National Chiao Tung University

Institute of Management of Technology

Thesis

The Effect of Taiwan Accelerator on the Growth of

Small and Medium Enterprises: Preliminary and

Empirical Study

Student

: Susy Ervina

Advisors : Prof. Hung Chih Young

Prof. Huang Ching Yao

The Effect of Taiwan Accelerator on the Growth of Small and

Medium Enterprises: Preliminary and Empirical Study

研 究 生:蔡雨雪

Student: Susy Ervina

指導教授:洪志洋

Advisor: Hung Chih Young

黃經堯

Huang Ching Yao

國 立 交 通 大 學

科技管理研究所

碩 士 論 文

A Thesis

Submitted to Institute of Management of Technology College of Management

National Chiao Tung University in Partial Fulfillment of the Requirements for the Degree of Master of Business Administration

in Management of Technology

July 2014

Hsinchu, Taiwan, Republic of China

i

The Effect of Taiwan Accelerator On The Growth of Small and Medium Enterprises: Preliminary and Empirical Study

Student : Susy Ervina

Advisors : Prof. Hung Chih Young

Prof. Huang Ching Yao

Institute of Management of Technology

National Chiao Tung University

ABSTRACT

The aim of this paper is to examine the performance of Taiwan Small and Medium Enterprises (SMEs) after joining an accelerator program in Taiwan. Business accelerator generally provide funding, mentoring, and networking services for nascent firms, known as ‘startups’, to help them grow quickly, and in return they take a small amount of firm equity. In Taiwan, the accelerator phenomenon has just begun to grow rapidly over the last several years and even includes helping existing firms. However, due to the lack of related research in this field and limited-access to data, the significance of the influences of accelerator programs is still being questioned in Taiwan. Therefore, this paper is presented as a preliminary and empirical study to examine the roles of accelerators in assisting Taiwanese firms and uses descriptive analysis and surveying methods to determine the effects of them. A review of accelerators background is first presented, then worldwide eminent business accelerator are investigated. Taiwan’s eminent business accelerator are limited; therefore, this research study will just focus on Start-up Taiwan Accelerator. From research findings, accelerator program effects are perceived more for small scale net income and capital SMEs. Funding and networking programs are necessary for SMEs in order to improve their financial performance, and mentoring programs are important to increase SMEs management performance. Since this research is preliminary, it is necessary for future researchers to compile more illustrative information and to do further interpretation of data.

ii 臺灣加速器產業對臺灣中小企業成長之影響—初步及實證之研究

學生 :蔡雨雪

指導教授:洪志洋 副教授

黃經堯 教授

國立交通大學科技管理研究所 碩士生

摘要

本研究目的是想要探討台灣中小型企業(SMEs)參與台灣加速器產業計劃後之 影響。加速器產業通常提供資金,指導和國際連結之服務來幫助新興中小型企業 或普遍被稱為“新創”公司。加速器產業幫助新創公司迅速成長但作為迴歸他們 要求少量的公司股權。臺灣加速器產業除了幫助新創公司以外也幫助現有的中小 型企業。在台灣加速器產業剛開始起步雖然在過去的幾年已快速的增長。然而, 因為缺乏在這一領域的相關研究,並限制訪問的數據,加速器產業影響的重要性 仍然被質疑。因此,本研究建立一個初步的實證研究來探討加速器產業在協助中 小型企業之影響,本研究方法是使用描述性分析和問卷調差分析方法。本研究首 先會探討加速器產業之背景,再來以全世界著名加速器公司為例來進行研究學 習。因為台灣著名的加速器公司有限;因此,此項研究只集中在臺灣加速器公司來 作為研究目標(Start-up Taiwan Accelerator)。從本研究結果得出加速器服務項 目對小規模的中小型企業比較有顯著的影響。加速器產業提供的資金和國際連結 之服務有幫助到中小型企業改善財務表現,並且加速器產業指導服務有幫助到中 小型企業改善他們的經營績效。最後由於本研究是初步之研究,因此在未來的研 究人員有必要編寫更多的說明資料,並做數據的進一步解釋。iii

Acknowledgements

First of all, I would like to thank my advisor Prof. Hung Chih Young for all the guidance and helped. I would also like to express my sincere gratitude to my co-advisor Prof. Huang Ching Yao; without his support, mentoring, and patience, this dissertation work would not be finished. I would also like to take this opportunity to thank to IAPS team works for supporting me with research data and kindness help during my research. Thanks also to my senior, Wen Yi, Lee for helping and mentoring me when I confront problems in writing my thesis.

Thank you to all of my best friends: Mai, Cindy, Melissa, Paul, and Julianto, who have stood by my side during my writing thesis process. I am fortunate to have such genuine, caring, and supportive friends. And to my lover, Candera Wijaya, who is always cheer me up and being with me when I am down and hopeless, an extraordinary role that you have played in my learning journey was invaluable. Thank you for all of your contributions and support.

To my lovely family, my parents: Chai Nam Fo and Ng Nyet Ngo; my siblings: Fuili, Susyono, Susy Chaiwani, and Susandy, thank you for constantly encourage me and confidence in my endeavor. Without all of your encouragement and understanding it would have been impossible for me to finish this thesis.

Finally, I am particularly grateful to my department office lady, Mrs. Yaling, who unselfishly helping me a lot during my degree accomplishment. Thank you. I really appreciate it. And for all, who love and care with me. Thank you.

Sincerely Your, Susy Ervina 2014.07.03

iv

Table of Contents

English abstract ... i Chinese abstract ... ii Acknowledgements ... iii Table of Contents ... iv List of Tables ... viList of Figures ... vii

Chapter 1 Introduction ... 1

1.1 Background and Motivation ... 1

1.2 Problem Statement ... 2

1.3 Scope and Limitation ... 2

Chapter 2 Literature Review ... 4

2.1 Incubator ... 4 2.2 Accelerator ... 4 2.2.1 Background ... 4 2.2.2 Accelerator Programs ... 5 2.2.3 Startups ... 6 2.2.4 Investors ... 7

Chapter 3 Identify Global Accelerator Companies ... 9

3.1 Accelerators in United States ... 9

3.1.1 Y Combinator ... 9 3.1.2 Techstars ... 11 3.2 Accelerator in Europe ... 12 3.2.1 Seedcamp ... 12 3.2.2 Startupbootcamp ... 14 3.3 Accelerators in Asia... 15 3.3.1 Chinaacelerator ... 15

3.3.2 Joyful Frog Digital Incubator ... 17

3.4 Accelerators in Taiwan (appWorks Venture and Start-up Taiwan Accelerator) 18 3.4.1 appWorks Venture ... 18

3.4.2 Start-up Taiwan Accelerator ... 20

3.5 Summary of Global Accelerator Study ... 21

Chapter 4 Data and Methodology ... 24

4.1 Research Framework ... 24

v

4.2.1 Questionnaire Design ... 26

4.2.2 Descriptive Data ... 28

Chapter 5 Result and Analysis ... 30

5.1 Questionnaire-survey ... 30

5.2 Descriptive Data ... 36

Chapter 6 Conclusion & Recommendation... 40

6.1 Research Conclusion ... 40

6.2 Recommendation for future research ... 40

References ... 42

Appendix 1 : Sample Questionnaire ... 44

Appendix 2 : Questionnaire Answers Pie Chart ... 49

vi

List of Tables

Table 1 Y Combinator ... 10 Table 2 Techstars ... 11 Table 3 Seedcamp ... 13 Table 4 Startupbootcamp ... 14 Table 5 Chinaaccelerator ... 16Table 6 Joyful Frog Digital Incubator ... 17

Table 7 appWorks Venture ... 19

Table 8 Start-up Taiwan Accelerator ... 20

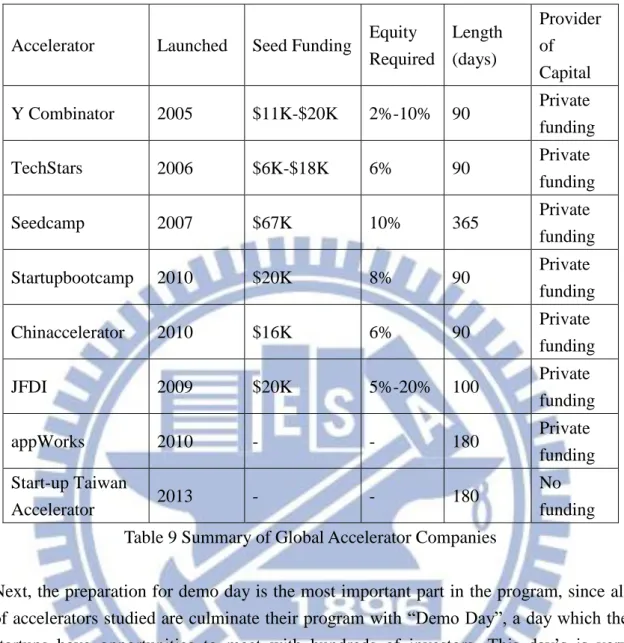

Table 9 Summary of Global Accelerator Companies ... 22

Table 10 Analysis of Variance for reliability and validity ... 31

Table 11 Result of testing overall average financial, management and satisfaction ... 32

Table 12 Regression Model for All Group Category ... 33

Table 13 Result of Group Category Testing ... 34

Table 14 Result of Testing Average Financial, Management and Satisfaction between 24 pioneer SMEs and other SMEs ... 34

Table 15 Result of Testing Average Financial, Management and Satisfaction of 24 Pioneer Companies ... 36

Table 16 Net Income Classification ... 38

vii

List of Figures

Figure 1 Research Framework ... 24 Figure 2 Start-up Accelerator Program Flowchart ... 25 Figure 3 Questionnaire Design ... 28

1

Chapter 1 Introduction

1.1 Background and Motivation

Since in the mid-1980s, Taiwan Small and Medium Enterprises (SMEs) has been making a big contributions on the growth of domestic economic. SMEs have been recognized as a key driving force on the economic development. They indicate as a local job provider, stabilizing force in society, being flexible in management, and be able to attend the needs of the markets, also capable in manufacturing various products on a small scale. According to Wang, an online newspaper reporter, in 2011, number of SMEs was 1,279,784, accounting for 97.63% of the total enterprises in Taiwan. Moreover, SMEs employed total 8,337,000 people, accounting for 77.85% of the total employments with totaled sales NT $ 11,226.9 billion. But on the average of 30 percent, the survivals of SMEs are no more than five years (Wang, Small Business make big contribution, 2010).

The high failure rates among new and small firms are course by most of them lacked of good understanding on start-up risks, improper financial management and marketing, also an inadequacy of industrial research and development (R&D); Therefore, only a small fraction of SMEs are successful in achieving exceptional performance and maintain a sustainable growth. So it is necessary for government and professional R&D in giving a solid assist (Jan & Chen, 2006).

Currently, started from 2005 to present, an entrepreneurial ventures, known as “startups” have been booming globally. First, they are initial from United States and spread quickly to Europe and Asia. ‘Startups’ are a highly growth companies with concentrated on unrepeatable and scalable business models. They are usually get funded by venture capitalists (VCs) and angel investors through ‘Accelerator programs’. And accelerator is a new business model of incubator, they were providing startups with mentoring and coaching as well as funding in earlier stage of new startups. (Casamatta,2003;Ueda,2004;Winton and Yerramill,2008).

In 2013, Taiwan has organized an event to set up a sustainable accelerating mechanism, namely “APEC Start-Up Accelerator Leadership Summit 2013”, the aims of this event is to attract more investment over the globe and to maintain a healthy start-up ecosystem for new startups and existing firms in Taiwan, especially in terms of

2

continuously facilitating job creation, creating new innovation of product and service, building a healthy trade and investment.

According to Global Accelerator Network (GAN) membership statistics (2012), currently, there are 60% of business accelerators located in North America, 14% in Asia, 13% in Europe, and 7% in Australia (Shen). This survey result brings forward the issue that emerging market economies may need more accelerators to raise from outside America.

1.2 Problem Statement

There are 131 business incubators in Taiwan; 61 in North district, 23 in Central district, and 47 in South district (SMEA, 2013). This business incubators have been known as economic development tools since 1995 (Wen-bo, Ying-Cheng, & Chu-Ching, 2013). Universities, governments, and corporations have been using incubators to accomplish a range of wealth-creation and social goals for a decade. In contrary, business accelerators in Taiwan is a new phenomenon. There are not more than 10 accelerators companies in Taiwan. Nonetheless, people are still unaware with significance of the influences and effects of accelerator program on SMEs in Taiwan. All of these because measurement performance of Taiwan’s accelerator program is still difficult due to the lack of accessing data, small-scale number of existing accelerators business companies in Taiwan, and the limitation of research in the field of accelerator; Therefore, this paper is try to examine business accelerators program, what are the influences and effects of accelerator programs on SMEs in Taiwan.

1.3 Scope and Limitation

This paper is primary focus on ‘Start-up Taiwan Accelerator’ accelerator programs, which is just started in May 2013. Before that, it is necessary to inform some of the caution that needs to be consider from this paper.

First, all the research data is collected over one period cycle of accelerator programs. Each cycle may have a different startups participants as well as there are may also have an updated issue in the accelerator programs. Second, besides Start-up Taiwan Accelerator, Taiwan still has many other accelerator business companies; therefore, this research paper cannot represent all accelerators companies in Taiwan, plus they may have a distinctive programs focus and SMEs target. Last, we are lacked of pre-existing research, knowledge and guideline to do the investigation since it is a preliminary

3

research study. Thus, it may be necessary for future researchers to provide more illustrative information and precise analysis.

Although this paper had several limitations; however, the results of this paper may lead several propositions for encourage Taiwan’s accelerator to consider carefully in future improvement of the accelerator program, especially for business accelerators companies with the same business model, and SMEs target. This paper can also serve as a fundamental framework to identifying the effect of Taiwan’s business accelerators for future research.

4

Chapter 2 Literature Review

2.1 Incubator

The study of business incubators is crucial since accelerators derive many of their characteristics from them. Both accept early startups that show potential economic viability, and they both provide an environment that is meant to serve the needs of startups (Barrehag, Larsoon, Mardstrom, Westergard, & Wrackefeldt, 2012).

The first incubator was started in the U.S. at Batavia Industrial Center in New York in 1959. But the concept of incubation did not become popular in other communities until the late 1970s. Today, there are approximately 1,400 business incubators in North America, about 200 in Mexico, 120 in Canada, and over 3,500 worldwide (Knopp, 2012).

According to Aaboen (2008) the development of incubators’ can be divided into three generations. The first generation focuses on job creation while the second generation focuses on supplying services such as networking, training and connecting to venture capital. The third generation on the other hand, focuses on Information and Communication Technology, where the most promising startups are prioritized (Aaboen, 2008).

Recently, in the report Startup Factories, Miller and Bound (2011) investigate a new way of incubating technology startups, the accelerator concept (Miller & Bound, 2011).

2.2 Accelerator

2.2.1 Background

Business accelerator is a relatively new phenomenon. It is usually involve of a group of experienced business people to serves the basis need of the ‘nascent’ firms. (Fishback, Gulbranson, Litan, Metchell, & Porzig, 2007). Incubator and accelerator are similar, but Menell (2010) argued that business accelerators more evolved form of profit then incubators.

5

The distinguish between business incubator and accelerator are :

- While both are open to anyone, accelerator have application process and it is highly competitive.

- Another difference is that accelerator provide seed funding, but in the context of return for equity in participant startups (DesMarais, 2013).

- Next, the focus of accelerators is on group, not on individual founders. It is because one person is considered insufficient to handle all the work associated with a startup (DesMarais, 2013).

- Further, startups must “graduate” by a given deadline, typically after 3 months. During this time, they receive intensive mentoring and training. They are expected to absorb all the information rapidly. Virtually all accelerators end their programs with a “Demo Day”, the day where startups can pitch their ideas in front of investors (Gilani, Aziz, Dettori, & Gianluca, 2011).

- The last is for startups accepted are supported in cohort groups or classes. The peer support and feedback that the classes provide are an important advantage. If the accelerator does not offer a common workspace for startups to meet regularly, the teams will meet periodically (Christiansen J. D., 2009)

The goal of accelerator business is to give startups a necessary resource to grow and scale quickly, so their product can reach to the market faster; in contrast to the entrepreneurs bootstrapping, they may need three years or more for reach their product to the market whereas an accelerator can cut down into a year (Chang, 2013).

2.2.2 Accelerator Programs

A paper name’s Copying Y Combinator: A framework for developing Seed Accelerator

Programmes (Christiansen J. D., 2009) illustrate that accelerator programs may consist

of five fundamental elements; funding, company founders, cohort support, education (business advice and product advice), and networking. Christiansen also mentioned that accelerator programs may or may not include office space, whether free or subsidized, and usually programs are culminated with a “Demo Day”, which is startups can earn extra funding from investors.

According to Shieber (2014), most of the accelerators provide seed funding investment, mentoring, workspace and professional services in exchange for an equity stake company. Typically, seed funding around $25,000 is exchanged with equity stake 6%. Accelerator selecting their startups in intent to gain financially outcome from their

6

initial investment. Take Y Combinator, one of the most successful seed accelerator programs, as an example, Y Combinator usually provided seed funding around $11,000 to $20,000 with exchange for equity around 2-10%, they have been funded over 634 companies since 2005 (April 2014). Omnisio was Y Combinator Winter 2008 cohort; it was purchased by Google in July 2008 for $15 million in cash. Assuming a 6% initial stake with no dilution, Y Combinator’s get return from Omnisio’s sale alone was $900,000 (Christiansen J. D., 2009).

Business accelerator program creating a valuable ecosystem for new companies, such as Y Combinator hosts a weekly dinners with entrepreneurs and investors, providing a rich structured sources throughout the programs, Seedcamp, a well-known European accelerator’s company, offer startups an opportunity to interact with investors and pitch theirs ideas to variety of potential investors throughout Seedcamp Week, TechStars, another famous accelerator company in U.S., host a talk show by entrepreneurs and investors in a structured manner throughout their programs in an effort to form connections. The most close relationship with a broadly, helps startups companies more easy in obtain fundraising.

Accelerators also provide value to their startups with intensive and high quality mentorship during the programs. One of the greatest obstacles that startups companies usually face are they are not understanding their target market, they don’t have a strong marketing expert working with them for their business, difficulties in reaching their customers, and lacked of overall experience in their proposed business (Hoffman & Radojevich-Kelley, 2012). In the accelerator program, they pair a technical expertise to each startup, offering a professional advice, typically in various business concepts such as branding, marketing, and customer development, and helping them to achieve more additional funding from investors.

Finally, accelerator programs are culminated with a ‘Demo Day’, the day where all the startups companies can demonstrate their products to investors. It is a big change for startups to get an additional funding from investors.

2.2.3 Startups

According to case studies, Miller and Bound (2011), Startups is one of an essential element in the accelerator programs because the initial of accelerator program is to help startups in developing their business ideas and also trying to connect them with worldwide investors. The important aspect that startups usually consider before joined

7

accelerator programs is the connection to future capital. It was extremely important to secure an additional funding once the program is over.

From startup’s point of view, financial support and initial funding are important, but they are also concerned about running appropriate business issues, such as; hiring right workers, a good public relations, marketing channel, and pricing strategy. If they started their business with a wrong step in the beginning, then it could be harmful in the long-term period (Christiansen J. D., 2009). Accelerators are very beneficial in helping startups avoid making early business mistakes; through their guest speakers and educational talk, startups can consider common problems that they may face in the future issues and need to pay attention for the growth of their company. It is also the best place to seek future funding.

Besides, accelerator companies are seeking startups that have a potential commercial viability. So during the selection process, accelerators will look at several aspects; high growth potential, team composition and experience, existing prototypes, intellectual property, market opportunities and what value that they can add and carry out in following three months or more. Most of the accelerators companies will have an interview and a review of startups applications prior to selecting their candidates. They may have various screening process and/or criteria to do the selection. Like TechStars as an example, the most important criteria for selecting candidates are their technical expertise and working prototype, different with LaunchBox Digital; they are more considered with strong lead founder and how idea solves a real problem. (Hoffman & Radojevich-Kelley, 2012)

2.2.4 Investors

According to Miller and Bound (2011) “investors are the most reoccurring in the accelerator context”. Angel’s investor typically is seeking a high return within a ten years period of investment. They usually asked for 25% Internal Rate of Return (IRR), and it is considerate of an appropriate claim because they need to inherit a risk in the early-stage investing (Christiansen J. D., 2009). Similar with VCs, they are also invest in high-risk with high-return investment. They like to invest in earlier startup venture because in business accelerator they can easily find a number of promising young companies to do more save investment since startups need passes a strict selection process set by the accelerator companies before they can join the accelerator programs. The final goal of VCs is either take the public offering or trade sale.

8

Why investors like to invest in accelerator business, let’s take Y Combinator accelerator programs as an example. In each program cycle, Y Combinator are expected 50 % of their startups companies to fail. “Despite in those failure rates, the programs is expected to generate significant returns for investors through early investment in companies with large exits” (Christiansen J. D., 2009). Takes one program cycle of accelerators as an example :

Investment : $20,000 for 5% equity Cohort size : 10 companies

VCs investment : $100,000/each companies for 10% equity Total Investment accelerator required : $200,000

Total VCs investment : 1,000,000

Assume 1 company achieves a large exit : $ 100,000,000, accelerator has 1% ownership at exit, VCs has 10 % exit, exit value for accelerator : $1,000,000, VCs : $10,000,000 Assume 4 companies achieve break even exit: $300,000, accelerator has 2 % ownership at exit, VCs has 10% exit, exit value for accelerator : $6,000, VCs : $30,000

Assume 10 companies lose all value : exit value for accelerator : 0, VC : 0

From the example above, we can see that this program generates return of investment 5x for accelerator and 10x for VCs. And since it is still in the early stages of investment, but it has already started to prove that this kind of business model generalized a high return for accelerators and investors. That why investors are interesting invest in accelerator programs companies.

9

Chapter 3 Identify Global Accelerator Companies

In this chapter, we are going to study a variety of eminent accelerator companies in United States, Europe, and Asia. First, Y Combinator and TechStars will be presented as United States Accelerator’s. And then, SeedCamp and Startupbootcamp will be presented as Europe Accelerator’s. Last, Chinaaccelerator and Joyful Frog Digital Incubator will be presented as Asia Accelerator’s. Business accelerators have been known worldwide as important resources for early startup to establish their organizations as well as for growth of firms. Business accelerators in worldwide are relatively sophisticated, especially in United States since they are initiator and started the program in 2005. Therefore, it is essential for us to understanding business accelerator globally. Overall, all information in these studies is obtained from secondary source.

3.1 Accelerators in United States

From numerous outstanding accelerators in the U.S., Y Combinator and TechStars was named as the top first and second startups accelerator companies by Forbes in 2012 (Gruber, Top 15 U.S. Startup Accelerators Ranked; Y Combinator and Techstars on Top, 2012). And again, in March 2014, they are still listed as the top, first and second the best accelerator companies in the U.S. rated by TechCrunch (Shieber, 2014). They are well-known accelerator companies in the U.S. with excellent reputation. Therefore, we think it is good enough for us to do a study about them.

3.1.1 Y Combinator

Y Combinator was first launched in Silicon Valley in 2005 by Paul Graham, Robert Morris, Thevor Blackwell and Jessica Livingston. The type of their business has been known as “Accelerator” (Gilani A., 2011) and has been recognized as the first business accelerator in the world (Barrehag, Larsoon, Mardstrom, Westergard, & Wrackefeldt, 2012).

Y Combinator has 2865 employees and has been successfully accelerated 566 companies since 2005. They have around 184 existing accelerator’s programs in the worldwide, 3151 companies were accelerated, and 11068 jobs had created from accelerators (The Brandery).

10

Y Combinator provided human resource support, legal assistance, public relation assistance and business facilities in their program and mainly focused on industry in the fields of cleantech, cloud, mobile, software, web-based, finance, gaming, media, SaaS, data/analysis, and entertainment (FindTheBest, 2014)

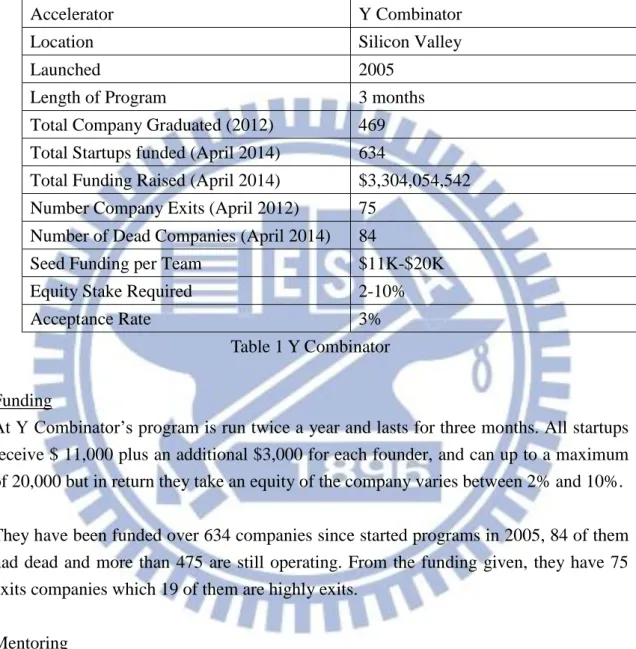

Table 1 Y Combinator Funding

At Y Combinator’s program is run twice a year and lasts for three months. All startups receive $ 11,000 plus an additional $3,000 for each founder, and can up to a maximum of 20,000 but in return they take an equity of the company varies between 2% and 10%. They have been funded over 634 companies since started programs in 2005, 84 of them had dead and more than 475 are still operating. From the funding given, they have 75 exits companies which 19 of them are highly exits.

Mentoring

Y Combinator does not provide common work spaces for the startup so the interaction between teams is limited, but they have a full time employed mentor; therefore, startups can book office hours with them anytime during the day. In Y Combinator, they are more emphasized in building the product during the programs (Y Combinator, 2014). Networking

Accelerator program in Y Combinator includes weekly dinners with successful speakers, like Venture Capitals (VCs) or founders of prominent tech companies. They are invite

Accelerator Y Combinator

Location Silicon Valley

Launched 2005

Length of Program 3 months Total Company Graduated (2012) 469 Total Startups funded (April 2014) 634

Total Funding Raised (April 2014) $3,304,054,542 Number Company Exits (April 2012) 75

Number of Dead Companies (April 2014) 84

Seed Funding per Team $11K-$20K Equity Stake Required 2-10%

11

to hold speeches so startups can achieve an informal networking during these occasions. Besides, they also have mentoring hours for variety of startups teams. Finally, the program is culminated in a “Demo Day”.

3.1.2 Techstars

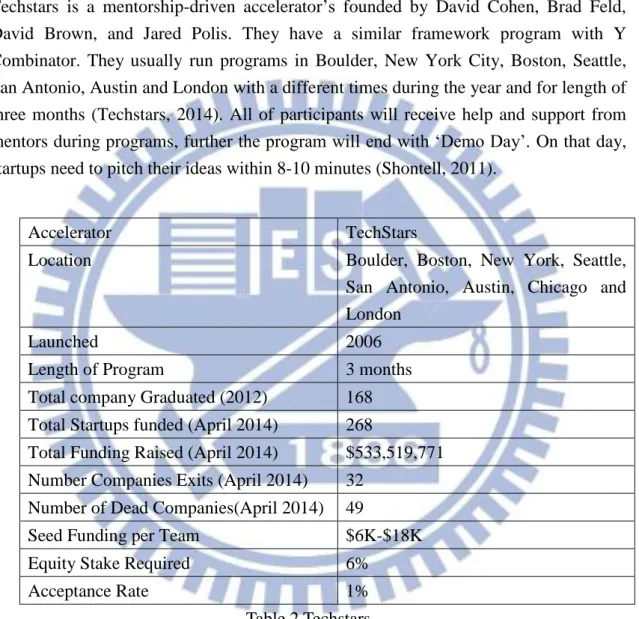

Techstars is a mentorship-driven accelerator’s founded by David Cohen, Brad Feld, David Brown, and Jared Polis. They have a similar framework program with Y Combinator. They usually run programs in Boulder, New York City, Boston, Seattle, San Antonio, Austin and London with a different times during the year and for length of three months (Techstars, 2014). All of participants will receive help and support from mentors during programs, further the program will end with ‘Demo Day’. On that day, startups need to pitch their ideas within 8-10 minutes (Shontell, 2011).

Table 2 Techstars Funding

Techstars is funded by more than 75 venture funds and angel investors. They provide startup teams seed funding around $6,000 to $ 18,000, depend on the number of founders. Upon startups has been accepted, they will receive $100,000 convertible debt note from a group of Venture Capitals (VCs) (Rao, 2011) and in return, they take 6% equity of the company

Accelerator TechStars

Location Boulder, Boston, New York, Seattle, San Antonio, Austin, Chicago and London

Launched 2006

Length of Program 3 months Total company Graduated (2012) 168 Total Startups funded (April 2014) 268

Total Funding Raised (April 2014) $533,519,771 Number Companies Exits (April 2014) 32

Number of Dead Companies(April 2014) 49

Seed Funding per Team $6K-$18K Equity Stake Required 6%

12

Recently, according to Christiansen “Techstars has achieve more than $ 504 Million funding raised” (Christiansen J. , 2014). They also declare that more than 80% of their startups will receives additional funding on demo day.

Mentoring

At Techstars, accelerator’s program was started with mentor dating to let startups meet with various mentors in purpose for finding which mentor’s is suits with them well and want to keep working with. The whole process will take a few weeks before they can focus on building their idea. Nevertheless, they still have opportunities to start practicing their pitch and presentation skills right from the beginning (Shontell, 2011). Techstar’s mentors have over 3,000 years combined experience over 600 startups which they have founded but none of them are formally employed in TechStars company (TechStars, 2014).

Networking

In January 2011, Techstars launched Global Accelerator Network (GAN) which links accelerator programs internationally. Nowadays, GAN has over 50 accelerators member around the world with network linked 63 cities across six continents and are still continued to grow (Global Accelerator Network, 2014). Members of GAN can enjoy unparalleled support, world-class networking opportunities, abundant with discounts and perks.

3.2 Accelerator in Europe

Accelerators in Europe are a few years behind those in the U.S., but they have close connection with well-known accelerators in the U.S., although European accelerators are not as sophisticated as in U.S., but numbers of startup program are as many or even more than those in the U.S. (Salido, Sabas, & Freixas, 2013). Abundant accelerators in Europe, Seedcamp and Startupbootcamp were stood for the top first and second position rate by Tech Cocktail (Gruber, Top 8 European Startup Accelerators and Incubators Ranked: Seedcamp and Startup Bootcamp Top The Ranking, 2011).

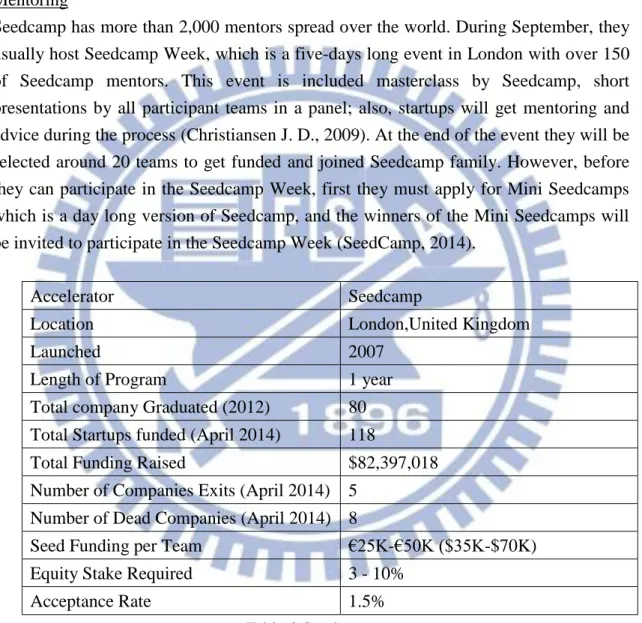

3.2.1 Seedcamp

Seedcamp is a leading seed funding and mentoring program in Europe. Most of the people call them, Europe version of Y Combinator. Seedcamp founded by a group of 30 European investors, they first started an accelerator program in 2007.

13

Funding

Seedcamp is open to entrepreneurial teams within and outside Europe who wants to build their business in Europe as a starting point. They provide seed investment up to $67,000 per teams in exchange for 8% to 10 % of the equity. Seedcamp’s program is an intensive a year-long program. They are focusing on all aspects of company development with investment cycle runs from October to September on each year. Mentoring

Seedcamp has more than 2,000 mentors spread over the world. During September, they usually host Seedcamp Week, which is a five-days long event in London with over 150 of Seedcamp mentors. This event is included masterclass by Seedcamp, short presentations by all participant teams in a panel; also, startups will get mentoring and advice during the process (Christiansen J. D., 2009). At the end of the event they will be selected around 20 teams to get funded and joined Seedcamp family. However, before they can participate in the Seedcamp Week, first they must apply for Mini Seedcamps which is a day long version of Seedcamp, and the winners of the Mini Seedcamps will be invited to participate in the Seedcamp Week (SeedCamp, 2014).

Table 3 Seedcamp Networking

Seedcamp has built their network around worldwide and distributed mentoring during the programs. They have been partnerships with local accelerator companies also with U.S. 500 Startups to stronger their position outside Europe. Seedcamp also has been sponsors by many well-known big corporations such as; Google, Nokia, Microsoft, Barclays, and Paypal (SeedCamp, 2014).

Accelerator Seedcamp

Location London,United Kingdom

Launched 2007

Length of Program 1 year Total company Graduated (2012) 80 Total Startups funded (April 2014) 118

Total Funding Raised $82,397,018 Number of Companies Exits (April 2014) 5

Number of Dead Companies (April 2014) 8

Seed Funding per Team €25K-€50K ($35K-$70K) Equity Stake Required 3 - 10%

14

The main different Seedcamp from Y Combinator and TechStars are:

- Seedcamp is a collective rather than an individual initiative by members of VCs community, serial entrepreneurs, mentors and angel investors.

- Seedcamp has a global event model, which can brings companies and mentors together immediately, through a Mini Seedcamp or Seedcamp Weeks. So, a startup can gets value with its first interaction with Seedcamp.

- Seedcamp specific incorporate European entrepreneurs in starting up businesses.

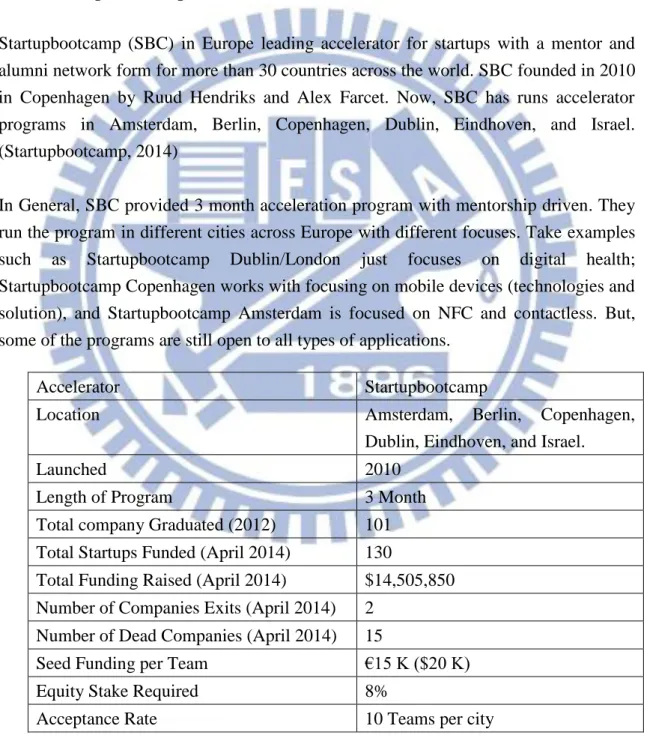

3.2.2 Startupbootcamp

Startupbootcamp (SBC) in Europe leading accelerator for startups with a mentor and alumni network form for more than 30 countries across the world. SBC founded in 2010 in Copenhagen by Ruud Hendriks and Alex Farcet. Now, SBC has runs accelerator programs in Amsterdam, Berlin, Copenhagen, Dublin, Eindhoven, and Israel. (Startupbootcamp, 2014)

In General, SBC provided 3 month acceleration program with mentorship driven. They run the program in different cities across Europe with different focuses. Take examples such as Startupbootcamp Dublin/London just focuses on digital health; Startupbootcamp Copenhagen works with focusing on mobile devices (technologies and solution), and Startupbootcamp Amsterdam is focused on NFC and contactless. But, some of the programs are still open to all types of applications.

Table 4 Startupbootcamp

Accelerator Startupbootcamp

Location Amsterdam, Berlin, Copenhagen, Dublin, Eindhoven, and Israel.

Launched 2010

Length of Program 3 Month Total company Graduated (2012) 101 Total Startups Funded (April 2014) 130

Total Funding Raised (April 2014) $14,505,850 Number of Companies Exits (April 2014) 2

Number of Dead Companies (April 2014) 15

Seed Funding per Team €15 K ($20 K) Equity Stake Required 8%

15

Funding

For firm who interests in join SBC can apply through filling an online application form; but, only 20 teams from the appliers will be chosen to participants in Startup Weekend. Startup Weekend is a two-day event to sorts out 10 best teams to be accepted into the program. They will be receive $20,000 in pre-seed investment with return of 8% equity company, a free co-working space and over $600,000 worth of deals from SBC’s sponsors and partners (Barrehag, Larsoon, Mardstrom, Westergard, & Wrackefeldt, 2012).

Mentoring

In SBC, startups spend much time in interaction with mentors for purpose to make sure that the startups can get on the right direction in the beginning of the program. SBC mentors have a different speech’s topic in each day such as; motivational speech or sharing story about their entrepreneur experience. Startups will be assisted in building theirs product, improving their business development rather than technical issues (Barrehag, Larsoon, Mardstrom, Westergard, & Wrackefeldt, 2012). Program of SBC is adjusted according to the basic needs of each startup periodically. Mentors will gets involved in every day operations for providing startups support and guidance if needed; further in the last two weeks, startups are focusing in pitch practice for the ‘Demo Day’; Moreover, SBC startups have opportunities to participants in the annual investor tour to London and Silicon Valley. At the end after 3 months, all startups are given a chance to pitch their company in a hundreds of Business Angels and Venture Capitalists at “Demo Days”.

Networking

SBC has numerous global sponsors and partners, such as in Amsterdam, they have Axicom and AVG, in Berlin, they have Cisco and Mercedes-Benz, and many others well-known sponsors. (Startupbootcamp, 2014). They also have an alumni community which is can open video chat with the startups team for helping and running discussions with them. In SBC, startups have change to go to London or Silicon Valley to get additional funding from investors.

3.3 Accelerators in Asia

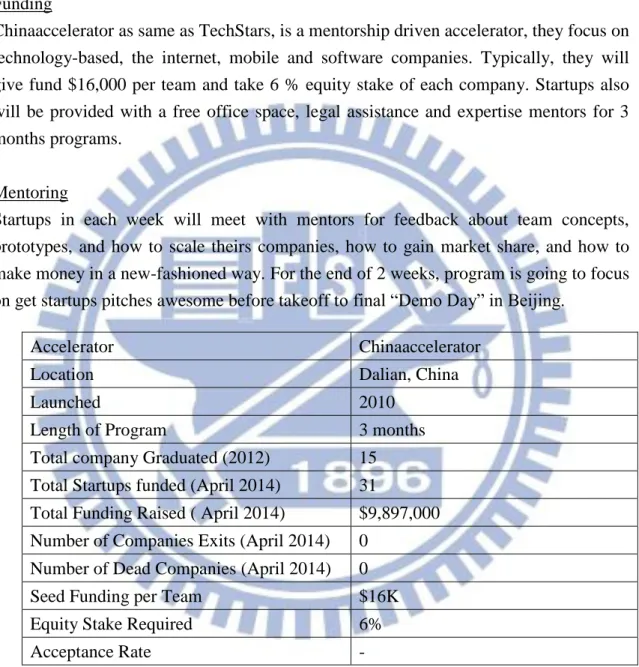

3.3.1 Chinaacelerator

16

Chinaaccelerator is one of a member of Global Accelerator Network (GAN) and also known as the first accelerator in China, founded by Cyril Ebersweiler and Sean O’Sullivan in 2010, Dalian. Cyril, before launched Chinaaccelerator, is a mentor of TechStars and 500 Startups as well as a Venture Capital (VC) for SOSventures.

Funding

Chinaaccelerator as same as TechStars, is a mentorship driven accelerator, they focus on technology-based, the internet, mobile and software companies. Typically, they will give fund $16,000 per team and take 6 % equity stake of each company. Startups also will be provided with a free office space, legal assistance and expertise mentors for 3 months programs.

Mentoring

Startups in each week will meet with mentors for feedback about team concepts, prototypes, and how to scale theirs companies, how to gain market share, and how to make money in a new-fashioned way. For the end of 2 weeks, program is going to focus on get startups pitches awesome before takeoff to final “Demo Day” in Beijing.

Table 5 Chinaaccelerator Networking

Since they are a member of GAN, they leverage a lot of benefits resources of GAN. Each accepted startup can access to over $100,000 free perks offered by over 25 the best vendors in the world, for example; $60,000 in Microsoft Azure Credits, $12,000 in Softlayer Hosting Services, $10,000 in PayPal Transaction Credits, $6,000 in Rackspace Hosting Credits, and so on. In the office, startups also can access a ton of amazing

Accelerator Chinaaccelerator

Location Dalian, China

Launched 2010

Length of Program 3 months Total company Graduated (2012) 15 Total Startups funded (April 2014) 31

Total Funding Raised ( April 2014) $9,897,000 Number of Companies Exits (April 2014) 0

Number of Dead Companies (April 2014) 0 Seed Funding per Team $16K Equity Stake Required 6%

17

workshops, events and media circuses, as well as free snacks and drinks in the office (Chinaccelerator, 2014).

The biggest difference between Chinaaccelerator with other accelerators; first, their program was built by entrepreneurs for entrepreneurs. Secondly, Chinaaccelerator just focuses on innovation. Third, all startups should be out of their comfort zone to evolve, so for people who interesting to participate in acceleration program’s must finding a place to live and build a team in Dalian. (Lim, 2011)

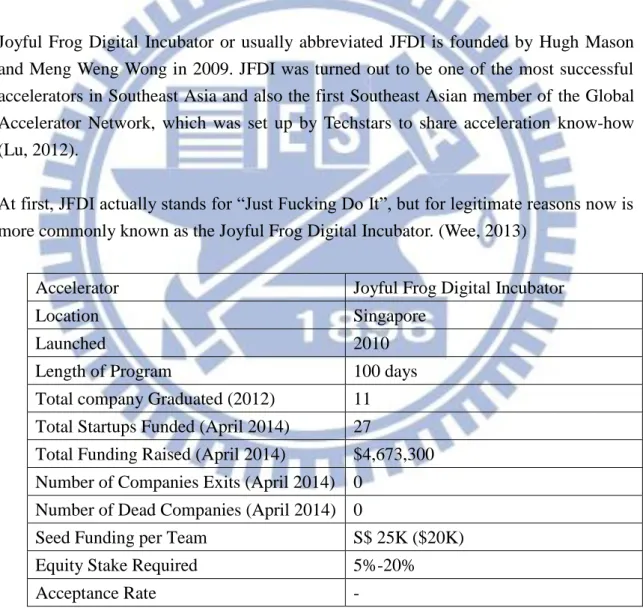

3.3.2 Joyful Frog Digital Incubator

Joyful Frog Digital Incubator or usually abbreviated JFDI is founded by Hugh Mason and Meng Weng Wong in 2009. JFDI was turned out to be one of the most successful accelerators in Southeast Asia and also the first Southeast Asian member of the Global Accelerator Network, which was set up by Techstars to share acceleration know-how (Lu, 2012).

At first, JFDI actually stands for “Just Fucking Do It”, but for legitimate reasons now is more commonly known as the Joyful Frog Digital Incubator. (Wee, 2013)

Table 6 Joyful Frog Digital Incubator Funding

JFDI’s is just focusing on digital applications made in Asia, each selected startup will be given $20,000 per-seed funding, over $80,000 in technical facilities, office

Accelerator Joyful Frog Digital Incubator

Location Singapore

Launched 2010

Length of Program 100 days Total company Graduated (2012) 11 Total Startups Funded (April 2014) 27

Total Funding Raised (April 2014) $4,673,300 Number of Companies Exits (April 2014) 0

Number of Dead Companies (April 2014) 0

Seed Funding per Team S$ 25K ($20K) Equity Stake Required 5%-20%

18

accommodation, intensive mentoring, and an introduction to more than 100 active early-stage investors and in return, JFDI will takes 5-20% of the equity depending on the stage of the project and value of the companies. (Lu, 2012)

Mentoring

JFDI offers core curriculum mentorships learning such as :

- Investor Psychology, Early Stage Fundraising Term Sheets and legalize - Key Metrics, Traction, Crossing the Chasm

- Solution, No Funding Needed, Agile Development.

Apart from the constant mentorships and product development in the day, every evening, is packed with courses to provide an extra nutrients for startups to grow stronger. (Wee, 2013)

Networking

JFID retain a strong network ecosystem, members all are linked together and were members of GAN; yet, they’re still in building an impressive ecosystem for their startups. Recently, they built forum OpenFrog Community, which is an informal forum where anyone can ask and answer question or discuss anything related to innovation, entrepreneurship and start-up (The Joyful Frog Digital Incubator, 2014). There are also a lot of knowledgeable people who stayed in the forum provided an exchange information about entrepreneur. JFID has partnerships come from multinational, ready in providing financial for early-stage, teaching and facilitating innovators and entrepreneurs in Southeast Asia.

3.4 Accelerators in Taiwan (appWorks Venture and Start-up

Taiwan Accelerator)

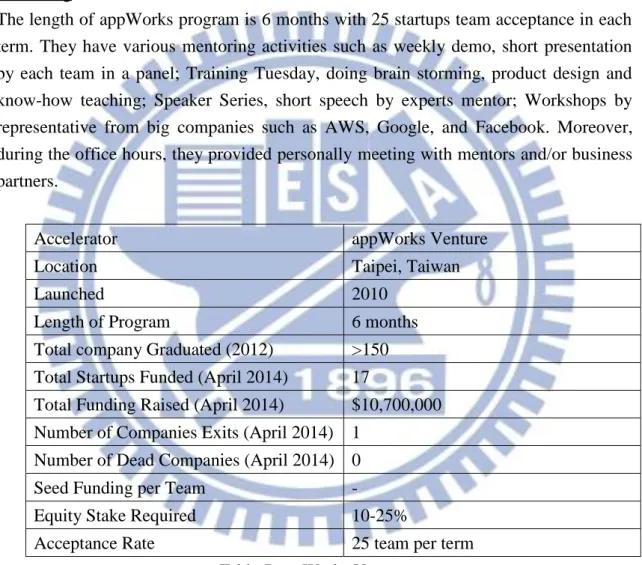

3.4.1 appWorks Venture

AppWorks was founded in 2010 by Jamie Lin in Taipei. They focus on consumer and mobile internet. AppWorks has known as the largest accelerator program in Asia as well as the largest private accelerator in Taiwan and since founded, they have been graduated over 150 Taiwan startups. They have a similar business model with U.S., Y Combinator and China, Chinaccelerator.

19

Funding

AppWorks did not provide earlier seed funding for accepted startups team, but a team with a potential business project will get funded around $10K to $100K with accounting for 10-25% of the equity (appworks, 2014). Each accepted team also will get office accommodation, business assistance, and an intensive mentoring. Presently, they claimed that they raised a total funding around $10.7 Million for investment in consumer internet and mobile internet startups team.

Mentoring

The length of appWorks program is 6 months with 25 startups team acceptance in each term. They have various mentoring activities such as weekly demo, short presentation by each team in a panel; Training Tuesday, doing brain storming, product design and know-how teaching; Speaker Series, short speech by experts mentor; Workshops by representative from big companies such as AWS, Google, and Facebook. Moreover, during the office hours, they provided personally meeting with mentors and/or business partners.

Table 7 appWorks Venture Networking

Like others Accelerators, at the end of the programs there will be a “Demo Day”, which is attended by a numerous investors. AppWorks have a strong alumni network with 150 business venture companies, 350 very friendly and helpful entrepreneurs’ team work to give assist for startups.

Accelerator appWorks Venture

Location Taipei, Taiwan

Launched 2010

Length of Program 6 months Total company Graduated (2012) >150 Total Startups Funded (April 2014) 17

Total Funding Raised (April 2014) $10,700,000 Number of Companies Exits (April 2014) 1

Number of Dead Companies (April 2014) 0 Seed Funding per Team -

Equity Stake Required 10-25%

20

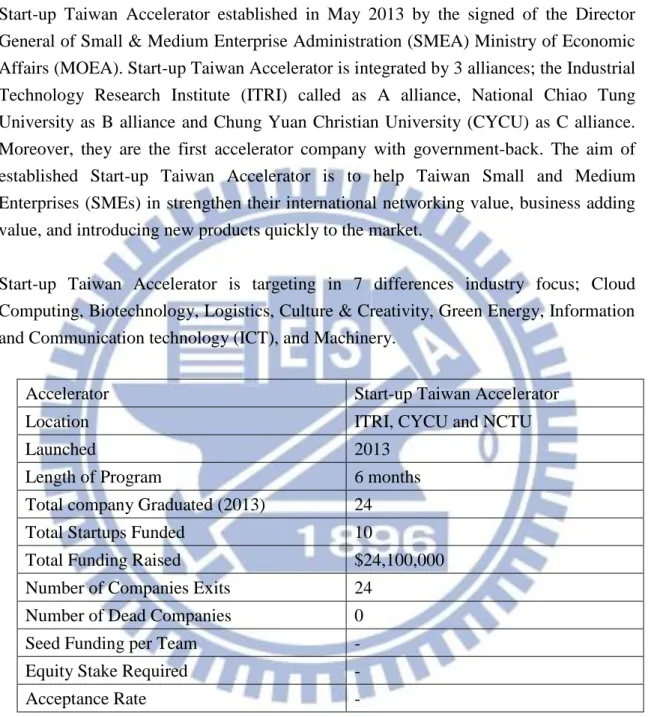

3.4.2 Start-up Taiwan Accelerator

Start-up Taiwan Accelerator established in May 2013 by the signed of the Director General of Small & Medium Enterprise Administration (SMEA) Ministry of Economic Affairs (MOEA). Start-up Taiwan Accelerator is integrated by 3 alliances; the Industrial Technology Research Institute (ITRI) called as A alliance, National Chiao Tung University as B alliance and Chung Yuan Christian University (CYCU) as C alliance. Moreover, they are the first accelerator company with government-back. The aim of established Start-up Taiwan Accelerator is to help Taiwan Small and Medium Enterprises (SMEs) in strengthen their international networking value, business adding value, and introducing new products quickly to the market.

Start-up Taiwan Accelerator is targeting in 7 differences industry focus; Cloud Computing, Biotechnology, Logistics, Culture & Creativity, Green Energy, Information and Communication technology (ICT), and Machinery.

Table 8 Start-up Taiwan Accelerator Funding

Similar to appWorks, Start-up Taiwan Accelerator did not provide early seed funding for acceptances, but they do help Taiwan SMEs obtain an additional funding from VCs and Angels around $ 24.1 Million in their first acceleration program.

Accelerator Start-up Taiwan Accelerator

Location ITRI, CYCU and NCTU

Launched 2013

Length of Program 6 months Total company Graduated (2013) 24 Total Startups Funded 10

Total Funding Raised $24,100,000 Number of Companies Exits 24

Number of Dead Companies 0 Seed Funding per Team - Equity Stake Required -

21

Mentoring

They program are run for 6 months with concentrate in counseling, matching funds, and linking international marketing. Since founded, their accelerator’s program has been attracting a number of SMEs around Taiwan. Most applicants are come from a recommendation of famous incubators central in Taiwan like; NCU Incubation Center, ITRI Incubation Center, and CYCU Incubation Center (Start-Up Taiwan Accelerator, 2014), but there are also other applicants who are actively applied for the programs without any recommendation from incubators central.

An intensive mentoring, extensive networking and matching funds event are only for those who has been accepted as Start-up Taiwan Accelerator startups teams.

Networking

Start-up Taiwan Accelerator has been partners and alliances with many outstanding companies such as; Nangang Software Incubator, Taichung Business Incubators Alliance, Chung Hua University Innovation & Incubation Center, Taipei Computer Association, N.T.U. Innovation Incubation Center, and K.M.U Innovation Incubation Center (Start-Up Taiwan Accelerator, 2014). They also create Co-Incubation Network with organization outside Taiwan, such as; Mainland China, Korea, Thailand, India, Singapore, Europe, etc. A strong partnerships and a healthy international networking will helped Taiwan SMEs a lot in growth their firm’s performances.

3.5 Summary of Global Accelerator Study

In the table 9 showed that most of the well-known accelerators in the worldwide are come from private funding, they provide startups early stage funding in exchange for a small percentage of equity. They used those equity’s charges to fund accelerator programs, and another amount of them is used for paying accelerators organization. From the study finding, most accelerators of studied have program cycles only for a few intensive months with a comprehensive mentoring and training. Furthermore, mentors in the accelerators program have play a significant role’s. Take the well-known accelerators, Y Combinator and TechStars as an example, both have mentorships resources more than 750 around the world. An expert mentor’s help startups team a lot, especially in the need to refine their ideas and planning in the earlier stage, mentors can give them a solid guidance on how to build a scalable business.

22

Table 9 Summary of Global Accelerator Companies

Next, the preparation for demo day is the most important part in the program, since all of accelerators studied are culminate their program with “Demo Day”, a day which the startups have opportunities to meet with hundreds of investors. This day’s is very important, startups just have 10 minute to pitch theirs idea, and within this 10 minute determine whether or not they got an extra funding from the investors.

Taiwan accelerator is a new phenomenon starting in these several years and most of them are still did not provided startups early seed funding. Start-up Taiwan Accelerator was the first government-back accelerator company in Taiwan; Although they are a new startup company in Taiwan, but they have been attracted a lot of attention from media, VCs, and Taiwan SMEs and collected around $ 24 million investment from VCs and Angels Capitalist.

All in all, to sum up this chapter, we would like to mention that all accelerators of studies have shown similarities in their programs, most of them provided funding, mentoring, and networking for earlier startups, and the way to distinguish them are used

Accelerator Launched Seed Funding Equity Required Length (days) Provider of Capital Y Combinator 2005 $11K-$20K 2%-10% 90 Private funding TechStars 2006 $6K-$18K 6% 90 Private funding Seedcamp 2007 $67K 10% 365 Private funding Startupbootcamp 2010 $20K 8% 90 Private funding Chinaccelerator 2010 $16K 6% 90 Private funding JFDI 2009 $20K 5%-20% 100 Private funding appWorks 2010 - - 180 Private funding Start-up Taiwan Accelerator 2013 - - 180 No funding

23

to see how attractiveness of accelerator programs that their providing, how much amount of their funding, how good quality of their mentorship network, and how many startups are get funding after the ‘Demo Day’.

24

Chapter 4 Data and Methodology

4.1 Research Framework

The initial purpose of this research is tried to examine whether the accelerator programs beneficial for those Taiwan SMEs or not.

Survey Data Descriptive Data Result Accelerators Program Influences SMEs Participants Conclusion IBM SPSS Descriptive Analysis

25

In this paper we are specifically concerned with investigation of descriptive data of accelerator program participants and questionnaire-survey respondents’ examination result. Moreover, we try to use SPSS analysis tools in testing all respondents of questionnaire-survey.

Start-Up Taiwan Accelerator Program Flowchart

Experts & Specialists Organization University

SME

Applicants

SMEs

Graduate

Cloud Applications Electronic Information Precision Machinery Biotechnology Logistics Cultural and CreativeGreen Energy Accelerator Programs: Fundraising Mentoring Networking Selection Process

SMEs

Participants

26

Start-up Taiwan Accelerator program is open to all Taiwan SMEs with 7 different industrials field; Cloud Computing, Biotechnology, Logistics, Culture & Creativity, Green Energy, Information and Communication technology (ICT), and Machinery. Applicants after submitted application form, they will face a selection process which is set by Start-up Taiwan Accelerator. Selection process was strict and intensive. Typically, it need several months in doing applicants evaluation process.

This paper is employs 2013 period cycle of Start-up Taiwan Accelerator program, in this period cycle they have 3 phrase selection process. First phrase selection, they will eliminate 300 SMEs applicants to 104 companies. Second phrase selection eliminate 104 SMEs applicants to 30 startups and finally, only choose 24 startups as pioneer SMEs to get fully accelerated in the program.

Although Start-up Taiwan Accelerator has a strict selection process but during the process, SMEs still have opportunities to meet with mentors, to do sharing and consulting as well as attended matching fund events to meets with worldwide investors. The whole accelerate process of the program is runs approximately 6 months and SMEs graduated from accelerator programs.

4.2 Research Method

The empirical data for this research consists of Questionnaire-survey data as collected by sending questionnaire to all SMEs program participants and descriptive data, which is provided by Start-up Taiwan Accelerator. Questionnaire data are analyzed using IBM SPSS tool, and descriptive data are investigated using descriptive analysis method.

4.2.1 Questionnaire Design

Questionnaire-survey are contained of 3 major measurement dimension; financial, management and satisfaction. In financial dimension contained of 10 statements; in management dimension contained of 11 statements; and in satisfaction contained of 5 statements.

All respondents have been asked to give a certain extent of their agreement on a five-point Likert scale (1= strongly disagree and 5 = strongly agree). Questionnaire is design in five pages length and has been sent to 65 SMEs respondents with authorizes by Start-Up Taiwan Accelerator.

27

65 SMEs questionnaire respondents consist of 16 Clouds Computing firms, 14 ICT Firms, 14 Biotechnology firms, 6 Green Energy firms, 6 Machinery firms, 4 Logistics firms, and 4 Culture & Creativity firms. And 24 of them are pioneer teams, which chosen by Start-Up Taiwan Accelerator at the end of the program.

Questionnaire-survey has been designed base on concept of Performance Measurement System (PMS) and Resource-Based View (RBV). Both theories are described about consideration of firm performance dimension. What dimension should be considerate when evaluate performance of firms.

Basically, in performance measurement theory indicate that financial dimension considered as a critical dimension of measurement SME performance; in operational dimensions, typically included product performance, productivity, resource utilization, goal achievement, future growth, market share, and so on; customer satisfaction, also cited as a critical measurement dimension to investigate performance of SMEs (Hudson, Smart, & Bourne, 2001)

According to Garengo, Biazzo, and Bititci (2005) Performance Measurement System (PMS) is important for support the decision-making processes in SMEs and help them improve their management processes and strategic control. PMS has been used to indicate SMEs performance over the past two decade.

Wernerfelt (1984) in concept of Resource-Based View (RBV) described that firm resources are heterogeneous and the differences in resources can be subject to sustainability. In the concept also mention that firm revenue is come from internal and external resources, which is set as an input and convert them into products or services; therefore, in order to understand what else value-added that accelerator has added to SMEs; financial, management and satisfaction dimension are implied in the questionnaire in aims to analyze firm resources and accelerator program correlation. In additional, financial resource can be used to grow, either for the expansion of companies or used in other activates. Fully utilized operational resources can achieve companies’ goals; plus, size of the firm, industry, and age of the firm were also found to be relevant to do further studies according to Moreno & Casillas (2007), which is mention about “firm size and age have been considered to be determination the growth of the firms”.

28 SMEs Performance Measurement Dimension

Financial

Satisfaction

Market Share RevenueManagement

…… Turnover rateLong/short term goal Business model R&D Human Resource …… Initial Expectation Profit objective Market objective Information Overall performance Net Sales

Figure 3 Questionnaire Design Outline

Last, in Murphy, Trailer and Hill (1996) research finding, single measurement of performance considers insignificant to measure firm performances. In their research, they suggest that if we want to examining performance of firms, we can try to imply multiple dimensions of performance such as operational dimensions and financial dimensions. That why in this paper we are applying multiple measurement dimensions to investigate the effect of accelerator programs.

4.2.2 Descriptive Data

Descriptive data consists of all basic information of SMEs participants, such as date of firm founded, number of current employees, amount of firm capital, and firm net income. These data are provided by Start-up Taiwan Accelerator and are collected before participants active in accelerator program.

Although during the research process, we are unable to obtain SMEs after joined the accelerator program data, especially like amount of firm capital and firm net income. But, we still acquire other information data about how many companies do get

29

beneficial order from big companies and SMEs who achieve additional funding from investors after joined the programs. We will explain it further in the next chapter.

30

Chapter 5 Result and Analysis

5.1 Questionnaire-survey

Questionnaires have been distributed by post mail to all SMEs program’s participants, two weeks after the mailing, a second phone call was made for companies that had not replied. The whole procedure take around 1 month and finally yielded a response rate of 55.78% from 65 questionnaires sent out. From the return mails, 6 of them are certify that they did not participate in the programs. Another 7 of SMEs respondents also deny ever participated in the programs when making second phone call. Therefore, from 65 questionnaire sent out, we got 29 SMEs respondents who are willing to give feedback about their involvement in accelerator programs.

Those respondents were consists of 8 Cloud Computing firms, 5 Biotechnology firms, 5 ICT firms, 4 Green Energy firms, 3 Machinery firms, 2 Logistic firms, and 2 Culture & Creativity firms. Moreover, 19 of them are SMEs which is choose as pioneer companies in the end of the program. Those companies consists of 4 Cloud Computing firms, 3 Biotechnology firms, 4 ICT firms, 4 Green Energy firms, 2 Machinery firms, 1 Logistic firms, and 1 Culture & Creativity firms.

From the questionnaire respondents, 59% of them have size of employee around 11-30; 21% less than 10 people; 10% between 31-50 and 10% more than 71 people. The average amount of respondents capital; 31% between NT$510K-NT$1,000K; 17% between NT$1,100K-NT$5,000K; 14% more than NT$50,000K; 10% less than NT$500K; 4% between NT$11,000K-NT$50,000K, and another 4% between NT$5,100K-NT$10,000K. From those collected data, we can see that most of the accelerator program’s participants are come from new venture companies with currents employee among 11-30 people within capital amount between NT$510K-NT$1,000K. From 29 questionnaire respondents, 43% of them wrote agree and 8% wrote strongly agree. The result show that half of respondents are agree with the statement accelerator programs has an influences for SMEs firm resource. And for further research, all return questionnaire data will be analyzed using IBM SPSS Statistics 20 linear regression. The purpose of this analyses is to investigate the relationships between each SMEs firm performance dimension with accelerators services items.

31

Reliability and Validity

To begin the research study, first we are try to tests questionnaire reliability and validity problem. Cronbach’s coefficient were used to determine the stability of financial dimension, management dimension, and satisfaction. Another spearman correlation coefficients also were used to assess the strength of accurately concept of the questionnaire items. All tests were two-sided and with assumption a 5% significance level. Result of the test is shown in the table 10.

Variables Cronbach’s Alpha 0.05 (2-tailed) Financial 0.977 Sig

Management 0.979 Sig Satisfaction 0.963 Sig

Table 10 Analysis of Variance for reliability and validity

From result of table 10 show that the reliability and validity testing of all items dimensions are significant at alpha 0.05 level. According Lee Cronbachto theory “if a coefficient testing is above Cronbach’s alpha 0.7, thereby its lending support to indicate suitability of the items in each dimension”.

Regression Model

We begin regression analysis with creating a regression model of average each item in financial dimension with funding, mentoring, and networking accelerator’s services.

= 0 + 1funding + 2mentoring + 3networking

Dependent variable ( ) is an average of each item in financial dimension of all survey samples; independent variable is an average of funding ( 1) , mentoring ( 2), and networking ( 3) in each item question of financial dimension. Next, all data were testing with coefficient’s alpha 0.05 level, result from regression linear testing revealed that funding was significant with a p-value = 0.002, networking significant with p-value = 0.001, only mentoring is not significant with p>0.05. Overall results from testing showed that performance of financial dimension SMEs has a close relationship with funding and networking accelerator programs.

Another regression analysis with regression model for average items of management

32

dimension also has been tested with coefficient’s alpha 0.05 level, dependent variable ( ) are average each item of management dimension and independent variable is funding ( 1), mentoring ( 2) and networking ( 3) in each item question of management dimension. The result of testing was only mentoring variance is significant with p-value < 0.001.

= 0 + 1funding + 2mentoring + 3networking

Finally, regression model for average items of satisfaction dimension has been tested with coefficient’s alpha 0.05 level. Dependent variable ( ) is an average of each item in satisfaction dimension and independent variable are funding ( 1), mentoring ( 2) and networking ( 3) in each item question of satisfaction dimension.

= 0 + 1funding + 2mentoring + 3networking The result of all testing are shown in the table 11 below:

Table 11 Result of testing overall average financial, management and satisfaction In the next research, we tried to group alike category together with giving an initial name for each group’s. In the financial dimension; revenue, sales, and net profit are grouped in firm income ( . Turnover rate capital ( is standing alone; marketing channel, market share and International expansion are grouped in market expansion ; funding resources and foreign investment are grouped in additional funding . In management dimension; long-term strategy, short-term strategy, and business model are grouped in firm objective ; human resources, firm regulation, IP management, R&D, and quality control are grouped in firm internal assist ; sales advice, overseas assist, and products exports assist are grouped in firm external assist . Furthermore, more detail of regression model for all group’s category are shown in the table 12.

Dependent Variable Independent Variables

Beta

Coefficients

P – Value (sig) Avg Financial Funding 0.406 0.006

Networking 0.499 0.001 Avg Management Mentoring 0.751 < 0.001 Avg Satisfaction Funding 0.388 0.013

33

= 0 + 1funding + 2mentoring + 3networking = 0 + 1funding + 2mentoring + 3networking = 0 + 1funding + 2mentoring + 3networking = 0 + 1funding + 2mentoring + 3networking = 0 + 1funding + 2mentoring + 3networking = 0 + 1funding + 2mentoring + 3networking = 0 + 1funding + 2mentoring + 3networking

Table 12 Regression Model for All Group Category Result of testing with group categories are shown in the table 13 below:

Dimension Categories Dependent variable Beta Coefficients P-value (Sig) Strong correlation with Firm income Revenue Funding 0.337 Networking 0.523 0.022 Funding 0.001 Networking Networking Sales Net Profit Turnover rate capital Turnover rate

Networking 0.441 0.012 Networking Networking

Market expansion Marketing Channel Funding 0.344 Networking 0.500 0.030 Funding 0.002 Networking Networking Market share International Expansion Additional funding Funding resources Funding 0.582 Networking 0.326 0.001 Funding 0.029 Networking Funding Foreign investment Firm objective Long-term strategy Funding 0.320 Mentoring 0.154 0.013 Funding <0.001 Mentoring Mentoring Short-term strategy Business model Firm internal assist HR management

Mentoring 0.751 <0.001 Mentoring Mentoring Firm