The Economic Effects of Pr ofit Shar ing and Taiwan-style

Employee Stock Owner ship Plans: Evidence fr om Taiwan’s

High-tech Fir ms

Tzu-Shian Han

*Associate Professor, Department of Business Administration, National Chengchi University

ABSTRACT

Since the early 1980s, Taiwan’s high-tech industries have gained substantial growth, in particular in the information technology (IT) industry. It has been often claimed that one of the major reasons for this success is due to profit sharing and employee stock ownership plans adopted by many Taiwan’s high-tech firms during the period of high growth. However, there is a lack of rigorous systematic studies examining their effects on performance, employment and wages that have increasingly drawn attention from academics in Western societies. The aim of this paper is to fill up this research gap. Drawing on data from 115 high-tech firms listed in Taiwan’s stock market, the empirical results show that profit sharing and Taiwan-style ESOPs are positively associated with firm performance, employment level as well as total compensation.

Keywor ds:

Employee Financial Participation, Profit Sharing, Employee Stock Ownership Plans, Economic EffectsⅠ. INTRODUCTION

In recent years, along with the developments of ‘knowledge-based economy’, profit sharing and, in particular, employee stock ownership plans (ESOPs) have spread throughout the world, including highly industrialized and industrializing countries. For instance, during the 1970s and 1980s, employee ownership of stock in U.S. firms became widespread. In 1991, an estimated 10.8 million employees, spread across 10,000 firms, were participants in broad-based ESOPs that held more than 4% of the company’s stock (Blasi, Conte, & Kruse, 1996). In the 1980s and 1990s, employee ownership of stock has also gained popularity in Asian countries (Jones & Kato, 1995; Today Weekly, 1998). These group incentives have been viewed as the mechanism for accumulating human capital for the success of the firm (Ben-Ner, Burns, Dow, & Putterman, 2000), in particular in high-tech sectors (Smith, 1988; Tsao, 1999).

The Economic Effects of Profit Sharing and Taiwan-style Employee Stock Ownership Plans: Evidence from Taiwan's High-tech Firms / Tzu-Shian Han

2

Thanks to their prominence in the past two decades, profit sharing and employee ownership of stock have increasingly gained attention from academics. As a result, theoretical work and empirical studies of the effects of these incentives have accumulated. Much of prior research in this area of study focuses on the productivity effects of profit sharing and employee stock ownership. Theoretical work presents two competing perspectives, namely positive and negative arguments (Alchian & Demsetz, 1972; Putterman, 1982). And empirical studies on the productivity effects show inconclusive results (Kruse, 1993; Blasi, Conte, & Kruse, 1996). This inconclusiveness in research, to a certain extent, has something to do with the methodological problems inherent in the empirical work, in particular the measurement problem. For instance, research has shown that diverse forms of employee participation may lead to different outcomes (Ben-Ner, Han, & Jones, 1996; Cotton, Vollrath, & Froggatt, 1988). Studies using dummy variables as the measures of profit sharing and/or employee stock ownership may ignore the variations associated with different types of incentive programs and obscure the true effects of these incentives (Ben-Ner, Kong, & Han, 2002). Owners not only are concerned with productivity but also care about profitability related to the investments in profit sharing and employee stock ownership. However, the latter issue is much less theorized and examined in prior research than the former despite its immediate importance and relevance to the firm’s decisions to share profits either in cash or in stock. In addition to performance effects, employment and wage effects of profit sharing and employee stock ownership are also of interest to management scholars but still lack of systemic studies. Due to the above-mentioned research gap and their importance to firm performance and workers’ well being, further investigation of the economic effects of profit sharing and employee stock ownership is deemed to be important.

Furthermore, prior theoretical and empirical research on the economic effects of profit sharing and employee stock ownership focuses on experiences of Western enterprises. Till now, it may be fair to say that very few rigorous studies published in international journals have examined such issues in Asian societies, particularly in Taiwan.1 One research question worthy of examining is whether these Western theories apply to Asian societies. Additionally, Taiwan’s high-tech firms provide an interesting source to examine the economic effects of profit sharing and employee stock ownership due to their strong incentive drive in terms of the degree and frequency of sharing. It is often claimed that profit sharing and employee stock ownership accelerated the developments of Taiwan’s IC industry during the 1990s (Tsao, 1999). From 1990 to 1996, the share of the manufacturing sector in Taiwan’s GDP declined from 33.3 percent to 28 percent due to the transformation of the economic structure from manufacturing to service economy. Nonetheless, the share of electronics industries in the manufacturing sector rose from 14 percent to 19.6 percent. In the electronics sector, the percentage of the IC industry rose from 2.5

1 One of the exceptions is a study of the productivity effects of employee stock ownership plans and bonuses in Japanese companies done by Jones & Kato (1995). A few studies on the performance effects of ESOPs in Taiwanese firms have been published in local journals. But all of them suffer from methodological problems in data and variable measurements, such as the endogeneity problem of included variables, lack of control for fixed effects, and so forth.

percent to 18.4 percent. It is exactly the period that employee stock ownership grew rapidly in the high-tech sector in Taiwan (Chen & Wong, 2001).

The purpose of this study is to investigate the economic effects of profit sharing and employee stock ownership in Taiwan’s context. The article is organized as below. First, the article discusses briefly the institutional background of Taiwan-style profit sharing and employee stock ownership. Second, this study articulates theoretical perspectives that may be plausible in explaining the effects of profit sharing and employee stock ownership in Taiwan’s high-tech firms and illuminates some empirical evidence. The next section presents the data set consisting of 115 firms in Taiwan's IT industry, the descriptive statistics of variables used in this study, and the econometric specifications. Then, this paper shows the empirical results of the effects of Taiwan-style profit sharing and employee stock ownership on productivity, profitability, employment and wages, using alternative measures of profit sharing and employee stock ownership. Finally, the concluding remarks will be made.

Ⅱ. TAIWAN-STYLE PROFIT SHARING AND EMPLOYEE STOCK

OWNERSHIP PLANS: AN INSTITUTIONAL BACKGROUND

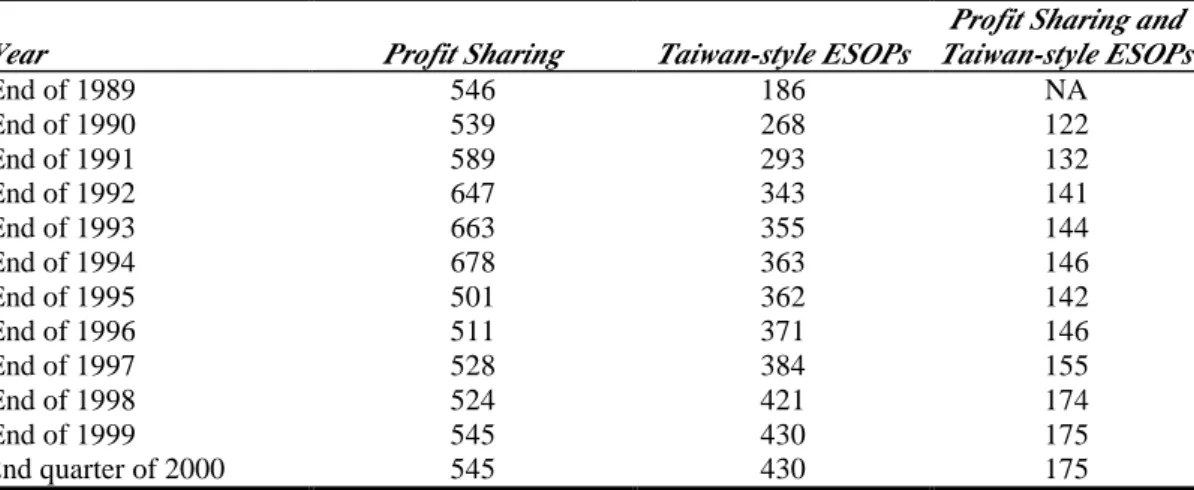

In recent years, Taiwan-style profit sharing and employee stock ownership plans (hereafter Taiwan-style ESOPs) have increasingly gained momentum in Taiwan’s economy, in particular in high-tech industries.2 Table 1 shows the trend of the developments of profit sharing and Taiwan-style ESOPs in Taiwan during the period of 1989-2002, based on government’s statistics. There is a growth in the incidence of these incentives, especially Taiwan-style ESOPs and the combination form.3 Among them, many adopters of profit sharing and/or Taiwan-style ESOPs are high-tech firms at the period of rapid growth (1985-2002).

2 In essence and practice, US-type ESOPs and Taiwan’s ESOPs have some similarities in that both plans purport to attract the talented from outside, retain them in the firm, and eventually link their efforts and intelligence to firm performance. Additionally, both plans reward employees with company stock when firm performance is enhanced. Thus, both plans are under the domain of employee ownership in general. Consequently, productivity theory developed by Western academics can be applied to explain the phenomenon of the effects of ESOPs on firm performance in Taiwan (Kruse, 1993). However, there exist some differences between these two types of plans. First, US-type ESOPs are long-term incentives in that employees share in long-term firm performance in form of stock ownership (e.g., broad-based stock option plans). Taiwan-style ESOPs, by contrast, are relatively short-term because many Taiwanese ESOP firms do not restrict their employees to sell their shares until certain point in time in the future. Furthermore, US-type ESOPs tend to encourage employees to direct their efforts towards future performance, while Taiwan-style ESOPs reward employees based on the profitability of the year prior to the stock is allocated.

3

Because the information in this table is collected by the Council of Labor Affairs, covering only a portion of establishments which are under jurisdiction of Fair Labor Standard Law. Thus, this table may underestimate the number of profit sharing and Taiwan-style ESOPs in Taiwan. The author’s personal interviews with the government agency in charge of data collection confirmed this above-mentioned judgement. Starting from 2002, information

The Economic Effects of Profit Sharing and Taiwan-style Employee Stock Ownership Plans: Evidence from Taiwan's High-tech Firms / Tzu-Shian Han

4

Table 1 Number of Pr ofit Shar ing and Taiwan-style ESOPs in Taiwan (Unit: Establishment)

Year Profit Sharing Taiwan-style ESOPs

Profit Sharing and Taiwan-style ESOPs End of 1989 546 186 NA End of 1990 539 268 122 End of 1991 589 293 132 End of 1992 647 343 141 End of 1993 663 355 144 End of 1994 678 363 146 End of 1995 501 362 142 End of 1996 511 371 146 End of 1997 528 384 155 End of 1998 524 421 174 End of 1999 545 430 175 2nd quarter of 2000 545 430 175

Sources: Monthly Bulletin of Labor Statistics, Taiwan, June, 1997, p 50.

Monthly Bulletin of Labor Statistics, Taiwan, September, 2000, pp. 58-59.

2.1 Pr ofit Shar ing

In Taiwan, profit sharing is regulated under three Taiwanese laws. Under Provision 40 of the Factory Law, manufacturing plants should reward employees with bonuses or profits if the plants are profitable and employees meet requirements set by employers at the end of each fiscal year. The Factory Law was first established in mainland China by the Nationalist Government in 1930. When Japan surrendered in 1945, Nationalist Government assumed control in Taiwan after a fifty-year period of colonial rule by the Japanese military government. At this time the Factory Law was first extended to Taiwan.

The Factory Law was succeeded by the Fair Labor Standards Act, which came into effect on July 30, 1984. Like the Factory Law, Provision 29 of the Fair Labor Standards Act stipulates that besides income tax payments, compensation for financial losses, and employers’ contributions to public funds, employers should reward qualified employees with bonuses or profits at the end of each year. However, this provision does not stipulate the extent of profits employers should share with employees. In addition, Provision 235 of the Corporate Law stipulates that corporate bylaws should promulgate the extent of employees’ profit sharing. These laws have provided the legal rules for Taiwanese enterprises adopting profit sharing plans.

In practice, companies adopting profit sharing plans typically share 2-15 percent of their profits with their employees annually after fiscal budgeting, auditing of accounts, and board meetings. The profit sharing bonus that each employee receives is usually based on his or her salary level, seniority, position (or job type), and individual performance rating. In large part because there are no tax advantages for companies to adopt profit sharing schemes, only a minority of firms in Taiwan practice profit sharing; this stands in sharp contrast to the tax advantages available for traditional bonus pay arrangements.

concerning the incidence of profit sharing and Taiwan-style ESOPs is no longer solicited by the agency.

2.2 TAIWAN-STYLE ESOPs

Taiwan-style ESOPs are the major organization-wide incentive currently popularizing in Taiwan’s high-tech firms. In fact, this organization-wide incentive is a stock bonus system according to the firm’s profitability of the previous year. The legal framework for Taiwan-style ESOPs is based on Provision 240 of the Company Law stipulating that, when the company transfers net profits to be the capital investment, according to company bylaws, the firm can give employees newly issued stock or cash as their shares of these profits. In the past fifteen years, Taiwan-style ESOPs were increasingly implemented by firms in Taiwan’s high-tech sector, in particular the semiconductor industry.

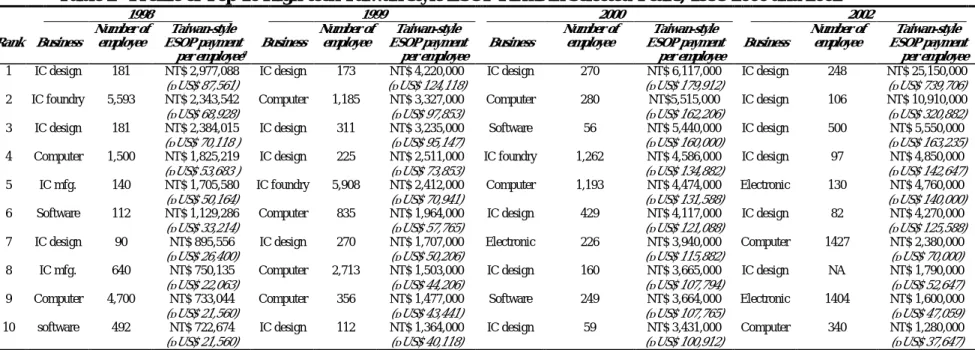

Since the mid-1980s, employee financial participation taking the combined form of profit sharing and stock bonuses has gained some popularity in Taiwan’s economy. Not only have many high-tech firms adopted these programs, but some enterprises in traditional industries have also followed their lead or considered the implementation of this participation scheme in the near future. This recently growing phenomenon can be viewed as a new milestone in the developments of employee financial participation in Taiwan in terms of motivational effects. Some high-tech companies shared a significant fraction of profits in stock form with their employees in recent years, which was rarely observed in the earlier experiments in employee financial sharing in Taiwan. UMC, a Taiwan-based semi-conductor firm located in Hsin-Chu Science-based Industrial Park, was among the first to launch the combination plan in 1983. Except for omitting sharing in 1985, and again in 1991 due to the financial losses incurred in 1990, UMC has paid out under the combination plan every year since its founding. To stockholders, the percentage of stock sharing relative to revenues ranges from 15% to 93% (Tsao, 1999: 22). Since UMC first initiated the combination plan in 1983, companies in Taiwan’s information and other related high-tech industries, as well as some companies in financial and other sectors have followed these trends and implemented their own Taiwan-style ESOPs. The amount of employee stock bonus among firms in Taiwan increased substantially from 1998 to 2002. Table 2 illustrates the profile of ten high-tech companies in Taiwan that were listed as top ten sharers in terms of the amount of Taiwan-style ESOP payment per employee among Taiwan-style ESOP firms. Most of the firms listed in the table are in computer or IC design industries. Additionally, the amount of Taiwan-style ESOP payment seems to have increased substantially across time. One major factor for this raise in Taiwan-style ESOP payment is due to the fierce competition for talented personnel in high-tech sectors and the firm’s ability to pay. These high-tech firms sharing large portion of ownership with their employees indeed have some advantages in attracting talented job candidates from the markets and retaining better personnel in the firm, thereby enhancing the efficiency of the business operation.

Table 2 Pr ofile of Top 10 High-tech Taiwan-style ESOP Fir ms in Selected Year s, 1998-2000 and 2002

1998 1999 2000 2002 Rank Business Number of employee Taiwan-style ESOP payment per employeea Business Number of employee Taiwan-style ESOP payment per employee Business Number of employee Taiwan-style ESOP payment per employee Business Number of employee Taiwan-style ESOP payment per employee 1 IC design 181 NT$ 2,977,088(≈US$ 87,561) IC design 173 (≈US$ 124,118)NT$ 4,220,000 IC design 270 (≈US$ 179,912)NT$ 6,117,000 IC design 248 NT$ 25,150,000(≈US$ 739,706)

2 IC foundry 5,593 NT$ 2,343,542

(≈US$ 68,928) Computer 1,185 NT$ 3,327,000(≈US$ 97,853) Computer 280 (≈US$ 162,206)NT$5,515,000 IC design 106 NT$ 10,910,000(≈US$ 320,882)

3 IC design 181 NT$ 2,384,015

(≈US$ 70,118 ) IC design 311 NT$ 3,235,000(≈US$ 95,147) Software 56 (≈US$ 160,000)NT$ 5,440,000 IC design 500 (≈US$ 163,235)NT$ 5,550,000

4 Computer 1,500 NT$ 1,825,219

(≈US$ 53,683 ) IC design 225 NT$ 2,511,000(≈US$ 73,853) IC foundry 1,262 (≈US$ 134,882)NT$ 4,586,000 IC design 97 (≈US$ 142,647)NT$ 4,850,000

5 IC mfg. 140 NT$ 1,705,580

(≈US$ 50,164) IC foundry 5,908 NT$ 2,412,000(≈US$ 70,941) Computer 1,193 (≈US$ 131,588)NT$ 4,474,000 Electronic 130 (≈US$ 140,000)NT$ 4,760,000

6 Software 112 NT$ 1,129,286

(≈US$ 33,214) Computer 835 NT$ 1,964,000(≈US$ 57,765) IC design 429 (≈US$ 121,088)NT$ 4,117,000 IC design 82 (≈US$ 125,588)NT$ 4,270,000

7 IC design 90 NT$ 895,556

(≈US$ 26,400) IC design 270 NT$ 1,707,000(≈US$ 50,206) Electronic 226 (≈US$ 115,882)NT$ 3,940,000 Computer 1427 NT$ 2,380,000(≈US$ 70,000)

8 IC mfg. 640 NT$ 750,135

(≈US$ 22,063) Computer 2,713 NT$ 1,503,000(≈US$ 44,206) IC design 160 (≈US$ 107,794)NT$ 3,665,000 IC design NA NT$ 1,790,000(≈US$ 52,647)

9 Computer 4,700 NT$ 733,044

(≈US$ 21,560) Computer 356 NT$ 1,477,000(≈US$ 43,441) Software 249 (≈US$ 107,765)NT$ 3,664,000 Electronic 1404 NT$ 1,600,000(≈US$ 47,059)

10 software 492 NT$ 722,674

(≈US$ 21,560) IC design 112 NT$ 1,364,000(≈US$ 40,118) IC design 59 (≈US$ 100,912)NT$ 3,431,000 Computer 340 NT$ 1,280,000(≈US$ 37,647)

a NT$ stands for new Taiwan dollars. Stock values in US$ are in parentheses. Currently, US$ 1 is approximately worthy of NT$ 34.

The results show that the top ranking firm in 2000 gave its employees stock bonuses worth NT$ 6,116,595 per person in that year, while the top ranking firm in 1998 only shared NT$ 2,977,088 per employee in stock. And the amount of stock value per employee went up to NT$25,150,000 at the top ranking Taiwan-style ESOP firm in 2002. The data reveal that a group of very profitable high-tech companies share a great amount of stock bonuses with their employees. In particular, some firms allow their employees to sell their stock as bonuses immediately upon receiving.

Taiwan-style ESOP have, to certain extent, generated several advantages both from employers’ and employees’ perspectives. It is reported that they have been an effective mechanism for attracting and retaining employees (Tien-Hsia Magzine, 1997; Today Weekly, 1998). Many foreign multinational corporations in Taiwan (e.g., IBM, HP, Philips, Texas Instruments, etc.), previously viewed by job searchers as the best firms to work for, are now confronted with “fierce warfare” with local high-tech firms for the talented. And many foreign companies also lost some of their most valued employees when some local high-tech firms recruited them with highly valuable stock bonuses. In some companies, profit sharing and employee stock bonus represent large shares of their total payroll costs (Fong, 1998). This parallels the experience in U.S. high-tech firms (Smith, 1988).

Despite the advantages Taiwan-style ESOPs possess, the plans have also brought out several problems. First and foremost, Taiwan-style ESOP dilute the interests of outside shareholders to a great extent. And this dilution of interests has led to severe criticisms among outside shareholders as well as some academics.

Secondly, some plans adopted by Taiwan's semiconductor firms manufacturing SRAM chips were sued by American SRAM firms for “dumping” practices in 1998. Owing to differences in accounting systems between Taiwan and the U.S., stock bonuses in Taiwan are not counted as payroll costs. In the American system, these bonuses should be counted as payroll cost. Thus, American SRAM firms claimed that Taiwan's counterparts ‘dumped’ their products in the U.S. market because the selling prices were lower than unit production costs. This dramatic development suggests potentially far-reaching implications of globalization for national practices of employee financial participation, perhaps eventually bringing some of these practices, at the very least their tax treatments, under the umbrella of trade agreements.

Thirdly, Taiwan-style ESOP operate effectively in profitable firms, but not in less profitable ones, showing their limited role in stabilization and expanding workplace incentives. Moreover, as the plans reward employees for previous performance, but not for future performance, this also reduces their long-term incentive effects.

Ⅲ. THEORY AND EVIDENCE

3.1 Per for mance Effects: Pr oductivity and Pr ofitability

Economic theories take two competing perspectives on the performance effects of profit sharing and employee stock ownership. On the one hand, theories argue that profit sharing and employee stock ownership can enhance firm performance. On the other hand, others predict that these incentives may deteriorate firm performance.

The Economic Effects of Profit Sharing and Taiwan-style Employee Stock Ownership Plans: Evidence from Taiwan's High-tech Firms/ Tzu-Shian Han

8

Theoretical rationales for the positive performance effects of profit sharing and employee stock ownership are many folds. First and foremost, it is argued that profit sharing and employee stock ownership can induce employees to put forth extra efforts or figure out ways to improve operational efficiency,4 thereby enhancing individual and organizational performance (Ben-Ner & Jones, 1995; Blasi, Conte, & Kruse., 1996). The rationale behind this argument is that the expectancy of high future cash and/or stock bonuses depending on the firm’s profitability and stock prices motivates them to work harder and smarter. In particular, the motivational and performance effects can be large when these incentives are broad-based and share a substantial amount of profits in cash and/or in stock with employees (Jones & Kato, 1995). Second, due to their linkage to a firm’s profitability, profit sharing and employee stock ownership can attenuate agency problems inherent in a fixed-wage employment contract and reduce the conflict of interests between the owner and the employees (Kruse, 1993).5 With this interest realignment, the employees will be more committed to the firm’s objectives and strive to accomplish the firm’s ultimate goals, notably high profitability, in that higher profitability will lead to higher cash profit sharing and stock bonuses (Chen & Wong, 2001). Third, when the payment of profit sharing and ESOPs is the ‘add-on’ portion to the total remuneration of an employee, this portion may have an ‘efficiency-wage’ effect that can reduce employees’ shirking and turnover problems, attract better qualified job applicants, and foster reciprocity in social exchange between the firm and employees (Akerlof & Yellen, 1986; Yellen, 1984). All these can facilitate the accumulation of firm-specific human capital and then organizational competencies, thereby improving firm performance. Fourth, profit sharing and ESOPs can create peer group pressures and motivate employees to monitor co-workers to enforce high performance standards across the firm (Kruse, 1993). More important, these group incentives can encourage cooperation among employees due to the nature of interdependence of these incentives (Weitzman & Kruse, 1990). Cooperation may foster the evolution of a group norm and thereby enhance firm performance (Kandel & Lazear, 1992; Lazear, 1992). In addition, cooperation may facilitate information flow in the firm and increase flexibility in management, thereby improving firm performance (Ben-Ner, Kong, & Han, 2002; Strauss, 1990).

The theoretical arguments against the performance effects of profit sharing and employee stock ownership are based on economic theory of problems assciated with group incentives. First, it is claimed that group incentives such as profit sharing and employee stock ownership may induce free-rider problems among employees in

4 Based on his personal experiences, Morris Chan, CEO of Taiwan Semiconductor Manufacturing Co. (TSMC), said that high rewards lead to innovation. TSMC is one of Taiwan’s high-tech firms that implemented profit sharing and Taiwan-style ESOPs as well as shared a large portion of profits with her employees on a broad basis in previous years. Such sharing can explain her economic success during the past fifteen years.

5 Hsin-chen Tsao, CEO of the second large semiconductor manufacturer in Taiwan (i.e., UMC), agreed that profit sharing and Taiwan-style ESOPs in his company improved labor relations and enhanced employees’ loyalty and organizational commitment. Profit sharing and Taiwan-style ESOPs are rewards for ‘intrapreneurship’, while fixed pay is the payment for being ‘hired employees’ (Tsao, 1999).

which the individual employee may have incentive to shirk when the group incentives are shared equally and the connection between individual efforts and reward is weak (Blasi, Conte, & Kruse, 1996). If the free-rider problems prevail, the performance of the firm under group incentives may deteriorate because participants in such ‘Prisoner’s Dilemma’ game will lead to sub-optimal equilibrium (Kruse, 1993). The second argument against the performance of group incentives draws on the theory of team production (Alchian & Demsetz, 1972; Jensen & Meckling, 1979). This theory posits that optimal monitoring requires that management of the firm be the ‘residual claimant’ to the equity of the firm. If profits are shared with employees under group incentives, management’s motivation to supervise employees will be diluted, thereby reducing firm performance.

When discussing the performance effects of profit sharing and employee stock ownership, researchers should look carefully at the reality of the workplace in a particular context. In Taiwan’s high-tech firms, evidence indeed shows that the arguments in favor of the performance effects of profit sharing and employee stock ownership are more applicable to explain the positive effects of such sharing schemes. Based on my personal contact and interviews with top management of many high-tech firms in Taiwan, most of them agreed that profit sharing and employee stock ownership led to favorable human resource outcomes (e.g., attraction, retention, motivation and accumulation of firm-specific human capital) and positive organizational behaviors (e.g., loyalty, organizational commitment). And these positive outcomes did help enhance performance in the firm. This manifests itself in the rapid growth of Taiwan’s high-tech industries in the past two decades. A large sharing of stock in some firms creates a high degree of the sense of psychological ownership and its behavioral consequences, which are usually pro-social and productive. This phenomenon is particularly evident in some Taiwan’s high-tech firms that share a large portion of profits with their employees. For instance, Lien-Fa Technology Co., a successful IC designer in Taiwan, distributed stock in the value of approximately US$ 514,285 on average to each employee in 2001 and US$ 739,705 in 2002, respectively. In reality, the shares of stock bonuses in most firms are not equally distributed while depending on performance, seniority, position level and others. In other words, top performers and management can receive much more stock bonuses. And such design has a great potential in reducing ‘free-rider’ problems frequently occurring in group incentives and increase management’s incentive to supervise. Till now, this record has reached the historical peak in sharing of profits and stock bonuses with employees in Taiwan. Although less than the amount Lien-Fa shared with its employees, Taiwan-style profit sharing and ESOPs indeed seem to lead to motivational effects in attraction, retention and performance.

3.2 Employment Effects

Prior research on the employment effects of profit sharing and employee stock ownership focuses largely on the level or change in employment. It has been argued that these group incentives with the nature of flexibility have stabilizing effects on employment variability. Theoretical underpinning of this argument is primarily based on Weitzman’s work (1983, 1984, 1985, 1986). According to Weitzman’s theory, the fixed portion of the total compensation represents the marginal cost of labor, while the variable pay is the flexible part which is not considered as part of

The Economic Effects of Profit Sharing and Taiwan-style Employee Stock Ownership Plans: Evidence from Taiwan's High-tech Firms/ Tzu-Shian Han

10

the marginal cost. Standard economic theory states that a firm’s employment decisions are based on the equilibrium between the marginal revenue of labor and its marginal cost. Firms with profit sharing and employee stock ownership may have lower marginal costs of labor than that of firms with fixed-wage systems. Thus, firms with such flexible payment systems will have incentive to retain workers when business shocks occur and to hire unemployed workers who may appear in the labor market (Kruse, 1993). As a consequence, profit sharing and employee stock ownership may have less variability on the employment level when negative demand shocks occur.

Although the flexible payment system may have a stabilizing effect on employment as predicted by Weitzman’s theory, its actual employment effects may also be contingent on the effects of other factors, such as economic conditions, labor productivity and real wage changes (Biagioli & Curatolo, 1999). During economic downturn, the flexible payment system may provide downward flexibility so that it can retain workers than the fixed wage system. Prior studies examining the employment effects of the flexible payment system focus largely on this scenario, namely negative demand shocks. Relatively few studies have investigated the employment effects of profit sharing and employee stock ownership when firms are at a rapid growth stage due to increased demand for their products and/or services. During such economic upswing, one possible scenario concerning the employment effect is that the flexible payment system may give firms a wider leeway for hiring more workers than the fixed wage system, thereby increasing the employment level and growth. The other scenario is that profit sharing and Taiwan-style ESOPs may help them establish firm-specific core competencies and then long-term competitive advantages that are prerequisites for their future growth and success in the competitive markets and hence increase the employment level. It seems that the latter tallies more with the reality of the developments of Taiwan’s high-tech industries in the past fifteen years.

During the period under investigation (1989-1998), Taiwan’s high-tech industries were at the stage of rapid growth in terms of their shares in the manufacturing sector. Many high-tech firms were initially small-sized startups and eventually emerged as large firms. Among them, many firms have expanded their businesses internationally and substantially increased the size of workforce. Profit sharing and Taiwan-style ESOPs are regarded as one of critical success factors for these high-tech firms (Chen & Wong, 2001).

3.3 Wage Effects

In contrast to the research on the performance and employment effects of profit sharing and employee stock ownership, less work has been done on their wage effects, that is worthy of an in-depth investigation. In many cases, profit sharing and employee stock ownership serve as a substitution for a fixed part of the total compensation (Biagioli & Curatolo, 1999). This feature gives firms with such group incentives some flexibility in adjusting their labor costs according to demand variations. Nevertheless, firms adopting these flexible payment systems also have

other aggressive objectives to achieve, in particular that of profitability.6 If profit sharing and employee stock ownership can have large incentive effects on performance, they must possess efficiency-wage characteristics that can attract better job applicants, retain and motivate them to not only work harder but also work smarter (Akerlof & Yellen, 1986; Ben-Ner, Kong, & Han, 2002; Yellen, 1984; Kruse, 1993).

Profit sharing and Taiwan-style ESOPs have gained popularity in Taiwan’s high-tech industries since the mid-1980s (Chin, Han, & Smith., forthcoming). Reasons for the prevalence of these group incentives in Taiwan’s high-tech industries are as below. First, tech firms are having great demands for high-caliber human resources, in particular engineers in various areas (e.g., research and development, quality etc.), that are scarce in the labor markets and critical for the success of the firm. In order to attract such talented personnel, many high-tech firms in Taiwan have adopted profit sharing and Taiwan-style ESOPs as a lure.7 Second, except the attraction function, firms also use profit sharing and Taiwan-style ESOPs as the retention and development mechanisms for firm-specific human capital to enhance the firm’s competence and performance. Lastly, job searchers with unique human capital view sharing of profits and ownership as one of the most important reasons for joining the firm. Given the large share of profits and stock values in total compensation in many companies and positions inside the firm, profit sharing and Taiwan-style ESOPs have indeed increased the annual earnings of their employees, as well as produced a group of wealthy “high-tech” people in Taiwan’s society.

Ⅳ. METHODOLOGY

4.1 Data

The data set used in the study comprises 11 years (1989-1999) of rich firm-specific accounting, profit sharing, employee stock bonus plans and payroll information on 115 firms in the information technology (IT) industry, whose stock is publicly traded in Taiwan’s stock markets. These data were collected by Taiwan Economic Journal (TEJ), a private agency conducting financial data collection of all publicly-traded companies in Taiwan. This data set is equivalent to that of COMPUSTAT data set in the United States. By focusing on single industry, we are able to control for heterogeneity problems that may trouble many prior studies. Further, our panel data allow us to control for fixed effects and the endogeneity problem that might lead to estimating biases when examining the economic effects of profit sharing and Taiwan-style ESOPs. To attenuate such biases, we include firm-specific fixed effects as well as time dummies by using least square dummy variables (LSDV) method and lagged variables of endogenous variables (i.e., fixed

6 In Taiwan’s high-tech industries, firms implementing profit sharing and Taiwan-style ESOPs distribute bonuses depending primarily on the level of the firm’s profitability in the previous year. As a consequence, the pay-out due to this sharing varies across time in each firm.

7 Concerning the effects of profit sharing and Taiwan-style ESOPs on recruitment in Taiwan’s high-tech firms, take TSMC as one example. At TSMC, it is not uncommon that operators performing operational tasks hold high academic degrees that can be done by high-school graduates.

The Economic Effects of Profit Sharing and Taiwan-style Employee Stock Ownership Plans: Evidence from Taiwan's High-tech Firms/ Tzu-Shian Han

12

capital, number of employees, profit sharing and employee stock bonus plans) as explanatory variables (Greene, 1993).

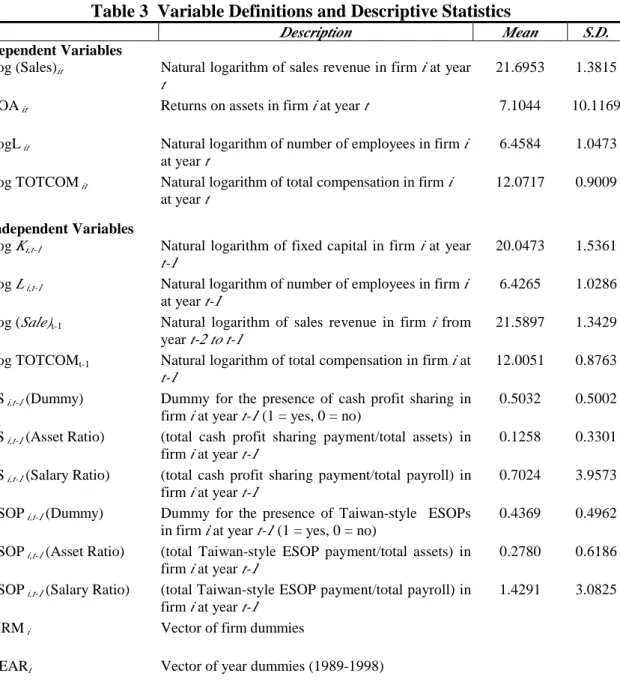

Table 3 illustrates the definitions of variables used in the study and the corresponding mean values and standard deviations associated with these variables.

Table 3 Var iable Definitions and Descr iptive Statistics

Description Mean S.D.

Dependent Var iables

Log (Sales)it Natural logarithm of sales revenue in firm i at year

t

21.6953 1.3815 ROA it Returns on assets in firm i at year t 7.1044 10.1169 LogL it Natural logarithm of number of employees in firm i

at year t

6.4584 1.0473 Log TOTCOM it Natural logarithm of total compensation in firm i

at year t

12.0717 0.9009

Independent Var iables

Log Ki,t-1 Natural logarithm of fixed capital in firm i at year

t-1

20.0473 1.5361 Log L i,t-1 Natural logarithm of number of employees in firm i

at year t-1

6.4265 1.0286 Log (Sale)t-1 Natural logarithm of sales revenue in firm i from

year t-2 to t-1

21.5897 1.3429 Log TOTCOMt-1 Natural logarithm of total compensation in firm i at

t-1

12.0051 0.8763 PS i,t-1(Dummy) Dummy for the presence of cash profit sharing in

firm i at year t-1 (1 = yes, 0 = no)

0.5032 0.5002 PS i,t-1(Asset Ratio) (total cash profit sharing payment/total assets) in

firm i at year t-1

0.1258 0.3301 PS i,t-1(Salary Ratio) (total cash profit sharing payment/total payroll) in

firm i at year t-1

0.7024 3.9573 ESOP i,t-1(Dummy) Dummy for the presence of Taiwan-style ESOPs

in firm i at year t-1 (1 = yes, 0 = no)

0.4369 0.4962 ESOP i,t-1(Asset Ratio) (total Taiwan-style ESOP payment/total assets) in

firm i at year t-1

0.2780 0.6186 ESOP i,t-1(Salary Ratio) (total Taiwan-style ESOP payment/total payroll) in

firm i at year t-1

1.4291 3.0825 FIRM i Vector of firm dummies

4.2 Econometr ic Specifications

Per for mance Effects: Pr oductivity and Pr ofitability8

Most of previous studies on the performance effects of profit sharing and Taiwan-style ESOPs employ the Cobb-Douglas production function as the major estimating technique.9 In this paper, I follow this traditional approach used by prior researchers in studying the performance effects of employee financial participation (Fakhhakh & Perotin, 2000). In order to control for firm-specific fixed effects (e.g., corporate culture, good leadership, organizational climate, management style, quality or workforce etc.) that are not measurable but have significant impact on firm performance, I adopt least square dummy variable (LSDV) method to include 114 firm dummies for this purpose. Also, firm performance may differ across time due to external time effects, such as economic turbulence, reorganization, changes in management, and so forth (Greene, 1993). To control for such time effects, ten year dummies were included in the estimating equations (Fakhfakh & Perotin, 2000; Kruse, 1993). Another crucial methodological problem that oftentimes troubles studies using cross-section data is the endogeneity of included variables on the right hand side of the estimating equations, thereby leading to biases in estimating the effects of these employee financial participation schemes. Given that the data used here are panel in nature, the above-mentioned concerns and problems can be taken into consideration and resolved. This paper follows prior studies using one-period lags of endogenous variables in the production function to attenuate the simultaneity biases, including fixed capital, number of employees and various measures of employee financial participation (Ben-Ner, Kong, & Han, 2002; Jones & Kato, 1995).10

8From empirical evidence, profit sharing and Taiwan-style ESOPs do lead to high firm performance and industrial growth in the IT sector, in particular ESOPs based on my personal interviews of many managers in high-tech industries. Recently, the debates on the effectiveness of Taiwan-style profit sharing and ESOPs have been heightened. Morris Chang, the chairman of TSMC, criticized that this incentive scheme would have adverse impact on human capital accumulation in the long run because they strongly reduced the willingness of young graduates in science and technology from universities to study abroad. However, it is doubtful that the reduction of willingness to study abroad is due to Taiwan-style profit sharing and ESOPs. But Mr. Chang still recognized that Taiwan-style profit sharing and ESOPs were really strongly attractive to the talented people, even from abroad. And many famous CEOs and argued that the success of Taiwan’s high-tech developments is, to a great extent, due to Taiwan-style profit sharing and ESOPs for their strong motivational effects.

9 For a comprehensive literature review of econometric studies on the productivity effects of employee financial participation, see Ben-Ner, Han, & Jones (1996) and Kruse (1993). 10Given the nature and reality that Taiwan-style ESOPs tend to be short-term and based on

the profitability of the year prior to the stock is allocated, it is plausible that Taiwan-style ESOPs are more likely to generate short-term performance effects rather than long-term results. Thus, we use one year lagged variables to examine the economic effects of employee financial participation to verify the above-mentioned arguments. Following your suggestions, we performed lagged variables at t-2 to examine the effects of profit sharing and ESOPs. The results showed that the coefficients are positive but insignificant, implying that profit sharing and Taiwan-style ESOPs tend to have short-term effects. In conclusion, our results showed that profit sharing and ESOPs led to firm performance in the next year. The authors also conducted several interviews of managers in some

high-The Economic Effects of Profit Sharing and Taiwan-style Employee Stock Ownership Plans: Evidence from Taiwan's High-tech Firms/ Tzu-Shian Han

14

In prior econometric studies of the productivity effects of profit sharing and employee ownership, two measures were often used for measuring productivity, including sales (or sales per employee) and value added (or value added per employee) (Ben-Ner, Han and Jones, 1996). Due to the data set limitation, sales volume is readily available for this study. And our analyses primarily refer to productivity measured in the logarithm of sales volume (Bradley, Estrin and Taylor, 1992; Kumbhakar and Dunbar, 1993; Wadhwani and Wall, 1990). The definitions of the major variables in this study appear in Table 3.

A standard Cobb-Douglas production function with the augmented element of profit sharing and Taiwan-style ESOPs can be specified as below,

Log(Sales)it = α0 + α1LogKi,t-1 + α2LogLi,t-1 + α3PSi,t-1 + α4ESOPi,t-1 + δ1FIRMi +

δ2YEARt + εit (1)

ROAit = α0 + α1LogKi,t-1 + α2LogLi,t-1 + α3PSi,t-1 + α4ESOPsi,t-1 + δ1FIRMi +

δ2YEARt + εit (2)

Where,

α1 and α2 = coefficients of the production function shift associated with LogKi,t-1

and LogLi,t-1,

α3and α4 = coefficients for profit sharing and ESOPs at firm i in year t-1,

δi= a vector of coefficients for FIRM and YEAR,

εit = error term. Employment Effects

To examine the employment effects of profit sharing and Taiwan-style ESOPs, this study primarily focuses on employment level. Equation (3) specifies the relations between employment level and its determinants as below,

LogLit = ϕ0+ ϕ1 Log(Sale)i,t-1 + ϕ2LogTOTCOMi,t-1 + ϕ3PSi,t-1 + ϕ4ESOPi,t-1 +

τ1FIRMi + τ2YEARt + υit (3)

where,

ϕi = coefficients for independent variables in the equation,

τi = a vector of coefficients for FIRM and YEAR,

υit = error term. Wage Effects

According to the theoretical discussions, this study develops the empirical log-linear specification for the wage determination equation in the following equation, LogTOTCOMit =κ0+κ1LogLi,t-1 +κ2PSi,t-1+κ3ESOPi,t-1 + γ1FIRMi + γ2YEARt +

ξit (4)

tech firms to seek their opinions on the validity of these results. Most of them thought our results reflected their experiences.

Where,

κi = coefficients of independent variables,

γi = a vector of coefficients for FIRM and YEAR,

ξit = error term.

Given the nature of time-series data, first-order autocorrelation may be a concern using ordinary least square (OLS) estimation since it may violate the assumption of no correlation among the disturbance terms in the classical linear regression model. In order to solve this problem, we employed generalized least squares (GLS) estimation method suggested by prior research (e.g., Fakhfakh & Perotin, 2000). GLS estimation is possible to produce a linear unbiased estimator with a smaller variance-covariance matrix. In other word, the GLS estimators are more efficient (Kennedy, 1993).

Ⅴ. RESULTS

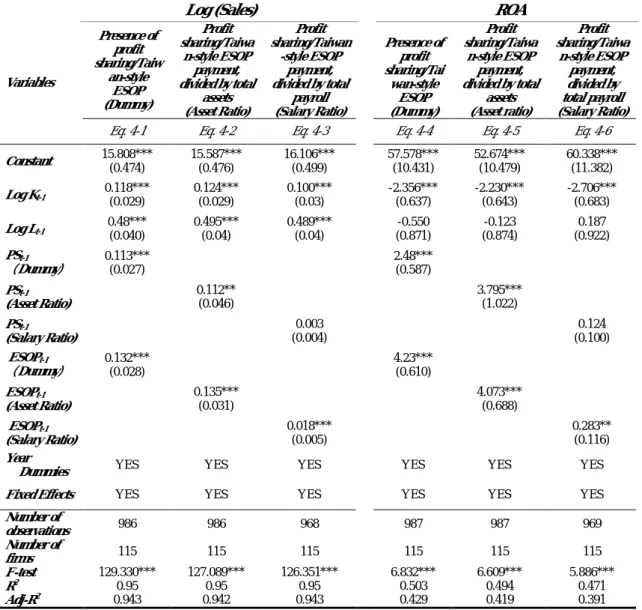

5.1 Per for mance Effects: Pr oductivity and Pr ofitability

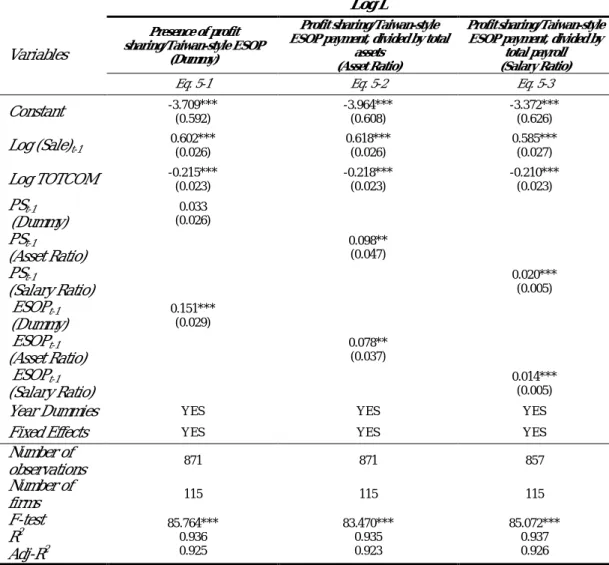

Concerning the performance effects of profit sharing and Taiwan-style ESOPs, this paper focuses on two popular performance measures in business research, namely productivity and profitability. Table 4 presents the estimates of the effects of profit sharing and Taiwan-style ESOPs on productivity measured by natural logarithm of sales revenues and profitability measured by returns on assets (ROA). The variables for profit sharing and Taiwan-style ESOPs consist of three different measures, accounting for the presence and degree of employee financial participation in firm’s profitability. And the presence and degree of this sharing may imply the enhancing effects on motivation and firm performance.

Except the variable for the total pay-out for cash profit sharing as percentage of total payroll, the majority of explanatory variables in this table are found to be positively associated with the measure of productivity at the 5 percent significance level. Eq. 4-1 and Eq. 4-2 illustrate that the presence of cash profit sharing and Taiwan-style ESOPs and their shares as percentages of total assets may raise productivity by 11-13 percent. And these results seem to be consistent with prior research in this subject (e.g., Fakhfakh & Perotin, 2000). Besides the effects of the existence of employee financial participation, this article includes another variable to catch the productivity effects of the degrees of profit sharing and Taiwan-style ESOPs. Eq. 4-3 shows that only Taiwan-style ESOPs payment as the percentage of total payroll raises productivity by 1.8 percent.

Eq. 4-4 to Eq. 4-6 present the empirical results for the effects of profit sharing

and Taiwan-style ESOPs on profitability measured by returns on asset. Consistency with the results in Eq. 4-1 to Eq. 4-3, except the variable of PSt-1 (Salary Ratio), all

other variables of employee financial participation are statistically positively associated with the profitability measures at the 5 percent significance level. These results may reflect the phenomenon in that profitability is usually in tandem with productivity.

In sum, these results seem to provide strong evidence for the performance effects of cash profit sharing and Taiwan-style ESOPs in Taiwan’s high-tech firms. From some anecdotal evidence regarding the practices of profit sharing and Taiwan-style ESOPs in Taiwan’s high-tech firms, more and more companies have offered very luring incentives in cash profit sharing and/or free stock bonuses to their

The Economic Effects of Profit Sharing and Taiwan-style Employee Stock Ownership Plans: Evidence from Taiwan's High-tech Firms/ Tzu-Shian Han

16

employees, in particular managerial and R&D professionals. And these financial incentive schemes provide these firms with competitive advantages in attracting highly qualified job applicants, retaining better employees and even motivate them to put forth more efforts and wisdom that may convert to firm performance.

5.2 Employment Effects

Table 5 presents the empirical results of the effects of profit sharing and Taiwan-style ESOPs on employment level. From Eq. 5-1 to Eq. 5-3, except PSt-1

(Dummy), all other explanatory variables of the previous year are found to be statistically positively associated with the number of employees of the current year at least at the 5 percent significance level.

Table 4 GLS Estimates of Per for mance Effects of Pr ofit Shar ing and Taiwan-style ESOPs (Panel Data, 1989-1999)

Log (Sales) ROA

Presence of profit sharing/Taiw an-style ESOP (Dummy) Profit sharing/Taiwa n-style ESOP payment, divided by total assets (Asset Ratio) Profit sharing/Taiwan -style ESOP payment, divided by total payroll (Salary Ratio) Presence of profit sharing/Tai wan-style ESOP (Dummy) Profit sharing/Taiwa n-style ESOP payment, divided by total assets (Asset ratio) Profit sharing/Taiwa n-style ESOP payment, divided by total payroll (Salary Ratio) Variables

Eq. 4-1 Eq. 4-2 Eq. 4-3 Eq. 4-4 Eq. 4-5 Eq. 4-6

Constant 15.808*** (0.474) 15.587*** (0.476) 16.106*** (0.499) 57.578*** (10.431) 52.674*** (10.479) 60.338*** (11.382) Log Kt-1 0.118*** (0.029) 0.124*** (0.029) 0.100*** (0.03) -2.356*** (0.637) -2.230*** (0.643) -2.706*** (0.683) Log Lt-1 0.48*** (0.040) 0.495*** (0.04) 0.489*** (0.04) -0.550 (0.871) -0.123 (0.874) 0.187 (0.922) PSt-1 (Dummy) 0.113***(0.027) 2.48*** (0.587) PSt-1 (Asset Ratio) 0.112** (0.046) 3.795*** (1.022) PSt-1 (Salary Ratio) 0.003 (0.004) 0.124 (0.100) ESOPt-1 (Dummy) 0.132*** (0.028) 4.23*** (0.610) ESOPt-1 (Asset Ratio) 0.135*** (0.031) 4.073*** (0.688) ESOPt-1 (Salary Ratio) 0.018*** (0.005) 0.283** (0.116) Year

Dummies YES YES YES YES YES YES

F ixed Effects YES YES YES YES YES YES

Number of observations 986 986 968 987 987 969 Number of firms 115 115 115 115 115 115 F -test R2 Adj-R2 129.330*** 0.95 0.943 127.089*** 0.95 0.942 126.351*** 0.95 0.943 6.832*** 0.503 0.429 6.609*** 0.494 0.419 5.886*** 0.471 0.391

Notes: * for p ≤ 0.10, ** for p ≤ 0.05, and *** for p ≤ 0.01. Standard errors are reported in parentheses.

From the results of Table 5, we may interpret that firms with cash profit sharing and Taiwan-style ESOPs tend to have higher employment level due to their performance effects which increase the demand for labor in the short run. In Taiwan, most of high-tech firms are newly established startups since the mid-1980s. During the period under study, most of them had a higher degree of growth in terms of sales revenues and the size of firm. Under such circumstances with high growth and potential, variable pay systems such as cash profit sharing and Taiwan-style ESOPs may be the proper financial incentives consistent with the high growth strategy. In order words, by using cash profit sharing and Taiwan-style ESOPs, firms not only boost performance but also increase employment levels subsequently. They also lead to high motivational effects on job incumbents to work harder and more efficiently.

Table 5 GLS Estimates of Employment Effects of Pr ofit Shar ing and Taiwan-style ESOPs(Panel Data, 1989-1999)

Log L

Presence of profit sharing/Taiwan-style ESOP

(Dummy)

Profit sharing/Taiwan-style ESOP payment, divided by total

assets (Asset Ratio)

Profit sharing/Taiwan-style ESOP payment, divided by

total payroll (Salary Ratio)

Variables

Eq. 5-1 Eq. 5-2 Eq. 5-3

Constant -3.709***(0.592) -3.964***(0.608) -3.372***(0.626) Log (Sale)t-1 0.602*** (0.026) 0.618*** (0.026) 0.585*** (0.027) Log TOTCOM -0.215***(0.023) -0.218***(0.023) -0.210***(0.023) PSt-1 (Dummy) 0.033 (0.026) PSt-1 (Asset Ratio) 0.098** (0.047) PSt-1 (Salary Ratio) 0.020*** (0.005) ESOPt-1 (Dummy) 0.151*** (0.029) ESOPt-1 (Asset Ratio) 0.078** (0.037) ESOPt-1 (Salary Ratio) 0.014*** (0.005)

Year Dummies YES YES YES

Fixed Effects YES YES YES

Number of observations 871 871 857 Number of firms 115 115 115 F-test R2 Adj-R2 85.764*** 0.936 0.925 83.470*** 0.935 0.923 85.072*** 0.937 0.926

Notes: * for p ≤ 0.10, ** for p ≤ 0.05, and *** for p ≤ 0.01. Standard errors are reported in parentheses.

The Economic Effects of Profit Sharing and Taiwan-style Employee Stock Ownership Plans: Evidence from Taiwan's High-tech Firms/ Tzu-Shian Han

18

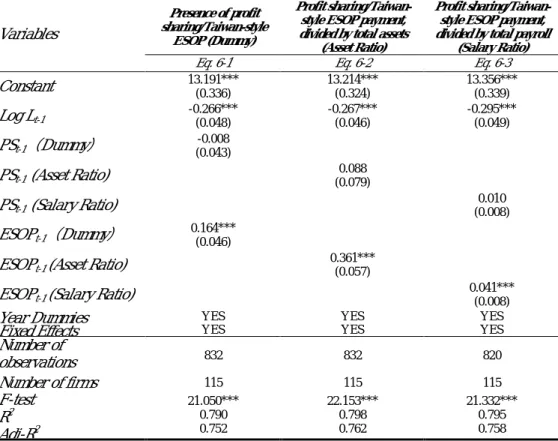

5.3 Wage Effects

Regarding the wage effects of profit sharing and Taiwan-style ESOPs in Taiwan’s high-tech firms, Table 6 illustrates that all measures of Taiwan-style ESOPs are statistically positively related to the natural logarithm of total compensation at the one percent significance level. However, no profit sharing measures are highly associated with the total compensation variable. In other words, employees in firms with Taiwan-style ESOPs normally receive higher total compensation than their counterparts in non-Taiwan-style ESOP firms. Our results seem to be consistent with the reality in Taiwan’s high-tech industries. Since Taiwan-style ESOPs were invented by UMC in the mid-1980s, many high-tech firms have emulated the practices employed by UMC and even offered better incentives to their employees. The primary objectives of Taiwan-style ESOPs are to attract better applicants and to retain them longer for their talents. Many job seekers with qualified credentials and competencies view Taiwan-style ESOPs as the major inducements for them to join and remain with the firm because such financial incentives will offer them quite huge financial returns. Taiwan-style ESOPs also create brain drain problems for non-ESOP firms in Taiwan, including many Western multinationals, which were previously viewed by Taiwanese workers as the desirable places to work for their lead policies in compensation. Now, the situations could be reverse.

Table 6 GLS Estimates of Wage Effects of Pr ofit Shar ing and Taiwan-style ESOPs: Log TOTCOM(Panel Data, 1989-1999)

Presence of profit sharing/Taiwan-style

ESOP (Dummy)

Profit sharing/Taiwan-style ESOP payment, divided by total assets

(Asset Ratio)

Profit sharing/Taiwan-style ESOP payment, divided by total payroll

(Salary Ratio)

Variables

Eq. 6-1 Eq. 6-2 Eq. 6-3

Constant 13.191***(0.336) 13.214***(0.324) 13.356***(0.339) Log Lt-1 -0.266*** (0.048) -0.267*** (0.046) -0.295*** (0.049) PSt-1(Dummy) (0.043)-0.008 PSt-1 (Asset Ratio) (0.079)0.088 PSt-1 (Salary Ratio) (0.008)0.010 ESOPt-1(Dummy) 0.164*** (0.046)

ESOPt-1 (Asset Ratio)

0.361*** (0.057)

ESOPt-1 (Salary Ratio) 0.041***(0.008)

Year Dummies YES YES YES

Fixed Effects YES YES YES

Number of observations 832 832 820 Number of firms 115 115 115 F-test R2 Adj-R2 21.050*** 0.790 0.752 22.153*** 0.798 0.762 21.332*** 0.795 0.758

Notes: * for p ≤ 0.10, ** for p ≤ 0.05, and *** for p ≤ 0.01. Standard errors are reported in parentheses.

Ⅵ. SUMMARY AND CONCLUSIONS

Profit sharing and employee ownership have become a worldwide phenomenon. Since the early 1980s, Taiwan’s high-tech industries have gained substantial growth, in particular in the information technology (IT) industry. It is often claimed that one of the major reasons for this success is due to the unique employee financial participation scheme adopted by many Taiwanese high-tech firms during the period of high growth. Taiwan-style profit sharing and ESOPs can be viewed as a combination plan of profit sharing and employee ownership because companies adopting these plans, in general, share profits with employees in stock form. This article has investigated the effects of Taiwan-style profit sharing and ESOPs on productivity, profitability, employment and wage. Drawing on data from Taiwan Economic Journal (TEJ), which provides rich information on company profile, financial data, employment, wages, as well as profit sharing and employee stock bonuses statistics of all Taiwan’s publicly-traded companies across time, this paper uses a sub-sample of the data set, consisting of 115 high-tech firms. The data set is a panel data set in design, which helps us control for the endogeneity problem and firm-specific fixed effects.

Our research results show that Taiwan-style profit sharing and ESOPs, to a greater extent, lead to higher firm performance in terms of productivity and profitability. Furthermore, the results tend to suggest that Taiwan-style profit sharing and ESOPs increase employment level and growth on the one hand, and have the stabilizing effects on employment on the other hand, depending on various measures of employee financial participation. Concerning the wage effects, the empirical results illustrate that only Taiwan-style ESOPs lead to high total compensation. Our results seem to reflect the reality in Taiwan’s high-tech sector in the last decade. Under circumstances characterized with high growth in the 1990s, profit sharing in general and Taiwan-style ESOPs in particular are often used as the important strategic compensation for attracting and retaining talented employees in the firm, which in turns convert to firm performance and higher employment level and total compensation.

It should be noted that our analyses of productivity primarily refer to measures of sales volume. Future research should collect more information on different productivity measures in order to make the investigation more plausible, consisting of total factor productivity, Tobin’s Q, labor hours, quality measures etc. Also, future research should do more work on investigating the diversity of employee financial participation programs in Taiwan.

REFERENCES

Akerlof, G., and J. Yellen, 1986. Efficiency Wage Models of The Labor Market.

New York: Cambridge University Press.

Alchian, A., and H. Demsetz,1972. Production, Information Costs, and Economic Organization. American Economic Review, 62: 777-95

Ben-Ner, A., and D. C. Jones, 1995. Employee Participation, Ownership and Productivity: A Theoretical Framework. Industrial Relations, 34: 532-554. Ben-Ner, A., Burns, W. A., Dow, G., and L. Putterman, 2000. Employee

The Economic Effects of Profit Sharing and Taiwan-style Employee Stock Ownership Plans: Evidence from Taiwan's High-tech Firms/ Tzu-Shian Han

20

Kochan (Eds.), The new relationship: Human capital in the American corporation: 194-240. Brookings Institution Press.

Ben-Ner, A., T. Han, and Jones, D., 1996. The Productivity Effects of Employee Participation in Control and in Economic Returns: A Survey of Econometric Studies. In U. Pagano and R. Rowthorn (Eds.), Democracy and efficiency in economic enterprise: 209-244. London, U.K.:Routledge.

Ben-Ner, A., F. Kong, and T. Han, 2002. Do ESOPs Matter? Productivity, Profitability, Employment, Wages, and Workplace Safety. paper presented at the AEA Annual Meeting, Atlanta, U.S.A., January.

Ben-Ner, A., T. Han, and D. Jones, 1996. The Productivity Effects of Employee Participation in Control and in Economic Returns: A Review of Econometric Studies. In U. Pagano & R. E. Rowthorn (Eds.), Democracy and Efficiency in Economic Enterprises: 209-244. London: Routledge.

Biagioli, M., and A. Curatolo, 1999. Microeconomic Determinants and Effects of Financial Participation Agreements: An Empirical Analysis of the Large Firms of the Engineering Sector in the Eighties and Early Nineties. Economic

Analysis: Journal of Enterprise and Participation, 2(2): 99-130.

Blasi, J., M. Conte, and D. Kruse, 1996. Employee Stock Bonus and Corporate Performance among Public Companies. Industrial and Labor Relations Review,

50(1): 60-79.

Bradley, K., S. Estrin, and S. Taylor, 1992. Employee Ownership and Company Performance. Industrial Relations, 29(3): 385-402.

Chen, A., and H. Wong, 2001. A study of Taiwan-style Profit Sharing and ESOPs. In J. Lee (Ed.), Human Resource Management in Taiwan’s High-tech

Industries, Taipei, Taiwan: Tien-Hsia Publishing Co. (in Chinese).

Cin, B. C., T. S. Han, and S. C. Smith, forthcoming. A Tale of Two Tigers: Employee Financial Participation in Korea and Taiwan. International Journal of Human Resource Management.

Cotton, J. L., D. A. Vollrath, and K. L. Froggat,1988. Employee Participation: Diverse Forms and Different Outcomes. Academy of Management Review,

13(1): 8-22.

Fakhfakh, F., and V. Perotin, 2000. The Effects of Profit-sharing Schemes on Enterprise Performance in France.Economic Analysis, 3(2): 93-111.

Fong, D. L., 1998. Profit Sharing in Taiwan’s Electronic Companies. Fortune

Information, May: 242-249. (in Chinese).

Greene, W. H. 1993. Econometric Analysis (2d ed.). Edition, New York: Prentice Hall.

Jensen, M., and W. Meckling, 1979. Rights and Production Functions: An Application to Labor-Managed Firms and Codetermination. Journal of

Business, 52: 469-506.

Jones, D. C., and T. Kato, 1995. The Productivity Effects of Employee Stock-Ownership Plans and Bonuses: Evidence from Japanese Panel Data.American

Economic Review, 85: 391-414.

Kandel, E., and E. P. Lazear, 1992. Peer Pressure and Partnership. Journal of

Political Economy, 100: 801-817.

Kennedy, P. 1993. A Guide to Econometrics, 3rd edition. Cambridge, Mass.: The MIT Press.

Kruse, D. L. 1993. Profit Sharing: Does it Make a Difference? Kalamazoo, Michigan: W. E. Upjohn Institute for Employment Research.

Kumbhakar, S., and A. Dunbar, 1993. The Elusive ESOP-Productivity Link: Evidence from U.S. Firm-Level Data. Journal of Public Economics, 52: 273-283.

Lazear, E. 1992. Compensation, Productivity, and the New Economics of Personnel. In D. Lewin., O. S. Mitchell and P. D. Sherer (Eds.), Research frontiers in industrial relations and human resources: 341-380. Madison, WI: Industrial Relations Research Association.

Putterman, L. 1982. On Some Recent Explanations of Why Capital Hires Labor. Economic Inquiry, 22: 171-187.

Smith, S. C. 1988. On the Incidence of Profit and Equity Sharing: Theory and an Application to the High Tech Sector. Journal of Economic Behavior and

Organization, 9: 45-58.

Strauss, G. 1990. Participatory and Gain-Sharing Systems: History and Hope. In M. J. Roomkin (Ed.), Profit sharing and gain sharing: 1-45. IMLR Press.

Tien-Hsia Magazine. 1997. New Strategy for Corporations to Hunt for People: The Talented Fly with Stock,197: 122-133. (in Chinese).

Today Weekly. 1998. A Survey of Employee Stock Bonus in Taiwan’s Electronic companies, May 5: 20-37. (in Chinese).

Tsao, H. C. 1999. On the Competitiveness of Taiwan’s IC Industry, Taipei, Taiwan: The UMC Group. (in Chinese).

Wadhwani, S., and M. Wall, 1990. Effects of Profit Sharing on Employment, Wages, Stock Returns and Productivity: Evidence from Micro-data. Economic Journal, 100: 1-17.

Weitzman, M. 1983. Some Macroeconomic Implications of Alternative Compensation Systems.Economic Journal, 93: 763-783.

Weitzman, M. 1984. The Share Economy. Cambridge, MA: Harvard University Press.

Weitzman, M. 1985. The Simple Macroeconomics of Profit-Sharing. American

Economic Review, 75: 937-953.

Weitzman, M. 1986. Macroeconomic Implications of Profit-Sharing. NBER Macroeconomics Annual 1986, Cambridge, MA: MIT Press: 291-335.

Weitzman, M., and D. Kruse, 1990. Profit Sharing and Productivity. In A. Blinder (Ed.), Paying for Productivity: A Look at the Evidence, Washington, D.C.: Brookings Institution: 95-140.

Yellen, J. 1984. Efficiency Wage Models of Unemployment. American Economic

The Economic Effects of Profit Sharing and Taiwan-style Employee Stock Ownership Plans: Evidence from Taiwan's High-tech Firms/ Tzu-Shian Han

22