of punctuality, service and safety but with most m a j o r carriers now provid- ing these as a basic part of the service, the F F P schemes that offer the most by way of incentives to individual pas- sengers are likely to be the greatest influence on their choice of airline. T h e large carriers will continue to d o m i n a t e the market with e v e r in- creasing partnership a g r e e m e n t s with o t h e r airlines and by providing m o r e opportunities to earn extra air miles and g o o d s or services. The future would seem to be built around even more airline groupings that tie in re- gional, national and international car- riers. V e r c h e r e I q u o t e s a British Air- ways spokesman who stales:

In FFP tcrms, an airline is less well placed in those marketplaces furthest from its hubs. The only way to respond to competi- tive activity at the far end of your route slructure i~ to find other ways of attracting people into a programme.

It is certain that the future will see a c o m b i n a t i o n of global FFPs, t o g e t h e r with a continuing ew)lution of both the ways tha! mileage is accrued and the m a n n e r m which these miles can be r e d e e m e d .

(;ury Mason and Nick Barker ('heltenham & Ghmcestershire Colh'ge of Higher Education

Francis (7ose Hall Swindon Road Chehenham (;hmcestershire (;LYO 4AZ. UK

References

~Vecherc,

I

"Fransport: Frequent Flyer Programmes" EIU Travel & Tourism Analyst 1993 (No 3) 5-19:Mowlana, H and Smith, G "Tourism in a global contest: the casc of frequcnt flyer programs' ,I Travel Research 1993 (Winter) 2(b-27

~l,ovcrseed, 1| "The US business and con- Icrence travel market' Travel and Tourism Anah'st 1993 (No 5) 37-5l

'British Airways Report & A('('oants, 1994-,5 British Airways, London (1995)

~'Anon 'Learning how 1o fly economy" The E(onomi.~l 1994 331 (78(-,4) 97 98 "l'ran. M "Air miles deal is heaven sent for undertakers" 771e Guardian 1994 (14 Janu- ary) 11

"Green, 1) "Top of the waiting list" Finan- (ial Time~ ]994 (1(1 October) V

~Prynn, J "Ministers told to shun perks' The Times 1994 (25 February) I 1

"Kecnan, S "('ollecting miles of free jour-

ney" The Times 1994 (28 April) 4/2 mAshworth, J 'Qantas in slipstream as BA aims to rule the airways" The Times 1994 (25 February) 29

~Churchill, D 1994 'And my partner came

too' Sunday Times 1994 (10 July) 9/45 iZVisa International Visa International (>rporate Travel Survo' (September 19941 ~Greenwald, J 'The fee for l]-ee flying' Time 1994 143 (19) 62

Trends in outbound tourism from

Taiwan

In 1979, Taiwan's government relaxed its ban on overseas travel, and permitted residents to travel to mainland China to visit relatives in 1987. In 1994, 4, 74 million people travelled abroad, about 22°/,, o f Taiwan's total population. Thus has Taiwan become one o f the world's most prominent tourist-exporting countries. In this article, we review govern- ment outbound tourism policies, analyze the market structure and the characteristics" o f travellers, discuss problems and propose solutions to improve the nation's outbound-tourism standing, and look at the future o f Taiwan's outbound travel.

As a result of T a i w a n ' s rapid econo- mic growth and increasing a m o u n t s of disposable personal income, travelling has b e c o m e part of the way of life for many people. This has fostered the d e v e l o p m e n t of T a i w a n ' s o u t b o u n d travel industry. In 1979, T a i w a n ' s g o w e r n m e n t relaxed its ban on overseas travel, and in 1987 p e r m i t t e d residents to travel to mainland China for the purpose of visiting relatives. In 1994, 4.74 million people travelled abroad, about 22% of T a i w a n ' s total popula- tion. In terms of p e r c e n t a g e , Taiwan o u t p a c e d o t h e r Asian countries, in- cluding J a p a n , which saw about 11)% of its citizens travel abroad in 1994. ~ While T a i w a n ' s e c o n o m y keeps on growing, the o u t b o u n d travel business will ~:ontinue to flourish. T a i w a n e s e travellers are known as high spenders too, contributing large tourism re- venues to host countries. This desir- able tendency makes Taiwan o n e (,f the most appealing tourist nations of origin in the world.

In this article, we first review gox- e r n m e n t tourism policies and m a j o r i m p l e m e n t a t i o n s m the d e v e l o p m e n t of T a i w a n ' s o u t b o u n d travel. W e also analyze the market structure and the characteristics of T a i w a n e s e o u t b o u n d travellers. In addition, we discuss the p r o b l e m s that arise from the tourism b o o m , and propose a solution to ira-

prove the nation's o u t b o u n d - t o u r i s m standing. Finally, we look tit the fu- ture of Taiwan's o u t b o u n d travel,

Government tourism policies

and major implementations in

outbound travel development

D e v e l o p m e n t of T a i w a n ' s o u t b o u n d travel occurred in the following four stages.Historical background: 1945-55 Taiwan was occupied by w m o u s for- eign powers for centuries until the end of the S e c o n d World War. F r o m 1895 to 1945, the island was under Japanese occupation. In 1949, the Republic of China ( R O C ) g o v e r n m e n t , d e f e a t e d in a civil war by the Chinese c o m m u n - ists, m o v e d to Taiwan and set up a provisional capital in Taipei. -~ Out- b o u n d t r a v e l was little k n o w n in Taiwan in those days.

blitial stages: 195(>78

Taiwan's "economic miracle" was still in its infancy. The main purposes for developing tourism were e c o n o m i c de- v e l o p m e n t , a t t r a c t i n g i n t e r n a t i o n a l tourists, boosting foreign exchange e a r n i n g s , p r o m o t i n g i n v e s t m e n t , c r e a t i n g e m p l o y m e n t o p p o r t u n i t i e s and increasing the p e o p l e ' s income. Owing to a shortage of toreign c u r r e m

Reports

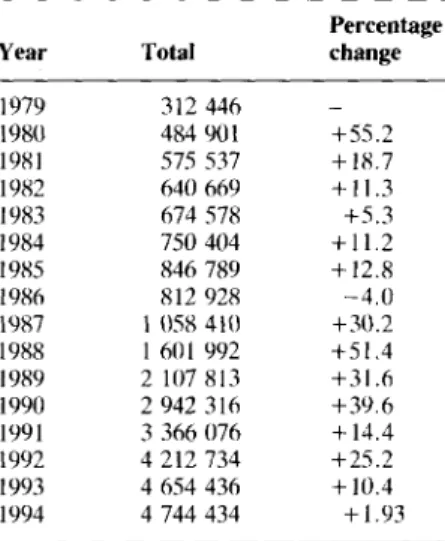

Table 1 Outbound departures of Taiwan- ese, 197%94

Percentage

Year Total change

1979 312 446 - 198(/ 484 901 +55.2 1981 575 537 + 18.7 1982 640 669 + 11.3 1983 674 578 +5.3 1984 750 404 + 11.2 1985 846 789 + 12.8 1986 812 928 -4.0 1987 1 058 41(I +30.2 1988 1 601 992 +51.4 1989 2 107 813 +31.6 1990 2 942 316 +39.6 1991 3 366 (176 + 14.4 1992 4 212 734 +25.2 1993 4 654 436 + 10.4 1994 4 744 434 + 1.93

Source:

Tourism Bureau, Ministry of Transportation and Communications, Taiwan, 'Annual report on tourism stat- istics, 1993' and 'Monthly report on tourism - Taiwan, February 1995".cies, the government stringently con- trolled its foreign expenditure, and a black market for foreign currency thrived during this period. The G N P was still low and people did not have m o n e y or t i m e e n o u g h to travel much.*

Expansion stage: 1979-90

People's interest in travel was kindled by the rise in per capita income. In 1979, the government relaxed its long- standing ban on overseas travel. Soon after this measure, local travel agen- cies switched their business focus from serving inbound foreign tourists to serving outbound domestic tourists. Restrictions on establishing new travel agencies were repealed as well. Con- sequently, the number of travel agen- cies increased dramatically, from 349 in 1979 to over 1100 in 1990. This led to chaotic price-cutting, a drop in quality of service and a proliferation of disputes between consumers and travel agencies. Measures were taken to maintain market order; above all, Travel Quality Assurance Associa- t i o n s w e r e f o u n d e d in T a i p e i , Taichung and Kaohsiung to protect

*The reason for choosing the year 1978 as a turning point was that the government re- laxed its travel policy and began allowing its people to travel abroad for pleasure purposes in 1979.

travellers' welfare and to ensure travel quality. In the meantime, Tourist In- formation Service Centers were also e s t a b l i s h e d in T a i p e i , T a i c h u n g , Tainan and Kaohsiung to provide in- struction on international etiquette and required guidelines for people going abroad so they would have a better understanding of special laws and customs in host countries. In 1990, the government repealed the E m b a r k a t i o n and D i s e m b a r k a t i o n Card (E/D Card) requirement for resi- dents, and also allowed them to de- clare and remit abroad foreign ex- change up to US$5 million per year.

Competitive adjustment stage: 1991-95

Per capita annual income reached nearly US$10 000. The leisure needs of the nation's people for travelling became more urgent. The tourism sites in Taiwan, however, failed to met demands in both quality and quantity. Some citizens now consider foreign countries as their ideal recreational sites. Consequently, Taiwan has be- come one of the world's most promin- ent tourist-exporting countries. Mean- while, to establish fair-trade practices and to promote healthy competition, the government has also strengthened travel agencies' accountability and re- sponsibility, and enforced stricter business regulation. R O C passport validity was extended to six years from 1995. The R O C government .has also tried to negotiate visa-free entry for local residents to facilitate overseas travel.M a r k e t s t r u c t u r e o f o u t b o u n d t r a v e l l e r s

Collection of data relating to out- bound travellers from Taiwan was in- i t i a t e d in 1979 by the T o u r i s m Bureau.* The total number of out- bound travellers grew 15-fold from 1979 to 1994

(Table 1

andFigure 1).

Developments over the last 16 years are analyzed below.Overall market development

From 1979 to 1986, the number of

*Unusually for a national tourism organiza- tion, the Tourism Bureau encourages out- bound as well as inbound tourism.

outbound travellers increased steadily and Japan got the biggest share of the market. The increase was dramatic: from 1.05 million in 1978 to 4.74 mil- lion in 1994. This growth resulted mainly from allowing Taiwan resi- dents to visit their relatives in main- land China. Hong Kong and Southeast Asia (namely, Singapore, Malaysia, Thailand, the Philippines and Indone- sia) were popular areas and showed t r e m e n d o u s g a i n s in T a i w a n e s e travellers. However, in 1994 growth was marginal. The global economic recession in the first half of 1994, m a i n l a n d C h i n a ' s ' Q i a n d a o Lake Incident '3'* in March, and the 'China Airlines' Nagoya Airplane Crash <** in April discouraged overseas travel.

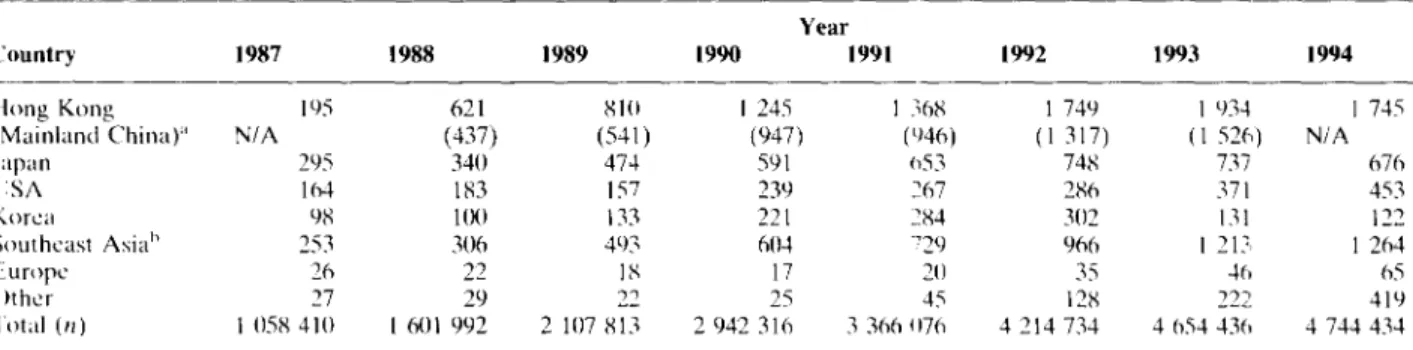

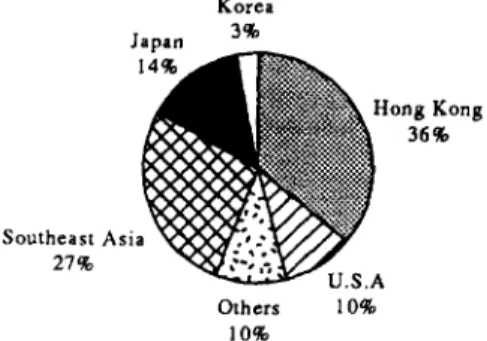

Market share

U n d e r Taiwan's current mainland China policy, direct flights between Taiwan and mainland China are prohi- bited. People going to mainland China must change aircraft in a third country or a r e a . T h e r e f o r e , T a i w a n e s e travellers are required to pass through Hong Kong, a roundabout way to mainland China. Consequently, Hong Kong's market share suddenly in- creased from 18% in 1987 to 36'7,, in 1994

(Tables 2

and 3). T a i w a n emerged as a fast-growing and large tourist contributor to Hong Kong. 5 The Japanese market dropped drasti- cally from 28°/,, in 1987 to 14% in 1994(Figure 2),

while the U S A ' s market share also decreased from 15% to 111%. With the cessation of suspension of official Taiwan-Korea diplomatic relations, the market for Korea de- clined from 9% in 1987 to 3% in 1994. By contrast, Southeast Asia's market share increased to 27% in 1994 and shows a tendency to flourish. Europe as a whole contributed only 1% of the total share; with ever-increasing eco- nomic and trade relations with Taiwan*Twenty-four Taiwan tourists and eight mainland crew were murdered on thc Qiandao Lake, Zhejiang province on 31 March 1994. Three mainlanders have becn arrested in connection with the mass mur- der.

**The China Airlines plane crashed at Nagoya airport in central Japan on 26 April 1994, killing 263 of 271 people aboard including 87 Taiwanese passengers.

d [--, ,,, e - E = H ~

a g

e ~ O . ,, g -

e ~ 5000 4500 4000 3500 3000 2500 2000 1500 1000 500 0 '79 '80 '81 '82 '83 '84 '85 '86 '87 '88Figure 1 Outbound departures of Taiwanese, 1979-1994

a n d i m p r o v i n g air l i n k s , t h i s is e x - p e c t e d to g r o w . Seasonal distribution T h e p e a k m o n t h s f o r o u t b o u n d t r a v e l a r c t h e s u m m e r m o n t h s - J u l y a n d A u g u s t . C h i n e s e N e w Y e a r (in J a n u - a r y o r F e b r u a r y w i t h v a r i a t i o n s o f t h e d a t e o w i n g to t h e C h i n e s e c a l e n d a r ) a n d S p r i n g H o l i d a y s ( f r o m 29 M a r c h to 5 A p r i l ) a l s o a t t r a c t t h o u s a n d s o f

youths to go on short-term trips. The off season usually occurs in November and December. These seasonal fluc- tuations apply to most markets except those of Hong Kong and Southeast Asia, which do not show much varia- tion.

Traveller characterivtics

The market was generally for males, aged 30M9. Most of them engaged in

'89 '90 '91 '92 '93 '94

trade or were merely general staff. They travelled for pleasure and stayed for 5-15 days. The ratio of males to females was 55:45. However, females s c o r e d a h i g h e r p e r c e n t a g e for travellers under age 29, because males must complete compulsory military service before they can travel abroad."

Mainland China market

Owing to visiting friends and relatives,

Table 2 Outbound departures of Taiwanese by country or region, 1987-94 (000s) Year

Count ry 1987 ! 988 1989 1990 1991 1992 1993 1994

l l o n g Kong 195 621 8111 1 245 1 368, 1 749 I 934 1 745

(Mainland China);' N/A (437) (541) (947) (~46) (1 317) (1 526) N/A

J apa n 295 34() 474 591 ~53 748 737 676 t ;SA 164 183 157 239 267 286 371 453 Korea 98 I/XI 133 221 284 302 131 122 Southcasl Asia b 253 3116 493 6114 729 966 I 212, 1 264 E u r o p e 26 22 l 8 17 211 35 4f, 65 ( l t h e r 27 29 22 25 45 128 222 419 Total In) 1 1158 410 I 6111 992 2 107 813 2 942 316 3 366 tl70 4 214 734 4 (~54 436 4 744 434 Notes: :'The n u m b e r of Taiwanese visitors going to mainland China is mostly included in the figurc to H o n g Kong. This figure is Irom the Ministry o1 Public Security, People's Republic of C h i n a in Yearbook of China Tourism, 1994.

~'Southcast Asia includes Singaporc, Malaysia, Thailand, the Philippines and Indonesia.

Source: T o u r i s m B u r e a u , Ministry of Transportation and C o m m u n i c a t i o n s , Taiwan, A n n u a l report on tourism statistics, 1993' and ' M o n t h l y report on tourism Taiwan, February, 1995'.

Table 3 Share of outbound departures of Taiwanese by country or region, 1987-94 (%) Year t'~nunt ry 1987 1988 1989 1990 1991 1992 1993 1994 t t o n g Kong 18.5 38.8 38.5 42.3 40.7 41.4 41.6 31~.8 ,I apan 27.9 21.2 22.5 20.1 19.4 17.7 15.8 14.3 U S A 15.5 11.5 7.5 8.1 7.9 6.8 7.9 t).6 Korea 9.3 6.3 6.3 7.5 8.5 7.2 2.8 2.6 Southeast Asia ~' 24.11 19.1 23.4 20.6 21.7 22.9 26.1 26.6 Europe 2.5 1.4 0.9 11.6 11.6 0.8 1.0 1.4 ( )thcrs 2.3 1.7 0.9 0.8 1.2 3.1 4.8 8.7 "['olal In) 1 1158 410 l 601 992 2 1117 813 2 942 316 3 366 076 4 214 734 4 654 436 4 744 434 'Vote: :'Southeast Asia includes Singapore, Malaysia, Thailand, the Philippines and Indonesia.

Source." T o u r i s m B u r e a u , Ministry of T r a n s p o r t a t i o n and C o m m u n i c a t i o n s , Taiwan, "Annual report on tourism statistics, 1993' and "Monthly report on tourism - Taiwan, February, 1995'.

Reports

Japan

Southeast27%

A s i i ~Korea

3%

~ H o n g

Kong

~

36%

U.S.AOth ers

10%

10%

Figure

2 Share of outbound depart- ures of Taiwanese by country or region, 1994 (%)economic investments, sports, cultural exchanges and academic exchange programs, traffic between Taiwan and mainland China has been increasing since 1979. The number of Taiwanese traveling to the mainland increased from 0.43 million in 1988 to 1.52 mil- lion in 1993, approximately quadru- pling over the five-year period

(Table

2). The mainland is the biggest des- tination for Taiwan's outbound tour- ists. Similarly, T a i w a n , excluding Hong Kong and Macao, contributed the largest number of tourists to the mainland China inbound market. 7

Traits of Taiwanese outbound

travellers

Studies concerning the unique charac- t e r i s t i c s o f T a i w a n e s e o u t b o u n d travellers are still limited. The follow- ing unique consumer behaviors of Taiwanese travellers are purely anec- dotal insights from many senior tour conductors, guides and sophisticated travellers. These distinctive character- istics seem to apply to Taiwanese more than to travellers of other coun- tries.

Custom of gift exchanging

J a p a n e s e offer

Omiyage

(gifts) to friends or relatives after returning from a trip, and Taiwanese share the same custom to the extent that it has b e c o m e p a r t o f t h e t r a d i t i o n a l culture, s This tradition prompts the shopping habits of Taiwanese and gradually turns them into enthusiastic shoppers. For some of them, shopping is a fashion and an overriding concern. Part of the reason may rest in the factthat imported goods were very expen- sive in domestic markets early in Taiwan's history.

Spending

Where shopping and enjoying haute cuisine are c o n c e r n e d , Taiwanese travellers are big spenders as well. They care more for shopping activities than c o m f o r t a b l e a c c o m m o d a t i o n s while traveling. 9

Diet

Taiwanese travellers pay much atten- tion to food during their vacations. So long as their appetites are taken good care of, minor flaws in the tour are tolerable. There should be at least one Chinese meal each day during the tour. Fortunately, there are quite a few Chinese restaurants around the world and this is not a problem. Like J a p a n e s e and Koreans, Taiwanese travelers do not expect to try exotic cuisine every day. ~o

Exploration

Where backpack travel is concerned, Taiwanese, especially young females+ are more exploratory in spirit than Japanese. i~

The survey of travel consumer be- haviors and preferences by Taipei Association of Travel Agents in De- cember 1994 showed that:

• preferable patterns of travel were group package tour 37%, semi- package tour 39% and backpack travel 18%; those in the 46-65 age group preferred to take package tours, whereas the 20-35 age group favored backpack travel;

• preferable types of travel destina- tions were theme tours 34%, island resorts 31% and single-stops in big cities 30% ;

• t r a v e l p r o d u c t c o n t e n t s w e r e single-stop and in-depth explora- tion 79%, multinational and a taste of tour styles 19%; and

• favorable destinations include: (a) Europe, (b) the United States, (c) Southeast Asia, (d) New Zealand and Australia, (e) Northeast Asia (Japan and Korea), (f) Canada, (g) mainland China, (h) Middle East, (i) South Africa.

Interestingly enough, their willingness

to travel, discretionary incomes and destination preferences are inconsis- tent with actual travel behaviors. For example, Europe is the top priority in f a v o r a b l e d e s t i n a t i o n s , H o w e v e r , time, expenditure, language and visa b a r r i e r s still p r e s e n t a hurdle to Taiwanese travellers going there. ~2

Challenges and opportunities

Here, we identify some obstacles pre- venting Taiwan's further outbound travel development.

Distribution system

The travel agencies in Taiwan are categorized into three types: general travel agencies (GTAs), tour operator travel agencies (TOTAs), and domes- tic retail travel agencies (DRTAs). Only the general travel agencies and tour operators are allowed to conduct outbound travel business. Purposely, general travel agencies function as travel wholesalers. G T A s plan, orga- nize both i n b o u n d and o u t b o u n d p a c k a g e t o u r s and m a r k e t t h e m through tour operators' and domestic retail networks. The distinction be- tween general travel agencies and tour operators is not clearly defined. Most G T A s also sell travel products and services. There are few 'pure' G T A s in Taiwan. Tile major differences in obligations and rights between G T A s and T O T A s are based on the mini- mum capital requirements, security deposits, sizes of business and the number of certified managers. More- over, some T O T A s are reluctant to work as agents for GTAs, preferring to operate their own tours through the 'Travel Pak System' and compete with G T A s in the market.* The chaos of this situation drives tour prices down.

Competition and bankruptcy

By the end of 1994, there were 1820 G T A s and T O T A s in Taiwan. Due to the keen competition, price discount- ing was the only way to survive. Therefore, low prices, inferior quality,

*'Travel Pak System' is a marketing strategy started by a group of TOTAs, working with air carriers, to achieve better buying powers and resources.

shopping commissions and "optional tour' rebates have become vital in- come and profit sources.* This is espe- cially true in Southeast Asian markets. Some practitioners also mentioned that customers are the biggest winners in this keen competition. Local and overseas agents cannot earn reason- able profits. In the worst-case situa- tion, customers may eventually be- eome victims too.

Airlines becoming tour vendors Air carriers are organizing their own package tours one after another, focusing on the business traveler seg- ment in particular. This 'air ticket plus hotel" product has been widely distri- buted and has met with success. It is becoming the predominant product for business travel. Obviously, it aroused great conflict between travel agencies and air carriers. Travel agen- cies insisted on getting higher commis- sions when selling carriers' bypass pro- ducts and demanded that the products only be sold through travel agencies" networks, otherwise carriers would be violating regulations set by the Tour- ism Bureau.

Visa barriers

Following withdrawal from the United Nations in 1971, Taiwan has had a difficult relationship with mainland China and the international commun- itv. Only 30 countries maintain formal diplomatic relations with Taiwan at the moment. Substantial relations can only be conducted with those coun- tries that do not have diplomatic rela- tions, through trade, cultural ex- change and technological cooperation. Taiwanesc travellers applying for for- eign visas must deal with some type of tourism promotion offices, cultural or trade associations in Taipei or in Hong Kong. ()wing to the nature of these informal organizations, the process is time consuming and costly. Apparent- 1\, lhose countries such as Singapore and Indonesia that provide visa-free programs to Taiwan are gaining favor.

~'Shopping Commissions', roughly 10- 30%, are tokens of appreciation given by 'die management of shops to tour leaders, tour guides and drivers for generating busi- ness.

Travel incidents, disputes and accidents

Recently, there have been a few travel incidents, disputes and accidents; for instance , 'the Qiandao Lake Inci- dent', and the robbery and murder incidents that have occurred in Main- land China, Indonesia, Thailand and Italy. Meanwhile, passports have been stolen in vast numbers by professional forgers and sold so that illegal immig- rants could enter the developed coun- tries under false pretenses. Such inci- dents can often be traced to travel industry personnel who were lacking in professional knowledge, abilities and legal concepts.

International marketing shortcomings The leading outbound general travel agencies seldom join international tourism organizations or participate in world travel marts. They depended exclusively on destination tour oper- ators owned by overseas Chinese to handle all their tour needs. They seem h e s i t a n t to deal with local non- Chinese travel service suppliers be- cause of language barriers. Travel is truly a s e r v i c e - o r i e n t e d business. Travel agencies should invest time_ money and effort in becoming mem- bers of the international tourism fami- ly to obtain the most up-to-date in- formation to meet the needs of the travelling public.

International etiquette

A very small percentage of Taiwanesc travellers, like those in the USA amt Japan in the 1950s and 1960s, have behaved inappropriately and damaged Taiwan's image. Guiding and correct- ing these behavior modes and shorten- ing this embarrassing phase in the process of becoming a fully developed c o u n t r y d e p e n d s on c o o p e r a t i v e efforts between the public and the private sectors.

The outlook

Synthesizing government tourism poli- cies, analyses of market structure and characteristics of Taiwanese travellers, and the accompanying challenges are some directions in the future devel- opment of Taiwan's outbound travel that merit special attention.

Increase in outbound travellers As the market has m a t u r e d , the t e n d e n c y t o w a r d high t w o - d i g i t growth of outbound travel seems to have run its course. However, single- digit rates of increase are still foresee- able. When Taiwan becomes part of the G A T T family, the local travel market inbound and outbound will feel the impact.

Airline deregulation

Due to airline deregulation, passenger seats appear to outnumber potential travellers. To fill their seats, the air- lines have to strengthen their market- ing strategies with incentives such as bypass products and frequent-flyer programs. These changes in policy will in turn make the retail market more competitive.

The changing structure (~ftravel agent services

To maximize profit enargms and nfini- mize costs of travel products, standar- dization seems to be the direction that travel agencies are taking. They be- lieve the future development of travel agencies will be toward one of two extremes: to become either a small sales outlet or a "central kitchen" for mega travel products. Regulations of t r a v e l a g e n c i e s in T a i w a n were amended in June 1995. Revisions re- quire the general travel agencies to put aside US$ 0.38 million each as security deposits: medium-size agen- cies will be forced to either merge or simply act as travel brokers: mega- agencies will be allowed more latitude in doing business: and mini-agencies will maintain their function as sales channels of the wholesalers and enjoy profits from sales commissions. Con- sequently, mega-agencies and mini- agencies will work togelher and inte- grate their roles in the market. Consumerism

Travel abroad has become part of the lifestyle of modern generations m Taiwan. The average age of outbound travellers will go down gradually while, on the other hand, their educa- tional levels will go up steadily. Con- sumerism is becoming prevalent. The buying process will become more rational and price will not be the only

Reports

criterion for purchasing. Planned holi- days will form the mainstream, and travel agency images will become a dominant factor in consumer purchas- ing behavior.

Diversified products

For senior citizens or those traveling abroad for the first time who would like to take a group package tour, one ticket will satisfy all their needs. However, as travellers become more sophisticated and d e m a n d i n g , the travel products need to be more finely tuned and diversified. Single stops, s h o r t e r d u r a t i o n s t a y s , c u s t o m - tailored and in-depth group package tours, foreign independent package tours and backpack travels are becom- ing popular travel styles. Those visit- ing Europe for the second time would prefer to spend 8-9 days in one loca- tion such as France, Italy, Germany or the UK. White-collar workers in par- ticular like this s i n g l e - d e s t i n a t i o n travel pattern. New Zealand and Au- stralia are good examples of this type of m a r k e t . 13 ' S h o r t e r ' , ' s m a l l e r ' , 'lighter' and 'thinner' will be the four ideal guidelines in developing tourism products for Taiwan's outbound mar- ket.*

The rise of regional tourism

As the Asia-Pacific region moves clos- er to the world's economic center, the prosperity of regional businesses will certainly enrich travel activities in this area, especially for business travel. The city package will have its place in this market. However, the air links between Taiwan and China via Hong Kong or Macao have become a wor- rying factor for Taiwanese outbound travel in the lead-up to 1997. The issue of the change in sovereignty of Hong Kong will affect the future of both sides' carriers. This is particularly the case in that Taiwan and China are still at political odds with one another. After 1997, as stated by the Chinese authorities, all traffic rights and bi- lateral air treaties will have to be

*All these items reflect the travel behaviors and preferences of Taiwanese outbound travelers aged 25-30 in particular: shorter in duration (time), smaller in radius (dis- tance), lower in price (money), and fewer prepaid activities (contents).

agreed by China. 14 Since Taiwanese t r a v e l l e r s p r e s e n t l y rank first or second in the generating market of Hong Kong and account for about one-third of the Taiwanese outbound market, it is hoped that there will be a new air accord worked out by 1997. In sum, if both sides' authorities abide by the rule of "separation of politics and economy' and settle the economic problems in a purely economic way, Taiwan and China will benefit each other. Will this happen? It remains to be seen.

Chun-Te Huang Institute of Management Science National Chiao Tung University Chi-Yeh Yung Travel and Tourism Management Dept National Kaohsiung Hospitality College and Jen-Hung Huang Institute of Management Science National Chiao Tung University Taipei, Taiwan

References

z Japan National Tourist Organization ONTO) and Ministry of Transport (MOT) Tourism in Japan 1993 Tokyo, Japan (1993) 1-6(/

2Government Information Office The Re- public of China Yearbook, 1995 Govern- ment Information Office, Taipei, Taiwan (1995) 80-87

~'Lien: Beijing on right track" The China Post 1994 (20 April) 1

4"Angry crash kin in Nagoya" The China Post 1994 (28 April) 1

5Go, F, Pine, R and Yu, R 'Hong Kong: sustaining competitive advantage in Asia's hotel industry' Cornell Hotel and Res- taurant Administration Quarterly 1994 35 (5) 50-61

6Department of Transportation Manage- ment, Tamkang University A Study to Establish the Forecasting Model for In- bound and Outbound Travelers in Taiwan Tourism Bureau, Ministry of Transporta- tion and Communications, Taipei, Taiwan (1993) 6.3-76

7Zhang, G 'Tourism crosses the Taiwan Straits' Tourism Management 1993 14 (3) 228-231

SNozawa, H 'A marketing analysis of Japanese outbound travel' Tourism Man- agement 1992 13 (3) 226-233

'~Perry Hobson, J S and Ko, G "Tourism and politics: the implications of the change in sovereignty on the future development of Hong Kong's tourism industry" J Travel Research 1994 32 (4) 2-8

mAhmed, Zu and Chon, K-S 'Marketing the United States to Korean travelers" Cor- nell Hotel and Restaurant Administration Quarterly 1994 35 (2) 9(I-94

l tMao, L-J 'FIT product strategy' Travel Trend News" 1995 99 (January) 6

~2Taipei Association of Travel Agents 'A travel survey of consumer behaviors in 1995' Bon Voyage Journal 1995 38 (Janu- ary) 6-11

l~Yung, C-Y Travel Agency - Principles', Practices', Philosophies" 2nd edn, Yang- Chih Press, Taipei, Taiwan (1993) 539-545 t4l-lobson, J S 'Hong Kong: the transition to 1997" Tourism Management 1995 16 (1)

15-20

'Reaching high in Denver' - S T T E

annual conference 1995

Technology and its relevance in tourism education was one o f the key themes f o r the seventh annual conference o f the Society o f Travel and Tourism Educators held in Denver, Colorado f r o m 9-12 N o v e m b e r 1995. Academics and practitioners f r o m Australia, N e w Zealand and the U K joined those f r o m the USA and Canada f o r the wide range o f research papers and commercial presentations.

Richard Meredith, President of the Colorado Travel & Tourism Authority (CTI'A), opened the first session of the conference, detailing how the organization came into existence in 1994 given the exigencies of public sector funding. Although created by

the state legislature, CTTA is gov- erned and funded by the tourism businesses it represents; revenue com- es from one-tenth of 1% of com- panies' annual gross revenue with a lower rate for restaurants to reflect the higher proportion of local clientele.