The use of a decomposed

theory of planned

behavior to study

Internet banking in

Taiwan

Ya-Yueh Shih and

Kwoting Fang

The authors

Ya-Yueh Shih is an Instructor at the Department of Information Management, MingHsin University of Science & Technology, Taiwan and a PhD student at the Institute of Information Management, National Chiao Tung University.

Kwoting Fang is a Professor at the Department of Information Management, National Yunlin University of Science & Technology, Taiwan.

Keywords

Virtual banking, Consumer behaviour, Mathematical modelling, Taiwan

Abstract

With the liberalization and internalization of financial markets, in terms of the entrance of the World Trade Organization, banks in Taiwan face pressures in service quality and administrative efficiency. Predicting customers’ intention to adopt Internet banking is an important issue. Attempts to understand how an individual’s belief, embracing attitude, subjective norm and perceived behavioral control, can influence intention. Two versions of the model of the theory of planned behavior (TPB) – pure and decomposed – are examined and compared to the theory of reasoned action (TRA). Data are collected from approximately 425 respondents and structural equation modeling is used to analyze the responses. Results generally support TRA and TPB and provide a good fit to the data.

Electronic access

The Emerald Research Register for this journal is available at

www.emeraldinsight.com/researchregister The current issue and full text archive of this journal is available at

www.emeraldinsight.com/1066-2243.htm

Banking is an information-intensive business in which information technology (IT) is increasingly important. One of the first examples of the growing importance of IT in the industry was the establishment in October 1995 of fully-fledged virtual banking by the Security First Network Bank in the USA (Grandy, 1995). This venture has subsequently attracted considerable attention and speculation in both the financial and

information technology communities.

Following Taiwan’s entry into the World Trade Organization (WTO), foreign banks will enter the island’s domestic market and bring with them the advantages of capital and financial innovation. Banks in Taiwan are thus facing dual competitive pressure in the areas of service quality and administrative efficiency. To cope with the increasing competition and government financial liberalization, Taipei Bank has accelerated the establishment of new communication networks via Internet banking, telephone centers and other digital channels.

Internet banking is a new type of information system that uses the innovative resources of the Internet and WWW to enable customers to effect financial activities in virtual space. Liao et al. (1999) identified the virtual bank as a “non-branch bank” and virtual banking as the provision of services via electronic media such as automated teller machines (ATMs), telephone, personal computers and/or the Internet.

One advantage of banks going online is the potential savings in the cost of maintaining a traditional branch network. Turban et al. (2000) indicated that Internet banking is extremely beneficial to customers because of the savings in costs, time and space it offers, its quick response to complaints, and its delivery of improved services, all of which benefits make for easier banking. Previous studies have shown that IT has helped banking organizations. For instance, a recent study of the US retail banking sector showed that the transaction costs of telephone banking are only 40 percent of those of providing the same service via physical branches (Tamlor, 1995).

Although Internet banking may help banks to reduce costs, there are important considerations, such as, the extent to which retail bank customers adopt new forms of banking, that is, the factors that influence intention toward adopting another form of banking and adoption differences between different forms of banking. These considerations are very important to the practitioners who plan and promote new forms of banking in the current competitive market.

Internet Research

Volume 14 · Number 3 · 2004 · pp. 213–223

qEmerald Group Publishing Limited · ISSN 1066-2243

Accordingly, Liao and Cheung (2002) presented empirical estimates to predict the marginal effects of the factors underlying perceived usefulness and willingness to use, and the substitutability between them. Their data demonstrated that the key quality attributes underlying perceived usefulness were expectations of accuracy, security, network speed, user-friendliness, user involvement and convenience. Additionally, Howcroft et al. (2002) obtained a better understanding of consumer attitude towards home-based services, i.e. telephone and Internet banking. Sohail and Shanmugham (2003) examined the factors that influence the adoption of Internet banking and investigated whether Internet users and others differed in terms of these factors.

Research into customer acceptance of Internet banking has thus improved understanding of what beliefs lead customers to use the facility and demonstrate how the beliefs influence Internet bank customer behavior. For example, Suh and Han (2002) conducted an investigation based on the technology acceptance model (TAM) to analyze customer acceptance of Internet banking. They proposed a further aspect of belief, that of trust, to enhance understanding of that

acceptance. They claimed TAM as an appropriate model for explaining acceptance in the context of Internet banking. TAM is based on Fishbein and Ajzen’s theory of reasoned action (TRA) (Davis et al., 1989) and is a general model that assumes that individual social behavior is motivated by behavioral attitudes. For Fishbein (1967) and Fishbein and Ajzen (1975), TRA is one of the most widely studied models of attitude and behavior (as detailed in section 2.2).

Further examples are provided by Liao et al. (1999) and Tan and Teo (2000). They used the theory of planned behavior (TPB) and innovation diffusion to study intention toward adopting Internet banking in an international financial city. In those studies, Liao et al. postulated that the TPB only partly explained relationships, in that behavioral intention is a function of attitude and subjective norm. In a further step, an additional construct, that of perceived behavioral control, is included in the TPB model to account for situations where individual cannot completely control their behavior (Ajzen, 1985, 1991; Ajzen and Madden, 1986).

Although studies of customers adopting Internet banking are not rare, most of them have dealt with the situation overseas. User behavior in Taiwan may differ from overseas, but little research into it has been undertaken. This paper is a comprehensive study the beliefs of individuals, their attitudes, subjective norms and perceived

behavioral control, and how these can influence intention toward adopting Internet banking.

Two version of the TPB, namely the pure traditional TPB and one in which the beliefs are decomposed into multidimensional constructs, are examined and compared to the TRA. The decomposed TPB model is adapted from Taylor and Todd (1995), using such constructs as relative advantage, complexity, compatibility from the diffusion of innovation theory (Rogers, 1983) and perceived behavioral control.

Since behavioral intention may not be reflected in actual use, this paper also examined the relationship between intended and actual use. The three models are compared using data from a survey of approximately 425 consumers

considering a decision to adopt and use technologically innovative Internet banking. We use the structural equation modeling (SEM) approach to validate the research model. The theoretical and managerial relevance of the models are then discussed.

Section 2 introduces the conceptual

background to the study, including the Internet banking revolution and explains the research model and hypotheses involved. Sections 4 and 5 present the research design and the survey results, respectively. Finally, Section 6 discusses

implications and outlines future research directions.

2. The evolution of Internet banking

Taiwanese commercial banks have been quick to realize the importance of competitive advantage. In May 1999, the Bureau of Monetary Affairs of the Ministry of Finance announced the signing of the Master Agreement concerning PC and Network Banking Services. This allowed for commercial banks to offer e-banking services, such as fund transfers and account summary inquires. To date, almost thirty banks have embarked on building new communication networks via Internet banking. Of these, the most typical and also the largest Internet banking entity is Chinatrust.

According to the fourth survey of Internet user survey conducted by ACNielsen Online (2001), there are seventeen million Internet users in Taiwan (coming third in Asia behind South Korea with fifty-three million and China with twenty-five million). However, not every Internet is an Internet banking customer. Hong Kong and Singapore are the Asia Pacific areas recording the most frequent engagement in financial activities in virtual space. The same survey noted that the security issue is a major influence on the growth of

Internet banking because of the processing of sensitive personal information involved. This concern was also agreed by Grandy (1995) as the most quoted. Despite this, standard transaction functions, the convenience of Internet use, and cost savings seem to constitute significant factors in customer satisfaction (ACNielsen Online, 2001). So it may be said that Internet banking in Taiwan is in its formative stage and offers considerable scope for growth.

3. Model explanation

This study postulates on the basis of the TPB and the diffusion of innovations theory that an individual’s intention to adopt Internet banking is determined by three factors – attitude, subjective norm and perceived behavioral control (Rogers, 1983). Three alternative models – the TRA, the TPB and the decomposed TPB, primarily adapted from Taylor and Todd (1995) – are here examined and compared.

3.1 Model 1: TRA

The TAM was proposed by Davis et al. (1989), the TRA by Fishbein and Ajzen (1975), and the extension of the TRA to the TPB by Ajzen (1991). The TAM focuses on explaining the attitude behind the intention to use a specific technology or service. For example, Lu et al. (2003) developed a TAM to explain the factors influencing user acceptance for Wireless Internet via mobile devices. In many ways, it corresponds to rational or utilitarian theories of media choice and use. The TRA, when applied to explain use or adoption behavior, embraces four general concepts – behavioral attitude, subjective norm, intention to use and actual use (shown in Figure 1). The inclusion of the subjective norm in the TRA represents an important addition when compared to the TAM. With this addition, the TRA takes account of the elements of social influence that are found in social explanations of the use of the media. In the TRA, attitude is equated with the

attitudinal belief (bi) that effecting a particular

form of behavior leads to a particular outcome, weighted by an evaluation of the desirability of that outcome (ei). Attitude is typically combined with

unidimensional constructs, i.e.Sbiei. A subjective

norm represents an individual’s normative belief (nbj) concerning a particular referent, weighted by

the motivation to comply with that referent (mcj),

i.e.Snbjmcj.

For our empirical case of Internet banking, attitudinal belief refers to an individual’s confidence that Internet banking represents speedier and more convenient transactions. This association indicates how important it is for that individual to have fast and convenient banking transactions. The normative belief refers to an individual’s perception of the use Internet banking by friends or colleagues. This perception plays the key role in influencing the referent group’s opinion.

3.2 Model 2: TPB

The TPB (Ajzen, 1985, 1991; Mathieson, 1991) is an extension of the well-known TRA (Fishbein and Ajzen, 1975). Both the TRA and the TPB assert that behavior is a direct function of behavioral intention. With the TRA, that intention is modeled as the weighted sum of attitude and subjective norm (Fishbein and Ajzen, 1975).

Like the TRA, the TPB postulates that behavioral intention is a function of attitude and subjective norm (shown in Figure 2). However, an additional construct, perceived behavioral control (PBC) is added to the TPB model to account for situations where individuals lack complete control over their behavior (Ajzen, 1985, 1991; Ajzen and Madden, 1986). Notably, a number of empirical studies have found a relationship between PBC and intention (Ajzen, 1991; Madden et al., 1992; Sparks et al., 1992). Perceived behavioral control refers to belief of the individual concerning control weighted (cbk) by the perceived facility (pfk), that

is, of the efficacy of the control factor in either inhibiting or facilitating the behavior. Control beliefs reflect the perceived difficulty (or ease) with which the behavior may be effected (Ajzen, 1991). Figure 1 The pure form of the theory of reasoned action

Perceived facility acts as an importance weighting (Ajzen, 1991). The association between control beliefs and PBC have been demonstrated empirically (Ajzen and Madden, 1986).

For our empirical case of Internet banking, the control belief refers to knowing how to perform transactions via Internet banking (self-efficacy; Bandura, 1977) and facility refers to externally based resource constraints, such as time, money and resources. The key role of these factors reflects the perceived difficulty (or ease) with which the behavior may be effected (Ajzen, 1991). 3.3 Model 3: decomposition TPB

Taylor and Todd (1995) indicated that a better understanding of the relationships between the belief structures and antecedents of intention requires the decomposition of attitudinal beliefs. Shimp and Kavas (1984) argued that the cognitive components of belief could not be organized into a single conceptual or cognitive unit. Taylor and Todd (1995) also specified that, based on the diffusion of innovation theory, the attitudinal belief has three salient characteristics of an innovation that influence adoption are relative advantage, complexity and compatibility (Rogers, 1983). Taylor and Todd (1995) showed that the decomposed model of the TPB has better explanatory power than the pure TPB and TRA models. So, the argument of our empirical study is that Internet banking is a technological innovation and thus the decomposed TPB model gives a more satisfactory explanation of adoption intention (shown in Figure 3).

Related advantage refers to the degree to which an innovation provides benefits which supersede those of its precursor and may incorporate factors such as economic benefits, image, enhancement, convenience and satisfaction (Rogers, 1983). Relative advantages should be positively related to an innovation’s rate of adoption (Rogers, 1983;

Tan and Teo, 2000). As noted, Internet banking allow customers to access their banking accounts from any location, at any time of the day and so provides tremendous advantage and convenience to users.

Complexity represents the degree to which an innovation is perceived to be difficult to

understand, learn or operate (Rogers, 1983). It is also defined as “the degree to which an innovation is perceived as relatively difficult to understand and use”. Innovative technologies that are perceived to be easier to use and less complex have a higher possibility of acceptance and use by potential users. Thus, complexity would be expected to have negative relationship to attitude. Complexity (and its corollary, ease of use) has been found to be an important factor in the technology adoption decision (Davis et al., 1989). As the Internet is very user friendly with its “point and click” interface, it is likely that potential customers may feel that Internet banking services are less complex to use, and hence are more likely to use them.

Compatibility is the degree to which the innovation fits with the potential adopter’s existing values, previous experience and current needs (Rogers, 1983). Tornatzkey and Klein (1982) find that an innovation is more likely to be adopted when it is compatible with the job responsibilities and value system of the individual. Therefore, it may be expected that compatibility relates positively to adoption. An innovation is likely to be adopted to the extent that its use of does not violate cultural or social norms. As Tan and Teo (2000) indicate, Internet banking has been viewed as a delivery channel that is compatible with the profile of the modern day banking customer, who is likely to be computer-literate and familiar with the Internet (Straits Times, 1997). Therefore, it may be expected that the more one uses the Internet, the Figure 2 The pure form of the theory of planned behavior

more one perceives it to be compatible with ones lifestyle.

As for the structure of normative belief, while some studies have found support for the

decomposition of normative belief structures (e.g. Burnkrant and Page, 1988), studies such as those by Shimp and Kavas (1984) and Oliver and Bearden (1985) have failed to identify a multi-dimensional structure for nbjmcj. Therefore, as

Taylor and Todd (1995), we also should not provide additional insight into the decomposition of the subjective norm.

In addition, according to Ajzen (1985, 1991), PBC reflects belief regarding access to the resources and opportunities needed to effect a behavior. PBC appears to encompass two components. The first is “facilitating conditions” (Triandis, 1979), which reflect the availability of resources needed to perform a particular behavior. This might include access to the time, money and other specialized resources. In fact, as supporting technological infrastructures become easily and readily available, Internet commerce applications such as banking services will also become more feasible. Accordingly, the government can play an intervention and leadership role in the diffusion of innovation. The second component is self-efficacy (Ajzen, 1991), that is, being confident of the ability to behave successfully in the situation (Bandura, 1977, 1982). An individual with the self-assured skill to use a computer and the Internet is more inclined to adopt Internet banking. This

component then refers to comfort with using the innovation.

4. Research methodology

4.1 Subjects

To determine user intention to adopt Internet banking and actual use, a survey was conducted during the first half of 2003. The data was gathered on personal banking customers with fifty-three Taiwanese banks. The participants in the main investigation were all customers at the bank where the data collection took place. Participation in the study was voluntary and was limited to customers with at least one bank account. A total of 425 usable, complete responses were obtained. The gender breakdown was 49 percent male and 51 percent female, almost all were in twenties or thirties. 34 percent had more than one experience with Internet banking, and approximately 65 percent at least once a week. Moreover, 81 percent had been using the Internet for more than a year. Table I gives a detailed description of the demographic statistics for the respondents.

4.2 Measurements

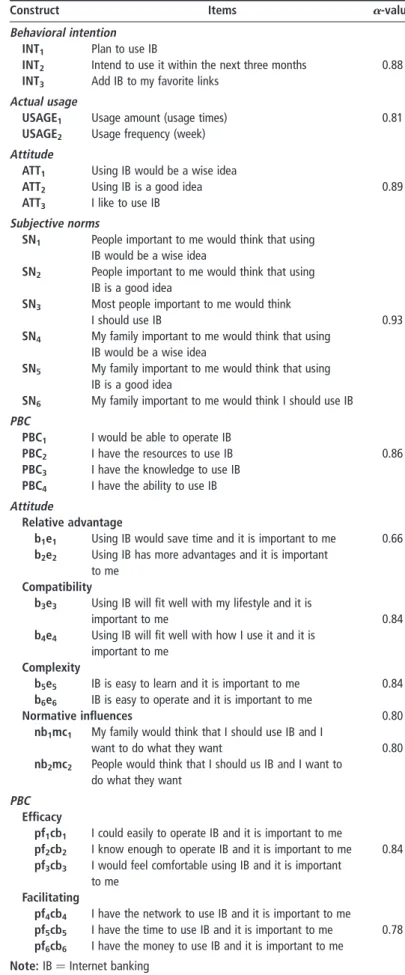

A questionnaire using a seven-point scale was employed to collect the data for the constructs of the research model. Items from previous studies were modified for adaptation to the Internet banking context. The measures of actual use, behavioral intention to use, attitude toward using, subjective norm, and perceived behavioral control were adapted from various studies related to the TRA and TPB (Taylor and Todd, 1995). Six decomposed beliefs – relative advantage, Figure 3 Theory of planned behavior with belief decomposition

compatibility, complexity, normative influence, efficacy and facility – were adapted from Taylor and Todd (1995), those were primary combined with the evaluative component using the

expectancy-value approach suggested in the TRA and TPB (i.e., biei, nbjmcj, pfkcbk). All the items

are shown in Table II. A Cronbach’s alpha reliability analysis was applied to test internal consistency with respect to the eleven

multidimensional attributes. As the data listed in Table II shows, items associated with any particular attribute were reliably related to each other ranging from 0.66 to 0.93. We agree with Nunnaly (1967) that a minimum Cronbach’s alpha of 0.6 is sufficient for the early stages of the research.

The measures were pilot tested on MIS graduate majors, who were asked to indicate agreement or disagreement with the survey items using a seven-point scale. The wording of the items was then modified based on the pilot test results and advice from MIS professors. A final version of the scales is presented in the Appendix. We adopted Cudeck and Browne’s (1983) suggestions regarding cross-validation to assess the model fit. The majority of the respondents were randomly assigned to a calibration sample of 300, and the remainder to a validation sample of 125. Table I Descriptive statistics of respondents’ characteristics

Measure Value Frequency Percentage

Gender Male 206 48.6 Female 219 51.4 Total 425 100 Age ,20 29 6.8 21-30 250 58.8 31-40 90 21.2 41-60 55 13 .60 1 0.2 Total 425 100

Degree of Internet experience ,1 year 79 18.6

1-3 115 27.1

4-6 159 37.4

.6 year 72 16.9

Total 425 100

Degree of Internet banking 0 times 278 65.5

experience 1-5 55 12.9

6-10 24 5.6

.10 times 68 16.0

Total 425 100

Usage frequency of Internet ,1 week 302 75.3

banking 2-3 27 6.4

3-4 36 8.5

.1 month 60 9.8

Total 425 100

Table II Reliability analysis for each construct

Construct Items a-value

Behavioral intention

INT1 Plan to use IB

INT2 Intend to use it within the next three months 0.88

INT3 Add IB to my favorite links

Actual usage

USAGE1 Usage amount (usage times) 0.81

USAGE2 Usage frequency (week)

Attitude

ATT1 Using IB would be a wise idea

ATT2 Using IB is a good idea 0.89

ATT3 I like to use IB

Subjective norms

SN1 People important to me would think that using

IB would be a wise idea

SN2 People important to me would think that using

IB is a good idea

SN3 Most people important to me would think

I should use IB 0.93

SN4 My family important to me would think that using

IB would be a wise idea

SN5 My family important to me would think that using

IB is a good idea

SN6 My family important to me would think I should use IB

PBC

PBC1 I would be able to operate IB

PBC2 I have the resources to use IB 0.86

PBC3 I have the knowledge to use IB

PBC4 I have the ability to use IB

Attitude

Relative advantage

b1e1 Using IB would save time and it is important to me 0.66

b2e2 Using IB has more advantages and it is important

to me Compatibility

b3e3 Using IB will fit well with my lifestyle and it is

important to me 0.84

b4e4 Using IB will fit well with how I use it and it is

important to me Complexity

b5e5 IB is easy to learn and it is important to me 0.84

b6e6 IB is easy to operate and it is important to me

Normative influences 0.80

nb1mc1 My family would think that I should use IB and I

want to do what they want 0.80

nb2mc2 People would think that I should us IB and I want to

do what they want PBC

Efficacy

pf1cb1 I could easily to operate IB and it is important to me

pf2cb2 I know enough to operate IB and it is important to me 0.84

pf3cb3 I would feel comfortable using IB and it is important

to me Facilitating

pf4cb4 I have the network to use IB and it is important to me

pf5cb5 I have the time to use IB and it is important to me 0.78

pf6cb6 I have the money to use IB and it is important to me

5. Results

The hypothesized paths in each of the above-described models (Figures 1-3) were tested by the Lisrel 8.3 package (Joreskog and Sorbom, 1993) to which a matrix of correlation between the variables was input, using the maximum likelihood

estimated. As suggested by Bagozzi and Heartherton (1994), each scale was divided to provide two indicators for each latent variable. In conducting the analysis, errors in the equations for the determinants of intention were specified as free parameters, and the independent constructs were allowed to co-vary.

In explanation, the total coefficient of determination (TCD) R2for the structural equations is shown in this paper. Furthermore, t-statistics for examining the correlation between the latent constructs and correlation among the latent constructs were used to test path links. t-statistics exceeded the critical value (1.96) for the 0.05 significant level as well as for the 0.01 significance level (critical value ¼ 2:576) (Reisinger and Turner, 1999). The levels of significance for individual paths were assessed by examining the values ofb and g. The path coefficients for models are shown in Table III.

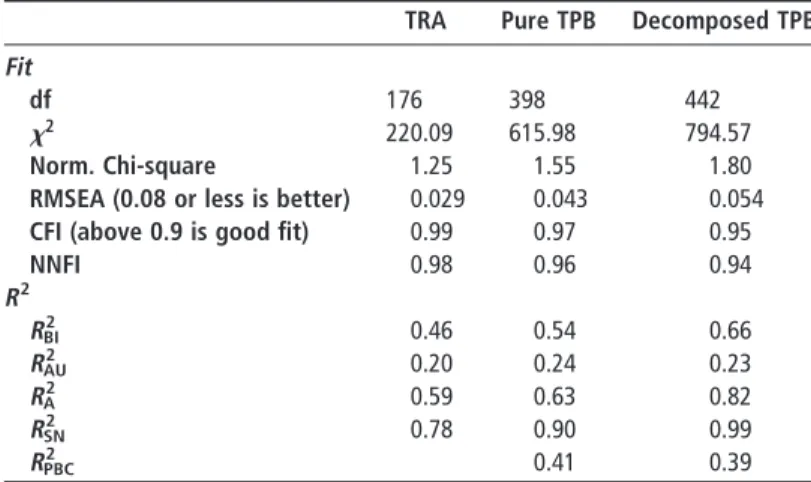

Then, the following four most acceptable indices were used to measure the overall model fit. These were as follows: a normed Chi-square (Chi-square/df) with a level between 1.0 and 2.0 (Hair et al., 1995); a comparative fit index (CFI) larger than 0.9 (Hair et al., 1995); a non-normed fit index (NNFI) with a level of 0.9 (Hair et al., 1995); and a root-mean-square error of approximation

(RMSEA) with a marginal acceptance level of 0.08 (Steiger, 1990).

5.1 Theory of reasoned action

The statistics indicate that the TRA model provides a good fit to the data (x2

176¼ 220:09,

p, 0:01; CFI ¼ 0:99; NNFI ¼ 0:98;

RMSEA ¼ 0:029). In terms of predictive power, the variance in all four dependent variables (R2BI, R2Usage, R2Aand R2SN) of the TRA model are equal to 0.46, 0.20, 0.59 and 0.78, respectively.

The path coefficients are as hypothesized in each case ( p, 0:05 in all instances). Attitudinal and normative structures are significant

determinants of attitude and subjective norm respectively. Although attitude is a significant determinant of behavioral intention, subjective norm is not. A further significant determinant of actual use is behavioral intention.

5.2 Theory of planned behavior The statistics indicate that the TPB model provides a good fit to the data (x2

398 ¼ 615:98,

p, 0:01; CFI ¼ 0:97; NNFI ¼ 0:96;

RMSEA ¼ 0:043). In terms of predictive power, the variance in all five dependent variables (R2BI, R2Usage, R2A, R2SNand R2PBC) of the TPB model are equal to 0.54, 0.24, 0.63, 0.90 and 0.41,

respectively. As the analytical results of Taylor and Todd (1995) show, although PBC is reasonably explained by belief control, it does not in turn provide better prediction of intention over and above that provided by subjective norm and attitude.

Path coefficients are as hypothesized in each case ( p, 0:05 in all instances). Not only are the attitudinal and normative structures significant determinants of attitude and subjective norm respectively, but the path from the control structure to PBC is particularly significant. Finally, although attitude is significantly related to intention, subjective norm and PBC are not. A further significant determinant of actual use is behavioral intention.

5.3 Decomposed TPB

The decomposed version of the TPB provides essentially the same fit as the pure TPB model (x2

398¼ 794:57, p , 0:01; CFI ¼ 0:95;

NNFI ¼ 0:94; RMSEA ¼ 0:054). Although there is no improvement in fit, the decompositon TPB better explains attitude, subjective norm and behavioral intention in relation to the TRA or the TPB (R2

BI¼ 0:66; R2Usage¼ 0:23; R2A¼ 0:82;

R2SN¼ 0:99 and R2

PBC¼ 0:39). Figure 4 illustrates

the significant paths in the decomposed model. Relative advantage and complexity are

significantly related to attitude. However, complexity has a negative impact on attitude. Although efficacy is a significant determinant of the PBC, facility is not. Attitude and PBC are significantly related to behavioral intention. Like the pure TRA and pure TPB models, subjective norm is not significantly related to behavioral Table III Path coefficients for each of the hypothesized models

Paths Pure TRA Pure TPB Decomposed TPB

bIntention, Attitude 0.88* 0.82* 0.57* bIntention, SN 0.11 0.11 20.06 bIntention, PBC – 0.05 0.40* bUsage, Intention 0.48* 0.53* 0.48* gAttitude, BIEI – gSN, NBMC 1.00* gPBC, CBPF –

gAttitude, Relative Advantage 0.82*

gAttitude, Compatibility 20.02

gAttitude, Complexity 20.74*

gPBC, Efficacy 0.75*

gPBC, Facilitating 20.14

intention. Finally, intention has a significant influence on actual use.

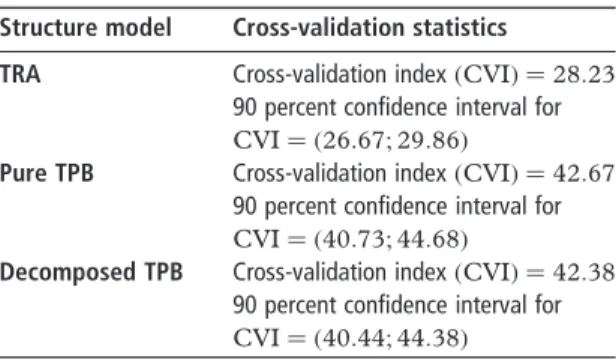

5.4 Cross-validation in covariance structure modeling

The cross-validation index (CVI) suggested by Cudeck and Browne (1983), was used to test the structures of the TRA, pure TPB and decomposed TPB models. The computation for the CVI measures the distance between the restricted variance-covariance matrix for the calibration sample and the unrestricted variance-covariance matrix for the validation sample. According to this, the smallness of the CVI value was better for estimating the predictive validity of models.

Table IV presents three models. In fact, the CVI values for the TRA, the TPB, and the decomposed TPB models all fell in the 90 percent interval of confidence. These models enable us to efficiently locate specific parameter estimates.

6. Discussion and conclusions

This study compared the TRA to two versions of the TPB model. The aim was to provide useful and interesting results to help Internet banking enterprises refine their strategic planning and enhance competitive advantage. Our analytical results show that both versions of the model exhibited a reasonable fit to the data. We adopted reasonable fit and explanatory power to evaluate them and determine which version was best (Taylor and Todd, 1995). The fit statistics and the R2values for each are shown in Table V. The R2for

each dependent construct is used to assess predictive power. The decomposed TPB model has better explanatory power for behavioral intention, attitude and subjective norm than the TRA and pure TPB models.

The findings show that intention to adopt Internet banking can be explained by attitude in both models. However, in the decomposed TPB model, only relative advantage and complexity are related to attitude, while compatibility is not. In our study, only 34 percent of the respondents had already adopted Internet banking services. Most users were accustomed to traditional branch banking. Therefore, we may infer that although people understand the advantages of Internet banking, many have yet to try it. As a result, they are unable to perceive whether Internet banking is compatible with their individual lifestyles or values.

With regard to subjective norm, the path from subjective norm to Intention failed to achieve Figure 4 Theory of planned behavior with belief decomposition: significant paths

Table IV Cross-validation of TRA, pure TPB, decomposed TPB Structure model Cross-validation statistics

TRA Cross-validation index ðCVIÞ ¼ 28:23

90 percent confidence interval for CVI ¼ ð26:67; 29:86Þ

Pure TPB Cross-validation index ðCVIÞ ¼ 42:67

90 percent confidence interval for CVI ¼ ð40:73; 44:68Þ

Decomposed TPB Cross-validation index ðCVIÞ ¼ 42:38 90 percent confidence interval for CVI ¼ ð40:44; 44:38Þ

significance in either model. More than 80 percent of the sample respondents had at least one year’s experience with the Internet. They may well have been more than averagely equipped to operate Internet banking services, but only 34 percent had actually opted to do so. Therefore, we may not infer that people who are important to them are able to influence their intention to adopt Internet banking. The possible factors of influence could be other network characteristics, such as information quality and security.

Furthermore, in the pure TPB model, the path from PBC to intention failed to achieve

significance. Ajzen and Madden (1986) claim that the PBC is less likely to be related to intention. According to the measure it had the highest mean and the lowest variance of all the measurement scales. On average, respondents reported high levels of PBC (mean equals 4.85 on a scale from 1 to 7) and there was less standard deviation, 1.19. Additionally, two components were encompassed in the decomposed TPB model. However, only self-efficacy was a significant determinant of PBC. Taylor and Todd (1995) found that self-efficacy predicted intention to use a wide range of technologically advanced products. Thus an individual with a confident command of computer skills and familiarity with the Internet is more inclined to adopt Internet banking. However, in this study, most respondents were familiar with the Internet and thus had easy access to technological resources and infrastructure. Therefore,

facilitating conditions did not influence perceived behavioral control.

In conclusion, these results have implications for research and practice. There is little prior research that uses a decomposed TPB model based on diffusion of innovations theory to discuss the intention to adopt Internet banking in comparison to traditional well-known TRA. Our results suggest that decomposing the belief

structures into multi-dimensional structures improve our understanding of these relationships.

From the commercial viewpoint, Internet banking has become more and more essential and is broadly accepted. Thus, how to build, maintain, and enhance customer relationships is an

important issue in a fiercely competitive

environment. Therefore, the results of this study indicate that it would be a valuable strategy for marketers to rethink how to educate potential customers and promote Internet banking using innovation characteristics.

Despite this, since our study was not limited to respondents experienced with Internet banking, it was difficult to measure their efficacy and the facilitating conditions. Therefore further research is needed to understand the group differences for the relationship of PBC and intention adoption between pre-behavior and post-behavior users. Furthermore, the nature of networks that influenced the evolution of banks may have an effect upon attitude, even on the adoption of Internet banking. This may provide a meaningful research area for the future.

References

ACNielsen Online (2001), “ACNielsen Online Taiwan online banking report”, available at: www.acnielsen.com.tw/ news.asp?newsID¼ 38

Ajzen, I. (1985), “From intentions to actions: a theory of planned behavior”, in Kuhl, J. and Beckman, J. (Eds), Action-Control: From Cognition to Behaviour, Springer, Heidelberg.

Ajzen, I. (1991), “The theory of planned behavior”,

Organizational Behavior and Human Decision Processes, Vol. 50, pp. 197-211.

Ajzen, I. and Madden, T.J. (1986), “Predication of goal-directed behavior: attitude, intentions, and perceived behavioral control”,Journal of Experimental Social Psychology, Vol. 22, pp. 453-74.

Bagozzi, R.P. and Heartherton, T.F. (1994), “A general approach to representing multifaceted personality constructs: application to state self-esteem”,Structural Equation Modeling, Vol. 1 No. 1, pp. 35-67.

Bandura, A. (1977), “Self-efficacy: toward a unifying theory of behavioral change”,Psychological Review, Vol. 84 No. 2, pp. 191-215.

Bandura, A. (1982), “Self-efficacy mechanism in human agency”,American Psychologist, Vol. 37, pp. 122-47. Burnkrant, R. and Page, T. (1988), “The structure and

antecedents of the normative and attitudinal components of Fishbein’s theory of reasoned action”,Journal of Experimental Social Psychology, Vol. 24, pp. 66-87. Cudeck, R. and Browne, M.W. (1983), “Cross-validation of

covariance structures”,Multivariate Behavioral Research, Vol. 18, pp. 147-67.

Davis, F.D., Bagozzi, R.P. and Warshaw, P.R. (1989), “User acceptance of computer technology: a comparison of two theoretical models”,Management Science, Vol. 35 No. 8, pp. 982-1003.

Table V Fit indices for each of the hypothesized models

TRA Pure TPB Decomposed TPB

Fit

df 176 398 442

x2 220.09 615.98 794.57

Norm. Chi-square 1.25 1.55 1.80

RMSEA (0.08 or less is better) 0.029 0.043 0.054

CFI (above 0.9 is good fit) 0.99 0.97 0.95

NNFI 0.98 0.96 0.94 R2 RBI2 0.46 0.54 0.66 RAU2 0.20 0.24 0.23 RA2 0.59 0.63 0.82 RSN2 0.78 0.90 0.99 RPBC2 0.41 0.39

Fishbein, M.A. (1967),Readings in Attitude Theory and Measurement, Wiley, New York, NY.

Fishbein, M.A. and Ajzen, I. (1975),Belief, Attitude, Intention and Behavior: An Introduction to Theory and Research, Addison-Wesley, Reading, MA.

Grandy, T. (1995), “Banking in e-space”,The Banker, Vol. 145 December, pp. 74-5.

Hair, J.F., Anderson, R.E., Tatham, R.L. and Black, W.C. (1995), Multivariate Data Analysis with Readings, Prentice-Hall International, Englewood Chiffs, NJ.

Howcroft, B., Hamilton, R. and Hewer, P. (2002), “Consumer attitude and the usage and adoption of home-based banking in the United Kingdom”,International Journal of Bank Marketing, Vol. 20 No. 3, pp. 111-21.

Joreskog, K.G. and Sorbom, D. (1993),LISREL 8: Structural Equations Modeling with the SIMPLES Command Language, Scientific Software International, Chicago, IL. Liao, S., Shao, Y.P., Wang, H. and Chen, A. (1999), “The adoption

of virtual banking: an empirical study”,International Journal of Information Management, Vol. 19 No. 1, pp. 63-74.

Liao, Z. and Cheung, M.T. (2002), “Internet-based e-banking and consumer attitudes: an empirical study”,Information & Management, Vol. 39 No. 4, pp. 283-95.

Lu, J., Yu, C.S., Liu, C. and Yao, J.E. (2003), “Technology acceptance model for wireless Internet”,Internet Research, Vol. 13 No. 3, pp. 206-22.

Madden, T.J., Ellen, P.S. and Ajzen, I. (1992), “A comparison of the theory of planned behavior and the theory of reasoned action”,Personality and Social Psychology Bulletin, Vol. 18 No. 1, pp. 3-9.

Mathieson, K. (1991), “Predicting user intentions: comparing the technology acceptance model with the theory of planned behavior”,Information Systems Research, Vol. 2 No. 3, pp. 173-91.

Nunnaly, J.C. (1967),Psychometric Theory, McGraw-Hill, New York, NY.

Oliver, R.L. and Bearden, W.O. (1985), “Crossover effects in the theory of reasoned action”,Journal of Consumer Research, Vol. 12 December, pp. 324-40.

Reisinger, Y. and Turner, L. (1999), “Structural equation modeling with Lisrel: application in tourism”,Tourism Management, Vol. 20, pp. 71-88.

Rogers, E.M. (1983),Diffusion of Innovations, Free Press, New York, NY.

Shimp, T. and Kavas, A. (1984), “The theory of reasoned action applied to coupon usage”,Journal of Consumer Research, Vol. 11 December, pp. 795-809.

Sohail, M.S. and Shanmugham, B. (2003), “E-banking and customer preferences in Malaysia: an empirical investigation”,Information Sciences, Vol. 150, pp. 207-17. Sparks, P., Hedderly, D. and Shepherd, R. (1992), “An

investigation into the relationship between perceived control, attitude variability, and the consumption of two common foods”,European Journal of Social Psychology, Vol. 22, pp. 55-71.

Steiger, J. (1990), “Structural model evaluation and modification: an interval estimation approach”,Multivariate Behavioral Research, Vol. 25, pp. 173-80.

Straits Times (1997), “Cyberbanking will open new windows”, Straits Times, Vol. 14 September, p. 5.

Suh, B. and Han, I. (2002), “Effects of trust on customer acceptance of Internet banking”,Electronic Commerce Research and Applications, Vol. 1 Nos 3/4, pp. 247-63. Tamlor, S. (1995), “New life for dinosaurs”,The Banker, Vol. 145

September, pp. 75-8.

Tan, M. and Teo, T.S.H. (2000), “Factors influencing the adoption of Internet banking”,Journal of the Association for Information Systems, Vol. 1 No. 5, pp. 1-42.

Taylor, S. and Todd, P. (1995), “Decomposition and crossover effects in the theory of planned behavior: a study of consumer adoption intentions”,International Journal of Research in Marketing, Vol. 12, pp. 137-55.

Tornatzky, L.G. and Klein, K.J. (1982), “Innovation characteristics and innovation adoption implementation: a meta-analysis of findings”,IEEE Tranactions on Engineering

Management, Vol. 29, pp. 28-45.

Triandis, H.C. (1979), “Values, attitudes, and interpersonal behavior”,Nebraska Symposium on Motivation, Belief, Attitudes, and Values, University of Nebraska Press, Lincoln, NE, pp. 195-259.

Turban, E., Lee, J., King, D. and Chung, H.M. (2000),Electronic Commerce: A Managerial Perspective, Prentice-Hall, Upper Saddle River, NJ.

Appendix. Questionnaire items

Behavior intention

INT1 ¼ I plan to use Internet banking.

INT2 ¼ I intend to use Internet banking within

the next 3 months.

INT3 ¼ I will add Internet banking to my

favorite links. Actual usage

USAGE1 ¼ How many times do you use Internet

banking.

USAGE2 ¼ How often do you use Internet

banking.

Attitude

ATT1¼ I feel using Internet banking is a wise

idea.

ATT2¼ I feel using Internet banking is a good

idea.

ATT3¼ I like to use Internet banking.

Subjective norms

SN1 ¼ Most people who are important to me

would think that using Internet banking is a wise idea.

SN2 ¼ Most people who are important to me

would think that using Internet banking is a good idea.

SN3 ¼ Most people who are important to me

would think I should use Internet banking.

SN4 ¼ My family who are important to me

would think that using Internet banking is a wise idea.

SN5 ¼ My family who are important to me

would think that using Internet banking is a good idea.

SN6 ¼ My family who are important to me

would think I should use Internet banking.

Perceived Behavioral Control

PBC1 ¼ I would be able to operate Internet

banking.

PBC2 ¼ I have the resources to use Internet

banking.

PBC3 ¼ I have the knowledge to use Internet

banking.

PBC4 ¼ I have the ability to use Internet banking.

Relative advantage

b1 ¼ Using Internet banking would save time.

e1 ¼ Using Internet banking would save time is

important to me.

b2 ¼ Using Internet banking has more

advantages.

e2 ¼ Using Internet banking has more

advantage is important to me.

Compatibility

b3 ¼ Using Internet banking will fit well with my

life style.

e3 ¼ The Internet banking will fit well with my

life style is important to me.

b4 ¼ Using Internet banking will fit well with

how I use it.

e3 ¼ The Internet banking will fit well with how

I use it is important to me.

Complexity

b5 ¼ Internet banking is easy to learn.

e5 ¼ Easy to learn Internet banking is important

to me

b6 ¼ Internet banking is easy to operate.

e5 ¼ Easy to operate Internet banking is

important to me.

Normative influences

nb1 ¼ My family would think that I should use

Internet banking.

mc1 ¼ Generally, I want to do what my family

thinks I should do.

nb2 ¼ Most people would think that I should use

Internet banking.

mc2 ¼ Generally, I want to do what most people

think I should do.

Efficacy

pf1 ¼ I could easily to operate Internet banking

on my own.

cb1 ¼ Being able to operate Internet banking is

important to me.

pf2 ¼ I know enough to operate Internet

banking.

cb2 ¼ Knowing enough to operate Internet

banking is important to me.

pf3 ¼ I would feel comfortable using Internet

banking.

cb3 ¼ Being comfortable using Internet Banking

on my own is important to me.

Facilitating

pf4 ¼ I have the network to use Internet banking.

cb4 ¼ Having the network to use Internet

banking is important to me.

pf5 ¼ I have the time to use Internet banking.

cb5 ¼ Having the time to use Internet banking is

important to me.

pf6 ¼ I have enough money to use Internet

banking.

cb6 ¼ Having enough money to use Internet