On: 26 April 2014, At: 00:06 Publisher: Taylor & Francis

Informa Ltd Registered in England and Wales Registered Number: 1072954 Registered office: Mortimer House, 37-41 Mortimer Street, London W1T 3JH, UK

Energy Sources, Part B: Economics,

Planning, and Policy

Publication details, including instructions for authors and subscription information:

http://www.tandfonline.com/loi/uesb20

The Value Migration and Innovative

Capacity of Taiwan's Photovoltaic

Industry

J.-L. Hu a & F.-Y. Yeh b a

Institute of Business and Management, National Chiao Tung University , Taipei , Taiwan

b

Science and Technology Policy Research and Information Center, National Applied Research Laboratories , Taipei , Taiwan

Published online: 10 Jan 2013.

To cite this article: J.-L. Hu & F.-Y. Yeh (2013) The Value Migration and Innovative Capacity of Taiwan's Photovoltaic Industry, Energy Sources, Part B: Economics, Planning, and Policy, 8:2, 190-199, DOI: 10.1080/15567240903394273

To link to this article: http://dx.doi.org/10.1080/15567240903394273

PLEASE SCROLL DOWN FOR ARTICLE

Taylor & Francis makes every effort to ensure the accuracy of all the information (the “Content”) contained in the publications on our platform. However, Taylor & Francis, our agents, and our licensors make no representations or warranties whatsoever as to the accuracy, completeness, or suitability for any purpose of the Content. Any opinions and views expressed in this publication are the opinions and views of the authors, and are not the views of or endorsed by Taylor & Francis. The accuracy of the Content should not be relied upon and should be independently verified with primary sources of information. Taylor and Francis shall not be liable for any losses, actions, claims, proceedings, demands, costs, expenses, damages, and other liabilities whatsoever or howsoever caused arising directly or indirectly in connection with, in relation to or arising out of the use of the Content.

This article may be used for research, teaching, and private study purposes. Any substantial or systematic reproduction, redistribution, reselling, loan, sub-licensing, systematic supply, or distribution in any form to anyone is expressly forbidden. Terms & Conditions of access and use can be found at http://www.tandfonline.com/page/terms-and-conditions

Energy Sources, Part B, 8:190–199, 2013 Copyright © Taylor & Francis Group, LLC ISSN: 1556-7249 print/1556-7257 online DOI: 10.1080/15567240903394273

The Value Migration and Innovative Capacity of

Taiwan’s Photovoltaic Industry

J.-L. Hu

1and F.-Y. Yeh

21Institute of Business and Management, National Chiao Tung University, Taipei, Taiwan 2Science and Technology Policy Research and Information Center, National Applied

Research Laboratories, Taipei, Taiwan

To alleviate global climate changes, solar energy has become an emerging industry in both developed and developing countries. This article utilizes value chain and value migration theory to analyze the trend of Taiwan’s photovoltaic (PV) industry. Allowing for an integrated innovation sheds new light on the strategy of PV industrial development. We find that a vertically integrated supply chain can promote higher scale efficiency and obtain global competitive advantages. We also perform a comparative study of the material and module model to examine innovation. In particular, we find that Taiwan’s innovative power comes from four sources: material innovation, technical innovation, application innovation, and financial innovation. Government authorities should establish cooperative mechanisms with China and encourage industry reinvestment to improve developments in the PV industry in the future.

Keywords: innovative model, photovoltaic (PV), R&D intensiry value migration

1. INTRODUCTION

Faced with climate changes and energy conservation, green energy has become an emerging industry around the world. The global production value of the renewable industry will reach US$163 billion in 2015, a growth of 30% compared to the end of 2008. The global photovoltaic (PV) world market grew in terms of production by more than 60% in 2007, where the most rapid expansion of production capacities can be observed currently in Taiwan (Jäger-Waldau, 2008). About 40% of global PV equipment comes from Asia where Taiwan is one of the main manufacturing bases.

Taiwan is an island nation with limited indigenous energy resources and energy imports were over 99.32% in 2009. To expedite domestic energy diversity as well as improve environment quality, a number of notable energy conferences have been held since 1998. In 2001, Taiwan’s authorities committed about a US$300 million budget toward R&D and the promotion of renewable energy conservation and drafted a report called The New and Clean Energies Utilization Potential in Taiwan (Energy Commission, 2001). Moreover, the Plan of Renewable Energy Development was implemented in 2002 for improving the capacity of renewable energy devices and expanding the demand of new energy industries. The conclusion of the Nuclear-free Homeland Conference

Address correspondence to Jin-Li Hu, Institute of Business and Management, National Chiao Tung University, 118, Chung-Hsiao West Rd., Sec. 1, Taipei City 100, Taiwan. E-mail: jinlihu@gmail.com

190

in June 2003 brought about a budget of US$90 million annually, commencing from 2004, for promoting the development of clean energy and improvements in energy conservation (Executive Yuan Council for Non-nuclear Homeland, 2003). In 2008 the production value of Taiwan’s energy industry was over US$4.5 billion and PV production values hit US$3 billion (Photonics Industry and Technology Development Association, 2007).

Compared to other countries, Taiwan ranks as the second-largest light emitting diode (LED) producing country and the fourth-largest solar cell producing country in the world. The energy planning of the 2009 National Energy Conference of Taiwan has developed new guidance for renewable energy. The renewable energy development target for Taiwan is 12% of total energy by 2020. It is estimated that the PV industry may generate a production value exceeding US$13.6 billion by 2015 (IEA, 2008).

In order to expand production scale and global market share, PV firms need to find their industrial competitive advantages and innovative capabilities. Taiwan’s past innovative pattern is learning-by-doing, which borrows much production knowledge from its previous semiconductor production. However, duplicating the experience of the electronics industry to renewable energy is not necessarily compatible. There has been a gap in solar technology between Taiwan and other competitive countries. It is important to observe the strategic position in Taiwan’s PV industry and to further address an innovation-focused policy.

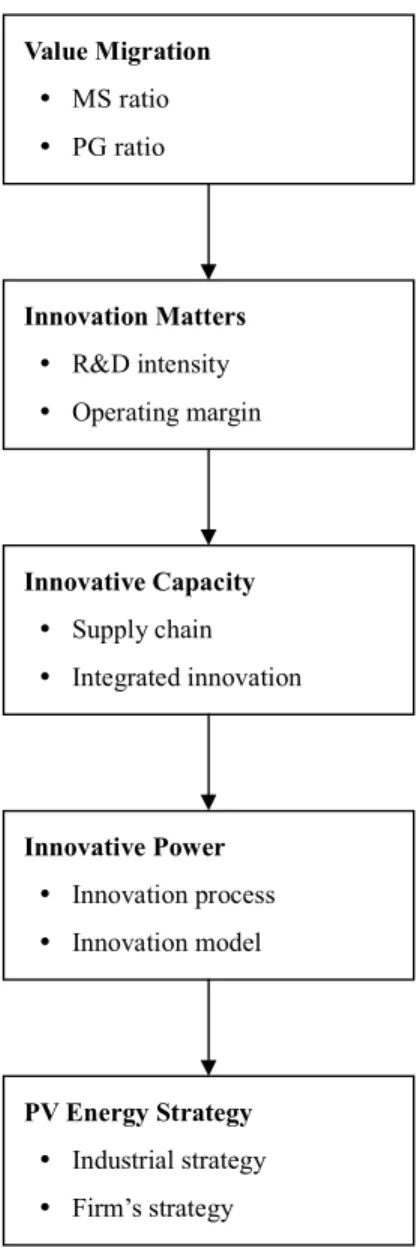

There are few existing studies on the quantitative analyses of PV industrial value migration and innovative capacity. Figure 1 depicts the research flowchart of this study. We first use the value migration theory to measure the shifting of value creation in Taiwan’s PV industry and the forces of industrial value flows. The values of Taiwan’s PV industry mainly come in the midstream, and hence we observe innovation matters of Taiwan’s PV industry from the midstream industry. We then perform a comparative analysis of the differences in research and development (R&D) intensity between material and module groups. We treat R&D expense as an index to evaluate how a company emphasizes innovation. In particular, we attempt to find the innovative capacity of Taiwan’s PV industry. We further propose a vertically integrated industrial supply chain and an integrated innovation. Finally, we induce the innovative power and competitive advantages in Taiwan’s PV industry. The innovative process is deconstructed in order to find the market power in the PV industry. Policy suggestions for promoting the PV industry are provided.

2. LITERATURE REVIEW

Solar energy is an environmentally convenient and economically competitive electric source for any part of the world (Shinnar and Citro, 2007). Strategic energy deployment is often limited to various economic or technological forces. The supply chain structure can change industrial competitive advantages and improve firms’ profitability. Slywotzky et al. (1999, p. 127) defines the value migration theory as “the process of customers shifting their purchases away from products or services generated by outmoded business models to new ones that create new kinds of value that had not previously existed in the industry.” This theory presents a perspective of the current industrial competitive advantage. It is also broadly applied to evaluate a firm’s competitiveness in the value chain. For example, Ng et al. (2005) use value migration to analyze strategic lessons in the information technology industry.

PV is a relatively emerging industry in terms of technology development and market penetration (Whitelegg, 1993). Many extensive studies look at the technologies and the policies of solar energy. Mokyr (1990) offers five innovative factors with reference to the solar PV market: geographical environment, norms and values, resistance to innovation, science and technology, and openness to information and institutions. Most solar energy technologies use the source of low energy density (i.e., solar panels).

192 J.-L. HU AND F.-Y. YEH

FIGURE 1 The research flowchart.

It is important to forecast the strategic position in the PV industry and to further address innovation-focused policies. A successful energy policy should focus on the systematic innova-tive process and the conceptualization of renewable energy (Tsoutsos and Stamboulis, 2005). Technology-based firms sustain competitive advantages through the effective management of their R&D activities (Bone and Saxon, 2000), and R&D intensity and efficiency are often used to measure firm performance. The R&D intensity is measured as R&D expenses divided by revenues, while R&D efficiency is measured by the firm’s operating margin. Both the ratio of R&D expenditures to sales and R&D expenditures are commonly used to represent a firm’s R&D intensity (Hu and Hsu, 2008). Galan and Sanchez (2006) find that R&D intensity has a positive effect on the degree of product diversification. Moreover, aside from enhancing R&D intensity,

increasing R&D efficiency can promote innovative capacity. Kaplan (1999) argues that solar energy can be diffused far more effectively through small wins, experimentation, and groping along.

In the past two decades, Taiwan has been an active participant in PV activities. Hwang and Hong (1984) find that the government lacks any long-term financial support for PV activities, though cost-effectiveness provides continuity and justification for PV developments in Taiwan. Hwang et al. (1998) also argue that Taiwan’s PV developments have taken a low profile with limited labor. Huang and Wu (2007) apply the technological system framework to analyze the evolution of PV in Taiwan. They make a comparative analysis on PV development between Germany and Taiwan. They show that the outcome of the formative phase in Taiwan is similar to that of Germany. In order to expand the market of PV in Taiwan, two issues are outlined. First, energy-pricing policies should be predictable, persistent, and powerful. Second, different prices for different renewable energy sources are needed, because Taiwan’s electricity price is too low.

How does Taiwan’s PV market need to be further expanded? More importantly, what is the next stage for Taiwan’s PV industry that should be explored in the future? Many firms are facing various threats from international PV firms’ vertically integrated model and the rapid development of the production scale of China’s PV industry. Under these circumstances, it is useful to have some insights after investigating the supply chain of the PV industry.

3. COVERING VALUE MIGRATION AND INNOVATIVE CAPACITY

3.1. Value Migration of Taiwan’s PV Industry

According to the concept of value migration, Taiwan’s PV industry is in the value inflow stage at present meaning that firms have a higher growth rate and higher profitability in this industry. The higher market acceptance is the midstream industry while the lower market acceptance is the downstream industry. Compared to the other two industries, the market to sales (MS) ratio in the midstream industry has a higher volatility due to the dependency and sensitivity of the business cycle. Since 2007, the MS ratio of the midstream industry is lower than the upstream and downstream industries due to the lower cost competition of China’s original equipment manufacturing (OEM) industry. Moreover, the global PV market has gradually changed from a seller’s market to a buyer’s market. This means a market condition characterized by low prices and a supply of commodities exceeding demand. As a result, Taiwan’s PV industry value has migrated to the upstream and downstream.

To reflect the pattern of the product life cycle, the profit growth rate (PG ratio) is also measured. As a result, midstream firms are in the mature period. Due to product standardization and more competitors entering, the PG ratio is decreasing for midstream firms. Moreover, there are greater fluctuations in the upstream and downstream firms’ PG ratio. Most PV firms depend on cutting costs by working on unifying product and equipment standardization to make solar energy competitive with other forms of energy. While solar prices are falling and international manufacturers at that time can control their profitability, there are greater fluctuations in the upstream and downstream.

3.2. Innovation Matters for Taiwan’s PV Industry

Based on the aforementioned empirical results, we realize that Taiwan’s PV industry is primarily the midstream. Subsequently, we only focus herein on innovation matters of the midstream. In the PV industry we use R&D expense as an index to evaluate how a company emphasizes innovation. The major midstream PV vendors are divided into two categories in terms of their profit capacity. There are the materials innovation group (MAI) and the modular innovation group (MOI). The

194 J.-L. HU AND F.-Y. YEH

MAI group covers all science parks from Hsinchu in the north to Southern Taiwan Science Park in the south. The MOI group has experienced and still continues to have the most rapid economic growth in Taiwan.

According to our analysis, two industrial strategies are provided. First, the mean operating margin in the MAI group is 15%–20%, which is much higher than 8%–10% of the MOI group during the sample’s years. It indicates that the materials vendors have higher profitability than the modular vendors. Since 2004, the MAI group still maintains positive profitability. This is due to the innovative pattern of the PV industry of learning by doing from successful strategies in the semiconductor industry and working on R&D in solar cell technology in order to cut costs and boost market share over a long period of time. Moreover, the MOI group’s scale is smaller than the MAI group. The small-scale firms and early developers can immediately and easily achieve positive profitability.

Second, both groups have been decreasing their R&D expenses from 2000 to 2009. Even experts suggest that companies should put up more R&D resources to raise the quality of products (Galan and Sanchez, 2006). However, there is no evidence to prove a positive relationship exists between R&D expenses and R&D intensity in Taiwan. It also indicates that the R&D expenses of the MAI group are significantly lower than the MOI group, but the R&D intensity of the MAI group is significantly higher than the MOI group.

3.3. Achieving Innovative Capacity Through an Integrated Supply Chain and Integrated Innovation

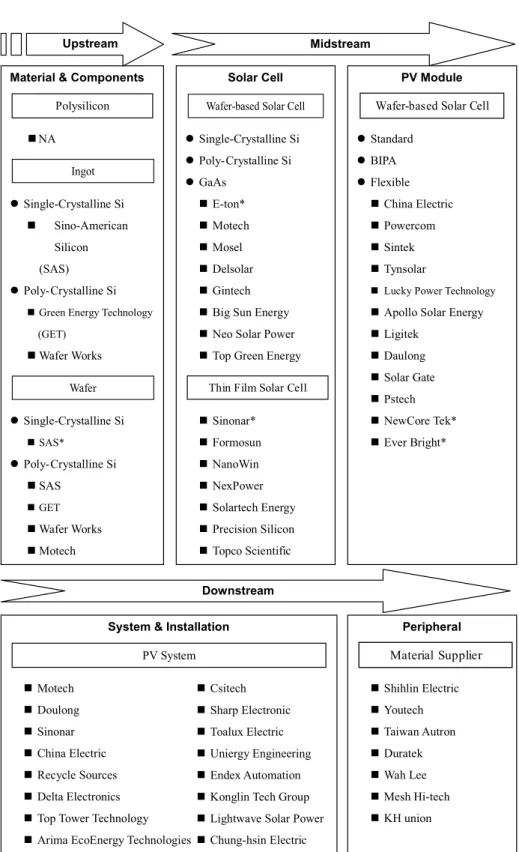

Why does the MAI group have higher R&D intensity and efficiency? One of the reasons is the highly integrated supply chain within the group. Figure 2 shows Taiwan’s PV industrial supply chain. The supply chain includes material and components, solar cell, PV module, system, installation, and peripherals. Except for polysilicon, domestic vendors can supply most of the key components. There are eight upstream firms, 46 midstream firms, and 32 downstream firms that provide specialized manufacturing services.

Fine (2005) argues that the supply chain of the global PV industry can differentiate between modular and integral. Taiwan’s supply chain has gradually transformed into integral PV firms and they have two advantages. First, products with an integral architecture tend to be complex and the subsystems are built explicitly for a particular product. It means that manufacturers can customize products and grasp market demand trends. Second, the integral supply chain architecture is characterized by strong cross-firm links and relatively high barriers to entry for new comers.

One example is Motech, which is the eighth-largest manufacturer of solar cells in the world. They have a successful strategy which is a vertically integrated industrial supply chain. Motech can reduce production costs by outsourcing material in their value chain, and the products tend to have components so interwoven that each may perform more than one function. They also control costs themselves through a working relationship with their counterparts in the manufacturing firms and other key suppliers. The highly vertically integrated supply chain helps Taiwan’s PV firms create a complete interaction between upstream and downstream and allows for more innovative chances.

Integrated innovation is another innovative capacity source. Taiwan has midstream and down-stream solar operations, but has to import 98% of its polysilicon needs; 40% of that from China. Furthermore, more than 98% of PV production is exported which combined accounts for around 42% of global solar cell shipments. This suggests that the condition for success is for both sides to cooperate across the industry chain. Taiwan can contribute its strength in manufacturing and efficient production, while China has supplies of polysilicon, the raw material for solar cells, and the potential for a huge market. They also can exchange technology through cross-sector

FIGURE 2 Taiwan’s PV industrial supply chain.

196 J.-L. HU AND F.-Y. YEH

cooperation of R&D institutions. The integration direction changes “from sand to system” to “from system to sand,” making the integration process easier.

3.4. Innovative Model of Taiwan’s PV Industry

As Figure 3 depicts, the PV firms’ innovative power comes from four sources. The first innovative power is internal interaction of resources, including R&D institution cooperation, industry-academia cooperation, and cross-industry strategic alignment. The main cooperative R&D institutions are the Industrial Technology Research Institute, Atomic Energy Council, and Chung-Shan Institute of Science and Technology. These institutions successfully trained the incubator companies of DelSolar and Arima EcoEnergy Technologies Corporation.

Cross-industry strategic alignment is another internal resource. Because the production process and technologies are similar in the PV industry, the advantages are in quickly acquiring new technology and easily transferring technology. In 2009, Taiwan’s government advocated the New Energy Industry Flagship Plan and Energy Country Science Plan to promote industrial alignment (Huang and Wu, 2007). To set up the critical technology and completeness industrial chain, the PV industry has tried to forge an alliance with the liquid crystal display (Chimei and Groundjay Digi-Tech) and compact disc (Ritek and Scheuten) industries since 2008.

The second success factor is an external interaction of resources. They include international technical cooperation, technological buy-in from foreign firms, and establishing overseas sub-sidiary companies. The Industrial Technology Research Institute is undertaking to import new foreign technology for local manufacturers. For instance, Win Win Precise Material Company has cooperated with a local German company to establish an overseas subsidiary company (Winergy Solar GmbH). They have built up their brand account and advanced their brand ranking and are now cooperating with Taiwan’s module firms for better quality and service. They produce higher quality products and marketing with their brand in Germany. This advantage helps them conveniently gain loans from European banks and their products have more competitiveness.

In addition to material and technical innovations for cost-down and conversion efficiency improvement, the other key issue for PV firms is financial innovation. With prices for residential PV systems rising higher, the residential market has slid such that homeowners are less willing to pay for the cost of a system. As a result, it is important to for entrepreneurs to realize that the PV industry needs more financial innovation than technical innovation. PV financial innovation supports domestic enterprises to continue to expand in the international market and maintain market share.

After having successful domestic experiences in products innovation, PV firms need modi-fications to meet market demand. They can get feedback from global customers and re-design products through customized design and localized design with overseas R&D centers.

4. CONCLUSION AND POLICY IMPLICATIONS

To alleviate global climate changes, solar energy has become an emerging industry in both developed and developing countries. We apply the value migration theory to find the strategic position of Taiwan’s current PV industry. Taiwan’s PV industry is in the stage of value inflow. Both the upstream and downstream industries have a higher MS ratio than the midstream industry. This evidence suggests that two industrial decisions must be made to pursue sustainable PV development. The first is to expand the production scale in Taiwan’s PV industry. Most producers can increase more labor and expand their production to improve scale efficiency. Such a growth industry can create opportunities for new technologies, applications, and companies (van den

F IG U R E 3 T ai w an ’s P V in d u st ri al in n o v at io n p ro ce ss m o d el in m id st re 197

198 J.-L. HU AND F.-Y. YEH

Heuvel and van den Bergh, 2008). Taiwan’s government should propose more energy policies focusing on solar and subsidies to customers. Second, Taiwan’s PV industry value has migrated to the upstream and downstream. It indicates that authorities should persuade new entrants to not invest in the midstream industry in order to support the existing midstream PV firms. Moreover, Taiwan’s government should encourage other domestic industries to reinvest in the upstream and downstream of the PV industry.

To promote greater scale efficiency and to obtain competitive advantages for PV firms, we calculate the R&D intensity and address an integrated supply chain. Three strategic decisions are proposed to promote innovative capabilities in Taiwan’s PV firms. The first decision is to increases PV firms’ R&D intensity. Due to cost and capital issues, PV firms should use internal and external resources more efficiently. Firms with higher R&D efficiency can enter a market with fewer barriers and develop more innovative products. The second decision is that an integrated supply chain can help manufacturers grasp market demand trends and boost market share. Except for polysilicon, Taiwan’s PV firms are induced to enter throughout the supply chain, yet PV firms need to control their sources of material and customer retention. These are the two key factors to keep their industrial competitive advantages. Finally, integrated innovation is rather noteworthy, suggesting that the condition for success is for both Taiwan and China to cooperate across the industry chain. Policymakers should change the integration direction “from sand to system” to “from system to sand.” Taiwan’s government should support further concrete cooperation between it and Taiwan in order to achieve technological breakthroughs.

We find the innovative power of Taiwan’s PV firms through the innovative model. Taiwan’s past innovative pattern is “learning by doing” which borrows much production knowledge from its previous semiconductor production. Taiwan’s PV industry has been proven effective in gaining market power from material innovation, technical innovation, application innovation, and financial innovation. PV firms acquire their technologies from domestic research centers, international technical cooperation, and technological buy-in from foreign firms, etc. Moreover, midstream producers in Taiwan have started to set up overseas R&D centers and subsidiary companies that can help redesign their products and meet demand in foreign markets. Taiwan’s government has to support further concrete cooperation and technological breakthroughs from domestic R&D centers.

ACKNOWLEDGMENTS

The authors thank the editor and two anonymous referees of this journal for their valuable comments. Financial support from Taiwan’s National Science Council (NSC98-2410-H-009-055) is also gratefully acknowledged. The usual disclaimer applies.

REFERENCES

Bone, S., and Saxon, T. 2000. Developing effective technology strategies. Research Technology Management 43:50–58. Energy Commission, Ministry of Economic Affairs. 2001. The new and clean energies utilization potential in Taiwan.

Taipei: Ministry of Economic Affairs. (in Chinese)

Executive Yuan Council for Non-nuclear Homeland (EYCNH). 2003. Nuclear-free homeland action plan. Taipei: EYCNH. (in Chinese)

Fine, C. H. 2005. Are You Modular or Integral? Be Sure Your Supply Chain Knows. Available at: http://www.strategy-business.com/article105205?gko=8a29a.

Galan, J. I., and Sanchez, M. J. 2006. Influence of industry R&D intensity on corporate product diversification: Interaction effect of free cash flow. Ind. Corp. Change 15:531–547.

Hu, J. L. and Hsu, Y. H. 2008. The more interactive, the more innovative? A case study of South Korean cellular phone manufacturers. Technovation 28:75–87.

Huang, Y. H., and Wu, J. H. 2007. Technological system and renewable energy policy: A case study of solar photovoltaic in Taiwan. Renew. Sust. Energ. Rev. 11:345–356.

Hwang, H. L., and Hong, C. S. 1984. The development of the photovoltaics industry in Taiwan. Sol. Cells 12:111–119. Hwang, H. L., Hsu, K. Y. J., Lee, W. I., Shing, Y. H, Hsu, K. C., and Tseng, B. H. 1998. Outlook for photovoltaic

developments in Taiwan. Prog. Photovoltaics 6:201–206.

International Energy Agency (IEA). 2008. IEA Energy Technology Perspective. Available at: http://www.iea.org/Textbase/ stats/index.asp.

Jäger-Waldau, A. 2008. PV status report 2008. Brussels: Joint Research Centre.

Kaplan, A. W. 1999. From passive to active about solar electricity: Innovation decision process and photovoltaic interest generation. Technovation 19:467–481.

Mokyr, J. 1990. The Lever of Riches. Technological Creativity & Economic Progress. New York: Oxford University Press. Ng, A. P. T., Lu, D., Li, C. K., and Chan, H. H. Y. 2005. Strategic lessons of value migration in IT industry. Technovation

25:45–51.

Photonics Industry and Technology Development Association (PITDA). 2007. The analysis and review of the photovoltaic industry in Taiwan.Taiwan: PITDA. (in Chinese)

Shinnar, R., and Citro, F. 2007. Solar thermal energy: The forgotten energy source. Technol. Soc. 29:261–270. Slywotzky, A. J., Morrison, D. J., Moser, T., Mundt, K. A., and Quella, J. A. 1999. Profit Patterns. New York: Times

Books.

Tsoutsos, T. D., and Stamboulis, Y. A. 2005. The sustainable diffusion of renewable energy technologies as an example of an innovation-focused policy. Technovation 25:753–761.

van den Heuvel, S. T. A., and van den Bergh, J. C. J. M. 2008. Multilevel assessment of diversity, innovation and selection in the solar photovoltaic industry. Structural Change and Economic Dynamics (in press).

Whitelegg, J. 1993. Transport for a Sustainable Future—The Case for Europe. Chichester, UK: John Wiley and Sons.

APPENDICES

1. Data Sources

The data are collected from Taiwan Economic Journal Database and public company annual reports from 2000 to 2007. We selected 26 PV firms which are all listed on the Taiwan Stock Exchange Corporation or the Over-The-Counter Exchange. These firms are Sino-American Silicon Products, Wafer Works, Green Energy Technology, Prolific Technology, Arima Optoelectronics, Motech, Sinonar, E-ton, Epistar, Visual Photonics Epitaxy, Precision Silicon, Powercom, Sintek, Gintech Energy, Solartech Energy, Tynsolar, Big Sun Energy, Neo Solar Power, DelSolar, Sysgration, Topco Scientific, Mosel Vitelic, China Electric, Chen Full, Delta Electronics, and Topco Technologies.

2. Innovation Performance Indicators, Definitions

This study uses three innovation performance indicators to evaluate innovative capacity in the PV industry:

1. The MS ratio is defined as the market value divided by operating income.

2. The PG ratio is defined as the ratio of profit in the current year minus profit in the previous year divided by profit in the previous year. It indicates the variations and the growth of an industry or a firm’s sales. A higher PG ratio implies higher growth rates.

3. Operating margin is defined as the ratio of operating income divided by net sales. It provides important insights into how effectively management is in controlling expenses, the amount of interest income and expenses, and taxes paid. A higher operating margin implies higher efficiency rates.