Commodity Futures Market in China: Recent Developments and Issues

Commodity Futures Market in Mainland China:

Recent Developments and Issues

Wensheng Peng, Ivy Yong and Rina Suo

Mainland China has seen rapid growth in commodity futures markets in recent years.

Our empirical analysis suggests that trading of futures contracts for commodities such as copper and aluminium have helped price discovery, and using futures contracts for hedging would lead to a substantial reduction in earnings volatility. But futures contracts of agricultural products seem to perform less effectively the functions of price discovery and risk transfer. The empirical evidence also suggests that commodity futures on the Mainland lack international pricing power, with the direction of influence running from overseas to local markets.

China has vast potential for developing commodity futures markets, given its growing importance in global consumption and production. Significant progress has been made in developing the market infrastructure for futures trading. For further market development, it would be desirable to relax the participation restrictions to increase the presence of institutional investors. The regulatory structure could also be adjusted, in view of the growing size of the market, to create a more conducive environment for product innovation. It is also important to gradually open up and establish greater linkages between local and international markets.

Hong Kong can contribute to the development of China’s commodity futures market, leveraging on its advanced financial market platform and large international institutional investor base. Hong Kong could help attract international investors to participate in the Mainland market in a paced manner, through appropriate arrangements such as dual listing and the Qualified Foreign Investor Scheme (QFII).

Futures trading could also be developed in Hong Kong for commodities in which it has a comparative advantage, such as gold, and the participation of Mainland entities could be arranged through the Qualified Domestic Investor Scheme (QDII).

Number 6/06, December 2006

China Economic Issues

I. Introduction

China has become one of the largest consumers and producers of many commodities, and the country’s importance in the global commodities market will rise along with its rapid economic growth.

China’s economic agents will therefore be increasingly exposed to fluctuations in commodity prices. An efficient commodity futures market will help producers and consumers of commodities to protect against unpredictable price changes.

Indeed, the development of commodity futures market on the Mainland has gathered pace in recent years.

Price discovery and risk transfer are two major functions of any futures market that help the organisation of economic activity.

Price discovery refers to the use of futures prices for pricing cash market transactions (Wiese 1978). For many physical commodities (particularly agricultural commodities), cash market participants often base spot and forward prices on the futures prices that are “discovered” in the competitive, open auction market of a futures exchange. Risk transfer refers to hedgers using futures contracts to shift the price risk to others (such as speculators) who are willing and often in a better position to take risks for a possible return (Working 1962). In this sense, a primary role of futures markets is to allocate risks efficiently. At the macro level, developing a futures market that is of global significance will help international commodity prices to reflect better the local demand and supply conditions. This will make an economy a price-setter in commodities of which it is a major consumer or supplier. Futures contracts form part of the array of financial instruments in an economy, and the development of a commodity futures market increases the breadth of the financial market.

However, there are also risks involved.

Excess speculative activities inhibit the healthy development of the market and could pose risks to financial stability. This is evidenced by the experience of the futures market on the Mainland in the 1990s. The Mainland started government bond futures trading in 1993, and the volume grew rapidly in the next two years. However, price manipulation and casino-type speculation were rampant, partly owing to deficient regulatory framework and market infrastructure. Futures trading was suspended at most exchanges in 1995, and it took almost ten years for the futures market to restart on a new footing. While commodity futures trading has grown rapidly in the past few years, there are important development and regulatory issues that need to be tackled in order to develop a market that is efficient and commensurate with the large and growing size of the economy.

This paper provides a review of the commodity futures market on the Mainland, and considers key issues in market development, in part by drawing on the experience of developed futures markets elsewhere in the world. Based on the analysis, some observations will be offered on the potential role of Hong Kong in developing China’s commodity futures market. Section II provides an empirical assessment of the efficiency of the Mainland market with regard to its price discovery and risk transfer functions. Section III considers the strengths and weaknesses of the Mainland’s commodity futures market, in relation to key development factors of supply and demand, price discovery mechanism, and market infrastructure.

Section IV discusses some development and regulatory issues from a public policy perspective. Section V concludes by drawing implications for Hong Kong in facilitating the development of the commodity futures market of the country.

II. An Empirical Analysis of Market Efficiency

Following the consolidation in 1998-2002, the futures industry recorded a strong recovery in 2003. There has been a sharp increase in both trading volume and prices in recent years (Chart 1).

Chart 1. China’s Futures Market Trading

0 4,000 8,000 12,000 16,000 20,000

93 94 95 96 97 98 99 00 01 02 03 04 05 Jan- Sep 06 Market Turnover

(in bn Rmb)

0 200 400 600 800 1,000 Trading Volume

(in mn)

Market Turnover (LHS)) Trading Volume (RHS))

Sources: Shanghai Futures Exchange Website, Dalian

Commodity Exchange Website, Zhengzhou Commodity Exchange Website.

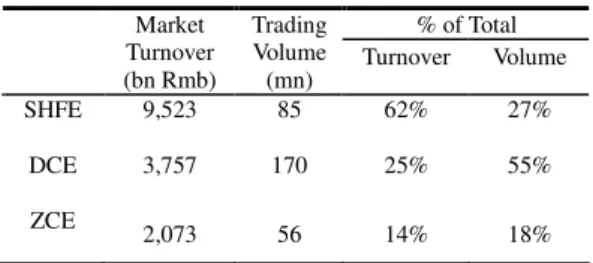

There are currently three commodity futures exchanges on the Mainland: the Shanghai Futures Exchange (SHFE), the Dalian Commodity Exchange (DCE) and the Zhengzhou Commodity Exchange (ZCE)1. The SHFE focuses mainly on industrial raw materials whereas the DCE and ZCE cover mainly agricultural products. The SHFE is the largest in terms of market turnover while DCE is the largest in terms of trading volume, the ZCE is relatively small (Table 1). Among the various types of commodity futures contract traded, natural rubber, copper and aluminium together make up slightly more than half of the turnover of all commodity contracts in the first nine months of 2006.

1 See Annex 1 for a brief history of events leading up to the emergence of these three futures exchanges.

Table 1. Overview of the Commodity Futures Exchanges (Jan-Sep 06)

% of Total Market

Turnover (bn Rmb)

Trading Volume (mn)

Turnover Volume

SHFE 9,523 85 62% 27%

DCE 3,757 170 25% 55%

ZCE 2,073 56 14% 18%

Sources: Shanghai Futures Exchange Website, Dalian Commodity Exchange Website, Zhengzhou Commodity Exchange Website

An empirical analysis is conducted to assess how well the commodity futures market on the Mainland has performed the functions of price discovery and risk transfer. In relation to price discovery, we also examine the linkages between domestic and international futures prices of the same commodity, and the influence of domestic conditions on international market prices. With regard to risk transfer, hedging efficiency is assessed by the reduction in earnings volatility as a result of using futures contracts to hedge.

Price Discovery

Price discovery refers to the use of futures prices for pricing spot market transactions, and it depends on whether new information is reflected first in changed futures prices or in changed spot prices. The empirical approach includes the following steps.2 First, a test of cointegration is employed to assess whether futures price and spot price of a commodity have a stable long-run relationship. On the basis of a cointegrated relationship, it is further tested whether a 1% change in futures price would be associated with a 1% change in spot price (the unbiasedness hypothesis).3 To assess

2 In the literature, cointegration analysis and Granger causality tests are often used in studying the relationship between futures and spot prices (Yang, Bessler and Leatham, 2001, and Zhang, 2006). The same methods are employed in this study.

3 It can be shown that the theory-consistent empirical specification for commodities (ignoring storage costs) is as follows: Ln Ft = u + Ln St + et

Where Ln F is the logarithm of futures price and Ln St is the logarithm of spot price, and u is a constant.

The unbiasedness hypothesis implies cointegration

whether futures markets, rather than spot markets, are the primary point for price discovery, restrictions on the adjustment coefficients are tested to see whether futures prices are weakly exogenous. The weak exogeneity of a futures price implies that it is a primary source of information in the long run and unidirectionally causes change in spot price. In the case of no evidence of cointegration, we test Granger causality between changes in futures and spot prices to see which have the information lead (technical details are provided in Annex 2).

The study uses five commodity products, namely copper, aluminium, soybean, soybean meal and soybean oil, partly because of data availability. Using data on daily spot and futures prices of these commodities from 2003 to 2006, we conducted cointegration analysis following the maximum likelihood estimation procedure developed by Johansen (1991) and Johansen and Juselius (1990). The results suggest that there exists a stable long-run relationship (i.e. cointegration) between the spot and futures prices of copper, aluminium and soybean oil. Based on these results, the Likelihood Ratio (LR) tests suggest that aluminium futures prices are an unbiased estimate of future spot prices (i.e. a 1% change in futures price is associated with a 1% change in spot price in the long run), but the same cannot be said for copper and soybean oil (Table 2).

Furthermore, the LR tests suggest that futures prices are the primary information source for copper and aluminium. (Table 3) As for soybean oil, both futures prices and cash prices are equally important as information sources in the market.

and a cointegration vector of (1,-1) between spot and futures prices (Brenner and Kroner, 1995).

Table 2. LR Test of Unbiasedness Hypothesis (H1: ββββ’=(1,-1))

Commodity β Estimates p-Value Decision: R(Reject) Or F (Fail to reject)

Copper (1,-1.004) 0.018 R

Aluminum (1,-1.000) 0.684 F

Soybean oil (1,-1.002) 0.004 R

Source: Staff estimates.

Table 3. LR Test of Prediction Hypothesis (H2: ββββ’αααα=0)

Commodity Hypothesis p-Value Decision: R(Reject) or F (Fail to reject)

Copper Futures→Spot 0.33 F

Aluminum Futures→Spot 0.52 F

Soybean oil Futures↔Spot 0.10 F Note: → denotes unidirectional information flow, and ↔

denotes bidirectional information flow.

Source: Staff estimates.

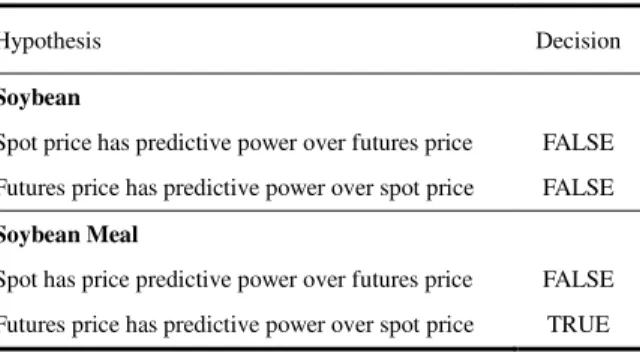

In the case of soybean and soybean meal for which no cointegration is found, the causality tests suggest that there is no link between changes in the futures price and spot price of soybean, but changes in the futures price of soybean meal have predictive information for changes in the spot price of soybean meal. This implies that futures price tends to lead spot price of soybean meal. (Table 4)

Table 4. Pair-wise Granger Causality Tests

Hypothesis Decision

Soybean

Spot price has predictive power over futures price FALSE Futures price has predictive power over spot price FALSE Soybean Meal

Spot has price predictive power over futures price FALSE Futures price has predictive power over spot price TRUE Source: Staff estimates.

Overall, the results suggest trading of futures contracts on aluminium, copper and soybean oil helps price discovery. This is shown by evidence of a stable long-run relationship between their futures and spot prices and signs of futures prices being a primary information source for pricing of aluminium and copper. Our finding is consistent with Wu (1997) who obtained evidence that copper futures prices had a lead effect on copper spot prices, but is not in line with Hua (2002) suggesting that copper spot prices had a stronger lead effect on copper futures prices. Also, Zhang (2006) found a strong correlation between spot and futures prices of soybean and that futures price generally had a lead effect on spot price. The difference in empirical results may reflect the difference in sample periods, with our sample reflecting the latest developments.

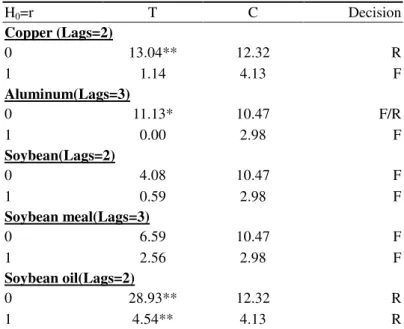

Pricing Power

To examine the pricing power of the futures market on the Mainland, we assess whether there is a close relationship between domestic futures price of a commodity and that in the international market and which

has the information lead in price changes.

There are three main channels through which price developments in overseas futures markets and the local futures market may influence each other: (i) price arbitrage in the underlying cash market; (ii) investor sentiment; and (iii) trading activities by a group of large State-Owned Enterprises (SOEs), approved by China Securities Regulatory Commission (CSRC), in overseas futures markets.

We employ the same empirical approach as the study on the relationship between domestic futures and spot prices. The cointegration tests suggest a stable relationship between domestic and overseas futures prices only for copper and weak exogeneity of overseas futures price. 5 The latter implies that overseas futures price has the information lead over its domestic counterpart. For copper, aluminium, soybean, and soybean meal, Granger causality tests suggest that changes in the overseas commodity futures prices tend to have a lead effect on local commodity futures prices (Table 5). No evidence of linkage is found between the local and overseas futures prices of soybean oil.

5 The LR tests suggest that overseas copper futures prices are not an unbiased estimate of local copper futures prices.

Table 5. Pair-wise Granger Causality Tests

Hypothesis Decision

Copper

Overseas futures has predictive power over China futures TRUE China futures has predictive power over overseas futures FALSE Aluminum

Overseas futures has predictive power over China futures TRUE China futures has predictive power over overseas futures FALSE Soybean

Overseas futures has predictive power over China futures TRUE China futures has predictive power over overseas futures FALSE Soybean Meal

Overseas futures has predictive power over China futures TRUE China futures has predictive power over overseas futures FALSE Soybean Oil

Overseas futures has predictive power over China futures FALSE China futures has predictive power over overseas futures FALSE

Source: Staff estimates.

Overall, the empirical evidence suggests some influence of international futures prices on domestic prices (but not the other way around), but the linkage is not strong enough to suggest a cointegration relationship between the two. This is consistent with the findings of other studies including Peng (2002), Zhang (2003) and Zhang (2006). This probably reflects the early stage of market development on the Mainland and restrictions including capital account controls that limit efficient arbitrage activity between domestic and international markets.

Risk Transfer

Hedging involves taking a position in the futures market, which is opposite to the position that one already has in the spot market. To achieve this, the hedger determines a hedging ratio, i.e., the number of futures contracts to buy or sell for each unit of the spot asset on which the hedger bears price risk. In empirical studies, hedge ratios are often estimated as the slope coefficient from a regression of futures price

changes on spot price changes (Ederington, 1979).6 To assess the effectiveness of hedging, the variance of return on a hedged position (as measured by the difference between log change in the spot price and the slope coefficient times log change in the futures price) is compared with the variance of return on an unhedged position (as measured by log change in the spot price).

The variance reduction is taken as an indicator of hedging effectiveness. The technical derivation of the estimates is provided in Annex 2.

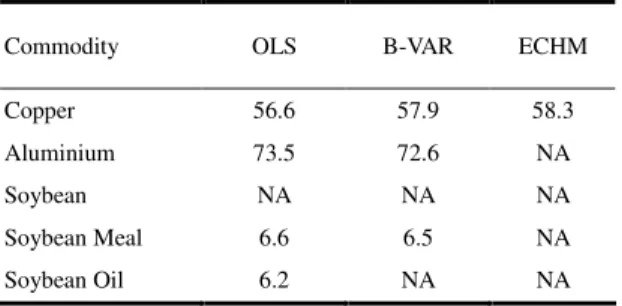

The empirical analysis makes use of three regression models to estimate the slope coefficient or hedge ratio. These include ordinary least square (OLS), bivariate vector autoregression (B-VAR), and error-correction model (ECHM) in the case of a cointegration between futures and spot prices. The variance reduction offered by hedging is computed for copper, aluminium,

6 A well-functioning price discovery process helps the use of hedging for risk transfer, as it implies a close relationship between spot and futures prices.

soybean, soybean meal and soybean oil using data from January 2003 to November 2006. The results suggest that hedging leads to a significant reduction in the volatility of earnings and is effective in protecting against spot price risk in the cases of copper and aluminium (Table 6).

Using aluminium as an example, the variance (volatility) of spot returns would be reduced by 73% if futures contracts are used for hedging. The results suggest that the hedging performance of nonferrous metals appears to be superior to that of agricultural products. Our conclusions are broadly consistent with that of Wang and Zhang (2005), which found that hedging generally leads to a reduction in risk exposure for copper, aluminium, hard wheat and soybean and that the hedging performance of copper and aluminium is far better than that of hard wheat and soybean.

Table 6. Hedging Performance of Commodity Futures:

Reduction in Spot Return Volatility (%)

Commodity OLS B-VAR ECHM

Copper 56.6 57.9 58.3

Aluminium 73.5 72.6 NA

Soybean NA NA NA

Soybean Meal 6.6 6.5 NA

Soybean Oil 6.2 NA NA

Note: Hedging performance is not available (NA) for some commodities/models due to the absence of cointegration/autocorrelation or insignificance of hedging ratio.

Source: Staff estimates.

In sum, the empirical analysis suggests that trading of commodity futures on the Mainland has helped price discovery and risk transfer. But the development of the markets is uneven, with trading of nonferrous metals contracts more efficient than that of agricultural products contracts.

Furthermore, commodity futures trading on the Mainland seems to lack international pricing power, with the direction of influence running from overseas to domestic markets and the relationship not strong enough to suggest cointegration between local and overseas futures prices. It is

useful to examine the main factors underpinning the futures market development on the Mainland and issues of concern. This is the task of the next section.

III. Key Factors in Developing Commodity Futures Market

The key factors that underpin the development of commodity futures markets can be broadly categorised under (i) supply and demand conditions; (ii) price discovery mechanism; and (iii) market infrastructure for trading and settlement.

Supply and Demand Conditions

There are at least three key factors that contribute to robust demand and supply conditions in a well-developed futures market. These are large and efficient underlying cash markets, active presence of speculators and provision of viable and innovative futures products.

Large and efficient underlying cash markets The existence of an efficient, liquid and integrated cash market for commodities is pertinent to the success of any commodity futures market. Some salient features of a well-functioning cash market for commodities are (i) large consumption and/or production of commodities; (ii) market-based pricing of commodities; and (iii) reliable and efficient transportation, warehousing and other distributions facilities.

The Mainland has in recent years emerged as one of the largest producers and consumers of many primary commodities (see Annex 3). Specifically, the Mainland is the largest consumer and producer of main metals such as aluminium, iron ore, lead, steel, tin and zinc, accounting for 15-33% of world consumption and 23-41% of world output. The Mainland is also the largest

consumer and producer of coal making up over 30% of world consumption and output.

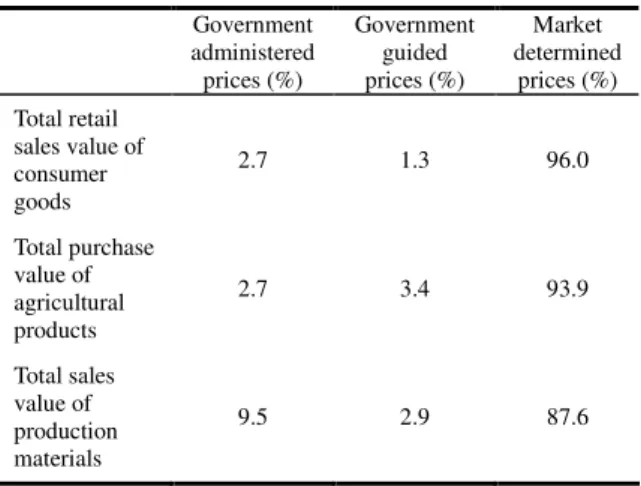

As to agricultural goods, the Mainland is the largest consumer and producer of cotton, rice and wheat accounting for 15-31% of world consumption and 15-28% of world output. The sheer size of the country’s consumption and production of commodities indicates a vast underlying demand for hedging against unpredictable price movements. Prices of most commodities are determined by market forces, with only a few commodities that are considered to be of strategic importance (e.g.

crude oil) still having their prices administered or guided by the government (Table 7). The Mainland lags behind international standards in terms of its transportation systems and warehousing facilities for commodities, but there will be improvement along with the growth of the economy.

Table 7. Types of Price Formation Mechanisms in China, 2001 Government

administered prices (%)

Government guided prices (%)

Market determined

prices (%) Total retail

sales value of consumer goods

2.7 1.3 96.0

Total purchase value of agricultural products

2.7 3.4 93.9

Total sales value of production materials

9.5 2.9 87.6

Source: “Report on the Development of China’s Market Economy 2003” The Economic and Resources Management Research Institute under Beijing Normal University, entrusted by the Ministry of Commerce

Active Presence of Speculators

Speculators are generally seen to contribute to market liquidity and efficiency by assuming risk on the other side of hedgers’

trades and also by assimilating all possible price-sensitive information, on which they can make a profit, into the futures market. In the Chicago Board of Trade (CBOT), it is

reported that about 60% of all trades on agricultural commodity futures are for hedging while another 30% are for speculative purposes. On the other hand, speculators with large sums of capital can move into less liquid markets and trade in a way that may destabilise financial markets.

This is why speculators are often viewed with reservations in emerging market economies.

The Mainland futures market has a relatively narrow base of speculators due to regulatory restrictions. All financial institutions are prohibited from engaging in futures dealing activities. State-owned enterprises (SOEs) are allowed to participate in the commodity futures market only for hedging purposes. The only market participants who may engage in speculative activities are private investors such as small enterprises and individual investors. These investors are generally of small scale, and are therefore unlikely to contribute meaningfully to market liquidity. The limited presence of speculators explains in part the relatively low liquidity observed in many of the commodity futures products traded on the exchanges.

Provision of Viable and Innovative Futures Products

The developed commodity futures markets are usually marked by a wide range of products traded and their innovative capacity in introducing new products (“The Commodity Futures Study” by Virtual Metals Research & Consulting Ltd, 2005).

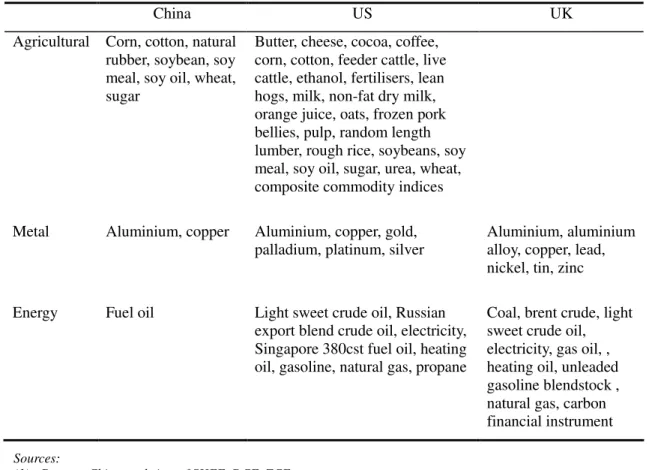

Until most recently, the Mainland authorities have adopted a rather conservative attitude towards market innovation, having experienced excessive speculation in the market when a wide variety of commodity futures contracts were traded in the 1990s. While the number of commodity futures contracts has increased from six in the aftermath of market consolidation to the current eleven, it is still limited when compared to the US and the

UK (Table 8).7 This is often cited as a major factor constraining the growth of the commodity futures market. At the China Financial Derivatives Forum held on 24 October 2006, senior representatives of the commodity futures exchanges revealed their

plans to gradually introduce new metal futures such as steel and zinc and energy futures including crude oil, natural gas and electricity, as well as options on the actively traded futures contracts such as copper.

Table 8. Futures Contracts Traded on China’s Commodity Futures Exchanges in Comparison with Commodity Futures Traded in the US and the UK

China US UK

Agricultural Corn, cotton, natural rubber, soybean, soy meal, soy oil, wheat, sugar

Butter, cheese, cocoa, coffee, corn, cotton, feeder cattle, live cattle, ethanol, fertilisers, lean hogs, milk, non-fat dry milk, orange juice, oats, frozen pork bellies, pulp, random length lumber, rough rice, soybeans, soy meal, soy oil, sugar, urea, wheat, composite commodity indices

Metal Aluminium, copper Aluminium, copper, gold, palladium, platinum, silver

Aluminium, aluminium alloy, copper, lead, nickel, tin, zinc

Energy Fuel oil Light sweet crude oil, Russian export blend crude oil, electricity, Singapore 380cst fuel oil, heating oil, gasoline, natural gas, propane

Coal, brent crude, light sweet crude oil, electricity, gas oil, , heating oil, unleaded gasoline blendstock , natural gas, carbon financial instrument

Sources:

(1) Data on China: websites of SHFE, DCE, ZCE

(2) Data on US: websites of Chicago Mercantile Exchange, Chicago Board of Trade, New York Board of Trade and New York Mercantile Exchange

(3) Data on UK: websites of London Metal Exchange, Intercontinental Exchange

7 This number does not include the PTA (purified terephthalic acid) futures launched on the Zhengzhou Commodity Exchange on 18 December 2006. PTA is the raw material used in fibre production

Price Discovery Mechanism

Efficient price discovery is underpinned by a number of factors, including a diverse investor base and efficient information gathering, processing and dissemination.

Diverse Investor Base

A distinctive feature of the well-developed futures market is a diverse investor base, and in particular, a significant presence of institutional investors who engage largely in speculative trading activities. Institutional investors enhance the price discovery process by improving the adjustment of asset prices to fundamental values because they enjoy economies of scale, good access to information and low transaction costs (Davis, 1988). The commodity futures market on the Mainland consists primarily of private investors (i.e. small-and-medium sized enterprises and individual investors), with institutional investors accounting for only 5% of the market participants.

Furthermore, international investors are not allowed to participate in the local market.

The lack of participation by institutional investors (both local and international) as speculators in the market reduces the efficiency of price discovery.

Efficient Information Gathering, Processing and Dissemination

An efficient price discovery process is characterised by the quick adjustment of market prices from an old equilibrium to a new equilibrium with the arrival of new information. This is underpinned by an efficient system for gathering, processing and disseminating information on the underlying assets. The price discovery process in the CBOT and Chicago Mercantile Exchange (CME) is greatly facilitated by the provision of high quality and timely information on commodities.8

8 For agricultural commodities, the National

The basic infrastructure for collecting, processing, analysing and distributing information on the Mainland lags behind.

In particular, there is a lack of standardisation in the format and timeliness of information analysis and distribution partly reflecting insufficient technical expertise. In this respect, the Ministry of Agriculture is working on improving the system for collecting, processing and disseminating agricultural information. The Dalian Commodity Exchange has also launched a project that aims at educating farmers and providing them with relevant statistics and information on agricultural commodities so that they will be encouraged to participate in the futures market.

Market Infrastructure

The market infrastructure for trading commodity futures consists mainly of the trading platform and clearing and settlement system.

Trading Platform

Trades in futures exchanges can be executed on the floor (open outcry) or through electronic trading depending on the level of sophistication of the exchange. There is a clear trend among futures exchanges in the world to move toward electronic trading.

The advantages of electronic trading include

Agricultural Statistics Service (NASS) owned by the US Department of Agriculture (USDA) issues reports that cover information on practically every aspect of US agriculture, including production and supplies of food and fibre, prices received and paid by farmers and farm income and finances. NASS carries out surveys with the support of many State departments of agriculture, land-grant universities and agricultural industries. Such cooperation has helped to generate much information at minimal cost and maintain consistency in the estimates produced by different public agencies. The USDA also releases world supply and demand forecasts for major commodities on a monthly basis. Farmers can obtain a comprehensive set of market information via the internet, phone or mail.

a large potential investor base (from around the world), greater convenience and lower transaction costs. Most of the well-developed futures exchanges, such as the CBOT and CME, offer a hybrid model providing investors access to futures products via an open outcry system as well as through the electronic trading system. In the case of CBOT, about 65% of all trades conducted in 2005 were done via the electronic trading system with the rest mainly done via the open outcry system. In CME, about 70% of all trades were conducted via the electronic trading system.

The Mainland’s futures exchanges enjoy the

“late-mover” advantage as they are set up relatively recently, and have adopted electronic trading systems. All three national futures exchanges are linked by a shared network to ensure that investors can trade in any of the futures products available on the exchanges.

Clearing and Settlement System

A safe and reliable settlement and clearing system helps investor protection. The function of the clearing house is to eliminate or reduce the counterparty credit risk by standardising and simplifying the transaction processing between market participants and the clearing house.

There are essentially three types of organisational structure for performing clearing and settlement function: (i) internal department of the futures exchange (since it is not a legal entity, the credit risk will be borne by the exchange); (ii) external company that is a spin-off from the exchange and of which the exchange is a main stakeholder; and (iii) external company that has no association with the exchange. There is no “one-size-fits-all”

structure that can be applied to all futures markets.9 Based on the past experience in

9 All three types of clearing and settlement systems for futures exist in the US. The New York Mercantile Exchange (NYMEX) conducts clearing and

the US, futures exchanges tend to opt for internal clearing and settlement in the early stage of development due to the small scale of the exchanges and limited clearing needs.

However, as the futures markets develop further, futures exchanges tend to spin off their clearing function and establish a subsidiary to increase efficiency and reduce costs. Such a clearing company then makes use of its low cost base and strong guarantor ability to attract clearing business from other exchanges and hence resulting in common clearing systems.

On the Mainland, the clearing and settlement of all commodity futures trades are performed by an internal department within the respective futures exchanges.

Some market analysts argue that the Mainland may not need to move toward a common clearing system at this stage for a number of reasons. First, given the limited range of commodity futures products currently available and the lack of overlap in products traded on the exchanges, the benefit of a reduction in margin requirements for investors is limited.

Second, it will require huge outlay in terms of increasing staff to operate the new system, upgrading existing systems and revising the relevant regulations. Third, there will be a concentration of credit risk in the clearing system which may not be easily managed given the nascent stage of market development.

IV. Development and Regulatory Issues As discussed in the earlier section, China has huge potential to develop a commodity futures market, but the growth of the market has been limited by a number of factors that

settlement of trades through its own internal department. The New York Board of Trade (NYBOT) clears all its futures and options transactions through its subsidiary, the New York Clearing Corporation (NYCC). The CME provides clearing and related services for CBOT through its wholly-owned clearing house under the Common Clearing Link.

are partly related to restrictive regulations.

The segregation between the domestic and overseas markets also limits the efficiency of price discovery and the influence of domestic demand and supply conditions on international pricing of commodities. This section considers two issues that are key to development of the commodity futures market in China, namely the balance between development and regulation and openness to international market.

Balance between Development and Regulation

Financial regulators are increasingly aware of the need to strike a balance between maintaining financial stability and encouraging financial innovation. The US, for example, has shifted from a more prescriptive regulatory approach towards a more flexible approach with the enactment of the Commodity Futures Modernisation Act (CFMA) in 2000. The futures exchanges can now approve new products through a self-certification process without having to seek prior regulatory approval.

Against the background of rampant speculation in the commodity futures market in the 1990s, the Mainland regulators have been inclined to take a more heavy-handed approach in ensuring good order in the marketplace.

Futures market regulation on the Mainland consists of three layers: (i) the China Securities Regulatory Commission (CSRC), which is in charge of regulating the entire marketplace; (ii) the China Futures Association, which takes the role of self-regulation; and (ii) the three national futures exchanges, which supervise daily trading, settlement and clearing. The futures market is regulated by the “Futures Trading Management Temporary Statute”, which was enacted by the State Council in 1999, together with four accompanying measures10.

10 These include (i) “Futures Exchanges

There are concerns that the existing framework for regulating commodity futures has become outdated and is impeding market development. First, current regulations prescribe a very narrow investor base for the commodity futures market, as noted in the previous section.

One way of addressing this deficiency is to open up the local futures market to financial institutions and investment funds. However, this could potentially increase financial stability risks if local financial institutions do not practise good corporate governance and prudent risk management. Second, futures brokers are struggling to survive given the narrow scope of business prescribed by regulation. They are permitted to engage only in low-profit pure brokerage business and are not allowed to engage in proprietary trading. Due to the lack of product differentiation, futures brokers often have to resort to “price war”. Third, the introduction of new commodity futures is largely driven by regulatory authorities. This is not conducive to market innovation.

In view of these concerns, the CSRC is currently working on removing some of the regulatory impediments to market development. The authorities are also drafting a “Futures Act” that will be the comprehensive law governing all types of futures trading in China.

Openness to International Market

Cross-border futures trading increases the overall liquidity of the local futures exchange by providing opportunities for arbitrage between the local and overseas futures exchanges, thus enhancing price discovery at the local exchange. The openness of a local exchange to international investors is also crucial in helping to establish the exchange as a global price-setting centre for relevant

Management Measure”; (ii) Futures Brokers Management Measure”; (iii) “Senior Manager Management Measure”; and (iv) “Professionals Management Measure”.

commodities.

The commodity futures market on the Mainland is segregated from the international market due to capital controls and other regulatory restrictions. Presently, foreign investors are not allowed to participate in the local commodity futures market. Furthermore, only large SOEs approved by the CSRC via a very strict application and approval procedure are allowed to hedge in offshore futures markets.

Currently, there are 31 such enterprises with approval to engage in hedging activities in the overseas futures market. Such restrictions have a negative impact on price discovery and price-setting functions of the local futures exchanges.

There are two possible ways of opening up to international market. One is to allow foreign participants access to the local commodity futures market. This can be done by extending the existing Qualified Foreign Institutional Investors (QFII) scheme to cover the commodity futures market, for example. This will be relatively easy to implement and the authorities can manage the amount of foreign capital entering the Mainland’s financial markets through the quota system. The presence of foreign institutional investors with substantial capital, better access to information and greater financial market expertise may have a disproportionate impact on the local market, which consists largely of small private investors, but this factor can be taken into account when deciding the pace of liberalisation.

The other way is to allow Mainland entities greater access to overseas futures markets.

This will enable Mainland enterprises to carry out hedging activities in the most liquid markets and also seize opportunities to profit from arbitrage between local futures prices and international prices.

Notwithstanding these benefits, good corporate governance and proper risk control are required to prevent enterprises

from taking excessive speculation in the overseas futures markets. A case in point is China Aviation Oil which suffered losses of up to USD 550 million due to speculative trading in crude oil options in 2004.

An important advantage of the first option over the second is that it helps to develop the commodity futures market in China. To limit the risk of a disproportionate impact of foreign funds on the local commodity futures market, the QFII scheme could cover only the more mature commodity futures contracts such as copper. It is also important to consider the role of Hong Kong in linking the domestic futures market to international markets (see below).

V. Possible Role of Hong Kong

As discussed above, the huge hedging demand arising from a large physical commodities market points to great potential of developing commodity futures markets in China. Furthermore, the Mainland benefits from establishing its futures exchanges relatively recently and hence is able to adopt latest technology (i.e.

electronic trading). However, the futures market suffers from heavy regulation and a lack of openness to international investors that hinder efficient price discovery and further market development.

Hong Kong, on the other hand, enjoys the advantages of being an international financial centre with a robust financial market infrastructure, a sound legal and regulatory framework, efficient and reliable trading and clearing and settlement systems, and a large pool of international institutional investors. However, Hong Kong is disadvantaged by its lack of a physical commodity market and the accompanying natural demand for commodity futures.

Hong Kong is also short of the necessary infrastructure to support physical settlement of commodity futures.

There appears to be a case for complementarity and cooperation between the two markets. The Mainland can leverage on Hong Kong’s advanced financial market infrastructure and large international institutional investor base while Hong Kong can leverage on the Mainland’s huge physical commodities market and supporting infrastructure for physical delivery and settlement of commodity futures.

There are two possible forms of cooperation between the Mainland and Hong Kong.

First, Hong Kong can help to link the Mainland market to the international market.

This could include dual listing of commodity futures contracts and development of a common trading platform with the Mainland. Such linkages would increase the breadth and depth of both markets by expanding the investor base and enhancing trading efficiency. Second, Hong Kong can develop its own commodity futures exchange and trade products that are not yet available on the Mainland’s exchanges. In this case, Hong Kong should leverage on the underlying demand on the Mainland and its own highly open and sophisticated financial markets.

Some issues need to be addressed in considering the optimal form of cooperation.

Perhaps the overriding obstacle is restrictions on renminbi convertibility for capital account transactions. To allow international investors to participate in the

Mainland’s markets and allow Mainland entities to participate in Hong Kong’s markets, the current scope of QFII and the Qualified Domestic Institutional Investors (QDII) schemes could be expanded to cover commodity futures trading. The second issue is regarding physical settlement of commodity futures. It would be cost-efficient for Hong Kong to cooperate with the Mainland entities to provide physical settlement on the Mainland.

The third issue concerns the type of commodity futures product that may be offered in Hong Kong. Hong Kong should focus on products that are not yet available on the Mainland’s exchanges and in which it possesses a competitive edge. Some market participants have suggested that Hong Kong should trade precious metals, specifically gold. Hong Kong has an active spot and forward market for gold, and has a large underlying demand for gold both from the jewellery industry as well as for investment purposes. There is an existing pool of expertise and talent in trading gold. A gold depositary is being built by the Hong Kong Airport Authority, and the Precious Metals Exchange of Hong Kong is expected to be launched soon to provide a 24-hour trading platform for gold. Others have suggested that Hong Kong may trade energy products, especially crude oil and natural gas, for which the Mainland has a large underlying demand but futures contracts are not yet traded in the Mainland’s exchanges.

Annex 1 – A brief history of futures markets in Mainland China

China’s futures market development can be broadly divided into three phases. The first phase, which may be termed as the early formation phase, spans the period from 1990 to 1994 during which China saw rapid growth in the futures market that was accompanied by widespread abuse by market players, triggering the first wave of reform. The second phase, which may be termed as the consolidation phase, spans the period from 1995 to 2000 during which China experienced another bout of excessive speculative activities in its futures market that led to the second wave of reform which included the introduction of a set of new rules and regulations to the futures market. The third phase, which may be termed as the recovery and controlled development phase, spans the period from 2001 to the present in which China enjoys a gradual recovery in futures trading activities after suffering from a sharp decline in trading activities as a result of the market consolidation exercise. Each phase in the development of China’s futures market is discussed in greater detail below:

Early Formation Phase (1990-1994)

The birth of the futures market in China was driven by the Government’s effort to reform the grain sector. At the time, Henan province was the second largest agricultural province in China and hence its capital city, Zhengzhou, became a natural candidate for the establishment of the first futures market in China. On 12 October 1990, China Zhengzhou Grain Wholesale Market (CZGWM) began operations. It was only in March 1993 that the Henan People’s Government ratified the CZGWM to start China Zhengzhou Commodity Exchange.

Subsequent to that, there was a rapid expansion in the futures market such that by the end of 1993 the number of futures exchanges increased to 40, the number of commodity futures contracts traded in the exchanges rose to 55 and the number of futures brokerages firms increased sharply to 500.

However, the rapid growth of China’s futures market was not accompanied by a commensurate advancement in risk management and as a result serious problems arose. On November 1993, the State Council issued a directive called the “Notice of Firmly Curbing the Blind Development of the Futures Market”. This marked the beginning of the first wave of reform in China’s futures market. Thereafter, the authorities slashed the number of futures exchanges to 14, delisted 20 futures contracts and banned all brokers from dealing in overseas futures business.

Consolidation Phase (1995-2000)

After the first round of reform in the futures market, many exchanges were forced to close down and the funds coming off those closed exchanges were seeking for new investment opportunities. At the same time, China’s equity market was not doing well. As a result, a large amount of such funds flowed into the 14 remaining futures exchanges. Due to lax risk management and control at the exchanges, China witnessed another round of excessive speculation from 1995 to 1998. A famous case that is symbolic of that period of wild speculation is the “327 T-bond scandal”.

The second wave of reform in China’s futures market took place in August 1998 and new rules were implemented. First, the number of futures exchanges was slashed further to three:

the Shanghai Futures Exchange, the Dalian Commodity Exchange and the Zhengzhou

Commodity Exchange. The number of commodity futures contracts was also reduced sharply from the previous 35 to only six: copper, aluminium, natural rubber, wheat, soybeans and green beans. Second, the increase in capital requirement on futures brokerage firms, from 10 million RMB to 30 million RMB, led to a 60% reduction in the number of futures brokerage firms with only 190 firms surviving. Third, China Securities Regulatory Commission established a unified regulatory framework, which consists of the “Futures Trading Management Temporary Statute” and the “Four Management Measures”.

Recovery and Controlled Development Phase (2001-present)

China’s futures market underwent a period of gradual recovery starting in 2001 as indicated by the pick-up in market turnover. The total volume of futures contracts traded increased from 54 million in 2000 to 120 million in 2001 and then to 322 million in 2005. The Government’s attitude toward the futures market also shifted somewhat during this period of time from being very cautious and risk-averse to encouraging the development of the futures market. This is evidenced by the release of two important documents: (1) “Nine Notices on Development in Capital Market” (February 2004) in which it states that China should gradually develop its futures market with a wider product range; and (2) “Proposal on Drawing Up 11th 5-Year Programme of National Economic and Social Development”

(October 2005) which requires that relevant parties steadily develop the futures market.

Furthermore, some new products were listed in the futures exchanges since 2001 such as cotton, fuel oil, corn, No.2 soybean, sugar and PTA.

Annex 2 – Empirical approaches and results

This annex describes the data set and modelling framework used to examine: (i) the relationship between commodity spot and futures prices on the Mainland; and (ii) the relationship between domestic and overseas futures prices. Some detailed results of the empirical test are provided at the end.

A2.1 Data

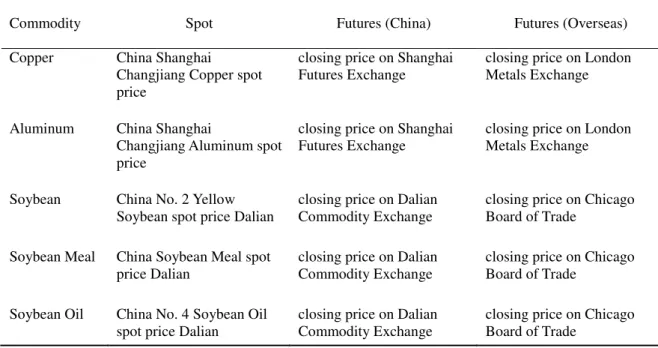

All the data are taken from Bloomberg. The starting dates of the sample periods range from Jan 2003 (Soybean meal) to Jan 2006 (Soybean oil). The ending dates of the sample periods for all commodities are November 2006. Table A2.1 provides a full description of the data used for this study.

Table A2.1. Description of Data

Commodity Spot Futures (China) Futures (Overseas)

Copper China Shanghai

Changjiang Copper spot price

closing price on Shanghai Futures Exchange

closing price on London Metals Exchange

Aluminum China Shanghai

Changjiang Aluminum spot price

closing price on Shanghai Futures Exchange

closing price on London Metals Exchange

Soybean China No. 2 Yellow Soybean spot price Dalian

closing price on Dalian Commodity Exchange

closing price on Chicago Board of Trade

Soybean Meal China Soybean Meal spot price Dalian

closing price on Dalian Commodity Exchange

closing price on Chicago Board of Trade

Soybean Oil China No. 4 Soybean Oil spot price Dalian

closing price on Dalian Commodity Exchange

closing price on Chicago Board of Trade

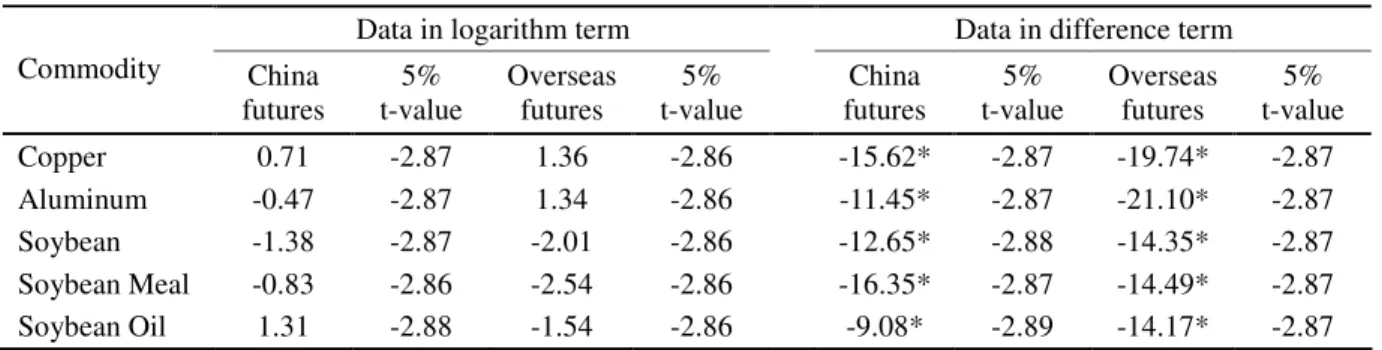

A2.2 Empirical methods A2.2.1 Price discovery

Cointegration test

Following Yang, Bessler, and Leatham (2001), cointegration analysis is conducted to assess whether there is a stable long-run relationship between spot and futures prices. The vector

Xt stands for

( , ) ' Xt = C F

where C denotes spot price and F is cash-equivalent futures prices (copper and aluminum) and futures price (soybean, soybean meal and soybean oil). ADF test is conducted to check

whether the two variables are integrated of order one. If two variables in Xt are cointegrated, it can be expressed by a vector autoregressive model with k lags:

1

( 1... )

k

t i t i t

i

X X− µ e t T

=

=

∑

Π + + =Cointegration is tested by the number of cointegration relations, r , as follows:

1( ) : '

H r Π =αβ (1)

where αβ'=(α α1, 2) '(β β1, 2). A trace test is conducted to test the null hypothesis that there are (at most) r ( 0≤ ≤ ) cointegrating vectors. The test statistics are as follows: r 2

2

1

ln(1 i)

i r

Trace T λ

= +

= −

∑

−where T is the number of observations and λi (called eigenvalues) is the 2 r− smallest squared canonical correlation of Xt−1 with respect to ∆Xt, corrected for lagged differences.

LR test of unbiasedness hypothesis

The unbiasedness hypothesis is formulated as restrictions on the cointegrating vector

1 2

' ( , ) (1, 1)

β = β β = − . Mathematically, the hypothesis testing is expressed as the following:

2| 1: ' 0

H H R β = (2)

where R'=(1,1) for the unbiasedness hypothesis. The likelihood ratio (LR) test statistics are as follows:

0, 1

ln (1 ) /(1 )

r

H i i

i

LR T λ λ

=

=

∑

− − LR test of prediction hypothesis

The prediction hypothesis is formulated as restrictions on the adjustment coefficients of the loading matrix α =(α α1, 2) '. Specifically, α2 = if the futures price leads the spot price, 0 and α1= if the spot price leads the futures in the long run. If there is a bidirectional 0 long-run information flow between spot and futures prices, then,α1≠ and 0 α2 ≠ . In 0 particular, if both futures and spot price are equally important as informational sources, then

2 1

α =α . The hypothesis testing is as follows:

3| 2: ' 0

H H B α = (3)

where B'=(1, 0)(or (0,1) ) if X1t(orX2t) is a weakly exogenous series 1 or B'=(1,1) if information flows both ways to and from cash and futures markets. As suggested by Yang, Bessler, and Leatham (2001), the prediction hypothesis and unbiasedness hypothesis are jointly tested for commodities (i.e. Aluminum) for which the unbiasedness hypothesis is not rejected. As mentioned in the main text, in the case of no evidence of cointegration, Granger causality test is applied to changes in futures and spot prices to see which dominate the other in terms of information flow.

A2.2.2 Risk Transfer

Hedging Ratio

Three different hedging models are often used in the literature to assess the hedging effect and the efficiency of risk transfer. The first uses the standard OLS regression, as in Witt (1987). Specifically, the following regression is run,

t t

t F

S = α +β ∆ +ε

∆ln 1 ln (4)

where, β1 is the hedging ratio, calculated as

1 Cov( lnSt, lnFt) /Var(lnFt) h

β = ∆ ∆ =

lnSt

∆ and ln∆ Ftare, respectively, log differences of spot and futures prices at time t; α is the intercept and εt, the error term.

The second method was first employed in Herbst, Kare, Marshall (1989) and Myers, Thompson (1989), where a Bivariate-Vector Autoregressive model (B-VAR) was used to correct the autocorrelation problem in the error term. The following system of equations are used:

1 1

1 1

ln ln ln

ln ln ln

l l

t s si t i si t i st

i i

l l

t f fi t i fi t i ft

i i

S C S F

F C S F

α β ε

α β ε

− −

= =

− −

= =

∆ = + ∆ + ∆ +

∆ = + ∆ + ∆ +

∑ ∑

∑ ∑

where, Cs andCf are the intercepts;αsi,αfi , βsiandβfiare the regression coefficients;

εstandεftare the error terms. An appropriate lag value L is sought to correct the error autocorrelation problem, subject to the following conditions:

( st) ss

Var ε =σ , Var(εft)=σff andCov(ε εst, ft)=σsf ; the hedging ratio can be calculated as follows:

1

( ln , ln | ln , ln )

( ln | ln , ln )

t t t i t i sf

t t i t i ff

Cov S F S F

h Var F S F

σ σ

− −

− − −

∆ ∆ ∆ ∆

= =

∆ ∆ ∆