w3γ eMIF/ .• tn 司, J-whI AZJ 叫他丹 mj wr3 們凶, ,', 你, 0 -P M G D O G 'n

c

金融服務業之服務創新策略:

逆向產品生命週期與創新型態的觀點

Service Innovation Strategies

in

Financial Service Industry:

the Perspective of Reverse Product Cycle and Innovation Type

楊宜興 PhilYihsing Yang國立臺中教育大學事業經營研究所

Graduate Institute ofBusiness Adminis仕ation,National Taichung University ofEducation

王健航 I Jian-Hang Wang

國立清華大學科技管理研究所

Institute ofTechnology Management, National Tsing Hua Universi可 阮旺殷 Wang-YinRuan

順德工業股份有限公司研究發展部

Department of Research & Development, Shuen Der Indus仕yCorporation

摘要:服務創新相關研究日益受到重視,但過去研究多是針對製造業的產品 與製程創新討論,鮮少針對金融服務業創新做相關研究,尤其針對服務創新 策略與企業績效的研究更是稀少。本研究以逆向產品生命週期理論與創新型 態為基礎,發展一 2泌的模型矩陣,建立四種服務創新策略,色含:(1)穩健加 值策略、 (2) 新興目標策略、 (3) 興旺事業策略、以及 (4) 碩彥效率策略,並進 一步分析四種創新策略對公司績效的影響差異。本研究以台灣金融業共 189 間總公司為研究對象進行調查,首先透過六位金融業經理人的意見訪談建立 專家問卷效度。並針對全體金融業的總經理進行二波問卷發放,共蒐集 48份 問卷,回收率為 24% 。經由透過集群分析發現穩健加值策略、新興目標策略與 興旺事業策略皆存在於金融服務業。其中,穩健加值策略的企業績效是明顯

1 Corresponding author: Institute ofTechnology Management, National Tsing Hua Universi吟, Hsinchu, Taiwan, Email: sl00073802@mlOO.nthu.edu.tw

32 Service Innovation Strategies in Financial Service Industry:

the Perspective 01 Reverse Product Cycle and Innovation 砂pe

高於新興目標策略與興旺事業策略 。 雖多數企業採用破壞性創新作為服務創 新策略相關之活動,但採用維持式創新幫助金融業在績效表現卻是明顯優於 破壞性創新。本研究所提供的服務創新策略皆能夠幫助管理者思考及時回應 客戶的需求與建立其企業本身的持續競爭優勢 。 最後,本研究針對研究結果 與發現提出管理及政策意涵 。 關鍵詞:服務創新;破壞性創新;逆向生命週期;公司績效

Abstract The importance of service innovation has been widely recognized for enterprises in responding to transformational economic structure. Previous studies have focused on manufacturing industry (e.g. product and process innovation);

little theoretical and empirical works have linked with financial service industry.

Little research investigated the appropriate service innovation strategies that influence fmn performance. This study developed a 2x2 matrix and c1assified innovation strategies into four cells inc1uding: Steady Value-Added

,

Emerging Goals, Prosperous Business, and Satisfactory Efficiency according to the theories of Reverse Product Cyc1e and innovation 可pe. This study used 189 public listed financial banking firms in Taiwan as samples. Ultimately, 48 general managers as the respondents retumed valid questionnaires (a response rate of24%). Through the c1uster analysis, the strategies Steady Value-Added, Emerging Goals and Prosperous Business were c1arified. Specifically, the firm performance of Steady Value-Added Strategy was higher than those of Emerging Goals Strategy and Prosperous Business Strategy. The result shows that the disruptive innovations are the majority in Taiwan's financial market; however, the sustaining innovations have the higher impacts on firm performance than the disruptive innovations. The innovation strategies combined with customized services help financial service firms to accurately respond to customers' demands and build sustainable competitive advantages. Managerial and policy implications 企om the research findings were provided in the conc1usions.Keywords: Service Innovation; Disruptive Innovation; Reverse Product Cyc1e; Firm Performance

Chiao Da Management Review 均1.33No.2, 2013 33

1.

Introduction

Along with the transformational economic structure

,

the planning and implementation of service innovations have gained attention to help enterprises responding to market changes (Hi仗, Hoskisson,

and Ireland,

1994; Kanter,

2006; Kline and Rosenberg,

1986; Leskovar-Spacapan and Bastic,

2007; Moore,

2005; Strecker,

2009; Teece,

1996). Over the past few years,

a considerable nurnber of studies have discussed innovation as a strategy, most of them focused on manufacturing industry (e.g. product and process innovation) (de Vries,

2006; Spath and Fähnrich, 2010; Sundbo, 2007). Little theoretical work has been linked with service innovation (Strecker,

2009; Windrum and Tomlinson,

1999). Following Miles (2000), the forerunner of service innovation of, the service industry has been neglected for a long time. There has been little study of innovation in the service studies in the last decade (Miles and Boden,

2000; Tether,

Hippand Miles

,

2001).Innovative service has become of great importance as in the most developed countries

,

services sector account for about seventy percent of employment (de Vries,

2006; Drejer,

2004; Gallouj,

2002; Tether et al.,

2001). Because service innovations can create high market value,

service industries are suggested to grow in the future (Fitzsimmons and Fitzsimmons, 2010). Furthermore, according to the year 2011 Indus仕y, Commerce and Service Census announced by the Taiwan Directorate-General ofBudget,

Accounting and Statistics,

Executive Yuan in 2010,

the service industry's output value in Taiwan accounted for almost seventy percent of the national GDP. The industry of banking and insurance (i.e. tinancial service industry) had the highest output value within the service industry in Taiwan. In fact

,

of the nominal GDP in 2010, it accounted for ten percent of the national GDP, showing the importance of the tinancial service industry.

The Taiwanese tinancial service industry plays an important role in the development of the economy (Chiou, 2009). The fmancial service indus甘Y 1S one of important platforms for savings or ventures, and it is also a crucial factor impacting the economic growth. However, in such a competitive environment with

34 Service lnnovation Strategies in Financial Service lndustη1: the Perspective 01 Reverse Product Cyc/e and lnnovation 砂pe

environmental uncertainty

,

the competition in the financial service industry is g becoming more intensive than ever. Because of the dramatic transformation in the market, as well as a variety of methods for investment; therefore, the financial service industry is starting to become aware of the importance and essentiality of service innovation (Vermeulen and Ra泊, 2007). To gain more advantages from service innovation strategies and predict the outcome of competition in such a race for innovative growth, Christensen (1997) proposed the “Disruptiνe Innovation "model from the perspective ofboth disruptive situations and sustaining situations to help growth builders shape their s仕ategi郎, so that they pick disruptive fights th剖 they can win. In particular, with the turbulence triggered by the economic shock since 2008

,

it is a critical point to face the uncertain times in the financial indust可 Therefore, it is necessary to achieve prosperous operational strategy which isstrongerthan

“

Disruptive Innovation Thinking" and can deal with the market in a flexible way (Anthony,

2009).Furthermore

,

in regard to the environment in the fmancial industry,

Barras (1986, 1990) observed a different feature of the product cycle in the financial industry-“

Reverse Product Cycle". Barras explained that the process of serviceinnovation in fmancial accountancy and administrative service is the reversal of that observed in the manufacturing sector. This also has an impact on output and employment. Moreover, investment in more new technologies could have the effect of capital widening. Generally

,

with the technological improvement and changes of the reverse product cycle, financial innovation has been one of the most influential trends prevailing in intemational financial markets since 1990s. For examples,

Euromarkets business,

contingent banking,

bank assets securitization and derivative instruments,

all have reflected the increasing importance of financial innovation (Molyneux and Shamroukh,

1999).However

,

so far the study of service innovation strategy has been superficial (Tether, et 瓜, 2001; Thrane, Blaabjerg and Moller, 2010). In addition, developments in fmance service innovation have played a critical role in spurring economic and social growth (Plosser,

2009),

but the importance of challenges and obstacles about service innovation in financial industry was got attention until the globaChiao Da Management Review Vol. 33 No.2, 2013 35

few to investigate the appropriate strategies of service innovation according to indus仕y's environment of opportunity with threat

,

and how to implement an appropriate service innovation strategy. To fill up the research gap and builds the appropriate strategies for financial service indust句, this study first build a 2x2 matrix and classify service innovation into four cells from the innovation theories of“

Disruptive Innovation" and“

Reverse Product Cycle". N ext, by using the企amework, this study also analyze and measure performance of these four service innovation types in fmancial industry in Taiwan in terms of the four different constructs. Practically, this study except all these service innovation strategies combining innovative services and customized services help financial service fmns to accurately response customer's demands and as a result build sustainable competitive advantages.

The remainder of this study is organized as follows. Literature reviews are presented in Section 2. Research methods are explained in Section 3. Research analysis and results are in Section 4. Finally

,

conclusions and research limitations are proposed in Section 5.2. Literature Review

2.1

The Financial Industry in Taiwan2.1.1 Environment of the Financial Industry

F or the national economy, the financial indus甘ynormally serves as the main intermediary institution of finance and cuηency. Its operation has great inf1uences on the society and people's livelihood. Taiwan's financial environment and rules are different 企omthose of other countries. To create more competitive advantages

,

the government has developed great forms and regulations to promote linkages with other countries since 2002.According to the

“

Standard Occupational Classification" from the National Statistics,“

Financial and insurance" is one of the industries within standard industrial classification. The definitions of“

Financial and Insurance" giving in the36 Service Innovation Strategies in Financial Service Industry: the Perspective of Reverse Product Cycle and Innovation 砂pe

National Statistics 泊,“the activities which engage in financial intermediary and auxiliary activities (including insurance and pension funds). Activities of holding assets like financial holding companies, and 甘囚的, funds and other fmancial vehicles are also classified in this activity. " Generally, the range of the financial industry includes deposit institutions, financial holding companies,仕usts ,自mds and other financial vehicles, personal insurance, property and liability insurance, remsurance

,

etc.According to gross domestic product information from the

“

Monthly Bulletin ofStatistics" ofthe National Statistics,

the service industry occupied from 67% to 68% of the GDP 企om2002 to 2009 among all industries. In particular, the percentage of the financial indus甘y in service industry also has made minor progress in recent years. The gross domestic product of the fmancial industry reached 10%. Moreover,企om 2000 to 2009, the total number of financialinstitutions increased 企om2,693 to 4,539. With regard to insurance, according to the Taiwan Insurance Institute statistics, from 2000 to 2010, the insurance density, insurance penetration and ratio of having insurance coverage reached NT$l 04,423, 17% and 210% respectively indicating the maturity and importance of the fmancial industry in Taiwan.

2.1.2 Development of the Financial Industry

The economic structure in Taiwan has changed along with social deve10pment. In Taiwan, the fmancial environment endured three important reforms. First, the R.O.C. government announced the Commercia1 Bank Establishment Promotion Decree in order to open up the financial market in 1991. The government then invited domestic and foreign investors to participate in Taiwan's financial industry and set up new

,

privately owned commercial financial firms since 1992. Second,

the Asian financial crisis in 1997 affected the operation of Taiwan enterprises, and also inf1uenced the financial industry. Third, after fmancial deregulation,

excessive opening of new financial frrms and foreign fmancial firms lead to fierce competition in the fmancial indus的'. Moreover, the government passed the Bank Mergers and Acquisitions Act,

and Financia1 H01ding Company Act in December 2000 and July 2001.Chiao Da Management Review Vol. 33 No.2, 2013 37

development of the financial industry. First, the government has formed the

regulations to abide with BASEL 11 and adjust the rates of Taiwan's financial

institutions to stimulate trade with other countries. Second

,

the government haspushed the policy of c。中orate govemance and strengthened the intemal

management system of all fmancial institutions. Third, it has relaxed the limits of

recruitment ofthe employees from abroad. Fourth, to expand the economic scale of

the financial industry in Taiwan

,

the government has also encouraged the mergingof financial institutions and opening up of cross-business operations in order to achieve the goals of integration and macro-scale operation of the financial industry ofTaiwan. In particular,“The Financial Region Service Center Plans" have focused on the five financial directions to enhance the intemationalization of the financial

market of Taiwan. This major policy plan has been in practice since 2005.

Moreover

,

the plan for national development in the financial market in 2010 isintended to guide the course of national development and improve efficiency in the utilization of total resources.

The competition in the financial industry is gradually getting more intensive,

because of the dramatic transform in the market and the variety of methods used to

invest. Innovative and versatile financial products have evolved due to the

globalization and intemationalization of the financial market Service innovation

strategy is a useful means that transforms invisibles property into visible property.

The successful operation of business does not just depend on economic prosperity,

though the boom and bust of prosperity cannot be controlled. Therefore, service

innovation strategy is the most vital subject for the financial industry today.

2.2

The Conceptions of Service InnovationIn the past

,

services were long thought to be laggards with regard toinnovation (Berry et al., 2006) 一 theywere assumed to be uninteresting adopters of

existing technologies rather than producers of new technology (Salter and Tether

,

2006). The literature on service innovation was scarce, and it seemed to be difficult

to understand the use oftraditional innovation theories and typologies (Damanpour

,

1991); it presupposed that service firms do innovate (Normann, 1991, 2001) or

38 Service Innovation Strategies in Financial Service Industry: the Perspective 01 Reverse Product Cycle and Innovation 1}μ

This perception still exists

,

and is a major reason why innovation in services remains under-researched. Although some studies have presented the empirical results ofinnovation activities in service firms (Barcet et al., 1987; Naslund, 1986),they have not discussed the reasonableness of presupposing that innovation is happening in service firms. However, services dominate advanced economies. Therefore

,

many scholars have begun to notice innovation activities in service.According to the work of Gallouj and Weinstein (1997), service innovation can inf1uence one or more organization structures or organization characteristics

,

including technology, service, and core competency. Also, they discussed changed service concepts or service delivery processes that deliver added value to the client by means of new or improved solutions to a problem

,

methods of improving performance,

or a desired opportunity for consumption or consumer services (Tidd and Hull,

2003). It has also been suggested that service innovation refers to a novel or considerable change of service concept,

leading to renew service functions that depend on new technologies and organizational competences to bring a brand new activity to a frrm, as well as new offerings to the market (A此, Broersma, andHert嗯, 2003). On the other hand, service innovation represents new or

considerably changed service concepts or service delivery processes that deliver added value to the client by means of new or improved solutions to a prob1em, methods of improving performance, or a desired opportunity for consumption or consumer services (Tidd and Hull, 2003). Additional旬, previous research has

argued that service innovation takes various forms because of its multidimensional nature as well as the enormous number of different 可pesof services that exist in the markets (Sundbo, 2007). Referring to the efforts of Sirilli and Evangelista (1998),

service innovation characteristics involve close interaction between production and consumption, high information content and the intangible nature of service output and the key role of human resources in the provision of services. Gallouj (2002)

also claimed that innovations involve intangible processes with specific features and interaction with several parties,可pically the service provider and customer, participating in the innovation process.

Chiao Da Management Review Vol. 33 No.2, 2013 39

2.3

The Conceptions of Disruptive InnovationThe concepts of disruptive innovation and sustaining innovation were popularized in the prior studies (Bower and Christensen

,

1995; Christensen,

1997; Christensen and Bower,

1996; Christensen and Overdorf,

2000; Christensen and Raynor, 2003). The differences are rooted in companies' track records at making effective use of sustaining and disruptive innovation. Sustaining innovation are innovations that make a product or service better along the dimensions of performance valued by customers in the mainstream market. Disruptive innovations bring to market a new product or service that is actually worse along the metrics of performance most valued by mains仕eam customers. Instead of devoting efforts to improving the performance attributes uniquely associated with the sustaining innovation,

tirms should focus on likely adopters and growth segments to promote disruptive innovations. The enterprises managers need to do more than assign the performance about service; 臼rthermore,they need to be sure that the organization in which those innovation resources will be working is itself capable of succeeding and in making that assessment.Disruptive innovation is detined as

“

the process by which an innovation transforms a market whose services or products are complicated and expensive into one where simplicity, convenience, accessibility, and affordability characterize the indust可" (Christens凹, 1997; Christensen and Rayn肘, 2003; Christensen, Roth,and Anthony, 2004). The the。可 of disruptive innovation helps explain how complicated

,

expensive products and services are eventually converted into simpler,

affordable ones.

2

.4 The Conceptions of Reverse Product CycleThe theory of reverse product cycle was proposed in the research of Barras (1986, 1990). This the。可 isbased on a large-scale empirical study carried out in the tinancial industry and administrative service. The reverse product cycle can be divided into three stages, including Improved Efficiency, Improved Quality and New Products/Services. The technology wave is an important factor. According to this idea, the model of reverse product cycle is followed by a product cycle. This

40 Service /nnovation Strategies in Financial Service /ndustry.

the Perspective 01 Reverse Product Cycle and /nnovation 砂>pe

theory is based on the development of technological revolutions in the manufacturing industry, and it can be further applied to the service revolution. 1n Barras 's (1990) model, the cycle of service innovation activities include three stages, 1ncremental Process, Radical Process and Product 1nnovation.

Stage 1: 1mproved Efficiency. The frrst stage is where the applications ofnew technologies are designed to increase the delivery efficiency of existing services. The first steps along the tr旬的tory are the most tentative. These steps apply the technology to obtain the simplest and most incremental process innovations, which are aimed at improving the efficiency and reducing the costs of delivery of existing products. At this stage, although it is the initial stage, the frrm can accumulate more knowledge and experiences 企om using new technology systems to enhance the abilities of innovation technologies in the future. Therefore

,

as for the impacts of the product factor in service, the feature of the frrst stage of reverse product cycle is improved efficiency,

which reduces the labor cost and widens the market for the firm's products.Stage II: 1mproved Quality. 1n the second stage, the technology is applied to improve the quality of services, rather than to reduce the firm's cost. Firms become more proficient at making use of new service technology systems through the experiences gained during the first stage and place stress on quality improvement.

For example, on-line insurance policy quotations and Automated Teller Machine (ATMs) are all type of improved quality. Barras (1990) suggested that the -leaming curve is a key point for changing operating procedures 企omthe frrst stage to the second stage. The leaming curve can enhance firm's innovation strength for service and strengthen abilities

,

creating foundation for developing service innovation opportunities. Due to the continuously changing environment,

individual firms do not tend to move at a uniform rate along the tr句 ecto月r of innovation being mapped out within the indus句. Therefore,

more initiative and conscious activity related to innovation or RandD are carried out during the second stage. Moreover, improved quality can also increase the market share and make a difference in the service provided to the others.Stage 1II: New Products/Services. In the final and third stage, technology assists in generating wholly transformed or new ser

Chiao Da Management Review Vol. 33 No.2, 2013 41

stage is creates more new market opportunities 企om product innovation or new services. Typical旬, the service industry has initially involved a mixture of technology monitoring and market research

,

so that firms can better appreciate their changing technological possibilities and market conditions 的 this stage (Ba叮as,1990). Furthermore, Barras (1986, 1990) pointed out that the technology of networks has a hand in assisting fmns to develop the opportunities of new services, which also provide more innovation strategy to face the market. By this stage

,

the technological trajectory in the vanguard industries can be described as being“

user dominated rather" than“

supplier dominated'\ It is through these accelerating processes of technological, market and institutional change that the vanguard industries do much to determine the character of the new techno-economic paradigm,

creating opportunities for. much wider spread of product innovations among other industries (Ba叮as, 1986, 1990).2.5

Firm PerformanceIn the current environment, business leaders and managers are constantly struggling to introduce new products

,

processes and service innovations. Previous research has revealed that service innovation activities have positive impacts on 跆ms' performance (Govindarajan and Kopalle, 2006; Prajogo, 2006; Shelton, 2009). Examples of this view of include product development process (B句句,Kekre, and Srinivasan, 2004), product design and customer feedback (Srinivasan, Lovejoy and Beach, 1997), and diffusion ofinnovations (Golder and Tel1is, 2004). Therefore, to face uncertain situations, firms' service innovations activities not only pursue survival, but also obtain more performance in the market. Prajogo (2006) pointed out the significant attributes of firm performance by comparing relationship between manufacturing and service firms; four concepts, including the number of innovations, the speed of innovation, the level of innovativeness, and the level of aggressiveness in adopting or generating innovation

,

were the most specific ways to exam the innovation activities in the service industry. Prajogo (2006) further adopted the financial performance concepts of sales growth, market share and profitability to measure the firm's performance.42 Service lnnovation Strategies in Financial Service lndustry: the Perspective 01 Reverse Product Cycle and lnnovation 砂>pe growth, rnarket share and profitability to rne部urefmns' perforrnance (e.g., Keah, Lyrnan, and Wisner, 2002; Michael, Jeen-Su, and Mark, 2005; Prajogo, (2006). However, for the service industry

,

service innovation could lead to rnore advantages not only for financial perforrnance, but it could also irnprove custorner satisfaction, service quality, or create a new rnarket and corporate irnage (Johne and Storey, 1998). Therefore, Johne and Storey (1998) suggested th前 the service innovation activities irnpacting fmn perforrnance rnight include fmancial perforrnance, the relationship with custorners and rnarket position. Furtherrnore, Storey and Easingwood (1998) pointed out that unlike cornpanies that produce tangible goods, service fmns typically cannot rely on product advantages as a rneans for ensuring the success of a new service, and also rnentioned three elernents (service product, service augrnentation and rnarketing support),

which have heavy irnpact on fmn perforrnance in the service indust可. Therefore, Storey and Easingwood (1998) provided three conceptions of rneasurable standards to rneasure firrn perforrnance in relation to service activities in the service indust旬的 follows.Sales perforrnance and irnprovernents in sales are very rnuch driven by irnprovernents in service augrnentation. Better sales perforrnance is driven by the strength and effectiveness of dis甘ibution and cornrnunication strategies. However, distribution and cornrnunication strategies are not able to sel1 a poor product. In addition

,

a forrnal and extensive launch strategy can have a strong irnpact on sales perforrnance. Gradually rolling out a new product rnay give the cornpetition tirne to react and affect sales.Profitability is all about better service augrnentation and good rnarketing suppo此In order to achieve high profits, cornpanies rnust effectively rnanage the quality of their service delivery. This is dependent on the skills and knowledge of the custorner contact staff. To ensure high-quality service delivery, intemal rnarketing and extensive staff 仕aining rnust take place. This shows that delivering is not a cost but a route to increased profitability.

Enhanced opportunities are what rnanagers want to reposition their cornpany, open up new rnarkets, develops platforrns for further new products. They can achieve these goals by producing a high quality, distinctive product and by

Chiao Da Management Review Vol. 33 No.2, 2013 43

reducing the customers' perceived risk. Core products are capable of opening up enhanced opportunities. For long-term success

,

spending time and effort in create a product with significant an advantage over current products is necessary. In financial services this may be difficult but the rewards are considerable.To ensure more accurate measurement of firm performance and service innovation activities in the service industry, only using financial performance to examine the relationship is not a useful way to understand the difference between the two. In particular, the characters of intangible, perishable, heterogeneous,

participated and not-separated products are all difficult to measure in the financial service indus的r. Therefore

,

the three conceptions of measurable standards proposed by Storey and Easingwood (1998) are more suitable for exploring the di能rences between different service innovation activities in the financial service industry.3. Research Methods

3.1

Research Design

This study developed a conceptual framework from innovation theories to enhance the scope of classifications of service innovation 的ategies for the financial industry. This study suggested that disruptive innovation can provides enterprises with viewpoints about strategy. Moreover, classification of disruptive innovation and sustaining innovation also offered important meaning in a competitive market. Furthermore, this study contained the dimension of reverse product cycle the。可 to give companies an assessment of service innovation strategy when facing challenges and opportunities in the market.

Dimension 1..Type

01

innovationAccording to the definitions of innovation by Christensen

,

companies have different track records when it comes to making effective use of sustaining and disruptive innovation. Sustaining innovations are innovations that make a product or service better along the dimensions of performance valued by customers in the44 Service lnnovation Strategies in Financial Service lndustry: the Perspective 01 Reverse Product Cycle and Innovation 砂pe

mainstream market. Disruptive innovations bring a new product or service to the market that is actual1y worse along the metrics of performance most valued by mams仕eamcustomers. Managers need to do more than assess the performance of service

,

they also need to be sure that the organization in which those innovation resources are working is itself capable of succeeding and in making that assessment.Dimension 2: Improvement on service

The the。可 ofservice innovation in a reverse product cycle points out service improvement intends increase service efficiency and create new services. This the。可 explainsthat the processes of services are the opposite of those observed in the manufacturing industry. It starts with incremental innovations intended to improve efficiency

,

and ends with the innovation conceiving a new service and entering new markets. As suggested by Barras (1986,

1990),

there are three s個ges in Reverse Product Life Cycle. Since the first stage and second stage are more similar than the third stage. Specifical1y, Stage 1 and Stage II focused on service improvement are different from Stage III that is focused on new service provision. To align with our tentative matrix of service innovation strategy as shown in Figure 1, this study argued a dichotomy of service orientation to distinguish these stages.This study depicted a 2x2 matrix in Figure 1. In the cel1 of Prosperous Business strategy, financial firms are providing new service with sustaining innovation to the existing customers who require less consistency. For example,

Firm 13 provides cash cards- A Comb Card in year 2004 which provide short-term funds with flexible application procedure for borrowers. In the cel1 of Emerging Goal strategy, fmancial fmns are providing new service with disruptive innovation to the potential customers who are unsatisfied with the available service provisions. For instance, Firm 2 has introduced personal service with Customer Relationship Management system in Children's Saving Accounts in year 2000. Unlike Emerging Goals仕ategythat aims to explore new markets with disruptive innovative services

,

Prosperous Business strategy is expected to create value-added services as long as the current service efficiency or service model cannot satisfy the dominant customers.Chiao Da Management Review Vol. 33 No.2, 2013 Service E丘lClency Improvement on Service New Service Figure 1

Classification of Service Innovation Strategy

Satisfactory Steady Efficiency Value-Added

Prosperous Emerging Goal Business

‘

Sustaining Disruptive Types of Innovation 45'

In the cell of Satisfactory Efficiency strategy, tinancial tirms are improving service efficiency with sustaining innovation to the existing customers who require consistent and standardized services. By conducting this strategy

,

tinancial tirms are expected to enhance their market shares and overall performances based on the target customers. In the cell of Steady Value-added strategy, tinancial tirms are improving service efficiency with disruptive innovation to the potential customers who require consistent and standardized services. For example, not like the most banks focus on VIP customers, Bank 3 provided fmancial management services in 2001 to the regular customers. Unlike Satisfactory Efficiency strategy that aims to exploit the existing markets with sustaining innovative services,

Steady Value-added strategy is expected to explore new market by providing the new service with improved service efficiency.Furthermore

,

Cainelli,

Evangelista,

and Savona (2004) suggested a positive relationship between service innovation and firm performance in the service46 Service lnnovation Strategies in Financial Service lndustη1: the Perspective

0/

Reverse Product Cyc/e and lnnovation 砂pepointed out that the banks, which are conscious of the aspect of innovation

activities, have higher performance than other competitions. Moreover, Alegre,

Lapiedra

,

and Chiva (2006) argued that innovation efficiency reflects the efforts toachieve high degree of success and innovation. Thus, when a frrm 仕iesto improve

its performance

,

it may be doing so far various reasons: reinventing business忱的gy (Johnson, Christensen and Kagermann, 2008), disruptive change

(Christensen and Overdorf, 2000) and process and value fitness on innovation

(Christensen and Raynor, 2003). Therefore, this study proposed that service

innovation is positively associated with firm performance. Figure 2 summarizes the 企ameworkof this research.

LA V 且 o w oiv 2m BLWVa zF F 叫 到個 nr ρ 』 P •• n o

c

、石〉

〈…叫ce

3.2

Sample Firm Selection,

Data Collection and Pilot StudyThe surveys in this study focused on the public1y listed companies that offer

financial productlservice dis仕ibution. These inc1ude large and diverse commercial

and state-own financial institutions in Taiwan serving c。中orate and consumer

Chiao Da Management Review Vol. 33 No.2, 2013 47

mortgage banking over a wide geographic region. The scope of the financial industry is based on the Taiwan Stock Exchange Corporation and Gre Tai Securities Market which includes deposit institutions, financial holding companies,

仕usts, funds and other financial vehicles

,

personal insurance,

property and liability insurance,

reinsurance,

etc. Furthermore,

to analyze the influence of firm performance on different service innovation strategies,

this study adopted the“

headquarters" to examine the financial holding companies classified as banks, life insurance,

property insurance and securities corporations. There are a total of 189 companies. Besides, this study also examines Taiwan's financial state-owned enterprises. According to the Council for Economic Planning and Development,there are 9 such companies belong to the fmancial industry. Thus 198 companies were included selected in the sampling in this study.

This study focused on decisions related to service innovation and how degrees of firm performance form four service innovation 的ategies. The questionnaire measured firm operational policy and operational performance. To ensure that respondents who are capable to answer the questions, only the stratum of manager and above were addressed

,

including CEO,

vice president,

etc. The definition of manager in this study is the top managers who has had a minimum of 5 years of experience in the financial indus仕y and takes part in or understand the firm's operational service innovation strategy. Managers must also understand the relationship between service innovation strategy and firm performance.Moreover

,

to achieve a more congruous survey and explore the results of previous studies of service innovation, the construct of interest must be measured as accurately as possible. Although most of the measures were adopted 企om existing scales,

in some cases,

an existing scale was not directly adopted as a whole,

or combinations of items from different scales were adopted in this study. Therefore,

this study also systematically piloted the questionnaire to refine and validate s叮veyin order to increase the context validity the of research instrument 企omthe survey based on expe此 interviews. Intemal consistency reliabilities were obtained for each of the measures. The expert interviews include 6 managers working for at least 4 different companies,

including banking,

insurance an48 Service lnnovation Strategies in Financial Service lndustry: the Perspecti阿 0/Reverse Product Cycle and lnnovation 砂pe

pilot study inc1uded 1 female and 5 male with an average age of 45 years. After the above pilot of expert interviews, the questionnaires survey were fmally sent to 198 respondents ofthe general survey along with a cover letter outlining the objectives of the research and a self-addressed stamped return envelop. The respondents were also promised and eventually received an executive summa可 of the research findings. Two rerninder / thank you postcard mailings were sent at two and three week's intervals respectively after the initial mailing. After a total oftwo rounds of mailing, 48 questionnaires were completed and retumed, resulting in an overall response rate of24%.

3.3

Characteristics of RespondentsThis study presents a demographic description of the 48 respondents made up of 20 general managers (4l.7%), 2 deputy general managers (4.2%), 12 managers (25%), 3 assistant managers (6.3%) and 11 others (22.9%). The average number of years working in the financial industry for the respondents was 23.8

years. 5 respondents came 企om state-owned enterprises (10.4%) and 43

respondents were from private enterprises (89.6%). Moreover

,

26 respondents (54.2%) were from the banking sector, which was the largest group ranked by industry status. 6 respondents (12.5%) were from the insurance sector, 10 respondents (20.8%) were 企om the securities sector, and 6 respondents (12.5%) were 企omthe other sectors. Regarding the firm age, 32 (66.7%) respondents were located in the age more than 31 years. 8 (16.7%) respondents located 11-20 years, 6 (12.5%) respondents located 21-30 years, and only 2 (4.2%) respondents located less than 10 years.4. Research Analysis and

Results

4.1

Validity Checks and Correlation AnalysisAfter the data were obtained, this study conducted an exploratory factor analysis of the variables of all the concepts. To verify the discrirninant validity of

Chiao Da Management Review Vol. 33 No.2, 2013 49

the constructs, this study examined the data by using the Kaiser-Meyer-Olkin (KMO) measure of sampling adequacy. The KMO measure indicates the comparable value between all interrelated coefficients and net interrelated coefficients (Hair et al., 2009). As shown in Table 1, all the KMO values were greater than 0.6, showing that the variables are appropriate for conducting factor analysis.

Service Innovation Innovation Level Improvement on Service Firm Performance

Table 1

KMO value of All the Dimensions

Dimensions KMO

.914

.811

751 .848

This study focused on the four dimensions of

“

Service Innovation",“

Service Types",“

Reverse Product Cycle" and“

Firm Performance" to conduct exploratory factor analysis,

via the principal component and varimax methods offactor analysis to examine variables. All of the variables were based on a six-point Likert-type scale rating from“

strongly disagree" (1) to“

strongly agree" (6), except for background information. First, about the concept of service innovation, the factor loadings all exceeded 0.5 and the eigenvalue reached 1.465. Moreover, the cumulative percent age of explanatory variance reached 78%. And the Crobach's alpha of this dimension achieved 0.93, which meets the standard as suggested by Hair et al. (2009). Secondly,

the factor loadings all exceeded 0.6 and the eigenvalue reached 4.343. Moreover, the cumulative percent age of explanatory variancereached 62%. And the Crobach's alpha of this dimension achieved O. 紗, which meets the standard as suggested by Hair et al. (2009). Third, about the concept of reverse product cycle, the factor loadings all exceeded 0.6 and the eigenvalue reached 3.214. Moreover, the cumulative percent age of explanatory variance

reached 64%. And the Crobach's alpha of this dimension achieved 0.83, which meets the standard as suggested by Hair et al. (2009). Ultimately, about the concept offirm performance, the factor loadings were all exceeded 0.7 and the eigenvalue

50 Service lnnovation Strategies in Financial Service lndustry: the Perspective 01 Reverse Product Cycle and lnnovation 砂'Pe

was reached 6.006. Moreover

,

the cumulative percent of explanatory variance reached 66%. And the Crobach's alpha of this dimension achieved 0.93,

which meets the standard as suggested by Hair et al. (2009). In the following, the study discussed the correlation analysis of the dimensions about service innovation, type of innovation,

improvement on service and firm performance. The result of correlation analysis was shown in Table 2.Table 2

Means, Standard Deviations

,

and CorrelationsaVariables Mean S.D. 1 2 3 1. Service Innovation 4.56 .877 2. Type ofInnovation 4.17 .85 .743.. 3. Improvement on Service 4.27 .89 .819.. .710.. 4. Finn Performance 4.64 .76 .678.. .658.. .693.. Note: 邪~=48 *p < .05,

**

p < .01; two-tai1ed testsAs for the concept of service innovation, the average number of service innovations was 4.56 with a standard deviation ofO.887. Positive correlations were shown foe all the variables. Specifically, the correlation coefficients of service types, reverse product cycle and firm performance were 0.743, 0.819 and 0.678 with a statistical significance of positive correlation (p < .05). These numbers indicate that the service innovation dimension was positively related to the service 可pes,reverse product cycle and firm performance. The average number of service 可pes was 4.17 with a standard deviation of 0.85. Positive correlations were shown for all the variables. Specifically

,

the correlation coefficients of service innovation,

reverse product cycle and fmn performance were 0.743,

0.710 and 0.658 with a statistical significance ofpositive correlation (p < .05). These numbers indicate that the service 句中的 dimension was positively related to service innovation, reverse product cycle and firm performance.Chiao Da Management Review Vol. 33 No.2, 20 J 3 51

Furthermore,的 to the concept of improvement on service, the average number of reverse product cycles was 4.27 with a standard deviation of 0.89. Positive correlations were shown for all the variables. Specifically, the correlation coefficients of service innovation, service types and fmn performance were 0.89,

0.710 and 0.693 with a statistical significance of positive correlation (p < .05). These numbers indicate that the reverse product cycle dimension was positively related to service innovation

,

service types and firm performance. As for dimension of fmn performance,

the average number of service types was 4.64 with a standard deviation of 0.76. Positive correlations were shown for all the variables.Specifically, the correlation coefficients of service innovation, service types and reverse product cycle were 0.678, 0.658 and 0.693 with a statistical significance of positive correlation (p < .05). These numbers indicate that the firm performance dimension was positively related to service innovation, service 可pes and reverse product cycle.

4.2

Cluster AnalysisBefore clustering all ofthe samplings, this study discriminated the firms with low participation in service innovation. This study first identified the firms in adopting service innovation strateg悶, and eliminated the firms with an average number of service innovation concepts lower than 3. Therefore, 47 fmns focused strategies related to service innovation, thus, conforrning with the pu中oseofthis study. This study used two stages to present the results. In the first stage

,

the Ward's method of hierarchical clustering was applied to consolidate the groups before clustering. Further, in the second stage, the K-means algorithm was selected to conduct cluster analysis due to its efficiency in clustering large data sets and its simple calculation process. The four service innovation strategies were used for cluster analysis. For con仕actors with different backgrounds, their service innovation strategic behaviors are different. Therefore,

the contractors were classified into different groups with different strategic orientations based on cluster analysis.52 Service Innovation Strategies in Financial Service Industry: the Perspective 01 Reverse Product Cyc/e and Innovation 砂pe

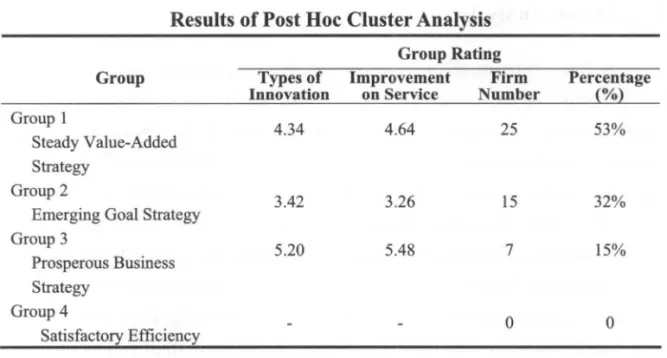

Table 3 shows the 可pesof innovation and improvement on service scores for the four clusters centers. The steady value-added strategy of group 1 consisted of 25 fmancial firms

,

which had higher ratings on types of innovation (i.e. focus on disruptive innovation) and improvement on service (i.e. focus on service efficiency). The emerging goal strategy of group 2 consisted of 15 financial fmns,

with higher ratings for 可pesof innovation (i.e. focus on disruptive innovation) and lower ratings for improvement on service (i.e. focus on new service). The prosperous business strategy of group 3 consisted of 7 financial fmns with lower average ratings for both 可pes of innovation and improvement on service concepts (i.e. focus on sustaining innovation and new service). And finally

,

for the satisfactory efficiency strategy, none ofthe respondents of fmancial fmns focused on sustaining innovation and service efficiency. The dendrogram using the Ward's method is shown in Appendix 1.Table 3

Results of Post Hoc Cluster Analysis Group Rating Group Group 1 Steady Value-Added S仕ategy Group 2

Emerging Goal Strategy Group 3

Prosperous Business Strategy

Group 4

Satisfactory Efficiency

Types of Improvement Firm Percentage Iooovatioo 00 Service Number (%)

4.34 4.64 25 53%

3.42 3.26 15 32%

5.20 5.48 7 15%

o

0Besides, this study also used discriminant analysis to test the results of K-means algorithm of cluster analysis. In frrst row

,

SPSS reports the overall Wilk's Lambda,

A = 0.16,

X2= 77.00,

p < .01. This test was significant at the 0.05 level and indicates that there were differences among groups across the three predictor service innovation strategies in the population. In the second row,

SPSSChiao Da Management Review Vol. 33 No.2, 2013 53

reports A = O.鉤,X2 = 5.48, P < .01. This test was si伊ifica凶 atthe 0.05 level and indicates that there was a significant difference among groups across all predictor variables in the service innovation strategies, after removing the effects associated with the first discriminant function.

4.3 Analysis of Variance (ANOV A)

The respondents were grouped into Steady Value-Added S仕ategy,Emerging

Goal Strategy and Prosperous Business Strategy. A summary of the grouping is shown in Appendix 2. It indicates that 25 Steady Value-Added Strategy firms constitute the largest group (53%)

,

followed by 15 Emerging Goal Strategy (32%) firms, 7 Prosperous Business Strategy (15%) firms and 0 Satisfactory Efficiency Strategy firms. Before conducting ANOVA to explore the fmn performance of different strategies,

three preconditions should be tested: multivariate normal distribution, homogeneity of variance test and independence. First, about multivariate normal distribution,

The Kruskal-Wallis test indicates that there was a significant difference in the medians, X2 = 4.93, p = .85. Because the overall testwas significant, pairwise comparisons among the three strategies should be conducted. Second

,

about homogeneity of variance test,

the rest of homogeneity of variance was not si伊ificant, Levene statistic values = .78,

P = .46. Becausethere may be a lack of power associated with the test due to the small sample size

,

the result of the homogeneity test dose not necessarily imply that are no di能rences in the service innovation strategy variances. About independence,

this study used Durbin-Watson statistic to detect the presence of autocorrelation. The D-W test = 2 indicates no autocorrelation in this study. Therefore, the variables ofthis study were suitable to use the ANOVA.

Table 4 indicates the firm performance of different strategies

,

inc1uding Steady Value-Added Strategy,

Emerging Goal Strategy and Prosperous Business Strategy. This study showed that Prosperous Business Strategy created better firm performance (M = 5.47) than th剖 ofSteady Value-Added Strategy (M = 4.85) andEmerging Goal Strategy (M = 4.00). The ANOVA test showed that the groups of strategy differences in firm performance were significant (p < .001). By conducting Sche缸's test

,

this study confirmed that Prosperous Business Strategy had54 Service Innovation Strategies in Financial Service Industry: the Perspective 01 Reverse Product Cycle and Innovation 抒pe significantly higher firm performance than the Steady Value-Added Strategy,

Emerging Goal Strategy and the Emerging Goal Strategy. The results revealed that the fmancial frrms

,

which adopted both the concepts of sustaining innovation and new service of Prosperous Business Strategy, had higher firm performance in Taiwan's financial environment. In contrast,

the profile offirm performance for the Emerging Goal Strategy had the lowest rating performance among three service mnovatlOn strategles.Table 4

Service Innovation Strategies on Firm Performance

Scheff's Subgroup 們) Mean S.D. F-value

test l.Steady Value-Added S仕ategy(25) 4.85 .54 21.66*** (1) > (2)

(1)<(3)

2.Emerging Goal S仕的egy(15) 4.00 .57 (2) < (1) (2) < (3)

3.Prosperous Business Strategy (7) 5.47 .34 (3) > (1) (3) > (2)

Note: *** p < .001

Furthermore, this study examined the profile of frrm performance conceptions for different service innovation strategies. Table 4 showed that Prosperous Business S仕ategy create prominent firm performance for financial firms (M = 5.47)

,

and the conception of enhanced opportunities provides moresupport (M = 5.71) than sale performance and profitability. Besides, although

Steady Value-Added Strategy was not the highest profile frrm performance among all ofthe strategies, it also provided excellent profiles for financial firms (M= 5.71),

especially for enhanced opportunities (M = 4.93). And, finally, the Emerging Goal Strategy provided the lowest firm performance among all three service innovation 忱的egies, revealing that service innovation strategy could contributed to the firm performance of financial frrms (M = 4.00). Among all of three service innovation

Chiao Da Management Review Vol. 33 No.2, 2013 55

strategies

,

Table 5 shows that the enhanced opportunities conception led to significantly higher performance excellence than other firm performance conceptions, meaning that service innovation strategy could create more opportunities for the financial industry.Table 5

The Profile of Firm Performance in Service Innovation Strategy Service Innovation Conceptions of Firm

Mean Performance (1) Sale Performance 4.74 (2) Profitability 4.89 (3) Enhanced Opportunities 4.93 (1) Sale Performance 3.57 (2) Profitability 4.2 (3) Enhanced Opportunities 4.2 (1) Sale Performance 5.38 (2) Profitability 5.33 (3) Enhanced Opportunities 5.71 AU ρLH Vu-Au ob-AU U-A

a---hu-m s 一叫川U

Au . 也 au 恥 E hh 此 cdp 、 uEmerging Goal Strategy

Prosperous Business Strategy

4.5 Discussion

For the past decades, the field of service innovation strategy has been much influenced by concepts and insights 宜。m the literature on core capabilities (Christensen and Overdorf, 2000). Indeed, the service innovation view is itself firmly rooted in consumers (users) ofmarket power and competition (Oliveira and von Hippel, 2011). Unfortunately, there remains much to be done to test empirically the relevance of some service innovation strategy notions of the financial industry for firm performance, and this is true as well of the s仕ategy-based view. Although there are long lists of candidates for valuable resources, there have been very few efforts to establish systematically, and how these resources influence firm performance. Perhaps more important, the literature

56 Service lnnovation Strategies in Financial Service lndustry:

the Perspective 01 Reverse Product Cycle and lnnovation 砂'Pe

contains many generalizations about the merits of some strategies

,

conjectures that often fail to consider the contexts within which strategy might be of value to an organization. Thus,

the conceptual framework of this study provides four strategies 企omdifferent situations to fill in research gaps.This study endeavors to make some progress in those directions. This study shows that both disruptive innovation and sustaining innovation that are useful to contribute to frrm performance: sale performance

,

profitability and enhanced opportunities. However,

the environment context of reverse product cycle was important in conditioning these relationships. Period of new service favored financial firms with disruptive innovation and sustaining innovation but did not reward those period of service efficiency with sustaining innovation. It follows that whether or not an asset can be considered an innovation level will depend as much on the context enveloping an organization as on the properties of the asset itself (Evangelista and Vezza凹, 2010).This study indicated that sustaining innovation on the stage of new service create higher firm performance than other strategy. The implication of this result revealed that sustaining innovation continues to provide generative impulses for innovation on an ongoing basis. Over time on the stage of new service

,

changes in the organization as well as individuals' circumstances give rise to new experiences,

opportunities and challenges. Financial firms can reinterpret the same narrative at a later point, bringing to light unrealized connections between actors, circumstances and outcomes. Besides

,

coordination is a central task that organizations must accomplish to innovate successfully 企omsustaining innovation (Bartel and Garud,

2009). In practice

,

frrms may often struggle to integrate their ideas and activities with others. It is often difficult for consumers to see the relevance of information,

ideas and practices that come 企omoutside their own work context and to draw on these to generate new products and services or novel ways of solving problems in their own locales. These translation problems can serve as a barrier to innovation. Therefore

,

of practical concem is the creation of a social fabric that provides both the coherence and the flexibility required to promote and sustaining innovation. Specially,

on the stage ofnew service ofreverse product cyChiao Da Management Review Vol. 33 No.2, 2013 57

open up and create new markets, in paral1el with the emergence of new or diversified service industries and organizations.

An auxiliary object of this research also shows that variety meaning of firm performance in disruptive innovation in different stage of reverse product cycle. F間, it is possible to identify key concept for financial firms and then derive quantitative indicators that reflect no mater on the stage of new service or service e旺iciencyofreverse product cycle

,

with greater or lesser accuracy,

a firm's wealth in such resources. Second,

this study also reveals that the firm performance of disruptive innovation concept is lower than sustaining innovation. Disruptive innovations create new market opportunities through the introduction of the new products or services. However,

it is easy as judged by the performance metrics thatmams悅am customers value in initially. These disruptive innovations did not

address the next-generation needs ofleading customers in existing markets

,

but had other attributes th叫 enabled new market applications to emerge (Christensen and Overdorf, 2000). Besides, disruptive innovations may occur so intermittently that no firm has a routine process for handling them. Furthermore,

because disruptive products nearly always make lower profit margins per unit sold and are not attractive to the firm 's best customers, they are inconsistent with the established firm's value. Therefore, this study considered it as the important reason that the firm performance of disruptive innovation was lower than that of sustaining lnnovatlOn.Prior work in both the academic and popular press has argued that the use of disruptive innovation way will be reflected in better firm performance. This study provides further discoveries in support of these assertions. The study revealed that the firm performance of service efficiency stage of reverse product cycle in disruptive innovation concept is higher than new service stage in disruptive innovation. These statistical1y significant values suggest that financial firms can indeed obtain more substantial financial benefits 企om investing in disruptive innovation when on the reverse product cycle of service efficiency. In addition

,

this study shows that no respondents clustered in the satisfactory efficiency strategy,

i.e. focuses on the sustaining innovation and the stage of service efficiency, the result imply considerable thinking in pra一一

58 Service /nnovation Strategies in Financial Service /ndustry: the Perspective of Reverse Product Cycle and /nnovation 砂pe fmancial fmn adopting this approach if industry conditions and social needs shift, requiring an organization to do things in fundamentally new ways. The satisfactory efficiency strategy concentrates on improvement of separate products has helped the fmancial fmn break out 企omthis strategy, but maybe it become a handicap over time as the divisions turned into hardened silos, each duplicating functions, proliferating products and raising total costs. Therefore, this study estimated imply that financial fmn could not survive simply by doing the old things with redoubled e宜iciencyand lower product costs. The fmancial firm needs to dramatically rethink its entire organizational model and related assumptions (Strecker, 2009).

Several reasons are conceivable to explain the differences in results depending on the 可pe of performance indicator. First, executing a sustaining innovation in service field orientation does entail additional costs, which are more strongly reflected in the measure of fmn performance than in innovation performance. Besides, setting up and running disruptive innovation in service fields is more expensive than innovating along existing service or product lines. Firm performance was measured as a multi-item construct encompassing several financial and non-fmancial indicators. However, profitability is only one of several fmancial indicators of innovation performance, whereas objective, firm performance indicators are strongly influenced by firm profitability. Second, service innovation field orientation is highly specific to innovation, but less relevant for the overall firm. Hence, it can have less impact on firm than on fmn performance. Third, the fact that innovation performance was measured from an intemal perspective and fmn performance 企om an extemal, capital market perspective, may further explain the di旺erent outcomes, Investors are foremost interested in a fmn's outputs, whereas intemal perspectives on performance are influenced by multiple factors. Summarizing, even though with a weaker performance effect than established dimensions, service innovation field orientation has proven to be a valid concept by itself and a relevant success factor in the context of innovation strategy. Overall, this study confmned that service innovation strategy in the fmancial indus的,has a positive influence on fmn-level performance, even though diffi

Chiao Da Management Review Vol. 33 No.2, 2013 59

In this study, an explicit attempt was made to merge the literatures on disruptive innovation concept and reverse product cyc1e concept. Specially, disruptive innovation and sustaining innovation were inc1uded investigations to test the di宜erence of firm performance. Besides

,

the influence of different stage through reverse product cyc1e was c1early demonstrated. To this study knowledge,

no previous attempt has been made to examine to Taiwan's fmancial market.

Therefore, these results provided a strong incentive to consider service innovation strategies as a key in relation to both competitive advantages and core advantages.

5. Conclusions

Service innovation strategy has not only been an emerging research field and but has also become a key element in finance s仕ategyand planning for the future (Alam, 2007). The emerging function of economic creation is being added to financial institutions

,

which will gradually mushroom the development of service innovation strategy. This study shed greater light on the relationships between fmn performance and service innovation strategies can be determinant by the dimensions of types of innovation and improvement on service. This study sets out to extend work on previous firm performance through the execution of service innovation, which developed a matrix by disruptive innovation perspective and reverse product theory.The conceptions of disruptive innovation the。可 is a dynamic process and any model that purports to explain the evolution of a dynamic process also defmes a dynamic system either explicitly or implicitly. This study revealed that most of the Taiwanese fmancial fmns adopted disruptive innovation approach to explore market opportunities. And the majority of financial firms were all on the later stage of enhancing service e伍ciency. Specially, this study verified the performance difference under different service innovation 甜ategy to fill up the variations in financial market. The analysis provided crucial insights to manage disruptive servÌce-mnovatlOn as a competltlve s個tegy.

60 Service lnnovation Strategies in Financial Service lndustry: the Perspective of Reverse Product Cycle and Innovation 砂pe total of 189 financial companies. This study mainly focused on headquarters for respondents to explore the relationship between service innovation strategies and firm performance. Even though the overall 48 valid questionnaires can be a limit, prior research suggested that quantitative studies of descriptive research with more than 20% of retumed response rate in small samples should be enough (G旬, Mill, and Airasian, 2008). Furthermore, the sampling companies were accounted to 63% operating revenue in Taiwan fmancial industry. The 6 retumed questionnaires were among the Top 10 operating revenue in year 2010 in Taiwan fmancial industry. Therefore, the sample can be representative.

5.1

Management and Policies ImplicationsThis study revealed that fmancial firms in Taiwan achieve financial performance via various service innovation strategies. This study suggested that fmancial managers should be aware of the importance of disruptive innovation in the link of frrm performance. Since the financial services in the market are similar and easy to imitate, hence, disruptive innovation has clear practical implications to distinguish and therefore create higher value. The results also explained why disruptive innovation thinking could create powerful operational s仕ategy and flexibili可 indealing with the financial indus甘ymarket (Anthony, 2009). Moreover, at the stage of service efficiency, this study argued that managers should devote necessary efforts to different innovation activities by improving present services.

Emerging Goals Strategy stresses the importance of developing new service. This strategy attained the lowest profile of firm performance among al1 the service innovation strategies. The financial firms' performances with this service innovation strategy were lower than with Steady Value-Added Strategy, it still provided benefits for firms. Also, according to the results the results of this study, Emerging Goals Strategy and Steady Value-Added would be useful for fmancial managers when considering why the financial performance were for all types of disruptive innovation. This study estimated that new service stages would increase firm performance, but also further produce costs in terms of project delay and project termination. However, these costs do not a宜ectinnovation performance at the frrm level (Cuijpers, Guenter and Hussinger, 2011). Therefore, this study