Intellectual capital: An empirical study of ITRI

Po Young Chu *, Yu Ling Lin, Hsing Hwa Hsiung, Tzu Yar Liu

National Chiao Tung University, Department of Management Science, 1001 Ta Hsueh Road, Hsinchu 30050, Taiwan Received 16 August 2004; received in revised form 12 September 2005; accepted 1 November 2005

Abstract

Intellectual capital (IC) could provide a new instrument for observing organizational hidden value. While most intellectual capital studies are either theoretical or exploratory, some western research facilities are publishing annual reports based on intellectual capital. Nevertheless, Asian empirical studies are much rarer than western ones, let alone conducting comparison among them. Industrial Technology Research Institute (ITRI), founded in 1973, is a non-profit national R&D organization, aiming to develop Taiwan industrial technologies. This paper firstly attempts to associate the components of the intellectual capital, namely, human capital, structural capital and relational capital with the value/performance of ITRI. Secondly, we find intellectual capital highly relevant to the value creation process and warrant strategic accumulation for R&D organizations.

D 2005 Elsevier Inc. All rights reserved.

Keywords: Intellectual capital (IC); Non-profit organization; Industrial Technology Research Institute (ITRI); R&D; Performance evaluation

1. Introduction

1.1. Intellectual capital: recent hot research topic for knowledge-base societies

The most critical ingredients of firm resource endowment are not tangible such as financial or physical assets, but are intangible and, thus, rare, valuable, imperfectly imitable and non-substitutable

[1]. During the decade of the knowledge economy, businesses have attempted to encode and store their intangible capital, including experience and knowledge. Business produced Intellectual Capital Reports

0040-1625/$ - see front matterD 2005 Elsevier Inc. All rights reserved. doi:10.1016/j.techfore.2005.11.001

* Corresponding author.

(IC Reports) based on supplementary materials or amendments of their annual reports. The process attempted to specifically measure intangible assets, the sources of knowledge-based organizations, and to describe the knowledge-based value creation process. Hopefully, through a complete presentation of the true nature of the business, the firm could provide a report on the organization to related parties.

In the process of finding a method for assessing internal intangible assets and intangible production procedures of organizations, intellectual capital can provide a completely new model for observing organizational value. The components of intellectual capital indicate firm future value and the ability to generate financial results. This is why a more systematic method of reporting on and managing these intangible dimensions is required. While most intellectual capital studies are either theoretical[2–4] or exploratory [5,6], some western research facilities are publishing annual reports based on intellectual capital (Austrian Research Center[7]; German Aerospace Center[8]). However, Asian empirical studies are much rarer than western ones, let alone conducting comparison among them.

1.2. ITRI: the most important and well-known R&D institute in Taiwan

The impressive development of Taiwanese high-tech industry can be partially attributed to Industrial Technology Research Institute (ITRI), a unique national industry technology application research institute established by the government in 1973. ITRI has improved technology core competence and supplied well-trained experienced human resources specialized in various high-tech fields. Notable spin-offs such as the United Microelectronics Corporation (UMC group) and Taiwan Semiconductor Manufacturing Company (TSMC) all resulted from timely research by ITRI on semiconductors and enabled the subsequent rapid development of the Taiwanese semiconductor industry.

1.3. Perspective of intellectual capital to assess the value of ITRI

ITRI non-profit nature makes it difficult to assess the value of ITRI. Key questions in relation to study are why value of ITRI should be assessed from an intellectual capital perspective and how an intellectual capital framework could enhance measurements that other methods could not. As ITRI has a 30-year history, its area of business and accumulated data have facilitated the conduct of an empirical study to assess the value of an Asian national R&D institute and its intellectual capital. Over the past decade, the rapidly growing realization of the importance of intangible assets and intellectual capital in organizational operations has created the need to manage companies and measure their performance in new ways. Unlike a research facility belonging to a regular business establishment, it is impossible to use operating income- or profits-generated by-products produced by ITRI to measure the rate of return on the resource investment in ITRI. Even if it was possible to quantify the input and output in financial terms, traditional financial report worksheets would not be a suitable means of measuring cost efficiency. In fact, financial worksheets measure short-term and tangible assets. Additionally, indices are lagging indices, and moreover, it is impossible to quantify or declare the external performance, deferred results, and intangible assets of ITRI. These concerns have made intellectual capital reporting extremely informative and desirable as a means of objectively assessing ITRI.

The important point here is that the value of ITRI is from the viewpoint of the customers, government and industries. Simultaneously, the value of ITRI should be systematically structured to examine the nature of intellectual capital in ITRI and its role in the value creation processes. To date, most intellectual capital research is theoretically based. There is a lack of empirical studies, particularly Asian case

studies. This study attempts to present the Intellectual Capital of ITRI and compares it with that of R&D institutes in western countries.

The paper is organized as follows. Section 1 briefs the motivation and purpose of the research. Section 2 reviews related literatures and studies about the intellectual capital. Section 3 structuralizes our research methodology consisting of research framework, data, and a brief introduction to ITRI.Section 4 summarizes and discusses the empirical results. Finally,Section 5 contains our concluding remarks.

2. Literature review

As many scholars point out, a major proportion of growth companies are valued beyond book value. The traditional financial report worksheets could not suitably measure its cost efficiency. As a matter of fact, financial worksheets measure short-term and tangible assets. These concerns have made the perspective of intellectual capital highly informative and desirable in order to objectively evaluate ITRI. 2.1. Intellectual capital: theoretical/exploratory

List [9]pointed to the need to build national infrastructure and institutions in order to promote the accumulation of bmental capitalQ1 and use it to spur economic development rather than just to sit back and trust bthe invisible handQ to solve all problems. Of crucial importance for List is the quantity of mental capital, which is the most important element differentiating developed from underdeveloped economies. Thus, development is perceived as a process of augmentation of mental capital. This leads List to the conclusion that the main role of the state in the economic sphere should be the nourishment of the national productive powers. Freeman [10,11] pointed out the importance of an active role for government in promoting the technological infrastructure in the spirit of List.

The intellectual capital statement movement of the 1990s can perhaps be said to have begun in the mid-1980s when some practitioners in the service industry in Sweden suggested an extension to the financial reporting [12]. Sveiby [13] and Dierkes [14] postulated that management could formulate strategic goals through the effective management of these intangible assets and, thus, foster the operation and development of the organization. The intellectual capital perspective was initially developed as a framework for analyzing the value contribution of intangible assets in an organization. The first major grounding of the work was published by Roos and Roos[15]and in more theoretical detail by Chatzkel

[2]and Pike et al.[3]. This approach, developed in parallel with the work by Amit and Shoemaker[16], shares many features with that view and drew on practical experience pioneered by Leif Edvinsson, Director of Intellectual Capital at Skandia [17].

Roos [4] postulated that the concept of intellectual capital is not the mere understanding and assessment or the illustration of the tacit value of an organization; it also aims at transposing the results of the assessment or illustration of organizational tacit values into new values. Scholars have presented varying perspectives on the matter of intellectual capital composition and meaning. As with most emerging theories, there are many definitions of intellectual capital, but over the last few years, there seems to have formed a consensus of dividing a company’s resources into three different groups. According to studies and definitions by Stewart [18], Edvinsson and Malone [5], Johnson [19], and

1

Smith and Parr [20], intellectual capital is comprised of three components: human capital, structural capital (organizational capital) and relational capital (customer capital).

The term human capital refers to the knowledge, seniority, mobility rate, skills, and experiences of the entire organization’s staff and management. The term structural capital refers to the general system and procedures of the organization for problem-solving and innovation. It includes assessment of the stored knowledge value, the cycle of liquid capital, as well as accounting of administration expenses. The term relational capital refers to the organization’s establishment, maintenance, and development of public relations matters, including the degree of customer, supplier, and strategic partner satisfaction, as well as the merger of value and customer loyalty. Petrash[21], through an interactive model of the three intellectual capitals (human, organization, and customer), postulated that the three intellectual capitals mutually share, promote, and grow. Therefore, a greater reciprocity of performance would contribute more to the value of the organization.

2.2. Some previous related empirical studies: empirical/practical

Presently, some research facilities are publishing annual reports based on intellectual capital. This non-monetary approach to measuring has been used by companies in Sweden since the mid-1980s and has created a Swedish Community of practice, with a unique experience in this area. Much published research has used annual reports as audit objects to ascertain the status of the intellectual capital of firms within countries [22–24] and between countries [25] and analyzed the annual reports of a sample of publicly traded firms in six countries, namely, the USA, Canada, Germany, UK, Japan and South Korea, to make an international comparison of human resource information and disclosure.

The reports present the core expertise and operating efficiency of the research facility. They not only completely manifest internal management conditions, but also probe into performance and production capacity. The Austrian Research Center (ARC), the largest technology research facility in Austria, started publishing its IC Report in 1999 as a supplement to its annual report. ARC then developed suitable indices, and based on the IC Report, it studied annually the increases and decreases in these indices for a better understanding of knowledge capital flow and accumulation. It sparked a following among the knowledge-intensive establishments in Austria and became the standard reference for IC Report construction. Abroad, the largest research facility in Germany, the DLR (German Aerospace Center), also evaluated its organizational features based on the ARC framework, and in 2000, it published its own IC Report.

3. Methodology

3.1. Introduction to ITRI 3.1.1. What is ITRI?

ITRI was established by the Ministry of Economic Affairs (MOEA) of Taiwan in 1973, a non-profit R&D organization, to provide for the technological needs associated with the industrial development of Taiwan. By year 2004, ITRI had grown to have a staff of more than 6000 people, and it now serves as the technical center for industry and an unofficial arm of the government’s industrial policies in Taiwan. ITRI comprises 12 professional business units, including seven laboratories and five technology development centers, as well as two integrated task units and four service centers (as shown in Appendix A).

The composition of the revenue of ITRI is unique. Government partnership provides around half of the revenue of ITRI. Moreover, the other half derives from private sector research and service contracts. This bfifty–fiftyQ arrangement provides ITRI with access to more resources than would be possible if it was entirely dependent upon either purely public or private resources.

The mission of ITRI is to implement mid-term and long-term national applied research projects that are comprehensive, progressive and cutting edge. In line with government measures, ITRI also advised small and medium businesses and participated in state enterprise R&D projects to help optimize national research resources. Under government leadership and the industrial sector cooperation, ITRI continued to develop technologies required by industry and regularly transferred these new technologies to firms. ITRI thus achieved the goal of improving the competitiveness of Taiwan in the areas of technology. 3.1.2. Historical reasons for the establishment of ITRI

List’s concept of bnational systems of productionQ took into account a wide set of national institutions including those engaged in education and training as well as infrastructures such as networks for transportation of people and commodities [9]. When ITRI was founded, Taiwan had no high-tech industry. In the 1970s, the Taiwanese government recognized the limitations imposed by the limited natural resources and domestic market size in Taiwan. Simultaneously, the government also realized the need to develop an export-oriented strategy, complemented by high-tech industrial development, to maintain national economic growth[26]. At that time, while industry needed technologies to achieve new breakthroughs, the R&D capabilities of the private sector were insufficient. Consequently, the government founded a non-profit R&D organization, serving as a public policy arm and the resource center to private enterprises, which at the time was an innovative and controversial proposal.

ITRI has helped guide the technological and economic growth of Taiwan. Today, Taiwan is a world-class player in semiconductors, personal computers, and numerous other high-tech sectors. ITRI has played a crucial rule in transforming the economy from being agriculture based to industrial based. ITRI, with the efforts it has expended on upgrading traditional industries and nurturing new technology-based enterprises, has been recognized as a significant contributor to the process. If Silicon Valley has been the greenhouse for the American high-tech sector, then ITRI and the neighboring Hsinchu Science-based Industrial Park (HSIP) has been the cradle for the Taiwanese high-tech industry.

3.2. Research framework

Firstly, in-depth interviews were performed as a judgment-based method to help understand the vision, operating mechanism and process of change at ITRI. The secondary data were collected from ITRI annual reports (1973–2003)[27], the ITRI 30-year special project[28], the ITRI Chronicle and the ITRI’s web-site

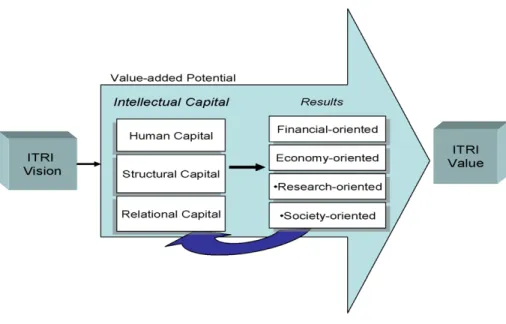

[29]. Secondly, we collected the list of spin-off companies listed or OTC-listed and the TAIEX-listed or OTC-TAIEX-listed companies of which the incumbent or past board chairmen or presidents were ITRI ex-employees of companies. Archived financial data from the Taiwan Economic Journal Data Bank for these companies were collected and used to conduct relative analyses. This study attempts to propose a framework for the intellectual report of ITRI for transparently identifying the hidden value of an Asian non-profit R&D institute. This also facilitates comparison studies and future improvement. ARC and ITRI are the largest technology research facilities in Austria and Taiwan, respectively. The measurement of intangible resources should be considered a key element in the ITRI’s vision also. The ITRI IC Report classification standard measures ITRI’s performance based on four aspects: financial-oriented,

economy-oriented, research-oriented and society-oriented. It traces the knowledge production processes and knowledge flows of a knowledge-based organization (shown asFig. 1).

Due to the characteristics of R&D organizations, the knowledge outputs will accumulate over time and later become new capabilities of the organizations. Progressively, the ITRI research results would eventually be changed into a form of intellectual capital (shown as Fig. 1). For example, yearly, new increased projects, seminars, and industrial services are counted as annual ITRI outputs in terms of flow measurement similar to the treatment of the net income in the income statement. Those results and activities would facilitate ITRI future cooperation with external stakeholders and then have accumulated lasting strength. Such effects could be viewed as stock instead of flow, similar to the treatment of retained earnings in the balance sheet. Hence, the indices of ITRI outputs would serve as the measurements of results as well as structural and relational capital, only differentiated yearly from accumulated figures. The study selected those workable proxy variables for measuring the intangible value of ITRI for intellectual capital that should be defined in individual organizational terms. Even so, why should the value of ITRI be assessed from an intellectual capital perspective?

4. Empirical results and managerial implications

Public investment in technological infrastructure and intellectual capital is crucial for a successful economic development[11]. Building competitiveness requires combining education, science, trade and industry policy. Research facilities comprise a key part of the national innovation system, and since some of their funding comes from the public sector, research facilities are required to clearly account for fund utilization to obtain government approval and budget allocation. During the past three decades, the government has invested a total of $4373.87 million2to support R&D activity by ITRI. It is difficult to

Fig. 1. Research framework.

2

measure R&D results in numerical terms. Although some results may be expressed numerically, for example, by 2003, ITRI obtained 7248 granted patents (domestic and overseas), held 13,227 seminars, and conducted 14,088 commissioned and joint research projects. However, efficiency should be assessed from numerous different angles to measure it properly.

4.1. Has ITRI’s intellectual capital really worked?

How does intellectual capital work with ITRI? What potential effects is the reporting of intellectual capital expected to have? The traditional accounting system looks largely at separable assets although recognition is given to some intellectual capital under the heading bgoodwillQ [30]. The intellectual capital statement underpins the development of the future value of the company, and consequently, its competitiveness in the knowledge economy[31]. The intellectual capital report is supplemented as the beginning of understanding ITRI’s complexity and potentiality.

4.1.1. Report on the intellectual capital of ITRI

The Intellectual Capital Report framework is listed inTable 1. This table shows the status of ITRI intellectual capital for the period 2001–2003, as well as the intellectual capital indices of ARC for 2001 and 2002 to provide a reference. However, owing to the varied natures of these research facilities, the problem of inconsistencies across variable definitions limits the applicability of the research results.

Table 1 lists the human capital of the two research institutes for comparison. Notably, employee turnover rate was approximately 10% in an annual rate. Management should consider excessively low or high employee turnover rates as a warning sign. Excessively low rates indicate that the training of the institute might not be keeping up to date with industry needs. On the other hand, excessively high turnover could impact the research institute R&D performance or signify the presence of problems in organization operations. Additionally, the ratio of R&D personnel to the total personnel could indicate the degree of R&D dynamism, or the lack of it, in the research facility. ITRI had a higher ratio of R&D personnel than ARC. Possibly, owing to the larger size of ITRI as well as its outsourcing of certain administration functions, ITRI has achieved economies of scale. Based on service seniority of its employees, ITRI has less service seniority, which is a reasonable and expected result considering ITRI’s mission of developing well-trained human resources for Taiwan’s high-tech industries.

An important index of structural capital must be considered when observing a research facility— percentage of non-government revenue. This study considers all ITRI non-government project income to be proxy variable of structural capital. An excessively low value indicates an excessive reliance on public-sector funds, thus making it too easy for ITRI to lose its competitive power. If a development facility is fitted to possess a significant capacity for self-generated capital, then the industries need the research facility. This has also significantly justified the role of ITRI in technology development. Regarding relational capital, number of seminars and number of commissioned projects and industrial services provided input indices. The number of seminars could be used to specifically measure knowledge sharing activities. During the past three decades, ITRI has always emphasized seminars. Each researcher has an average of 0.1 contribution on seminar and the ratio has continued to grow with time. This study divides the measurement of the performance of ITRI into four areas. Finance-oriented measurement was expressed based on the ratio of the non-government revenue to the total revenue. A higher figure indicates less reliance on government budget allocation or a more market-oriented performance. During the past three decades, this ratio has been steadily approaching 50%.

Economic-Table 1

Intellectual capital performance indices: comparison between ITRI and ARC Unit: million US$ Cases

ITRI ARC

2001 2002 2003 2001 2002

Intellectual capital

Human capital: Human resources

Number of staff 6068 6302 6193 371 377

Number of R&D staff 4859 5115 5063 215 217

Total staff fluctuation (%) 10.3 10.4 8.4 10.9 9.6

Proportion of R&D staff (%) 80.1 81.2 81.8 56 55.1

R&D personnel turnover rate (%) 10 10.4 8.43 12 14.7

Service seniority of employment (years)

8.8 8.6 8.6 11.3 12

Structural capital

Accrued number of commissioned and industrial service

697,558 749,254 804,697 – –

Accrued non-government project revenue

898.07 981.9 1071.81 33.26 (2001 only) 34.3 (2002 only) Relational capital: Project cooperation

and networking

Accrued number of seminar 10,937 11,893 13,227 1107 (2001 only) 827 (2002 only) Accrued number of commissioned

and joint research projects

12,081 13,136 14,088 221 (2001 only) 173 (2002 only)

Results

Finance-oriented results

Non-government project revenue 215.34 262 281 33.26 34.3

Non-government project revenue (%) (Financing from own resources)

44.7 49.5 49.9 63 63

Total revenue 481.8 529.1 562.9 52.8 54.5

Economy-oriented results Number of commissioned and industrial service

57,142 51,696 55,443 221 173

Number of commissioned and joint research projects

1159 1055 952

Number of seminar 933 956 1334 – –

Number of technology transfer 337 414 641 – –

Research-oriented results

Number of patent acquired 862 821 766 2 3

Number of patent application 1075 1259 1546 16 20

Patent acquired/researchers (%) 18 16 15 1 1

Patent applications/researchers (%) 22 25 31 7 9

Social-oriented results

Government project revenue 266.4 267.1 282 19.54 20.17

Number of spin-off 1 2 1 1 0

b–Q due to the differential of operational definition base, the data cannot compare between two institutions.

oriented measurement can be observed based on various angles such as the number of cases of technology transfer, seminars, joint research projects and commissioned industrial services. The research-oriented results of ITRI have demonstrated validity in terms of patent applications and patents acquired. During its early years, ITRI put little emphasis on patent applications; consequently, significant variation has been observed in the 30-year period with a distorted value on the average. A stable growth pattern has been illustrated during the past 10 years. Compared with the ARC, ITRI displays relatively good performance in terms of patent issued.

This study used number of spin-offs as a yardstick to measure spin-off activities and investment efficiency. ITRI established a total of 12 spin-offs pursuant to the bITRI Spin-off Organization ProcedureQ during the past three decades, less than the number for ARC. However, if the 13 companies incorporated under ITRI direction and six companies incorporated with direct ITRI assistance are also included in the study, then the economic contribution of ITRI reaches 31 companies, a notable achievement.

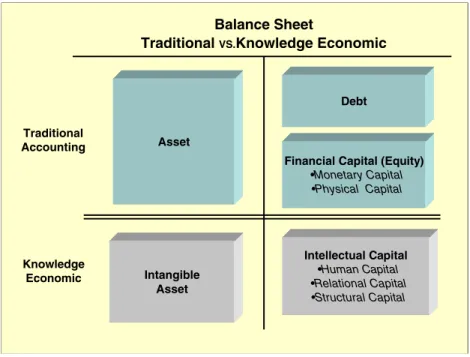

4.1.2. Balance sheet of intellectual capital and intangible assets

Intellectual capital refers to the hidden resources of an organization not fully captured by traditional accounting reports. Traditionally, the only intangible assets recognized in financial reporting statements were intellectual property, such as patents and trademarks, and acquired items such as goodwill. Intangible assets and knowledge flows are essentially non-monetary. In a general sense, measuring involves identifying the flows that change or otherwise influence the value of the assets illustrated in the figure. When the organization is based on intellectual capital, multiple knowledge inputs are possible without knowledge loss. This means value can accumulate and multiply. Financial capital is deducted from the rate of return, while intellectual capital is added to the rate of return. Consequently, from a continuous operation perspective, an organization that manages to continually increase its intellectual capital can power its long-term growth.

Fig. 2shows the components of intellectual capital as elements that combine and interact both with one another and with traditional capital elements (physical and monetary elements) in unique ways to create value. The resources that actually make up the categories are unique to each organization, as only those resources that are important for creating value should be included in its distinction tree [32]. Traditional financial statements were structured in such a way that R&D expenditures were considered expenses which were not under the assets categories. Adopting this approach could underestimate the organizations’ intellectual capital. If intellectual capital is regarded as the report form structure of R&D organization, then human capital, relational capital and structural capital are clearly the basic value sources of an organization. Intellectual capital can be deployed on the right side of the balance sheet.

Intellectual capital can accumulate considerable energy. Because of employing appropriate timing and co-operation strategies, ITRI has spun off or indirectly set up numerous firms. The spinning-off firms is the typical intangible asset of ITRI. The intellectual capital on the right side is equal to the intangible assets on the left-side of the balance sheet. The capital transforms itself into assets and then creates revenue and profit. The intellectual capital of ITRI also belongs to national intellectual capital that can fuel the growth of Taiwan GNP.

ITRI provided key technology components during the initial and growth periods. Consequently, physical capital is the main consideration factor. However, with the maturing of the industry, the mission of ITRI is upgraded to fill the gap between the present and future capabilities of Taiwan industries. Meanwhile, the concepts of the knowledge economy recently have become a hot topic. Intellectual capital effects thus have become increasingly important measurement criteria.

4.2. How is intellectual capital associated with ITRI’s performance?

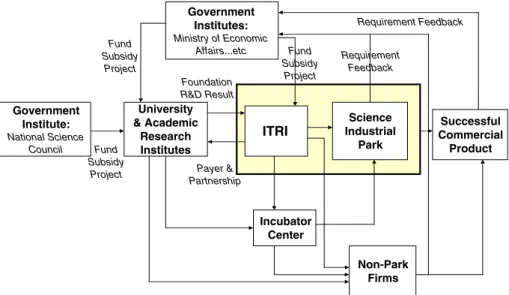

Not only has ITRI generated commercializable R&D results, but it has also markedly reduced technological uncertainties and the risk of manpower shortages. ITRI provided professional human, market, technology, and information to the HSIP and other firms, thus creating a symbiotic effect and optimizing its external economic effects.

4.2.1. Human capital

People are the key asset in any R&D institution. Human capital is important because it is a source of innovation and strategic renewal[6]. During the 1970s, Taiwan suffered a lack of high-tech researchers. The chief executive leaders were appointed by the government, such as Guo-Ding Li, Yun-Xuan Sun, etc., who were excellent leaders in Taiwan. Meanwhile, some talented people selected high-tech careers in ITRI rather than overseas. By 2003, ITRI had become an operation comprising 6193 persons. Doctoral or master’s degree background has become the main human structure increasing from 18.66% in the initial period to 62.7% in 2003. Scale effect was not notable in the initial stage as ITRI did not have sufficient experience and the relationship. However, the organization is becoming complete with better infrastructure developed over time. The performance of ITRI has become significant. The analogy is similar to the building of a highway. Human capital, currently the most valuable intangible asset, comprises most R&D staff (78%) and experienced employees (50% with more than 10 years professional experience). Although ITRI is not an educational institution, it is one of the main suppliers of industrial leaders, especially in high-tech sectors, in Taiwan. ITRI set up ITRI College as an industrial academy to propagate its knowledge and accelerate the training of the human resources required for the knowledge-based economy. ITRI also offers systemized programs to preserve and enhance industrial competitiveness, including strategic

Asset

Debt

Financial Capital (Equity)

•Monetary Capital •Physical Capital

Balance Sheet

Traditional VS.Knowledge Economic

Intangible Asset Intellectual Capital •Human Capital •Relational Capital •Structural Capital Traditional Accounting Knowledge Economic

technology, new knowledge, customized and specialized management courses. ITRI also provides both on-the-job training and development programs for employees. The broad research scope, excellent facilities, close industrial ties and interdisciplinary approach combine to create a uniquely effective hotbed for industrial talent. The Elite Training Program newly initiated by ITRI has enabled young ITRI scientists to interact with world-class researchers. This gateway helps researchers to increase their own knowledge as they contribute to local and global advances in technology.

4.2.1.1. Human resources diffusion. Regarding the contribution of ITRI to human resources diffusion, knowledge products frequently cause aggressive external economic effects. One of the objectives of ITRI is to distribute technology among private enterprises, and this objective is achieved by turning ITRI researchers into industrial technologists. Nevertheless, personnel diffusion and the networking for the hi-tech cluster in Taiwan via ITRI are format robust. Since its establishment in 1973, ITRI has transferred 16,401 personnel to other sectors (as of 2003), including transferring 13,246 to the business sector, 660 to government institutions, 1673 to academia, and 822 to pursue advanced studies. Further considering the contribution of ITRI to human capital diffusion in Taiwan, this study surveyed TAIEX-listed or OTC-listed companies with incumbent or past board chairmen or presidents who were ITRI ex-employees. A total of 55 companies were found to have had previous presidents or board chairmen transferred from ITRI, and around 13 had incumbent presidents or board chairmen transferred from ITRI. The accrued operating revenue generated by these companies over the years was $58.87 billion by 2003. Although the flow of professionals leaving ITRI for the industrial sector negatively influenced the maintenance and accumulation of the research results of ITRI itself, it enhanced general industry productivity.

4.2.2. Relational capital

Relational capital represents the relations with internal and external stakeholders[33]. The number of seminars and the number of commissioned projects and industrial services were used as indices of relationship capital input. Research projects conducted by ITRI are mainly government funded, but the technologies produced are not merely for government use. ITRI thus enhanced the competitiveness of industrial technology in Taiwan by closely cooperating with government, industry, academia, and the research communities. It has been involved in numerous technology transfers, spin-offs, joint R&D projects, cross-licensing, consulting, exchange and other transactions with industry clusters in Taiwan.

4.2.2.1. Cluster and spin-off effect. Fig. 3 displays a model of the interaction between ITRI and industrial clusters and shows the interrelations involved. The clustering effect in HSIP and other science-based parks is one of the key externalities created by ITRI. ITRI has increased cluster effects and innovation to stimulate economic growth. Fig. 3 show how the relational capital of ITRI has functioned and accumulated. A successful technology innovation process is much more than simply an emphasis on fundamental research. Such a process must integrate strong applied development competence and network partners. Therefore, to accelerate industrial improvement, all sectors including government, industry, academia, and research communities should cooperate closely. Backed by government support, ITRI cooperates with academic establishments and the R&D departments of large corporations via seminars, the Open Lab, Incubators, commissioned or joint research projects, almost all possible formats robust.

Regarding the external effect, this study measured the performance of ITRI. In 2003, the total operating revenue of the five3TAIEX-listed or OTC-listed companies among the 12 spin-off companies was $10.1 billion with accrued operating revenue reaching $50.09 billion and accrued net income of $12.48 billion. Although the report cards of these companies did not result entirely from the contributions of ITRI, the support of ITRI was necessary to making these companies a reality. The operating procedure for this kind of tacit knowledge and management hierarchy markedly influenced intangible resource accumulation and generation. ITRI’s organizing culture to encourage spin-off, commissioned and industrial service are exchanged. This kind of institutional framework and culture, the essence benefit surmounts its monetary benefit. It could be a big help to firms or industries to develop.

4.2.3. Structural capital

Structural capital is defined as the structural ability of a firm to translate human capital innovation and energy into company property and to capitalize on that innovation to create wealth. Structural capital generally describes the general system and procedure for problem-solving and produces values in an organization, including the accounting-based value and accrued capital revolving rate. Since ITRI must assume some of the self-generated capital such as the number of commissioned projects and industrial service cases, this variable may be serve as the index for internal efficiency of ITRI. More commissioned projects and industrial service cases indicate better structural capital. Therefore, it can provide a measurable proxy variable of structural capital. These empirical findings confirm that accumulated structural capital is an important input element for producing output for ITRI.

Structural capital is also defined as the knowledge that stays within the firm. Examples are organizational flexibility, the existence of a knowledge centre, the general use of information technologies

3

United Microelectronics Corporation (UMC group), Taiwan Semiconductor Manufacturing Co. (TSMC), Taiwan Mask, Mirle and VIS.

Government Institute: National Science Council Science Industrial Park ITRI University & Academic Research Institutes Government Institutes: Ministry of Economic Affairs...etc Non-Park Firms Incubator Center Successful Commercial Product Foundation R&D Result Payer & Partnership Fund Subsidy Project Requirement Feedback Requirement Feedback Fund Subsidy Project Fund Subsidy Project

and organizational learning capacity[34]. ITRI was designed to build a change potential in their structures, processes and activities. As a result, ITRI can balance adaptation to change in the environment, while being instrumental in creating the future for themselves and other developing organizations. In 2000, ITRI classified research projects and grouped them into five technology groupings (Communication and Optoelectronic, Advanced Materials and Chemical Technology, Precision Machinery and Mems Technology, Biomedical Technology, and Sustainable Development Technology) to facilitate further integration of ITRI structural capital (as shown in Appendix B). Having performed the knowledge objectives, it conducted a departmental sorting of the results and effects of the knowledge capital framework. Hence, the strategic planning of research facilities should be guided using a far-sighted perspective, as it can significantly influence organizational development.

5. Conclusion and limitations 5.1. Conclusion

The knowledge and services generated from a non-profit R&D organization create considerable externalities. Public R&D institute performance affects not only the operations of that institute but also crucial decisions regarding resource allocation. Consequently, solving the inherited problems of traditional financial reports including short-term nature, time-lag effects, and difficulty of quantifying externalities is vital for assessing the performance of non-profit organizations. Gaining insight into how value is generated can lead to efficient resource allocation. Intellectual capital is the group of knowledge assets that are attributed to the value creation of an organization. With the supplement of intellectual capital reporting, the value of a non-profit institute like ITRI could be better assessed, understood and communicated.

Complementary to the ordinary conventional balance sheets, three invisible equities remain for measurement on the right side of the balance sheet: human capital, structural capital and relational capital. Human capital comprises the competence, skills, and intellectual agility of the individual employees; relational capital represents the valuable relations with customers, government and other relevant academic institutes; and structural capital includes processes, structures, brands, intellectual property and other intangibles that are owned by firms but do not appear on its traditional balance sheets.

ITRI has continuously provided desperately needed professional human resources, market information, and technologies to Taiwanese firms, thus creating a symbiotic effect and optimizing its external economic effects. This study explores the concept of intellectual capital and to further develops the intellectual capital reports for ITRI. Hopefully, such efforts could enable both academics and practitioners to value the importance of intellectual capital and its influence on organizational performance in a knowledge-based era. The framework of this IC report is proposed as a method of more fairly, objectively and transparently identifying the hidden value of the ITRI.

Another aim of this study is to associate human capital, structural capital and relational capital with the value/performance of ITRI. Overall, the empirical findings demonstrate the considerable relevance of intellectual capital to the value creation process for ITRI. Consequently, ITRI and similar research institutes should not consider such intellectual capital establishment activities as expenses per se under conventional accounting practices. Instead, they should be planned with a wise and aggressive attitude, since intellectual capital is an important value creation source for R&D organizations, whether public or private.

ITRI established the infrastructure for the development of the Taiwanese high-tech industry. Technological leadership provides an absolute rather than a comparative advantage, and technological leadership will reflect institutions supporting coupling, creating, clustering comprehending and coping in connection with technology[11]. During three decades, ITRI has more than fulfilled the mandate of the government, helping new industries emerge from nothing and enabling them to become prominent internationally. Driven by the spirit of technological innovation and the pursuit of excellence, ITRI has acted as a pioneer, leading the nation into the knowledge economy era. Knowledge has externality nature and needs to accumulate over the long term, so government subsidizes are crucial. ITRI did not have manifest performance before the 1990s. However, following 1990, achieved significant results. Although ITRI is not an educational institution, it is one of the key suppliers of industrial leaders in Taiwan.

An important question involves the role of intellectual capital in the ITRI case. Assessing the intellectual capital of ITRI does not mean answering or solving the problems. The intellectual capital report facilitates better decisions with analyzed information. Without the contribution of ITRI, Taiwan would have no high-tech industry. The question thus arises of how the value of ITRI contributes to the model from the perspective of intellectual capital. Simultaneously, this study proposes an alternative view that can help the government decide whether or not to continue an investment. Intellectual capital reporting would serve as a very important instrument facilitates such critical decisions.

The European Union, for instance, has recently set the goal of devoting 3% of GDP to R&D on the average by the year 2010. As for Taiwan, the goal is to increase R&D expenditures similarly to reach 3% of GDP as specified in the bChallenge 2008 National Development Plan,Q and even plans to meet this target ahead of schedule by the year 2006. Although gross domestic expenditures on R&D reached 2.30% of Gross Domestic Product (GDP), comparing with 1.94% for Austria in 2002, this is still a considerable gap from the 3% of GDP goal set in the Challenge 2008 plan, and is slightly lower than that of advanced countries; therefore, government and private sectors should continue investing heavily in technology and building up their intellectual capital to fuel competitiveness.

5.2. Limitations

In this paper, every observation on each measure of intellectual capital is assumed equivalent. However, R&D is not a standard product, and the inputs are not standardized either. For R&D institute, while it is quite important to have some countable measures, it is difficult to calculate the exact weights of the parameters. Nevertheless, as being the national-level R&D organization, the externality to the whole economy is certainly more important. One exceptional person, one service, one seminar, one research project may make all the difference. This paper only tries to propose some key factors for reference. These limitations obviously warrant more future studies.

Acknowledgement

The authors appreciate the valuable comments from two anonymous reviewers and encouragement from Professor Linstone. Without the strong support from C.T. Shih, the ex-President of ITRI, D.X. Luo, S.C. Chiou and C.J. Hsu, the managers of ITRI, and all of the interviewees we have visited, this research would not be possible. The authors appreciate all of them greatly.

Append ix A. Organization of ITRI

Appendix B. Technology groupings of ITRI

Advanced Materials and Chemical Technology MRL,ERSO, UCL,OES,MIRL Sustainable Development Technology ERL,UCL,CESH,BMEC,MRL Biomedical Technology BMEC,ERSO,UCL, CCL,OES,CMS, ERL,MRL,MIRL

Precision Machinery and Mems Technology MIRL,ERSO,ERL,OES, CMS,MRL,STC,CAST Communication and Optoelectronic Technology ERSO,MRL,CCL,UCL, OES,MIRL,STC,CMS

ITRI

References[1] J. Barney, Firm resources and sustained competitive advantage, J. Manage. (17) (1991) 99 – 120.

[2] Jay Chatzkel, A conversation with Go¨ran Roos, in: Chatzkel (Ed.), Article Accepted for the Journal of Intellectual Capital and Accepted as a Chapter in the Internet-Published Book Conversations on Intellectual Capital, 2001.

[3] S. Pike, A. Rylander, G. Roos, Intellectual capital management and disclosure, in: N. Bontis, C.W. Choo (Eds.), The Strategic Management of Intellectual Capital and Organizational Knowledge—A Selection of Readings, 2001.

[4] Roos Johan, Exploring the concept of Intellectual Capital (IC), Long Range Plan. (31) (1998 (February)) 150 – 153. [5] Leif Edvinsson, Michael S. Malone, Intellectual Capital, 1997.

[6] Patricia Ordonez de Pablos, Evidence of intellectual capital measurement form Asia, Europe and the Middle East, J. Intellect. Cap. 12 (3) (2002) 287 – 302.

[7] Intellectual Capital Report, Austrian Research Center 1999–2002. [8] Intellectual Capital Report, German Aerospace Center 2001.

[9] Friedrich List, The National System of Political Economy [English translation by S.S. Lloyd, Longmans (1904)], 1845.

[10] C. Freeman, The National Innovation Systems in historical perspective, in: Cambridge Journal of Economics, vol. 19 (1), 1995.

[11] Christopher Freeman, Technological infrastructure and international competitiveness, Ind. Corp. Change 13 (3) (2004) 541 – 569.

[12] P.N. Bukh, H.T. Larsen, J. Mouritsen, Constructing intellectual capital statements, Scand. J. Manag. 17 (2001) 87 – 108. [13] K. Sveiby, The New Organizational Wealth, Berrett-Koehler, San Francisco, 1997.

[14] M. Dierkes, A. Berthoin Anatal, Child 3. Nonaka I. Handbook of Organizational Learning, Pinter, London, 2001. [15] G. Roos, J. Roos, Measuring your company’s intellectual performance, Long Range Plan. 30 (3) (1997). [16] R. Amit, P.J.H. Shoemaker, Strategic assets and organization rent, Strateg. Manage. J. 14 (1) (1993) 33 – 46. [17] Leif Edvinsson, Director of Intellectual Capital at Skandia, 1994.

[19] W.H.A. Johnson, An integrative taxonomy of intellectual capital: measuring the stock and flow of intellectual capital components in the firm, Int. J. Technol. Manag. 18 (5/6/7/8) (1999) 562 – 575.

[20] Gordon V. Smith, Russell L. Parr, Valuation of Intellectual Property and Intangible Assets, 3rd ed., John Wiley & Sons, Inc., New York, 2000.

[21] Gordon Petrash, Dow’s journey to a knowledge value management culture, Eur. Manag. J. 14 (1996) 365 – 373. [22] Indra Abeysekera, James Guthrie, An empirical investigation of annual reporting trends of intellectual capital in Sri Lanka,

Crit. Perspect. Account. 16 (2005) 151 – 163.

[23] N. Brennan, Reporting intellectual capital in annual reports: evidence from Ireland, Account. Audit. Account. J. 14 (4) (2001) 423 – 436.

[24] B. Olsson, Annual reporting practices: information about human resources in corporate annual reports in major Swedish companies, J. HRCA 6 (1) (2001) 39 – 52.

[25] A.V. Subbarao, D. Zeghal, Human resources information disclosure in annual reports: an international comparison, J. HRCA 2 (2) (1997) 53 – 73.

[26] C.W. Hsu, H.C. Chiang, The Government Strategy for the Upgrading of Industrial Technology in Taiwan, Technovation 21 (2001) 123 – 132.

[27] Industrial Technology Research Institute (ITRI) Annual Reports (1973–2003). [28] Industrial Technology Research Institute (ITRI) 30-year Sepcial Project, 2003. [29] ITRIhttp://www.itri.org.tw.

[30] J. Davies, A. Waddington, The management and measurement of intellectual capital, Manage. Acc. (UK) 34 (1999 (September)).

[31] Danish Agency for Development of Trade and Industry, Intellectual Capital Statement towards a Guideline, Copenhagen, 2000.

[32] N. Bontis, N.C. Dragonetti, K. Jacobsen, G. Roos, The knowledge toolbox: a review of the tools available to measure and manage intangible resources, Eur. Manag. J. 17 (4) (1999) 391 – 402.

[33] J. Roos, G. Roos, L. Edvinsson, N.C. Dragonetti, Intellectual Capital: Navigating in the New Business Landscape, New York University Press, New York, 1998.

[34] Jon-Arild Johannessena, Bjorn Olsena, Johan Olaisen, Intellectual capital as a holistic management philosophy: a theoretical perspective, Int. J. Inf. Manage. 25 (2005) 151 – 171.

Po Young Chu is the president of Aspire Academy, which prides itself on training executives and managers to cope with the highly dynamic business environment. He also is a professor of the Department of Management Science and a former director of EMBA programs at National Chiao Tung University in Taiwan. His major research interests include innovation, entrepreneurship, and corporate finance.

Yu Ling Lin is currently a PhD student of the Department of Management Science of National Chiao Tung University and a lecturer of the Department of Information Management of Ta-Hwa Institute of Technology in Taiwan. Her current research interests are in the areas of business strategy and innovation.

Hsing Hwa Hsiung is currently a PhD student of the Department of Management Science of National Chiao Tung University and a lecturer of the Department of Finance of Chung-Kou Institute of Technology in Taiwan. Her current research interests are in the areas of business strategy and corporate finance.

Tzu Yar Liu is currently a PhD student of the Department of Management Science of National Chiao Tung University and a project leader of Center for Environmental, Safety and Health Technology Development on ITRI in Taiwan. His current research interests are in the areas of business strategy and environment management.