www.elsevier.comrlocaterjengtecman

Case study

Demand for business information service of firms in

Taiwan: a case study of Hsinchu Science-based

Industrial Park and Hsinchu Industrial Park

Benjamin J.C. Yuan

), Ming Yeu Wang, Chen Chien Wang

Institute of Management of Technology, National Chiao Tung UniÕersity, 1001 Ta-Hsueh Rd., Hsinchu, 300,Taiwan

Abstract

Continuous development of technology brings changes in economic environment and market structure. Enterprises should be equipped with speedy and accurate analytical capabilities on business information so that they can foresee the future. For countries such as Taiwan where the majority of the enterprises are small or medium businesses, these enterprises lack the economies of scale and skilled professionals in collecting and analyzing business information in their business environment. External professionals, on the other hand, fit better into their needs. In this case study research, based on organizational buying theory and through questionnaire survey, we try to understand the demand motives, awareness, interest, evaluation items and purchase intention of enterprises for business information in Taiwan. At the end of the case study, we also try to make a few recommendations for information service providers. q 1999 Elsevier Science B.V. All rights reserved.

Keywords: Business information; Information broker service; Organizational buying; Information technology

1. Introduction

Continuous development of technology brings changes in economic environment and market structure. Enterprises should be equipped with speedy and accurate analytical capabilities on business information so that they can foresee the future. Information, therefore, is the most important resource for enterprises. If enterprises can collect, evaluate information and make proper deduction, then they will gain more competitive

)

Corresponding author. Tel.: q886-3-5727657; fax: q886-3-5727653; E-mail: benjamin@cc.nctu.edu.tw

0923-4748r99r$19.00 q 1999 Elsevier Science B.V. All rights reserved.

Ž .

advantages than their competitors. Nomura Research Institute once presented its view-point of ‘‘information lead manager’’1 and commented that there will be a strong demand for business information by enterprises in the next century.

More and more enterprises continue to downsize their organizations, reduce their core staff to the minimum, and out source marginal activities to external professionals. They do so just because they want to improve the flexibility in their organizations. Along with this trend, when enterprises are in need of business information, they very often just rely on external professional organizations for the collection, compilation and analysis of information.

In addition to relying on external professionals, enterprises can also hire an informa-tion specialist to help them identify their informainforma-tion needs. However, only large

Ž

enterprises can afford to hire in-house information specialists Everett and Crowe,

.

1994 . For countries such as Taiwan where the majority of the companies are small or medium businesses, hiring in-house specialists is not appropriate. External professionals, on the other hand, fit better into the needs of small and medium companies in Taiwan as they allow smaller scale companies to still enjoy economies of scale in their collection and analysis of business information.

Professional organizations providing business information services have been around for quite some time in developed countries. They have grown to be a pretty large scale

Ž .

industry and will continue to maintain a certain growth rate Everett and Crowe, 1994 . Taiwan, in the past, has very little demand for business information services. But, the situation has changed. Due to increasing competition from peers and strong promotion by the government and non-profit organizations, enterprises in Taiwan have started to recognize the fact that information collection and analysis have become an indispensable tool for strengthening competitive capabilities. Thus, the demand for business informa-tion services starts to boom. It is crucial for business informainforma-tion service providers to understand the demand motives of major clients, their interest and how they evaluate such services so as to develop services that meet the clients’ expectations. In this case study research, based on organizational buying theory and through questionnaire survey, we try to understand the demand motives, awareness, interest, evaluation items and purchase intention of enterprises for business information. At the end of this paper, we also try to make a few recommendations for information service providers.

2. Literature review

The term ‘‘information’’ has been used quite broadly. To define ‘‘business informa-tion’’ used in this case study, we first discuss ‘‘levels’’ of information and current status in Taiwan so as to define the research scope of this paper. In addition, as enterprises are the major target consumers of business information, this paper will then discuss some

1

important organizational buying theories and formulate research framework based on these theories.

2.1. Definition and leÕels of information

Scholars have not reached consensus in the definition of ‘‘information’’. Some scholars have a narrow interpretation of the term by thinking that information is merely

Ž .

a pooling of scattered bits of data or knowledge Weiss, 1992; Fuld, 1994 . These

Ž .

scholars tend to classify information into several levels. Weiss 1992 once classified information into four levels. The first level is raw data. The second level is information, which is the compilation of raw data. The third level is knowledge, which involves applying information to improving clients’ situation. The fourth level is wisdom, which is an integration of knowledge on policies, expertise required and client culture and can

Ž .

be accessed by clients. Fuld 1994 classified information into the following four levels: data, information, analysis and intelligence. Under the above interpretations, information seems to have only preliminary and basic contribution to enterprises. However, some other scholars have broader interpretation on information. They believe that information

Ž .

covers nearly everything Lavin, 1992; Rugge and Glossbrenner, 1995 . Under this interpretation, information covers all previously mentioned levels, each of which contributes to enterprises with a slightly difference.

In terms of size, currently the largest information service organization in Taiwan is

Ž .

Industrial Technology Information Service ITIS . ITIS is a government-sponsored organization, which is engaged in the collection and analysis of industrial information. The purpose is to promote the competitive advantages of Taiwan industries and to promote industrial upgrading. ITIS was established in 1989, involving quite a few non-profit organizations such as Industrial Technology Research Institute, Institute for Industry Information, Taiwan Economic Institute, Development Center for Metals, Development Center for Biotechnology, Development Center for Ships and Boats, Development Center for Textile. Current researches at ITIS include information, indus-trial materials, chemical industry, biotech, food, photonics, electrical engineering, industrial safety and hygiene, textile, aerospace, autos, communication, consumer elec-tronics, precision machinery, machine tools, semiconductors, metals and non metal

Ž

industries. ITIS provides its service through publications, electronic media electronic

. Ž

information network , seminars, consulting services and projects projects in relation to

. 2

market survey and investment trend analysis .

Other than ITIS, there are other organizations that provide business information services as well. Among them are firms that provide services in management consulting, credit check, market research, commercial database, newspaper clippings, periodical index, and information brokerage. These institutions spread across private firms, govern-ment agencies, non-profit organizations and academic units. Independent service organi-zations are usually smaller in scale. The business nature and service items of the previous organizations are not exactly the same and the information they provide is in some aspects overlapping.

2

2.2. Enterprises’ demand for business information serÕice

Enterprises need business information most when they do not understand the business

Ž .

environment they are in. According to Daft et al. 1988 , there are six types of information on external environment that enterprises need to understand. They are competition, customer, technology, regulation, economics and social culture. Daft et al. further defined the first three as task environment information, the last three as general environment information.

After we examine the views of various scholars on this issue, we find that the basic function of information for an enterprise is used in examining business environment.

Ž . Ž . Ž . Ž .

Galbraith 1973 , Tushaman 1977 , Hambrick 1981 , Culnan 1983 , and Jemison

Ž1984 come up with enough business information for managers to identify opportuni-. Ž .

ties, to detect and understand where the problems are. Lavin 1992 put forward that information can reduce uncertainty because it allows managers to understand more related messages to assure possible outcomes, to reduce decision risks in an ever changing environment. Throughout the operation of any enterprise, the most important application of information may be in the field of long term strategic planning. Informa-tion that can be used in strategic planning is called ‘‘intelligence’’ according to Lavin. Business information is very helpful in the scan of environment, the reduction of uncertainty and the formulation of strategic planning. However, enterprises may have to

Ž .

turn to external professionals for help. McGonagle and Vella 1990 pointed out that when enterprises lack professional skillsrin-house specialists, are under time pressure, or solicit objective viewpoints, they might as well go out to find assistance in getting

Ž .

business information and competitive intelligence. Lavin 1992 also mentioned that enterprises will be motivated to seek professional business information services if they lack professional skills internally, confront complicated cases, need external objective opinions or even find out their competitors are seeking external information inputs.

Despite the need for external business information services, enterprises still have to carefully evaluate the costs resulting from the services as well as the quality of service

Ž .

organizations. Glossbrenner 1987 proposed nine evaluation criteria on information providers. The criteria are simpatico, communication skills, internal research resource, specialty, internal database, customer satisfaction, customer trust, employees training and experience, and reputation.

2.3. Information serÕice contents

There are quite a few companies in the US that provide information related services. In addition to publishers and database producers, there are three other important information service providers such as market research firms, consultants and information

Ž .

brokers Lavin, 1992 .

Around the world there are many multinational companies that provide business information services. DataQuest, Arthur D. Little, IDC in the US, Nomura Research

Ž . Ž .

Institute NRI , YANO, Daiwa Integrated Research DIR , Mitsubishi Research Institute

ŽMRI in Japan are some examples. The service scope of the previously mentioned.

being one of the most prestigious institutes in industry survey and analysis, NRI provides two major services. One service is to identify new trends in social, domesti-callyrinternationally economic, financial, investment, industrial and technological re-searches. The second service is to provide solutions to managerial and investment

3 Ž .

problems of client companies. Sanwa Research Institute SRIC provides services mainly in the fields of city development, geographical development investigation, survey on industrial and technological trends, economics, industries, related social policies,

Ž .

finance and internationalization ITIS, 1995 .

Information brokers provide real time appropriate information based on customers’

Ž .

demand. They have a wide range of services. Lavin 1992 listed 35 services altogether. The services include abstracting, analyzing information, bibliography collection, and trend analyses, just to name a few.

2.4. Organizational buying behaÕior theory

Industrial buying behavior includes all activities of organizational members as they define a buying situation and identify, evaluate, and choose among alternative brands

Ž .

and suppliers Webster and Wind, 1972 . Over 25 years ago, Patrick Robinson, Charles Faris and Jerry Wind introduced the Industrial Buying Process as an important area for

Ž

research in their 1967 seminal work, Industrial Buying and CreatiÕe Marketing

John-.

ston, 1994 . Within a few years, others began to examine this area through empirical studies and conceptual models. The two best known early models were introduced by

Ž . Ž . Ž .

Webster and Wind 1972 and Sheth 1973 . The model of Webster and Wind 1972 consists of four classes of variables determining organizational buying behavior. They are environmental, organizational, social and individual. The model proposed by Sheth

Ž1973 stresses more on psychological factors and is a more integrated model. Choffray. Ž .

and Lillien 1978 considered the Sheth model too complicated, so they proposed a simplified model, which was called industrial market response model. This model allows actual application of analysis results and helps managers to formulate an effective

Ž .

marketing strategy. In addition, Kolter 1994 studied hundreds of research reports and concluded that both organizations and individuals experience five stages before they accept any innovative products. These five stages are awareness, interest, evaluation,

Ž .

trial and adoption. As these early models have fairly robust nature Johnston, 1994 and the information that Taiwanese firms need tend to be innovative, this case study therefore used Kolter’s model to build the research framework. Industrial market response model is also used as a complement.

3. Methodology

As mentioned before, the research framework of this paper is based on Kolter’s model and industrial market response model. The two dimensions from which we

3

analyze the demand of enterprises for business information are the enterprise profile and environmental constraint. After finishing literature review and conducting preliminary discussion with information service providers, we determined variables for each dimen-sion. Afterwards, questionnaire investigation was conducted for us to understand how Taiwanese enterprises respond to these variables. In addition to conducting statistical methods to analyze the questionnaire, we also interviewed experts to seek their opinions so as to make our conclusions more valuable.

3.1. Scope of research

The information provided by most information service providers in Taiwan are

Ž . Ž .

mostly ‘‘information’’ level as defined by Weiss 1992 or Fuld 1994 . However, some other companies do provide ‘‘intelligence’’ or ‘‘wisdom’’ levels of information. This research focuses on information level, with some reference to ‘‘intelligence’’ or ‘‘wisdom’’ levels of information. All of these three types of services are called ‘‘business information service’’ in this research.

3.2. Research framework and Õariables

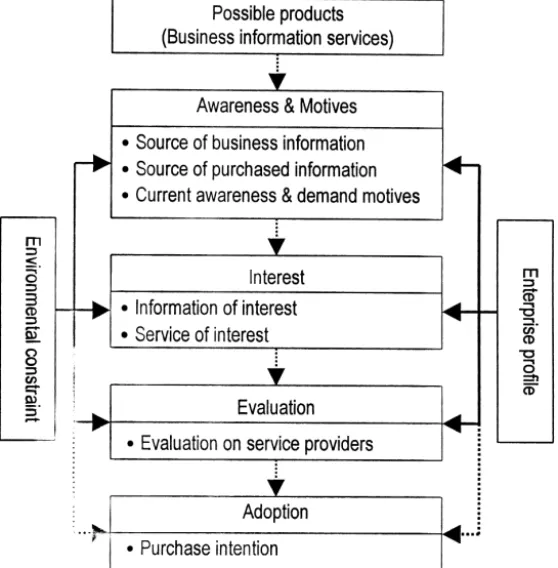

The framework of this research consists of four dimensions: awareness and motives, interest, evaluation and purchase intention of enterprises for business information services. The framework is as shown in Fig. 1. The following is the discussion of the variables in each dimension.

3.2.1. Awareness and motiÕes

The variables of this dimension include sources of business information services, sources of purchased information, enterprises’ current awareness of availability of such information, and their motives to purchase such services.

Ž .1 There are 15 possible sources of business information services: private market research firms, domestic consulting firms, foreign consulting firms, competitors, credit check firms, professional databases, ITIS publications, newspapers and magazines, government or financial institutions, exhibitions, associations, seminars, and non-profit organizations.

Ž .2 There are 12 possible sources of purchased information: associations, visitorsrsales, DM, periodicals, seminars, exhibitions, experts recommendations, rela-tives’ or friends’ recommendations, internet, competitors, libraries, and electronic media.

Ž .3 Awareness of existence of such services is classified into three scales: fully aware, a bit aware, and not aware.

Ž .4 Taking into consideration the arguments of McGonagle and Vella 1990 andŽ . Ž .

Lavin 1992 , we listed eight possible purchase motives. They are gaining professional knowledge, seeking objective viewpoints, reducing costs, buying time, identifying problems, reference for decision making, reference for investment evaluation, and elevating knowledge of employees. In the questionnaire we conducted, the respondents

Fig. 1. Research framework. Note: the direction pointed out by the dotted line is not within the scope of this research.

were asked what they think of these eight motives, we used Likert 5-point scale to measure their answers.

3.2.2. Interest

For this dimension, we have variables including types of information and services items that enterprises might be interested in. After going through the service items of most information service providers, we listed 13 types for the former and 11 items for the latter.

Ž .1 The information types that enterprises might be interested in are: trends of economic cycles, trends of finances and loans, uprdown stream supply and demand, price trends of raw materials and products, forecasts in production and sales, govern-ment industrial policies and related regulations, intellectual property rights and patents analysis, strategic analysis on markets, trend analysis on industrial developments, information on new products, investigation on firms’ activities and credit status, trends on technological developments, and investigation on land and geographic developments. In the questionnaire, we use Likert 5-point scale to measure how enterprises value these types of information.

Ž .2 The service items that enterprises might be interested in are: real time information service, professional electronic database indexrfull-scale service, newspaper clippingsrperiodicalsrlibrarian information services, seminars on industrial activities, publications analysis on related industriesrproductsrmarkets, research service provided to one single firm, research service provided to multiple firms, consulting services, services provided on membership basis, training courses on industrial research, and patents maprlegal consulting services. In the questionnaire, we use Likert 5-point scale to measure the preference of enterprises for these service items.

3.2.3. EÕaluation

For the evaluation on information service providers, we take into consideration the

Ž .

arguments of Glossbrenner 1987 as well as opinions from service providers; we single out 16 criteria that service providers should meet. They are reputationrimage, objectiv-ity, confidentialobjectiv-ity, reputation of professionals, professional knowledge of analysts, working experience of professionals, comprehensive after-sale service, service quality control, scale of service providers’ organization, lower pricing, availability of databases and publications, fully computerized system, availability of real time information, prospective information, prospective information, in-depth technical background sup-port, and international database support. In the questionnaire, a Likert 5-point scale was used to assess the enterprise’s perceptions of these items.

3.2.4. Purchase intention

When the information types and service items meet the requirements of enterprises, the discussion on the purchase intentions of enterprises follows. The purchase intentions can be categorized into four levels.

3.2.5. Enterprise profile

The enterprise profile needs to be looked at: years of operation since establishment, type of industry, 1996 sales, level of office automation, and internet equipment availability.

3.2.6. EnÕironmental constraint

Ž . Ž . Ž . Ž .

Tushaman 1977 , Culnan 1983 , Galbraith 1983 , Jemison 1984 , and Hambrick

Ž1989 all pointed out that the reason why enterprises need business information is for.

them to examine the external environments of the enterprises. This research designs seven external environmental variables: government policies, technological trends, social environment, cross-strait economic and trading activities between Taiwan and Mainland China, competition, and dominance of enterprises in the industry. In the questionnaire, the inquires on the first six variables focus on the impact levels of the changes in these six variables on the enterprises. The last variable is aimed to inquire about the dominance degree of the enterprises in the industry. We still use Likert 5-point scale to measure the answers given by the respondents.

3.3. SurÕey and statistics on recoÕery of questionnaire

There are two survey targets conducted for this research. One is firms at Hsinchu Science-based Industrial Park, who face highly uncertain and ever-changing

technologi-cal environment and are in desperate need of professional business information services. The second target is firms at Hsinchu Industrial Park, who need business information to help them through the transition from traditional industries to technology intensive industries.

In 1996, this research picked 423 firms from the directories of HSIP and HIP. After first round of phone contacts, it was found that six of them closed down, thus the survey firms were reduced to 417 firms. In March 1997, questionnaires were sent to presidents or vice presidents of these firms.

The returned questionnaires totaled 133, in which nine questionnaires were invalid due to incomplete answers and three indicated that they have no needs for business information. After phone confirmation, these three firms indicating no needs for business information are all subsidiaries and their parent companies provide such information. Therefore, valid questionnaires are 121; the recovery rate is 29%.

3.4. Analysis methods

The analytical tool for this research is the statistics software called SPSS. Based on different analytical demands, the following statistical methods were used.

3.4.1. DescriptiÕe statistics

The averages and frequency percentages of some variables are listed so that we can have preliminary understanding of the distribution of variables.

3.4.2. Factor analysis

We conduct factor analysis on the variables in the dimensions of motives, interest and evaluation. The purpose is to find out the potential characteristics among the variables in the hope that we can use less number of dimensions to present the original data structure and to conduct further analysis. We use principal component analysis to extract common

Ž .

factors and use eigenvalue bigger than 1 Kaiser’s rule as the factor selection criterion. Afterwards, we use Varimax for rotation.

After the factors were extracted, we calculate the averages of the variables contained in each factor to see whether there is difference among factors. We then use the averages as the factor score for that particular factor. In addition, all subsequent statistical analyses use standardized factor score generated by computer outputs.

( )

3.4.3. One-way analysis of Õariance ANOVA

ANOVA is used to understand whether significant difference exists among factors in each dimension. ANOVA is also used to understand how enterprises with different attribute react to each factor.

3.4.4. Multiple pairwise comparison — Tukey’s method

When the ANOVA results show significant difference, we use Tukey’s method to identify the source of the difference.

3.4.5. Correlation analysis

This method is used to analyze the relationship between environment constraint variables and all extracted factors.

4. Empirical results

4.1. DescriptiÕe statistical analysis

4.1.1. Analysis on awareness and demand motiÕes

4.1.1.1. Sources of business information. The major sources of business information

Ž . Ž . Ž .

include newspapers and magazines 22.9% , seminars 14.5% , exhibitions 14.5% ,

Ž . Ž . Ž .

competitors 13.3% , associations 10.5% , ITIS publications 8.2% , foreign consulting

Ž . Ž . Ž

firms 3.8% and others 12.4% As this question is a multiple-choice question, so the above percentages are derived by dividing the frequency that each answer has been

.

chosen by the total .

4.1.1.2. Sources of purchased information. This question is a multiple-choice question.

Ž . Ž .

The major sources of purchased information are periodicals 21.4% , seminars 15.6% ,

Ž .

DM 14.0% . These are all information channels that firms can access easily.

Competi-Ž . Ž . Ž . Ž .

tors 7.8% , associations 7.8% , Internet 6.6% , expert’s recommendations 6.6% , and

Ž .

exhibitions 6.6% follow these sources. Other channels account for 13.6%.

4.1.1.3. Awareness of business information serÕices. This question aims to find out

whether the respondents of the questionnaire are aware of the availability and service contents of business information services in Taiwan. 25.3% of those who responded expressed that they are ‘‘fully aware’’ of that services in Taiwan; 61.6% indicates ‘‘commonly aware’’; 13.1% indicates ‘‘unaware’’.

4.1.1.4. Demand motiÕes. The demand motives of the responding firms for seeking

Ž .

business information services are ranked by the averages of each motive : reference for

Ž . Ž . Ž .

decision-making 4.12 , identifying problems 4.09 , buying time 3.98 , reference for

Ž . Ž .

investment evaluation 3.87 , gaining professional knowledge 3.80 , seeking objective

Ž . Ž . Ž .

viewpoints 3.58 , elevating knowledge of employees 3.44 , and reducing costs 3.43 .

4.1.2. Analysis on interest

4.1.2.1. Information of interest. Business information that interests the responding firms Žranked by the averages are: price trends of raw materials and products 4.46 , trend. Ž .

Ž .

analysis on industrial developments 4.43 , supply and demand in uprdown stream

Ž . Ž .

industries 4.37 , trends on technological developments 4.26 , forecasts in production

Ž . Ž . Ž .

and sales 4.18 , information on new products 4.16 , analysis on markets 4.08 ,

Ž .

investigation on firms’ activities and credit status 4.00 , trends of economic cycles

Ž3.91 , policies and regulations 3.60 , intellectual property rights and patents analysis. Ž . Ž3.59 , trends of finances and loans 3.19 , and investigation on land and geographic. Ž .

Ž .

developments 2.74 .

Ž

4.1.2.2. SerÕice of interest. Service items that interest the responding firms ranked by

. Ž .

the averages are: seminars on industrial activities 4.06 , real time information service

Ž3.93 , newspaper clippingsrperiodicalsrlibrarian information services 3.72 , profes-. Ž .

Ž . Ž .

sional consulting service 3.41 , research service provided to multiple firms 2.97 ,

Ž .

research service provided to one single firm 2.95 , services provided on membership

Ž . Ž .

basis 2.91 , training courses on industrial research 2.88 , patent mapsrlegal consulting

Ž .

services 2.86 .

4.1.3. Analysis on eÕaluation of information serÕice proÕiders

Ž .

The evaluation criteria that the responding firms use ranked by the averages are:

Ž . Ž .

confidentiality 4.53 , availability of real time information 4.43 , prospective

informa-Ž . Ž .

tion 4.42 , experience of professionals 4.31 , professional knowledge of analysts

Ž4.28 , service quality control 4.28 , after-sale service 4.27 , objectivity of service. Ž . Ž .

Ž . Ž .

providers 4.25 , international database support 4.21 , reputationrimage of service

Ž . Ž . Ž .

providers 4.20 , in-depth technical background support 4.12 , lower pricing 4.10 ,

Ž . Ž .

availability of database and publications 3.99 , reputation of professionals 3.86 , fully

Ž . Ž .

computerized system 3.74 and scale of service providers 3.45 .

4.1.4. Analysis on purchase intention

Suppose that above service items meet the requirements of the responding firms, the

Ž .

purchase intention of the firms are ranked by percentages : very interested in

purchas-Ž . Ž . Ž .

ing 27.3% , somewhat interested 43.7% , uncertain 26.1% , and not interested at all

Ž2.5% ..

4.2. Exploratory factor analysis 4.2.1. Analysis on demand motiÕes

After factor analysis is conducted, two factors are extracted. Accumulated explained variance is 65.6%. The factor analysis results are shown in Table 1. There are five variables in factor I. The common characteristic of the five variables are effectively accumulating knowledge, thus they are named as ‘‘knowledge motives’’. Factor II consists of three variables that are mostly used for business decision-making, thus they are named as ‘‘decision motives’’.

4.2.2. Analysis on interest

4.2.2.1. Information of interest. Results of factor analysis on business information that

interest enterprises are shown in Table 2. Factor I includes six variables, which

Ž .

according to the definition by Daft et al. 1988 are then named ‘‘task environment information’’. The three variables in factor II are related to information on supply-de-mand and are thus named as ‘‘supply-desupply-de-mand information’’. The four variables in factor III focus on the research on macro-economic environment and are thus named as macro-economic environmental information. The accumulated explained variance is 63.3%.

4.2.2.2. SerÕice of interest. The results of factor analysis on services that interest

Table 1

Factors on demand motives

Factor Variables Factor Accumulated Naming of factor

loading explained

Ž .

variance %

I Gaining professional knowledge 0.8432 42.8 Knowledge motives

Buying time 0.8097

Reducing costs 0.7828

Seeking objective viewpoints 0.7543 Elevating knowledge of employees 0.6539

II Reference for investment evaluation 0.8698 65.6 Decision motives Reference for decision-making 0.7511

Identifying problems 0.6570

requested and specified by clients. As these services tend to be unique to certain firms, they are thus named ‘‘customized project-based services’’. Factor II consists of five variables. These five services are designed by service providers and can meet the needs of a broader base of customers. Therefore, they are named ‘‘general information broker services’’. The accumulated explained variance is 64.6%.

4.2.3. Analysis on eÕaluation of serÕice proÕiders

From Table 4, we know that the three variables in factor I are related to the quality of analysts in the service providers and we name them ‘‘quality of professionals’’ accordingly. The three variables in factor II reflect firms’ requirement of quality of information, and they are thus named ‘‘quality of information’’. The four variables in

Table 2

Factors on business information of interest

Factor Variables Factor Accumulated Naming of factor

loading explained

Ž .

variance %

I Trends of technological development 0.7864 34.0 Task environment

Information on new products 0.7753 information

Trend analysis of industrial development 0.7712

Analysis of markets 0.6815

Intellectual property rights and patents analysis 0.4542 Investigation of firms’ activities and credit 0.4488

II Price trends of raw materials and products 0.8428 52.4 Supply–demand Supply and demand in uprdown stream industries 0.7810 information Forecasts in production and sales 0.6411

III Investigation on land and geographical 0.7592 63.3 Macro-economic

developments environment

Policies and regulations 0.6418 information

Trends of economic cycles 0.6374

Table 3

Factors on services of interest

Factor Variables Factor Accumulated Naming of factor

loading explained

Ž .

variance %

I Consulting services 0.7572 49.6 Customized

project-Training courses 0.7496 based services

Research services provided to multiple firms 0.7217 Services provided on membership basis 0.7200 Research services provided to one single firm 0.6693

IPR and patents analysis 0.5946

II Electronic database index 0.8459 64.6 General information

Newspaper clippingsrperiodicalsrlibrarian 0.7879 broker services Publications of various analysis reports 0.7137

Real time information services 0.6459 Seminars on industrial activities 0.5881

factor III are concerned with the impression that service providers left with clients, and they are thus named ‘‘goodwill of service providers’’. The variables in factor IV are concerned with the quality of service, and they are thus named ‘‘quality of service’’. The variables in factor V are concerned with databases, and they are thus named ‘‘completeness of database’’. The accumulated explained variance is 71.3%.

4.2.4. Comparison between factors

After factors are extracted, this research conducts variance analysis in order to understand whether there is significant difference among factors in each dimension. The

Table 4

Factors on evaluation of service providers

Factor Variables Factor Accumulated Naming of factor

loading explained

Ž .

variance %

I Professional knowledge of analysts 0.8724 38.4 Quality of professionals Reputation of professionals 0.7340

Experience of professionals 0.6807

II Prospective information 0.8415 48.7 Quality of information

Availability of real time information 0.8214 In-depth technical background support 0.3896

III Scale of providers 0.7485 57.7 Goodwill of services providers

Objectivity of providers 0.7077

Confidentiality of providers 0.6778 Reputationrimage of providers 0.4478

IV After sale service 0.8456 65.0 Quality of services

Service quality control 0.7553

Fully computerized system 0.5843

V Lower pricing 0.7833 71.3 Completeness of database

Completeness of database and publications 0.6705 International databases support 0.4221

P values of each dimension in Table 5 are less than 0.05 significant level, thus we know

that there is significant difference among the factors in each dimension.

Afterwards, we use Tukey’s method to figure out the resources of difference. In the dimension of ‘‘demand motives’’, the score of decision motives is significantly higher than knowledge motives. In the dimension of ‘‘information of interest’’, the scores of task environment and supply–demand information are significantly higher than that of macro-economic environment information; supply–demand information has significantly higher score than that of task environment information. In the dimension of ‘‘service of interest’’, general information broker services have significantly higher score than customized project-based services. In the dimension of ‘‘evaluation on service providers’’, the score of quality of information is significantly higher than quality of service and completeness of database.

4.3. Business profile Õs. factors

We use ANOVA, Tukey’s method, and correlation analysis to examine whether different business profiles make firms react differently towards the factors. The results are shown in Table 6.

4.3.1. Demand motiÕes

In terms of knowledge motives, the factor scores of communications, photonics, semiconductors, materials, chemical industries are all significantly higher than mechani-cal industry. However, there is no significant difference among different type of industries for decision motives.

4.3.2. Information of interest

Computers and peripherals, communications, photonics, semiconductors, biotech industries all have significantly higher score for task environment information than

Table 5

Results of ANOVA and multiple pairwise comparison in each dimension

a b

Dimension Name of factor Factor F value M.P.C.

score

UUU

Ž .

Demand motives 1. Knowledge motives A 3.6479 8.608

Ž . Ž .

2. Decision motives B 3.9174 B.A.

UUUU

Ž . Ž .

Information of interest 1. Task environment A 4.0882 59.025 A, C

Ž . Ž . Ž . 2. Supply–demand B 4.3388 B, A B, C Ž . 3. Macro-economic environment C 3.4066 UUUU Ž . Ž .

Service of interest 1. Customized project-based services A 2.9959 96.613 B, A

Ž .

2. General information broker service B 3.9533

U

Ž .

Evaluation on 1. Quality of professionals A 4.1515 2.609

Ž . Ž . Ž .

service providers 2. Quality of information B 4.3223 B, D B, E

Ž . 3. Goodwill of providers C 4.1054 Ž . 4. Quality of service D 4.0992 Ž . 5. Completeness of database E 4.0994 aU P - 0.05;UUUP - 0.005;UUUUP - 0.001. b Ž .

M.P.C. means multiple pairwise comparison. A, B indicates that factor A has significantly higher score than factor B at 0.05 significant level.

() B.J.C. Yuan et al. r J. Eng. Technol. Manage. 16 1999 349 – 372 363

Enterprises profiles vs. factors

Enterprises Dimension Demand motives Information of interest Service of interest Evaluation on service providers

profile Factor Knowledge Decision Task Demand– Macro- Project- Infor- Quality of Quality of Goodwill Quality of Database

environ- supply economic based mation profes- information services

ment envir. service broker sionals

Type of F value 2.973 0.485 4.501 4.134 2.484 2.623 3.988 2.930 1.134 1.121 1.116 1.159

UU UUUU UUUU U U UUU UU

a industry P value

b Ž . Ž . Ž . Ž . Ž . Ž . Ž . Ž . Ž . Ž . Ž . Ž .

M.P.C. B,D C,D – A,D B,D A,H C,H B,C C,D A,D B,D A,D G,D – – – –

ŽE,D. ŽF,D. ŽC,D. ŽE,D. ŽE,H. ŽF,H. ŽE,D. ŽC,D. ŽE,D.

ŽG,D. ŽH,D. ŽG,H. ŽG,D.

Years Corr. 0.045 y0.044 y0.069 y0.071 0.007 y0.006 y0.077 y0.188 y0.106 y0.008 0.265 0.018

U U P value Sales F value 0.822 0.485 1.073 1.751 1.064 0.924 1.738 1.740 0.498 4.380 1.930 5.205 UUU UUU P value c Ž . Ž . Ž . Ž .

M.P.C. E,A D,A B,E D,E

Computer- F value 1.407 2.349 4.521 1.004 3.802 3.405 0.954 1.233 0.453 0.939 2.536 0.365

U U U

ization P value q q

d

Ž . Ž . Ž .

M.P.C. – – A,C – A,C A,C – – – – – –

Internet T value y0.76 1.03 1.92 y0.60 1.09 1.52 1.46 y0.54 1.82 1.36 0.30 y0.81 P value q q e Ž . Ž . M.P.C. – – A,B – – – – – A,B – – – a qP - 0.1;UP - 0.05;UUP - 0.01;UUUUP - 0.001. b Ž .

‘‘M.P.C.’’ means multiple pairwise comparison. The significant level for multiple pairwise comparison is 0.05. A, B indicates that factor A has significantly higher score than factor B at 0.05 significant level. The symbols for type of industries are as below: A — computers and peripherals; B — communications; C — photonics; D — mechanics; E — semiconductors: F — materials; G — chemical; H — biotech.

c

Ž .

The symbols for 1996 sales Unit: NT$ . A — below 10 million; B — 10 ; 40 million; C — 40 ;100 million; D — 0.1;1 billion; E — more than 1 billion. d

The symbols for levels of computerization are as below: A — fully computerized; B — mostly computerized; C — a little or not computerized. e

mechanical industry. Fully automated firms also have significantly higher score for task environment information than firms that are less automated or not automated at all. As for product supply–demand information, biotech industry has significantly lower score than computers and peripherals, photonics, semiconductors, materials, and chemical industries. For macro-economic environmental information, communications industry has significantly higher score than photonics industry. Fully computerized firms have significantly higher score than firms that are less computerized or not computerized at all. There is no significant difference among other factor scores.

4.3.3. SerÕice of interest

For customized project-based service, the scores of photonics and semiconductors industries are significantly higher than mechanical industry. Fully computerized firms have significantly higher score than firms that are less computerized or not computerized at all. For general information broker services, computers and peripherals, communica-tions, photonics, semiconductors, and chemical industries have significantly higher score than mechanical industry.

4.3.4. EÕaluation on serÕice proÕiders

In terms of quality of professionals, the scores of computer and peripherals and chemical industries are significantly higher than mechanical industry. There is a significantly negative correlation between duration of firms and quality of analysts. This means that firms with fewer years of operation put much emphasis on quality of professionals. In terms of quality of information, firms with Internet access equipment have significantly higher score than firms without that sort of equipment. In terms of goodwill of service providers, firms with 1996 sales between NT$0.1–1 billion and more than NT$1 billion have significantly higher score than those firms with sales below NT$10 million. This means that larger companies value the goodwill of service providers more. There is a significantly positive correlation between years of operation of firms and quality of service. This means that firms with longer history put more emphasis on quality of service. In terms of completeness of database, firms with 1996 sales between NT$10–40 million and firms with 1996 sales between NT$0.1–1 billion have significantly higher scores than firms with 1996 sales over NT$1 billion. This means that smaller companies have more emphasis on the completeness of database since the databases in the large companies usually have already complete.

4.4. EnÕironmental constraints Õs. factors

The analysis results for this section are listed in Table 7. In terms of demand motives, knowledge motives are positively correlated to technological trends, social changes, and cross-strait economicrtrading activities. Decision motives are positively correlated to all external environmental variables. In terms of information of interest, task environmental information is positively correlated to technological trends, social changes and market competition. Product supply–demand information is positively correlated to cross-strait activities and market competition. Macro-economic environmental information is posi-tively correlated to government policies, social changes; it is also posiposi-tively correlated to

() Yuan et al. r J. Eng. Technol. Manage. 16 1999 349 – 372 365

Environmental constraints vs. factors

Environ- Dimension Demand motives Information of interest Service of interest Evaluation of service providers

mental Factor Knowledge Decision Task Demand– Macro- Project- Infor- Quality of Quality Goodwill Quality of Database

constraints environ- supply economic based mation Profes- of infor- services

ment environ- service Broker sionals mation

ment

Policy Corr. 0.138 0.229 0.143 0.097 0.416 0.408 0.053 0.228 0.058 0.187 0.187 y0.002

U UUUU UUUU U U U

P value

Tech. trend Corr. 0.319 0.226 0.401 0.154 0.177 0.338 0.291 0.110 0.345 0.266 y0.026 y0.009

UUUU U UUUU UUUU UUU UU UU

P value

Social Corr. 0.264 0.367 0.221 0.111 0.464 0.264 0.202 0.245 0.120 0.240 0.262 0.146

UUU UUUU U UUUU UUU U

environment P value

Cross-strait Corr. 0.316 0.241 0.005 0.27 0.107 0.205 0.196 0.119 0.080 0.184 y0.071 0.211

activities P value UUUU UUU UUU U U U U

Market Corr. 0.056 0.344 0.292 0.232 0.115 0.250 0.385 0.249 0.211 0.144 y0.085 y0.035

UUUU UUU U UU UUU UU U

competition P value

Dominance Corr. 0.137 0.371 0.120 0.061 0.343 0.353 0.124 y0.028 0.143 0.251 0.256 y0.045

UUUU UUUU UUUU UU UU

P value

U

the dominance level of the firms. In terms of service of interest, customized project-based services are positively correlated to all external environmental variables. Information broker services are positively correlated to technological trends, social changes, and cross-strait activities and market competition. In terms of evaluation on service providers, quality of information is positively correlated to technological trends and market competition. Goodwill is positively correlated to government policies, technological trends, cross-strait activities; it is also positively correlated to the dominance level of firms. Quality of service is positively correlated to government policies; quality of service is also positively correlated to the dominance level of firms. The completeness of database is positively correlated to cross-strait activities.

5. Analysis and discussion

5.1. Analysis on awareness and demand motiÕes

Currently, the major source of business information received by enterprises is newspapers and magazines as they are easily accessible and timely. Seminars and exhibitions follow newspapers and magazines. Enterprises also value their verbal exchanges of information, as most firms in Taiwan are small and medium businesses and interpersonal relationships are closely intertwined. Due to frequent contacts among leaders of enterprises, it is quite easy for them to acquire information verbally. Getting information from foreign consulting firms is not common. On the other hand, the sources of purchased information are periodicals, seminars and DMs. Therefore, we know that enterprises usually acquire information through seminars and exhibitions. If an information provider wants to offer service through publications, it is better to consider the timeliness and accessibility of such a channel.

Only 25.3% of the respondents in the questionnaire indicate that they are fully aware of the institutions offering information services in Taiwan. Most enterprises are only a bit aware. Therefore, information service providers need to further improve their functions and to promote their businesses.

After factor analysis is conducted, we found that there are two major motives for purchasing industrial information, i.e., accumulating knowledge and reference for deci-sion-making. Based on the statistical analysis results, the factor score of the latter is significantly higher than the former. This means that the major purpose for purchasing industrial information is for the reference for decision-making. This also corresponds to what Lavin described about American industries.

There is no significant difference among the factor scores for different industries in the use of business information for decision-making. Thus, all industries are in much need of business information to facilitate their decision-making. Mechanical industry usually does not purchase external business information because of the need to accumu-late knowledge.

From correlation analysis on the external environmental variables and motives variables, we found that when external environments exert more influence on enter-prises, the demand by them for business information services grows stronger. Any

changes in external environment can trigger the motives of enterprises to use external information to assist the decision-making process. With the help of external information in decision-making, the uncertainty resulting from changing external environments can be effectively reduced. Also, the changes in technological trends, social environment, and cross-strait economicrtrading activities between Taiwan and Mainland China bring about the demand of enterprises for accumulating knowledge.

5.2. Analysis on interest

5.2.1. Business information of interest

The information that enterprises are interested in includes information on task environment, product supply–demand, and macro-economic environment. Based on multiple pairwise comparison results, we know that enterprises as a whole are more interested in product supply–demand and task environment information than in macro-economic environmental information. Meanwhile, enterprises have a significantly higher interest in product supply–demand information than in task environmental information. This result reflects the fact that firms in Taiwan have been very sensitive to changes in product supply–demand and in raw material prices because of the shortage of raw materialsrresources and market demand, limitations imposed by Taiwan’s natural environment. In addition, task environment information is information that concerns the whole industry, which helps enterprises to grasp changes in their own industries and to understand future technological and industrial development trends. Therefore, task environment information attracts more interest from enterprises than macro-economic environmental information. Macro-economic environmental information is the kind of information that is needed for long term planning. Firms in Taiwan currently do not put

Ž .

much emphasis on it yet. This differs dramatically from what Daft et al. 1988 found about the small and medium businesses in the US The businesses in the US put greater emphasis on economic environmental information, even more than technological envi-ronment information.

However, enterprises in different industry sectors do have different preferences for business information. Technology intensive industries such as computer and peripherals, communications, photonics, semiconductors, and biotech are more interested in task environmental information. This is because the firms in these industries confront very fast changes in their respective industries and are usually not dominant players. Constantly examining their industrial environments is pivotal to them. All industries except Biotech put much emphasis on product supply–demand information. The firms in the communications are more interested in macro-economic environmental information. As Taiwan government has been slow in opening communications industry, taking into consideration the government policies is central to their decision-making. In addition, firms with high degree of office automation are more interested in task environmental and macro-economic environmental information than less computerized firms are.

Different impacts that external environments have on enterprises result in their different interest level in various types of information. When the influence that govern-ment policies, social environgovern-ment and market competition have on enterprises becomes stronger, the demand of enterprises for task environmental information is greater.

Enterprises have higher demand for product supply–demand information if cross-strait economicrtrading activities and market competition exert greater influence on them. And for firms that are greatly influenced by government policies and social changes, their need for macro-economic environmental information is also greater. As for firms that play a dominant role in their industry, they put more emphasis on macro-economic environmental information that is indispensable to long term planning.

5.2.2. SerÕice of interest

There are two types of services that enterprises are interested in: customized project-based service and general information broker service. Based on pairwise compar-ison, respondents show greater interest in general information broker service than in customized project-based service. The former can be accessed more easily and does command more demands. The latter, however, does not meet the requirements of most firms. Small and medium firms would not consider it due to cost concern or lack of actual need; large companies are usually equipped with their own in-house information specialists and thus do not eagerly require such services. Since there is very limited demand for customized project-based services, service providers have to spend more efforts in designing service contents.

The mechanical industry shows less interest in customized project-based service than photonics and semiconductors do. It also shows less interest in general information broker service than most other industries do. This suggests that the mechanical industry has almost no motive to seek business information from externals. Highly computerized firms have greater interest in customized project-based service as they usually can afford such services.

From the correlation analysis on external environments and services, there is a positive correlation between customized project-based services and all external environ-mental variables. Those firms that suffer from more impacts from external environments rely more on customized project-based services to reduce such impacts. When firms suffer from more impacts from technological trends, social environment, cross-strait economicrtrading activities and market competition, they have higher demand for general information broker service.

5.3. Analysis on eÕaluation of information serÕice proÕiders

There are five factors in the evaluation of enterprises on information service providers. The five factors ranked in descending order are quality of information, quality of professionals, goodwill of providers, quality service, and completeness of database. The multiple pairwise comparison results show that the respondents put significantly more emphasis on information quality than on service quality and database complete-ness.

Computer and peripherals and chemical industries emphasize more on quality of professionals than mechanical industry does. Firms with longer history put less emphasis on quality of professionals, rather they emphasize more on service quality. Larger firms put more emphasis on goodwill of providers than on completeness of database as they usually have an in-house database.

From the evaluation items of enterprises on service providers, we can see what environmental impacts that firms are suffering from. When firms suffer from greater impacts from technological trends and market competition, they will put more emphasis on information quality. Firms that play dominant roles usually put more emphasis on the reputation of service providers. When firms suffer from greater impacts from govern-ment policies, technological trends and cross-strait economicrtrading activities, they also have significantly greater emphasis on reputation of service providers. If firms are influenced by government policies, they will put significantly more emphasis on service quality. If firms are greatly influenced by cross-strait economicrtrading activities, completeness of database will then receive significantly more emphasis — as the actual statistical data for Mainland China are not easy to obtain.

6. Recommendations

The fact that information or intelligence can be traded like commodity is a sign that the ‘‘information revolution’’ has now entered into a mature stage. From previous analysis, we know that firms that are now confronting transition or upgrading have a high demand for business information. However, assuming all currently available

Ž .

information meets the demand of enterprises, most firms 43.7% are only ‘‘slightly’’ interested in such services. This indicates that most firms still hesitate to adopt such services and they would rather still wait and see for a longer while. As information service industry is a highly professional one, most people feel uncertain toward its

Ž

quality. Also, firms in Taiwan have limited awareness of such services only 25.3% are

.

fully aware , we therefore propose the following marketing recommendations on how to promote such professional service:

6.1. Increase Õalues of business information to enterprises

As enterprises put the most emphasis on information quality when they evaluate service providers, it is therefore important to improve the accuracy, depth, timeliness, completeness, and prospect of information. By doing so, the needs of enterprises for information can thus be satisfied, particularly the needs for decision-making.

If information does bring more benefits to enterprises, then it would be easier for service providers to promote such services and to develop markets.

For service providers that have target markets in high tech firms, information quality is peculiarly important. Generally speaking, photonics, communications, and computer and peripherals industries have greater demand for task environmental and product supply–demand information. As these industries have a highly dynamic nature, so the accuracy of information is very crucial to them. For service providers, the key to success in servicing these industries is to provide accuratervisionary information, completerfast data networks and experienced analysts.

6.2. Establish certification system on serÕice quality

There is so-called ‘‘perceived risk’’ in relation to professional service such as business information service. The risk mainly results from the difficulty in determining

the quality of service. From the evaluation of service providers, the second criterion that firms watch is quality of professionals. Therefore, it helps if a certification system of professional professionals is established. Not only will this improve clients’ understand-ing of quality, but also reduce clients’ perceived risk. Also, the certification system the helps with the quality control of service.

6.3. Establish track record aggressiÕely

According to Kolter, consumers of business information service tend to make their purchasing decisions on the basis of past track record of service providers. They tend not to believe in the advertisements posted by service providers. Track record, or reputation, therefore, becomes a very important competitive weapon. In addition, expert recommen-dations are also a good marketing method. Very few service providers in Taiwan have used this method. This method deserves some attention and may prove to be effective.

6.4. Increase clients’ confidence

As most firms still have greater demand for product supply–demand information than for other information, it may be wise to start with providing information on product supply–demand first to build clients’ confidence and dependence. Other high value added service such as customized project-based service can then be offered at a later date. The strategies to build clients’ confidence include soliciting satisfied clients’ testimony; providing endorsements by experts or opinion leaders; holding exhibitions for trial opportunities; improving two-way communications, lowering pricing, providing additional services, and emphasizing product benefits.

6.5. Understand needs of each industry, build a niche market

The change in industrial structure in Taiwan brings ample opportunities to business information service industry. However, it is very difficult to a service provider to provide full-scale services that satisfy all clients. Thus, it is necessary to understand the characteristics of each market, information level required, and service contents required before markets can be segmented. Service providers have to consider their own advantages and use them to enter a niche market.

6.6. Utilize information technology unto data processing; improÕe database and on-line index

Information technology not only changes data processing in a revolutionary way by simplifying and streamlining collectionrprocessingranalysisrstorage of data, it also provides a faster and more convenient service channel for service providers. From the respondents in the questionnaire for this research, we know that most firms are already highly computerized. 88.4% of the firms are equipped with network equipment. Informa-tion technology continues to advance, so service providers cannot ignore the use of IT in providing services.

Ž

Currently, there is very little use of foreign consulting firms only 3.8% of the

.

respondents , so there is still ample room to grow. Therefore, foreign consulting firms that have years of experience and database can utilize information technology to access domestic markets. In addition, they can also use information technology to build a contact channel with domestic potential clients and obtain valuable first-hand data on the firms.

6.7. ProÕide serÕices that respond to enÕironmental changes

When greater impacts from external environmental changes fall on enterprises, enterprises have higher interest in soliciting information services. What is special is when firms play a dominant role in their industries, they have much more interest in customized project-based service than in general information broker service. The former has higher value added, while the latter is more common and commands a much bigger market. Therefore, it is recommended to adopt the 80–20 law in marketing tip. Eighty percent of business concentrates on providing general information broker services through low pricing penetration and large volume sales, which hopefully will generate enough profits to sustain provider’s daily operation. The rest of the 20% of business then centers on customized project-based services, which command higher premium pricing and gain much higher profits.

6.8. Build up clients’ habits in using such serÕices

Business information industry suffers not only from problems in perceived risks and quality instability, but also faces a major problem that all emerging industries will bump into — clients not yet used to using such services. At this stage, we can adopt marketing strategies such as innovation group and early adoption group. The marketing purpose for the former is to induce actual buying behavior and to increase awareness level of consumers. The action plans include developing products that meet consumers’ expecta-tions and launching aggressive promotion campaigns. The marketing purpose for the early adoption group strategy is to increase recognition level of consumers by educating consumers through sales force visits and professional seminars.

References

Choffray, J.M., Lillien, G.L., 1978. Assessing response to industrial marketing strategy. Journal of Marketing 42, 20–31.

Culnan, M.J., 1983. Environmental scanning: the effects of task complexity and source accessibility on information gathering behavior. Decision Sciences 14, 194–206.

Daft, R.L., Sormunen, J., Parks, D., 1988. Chief executive scanning, environmental characteristics, and

Ž .

company performance: an empirical study. Strategic Management Journal 9 2 , 123–139. Everett, J.H., Crowe, E.P., 1994. Information for sale, WindcrestrMcGraw-Hill, NY. Fuld, L.M., 1994. The New Competitor Intelligence, Wiley, NY.

Galbraith, J.R., 1973. Designing Complex Organizations, Addison-Wesley, MA, Reading. Glossbrenner, A., 1987. How to Look It Up Online, St. Martin’s Press.

Hambrick, D.C., 1981. Environment, strategy, land power within top management teams. Administrative Science Quarterly 26, 253–257.

ITIS, 1995. Reports on Japanese Industrial Information, ITIS Office, Department of Economic Affairs of Executive Yuan, Apr.

Jemison, D.B., 1984. The importance of boundary spanning roles in strategic decision-making. Journal of Management Studies 21, 131–152.

Johnston, W.J., 1994. Organizational buying behavior — 25 years of knowledge and research. Journal of

Ž .

Business and Industrial Marketing 9 3 , 4–5.

Kolter, P., 1994. Marketing Management: Analysis, Planning and Control, 8th edn., Prentice Hall. Lavin, M.R., 1992. Business Information, 2nd edn., The Oryx Press, Phoenix, pp. 3–6, pp. 36–37. McGonagle, J.J., Vella, C.M., 1990. Outsmarting the competition, Sourcebooks.

Rugge, S., Glossbrenner, A., 1995. The Information Broker’s Handbook, 2nd edn., McGraw-Hill, NY, p. 5. Sheth, J.N., 1973. A model of industrial buyer behavior. Journal of Marketing 37, 50–56.

Tushaman, M.L., 1977. Special boundary roles in the innovation process. Administrative Science Quarterly 22, 587–605.

Webster, F.E. Jr., Wind, Y., 1972. A general model for understanding organization buying behavior. Journal of Marketing 36, 12–19.