining and maintaining products and services. In accordance with 立 and planning for effective promotion and customer communication. The second. the customer profile, it is also important to assess the portfolio of merged products. ‧ 國. 學. and services and the refinement of the products and services post-merger (Goff, 1999).. y. sit. n. al. er. io. Service Culture. Nat. services.. ‧. Firms may lose customers after a merger due to reduced quality of products and. Ch. The term “culture” means an organization’s set. engchi. v i n of U expectations. for employees. (Hofstede, 1980). A service culture is defined as a customer-centric culture. Organizations of high service culture strive to develop service and performance competencies to exceed customer expectations and create superior value to attract and retain customers. The expected performance outcomes of a service culture involve improved product quality, increased market performance, and increases in customer satisfaction measures (Beitelspacher et al., 2011). However, due to a lack of standard service quality and service guidance, the merged service force may provide inconsistent services as they gain acquaintance with new customers and may manifest inappropriate attitudes (Gotschall, 1998). 6.

(17) Because of the different values and beliefs regarding customer services in the merged companies, the integrated operation may provide customers with different experiences. For instance, if one of the merged firms used to measure customer services by revenue generated and the other firm focused on customer satisfaction, the service providers of the merged firm may have to respond differently when facing customers with problems and when arranging resources to provide solutions (Harper, 1998).. 政 治 大 management style, and working patterns (Harper, 1998). Different strategies and 立 Cultural clashes are mostly reported due to differences in organizational values,. customer service orientations will lead to great cultural differences between the two. ‧ 國. 學. companies. In order to safeguard their own interests and communication service mode. ‧. after the merger, the two merged firms may experience clashes at work. This could. sit. y. Nat. lead to reduced employee productivity, responsiveness, and innovation at work. io. er. (Marks, 1997; Mayoff & Cherba, 1998). Both merging parties tend to protect their own way of customer communication and their problem-solving approaches. This. al. n. v i n C h companies to serve makes it difficult for the two merged customers who are used to engchi U. previous products and services. The cultural clash could also be underlined by differences in performance expectations, and employees post-merger could experience difficulties in adjusting to different forms of performance evaluation (Harper, 1998). The cultural conflicts can make customers suffer from unstable or inconsiderate services. For instance, Novell Inc. acquired WordPerfect Corp. (1994) and experienced cultural and cognitive clashes with WordPerfect. The two companies had fundamentally different ideas about customer service, and this raised many internal arguments (Harper, 1998). The results led to alienated customers and lower service quality (Vestring et al., 2004). 7.

(18) Process Integration Process integration for business merger requires a well-thought-out plan to provide similar or improved services to customers (Pai & Tu, 2011). An integrated system can support, and most of the time enforces, standardization of data and processes within the merged firm (Shang, 2005). This includes business policy discussion, dataflow synchronization, and procedure standardization to provide consistent services to customers. The integration process can become an opportunity to strengthen the. 政 治 大 (Robbins & Stylianou, 1999). To ensure customer satisfaction after the M&A, the 立. capabilities of the combined organization and place it in a better competitive position. merged firms need to invest appropriate effort in making the integrated processes. ‧ 國. 學. serve customers in a convenient and reliable way and in capturing proper information. ‧. (Xu & Walton, 2005; Salami, 2008). For instance, Wells Fargo Bank acquired. sit. y. Nat. Norwest Corporation (1998) with a focus on customer service, and thus it planned. io. er. several ways to integrate processes and kept the quality of customer service as the priority. For one thing, they put customer convenience the top of the list in all services. al. n. v i n (Domis, 1998). Customer baseCincreased after the U h e n g c h i merger due to. lower cost and. minimized error rate in processes (Costanzo, 2002). A successful transition from M&A should avoid errors from different business process methods (Alsmadi & Alnawas, 2011). Therefore, it is important to standardize the integrated processes, remove redundant items, and build a synchronized practice in serving customers (Childs, 2007). In addition, employee familiarity with the operation is another key for process integration. Employee education on the new processes can avoid customer confusion and increase responsiveness to customers.. Technology Integration 8.

(19) An integrated system providing quality information can lead to user satisfaction (Alaranta, 2005) after merger. The first task of system integration is database conversion. Loss or error in customer data during system conversion can lead to customer dissatisfaction, and slow and inflexible data access can create inconvenience in serving customers. For instance, when Wells Fargo acquired First Interstate Bank (1996), Wells Fargo did not link up the reaction of First Interstate’s workers and customers (Hiltzik & Mulligan, 1996). Millions of dollars in deposits were posted to the wrong customers' accounts, checks took weeks to clear, an automated telephone. 政 治 大 data losses led to a large decrease in customer base. As mentioned earlier, the bank 立 banking system went dark for several days, direct deposits were delayed, and several. lost $180 million in a single quarter because of problems in the system integration. ‧ 國. 學. (Anthes, 1998). The merging of inconsistent infrastructures can cause system clashes. ‧. and low operational performance (McKiernan & Merali, 1995). In most M&A cases,. sit. y. Nat. the two firms possess different technology infrastructures with a variety of supports. io. er. from different partners. This can cause operational delays, loss of opportunities, and decreased revenues (Harrell & Higgins, 2002). Because of technology infrastructure. n. al. Ch. differences, companies need to learn the other. engchi. v i n company’s U. system and build an. effective plan for technology integration.. Communication Communication is always an important task in all business change projects. Communication with both employees and customers can smooth the transition and reduce uncertainty in the changing period. Miscommunication about the business plan, business expectations, and the progress of the project can cause a decrease in employee morale and an increase in customer attrition rate (Atkinson, 2004). Clear communication with employees can prevent operational errors and negative attitudes 9.

(20) at work. To help employees respond to multifaceted changes, sufficient communication is a key factor for a successful transition into the new environment and for building employee confidence in the merged company (Xu et al., 2002; Wu, 2010; Davidson, 2011). Communication with customers about the M&A process and to assure the same customer rights and service quality post-merger can reduce confusion in business operation (Davidson, 2011). Full communication can help customers understand the company’s strategy and planning for the future, which can increase customers’ satisfaction because they feel respected and feel they are treated. 政 治 大. as individuals (Xu et al., 2002; Wu, 2010; Davidson, 2011).. Organizational Inertia. 立. ‧ 國. 學. Business integration systems drive dramatic changes in both daily operations and. ‧. critical decision making, affecting multiple levels of work, along with the distribution. sit. y. Nat. of power (Shang, 2005). Employees may manifest resistance through such behavior as. io. er. sabotage and vocal protests or attitudes such as withdrawal and reduced commitment (Hultman, 1979). These resistance behaviors may lower productivity, affect the quality. al. n. v i n of goods or services, raise the C costs of production, or h e n g c h i Ulower the quality of services. (Hultman, 1979, 1995; Judson, 1991; Odiorne, 1981). Individuals who are resistant to the changes may intentionally or unintentionally attack the new processes of the IT-enabled change, thus reducing productivity and/or quality by passive uncooperative actions (Marakas & Hornik, 1996) such as neglecting or delaying work assignments (Hultman, 1979, 1995; Judson, 1991; Odiorne, 1981), being reluctant to learn new knowledge and skills (Hultman, 1979, 1995; Judson, 1991; Odiorne, 1981), refusing to cooperate with other employees (Hultman, 1979, 1995), or making careless mistakes (Hultman, 1979). As another act of passive resistance, employees may devise creative “workarounds” that produce a sense of reskilling to counter the deskilling produced by 10.

(21) the change to the new system (Alvarez, 2008). Sometimes they may passively accept lower quality when they have difficulties in adapting to the changes (Hultman, 1979). Such organizational inertia can cause delays in responding to customer requests, deficiencies in services, and decreased efforts to understand markets and customers and to improve products and services.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 11. i n U. v.

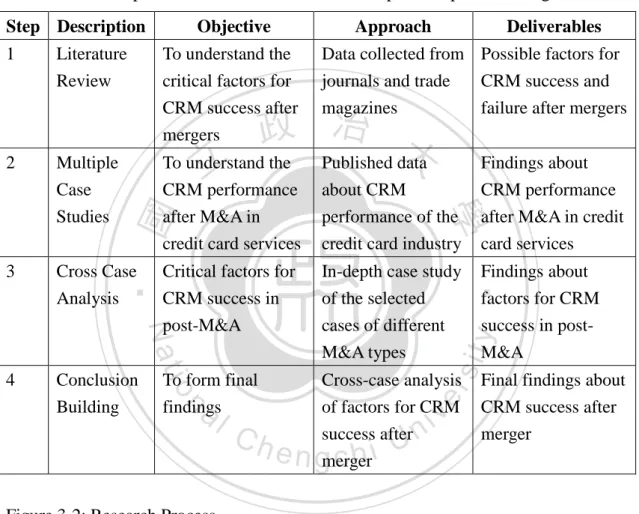

(22) CHAPTER 3: RESEARCH METHODOLOGY To fulfill the research objective of understanding the CRM performance after M&A, this research plans two stages of empirical study. The first stage is to build a preliminary finding about the industry M&A by longitudinally tracking CRM performances of M&A cases in credit card services. The second stage is to conduct multiple case studies on selected M&A cases regarding their efforts in making the merger a success or a failure in CRM.. 3.1 Research Framework. 立. •Process integration. •Loyalty •Retain. •Customer contribution. •Communication. io. •Organizational inertia. y. Nat. •Technology integration. sit. •Organizational mindsets. •Service culture. •Growth. ‧. •Brand effect. ‧ 國. •Customer base. •Strategy for rebuilding customer base and service portfolio. CRM outcomes. 學. •Strategic purpose. Critical factors. er. Influence factors. 政 治 大. n. a•Standard of procedures of iv ltheCbusiness n U h e ntransition i h c g •Customer care. Figure 3-1 Research Framework This research is based on the framework in Figure 3-1 to understand how companies retain customer relationships after merger and what factors could affect CRM success in the M&A process. The research planned to answer the first research question “can enterprises retain the same quality of CRM after the M&A?” by multiple case studies. The research uses four CRM outcomes to measure the CRM results of merger implementation in the cases studied. 12.

(23) For the second research question “how do organizations retain the quality of CRM after the M&A?” this research applied cross case analysis. The research results propose eight critical factors which companies need to pay attention in the M&A process. Four influence factors are also identified that could affect company success in maintaining CRM quality after merger.. 3.2 Selected Industry and Studied Services. 政 治 大 taken place only since the Asian financial crisis in 1997 (Wong & Cheung, 2009). It is 立. Merger-and-aquisition activities are in an upsurge globally. In Asia, they have mostly. not only governments that have encouraged M&A but also stockholders who want to. ‧ 國. 學. upgrade competitive ability and reduce costs in order to increase revenue. In Taiwan,. ‧. because of opening to set up the commercial banks in 1990, so led increasing the. sit. y. Nat. banks of privatization and the non-performing loans also have increased. By passing. io. er. the Finance Holding Company Law in 2001 to address the over-banking and non-performing loans problem, the Government of Taiwan started to promote M&A. al. n. v i n C hThe objective was toUincrease banks' profit margins activities in the financial industry. engchi. through mergers and diversification of the industry (Tan, 2009). Since then, M&A activities have been prevalent in the finance industries—in fact, M&A has become a mass fervor activity in banks.. In this context, consumer banking is more closely connected to customers’ daily activities than corporate finance—it touches customers directly. Most banks have established customer-service centers to serve retail customers, and they have also established a CRM function to track and trace customer behavior and to work closely with the product sales, product development, and marketing functions. This study 13.

(24) selects credit card services in consumer banking as our study field because out of all the business services provided by consumer banking, credit card services relate most closely to customers. It is integral to customer consumption in daily living.. 3.3 Research Process There are four steps to establish the research. The steps are explained in Figure 3-2. Step Description. To understand the. Data collected from Possible factors for. Review. critical factors for CRM success after mergers. journals and trade magazines. 政 治 大 To understand the Published data 立 CRM performance about CRM after M&A in credit card services. performance of the credit card industry. Findings about CRM performance after M&A in credit card services. Critical factors for CRM success in. In-depth case study of the selected. Findings about factors for CRM. post-M&A. cases of different M&A types. To form final findings. Cross-case analysis of factors for CRM success after merger. io. al. n. Conclusion Building. Ch. engchi. i n U. success in postM&A. y. Nat. 4. ‧. Cross Case Analysis. sit. Multiple Case Studies. CRM success and failure after mergers. 學. 3. Deliverables. er. 2. Approach. Literature. ‧ 國. 1. Objective. v. Final findings about CRM success after merger. Figure 3-2: Research Process. First, based on previous studies and practical cases, the study formed factors for CRM success after merging. Then, we conducted empirical analysis on M&A cases since 2004 regarding CRM performance in the credit card industry. Next, based on the case analysis from the previous stage, we selected five cases of different types of M&A, and we cross-case analyzed patterns of CRM success and failure with previously formed CRM success/failure factors verified and enhanced. 14.

(25) Data Collection of the First Stage In the case-analysis stage, this study collected data from government published reports about credit card services in Taiwan between 2004 and 2011. Eight M&A cases were selected, and we analyzed CRM performance data one year before and after the declared date of merger. The reason for analyzing data one year after the merging was to assure that we eliminated the effects of post-merger turbulence such as a period of refinement of the customer base, activities related to cleaning out. 政 治 大. customers with bad credit, and learning the path for the new customer base.. 立. The Banking Bureau of FSCEY reports the credit card performance of all credit card. ‧ 國. 學. issuers on a monthly basis. The published data of each credit card service include a. ‧. total number of credit cards issued, effective cards, active cards, cards cancelled, retail. sit. y. Nat. sales volume, and the revolving balance of the issued cards. In credit card terms, the. io. er. retail sales volume is the amount of charges owed to the credit card company; the revolving balance is also called the consumer credit amount, which is the portion of. al. n. v i n C h at the end of eachUbilling cycle. credit card spending that goes unpaid engchi. Four CRM measures—customer growth, customer loyalty, customer retention, and customer contribution—are used to measure the CRM performance of credit card services before and after the merger. The indexes and calculation of the indexes are listed in Table 3-1.. Table 3-1: CRM Measures in Credit Card Services CRM Measures. Indexes. Calculation 15.

(26) • Cards issued Growth. • Cards issued • Effective cards • Market share. Loyalty. Active cards. • Active cards. Retain. Attrition rate. • Attrition rate = cards cancelled/cards issued. Customer Contribution. • Effective cards = total cards issued – total cards cancelled • Market share = effective cards/effective cards of all banks. • Revolving balance per card • Balance per card. • Revolving balance per card = revolving balance/effective cards • Balance per card = retail sales volume/effective cards. 政 治 大. • Customer growth means a company’s efforts to acquire customers; it can mean the. 立. company’s marketing strength in obtaining customers in the market and its ability. ‧ 國. 學. to maintain customers’ active use of the card. It is reflected in the total cards issued, effective cards, and market share.. ‧. • Customer loyalty means customer continuous use of the services, which is. y. Nat. sit. measured by the return on investment of the efforts put into serving customers and. n. al. er. io. promoting card use. In other words, it is reflected in customer use of the credit card.. Ch. engchi. i n U. v. • Customer retention is about a company’s efforts to retain customers, and it is reflected in the customer attrition rate. • Customer. contribution. means. a. company’s. efforts. to. promote. more. products/services to customers, such as cross-selling to gain more customers’ pocket-share. It is reflected in the card’s revolving balance and balance per card. Customer revolving balance is for the card issuers’ to earn interest on this debt. When the revolving balance amount is higher, the credit card issuer will earn interest, and income will increase. The balance of the card refers to the use of the. 16.

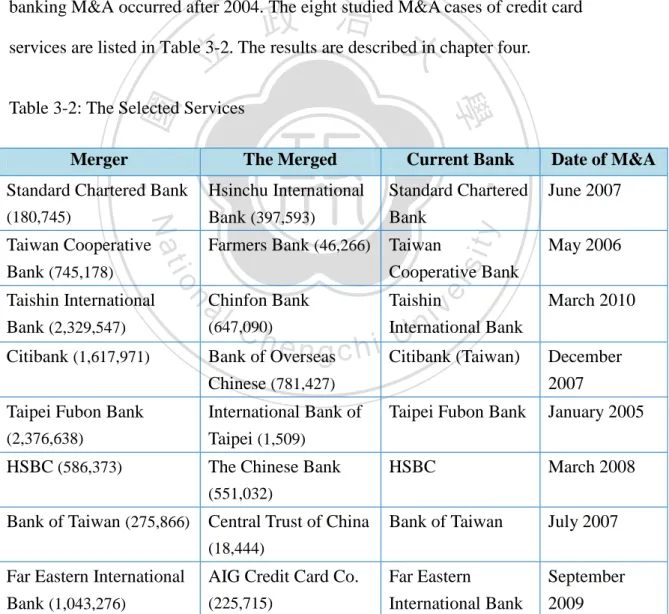

(27) credit card to buy products or services, and it reflects customers’ preference for using the services.. These CRM indexes of credit card services are provided by the Financial Supervisory Commission, Executive Yuan, R.O.C. (FSCEY). The FSCEY was established in 2004 to provide unified financial supervision (Tan, 2009) after the passing of the Finance Holding Company Law in July 2001 and the growth of mergers or alliances in the industry. The range of data collection is between June 2004 and 2011 because most. 政 治 大 services are listed in Table 3-2. The results are described in chapter four. 立. 學. ‧ 國. banking M&A occurred after 2004. The eight studied M&A cases of credit card. Table 3-2: The Selected Services. Current Bank. Standard Chartered Bank. Hsinchu International. Standard Chartered. (180,745). Bank (397,593). Bank. Farmers Bank (46,266). Taiwan Cooperative Bank. Citibank (1,617,971). Chinese (781,427) Taipei Fubon Bank. Date of M&A June 2007. y. sit. er. Bank Taishin v aChinfon i l (647,090) International Bank n Ch U e n g c h i Citibank (Taiwan) Bank of Overseas. n. Taishin International Bank (2,329,547). io. Taiwan Cooperative Bank (745,178). ‧. The Merged. Nat. Merger. May 2006 March 2010 December 2007. Taipei Fubon Bank. January 2005. (2,376,638). International Bank of Taipei (1,509). HSBC (586,373). The Chinese Bank. HSBC. March 2008. Bank of Taiwan. July 2007. Far Eastern International Bank. September 2009. (551,032). Bank of Taiwan (275,866). Central Trust of China (18,444). Far Eastern International Bank (1,043,276). AIG Credit Card Co. (225,715). NOTE: The figures in the table mean effective cards before one month of M&A.. 17.

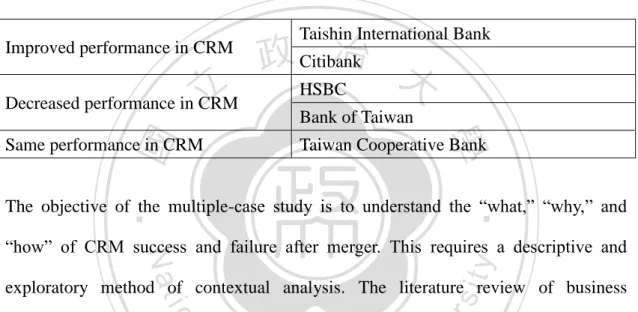

(28) Multiple Case Studies Based on the findings of the previous case analysis of the eight M&A cases (refer to the Appendix 1), we selected four typical cases to examine the factors for running CRM with a successful or failure result. The selected cases include two with improved CRM performance one year after the M&A and two with decreased CRM performance one year after the M&A. The case information is listed in Table 3-3 Table 3-3: Five Cases. Improved performance in CRM. 立. Decreased performance in CRM. Taishin International Bank. 治 政 Citibank 大 HSBC Bank of Taiwan. ‧ 國. 學. Same performance in CRM. Taiwan Cooperative Bank. ‧. The objective of the multiple-case study is to understand the “what,” “why,” and. sit. y. Nat. “how” of CRM success and failure after merger. This requires a descriptive and. io. al. er. exploratory method of contextual analysis. The literature review of business. n. integration and customer relationship management in the previous section provides a. Ch. engchi. basis for understanding some factors for M&A. iv n failure U with. CRM. Though the. previous literature analysis does not provide well-established hypotheses explaining the behavior of managing customer relationships, it provides sources for exploring answers to such questions as: “Why do organizations experience CRM success?” Based on the organized points and explanations of CRM success and failure in the previous section, this study seeks patterns of CRM success after merger, with findings deduced from multiple sources of evidence. The case-study approach (Yin, 1994) is used because of the need to investigate, in depth, business and technology design and management. Because the factors of CRM success and failure after merger are 18.

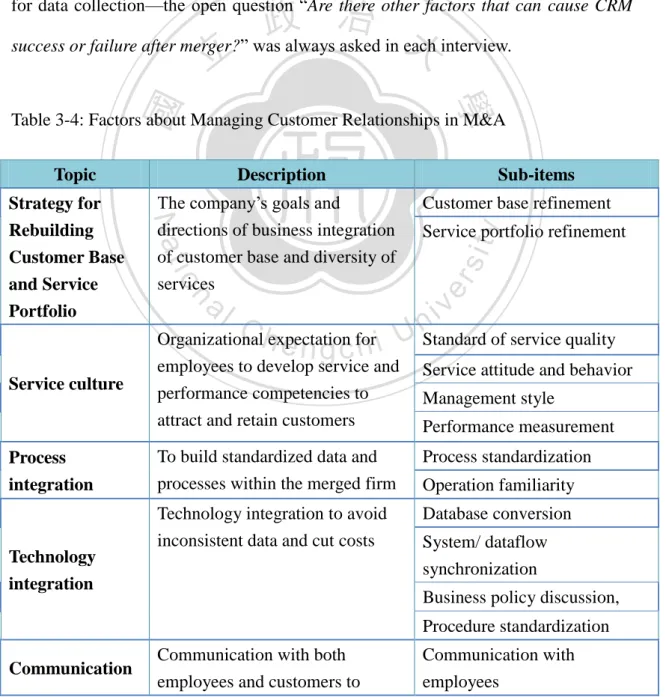

(29) dynamic, a semi-structured questionnaire with open questions exploring the underlying. causes. of. the. management. of. customer. service. and. the. knowledge-management process integration was used as an instrument for data collection and knowledge enhancement as well as subject exploration. The semi-structured questionnaire (APPENDIX 2) is developed based on a literature review of critical factors for CRM success after merger. Table 3-4 lists the possible factors for CRM success after merger that were used for building the semi-structured questionnaire (APPENDIX 2). However, the listed items were not used exclusively. 政 治 大 success or failure after merger?” was always asked in each interview. 立. for data collection—the open question “Are there other factors that can cause CRM. ‧ 國. 學. Table 3-4: Factors about Managing Customer Relationships in M&A. The company’s goals and. Customer base refinement. n. al. Ch. engchi. y. Service portfolio refinement. sit. directions of business integration of customer base and diversity of services. io. Service culture. Sub-items. Nat. Rebuilding Customer Base and Service Portfolio. Description. er. Strategy for. ‧. Topic. iv n U Standard of service quality. Organizational expectation for employees to develop service and performance competencies to attract and retain customers. Service attitude and behavior Management style Performance measurement. Process. To build standardized data and. Process standardization. integration. processes within the merged firm. Operation familiarity. Technology integration to avoid inconsistent data and cut costs. Database conversion. Technology integration. System/ dataflow synchronization Business policy discussion, Procedure standardization. Communication. Communication with both employees and customers to 19. Communication with employees.

(30) Organizational inertia. smooth the transition and reduce. Communication with. uncertainty in the changing period. customers. Employees may manifest resistance through different kinds of behavior due to business-integration projects. Low productivity Low quality of services Low intention to cooperate Low intention to innovate. One to two managers were interviewed in each case, and cases supporting the success or failure of CRM were collected and re-examined to form a consistent explanation of CRM success. Table 3-5 lists the information from the interviews. Cross-case analysis. 政 治 大 sources of factors for CRM立 success and failure.. 學. Table 3-5: Information from Interviews Bank. Interviewer. y. Manager of Customer Management. Nat. Department. sit. Bank A. ‧. ‧ 國. was then conducted to identify common traits and different traits with regard to. Time 2h. Director of Personal Finance Department. 2h. Bank D. Ch. Specialist of Marcom Department. 2h. Bank E. Assistant Manager of branch. 2h. al. n. Bank C. er. 3h. io. Manager of Credit Card Department Manager of branch in Bank B1. Bank B. engchi. i n U. v. The interviews were conducted with both business managers and business operators, and interviewees were encouraged to think retrospectively on the instances of CRM challenges associated with the implementation of the integrated practice. The purpose of this was to build a multi-dimensional view of CRM before and after the merger. Next, causes of CRM success and failure were examined using both open and structured questions. This session usually elicited an interesting debate on the causes 20.

(31) of M&A success or failure. The researcher invited different views and explanations and sought supporting evidence from different sources. Modification and verification of the case results were performed iteratively. Answers of the open question of “why?” (i.e., why the success?) were content analyzed, and the findings were then triangulated and structured with further links to existing theories of organizational management. Then, this research does cross-case studies based on verbatim transcripts (APPENDIX 3) in order to verify and enhanced the list of critical factors for CRM success but also discovered influential factors that can affect the effectiveness of CRM after merger. It. 政 治 大. presented in the following sections.. 立. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 21. i n U. v.

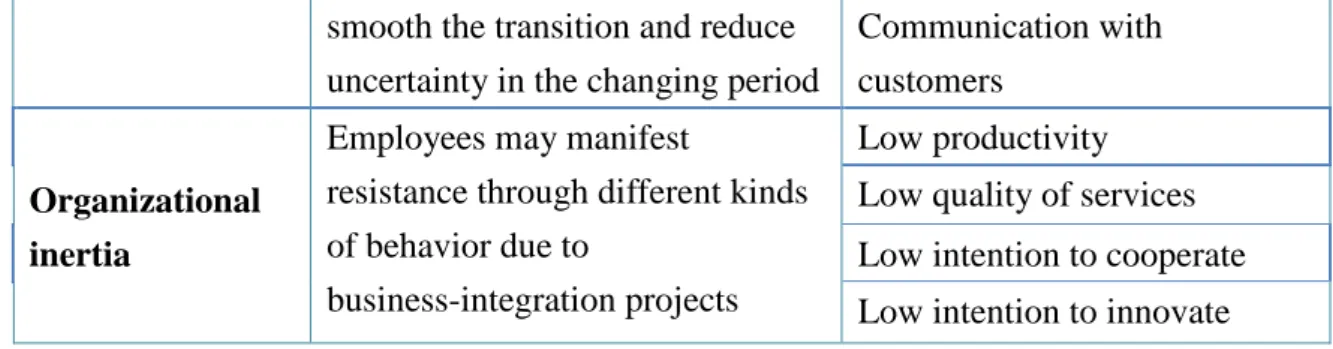

(32) CHAPTER 4: FINDINGS FROM THE EMPIRIC AL ANALYSIS The CRM performances after M&A of the eight selected credit card services are summarized in Table 4-1. The symbol “+” refers to improved performance a year after the mergers, the symbol “−” refers to decreased performance one year after the mergers, and the symbol “≈” refers to performance remaining the same.. As shown in Table 4-1, this research used four types of indexes to track CRM performance. The four types of CRM indexes are to reflect the customer growth,. 政 治 大 that are usually performed. loyalty, retention, and contribution. “Effective Cards” reflects the card issuer’s ability to acquire customers, tasks. 立. by the marketing or. performance-management department. For example, the number of effective cards in. ‧ 國. 學. HSBC after the acquisition of the Chinese Bank is lower than the total effective cards. ‧. of the two banks before the merger. The effective cards continued to decrease for six. sit. y. Nat. months after the merger, and after a year the amount is still lower than the combined. io. er. amount of effective cards of the two banks before the merger. Therefore, we put the symbol “−”, indicating the decreased quality or customer acquisition. “Active Cards”. al. n. v i n C his usually the responsibility reflects customer loyalty, which of the marketing or engchi U. performance management department. In the case of Citibank’s acquisition of Bank of Overseas Chinese, it demonstrated a growing trend for more than six months over the combined quantity of active cards of the two banks before acquisition. We put a symbol “+” to indicate the improved performance.. 22.

(33) Table 4-1: CRM Performance in the Merged Credit Card Services. (b). (c). Active Cards. Standard Chartered Bank. ≈. −. −. −. Taiwan Cooperative Bank. ≈. −. +. Taishin International Bank. +. ≈. ≈. Citibank. +. ≈ 立. Taipei Fubon Bank. −. −. −. −. −. −. −. −. − −. ≈. io. (d). (e). +. −. −. −. −. −. −. ≈. +. −. −. +. +. ≈. ≈. −. −. −. −. −. −. −. −. ≈. −. −. ≈. ≈. −. −. −. Rate. 政 治 大 + +. a l (d) Revolving balance per cardi v C h per card U n (e) Balance engchi. n (a) Cards issued (b) Effective cards (c) Market share. Contribution. sit. Far Eastern International Bank. Customer. er. Bank of Taiwan. Nat. Three cases of decreased CRM performance. Attrition. 學. HSBC. ‧ 國. Two cases of improved CRM performance. (a). Retain. ‧. M&A Cases. Loyalty. y. Growth. By deeply analyzing the performance of the eight banking M&A cases, this research formed a clearer view of the impact of M&A on CRM in credit card services. The seven CRM indexes of the eight M&A cases demonstrated some increases and some decreases in CRM performance (refer to Appendix 1). Overall, there are three declining CRM cases and two cases with improved CRM performance a year after the M&A. This research does not consider the Taipei Fubon Bank case because the customer base of this bank (2,376,638 customers) is much larger than that of the 23.

(34) International Bank of Taipei, which has only 1,509 customers. There is no need to study the system integration or synergy building between these two enterprises. Therefore, based on the case analyses, this research give up these three cases not to consider, due to the Taipei Fubon Bank customer base is much larger than the International Bank of Taipei, the Far Eastern International Bank merger type as same as Taishin International Bank and the Standard Chartered Bank we could not find any interviewer to do interview. Therefore, this research selected remaining five cases for in-depth examination. It is hoped that we can learn from these cases about managing. 政 治 大 building synergy in CRM after M&A. 立. customer relationships after a merger and help companies develop effective plans for. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 24. i n U. v.

(35) CHAPTER 5: FINDINGS FROM THE CROSS-CASE STUDIES 5.1 Cross-Case Analysis This research selected five cases according to previous research results to do in-depth interviews. Then, this research base on verbatim transcript (APPENDIX 3) summarized the results in Tables 5-1 to 5-6 beginning on the next page.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 25. i n U. v.

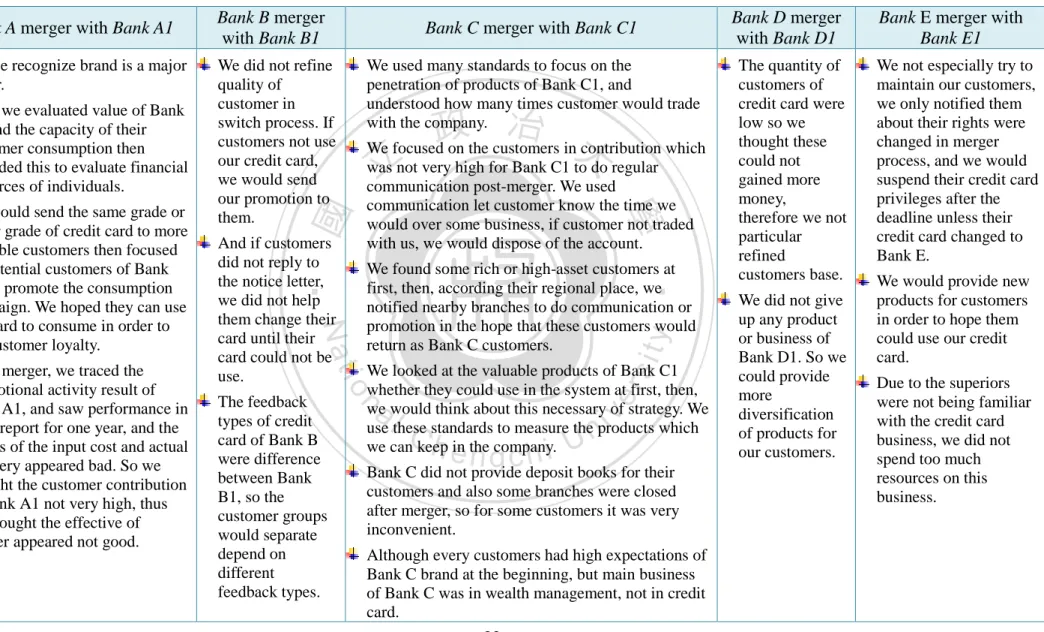

(36) Table 5-1: Strategy for Rebuilding Customer Base and Service Portfolio. 治 政 We focused on the customers in大 contribution which was not very high for Bank C1 to do regular 立 communication post-merger. We used 學. communication let customer know the time we would over some business, if customer not traded with us, we would dispose of the account.. y. We looked at the valuable products of Bank C1 whether they could use in the system at first, then, we would think about this necessary of strategy. We use these standards to measure the products which we can keep in the company.. al. n. The feedback types of credit card of Bank B were difference between Bank B1, so the customer groups would separate depend on different feedback types.. We found some rich or high-asset customers at first, then, according their regional place, we notified nearby branches to do communication or promotion in the hope that these customers would return as Bank C customers.. ‧. And if customers did not reply to the notice letter, we did not help them change their card until their card could not be use.. io. After merger, we traced the promotional activity result of Bank A1, and saw performance in daily report for one year, and the results of the input cost and actual recovery appeared bad. So we thought the customer contribution of Bank A1 not very high, thus we thought the effective of merger appeared not good.. We used many standards to focus on the penetration of products of Bank C1, and understood how many times customer would trade with the company.. Nat. We would send the same grade or better grade of credit card to more valuable customers then focused on potential customers of Bank A1 to promote the consumption campaign. We hoped they can use our card to consume in order to get customer loyalty.. We did not refine quality of customer in switch process. If customers not use our credit card, we would send our promotion to them.. sit. First, we evaluated value of Bank A1 and the capacity of their customer consumption then accorded this to evaluate financial resources of individuals.. Bank D merger with Bank D1. Bank C merger with Bank C1. er. People recognize brand is a major factor.. Bank B merger with Bank B1. ‧ 國. Bank A merger with Bank A1. Ch. engchi. i n U. v. Bank C did not provide deposit books for their customers and also some branches were closed after merger, so for some customers it was very inconvenient. Although every customers had high expectations of Bank C brand at the beginning, but main business of Bank C was in wealth management, not in credit card. 26. The quantity of customers of credit card were low so we thought these could not gained more money, therefore we not particular refined customers base. We did not give up any product or business of Bank D1. So we could provide more diversification of products for our customers.. Bank E merger with Bank E1 We not especially try to maintain our customers, we only notified them about their rights were changed in merger process, and we would suspend their credit card privileges after the deadline unless their credit card changed to Bank E. We would provide new products for customers in order to hope them could use our credit card. Due to the superiors were not being familiar with the credit card business, we did not spend too much resources on this business..

(37) Table 5-2: Service Culture. 立. The employees of Bank B1 felt like “rootless orchids” after the merger, because they were separated to different departments, so the result in some people could adapt new environment, but some people could not adapt.. We had serious performance evaluation on individuals, so if the employees wanted to stay in this company they had to provide good services to customers.. We based on methods of assessment of state-owned enterprise to evaluate performance, so we had not too many difference between each other.. ‧. The culture of Bank C1 is not clear, so we did not have culture clash problems.. y. sit. n. The superiors of Bank B would select employees of Bank B1 who they want to stay or were alienated.. Ch. Due to we had different management style from Bank C1, so the employees of Bank C1 did not adapt this changes, for example, the employees used professional title to call their colleague of Bank C1, but we used their English name to call our colleague in Bank C.. er. io. The Bank B required performance more than Bank B1, so if you could not adapt you had to leave.. al. Bank D merger with Bank D1. 政 治 大. Nat. We had different preferential and services from Bank A1, for example, we used SMS or phone call to reminder our customers when the credit card be used. Other differences included the format of bill and benefits of cards, all these let customers feel differences.. Since we had different organizational types between each other, so there was culture clash after the merger, for example, the credit card department had to do everything related with credit card business in Bank B1, but they were doing business by function in Bank B.. Bank C merger with Bank C1. 學. We only bought the credit card business from the Bank A1, so the employees of Bank A1 did not come into our company, therefore we did not consider any culture problems.. Bank B merger with Bank B1. ‧ 國. Bank A merger with Bank A1. engchi. The performance system of Bank B evaluated performance on individual, so they not due to evaluate performance difference to provide different services to customer, because these would affect their performance evaluation. 27. i n U. v. Due to the workload changed, there had some employees felt unbalance after merger, but we did not receive any customer complaints.. Bank E merger with Bank E1 Even had dissatisfied on personnel promotion for employees of Bank E1. But the employees of Bank E had huge tolerance, so there were not any culture clash problems. Even we had different performance evaluation, but all employees had to follow performance evaluation of Bank E after merger. Some employees of Bank E1 not familiar in new operation, they said they felt they had to work harder than before..

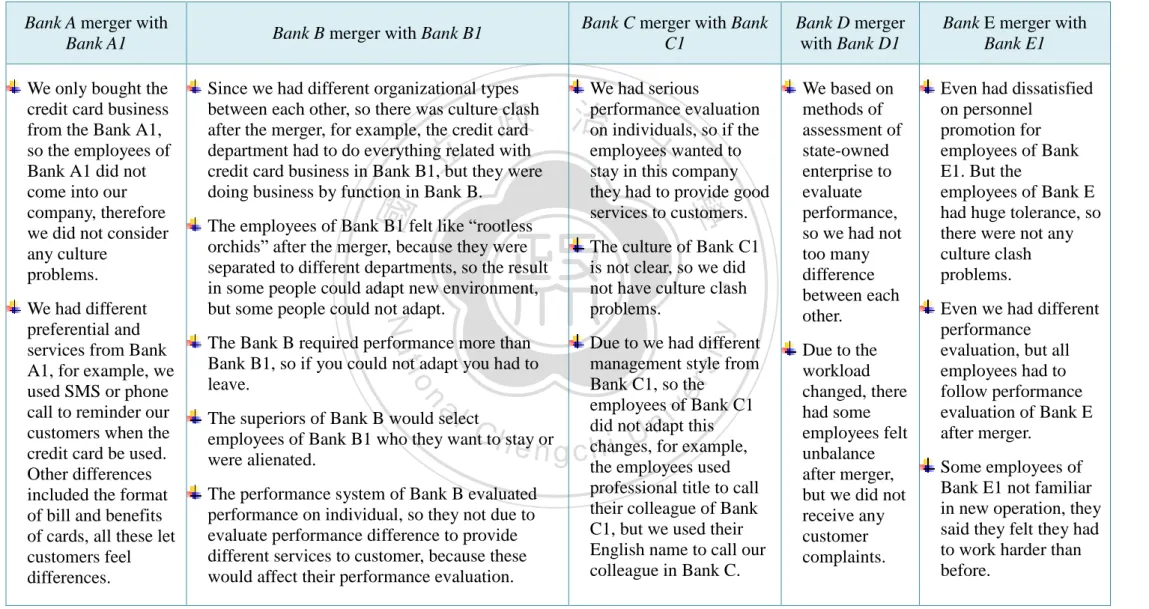

(38) Table 5-3: Process Integration. The business process used the process of Bank D, but some products we retained from the Bank D1.. The training strategy of Bank E was to exchange their employees to Bank E1, thus facilitating employee skills such as operation and process. n. Customers had different feeling in the process operation at first. For example, customers thought our desk teller were all-around know every business, because they thought the desk teller would handle every customers problems. But now, customers had to take phone call to call center of Bank B, the call center would deal with customer problems. Therefore, customers would feel not suitable on these changes.. Ch. We did education training in six months.. y. We assigned our employees to new branches teach new operation way to employees of Bank C1.. sit. io. al. Because Bank C had global standards, so the Bank C1 need changed their process to be the same as Bank C.. ‧. We used systems and processes had situation like “double track” in one year. In the education training, the superiors of Bank B1 assigned their outstanding staffs to learn new process methods of Bank B then came back to teach other people.. Nat. The PM delivered education training program to the customer services department, then they had trained front-line staffs about new customer services. The training program of customer services totally had three times in every day.. Bank E merger with Bank E1. 政 治 大. We split the training to many stages for our staff. And the superior s of Bank B assigned their trainers to train us about two months before merger. Every morning we had to study operation manuals and took test in the meeting. We had performance evaluation required on individuals, therefore everyone had different education training problem.. 立. Bank D merger with Bank D1. 學. The service process used process of Bank A.. We used process of Bank B and did very well on education training.. Bank C merger with Bank C1. er. After we bought customer lists of Bank A1, we could understand customer condition at first.. Bank B merger with Bank B1. ‧ 國. Bank A merger with Bank A1. iv. Bank n C had SOP U e n g c h i that we could follow it in every operation.. 28. We did not have SOP to follow it so we just follow the operation way from the Bank D. We took eighteen months to complete the merger. We used these months to do education training.. We took four months to do education training..

(39) Table 5-4: Technology Integration. io. al. n. The data of credit card used batches transfer to Bank B. We had two systems in a half year until the systems of Bank B was stable then shut down systems of Bank B1.. 政 治 大. We had three times technology operation tests in order to fit the technology of Bank D, and through tests could actually find operation problems then modified it as possible.. ‧. Nat. The systems we used Bank B systems, and we took one year to transfer systems, it included six months to plan the data conversion and six months to maintain systems.. Due to computers of Bank D were full load in currently and difference with Bank D1, so all systems of Bank D needed updating.. y. 立. Systems need integrated in M&A process, so the form of system documents of Bank C1 need changed to Bank C. And this changed not let every customer satisfaction, for example, almost banks had deposit book but Bank C did not provide for their customers, they only provided statements of account to customers. The customers personality of Bank C1 belonged conservative or localization, so they could not accept Bank C did not provide deposit books.. sit. Bank B only had IT operation staffs in Taiwan, and the design staffs and host computers were located in Singapore, so we systems had to connect to Singapore. Thus, the staffs had to leave when the IT complete integrated.. 學. We analyzed the reports from Bank A1 to do customer segmentation in order to understand their customer condition.. Bank D merger with Bank D1. Bank C merger with Bank C1. er. It took three months to do data conversion.. Bank B merger with Bank B1. ‧ 國. Bank A merger with Bank A1. Ch. engchi. i n U. The systems integration took six months after merger. The accounts were changed need to notice customers.. 29. v. Bank E merger with Bank E1 Our systems and specifications were used operation of Bank E. Because the customer base of Bank E1was small so even we had difference in defined data of database we also could switch quickly. We had tables include customers of Bank E1 then we would observe their consumption after merger..

(40) Table 5-5: Communication. 立. We announced three to five days in newspaper for customers and send letters to notice them can deal with business before declared date of merger.. y. sit. Due to every communication channels had different costs, so we picked up the more valuable customers to use phone call or dispatched employees to visit them and we send email to connect the customers who we thought they had little valuable, therefore all customers we had communication.. We not only ensured employees work right but also retain employees benefits and not change their work place, so employees not had dissatisfaction in merger process.. ‧. We told customers who had corporate card they could not use until changed to our credit card. And we also notified customers who had bank card of Bank B1, if they had not any comments we would change their bank card to our credit card.. 政 治 大. Because we had difference background so even we had communication with their employees before merger, but the employees of Bank C1 also opposed us. For example about email, many employees of Bank C1 could not use computers, so they could not use email in the work, therefore the clash occurred. But we had many channels for employees of Bank C1 can reflect the confusion, for example you could reflect to your senior supervisor. This shows we had good communication with employees.. io. al. n. We had a group to provide services and telephone sales for customers. They would describe the interests of credit card in welcome call then please customers used their credit card.. We belong to a foreign company but Bank C1 belongs to a local company.. Nat. If customers did not reply to the letter in two to four weeks, we would do three follow up calls, but we did make follow up calls to all customers, we only called we thought more valuable customers. We would encourage customers of Bank A1 to change their credit card to Bank A, but if they not tell us they want to cancel, we would issue our credit card automatically.. We had communication with employees of Bank B1. We told them their salary and welfare would more than before.. 學. Employees of Bank A1 sent the notice letter to tell customer that their business would change to Bank A, and the customers need to confirm this notice letter.. Bank D merger with Bank D1. Bank C merger with Bank C1. er. Because we only bought the customer lists of credit card of Bank A1, so we only announced this news for our employees, but the superiors of Bank A1 need to communicate with their employees.. Bank B merger with Bank B1. ‧ 國. Bank A merger with Bank A1. Ch. engchi. i n U. v. Because the customers main bank not Bank C1, so the customers of Bank C1 were not what Bank C wanted. We had two to three times communication with the customers of the Bank C1 at least, thereafter all customer accounts of the Bank C1 would change to Bank C. 30. The customers never complained anything after merger.. Bank E merger with Bank E1 We told employees that this policy was imperative, so even employees unwilling to merger, we also still merged the Bank E1. Due to customer base of Bank E1 not too much, so we not wanted to waste resources to maintain these customers. We did not do follow call to customers of Bank E1, we just only provided them our phone numbers of the call center. Almost all customers knew merger notice from letter, newspaper and the announcement post in every branches, just only few customers did not know because they maybe in overseas not in Taiwan, but we retain the original phone number so these people could call this phone number to find the place of original branch. The employees of branches could solve every customer problems, and we also used phone call to provide more services for more valuable customer..

(41) Table 5-6: Organizational Inertia Bank A merger with Bank A1. Bank B merger with Bank B1. Bank C merger with Bank C1. Bank D merger with Bank D1. Bank E merger with Bank E1. Employees of credit card department had to switch credit card of customer to Bank A, and the bonus would be recorded in the performance of employee of Bank A when the credit card changed success.. If your performance not good that would affect your income and the stress would bigger than before, therefore you had to be familiar with new methods in one year, if you could not adapt, you had to leave.. Due to the employees of Bank C1 older than us, so we felt difficult teaching new operation methods to them.. Since we did not worried about being laid off so even there had a little friction occurred in merger process, but in the result we had smooth integration after merger.. Due to the employees of Bank E1 not too much so we did not have adapted problems by employees.. 立 We would communicate. ‧. ‧ 國. 學. with the employees of Bank C1 and told them we would change our organization framework.. n. al. er. io. sit. y. Nat. The bonus is very important can avoid employees complain due to business increase.. 政 治 大. Ch. engchi. 31. i n U. v. The employees of Bank E1 maybe had not adapted in operation, but we gave them a period time to learn, so there not a lower service attitude..

(42) 5.2 Discussion This research is based on Tables 5-1 to 5-6, which verify six critical factors and finds other factors that affect the CRM in post-merger companies.. 5.2.1 Strategy for Rebuilding Customer Base and Service Portfolio Again, the “strategy” refers the company’s goals and direction for business integration. These strategies concern refining and maintaining the customer base, and the products and services that firms need to scrutinize in order to make a smooth transition for customer service post-merger. 立. 政 治 大. Since the Bank E’s merger with the Bank D was a policy-driven merger, so they did. ‧ 國. 學. not need to pay much attention onto their customer relationships, therefore they did. ‧. not do customer base assessments. The managers of Bank A and Bank C assessed. sit. y. Nat. their customer bases in the merger process. These two banks also focused on more. io. er. valuable customers for promotions and maintaining their customer relationships. For example, the representative of Bank A interviewed said, “we focused on potential. al. n. v i n C hthe consumption campaign,” customers of Bank A1 to promote and the representative engchi U. of Bank C said, “we found some rich or high-asset customers at first, then, according. their regional place, we notified nearby branches to do communication or promotion in the hope that these customers would return to be customers of Bank C.”. 5.2.2 Service Culture Service culture refers to how the merged organization strives to develop service and performance competencies to exceed customer expectations and create superior value to attract and retain customers after the merger. 32.

(43) Since the Bank E and Bank D were both official banks and their target company were also managed by the government, their service culture style were similar to each other, therefore they did not have culture clash. Bank B and Bank C each had distinctive service cultures. Because their organizational frameworks and services were different from the target companies, there would be culture clash after the merger. This would cause customers to get inconsistent service and have a mixed experience. For example, the representative interviewed from Bank B1 said “The employees of Bank B1 felt like “rootless orchids” after merger, because they were taken apart to difference. 政 治 大 The business departments of Bank B still kept Bank B1 system, but Bank B required 立. departments, some employees could adapt to the new environment but some could not.. performance more than Bank B1, so if you could not adapt you have to leave.” For. ‧ 國. 學. example, “The credit card department had to do all the businesses in terms of credit. Nat. sit. y. ‧. cards in Bank B1, but in Bank B they are doing by function.”. io. er. 5.2.3 Process Integration. Process integration includes business policy discussions, dataflow synchronization,. n. al. Ch. and procedure standardization which the merger. engchi. v i n firm U must. deal with to provide. consistent service to customers in order to avoid customer attrition. They must give employees continuous training in order to provide the same service quality and attitude towards customers. The process of training helps employees quickly learn in order to decrease customer inconvenience and confusion.. In our selected cases, we found that all the process integration depend on the acquiring company rather than the target company, and all the merger companies held training for their target companies. The exception was Bank A, which only bought Bank A1’s credit card business, so employees do not move to Bank A. The other 33.

(44) banks training strategy was to exchange their employees to target companies, thus facilitating employee’s skills with areas such as operation and process.. 5.2.4 Technology Integration Because each company had different IT infrastructure and systems, so technology integration can provide quality information to customer and lead customer satisfaction.. 政 治 大 larger, so they only took four months to switch and no big problems occurred in 立. Since Bank E and Bank D their customer base of target companies were not too much. merger process. The customer base of Bank B almost as large as the customer base of. ‧ 國. 學. Bank B1, therefore the data needed spend one year for conversion. In the system. ‧. transfer process, since all the documents in the Bank C1 format needed to be changed. sit. y. Nat. to the Bank C type, a lot of customers of Bank C1 were not satisfied with the change. io. 5.2.5 Communication. al. n. C.. er. and the customers would not accept only getting the statement of account from Bank. Ch. engchi. i n U. v. Communication with both employees and customers helps them understand the company’s future strategy, operation, and how they will benefit in order to ensure a smooth transition and reduce uncertainty during the period of change.. All the cases followed the standards of FSCEY in the merger process. So, they needed announcements or sent letter to customers. All the cases had communications with their customers and employees. Bank B not only took the initiative to help customers 34.

數據

相關文件

Computers, the internet and Information Communication Technology (ICT) in general is rehaping education in the 21 st Century in the same way as the printing press transformed the

Peppard, J., “Customer Relationship Management (CRM) in Financial Services”, European Management Journal, Vol. H., "An Empirical Investigation of the Factors Influencing the

This research is focused on the integration of test theory, item response theory (IRT), network technology, and database management into an online adaptive test system developed

並整合「 顧客關係管理」,以問卷調查方式,了解機械行業對「顧 客關係管理」的認知與狀況。 在前述的基礎下, 探討企業實施顧 客關係管理在

The exploration of the research can be taken as a reference that how to dispose the resource when small and medium enterprise implement management information system.. The

Mason,”Global Business Drivers:Alinging Information Technology to Global Business Strategy”, P.146 IBM Systems Journal 32(1993). Langenwalter; Enterprise Resource Planning and

“ Customer” ,employs the fuzzy analytic hierarchy process (FAHP) to develop a systematic model for the evaluations of knowledge management effectiveness , to reach the goal

However, the CRM research was seldom used by the Science Park logistic industry; this research used structural equation modeling (SEM) to research the relationship in CRM,